HMRC digital strategy: 2014

Updated 24 November 2014

1. Introduction

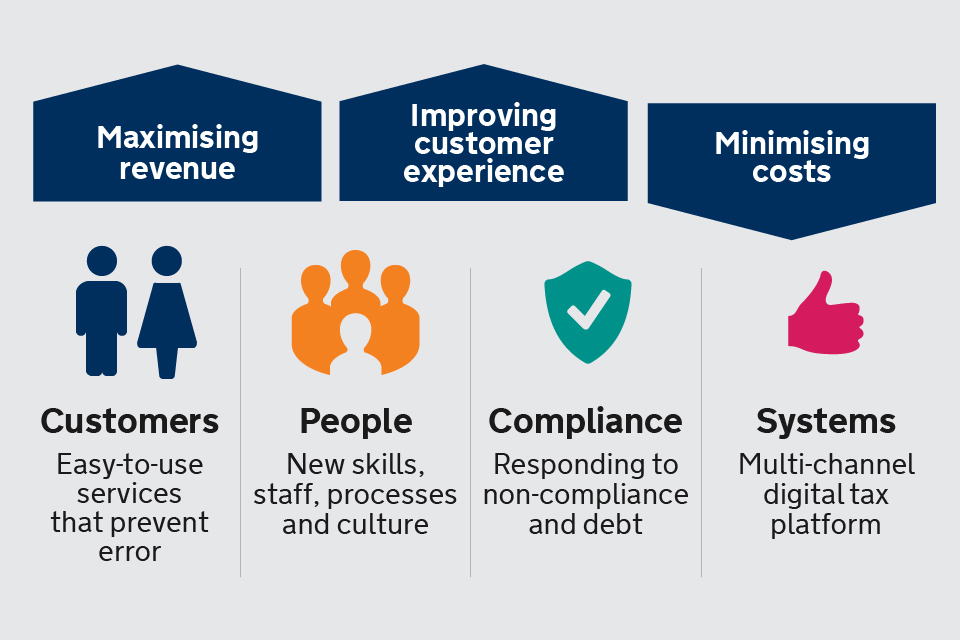

HMRC plays a crucial and unique role in the UK. We collect the money that pays for the UKs public services, and help families and individuals with targeted financial support. We help the honest majority to get their tax right and make it hard for the dishonest minority to cheat the system.

HMRC has continually increased the amount of revenue we collect – effectively, efficiently and impartially. We have improved our services to our customers and we have delivered some major projects, which have radically improved the UK’s tax system.

Improving our services means changing how we think about compliance. By designing services that make it easy for customers to get things right, we will reduce customer error. Our digital services will give us better data and insight about risks to compliance. This will allow us to focus our compliance activity and expertise on those determined to dodge their responsibilities. Digital services will allow us to consult our customers on policy proposals and changes so that we can improve them.

Every customer in the UK will have their own personalised digital tax account, so we can help make it simpler, quicker and easier to pay the right tax at the right time.

This will have big implications for our staff, as well as our customers, involving changes to the types of job we will be doing and the skills we will need.

Image showing how HMRC can maximise revenue and improve customer experience, whilst minimising costs.

1.1 HMRC Digital Vision

We will design digital services for our customers that:

- are easy-to-use, convenient and personalised for individuals, businesses and agents

- promote digital take-up and voluntary compliance by designing for customer needs

- use data to help customers avoid errors through pre-population

- provide assistance in using or accessing our services for those who need it

We will give our people the skills to make the most of digital tools and services by:

- investing substantially in training, new tools and better IT

- working together in new, multi-disciplinary teams

- using better data to make management, policy, operational and intervention decisions

- embedding a culture of continuous improvement of services and processes

Our digital services will move compliance work upstream:

- intelligence-led responses, supported by better data and risk analysis

- more rapid responses that benefit from better information

- greater cross-government integration and analytics for debts owed

We will enhance the systems that provide and support our digital services by:

- building a multi-channel digital tax platform, upon which all new digital services operate

- connecting with HMRC’s existing systems and joining up services

- ensuring our services are safe, secure, trusted and fully accredited

- managing customer authentication and agent authorisation in a straightforward way

2. Our current position

HMRC is responsible for more than two-thirds of all government transactions, with 1.23 billion during 2012 to 2013. This covers all methods of contact.

Our ‘exemplar’ digital projects for individuals have already been launched:

- PAYE for Employees – making it easier for customers to tell us about changes that affect their tax code

- Digital Self-Assessment – making Self-Assessment filing a completely digital process

We are improving digital services for businesses through:

- Your Tax Account – which joins up existing online services for small business customers

- Agent Online Self-service – which makes it easier to register as an agent for our services

In 2012 to 2013 telephone and paper contact was:

- 245 million forms and guidance

- 200 million outbound letters

- 73 million customer support phone calls

- 70 million items of post received

Image showing the numbers for telephone and paper contact.

There is more to do. We are working on enhancing our digital services to support all of our customer groups.

