Government evidence to the Senior Salaries Review Body on the pay of the Senior Civil Service (October 2025) (HTML)

Updated 30 October 2025

Executive Summary

Introduction

1. The Government continues to place the highest value on the leadership role that senior civil servants play to drive forward its ambitions on public sector reform and deliver critical public services. The Senior Civil Service (SCS) is a long established and much valued cadre of civil servants, and it has never been more critical that the SCS is equipped to efficiently deliver its role at collective and individual level.

2. The Government wants a fundamental reshaping and renewal of the state to deliver the Plan For Change and improve national security. The aim is to create an agile and productive state focused on delivery for working people. The Government needs a Civil Service that is able to bring the best talent in and is able to retain and incentivise those delivering the highest priority, critical areas for the Government,

3. The Government invites the SSRB to comment on the proposals contained in its evidence to ensure the SCS reward system supports the development of a senior leadership cadre for the Civil Service that is able to meet the challenges of the future.

4. The Government’s evidence is provided in two parts. The first part is the main evidence in narrative form and sets out:

- Chapter 1 – 2025 SSRB recommendations for the SCS

- Chapter 2 – SCS vision, priorities and direction of travel

- Chapter 3 – Wider context for the SCS and Civil Service

5. The following information is annexed to the main evidence:

- Annex A - SCS pay on appointment exceptions

- Annex B - Pensions

- Annex C - Permanent Secretary Remuneration

- Annex D - Government Commercial Organisation (GCO)

- Annex E - Accelerated Development Schemes

- Annex F - SCS data

6. SCS pay awards for 2025 are still in the process of being implemented in some departments, so this written evidence does not currently include final data figures related to SCS pay for 2025. Provisional workforce figures are provided from the Cabinet Office SCS database, but are not yet finalised and will need to be updated when SCS pay awards are and the central collections are complete.

7. We will ensure the SSRB has the finalised data when it is available to support the development of its Report, and will provide further data in advance of oral evidence when it is available. The Chancellor of the Exchequer is committed to provide more timely pay awards for the public sector. This means that this year, even more so than the previous year, a more advanced timetable is needed for all Pay Review Bodies as we transition to a timetable which enables the Government’s ambition for earlier awards. Cabinet Office officials continue to work closely with the SSRB secretariat to manage any impact and to provide any additional information required.

8. The second part is the supporting statistical data requested by the SSRB. In addition, the SSRB will receive separate economic evidence from HM Treasury.

Economic Context

Macroeconomic context

9. The UK economy has shown resilience to economic uncertainty of global trade and volatility in domestic demand, emerging as the fastest-growing G7 economy cumulatively across the first half of the year. Looking ahead, expectations for 2026 have softened compared to the spring: the most recent IMF forecast (July 2025) was 1.4%, compared to 1.5% in January, while the latest Bank of England (August 2025) forecast was 1.25%, compared to 1.5% in February. There has been a persistent slowdown in UK productivity growth since the Global Financial Crisis, which has worsened since the Covid-19 pandemic as productivity growth has largely flatlined. Sustained productivity growth is required to support sustainable growth in real wages.

10. Low and stable inflation is a key component of a stable macroeconomic environment and a prerequisite for sustainable economic growth and improved living standards. Headline Consumer Prices Index (CPI) inflation has risen over the past year to 3.8% in September – above the 2% target - primarily due to one-off factors such as a rise in global energy market prices and regulated water bills. Services inflation, an indicator of underlying inflationary pressure, has fallen by 1.0 ppts since the start of Q1 24-25. According to the Bank of England’s August Monetary Policy Report, inflation is expected to return sustainably to target in 2026–27. Overall, risks to inflation remain two-sided, reflecting domestic cost pressure from wage growth which has been a major factor in services inflation persistence, and prices as well as external pressures from energy markets and trade policy.

11. The UK economy remains exposed to several risks, including potential global spillovers from new US trade tariffs, heightened geopolitical tensions in the Middle East, and the ongoing impact of Putin’s illegal invasion of Ukraine. Overall, risks to UK growth remain elevated and skewed to the downside.

Labour market context

12. The unemployment rate has risen over the last year, reaching 4.8% in the three months to August 2025. Wider sources also suggest that the labour market has continued to loosen. Vacancy levels in the economy have fallen over the past three years, and RTI data on payrolled employees shows a gradual fall over the last seven months.

13. Whole economy total average weekly earnings growth was 5.0% in the three months to August 2025, having eased over the first half of 2025. Recent increases reflect changes in the timing of public sector pay settlements, but private sector regular pay growth has continued to fall to 4.4%. Measures of average wage growth have historically been higher than median pay settlements, as they are affected by compositional changes in the labour force and factors such as changes to working hours. Settlement data are the most comparable data to PRB decisions, as they are a direct measure of consolidated pay awards, and are not directly affected by other factors such as changes to working hours or changes in the composition of employment. According to Brightmine, median settlements across the economy were 3% in Q1 and Q2 2025. Relative to this, the 2025-26 award of 3.25% and an additional 0.5% for addressing pay anomalies for the SCS should support an improvement in recruitment and retention.

14. Average earnings growth is forecast to slow further over the coming months, with the OBR expecting earnings growth to fall to 2.2% in 2026/27.

Affordability of pay award to the SCS

15. As outlined above, average earnings growth is forecast to slow further over the coming months, with the OBR expecting earnings growth to fall to 2.2% in 2026/27. The Government has also further brought forward the pay round this year, which makes it particularly important that pay review bodies consider forecasts for wage growth. The Government has considered these factors whilst carefully evaluating the overall affordability position and recommends that the total increase in paybill for the SCS should be no higher than 2.5%.

16. As in previous years, HM Treasury has been clear that there will be no additional funding to departments for 2026/27 pay awards. The Cabinet Office will need to carefully consider the justification for any recommendation higher than 2.5%, and whether departments can make countervailing measures to meet the cost.

SCS Vision and Strategy

17. The SSRB has for many years identified the need for a strategic vision for the SCS and the Government accepts the SSRB’s longstanding position that fundamental changes are required to resolve workforce problems affecting the SCS. It has been clear in the SSRB’s recent reports and the Government agrees this is more critical than ever before to set the role the SCS need to play in supporting the Government’s priorities. The Government accepted and welcomed the SSRB’s recommendation last year for a fundamental review of the SCS pay and reward framework. It is the Government’s ambition that in accepting this recommendation, reform of the reward system will ensure the future sustainability of the Civil Service’s most senior workforce.

18. The overarching recommendation can only be fulfilled if it is underpinned by a coherent overall strategy for the SCS. As the SSRB will be aware through last year’s Government evidence and direct engagement, good progress has been made on a wider SCS Strategy. We remain grateful for the important contributions SSRB members continue to make and remain interested in any further views.

19. The strategy will seek to improve the way in which our senior leaders deliver within the context of mission-led government, and establish the right approach to realise much needed reform of the SCS. The vision set out in that strategy for the future SCS workforce is: “A united, professionalised and high-performing SCS workforce that attracts and retains the senior talent needed to advise, lead, direct and influence the Civil Service in optimally delivering its objectives.”

20. The intended outcomes from the SCS Strategy will be to: (i) realise efficiencies through right-sizing of the workforce, (ii) to improve the effectiveness of the SCS, including motivation, morale and wellbeing and (iii) to deliver better outcomes in both policy and delivery by having a SCS workforce that reflects the UK population. The Report on the SCS Strategy is being finalised.

21. Alongside this is commitment to a strategic approach to Civil Service reward that will align and integrate with the SCS Strategy. This is also underpinned by wider activity ongoing within the Government People Group focused on capabilities, skills, performance, recruitment, and strategic workforce planning. There will be a vision, goals and action plan to address reward issues within the Civil Service for both the delegated pay structure and at the SCS level. The aim is to achieve a more coherent, flexible, and individualised reward framework by 2030.

