Government Legal Department Annual Report and Accounts 2024–25

Updated 21 August 2025

Government Legal Department: Annual Report and Accounts 2024-25

For the year ended 31 March 2025

Accounts presented to the House of Commons pursuant to section 7 of the Government Resources and Accounts Act 2000

Annual Report presented to the House of Commons by Command of His Majesty

© Crown copyright 2025

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated

To view this licence, visit: www.nationalarchives.gov.uk/doc/open-government-licence/version/3

Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned

This publication is available at: www.gov.uk/official-documents

Any enquiries regarding this publication should be sent to us at:

Government Legal Department,

102 Petty France,

London,

SW1H 9GL

ISBN 978-1-5286-5705-1

E03357413

07/25

Preface

About this Annual Report and Accounts

This document integrates performance and financial data to help readers gain a better understanding of the work of the Government Legal Department (GLD). It covers the activities of GLD from 1 April 2024 to 31 March 2025 and is split into 3 main sections:

The Performance Report includes a summary of the department's purpose, strategy and activities (the Performance Overview) followed by a review of progress against our performance measures and key priorities (the Performance Analysis).

The Accountability Report is further split into 3 sub sections and includes:

-

a Corporate Governance Report, which includes the Directors’ Report, the Statement of Accounting Officer’s responsibilities and a Governance Statement;

-

a Remuneration and Staff Report, which includes pay and benefits received by executive and non-executive Board members and details of staff numbers and costs; and

-

a Parliamentary Accountability and Audit Report, which includes a copy of the Audit Certificate and Report made to the House of Commons by the Comptroller and Auditor General setting out his opinion on the financial statements and other information in the Annual Report.

The Financial Statements show GLD’s income and expenditure for the financial year, the financial position of GLD as at 31 March 2025 and additional information designed to help readers understand these results.

Chief Executive’s Report

I am pleased to share the Government Legal Department’s Annual Report and Accounts for 2024-25. Since taking up my position as Treasury Solicitor in 2021, I have always been proud of the way my department, the Government Legal Department (GLD) has delivered our legal services in service of our long-standing purpose: to help the government to govern well, within the rule of law. The last year has been one of significant change at home and challenge across the globe. Following the General Election in July 2024, GLD teams seamlessly supported the transition and the focus on mission-led government, to deliver for the people of the United Kingdom.

We have supported the government taking its first steps to deliver the Plan for Change and other critical work. I am immensely proud of the work undertaken by our teams producing new legislation, negotiating trade deals, conducting high profile litigation and advising on sensitive national security matters. Across all our disciplines - our dedicated lawyers, supported by vital corporate services colleagues, have helped the government to deliver their priorities. You can read examples of our work within this report. Our People remain at the heart of all we do, and to renew our commitment to them, in February, we launched our new People Strategy, setting direction and focus over the next three years to equip us to deliver much more than the law - highlighting the difference we make to society.

At the end of September, we held an all-staff conference: the first since 2018. Over 1,500 colleagues came together to connect, to learn and show case our role supporting the government of the day. We highlighted the new mission-based approach to government, welcomed the Attorney General’s commitment to the rule of law and his championship of government lawyers and enjoyed hearing about the role GLD plays across the legal profession with the Law Society and Bar Council. The atmosphere in the hall was electric, not least during our GLD Awards ceremony celebrating the brilliant work of colleagues across the department. I ended the day on a real high, feeling immensely proud of what we've achieved over the year and its impact on our fellow citizens.

I will pick out two achievements over the past year that we will continue to build on: Firstly, GLD’s structure as the main provider of legal services across Government has enabled us to pivot quickly to this mission-driven government. We have GLD Directors General on each Mission Board co-ordinating the right legal expertise to support mission priorities and we will continue to play an integral role in fixing the foundations of the country, achieving the milestones of the Plan for Change and supporting the decade of national renewal.

The second is in the evolution of our corporate services and systems through the introduction and developing capability of our Chief Operating Officer (COO) Group. Our legal expertise must be enabled by great technology, data management and excellent cross-functional professional experts, with a key step forward this year being the establishment of the Legal Operations Directorate. Learning from the best in the private sector we are continually challenging ourselves to be more professional and more efficient.

I would like to take this opportunity to thank our Non-Executive Directors, the Rt Hon Dame Janet Paraskeva DBE PC, Mike Green and Tim Fallowfield OBE, for their advice and challenge throughout the year to myself and my Executive Team, and for the assurance they provide to the Law Officers.

Finally, I would like to take this opportunity to thank all colleagues for their individual contributions to our achievements this year, and for their ongoing commitment to public service. I hope they will agree that our work is as rewarding as it is valuable to the government of the day and wider society. As we enter our tenth year as the Government Legal Department, I am confident that we will continue to support the government to govern well within the rule of law and go from a great to outstanding legal organisation.

Susanna McGibbon KC (Hon)

Treasury Solicitor and Permanent Secretary

Chair of the Board’s Foreword

This has been my first full year as Lead Non-Executive and Chair of the GLD Board and Honours Committees, I chaired our inaugural Board Meeting in March 2024. My keenness to take on this role as GLD’s first independent chair came from a huge respect for the Civil Service, built over many years and getting to know it well as First Civil Service Commissioner. My first impressions of GLD were that its people are highly committed public servants focused on ensuring the government has access to the best legal advice and services and I have continued to be impressed as the year continued.

The Board supports the strategic ambitions set out in the GLD Strategy 2024-27 and its role is to ensure that the organisation is clear on its direction of travel within that Strategy. It is the role of the Non-Executive Board Members to bring our external experience and insight into the organisation to help and shape progress of that Strategy, to hold the Chief Executive to account for its delivery, and to provide assurance to the Law Officers. Our knowledge and experience of the Civil Service, of the legal sector and beyond enables us to scrutinise, challenge, and offer advice to the GLD Executive Team, from the development of the GLD Budget and Business Plan, through to Spending Review proposals.

We have also played an active role in staff engagement throughout the year. I was delighted for example, to attend the All-Staff Conference in September, where I had the opportunity to meet many GLD colleagues. The biggest strategic challenge for me, I believe, is ensuring the department operates ‘as one’, with all staff feeling they contribute to the whole picture, providing coordinated advice to government, whilst understanding the work and challenges of individual client departments with which they are working.

In April, GLD celebrates its tenth anniversary. As well as taking time to look at how far it has come, this will also be a great opportunity for the organisation to consider what it can achieve going forwards, and how it might do that.

The long-term future of legal services to government continues to be considered by the Executive Team throughout the year. The team needs to pursue improvements in organisational agility and identity. We can be sure that the operational context will see demands for new types of legal services. This will require increased and different uses of technology and data, as well as needing GLD to adapt its processes and systems and drive innovation and new skills into the delivery of its legal services.

We also know that cross-government collaboration is required to address challenges the UK is facing. The government’s Plan for Change emphasises working beyond departmental boundaries. GLD’s operating model, with teams embedded across government departments nationally, is uniquely designed and able to support this ambition at pace. This renewed focus on mission delivery has empowered the Board to challenge GLD to deliver greater impact, in the service of ambitious, cross-government milestones, demonstrating the value of its unique model.

On behalf of myself and my fellow Non-Executives, I would like to thank Susanna McGibbon and her Executive Team for their leadership of the organisation and all its people for the roles they hold and the extra mile they take in the delivery of their work. Thank you all for supporting the government to govern well within the rule of law.

The Rt Hon Dame Janet Paraskeva DBE PC

Chair of the Board

Performance Report

Performance Overview

Who we are

The Government Legal Department (GLD) is a non-ministerial government department and executive agency providing legal services to the majority of government departments and other publicly funded bodies in England and Wales.

We are currently one of the largest legal organisations in the country, with around 3,700 staff, of whom the majority (c2,900) are lawyers and paralegals based in 18 locations (including client sites).

