[Withdrawn] Help to Grow: Digital – vendor application guidance (wave 1)

Updated 9 September 2021

The eligibility and product criteria below applied to wave 1 only. We will review and update the eligibility criteria ahead of future waves.

Vendor application and onboarding timeline

The timeline below provides an indicative overview of the key dates between this publication and the scheme going live. Beneath each date is the corresponding milestone and the actions eligible vendors should expect to take at each stage.

More information on these milestones and actions is provided in the How to apply and If your application is successful sections. Further details will be provided to eligible vendors.

Please note that these dates are liable to change.

29 July 2021:

- launch of vendor and product application process

8 September 2021:

- vendor and product application window closes

By 8 October 2021:

- vendors notified of application outcomes

- unsuccessful vendors will be informed of the appeals process

Mid-October 2021:

- vendors receive additional information on technical requirements and grant token redemption

- vendors submit additional information for the product list

Mid-November 2021:

- deadline for providing additional information on products

- deadline for changes on vendor site to accept grant tokens

- all testing of system and integration between vendor and system administrator to be completed

By the end of November 2021:

- vendors provide bank details and set up redemption process with scheme administrator

- Help to Grow Digital scheme ready for launching with SMEs to apply for grant tokens and make purchases from vendor website

Vendor eligibility

Vendors who wish to be eligible to provide technology products through Help to Grow: Digital will be required to submit an application form providing details of their business and proposed products.

Eligible vendors will:

- be registered in the UK at Companies House

- have been trading for at least 12 months

- be a producer and vendor of eligible technologies (we are not accepting resellers or partner networks for wave 1, but will keep this under review for future waves)

- demonstrate cyber security measures are in place

- be GDPR compliant

You will need to undergo fraud checks in line with the terms and conditions of the scheme.

You will need to put in place additional technical capabilities in order to comply with the grant token requirements.

Product eligibility

The 3 technology types eligible for wave 1 are:

- accounting

- customer relationship management (CRM)

- e-commerce

You will need to provide an application for each product you wish to be considered for inclusion in Help to Grow: Digital (though these multiple applications can be done through a single spreadsheet-based application form, see below). You can submit up to 3 eligible products per technology category for wave 1.

If you have tiered offers within your products (for example, basic, standard, ultimate) you will need to submit these as separate products for wave 1.

Each product, as defined above, will need to be submitted separately within the application form.

You will need to demonstrate that eligible products:

- are 1 of the 3 technology types eligible for wave 1

- can be purchased through a complete online retail buying journey in a self-service capacity, at the time of the application

- have a listed price without the need for a negotiated sales process

- have out of the box functionality with minimum configuration required (the product should have business ready processes, screens, and data requirements available as a default solution)

- meet minimum functionality criteria

- have an existing UK SME customer base, illustrating that it’s supporting UK SMEs

- provide the expected functionality and capability provided in a stand-alone solution

- demonstrate adherence to cyber security protection measures

- are sold as a software solution (either as a Software as a Service (SaaS) or on-premise solution including monthly subscription, annual or multi-year contract) and not as a pay per use service

- have a verifiable history of use (over 12 months) by SMEs using customer retention rates

- are endorsed by customers through the use of public rating sites (G2 or Capterra), we will need you to provide links

In addition:

- accounting software products should demonstrate compliance with Making Tax Digital for VAT

- e-commerce products must be provided as standalone software enabling the SME to publish their own commerce presence and storefront online

All eligibility criteria listed above must be met at time of application. Applications will not be considered where the vendor must make changes to products or processes to make them eligible as part of wave 1.

This eligibility criteria applies to wave 1 only. We will review and update the eligibility criteria ahead of future waves.

Excluded products

For wave 1, accounting, CRM or e-commerce must be the core capability provided by eligible products and not a module within a larger product ecosystem.

Products not eligible for wave 1 of the scheme include:

- enterprise resource planning (ERP) solutions that provide accounting capability within a modular solution

- add-ons and integrated solutions that extend capability following an ecosystem approach (this applies to all technologies that take a similar modular approach to providing capabilities or have an app marketplace that sells add-on components developed by independent software vendors or partners (ISVs/ISPs))

- single product ‘business management solutions’ targeting fuller operational capability and broader functional coverage providing capability for end-to-end operational management

- existing marketplace ‘seller accounts’ that allow an SME to publish and sell their product catalogue

- services that involve paying for one-off, per-use delivery of the capability on an ongoing ‘whenever used’ basis, such as transactional costs or service execution

This is not an exhaustive list of excluded software types or packages. You should consider how your product fits against all eligibility criteria when submitting your applications.

