HMRC third party tax software and application programming interface (API) strategy

Published 1 September 2015

1. Summary

HMRC recognises that many of its customers, particularly businesses and agents, choose to use commercially available tax software.

The department plans to work more closely with software developers to enable them to bring new and more sophisticated products to the market. One of the key ways we will do this is by releasing application programming interfaces (APIs) with richer capabilities. These will allow developers to do much more, and encourage innovation.

This is good news for customers. It will mean more tax software products to choose from; ones that increasingly help customers to get it right first time and make tax easier.

At the same time it is good news for HMRC as it will help us to improve compliance.

To find out more or to be involved as part of our testing and consultation, please email our Software Developer Support Team.

2. Introduction

HMRC is becoming a digital organisation. We are introducing digital tax accounts for all UK businesses and individuals, which will give customers a personalised user experience and show exactly what’s owed.

We recognise that third party software, such as commercially available tax software packages, will remain the first choice for many of our customers, particularly businesses and agents. This means that, as well as delivering high-quality HMRC digital services, we will need to do more than we have in the past to help and support developers of tax software.

This strategy sets out how we plan to do that. The information in it will mainly be of interest to software developers, tax agents and intermediaries.

2.1 HMRC Third Party Tax Software and API Vision

When, for example, a company uses an accountancy software package to calculate and submit its Corporation Tax return to HMRC, the software speaks to the HMRC service using APIs. These are open sets of standards that describe how information can be exchanged between applications and services.

Our vision is to provide software developers with better and richer APIs that:

- bring new and more sophisticated software products to the market

- generate greater competition in the software industry, which will result in more choice for customers

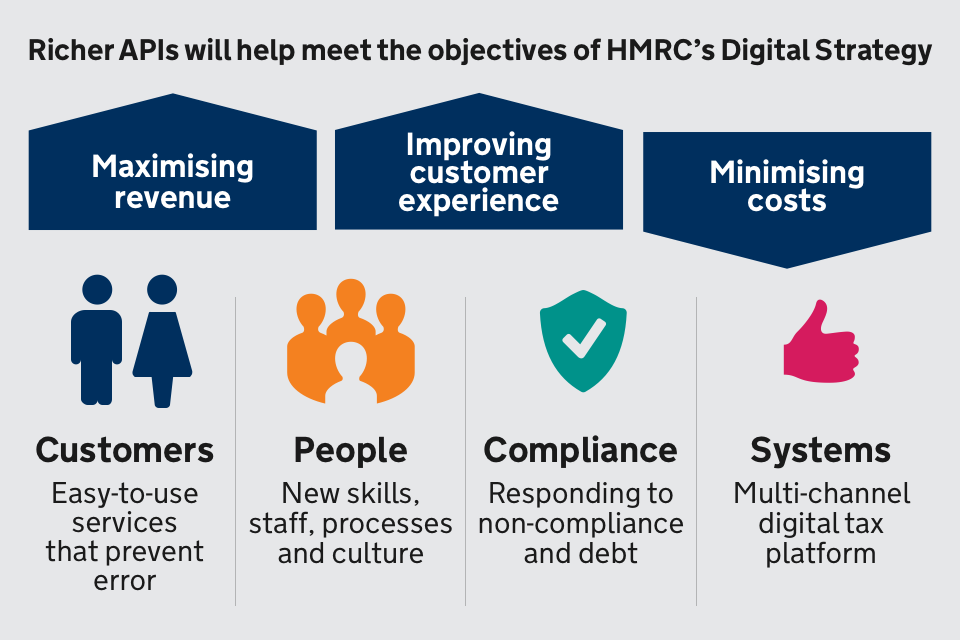

- at the same time, help HMRC meet its key objectives of maximising revenue, improving customer experience, and minimising costs

Diagram showing how Richer APIs will help deliver HMRC’s digital strategy

Our vision is based around six core principles. We will:

- promote a ‘third party software first’ approach for businesses and agents

- build APIs with richer capabilities; allowing existing developers to do more and encouraging new intermediaries into the tax software market

- seek to reduce error closer to the point of transaction and use APIs to help our customers get it right first time

- develop APIs that help make interactions straightforward for users of third party software, enabling third party products to work seamlessly with HMRC systems

- publish performance figures for our APIs that help developers to improve their products

- help make third party software more attractive for customers and reduce the dependency on HMRC products and support

3. Our current position

We currently have APIs in place for 21 of our services (listed in Annex A) and the majority of transactions carried out online with HMRC come via third party software.