3. Building our digital future

3.1 Moving to a digital HMRC

We need to transform how we interact with our customers in three key ways:

Becoming a more digital organisation

| When | Our position |

|---|---|

| Now | HMRC has high volume online transactions, but for a small number of services |

| Few services are provided through digital channels from beginning to end | |

| Transitional (2014 to 2015) | Four services (PAYE for Employees, Digital Self-Assessment, Your Tax Account and Agent Online Self-service) deliver stand-alone, end-to-end services through digital channels |

| Benefits and Credits service to support tax credits customers to renew their claims | |

| Transforming (to 2018, and beyond) | Most interaction with customers will be automated through digital self-service |

| New channels (e.g. social media) provide efficient means of communication | |

| Using better data to make management, operational and intervention decisions |

Expanding our interactive relationship with customers

| When | Our position |

|---|---|

| Now | The majority of individual customers have no active relationship with HMRC, because they pay Income Tax through PAYE |

| Transitional (2014 to 2015) | Active relationships develop with customers through digital tax accounts and assisted digital services |

| First wave of digital services for individuals and businesses designed to help customers pay the right tax at the right time | |

| Transforming (to 2018, and beyond) | Dealing with HMRC through personalised, multi-channel digital services is the norm for the majority of customers |

| Direct interventions occur where they can be most effective (e.g. sophisticated and complex non-compliance) or for those most in need of support |

Collecting and enforcing intelligently

| When | Our position |

|---|---|

| Now | Data will be collected and analysed over long periods (e.g. yearly or monthly), limiting pace of change |

| Much compliance activity is ‘downstream’ (post filing), involving high contact, resource intensive work to address error | |

| Data analysis and ‘risking’ (risk analysis) supports better case selection and development of campaigns to address non-compliance and minimise debt | |

| Transitional (2014 to 2015) | Digital services provide data and customer insight that informs the improvement of those services as well as the development of policy |

| Analytical capabilities are developed to support a range of HMRC activities e.g. identifying indicators of evasion, enabling more refined planning of intervention activity | |

| Transforming (to 2018, and beyond) | Data is collected and analysed over short periods (e.g. daily or hourly), enabling near real time responses to change |

| Much more compliance activity will be ‘upstream’ (pre-filing). Pre-population, helps prevent error and large-scale automated activity based on circumstances and risk | |

| Use of digital tools throughout the organisation gives greater flexibility and speed in responding to changing circumstances (including new tax risks) |

3.2 Increasing our digital capability

All our people will need tools and training to support our digital transformation.

Specialist digital skills

We will increase our in-house digital development skills.

| When | Our position |

|---|---|

| Now | Limited specialist digital development skills – sourced primarily from external partners |

| Transforming (to 2018 and beyond) | In-house teams of digital specialists are well established, delivering best-in-class, end-to-end digital services |

Digital throughout the organisation

We will increase our digital skills and use of digital tools in all areas of work.

| When | Our position |

|---|---|

| Now | Digital knowledge and skills largely limited to those working on digital projects |

| Transforming (to 2018 and beyond) | Staff throughout the business will be familiar with the latest digital developments and tools |

Culture and mindset

We will have an increasing number of cross-functional service delivery teams.

| When | Our position |

|---|---|

| Now | Teams primarily organised in terms of similar skill sets. Culture characterised by relationships based on tax regimes |

| Transforming (to 2018 and beyond) | Multi-disciplinary teams of policy, compliance, operational and digital specialists. Service-oriented culture characterised by collaboration, flexibility and openness |

Service development

We will increase the number of continuously improving digital services.

| When | Our position |

|---|---|

| Now | Early agile developments establish service delivery teams, principles and ways of working. Insights fed back in order to improve development process |

| Transforming (to 2018 and beyond) | Customer feedback and service data used to continually develop services, which are delivered through a fortnightly release schedule |

Governance and funding

We will increase the flexibility of funding arrangements for services.

| When | Our position |

|---|---|

| Now | Rigid governance of service delivery, subject to gateway approvals and based on fixed solutions outlined in business cases |

| Transforming (to 2018 and beyond) | Funding based on iterative business cases, enabling ‘test and learn’ approaches to delivery. Digital service managers will be empowered to implement what works best on a continual basis |

4. Our multi-channel digital tax platform

We are building a new digital platform with a common infrastructure that links existing and new systems. This means we will be more consistent and responsive in the way we provide our services. The platform will be secure, reliable, flexible and scalable, allowing us to develop services quickly. We will be able to manage customer contact flexibly through a range of communication channels including phone, secure messaging and webchat.

Image showing technology and communication themed icons.

The platform has some key features that will help us deliver digital services in new ways:

- GOV.UK Verify will provide common authentication for citizens – to use our services, businesses and their representatives will also be authenticated

- Application Programming Interfaces (APIs) will link digital services on our platform to our existing tax, duty, levy and third party systems – allowing us to provide services in a consistent, yet flexible way

- Customer Relationship Management (CRM) systems will keep a record of and manage our interactions with customers, allowing us to personalise our services

- it will provide a platform upon which all new digital services can operate

- it will build connections to HMRC’s existing systems

- it will ensure all our digital services operate in a way that is safe, secure, and fully accredited

- it will support flexible, responsive digital service development

The platform will provide customers with a secure service in line with the departmental security strategy.

5. What digital will mean

5.1 For our customers

Digital tax accounts – individual and business tax accounts for all of our customers

All of our customers and the businesses we serve will have access to a personalised online tax account. They’ll be able to file, pay and make changes across all of their taxes, in a single place. Customers will increasingly be able to get what they need from us online. If they do need to contact us via another channel they will receive a fuller service covering the range of taxes they pay.

