HMRC issue briefing: calculating the 2014 to 2015 tax gap

Published 20 October 2016

1. What is the tax gap?

The tax gap is the difference between the amount of tax due and the amount collected. It is impossible to collect every penny theoretically owed in tax, so a ‘tax gap’ will always exist. For example, we cannot legally collect taxes from companies that owe tax and are insolvent.

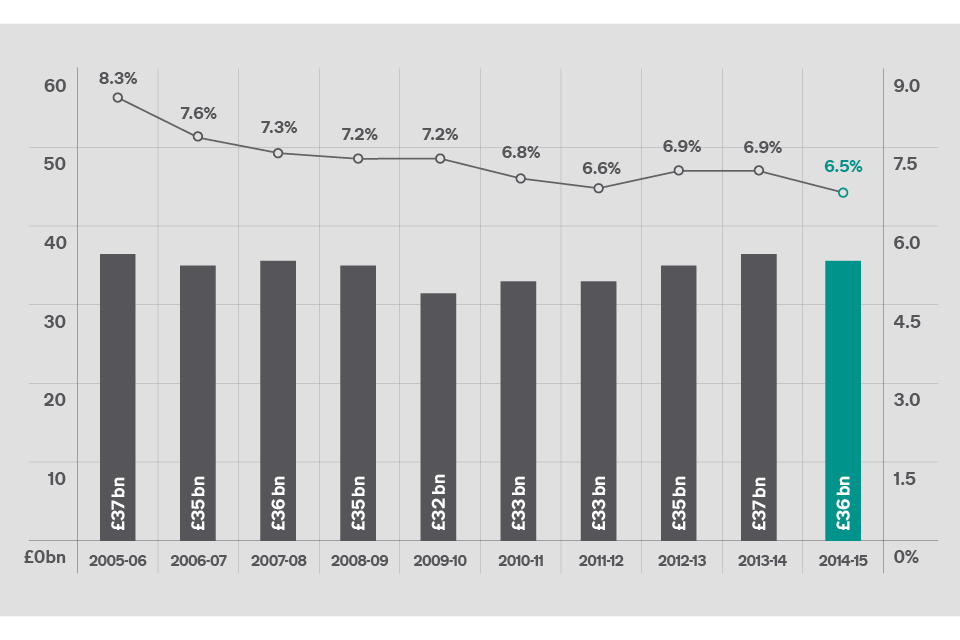

1.1 Tax gap and percentage of liabilities: tax year 2005 to 2006, to tax year 2014 to 2015

This chart shows the tax gap and percentage of liabilities: tax year 2005 to 2006, to tax year 2014 to 2015. It also shows what percentage each tax gap was of the total amount of tax owed.

When comparing over time, the tax gap as a percentage of liabilities is a more meaningful measure because it is not as affected by rate changes or changes in the size of the economy.

2. Why we measure it

The tax gap is an official statistic. We estimate the tax gap, because it provides a useful tool for understanding the relative size and nature of non-compliance.

Tax gap calculations cannot be used for precise performance management for a variety of reasons. For example, some components take a long time to calculate, the estimates are not accurate enough and they are updated when new data becomes available.

We publish tax gap figures every year to show broad trends in compliance and because we want to be transparent in our thinking on this important issue of public interest.

3. Latest calculations

We estimate the 2014 to 2015 tax gap was 6.5% of total tax and duties due to HMRC – a reduction from 6.9% in 2013 to 2014.

This equates to £36 billion, after we deduct the money we bring in through our compliance activities. This indicates that more than 93% of tax due was paid in the tax year 2014 to 2015. There is an overall downward trend from 8.3% in the tax year 2005 to 2006 to 6.5% in the tax year 2014 to 2015, although the tax gap has levelled out in recent years.

The current tax gap estimate of £36 billion is £11 billion lower than it would have been if the percentage tax gap had remained at the 2005 to 2006 level of 8.3%. The adjustment in the figures for 2013 to 2014 from £34 billion to £37 billion largely result from two factors:

- projected information has been replaced by actual data

- improved data analysis arising from an upgrade in the way HMRC identifies risk

3.1 PAYE tax gap and percentage of liabilities: tax year 2005 to 2006, to tax year 2014 to 2015

This chart shows the PAYE tax gap and percentage of liabilities: tax year 2005 to 2006, to tax year 2014 to 2015.

Introducing Real Time Information (RTI) for Pay As You Earn (PAYE) in 2013 is likely to have made a significant contribution towards a large reduction in the PAYE tax gap to £2.8 billion (1.1%) in 2014 to 2015, compared to £4 billion (1.6%) the year before.