This eligibility criteria applies to wave 1 only. We intend to bring additional technology categories into the scheme in future waves.

Cyber security considerations

The vendor must self-declare their proposed products follow recognisable industry standards related to cyber security set by the National Cyber Security Centre (NCSC).

The focus should be on how this capability is designed to provide data protection assurance and prevent unauthorised access.

The list below is provided as a guideline and not considered to be comprehensive, nor is the vendor or product expected to meet all of the listed requirements. The vendor must be able to demonstrate that they have an awareness of cyber security concerns and have incorporated that into their product development work.

In order to provide evidence of resilience against compromise, please tell us what security measures from the list below apply to your product:

- has undergone appropriate verification (such as testing, review and static code analysis) to reduce the risk of defects and exploitable vulnerabilities being present

- contains no default passwords or, where this is unavoidable, forces them to be changed immediately

- implements 2-factor authentication (2FA) on all ‘important’ accounts (that is ’high value’ accounts (such as administrator accounts)).

- validates all input data, whether that be entered via user interfaces, transferred from other systems (perhaps through the use of application programming interfaces (APIs))

- only contains third-party components that are frequently monitored to determine whether they contain vulnerabilities (for example, through regular scanning) and where vulnerabilities are detected prompt and appropriate action is taken

- is kept updated, with easy to implement updates of assured provenance (for example, through the use of cryptographic hashes that can be verified before installation) released to supported customers in a timely manner

- has a vulnerability disclosure policy that contains a suitable mechanism by which externally discovered security defects can be reported (this will enable mitigations to be developed, tested and deployed before flaws can be exploited)

Please tell us about other cyber security measures you have that you think are relevant, including any accreditation or certifications you have in place.

Product metrics and extensions at additional cost

In addition to licenses being sold based on numbers of users, products often include maximum thresholds as part of the offering and license terms.

These may be in the form of:

- cloud storage space

- customer data volumes

- number of transactions

- lower-level technical thresholds that limit customisation, such as maximum number of lines of code, number of API calls (on an hourly or daily basis), as well as other limitations the vendor has imposed

The limits are monitored and measured by the vendor and the customer must stay within and adhere to the limits as part of acceptable and agreed use of the product. Often these limits and thresholds can be exceeded or expanded for specific customers but priced separately and at an additional cost to the customer. The vendor may not reduce these limits from what they offer as standard to other customers or create a new product with lower limits.

The standard limits that the vendor imposes on SMEs who use the technologies will be requested during the product application process. The limits provided by the vendor solution in this context should be enough for an organisation with between 5 to 249 employees to operate for more than 1 year, based on vendor experience with similar sized customer organisations in similar sectors or industries, and be part of an existing product configuration that has been sold to other customers prior to the launch of the scheme.

Additional costs in relation to exceeding these standard limits, along with any product support enhancements or uplifts beyond a standard support offering, are not included in the scheme for redemption. However, SMEs participating in the Help to Grow: Digital scheme should be able to access enhancements at the same price as available to other customers and vendors should ensure that any price for enhancements offered to SMEs is equal to or lower than the price advertised on the vendor website to other customers.

Product definitions and capabilities

Accounting software

Accounting software can perform a variety of tasks. It allows businesses to automatically record financial transactions, along with reporting and analysis. This is particularly useful for enabling tasks like bank reconciliation.

Accounting software functionality differs from product to product. It offers tools like bookkeeping, financial reporting, invoicing and bill payment, as well as facilitating mandatory compliance activities such as digital filing for organisations who must comply with HMRC Making Tax Digital constraints.