We will use the data and intelligence we have about our customers to present the personalised service. They will feel that we have a really good understanding of what is going on in their lives. When they deal with us it will be as though we are picking up a conversation where they left off – rather than starting all over again.

| Key functions | Customers will be able to… |

|---|---|

| Providing information and support | See all tax statements in one place |

| View and amend tax codes | |

| Access customer support using a range of secure digital channels | |

| Link accounts with authorised partner or family | |

| Making transactions simple | Notify us of changes of circumstances |

| File tax returns and pay online | |

| Secure access for personal accounts | |

| Secure access for business and agent accounts | |

| Receive alerts of forthcoming filing requirements or payments due | |

| Provide an agent or representative with delegated authority to act on their behalf | |

| Using data intelligently | Spot possible errors as the system uses analytics to grade their risk (e.g. businesses with abnormal profit levels) |

| See their return pre-filled with existing information (e.g. PAYE data) | |

| Have third party data integrated with their tax account (e.g. asset disposals) |

To ensure that no one is excluded from our digital services, we will provide extra support to customers who need it through our assisted digital and inclusion services.

5.2 For our people

Moving to a digital way of working

Our work will be more about handling the complex tasks that can’t be taken care of automatically. Digitisation will change how we work in HMRC, automating many processes that are currently done manually. This will reduce the need for some roles and create new roles, with new skills and new flexible ways of working.

Greater analysis of digital data will mean we become better at linking third party and customer data. More transactions will be automatically risk-assessed in real time and we will find ways to respond to customers that improve their compliance. This will mean we can focus more on tackling evasion, deliberate non-payment and criminal activity.

We will design tax policy that we can implement digitally, which makes the most of the opportunities that digital services provide.

Ways of working

| Area of work | Change/impact |

|---|---|

| Customer support | Staff are cross-skilled to support a range of services |

| Fewer ‘handoffs’ required to deal with customer queries | |

| Operational | Move to cross-functional digital service delivery teams comprising digital, operational and other specialists |

| Compliance | Compliance expertise integral to design of digital services |

| Better data and improved risk analysis to produce intervention cases | |

| People intensive enforcement used to tackle sophisticated non-compliance |

Skills and capabilities

| Area of work | Change/impact |

|---|---|

| Customer support | Increased use of digital tools that improve effectiveness and efficiency |

| New IT to support digital services | |

| Operational | Increasing skills in gathering customer insight and analysing data, to provide continuous feedback to service development teams that improves service quality |

| Compliance | Greater innovation and collaboration to translate compliance insight into digital ways to address risk |

| Compliance experts trained to carry out intelligence-led complex interventions |

Customer journeys

| Area of work | Change/impact |

|---|---|

| Customer support | Increasingly deal with those customers who we know need most support |

| Continually finding ways to help more customers self-serve | |

| Operational | Focus on improving end-to-end service quality (rather than reducing inbound volumes or rates of customer error) |

| Compliance | Understanding how best to help customers pay the right tax at the right time becomes a critical part of customer journeys |

Roles and responsibilities

| Area of work | Change/impact |

|---|---|

| Customer support | As digital services mature and provide greater customer insight, new roles will develop to meet new challenges |

| Operational | Making key decisions about how to move staff between back-end processing and digital and phone or post support |

| Compliance | Compliance support, risking, analytics, automated intervention and tackling deliberate non-compliance will be key roles |

Measures of success

| Area of work | Change/impact |

|---|---|

| Customer support | Reduction in overall post and phone volumes and times |

| Reduction in paper handling and number of exceptions | |

| Fewer errors made by customers | |

| Operational | Continuous improvement of digital service uptake and quality |

| We will be able to react in real time to customer behaviour | |

| Compliance | Increase in voluntary compliance and fewer errors made by customers |