Our responsibilities include:

- advising ministers and policymakers on domestic, public and private law, trade policy, international law and human rights

- providing litigation services to government departments and public bodies, covering public and private law issues

- drafting statutory instruments and other subordinate legislation

- preparing instructions for bills to be drafted by Parliamentary Counsel and advising ministers and policymakers during the passage of bills through Parliament

- providing legal services to support public inquiries

- advising the Cabinet Office (CO) and His Majesty’s Treasury (HMT) on cross-Civil Service wide employment issues and policies, as well as dealing with individual employment issues, including in the Employment Tribunal

- supporting complex government procurement transactions and dispute resolution

- collecting, managing and disposing of bona vacantia (ownerless personal and corporate property and other assets) on behalf of the Crown’s Nominee

We are led by the Treasury Solicitor and Permanent Secretary, Susanna McGibbon KC (Hon), and are sponsored by the Attorney General’s Office (AGO). The Attorney General is the government’s chief legal adviser and has a number of independent public interest functions, as well as overseeing the Law Officers’ departments. The Law Officers are accountable to Parliament for the performance of GLD. GLD's governance structure is set out in the Governance Statement on page 33.

GLD also provides support to the Attorney General’s Office and HM Crown Prosecution Service Inspectorate (HMCPSI), the independent inspectorate of the Crown Prosecution Service.

The financial statements at pages 64 to 78 relate to activity carried out by GLD in the year 2024-25 and are prepared under a direction issued by HMT, in accordance with Section 7(2) of the Government Resources and Accounts Act 2000.

Case Study: The Leasehold and Freehold Reform Act 2024

The Leasehold and Freehold Reform Act 2024 enacted Law Commission recommendations to make leasehold enfranchisement easier and cheaper for leaseholders, to strengthen rights and protections for leaseholders and residents on managed freehold estates, and to ban the sale of leasehold houses. As well as dealing with the complex underlying legal framework, Ministry of Housing, Communities and Local Government (MHCLG) Legal Advisers advised on the delicate balance of interests involved in shifting aspects of the framework to the benefit of leaseholders. During passage of the Bill, the scale of the reforms expanded significantly, while Parliamentary time was constrained. At Introduction, the Bill already comprised 65 clauses and 8 lengthy Schedules (totalling 140 pages). By Royal Assent, it had reached 125 clauses and 13 Schedules (totalling 257 pages). To deliver this, the team had to expand resource rapidly, bringing in secondees and triggering the GLD Rapid Response Team, while working alongside the Law Commission and private sector partners to deliver the necessary advice. When the General Election was called, the Bill appeared likely to fall, but was saved in last minute wash-up discussions. Over a dramatic and pressured 36 hours, the team worked at pace with Office of the Parliamentary Counsel (OPC), policy clients and the Centre to save the Bill, which was passed as the final Act of the previous Parliament.

Core Purpose and Vision

We help the government to govern well, within the rule of law.

Our vision is to be:

-

An outstanding legal organisation, committed to the highest standards of service and professionalism; and

-

A brilliant place to work, where we can all thrive and fulfil our potential.

GLD Strategy 2024-2027

In February 2024 we launched our GLD strategy for 2024-27. Our strategy sets out a clear and ambitious vision for how we will deliver and develop as a department, enhancing our support to the Law Officers as the government’s trusted legal advisers.

Over 2024-25 we have continued to make progress to deliver our strategy, realising our vision of being an outstanding legal organisation committed to the highest standards of service and professionalism which delivers much more than law. Our strategy sets out three overarching strategic ambitions which align to the Civil Service Change Priorities.

Our three strategic ambitions are:

Becoming A National GLD

We are a vibrant, inclusive, and integrated GLD that is influential and respected in government and beyond. Our state-of-the-art offices are equipped to enable all colleagues, at all levels, to work closely together and contribute to our success. In all our locations, we reflect the communities we serve and are recognised as leaders in the legal community.

Rewarding Careers for All

Colleagues across GLD clearly understand how they contribute to our Purpose, Vision and Values. As a result, they feel valued and respected. A clear and accessible career pathway supports colleagues to progress within their chosen professions and specialisms. We attract and retain sufficient talent across many Civil Service professions including the law, maintain our high standards and provide colleagues with an attractive work-life balance in a diverse and inclusive community.

Environment Fit for the Future

We are a modern, sustainable and innovative GLD, equipped to respond to a rapidly changing world. We embrace the opportunities of technology to streamline our processes and deliver excellent legal services in a high-quality working environment. We are committed to continuous improvement ensuring outstanding value for money for the taxpayer.

Looking back on 2024-25 (Business Plan 2024-25)

Our Business Plan 2024-25 featured the legal priorities we anticipated delivering and identified key corporate activities that would deliver against our Strategy 2024-27 and wider Civil Service priorities. Throughout the year we continued efforts towards realising our Vision to be an outstanding legal organisation, committed to the highest standards of service and professionalism.

Our Business Plan acknowledged we were in a General Election year and would need to be sufficiently agile to respond to its outcome. Irrespective of the outcome, our Purpose, to help the government govern well, within the rule of law, remained constant. Equally, our Values of respect for each other, pride in our high standards of service and willingness to embrace ideas and collaboration, remained unchanged, and supported us to deliver through the pre-election period and transition between governments.

We adjusted our legal priorities after the General Election, and, to reflect this, we published a ‘mid-year update’ to our Business Plan in December, following the release of the government’s Plan for Change.

Below we set out some of our key achievements during the 2024-25 financial year, describing our legal delivery against the government’s Plan for Change and our activities to deliver against our GLD Strategy 2024-27 and wider Civil Service ambitions.

Notable Key Achievements - Legal and Strategic delivery - over the financial year 2024-25

Quarter One (April – June)

-

Legislation that received Royal Assent as part of parliamentary wash-up in May: The Victims and Prisoners Act, the Post Office (Horizon System) Offences Act, the Leasehold and Freehold Reform Act and the Digital Markets, Competition and Consumers Act.

-

We advised on the formalities of the pre-election period of sensitivity, as well as several machinery of government changes.

-

We prepared draft emergency legislation in the event of reaching critical prison capacity.

-

We delivered the second year pay uplift for our grade 6 and 7 lawyers that was agreed in our pay business case.

Quarter Two (July-September)

-

Module 1 (Resilience and Preparedness) Covid Report, published.

-

Infected Blood Compensation Scheme, regulations laid.

-

The Budget Responsibility Act, which received Royal Assent.

-

The Great British Energy Bill, introduced.

-

The Terrorism (Protection of Premises) Bill and the Renters’ Rights Bill, introduced.

-

We held our All Staff Conference, with over 1,500 colleagues attending over the course of the day.

-

We developed the ‘Departmental Leadership Group’ (DLG) programme to build high performance leadership capability at our most senior levels.

Quarter Three (October – December)

-

The Passenger Railways Services (Public Ownership) Act which received Royal Assent.

-

The Data (Use and Access) Bill, and the Employment Rights Bill, introduced.

-

The Children’s Wellbeing and Schools Bill, and the Institute for Apprenticeships and Technical Education (Transfer of Functions etc.) Bill, introduced.

-

The Tobacco and Vapes Bill and the Mental Health Bill introduced.

-

Agreed to retain our central London footprint until late 2028.

-

Delivered the 2024-25 pay award for colleagues who were not covered by our legal pay business case.

-

Established a new Legal Operations Directorate within the Chief Operating Officer’s Group.

Quarter Four (January – March)

-

The Border Security, Asylum and Immigration Bill, introduced.

-

Infected Blood Compensation Scheme Regulations 2025 made

-

Crime and Policing Bill introduced

-

Established a new directorate, the EU Relations Legal Advisers, to support the Minister for EU Relations and the European and Global Issues Secretariat in the Cabinet Office.

-

Published our People Strategy 25-28.

-

Launched the Legal Panel for Government invitation to tender.