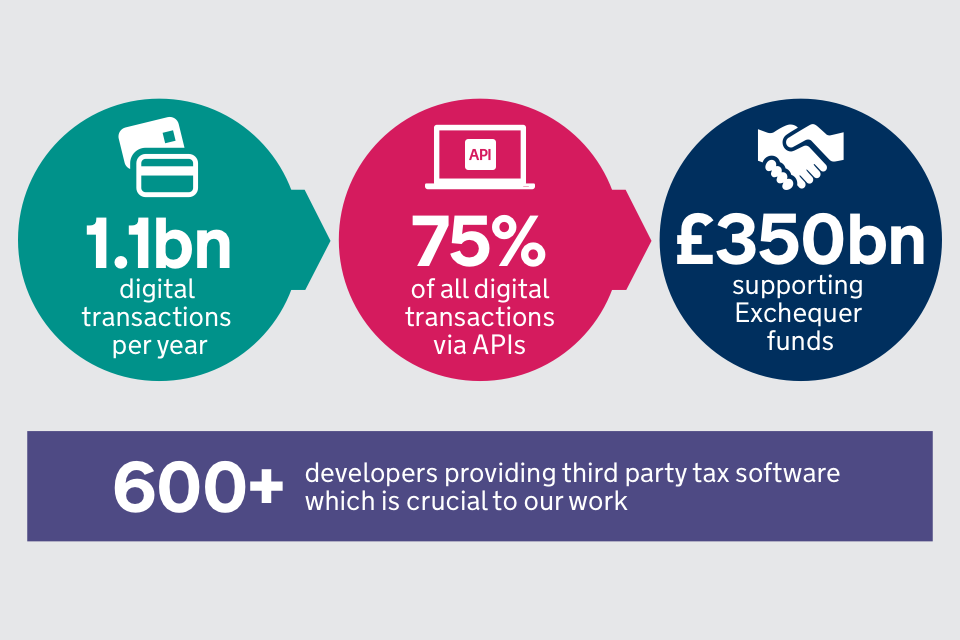

HMRC is responsible for more than two-thirds of all government transactions, or 1.24 billion per year counting online, post and telephone. More than 1.1 billion (92.7%) are digital and three quarters of these are completed through an API using a third party product.

These API submissions are supported by a community of more than 600 third party software developers who are responsible for the products many of our customers use. It’s clear that third party software products, and those who develop them, are crucial to HMRC’s role in collecting tax.