| Increase in automated interventions |

5.3 For our Organisation

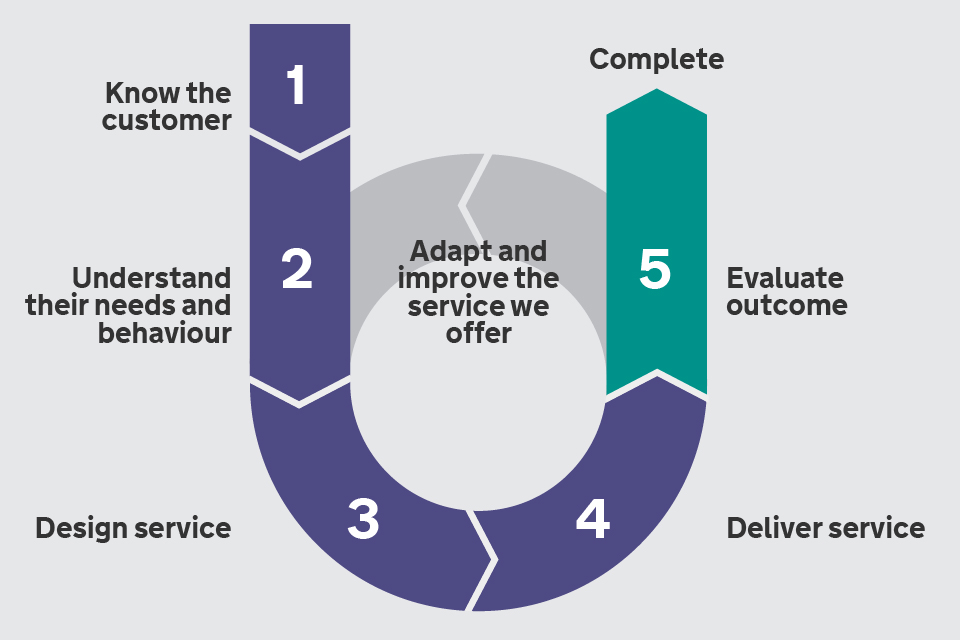

Starting with our customers

We will work more closely with our customers to understand their needs so that we can be sure our services are helping them get things right first time. We need to build up teams that can understand customer behaviour, deliver and run services, change policy and address tax risks at the same time.

Image illustrating the process of creating a digital service.

Eventually, we will be able to respond in near real time improving and adapting our services and evaluating our policy.

6. How we will deliver the change

6.1 Key areas of our work

Developing new skills

We will recruit new staff as we increase our digital capacity – ranging from experienced specialists to talented graduates and apprentices and form flexible multi-disciplined teams, located together.

Delivering our digitised service improvements:

- digital infrastructure and our current systems – a flexible, scalable platform for digital services

- digital contact – secure digital contact with HMRC

The digital tax account will provide every customer with a secure personal mailbox for two-way communication with us. We are exploring other methods of digital contact (webchat, SMS etc) so that we can address different customer needs. Email will not be used to exchange personal or customer information, though it will be used to alert customers to messages in their secure mailbox and for other non customer-specific responses.

Customer support model and tools – better integrated customer support

Tailored routes for customers to address queries based on their needs – including the ability to self-serve digitally where ever possible.

Digital tools for staff

Our customer support staff will also benefit from these digital tools that increase their ability to help customers quickly and effectively – including knowledge databases and a single, integrated customer contact history that provides a better overall picture of their circumstances.

GOV.UK Verify and authentication

Authentication management using GOV.UK Verify will provide a secure login for citizens that utilises best-in-class security. We will also adopt a common, secure approach to authentication for businesses, which will also provide authority management for agents and intermediaries.

Software developers and third party applications – building for customers together

We will be working with software developers in the development of our own digital services. We will continue to explore the development of APIs (Application Programme Interface) for commercial software developers where there are real customer needs that can be better served by the wider market.

Risking and analytics systems – moving towards easy intelligence led interactions

We will be using data intelligently to enhance our analytical systems and expertise in order to support new functions, such as prompts for customers to review information where potential errors have been identified.

7. The Future

Currently, our digital services are at different stages for different groups of customers, products and services. Some are already wholly or partially online, such as RTI for employers and SA filing; we need to bring all of services up to the same level.

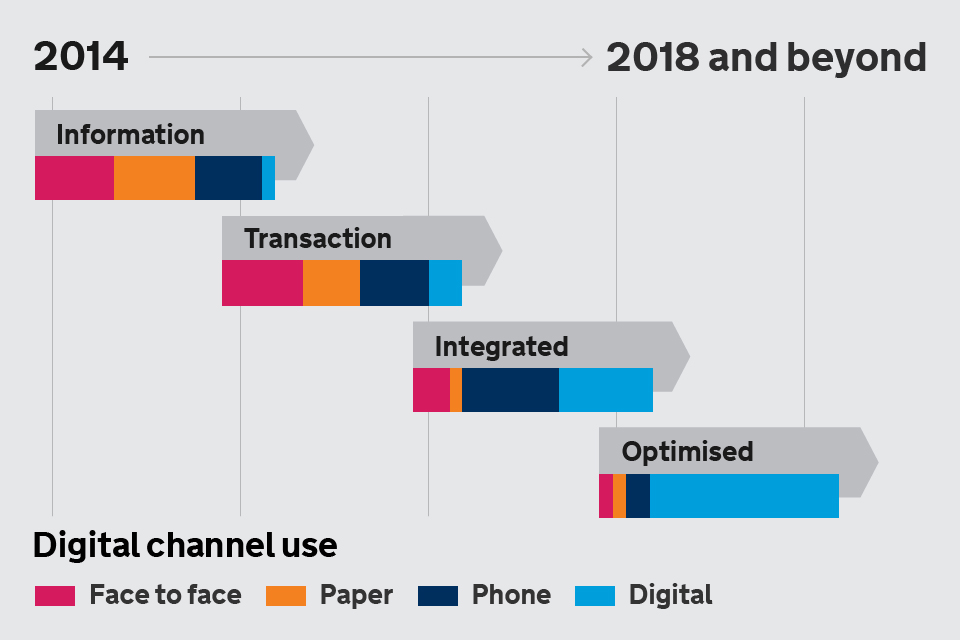

For individuals, our services to customers will evolve in four phases, moving from largely information-based customer services to an integrated set of digital services. Much of the business interactions are at a transactional level.

