Housing Ombudsman annual report and accounts 2021 to 2022

Published 24 February 2023

Ombudsman’s foreword

This extraordinary year saw an unprecedented volume of casework reach the Ombudsman. Our dispute support team, which assists with early enquiries and complaints that are still with the landlord, handled more than 26,000 cases - far in excess of any previous year. Our service received a telephone call around every 2 minutes and our website had more than 1.3 million hits. These high volumes led to an increase of almost 80% in requests for formal investigation, presenting real challenges for us and we continue to work hard to deliver cases.

If demand remains at these levels, we will shortly be determining around 10,000 cases every year – a four-fold increase. While it will be hard for us to maintain the historically low investigation time we have achieved, they will still be competitive by recent standards as well as meeting our exacting quality standards.

Investigation on this scale provides unparalleled insight for landlords into what’s driving resident dissatisfaction and service failure. The sector must learn from this period. Investigations are evidently more complex with the rate of findings and remedies increasing. That we witnessed a tenfold increase in severe maladministration findings in 2021 to 2022 underscores the seriousness of the issues we are examining.

What generated these volumes? There are several reasons but three are central: the impact of our Complaint Handling Code that led to complaints being properly recorded and handled by landlords, the social housing sector’s continued struggles with repair performance, and sustained media scrutiny and public debate about the quality of social housing that, in turn, increased awareness of and access to the Ombudsman. The pressures on social tenants and landlords, which emerged during this year, have only increased and we expect therefore disputes to remain high in this uncertain climate.

However, it is a testament to the energy and commitment of colleagues that in response to these pressures we again reduced our average formal investigation time to the lowest recorded in recent years and met our related performance indicators. The service is now undergoing a significant expansion and recruiting new caseworkers to manage the higher volumes of casework but it’s important to reflect that during this year our performance was achieved with a less than 1% increase in headcount. However, as we recruit new colleagues at pace, the effects of this surge in casework over such a short period requires careful management this year.

The value of our service should be measured not only by its efficiency, but also by the quality and impact of our work. The openness with which we work - routinely publishing our investigations - and the quality of our casework means it reaches beyond the individual whose dispute we have resolved.

This was the first full year of Complaint Handling Failure Orders, issued when the landlord has failed to handle the complaint in line with our Code, and these should act as a red flag to the landlord that something may not be working in its procedures. There was a step change in the number of orders and recommendations we made to landlords to put things right and learn, to more than 4,500, including a substantial increase in total compensation to more than £600,000. And the number of findings of severe maladministration, accompanied by special reports, not only promoted accountability but also learning across the sector.

This role for the Ombudsman to promote fairness and learning is essential, from our unique, independent perspective. With almost half of the cases we investigated upheld, it is essential landlords proactively learn from them to improve services and prevent complaints arising. This year we published our first annual review of complaints, which revealed where service failure was highest (repairs and complaint handling) and how it was much higher for some types of landlords than others.

The Ombudsman also continues to exercise its new powers. We used them for the first time to conduct a wider investigation into an individual landlord based on investigations into several individual complaints to identify any repeated service failure and themes; and this approach has now been extended to other landlords where learning and improvement in specific complaint areas may be required.

The use of our systemic powers to investigate sector-wide challenges produced reports on cladding, managing agents and, notably, damp and mould. These reports have been accessed more than 7,000 times from our website and more than 2,300 people participated in our events. It is encouraging to see such high engagement levels, which reinforces the importance of this work to provide landlords with essential support to promote professionalism. Further they help landlords consider whether their policies or approach in different service areas could be strengthened. The Complaint Handling Code was also strengthened and is proving an essential tool to promote a positive complaint handling culture.

Indeed, discussion about culture as the debate on quality of social homes unfolded was a constant theme over this period. The House of Commons Select Committee undertook an important inquiry into these issues, to which we submitted evidence. The inquiry made a number of valuable recommendations; and we welcomed the focus on the importance of complaints, our role, and its recognition of areas like our Code and systemic work.

This debate has been accompanied by legislative change that develops our role and remit. The legislation to remove the ‘designated person’ requirement - a key barrier to accessing redress - reached the statute and we worked with the government and Regulator of Social Housing as proposals continue to evolve to change consumer regulation. To support us through these changes we developed our governance, introducing a new Advisory Board to provide an external perspective and challenge.

Social housing offers wonderful opportunities to build lives and communities; despite the challenges, strengthening landlord-resident relationships should be central to the response.

Complaints and an independent, proactive and visible Ombudsman are vital to inform the right culture, values and approach.

Richard Blakeway

Housing Ombudsman

Performance report

Performance overview

The performance overview contains a short summary of our vision, values, strategic objectives, structure, operating environment, key activities during the year, performance and risks.

What we do and how we do it

Our role

The Housing Ombudsman makes the final decision on disputes between residents and member landlords. Our decisions are independent, impartial and fair.

We also support effective landlord-tenant dispute resolution by others and promote positive change in the housing sector.

Our service is free to the 4.7 million households eligible to use it.

Our role is set out in the Housing Act 1996 and the Housing Ombudsman Scheme approved by the Secretary of State.

Our membership

Membership of the Scheme is compulsory for social landlords - primarily housing associations who are or have been registered with the Regulator of Social Housing and local authority landlords. Additionally, some private landlords are voluntary members.

Membership as at 31 March 2022:

- 2,344 member landlords

- 4.7 million households

- 1,916 housing associations with 3 million households

- 329 local authorities with 1.6 million households

- 71 voluntary members with 30,000 households

The Scheme is funded by subscriptions from members and is paid on a per housing unit basis.

Our vision, values and strategic objectives

Our vision:

- improving residents’ lives and landlords’ services through housing complaints

Our strategic objectives:

- making a difference – on individual complaints and across the sector

- deliver a fair and impartial service, resolving complaints at the earliest opportunity

- promote positive change in the sector

- provide a service that is professional, accessible and simple to use

- ensure our service is open and transparent

Our values:

- Fairness: We are independent and impartial; we take time to listen carefully and to understand the evidence

- Learning: We share knowledge and insights to maximise our impact and improve services

- Openness: We are accessible and accountable; we publish information on our performance and decisions

- Excellence: We work together to provide an efficient, high-quality service

Our dispute support and resolution process

Dispute support:

- we support the resolution of complaints while they are within the landlord’s complaints process

Dispute resolution:

- we make the final decision on complaints that remain unresolved through independent, impartial and fair investigation

Our work at dispute support and dispute resolution follows our dispute resolution principles:

- be fair

- put things right

- learn from outcomes

Who we are

Senior Leadership Team

The Senior Leadership Team is the most senior decision-making group and operates collectively, concentrating on strategic issues affecting organisational performance. It also scrutinises and challenges policies and performance with a view to the long-term health and success of the service.

Richard Blakeway - Housing Ombudsman and Accounting Officer

Andrea Keenoy - Chief Operating Officer

Emma Foxall - Deputy Ombudsman (until 31 December 2021)

Joyce Adu - Director of Dispute Support & Resolution (until 30 June 2022)

Gillian Day - Director of Finance & Corporate Services

Rebecca Reed - Head of Insight & Development

Roz D’Cruz - Head of Commercial Services

Jennifer Ryans - Head of Dispute Resolution

Verity Richards - Head of Dispute Support

Tracey Hindley - Head of Human Resources (HR)

Jackie Feeney - Communications Manager

Audit and Risk Assurance Committee

The Ombudsman is assisted by an Audit and Risk Assurance Committee that is independent of the Ombudsman and their executive team. The committee provides independent assurance on the adequacy of the risk management framework, the internal control environment, governance processes and the integrity of financial reporting. It oversees the work of both internal and external audit, and makes an important contribution to ensuring that effective assurance arrangements are in place.

Sue Harvey - Chair (tenure expired 30 Sept 2021)

Tim Leslie - Member and Chair (from 1 Oct 2021)

David Horne - Member

Christina Coker - Member

Vikki Lewis - Member

Advisory Board (from 1 October 2021)

The Advisory Board provides support and advice to the Ombudsman and brings an external perspective to assist in leadership, good governance and the development of the organisation. In particular, the Advisory Board provides advice and support to the Ombudsman on the development and implementation of vision, values and objectives; strategic direction and business planning; and public accountability for the subscriptions received.

Gill Bull

Maureen Corcoran

Michael Rich

Kevin Williamson

Audit and Risk Assurance Committee (ARAC) members of the Advisory Board: Tim Leslie and David Horne

Senior Leadership Team (SLT) members of the Advisory Board: Richard Blakeway and Andrea Keenoy

Panel of Advisors (until 30 September 2021)

The Panel of Advisors was a forerunner of the Advisory Board, recruited on a stakeholder representative model. See the Leadership and Direction section for further information on the move from the Panel to the Advisory Board.