22. Chapter 2 sets out further details on the proposals and current direction of this work, and the Government People Group will continue to engage with members during its development and provide further information at the upcoming oral evidence. The Government would like the SSRB to comment on the current proposals in the overall SCS Strategy.

2026/27 Pay Priorities including the Fundamental Review of SCS reward

23. Work on the fundamental review of SCS pay and reward framework is progressing at pace. The Government recognises the SSRB’s position that this is undertaken with urgency. This is a core part of the wider strategy for the SCS and the Government is committed to ensure that longstanding challenges in SCS reward are addressed and meaningful sustainable reform is delivered.

24. Chapter 2 sets out further details on the progress and current direction of the review. The current immediate priorities for this work are to:

- set clear reward principles for the SCS;

- address the current pay band spans and overlaps; and

- explore a pathway to pay progression.

25. In light of the need for urgent progress and the moving forward of the pay round, this work will continue following the publication of this evidence and we will ensure the SSRB are provided with the latest information of proposals by oral evidence. The Government further welcomes the SSRB’s offer in its recent report for further engagement and assistance on addressing the longstanding and extended challenges in SCS reward.

26. It is the Government’s ambition for the 2026/27 pay award to act as a pathway to sustained reform of the SCS reward structure, with clear and achievable outcomes. Our initial view is that this can be achieved over a period of three years to ensure an affordable and well impacted transformation. The Government would welcome the SSRB’s views on the current direction of travel and to provide recommendations this year which enables an initial step in phased reform.

27. We recommend that the SCS pay award for 2026/27 should be prioritised as follows:

- Priority 1: Implementation of measures from the fundamental review of SCS pay;

- Priority 2: to allocate a consolidated basic pay increase to all SCS; and

- Priority 3: for departments to address acute issues stemming from the operational application of the pay ranges and other workforce factors.

28. For this year, the Government’s position is that an award should be targeted to address these priorities, whilst set in the context of the Government’s wider affordability position and providing a clear pathway for future reform of the SCS pay framework.

29. The Government will provide further information to the SSRB on its proposals during its oral evidence.

Permanent Secretaries

30. From time to time, the SSRB has provided specific views and recommendations on Permanent Secretary remuneration and the Government accepted the SSRB’s recommendation in the 2025/26 report to address structural issues within the pay band. While the Government is not seeking any specific recommendations this year on Permanent Secretary pay, it recognises the importance of ensuring that the current pay framework is able to attract and retain the most senior Civil Service leaders. In light of the SSRB’s recommendation for a fundamental review of the SCS pay framework, the Government would welcome the SSRB’s view on whether a review of the Permanent Secretary framework should be included in this work or indeed be subject to a separate review.

Performance Management

31. The Government is committed to ensuring that the performance management system drives the delivery of mission-based government. The changes made to the SCS performance management framework in February 2025 were designed to tighten the approach, ensuring minimum standards expected of SCS underlined the approach. This is a first step in what the Government believes should be a more radical review of the approach on SCS performance management. We remain clear that an effective performance system, incentivising the best performers and tackling poor performance is key to an approach that drives delivery in government.

32. The changes to the SCS Performance Management framework in February 2025 are outlined in Chapter 2. Further reform continues to be explored as part of the work on the fundamental review of SCS pay and in SCS Strategy. The Government continues to welcome SSRB’s views and ideas about performance.

Chapter 1 – SSRB’s 2025 Recommendations for the SCS

1. Recommendation 1:

As a pay award for the Senior Civil Service we recommend:

- all members of the Senior Civil Service should receive a 3.25 per cent consolidated pay increase from 1 April 2025.

2. Recommendation 2:

We recommend the following changes to SCS pay band minima and maxima from 1 April 2025.

- An increase of £5,000 to the minimum and £12,200 to the maximum for SCS 1.

- An increase of £5,000 to the minimum and £1,100 to the maximum for SCS 1A.

- An increase of £2,000 to the minimum and £500 to the maximum for SCS 2.

- An increase of £2,000 to the minimum and £900 to the maximum for SCS 3.

- An increase of £2,000 to the minimum and £20,000 to the maximum for SCS 4.

3. Recommendation 3:

We recommend an anomalies pot, comprising 0.5 per cent of the SCS pay bill. This should be used to address acute skills gaps and equal pay issues. Exceptionally, it may be used to mitigate the effects of pay overlaps with the delegated grades. The Review Body should be provided with a report on the extent of its use, and for what purposes, in next year’s written evidence.

4. Recommendation 4:

We recommend that, in light of the longstanding issues and anomalies, a fundamental review and ‘reset’ of SCS pay and reward frameworks is undertaken by the Government with urgency. This review should support the development and implementation at pace of long-term solutions to the issues and anomalies that have been highlighted over many years by the Review Body – including, but not limited to:

-

A coherent SCS Strategy which addresses the fundamental questions relating to the SCS’ purpose, size and composition.

- A clear set of reward principles for the SCS.

- A pay structure that can recruit and retain in-demand specialists.

- A simple pay progression system for those delivering in role and demonstrating expertise.

- Addressing salary band overlaps between the delegated grades and the SCS, and within the SCS.

- Reducing reliance upon anomalies pots and non-consolidated payments.

- Benchmarking SCS pay and reward relative to comparable leadership roles and responsibilities across the public and private sectors.

33. In making their pay recommendations, the SSRB stated it was mindful of a number of factors, including:

- The challenges affecting SCS recruitment, retention and morale, and the risk posed by these for the provision of the high-quality, efficient and cost-effective public services, balanced against affordability considerations; and

- the continued, and urgent need for an effective strategy to address the shortcomings in the SCS structure.

34. The Government accepted the SSRB’s recommendations on SCS headline pay for 2025. In reaching this decision, the Government carefully considered the need to to attract, retain and develop the very best senior talent for government, whilst considering affordability and fairness between senior pay and the delegated pay award.

35. Regarding the SSRB’s recommendation for increases to pay band maximums (£12,200 for SCS pay band 1, £500 for pay band 2, and £900 for pay band 3), the Government asked for this to be deferred to form part of the fundamental review.

36. In accepting SSRB’s recommendations on SCS headline pay, and in recognition of the SSRB’s concerns about the lack of consistency in the application of consolidated pay increases by departments in recent years, the Cabinet Office, consistent with its approach in recent years, was explicit in how the award was implemented across the SCS. This was to ensure consistency in the application of the award, and departments were informed of the criticality of following the advice and recommendations of the SSRB in the 2025 SCS Pay Practitioners Guidance. The Practitioners Guidance specified that:

- Departments must give all eligible members of the SCS a consolidated pay increase of 3.25% of their base pay from 1 April 2025.

- An anomalies pot comprising 0.5% of the SCS pay bill to address acute skills gaps and equal pay issues (and exceptionally, to mitigate pay overlaps with delegated grades).

- Increases of £5,000 to the minimum salaries for SCS pay band 1, and £2,000 for SCS pay bands 2 and 3.

37. Where departments proposed to depart from this approach, they were required to seek Cabinet Office approval first. Special dispensation was again agreed for FCDO in 2025/26 to reflect their unique workforce needs, including the continuing need to address harmonisation issues resulting from the merger of former FCO and DFID.

38. Due to the shorter timeframe for publishing this evidence, the Cabinet Office will provide the SSRB with its summary of the application of the 2025/26 award in advance of oral evidence. This is due to some departmental awards being implemented up to the publication of this evidence. We fully acknowledge and share the SSRB’s concerns with the speed with which departments are implementing their pay awards for the SCS.

Chapter 2 – SCS Vision, Pay Priorities and Direction of Travel

Future Strategy for the SCS

39. The Government recognises that the SSRB has consistently identified the need for a clear strategic vision for the SCS. The SSRB made clear in its 2025 report that any review of the current pay and reward frameworks should be underpinned by a coherent strategy, and the Government accepts the recommendation for a coherent SCS Strategy which addresses the fundamental questions relating to SCS purpose, size and composition.