Its introduction has fundamentally reformed the PAYE system, allowing employers to send tax information at the time, or before, they make payment to their employees.

RTI has led to information on payroll taxes being recorded more accurately and on a more frequent basis. This has speeded up the collection of money we estimate we are owed by employers. It is allowing us to identify debts and take action at an earlier stage than previously – reducing the risk of the debt becoming uncollectable and having to be written off.

The VAT gap is at its lowest level of 10.3% (£12.7 billion) for 2014 to 2015, compared to 11.4% (£13.5 billion) the year before. The VAT gap is reducing due to the combined effect of a number of our measures, including:

- putting pressure on organised crime, particularly where fraudsters charge VAT and then go missing before paying it over to the Exchequer, which is known as Missing Trader Intra-Community Fraud, (MTIC). We have responded to new risks by amending our operational processes, as well as sharing information with other countries

- taking VAT online, including online filing of VAT returns and VAT registration - this has removed opportunities for people to make basic errors, for example, the introduction of the Notification of Vehicle arrivals (NOVA) service has removed the opportunity for VAT fraud on cars entering the UK

- introducing legislation that has had a major impact on VAT avoidance, which along with a change in the general climate has made aggressive tax planning less acceptable

The tobacco duty tax gap is made up of the illicit market in cigarettes and hand-rolling tobacco and is estimated to be £1.4 billion (12.8%) in 2014 to 2015, compared to £1.9 billion (16.6%) for the year before.

4. Quality of the calculations

Tax gap calculations are a complex series of measurements; this is partly why very few countries produce a tax gap estimate and the estimates themselves are subject to constant revision.

We have access to data that covers most tax sources, and use experimental statistics in a consistent way where limited evidence is available. Because we have had our calculations reviewed and endorsed by the International Monetary Fund, we are confident that our calculations are as accurate as they can be. We publish our methods and set out clearly any changes we make.

To put the £36 billion tax gap in context, we collected £517.7 billion in tax during 2014 to 2015. The figures, combined with our own customer research, show the vast majority of UK taxpayers pay what they owe, with only a small minority choosing to bend or break the rules.

5. Our approach to tackling the tax gap

Calculating the tax gap and its different component parts means we can focus in a more targeted way on the non-compliance that exists within our different customer groups.

We are well underway in implementing our ‘promote, prevent, respond’ approach to non-compliance. We aim to make paying tax simple and efficient for the compliant majority, through promoting good compliance and preventing errors when they deal with HMRC. This allows us to target and respond in a more robust way with the small minority intent on cheating the tax system.

Through significant new powers to tackle tax avoidance, we have made it far less attractive for individuals and companies to try to bend the tax rules to their own advantage.

In the two years since we introduced Accelerated Payment Notices, which require those who have entered into tax avoidance schemes under HMRC investigation to pay the disputed tax upfront within 90 days, we have secured more than £3 billion in disputed tax. By the end of 2016, we expect to have issued 64,000 notices – securing £5.5 billion in tax for the UK by March 2020.

Outstanding debt forms part of the tax gap and we give people who have tax or tax credits debt every opportunity to pay, including Time to Pay arrangements. For the small minority who refuse to comply, and after applying rigorous checks first, we use ‘direct recovery of debt’ powers to recover the money owed from their bank and building society accounts.

We continue to close the net on hidden wealth offshore through voluntary disclosure facilities that have attracted more than 57,000 disclosures and raised more than £1.6 billion since 2007. We also launched more than 100 taskforces aimed at employment sectors at high-risk of non-compliance since May 2011, bringing in more than £404 million and continue to enforce strict controls on wholesalers in the alcohol sector, to prevent excise fraud.

Making it easier, more efficient and cost-effective for customers to deal with HMRC drives compliant behaviour and is fundamental to how we tackle the tax gap. We are already introducing digital services that are transforming the way individuals and businesses pay what they owe and claim entitlements.

By 2020 customers will be able to see all their tax affairs in near real-time, in one place, with overpayments offset against liabilities. They will not need to provide information that HMRC already holds, whether directly from customers or from third parties. Prompts built into digital tools will eliminate common errors, giving businesses greater certainty that they’ve got their tax right first time. Targeted guidance and tailored alerts will make businesses more aware of relevant obligations, entitlements and reliefs.

More than five million individuals have already signed up for Personal Tax Accounts where customers can check their records and manage their dealings with HMRC. Small businesses are benefitting from support across a range of digital channels, including webinars, YouTube video tutorials and e-learning packages.

The full report - Measuring tax gaps - contains detailed information about the tax gap and how we measure it.