Resident representatives:

Frank Chersky

Elizabeth O’Hara

Phil Morgan

Landlord representatives:

Sarah Thomas

Paul Smith

Kevin Williamson

ARAC representatives: Christina Coker and David Horne

Independent Reviewer of Service Complaints

The Independent Reviewer of Service Complaints supports the Ombudsman in learning from complaints about our service to continually improve our performance.

Adam Sampson

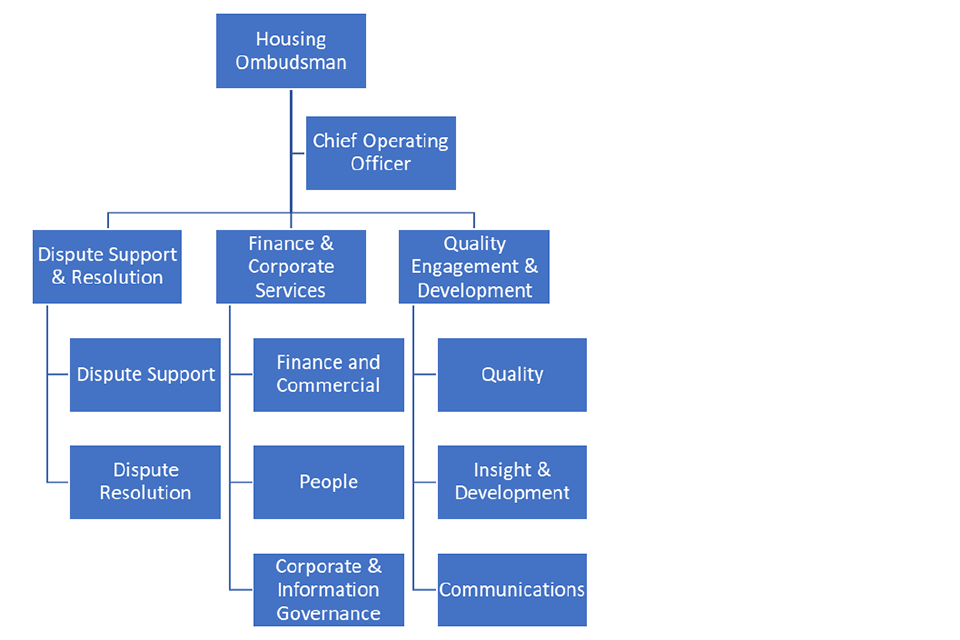

Organisational structure

- Housing Ombudsman

- Chief Operating Officer

- Dispute Support and Resolution

- Dispute Suport

- Dispute Resolution

- Finance and Corporate Services

- Finance and Commercial

- People

- Corporate and Information Governance

- Quality Engagement and Development

- Quality

- Insight and Development

- Communications

Our people

Gender

Mean (average) gender pay gap using hourly pay

| Mean gender pay gap (%) | -4.5 |

- this year’s average is an improvement on last year’s position of –4%

- the mean gender pay gap is the difference in hourly wage between men and women. A negative percentage reveals that on average male employees have lower pay than female employees. The reverse is true for a positive percentage

Median gender pay gap using hourly pay

| Median Gap (%) | 0 |

- the median gender pay gap figure is the difference between the hourly pay of the median male and the hourly pay of the median female

Race and disability

- 24% of the workforce who responded to our Equality and Diversity survey identified themselves as black, Asian, mixed or from other non-white racial groups compared to 13% nationally

- 15% of our workforce who responded to our Equality and Diversity survey considered themselves to have a disability or health condition, compared to a national average amongst working age adults of 21%

The year in review

Our work and our organisation

Impact on individual residents

Handled

26,771

complaints and enquiries (up from 16,337 in 2020 to 2021)

Made

2,618

complaint determinations (up from 2,185 in 2020 to 2021)

48%

of determined cases upheld

Top

three

areas of complaint:

- Repairs: 44%

- Complaint handling: 17%

- Tenant behaviour: 12%

Issued

101

complaint handling failure orders

4,569

orders and recommendations made (up from 3,455 in 2020 to 2021)

Including:

- 2,210 to pay compensation

- 290 to carry out repairs

- 355 to review policy/change process

£619,000

compensation ordered and recommended for residents

We answered a call every

two minutes

Impact on the sector

Presented

81

webinars and other training events over the year to nearly

2,300

delegates

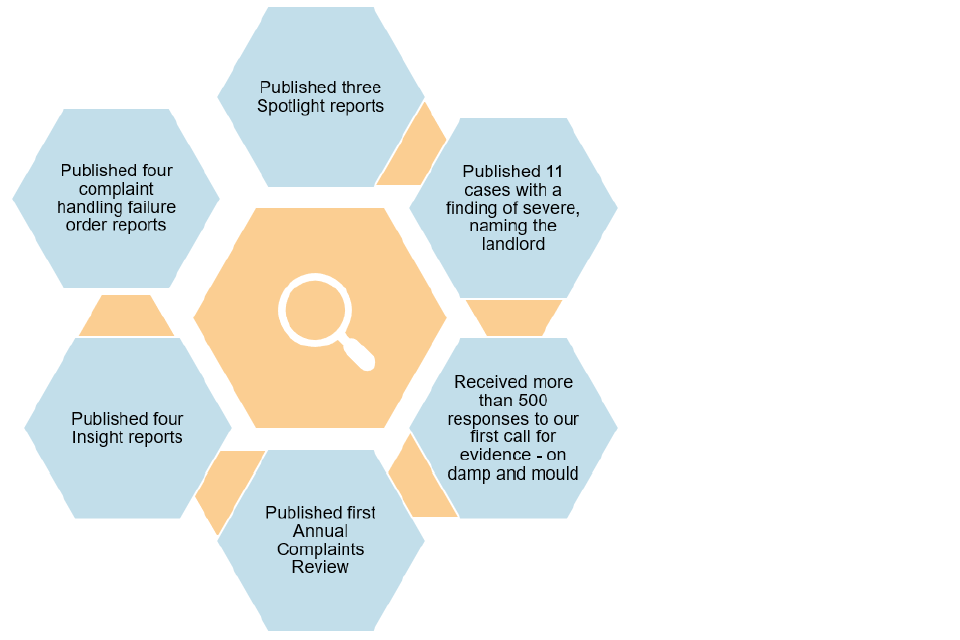

- Published 3 Spolight reports

- Published 11 cases with a finding of severe, naming the landlord

- Received more than 500 reponses to our first call for evidence - on damp and mould

- Published first Annual Complaints Review

- Published 4 Insight reports

- Published 4 complaint handling failure order reports

1.3 million

hits on our website

12,000

downloads of the Complaint Handling Code

7,000

downloads of Spotlight reports

2,400

downloads of the Code self-assessment form

Launched a

new series of podcasts

– four episodes in 2021 to 2022

Held

four

Meet the Ombudsman events, hosted by landlords

Held the first meetings of our new

600

strong Resident Panel

93

landlord performance reports published

Published nearly

1,800

individual decision reports

Organisational change

Held

two

all colleague virtual half day events

and

fortnightly

breakfast briefings throughout the year

Increased our headcount by

0.8%

over the year

Our ‘mean gender pay gap’ is

-4.5%

meaning that on average, women are paid

4.5%

more than men per hour

Facilitated a move to

permanent remote working

for staff who wanted this

The year in review

A month by month view:

- April 2021: We issued our first call for evidence to support a thematic investigation looking at damp and mould

- May 2021: We published a Spotlight report on dealing with cladding complaints, identifying three key lessons for landlords; and our first report on how we used our new power to issue complaint handling failure orders

- June 2021: Our Insight report covering January to March 2021 showed a significant increase in the number of enquiries and complaints received

- July 2021: We launched our first podcast to provide more insight on casework and share best practice, focused on the impact of the pandemic on complaints

- August 2021: We issued our first survey to Resident Panel members seeking their views on their landlords’ complaint handling and awareness of the Ombudsman

- September 2021: We launched a new project to explore accessibility of the complaints system among potentially hard to reach groups

- October 2021: We published our Spotlight report on damp and mould, calling for a zero-tolerance approach by social landlords

- November 2021: We held two Meet the Ombudsman events hosted by landlords, giving their residents the opportunity to put questions direct to the Ombudsman

- December 2021: We started work on developing a new online interactive portal aiming to provide a one-stop-shop for residents and landlords to directly upload information and evidence, and to view the status of their cases

- January 2022: We published three cases with severe maladministration findings, which all shared the lessons learned by the landlords following the decisions

- February 2022: We issued our first report on an individual landlord using our new powers under the Scheme. It followed the volume and frequency of complaint handing failure orders issued and a series of formal investigations

- March 2022: We published our first Annual Complaints Review examining the sector’s performance, plus our refreshed and strengthened Complaint Handling Code

Strategic aims for year

Our 2019 to 2022 corporate plan had the overarching strategic aim of Making a difference - on individual complaints and across the sector. Having spent year one designing our new operating model and year two transitioning to it, year three was about realising the benefits of the new model by increasing our efficiency, our transparency and the volume of learning we share with the sector. By realising these benefits during the year we were able to:

- significantly increase the volume of enquiries and complaints handled and the number of formal investigations issued through more efficient casework processes

- make our work more transparent through the publication of nearly 1,800 determinations on our website, another set of annual landlord performance reports, four Insight Reports and the inclusion of more data analysis in our Spotlight Reports

- substantially increase the volume of learning we shared with landlords on complaint handling and dealing with substantive issues through Spotlight Reports containing 52 recommendations in total

Performance appraisal

Our performance continues to go from strength to strength. During the year we significantly increased the volume of our reports and tools that both held the sector to account for its performance, and supported them to improve their services for the benefit of all residents. We also increased the volume of direct awareness raising and engagement activities with residents.

