HMRC business plan: 2014 to 2016

Published 14 April 2014

1. Foreword

As the Chief Executive of HM Revenue and Customs, I am delighted to introduce this business plan, which sets out what we are going to deliver over the next two years.

The scale of our work is huge, as we serve almost every individual and every business in the UK. And our role - to collect the money that pays for the UK’s public services and to help families and individuals with targeted financial support - is of crucial importance to the country, and never more so than during a period of austerity.

This plan builds on some really big achievements of which everyone in HMRC should be rightly proud. In the 2012 to 2013 tax year we brought in total tax revenues of £475.6 billion and record compliance revenues of £20.7 billion, with 2013 to 2014 looking likely to match or better this performance. And we’ve continued to improve customer service and deliver sustainable cost savings. We’ve achieved all this while delivering some major projects, such as Real Time Information for PAYE.

The government has allowed us to reinvest some of the efficiency savings we are making. This has helped us to better meet the public’s desire for increased levels of performance and to collect the tax that is due, when it is due, at the best cost to the taxpayer. The decision to invest in us is a huge vote of confidence in HMRC, in what we are doing and how we are doing it.

Our achievements in recent years show how HMRC and our people are serving our nation with expertise, commitment and increasing effectiveness. But this doesn’t mean that we have reached where we need to be: we will continue to try to do things better and smarter - for individual taxpayers, for businesses, for our people, and for the UK.

We know that most taxpayers want to comply with their obligations and we must make it as easy as possible for this honest majority to get their taxes right, as it helps free up our compliance teams to focus on those who really are trying to cheat the system. Because the needs and expectations of our customers continue to change, we must change as well by truly putting customers at the heart of everything we do.

One of the ways we’ll meet the rising expectations of our customers is by offering them first-class online services - like they experience with online banking and shopping - and this business plan explains how we’ll start to do this, by setting out how digital technology will change the way we all work.

All of this will have big implications for our people: what it will feel like to work for HMRC; the types of jobs we’ll be doing and the skills we need; and the kind of workplaces we’ll be based in. That is why we are embarking this year on a nationwide face-to-face conversation with our people about how we are building our future. Beginning in May, we will be rolling out the biggest internal communications initiative that we have ever undertaken across the country, ensuring that everyone has the chance to hear about our future, to discuss it and to have a say in how we build it.

We need to do all this while continuing to deliver the expectations that ministers have placed on us. In 2015 to 2016 we have been asked to make a further 5% reduction to our budget and to bring in compliance revenues of £26.3 billion.

We know it’s also important to maintain public confidence in our integrity, impartiality and even-handedness. We will work hard to demonstrate those qualities and ensure we collect the taxes that are due under the law.

Things will change as we implement this plan. But it is right that we have clarity of purpose and direction in building our future for our customers and for the UK.

Lin Homer, Chief Executive and Permanent Secretary

2. What we do and how we do it

2.1 What we do

We collect the money that pays for the UK’s public services and help families and individuals with targeted financial support. We help the honest majority to get their tax right and make it hard for the dishonest minority to cheat the system. As an effective, efficient and impartial tax and payments authority we are making a real difference to the UK at a crucial time.

We are one of the UK’s biggest organisations, with around 61,000 full-time equivalent staff in 360 offices, and revenues fast approaching £500 billion a year from 45 million individuals and 4.9 million business customers.

And we contribute to the country’s economic and social well-being. The UK is the world’s seventh largest economy and the third largest in the EU. International trade is currently worth billions of pounds a year to the UK economy, and we play our part by making it as easy as possible for industry and business to trade.

As part of the government’s wider ambitions to support working families, we will be launching the new Tax-Free Childcare scheme in autumn 2015. We also work with a number of other government departments to help deliver their objectives, for example in collecting student loans and in enforcing the National Minimum Wage.

We also work in partnership with HM Treasury to make sure that tax policy is designed in a way that reflects our experience of customers and their behaviour, as well as delivering the government’s objectives for fairness and economic growth.

2.2 Delivering against our key objectives

Our key objectives, set by the government, are to:

- maximise revenues

- improve the service that we give our customers

- make sustainable cost savings

And to do this we’ll need to include and involve our people in how we meet these key objectives and ensure that we invest in their skills, capability and the experience they have of working in HMRC.

We have high expectations that our performance this year will match or exceed what we achieved last year. Here’s a summary of what we have achieved against these objectives:

Maximise revenues

We collected more than £455 billion[footnote 1] in total tax revenues between April 2013 and February 2014 - a record for this point in the year. We also achieved our best-ever compliance performance, collecting £18.5 billion in additional revenues from compliance activity during this period.

