An independent review of the National Employment Savings Trust (Nest)

Updated 15 February 2022

An independent report by David Bennett to the Secretary of State and the Minister for Pensions and Financial Inclusion at the Department for Work and Pensions (DWP) on the National Employment Savings Trust’s (Nest) delivery of its objectives, including provision of value for money for its members and taxpayers, with recommendations to further strengthen these areas.

1. Scope and Methodology

1.1 Scope

The Minister for Pensions and Financial Inclusion at the Department for Work and Pensions (DWP) requested an independent review of the National Employment Savings Trust (Nest) broadly in line with its 10-year anniversary. The scope of the review was focussed on three specific areas:

i) to what extent Nest has achieved/is delivering on its original objectives;

ii) does the organisation deliver value for money to members and the taxpayer (if appropriate); and

iii) make recommendations on how the organisation could further improve.

The review was supported by DWP analysts and a secretariat team.

1.2 Purpose and timeframe of the review

The purpose of this review was to look back at Nest’s role in relation to the impact on both the market it serves and the wider workplace pensions market since it opened for business in 2011 up to the present date. I was asked to conduct the review between September and December 2021 and provide a report of my findings to the Minister before the end of December.

Given the short timescales involved, my approach has been to undertake a strategic and targeted review, with a proportionate evidence gather and analysis of the issues, consistent with the terms of reference. This review provides a high-level analysis. It is not a comprehensive study of Nest Corporation and the Nest pension scheme. I have been furnished with relevant material related to the operation of Nest Corporation and the pension scheme, including the 2018 Tailored Review of Nest Corporation, its conclusions and implementation, relevant corporate and financial reports as well as the Department’s quarterly accountability reviews.

1.3 Methodology

Nest provided relevant material at the outset of the review regarding why it was set up, who it was intended to serve and information about the delivery of its aims and objectives. Discussions were also held with the Nest senior team who provided additional supporting evidence alongside information provided by DWP officials relating to value for money for scheme members and taxpayers. From this information a high-level benchmarked analysis was completed as part of this review process in relation to Nest and other workplace schemes in the Automatic Enrolment market.

The review was carried out in three phases. In September and October evidence and supporting material were gathered. Introductory meetings with the Chair, Chief Executive Officer and senior members of the Nest team were held. This was followed up with two detailed workshops hosted by Nest which focused on the original drivers in establishing Nest and the impact Nest has had for its members and on the broader workplace pensions market.

In October and November review meetings were held with DWP and HM Treasury (HMT) officials, the Pensions Regulator, the Financial Conduct Authority, consumer bodies and a range of external stakeholders in the pensions industry, in particular pension providers operating in the Automatic Enrolment market. A list of all interviewees is contained in Annex 3.

A follow up session was also held with the Chair and Chief Executive of Nest to discuss the draft recommendations. I also attended the Nest Board meeting on 25 November 2021.

I would like to thank the Nest Corporation senior team and staff for their openness and for accommodating my requirements during this review. I would also like to thank stakeholders who contributed to the review process and the DWP officials who supported my review, working to the timescales required.

2. Executive Summary

2.1 To what extent Nest has achieved/is delivering on its original objectives?

The available evidence and input into the review has confirmed that the Nest Corporation and the Nest pension scheme have successfully delivered on the objectives to support the successful delivery of Automatic Enrolment (AE).

Nest holds a unique position in the AE workplace pensions market. It has to balance the primacy of its trustee fiduciary role with Nest Corporation’s role as a public corporation funded by patient capital in the form of a Government loan. This presents specific risks and tensions which differ to those of private sector pension providers. Nest’s behaviours and relationships are, therefore, highly important in terms of managing those risks in respect of both its relationships with DWP and the broader workplace pensions market in which it operates. For example, the Nest Board must consider the financials relating to the loan in its decision-making on service delivery and other matters. It must also consider its impact in relation to the integrity and importance of AE. These are set out in Nest’s framework document with DWP [footnote 1].

AE was introduced with expectations of Nest to deliver a basic workplace pension scheme to employers and workers who qualified. Given the scale and the delivery timescales involved in the implementation of the AE policy intervention and recognising Nest commenced from a standing start, Nest has performed well. This has included building scale, systems, capability and managing the considerable risks and uncertainty involved to successfully address the supply-side challenge of extending workplace pension saving to under-pensioned parts of the labour market. In my opinion Nest has been integral to the success of AE.

Despite the deferred roll-out of the original AE policy blueprint and considerable changes in the economic and pensions landscape, which presented challenges including delivery and financial risk, Nest has successfully delivered on its main objectives of on-boarding employers at significant scale to meet their AE obligations. At the height of AE staging, 1,500 new employers were setting themselves up with Nest every day over a 6-month duration [footnote 2]. In 2020/21, its net growth in employers averaged broadly 6,500 per month [footnote 3]. The majority of employers that have accessed Nest since inception are small to medium sized by employee numbers [footnote 4]. This is reflected in the governance report that Nest share with DWP each month. Going forward, it will remain important for Nest and DWP to explicitly monitor the types of employer that are being onboarded to ensure that the Nest scheme remains sufficiently focussed on its target market.

Data confirms that Nest’s target market continues to be low to moderate earners and employers operating in these sectors (with less than 250 employees) [footnote 5]. It has remained fully open to all employers and the self-employed consistent with its Public Service Obligation (PSO). The Corporation and its scheme administrator have coped with the challenges of the Covid-19 pandemic and its impact on the workplace pensions market. Nest does not levy any charges directly on employers. It has introduced innovations specifically for small and micro employers (such as Nest Connectors and payroll integration).

Nest membership is concentrated in the low to moderate income segment, in part younger people in formerly under-pensioned sectors (including, those working in small and micro employers) [footnote 6]. Its membership also includes a significant proportion of women (47%) [footnote 7].

Nest’s success has derived, to a great degree, from the effectiveness of its partnership with DWP and The Pensions Regulator, initially as part of the AE Programme. Since the closure of the programme the sponsorship and engagement between DWP/Nest Partnership and Policy teams has provided effective challenge, scrutiny and assurance.