40. As outlined in last year’s report, and discussed further with the SSRB, this work is underway and continues to evolve. Through setting a bold ambition for the future SCS cadre, our ambition is that the final strategy will improve the way in which our senior leaders deliver within the context of mission-led government, thereby being a key way to realise meaningful public sector reform.

Background

41. The SCS has a crucial role in the effective delivery of better public sector outcomes, and as change leaders for wider public sector leadership. The existing SCS workforce model, which came into effect in 1996, has become outdated and lacks the agility needed to respond to the challenges of supporting modern government, there are systemic issues particularly with SCS reward, and the senior workforce is not optimally set up to support the ambition of a rewired, productive and agile, public state.

42. In February 2024, the Government People Group (GPG) started work to deliver a SCS Strategy which would address the systemic issues and set a clear path forward for the workforce. This was confirmed as a commitment within the Civil Service People Plan (January 2024). GPG is finalising its final report, which provides a holistic set of proposals for the future SCS workforce, and the associated delivery plan, to achieve the vision. This chapter provides an outline of the current direction of the report, and the Government commits to sharing further information at the upcoming oral evidence.

Current direction - vision and purpose

43. The intended outcomes from the SCS Strategy will be to: (i) realise efficiencies through right-sizing of the workforce, (ii) to improve the effectiveness of the SCS, including motivation, morale and wellbeing and (iii) to deliver better outcomes in both policy and delivery by having a SCS workforce that reflects the UK population.

44. The current proposed vision for the future SCS workforce is: “A united, professionalised and high-performing SCS workforce that attracts and retains the senior talent needed to advise, lead, direct and influence the Civil Service in optimally delivering its objectives.

45. This vision covers three core areas:

- United: the SCS workforce should be clearly aligned under the priorities of the Government of the day and shared values.

- Professionalised: clear expectations and accountabilities, and the core skills and knowledge needed to fulfil roles now and into the future, should be understood and embedded.

- High performing: the workforce should enable the Civil Service to deliver to its best and drive continuous improvement.

46. To deliver the vision for a reformed SCS, it is our view that work is required in four key areas:

i. Clear and modernised expectations and accountabilities: Establishing a clear framework of professional expectations and accountabilities for the future SCS, to be integrated into all phases of the employee lifecycle, with every SCS role realigned to meet these enhanced standards.

ii. A reformed reward package to incentivise the SCS workforce to deliver with impact: Rewarding and recognising high performance and those who go above and beyond, whilst holding SCS accountable for not meeting expectations by quickly addressing underperformance.

iii. World-class attraction, retention and development practices: The ability to recruit, retain and train best-in-class, diverse SCS talent, including for technical and specialist roles, oriented around the delivery of government priorities and future skill requirements.

iv. Optimised workforce management and service delivery: A best-in-class service to support and manage the SCS workforce; one that is performance-led, data-driven and tech-enabled, with streamlined controls and processes to ensure best value for the taxpayer.

47. These proposals are the key areas of change that the Government believes are required to achieve the vision. Where the existing SCS workforce model works effectively and serves the vision, it will be important that this is maintained.

Delivery of the strategy

48. The final report will set out a full delivery plan for these four key areas. It is our ambition that the full strategy should be implemented by 2029/30. The Government is ready to deliver at pace, and where appropriate, to test and learn or pilot initiates to ensure viability before wider implementation.

49. We have been grateful for engagement with the SSRB this year whilst the SCS Strategy has been in progress, and will continue engaging with members on this important work.

Fundamental review of SCS reward and 2026/27 Priorities

50. The GPG has commenced the fundamental review of SCS pay and reward frameworks and recognises the SSRB’s position that this is undertaken with urgency. This is a core part of the wider strategy for the SCS and the Government is committed to ensure that longstanding challenges in SCS reward are addressed and meaningful reform is delivered. This key area of work sits under the core proposal of ‘reformed incentives to enable performance and delivery’.

51. Our ambition is for a phased reform to the reward framework over the next three years to ensure affordable and well impacted transformation. The current immediate priorities for this work include:

- setting clear reward principles for the SCS;

- addressing the current pay band spans and overlaps; and

- developing a pathway to pay progression.

52. In light of the need for urgent progress and the advanced timing of the pay round, this work will continue to evolve following the publication of this evidence and we will ensure the SSRB are provided with the latest information on the proposals at the upcoming oral evidence. The Government further welcomes the SSRB’s offer in its recent report for further engagement and assistance on addressing the longstanding and extended challenges in SCS reward.

53. The Government would welcome the SSRB’s views on the current direction of travel and to provide recommendations this year which enables an initial step in phased reform.

Reward principles

Through this review, clear reward principles are being established that will apply to any decisions around the design of the future senior reward system. A future SCS reward framework should:

- enable a simple, progressive, and competitive offer

- enable the Civil Service to recruit and retain senior talent;

- provide the most efficient and effective service to end users and for taxpayers;

- support an increasingly technical and specialist workforce;

- incentivise delivery; and

- support a geographically dispersed workforce.

Pay ranges

54. Addressing the current pay band spans and overlaps is an immediate priority, as outlined above, as part of the review of the current SCS pay framework. It is our view that addressing the current pay bands is a key measure to addressing many of the structural issues that the SSRB has raised for many years. The Government continues to share the SSRB’s concerns of the issues arising in a number of departments with overlap between SCS1 and those in the delegated departmental pay structure. We would underline that some progress has been made over the years to continually apply increases to the pay band minima, and highlight the increases implemented following the SSRBs last report, which presented some of the highest minima increases in recent years. We continue to support increases to the pay band minima as a mechanism to improve attraction to the SCS, and to address overlap concerns.

55. As part of a phased approach to reform, our immediate ambition is to significantly reduce grade overlaps, notably between SCS1 and those in the delegated departmental pay structure. In the Government’s response to the SSRB’s 2025 recommendations, it asked that the recommendation to increase the pay band maxima for SCS1 to SCS3 be deferred so it could be considered as part of the wider review of the SCS pay framework. This has been carefully considered and we would welcome further discussions on this at oral evidence.

Enabling pay progression

56. The Government recognises and accepts the SSRB’s ongoing concerns regarding the lack of implementation of a simple pay progression approach for the SCS, following the pausing of a model for capability-based pay progression in recent years. In accepting the SSRB’s recommendations, the Government is committed to exploring a simple pay progression system that it can consider expanding to cover the wider workforce. We will share our proposal on this in time for the oral evidence session.

Priorities for the 2026/27 award

57. It is the Government’s ambition for the 2026/27 pay award to act as a pathway to sustained reform of the SCS reward structure, with clear and achievable outcomes. Our main priority this year is to ensure suitable measures from the fundamental review are implemented.

58. In recent years, the SSRB has recommended a general consolidated pay uplift applied to all members of the SCS (unless they are underperforming) as a significant part of the pay award. In the current economic context, we agree that this remains an important element of the SCS pay award.

59. The Government accepts the SSRB’s view that an anomalies pot should be applied only exceptionally and in a more meaningful solution is required to address pay anomalies. It is therefore our ambition that long-term reform should negate the need for an anomalies pot. Whilst we transition to a future framework, we believe that it should remain a priority that a portion of the award is used to address the acute issues stemming from current application of the pay ranges.

60. We recommend that the SCS pay award for 2026/27 should be prioritised as follows:

- Priority 1: Implementation of measures from the Fundamental Review of SCS pay;

- Priority 2: to allocate a consolidated basic pay increase to all SCS; and

- Priority 3: for departments to address acute issues stemming from the operational application of the pay ranges and other workforce factors.

61. For this year, the Government’s position is that an award should be targeted to address these priorities, whilst set in the context of the Government’s wider affordability position and providing a clear pathway for future reform of the SCS pay framework.