This was achieved while we coped with an unprecedented surge in demand for our service; cases submitted for formal investigation increased by 78% compared to the prior year - resulting in almost two years’ of cases arriving in one. This level of growth was significantly greater than any historical experience and, therefore, our planning assumptions for the year.

We believe the largest contributors to this significant growth are the introduction of our Complaint Handling Code, landlords’ repairs performance and an increased awareness of complaints procedures as a result of media coverage. The on-going effects of the pandemic will also have played a role.

This growth in demand is a success - more residents are aware of our service, more complaints are being recognised by landlords and these are being dealt with more promptly. But we also recognise there is more to do; consistently residents sharing their stories in the media did not come to us or said they aren’t aware of us. During 2022 to 2023, we plan to increase our caseworker resources to meet this and further expected increases in demand. We will also do more to raise awareness of our service.

Performance against our 2021 to 2022 Business Plan commitments is set out below:

Strategic Objective 1: Deliver a fair and impartial service, resolving complaints at the earliest opportunity

Activities:

- embed our new operating model and realise the benefits (also applies to Strategic Objective (SO) 1.2)

- embed the new Scheme (also applies to SO 1.2)

- implement a structured approach to landlord support

- publish continued non-compliance with the Ombudsman’s orders and consider referral to the Regulator

- continue to regularly quality assure a sample of our work at all stages and act on findings

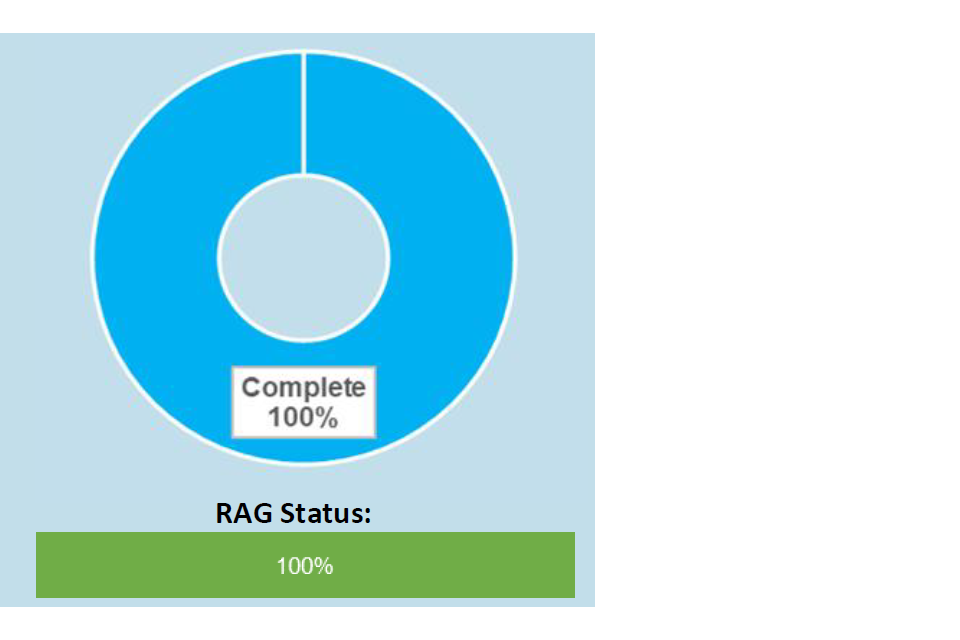

RAG Status:

| Complete | 100 |

Strategic Objective 2: Promote positive change in the sector

Activities:

- implement a structured approach to landlord support

- undertake systemic investigations of individual landlords in accordance with our published framework

- engage with our Resident Panel and host at least two full meetings

- start to build a comprehensive range of information, tools and training to support learning for residents and landlords

- publish four reports/detailed guidance notes across the year

- embed the Complaint Handling Code

- continue to publish data on the complaints we receive

- strengthen our relationship with the Regulator of Social Housing through increased information sharing and referring cases of non-compliance or potential systemic failure in line with our latest Memorandum of Understanding (MoU)

- engage with Department for Levelling Up, Housing and Communities (DLUHC) and Health and Safety Executive (HSE) on the development of the Building Safety Regulator

- engage with DLUHC and the Regulator to support development of the Access to Information Scheme and develop measures of success

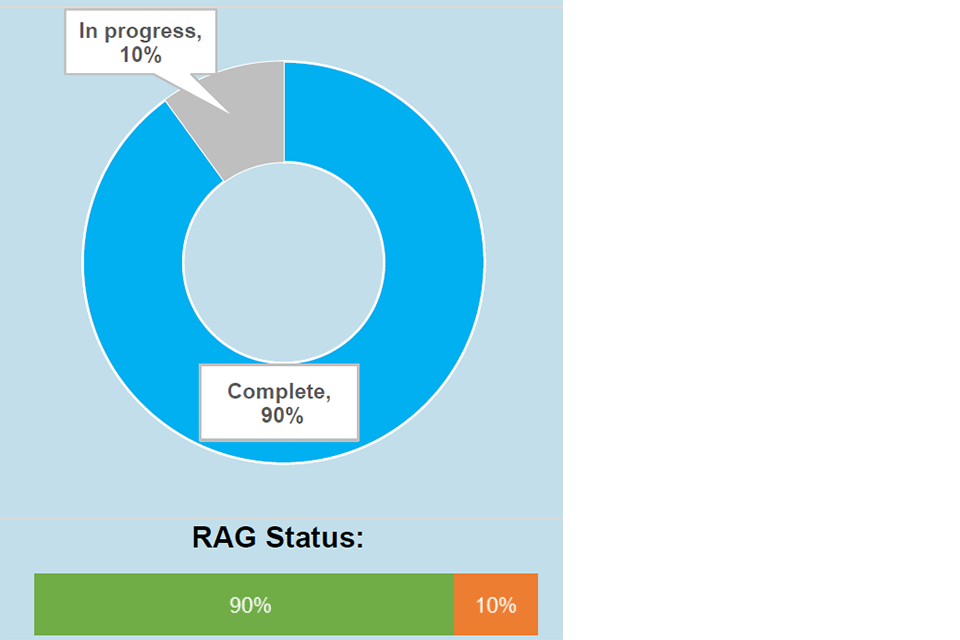

RAG Status:

Strategic Objective 3: Provide a service that is professional, accessible, and simple to use

Activities:

- undertake activities to raise awareness of our service directly with landlords and residents and in under-represented groups

- evaluate webchat and roll out if successful

- continue awareness raising work with advice and support agencies and designated persons

- continue to engage with other housing redress providers to improve access to redress

- gather insight into the customer journey through our Resident Panel, ‘Meet the Ombudsman’ events and direct landlord engagement

- continue to act on customer feedback and complaints to improve our service

- continue to invest in our colleagues’ learning and development, ensuring this promotes diversity and inclusion

- invest in our colleagues’ health and well-being and more flexible remote working, particularly in response to COVID-19

- understand the costs and benefits of digitising our systems; deploy solutions early where possible

RAG Status:

| Complete | 100 |

Strategic Objective 4: Ensure our service is open and transparent

Activities:

- continue to publish the Ombudsman’s decisions

- continue to publish landlord performance reports

- continue to publish more data on the complaints we receive

- publish the reports of the Independent Reviewer of Service Complaints and our progress in addressing their recommendations

- continue to benchmark our service against Ombudsman Association best practice and take action to address areas for improvement

RAG Status:

| Complete | 100 |

We have successfully delivered the vast majority of our business plan commitments for 2021 to 2022. The one activity that was not fully delivered in year was the implementation of a structured approach to landlord support. Work has been piloted in this area but implementation was put on hold so that it could be incorporated within the new 2022 to 2025 Corporate Plan intelligence-led approach to dispute support strategic programme.