Nest has had a positive and complementary impact on the market

Nest has demonstrated it has acted as a spur to the private sector through its:

- provision of workplace pensions digital service delivery in the AE market

- fund management

- responsible investment

- user-led insight

Financial sustainability over the longer term

Available evidence has confirmed that, at this stage, Nest is expected to be financially sustainable over the longer term. The Department’s forecast demonstrates that it is expected to repay the Government loan by 2038 [footnote 8]. However, scheme risks are likely to become more material over time. Nest’s PSO costs and risks are now known. This means that the costs associated with the PSO are better understood and should reduce or stabilise over time. However, Nest probably has a greater share of deferred members with small pots and potentially a greater risk of non-compliant employers which brings additional costs and risks. This could have an impact on value for money to the member and/or taxpayer.

2.2 Does Nest deliver value for money for members and taxpayers?

Members

The available evidence and analysis gathered as part of the review has confirmed that Nest provides value for money for its scheme members.

Nest provides high standards of governance and administration which translates into members being able to benefit from the same service offering irrespective of the contributions from members or employer size. Nest is not authorised to provide advice but provides support to its scheme members at retirement using appropriately tailored information and simple processes. Nest provides an accessible online account for members to use which offers multiple channels of help and support.

-

members benefit from moderate investment performance, low-volatility and good quality governance (See Annex 5 - Corporate Adviser Pensions Average returns). This includes other investment fund options available to members, beyond the default fund

-

Nest’s member communications are clear and easy to understand. However, there could be some improvements to engagement regarding retirement outcomes

-

member charges are broadly comparable with the costs, charges and benefits of other Master Trusts in the AE workplace pensions market (see Annex 4). Once Nest is self-financing there will be scope for Nest, working with DWP, to look at the appropriate charging level and structure; however, recognising it will be important to understand and mitigate any unwelcome impacts on market competition

Taxpayers

Nest is expected to be financially sustainable over time and to repay the loan in its entirety which should eliminate the cost to the taxpayer other than the opportunity cost of the patient capital provided. AE and Nest policy interventions, however, were designed to address long term fiscal consequences of retirement under-saving, thereby, helping to mitigate cost consequences for future taxpayers.

DWP and Nest have put in place effective governance alongside Nest’s internal controls to ensure risks are managed effectively and which recognise the unique position of the Nest trustee and its role as a public corporation.

The role of Nest Insight

The review has found that Nest Insight has played a key role in improving the research and evidence base for the AE/DC generation. However, some concerns were raised about its role, funding and whether or not the services are already - or could be - provided by others in the industry. Nest Insight provides a positive service to the AE workplace pensions market. Its access to the Nest member data, combined with its high-quality research-orientated approach means its outputs are valuable. Given, however, its value in operating with and for the AE market there is a question about its naming convention/branding, its funding and its location within Nest.

2.3 Recommendations on how the organisation could further improve

Nest’s role – future strategy

i) The Nest Trustee is unique in having to balance the primacy of its fiduciary role, with Nest’s role as a public corporation. The corporation and scheme risks will likely become more complex as Nest matures. This creates tensions, around areas including risk, costs and reputation. Nest’s relationship with DWP and HMT officials and the wider workplace pensions market is key in terms of managing tensions through effective information flows, feedback and appropriate controls.

Building on the current working relationships and governance arrangements Nest and DWP should discuss and develop a more formal and appropriate approach, at the right point, to jointly explore the future strategic vision for Nest and ensure that information flows/controls are operating as effectively as possible to support this.

Governance and internal controls

ii) It is recommended that the Nest trustee board consider carrying out a wider review on the role of both its member and employer panels to ensure their terms of reference and objectives remain appropriate. (mindful of the legal framework within which the panels operate).

Member Engagement

iii) The Trustee should consider strengthening retirement outcome strategies and communications with the aim of managing Nest members’ expectations and improving member engagement with later life planning.

The Nest member engagement strategy refresh provides a clear opportunity to make headway, recognising longevity, levels of retirement under-saving and financial literacy levels.

Self-employed

iv) As part of Nest’s engagement with its scheme members on retirement saving and saving outcomes, there is a clear role for strengthening engagement with those members who identify as self-employed. There has been a significant decline in pension saving among self-employed individuals [footnote 9]. Improving retirement saving among the self-employed is a wider public policy issue. It is recommended, however, that Nest uses the opportunity of its member engagement strategy refresh to identify learnings/insights to inform and maximise effective engagement strategies with self-employed members.

Investment strategy

v) With growing assets under management, Nest should continue to use its size to negotiate lower investment charges and fees and drive down its investment costs. While recognising its own and other schemes’ fiduciary duties, Nest could use its scale and expertise to open-up private markets, within the charge cap, for all schemes by sharing lessons-learned and negotiating Defined Contribution-specific arrangements.

Small pots

vi) The Trustee should consider making changes to Nest rules to maximise opportunity to work towards solutions.

It is recommended that the Nest Trustee considers actively participating in the member exchange pilot, recognising this would necessitate a Rule change to the Nest scheme Order and Rules in order to do so. This could help support the AE market in exploring and working towards potential market-based solutions.

Nest Insight

vii) The future role of Nest Insight is something that Nest, working with DWP, is recommended to consider. In particular, a review of the location, governance, branding and sources of funding of Nest Insight, including to establish whether it remains appropriate for Nest Insight to remain (part of) a public sector body.

3. Has Nest achieved and is it delivering on its original objectives?

3.1 Background

The 2006 Pensions White Paper, adopted the Pension Commission’s proposed approach of an integrated package of reforms: a new pension saving scheme, along the lines of the Commission’s proposed National Pension Savings Scheme, and reform of the state system with the aim of “providing a foundation for private saving.”

The first part of this package of reforms was provided for in the Pensions Act 2007. This provided for reforms to the state system and established a Personal Accounts Delivery Authority (PADA) to enable the Government to harness private sector expertise in preparatory work for the new scheme. The Pensions Act 2008 introduced new duties on employers to automatically enrol jobholders into, and to contribute to, a qualifying workplace pension scheme, and also provided for the introduction of the duty for the Secretary of State to establish a new pension saving scheme. This was initially called “personal accounts” but is now called the National Employment Savings Trust (Nest). The EU provided public approval to set up Nest on 6 July 2010 (required under State Aid rules).