62. The Government will provide further information to the SSRB on its proposals at the upcoming Oral Evidence.

Permanent Secretaries

63. From time to time, the SSRB has made recommendations and commented on Permanent Secretary remuneration. A robust framework applies to Permanent Secretary pay: roles are assigned to one of three pay tiers within the overall range (pay band) based on size and complexity. Specialists who receive market premium pay for their roles (e.g. the Cabinet Secretary and Chief Medical Officer) sit outside of the tiers.

64. For 2025/26, the Government accepted the SSRB’s recommendation of a 3.25% consolidated increase for all eligible members of the SCS. The Permanent Secretary Remuneration Committee (PSRC) agreed to mirror this for eligible Permanent Secretaries. They also agreed to implement the recommended new Permanent Secretary pay range of £155,000 - £220,000 (reflecting an increase to the pay band minimum of £2,000 and to the pay band maximum of £20,000), using the opportunity to review the Permanent Secretary tiers (within the band range). With effect from 1 April 2025 the new tiers are:

- Tier 1 - £200,000 - £220,000

- Tier 2 - £175,000 - £200,000

- Tier 3 - £155,000 - £175,000

65. In implementing the new pay range, PSRC also noted that increasing the pay band maximum would mean that all eligible Permanent Secretaries received a fully consolidated increase (a change from 2024/25)[footnote 1].

66. Table 1 sets out, in £5,000 bands, the salaries of Permanent Secretaries within the tiers as at 1 April 2025.

Table 1: Permanent Secretary salaries by tier, in £5,000 bands

| Salary bands (£000) based on salaries at 01.04.25 | Number of Permanent Secretaries in the Salary Band |

|---|---|

| 225 - 230 | 1 |

| 220 - 225 | 0 |

| 215 - 220 | 0 |

| 210 - 215 | 0 |

| 205 - 210 | 6 |

| 200 - 205 | 1 |

| 195 - 200 | 1 |

| 190 - 195 | 0 |

| 185 - 190 | 6 |

| 180 - 185 | 3 |

| 175 - 180 | 3 |

| 170 - 175 | 2 |

| 165 - 170 | 2 |

67. Further information on Permanent Secretary remuneration, including performance ratings, can be found in Annex C.

68. No specific recommendations are proposed by the Government this year on Permanent Secretary pay. However, the recognises the importance of ensuring that the current pay framework is able to attract and retain the most senior Civil Service leaders. In light of the SSRB’s recommendation for a fundamental review of the SCS pay framework, the Government would welcome the SSRB’s view on whether a review of the Permanent Secretary framework should be included in this work.

Non-consolidated pay

Pivotal role allowances

69. Pivotal Role Allowances (PRAs) have been in place since 2013 to help retain SCS delivering critical programmes and those responsible for implementing the Government’s priorities. They are widely recognised as a helpful tactical solution to address flight risk, pending longer term reform of the SCS pay system.

70. Since their introduction, more than 400 PRAs have been agreed for people responsible for delivering the Government’s priorities, including: EU exit priorities, COVID-19 response, major transport infrastructure projects and sustainable energy programmes, key health and safety specialists, those protecting the borders and national security, those providing digital services to the public and across government, and those in highly technical defence roles.

71. PRAs are removable and non-pensionable and controlled within a notional central pot set at 0.5% of the overall SCS pay bill. Around 104 PRAs are currently in payment. 39 PRAs were agreed in 2024/25, compared to 56 PRAs agreed in 2023/24. From April 2025 to the end of September 2025, a further 15 PRAs have been agreed. PRAs generally range from £10,000 - £15,000 per annum in value and are paid to retain people for up to three years. The PRAs currently in payment are spread across a wide range of professions, but are being used mainly by Finance (28%), Digital, Data and Technology (20%), Policy (15%) and Project Delivery (10%).

72. In addition, separate bespoke PRA arrangements have previously been agreed for the Infrastructure and Projects Authority to support the recruitment and retention of Senior Responsible Owners responsible for delivering projects in the Government Major Projects Portfolio and the Digital profession to support the recruitment and retention of highly skilled SCS1/2 Digital, Data and Technology specialists.

Performance-related pay

73. The current non-consolidated pay pot for SCS is 3.3% of the overall SCS pay bill. The pot is used to fund end-of-year awards and in-year awards. Following the removal of forced distribution, there is no cap on the number of staff eligible for an end of year award. All staff are eligible for in-year awards, up to £5,000, to recognise high performance in the moment provided they are not on formal poor performance measures.

74. SCS who receive an ‘Exceeding’ box marking must receive an end of year award, and we have now stipulated that departments must also award High Performing’ (they previously had flexibility to choose whether to reward High Performing). Departments currently have discretion to differentiate the level of payment they award each box marking to acknowledge different levels of contribution.

75. Following a pause to the review of non-consolidated performance related payments for the SCS, work remains in the early stages of designing this work. In light of the SSRB’s recommendation for a fundamental review of the SCS reward framework, this work will be expedited and form a clear part of the phased approach to reform. We expect the review to have concluded by 2026/27 and welcome the SSRB’s advice and engagement on its priorities.

Performance management

The current framework

76. The SCS Performance Management Framework was updated in February 2025 following a review of the consistency of implementation across departments. That work found inconsistency in expectation and objective setting (particularly for the mandatory objectives), outcomes, and a continued difficulty in identifying and addressing poor performance.

77. The key changes made to the framework are:

- Introducing four ‘Minimum Standards’ to subsume and replace the mandatory objectives;

- Setting an ‘Expected Distribution’, which should not operate as forced distribution, of 15% Exceeding, 20% High Performing, 60% Achieved, and 5% Partially Met.

- Introducing a cross-government level consistency check where HR Directors can discuss their performance outcomes and process, including approaches to tackling poor performance.

78. These changes provide necessary adjustments to the framework and the way it currently works, with the aim to increase consistency of implementation. Following a review of departments’ approach to objective setting, the Cabinet Office found an inconsistent approach and poor standard to the objectives set in the finance, people and capability, diversity and inclusion (D&I), and corporate contribution areas, meaning the baseline from which all SCS were assessed was inconsistent.

79. In March 2025, the Prime Minister made clear that the Government intends to fundamentally reshape the way the state delivers and serves working people by becoming more tech-driven, productive, agile and mission focused. These announcements have therefore provided the opportunity to amplify the changes, and drive the culture and leadership shifts that are necessary to ensure that we identify and manage poor performers, particularly in the SCS given the impact that underperformance has on productivity and delivery against the Government’s ambitions.

80. The introduction of the end of year consistency check meeting will ensure greater consistency of implementation of the framework across the centrally managed cadre and support the culture and leadership shifts that are necessary in identifying and managing poor performers. As part of this, a new data collection is being introduced, which will focus on poor performance. Improving transparency, and providing a forum for challenge, will drive actions across government to ensure performance management approaches are robust.

81. Amendments to the SCS performance management framework for the for 2025-26 have sought to increase the consistency of expectation and outcome across the cadre, as well as considering opportunities to utilise the performance management system to drive mission-led government. These amendments address some of the concerns raised about the existing model, however there is still opportunity to go further. We welcome the SSRB’s engagement as this work progresses.

Director General Remuneration Committee (DGRC)

82. The new Director General Remuneration Committee (DGRC) was created in 2023 and has the same membership of DGPC, with the addition of a HMT representative and two Non-Executive Directors.

83. The remit of the DGRC is to:

- determine and implement a coherent Reward Strategy for the DG group:

- provide an annual independent assessment of the DG pay landscape and make recommendations to SSRB and Departments to ensure the delivery of the Reward Strategy;

- provide oversight of individual remuneration, including the need for pay exceptions, to ensure alignment with principles of reward and future Reward Strategy.

84. The DGRC delivers two principal functions:

- setting principles and approach to DG remuneration, including being the sponsor of a robust and reliable internal and market-facing dataset.

- taking decisions on individual pay and exit cases by actively using an agreed set of principles and consideration of internal and market data.