Image showing the progress of digital channel use in four phases - information, transaction, integrated and optimised - over the period 2014 to 2018

| Type of service | What customers will see |

|---|---|

| Information-based services | |

| Efficient, effective methods of delivering important information to customers. Digital becomes the primary channel for delivering information and publications, leading to a reduction in phone, face-to-face and postal volumes | GOV.UK – an easier to use, customer-focused website, allowing customers quickly and accurately to find the information and forms that they need |

| Transaction-based services | |

| Self-service applications relating to core tax obligations. Services for individuals are product-based. Begin to bring business applications into a single dashboard view | Business applications integrated into a single dashboard view with PAYE employee services updating information at the time it is entered (in real time). |

| Integrated services | |

| A seamless end-to-end experience for customers, with self-service applications ‘bundled’ together to provide integrated services based around life events and addressing tax risks | Personalised services through the digital tax account, which shows customers all their information and transactions in one place. An additional ten million individual customers access online services, vastly reducing paper and face-to-face contact |

| Optimised services | |

| Highly effective integrated services available across all key devices and channels use third party data and real time information updates to enhance services (e.g. through pre-population) | Services check information at point of capture (upstream compliance). Automatic pre-filling of some customer information and ‘nudges’ (reminding customers to undertake actions). 4.9 million SMEs and 70% of our forty-five million individual customers have access to our digital services, with Assisted Digital channels for those who need help |

7.1 Measuring our services

| We will measure customer satisfaction and costs for each of our digital services, checking them to make sure that | |

|---|---|

| Take-up increases | We will analyse the performance of our digital services to find where we can make improvements – using the latest data and feedback available. |

| Cost per transaction decreases as our customers are more able to self-serve | We will choose performance indicators for services that show us how well we meet customer needs and use this information to improve the performance of our services |

| Completion rates increase as they become easier to use | |

| Customers’ satisfaction increases as we deliver what they need and make improvements to their experience |

| Meeting customer needs | |

|---|---|

| Access services quickly and easily (including completing transactions, handling digital communications etc) | Know what happens next and when it is finished |

| Understand what they have to do and when | Get the right outcome first time, every time |

| Performance of digital services | |

|---|---|

| Available when customers need them (via the multi-channel digital tax platform) | Increasing proportion of transactions processed without the need for manual intervention |

| Increasing proportion of transactions assessed for risk at time of submission | Increasing proportion of online transactions pre-populated with data |

| Measuring the right things and checking them continuously will tell us if our digital services are improving |

7.2 What success will look like

As we build and improve our services to deliver more digitally, we expect to see things change for our people and organisation. At a high level our metrics will include:

- the number of new digital users and uptake of digital transactions

- the quality of digital services

- the volume of transactions via phone and paper channels, both inbound and outbound

- the relationship between channel traffic, for example reduction in outbound post and the increase in text messaging and secure mail as replacement services

We have set out our digital journey where we will be rolling out services which will be used by millions. Over the next few years in which digital services will be at the heart of everything we are doing – for online customer services, for personalising our relationships with customers, for compliance and for you. This is our digital journey.

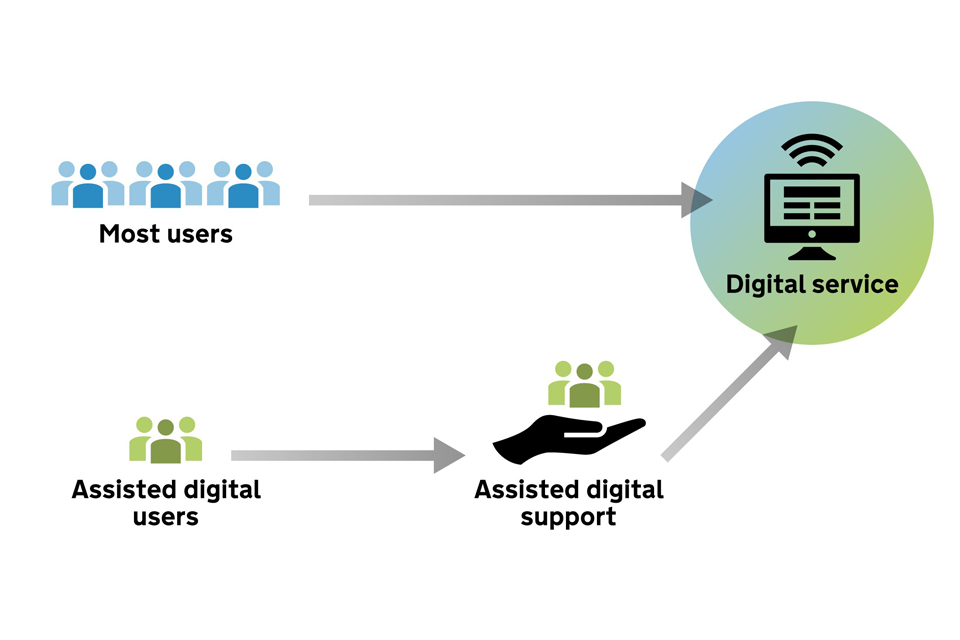

8. Digital and inclusion – How we will support the Digital Strategy

We’re putting digital at the heart of everything we do. Our Building our Future work explains how we’re changing every aspect of our organisation to support a fully digital way of working, and our Digital Strategy sets out how we’ll provide all of our customers with their own personal online tax account – a single place where they’ll be able to see all of their taxes, file, pay and make the changes that they currently do by post and by phone. In the months and years to come, customers will increasingly be able to get what they need from us online.