Improve the service that we give our customers

We handled 78.4% of all call attempts to our contact centres in the eleven months to February 2014. This is an improvement on the same period last year, and in three out of the last four months we hit our 90% target. We introduced Intelligent Telephony Automation (ITA) in November 2013.

This is new speech recognition technology that reacts to what the caller says, instead of asking them to select an option by pushing a button on their phone. Early indications are that compared to the previous system, ITA is helping customers get through to the right place more quickly.

We also cleared UK tax credits and Child Benefit claims and changes of circumstance in an average of 15.9 days in the year to January 2014[footnote 2] - well within our target of 22 days. Over the same period, we cleared international claims and changes of circumstance in an average of 88.5 days, ahead of the 92-day target.

Our performance on post turnaround times also continued to improve. From April 2013 to February 2014, we cleared 82.4% of post within 15 working days, exceeding our target of 80%.

We are also making good progress in improving the service that we give our customers. Since we introduced Real Time Information (or RTI) in April 2013, more than 1.6 million PAYE schemes with employees have started reporting in real time. RTI is the biggest change to PAYE since the system was designed 70 years ago. It brings PAYE up to date with today’s employment patterns, where people change jobs more frequently than in the past and can have more than one job or pension.

Make sustainable cost savings

We have achieved significant cost reductions since 2010. By the end of the tax year 2014 to 2015 we will have made gross sustainable cost savings of almost £1 billion primarily through improving efficiency, productivity and performance, including reducing our estate by 300,000 metres squared and our IT costs by £87 million. Efficiency and productivity improvements will have enabled staff reductions of more than 12,000 by 2014 to 2015. We have also reinvested almost £1 billion of these savings to bring in additional compliance revenue of £7 billion a year by the end of 2014 to 2015.

A total of £723 million of the efficiency savings were due to be made by the end of 2013 to 2014. We expect to exceed this target by almost £50 million, achieving around £770 million of sustainable efficiency savings. At the same time we are continuing to improve performance in collecting additional compliance revenues and tackling fraud, error and debt.

What this means for our people

We have focused on enhancing our people’s professional skills so we can deliver high-quality services. We have developed career pathways for people working in operational delivery, tax policy and programme and project management, and introduced a number of formal operational delivery qualifications. This has encouraged staff to build their professional capability and improve services for our customers.

We have also developed resources to help us improve our leadership and management capability. We have developed a number of ways in which people can progress through the organisation - from our Spring School for more junior grades to the Ascend programme for those aspiring to become part of the Senior Civil Service. Everyone is encouraged to undertake at least five days of learning a year. Almost 210,000 days of learning had been undertaken to the end of February 2014.

2.3 Delivering our key objectives in the future

To make sure we continue bringing more money in, we’ve focused on making HMRC a highly efficient organisation that reinvests in our compliance activities. That’s still the case and will continue throughout 2014 and beyond as we alter how we deliver our core work.

Maximise revenues

We know that the UK has high levels of voluntary compliance - we collect 93% of the tax that is due - and our personalised approach will mean that we’ll be able to nudge more customers into voluntary compliance, which will help keep our costs down. It means we won’t have to go back and rework or correct as many things as we do at present.

And that will help us focus our compliance teams on the minority who really are trying to cheat the system, using all the data analysis tools we need to identify and target deliberate cheats.

We will:

- promote and design good compliance into all of our systems and processes to make it easier for customers to get it right first time when they send us tax returns

- prevent non-compliance by making it harder for people to make mistakes or deliberately cheat the system when they file tax returns or update their circumstances

- respond to non-compliance firmly by tailoring our activity to maximise its impact when we have to intervene to address compliance risks

Improve the service that we give our customers

Over the next two years and beyond we will continue to improve the service that we give our customers by designing all of our services around them. This will help us to collect the right tax at the right time, pay out what is due, and drive continued cost reductions.

We will design products and services that are personalised to customers, that customers will find easier than ever to use and which will help them to get things right - in effect, making voluntary compliance an integral part of our customer services.

This means making better use of the data that we hold, so that we can deal with issues at the very point where a customer deals with us - such as when they file returns or update their circumstances.

This transformation is already underway. We have invested £200 million from the government in an ambitious programme of products, processes and services based around what our customers need. We will:

- provide online services that are so straightforward and convenient that everyone will want to use them, so they will not have to use paper forms and post

- give customers the ability to see all of their taxes in a single place online, so they will not have to navigate different systems for different tax regimes

- deliver a service that feels personalised, so they will not have to provide the same information many times

- resolve queries quickly; we call this ‘once and done’

And we will also continue to support the minority of customers who need extra help over the phone or face-to-face.

This transformation will be driven by a number of digital ‘exemplars’ that will not only continue to improve the service that we give to customers, but will also allow us to make sustainable cost savings through more automation of our work.