-

Updated our Legal Learning Framework.

-

Offered a diverse range of development opportunities through our early talent schemes and delivered a range of internships.

-

Developed legal and cross-functional professional career pathways.

-

Launched the Counsel Diversity Project to further diversity and inclusion by supporting and promoting use of counsel from a diverse range of backgrounds.

More information on our performance can be found in the ‘Performance Analysis’ section.

Case Study: Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)

In December 2024, the UK acceded to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). This is a free trade agreement that spans 12 economies across Asia, the Americas, and now Europe with the UK as a party. GLD lawyers across multiple government departments supported negotiations with the CPTPP parties to agree how the UK would join the free trade agreement. This involved navigating the complexities of international trade law, and also attending negotiations both online, across several time zones, and in person, in international locations including Australia, Japan and Vietnam. GLD Lawyers drafted legislation to ensure that the UK’s law would comply with the terms of CPTPP when the UK became a party. We supported departmental colleagues throughout the Parliamentary processes required to pass that legislation. The UK’s accession to CPTPP was a true example of cross-government collaboration to ensure the best outcomes for the UK, and GLD lawyers were involved each step of the way. This collaboration continues at pace with the announcement in November 2024 that the CPTPP parties have established an Accession Working Group to progress Costa Rica’s application to join CPTPP.

What we do

Our principal activities are delivered as follows:

Legal Divisions:

Advisory - GLD has expert advisory teams specialising in the work of their client departments, providing risk-based and solution-focused legal advice. GLD lawyers are crucial throughout the lifecycle of government policy. They advise on and draft legislation and work to take it through Parliament; advising departments and ministers on the legal implications of government policy and ensuring it stands up to Parliamentary scrutiny.

Litigation - GLD’s Litigation Group is comprised of 4 divisions: Defence and Security, Home Office and Immigration, Justice and Development and the Covid Inquiry Team. Litigation lawyers handle high profile public and private law litigation for central government departments, security agencies and other public bodies; including UK military and security bodies. The divisions also undertake inquest, inquiry and injunctive work for GLD’s clients. Our litigation teams are currently handling approximately 27,000 pieces of litigation.

Employment - As one of the largest employment law practices in the country, GLD’s Employment Group advises on complex and fast-moving legal areas including: claims for unfair dismissal and relating to discrimination; pay issues; contractual issues and terms and conditions, and whistleblowing claims. The TUPE (Transfer of Undertakings Protection of Employment) and Transactional Hub provides specialist advice on employment and pensions issues to help manage employment-related risks, while the Industrial Hub advises on trade union matters and industrial action. The National Security Hub manages advice work and litigation claims requiring a knowledge of security vetting or the management of protected material.

Commercial - The Commercial Law Group provides expert advice on transactional, litigation, property and advisory commercial legal matters. Transactional and advisory teams advise government departments on their commercial work, ensuring value for money in the purchase of goods and services for the public sector. The Litigation and Dispute Resolution Team supports the government in high profile legal claims and saves taxpayer money by pursuing alternative forums (mediation, adjudication). The Property Hub provides strategic commercial property advice and supports government departments and agencies via training on property issues.

Statutory Instrument Hub - The Statutory Instrument (SI) Hub is GLD’s specialist statutory instrument drafting service and Centre of Excellence for secondary legislation, with 30 lawyers drafting secondary legislation for all of GLD’s client departments. The SI Hub Centre of Excellence makes a major contribution to helping lawyers across GLD improve the quality of their drafting, through its structured SI training programme, the annual SI conference and drafting guidance.

Chief Operating Officer Group:

The Chief Operating Officer (COO) Group is responsible for developing the department’s strategy and plans and leading and coordinating programmes of activity across the department to deliver cost effective legal and support services that address the needs of our clients and staff.

The Finance, Operations and Digital Directorate covers finance, planning and performance, procurement, facilities management, security, digital and data, business assurance and resilience and records management services.

The Strategy, People and Culture Directorate covers human resources (HR), governance and strategy, business management, communications and engagement, and project delivery.

The Legal Operations Directorate includes: Bona Vacantia Division, on behalf of the Crown’s Nominee, administers the estates of people who die intestate and without relatives entitled to inherit and collects the assets of dissolved companies and failed trusts in England, Wales and Northern Ireland, except in the Duchies of Cornwall and Lancaster. The costs of the division are recovered from the estates and assets it administers. The proceeds of bona vacantia are accounted for in the Crown’s Nominee Accounts and separately notified to Parliament as prescribed in the Treasury Solicitor (Crown’s Nominee) Rules 1997 (SI.1997/2870).

The Knowledge and Innovation Division lead on developing the department’s integrated Legal Knowledge, Capability and Innovation Strategy, working with legal divisions to professionalise legal knowledge and learning activity and to develop innovative and flexible approaches to meeting client needs.

The Legal Delivery Division leads on building a future-fit legal environment through standardisation, automation, and innovative technologies, including AI. The division offer lawyers integrated support, flexible resourcing, and data-driven insights. Its focus is on efficiency, smart resource allocation, and continuous improvement to deliver high-quality legal services.

GLD also has 17 Centres of Excellence; formal networks of lawyers who have recognised expertise in an area of law or legal practice that has relevance across a number of GLD divisions and teams.

Case Study: Global Combat Air Programme

The Global Combat Air Programme (GCAP) is a strategic partnership between the governments of the UK, Italy and Japan to deliver a 6th generation combat aircraft in 2035, providing significant combat air capability well beyond that date. To facilitate the delivery of the programme, the partner nations agreed to form the “GCAP International Government Organisation” (GIGO) and base it in the UK. Ministry of Defence (MoD) Legal Advisers lawyers played an integral part in the tri-national negotiations and drafted and advised on both the Treaty text creating the GIGO and Implementing Arrangement setting out details on its operating structure and governance model. GLD lawyers also worked closely with Foreign, Commonwealth and Development Office (FCDO) lawyers to deliver secondary legislation to provide the GIGO with the key privileges and immunities it required as an International Organisation. To meet the programme timetable and remain on-track for the 2035 delivery date, and with representatives from each of the partner nations already starting to take up key roles within the organisation, GLD lawyers delivered the legal elements to this programme at considerable pace. The GIGO was fully established in December 2024.

Case Study: Russian sanctions litigation

In response to Russia’s illegal invasion of Ukraine in 2022, the UK Government has introduced a comprehensive and unprecedented range of sanctions which have been carefully designed to increase pressure on Russia to desist its actions destabilising Ukraine or undermining or threatening the territorial integrity, sovereignty or independence of Ukraine. The response of the UK, in coordination with many international partners, is considered to be proportionate to the severity of Russia’s invasion of Ukraine, which represents the most serious threat to European security and international order since the end of the Second World War.

GLD’s Litigation Directorate has been dealing with a number of challenges relating to decisions made under the Russian sanctions regime and the government has not lost a challenge yet. Two cases were heard by the Supreme Court in January 2025, and judgment is now awaited. The case of Shvidler v Secretary of State for Foreign, Commonwealth and Development Affairs relates to the decision to maintain the designation of the Appellant, who is a US-British dual citizen and is designated for the purpose of an asset freeze, transport and trust services sanctions on the grounds of his association with Roman Abramovich and his previous position as a Non-Executive Director of Evraz plc. The case of Dalston Projects Ltd & Others v Secretary of State for Transport challenges the decision to detain a superyacht, “the Phi”, which is valued at c.£38 million and is detained on the grounds that it is owned, controlled or operated by a person connected with Russia.

The Appellants in both cases rely on grounds relating to their rights under the European Convention of Human Rights, with both contending that the sanctions are a disproportionate interference with their right under Article 1 of the First Protocol to peaceful enjoyment of their possessions. Shvidler also contends that the restrictions imposed on him and his family by his designation constitute a disproportionate interference with his Article 8 right to private and family life. Shvidler and Dalston are the leading cases on the UK’s autonomous sanctions regimes. Both cases were successfully defended by the government in the High Court and Court of Appeal. This will be the first time the Supreme Court has considered the UK’s sanctions regime as established under the Sanctions and Anti-Money Laundering Act 2018.

