Freeport Programme in Wales: bidding prospectus

Updated 28 October 2022

Applies to Wales

Delivered in partnership by the Welsh Government and the UK Government

Please note that this prospectus is available in both English and Welsh

Ministerial forewords

Welsh Ports have a long history in helping to shape the economic, social, and cultural fabric of Wales. Today, they remain a central feature in establishing new trading links across the globe and growing the UK’s international trade and investment potential.

The UK Government’s Plan for Wales commits to strengthening Wales’ place at the heart of a prosperous UK, supporting economic growth, Levelling Up and spreading opportunity across Wales. The ports and harbours dotted along the Welsh coast we know today helped shape Britain as an outward-looking global nation. These same ports are now helping us build the greener, cleaner, more energy-independent Britain of tomorrow.

The UK Government wants to work with our partners, including the Welsh Government to make sure Wales takes full advantage of its enormous strengths so that together we can level up communities across Wales stretching from Beaumaris to Barry.

Our new Freeport Programme, jointly delivered with the Welsh Government and backed by an initial £26 million of funding, will help us make this vision a reality.

The Freeport Programme has the potential to help Wales compete for global investment and trade, creating thousands of new jobs and putting coastal communities on the path to long-term growth and prosperity.

The publication of this prospectus marks an exciting next step in the Freeport Programme – the bidding phase. This document sets out the essential selection criteria for a successful bid.

As you would expect, we have set the bar high. We want every bid to promote regeneration and job creation. We want a vision for how the Freeport would turn your area into a hub for global trade and investment, and we want ideas for how it will foster an innovative, business-friendly environment.

Crucially, we want bidders to clearly demonstrate how they will use their Freeport status to generate increased economic activity across Wales, stimulate a net growth in jobs, create high quality job opportunities and support decarbonisation in the transition to Net Zero. Both governments will have an equal say on the successful Freeport bid.

Low taxes and low regulation combined with seed funding and the backing of not one but two governments, make this an unmissable opportunity.

I look forward to seeing ambitious bids come forward that seize this opportunity and deliver for Wales, as part of a joint commitment between our two Governments to level up opportunity and prosperity across the whole country.

Rt Hon Greg Clark MP

Secretary of State for Levelling Up, Housing and Communities

The Welsh Government has a clear Economic Mission to establish the Welsh economy as more prosperous, equal and green than ever before. Turning that ambition into a reality hinges on how we ensure investment reinforces our commitments to fair work, sustainability and supporting the services and industries of the future.

As an intrinsic part of our rich industrial history and the engine room of our economy, ports have huge potential to accelerate future industries which support net-zero from off-shore energy to advanced manufacturing. Thanks to the agreement we’ve secured with the UK Government we are launching a Freeport Programme in Wales which offers an opportunity to harness Wales’s abundant economic potential domestically and internationally by reimagining the role of ports, whilst promoting fair work and sustainability.

This Welsh Government believes a better deal for workers is essential to a fairer and more equal Wales. It is vital to the Welsh Government that our public policy interventions contribute to fair work and to our social partnership way of working. That is why this prospectus highlights the importance we place upon fair work and social partnership. This includes the engagement of trade unions in a Workers Consultative Forum, which will form part of the local governance of a Welsh freeport.

We are inviting progressive applications which deliver regeneration and high-quality jobs, boost investment and trade and foster innovation. The successful bid will receive up to £26 million seed investment as well as a package of benefits which span tax and rates relief, streamlined planning, customs site designation and wider government support for trade, investment and innovation.

As well as demonstrating a holistic investment plan which supports emerging clusters and maximises the growth potential of the local area, proposals must embody Well-being of Future Generations (Wales) Act 2015 values and ensure dignity and fairness for people are at their core.

I am looking for bids that break the industry ceiling on net zero standards, exemplify the high labour standards set out in our Economic Contract and articulate a shared vision formed by long-lasting coalitions which genuinely involve all social partners.

Both governments will jointly decide the outcome of the competition and I look forward to considering innovative bids which deliver meaningful economic and social benefits for Wales.

Vaughan Gething MS

Minister for Economy

Section 1. Introduction and context

1.0.1 The Freeport Programme in Wales represents a new opportunity to help Wales continue to develop a globally competitive, entrepreneurial, inclusive and sustainable economy, whilst building the strength and resilience to overcome economic shocks experienced during the COVID-19 pandemic. It represents a key commitment within the UK Government’s Levelling Up White Paper and will make a positive contribution to the Welsh Government’s commitments to the economy, fair work and the seven well-being goals set out in the Well-being Future Generations (Wales) Act 2015 which deliver long term benefits to improve the economic, social, environmental and cultural wellbeing of Wales.

1.0.2 The Freeport Programme will look to incentivise private businesses to invest in new opportunities in Wales, particularly in relation to climate resilience and making maximum progress towards decarbonisation. The Freeport Programme in Wales will build on existing local strengths and will make the nearby Welsh cities, towns and villages even better places to live and work.

1.1 Policy context

1.1.1 In February 2020, the UK Government announced its intention to establish Freeports to help regenerate communities by unlocking the economic potential of UK ports. When the UK Government launched the Freeports Bidding Prospectus for England in November 2020, a commitment was made to work with the devolved governments to ensure the whole of the UK could benefit from Freeports.

1.1.2 In February 2022, the UK Government published the Levelling Up White Paper. The paper recognised the significant spatial disparities on a range of indicators between different places across the UK and set 12 ambitious missions to drive levelling up. A key theme of the White Paper is boosting productivity, pay, jobs and living standards by growing the private sector, including through support for inward investment and trade. The White Paper reiterated the UK Government’s commitment to establish new Freeports across Wales, Scotland and Northern Ireland, working with the devolved governments.

1.1.3 The Welsh Government’s updated Programme for Government outlines its commitment to deliver a stronger, fairer, greener and more compassionate Wales. The Welsh Government is placing a strong emphasis on fair work, sustainability and supporting the industries and services of the future.

1.1.4 The UK Government’s Plan for Wales commits to strengthening Wales’ place at the heart of a prosperous UK, supporting economic growth across Wales, building back greener, more connected communities. Together, the Welsh and UK Governments have worked constructively to develop a Freeport Programme that reflects our respective values, the unique opportunities in Wales, and benefits for businesses, ports and communities across Wales.

1.2 Freeport Programme in Wales

1.2.1 Many features of the Freeport Programme in Wales will operate in the same way to the Freeport Programme in England, as well as the Green Freeport Programme model being taken forward in Scotland. The Freeport Programme in Wales will help to improve the economic, social, environmental and cultural well-being of Wales by contributing to the seven well-being goals set out in the Well-being of Future Generations (Wales) Act 2015. This means supporting Wales to build a stronger, greener economy as it makes maximum progress towards decarbonisation with an emphasis on fair work and supporting the industries and services of the future.

1.2.2 The Welsh and UK Governments want to partner with leaders in the private and public sectors to support businesses with a global reach, and businesses who aspire to a global reach, to achieve their ambitions. This will unlock the potential of Wales’ regions for the benefit of the national economy, businesses, workers, and local communities, and builds on successful partnership working that is already established between UK and Welsh Government through the implementation of City and Growth deals across Wales.

1.2.3 We recognise that different regions will have different existing strengths, institutions, and economic strategies. Applicants should set out why a Freeport is right for their area; how they will use the measures; and how they will deliver on the key objectives. Both governments want Freeport applicants to form strong coalitions which will develop ambitious and deliverable proposals. These coalitions must include: a port (sea, air, or rail) and the local authority/authorities in which the Freeport is located. These coalitions will also include: local businesses; international businesses; academic institutions; Regional Economic Partnerships and local authorities.