Particular deliverables to note are:

- the three Spotlight Reports covering cladding, damp and mould, and landlords’ engagements with private freeholders and managing agents. These topics were selected due to their impact on residents’ lives or challenges to landlords’ service delivery and they each made a series of strong recommendations to support sector improvement

- the three guidance notes produced for landlords’ complaint handling teams to provide clear advice in difficult or challenging areas. These covered effective complaint correspondence, dealing with pre-action protocol for housing condition claims and the effective involvement of governing bodies in complaints

- the refreshed Complaint Handling Code, published in March 2022. The refresh sought feedback from landlords, our caseworkers and our Resident Panel. It clarified provisions where there were differing interpretations and strengthened others, for example, with regard to awareness raising and accessibility

- the delivery of a further investigation into a landlord to identify wider learning following a series of complaints and high volume and frequency of Complaint Handling Failure Orders which used our new powers. This was published in February 2022

- the publication of four quarterly Complaint Handling Failure Order reports, identifying landlords who were not meeting the requirements set out in the Complaint Handling Code

Performance against our Key Performance Indicators (KPIs) is set out in the table below:

| KPI: Casework | Year-end Actuals 2018-19 | Year-end Actuals 2019-20 | Year-end Actuals 2020-21 | Target 2021-22 | Actual 2021-22 | Trend |

|---|---|---|---|---|---|---|

| Service delivery | ||||||

| Cases determined within 12 months | 100% | 100% | 100% | 99% | 100% | Performance maintained ↔ |

| Average time for determinations within our formal remit | 6.7 months | 5.8 months | 5.2 months | 4.5-4.9 months | 4.6 | Improvement ↑ |

| Level of compliance with our orders within three months | 97% | 95% | 99% | 95% | 99% | Performance maintained ↔ |

| Level of compliance with our orders within six months | 100% | 99% | 100% | 99% | 99% | Performance maintained ↔ |

| Quality assurance reviews find casework was acceptable or better | N/A | N/A | 96% | 95% | 95% | Performance maintained ↔ |

| Increase in page views | N/A | N/A | 130% | 20% | 153% | Improvement ↑ |

| Customer feedback | ||||||

| Landlords that thought our complaint handling work improved their complaint handling or housing services | N/A | N/A | 88% | 85% | Insufficient data to report | N/A |

| Residents whose complaint was upheld and were satisfied with the service provided | N/A | N/A | 82% | 80% | 83% | Performance maintained ↔ |

| Residents whose complaint was not upheld and were satisfied with the service provided | N/A | N/A | 56% | 60% | 60% | Improvement ↑ |

| Landlords that thought our sector development & engagement work improved their complaint handling or housing services | N/A | N/A | 99% | 85% | 98% | Performance maintained ↔ |

| Residents that thought our sector development & engagement work was helpful | N/A | N/A | 97% | 85% | 98% | Performance maintained ↔ |

| Residents who thought our advice or assistance was helpful in moving their complaint forward | N/A | N/A | Insufficient data to report | 85% | 45% | N/A |

| Residents who were satisfied with the service provided at dispute support | N/A | N/A | Insufficient data to report | 85% | 60% | N/A |

Early in the year, we agreed a revised target range for our average determination case time KPI with the DLUHC, our sponsor department, increasing this from 3 to 4 months to 4.5 to 4.9 months. This target was originally set in 2019, well before we had knowledge of the pandemic, the increased media attention on social housing conditions or the impact our Complaint Handling Code would have. These factors combined to create an unprecedented surge in demand for our service in 2021 to 2022 and made reaching the initial target timescales untenable.

We ended the year at the lower end of the revised range while still achieving our complementary stretching KPIs related to the quality of our casework, high levels of customer satisfaction regardless of outcome and compliance with our orders. This continued the downward trajectory on our average determination case time that we have maintained since 2016 to 2017.

For the first time this year, we obtained sufficient customer feedback to report resident views on our dispute support service, just passing the threshold to be statistically viable (a 3% response rate). Performance here is disappointing and analysis of the narrative responses to both questions indicates much higher resident expectations of our service than we have the power to deliver – at this stage the complaint remains the landlord’s responsibility and we cannot force action or investigate. We believe expectations have been raised as a result of our new Complaint Handling Failure Order (CHFO) powers and the publication of the Complaint Handling Code.

During 2022 to 2023, we will review all of our resident communications in dispute support to be clear as to what we can and cannot do, and what is their landlord’s responsibility. We will also look at ways to increase response rates further to give a broader perspective.

Risks

The section below summarises the strategic risks that affected delivery of our objectives during the year and the actions taken to mitigate these.

Strategic risk - Unprecedented demand affects service performance and delivery

The unprecedented surge in demand was significantly greater than any historical experience and planning assumptions. There was a risk that we would not be able to meet the deliverables set out in the Business Plan, our KPI targets for the year and other customer service commitments.

Mitigating actions:

- immediate internal efficiency measures were deployed to remove residual administrative tasks from caseworkers. The triage and evidence gathering team were expanded so these activities could keep pace with demand

- a revised average determination case time target was agreed with our sponsor department of 4.5 to 4.9 months to recognise the impact the unprecedented surge in demand would have on performance

- additional budget approval was obtained from our sponsor department to support an increase in temporary staff and outsourcing, funded from reserves

- further measures to increase the time caseworkers could spend on cases were agreed, including ceasing non-essential project work, non-casework meetings and non-casework training

- corporate planning sought and received a significant increase in resources to allow us to continue to deliver high quality and timely casework over the next three years

- at year-end, our annual average performance was at the bottom end of the reforecast range

- temporary recruitment for both us and our outsourced provider proved challenging due to the buoyant market; we both carried vacancies in the second half of the year and not all of the additional budget was spent. This has resulted in a larger opening caseload for 2022 to 2023 than planned

Strategic risk - Our offer is not relevant or valued by stakeholders

Our new operating model supports delivery of a greater volume of learning tools for the sector. There was a risk that these would not be relevant or helpful to landlords. For residents, there was a risk that we would not be relevant if we did not raise awareness of our service and the difference complaints can make.

Mitigating actions:

- during 2021 to 2022 we strengthened our approach to producing Spotlight Reports to ensure they were relevant, balanced and proportionate. These were refining our approach to selecting Spotlight topics to focus on those with high resident impact or where landlords faced complexities and challenging relationships in service delivery; introducing calls for evidence to supplement the evidence base available from our casework; discussing all draft reports with our Sector Expert Panel, at landlord round tables and with our Resident Panel to ensure these are balanced and proportionate and surveying named landlords following the publication of cross-sector reports to understand the impact of our recommendations

- we increased our range of learning tools by producing podcasts to accompany Spotlight reports for the first time

- activities to remain relevant with residents increased significantly. A full year of ‘Meet the Ombudsman’ events, including in-person, were held to raise awareness of the service and explain our role directly to residents. We continued to publish landlord learning comments in our severe maladministration reports to demonstrate the difference complaints can make. These reports increased in volume from three in 2020 to 2021 to 11 in 2021 to 2022. We consulted our Resident Panel throughout the year to ensure we captured the resident experience in all of our work and service design

- by year-end, strong measures were in place to ensure landlord learning is relevant and proportionate. There is more to do to ensure all residents are aware of our service and this will be taken forward as one of the strategic programmes in our new corporate plan

Strategic risk - There is a significant data or cyber security breach

We deal with high volumes of personal data. There was a risk that inappropriate or third-party disclosure of residents’ personal information would cause harm to residents and/or reputational damage to our service.

Mitigating actions:

- we increased the frequency of staff training and began regular lunch and learn sessions to raise awareness of data protection and highlight new developments

- we introduced regular test phishing emails to ensure staff remained vigilant to potential cyber-attacks

- we increased the accreditation level on our cyber security from ‘essential’ to ‘plus’

- we completed a MS-backed IT health check which rated us as above average for an organisation of our size

- we introduced dashboard reporting to the Senior Leadership Team setting out the volume and type of cyber-attacks and nature of DPA breaches to increase senior management awareness

- our risk management here is strong. As a result there were no reportable breaches to the Information Commissioner’s Office (ICO) and no successful cyber-attacks, protecting our reputation with stakeholders. This risk was downgraded to management through the Family and Children Services (F&CS) Directorate Risk Register at the end of the year

Strategic risk - The workforce loses step with changes needed to deliver the new operating model

New skills and expertise are needed to deliver our operating model. There was a risk that staff lose step with new ways of working, systems developments and digital innovations.