But we know that not everyone is ready (or able) to use digital services. People have a range of needs, so, for example we’ll need to provide extra support and encouragement for those who need a bit of help, right through to offering different ways for people to get their information into our digital services for those who really can’t do it alone.

8.1 What is assisted digital & inclusion?

Assisted digital (AD) is the help and support we provide to customers who are not able to use our digital services on their own.

We know that not all our customers are online - often because they don’t have access to a machine or connectivity or because they lack the motivation, ability, skills or confidence. Inclusion is about ensuring that as we continue to become a digital by default organisation, we’ll have to be careful that we don’t leave any of these ‘digitally excluded’ customers behind.

Good assisted digital support should encourage and equip people with the skills to eventually self-serve. As more of our customers find themselves able to use our digital services, we’ll be able to increasingly focus on helping people become capable of using and benefiting from the internet and those who really can’t, even with help ensuring that no one is digitally excluded.

8.2 How do digital inclusion and assisted digital work together?

At first glance, digital inclusion and assisted digital can seem like the same thing, and in truth they are closely related. Think of it as a journey – before a customer can even think about using one of our digital services, they need a few essentials:

- access to a computer (which might be a traditional desktop computer, or a smartphone or tablet or potentially any kind of internet enabled device) or a smartphone or tablet or potentially any kind of internet enabled device

- an internet connection

- basic digital skills (for example, how to use a browser)

Helping to provide these essentials is part of digital inclusion. Simply put, it’s what we do to help customers get to the point where they’re able to try using our digital services. To ensure no-one gets left behind we are working with other government departments and organisations in the public, private and voluntary sectors to support the Government Digital Inclusion strategy. To help us get it right we will:

Get to know more about our customers

- we know that our customer base covers pretty much the entire spectrum of UK people – so going by the following data and this data it’s reasonable to assume that a large number of our customers will be digitally excluded

- commission research, and kick off a pilot project in this area to provide benchmarks against our progress on Assisted Digital and inclusion

Providing this service and support to our customers is not just about providing some extra help over the phone (although that might be part of it). In HMRC, assisted digital means:

| Everyone working together to help make sure that our customers can access and use our digital services, whether it’s (for example): | Signposting our customers towards places that can help them find: |

|---|---|

| the people who develop our policy and legislation thinking about how it will be translated into great digital services | free or low cost digital devices and/or access the internet |

| those who build our digital services making sure they apply the very latest in accessibility and usability thinking | digital skills training |

| those who design our internal processes making sure there’s provision for customers who can’t use computers or those who directly support our customers Understanding the range of assisted digital options | For more about helping people get basic internet access and skills, see the Government Digital Inclusion Strategy |

| Providing alternative options for those who, after everything, are still unable to use our digital services |

8.3 Who might need our help

Customers needing assisted digital help and support may include those who:

| Customers Who… | Why they need our help |

|---|---|

| lack skills / confidence | some of our customers are unfamiliar with digital devices and simply don’t have the skills or confidence to use them successfully without support |

| lack IT access | GDS research suggest a large number of UK adults don’t have access to either the necessary hardware or have a connection to the internet |

| are disabled | Again, GDS research suggest a large proportion of disabled adults have never used the internet |

| are digital objectors | Some customers are practising members of a religious society whose beliefs prevent them from using computers |

8.4 Our principles

We’ve developed high level principles to help us stay focused on providing the best possible assisted digital and ensuring all customers are always included. These are that we need to:

- be clearly based on the needs of the user, including the need for enhanced digital accessibility in our products

- provide an alternative way to access our digital services

- include an opportunity for learning, and (where appropriate) encourages users to use our digital services independently in the future

- help users to get their tax right

- we will build digital inclusion into our digital service support to ensure everybody who needs it has access is supported and encouraged to use them

| No. | Principles | How we will deliver |

|---|---|---|

| 1 | No one is left behind | We will continue to provide assistance for those who cannot get online so that no one is excluded from HMRC’s digital services. |

| 2 | Provide clear signposting | We will provide simple, effective signposting to Digital Inclusion and assisted digital support available both within HMRC and through external providers. |

| 3 | Collaboration | We will work with GDS and other government departments to use shared capabilities. We will consider external procurement where this provides the most suitable option for our customers and where it also provides the best value for money. We will support initiatives that simplify the processes for customers who wish to make use of partners, agents and intermediaries to assist them when dealing with us. |

| 4 | Secure services | Any assisted digital support provided by third parties should include robust Authority Management procedures to maintain the integrity, confidentiality and security of the service. |

| 5 | Appropriate services | The type and range of assisted digital support we provide will be appropriate the needs customers, the service provided and the compliance risk posed. |

| 6 | Build in Compliance | Assisted digital continues beyond our first contact with customers to include how we interact with them to address compliance risks. |

| 7 | Understand our excluded customers | We’ll do everything we can to understand the changing needs of our digitally excluded customers. We’ll involve customers in the testing of our digital services and use their feedback to understand how we can make our services more inclusive. |

| 8 | Enable everyone to play their role | We’ll identify opportunities for everyone to promote digital inclusion, both within and beyond HMRC. |

| 9 | Build simple, relevant and trusted services | We’ll focus on the needs of our customers to make our services are as simple to understand and use as possible. We will ensure they are available on the platforms and devices our customers use and accessible for those with disabilities. |

To deliver the above we will develop and implement a governance process to provide effective assisted digital delivery. As digital use increases and the demand for non-digital services falls we will, over time, reduce the resources made available for alternative channels for the digitally able.

