Affordable home ownership schemes in England (updated September 2020)

Updated 16 September 2020

- Serial Number: JSHAO/05

- Date: March 2020

- Review date: April 2021

This handout has information on:

-

Help to Buy: Equity Loan

-

Shared Ownership

-

Starter Homes

-

Help to Buy Agents England

Many personnel may have discounted the idea of buying a property because they believe that they can’t afford it. Over recent years it has become increasingly difficult to obtain an affordable mortgage unless you have a significant deposit. The Mortgage Market Review has also impacted on mortgage applications as providers are now required to look more closely at how affordable your initial mortgage repayments will be, taking into account not just your income but also your outgoings such as general cost of living and existing loans. Lenders will also look at the future affordability of your mortgage payments to ascertain whether a rise in interest rates would impact on your ability to meet your repayments.

Whilst the tightening of mortgage regulations may appear to make home ownership even harder to achieve, Affordable Housing Schemes are designed to bridge the gap between the asking price for a property and the available mortgage, increasing the range of people who are able to get on, or move up, the property ladder.

This handout will focus on the Affordable Housing Schemes available in England. Similar schemes are available throughout the UK and information on those specific to Scotland, Wales and Northern Ireland are available on request from JSHAO. Service personnel have been designated as ‘Priority Status’ on these schemes (excluding Northern Ireland). Although this is no guarantee that an application will be accepted, it ensures applications from service personnel will be treated the same as social housing tenants for a period up to 12 months after discharge.

Help to buy equity loan

You can use Forces Help to Buy with this scheme, JSP 464 Part 1 Chapter 12.

How does it work?

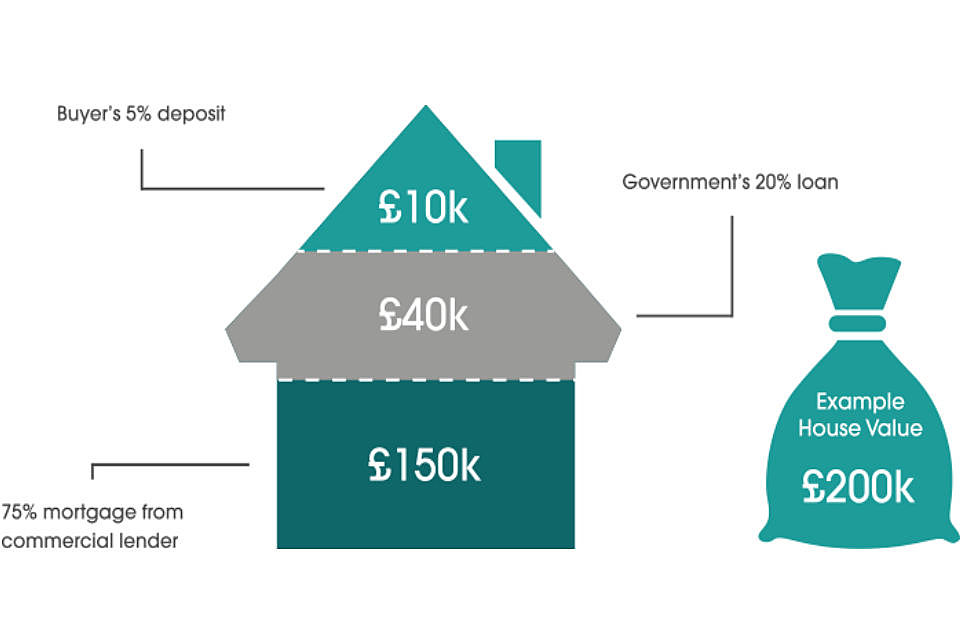

With a Help to Buy: Equity loan the Government lends you up to 20% of the cost of your new-build home (40% in London), so you’ll only need a 5% cash deposit and a 75% mortgage to make up the rest. You won’t be charged loan fees on the 20% loan for the first five years of owning your home. Thereafter interest is charged at 1.79% until the loan is repaid.

Infographic showing a home for £200,000, sold for £210,000, you’d get £168,000 (80%, from your mortgage and the cash deposit) and you’d pay back £42,000 on the loan (20%).

Example: for a home with a £200,000 price tag If the home in the example above sold for £210,000, you’d get £168,000 (80%, from your mortgage and the cash deposit) and you’d pay back £42,000 on the loan (20%). You would need to pay off your mortgage with your share of the money. For more information (including advice on fees and paying back your loan) please download the Help to Buy: equity loan buyers’ PDF guide

Who is eligible?