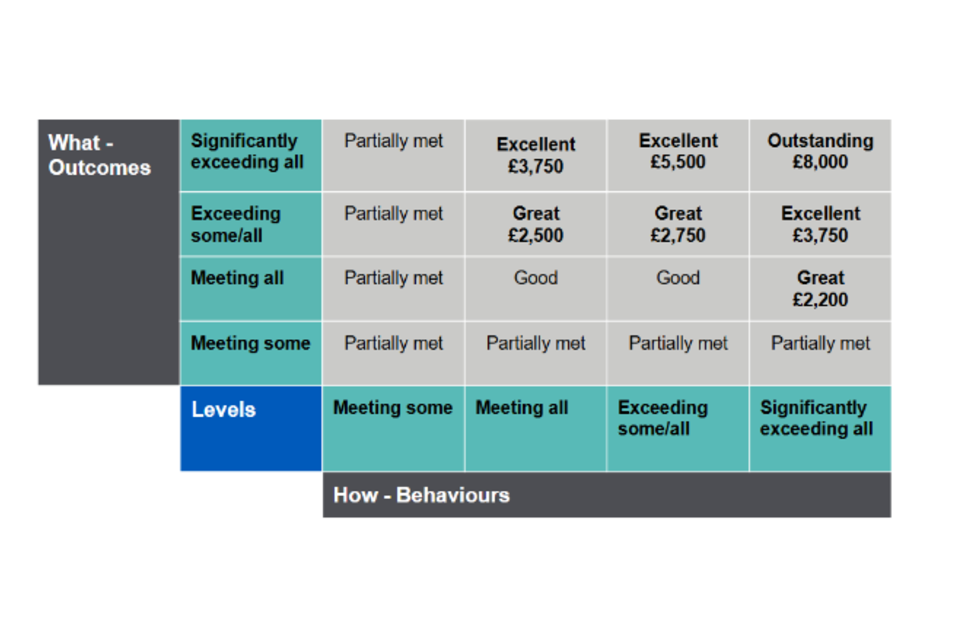

Quantum of End of Year Bonuses

85. The committee commissioned work in order to consider options that would provide coherence to the application of end of year performance related bonuses across the DG cadre. This is as a result of data provided to the committee which indicated an inconsistent approach across departments to the amount being awarded for the two highest performance ratings at the end of the performance year.

86. The current non-consolidated performance related payments (NCPRP) pot is set at 3.3% of the overall SCS paybill for each department, and there is currently no formal guidance on the resulting NCPRP quantum for Exceeding and High Performing year-end ratings, at any pay band.

87. Based on the data and research provided to the Committee, they decided to introduce a quantum of bonuses for those that achieved an Exceeding and High Performing end of year performance marking, as it was felt that this was the best way to ensure consistency of application of awards for the DG cadre. The amounts are set out in the table below. The amounts were determined by ensuring proportionately the use of the NCPRP for awarded performance throughout the year as well as recognised sustained performance throughout the year, all within the bonus pay controls.

Table 2: Quantum of Bonuses for DG Cadre

| Performance Marking | NCPRP Award |

|---|---|

| Exceeding | £12,500 |

| High Performing | £6,250 |

The Devolved Governments

88. The SCS in Scotland and Wales continue to be part of the centrally managed cadre which is governed by the UK, which differs from the delegated grade structure, which is managed by their own respective government.

89. For both governments, over time, the position in regards to the SCS has shifted in recognition of the changing shape of devolution. For example, the sign off for new senior appointments moved from the Prime Minister to the First Minister of the respective government, and there has been a delegation of certain decisions regarding the Civil Service Compensation Scheme. While these changes in responsibilities did not require amendment of the Civil Service Management Code, they do acknowledge the different position of devolved governments when compared to UK Government departments.

90. Financial accountability to the Scottish Parliament and Senedd and increasing fiscal autonomy, such as the Scottish and Welsh Rates of Income Tax, also factor as part of the developing context. One feature of the evolving devolution context is that Scottish Ministers now have an established and distinctive Public Sector Pay Policy. As this has diverged from the UK Government’s policy choices, the position for the reserved SCS in the Scottish Government has become increasingly complex to navigate. This is also increasingly an issue for SCS in the Welsh Government as Welsh Ministers move towards greater co-ordination on pay across the Welsh public sector.

91. Both governments operate remuneration committees (similar to those in UK Government departments). The Welsh Government’s People and Remuneration Committee is responsible for recommending senior pay decisions and managing the performance, potential and talent of senior staff. The Committee ensures remuneration is handled in a fair and appropriate way and in line with UK Government guidance.

Issues affecting the Devolved Governments

92. For a number of years an overview of the issues affecting senior reward arrangements for the Devolved Governments has been included in the Government’s evidence to the SSRB. Some of these are also experienced by UK Government departments, such as the loss of senior staff to the wider public sector where pay levels are higher or access to pay progression exists, and the ‘leapfrogging’ and overlap issues at the low end of the SCS1 range. However, some are particular to the Devolved Governments, including the ministerial decision on the non-payment of performance awards.

93. The issue of leapfrogging continues to be exacerbated in the Devolved Governments by the practice of pay progression at those in the delegated pay structure leading to many of the Grade 6 and 7 cadre sitting at the top of the pay band while the members of the SCS stay clustered towards the bottom of the pay band. Higher pay awards to delegated grades and the use of pay supplements in specialist roles further highlights the challenge of maintaining differentials for SCS.

94. The UK Government continues to endorse the model of a UK-wide SCS. The SCS strategy continues to look at reviewing the current UK-wide SCS approach. We will involve both governments as this work progresses.

Chapter 3 – Wider Context for the SCS and Civil Service

Civil Service People Plan

95. In the Civil Service we are committed to having the best people leading and working in government to deliver better outcomes for citizens. The Civil Service People Plan (2024-2027), published in January 2024, is about the Civil Service understanding our big people challenges and setting out what we will do to address them. It sets a clear direction and focus for the Civil Service to be the most dynamic, skilled and efficient that it can be. It establishes five People Priorities, set out below, that will ensure a Civil Service that is fit for current and future challenges:

- Learning, Skills and Capability - Providing a clear and targeted learning offer to ensure civil servants have the skills they need now and for the future.

- Pay and Reward - Rewarding excellence in public service delivery and recognising proven delivery and productivity.

- Employee Experience - Promoting an engaged workforce and culture of performance excellence, with effective line management.

- Recruitment, Retention & Talent - Securing the best people working in the right place with the right incentives in a timely way.

- High-performing HR function - Delivering innovation, expertise and agility, to help build thriving cultures, drive organisational success, streamline processes, and simplify the availability of our services to our employees.

96. The work continues on developing and implementing the People Plan, with a refresh / updating of the Plan expected in Autumn 2025 subject to Ministerial approval. We will share further details of the refreshed plan with the SSRB in due course.

97. The People Priorities cover a range of work focused on delivering an effective SCS. Good progress has been made across Government on the delivery of the 45 commitments against these priorities, with 42% of the commitments now having been delivered and 55% on track for delivery by the end of the plan. Updates on key areas of work have been outlined below.

Learning, Skills and Capability

98. As set out in the Civil Service People Plan, Government Skills aims to build a skilled, knowledgeable, and networked Civil Service. Confident and capable civil servants must develop the full spectrum of skills relevant for their role, including gaining both broad universal knowledge and deep specialist skills.

99. Our curriculum framework defines: 1) core skills, 2) specialist skills, and 3) leadership and management skills. New work has more clearly defined the core skills for every civil servant, from induction onwards. Specialists are offered the tools and training to deepen their expertise, including in high-demand areas like digital, data, science, commercial and project delivery. Professionalisation of skills will be celebrated, and capability will be assessed objectively against robust standards and accredited, where appropriate. We are fostering a culture of continuous learning and improvement at all levels, led by the SCS. And we are becoming a data-driven learning organisation that is committed to impact evaluation and using insights to actively deploy and manage our workforce.