How we are funded

We are funded almost entirely through the fees we charge clients for legal services. Approval to make capital investment and spend the income generated each year is obtained through the Parliamentary Supply process and allocated in the HM Procurator General and Treasury Solicitor Main Estimate. The following table provides a more detailed analysis of how we fund our work. As agreed with HMT, we do not seek to make a surplus, although accidental surpluses may arise. The charging regime for 2024-25 reflects the mutual relationship we have with our clients.

| Group/Division | Funding |

|---|---|

| Advisory | Fixed fees. A small proportion of work is charged at hourly rates |

| Litigation | Primarily hourly rates to client departments. A small proportion of general public interest work is funded from the Parliamentary Estimate |

| Employment | A mix of fixed fees and hourly rates, depending on the nature of the work |

| Commercial | A mix of fixed fees and hourly rates, depending on the nature of the work |

| Bona Vacantia | Costs are funded from the proceeds of bona vacantia |

| Chief Operating Officer Group* | Recovered by the charges for our legal service to our clients |

| *Chief Operating Officer Group includes Finance, Operations and Digital, Strategy, People and Culture and the Legal Operations Directorates |

|

Risk management

GLD risks are aligned with the risk categories in HM Treasury’s risk management guidance - “The Orange Book". The risks were agreed by the GLD Board in December 2024. GLD's principal risks are:

-

GLD does not deliver on its Health and Safety obligations caused by poor management leading to unsafe and unsuitable buildings or unsuitable equipment for staff.

-

We do not prepare for significant external events which impact the delivery of legal services or cost recovery.

-

We do not keep pace with emerging threats or a failure of compliance as a result of inappropriate awareness, culture and practice across personnel, physical and cyber security domains. Resulting in harm, or sanctions, or has an adverse impact on our ability to deliver legal services to our clients.

-

We fail to provide IT tools on a consistent basis, impacting efficiency and productivity. Inadequate IT could impact Core Purpose and strategic vision delivery; staff morale and productivity; and service delivery.

-

GLD could lose money due to fraud and error as a result of fraudulent staff, fraudulent suppliers or external fraudsters making fraudulent payments, changes to bank details, authorising fake invoices leading to inappropriate use of GLD assets, loss of assets, selling GLD data, or inappropriate use of GLD travel contracts.

-

We do not generate sufficient income to achieve full cost recovery and/or we breach one of our HM Treasury Control Totals.

-

We are unable to attract and retain sufficient legal and other professionals necessary to deliver against the demand for GLD’s services.

-

GLD fails to meet the demand for high quality, trusted and integrated legal services (utilising a combination of internal and external legal provision) at an acceptable cost to clients, leading to loss of confidence in GLD and undermining our role as the default provider of legal services to government.

-

GLD’s project to implement a Legal Practice Management (LPM) system is unsuccessful, does not deliver its anticipated benefits in full or significantly slips and not completed before the existing unsupported core operational Case Management System (CMS) fails (critical issue for GLD), adversely impacting legal service delivery and compliance, resulting in financial penalties, reduced productivity and reputational damage.

-

The absence of a clear innovation strategy, well-defined innovation processes, and strong innovation capabilities - combined with the rapid development and wider availability of generative artificial (Gen AI) could obstruct future efforts to foster innovation and build an innovation-driven culture and result in missed opportunities for improved efficiencies in GLD.

-

GLD’s annual workforce planning process limits our understanding of medium to long term capability and capacity requirements for legal services across government, constraining medium-long term organisational (GLD) design and development. This could result in skills and capability gaps, a less effective workforce and inefficient deployment of GLD’s capacity.

Our plans and mitigations in respect of these principal risks are set out in the Governance Statement on page 42.

Case Study: Implementation of the Automated Vehicles Act 2024

This project is a good example of the unique role the GLD has in the development of policy and the making of new laws.

The Automated Vehicles Act 2024 sets out legal responsibilities, establishes a safety framework and creates the necessary powers to regulate self-driving vehicles. GLD lawyers in Department for Transport supported ministers with the Bill’s passage through Parliament so it could become the 2024 Act, and are now supporting ministers and the government’s Centre for Connected and Autonomous Vehicles (CCAV) with the implementation of the 2024 Act.

The aim is to develop a regulatory framework that supports safe innovation and strengthens public confidence in self-driving vehicles.

GLD lawyers are helping ensure that policy proposals are consistent with the new framework of the 2024 Act. They are also making sure that planned public consultations ask suitable questions to help consultees respond in ways that will help inform the policy decisions. The topics covered in these consultations will include gathering information to inform a statement of safety principles which will be applied when the government decides whether to authorise a vehicle as a self-driving vehicle, and consulting on draft regulations to govern the more detailed aspects of the framework.

In advance of the full implementation of the 2024 Act, GLD lawyers are helping CCAV to develop options for ways to help advanced trials and early commercial pilots of self-driving vehicles.

Looking to the future

Delivery of our Business Plan in 2025-26 will see us progress our strategic ambitions in the second year of our strategy (2024-27). We will build on our previous success expanding our national offices, strengthen our deployment of collaborative tools and technologies, and enhance both our leadership capabilities and offer to our people as we implement our new People Strategy. In developing our Business Plan for 2025-26, we have tested the scale of our ambition, and ensured our projects and initiatives will improve productivity and efficiency, supporting commitments made during Spending Review 2025. Below we have provided some illustrative examples of our projects and initiatives from our Business Plan 2025-26.

A National GLD

We will continue to increase our footprint outside of London as part of the government’s Places for Growth programme. We will relocate our Bristol office as part of enabling our people to work effectively and efficiently from any location across a state-of-the art national estate. We will implement our External Relations Strategy and celebrate our 10-year anniversary, raising our profile as a national organisation with a common culture that attracts people by offering career opportunities across all our office locations.

Rewarding Careers for All

We will implement our People Strategy, focusing on collective leadership; diversity, inclusion and wellbeing; connection and engagement; learning and performance culture; and inclusive talent. We will continue to address capability and development needs, invest in high performance amongst our leaders and in early talent and improve our legal learning framework. Through these initiatives, we will attract and retain a diverse and inclusive workforce that embraces our organisation’s Vision and Values. All will be able to reach their potential and succeed as experts in their chosen professions, making us an outstanding legal organisation.

Environment Fit for the Future

The evolution of our Chief Operating Officer Group will enhance the delivery of the services we offer. It will bring our teams closer together, identify efficiencies we can make, help us to evaluate and streamline our systems, and drive optimisation of our services through the adoption of new technology such as artificial intelligence. A key aim is to ensure that legal resource is optimised, that we exploit opportunities to improve how we deliver our services, and deliver efficiencies as per our commitments in the Spending Review.

Case Study: Public Authorities (Fraud, Error and Recovery) Bill

GLD Lawyers in Department for Work and Pensions Legal Advisers and Cabinet Office Legal Advisers worked together at pace through the Autumn and Winter of 2024 on the Public Authorities (Fraud, Error and Recovery) Bill, which was introduced into Parliament in January 2025. The Bill contains new powers for the Cabinet Office to tackle fraud across the public sector, including Covid-related fraud, and powers for DWP to combat fraud and error in the welfare system. The measures include information gathering and investigatory powers, debt recovery powers, the ability to impose civil penalties, and eligibility verification measures. The Bill is expected to save tax-payers over £1.5 billion over the next five years. It is anticipated that the Bill will complete its Parliamentary passage and gain Royal Assent by the summer recess.