Mitigating actions:

- a comprehensive learning and development plan was produced and delivered covering the whole organisation

- corporate Chartered Institute of Housing (CIH) membership was also introduced to provide all caseworkers with access to a wide range of guidance and updates on housing matters

- our ‘People programme’ training, focussed on behaviours and core competencies, was commenced and will continue into 2022 to 2023, covering the whole organisation

- our training allowance was relaunched and allows colleagues to access wider skills development

- the portal implementation plan includes training for all relevant colleagues

- the IT roadmap development included future training needs identified

- we continued to recruit in skills for new areas of work or specialist roles where we could not develop our own staff

- throughout 2021 to 2022, staff have kept in step with requirements, and this has allowed us to deliver quality outputs across the organisation

Strategic risk - There is a failure to continue to deliver our service

We are reliant on outsourced IT systems, suppliers and our employees to continue to operate. There is a risk that a natural or man-made disaster could cause service disruption.

Mitigating actions:

- our business continuity plan was reviewed and updated to ensure it remained fit for purpose and incorporated lessons learned from the pandemic

- all colleagues have been informed of the updated plan via the breakfast briefings and drop-in sessions

- due to the strength of arrangements in place, this risk was downgraded from the Corporate Risk Register to the F&CS Directorate Risk Register at the end of the year where it continues to be actively reviewed and managed

At the end of the year, our risk profile shifted to reflect the challenges emerging from our new corporate plan and its new strategic objectives. To deliver the plan and its stretching targets, we need to increase our headcount significantly - from 125.7 full-time equivalent (FTE) at the end of 2021 to 2022 to just over 300 at the end of 2022 to 2023.

SLT conducted a zero-based review of the risk register in March which took into account the Advisory Board’s risk horizon-scanning review. Following assurance at the Audit and Risk Assurance Committee, the following risks were recognised in the April 2022 corporate risk register:

- demand on the service continues to increase

- we fail to achieve the growth and changes need to deliver our new strategic objectives

- digital solutions are unable to reach maximum impact on service delivery

- we miss opportunities to effectively influence landlords, residents and government

- we lack permanent leadership

The proximity of some aspects of risk 2 and the entirety of risk 5 were very short-term at the start of the financial year and action was being taken to mitigate these as far as is possible within our sphere control. For risk 2, we set up a cross-organisational recruitment and induction working group tasked with developing a deliverable approach from job role evaluation through to the end of probation, suggesting ways to streamline, increase efficiency and outsource, where appropriate. Risk 5 was our highest-ranking risk at the end of the year. The Ombudsman’s contract was extended for a further three years in August 2022. The Governance Statement sets out our risk management framework.

Responding to COVID-19

In common with most organisations, the impact of COVID-19 on service delivery during 2021 to 2022 was reduced compared to the prior year. Our systems continued to support effective homeworking and our focus on colleagues’ health and wellbeing remained, for example, through a regular slot in our fortnightly all-colleague breakfast briefings. These also served as a means of communicating corporate messages and promoting our values.

During quarter three, as national infection rates increased, staff absences peaked with 20% of casework staff recording coronavirus-related sickness absence compared to 6% in the previous quarter. During quarter three 33 days were lost to casework employees recorded as sick due to coronavirus-related illness. This increased in quarter four with 48 days lost to casework staff recording COVID-19 related illness which had an adverse impact on delivery of determinations.

Indirectly related to the pandemic, the buoyant market for temporary staff saw us struggle to recruit sufficient caseworkers to fill vacant posts and begin to expand our workforce. Average caseworker vacancies in quarter two stood at 1.2 FTE posts, moving to 6.3 FTE in quarter three and reaching 8.2 FTE in quarter four.

As a result, of the two factors above, we determined fewer cases than forecast and carried forward a higher than predicted open caseload into 2022 to 2023.

External impacts

While we experienced an unprecedented surge in demand during the year, we do not believe that the main contributory factors for this are related to the pandemic. The introduction of the Complaint Handling Code, landlords’ repairs performance and media spotlight are the more significant causes, evidenced by lower growth in demand for other public service Ombudsman Schemes which did not have these factors in play.

During quarter three, we found that the provision of landlord evidence to support formal investigations took longer and required more chasers - 84% of requests received an initial chaser in quarter three compared to 50% in quarter one. In quarter four this was 64%. We believe staff sickness at landlords lay behind this as it was a temporary feature and performance is now back to usual levels.

Adoption of going concern basis for accounts preparation

Our accounts report significant net liabilities (£1.5 million) relating to our participation in the Local Government Pension Scheme (LGPS) where our share of the underlying assets and liabilities can be determined. We have a letter of comfort from the DLUHC stating that they will cover pension liabilities should we not be able to meet them, and that our general fund does not need to offset the pension reserve.

Our income recovery has been consistent compared to previous years and we have remained comfortably within our reserves policy requirement of maintaining at least four months operational expenditure in our general fund on a rolling 12-month basis throughout the year. We continue to maintain this position at the date of signature of the accounts and this is reported to the Senior Leadership Team on a monthly basis.

There are no known current or potential changes in legislation or government priorities that would indicate our service is likely to be abolished, instead our remit will be expanded in the future to decide appeals under the new Access to Information Scheme.

Consequently, management have decided that the adoption of the going concern basis of accounts preparation remains appropriate for 2021 to 2022.

Performance analysis

Purpose

This section provides a more detailed view of performance against our key performance indicators and business plan deliverables under each of our strategic objectives.

Strategic objective 1: Deliver a fair and impartial service, resolving complaints at the earliest opportunity

Context

This year saw an unprecedented surge in demand for our service. The volume of requests for formal investigations increased by nearly 80% compared to the prior year and the total volume of enquiries and complaints closed by the service increased by 64%, reaching 26,771 for the year. While the effects of the pandemic will have made some contribution to this, our demand increase outstripped that of other public service ombudsman schemes. Consequently, we strongly believe the unique factors of our Complaint Handling Code, landlords’ repairs performance and media attention were the main drivers for this surge.

Despite this pressure, our operating model ensured we were resilient and could continue to deliver a timely, quality, impactful service to residents with high levels of customer service – we answered a call every two minutes and we made a remedy following an investigation every 20 minutes. It also allowed us to manage the risks arising from the surge in demand successfully, as set out in the risks section in the performance overview.

Quality assurance, collection of customer feedback and tracking of compliance with the Ombudsman’s orders continued throughout the year to ensure we delivered a good service in all areas despite the pressures arising from high volumes.

| 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | |

|---|---|---|---|---|---|

| Complaints and enquiries received | 14,445 | 16,294 | 14,903 | 15,914 | 26,259 |

| Complaints and enquiries closed | 14,863 | 16,833 | 15,832 | 16,337 | 26,771 |

| 2017-18 | 2018-19 | 2019-20 | 2020-21 | 2021-22 | |

|---|---|---|---|---|---|

| Cases entering our formal remit | 1,763 | 2,217 | 1,981 | 2,253 | 4,001 |

| Number of determinations | 1,712 | 2,214 | 2,138 | 2,185 | 2,618 |

Embedding our Scheme and the Complaint Handling Code

Our Complaint Handling Code went live on 1 January 2021 and 2021 to 2022 was its first full year of operation. The Code set a universal definition of a complaint and clear timescales within which landlords should deal with these at Stage 1 and Stage 2 of their processes. These had the effects of expanding the volume of complaints recognised by landlords and speeding up the rate at which they flowed through to us. We strongly believe this is the primary reason for the unprecedented surge in demand experienced in 2021 to 2022.

We also asked all landlords to self-assess against the provisions in the Code, to share the results for discussion with their governing body and to publish the final assessment on their website.

Our caseworkers made full use of the Code when conducting their investigations. Where poor complaint handling was identified, this was added to areas under investigation if not already raised by the resident. The requirements within the Code were then used to determine the findings made. This contributed to the rise in findings of severe maladministration this year; of the 30 findings, 11 related to poor complaint handling.

As well as the ability to publish the Code, the new Scheme allowed us to issue Complaint Handling Failure Orders where a landlord was slow to recognise or progress a complaint through its procedure (type 1), slow to provide the evidence requested by the Ombudsman to support their investigation (type 2), or where a landlord fails to comply with its membership obligations (type 3).

Over the year, we issued 76 ‘type 1’ CHFOs, 23 ‘type 2’s and 1 ‘type 3. We also published quarterly reports, naming landlords who had received a CHFO and identifying whether they had complied with the order or not. The response of named landlords has, overall, been positive with concerted efforts to identify learning and remedy the source of the issues. We share these reports with the Regulator of Social Housing and did not have cause to formally refer a landlord for non-compliance during 2021 to 2022.

Dispute Support

We continued to refine this part of our service the year to enhance its capacity and capability. Our enquiries service answered 92% of calls first time and we responded to 93% of correspondence within three days, despite the significant increase in demand experienced during the year. We have appointed designated mentors to support less experienced colleagues, provided lots of training and guidance to help caseworkers respond immediately and completely to issues raised and we have created a dedicated team to ensure cases can move as speedily as possible from completion of the landlord’s complaints procedure to our triage stage.