Minimum capability required:

- chart of accounts

- accounts payable (AP)

- accounts receivable (AR)

- general ledger

- bank reconciliation

- tax management (VAT)

- tax management (company income)

- period close management

- profit and loss statements

- expense tracking

- balance sheet management

- user management

- compliance with Making Tax Digital requirements for VAT

Advanced capabilities:

- financial reporting and analytics

- billing and invoicing

- project accounting

- revenue management

- contract accounting

- revenue recognition

- supplier management

- work breakdown structure (WBS) management

- purchase request management

- purchase order management

- asset management

- debt management

- interest management

- cash position management

- financial risk management

- currency management

- expense management

- purchase order (PO) workflow and approvals

- payment management

- earnings before interest, taxes, depreciation and amortization (EBITDA) calculation

Customer relationship management (CRM)

A customer relationship management (CRM) system is used to manage interactions with customers via capture and analysis of a wide range of compiled data and associated processes. A CRM system helps businesses build and manage customer relationships and streamline processes so they can increase sales, improve customer service and gain and share insight into their target audiences.

There are several different variations of CRM that perform a variety of functions:

Vendors can make an application for up to 3 products per technology category. CRM is considered 1 product category and so a vendor will be able to list up to 3 CRM products in total, irrespective of the variation. Any CRM product proposed will be assessed against the variation proposed and the criteria set out below.

CRM sales

CRM sales (also known as ‘sales force automation software’) helps users organise sales force functions and increase sales productivity and customer visibility.

Functions include lead management, customer account management, contact management, and product management. CRM sales software also often enables automated sales analysis and structured sales processes for an organisation.

Minimum capability required:

- account management

- contact management

- lead management

- opportunity management

- sales process management

- activity management

- interaction management

- sales pipeline analysis

- product management

- pricing management

- user management

Advanced capabilities:

- configure, price, quote (CPQ)

- offer management

- order management

- contract management

- document templates

- document management

- correspondence management

- quote management

- territory management

- invoice management

- event management

- comms preferences

- brand management

CRM service

CRM service (also known as ‘customer service software’) helps make customer service and customer interactions more efficient as well as improving understanding of customer history.

This is done through a case management system for resolving customer queries; gathering customer requests collected from a variety of support channels into one place; and providing analysis into customer interactions and the user’s customer service experience.

It also entails compiling and evolving a knowledge base for service agents to enable consistent messaging, customer experience and process across all customer service channels.

Minimum capability required:

- account management

- contact management

- case management

- channel management

- service process management

- activity management

- interaction management

- knowledge management

- user management

Advanced capabilities:

- assignment management

- skills management

- contract management

- service level agreement (SLA) management

- asset management

- install base management

- customer portal and self-service

- document templates

- correspondence management

- workflow management and process automation

- product management

- notification and alert management

- workforce management

- service analysis

CRM marketing

CRM Marketing (or ‘marketing automation software’) improves the efficiency of marketing processes and helps users develop and manage marketing campaigns.

Common functions include campaign management, campaign and marketing analytics, customer segmentation, and communications templates and preference management to enable organisations to identify potential opportunities for increased sales within their existing customer base as well as targeting new potential customers.

Minimum capability required:

- account management

- contact management

- list management

- comms templates

- comms preference management

- lead generation

- prospect management

- campaign management

- campaign and marketing analytics

- customer segmentation

- user management

Advanced capabilities:

- communications management

- multi-variant testing

- digital marketing management

- personalisation

- loyalty management

- next best action (X-sell / upsell)

- survey management

e-commerce

e-commerce platforms in their simplest form allow businesses to sell their goods and services online via customer self-service. Many platforms have also been developed to include additional features such as order management, inventory management, website building tools, accounting, and customer service platforms.

e-commerce products included in Help to Grow: Digital must be provided as standalone software enabling the SME to publish their own commerce presence and manage an independent online storefront. Existing marketplace ‘seller accounts’ that allow an SME to publish and sell their product catalogues within a third-party market solution are not eligible for the scheme.

Minimum capability required:

- online store front management

- product catalogue management

- pricing management

- product content management and presentation

- shopping cart management

- order management

- account/customer management

- customer experience and user journey management

- payment management

- payment integration

- user management

Advanced capabilities:

- pricing rule management

- transactional configure, price, quote (CPQ)

- discount management

- coupon management

- order orchestration

- inventory management

- supply chain and distribution integration

- commerce analytics

- product analytics

- personalisation

- digital marketing

- loyalty management

- currency management

- service activation and provisioning

- product search

- product comparison

- product recommendation

- order history management

- return materials authorisation (RMA) management

- customer review management

- customer service integration

- warranty and entitlement management

- translation and region variants

What the grant token covers

Help to Grow: Digital will offer eligible SMEs a grant token worth up to £5,000 to cover up to half of the costs of pre-approved, digital technology solutions for 12 months.