Case Study: Post Office (Horizon Systems) Offences Bill

In 2024 the Department for Business and Trade Advisory division, working closely with colleagues in the Ministry of Justice Advisory division advised and instructed on the Post Office (Horizon Systems) Offences Bill. The Bill exonerated en bloc the postmasters who had fallen victim to the Horizon scandal and set up the legal process for expunging their convictions from police records. It also established a process for deleting formal cautions given to postmasters suspected of relevant offences. Public interest in the plight of the postmasters had intensified following the “Mr Bates versus the Post Office” drama broadcast on ITV in January. GLD lawyers actively influenced the framing of the Bill, including defining the categories of convictions and cautions within scope, the mechanism for quashing convictions, and devolution and procedural aspects. The Bill was constitutionally novel and sensitive as regards the separation of powers between government, Parliament and the courts, and GLD lawyers advised on the handling of these matters. The Bill passed all of its Parliamentary stages between 13 March and 23 May 2024, receiving Royal Assent the next day. The new Act removed a significant impediment to achieving justice for the postmasters and opened the way for compensation for many of them. Earlier, DBT advisory lawyers had instructed on the Post Office (Horizon System) Compensation Bill, which completed its Parliamentary stages between 29 November 2023 and 25 January 2024. That bill ensured that legal authority was available to the government for all compensation payments arising out of the Horizon scandal.

Case Study: Criminal Justice Act 1988 (Offensive Weapons) Order

Against the background of high levels of knife crime, the Home Office instructed lawyers in the Statutory Instrument (SI) Hub to draft regulations to ban zombie knives.

The desire to tackle violent crimes continued when the new Labour Government brought in its five missions, one of which was to "take back our streets". Ministers therefore decided to outlaw ninja swords as well. Regulations were drafted at pace to achieve this.

The Regulations made amendments to the Criminal Justice Act 1988 (Offensive Weapons) Order 1988 (“1988 Order”), which sets out descriptions of the weapons to which the offences in section 141 of the Criminal Justice Act 1988 apply. When a weapon is added to the 1988 Order, it becomes an offence to manufacture, sell, or import that weapon, and to possess that weapon in private.

One of the challenges in drafting both these sets of regulations was to define with sufficient precision the weapons to be banned Another challenge was to make sure different stages of the scheme (the surrendering, compensation, and ban) would come into force stage by stage smoothly. The SI Hub lawyers rose to the challenge with enthusiasm and yet again demonstrated their expertise.

Case Study: Winter Fuel Payments

On 29 July 2024, the Chancellor of the Exchequer made a statement to Parliament to the effect that there was a £22 billion hole in the public finances, leading to difficult decisions to be taken by the government. The Secretary of State for Work and Pensions decided that only pensioners in receipt of pension credit or certain other means-tested benefits would continue to receive the winter fuel payment (an annual tax free payment of between £100 and £300 that was previously paid to everyone above state pension age).

Departmental lawyers worked with their policy colleagues at considerable pace to develop the policy and draft regulations. Complexities included whether the winter fuel payment would be payable in European Economic Area states and Switzerland and which means-tested benefits would lead to entitlement. Regulations were made and laid on 22 August, less than a month after the Chancellor’s announcement.

Lawyers supported officials and the ministers when the regulations were debated in both Houses and then supported the operational teams implementing the policy. GLD Litigation lawyers are now supporting officials to defend the Regulations against two judicial review challenges in the High Court in England and Wales and the Court of Session in Scotland.

Performance Analysis

Performance measures

Our performance measures reflect our continued commitment to high professional standards as well as delivering client satisfaction, whilst recovering our operating costs in full by the year end.

Client satisfaction

To improve our client satisfaction rating

| Client satisfaction rating | 2024-25 | 2023-24 |

|---|---|---|

| Percentage receiving Good or Excellent rating | 95% | 95% |

| Average score (Excellent: 10, Good: 5, Acceptable: 0, Poor: -5, Unacceptable: -10) | 7.99 | 7.85 |

Our aim is to achieve a 95% or above rating in our annual survey of client satisfaction, and while 95% of our clients rated our services as Good or Excellent the percentage score was static. Using the average score, we scored 7.99, a 2% increase from last year. The survey has highlighted some issues that need to be addressed, and actions are being taken in response.

Lexcel

To maintain Lexcel accreditation

Lexcel is the Law Society's legal practice quality mark for practice management, compliance and client care, and GLD’s contentious teams have been Lexcel accredited since November 2006.

| 2024-25 | Achieved |

| 2023-24 | Achieved |

Our Litigation, Employment and Commercial Law Directorates were once again found to meet the requirements of the Lexcel Standard, after a full re-assessment by an independent external auditor, leading to reaccreditation by The Law Society. The Lexcel assessor concluded that “it remains very clear … that in Lexcel terms, the organisation remains an extremely well run, and extremely well managed organisation.”

Recovery of operating costs

To recover from clients the full operating cost of chargeable services

| 2024-25 | Achieved |

| 2023-24 | Achieved |

We are primarily funded from the fees charged to clients for our legal services. Our fee rates are set in accordance with the HMT publication - Managing Public Money - and are designed to recover the costs incurred by the department. Financial performance is monitored throughout the year, and on a quarterly basis, we undertake a formal exercise to forecast the financial outturn for the year. Our commitment to our clients is to ensure that they benefit from better than budgeted financial performance and if the forecasting exercise at the end of quarter 2 predicts a significant surplus, we evaluate the underlying reasons, consider the financial risks for the remainder of the year and assess whether a fee reduction should be made in-year.

Full cost recovery was achieved in 2024-25 and, a surplus of £15m (2023-24: £8.3m) was generated after rebates of £12m. From this surplus £4m was set aside to fund additional capital requirements. In setting fees and budgets for the year, key factors include the level of litigation demand, the level of staff turnover, the level of investment required to deliver our objectives and the use of third parties to support our legal work. In determining these and other financial factors, we take account of the factors underlying the previous year's financial performance and the likelihood of them recurring. We also continually review and refine our fee setting and forecasting processes to minimise the level of surplus that may arise.

Delivery in 2024-25 against our strategic ambitions (2024-27)

Helping the government to govern well within the rule of law

With the announcement in May 2024 that a general election would be held on 4 July, our lawyers worked at exceptional pace to ensure that key bills were passed during parliamentary wash-up. These included the Victims and Prisoner Act, the Post (Office Horizon System) Offences Act, the Leasehold and Freehold Reform Act and the Digital Markets, Competition and Consumers Act.

We ably supported the government through the election period, providing the full range of legal services to support business-as-usual governance, specific legal questions related to the election, prorogation, the delivery of the election, and, subsequently, preparation for the new administration, supporting new ministers to understand the legal context in which they now work and the support we can provide.

We reset our legal priorities under the new administration, aligning to the Plan for Change. Throughout the year, we have supported the new legislative agenda, offered expert legal advice on complex issues and casework, and continued to support high-profile inquiries. The following table sets out legal delivery over the year at a high-level.