Diagram showing HMRC’s current situation

4. Optimising our services

4.1 What we mean by optimising services

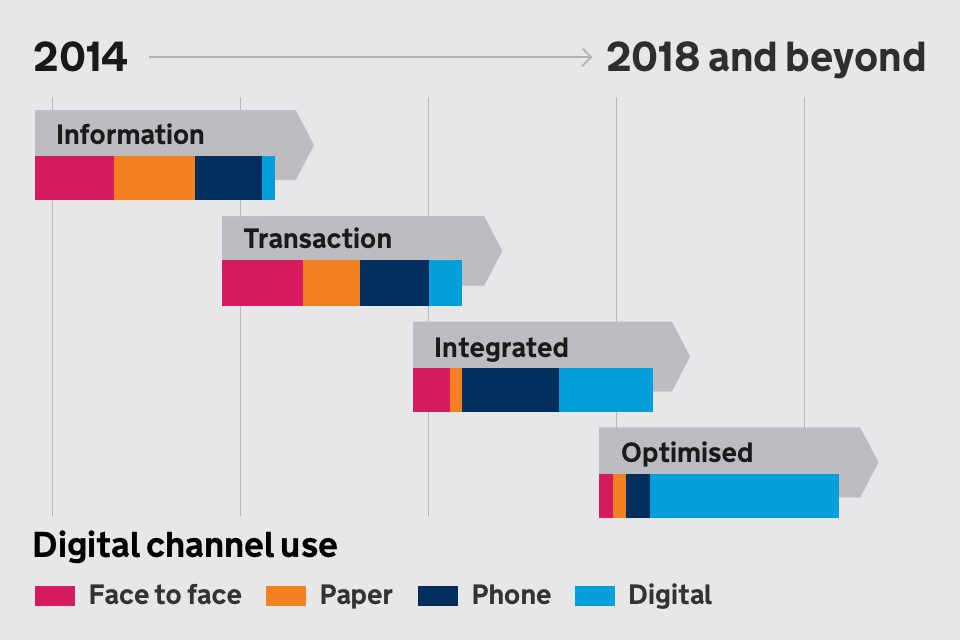

For HMRC to achieve its digital ambitions, APIs will become increasingly important. As the HMRC Digital Strategy outlines, we are on a digital journey to move from information and transaction-based services to services that are fully integrated and optimised. These will offer a smooth, consistent, real time experience for our customers.

Chart showing HMRC’s digital journey to move from information and transactional services to integrated and optimised services

We want our customers who choose third party software to benefit from more integrated and optimised products; ones that work seamlessly with HMRC systems. We will build a suite of APIs that will enable third party products to carry out more tax functions and in greater detail.

4.2 The difference between transactional, integrated and optimised services

Transaction-based APIs: These APIs enable applications that let customers complete core tax obligations, such as submitting returns. Test environments are available for each API and statistics for product performance.

Integrated services: APIs designed to support development of applications with ‘bundled’ services, in other words third party software that lets customers carry out a number of different transactions. A broader range of APIs allowing software users a seamless end-to-end experience within their application.

Optimised services: APIs capable of supporting highly effective, integrated applications across a number of devices and channels. HMRC reporting requirements are integral to business applications.

5. Delivering our API objectives

HMRC’s strategic API objectives are to:

- grow the market of developers and intermediaries

- stimulate the demand for their services

- increase the internal efficiency of our organisation

Chart showing HMRC’s 3 strategic API objectives

What we mean by each of these and how we plan to achieve them is explored here in more detail.

5.1 Grow the market

Growing the third party tax software market will give our customers, particularly businesses and agents, more choice. It will also help encourage economic growth. We will start this growth by improving our offer to developers, increasing collaboration with developers we already have a relationship with, and encouraging new ones into the market.

We will do this by:

- promoting third party software products that meet the needs of a wider range of customers

- removing entry barriers for new third party software developers to stimulate the market and provide increased opportunities for smaller, innovative developers

- sharing HMRC business rules with third parties to empower software developers to develop products allowing customers to get it right first time

We will:

- work more closely with developers, and earlier in the technology lifecycle, so that they can spend more time developing great software

- build a self-serve developer hub with performance dashboards, standardised documentation and integration tooling to improve the experience for all developers

- publish internal and external APIs that prepopulate data and HMRC business rules to reduce errors

We will measure:

- number of registered third party software developers and products

- number of new services available via the API Platform

- customer satisfaction in new products and services

5.2 Stimulate demand

We will stimulate demand for third party software products by building APIs to industry standards and allowing consumption by all organisations, including other government departments. This will give software developers access to more APIs and enable them to develop a wider range of products. APIs will allow the use of data that can help customers get things right first time, improving HMRC’s response times.