Although we provide many services online, we still rely on manual processes - receiving and sending millions of letters and receiving millions of telephone calls each year. Customers now expect us to provide more and better digital services, and we are going to deliver them. In future, we will offer more personalised, online services that people will want to use. The exemplars are described in more detail in section 3.2.

Make sustainable cost savings

We also have to play our part in delivering the sustainable cost savings that are being sought right across government. Our recent achievements also reflect the fact that we’ve delivered major efficiencies and budget reductions at the same time. We will make a further £205 million in savings in 2015 to 2016.

What this means for our people

Central to all of this is investing in our people. That means creating interesting and stretching job roles, making sure there are ample opportunities to build great careers in HMRC and developing the skills that will enable us to deliver even more for the UK. As part of this we will create modern workplaces that are collaborative, open and forward-thinking.

3. Our plans

3.1 Maximise revenues

The government has allowed us to invest more than £1 billion of savings to tackle tax evasion, avoidance, criminal attack and debt since 2010. By tailoring our approach to target the highest risks, we will bring in an additional £24.5 billion revenue in 2014 to 2015, rising to £26.3 billion in 2015 to 2016.

We are committed to reducing the tax gap, which is the difference between the amount of tax due and the amount actually collected in any given year. The latest published tax gap was for 2011 to 2012 and, at 7% of the total tax due (£35 billion), continues a long-term downward trend from 8.3% in 2005 to 2006.

By using a promote, prevent, respond approach to how we maximise revenue, we will deliver the following activity over the next two years and beyond:

Better use of data and automation

We will:

- reduce the simpler forms of non-compliance, by creating an ‘intervention centre’ to deal with straightforward compliance cases by phone

- make greater use of existing and new sources of data, including data from merchant acquirers, that will allow us to track sales through the use of credit cards

Adding capacity to tackle debt, error and fraud

We will:

- work with a private sector supplier from autumn 2014 to significantly add to the number and coverage of tax credits compliance checks that HMRC already carries out; this will add five and a half million more compliance checks over the next three years, with the potential to reduce incorrect payments by up to £2 billion

- tailor our debt collection activity based on a customer’s previous behaviour, the risks of non-payment and the taxpayer’s likely ability to pay

- use new ways of collecting debt so all relevant government departments and bodies can access a range of private sector debt collection, analytics and enforcement services - known as the Debt Market Integrator

- use new powers to modernise the way we collect debt, and tackle the persistent minority who refuse to pay what they owe, by recovering money from debtors’ bank and building society accounts, including ISAs

Cracking down on tax evasion

We will:

- use specialist teams to identify individuals with hidden assets in the UK or offshore. Our ‘affluent’ teams have delivered £284 million in additional compliance revenues in their first 35 months and are expected to deliver £520 million by 2015 to 2016

- deploy around 20 taskforces each year, aimed at a variety of trades and professions, including doctors, dentists and legal professionals. We have already raised £144 million in additional revenue from more than 60 taskforces launched since 2011

- strengthen our picture of the compliance risk among large businesses, by further strengthening our Large Business Risk Assessment Taskforce

- prevent and deter evasion by publicising our successes, reassuring the honest majority that we are cracking down on those who are breaking the rules

- monitor persistent evaders and publicly name deliberate defaulters in serious cases

- take action against those who hide money offshore to evade tax and those who support them. The likelihood of being caught is increasing, through international agreements with countries such as Liechtenstein, Switzerland and the USA

Closing down tax avoidance

We will:

- reduce the amount of money lost to the Exchequer each year due to tax avoidance — one of our highest priorities. Disclosures of tax avoidance schemes fell by almost 50% between 2011 to 2012 and 2012 to 2013. More than 80% of avoidance cases heard in the courts were won by HMRC in 2012 to 2013, with around £2.2 billion in tax protected, including more than £1 billion from large corporate tax avoidance schemes

- continue challenging wealthy individuals by allocating our resources to those customers who we consider to have the most complex tax affairs, or pose the highest risks of non-compliance through avoidance or evasion

- use new powers to force those involved in avoidance schemes to pay HMRC money up front if they are using an avoidance scheme that was the same as, or similar to, a scheme already defeated in the courts.

Catching organised criminals

We will:

- strengthen our capacity to disrupt the activities of organised criminal gangs operating in the illicit road fuel market. We are expanding our Fiscal Crime Liaison Officer network and creating a joint HMRC/Border Force fiscal border debriefing and intelligence team

- introduce new measures to reduce the illicit trade in alcohol products, including a registration scheme for alcohol wholesalers and a due diligence requirement for HMRC-approved alcohol businesses

- increase resources for our Road Fuel Testing Units to tackle the oil revenue lost through oils fraud. Additional investment announced in the 2013 Autumn Statement aims to stop this large-scale criminal and commercial fraud.