1.3 This prospectus

1.3.1 This prospectus document is intended as a guide for applicants and a version is also available in Welsh. It provides detail on:

a. objectives of the Freeport Programme (Section 2)

b. Freeport geography, including guidelines on site size and design (Section 3.1)

c. how the different policy levers will work (e.g. how reserved and devolved taxes will work) (Section 3.2 to 3.8)

d. governance and delivery of the Freeport Programme (Section 4)

e. the fair, open, and transparent selection (Section 5)

f. the application questions (Sections 5.6 to 5.9)

1.4 Application process

1.4.1 Applicants and multi-applicant partnerships must submit their proposals to both governments via the Department for Levelling Up and Communities (DLUHC) portal by 6pm on 24 November 2022. Applicants will have 12 weeks from the publication of the prospectus to complete and submit their bids. Proposals should be submitted via the Freeport application portal which will be sent to parties who register an interest in bidding for Freeport status. The registration form can be found here. All questions asked as part of the application can be found in sections 5.6 to 5.9 of this prospectus.

1.4.2 Potential applicants will be able to request clarification on the content of this applicant prospectus until 13 October. A summary of answers provided will then be published online no later than 27 October.

1.4.3 Proposals will be assessed via an open competitive process, with chosen designations announced in early Spring 2023.

1.4.4 The successful applicant will be granted some revenue funding subject to an initial governance review to support governance set-up costs. They will also work with us to develop detailed business cases for their spending plans associated with the award of any additional Freeport funding offered.

1.5 Summary of key dates

1 September 2022 - Prospectus published, applicants can submit clarification questions, and application portal opens

13 October 2022 - Deadline for all prospectus clarification questions to be submitted

27 October 2022 – Deadline for publication of summary of prospectus clarification question responses

24 November 2022 – Application deadline, 6pm

Early spring 2023 – Announcement of winning bid

Summer 2023 – Freeport becomes operational

Section 2. Objectives

2.0.1 This document is the applicant prospectus for the Freeport Programme in Wales only.

2.0.2 The Welsh and UK Governments have worked together to design a Freeport model which will deliver on three main objectives which must be met by applicants:

a. promote regeneration and high-quality job creation;

b. establish the Freeport as a national hub for global trade and investment across the economy;

c. foster an innovative environment.

2.0.3 No two local economies or ports are the same. To meet the ambition of the Freeport Programme in Wales, applicants should: reflect on the characteristics of their local economy or port; consider how to optimally use their assets and tackle their relative weaknesses; and set out a strategy for inclusive growth founded on the Freeport objectives. Applicants will submit a strategy in their bid to evidence this (Question 2) and how they will achieve each of the objectives set out in this section. This written submission will form a key part of the overall application for Freeport status.

2.0.4 In practice, many of the activities described will achieve more than one objective and create virtuous cycles, with one activity reinforcing another. For example:

a. a strategic site adjacent to an established port is developed which builds on existing assets in a capital intensive sector that benefits from the firm’s location, for example, building components for wind turbines. This Freeport could effectively market itself to international investors in the wind energy and related sectors by pointing to its existing industrial strengths, allowing a large firm to establish itself quickly by accessing an existing supply of skilled workers and suitable infrastructure at the port. As the site is adjacent to the port, it would lower transport costs, so firms with goods that carry high transport costs may benefit in particular. For the local community, this new and significant demand for their skills should boost wages and create job opportunities in more disadvantaged areas

b. once a large firm has been attracted, it could increasingly interlink with local supply chains, with by-products of one process acting as inputs to others. This could grow a new cluster of firms, allowing them to benefit from shared infrastructure, storage facilities and transport, with energy intensive industries benefitting from reduced costs and so greater environmental compliance. These increases in efficiency should further boost job creation and increase wages

c. firms could pool their training budgets to establish a further education provider focused on technical skills, in partnership with existing skills providers. This could provide training opportunities on site, so that learners can benefit from work experience and ensure the labour market best meets the needs of this emerging industrial cluster. There may be opportunities to pilot innovative schemes around clean energy, helping to develop the industrial strengths of the future

2.1 Promote regeneration and high-quality job creation

2.1.1 Both governments aim to promote regeneration and job creation through inclusive and sustainable growth. A key aim of the Freeport Programme in Wales is to stimulate net growth in jobs across innovative industries and sectors of the economy, creating high quality job opportunities, sustainable and inclusive economic growth, and regenerating the areas which need it most. Applicants should include in their application, a demonstration of the benefits to supply chains across Wales, and details of positive economic impacts for local and regional economies.

Promoting Regeneration – local authorities, ports, and business working together

2.1.2 We want the Freeport Programme in Wales to help promote regeneration across local economies and communities by driving inclusive and sustainable growth locally, regionally and nationally. A Freeport will support the Welsh Government’s Mission to build a prosperous, green and equal economy based on the principles of fair work, sustainability, and the industries and services of the future. The Freeport will further enhance Wales’ ability to attract investment and new businesses, bringing growth and prosperity to some of our most deprived communities and supporting delivery of key economic growth commitments set out in the UK Government’s Plan for Wales.

2.1.3 A Freeport applicant is encouraged to demonstrate throughout their bid, its commitment to supporting Wales becoming a more sustainable nation through improving the social, economic and cultural well-being of Wales, specifically how they have applied the sustainable development principle designed to maximise contribution to achieve each of the Well-being goals as set out by the Well-being of Future Generations (Wales) Act 2015.

2.1.4 To attract the private investment needed to drive this regeneration, the Freeport Programme will provide: access to a mixture of financial incentives; good governance that supports a strong partnership between local, private and public sector stakeholders; support of both the Welsh and UK governments in attracting investment; and support to create a strong local and regional skills base.

2.1.5 We expect local authorities to help shape regeneration plans, by sharing relevant local and regional plans for inclusive and sustainable growth. In turn, private operators and beneficiary businesses must:

a. put in place provisions to ensure investment, that is additional and aligned with the policy objectives, is brought forward on tax sites, including through landowners working with a Freeport to shape the end use of their land

b. focus investment on activity which is genuinely additional to their existing investment plans, either by significantly accelerating investment, or by tackling promising development sites which would otherwise be unviable. Bids that demonstrate genuine and tangible commitments from all partners to the delivery of the regeneration objective will be looked on more favourably

c. demonstrate how they can benefit other local businesses, wider supply chains and local communities via engagement and collaboration with the local authority/authorities and prioritising local and regional recruitment where possible

Support emerging industrial clusters

2.1.6 Freeport applicants should set out a clear sectoral focus, and identify the rationale for the sector choices, including any research that supports these choices. The proposal should also outline how emerging clusters in those sectors help deliver the policy objectives. By targeting particular sectors that are present and growing in the local or regional economy, a Freeport should further catalyse innovation to support emerging clusters. This should involve collaboration with Welsh enterprise agencies, universities, and colleges. Industrial strengths and clusters can be identified using several methods, from statistics on industries ranked by local job share to “Economic Complexity Analysis”.

2.1.7 Applicants should give evidence of these emerging clusters in their local economy and how they intend to support them, including how the Freeport status could help address any investment viability gaps. Clear evidence of new private sector investment – either from commercial property developers serving those sectors or from occupiers themselves – will be rewarded with a higher assessment against relevant criteria.

2.1.8 Some clustering benefits have been observed at local and even office premises level. Therefore, applicants must also show how they intend to align the skills available in the local labour market to the needs of the businesses and sectors being targeted, including support for upskilling in line with local and national skills strategies. Bids that propose commercial property development should show how they will enhance these effects, demonstrating how they will attract larger “anchor firms” around which other firms can cluster or ensuring that estates are well-designed to promote collaboration.

Creating high quality jobs, delivering fair work and enhancing the local skills base

2.1.9 By supporting emerging clusters and taking advantage of incentives, the Freeport Programme can produce high quality jobs, with higher wages in innovative industries. We want to see firms in target sectors commit to high standards around employment practices at the bidding stage. For example, applicants could provide evidence of existing good working practices and commitments, including constructive engagements with employees and trade unions.

2.1.10 The appointed bidder should engage with Welsh Government to develop an Economic Contract in line with current Welsh Government policy. Applicants can, and should, act as examples to others and show how their business practices promote the principles of fair work and sustainability. Applicants can also show how they comply with good practice in procuring goods and services in Wales, such as the ethical employment supply chains code of practice.