This grant token will be redeemable with eligible vendors against eligible products. It will be for vendors to calculate and provide the discount when an SME makes an eligible purchase, in line with the Terms and Conditions [embed link].

SMEs may wish to add additional functionality or services that are not covered by the grant token when making a purchase; it will be the vendors responsibility to ensure SMEs are aware that they are solely liable for these costs and to ensure the grant token is not applied to out of scope functions or services.

It will be the vendors responsibility to seek reimbursement for the value of the grant token from the scheme administrator.

The grant token will cover:

- 12 months of eligible product core costs (as set out above) exclusive of VAT

Vendors will be expected to price any eligible products listed through Help to Grow: Digital in line with pricings on their public websites as set out in the terms and conditions.

SMEs should have access to any free trials offered to customers through the vendor’s public site. Any free trial period will not count towards the 12-month grant token period.

SMEs should have access to any discount periods offered to customers through the vendor’s public site. These discount periods will be included within the 12-month grant token period.

The grant token will not cover:

- VAT

- implementation (planning or delivery) services

- vendor professional services beyond what might be included as standard or that are incurred at additional cost

- support package uplifts that are provided at additional cost and provide more than the standard vendor support model

- scenarios not adhering to the approved upgrade options

- training (end user or technical) beyond what might be included as standard or that are incurred at additional cost

- infrastructure costs (for on-premise solutions or private cloud options whether externally hosted, or deployed within the customer SME data centre and where infrastructure costs are separate)

- extensions to the standard product capacity limitations (in reference to the previous section regarding product metrics and extensions at additional cost)

- application management services provided by the vendor or a third-party to support system administration and overall operational support and management of the product

- back-up and recovery tools or services related to customer data management if the back-up and recovery services the vendor would be providing as part of delivering their cloud-based service does not include customer data

- business continuity or disaster recovery solutions

- other ineligible products being procured from the vendor at the same time as the eligible product (add-ons)

- products developed by partners or independent solution vendors (ISVs) intended to work with the core product and sold as integrated components or via a vendor app store or marketplace

- multiple eligible products

Upgrades

The Help to Grow: Digital scheme is primarily intended for SMEs adopting new to firm technologies. However, upgrades of existing products will be permitted in some circumstances providing the outcome is to improve firm level productivity.

Wave 1 is focused on enabling SMEs to purchase software with the core features of the eligible product categories. The grant token may not be used to extend an existing solution already in use by the SME with either partner products or other supporting modules. The grant token cannot be used to cover the full purchase price of core software plus these add-ons for new customers. The grant token can only be applied to the core product price.

For example, accounting add-ons or solutions that integrate with the core accounting products to enable the vendor’s ecosystem or modular product strategy are not eligible to be purchased under the scheme. Existing SME customers cannot use the grant token to purchase solutions that extend their current systems beyond the core product capabilities, and new customers will only receive a grant token on the core product price if they choose to include any add-ons during their purchase.

This is applicable not just for accounting solutions but also extends to CRM and e-commerce solutions that take a similar modular or ecosystem approach and/or that have an app marketplace that sells add-on components provided by the vendor, their partners or other independent software vendors (ISVs) that provide compatible solutions to expand the core product capabilities.

Upgrades that will be permitted on the scheme for wave 1 are:

- moves between vendors for similar products (an SME may wish to move to a supplier that has software solutions that better meet the needs of their company and deliver improved productivity)

- major upgrades that represent an architectural shift and change in operations, for example from desktop-based applications to cloud based software as a service (this will be allowed for existing vendor customers)

- new product variants from the existing vendor, or a new vendor, to expand the functionality and include additional capability (the new product variant must be from 1 of the 3 approved technologies for wave 1; this might include adding CRM Sales if an SME already has CRM Marketing as CRM Sales is from a new product variant)

This eligibility criteria applies to wave 1 only. We will review and update the eligibility criteria ahead of future waves.

How to apply

Applications for wave 1 of the scheme are now closed.

We will review and update the guidance ahead of future waves.

1. Agree to the terms and conditions

At the beginning of the application form, you will be asked to agree to the terms and conditions for being an eligible vendor in the scheme.

You will need to be authorised to agree to the terms and conditions on behalf of your company.