Enforcing the rules

We will:

- continue to tackle the misuse or abuse of pension tax rules by identifying unscrupulous promoters offering pension liberation schemes. Where the rules are not adhered to we will de-register the pension scheme and pursue the promoters for all penalties due

- build on the success of the National Minimum Wage compliance programme by helping deliver a cross-government taskforce to protect vulnerable workers and tackle non-compliance in the labour market

- tighten the rules on the payment of Child Benefit and Child Tax Credit to people who arrive in the UK without a job. We will also work with EU partners to negotiate tighter rules on the payment of family benefits for children who live in a different country from their parents

- strengthen our work to make sure migrants from the European Economic Area claim the right amount of Child Benefit and Child Tax Credit, by introducing a range of new compliance checks.

3.2 Improve the service that we give our customers

How we serve our customers is critical to how we maximise our revenues and sustainably reduce our costs. It is about more than improving their experience of our services, but making a fundamental shift in the services we provide, making it simpler and more convenient for customers to get their taxes and entitlements right and thereby improve voluntary compliance.

An important part of this is our work to move away from designing services around the taxes customers pay towards operating in real time. We will use the up-to-date information we hold to reassure customers and simplify their dealings with us, minimising the need for us to intervene.

We are building digital services that will enable most of our customers to manage their tax affairs and payments online, while reshaping our products, processes and services around their needs.

We also know that there will always be customers who need to contact us for support, and we will make improvements to the services they receive over the phone, through the post and face-to-face.

Our move towards the new digital service has already begun with HMRC piloting a number of ‘exemplars’ that include:

PAYE Online

When fully launched, this will allow our 41 million PAYE customers to use tax calculators, access guidance and report online changes to their circumstances affecting their tax code. Our contact centres currently receive 4.7 million calls a year about tax codes and we estimate that this online service will remove the need for around 1.8 million of these calls. The new service began in February with a limited private beta (a trial run carried out among a small group of customers) and will be progressively scaled up over the next two years.

Digital Self Assessment

More than eight and a half million (or about 85%) of Self Assessment customers already file online, but we then communicate with them by letter, sending out 40 million pieces of paper every year. We are piloting paperless services so that customers who opt in will get email alerts to direct them to their online account, with a limited private beta launched in February. In due course Self Assessment customers will also be able to have queries answered by a new ‘webchat’ facility.

Your Tax Account

This will make it simpler for the UK’s 4.9 million small and medium-sized businesses to manage their tax affairs in a single place through a personalised homepage. They will be able to register, file and pay what they owe across Self Assessment, Corporation Tax, VAT and PAYE for employers. They will also be able to see their liabilities for these taxes, and have links through to relevant guidance. We launched a limited private beta of this service in February.

Agents Online Self Serve

We will design services to enable agents to act on their clients’ behalf. We will introduce a new, single and more secure process for agents to register with HMRC and deal with us across a range of taxes on behalf of their clients. A significant number of businesses and individuals pay tax agents to do part or all of their tax compliance - and this is something that will continue in the future. We plan to start on a small scale from late 2014 and increase the services for wider use in 2015.

All customers

These projects will give us a strong foundation for the online tax account for both individuals and businesses. But our ‘digital roadmap’ over the next two years will go well beyond the scope of the pilot exemplars. During 2014 to 2016 we will also deliver the following activity for different groups of customers:

We will:

- pre-populate customer forms and new online accounts with real-time information, saving customers time and reducing the need for them to contact us

- reduce the need for customers to contact us more than once, changing our processes and ways of working to minimise referrals to different parts of the department

- bring in a new system of scanning customer correspondence, enabling us to move it around the organisation more quickly so that we can respond sooner to our customers’ letters

- introduce SMS messaging to reassure customers that their information has been received, or that their case is being dealt with

- deliver tax summary statements to 24 million customers by April 2015, providing them with a clear record of the tax they have paid and how it is spent

- deliver new policies in a way that is simple for customers to understand and access - for instance, the £2,000 Employment Allowance for employers

- increase our capacity to move extra teams from across HMRC onto our customer helplines in times of high demand, through the introduction of new telephone technology

Individual customers

We will:

- make ‘webchat’ and email alerts available for Self Assessment customers who can already complete their returns entirely online

- enable customers to pay us through an automated phone service, saving them time and money on straightforward transactions

- build automatic links to share data with the Department for Work and Pensions, improving the accuracy of tax codes for people moving between work and benefits

- offer a new digital service to eligible customers, enabling them to set up ‘time to pay’ agreements online

Small and medium-sized business customers

We will:

- trial new online accounts for small and medium-sized businesses: personalised sites where they can plan and manage all of their tax affairs in one place

Customers needing additional support

We will:

- provide customers needing extra help with new tailored services that are more accessible and targeted to their needs - including specialist help over the phone and face-to-face support at locations convenient for them, in their local community or their own homes

Tax credits customers

We will:

- introduce a new digital option for tax credits customers with no changes in circumstances to renew their claim online in 2014, removing their need to call us. We will consider scaling this option up in 2015 to help prepare our customers for Universal Credit, and to reduce over-payments and debt ahead of their transition

Tax-Free Childcare customers

We will:

- provide support for working families though the new Tax-Free Childcare scheme. Under this scheme, up to £2,000 will be available for eligible families per child, per year, based on a 20% government contribution. Phased in from autumn 2015, Tax-Free Childcare will be managed by HMRC in partnership with National Savings & Investment. The online service will be simple, flexible and secure.

3.3 Make sustainable cost savings

Like all government departments, our goal is to deliver our services more efficiently by sustainably reducing our costs. We will continue to generate these cost efficiencies through improvements in the way we deliver our products and processes, transforming the way we do our core work.

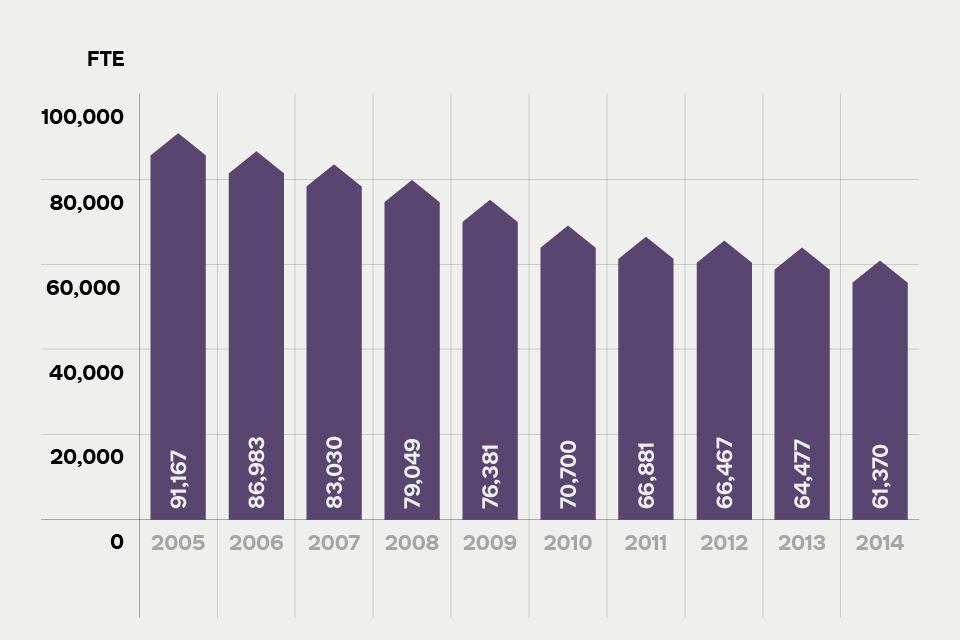

We have a strong track record of delivering savings. Between 2011 to 2012 and 2015 to 2016 we will have reduced our workforce by 22% and our total departmental expenditure by £1.2 billion a year (before reinvestment in compliance and digital), while increasing compliance revenues by more than £11 billion a year to £26.3 billion in 2015 to 2016.

We will continue to become leaner and more streamlined by:

- reducing our full-time equivalent employees (FTE) to around 52,000 by 2015 to 2016, from around 61,000 in April 2014, based on our Spending Review plans

- reducing the size of our estate by 60,000 metres squared in 2014 to 2015 and 35,000 metres squared in 2015 to 2016