2.1.11 This could include committing to raise the wage floor, investing in the skills of their workforce, tackling the gender pay gap, creating more inclusive workplaces, and avoiding inappropriate use of zero-hours contracts. Applicants should submit a strategy to show how they will achieve the desired outcome of better and fairer jobs and improved wages. It should include:

a. how the Freeport itself will enable the creation of new higher paid jobs

b. how it will attract companies to locate in the area

c. how fair work practices will be embedded across the area

2.1.12 Applicants must also show how they intend to align the skills available in the local labour market to the needs of the businesses and sectors being targeted, including support for upskilling in line with local and national skills strategies.

2.1.13 In developing their strategies, bidders may wish to consider alignment with the Welsh Government’s fair work criteria[footnote 1]. For example, this could include commitments in relation to the real living wage and trade union engagement. These will be taken into account where they support the overall objective.

Transport

2.1.14 Applicants should identify the potential surface transport impacts resulting from development, in line with relevant planning policy, and where mitigation is required, this should be identified and delivered by the applicant. Applicants should make sure activity:

(1) supports the vision and the priorities set out in Llwybr Newydd The Wales Transport Strategy 2021, especially the use of the Sustainable Transport Hierarchy to guide decisions

(2) is aligned to the greatest practicable extent with the appropriate existing Regional Transport Plans (available via local authorities) and Metro programmes (Welsh Government officials can facilitate access to details of the Welsh Metro programmes. For the purposes of this document, Metro programmes include the work to deliver the recommendations of the South East Wales Transport Commission.)

(3) is not critically-dependent on transport developments that are subject to existing reviews/commissions in Wales, such as the Roads Review and North Wales Transport Commission.

2.1.15 Bids giving consideration to Transit-Oriented Development, with new employment and logistics sites being located close to existing transport links, will be considered in a more favourable light.

2.1.16 Applications should show as appropriate how the Freeport could stimulate the adoption of more sustainable shipping, aviation and/or rail movements. For example, this could be through the provision of more sustainable fuels, incentivising the use of more efficient ships/aircraft/trains, or more energy-efficient operations.

2.2 Establish hubs for global trade and investment

2.2.1 A prospective Welsh Freeport will need to demonstrate how it will support increased global trade and investment furthering economic activity across Wales, and the wider UK. The economic impact that international investment has on host economies is well established; with the benefits secured from good inward investment including employment, higher wages, productivity gains, increased exports spread across many of our regions in a number of key sectors and regeneration of communities. The Freeport will need to outline its plans for interacting with the global investment market to secure FDI and capital investment into their Freeport.

2.2.2 Wales’ trade policy is underpinned by the Welsh Government’s wider commitments to sustainability and to act as a responsible nation on the global stage; to respect and protect human rights; to take action to respond to the global climate emergency and to safeguard our valued public services. Wales has welcomed and supported businesses from all over the world, helping them to develop, grow and realise their full potential.

2.2.3 Applicants should clearly demonstrate how proposals will capture the additionality provided by a Freeport to increase trade. A Freeport should make clear whether it seeks to become an import and/or export facility, or whether it is seeking to prioritise the import market. If applicants are seeking to enhance export activities, proposals should identify target markets and outline the approach to use existing market relationships, as well as generate new markets to benefit the local community. They will also need to evidence how they will encourage small and medium sized enterprises (SME’s) to export as part of their exportation plan. Applicants should consider how their proposals align with the UK’s Made in the UK, Sold to the World export strategy and the Welsh Government’s Export Action Plan.

2.2.4 Proposals should include how applicants intend to adopt best practice to support the achievement of greener and more sustainable infrastructure and construction.

2.2.5 Further detail on the UK and Welsh Governments’ ambitions can be found in: the Levelling Up White Paper and the International Strategy for Wales.

2.2.6 Proposals should focus on:

a. demonstrating how the Freeport will bring new investment into the surrounding areas and increase trade through the port(s) (sea, air or rail) involved, including demonstrating an understanding of Foreign Direct Investment and inward investment propositions. The standard governmental policies on Foreign Direct Investment will still apply (such as the National Security and Investment Act 2021)

b. outlining how they envisage their Freeport will support internationalisation of the economy, showing how they will work with local and international businesses to enhance the impact of increased investment in a way that supports sustainable, inclusive growth, making trade processes easier and more efficient, and ensures creating opportunities for all, distributing the dividends of increased prosperity fairly

c. indicating which sectors would benefit from having a Freeport (e.g. to assist with any necessary import/export checks or supporting their supply chain needs)

d. a description of their investor and company onboarding and management process, providing detailed process maps which identify each of the engagement steps throughout the company or investor journey

e. examples of specific investment opportunities which demonstrate how these are supportive of the wider Welsh and UK government objectives

2.3 Foster an innovative environment

2.3.1 A Freeport will focus private and public-sector investment in research and development (R&D); it will be a dynamic environment that brings together innovators to collaborate in new ways, while offering controlled spaces to develop and trial new ideas and technologies. We expect landowners to prioritise more innovative investments and the Freeport executive to bring businesses into contact with the Freeports Regulation Engagement Network (FREN). All Freeport partners should seek opportunities to access wider innovation funding.

2.3.2 Applicants should align their bids to the objectives in the cross-government, outcome-based approach to innovation, as outlined in the Welsh Government’s Draft Innovation Strategy: Innovation strategy for Wales . Applicants should also take note of the UK Government’s R&D Roadmap and Innovation Strategy. The Integrated Review also outlined a new approach to growing the UK’s science and technology power in pursuit of strategic advantage.

Innovation in the Freeport Programme

2.3.3 Innovative activity in a Freeport location can be characterised into three distinct areas of focus. Applicants could focus on any, or all of these in outlining their innovation ambitions.

a. port-specific innovation – innovation that directly benefits air, rail or maritime ports e.g. autonomous cranes and cargo-handling equipment, digital security, customs software that can track goods across a broader area, creative use of people and skills to develop innovative solutions driving efficiency and effectiveness

b. port-related innovation – innovation that indirectly benefits air, rail or maritime ports or their supply chain e.g. autonomous transport, modal shift from road transport, decarbonisation of transport, industrial decarbonisation etc.

c. non-port-related innovation – innovation unrelated to air, rail or maritime ports that can take advantage of port-proximate locations or the Freeport wider offer e.g. renewable energy technology, pharmaceuticals, quantum technologies, advanced materials, robotics, AI

Innovation activity

2.3.4 In creating a successful innovative environment, proposals should highlight how having Freeport status can bring additionality to those already collaborating in the region and consider the following:

a. capability and investment: build and reinforce the capability for R&D in the Freeport region, by funding and supporting private and public investment in research, innovation and skills

b. collaboration and commercialisation: facilitate translational research, skills development and data-sharing in the Freeport region, by linking start-ups, businesses and ports with academic institutions, innovation structures and regulators and by making best use of the Freeports Regulation Engagement Network (FREN)

c. novel solutions: driving the development, testing and application of new ideas, technologies, and social programmes, including developing innovative solutions to problems faced by the Freeport Programme.

2.3.5 We are also particularly interested in how innovation ambitions can protect the environment and support the decarbonisation and net zero agendas, as outlined in Section 4.2.

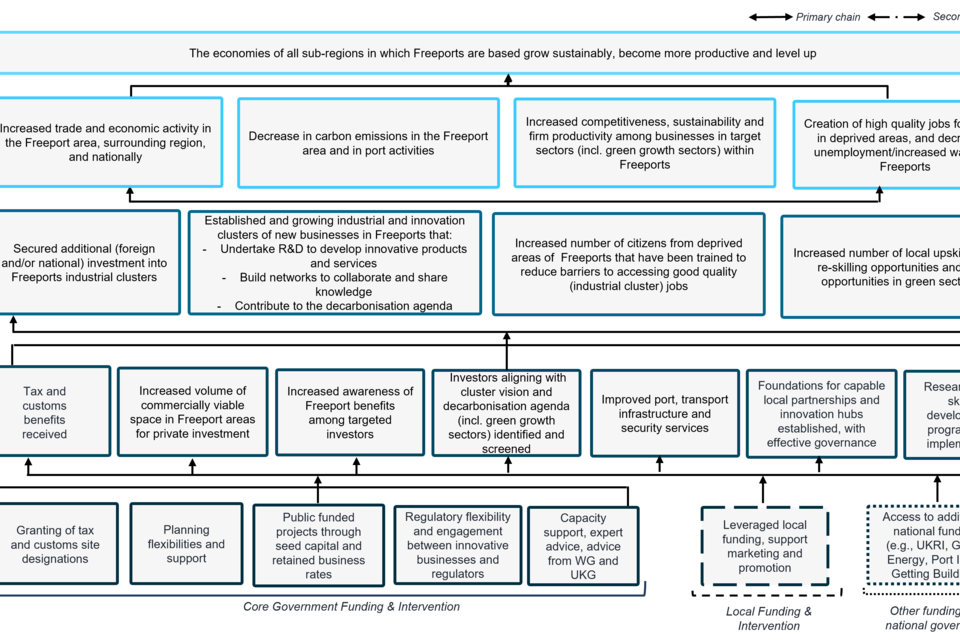

2.4 Logic model

Logic model

Figure 1:The Logic model – a map of the inputs and activities delivered with their respective outputs followed by the expected long-term impacts of the policy.