The Nest pension scheme was launched in 2011 (to support AE from 2012) following an independent review “Making Automatic Enrolment Work Review in 2010” which examined the role of Nest. It concluded Nest was necessary, in order to ensure universal access to a workplace scheme at an acceptable cost to the member. Nest was given clear aims, which are:

- to provide a basic pension scheme to employers and workers affected by automatic enrolment

- to complement the market by being targeted at groups at risk of being poorly served by the existing industry

- to achieve the scale needed to be financially sustainable over time, delivered at nil cost to the taxpayer and low cost to members

Nest is the only pension scheme that has a Public Service Obligation (PSO) to accept any employer that wants to use Nest to fulfil their AE duties. It is also required to admit a self-employed person aged at least 16 and under 75 who is working or ordinarily works in the UK and who is not a qualifying self-employed person. The PSO, which requires Nest to offer a workplace pension irrespective of profitability, remains necessary for the ongoing success of AE and to meet the government’s strategic objective to ‘increase saving for, and financial security in, later life’.

Stakeholders, including pensions providers, employers and member representatives were clear when interviewed that the PSO should remain and Nest is best placed to meet the obligation. One provider believed it could offer the same or a similar service to Nest. It acknowledged that the introduction of Nest had been positive in terms of requiring it to revalue and reposition itself in the market and contended it could fulfil the role of Nest. However, there appeared to be little appetite for Nest’s role to be undertaken by anyone else.

3.2 Is Nest sufficiently focussed on its member target market?

The pensions landscape has changed considerably since 2010. The supply side has changed as a result of labour market changes, employer costs and automatic enrolment resulting in a rapid emergence of DC schemes. This is the fastest growing sector in the workplace pensions market, albeit it is still in its infancy.

AE was designed to extend pension saving to lower to moderate earners and people with interrupted working lives and Nest was set up to enable this to happen. They have done this effectively.

There was a common message, across the pension providers, employer and member communities, that Nest has compensated for a market failure by providing a service to employers in line with its first objective. Due to volumes, this failure would not have been corrected in its entirety by other providers. For example, Nest has maintained its position as a provider for small and micro employers in sectors, including health and social care, that some in the industry would not have seen as profitable to serve.

Nest is committed to meeting its original aims and objectives. It has remained fully open to all employers without delays or interruptions allowing 881,000 employers [footnote 10] to meet their employer duties on time/along with identifying ways of evolving. The majority of employers that have accessed Nest since inception are small to medium sized by employee numbers [footnote 11]. Going forward, it will be important for Nest and DWP to explicitly monitor the types of employer that are being onboarded to ensure that the Nest scheme remains sufficiently focussed on its target market.

Nest has proved that the low-cost digital delivery of Master Trust pension schemes works. Nest’s digital first model for its members provides members with their own online access through which they can see their current pot value, make additional contributions, select their investment fund and change details such as their address or beneficiaries.

3.3 Is Nest complementing the Automatic Enrolment and Defined Contribution market – or getting ahead of the market?

Nest has focussed on its target market providing a basic workplace pension scheme to employers and workers affected by AE. It was designed to complement the market by targeting the group at risk of remaining otherwise poorly served or excluded from pension saving, while helping raise the standards more generally in the wider market (e.g. governance, charges, default investment strategy). Some of the Master Trusts that operate in the same market have historically experienced competition in some of the sectors they serve. The supply gap Nest was required to fill was not limited to employers of a certain size. In doing so it would have limited employers’ options to meet their AE duties. It also means that the cross-subsidy in operation within Nest works effectively. This is explored further in Chapter 4.

The success of Nest is demonstrated by its membership which at 31 March 2021 stood at 9.9 million members. In addition, 881,000 employers had accessed the Nest scheme between launch and 31 March 2021. Nest’s assets under management had increased to £17.6 billion by March 2021 from £9.9 billion at March 2020 [footnote 12].

3.4 Conclusions

The review has found that Nest Corporation and the Nest scheme is an effective and important member of the pensions market and is meeting its primary objective which was to provide a basic workplace pension scheme to employers and workers affected by Automatic Enrolment.

Nest is recognised by the industry as a key player and is largely complementing the market rather than seen as a competitor, targeting groups at risk of being poorly served by the existing industry. Work should be done to evidence this clearly going forward and, in particular, the new employers onboarded by Nest.

4. Does Nest as an organisation deliver value for money for its scheme members and the taxpayer (if appropriate)?

Assessing value for money for scheme members is an evolving area in the industry and for the Department. Value for money is a subjective and, therefore, complex concept given differences in organisations and what users consider as value for money. The Financial Conduct Authority (FCA) and TPR have recently published a joint discussion paper inviting views on a holistic approach to assessing value for money consistently across all FCA and TPR regulated schemes [footnote 13]. The feedback and outcomes will be published early in 2022.

The review focussed on:

- Trustee governance and engagement with members

- costs and charges

- investment performance

Alongside this, the review also considered:

- the issue of deferred members with small pots

- the role of Nest Insight

4.1 Trustee governance and engagement with scheme members

Digital first service

Nest’s website displays information about its charges, investments, performance, policies and operation. As a public corporation Nest is required to publish its Annual Report and Accounts setting out its performance and management of the scheme.

Nest provides information on its website that is over and above the documents that scheme providers are required to make publicly available.

Nest Member and Employer panels

The Pensions Act 2008 required Nest to establish an Employers’ Panel and a Members’ Panel. This was to ensure that Nest’s participating employers and scheme member voices were heard and taken into account. There is a responsibility on the Nest Trustee to consult the panels on its Rules and relevant service delivery matters.

The Panels also act as a sounding board for ideas and recommendations on key issues affecting Nest’s participating employers and members. The review established that both panels have a good working relationship with the Board and posed a few challenges mainly in the operational areas. The Chairs of both panels have been previous members of the Board. This raises a potential question of whether the panels are sufficiently independent to provide challenge and bring a sufficiently healthy diversity to the member and employer voices.

Nest has clearly changed since inception and is now in a more stable or “steady” state. It would, therefore, be reasonable for the Nest Trustee Board to consider and carry out a wider review of both panels to determine whether or not the original objectives and roles remain appropriate or if changes are required – working with DWP as appropriate recognising the panels have a statutory basis under the Pensions Act 2008.

Scheme member engagement

Nest service provides high standards of governance/administration – members benefit from the same service offer irrespective of contributions/employer size. Members have access to online accounts, call centre support and postal communications.

It is recognised that levels of understanding of and trust in pensions is traditionally low. Discussions with Nest explored how it communicates with members on adequacy of its likely retirement outcomes. From 2011 to 2019 Nest had focused on implementation. Nest explained there had been unprecedented operational challenge during the staging period, with a need to design for uncertain demand as well adapt for different types of employers - from large corporates with experience of pensions to potentially hundreds of thousands of micro employers with little experience. There was a need to protect operational capacity (call centre demand). Retirement saving was new for many in the AE generation.