During the year, we trialled approaches to landlord support within this function. Landlords selected were those with high volumes of CHFOs during the first two quarters of the year and support included regular provision of current caseload information, reviews of landlord policies and procedures, and regular online meetings to discuss progress against agreed actions. The outcomes of this work were positive and improvements were seen in complaint handling across several of the participants. Our 2022 to 2025 corporate plan recognised the importance of this landlord intervention work and its potential to extend fairness to all residents through improved local complaint handling. As a result, we decided to hold open this business plan deliverable at the end of the year to carry it forward into the related strategic programme for 2022 to 2025.

As in previous years, the most popular categories of complaint received at this stage of our process are property condition, complaint handling and tenant behaviour. There continues to be a slow channel shift in first contact with the service as phone calls slipped to below 50% for the first time, with email and via the website taking a larger share.

Of the enquiries made to our service, 25% were outside of our jurisdiction which is in line with prior years. Where this is the case, we seek to signpost the residents to an alternative Ombudsman scheme or an advice provider. As in previous years, we signposted most frequently to the Local Government and Social Care Ombudsman followed by the Property Ombudsman. Next popular were Citizens Advice, Shelter and Civil Legal Advice indicating a significant proportion of residents in the private sector are seeking redress where none is currently available.

Dispute Resolution

As with dispute support, we continued to refine our processes during the year. In particular, caseworkers made use of the clear expectations set out in our Spotlight Reports to inform their investigations and findings. As a result, the Ombudsman made 13 findings of severe maladministration related to damp and mould.

Complaint categories remained in line with prior years; property condition was the most popular, followed by complaint handling and anti-social behaviour. Property condition complaints increased over the last year, rising from 30% to 34%, with the other categories remained static.

Referrals from designated persons dropped slightly from 9% to 7% of all cases entering our formal remit. Removal of the Designated Person requirements was effected through the Building Safety Act 2022 and came into force on 1 October 2022. We welcome the removal of this barrier that prevented residents from accessing our service directly.

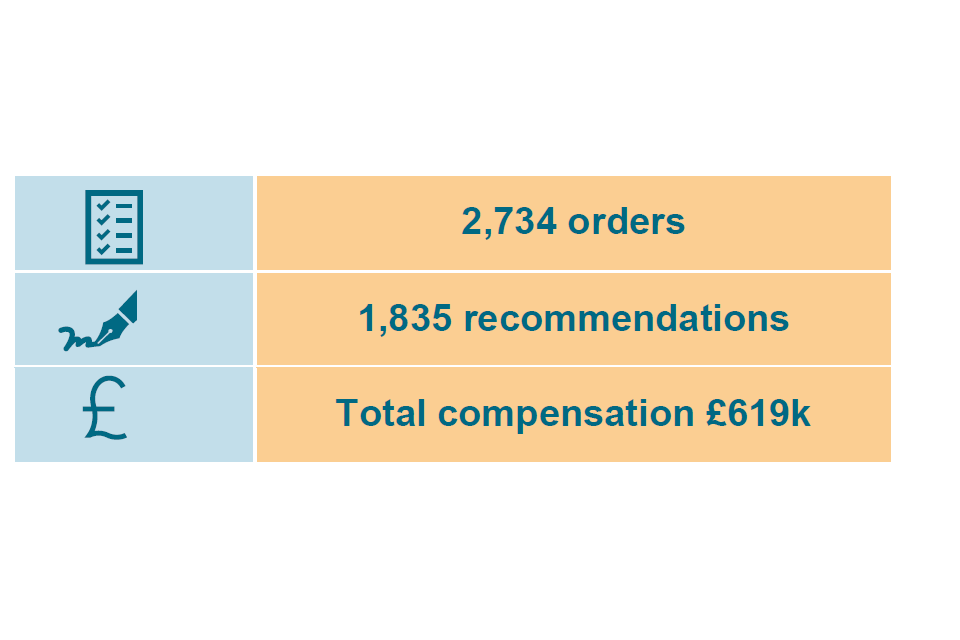

The proportion of cases upheld remained in line with 2020 to 2021 at 48% of cases overall. This breaks down into 1,810 upheld findings out of 4,940 findings investigated (an increase from 1,471 upheld findings out of 3,872 in 2020 to 2021). The average number of findings per case increased from 1.8 to 1.9. We also issued 2,734 orders and 1,835 recommendations with total compensation of £619,000. The average number of orders per case upheld (excluding resolved with intervention) increased from 2.0 in 2020 to 2021 to 2.3 in 2021 to 2022. The uplifts to these average figures demonstrate the increasing complexity of our casework – meaning more time is required to investigate all issues that are brought to us and to set out appropriate remedies.

The volume of cases where a review of the Ombudsman’s decision was requested reduced slightly in 2021 to 2022 to 13% from 18% in the previous year. The volume of reviews where the decision was revised as a proportion of total determinations remained consistent at 1%. During 2021 to 2022, the volume of requests for a judicial review of the Ombudsman’s decision reduced to two from six in 2020 to 2021. In total, five applications for judicial review were concluded in-year with none of these progressing to a hearing.

2,734 orders 1,835 recommendations Total compensation £619,000

Future plans and performance

Managing demand on our service will continue to be a key challenge during 2022 to 2023. Not only has the unprecedented surge in the volume of casework received during the year resulted in a larger open caseload on 1 April 2022 than predicted, but the removal of the designated persons requirements will also result in three months’ worth of cases entering our formal remit at the point of removal. Ongoing increases to demand following this are expected as ‘complaint fatigue’ is reduced, as are increases arising from increased awareness of our service.

Further increases will come from the external environment in which member landlords are currently operating – pressure on repairs budgets as requirements to remediate cladding and to achieve net zero increase, increased merger activity or bringing services back in-house and the change to proactive consumer regulation will be exacerbated by the cost of living crisis and the rent cap.

As a result, delivering a timely, quality, impactful and customer focussed service will continue to be a challenge in 2022 to 2023, particularly as we are also transitioning to a new way of reporting our performance – switching from an average to a maximum time which is fairer and more transparent by giving residents greater certainty about when they can expect an investigation to be completed.

We have plans in place to deal with these issues including a rapid increase in internal resources to allow us to meet the surge in demand already experienced and that is expected in the coming year. We will also expand further our bank of flexible Adjudicators and our outsourced support. Digital innovations will also assist; webchat will enable us to manage more contacts at the front-end of our service and our portal will enable residents and landlords to upload information and get real time updates on the progress of cases.

Strategic objective 2: Promote positive change in the sector

Context

This year saw us realise the benefits of the creation of our Quality, Engagement and Development Directorate which is responsible for delivery of our internal and external learning tools. Using our powers under the Scheme, their work has had significant impact on the sector and in assuring the quality of our casework:

- 2,298 participants in our webinars and other training events

- complaint Handling Code web page views 20,405

- 2,412 downloads of the Code self-assessment form

- published three Spotlight reports

- 98% of landlords thought our sector development and engagement work improved their complaint handling or housing services

- 100% of residents thought our sector development and engagement work was helpful

Sector learning

We published three Spotlight Reports during year with topics selected for their impact on residents’ lives or to assist landlords where complexities and challenging relationships needed to be managed to deliver services successfully.

The first of these was on cladding. This recommended that landlords communicated proactively with residents, provided a clear road map on inspections with timescales, and addressed individual circumstance to exercise discretion where appropriate.

Our second report was on damp and mould. Following the ITV news coverage of the terrible conditions experienced by some social housing residents, we decided to expand our evidence base for this report from our own casebook and data through our first call for evidence. We received 555 responses - 416 from residents and 139 from landlords and sector expert practitioners - which we used to add weight to our findings and recommendations. This report received national news coverage and has been frequently cited. Landlords are using the 26 recommendations to drive their investment programmes, review their policies and report to their own governing bodies.

Our final report for the year looked at managing agents. We highlighted the clash between regulated and unregulated sectors in this area and highlighted the challenges this creates for social landlords in delivering services to their residents. As a result, we called for a standalone regulator to oversee the managing agent sector.

We also produced three guidance notes for the sector in-year: effective complaint correspondence; disrepair claims and the complaints process; and the effective involvement of governing bodies. Supplementing our reports and guidance, we also continued to host webinars and began to produce podcasts with four published during the year. In total, our spotlight reports have been downloaded more than 7,000 times and our 81 training events have reached more than 2,200 landlord staff and residents.

Complaint handling

We continued to embed our Complaint Handling Code and, in January, began a review one year on. This sought feedback from residents, landlords and our own caseworkers to understand which areas were working well and where further guidance or clarification was needed. Following consultation with the external panel that assured the first Code, a refreshed and strengthened update was published in March 2022. The changes:

- increased the obligations on landlords to raise awareness of the complaints process and the Housing Ombudsman

- set good practice for a member of the governing body to be identified as having lead responsibility for complaints and for all landlord staff to have a standard objective related to effective complaint handling

- reinforced the importance of learning from complaints by being explicit that the self-assessment should be completed as an annual exercise

As well as cross-sector learning, we held individual landlords accountable for potential failings against the Code that would have repercussions for all residents. We did this through our type 3 Complaint Handling Failure Orders where we issued one during the year and brought 29 other landlords into compliance after our initial communication.