Accessible version

6 years +

The economies of all sub-regions in which Freeports are based grow sustainably, become more productive and level up

4 years +

Increased trade and economic activity in the Freeport area, surrounding region, and nationally

Decrease in carbon emissions in the Freeport area and in port activities

Increased competitiveness, sustainability and firm productivity among businesses in target sectors (incl. green growth sectors) within Freeports

Creation of high quality jobs for people in deprived areas, and decreased unemployment/increased wages in Freeports

3 years +

Secured additional (foreign and/or national) investment into Freeports industrial clusters

Established and growing industrial and innovation clusters of new businesses in Freeports that:

-Undertake R&D to develop innovative products and services

-Build networks to collaborate and share knowledge

-Contribute to the decarbonisation agenda

Increased number of citizens from deprived areas of Freeports that have been trained to reduce barriers to accessing good quality (industrial cluster) jobs

Increased number of local upskilling and re-skilling opportunities and job opportunities in green sectors

1 year +

Tax and customs benefits received

Increased volume of commercially viable space in Freeport areas for private investment

Increased awareness of Freeport benefits among targeted investors

Investors aligning with cluster vision and decarbonisation agenda (incl. green growth sectors) identified and screened

Improved port, transport infrastructure and security services

Foundations for capable local partnerships and innovation hubs established, with effective governance

Research and skills development programmes implemented

Inputs/outputs delivered

Core government funding & intervention:

Granting of tax and customs site designations

Planning flexibilities and support

Public funded projects through seed capital and retained business rates

Regulatory flexibility and engagement between innovative businesses and regulators

Capacity support, expert advice, advice from WG and UKG

Local funding and intervention:

Leveraged local funding, support marketing and promotion

Other funding from government:

Access to additional national funding (e.g., UKRI, Green Energy, Port Infra, Getting Building)

2.5 Expected outcomes

2.5.1 Each objective is underpinned by a set of key outcomes describing what the Welsh and UK governments want to achieve. It is a non-exhaustive list and applicants must show how they will deliver these key outcomes within their plans for addressing the key objectives. Progress on these outcomes will be measured and form the basis for subsequent evaluation of the success of the programme overall.

2.5.2 The performance of the Freeport Programme will be assessed against all of these outcomes as part of the monitoring and evaluation process. At this proposal stage, submitted applicant implementation plans will help in our assessment of the highest quality bids.

Promote regeneration and high-quality job creation

a. increased number of jobs and average private sector wages within the Freeport, host local authority area(s), wider regional economy, and specifically disadvantaged areas in the host local authority area(s).

b. increased economic activity through new UK-registered company formation and expansion of existing companies in the Freeport tax sites, wider designated area and the regional economy

Establishing hubs for global trade and investment

a. net increases in inward investment within the Freeport boundary area, surrounding region and nationally.

b. increased transactions in trade throughput through the designated port(s)

c. attracting inward investment, creating new jobs and opportunities for people in Wales

Foster an innovative environment

a. increased public and private sector funding in R&D and innovation in the Freeport area, enabling increased productivity in the wider region. Scale of sectoral clusters is increased by innovation and collaboration with Welsh enterprise agencies, universities, and colleges.

Section 3. Economic levers and design of interventions

3.0.1 This section details the specific design of a Freeport, including geography and economic levers offered to applicants as they would apply in Wales. The Freeport model is based on the model the UK Government have used for Freeports in England and that is used by UK Government and Scottish Government for Green Freeports in Scotland.

3.1 Freeport geography

3.1.1 The Freeport model is geographically flexible, which applicants should best apply to their specific space and geography.

3.1.2 The model allows for multiple sites to be designated within the overall Freeport, enabling applicants to best reflect existing economic geographies, and maximise collaboration between ports, businesses, wider stakeholders and relevant economic assets by allowing them to benefit and contribute to the Freeport. However, limits must ultimately apply to generate agglomeration benefits and control costs. These limits, and flexibilities around them in exceptional cases, are set out below.

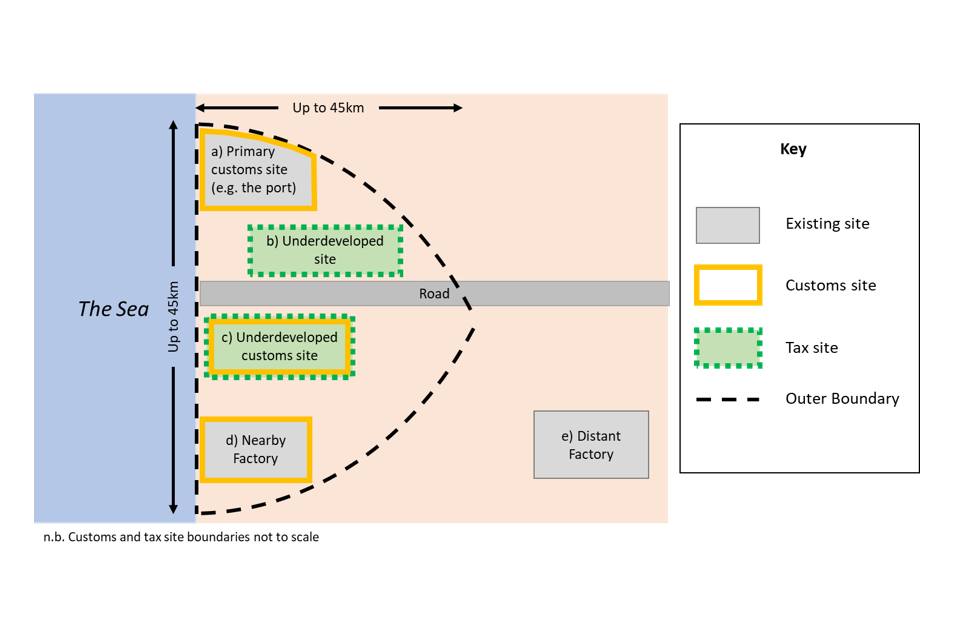

Overview of the Freeport model

a Freeport with the Outer Boundary, customs sites, tax sites and existing sites labelled

Figure 2: The Freeport model – a Freeport with the Outer Boundary, customs sites, tax sites and existing sites labelled. Customs and tax site boundaries not to scale.

3.1.3 The above shows a hypothetical Freeport focused around a seaport. It is demarcated with an Outer Boundary containing:

a. a primary customs site around the seaport – site a) which, in this case, is not within the tax site, so businesses inside benefit from the customs measures, but not tax measures

b. additional “underdeveloped” land separate from the primary customs site – sites b) and c) where businesses in both sites will benefit from the tax measures

c. an additional customs site – site c) which is also part of a tax site so businesses inside benefit from both the customs measures and the tax measures

d. a nearby factory site – site d) which is an additional customs site but is not covered by the tax site, so businesses inside site d) benefit from customs measures but do not benefit from tax measures – as per site a)

e. a distant factory – site e) which is outside the Outer Boundary, so cannot be a customs site or part of a tax site without a special economic case for inclusion

Outer Boundary

3.1.4 Applicants must define an Outer Boundary in their application that reflects a coherent economic geography. The Freeport model is designed to support places, and the Outer Boundary ensures tax and customs sites are focused on supporting that clearly defined place. Applicants will need to provide clear economic rationale for why the Outer Boundary is defined as it is. Applications judged to be designed simply to maximise the area contained within the Outer Boundary without a clear economic rationale will fail the application process at the pass/fail stage.