Going forward, Nest is reviewing its member strategy and how it approaches these matters. Nest has focused and has been building initial trust and confidence among its members using several approaches e.g. proactive communication through member campaigns which focused on stimulating online registration as a gateway to building an engaged relationship at low cost in the future. This approach saw registrations almost double (15% to 28%) from 2018 to March 2021 [footnote 14].

One area specifically explored as part of the review was whether Nest members, given that they tend to be low earners on average, were sufficiently engaged in terms of retirement outcomes/later life financial planning. I am concerned that members, knowing they have a Nest pension and possible entitlement to a State Pension, may believe that their income needs in retirement will be met. In addition, their expectations of their retirement outcomes may be unrealistic.

Within the context of the Trustee fiduciary responsibilities, the Trustee should consider strengthening retirement outcome strategies and communications with the aim of improving Nest member engagement with later life planning.

The Nest member engagement strategy refresh provides a clear opportunity to make headway, recognising longevity, levels of retirement under-saving and financial literacy levels. Nest should also take into consideration market innovation and best practice operated by other schemes in the market. Success stories shared included one scheme that was able to increase member engagement from about 20 members in 2019 at a face-to-face event to broadly 3,300 at a virtual member forum in 2020. Further engaging with members on what they wanted from the forums further increased attendance in 2021 to 9,600.

Self-employed members

Article 19 of the Nest Order [footnote 15] allows Nest to admit workers in certain circumstances (including a self-employed person) where AE obligations do not apply. Indeed, as the 2010 EU commission State Aid letter [footnote 16] states, Nest’s Public Service Obligation includes that “the trustee must also accept those who are not eligible for auto-enrolment but nonetheless wish to save, such as self-employed individuals and those whose earnings are below the minimum eligibility level.”

The self-employed population is currently (Autumn 2021) around 4.3 million people [footnote 17], comprising a diverse population working across a wide variety of sectors and occupations. Income levels and wealth and assets ownership, therefore, vary widely and not all the self-employed population are under-saving for retirement. DWP analysis shows that only about 16% of self-employed people were saving into a private pension in 2019/20 [footnote 18] . This is partly because pensions can be seen as inflexible and other saving products are more appropriate. In addition, some self-employed believe they can realise value from their businesses.

Nest currently has around 15,800 self-employed members [footnote 19]. This has grown from around 7,000 [footnote 20] in 2018 and has levelled off during the Covid-19 pandemic. However, it still remains a low proportion of their total membership. Actively engaging the self-employed was not part of the communication work programme with Tata Consultancy Services this year. There is a recognition for the value and importance of member engagement, generally and in particular with the self-employed. Given Nest’s size, there is a role for Nest to play in innovation in this area.

While it is clear from the stakeholder interviews that engaging the self-employed is a public policy issue that needs to be addressed, it is recommended that Nest uses the opportunity of its member engagement strategy refresh to identify learnings/insights to inform and maximise effective engagement strategies with self-employed members.

4.2 Costs and charges

Member charges

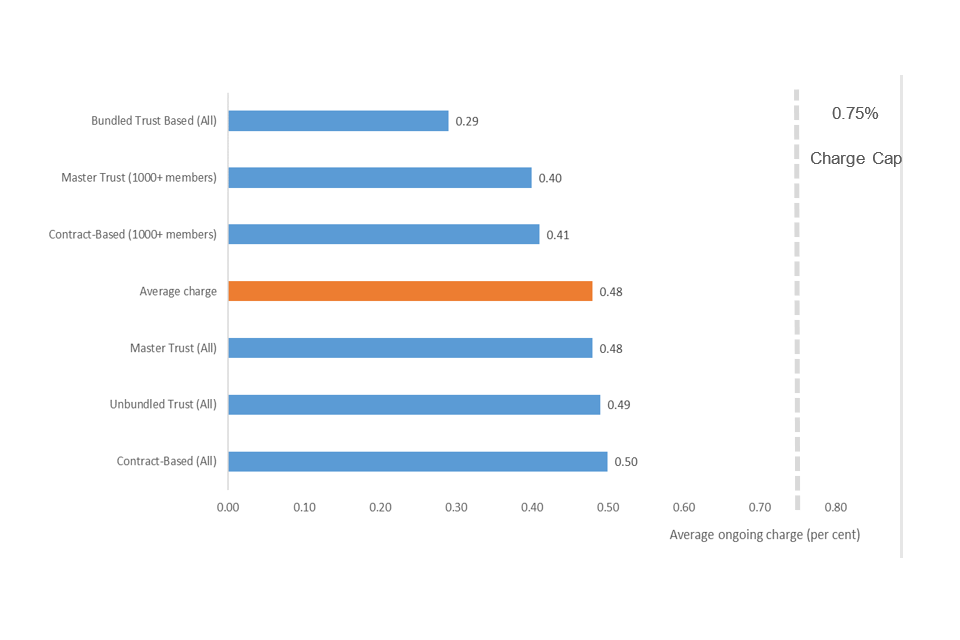

Nest has a combination charging structure which involves a 1.8% contribution charge on all contributions to the pot and a 0.3% annual management charge on the pot value [footnote 21]. This roughly equates to 0.5% [footnote 22]. The Pension Charges Survey 2020 found the average charge for members in qualifying scheme was 0.48% [footnote 23]. Nest charge near the average charge and their Master Trust competitors (Annex 4).

Figure 1 shows the average ongoing charges paid by members across the different types of schemes - Nest’s average member charge of 0.5% is slightly above the average of 0.48% across all scheme types, but significantly lower than the charge cap. Note that, unlike some other providers, Nest does not charge its employers.

Figure 1: Average ongoing charge paid by member of each scheme type [Source: Pension Charges Survey 2020, DWP]

Nest has the same pricing for all members [footnote 24] whereas other providers may use bespoke pricing. This pricing may be based on a number of factors, such as employer size or investment choice. Therefore, there may be some employers who benefit from Nest’s capped pricing for a “standard” service offering, while other employers will benefit from bespoke pricing with more tailored services – which they can pass on to their employees.

With reference to Table 1 in Annex 4, members with small pots or those with low levels of monthly contributions may find the charging structure one of the best available to them. In addition to this, deferred members are less likely to see their pot significantly eroded. Conversely, due to the 1.8% contribution charge that Nest operates, members with higher monthly contributions may find the Nest charging structure higher than the average DC scheme in the AE market, in comparison to a provider who charges a flat fee.