We will do this by:

- making third party software the default choice for businesses and agents

- giving third party software developers access to more APIs to promote a wider range of products, which are tailored to meet the needs of users

- encouraging new intermediaries to enter the market by removing barriers to entry

We will:

- focus on building HMRC’s digital services for those users that need them most, such as individuals and micro-businesses

- provide APIs that allow customers to greater access to their own data and services in real-time within software products

- develop richer and more granular APIs allowing greater accessibility for intermediaries to support the needs of customers

We will measure:

- percentage change in the number of submissions per service made via APIs against other channels

- number of API submissions made per service per year

- number of new intermediaries entering the market

5.3 Increase efficiency

Through better APIs, third party software will be able to use the same rules and logic that HMRC services use and can be prepopulated with data. This will make tax easier for customers and help more of them get it right first time. In turn, this will allow HMRC compliance staff to focus their efforts on the minority of deliberate rule-breakers, and not the majority who are trying to do the right thing.

We will do this by:

- equipping HMRC to best serve the needs of software developers

- empowering users to self-serve through third party software and reduce their dependency on HMRC support

- reducing the cost of our legacy channels and providing a migration path to the new API Platform

We will:

- deliver a self-service API Platform that permits testing in live environments

- share real-time APIs for HMRC business rules enabling software developers to build risking capabilities into their software

- shift compliance effort to more effective interventions by reducing errors at the point of transaction

We will measure:

- the total cost to HMRC of receiving submissions via third party software

- the number of calls made by customers to HMRC in relation to third party software

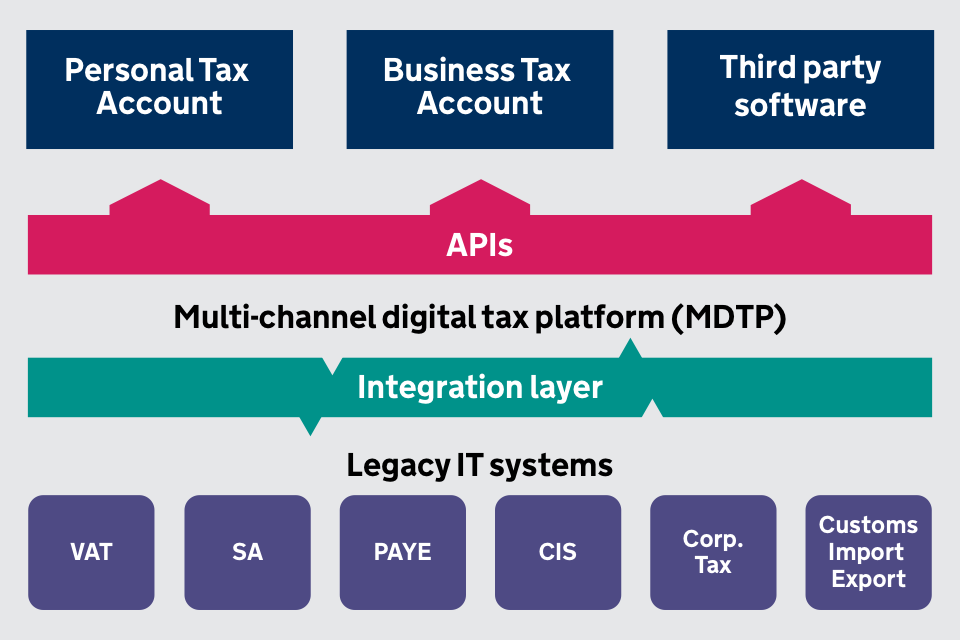

6. High level architecture

We will build an API platform that forms part of our Multi-Channel Digital Tax Platform (MDTP). The MDTP is a new digital platform with a common infrastructure that links existing and new systems. This enables HMRC to be more consistent and responsive in the way it provides services. The platform is secure, reliable, flexible and scalable allowing HMRC to develop services quickly. HMRC will be able to manage customer contact flexibly through a range of communication channels including phone, secure messaging and web chat.