100. Through a standardised skills taxonomy, the new Government Skills Campus digital platform and robust evaluation framework we will take a data driven approach to ensure that training is having a positive impact, resulting in better policy making and better public services for the country. We are also doing more to support our ministers to be effective, both in induction, and throughout their ministerial careers.

101. We continue to roll out our cross-Civil Service induction with over 35,000 participants across 25-30 departments and agencies, and a new model for SCS induction was introduced to build strong local networks. We have further invested in digital and data skills for all to raise digital and data literacy across Government including masterclasses for senior leaders in data (2020) and innovation (2021) and both are now well established. We launched the Digital Excellence Programme (DEP), with four SCS-level courses, including AI confidence, in 2023 - with over 3,200 participants to date. The DEP was evaluated through a robust Randomised Control Trial (RCT) process, commenced in November 2024, reflecting control and treatment group impact, with the DEP showing evidence of promise. In addition, formative monitoring of DEP highlighted improved learner competence. We also supported One Big Thing (OBT) 2023 that helped all civil servants build their data skills, along with leading the design of an SCS AI Pathway for OBT in 2025.

102. In 2024 we undertook a full scale core curriculum review of the Fast Stream to keep the offer current and to a high quality and designed a reformed future Fast Stream that will ensure a pipeline of leaders and managers to support the corporate functions. We also delivered a refreshed attraction and selection approach giving potential candidates a clearer preview of the Fast Stream offer, and which will aim to attract a greater number of graduates with a STEM background. In May 2025 we set an ambition of 50% of Fast Steam roles to be outside of London by 2030 as part of wider plans to bring people closer to communities they serve. Further information on the Fast Stream can be found in Annex E. In August 2025, we launched the Career Launch Apprenticeship which is a new cross Civil Service apprenticeship programme aimed primarily at young people. The programme will have roles at AO level, in various departments, across three cities (Birmingham, London and Manchester). Participants will join in January 2026, on a two year contract, completing the Level 3 Business Administrator apprenticeship. The aim is to open up the Civil Service by creating entry level roles whilst supporting skill development and breaking down barriers to opportunity.

103. These principles apply fully to the SCS: new members of the SCS have already been benefiting from revised SCS inductions and a new SCS orientation for those joining from outside the Civil Service. Alongside this, Government Skills’ work to reform management and leadership skills is bringing greater coherence to central leadership programmes, delivered in collaboration with departments, functions, professions, and public sector organisations. We launched the new management pathways, supporting managers at all levels of the Civil Service to increase their line management capability.

Pay and Reward

Civil Service Reward Strategy

104. In addition to the continued work to develop an SCS strategy, as outlined in Chapter 2, work continues to develop a new Civil Service Reward Strategy that will address the systemic and long-standing problems with the Civil Service pay and reward framework.

105. The strategy’s overall aim is to provide a sustainable pay and reward framework. This framework will be one that enables the Civil Service to attract and retain the best workforce possible in order that the Government can deliver its missions, wider programmes and deliver for the public. One that maximises impact and value whilst minimising taxpayer burden. There are significant, long-standing, complex and entrenched issues that the Civil Service needs to address. The absence of a unified strategy - aligned to other aspects of the workforce and reform priorities - makes the task of solving these problems much harder.

106. We would actively welcome further engagement with the SSRB as we progress this important area of work.

Employee Experience

Places for Growth

107. The Civil Service has been reshaping the workforce to enable end-to-end careers and strengthen presence nationwide through the Places for Growth (PfG) programme, bringing government closer to the communities it serves. As of June 2024, Places for Growth located 23,249 roles and c.33% of UK-based SCS outside London.

108. The next phase of the programme will: strengthen the UK-wide Government presence; support Government Missions and Public Sector Reform; continue role relocations; enhance policy and decision-making outside London; increase collaboration with local partners; grow Civil Service locations across the UK; and manage workforce and estate strategically in London.

109. By 2030, more senior and policy roles will be based outside London, targeting 50% of UK-based SCS roles outside the capital. This is underpinned by evidence that a strong senior cadre supports thriving, sustainable Civil Service communities with end-to-end careers and productive local partnerships. Recruitment will support sustainable career pathways in all locations and enable diversity of thought and experience to grow and flourish within the Civil Service.

110. Thematic campuses will be strategically aligned to support the delivery of Government Missions and Public Sector Reform. This includes utilising campuses as locations for Mission Delivery Challenges and as locations for implementing Test & Learn approaches to identify how multi-disciplinary teams can tackle shared challenges in places across the UK.

111. The Civil Service needs to be visible in, and representative of, the entire UK, across all departments, functions and professions. By having policy-makers, strategists and a large percentage of the SCS based beyond Whitehall, the Civil Service can take full advantage of the untapped and diverse talent available in places across the whole of the UK.

A more inclusive Civil Service

112. The Civil Service Diversity & Inclusion Strategy 2022-2025 is currently being renewed. The existing Strategy outlines our commitment to having a truly diverse workforce with a culture of openness and inclusivity - not as ends in themselves but as means of delivering better outcomes to the citizens we serve. It outlines our aim of a Civil Service that:

- understands and draws from the communities it serves – drawing from a range of backgrounds, experiences and locations.

- is visible to everyone – engaging the communities we serve and showcasing what the Civil Service offers.

- is flexible – supporting innovation, performance and engagement.

- welcomes talent from wherever it comes – attracting the best talent from all backgrounds.

113. It sets a clear vision on how to achieve those aims, being a Civil Service that:

- Values Diversity of Teams;

- Challenging groupthink and inspiring a greater diversity of thinking.

- Values and invests in its People;

- Enabling career development through accessible and universal training.

- Has Collaborative Partnerships Underpinned by Our Values;

- Systems and communities working collectively to deliver improved inclusion.

- Tackles Bullying, Harassment and Discrimination;

- Specific actions for departments to take in continuing to address BHD.

- Tests its Policies.

- Activity to be data-driven, evidence-led, and delivery focussed.

114. The Government will build on the progress achieved to date, using the strengthened evidence base to embed a more professional, consistent and outcomes-focused approach to delivering Equality, Diversity and Inclusion (EDI). This will underpin the development of the new Civil Service Equality, Diversity and Inclusion Strategy which will also have a strong focus on Social Mobility, and will succeed the current D&I Strategy concluding this year.

115. We are reviewing progress made within departments on implementing the recommendations from the major review (PDF, 679KB) (by Dame Sue Owen) of the Civil Service arrangements for tackling bullying, harassment and discrimination (BHD); to identify what more we can do to continue to make progress. Recommendations from this Review will feed onto the development of the new Strategy.

116. We are investing in innovative ways to improve our ability to address what can often be the biggest barrier to achieving improvements in workplace culture around BHD by using the Organisational Readiness Tool. Developed by Loughborough University this tool gives Civil Service organisations the ability to understand how to better prepare and plan BHD interventions. By enhancing an organisation’s readiness to change around BHD, we can improve its ability to successfully implement and uphold BHD interventions in the long-term. Thus, reducing the need for repetitive expenditure on those that are ineffective.

117. We are also monitoring progress on bullying, harassment and discrimination through the Civil Service People Survey, with increased reporting of instances, as a result of individuals feeling able to raise concerns, providing the data and evidence for robust interventions.

118. The annual ‘Speak Up’ campaigns across government, encourage reporting of issues where they arise while providing case studies highlighting actions taken as a result.

119. The Evaluation Framework, launched in December 2024, is supported by guidance to help departments maintain a culture of testing and tracking interventions and theories of change, with a focus on achieving the right outcomes. It will help identify and share best practice, as well as highlight areas of concern so they can be addressed swiftly in an evidence-led way. The Evaluation Framework continues to be rolled out to departments, enabling them to assess their interventions and programmes at the design, trialling, implementation, delivery and review stages of development.