There is also no risk any pot at Nest will be charged out and fall to £0 whereas, under current legislation, this is possible for deferred pots with some providers that charge a flat fee. The forthcoming legislative changes introducing the de minimis on flat fees would limit the erosion of pots of £100 or less [footnote 25]. This may help reduce the difference of the impact of different charging structures on deferred pots worth less than £100.

In summary, it is important to recognise that Nest’s charging structure is also linked to its funding arrangements and expenditure needs. Each charging structure in the AE market will present different impacts for members. The charging structure will be relevant to the scheme business model, the maturity of the scheme and financial sustainability. Currently, Nest’s member charges are, on average, broadly comparable with the average costs and charges for other Master Trusts in the AE workplace pensions market. Annex 4 provides a comparison for key Master Trusts in the market.

Employer charges

Nest does not charge employers joining or ongoing administration fees [footnote 26]. It has an obligation to take on all employers who choose to use the scheme and, therefore, provide an opportunity for employers to enrol their employees in a quality and low-cost scheme.

The available evidence on how employers choose a scheme is limited. Qualitative interviews with newborn employers found regardless of previous experience, it was rare for employers to engage in extensive whole of market reviews of options: they usually sought just enough information to become compliant [footnote 27]. For these newborn employers the most commonly used provider was Nest, although some opted for a different provider.

Some of the reasons why newborn employers choose Nest included:

- Nest was seen as the “Government pension scheme for AE” and an obvious safe option

- Nest didn’t charge set up fees which appealed to new businesses in their early days who were concerned about cash flow. Lack of fees also appealed to employers who had lower enthusiasm for AE as they saw it a lower investment in something they viewed as unnecessary

- the well-known reputation of Nest or previous experience with them

- the compatibility between the employer’s and Nest’s payroll software

Therefore, Nest provides significant value for money for employers. In contrast other providers can choose which employers to serve and some will price to select against certain types of employer.

4.3 Investment strategy

At 31 March 2021, Nest had £17.6 billion assets under management [footnote 28]. It provides a default fund for each year in which they expect a member to retire and then manage these assets based on member’s age and market performance.

As of 31 March 2021, around 99% of Nest’s members were invested into their retirement date funds - these funds automatically phase members’ pots based on the period to their chosen retirement date [footnote 29]. In addition, Nest provides 6 other funds that members are able to choose from - High Risk, Ethical Growth, Pre-retirement, Lower Growth, Sharia, Guided Retirement. These diverse options are set out clearly on their website [footnote 30].

Irrespective of the funds a member may choose, Nest is committed to investing responsibly including in companies who they encourage to meet high standards of environmental, social and corporate governance. A particular focus is on climate change with Nest committing to help their investments reach net zero emissions by 2050. 73% of Nest’s members want their pensions to be invested responsibly [footnote 31].

More recently, Nest has been diversifying its portfolio further by moving more into illiquid assets including renewable energy infrastructure and planning growth private equity. With growing assets under management, Nest is a market leader for Master Trusts in innovative investment.

As a market leader, Nest could consider sharing its experience in relation to illiquid investments with the wider market, maximising opportunity to share learning and best practice.

Investment Costs

The Nest Investment strategy has evolved over time and will continue to do so. Nest has identified that, in the end, investment costs will become its single largest cost. Identifying an approach that optimises risk and returns, whilst keeping within an affordable cost envelope, limiting impact on member charges, as the scheme gets larger is, therefore, critical.

Nest has successfully used its present and predicted scale to negotiate hard on fund manager fees to provide members an affordable but high-quality investment proposition.

Nest should continue to use its scale to negotiate effectively across all asset classes, while balancing risks versus returns. This includes opening up new, affordable asset classes for defined contribution pension schemes via negotiation.

Investment returns

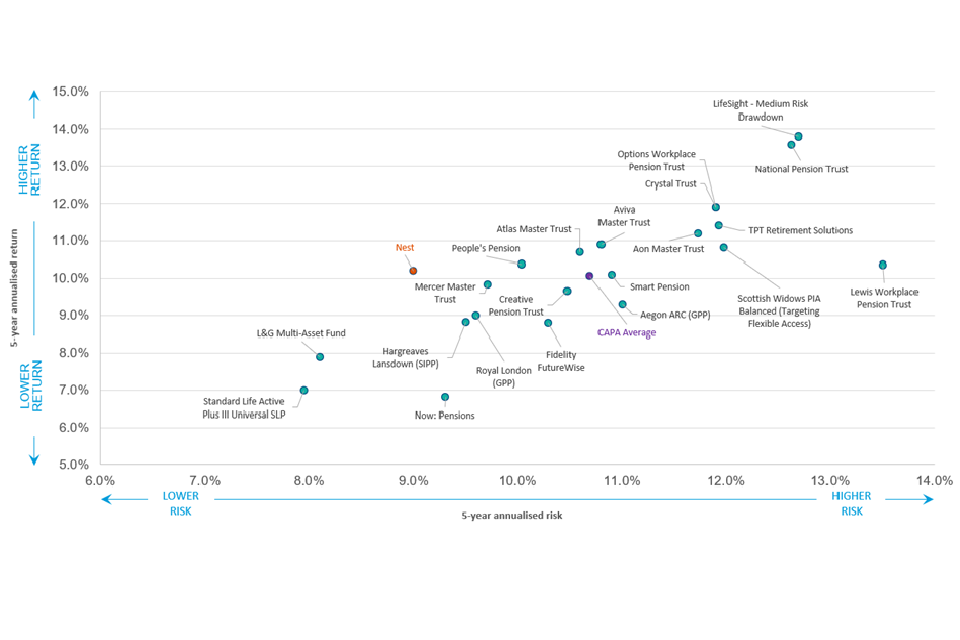

Based on the Corporate Adviser Pensions Average (CAPA) Index as at 30 June 2021 [footnote 32], Nest’s returns were similar to the CAPA average and slightly outperformed other master trusts but, additionally, with a lower than average risk. The chart in Annex 5 summarises this. At 30 June 2021, Nest’s average gross annualised return was 10.2% (annualised volatility 9%). The CAPA average was slightly lower at 10.1% but with a higher annualised volatility of approximately 10.7%.

As Nest evolves its investment strategy, it continues to evaluate different cost options and how these effect net returns to its members. This work will continue to balance the need to optimize member returns whilst managing its loan repayment commitments.