Vendors should note that by submitting the application form they are accepting how we will use and process the data provided, as outlined in the privacy notice. The privacy notice gives permission for their information to be shared with other government departments if necessary, and the future scheme administrator.

2. Complete the application form

You will need to download a copy of the application form and complete the form offline.

The deadline for applications to be submitted to BEIS is 11:59pm on 8 September 2021.

Any single vendor can submit up to 3 products for each of the 3 technology categories, up to a maximum of 9 applications in total using separate tabs in the spreadsheet.

CRM is considered 1 product category and so you will be able to list up to 3 CRM products in total, irrespective of the variation. Each (spreadsheet) application form has additional sheets so that you can submit up to the maximum 9 products in a single form.

An accessible .odt version of the application form is also available. Please note that if you use the .odt version of the form, unlike the spreadsheet version where you can submit multiple products in a single application, you will need to submit a separate application for each product.

If you need any help preparing for, or submitting your self-assessments or application form, you can contact us at: vendors.helptogrow@beis.gov.uk.

Further information about what to expect in each section of the application can be found below:

Section 1: Vendor (Company) Self-Assessment

Section 1 asks questions about the vendor’s company itself, such as whether it is registered in the UK and has been trading for at least 12 months.

It is essential that your application responds ‘yes’ to all the statements as part of the minimum eligibility requirements for being a vendor on the scheme.

If for whatever reason you believe that you are eligible despite answering ‘no’ to one of these questions, please email us at vendors.helptogrow@beis.gov.uk.

Section 2: Vendor (Company) Details

This section asks for essential information about your company, including details that can be checked against records held by Companies House and others, and to facilitate anti-fraud checks.

This section also asks for the contact details of the primary (and if needed, secondary) points of contact going forward. Please be aware that we will only correspond with individuals named in this form, or explicitly authorised via future correspondence with the original named point(s) of contact.

Section 3: Product Self-Assessment

This section asks questions about the product, such as what type of (eligible) technology it is, and whether it is compliant with the core capabilities required for the technology.

The product ‘minimum capabilities’ question specifically requires you to review the lists provided in this guide: ‘Product Definitions & Minimum and Advanced Capabilities’. The requirements are different for each of the three types of technology, and for the three types of Customer Relationship Management system (sales, service, marketing).

It is essential that your application respond ‘yes’ to all the statements as part of the minimum eligibility requirements for being a vendor on the scheme.

If for whatever reason you believe that you are eligible despite answering ‘no’ to one of these questions, please email us at vendors.helptogrow@beis.gov.uk.

Section 4: Product Details

This section asks for essential information about the product itself to assess eligibility.

Some information is asked for that will not be used to assess the product directly, but for reference only. This information will be important to assist BEIS in the future development and evaluation of the scheme.

The product ‘advanced capabilities’ question specifically requires you to review the lists provided in ‘Product Definitions & Minimum and Advanced Capabilities’. The requirements are different for each of the three types of software, and again for each of the three types of Customer Relationship Management system (sales, service, marketing).

In the spreadsheet version of the application form, additional sheets are provided so that you can submit up to three products in a single form but note that these must all be from the same category (accounting, customer relationship management, e-commerce). If you wish to submit products from different categories you will need to submit multiple application forms. If you are using the accessible .odt version of the application form you will need to submit a separate form for each individual product.

5. Submit the application form

You will need to attach your application form to an email and send it to the central vendor inbox (vendors.helptogrow@beis.gov.uk) using the subject line: APPLICATION [Company Name].

After you’ve applied

After submitting your application, you will receive an automatic confirmation that your application has been successfully received.

You will later receive a follow up email which will include a unique reference number for your application. You will need to quote this in any follow up communication to help us to process your query.

Your application will be reviewed, alongside checks to confirm the validity of the details provided, and any history of fraud associated with your company.

Vendors will be notified about the outcome of their application by 8 October 2021.

For those applications which are unsuccessful there will be routes available to:

- lodge an appeal

- make a complaint

We will not accept a second application for the same product if it is assessed to be ineligible for the scheme. If this happens to your product and you disagree with the assessment you will have the option to appeal the decision.

If your application is successful

Next steps

1. Receive additional information on website change requirements

Technical instructions will be communicated to your company on how to make the necessary changes to your website so that it will be able to accept and process the grant tokens that SMEs will use to make their purchases.