8.5 What success will look like

Our work on Assisted Digital and Inclusion will be successful if our customers tell us:

- they’re able to use our digital services where they couldn’t before because they have received the right support

- they’re saving money and time as our digital services are simpler, quicker and more convenient than before – enabling them to (for example) self-serve digitally, spend less time contacting us or avoid penalties through better understanding of their obligations

- our digital support will help customers who need it first time

We would also expect to see the following over time:

- a decrease in the number of digitally excluded customers

- an increase in the proportion of customer contact that comes in via digital channels

- increasing ability of particular customer groups to deal with us, especially where we have specifically targeted them with digital inclusion initiatives

8.6 Assisted Digital Inclusion and Support Model

| Customer Needs | Current Support | Additional / Alternative |

|---|---|---|

| Simple advice and Support | Technical help – browser advice, screen settings, text sizing, using PDF, links to external resources | New apps for easy completion |

| Online Tools and calculators | ||

| Signposting | Provision of IT - IT terminals and support available for assisted filling for the following customers- dyslexic, illiterate, disabled, partially sighted, impaired vision, pensioners, people lacking confidence | Intelligent telephony |

| Digital support as part of the new support model for supporting those customers who need extra help | ||

| Signposting - to external D support (third party / voluntary sector) and to skills training and availability of free or low cost public - PCs to enable customers to get online | ||

| Grant funding – extend existing model to include Assisted Digital support | ||

| Dedicated specialist support | Small business advice - Online Demonstrator / Registration advice Self-employment eLearning Bite sized HMRC tax information videos | Triage options e.g file by phone |

| Dedicated telephony support - For example – Welsh Agents | Mobile devices – as usage increases for transacting purposes, consider bespoke help and guidance | |

| SME education – Educational internet content – YouTube channel | Dedicated telephony support – MyTaxAccount 24/7 response line | |

| Assistive technology – Advice on assistive software packages | Assistive technology – Advice on procuring assistive software packages / online guidance | |

| Disability – Face to face support for deaf/blind customers – Free language interpretation service that the Visually Impaired Media Unit provide | Support via web chat | |

| Revised face by face model - Telephony triage – Mobile outreach |

8.7 Progress

| Actions | Commitments | Section | Status |

|---|---|---|---|

| Action 1 – Digital Service Managers will be in place for HMRC’s exemplar digital services from April 2013. Job holders will be offered training to top up their digital skills. | Communication plans are in place to deliver timely, focused and targeted messages to customers who will be using new public beta digital services over the next year. A multi media approach is being used - via HMRC internet, radio media, specialist customer groups and conferences. Our digital roadmap outlines how we will achieve our Spending Review 2013 (SR13) commitments. We will continue our work on identifying how we will transition customers to Digital through our research and modelling activities and align this with the Digital road map. | 3 | COMPLETED |

| Action 2 – HMRC will ensure that all transactional digital services have clearly identified Service Managers by March 2015. | We will continue working with GDS and the selected partner organisation to help us build our capability and to design new agile processes. In order to scale up our development capacity we will work closely with our partners, Small and Medium Enterprises, academia and utilise HMRC Apprenticeships and Graduate schemes. To deliver the departments digital roadmap through to 2016 to 2017 we expect to increase our development capability to around 20 sprint teams. | 3 | |

| Action 3 – Plans to improve HMRC’s digital capability will be included in our business plan for 2013 to 2014. These plans will deliver a strategic and sustainable approach to digital, rather than tactical digital solutions, and will include HDS developing a digital literacy programme and HMRC creating a web development team to deliver projects in an agile way. | We will continue working with GDS and the selected partner organisation to help us build our capability and to design new agile processes. In order to scale up our development capacity we will work closely with our partners, Small and Medium Enterprises, academia and utilise HMRC Apprenticeships and Graduate schemes. To deliver the departments digital roadmap through to 2016 to 2017 we expect to increase our development capability to around 20 sprint teams. | 3 | |

| Action 4 – HMRC will ensure that newly appointed Digital Service Managers are allowed full access to the extensive programme of training and support, run by the Government Digital Service from summer 2013. | 3 | COMPLETED | |

| Action 5 – As one of the seven ‘transactional’ departments, HMRC is required to agree three exemplar services with the Cabinet Office and identify these in their digital strategy in December 2012. These services – including the necessary business process re-engineering – will be included in HMRC’s business plan for 2013 to 2014. Redesign will start by April 2013 and the services will be implemented by March 2015. | We will continue to work closely with GDS to redesign our services in line with Spending Review 2013 (SR13) Transformation. | 7 | COMPLETED |

| Action 6 – Learning from the exemplars, HMRC is required to redesign all services with over 100,000 transactions by the end of the next spending review period. The deadlines for completion of each service will be included in the annual update to the HMRC business plan following agreement from Cabinet Office. | We will continue to work closely with GDS to redesign our services in line with Spending Review 2013 (SR13) Transformation. | 4 | |