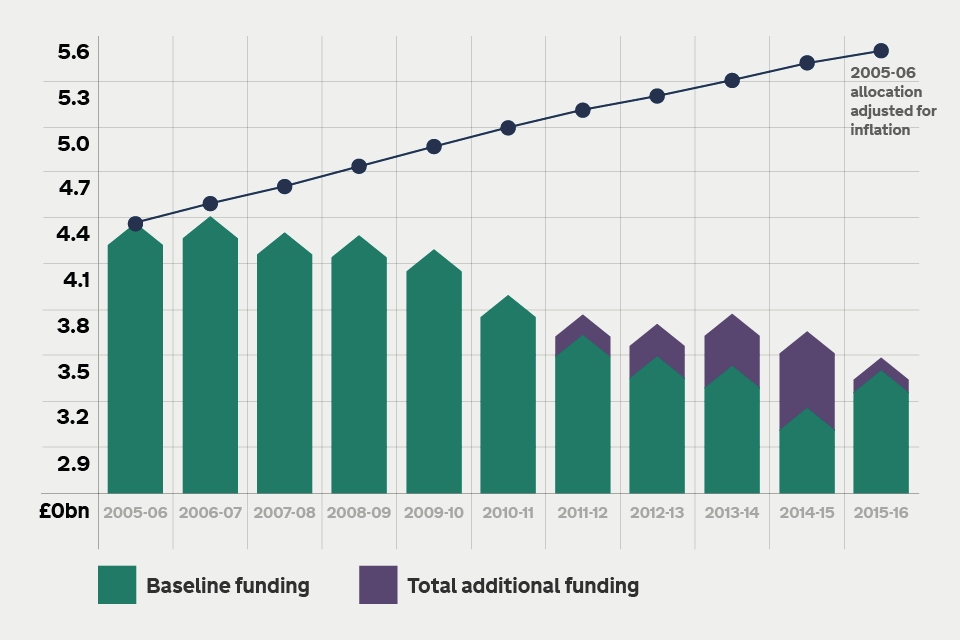

HMRC resource budget

Graph showing HMRC resource budget

We plan to make the necessary workforce reductions as people retire, leave HMRC for other jobs, and with targeted, managed exits. To maintain performance while we move to a more strategic compliance model, we will use fixed-term appointments where needed to retain key frontline posts.

Reducing costs for customers

By tailoring our services to meet the needs of our customers we will reduce levels of error and non-payment, and reduce costs for compliant customers and ourselves. This will free-up existing resources so that we can offer more help to customers to avoid errors and put more resource into tackling non-compliance.

We will achieve this by delivering a range of digital services over the next two years that will make it cheaper and easier for customers to deal with us. To that end, we will reduce the burden that tax administration places on compliant businesses by £250 million by March 2015. We are also working closely with the Cabinet Office to deliver the Identity Assurance (IDA) project needed for both individuals and businesses, which gives users a simple, trusted and secure means of accessing public services.

The introduction of new flagship digital services for tax agents and SMEs (see section 3.2 for more details) will reduce customer costs by almost £18 million in 2014-15, rising to £24 million in 2015 to 2016. There is potential for more cost savings in the future - depending on how well we are able to promote take-up rates among customers. We also expect significant savings in 2015 to 2016 and beyond through the delivery of Your Tax Account.

How we are reducing our own internal costs

We plan to make £198 million (5.5% of our total resource budget) of sustainable cost savings in the tax year 2014 to 2015, with a further £205 million in savings planned for 2015 to 2016. A significant contributor to this is the ability to reduce the size of our workforce as we change the way we do things (see next section).

We will benefit from Cabinet Office negotiations with suppliers to drive down the cost of cross-government contracts and also introduce new ways of working that support how we plan to transform our IT in the future. This means having greater control of IT delivery with a broader range of suppliers, including SMEs.

We will also have reduced the cost of our estate by £94 million between March 2010 and March 2015. We are investing to improve workplace facilities over and above the services provided by our third-party suppliers between 2012 and 2015, and have already spent £2.8 million.

3.4 What this means for our people

We want to be an organisation that is able to respond to the future needs of our customers, and at the same time treat our people with respect and help them through the journey we are making. The way we transform HMRC will create a number of exciting opportunities for our people, but there’s no getting away from the fact there will be fewer staff based in fewer strategic locations. This is not something new. Since 2005 we have said that we need to become a smaller organisation with fewer people doing more highly-specialised roles.

HMRC staffing levels

Graph showing HMRC staffing levels

We will continue to focus work at our larger sites throughout the UK, as we have since 2009. We want more of our people working in roles that use judgement and problem-solving skills, data and risk analysis, tax policy and IT skills and which require staff to demonstrate excellent customer service. This approach is already being pioneered at our newly-opened digital centre in Newcastle.

We want our people to have interesting, rewarding and challenging roles, and an opportunity to develop exciting careers. This is vital to building better staff engagement and will help ensure that they continue to deliver high-quality work. As part of this we have identified the following critical elements and supporting activities that will help us deliver our priorities in the future.

Leadership

We need outstanding leaders at all levels who show passion and commitment and who understand, own and promote what we want to achieve. We want them to drive continuous improvement in how they communicate with our people and support and identify talent for the future, which is a key priority. We will develop and invest in our leaders and managers, and they will be at the forefront of helping us transform the organisation. This will require a significant amount of time and investment in preparing to deliver this change over the next 12 months.