Indicative details of what the full instructions will contain, in terms of the functionality that will be needed to accept grant tokens and redeem funds from the scheme can be found below.

These changes will need to be completed by mid-November 2021.

Support will be available in the form of technical advice to vendors’ digital staff or provider, accessible via vendors.helptogrow@beis.gov.uk.

2. Submit additional product information

Product information for approved products will need to be provided for use on the Help to Grow: Digital platform. This will provide core information for the product list that we will create, and will be presented to SMEs in a comparable manner.

The product list will also be used to help SME customers to easily compare products and choose the best technology for their needs. The Help to Grow: Digital platform is in the process of being built and we will require additional information about the product to that which was initially provided in the application form; the specifics and fields will be communicated in due course.

Please note this will require a price to be listed for the product and kept up to date, as set out in the terms and conditions.

3. Successful onboarding and scheme goes live

BEIS is in the process of appointing a scheme administrator to help deliver the Help to Grow: Digital scheme. Further information, including bank details, will need to be provided to them ahead of scheme launch. Further instructions and timescales will be communicated in due course.

Whilst the launch date is yet to be confirmed, we will require all information to be provided and any technical changes required by the vendor to effectively operate as part of the scheme, by mid-November 2021. Testing of the platform will be required ahead of launch. Further information will be provided to successful applicants at the time of approval and further technical information.

If all the above steps are completed successfully, your product will be onboarded onto the product list in time for the launch. SMEs will then be able to use their grant tokens on your company’s website to purchase software. Your company will in turn be able to reclaim the value of the grant token from the scheme. Details on this process will be communicated in due course.

Vendors will continue to be able to access administrative and technical support from the scheme during its operation via vendors.helptogrow@beis.gov.uk.

4. Seeking reimbursement of grant tokens

Once an SME has signed up to an eligible technology the vendor will be able to submit evidence for reimbursement through the Help to Grow: Digital portal. It will be the vendors responsibility to calculate the SMEs discount and apply for the reimbursement.

Vendors will be required to submit information in order for us to validate and verify the redemption. This information will need to include details of the SME, their grant token and the purchased technology. This will be supported by the grant token redemption URL approach outlined below. Where a grant token is redeemed against a monthly subscription, the vendor will be required to redeem the grant token pro-rata on a monthly basis, for up to 12 months.

Vendors will be required to inform us if an SME cancels or reduces their subscription to ensure any future redemption is correct. Any changes to the subscription or product that results in any increased costs (such as new licences or users) are not eligible for any discount.

5. Requirements for the grant token URL approach

To facilitate the scheme and ensure we are able to provide the correct grant to SMEs and reimburse vendors correctly we will be implementing an URL based approach for grant token redemption.

This is designed to:

- ensure a smooth SME journey and hand over to the vendor

- provide vendors with reassurance of SME eligibility and grant status

- allow BEIS and the scheme administrator to monitor grant token use

In order to participate, a vendor will need to take the following actions:

- develop a grant token redemption URL endpoint in their website where they would like the SME to land, when directed from the Help to Grow: Digital platform or email link (the URL endpoint should have the ability to extract the grant token code added to the URL)

- develop a call back to the service (API) for finding out the grant token details like discount available, SME details, Product SKU and authorisation code

- adapt their service to use the scheme logic of applying the right discount and details to the product fulfilment process

- develop a call back to inform the service that a grant token is being redeemed

- send an end of day reconciliation of all purchases made with a Help to Grow: Digital grant token for the day via an API

How the grant token will work

In order for the grant token to work there will need to be a number of transfers of data between the grant token application process and the vendor. Many of these will need to be instantaneous.