4.4 Deferred members with small pots

The significant and projected growth of deferred members with small pots in the AE market presents a systemic challenge for the pensions industry, representing costs and disadvantages for scheme members. Some providers try to match existing inactive pots with active pots when an individual returns to the scheme. Nest operates a ‘pot for life’ approach as part of its design: this means when a member is enrolled into the scheme, if their data matches that of an existing member, they are automatically merged into a single pot. The intention is to help keep costs low and offer a better customer experience.

Nest is playing an active role in discussions with other Master Trusts about the feasibility of consolidating deferred small pots across different providers via a “Member Exchange” mechanism. However, it is not a participating member of a potential proof of concept trial of that mechanism. A number of interviewees raised concerns that if Nest, as the largest AE pension provider, decide not to actively participate in the proof of concept trial this could impact the motivation and behaviour of other market players – whereas Nest’s involvement could help give greater impetus behind the project.

Participation in the member exchange would require the Nest trustee to be able to transfer members’ benefits out of the scheme without their consent if the feasibility study supports this. There are currently no explicit provisions in Nest’s Order or Rules allowing the trustee to allow bulk transfers out without consent. The trustee is invited to consider making these changes to the Nest Rules, following consultation, to maximise the opportunity to work towards solutions.

This is a complex Trustee decision, which applies to all Master Trusts involved in the member exchange pilot, taking account of various factors including

- member opportunity and net benefit value derived from combining deferred pots (including reducing the totality of costs in the system, which could improve overall member value, potential improved engagement and confidence in the AE system)

- ember detriment and the variation in scheme charging structures

- the detriment to those members who are cross-subsidising smaller pots

- tax implications on members whose pots are combined

- current oversight from TPR

4.5 Nest Insight

The review also looked at the work of Nest Insight. The Nest Corporation is legally and wholly indivisible from it. Any work it undertakes must fall under the formal vires of the Corporation and be managed within the same governance and compliance frameworks around issues such as data protection and sharing, partnership formation and procurements as any other part of Nest.

Nest Insight is seen as an important part of Nest’s ethos. In discussions with Nest four distinct areas were identified on how it adds value:

- saver outcomes: Nest exists to provide better retirement outcomes for savers and believes through Nest Insight there is a lot which can be learnt from others about how best to do it

- ethos: Nest was born out of a public policy programme and the application of academic insight. Nest believes it has a social purpose and a value of transparency. It acknowledges members will not always be saving with it and believes it should do this work and disseminate information

- demand: Nest is approached by people because they are interested in what Nest has done and in ways of collaborative working in the future. Nest feel the saver population is unusual and under-researched in a pension’s context

- reputation: Nest Insight enhances Nest’s reputation and builds trust in the brand to do this kind of work

Nest Insight operates under its own sister-brand to the broader Nest and acts according to a set of policies and principles that make its work programme distinct from the rest of Nest. In particular:

- all its research is published and made widely and freely available

- Nest does not benefit commercially from insights generated by Nest Insight work – research is only shared once completed and ready for publication

- Nest Insight raises core funding to cover the costs of people and other core costs, and project-specific funding to support individual research projects. It does receive both a financial contribution to costs, and in-kind support from Nest. Around 80% of Nest Insight’s income is derived from external funding and the call on Nest is projected to reduce over the coming years

The future role of Nest Insight is something that Nest, working with DWP, is recommended to consider. As part of the input into the review there was a perception that the current arrangements may not be optimal in terms of its independence and impartiality. However, it was also recognised that its current location within Nest provided a valuable link to a large member data source. A review could, therefore, consider the location, governance, branding and sources of funding of Nest Insight, including to establish whether it remains appropriate for Nest Insight to remain (part of) a public sector body but with due regard to the access of a large data source.

4.5 Delivering value for money for taxpayers

DWP and Nest have put in place effective governance and internal controls to ensure risks are managed effectively and which recognise the unique position of the Nest Trustee and its role as a public corporation.

An issue in relation to unauthorised retention payments has recently been identified which has delayed the publication and has led to the qualification of the Corporation Annual Report and Accounts on an issue of regularity [footnote 33]. As part of the review process it was clear that the Board is very cognisant of this and has provided DWP with assurances that there will be no repetition in the future.

Nest is expected to be financially sustainable over time and is forecast to repay the taxpayer loan by 2038. Therefore, there should be no cost to the taxpayer other than an opportunity cost from Nest being provided with patient capital, which presumably could have been deployed elsewhere. AE and Nest policy interventions, however, were designed to address long term fiscal consequences of retirement under-saving, thereby, mitigating cost consequences for future taxpayers.

Nest’s PSO costs and risks are now known. This may mean that the costs associated with the PSO are better understood and should reduce or stabilise over time. Nest probably has a greater share of deferred members with small pots, however, and potentially a greater risk of non-compliant employers which brings additional costs and risks. This could have an impact on value for money to the member and/or taxpayer.

Following a major re-contracting exercise Nest is in the process of moving to a new supplier for member administration services from 2023. It will, of course, be important that the Board considers how to maximise and make the most of corporate efficiencies arising from this transition and how to manage and mitigate the associated risks.

4.6 Conclusions

Nest members benefit from online services and customer support, as well as a clear and easy to understand website.

Nest provides value for money for scheme members through high standards of governance and transparency. Its charges and investment returns are in line with the average in the Master Trust market, and in line with the objectives under which it was set up. Of course, given the role of the subsidy and its wider impact on the market, it remains important for DWP to keep these areas under review.

Nest should consider:

- reviewing the purpose and role of the employer and member panels, mindful of the Pensions Act 2008 provisions

- how to better engage with members in terms of retirement outcomes/later life financial planning.

- how to better engage the self-employed

- how to continue to drive efficiencies and manage investment costs given its scale. This has recently been done for administration costs

- consider sharing its experience in relation to private markets with the wider market, as a market leader, maximising opportunity to share learning and best practice

- how to work with the rest of the industry in better supporting the Small Pots member exchange pilot (and to consider making changes to the Nest Rules, following consultation, to maximise the opportunity to work towards solutions, following consultation)

- with DWP, reviewing the location, governance, branding and sources of funding of Nest Insight, including to establish whether it remains appropriate for Nest Insight to remain (part of) a public sector body.

5. Recommendations

5.1 Nest’s role - future strategy

The Nest Trustee is unique in having to balance the primacy of its fiduciary role, with Nest’s role as a public corporation. The Corporation and scheme risks will likely become more complex as Nest matures. This creates tensions around areas including risk, costs and reputation. Nest’s relationship with DWP and HMT officials and the wider workplace pensions market is key in terms of managing tensions through effective information flows, feedback and appropriate controls.