Equity loans are available to first time buyers as well as homeowners looking to move. The home you want to buy must be newly built with a price tag of up to £600,000. You won’t be able to sublet this home or enter a part exchange deal on your old home. You must not own any other property at the time you buy your new home with a Help to Buy equity loan. This scheme is available in England only. The Scottish Government, Welsh Government and Northern Ireland Housing Executive run similar schemes - check out their websites.

How to apply?

The Help to Buy: equity loan scheme is run by government-appointed Help to Buy agents. They can guide you through your purchase, from providing general information about the scheme to dealing with your application. Or look out for the Help to Buy logo on new-build developments and ask about the scheme there. You can get more help and advice from the Money Advice Service and other useful contacts.

Find your local Help to Buy Agent. Your local Help to Buy agent can guide you through the options available and explain the eligibility and affordability criteria. Help to Buy agents are appointed by the Government’s Homes and Communities Agency. Help to Buy agents administer the Help to Buy: equity loan scheme but not the mortgage guarantee scheme. They have the authority to give the go-ahead for you to purchase a home with help from the equity loan scheme. The agents make other key decisions during the purchase process. For the Help to Buy mortgage guarantee, please contact the participating lenders directly.

Important notes

Can I sub-let my Help to buy home?

No. Help to Buy is designed to assist you to move on to or up the housing ladder. If you wish to sublet, you will first have to repay the Help to Buy equity loan assistance. In exceptional circumstances (for example; a serving member of the armed forces staff whose tour of duty requires them to serve away from the area in which they live for a fixed period, then sub-letting can be considered. In these circumstances you would also require approval from your mortgage lender).

Can I own other homes and buy a Help to Buy home?

No. Help to Buy is designed to assist you to move up the housing ladder and must be your only residence (unless you live in SFA, see question one). This means you will be expected to sell your current home if moving up the ladder. The disposal of your current home will be verified by your solicitor/conveyance before you can proceed to exchange contracts on the Help to Buy Home.

Can I own a Help to Buy home and buy a second home?

No. Help to Buy is designed to assist you to move up the housing ladder. If you can afford to purchase another home, you will have to repay the Help to Buy equity loan. Please visit the following link for more information on Help to Buy equities loan.

Shared ownership

You can use Forces Help to Buy with this scheme, JSP 464 Part 1 Chapter 12

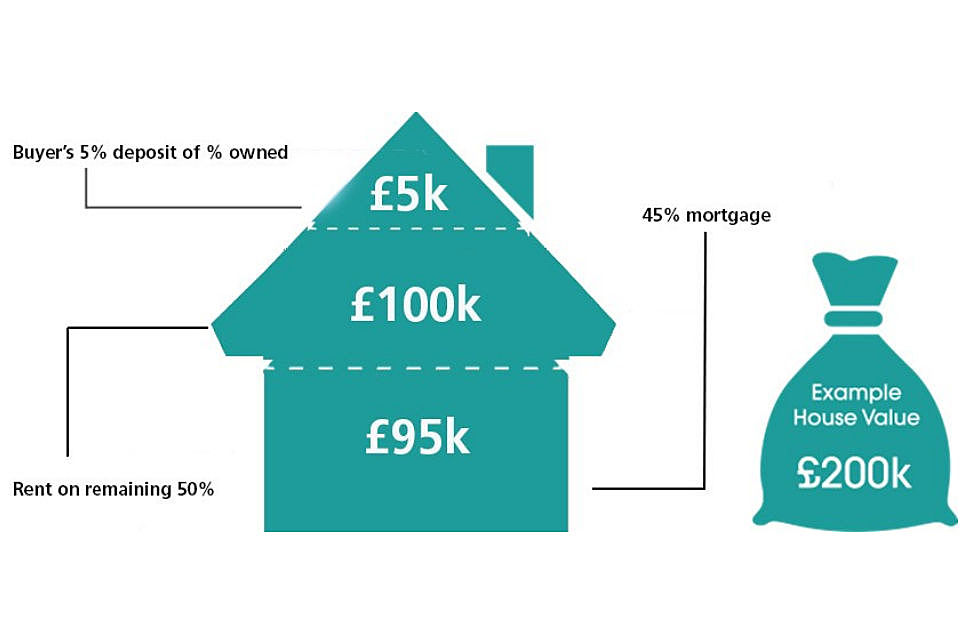

Shared ownership schemes (part buy/part rent) are provided through housing associations. You buy a share of your home (between 25% and 75% of the home’s value) and pay rent on the remaining share. You can buy bigger shares at a later stage when you can afford to.