3.1.5 Freeport Outer Boundaries should be no larger than a 45km circle, with no Freeport sites more than 45km apart, as demonstrated by the hypothetical multi-port Freeport in Figure 2. Applicants will need to submit a map with the Outer Boundary marked on it to delineate the geography of the Freeport.

3.1.6 We anticipate that all customs sites and tax sites associated with the Freeport will be contained within the Outer Boundary. However, the Welsh and UK Governments will consider bids proposing customs sites and tax sites outside the Outer Boundary, where this can be supported by a clear economic rationale. This should include a significant relationship between the activity in the proposed customs or tax sites outside the Outer Boundary, and the area within the Outer Boundary. Applicants must provide a written submission with clear and specific reasoning justifying such additional proposals.

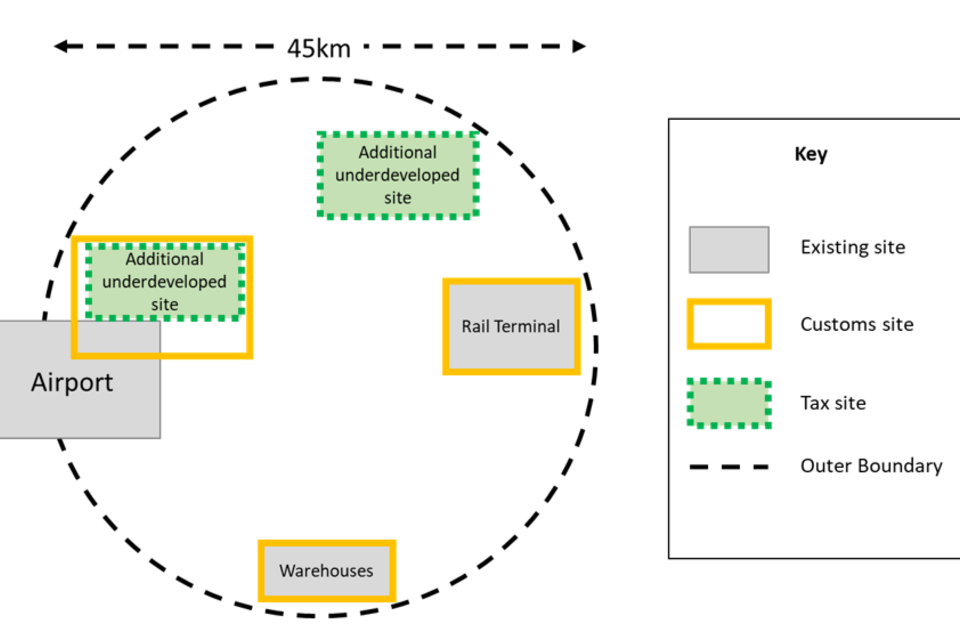

a Freeport with multiple ports within the 45km Outer Boundary. Customs and tax site boundaries not to scale.

Figure 3: The Freeport model – a Freeport with multiple ports within the 45km Outer Boundary. Customs and tax site boundaries not to scale.

The Port

3.1.7 Applicants must include at least one port of any mode (sea, air, rail) within their Freeport Outer Boundary. The port does not have to be a tax site or a customs site. Applications without a port within their Outer Boundary will fail the applicant process at the pass/fail stage.

The Customs Site(s)

3.1.8 Applicants must include at least one customs site within their Freeport Outer Boundary, within which the customs benefits outlined in Section 3.3 will apply. Applications without at least one viable customs site will fail the application process at the pass/fail stage. Applicants must provide clear rationale for the customs site(s) including expected uses; outputs/benefits expected to be generated; and how they relate to each other and the wider Freeport.

3.1.9 Applicants may apply for as many customs sites within the Outer Boundary as they can deliver, so long as they are relevant to the Freeport area. To apply for multiple customs sites, applicants must submit a written justification for why additional sites are required and clear justification of every site’s relationship to the wider Freeport. There is scope for customs sites outside the outer boundary provided a clear and rational justification is provided.

3.1.10 If a multi-site application is submitted, it will be approved conditionally on at least one customs site being viable, with any additional customs sites considered unviable, being removed or amended.

3.1.11 The UK Government is prepared to authorise customs sites in inland locations provided an economic relationship can be clearly demonstrated between the site and the port. The UK Government will consider customs sites of any size, so long as a clear economic case for the site can be made, and strict security requirements enabling HMRC and Border Force to monitor the sites effectively can be met.

3.1.12 We will expect applicants to meet the cost of establishing and securing all customs sites (primary and additional) according to these requirements. Overly expansive or inadequately secured customs sites will not be authorised.

3.1.13 The operator of the site (who monitors goods moving in and out of it) must be authorised by HMRC. Businesses that operate in the operator’s site must also be authorised by HMRC. The process for becoming an approved site operator and Freeport business operator can be found on gov.uk. Applicants should ensure that the operator of each customs site is willing and able to undergo the relevant customs authorisation.

3.1.14 The operator could host multiple authorised businesses, creating a hub for trade – or the operator could host a single company, acting as both the operator and the business.

3.1.15 For more detail about the obligations and benefits of the customs offer, see Section 3.4 Customs.

The Tax Site

3.1.16 Bidders should aim for a single tax site to benefit from the tax offer. When there is an economic case to do so, applicants may define up to three individual areas as the location of the tax sites. New and existing businesses who expand or invest further within these tax sites may benefit from the tax reliefs outlined in Section 3.2.

3.1.17 A tax site can encompass all, or part, of the primary customs site and/or any additional customs site but does not have to encompass either. Tax reliefs will only apply in customs sites located within a Freeport tax site.

3.1.18 As with customs sites, tax sites should be located within the 45km Outer Boundary. However, if applicants are considering multiple tax sites and have a strong economic and geographic rationale for including a tax site outside the Outer Boundary because it has a significant relationship to the area within the Boundary, they may apply to do so. Applications which fail to provide justifiable reasoning for any proposed tax sites outside the Outer Boundary will be disadvantaged in the application process.

3.1.19 The tax sites:

a. should be underdeveloped, with reference to section 3.1.26

b. should be clearly delineated on a map – they should not be engineered to create a single site with the use of long and narrow lines (if there is an economic case for it there can be multiple sites, please see point c)

c. should encompass a single site within the Freeport of no greater than 600 hectares, or up to three individual sites aiming to be between 20-200 hectares. We will consider submissions that make an economic case for an individual site that falls outside the 20-200 hectares guideline, but the total area of the individual sites within the Freeport must not exceed 600 hectares. Those that do exceed 600 hectares will automatically fail the Freeport application process at the pass/fail stage

d. can have uneven boundaries, if that helps capture promising areas while cutting out areas that are more developed, so long as those sites are justifiably single and individual

e. do not have to be a single piece of land – for example, a single site could be two pieces of land split by a road. If there is no portion of land connecting the sites – for example, if they are split by a river, or residential property – we would consider these two separate sites unless very clear geographic and economic interconnection can be demonstrated. We are open to one single site containing multiple parcels of land split by a road, protected area or geographic feature (such as a river) so long as the parcels within the land can reasonably be considered one single site because geographic and economic interconnection between the sites can be demonstrated (e.g. travel between them is plausible)

f. do not all have to be owned by one owner – it can include multiple, separately owned parcels of land that all fall under the single delineated site. Applicants must provide evidence that landowners have signed up to the vision for the proposed tax site and will take appropriate steps to ensure development on the site aligns with the Freeport’s objectives and those of the wider Freeport policy

g. do not need to be fenced – but it should have clearly identifiable boundaries (for enforcement purposes) and be clearly delineated on a map provided as part of the application

h. should ideally be located in areas with:

i. below the UK’s national average GDP per head currently or over the last five years

ii. above the UK’s average national unemployment rates currently or over the last five years

3.1.20 Applicants will need to provide evidence and justification as to why an area which does not meet the criteria in 3.1.19.h requires regeneration and would benefit from being a tax site.