Building on the current working relationships and governance arrangements Nest and DWP should discuss and develop a more formal and appropriate approach, at the right point, to jointly explore the future strategic vision for Nest and ensure that information flows/controls are operating as effectively as possible to support this.

5.2 Governance and internal controls

It is recommended that the Nest Trustee Board consider and carry out a wider review of both its member and employer panels and ensure that their terms of reference and objectives remain appropriate going forward (mindful of the legal framework within which the panels operate).

5.3 Member Engagement

The Trustee should consider strengthening retirement outcome strategies and communications with the aim of managing Nest members’ expectations and improving member engagement with later life planning.

The Nest member engagement strategy refresh provides a clear opportunity to make headway, recognising longevity, levels of retirement under-saving and financial literacy levels.

5.4 Self-employed

As part of Nest’s engagement with its scheme members on retirement saving and saving outcomes, there is a clear role for strengthening engagement with those members who identify as self-employed. There has been a significant decline in pension saving among self-employed individuals.

Improving retirement saving among the self-employed is a wider public policy issue. It is recommended, however, that Nest uses the opportunity of its member engagement strategy refresh to identify learnings/insights to inform and maximise effective engagement strategies with self-employed members.

5.5 Investment strategy

With growing assets under management, Nest should continue to use its size to negotiate lower investment charges and fees and drive down its investment costs. While recognising its own and other schemes fiduciary duties, Nest could use its scale and expertise to open-up private markets, within the charge cap, for all schemes by sharing lessons-learned and negotiating Defined Contribution-specific arrangements.

5.6 Small pots

The Trustee should consider making changes to Nest rules to maximise opportunity to work towards solutions.

It is recommended that the Nest trustee considers actively participating in the member exchange pilot, recognising this would necessitate a Rule change to the Nest scheme Order and Rules in order to do so. This could help support the AE market in exploring and working towards potential market-based solutions.

5.7 Nest Insight

The future role of Nest Insight is something that Nest, working with DWP, is recommended to consider. In particular, a review of the location, governance, branding and sources of funding of Nest Insight, including to establish whether it remains appropriate for Nest Insight to remain (part of) a public sector body.

6. Forward Look

The scope of this review was limited to three specific areas. However, it may be helpful to provide some observations on issues the DWP may wish to consider with Nest going forward.

6.1. Nest, relatively speaking, is still in its early stages and currently is achieving what it set out to do. However, as the scheme matures there will be some significant challenges and timescales and factors DWP should consider in relation to Nest’s continuing emerging role in the pensions market:

- what will be the future role of Nest?

- when is the appropriate time to look at this and what are the key factors DWP should consider when looking at this issue?

6.2. Nest was set up to address a supply-side market failure within the pension accumulation market. As part of the review some input was offered by Nest and stakeholders about the potential role of the Nest scheme in relation to other markets, in particular concerning the retirement solutions/decumulation market. This area did not form part of the review and has, therefore, not been looked at in detail, consistent with the review’s terms of reference.

There is an unresolved question concerning the provision of retirement pathways for Nest members, recognising they do not have the same opportunity as others to benefit from pension freedoms, without making the active choice to change scheme. As part of DWP’s consideration of both the decumulation offer within trust-based schemes and this review’s recommendation concerning the future vision for Nest, it will be important to address this question at a suitable time, mindful of the changing needs and demand of Nest members over time and the importance of supporting competition.

6.3. As Nest matures and becomes self-financing, its member charges will need to be re-assessed:

- What would be the appropriate charge structure and level?

- What is the right timescale to look at this?

There are a number of factors that would need to be considered including competition impacts and member value for money.

7. Annex 1: Terms of reference/scope of the review

7.1 Background/Context

1) AE has successfully extended pension saving to millions of today’s workers. It has been based on widespread consensus. Employers, pension scheme providers and private sector delivery partners throughout the supply chain have been central to its success.

2) Nest Corporation, the Trustee that runs the Nest pension scheme, is a Public Corporation set up in 2010 to support the Government’s AE programme. It receives financial support from Government in the form of a loan to cover its administration costs.

3) Nest has a broad membership spread throughout the UK. It mainly serves the AE target population of lower earners who are often on short term employment contracts and who work for small to medium enterprises. Nest is the only pension scheme that has a Public Service Obligation (PSO) to accept any employer that wants to use Nest to fulfil their AE duties and self-employed individuals who choose to use the scheme.

4) The PSO which requires Nest to offer a workplace pension irrespective of profitability, remains necessary for the ongoing success of AE and to meet the Government’s strategic objective to ‘increase saving for and, financial security in, later life’.

5) In 2010, Nest was given clear aims and objectives following detailed consideration of its role by the Pensions Commission, Government, external stakeholders and Parliament. These were:

- to provide a basic pension scheme to employers and workers affected by automatic enrolment

- to complement the market by being targeted at groups at risk of being poorly served by the existing industry

- to achieve the scale needed to be financially sustainable over time, delivered at nil cost to the taxpayer and low cost to members

7.2 Purpose and scope

6) The purpose of this independent review to DWP ministers is to provide a robust challenge to, and assurance of Nest Corporation with regard to its delivery of its original objectives and current functions. The scope of the review is to consider:

- to what extent Nest has achieved/is delivering on its original objectives

- does the organisation deliver value for money to members and the taxpayer (if appropriate)

- make recommendations on how the organisation could further improve

7) The scope of the review will be limited to these three areas. The review should not consider future accumulation/decumulation services.

7.3 Approach/Methodology

8) The Independent review to DWP Ministers will be conducted on behalf of the Secretary of State for Work and Pensions and will be designed to be proportionate, challenging, transparent, and delivered at pace. To ensure the objectivity of the review, the Reviewer has been appointed from outside of the Department’s Arm’s-Length Bodies Partnership team and Nest Corporation.

9) The review will provide evidence-based advice (the evidence and data gathering process where relevant will be in accordance with accepted standards and best practice) on these three areas.

7.4 Outputs and timescales

10) The Review will begin in mid-September and report in December 2021. The Reviewer will be supported by departmental staff within the Private Pensions and Arm’s-Length Bodies Directorate.

7.5 Resources

11) The Department will provide all secretariat support for the Review.