Alongside the refreshed Code, we also published our first Annual Complaints Review, accompanied by our annual landlord performance data. This identified the key strategic challenges facing members in effective complaint handling for consideration at governing bodies. These included the need for all landlords to adopt a positive complaint handling culture, the need to increase trust among residents that complaining will make a difference and the need to address the procedural failings which were resulting in high uphold rates in complaint handling – 66% of all complaints about complaint handling were upheld. Operational challenges identified were poor record keeping, high volumes of missed or unproductive appointments, and poor communication with a lack of follow up.

Engaging others

We significantly increased our direct engagement with residents in 2021 to 2022. We held a full set of quarterly Meet the Ombudsman events with the final one being held face to face rather than remotely. We also engaged our Resident Panel on a wide range of issues including the development of our 2022 to 2025 corporate plan and 2022 to 2023 business plan, our customer charter, our portal and our spotlight reports.

We sought to broaden engagement with our work both to raise awareness of the learning it contains for landlords and to show the difference complaints can make to residents. In total, we issued 44 press releases in year and coverage of our work continues to expand across the housing trade press, and local and regional media. Website visits increased with over 1.3 million page views during the year, compared to 940,000 in 2020 to 2021 and e-newsletter subscribers reached 7,271 by year-end (1,954 on 31 March 2021). Followers on social media grew over the year from 2,022 to 3,179 on Twitter and from 1,522 to 3,156 on LinkedIn.

We continued to build on our strong relationship with the Regulator of Social Housing. We referred 13 cases to them during the year and met regularly to share insight and data. We also began discussions on effective working under pro-active consumer regulation and these discussions will continue into 2022 to 2023.

During the year, we met with the Building Safety Regulator and will continue to meet into the future as this area of regulation develops. In July, DLUHC set up an Access To Information Scheme project group and we were a member of this, attending all meetings, along with officials and representatives from the Regulator of Social Housing.

Landlord feedback on the Complaint Handling Code:

- “The proactive approach taken by the Ombudsman is very welcome and is a living example of positive role-modelling to the sector.”

- “It has been fantastic for the Housing Ombudsman to generate this focus across the sector to drive a more positive complaints culture to enhance services to customers.”

- “We have really appreciated the guidance that the code has provided and the subsequent reporting that has continued to help us embed this good practice.”

Feedback from participants in Code webinars:

- “A better understanding of the Scheme and the Code and that the complaint handling failure order is used as a last resort. They are measures to help, not to punish!” (landlord)

- “It clarified the direction of travel that the Ombudsman will head in to further improve public housing service provision.” (landlord)

- “Clear information, clear updates on progress with the Complaint Handling Code.” (resident)

- “Reference to the landlord’s complaints procedure and the necessary input of stakeholders and tenants.” (resident)

Future performance and plans

During 2022 to 2023, we will start to develop our Centre for Learning – one of our strategic programmes under our new Corporate Plan. It will champion excellence in complaint handling through an integrated offer, bringing all of our learning tools together in a single, easily accessible portal. It will have content aimed at complaint handlers, executives and those on governing bodies and it will also be tailored by size of landlord.

We also intend to continue to develop our approach to cross-sector learning through innovative approaches to evidence gathering. And we will evolve our Annual Complaints Review to provide more analysis and start to show trends in the data.

Other areas of focus will be reviewing our key casework policies, developing a series of subject-specific guidance notes and continuing to increase the reach of our work.

Strategic objective 3: Provide a service that is professional, accessible and simple to use

Context

The unprecedented surge in demand for our service indicates that awareness of the Housing Ombudsman has never been higher. We have done much to increase awareness of our service over the year - directly with residents and advice agencies and through our increased media profile - and we have taken a number of steps that increase accessibility. We will continue to work in both of these areas over the next corporate planning period as awareness is not consistent across our resident population and there is more we can do to increase access. To increase awareness:

- we held two rounds of Resident Panel meetings

- we held quarterly ‘Meet the Ombudsman’ events, including one face-to-face

- we signposted residents on 6,559 occasions to organisations that may help when their complaint was not within our remit

The top five most signposted organisations were:

- Local Government and Social Care Ombudsman (LGSCO) – 28%

- The Property Ombudsman – 20%

- Citizens Advice – 15%

- Shelter - 12%

- Civil legal aid - 8%

Awareness

Direct awareness raising continued this year with our webinars and we continued to deliver training through partner bodies such as TPAS. In total, we hosted 11 events, reaching 325 residents. As noted under Strategic Objective two, we also completed our first full set of quarterly Meet the Ombudsman events and held numerous engagements with our Resident Panel to get their feedback on our work and the customer journey.

We engaged with numerous MPs and councillors throughout the year who had taken on cases on behalf of their constituents and have set up a dedicated email address for them to use in contacting us. We intend to build on this work going forward by hosting events to raise awareness of our work and what we can do to support MPs and councillors.

We also met with executives in both Shelter and Citizens Advice, and we have engaged with a wide range of stakeholders to raise awareness of our work. These have included the National Housing Federation (NHF), CIH, G15, Northern Housing Consortium, Regulator of Social Housing (RSH), Local Government and Social Care Ombudsman (LGSCO), TPAS and G320.

Accessibility

We have increased the access routes into our service during the year. The first way in which we have done this is through the full launch of our webchat service following an earlier trial and successful evaluation. This has enabled our front-end service to cope with higher volumes and phone lines to be freed up for customers who cannot interact digitally or need to speak to someone as part of their reasonable adjustments.

Having assessed the costs and benefits, we built an online portal during the year which will allow landlords and residents to upload information and get real time updates on case progress. This will be launched during 2022 to 2023 and will also divert traffic to digital channels for those who want to engage in this way while further freeing up phone lines capacity.

We also set up an Accessibility Expert Group to advise us on accessibility to both landlords and our own complaints processes. This group contains representatives from TPAS, Age UK, Shelter, Parliamentary and Health Service Ombudsman, Public Service Ombudsman for Wales, BME National, Raven Housing, Poplar HARCA and Westminster University. It met once during the year. It will continue into 2022 to 2023 and provide valuable insights on accessibility issues, particularly for groups who do not use complaints processes as much as others. The first areas we are tackling are older and younger residents who are consistently under-represented in complaints processes compared to other age groups.

We continue to work closely with the Local Government and Social Care Ombudsman to quickly signpost complaints that come to the wrong service and on cases under investigation where it becomes apparent that the complaint has elements that fall into both parties’ jurisdictions.

We have also met with the Property Ombudsman and the New Homes Ombudsman and will issue Memoranda of Understanding setting out how we will work together in 2022 to 2023. We will take a similar approach with the Building Safety Regulator, who we have also met, once their approach to regulation is further advanced.

Customer journey

In addition to consulting our Resident Panel on a range of topics and hosting Meet the Ombudsman events as set out in strategic objective two, we have continued to analyse our customer feedback and learn from this. Following analysis in the first half of the year, we identified a number of improvements for the dispute resolution teams including increased resident communication throughout the investigation and training on making effective orders. This resulted in improvements to our customer feedback scores and we finished the year exceeding our stretching KPI targets in this area.

On the dispute support side, feedback was slow to arrive in sufficient volume and analysis was necessarily delayed until later in the year. Actions identified here are to manage resident expectations better as to what we can and cannot do in this part of our service through clearer communication as well as looking at ways to increase response rates overall.

Learning and development

Colleague learning and development was an area of focus during 2021 to 2022. We recruited a HR manager whose role is to lead on developing and implementing a rolling programme of learning and development activities which resulted in a cross-organisational plan being created and delivered. Our organisational development programme, the People Programme, was launched initially for line managers with all staff participation occurring in 2022 to 2023. We also relaunched our training allowance enabling colleagues to broaden their skills outside of their immediate job role. Work will continue in this area throughout 2022 to 2023 as we develop our offer and promote continuous development for all our colleagues.

Diversity and inclusion (D&I) and health and well-being (H&W) continued to be important issues taken forward by colleague-led groups. The D&I group hosted events to mark one year since the murder of George Floyd and black history month as well as celebrated a range of festivals and other events throughout the year. The senior leadership team recognised the importance of health and wellbeing by changing our staff engagement survey to one that recognises colleagues with high wellbeing scores are more likely to be engaged. In response to the survey results, the H&W group led on a number of monthly challenges to encourage physical activity and health eating. Permanent homeworking was also offered to all colleagues during the year, enabling them to better balance their work and home lives, and this was taken up by 77% of our staff.