120. In addition, the audit of Equality, Diversity, and Inclusion (EDI) spending in 2024, enabled us to draw out key areas of spending and opportunities to implement mechanisms to rigorously evaluate the impact of this expenditure. Following its conclusion, a presumption against external EDI spending and increasing ministerial scrutiny of EDI spending whilst streamlining EDI training and HR processes with a view to getting value for the taxpayer has been introduced with the publication of Civil Service EDI Expenditure Guidance.

121. We have issued new guidance to ensure that all civil servants, including those leading cross Civil Service diversity networks understand their responsibilities in relation to key behaviours which support inclusion. This also includes the Civil Service EDI Expenditure Guidance and Guidance on Diversity and Inclusion and Impartiality for Civil Servants.

122. We are also finalising new policy specifically for cross Civil Service Equality, Diversity and Inclusion (EDI) networks to help them to operate effectively, efficiently and in line within the Civil Service Code, values and context.

Line management Capability

123. As part of the People Plan commitments to improving capability and employee experience, the core Line Management Standards were launched in June 2024. The Standards provide a framework for all line managers across government, providing clear and consistent expectations for good line management practice. The Standards have drawn on best practice evidence from academic research, professional bodies, across sectors and within government.

124. The Line Management Capability (LMC) programme will:

- Improve the productivity and capability of line managers across the Civil Service. The programme sets externally accredited Standards and requirements for line managers, with a commitment that 70% of the identified target cohort of priority line managers will achieve or be working towards accreditation by the end of 2025. The programme supports Government Skills and departments to enhance management learning offerings which are aligned to the new Standards.

- Raise the profile of and esteem for line management. The programme highlights the value and importance of the line manager’s role using insights from line managers themselves and featuring real life lived experiences of Civil Service line managers. This includes involvement in management and leadership sessions at CS Live and a series of live and recorded panel sessions and video features.

- Improve employee experience for staff and managers. The programme is advising on changes to ensure the Standards are embedded across the employee lifecycle. This includes development of tools and toolkits to support line managers, as well as amending policies linked to recruitment, performance management, learning and development and promotion. Line Management Standards will also be incorporated into functional and professional frameworks.

The Civil Service Leadership Standard

125. The LMC Programme has developed the Civil Service Leadership Standard, defining the need for excellent leadership from all Senior Civil Servants. This work was commissioned by the People Board following the March 2024 NAO report, which emphasised the need for clearer expectations of good leadership across the Civil Service. The Standard will clearly outline expectations of leadership in the Senior Civil Service by providing a consistent definition for all departments across government to adhere to. By establishing a shared understanding of what effective leadership looks like, delegated grades will see behaviours waterfall down, ensuring that leadership qualities and values are embedded across government.

126. Following extensive research and consultation with a wide range of senior leaders, delegated grades, and a round table discussion led by Permanent Secretary Susannah Storey, with Permanent Secretaries, Directors General, and COO’s the Leadership Standard has been shaped and refined. The final version of the Standard has since received sign-off from the People Board in April and Heads of Departments (HoDs) in June. The Leadership Standard is now nearing its formal launch scheduled for October 2025 on Gov.UK.

127. Clear leadership expectations will improve productivity by giving our leaders an aligned understanding of priorities, values, and long-term goals to aid effective delivery, whilst encouraging the behaviours we want to see every day. The waterfall of behaviours ensures that the Standard is not merely aspirational but becomes integrated into everyday practice, positively influencing organisational culture, reducing discrimination and bullying, and improving organisational experience, wellbeing, and leadership across the Civil Service.

Recruitment, Retention and Talent

128. As set out in previous evidence, the people priorities clearly reflect the need to ensure ‘the right people are working in the right places with the right incentives’.

a. Driving forward a raft of measures to improve recruitment (outcomes of 2023’s End to End Recruitment Review), including improving the speed of recruitment, Civil Service attraction, and recruitment Test and Learn initiatives.

b. Ensuring that all departments, functions and professions use secondments as a part of their strategic resourcing plans. Secondments will be used as a lever for bringing cutting edge skills into the Civil Service where needed most, and talent development.

129. To address the issue of undesirable turnover (and churn) in the SCS, a new assignment duration policy was introduced on 4 July 2022.

130. This policy sets the expectation of assignment durations as a default minimum duration of 3 years for all SCS 1 and 2 posts. The exact length in role to be set by the vacancy holder to support delivery of the requirements of the Outcome Delivery Plans and/or Project timelines for roles. There is scope for exceptions to assignment durations in line with business requirements and to take into account personal circumstances. This does not constitute a contractual change, but will instead be driven by a change in culture and organisational and vacancy holder and applicant expectations.

131. The initial impact of the policy is currently being reviewed and we can confirm that all 17 Whitehall Departments have fully implemented the policy and do give assignment durations to all relevant roles. A fuller evaluation will be completed in July 2026, following completion of the first 3-year period.

132. In May 2025, it was announced as part of the Places for Growth 2030 programme that the Civil Service will launch a local government interchange programme in partnership with the Local Government Association (LGA). The scheme launches in September 2025 and aims to harness the invaluable skills and experience that frontline workers and those embedded in their local areas can use to inform national policy - and enable central government to share learnings and perspectives with local areas.

Talent Pipeline

133. The Civil Service talent approach works to ensure that the Civil Service attracts, develops and retains talented people from a diverse range of backgrounds, to create a brilliant Civil Service now and for the future.

134. The Government’s aim is to develop a strong and diverse pipeline of inspiring, confident and empowering leaders to shape the future of the Civil Service. The cross-Civil Service centrally managed accelerated development schemes aim to create a strong, diverse and robust pipeline through to the most senior roles in government. Annex E provides further information and latest data on development schemes.

SCS Recruitment

135. Recruitment across the Civil Service is governed by the Civil Service Commission’s (CSC) Recruitment Principles which set out the legal requirement for appointments to the Civil Service to be made on merit on the basis of fair and open competition. All Civil Service appointments, including decisions regarding SCS, are made in line with these principles.

136. The Civil Service advertises all SCS1 and SCS2 vacancies on the principle of External by Default. External by Default means that vacancies will be open to external candidates outside the Civil Service, as well as existing civil servants, unless an exception applies. At the end December 2023, 96% of all SCS 1 and 2 permanent vacancies were advertised externally. The policy helps ensure we are getting the right skills, in the right place, at the right time, in order to strengthen our ability to deliver quality outcomes for UK citizens and to strengthen equality of opportunity by opening up vacancies to the widest possible pool of candidates.

137. Director General and Permanent Secretary recruitment is overseen by the Senior Talent and Resourcing Team. They also run all Permanent Secretary competitions and the majority of Director General campaigns. Although there are clearly similarities in the recruitment approach and we aim to provide consistency to all candidates, processes for Deputy Director and Director differ from those for Director General and Permanent Secretary.

138. Deputy Director and Director recruitment is run by departments with central policy and guidance provided by GPG.

139. All SCS recruitment products are developed by GPG in consultation with the CSC as the independent regulator and owner of the Civil Service Recruitment Principles.

140. The CSC is further involved for SCS2 externally advertised campaigns. Person specifications must also be signed off by the Civil Service Commissioner chairing the campaign.

End-to-end Recruitment Improvements

141. GPG Recruitment Directorate set out a significant and ambitious work plan designed to improve effective recruitment, following the recommendations set out in the End-to-End Recruitment Review (E2ERR). The work incorporates complementary commitments made by the then Minister for Cabinet Office (MCO) in July 2023 on recruitment and secondments as part of the next phase of Civil Service reform plans.

142. Building on Review findings, GPG has delivered the first Civil Service recruitment metrics for speed, experience and diversity of recruitment, and benchmarks to drive improvements in time to hire. It has also concerted a series of Test and Learns to trial new ways of delivering recruitment with the findings shared across government. The initiatives can be increased in scale, complexity or delivered in new environments to build up improvements to recruitment processes and practices. Areas explored include use of AI, digital recruitment, new selection approaches, and better use of SCS reserve lists by professions.