3.1.21 Applicants that are successful will receive formal confirmation of the boundary for their proposed tax site(s), where tax reliefs will be available at the end of a separate tax site approval process. The final scope of the site will take into consideration the ability of HMRC, and where appropriate Welsh Revenue Authority, to monitor the activity that takes place within this site effectively. Being awarded Freeport status in the initial bidding round does not constitute formal approval of the proposed tax sites. In most cases we anticipate that these confirmed sites will be of the same size as the original applications, however some adjustments may be needed to comply with the criteria in this document.

3.1.22 To minimise the risk of tax evasion or other criminal activity in the tax site, the Freeport governance body will be required to maintain a record of all of the businesses operating or applying to operate within the tax site. This record will need to be readily accessible by HMRC, Welsh Revenue Authority, the NCA, and Border Force operatives.

Justifying tax site locations

3.1.23 Applicants should submit an analysis explaining:

a. how their proposed sites are “underdeveloped” (see criteria below in 3.1.25)

b. if any proposed sites are not a qualifying area as set out above, why the proposed site(s) needs regenerating

c. how the tax measures will generate additional economic activity in the site(s) and create genuinely new economic activity

d. why the proposed site(s) are the optimal choice for the local area, representing good value for money

3.1.24 The assessment process will ensure that the criteria outlined in 3.1.19.b and c are met. Applicants should note the remaining criteria of 3.1.19 as these will provide supporting evidence for assessment of their chosen tax site(s). Applicants should also note the level of wastage of expenditure that will occur in these sites will be considered, to support our objective of generating additional economic activity.

3.1.25 Tax sites should be “underdeveloped” so that the tax measures support areas with economic potential, rather than already economically successful sites. Under this broad, economic definition, empty land, brownfield land, underutilised land with some construction and vacant premises are some examples of what might be considered “underdeveloped” so long as a good case is made. When justifying how their sites are “underdeveloped”, applicants should consider three main criteria underpinning our definition:

a. underutilised: tax sites should have sufficient viable, but unoccupied physical space that is yet to be developed or used; to allow new or expanding businesses to construct, renovate, purchase or lease new premises in the Freeport

b. potential investment growth: applicants should explain how Freeport status will lead to additional investment by new and/or existing businesses in the tax site(s) significantly above current levels

c. high quality job creation: applicants should evidence that their proposed tax site does not contain significant incumbent employment in relation to the local region. Applicants should then explain how Freeport status will lead to additional high-quality employment in the Freeport tax site(s) by new and/or existing businesses above current levels

3.1.26 Existing buildings with planned obsolescence within the timeline for Freeport tax sites can be part of the Freeport tax site. However, only new investments or employments, such as new investment funding the renovation of an existing building eligible for the Structures and Buildings Allowance (SBA), will be eligible to benefit from the tax offer.

3.1.27 In addition, applicants will also be required to explain how their choice of tax site location(s) minimises displacement of economic activity from wider local areas, especially other economically disadvantaged areas.

3.1.28 In the case that a substantial part of a proposed tax site includes existing or planned public sector facilities, the Government will be open to discussions on how these public sector facilities could be accommodated onto the proposed site without limiting the site’s commercial viability.

Freeport Distribution

3.1.29 Ports of all modes: the model has been designed to apply effectively to areas with seaports, airports and rail ports. Every mode of port is welcome to make an application or form part of an applicant coalition.

3.1.30 Multiple Ports: we welcome applications that include multiple ports, including multiple ports of different modes.

3.1.31 If there are two or more ports located within the Outer Boundary distance which are interested in being part of a Freeport, and their economic activity affects one another and the region, they may be able to make a strong case for collaboration in support of the wider economic geography. However, proximate ports of different scale, or with different economic focus are also free to be part of separate applications, if they have a strong individual case for a distinct economic Freeport cluster.

3.1.32 Should applicants wish to include a port outside the Outer Boundary (because there is a strong economic rationale), they may present such a case for consideration.

3.2 Tax

3.2.1 Successful bidders will be able to access a range of tax reliefs comparable with the English Freeports offer once an Outline Business Case (OBC) has been agreed with both governments. The exact time in which businesses can apply and then benefit from tax reliefs is closely aligned to English Freeports and Scottish Green Freeports. The Welsh Freeport tax relief deadlines are outlined for each relief below.

Land Transaction Tax Relief

3.2.2 The Welsh Government proposes to offer a specific Land Transaction Tax (LTT) relief on relevant land transactions within qualifying tax sites in Wales where that property is to be used for qualifying commercial activity.

3.2.3 Legislation to provide for this is required to be laid before the Senedd and subsequently approved before any relief can be made available. As such, the timing for this is subject to confirmation.

3.2.4 Further details on the Welsh Government’s proposals will be provided in due course, but for planning purposes the UK Government’s relief for its equivalent tax is available for a period of up to five years.

3.2.5 Where relief is available, clawback provisions will apply in the event that land, or property, is not used for a qualifying purpose within a control period which will be set out in the legislation.

3.2.6 Applicants should note that as LTT policy is devolved, the details of relief may differ from the Stamp Duty Land Tax relief, based on the specifics of the Welsh approach.

Enhanced Structures and Buildings Allowance (SBA)

3.2.7 The UK Government intends to offer an enhanced SBA rate for firms constructing or renovating structures and buildings for non-residential use within Freeport tax sites in Wales. This accelerated relief will allow firms to reduce their taxable profits by 10% of the cost of investment every year for ten years, compared with the standard 3% p.a. over 33 1/3 years available nationwide. This relief would be claimable where qualifying expenditure is incurred, all associated construction contracts are entered into and the asset in question is brought into qualifying use between the date the tax site is designated and the expiration date of the tax relief.

3.2.8 Firms incurring qualifying expenditure can claim capital allowances as part of their income or corporation tax return. As is standard under the existing SBA, claimants will be required to retain an allowance statement to demonstrate eligibility for claims throughout the 10-year period over which relief can be claimed. This relief in Wales will be available where qualifying expenditure is incurred and the building or structure is brought into use by 29 February 2028.

3.2.9 The standard SBA capital gains clawback and anti-avoidance provisions will be maintained under the enhanced SBA in Freeport.

Enhanced Capital Allowances (ECA)

3.2.10 The new ECA the UK Government intends to offer in Freeport tax sites in Wales will provide enhanced tax relief for companies investing in qualifying new plant and machinery assets. This accelerated relief is intended to allow firms to reduce their taxable profits by the full cost of the qualifying investment in the same tax period the cost was incurred. Firms investing in the Freeport tax site would be eligible to benefit from the relief where the qualifying expenditure is incurred after the tax site is designated until the expiration date of the tax relief. Assets eligible for relief must be for use primarily within defined Freeport tax sites.

3.2.11 Firms will access the measure by claiming capital allowances as part of their corporation tax return. This relief will be available until February 2028 in Wales.

3.2.12 As is standard for capital allowances, the Freeport ECA will feature a balancing charge in some situations where a purchased asset for which the ECA has been claimed is then later sold (disposed of). The standard disposal rules for capital allowances for plant and machinery will apply including, where appropriate, balancing charges.

Employer National Insurance Contributions (NICs)

3.2.13 The UK Government intends to enable employers operating in a Freeport tax site to pay 0% employer NICs, and from April 2023, the Health and Social Care Levy (employer NICs element) on the salaries of any new employee working in the Freeport tax site. This 0% rate would be applicable for up to three years per employee from the start of their employment on earnings up to a £25,000 per annum threshold.

3.2.14 An employee will be deemed to be working in the Freeport tax site if they spend 60% or more of their working hours in that tax site.

3.2.15 NICs relief will be legislated to be available to February 2028 in Wales. NICs relief across the whole UK Freeports Programme will then be reviewed part way through the programme and the UK Government shall consider further extension up to 2031. Employers will be expected to apply good practice in recruiting, managing and developing their people. However, the UK Government will ensure it has the power to prevent access to the relief for those employers found to be abusing this relief by manipulating their employment practices, for example dismissing staff specifically to benefit from it.