Similarly, the API platform will provide the shared tooling, documentation and test environments to enable an HMRC-wide approach to APIs. By centralising the API architecture we will make the process of composing, securing and managing APIs simpler and more consistent.

HMRC will use MDTP’s micro-service architecture in order to deliver a best practice API platform with API management capabilities. This supports our movement to an ‘API first’ approach to digital delivery. As we move to this way of working, we will treat HMRC digital delivery teams in the same way as external software developers. Both will be building services on the APIs that HMRC has built and released via the API platform. We will reduce the time to market for the release of APIs, focusing our efforts in building great online services in the areas where our customers need an HMRC option.

Diagram showing HMRC’s API architecture

7. What our approach will mean

7.1 For our customers

More choice: More high-quality APIs will encourage new and more sophisticated tax software products. By building upon our existing digital tax platform to deliver integration tools and share development environments, we will remove barriers to entry into the market, allowing for innovation and increasing competition. All of this means more choice for our customers. In addition, allowing third party software developers to provide support as intermediaries will broaden the choice for customers when they need help

A better experience: APIs will enable an integrated experience for our customers allowing us to use the data and intelligence we have about them to give them a personalised service, whether they choose to interact with us directly or through third party software. We will be able to prepopulate data and embed risk triggers within third party software, helping customers to get it right first time and making tax easier

7.2 For HMRC

A clearer focus: Our third party tax software and API approach will allow HMRC to focus on building digital services for those that need them most. By creating the opportunity for third party software developers to build products that better meet the needs of those who already choose to use them, we can focus on improving the experience for those customers who prefer to engage with us directly

Improved compliance: Sharing HMRC business rules will help customers get it right first time and reduce the amount of errors in returns. This will allow HMRC’s compliance staff to focus their time on investigating deliberate rule-breakers and those trying to commit fraud.

8. Next steps

8.1 Working closely with software developers

HMRC has a long and productive relationship working with software developers. The transformation of PAYE through the introduction of Real Time Information (RTI) was achieved through HMRC working closely with third parties. We will build on these strong foundations by opening a collaboration zone to provide a physical space for software developers and our support teams to work together.

This is an evolution in our ways of working with the software industry. It will strengthen our existing relationships with developers even further, and help ensure that where there are real customer needs that can be better served by the wider market, these are met.

8.2 Consultation

We will engage early and consistently with software developers both internally and in the external market to ensure that what we deliver, and what we enable, will meet their needs. We will run workshops, conduct in depth interviews and create feedback loops that will allow us to continually improve.

8.3 Proving the technology

We will concentrate our efforts on developing and proving the core technology that will enable us to deliver what we have set out in this document. Through the use of agile methodology we will quickly build a minimum viable product that will be improved iteratively. We will also continue the engagement with third parties to ensure the products we develop are valuable.

9. Contact us

If you have any questions or comments or would like to be involved as part of our testing and consultation, please email our Software Developer Support Team.

10. Annex A: List of current services with APIs

- Alcohol & Tobacco Warehousing Declarations (ATWD)

- Charities Online / Charities for Agents Online

- Child Trust Fund (CTF)

- Construction Industry Scheme (CIS)

- Corporation Tax (CT)

- Customs Freight Simplified Procedures (CFSP)

- Customs Handling of Import Export Freight (CHIEF)

- EC Sales List (ECSL)

- Excise Movement and Control System (EMCS)

- Foreign Account Tax Compliance Act (FATCA)

- Import Control System (ICS)

- National Export System (NES)

- New Computerised Transit System (NCTS) XML

- Online Agent Authorisation

- Pay as You Earn (PAYE) RTI, which includes:

- Incoming transactions - RTI submissions, and Expenses & Benefits (EXB)

- Outgoing notifications - Data Provisioning Service (DPS)

- Pension Schemes

- Self Assessment (SA)

- Stamp Duty Land Taxes (SDLT)

- VAT Online (VAT Returns)