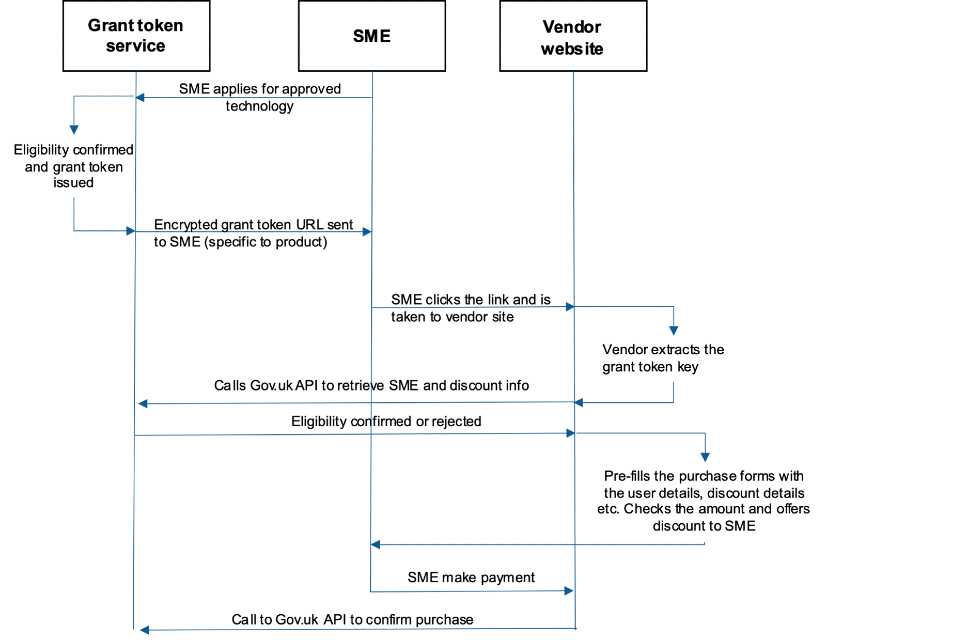

Schematic of how the grant token approach will work

Onboarding approved products

During the product upload process, the vendor will need to declare a forwarding URL on their site to which the SME will be redirected in order to redeem the grant token.

This may be the vendor’s basket page, their product page, or any other custom URL that the vendor deems fit.

The grant token redemption URL will be appended with the encrypted grant token which the vendor will need to extract from the URL.

SME application and creating the grant token

Once an SME has had eligibility confirmed they will be required to choose a product listed on the Help to Grow: Digital platform against which they can redeem their grant token.

The grant token will be produced. This will be an encrypted code that will be appended to the forwarding URL.

The grant token will be allocated a grant amount, a product code, the timestamp it is valid from and an expiry date. The grant token can either be used immediately by the SME by clicking through to the vendor site or can be used later via an emailed link.

The grant token will be registered against that SME application on the scheme administrator’s system. It will include the approved product, expected price and expiry date.

Vendor validating the grant token

When the SME is ready to make the purchase, they can use the grant token URL to be directed to the vendor’s website for the approved product. The vendor will need to extract the grant token information from the URL.

Once the grant token is extracted from the URL, the vendor will need to call a pre-set API on the Help to Grow: Digital scheme administrator’s system to retrieve the details of the grant token. This API will work instantaneously so that it does not disrupt the SME journey and to provide vendors certainty of the SME’s eligibility.

The call to the API will return details about the grant token to the vendor, including an authorisation code, details of the SME, the name of the eligible product that the SME is approved to purchase with their grant token, the funding available and any other necessary information to process the grant token.

Vendor informing scheme of grant token redemption

Once the vendor has received this information they will need to calculate the relevant discount on the product tagged in the grant token, in line with the terms and conditions of the scheme.

The grant token is valid for up to 50% of the cost of the primary applicable product, up to the maximum value of £5,000 excluding VAT. Please note, SMEs may wish to add on additional products or services that are not eligible against their grant token. Vendors will need to ensure that SMEs are aware that they are liable for the whole costs of these and that the discount calculation does not include these.

The vendor will need to call a Help to Grow: Digital API at the completion of the purchase to inform Help to Grow: Digital to deactivate the grant token from further use.

End of day reconciliation

The vendor will need to call an end of day reconciliation API to report all their Help to Grow: Digital eligible sales to the grant administrator including invoices and receipts if required.

The Help to Grow: Digital scheme administrator will conduct necessary checks and create automated payment files in order for the vendor to claim reimbursement of funds.

Make an appeal or complaint

If you’re informed your application is unsuccessful you have the right to appeal the outcome within 10 working days of the receipt of your application outcome.

You also have the right to make a complaint at any stage of the application process, or during the operation of the scheme for successful applicants.

Further information on how to make an appeal or complaint will follow in due course. If you wish to discuss either with us in the meantime, please email us at vendors.helptogrow@beis.gov.uk.

Help and guidance

You can find more information in the following documents:

If you cannot find the answer to your question in this document or the others linked above, please email us at vendors.helptogrow@beis.gov.uk and we will respond to your query as soon as possible.