With shared ownership you can buy a newly built home or an existing one through resale programs from housing associations.

You’ll need to take out a mortgage to pay for your share of the home’s purchase price, or fund this through your savings.

Shared ownership properties are always leasehold and you can buy a home this way if:

- your household earns £80,000 a year or less

- note: In London household earnings of £90,000 a year or less

- you’re a first-time buyer (or you used to own a home, but can’t afford to buy one now).

Infographic showing home valued at £200,000, with an individual buying 50% share, would require a deposit of 5% of share in the property. The remaining 50% would need to be covered by a mortgage. You would then pay rent on the remaining 50%.

Example: A home valued at £200,000, with an individual buying a 50% share in the property. You would require a deposit amounting to 5% of your share in the property (£5,000). The remaining 50% of your share in the property (45% - £95,000) would need to be covered by a mortgage. You would then pay rent on the remaining 50%.

If you rent a council or housing association property, then you will receive priority for buying a home through shared ownership. The same priority is given to armed forces personnel.

Local authorities with shared ownership home building programmes may have further priority groups, based on local housing needs, such as people already living or working in the area.

People with disabilities

Home Ownership for People with Long-Term Disabilities (HOLD) can help you buy any home that’s for sale on a shared ownership basis if you have a long-term disability.

You can only apply for ‘hold’ if the properties available through the other home ownership schemes don’t meet your needs, for example you need a ground-floor property.

Older people

You can get help from another home ownership scheme called Older People’s Shared Ownership if you’re aged 55 or over.

It works in the same way as the general shared ownership scheme, but you can only buy up to 75% of your home. Once you own 75% you won’t have to pay rent on the remaining share.

Applying for a shared ownership scheme

To buy a home through a shared ownership scheme contact the Help to Buy agent in the area you want to live.

You can also find out further information about shared ownership on gov.uk on the JSHAO: housing advice leaflets.

Read more at the following link Help to Buy: Shared ownership.

England: Starter homes

This scheme is not compatible with the Forces Help to Buy scheme, JSP 464, Part 1 Chapter 12.

What is Starter homes?

The government has announced a new Starter Homes initiative in England that aims to help young first-time buyers (below 4 years of age) to purchase a home with a minimum 20% discount off the market price.

If you would like to get the latest information about the scheme as it becomes available and receive updates in the future when homes become available, you can complete a form by accessing the New Homes website.

Help to buy agents

Your local Help to Buy agent can guide you through the options available and explain the eligibility and affordability criteria. Help to Buy agents are appointed by the Government’s Homes and Communities Agency.

Help to Buy agents administer the Help to Buy: equity loan scheme but not the mortgage guarantee scheme. They have the authority to give the go-ahead for you to purchase a home with help from the equity loan scheme. The agents make other key decisions during the purchase process. For the Help to Buy: mortgage guarantee, please contact the participating lenders directly.

Help to Buy London provides the administration of the Help to Buy: Equity Loan scheme only. Help to Buy London staff cannot guide potential purchasers on wider housing options.

| East Midlands | |||

|---|---|---|---|

| Derbyshire | Help to Buy Midlands | 0345 850 2050 | https://www.helptobuyagent2.org.uk/ |

| Leicestershire | Help to Buy Midlands | 0345 850 2050 | https://www.helptobuyagent2.org.uk/ |

| Lincolnshire | Help to Buy Midlands | 0345 850 2050 | https://www.helptobuyagent2.org.uk/ |

| 0345 850 2050 | https://www.helptobuyagent2.org.uk/ | ||

| 0345 850 2050 | https://www.helptobuyagent2.org.uk/ | ||

| 0345 850 2050 | https://www.helptobuyagent2.org.uk/ | ||

| East of England | |||

| Bedfordshire | Help to Buy East and South East | 03333 214044 | https://www.helptobuyagent3.org.uk/ |

| Cambridgeshire | Help to Buy East and South East | 03333 214044 | https://www.helptobuyagent3.org.uk/ |

| Essex | Help to Buy East and South East | 03333 214044 | https://www.helptobuyagent3.org.uk/ |

| Hertfordshire | Help to Buy East and South East | 03333 214044 | https://www.helptobuyagent3.org.uk/ |

| Norfolk | Help to Buy East and South East | 03333 214044 | https://www.helptobuyagent3.org.uk/ |

| Suffolk | Help to Buy East and South East | 03333 214044 | https://www.helptobuyagent3.org.uk/ |

| North East | |||

| Durham | Help to Buy North East, Yorkshire & the Humber | 0113 8256888 | https://www.helptobuyagent1.org.uk/ |