| Missions | Achievements Our lawyers have supported the delivery of the Plan for Change by working and advising on: |

|---|---|

| Kickstart Economic Growth | • Legislation to promote financial stability and support economic growth. Including the Bank Resolution (Recapitalisation) Bill which was introduced in July 2024 and the Budget Responsibility Act, which created a ‘fiscal lock’ to impose duties on the Treasury and the Office for Budget Responsibility regarding announcements of fiscally significant measures. This Bill received Royal Assent in September 2024. • The Employment Rights Bill, introduced in October 2024, which will update the legislative framework in relation to employment rights, and create the right conditions to allow sustainable economic growth. • The Passenger Railways Services (Public Ownership) Act which received Royal Assent in November 2024. This Bill brings rail services into public ownership. • Artificial Intelligence (AI), including the AI Opportunities Action Plan, published in January 2025, which sets out the government’s plan to harness AI, and the Data (Use and Access) Bill which was introduced October 2024. |

| Make Britain a clean energy superpower | • The Great British Energy Bill, introduced in July 2024. This will establish Great British Energy, a new publicly owned energy production company, which will deliver benefits to the UK. This includes facilitating clean energy deployment, job creation and boosting energy independence. • The National Energy System Operator which went live in October 2024, projects and funding for Track 1 of the Carbon Capture Utilisation and Storage Programme (CCUS), and a new funding regime for long duration energy storage (LDES) and the smart metering implementation programme. |

| Safer Streets | • The Terrorism (Protection of Premises) Bill, introduced in September 2024 and also known as Martyn’s Law, which will ensure that certain premises and events are prepared to respond to a terrorist attack. • The Border Security, Asylum and Immigration Bill, introduced in January 2025, which will develop a framework of powers and offences to strengthen the UK’s asylum and immigration system and improve border security. |

| Break down barriers to opportunity | • The Renters’ Rights Bill, introduced in September 2024, which will end Section 21 ‘no fault’ evictions and give greater rights and protections to people renting their homes. • The Institute for Apprenticeships and Technical Education (Transfer of Functions etc.) Bill, which was introduced in October 2024. This Bill will transfer functions from the Institute for Apprenticeships and Technical Education (IfATE) to the Secretary of State and pave the way for the creation of Skills England. • The Children’s Wellbeing and Schools Bill which was introduced in December 2024. This will make significant reforms to children’s social care and schools, by raising education standards and ensuring children are better protected. |

| Build an NHS fit for the future | • The Tobacco and Vapes Bill, will gradually phase out the sale of cigarettes, create powers to ban smoking in certain outdoor settings, and ban vape advertising and sponsorship. This Bill was introduced in November 2024. • The Mental Health Bill, which was introduced in November 2024, will reform the detention and compulsory treatment regime. |

| Other critical work | • Our lawyers worked at pace on legislation that received Royal Assent as part of parliamentary wash-up. This included: The Victims and Prisoners Act, the Post Office (Horizon System) Offences Act, the Leasehold and Freehold Reform Act and the Digital Markets, Competition and Consumers Act. • We played a key role advising on the formalities of the pre-election period of sensitivity, as well as several machinery of government changes. • We prepared draft emergency legislation and advised on non-legislative options in the event of reaching critical prison capacity. • The Litigation Group worked and advised on the Module 1 (Resilience and Preparedness) Covid Report which was published in July 2024. • Our Commercial Law Directorate helped over 1,800 Afghan Asylum seekers in the Ministry of Defence’s Afghan Relocation and Assistance Programme. • Our Employment Directorate helped develop good employment policy, ensuring the workforce is managed in accordance with the law, including Gilham v Ministry of Justice on whistleblowing protections and O’Brien v Ministry of Justice on age discrimination in pensions. • The SI Hub along with Cabinet Office legal advisors have been working on the Infected Blood Compensation Scheme, with regulations laid in August 2024 and March 2025. |

Detailed accounts of legal work are set out in case studies throughout this report and illustrate the variety and complexity of the work we undertake.

The following commentary sets out 2024-25 performance in the first year of the GLD 2024-27 strategy.

A National GLD

We are continuing to ensure our workforce planning addresses the need for growth across national offices, while recognising the challenges associated with the distribution of the legal profession across the country. These include the location of the talent market and the proximity to the courts required for the delivery of some of GLD’s services.

15% of our workforce is now based outside London and we expect to see continued steady growth of our national estate occupation over the life of our Strategy.

Table showing full time equivalent staff (FTE) and where they are based, illustrating growth of our staff based nationally

| Location | Quarter End | Percentage change on 23-24 | ||||

|---|---|---|---|---|---|---|

| 31/03/2024 | 30/06/2024 | 30/09/2024 | 31/12/2024 | 31/03/2025 | ||

| London | 2,779 | 2,785 | 2,833 | 2,862 | 2,840 | 2% |

| National | 383 | 425 | 472 | 488 | 516 | 35% |

We launched our hybrid working policy in February 2024 with an implementation date of the start of April 2024. We expected that the policy would take time to embed and we are working to increase office attendance across our estate, with ongoing evaluation taking place.

Across our national offices each location has a nominated ‘Head of Place’. These leaders work to bring people together across our geographical locations and a range of Civil Service professions, to embed GLD culture and values, share information and good practice and make our offices a great place to work. For example, across our national offices we have colleagues that take part in a variety of volunteering activities in the local community including organising foodbank collections, supporting young people with reading and leading education and outreach activities with local schools.

Our Bristol office relocation was delayed to the following financial year due to building safety issues outside of our control, but we expect to make progress on this in 2025-26. We have agreed to remain in our current London accommodation until at least 2028.

Rewarding Careers for All

We created a new ‘Directors’ Leadership Group’ to focus on collective leadership and delivery of our strategy. We have reviewed and improved the governance of and approach to performance and talent management for our senior leadership cadre, in line with the wider Civil Service approach.

For the first time in over five years, we convened an all-staff conference, focused on emphasising the real-world impact of our work, celebrating our successes, hearing from the Attorney General and championing the unique role we play at the heart of government, upholding the rule of law.

GLD was at the forefront of launching a Government Legal Profession (GLP) Strategy in November 2024 which sets a clear direction for the profession. Collaboration and working even better together as a legal community, whilst developing knowledge-rich teams, will support us to achieve greater effectiveness and efficiencies whilst continuing to deliver excellent legal services to government. The GLP Strategy indicates our intention to enhance legal career pathways and improve diversity and inclusion across the legal sector.

Our staff engagement score increased to 64% in the 2024-25 Civil Service People Survey (up 3% from 2023-24).

Talent management is a key element of our strategic ambition to offer rewarding careers for all and this year we have ensured we offer a diverse range of high-quality development opportunities through our Early Talent schemes, including solicitor and graduate solicitor, trainee solicitor and pupillage places in addition to delivering a range of internship opportunities across all of our locations.

As the bridge between our corporate strategy and our people, we published our refreshed People Strategy 2025-28 in February 2025. The strategy sets out how we will continue to build the cultural capabilities and relationship between the organisation and its and employees, and how we will attract, retain and develop the talent we need to succeed and continue to deliver much more than law. There are five ambitions within the People Strategy:

-

Collective leadership;

-

Diversity and inclusion and wellbeing;

-

Connection and engagement;

-

Learning and performance culture; and

-

Inclusive talent.

We launched our strategic sourcing principles, setting out our approach to outsourcing legal work, in February 2025. The aim is to improve consistency across the organisation, ensuring we retain work in-house where we have the skills and capabilities to do so and outsourcing only when we do not. This helped to ensure our career offer is unique to attract and retain talented legal resource.

Environment Fit for the Future

We adjusted our organisational structure, creating a Legal Operations Directorate within our Chief Operating Officer’s Group. This new directorate ensures that we are applying the right skills to the right work, with our corporate services enabling GLD lawyers to excel through seamless, innovative, and outcomes-focused support. As an organisation we will continue to make the best use of data, tools and technology to improve the effectiveness and efficiency of services underpinning legal delivery.

We will continue to ensure our business processes are as effective as they can be and deliver savings for the public purse by displacing externally-sourced legal services with in-house provision where it supports government's efficiency agenda.

In February 2025, we launched an Invitation to Tender for Legal Panel for Government contracts, with awards expected to be made in the 2025-26 financial year.

The focus of the cross-government One Big Thing initiative this year was innovation. This is a key ambition in our GLD strategy and important to our work, mindset and culture.

Around 1000 colleagues have participated in the Civil Service-wide Innovation Masterclass, designed to equip teams with foundational innovation skills. This initiative has prompted over 40 proposals across the organisation, ranging from scalable changes in everyday ways of working to improving legal processes. Furthermore, we will establish an Innovation Seed Fund and an innovation process in GLD, to embed both corporate and grassroots innovation into the organisation.

We are horizon scanning to understand what future demand for legal services may look like and the actions our organisation might need to take to address this. This will in time support preparations for our next strategy, from 2027.