We will:

- make it easier for our leaders and managers to access leadership and management learning through the Civil Service Learning portal

- implement a new coaching strategy and provide tools for our leaders and managers to use to support the creation of a coaching culture

- deliver a project that will identify the role of leaders in the future

Workforce

As we transform the way we work to better meet the needs of our customers, we must also continue to make cost savings. We will identify future skills gaps and plan recruitment activity if we can’t find the appropriate skills in-house. As we change the way we organise ourselves, we will simplify our structure to improve communication and facilitate collaborative working across our businesses. Our increasing digital capability will mean we can offer more flexible working arrangements - providing better jobs for our people. We want the way we transform HMRC to be an opportunity for our existing people.

We will:

- continue supporting our transformation and driving continuous improvement using our departmental improvement plan framework

- continue to deliver a modern workforce, developing and delivering HR policies and working within the Civil Service Reform framework

- develop and deliver resourcing plans to deliver business priorities as part of our 2015 to 2016 commitments

Engagement

We want to create a more engaged workforce by communicating with our people more openly and honestly. We will create an inclusive workplace where everyone knows that they are valued and will be treated fairly. We will change the way it feels to work within HMRC, making sure that accountability and decision-making is placed at the right management level, allowing people to feel empowered to take decisions that they are best placed to make. The organisation will reflect the communities we serve, meaning that we will be recognised for providing opportunities and rewarding jobs to our people from whatever background they come from. Throughout all of this we will support our people’s well-being.

We will:

- regularly use staff surveys to encourage open and honest feedback

- roll out our new diversity strategy, that supports more diverse representation on all our talent programmes

- pilot the use of a health needs assessment tool

- consult with staff representatives on health and safety matters through updated governance arrangements

Skills

We want our people to have the opportunity to learn, develop and progress in their careers, so we will invest in their skills and knowledge. We recognise that we are going to have to develop new skills, so we can interact with customers in a digital world. Our skills priorities include our tax, policy and operational delivery professions, as well as digital, programme and project management and commercial and change leadership, which are critical to the future delivery of our business. By increasing the range of skills and knowledge that our people have, we will be able to deploy them more flexibly across the organisation.

We will:

- focus learning and development opportunities on building the skills and knowledge identified as priority areas in our capability plan - digital, leading change, programme and project management and commercial skills

- launch the first tax apprenticeship programme for 68 apprentices and a new training programme (the tax specialist programme) for future tax professionals

- develop consistent role profiles across HMRC, starting with the tax, operational delivery and policy professions.

Performance

To make sure we remain a high-performing organisation, we will set clear objectives around what we expect from our people - in terms of what they deliver and how they deliver it - by holding people to account and giving honest feedback. We will continue to embed our performance management work and make sure that development conversations become a regular part of the way we do things. We will encourage our people to reward those who deliver excellence and at the same time we will identify and address poor performance so that we support our people to develop and improve. We will continue to use PaceSetter[footnote 3] principles and tools to empower our people.

We will:

- use our performance management system to make sure that our best performers are recognised through our reward and recognition processes and that we address poor performance by supporting our people to continually develop and improve

- work with our leaders and managers to make sure that everyone utilises their five days learning and development a year

- support workplace assessment activity to continually review how well PaceSetter is working in the business

We want to offer employment that is realistic and practicable in the modern world, with the aim of attracting new talent to HMRC. We are confident that by focusing on these elements, we will move significantly closer to achieving the culture that will allow us to flourish.

3.5 Managing risks to our delivery

In changing how we deliver our objectives, parts of HMRC will change significantly in size and shape during the next two years, so we need to manage the risks associated with those changes. Our business planning involves identifying issues that pose a significant risk to our performance - and then managing these risks through regular oversight and, when appropriate, taking action to reduce the impact of the risk.

We do this by regular oversight and scrutiny via our departmental Performance Committee and assurance by our Audit and Risk Committee. Each risk has a clear owner who is accountable for taking actions to mitigate the impact of the risk; these actions will vary but include:

- ensuring that there are effective controls in place

- focusing resources in priority area

- investing in enhanced capabilities

Our current departmental risks include:

Delivery of change and how we transform HMRC

The risk that:

- we do not mobilise quickly or effectively enough to deliver the transformation (transforming HMRC)

- we are unable to manage the large-scale transition from tax credits to Universal Credit (HMRC and Universal Credit)

- we do not deliver our commitments to raise additional revenues (additional revenue raised).