| Northumberland | Help to Buy North East, Yorkshire & the Humber | 0113 8256888 | https://www.helptobuyagent1.org.uk/ |

| Tyne and Wear | Help to Buy North East, Yorkshire & the Humber | 0113 8256888 | https://www.helptobuyagent1.org.uk/ |

| North West | |||

| Cheshire | Help to Buy North West | 0300 7900570 | https://www.helptobuyagent1.org.uk/ |

| Cumbria | Help to Buy North West | 0300 7900570 | https://www.helptobuyagent1.org.uk/ |

| Greater Manchester | Help to Buy North West | 0300 7900570 | https://www.helptobuyagent1.org.uk/ |

| Lancashire | Help to Buy North West | 0300 7900570 | https://www.helptobuyagent1.org.uk/ |

| Merseyside | Help to Buy North West | 0300 7900570 | https://www.helptobuyagent1.org.uk/ |

| South East | |||

| Berkshire | Help to Buy South | 0800 456 1188 | https://www.helptobuyagent3.org.uk/ |

| Buckinghamshire | Help to Buy East and South East | 03333 214044 | https://www.helptobuyagent3.org.uk/ |

| East Sussex | Help to Buy East and South East | 03333 214044 | https://www.helptobuyagent3.org.uk/ |

| Hampshire | Help to Buy South | 0800 456 1188 | https://www.helptobuyagent3.org.uk/ |

| Isle of Wight | Help to Buy South | 0800 456 1188 | https://www.helptobuyagent3.org.uk/ |

| Kent | Help to Buy East and South East | 03333 214044 | https://www.helptobuyagent3.org.uk/ |

| London | Help to Buy London | 0300 5000996 | https://www.helptobuyagent2.org.uk/ |

| Oxfordshire | Help to Buy South | 0800 456 1188 | https://www.helptobuyagent3.org.uk/ |

| Surrey | Help to Buy East and South East | 03333 214044 | https://www.helptobuyagent3.org.uk/ |

| West Sussex | Help to Buy East and South East | 03333 214044 | https://www.helptobuyagent3.org.uk/ |

| South West | |||

| Bristol | Help to Buy South | 0800 456 1188 | https://www.helptobuyagent3.org.uk/ |

| Cornwall | Help to Buy South West | 0300 100 0021 | https://www.helptobuyagent3.org.uk/ |

| Devon | Help to Buy South West | 0300 100 0021 | https://www.helptobuyagent3.org.uk/ |

| Dorset | Help to Buy South West | 0300 100 0021 | https://www.helptobuyagent3.org.uk/ |

| Gloucestershire | Help to Buy South | 0800 456 1188 | https://www.helptobuyagent3.org.uk/ |

| Somerset | Help to Buy South West | 0300 100 0021 | https://www.helptobuyagent3.org.uk/ |

| Wiltshire | Help to Buy South | 0800 456 1188 | https://www.helptobuyagent3.org.uk/ |

| West Midlands | |||

| Herefordshire | Help to Buy Midlands | 0345 850 2050 | https://www.helptobuyagent2.org.uk/ |

| Shropshire | Help to Buy Midlands | 0345 850 2050 | https://www.helptobuyagent2.org.uk/ |

| Staffordshire | Help to Buy Midlands | 0345 850 2050 | https://www.helptobuyagent2.org.uk/ |

| Warwickshire | Help to Buy Midlands | 0345 850 2050 | https://www.helptobuyagent2.org.uk/ |

| West Midlands | Help to Buy Midlands | 0345 850 2050 | https://www.helptobuyagent2.org.uk/ |

| Worcestershire | Help to Buy Midlands | 0345 850 2050 | https://www.helptobuyagent2.org.uk/ |

| Yorkshire and the Humber | |||

| East Riding | Help to Buy North East, Yorkshire & the Humber | 0113 8256888 | https://www.helptobuyagent1.org.uk/ |

| North Yorkshire | Help to Buy North East, Yorkshire & the Humber | 0113 8256888 | https://www.helptobuyagent1.org.uk/ |

| South Yorkshire | Help to Buy North East, Yorkshire & the Humber | 0113 8256888 | https://www.helptobuyagent1.org.uk/ |

| West Yorkshire | Help to Buy North East, Yorkshire & the Humber | 0113 8256888 | https://www.helptobuyagent1.org.uk/ |

Contact the Joint Service Housing Advice Office on the Civilian number: 01252 787574 and Military number: 94222 7574. You can also email the office on rc-pers-jshao-0mailbox@mod.gov.uk.