We continue to develop key strategies that will enable us to exploit opportunities from technological advances: our Artificial Intelligence (AI), Innovation and Data strategies. The development of our Innovation strategy and data strategy and the launch of our AI Programme will lay the foundation for our programme of system improvements.

We are keen to understand how we can use Generative AI (GenAI) to provide an even better legal service to the government. During 2024-25 our AI Programme has piloted GenAI-based tools, and investigating the possibilities for innovation, in line with the government's new AI Action Plan and the new AI Playbook.

We made significant progress in our priority to develop a new system to manage our legal services delivery. We concluded a discovery phase at the end of this year and developed a business case for a second Alpha phase of the project. Pending the results of the Alpha outcomes, we will then prepare a business case for the Beta stage of the project to implement a modern, digital Legal Practice Management system that complies with government digital standards and improves our service delivery through improved data management, processes and analytics across the organisation.

In support of our commitment to reduce emissions by 2030 and achieve net zero by 2050, GLD has this year signed the Greener Litigation Pledge. Greener Litigation is an initiative to reduce the environmental impact of dispute resolution and is a commitment to action by solicitors' firms, barristers' chambers and other disputes professionals. In support of this commitment, we have improved our internal data monitoring and introduced monitoring and holding to account panel law firms working on behalf of GLD.

Case Study: Launch of the Chief Operating Officer’s Group

In 2024, we welcomed our new Chief Operating Officer (COO), joining the Executive Team and Board. This new Director General role was created to modernise and develop the organisation through the transformation of our corporate services and legal operations functions, ensuring we continue to offer the best legal services to government.

The COO Group is responsible for ensuring GLD uses the most modern corporate and operational service approaches - from the Civil Service and legal sector - to support the delivery of the department’s strategy. It does this through the services, outcomes, partnerships and functions provided by and delivered through the Group which include ensuring GLD:

-

Fulfils its statutory obligations

-

Complies with its obligations to Parliament

-

Has effective and efficient operational support underpinning its service, and

-

Builds legal capability and shares knowledge.

A new Legal Operations Directorate was formed within the COO group, bringing together Legal Delivery, Bona Vacantia and Knowledge and Innovation divisions, with additional teams in scope for 2025-26.

Establishing the COO Group ensures that we have the leadership, organisational structures and culture across our national estate, investing in careers and development for all our cross-functional professionals. Recognising the value of corporate and operational services to the department enables us to support the department in fulfilling its purpose and achieve its vision of being both an outstanding legal organisation and a brilliant place to work.

Financial performance

Income

Total operating income (excluding disbursement income) for the year was £339.3m (2023-24: £298.3m), an increase of 14%. Our income from legal fees and charges to clients increased this year to reflect demand for our services and the increase in our fee rates due to inflationary pressures and the introduction of capability based pay for lawyers. Our other income includes income from secondments, subscriptions for the Legal Information Online Network (LION) and the recovery of the costs of administering bona vacantia from the Crown’s Nominee.

Expenditure

Our administration costs (excluding disbursements) this year were £321.0m (2023-24: £285.7m), an increase of 12%. The majority of this increase was related to increased staff costs which reflects, in line with our strategy, increasing our resources so that we can undertake more of the government’s legal work rather than it being delivered by external legal firms.

Staff costs represent 88% (2023-24: 87%) of non-disbursement expenditure and have increased by £32m in line with the increased demand for our legal services and pay inflation. The ratio of staff costs to legal fees and charges income is 85% (2023-24: 85%).

We continue to employ agency and contract staff where there is a need for specialist skills and where for business reasons the Board has agreed there should be a mixed economy of permanent and contract staff to provide some flexibility to cope with changes in demand. We also employ agency staff to support our resourcing where we do not have the permanent staff required to deliver our work. Spend this year was £26.8m (2023-24: £25.2m). Agency staff accounted for 10% of average staff costs for the year (2023-24: 10%).

Non-staff costs (excluding operational disbursements) have increased by 9% to £40.3m (2023-24: £37.1m). This increase mainly relates to increased accommodation costs.

Expenditure on legal disbursements varies from year to year depending on the number, type and complexity of cases. The majority of this expenditure is passed on directly to clients. The cost for 2024-25 was £57.1m (2023-24: £55.5m).

Net operating income

The net operating income for the year was £15.4m (2023-24: £8.3m) after rebates of £12m. The surplus has primarily been driven by higher than expected demand for litigation services which has resulted in increased resources and higher than expected chargeable hours per member of staff in the GLD Litigation Group.

Capital expenditure

Capital investment was £11.7m (2023-24: £4.5m) relating to investment in ICT equipment and infrastructure of £5.0m and additions made to leasehold right of use assets of £6.7m.

Financial position

Taxpayers' equity at 31 March 2025 is £22.0m (31 March 2024: £25.4m) comprising total assets of £108.2m (non-current assets of £29.3m, trade and other receivables of £53.5m and cash of £25.3m) and current and non-current liabilities of £86.2m (trade and other payables, lease liabilities and provisions). Further details are in the Notes to the Accounts. Cash flow and debtors are both closely monitored throughout the year to ensure that we have sufficient cash to meet our liabilities and pay our creditors promptly; we rely on receipts from our clients for our cash flow. We ended the year with cash of £25.3m (2023-24: £11.3m) and a trade receivables balance of £26.0m (2023-24: £31.9m).

The financial statements and notes are set out on pages 64 to 78.

Community and social matters

Our Pro Bono and Volunteering Network has continued to support and encourage pro bono and volunteering activity within GLD, including raising awareness of GLD’s policy of allowing staff to spend 6 days a year undertaking volunteering activity (subject to business need).

We are members of the Attorney General’s Pro Bono Committee and we have continued to develop our relationships with pro bono organisations, including through our regular support for Pro Bono Week which we promoted widely across GLD and hosted events to raise awareness of pro bono opportunities and the range of pro bono organisations.

GLD members have continued to engage in a wide range of volunteering activities either individually or with their GLD colleagues. This has included the Supreme Court debate days and supporting advice centres, as well as acting as school governors and charity trustees and undertaking many other very worthwhile charitable activities. This year for the first time we have nominated a number of people for the Pro Bono Recognition List, and we hope to continue to increase this number.

GLD’s support for volunteering and pro bono work clearly has a positive impact on staff engagement and wellbeing, in addition to the benefits to society that it also brings; we continue to make efforts to expand our pro bono offer.

Sustainability

All departments are required to report their performance against the Greening Government Commitments (GGC) and to report on Task Force on Climate-related Financial Disclosures (TCFD). GLD’s sustainability performance can be found at Annex A (page 79).

Susanna McGibbon KC (Hon)

Accounting Officer

4 July 2025

Accountability Report

The Accountability Report includes a corporate governance report, a remuneration and staff report and a parliamentary accountability and audit report. These sections reflect financial reporting and parliamentary accountability reporting requirements.

Corporate Governance Report

Directors’ Report

Directors

The Governance Statement includes the composition of the GLD Board on page 34.

Register of interests

No directorships or other significant interests, which may have caused a conflict with their management responsibilities, were held by any Board members. Note 16 to the Accounts includes related party interests identified.

Personal data related incidents

All government departments are required to publish information about any serious personal data related incidents, which have to be reported to the Information Commissioner. There was one personal data breach incident which was duly referred to the Information Commissioners Office for review in 2024-25.

Audit

GLD’s Accounts are audited by the National Audit Office (NAO) on behalf of the Comptroller and Auditor General. The NAO also audit the Crown’s Nominee Accounts administered by the department’s Bona Vacantia Division. The auditors provide no further assurance or other advisory services.

Remuneration to auditors for non-audit work

We did not pay any remuneration to the NAO for non-audit work. The notional audit fee for the GLD audit was £87k (2023-24: £84k).