143. In September 2025, GPG Recruitment Directorate concluded a review into Selection Approaches in the Civil Service, including the SCS. This has recommended a series of activities to develop our recruitment strategy, best practice approaches to recruitment, and further Test and Learn initiatives.

Retention

144. Turnover in the SCS decreased to 9.6% in 2024/25 (down from 11.6% in 2023/24, and the lowest recorded under the current methodology). Departmental turnover, which includes movements between departments, decreased to 13.5% (down from 16.0% in 2023/24, and 27.7% in 2022/23 where a substantial portion of movements between departments occurred due to machinery of government change in DIT/BEIS/DCMS. As such, departmental turnover rates in 2022/23 should be interpreted with caution as they may not represent the underlying rates). The resignation rate decreased to 3.4% in 2024/25 (down from 4.3% in 2023/24 and the lowest level since 2020/21 when the resignation rate was 3.1%).

145. Median tenure in post was 2.7 years as of the 1st April 2025, an increase from 2024 and the highest recorded since 2012. Median tenure within the pay band was 3.5 years at 1st April 2025, an increase from 2024 when it was 3.3 years.

146. Although movement amongst senior talent is not problematic in itself (and indeed may be reflective at times of necessary agility to respond to changing Government priorities such as the response to Covid-19), churn within the SCS is felt to occur too frequently without reference to business need, exacerbated by the current incentives within the system.

Annex A - SCS Pay on appointment exceptions

1. In April 2018, a new pay on appointment policy for the SCS was introduced to help control departmental turnover. The rules are:

a. that no increase is given for moves on level transfer; and

b. that on promotion, SCS receive no more than 10% increase or the minimum of the new grade.

2. An exception process is, however, available in cases where internal candidates are moving to roles with greater scale or responsibility for increases to be offered, with the agreement of the Permanent Secretary and the relevant Head of Profession.

3. Starting pay exceptions at Director General level require the approval of a DG RemCo. Less than five Director General exceptions were agreed in 2024/25. During this period there were 24 new Director General appointments, of which 15 were internal moves (eight on promotion and seven level transfers). Nine of the DG appointments were from outside of government. At Director and Deputy Director level, main departments have reported 66 exception cases. The table below shows the number of cases and median salary agreed for each SCS grade.

Pay on appointment exceptions by pay band

| Grade | Deputy Director | Director | Director General |

|---|---|---|---|

| Number of exceptions | 49 | 17 | N/D |

| Median salary agreed | £87,780 | £110,000 | N/D |

1. Cabinet Office issues guidance to departments with the annual SCS pay award practitioners guide. SCS pay exceptions are subject to the following criteria:

- Sustained high performance, increased effectiveness, deepened capability and expertise; and

- That the individual is relatively low in the pay range and/or have benefited less or not at all from the rise in the minima.

Departments should also consider the equality impact of any decisions made on exceptions, as well as any precedents they might be setting.

2. Cabinet Office helps departments make assessments of pay position by providing pay data by profession (lower quartile/median/upper quartile) annually. Some professions (e.g. Finance, DDaT) also actively support departments with applications by providing additional guidance and benchmarking.

Assessment of cases – Directors General

3. More information is held centrally on Directors General cases because they require approval of a DG RemCo, but is not disclosable due to the small numbers (less than five) approved. In accordance with the criteria, the weight and challenge of the role was considered as well as the skills and experience of the individual. Decisions are informed by pay quartile data by profession.

4. Less than five DG exceptions were agreed by the DG Pay Committee in 2024/25.

Assessment of cases – Deputy Directors and Directors

5. Main Whitehall departments reported that 66 exception cases were agreed at SCS1 and 2 level in 2024/25. The key headlines are:

| Pay Band | Level transfer cases agreed | Pay on promotion cases agreed |

|---|---|---|

| SCS1 | 13 | 36 |

| SCS2 | 10 | 7 |

| Total | 23 | 43 |

- Exceptions have been granted for 11 different professions – Digital, Data and Technology, Operational Delivery, Government Finance and Human Resources have the highest numbers.

- The median increase agreed for level transfer was 6% and 18% for pay on promotion.

Annex B - Pensions

1. Pensions continue to form a critical part of the Civil Service total reward package, with both Defined Benefit and Defined Contribution pensions arrangements[footnote 2] available to members of the SCS.

2. Civil Service Pensions established ‘alpha’, a Career Average Defined Benefit pension scheme, on 1 April 2015. Since that date, all new joiners of Civil Service Pensions participate in alpha for future pension accrual, and the final tranche of all legacy scheme (PCSPS) members moved to alpha on 1 April 2022 for future accrual, although those with service in the final salary sections (classic, classic plus, and premium) will have their final salary calculated based on their salary when they leave service, even if that is many years in the future.

3. Alpha has an accrual rate of 2.32% of pensionable earnings, and is revalued each year by the change in the CPI index with no cap. Benefits are payable without reduction from an individual’s State Pension age. A key feature of the scheme design is that the value of a member’s accrued pension is not reduced by leaving the scheme, eg, if they leave service. Hence the scheme does not create barriers to labour market mobility. Members can transfer-in external pensions within their first 12 months of scheme membership. Members can only transfer pension out to Defined Benefit schemes.

4. As a consequence of the McCloud judgment, those who were active members of the defined benefit scheme on 31st March 2012 and have service between 1 April 2015 and 31 March 2022, will be provided with a choice at retirement of either their pre-2015 scheme benefits or alpha benefits for the period 2015-22[footnote 3].

5. Individual member contributions are determined by actual annual earnings which benefits part-time workers. The salary bands are shown in Table 1 below. The overall average employee contribution rate is 5.6%, which is in line with the yield target set by HM Treasury and lower than most other contributory major unfunded Public Service Pension Schemes.

Table 1: Civil Service pension scheme member contribution rates, 1 April 2025 - 31 March 2026.

| Actual Earnings | Contribution Rates |

| £0.00 to £34,799 | 4.60% |

| £34,800 to £56,000 | 5.45% |

| £56,001 to £150,000 | 7.35% |

| £150,001 and above | 8.05% |

Contribution rates for 2026/27 will remain the same. The £56,001 and £150,001 salary thresholds will remain unchanged in 2026/27. Currently the lowest salary threshold is increased on 1st April each year in line with CPI from the preceding September, and the new threshold from 1st April 2026 will be confirmed no later than November 2025.

6. The pension valuation cycle sets the ‘employer’ contribution rate, which is a flat-rate of 28.97%. This consists of:

a. 23.60% for the cost of newly accruing pension

b. 5.10% past-service deficit payment and

c. 0.27% administration cost.

7. For SCS who pay a higher member contribution rate of 7.35%, the average value of the employer contribution for newly accruing pension is 21.85%.

8. It should be noted that the value of alpha benefits is significantly higher for older members (members aged 50+), but the figures above are based on scheme-wide averages. A 40 year old SCS member would have an employer contribution valued at around 20%, whereas a 60 year old SCS member would have an employer contribution valued at around 30% when their ages and salaries are taken into account rather than using scheme-wide averages.

9. The employer contribution rate is generous when compared to the private sector where employees will generally be provided with a defined contribution scheme. As defined contribution schemes are investment based, the employee also bears the risk of the pension not providing the expected level of income in retirement.

10. Most members of private sector pension schemes receive an employer contribution of 3 to 4% of salary. Pensions UK publish Pension Quality Mark (PQM) Standards[footnote 4] which set long-established standards for higher quality employer pension schemes. These include a requirement to contribute:

a. 12% of pensionable pay, with at least 6% from employer for PQM

b. 15% of pensionable pay, with at least 10% from the employer for PQM+

11. The Partnership pension scheme is a Defined Contribution pension scheme, which civil servants can switch to at any time after they join the Civil Service.