Managing the capability of our people

The risk that:

- we do not have the right staff in the right place with the right skills to deliver our strategic objectives (people skills and technical capability)

- we do not have the capability needed to deliver departmental transformation and improve business performance (leadership and management)

- we do not have sufficient capability or capacity in our policy community to meet the demands of our customers and enable HMRC’s effectiveness (tax policy skills)

- we experience a significant deterioration in industrial relations, sustained industrial action and unrest (employee relations)

- our ability to deliver change and maximise performance is compromised by low staff engagement (people engagement)

Information and data

The risk that:

- we are unable to protect ourselves against cyber threats (cyber threats)

- our culture and capability is silo-based and does not support the data flows required to deliver ‘digital by default’ (information management)

- we do not protect the confidentiality, integrity or availability of our assets (protective security)

Threats to our people and buildings

The risk that:

- we experience a significant event and our plans and arrangements are insufficient to enable delivery of key objectives (business continuity capability)

- we fail in our duty of care as an employer and leaseholder towards employees, customers and building users (health and safety)

Effectively managing our customer and external relationships

The risk that:

- we fail to embed or effectively use communications and stakeholder management proactively to manage our reputation, and to respond appropriately to a crisis situation (reputation management)

- we do not fully understand the impact of changes to our operating model on customer service levels, experience and behaviour, or use that understanding to shape services (understanding customers)

- we discover a key supplier is unable to fulfil their contract (supplier sustainability)

Our operating model and business direction

The risk that:

- we do not develop a realistic, affordable and understood long-term vision for the department, that enables delivery of our long-term aims (business direction)

- we do not have an effective approach to forecasting demand and balancing capacity with workload (workload, capacity and resource management)

- we are unable to deliver a sustainable and affordable business model which maintains improved service delivery at a lower cost (sustainable and affordable Personal Tax business model)

4. Annex A. Measuring success

Our success will be measured by how well we achieve our objectives. We aim to continuously improve what we do and have set ourselves challenging targets for the next two years. We will continue to monitor our performance throughout the year and to review our targets, setting new ones where necessary.

4.1 Maximise revenues

A key measure of success is the additional tax revenue we bring in through our compliance and enforcement activity. We plan to deliver additional compliance revenues of £24.5 billion in 2014 to 2015 and £26.3 billion in 2015 to 2016.

We will aim to reduce losses through error and fraud in the tax credits system towards 5.5% of finalised tax credit entitlement by 2014 to 2015, down from 7.3% in 2011 to 2012.

4.2 Improve the service that we give our customers

In the tax year 2014 to 2015 we plan to:

- work towards our aspiration of handling 90% of calls across all of our helplines, achieving a consistent level of at least 80% in 2014 to 2015

- handle 80% of correspondence within 15 working days and 95% within 40 working days, with at least 90% passing quality standards

For our benefits and credits customers we will continue to:

- handle all new claims and changes of circumstances for UK customers within 22 days

- handle all new claims and changes of circumstances for international customers within 92 days

By March 2015, 75.8% of our customers will find it straightforward to deal with us.

4.3 Make sustainable cost savings

- we will make sustainable cost savings of £198 million in 2014 to 2015 and a further £205 million in 2015 to 2016

- we will also deliver business cost reductions totalling £250 million by March 2015, as part of a wider improvement in business customer experience

4.4 What this means for our people

We plan to:

- improve employee engagement over the next two years by continuing to work towards our ambition of achieving the Civil Service benchmark of 58%

- improve engagement among the Senior Civil Service by achieving an engagement score of 72% in 2014 to 2015 and 75% in 2015 to 2016

- close the capability gap for the change leadership priority with an increase of 21% in 2014 to 2015, and 15% in 2015 to 2016

- increase the percentage of staff who feel they have the skills required to do their job to 85% in 2014 to 2015 and 91% in 2015 to 2016

- reduce the average working days lost per employee to seven in 2014 to 2015 and 6.5 in 2015 to 2016.

4.5 Environmental impact

In 2014 to 2015 we will:

- reduce greenhouse gas emissions from a combination of energy use and business travel by a further 4% in 2014 to 2015 and 2015 to 2016

- reduce waste generated by 3% in 2014 to 2015 and 2015 to 2016

- continue efforts to drive down water consumption by 2% in 2014 to 2015 and 2015 to 2016 and improve water efficiency to 6m3/FTE

- cut paper usage by 5% in 2014 to 2015 and 2015 to 2016

- increase the level of waste we divert from landfill from 66% in 2012 to 2013 to 75% in 2014 to 2015, and rising to 100% in 2015 to 2016

- reduce the number of domestic flights undertaken by 20% by 2014 to 2015

-

The latest available figures at time of publication. They provide an indication of our performance during the tax year 2013 to 2014, and are subject to revision and audit. Final performance figures will be made available when we publish the audited accounts and departmental report in June 2014. ↩

-

The latest available figures at time of publication. ↩

-

PaceSetter is a set of principles, supported by tools and techniques, which is used to improve staff efficiency in the workplace. It identifies and cuts wasteful processes which are not focused on the customer. ↩