Feedback from residents:

- “You were fantastic at helping me and with your help me and my children can be safe and happy.” (dispute support)

- “I’ve been so grateful for such a much needed service that has provided assistance and sped up things that could have been forgotten about. There’s been well explained information and good listeners. It was really helpful to air the matter.” (dispute support)

- “[The caseworker’s] approach to my sensitive and highly personal past, was treated with dignity and respect. [Their] tone of voice and compassion to my vulnerabilities were a great comfort, as I felt so very alone fighting a big organisation. [Their] determination and recommendations have enabled me to finally have my voice heard. And I can only hope that I will never encounter this kind of situation again. I would like to sincerely thank you, your employees, and everyone involved in helping the voiceless be heard.” (dispute resolution)

- “It was great to have someone who helped with the difficult situation we were put in with [the landlord]. It helped to have someone who understood what we were going through and how we felt. The service was excellent and since receiving your decision a lot of the outstanding issues have been resolved and we are being treated much better by the housing association. The only issue we had was time scale but understand this year has been a unique one for everyone, as none of us have ever lived through a pandemic. Thank you for all your help and understanding and managing to get [the landlord] to carry out the work they kept putting off.” (dispute resolution)

Future performance and plans

Although the high demand on our service this year indicates awareness raising and accessibility efforts have been a success, there is evidently still more to do - many of the residents who shared their experience of terrible housing conditions in the media this year had not chosen to come to us, often because they were not aware. This caused us to designate awareness raising as another of our 2022 to 2025 corporate plan strategic programmes and work on this will begin next year.

Learning and development, under our employer brand strategic programme, will also be a key area of focus for us – both for new colleagues as we deliver our significant expansion, and for existing colleagues as we help them develop their skills and experience.

Strategic objective 4: Ensure our service is open and transparent

Context

Openness and transparency are key tools to shine a light on sector performance and drive positive change. Our transparency has increased significantly over the year as the publication of Ombudsman’s decisions reached their first anniversary and we continued with our other transparency documents, meaning a large volume of information is available on our website from which landlords can learn:

- 93 individual landlord performance reports published (5 or more determinations) accompanying the publication of our national complaints overview

- Four Insight reports published

- 1,800 decisions published from 9 March 2021

- Independent Reviewer of Service Complaints completed two reports

- Annual complaints review completed

Transparency

By the end of the year, fortnightly publication of Ombudsman’s decisions meant the number of cases available on our website and searchable using a range of different criteria reached nearly 1,800. We continued to highlight findings of severe maladministration in each publication batch through dedicated reports which set out the complaint and gave the landlord the opportunity to state what learning it has taken from the case.

We also published our second set of annual landlord performance reports, using these as the bedrock for our Annual Complaints Review which we published in March.

We continued with our quarterly Insight Reports. These provide an analysis of the enquiries and complaints we have received in the related quarter and the decisions we have issued. They have also retained their regional focus by breaking down some of the national figures into data for the region under review and by using case studies from the region to illustrate particular learning points.

Openness

As we hold others to account, so we also seek to hold ourselves to account as transparently as possible. Our Independent Reviewer of Service Complaints published their first two reports this year which identified service improvements based on a sample of complaints about our service received over a six-month period. In agreement with the Independent Reviewer, we have slightly skewed each sample to focus on a particular area where we face challenges so to draw on their expertise through their recommendations. The first sample looked at managing temporary peaks in demand in our dispute support process and the second at challenging cases where either a single point of contact had been appointed, a request for reasonable adjustments or an alert had been placed on the case. The Independent Reviewer’s full reports are available on the Housiong Ombudsman website and we have actioned all recommendations to the agreed timescales.

We have also continued to benchmark our services against the Ombudsman Association’s Service Standards to demonstrate we are providing a high quality, efficient and effective service to residents and landlords. The results are summarised in the Annex and we are doing well across all measures.

Finally, we submitted written evidence to the Levelling Up, Housing and Communities Select Committee’s inquiry into the regulation of social housing in December 2021. The Ombudsman appeared as a witness before the committee in April, alongside a representative from the Regulator of Social Housing, and called for greater powers to improve complaint handling across the sector. These were supported in the Committee’s report.

Future performance and plans

Through our work this year and last, transparency and openness have become business as usual. For this reason, the new corporate plan includes no new or specific actions in relation to this.

Financial review

Subscription income for 2021 to 2022 totalled £10.4 million and remained consistent with the prior year. This was expected as the subscription rate remained unchanged at £2.16 and unit numbers were broadly consistent.

Throughout the year, expenditure was managed to ensure value for money. No instances of fraud or error occurred and key financial controls provided full assurance.

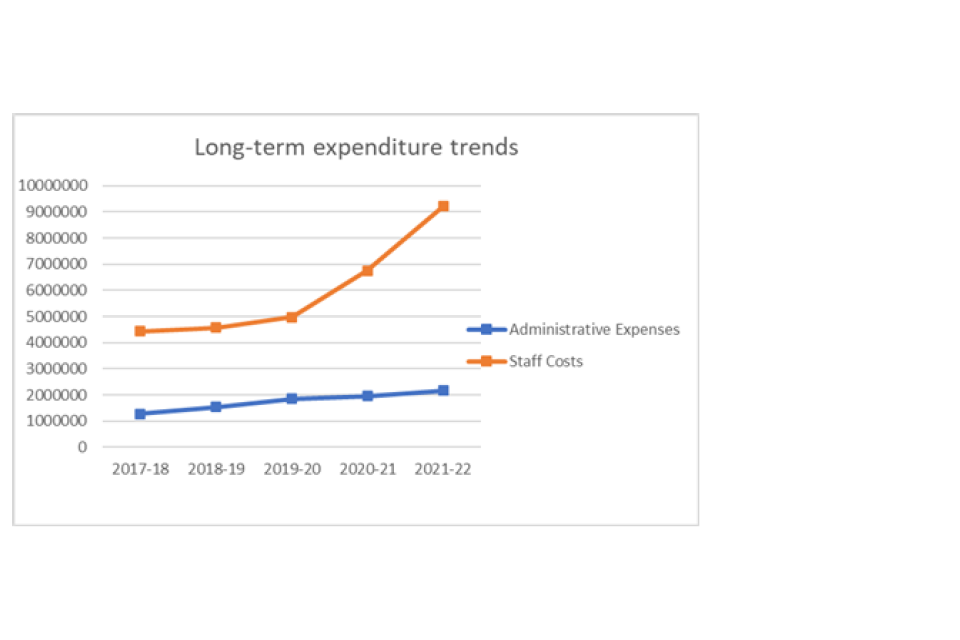

Recruitment continued through the year to fill established posts although most vacancies had been filled during the previous year. This resulted in increased staffing costs due to full recognition of annual cost for salaried posts and additional service costs in pensions. This full staffing cost, including pensions and agency staff, resulted in a 35% increase in staff costs, moving from £6.8 million to £9.2 million. Staff costs in 2022 to 2023 will be higher again to reflect the large expansion required to meet demand.

Administrative expenditure increased by 10% during 2021 to 2022 and totalled £2.2 million. This was due to increased expenditure on outsourcing support to meet casework demand and additional support from the call centre provider.

Consequently, the results for the year show a deficit after tax of £1.1 million compared to a surplus of £1.6 million in 2020 to 2021.

The £3 million net actuarial gain on the pension fund includes a £2.7 million gain from changes in financial assumptions (the combination of an increase to the discount rate and an increase to both pension and salary growth), and a £0.3m return on scheme assets.

These changes flow through into the pension liability recorded on the Statement of Financial Position, reducing it from £3.2 million to £1.5 million representing a 53% decrease. In 2020 to 2021, the pension liability was £3.2 million (2019/20 £1.9 million).

At year-end, the cash balance was consistent with the prior year (£5.2 million). The impact of the movements above have resulted in an increase to overall net assets of £1.9 million, increasing these to £3.7 million from £1.8 million in 2020 to 2021. Consequently, we remain a going concern and able to meet all future expected liabilities as they fall due.

Richard Blakeway

Housing Ombudsman and Accounting Officer

13 February 2023

Accountability report

Corporate governance report

Ombudsman’s report

Leadership and direction

The Who we are section identifies the members of the SLT, the ARAC and the Advisory Board (AB). The Governance Statement sets out how we are structured to deliver organisational direction and control as a corporation sole under the leadership of the Housing Ombudsman.

During the year, we revised our governance structure to replace the Panel of Advisors with a new Advisory Board, recruited to a skills rather than stakeholder model. This change reflected the increased assurance needs of our organisation as it grows in size and complexity. Since its inception, the Advisory Board has discussed the new corporate and business plans, in-year performance, and the implications of the new Social Housing Regulation Bill. During 2022 to 2023, it will advise on all our expansion plans and strategic programmes, and will continue to monitor performance.