Statement of Accounting Officer’s Responsibilities

Under the Government Resources and Accounts Act 2000, HMT has directed GLD to prepare for each financial year a Statement of Accounts in the form and on the basis set out in the Accounts Direction.

The Accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of GLD and of its income and expenditure, Statement of Financial Position and cash flows for the financial year.

In preparing the Accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual, and in particular to:

-

observe the Accounts Direction issued by HMT, including the relevant accounting and disclosure requirements, and apply suitable accounting policies on a consistent basis;

-

make judgments and estimates on a reasonable basis;

-

state whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed, and disclose and explain any material departures in the Accounts;

-

prepare the Accounts on a going concern basis; and

-

confirm that the Annual Report and Accounts as a whole is fair, balanced and understandable and take personal responsibility for the Annual Report and Accounts and the judgments required for determining that it is fair, balanced and understandable

HMT has appointed the Treasury Solicitor and Chief Executive as Accounting Officer of GLD. The responsibilities of an Accounting Officer, including responsibility for the propriety and regularity of the public finances for which the Accounting Officer is answerable, for keeping proper records and for safeguarding GLD’s assets, are set out in Managing Public Money, published by HMT.

As Accounting Officer, I have taken all the steps that I ought to have taken to make myself aware of any relevant audit information and to establish that GLD’s auditors are aware of that information. As far as I am aware, there is no relevant audit information of which the auditors are unaware.

Governance Statement

The Office of the Solicitor for the affairs of His Majesty’s Treasury (the Treasury Solicitor) was incorporated as a corporation sole by the Treasury Solicitor Act 1876.

The Government Legal Department is a non-ministerial department and was established as an Executive Agency on 1 April 1996. Ministerial oversight and accountability to Parliament lies with the Attorney General. HM Procurator General and Treasury Solicitor leads the department, in the roles of Permanent Secretary and Chief Executive.

The Treasury Solicitor is accountable to the Attorney General for the running of GLD; and as Chief Legal Adviser to government, the Attorney has a close interest in the legal advice and legal services being provided to government by GLD and the wider Government Legal Profession. An interim Framework Agreement governs the relationship between GLD and the Law Officers and the Attorney General’s Office.

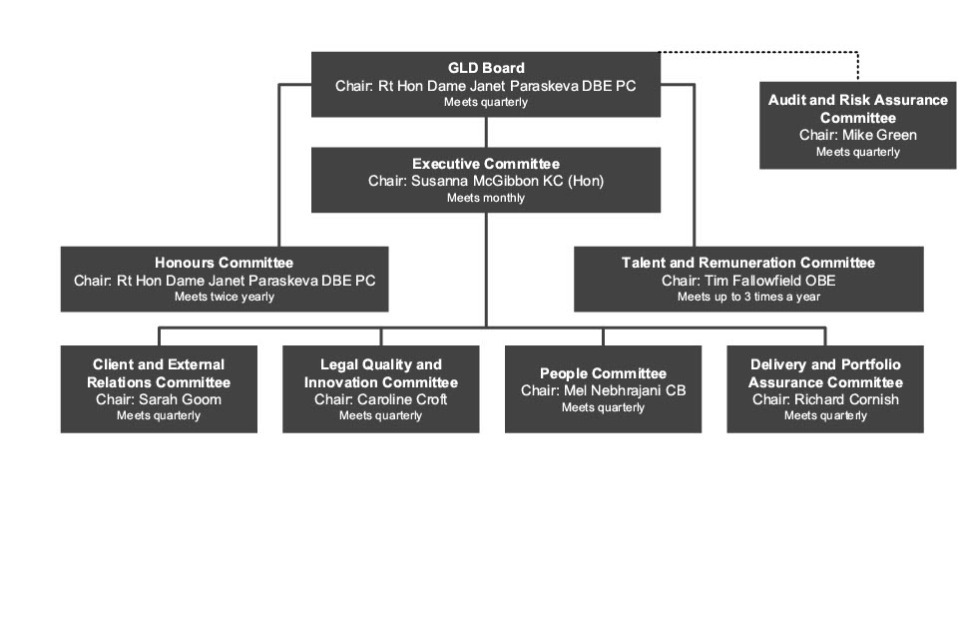

GLD Board and sub-committees

The GLD Governance structure at the reporting period date is set out below:

GLD Board

Chair: The Rt Hon Dame Janet Paraskeva DBE PC, Lead Non-Executive Board Member

The Board is GLD’s collective strategic leadership group, comprised of Executives and Non-Executive members, and a representative from the Attorney General’s Office. It focuses on strategic matters for the department, setting the overall vision and strategic direction for the organisation, to ensure the delivery of GLD’s strategic aims and objectives through long-term business and financial planning, and the GLD 2024-27 Strategy (which sets the department’s priorities, current and future needs). It supports the Chair in providing leadership of strategic business matters, and oversight of the delivery of legal services as well as the performance and governance of the organisation. It also supports the Permanent Secretary and Treasury Solicitor in their role as Chief Executive and Accounting Officer of GLD, and in their accountability to the Attorney General. The Board operates collectively, holding the Executive to account for the leadership and outcomes of the department.

The Board is supported by the Board’s sub-committees which comprise of the Executive Committee, the Audit and Risk Assurance Committee, the Honours Committee, and the Talent and Renumeration Committee.

Changes made during the reporting period

Having established a new composition in March 2024 (via the recruitment of two Non-Executive Board Members in February 2024), one of which is the new independent Chair, the new Board construct is now advisory rather than decision-making, supported by its refreshed Terms of Reference and Board Operating Framework (the terms of reference for other committees in the governance structure are being updated to align and strengthen the structure). See Professionalisation of GLD’s Governance section below.

Committee Membership

Current committee membership is drawn from GLD’s Executive (relevant to expertise), and Non-Executives. The Lead Non-Executive Board Member is independent Chair of the Board.

Board Members

Membership of the GLD Board from 1 April 2024 to 31 March 2025 was as follows:

Executive members:

Susanna McGibbon KC (Hon), Permanent Secretary, Treasury Solicitor and Chief Executive

Richard Cornish, Director General Chief Operating Officer

Carmel Thornton, Finance, Operations and Digital Director

Ex-officio member:

Douglas Wilson KC (Hon) OBE Director General, Attorney General's Office

Non-Executive Board Members:

The Rt Hon Dame Janet Paraskeva DBE PC

Mike Green

Tim Fallowfield OBE

Non-Executive Board Members

The Rt Hon Dame Janet Paraskeva DBE PC, Lead Non-Executive Board Member

Dame Janet was Chief Executive of the Law Society from 2000 to 2006, preparing it for the advent of the Legal Services Act 2007 by establishing separate regulatory functions for the SRA and the OLC.

She has since served as First Civil Service Commissioner, been an independent member of the Consumer Council for Water, a Non-Executive Director of the Serious and Organised Crime Agency, Chair of the Child Maintenance and Enforcement Commission, and Chair of the Appointments Commission for the States of Jersey. She also serves as a trustee of the charity Contemporary Applied Arts, as Vice Chair of the Games Rating Authority, Chair of Primary Eye Care Services, and is Chair of Council for Licenced Conveyancers, the Construction Skills Certification Scheme, and the Southern Co-op.

Dame Janet was made a Privy Councillor to assist in her role as a member of the Detainee Inquiry established by the Prime Minister in 2010.

Mike Green, Non-Executive Board Member

A Fellow of the Institute of Chartered Accountants in England and Wales and a graduate of the London School of Economics, Mike qualified as a chartered accountant with what is now KPMG and spent 11 years with the audit practice before a 20-year career in Commercial Television. He has held senior finance roles at TVS Television Limited and Carlton Communications plc and was involved in the Carlton/Granada merger which formed ITV plc. Following the merger, Mike moved to ITV and ultimately held the role of Deputy Group Finance Director. He also represented ITV on a number of joint venture boards in the UK and internationally.