3.2.16 Employers will be able to claim the relief through the existing Real Time Information returns, and the UK Government will work with payroll software providers to facilitate this. Employers will be required to notify HMRC when an employee is no longer eligible due either to the three year per-employee eligibility period coming to an end, or to the employee or employer ceasing to meet the eligibility criteria.

Non-Domestic Rates Relief (NDRR)

3.2.17 Businesses may be eligible for up to 100% relief from non-domestic rates on certain properties and property improvements within designated tax sites. The intention is that this relief will be designed to support new businesses, and existing businesses when they expand into new or unused space. It would apply for up to five years from the point at which the beneficiary first receives relief. Applications for relief must be received by 31 March 2028. Applicants should note that as Non-Domestic Rates policy is devolved, the details of relief may differ from the Non-Domestic Rates relief in England, based on the specifics of the Welsh approach.

3.2.18 Eligible firms will be able to apply to the relevant local authority, or local authorities, to access this relief.

3.3 Customs

3.3.1 Authorised businesses operating within Freeport customs sites can import goods for storage and / or processing with import duties suspended. They will only have to pay these duties where goods are then declared for home use in the UK. In doing so, they will usually be able to elect to pay duties on the imported goods either as they stood before (inputs) or after processing (finished good) in the customs site. Subject to the UK’s trade agreements, businesses may also be able to take advantage of customs duty exemption on goods that are exported from a customs site. (Some Free Trade Agreements (FTAs) contain a Duty Drawback Prohibition. Duty drawback is refund of import duty when the goods are re-exported. This clause prohibits granting tariff preferences to goods that benefitted from duty drawback on third-country inputs. This means businesses have to choose between whether they want to benefit from the duty drawback or the preferential rates under the FTA (provided they meet the rules of origin test under that FTA). The UK has rolled over 15 FTAs that contain this prohibition.) They will also be able to suspend import VAT on goods entering the Freeport customs site and benefit from a VAT zero-rate in respect of certain transactions that take place within the Freeport customs site.

3.3.2 Authorised Freeport businesses importing goods subject to excise duty will be able to suspend payment whilst the goods are stored or processed within the customs site. Businesses will also be able to produce excise goods from raw materials under customs duty suspension (subject to being authorised under the existing excise production legislation).

3.3.3 Payment of any duty will follow general customs requirements (release to free-circulation) and UK duty is not due if the goods are exported. In addition, authorised businesses operating in a Freeport customs site will be able to use simplified import and export procedures. This model expands on existing customs facilitations and procedures available to business. 3.3.4 Authorised businesses operating in the Freeport customs site will be responsible for following the rules of their HMRC approval.

3.3.5 Operators of customs sites will need to obtain authorisation from HMRC. When authorised, the site for which they are responsible will need to be designated by HMG by statutory order. Applicants should ensure that the operators of all proposed customs sites are willing and able to undergo appropriate authorisation.

3.3.6 See full details on how to apply for authorisation to be a Customs Site Operator.

3.3.7 See full details relating to Freeport customs sites.

Responsibilities of operators of customs sites

3.3.8 Principally, the operator of a Freeport customs site is responsible for the control of movement of goods and people in and out of the customs site. This will include ensuring that goods are only able to leave the Freeport customs site when the appropriate conditions have been met.

3.3.9 Operators of Freeport customs sites must adhere to the OECD Code of Conduct for Clean Free Trade Zones – and the specific anti-illicit trade and security measures therein. They will also need to maintain the current obligations set out in the UK’s Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017.

3.3.10 An operator of a Freeport customs site will be jointly and severally liable with a declarant for any import duty liability arising where there is a breach of any requirement of the Freeport customs site operator’s authorisation in relation to the keeping of goods in the Freeport customs site. This is consistent with other authorisations.

Authorisation requirements

3.3.11 As set out in 3.2.8, applicants will need to set out any sites within the Freeport area they intend to use as a customs site. Each site will need to be designated before it can operate as a customs site and have an authorised site operator to run it. To get authorised as a customs site operator, the relevant business will need to meet the requirements set out by HMRC. Authorisation of the Freeport customs site operator is dependent on meeting the existing Authorised Economic Operator security and safety (AEO(S)) standards or the Freeport alternative. Customs site operators may also wish to apply for a temporary storage approval at their customs site. In doing so, they’ll need to amend their customs site designation to reflect the arrangement.

3.3.12 See further details on authorisations.

Other customs authorisations

3.3.13 Infrastructure will be required by HMRC, Border Force and other government agencies to carry out checks in line with existing arrangements at ports. Freeport operators will be required to provide this infrastructure. Infrastructure may include, but not be limited to, examination facilities, potential sites to scan goods and vehicles, and a dedicated area to securely store goods.

3.3.14 Operators of Freeport customs sites may wish to facilitate Transit movements to and from their customs sites. To do this, operators may offer Transit facilities and Authorised Consignee and Consignor functions to businesses on site. This will offer a streamlined approach for businesses to start and end their transit movements within the Freeport.

3.3.15 To offer Transit facilities and Authorised Consignee and Consignor functions, operators will need to have the appropriate authorisations in place.

Future border requirements

3.3.16 The requirements will be regularly reviewed, and applicants will be expected to keep up to date with the requirements and co-operate with government agencies.

3.3.17 The UK Government recently published the 2025 UK Border Strategy. One of the aims is to support “ports of the future” to make the experience smoother and more secure for businesses and traders. Applicants are encouraged to set out how they would be able to contribute to making a highly digitised process available for businesses and providing infrastructure that is resilient, multifunctional and facilitative.

Removal of authorisation

3.3.18 Operators of Freeport customs sites are always required to meet the conditions as set out in their designation. Failure to meet any of these conditions may result in revocation of their designation.

3.4 Seed capital, retained non-domestic rates, and local authority capital

Seed Capital

3.4.1 The successful applicant will have the opportunity to access seed capital funding of up to £25 million. The amount accessed will depend on the submission of an outline business case (OBC) and full business case (FBC), the quality of those business cases and the proposals strategic fit with the policy. Business cases will be approved by the Freeport Programme board with joint representation from Welsh Government and UK Government. We expect that any funding provided will be matched or part-matched by private sector investment, local authority borrowing and co-funding from other public bodies where relevant. When released the funding will be issued to the local authority within the Freeport governance body. They will be accountable to the Welsh Government for the expenditure and management of Freeport seed capital funding. Where there is more than one local authority on the governing body, a lead local authority will be identified.

3.4.2 Applicants should provide outline proposals for how they will spend seed capital funding within their Outer Boundary in order to contribute to the Welsh and UK Government objectives for the Freeport Programme and take account of the Welsh Government’s Infrastructure Finance Plan.

3.4.3 We expect proposals to be focused primarily on land assembly, site remediation, and internal small-scale transport infrastructure to connect sites within the Freeport to each other, the immediate surroundings, or other economic assets within the Outer Boundary. These should embed transport strategies, sustainable transport and investment hierarchies. Proposals for spending seed capital on skills, digital and/or other infrastructure will only be considered in exceptional circumstances. Seed capital may not be spent on security infrastructure for customs sites.

Non-domestic rates and local authority capital

3.4.4 Local authorities should also consider how they can use an uplift in non-domestic rates to cover borrowing costs for infrastructure (where relevant); re-invest in the Freeport tax site to generate further growth; or offset expected effects of displacement of local economic activity from disadvantaged areas.

3.4.5 It is intended that the local authority, or local authorities, in which the Freeport tax sites are located will retain the non-domestic rates growth for that area above an agreed baseline. This will be guaranteed for 25 years, giving local authorities certainty that they need to borrow to invest in the regeneration and infrastructure which will support further growth. Retained receipts should be used to cover borrowing costs (where relevant); re-invest in the Freeport tax site to generate further growth; or offset expected effects of any displacement of local economic activity from deprived areas. Bidders should set out the relevant local authority decision-making processes for agreeing how additional rates yield would be raised and how any retained yield will be reinvested.