8. Annex 2: The review team

8.1 David Bennett – Lead reviewer

David is a Non-Executive Director with over 30 years’ experience in financial services having held a range of senior executive positions in retail banking both in the UK and overseas, including the USA and Australasia.

He was a Director of Alliance and Leicester plc between 2001 and 2008 serving as Group Finance Director and then Group Chief Executive until its sale to Santander in 2008. He has also held a number of executive positions in Abbey National plc, Cheltenham & Gloucester plc, Lloyds TSB Group and the National Bank of New Zealand.

He is currently Chairman of Virgin Money UK plc and of Ashmore plc and a Non-Executive Director of PayPal (Europe) Ltd and the Department of Work and Pensions, which he joined in 2021.

Previous appointments include Chairman of HomeServe Membership Ltd and Non-Executive Director at Together Money, Bank of Ireland UK and easyJet plc. He also acts as an adviser to Fintech businesses and is an independent coach and mentor.

David holds an MA in Economics from Cambridge University. He also attended PMD at Harvard Business School in 1994.

8.2 The DWP secretariat team

The team supporting David included:

Grace Cassidy (Pensions and Later Life Analysis).

Mike Moore (Private Pensions and Arm’s Length Bodies).

Muna Mohamed (Private Pensions and Arm’s Length Bodies).

Sarah Murdock (Private Pensions and Arm’s Length Bodies).

Waheeda Noormohamed (Private Pensions and Arm’s Length Bodies).

9. Annex 3: List of Interviewees

Association of British Insurers

Aviva

Baroness Jeannie Drake

Creative

Department for Work and Pensions

Financial Conduct Authority

HM Treasury

Legal & General Master Trust

Michelle Cracknell CBE

Money and Pensions Service

Nest (members of the Board and Executive Team)

Nest Employer Panel

Nest Member Panel

Now: Pensions

Pensions and Lifetime Savings Association

Small Business Commissioner

Smart Pension

The Pensions Regulator

The People’s Pension

Which?

10. Annex 4: Comparison table for the key Master Trusts in the market

| Provider Name | Members | Total employers | Assets under management | Employee charging structure | Employee charges | Employer charges |

|---|---|---|---|---|---|---|

| Nest (1) | 9.9 million | 881,000 | £17.6 bn | • Annual management charge of 0.3% (value of pot) • Flat rate of 1.8% contribution charge on all contributions Source: Nest website |

~ 0.50% | Free for employers to use Source: Nest website |

| The People’s Pension (2) | 5.3 million | 99,000 | £13.8 bn | • Annual management charge of 0.5% (value of pot) • An annual flat fee of £2.50 • Potential rebate (between 0.1%-0.3%) on some of management charge for savings over £6k Source: The People’s Pension website |

~ 0.50% | £500 + VAT or £300 + VAT for employers who sign up with a business adviser, accountant, bookkeeper or other payroll professional Source: The People’s Pension website |

| Now: Pensions (3) | 1.8 million | Unknown | £2.5 bn | • Annual investment charge of 0.3% (value of pot) • A monthly administration charge of £1.50 (£18 a year) Source: Now: Pensions website |

~ 0.49% | Monthly charge between £12.50+VAT and £36+VAT, dependent on employer (based on number of employees and use of payroll bureau) Source: Now: Pensions website |

| Legal & General WorkSave Mastertrust (4) | 1.2 million | 180 | £12.45 bn | • Bespoke annual management charge per employer | Bespoke/unknown | Specific to each employer and not published. |

| Smart Pension (5) | 0.8 million | Unknown | £1.8 bn | • Annual management charge of 0.3% • A monthly flat fee of £1.25 (£15 a year) Source: Smart Pension website |

~0.46% | £15+VAT employer account charge. BACS fee £30 per month but free if Direct Debit. Additional charges added if employers requestion additional services. Source: Smart Pension website |

| Creative (6) | 0.2 million | 14,281 | £0.32 bn* | • Annual management charge of 0.4% • A monthly flat fee of £2 (active pots) and £1.20 (deferred pots) Source: Creative website |

~0.67 (active) or ~ 0.56% (deferred) |

Monthly charge of £21.50. Source: Creative website |

(1) Nest scheme annual reports and accounts 2020/21. Figures at March 2021.

(2) The People’s Pension Scheme annual report and financial statements for the year ended 31 March 2021. Figures at March 2021.

(3) Now: Pensions Press Release. Figures at June 2021.

(4) L&G Master Trust Press Release. Figures at January 2021 and relate to Mastertrust only.

(5) Smart Pension Press Release. Figures at July 2021.

(6) Corporate Advisor Intelligence. Master trusts and GPP Defaults Report April 2021.

*Assets under default rather than assets under management.

Note: The four largest Master Trusts in the market are currently Nest, NOW, The People’s Pension and L&G.

11. Annex 5: Invest risk vs returns: CAPA index

Annex 5 shows a chart outlining the 5-year annualised risk and return for a pension saver 30 years from retirement across different Master Trusts and Group Personal Pensions. Nest’s 5-year annualised return for a member 30 years from retirement is 10.2%, slightly above the CAPA Index average of 10.1%. Nest’s 5-year annualised risk for a member 30 years from retirement is 9.0%, below the CAPA Index average of 10.7%.

Source: Corporate Adviser Pensions Average (CAPA) Index as at 30 June 2021. 30 years from retirement, 5-year annualised.

-

Nest library: Annual Scheme and Corporation report and accounts, Corporate Plans – Archives. ↩

-

Workplace pension participation and savings trends of eligible employees: 2009 to 2020: DWP 2021 ↩

-

As at 31 March 2021, 881,000 employers have accessed the Nest scheme since inception. Source: Scheme annual report and accounts 2020/21 (page 16). ↩

-

Driving value for money in defined contribution pensions: The Pensions Regulator ↩

-

This compares to a total work force of 32.5 million, making the self-employment 13.1% of this workforce: ONS 2021. ↩

-

Workplace pension participation and savings trends of eligible employees: 2009 to 2020: DWP 2021. ↩

-

Nest MI as at 31 October 2018 . ↩

-

Combination charging structures (such as those used by Nest) and how they compare to percentage funds under management charges is based on modelling by DWP. ↩

-

Consultation: Permitted charges within defined contribution pension schemes. ↩

-

Automatic Enrolment Qualitative Research Newborn Employers ↩

-

Nest funds – Nest Pensions ↩

-

New research finds savers want pensions with strong environmental and social credentials – Nest Pensions ↩

-

30 years from retirement, 5-year annualised ↩