| Action 7 – From April 2014, all new or redesigned transactional services will meet the Digital by Default service standard. | We will continue to work closely with GDS to redesign our services in line with Spending Review 2013 (SR13) Transformation. | 3,4 | |

| Action 8 – Between November 2012 and March 2013, the corporate publishing activities of HMRC will move on to GOV.UK. we are planning to expand publishing of APIs with third parties for our new registration service. | HMRC is making good progress and has an agreed delivery plan with GDS to transition the HMRC website to GOV.UK by the end of 2014. | 7 | |

| Action 9 – March 2014, the information publishing activities on HMRC’s website will move onto GOV.UK. | HMRC is making good progress and has an agreed delivery plan with GDS to transition the HMRC website to GOV.UK by the end of 2014. | 7 and Digital Roadmap | |

| Action 10 – HMRC will produce a refreshed channel strategy and will set out plans to encourage channel shift to digital in the Departmental business plan for 2013 to 2014. | Communication plans are in place to deliver timely, focused and targeted messages to customers who will be using new public beta digital services over the next year. A multi media approach is being used – via HMRC internet, radio media, specialist customer groups and conferences. Our digital roadmap outlines how we will achieve our Spending Review 2013 (SR13) commitments. We will continue our work on identifying how we will transition customers to Digital through our research and modelling activities and align this with the Digital road map. | n/a | COMPLETED |

| Action 11 – HMRC’s business plan for 2013 to 2014 will clearly identify the savings HMRC expects to make as a result of increased use of digital services in 2013 to 2014. | n/a | COMPLETED | |

| Action 12 – will work up an assisted digital strategy, taking a cross-government approach where possible. As part of that work, HMRC to explore a digitisation solution to apply to the (reduced) amount of paper that will still flow in to HMRC. | The Digital Strategy outlines our commitments and principles for Assisted Digital and Inclusion. | Appendix | COMPLETED |

| Action 13 – HMRC will work with GDS as part of GDS’s strategic supplier management function to maintain a forward looking pipeline of digital work, updated quarterly. | We will continue to work with the cabinet office and GDS to encourage pre-market engagement and take advantage of the training GDS will offer. This will be incorporated within our capability strategy and transformation plan. | Digital Roadmap | COMPLETED |

| Action 14 – HMRC will use the existing Cabinet Office spend controls process to encourage better pre-market engagement, shaping specifications to take advantage where appropriate of the market’s latest offerings and innovations. | We will continue to work with the cabinet office and GDS to encourage pre-market engagement and take advantage of the training GDS will offer. This will be incorporated within our capability strategy and transformation plan. | n/a | COMPLETED |

| Action 15 – HMRC will take full advantage of the training GDS will offer to departmental procurement leads in support of new procurement arrangements. | We will continue to work with the cabinet office and GDS to encourage pre-market engagement and take advantage of the training GDS will offer. This will be incorporated within our capability strategy and transformation plan. | 3 | COMPLETED |

| Action 16 – HMRC will use these common technology platforms for Digital by Default services for new and redesigned services, unless a specific case for exemption is agreed. | Complete delivery and further develop the Multi Channel Digital Tax Platform inline with our agreed prioritisation and pipeline. | 4 | COMPLETED |

| Action 17 – HMRC will begin reporting against defined data-sets provided by Cabinet Office from April 2013. | We will complete the delivery of KPIs and metrics for exemplars. We will also develop a set of metrics in line with departmental measures to track progress away from paper, phone and post. | 7 | COMPLETED |

| Action 18 – HMRC’s new Digital by Default services will include automated collection of management information. | We will complete the delivery of KPIs and metrics for exemplars.We will also develop a set of metrics in line with departmental measures to track progress away from paper, phone and post. | 4,7 | COMPLETED |

| Action 19 – HMRC will embed digital by default service delivery in the heart of its policy-making process. Where relevant, advice to Ministers will include information on how new policies are being developed to the digital by default standard. | As part of our capability development plan we will implement the relevant training and development for policy makers. | 3,5 | |

| Action 20 – HMRC will train and develop policy makers to understand and use a wider range of digital methods and channels, and use these to engage and consult stakeholders around areas of policy development, up to and including formal consultations. This will be reflected in HMRC’s Business Plan for 2013 to 2014. | We will continue work with policy experts as part of joint working and business planning to determing the impact of digital with a view of developing a package of policy and legislative measures to ensure we can deliver on our Spending Review 2013 (SR13) commitments. | 3,5 | |

| Action 21 – We will pilot the use of social media for simple customer queries and will continue to work up HMRC’s email strategy. | All services are designed with integrated feedback forms for customers. We are about to undertake a limited social media pilot with customers during Autumn 2014. We will use the pilot to test a number of social media tools. Our evaluation and customer feedback will outline our approach to using social media to improve engagement and support customers. We have outlined in the digital strategy our approach to engage with customers. | 6 | |

| Action 22 – Policy experts to work closely with digital specialists on the design of the exemplar services. Discussions will be held early in each design process and will be continued throughout development. | We will continue work with policy experts as part of joint working and business planning to determining the impact of digital with a view of developing a package of policy and legislative measures to ensure we can deliver on our Spending Review 2013 (SR13) commitments. | 3,5 |