3.4.6 Applicants should detail the costs of delivering their proposal, as well as the source(s) of funding (e.g. Freeport seed capital, private sector investment, local authority borrowing, co-funding), and application partner responsible for that cost in their response. As far as possible this should be broken down by financial year. Key delivery milestones should also be reflected in applicant responses as part of their implementation plan. Proposals should also detail community support, and any critical interdependencies.

3.4.7 To ensure resources in the local economy are used effectively, Freeport proposals should build on and add to existing partnerships and plans for the port, and complement pre-existing strategies such as Regional Economic Plans and Frameworks, Local Development Plans, spatial strategies and national, regional and local transport plans.

3.5 Wider government funding

3.5.1 Applicants should outline how their proposal could be complemented by funding from existing or additional upcoming funding rounds from across government. The Freeport proposal should be viable without these additional sources of unsecured funding, though government may choose to align allocations across funds where objectives and timing allows.

3.6 Innovation

3.6.1 Freeport applicants are key to creating an innovative environment for businesses. Proposals should highlight how their Freeport status can bring additionality to those already collaborating in the region. Both governments are particularly interested in private sector-led innovation within the Freeport, and innovation ambitions that contribute to the decarbonisation agenda or net zero.

Freeport innovation funding

3.6.2 It is expected that all partners seek opportunities to access wider innovation funding. Applicants should set out their initial ideas for how this funding could be delivered, as well as any industry commitment they have secured to invest in innovative activity or the testing of new technologies.

3.6.3 The official Welsh Government “Business Wales” website provides the ability to search for support across Wales. Additionally, the UK Government portal “Apply for innovation funding” provides a similar opportunity to search for UK-wide support, including Innovate UK funding to help commercialise ideas and grow through innovation and UK Research and Innovation’s (UKRI’s) website which outlines current UKRI funding opportunities.

Freeport collaboration hub

3.6.4 The Freeport Programme in Wales should enhance local and national innovation ecosystems ensuring collaboration is supported in line with the Freeport objectives. Applicants should set out their proposals to establish the Freeport as a collaboration hub, including as far as possible, a coherent plan for engaging with local leadership to help them accelerate economic growth through R&D, any plans to establish new facilities or link with existing facilities, facilitate skills development, and promote Freeport-specific research programmes.

Freeport regulatory innovation

3.6.5 We are committed to working together to ensure the Freeport model maintains the high standards set in Wales and the UK with respect to security, safety, workers’ rights, data protection, biosecurity and the environment, while ensuring fair and open competition between businesses.

3.6.6 However, the government recognises that regulation in some cases can be challenging to navigate for innovative firms as they develop, test and apply new ideas and technologies in some sectors.

3.6.7 Therefore, we will facilitate engagement between the Freeport and relevant regulators through a “Freeport Regulation Engagement Network” (FREN). The FREN’s exact operation in Wales will be confirmed after the competition concludes, but FREN will:

a. enable an early engagement process between innovative businesses and regulators

b. support businesses on regulatory issues, minimising bureaucracy and uncertainty

c. generate ideas to engage businesses and regulators on areas of potential opportunity

d. identify opportunities for regulatory flexibility and new regulatory sandboxes

3.6.8 In outlining their innovation ambitions, applicants should outline how they would look to take advantage of the Freeports Regulation Engagement Network to support these proposals; for example, how they would benefit from an early engagement process with specific regulators.

3.7 Trade and investment support

3.7.1 Applicants should outline what specific trade and investment support measures they believe would benefit a Freeport in their area. Proposals should emphasize the type of support required and the frequency and timing of said support. The longevity of the support over the first five years of the Freeport’s operational life should also be included.

3.7.2 The Welsh Government and its agencies will work with the successful applicant and the Department for International Trade (now the Department for Business and Trade) to ensure a workable business support programme is developed to attract companies that may be considering locating within a Freeport. This will be complemented by a range of investment support services within the existing portfolio provided by the Welsh Government and its agencies and the Department for Business and Trade.

3.7.3 Applicants should demonstrate an independent Trade and Investment function within the Freeport proposal. This should be adequately staffed, properly financed and contain requisite expertise. The proposal should demonstrate the functions a Freeport will provide and how these will intersect with existing Trade and Investment services across the Welsh Government and from within DIT. For example, working together to identify and package opportunities for development of real assets which may be attractive to capital investors internationally.

3.7.4 Trade and Investment activities should be matched with the sectoral proposition. Applicants should show knowledge and understanding of the competitor environment and should include the applicant’s strategy for competing successfully within their chosen market(s).

3.8 Planning

The Place-based planning approaches

3.8.1 Future Wales - The National Plan 2040 provides the national development plan context for Freeport applications in Wales. Demonstrating compliance with Policy 1 - National and Regional Growth areas and Policy 10 – International Connectivity will be important for all Freeport applications. Applicants will also need to demonstrate how their proposals align with the most up-to-date edition of Planning Policy Wales and associated Technical Advice Notes.

3.8.2 In addition to the national planning context, local authorities should consider the application of local placed based tools such as Simplified Planning Zones or Local Development Orders. Both Simplified Planning Zones and Local Development Orders can provide greater certainty to business by removing the need to apply for planning permission for developments covered by the order.

3.8.3 Applicants will need to demonstrate relevant stakeholder support for their proposals to ensure successful delivery. Applicants should consider the planning needs across the entirety of the outer boundary particular those associated with the tax sites, seed capital projects, customs sites and any other supporting investment.

3.8.4 The relevant local authorities must:

a. be part of the application coalition

b. have discussed the fit with relevant development plans and policies (and the potential use of place-based planning approaches referred to above) as part of compiling the application

3.8.5 Such cooperation will help to ensure development proposals progress smoothly through the planning system. Applications should demonstrate local authority support for commercial property development within tax and customs sites, to support their growth. Proposed development will be subject to local planning approvals where necessary.

3.8.6 We welcome applications which present innovative development proposals, including those that are forward leaning on using available land to bring forward infrastructure and support businesses that further the Welsh and UK Governments’ net zero ambitions.

3.8.7 For each relevant site successful applications should:

a. explain the current planning status including status in relation to Future Wales and the local development plan

b. explain the planning needs for the anticipated development

c. detail how these development needs will be met, including what options have been considered

d. explain the steps taken (or planned) to engage with local communities to consider how proposals will maintain and enhance where possible the quality of the locality within which the proposal is located

e. explain how any relevant requirements for environmental assessment will help to mitigate any adverse impacts and offer net positive environmental benefits. Applications can also usefully indicate whether any early engagement with key agencies has been undertaken as part of this

f. provide evidence of early discussions with planning authorities on the potential use of place-based planning tools

Section 4. Delivery Requirements

4.1 Alignment with the Wellbeing of Future Generations (Wales) Act 2015

4.1.1 The Wellbeing of Future Generations (Wales) Act 2015) applies to all local authorities in Wales, so applications should set out how the local authority, or local authorities, involved would comply with the legislation when supporting the delivery of a Freeport.

4.1.2 Applications should show how their proposals would contribute to the seven National Wellbeing Goals:

(1) A prosperous Wales

(2) A resilient Wales

(3) A healthier Wales

(4) A more equal Wales

(5) A Wales of cohesive communities

(6) A Wales of vibrant culture and thriving Welsh language

(7) A globally responsible Wales

4.1.3 Applicants should consider which of the 50 National Wellbeing Indicators are relevant to their proposals and, where possible, provide an estimate of the degree to which their proposals would make a positive difference against those Indicators.

4.1.4 Applications should also show how delivery of the proposals would adhere to the five Ways of Working in the Act:

(1) Collaboration

(2) Integration

(3) Involvement

(4) Long-term

(5) Prevention

4.2 Alignment with decarbonisation and environmental goals

Driving the decarbonisation agenda

4.2.1 The Freeport Programme has great potential to contribute towards achieving the Welsh and UK Government’s decarbonisation agenda and net zero ambition. Applicants must present an outline decarbonisation plan for the Freeport including how Freeport status will unlock decarbonisation opportunities for existing businesses. This should be followed by a robust plan of action setting out how they intend to contribute to meeting net zero carbon emissions by 2050, including how they can facilitate decarbonisation of a Freeport following designation.

4.2.2 An applicant’s approach to planning will: