FCDO Services Annual Report and Accounts 2024 to 2025

Published 4 July 2025

-

Presented to Parliament pursuant to section 4(6) of the Government Trading Funds Act 1973 as amended by the Government Trading Act 1990

-

Ordered by the House of Commons to be printed 3rd July 2025

-

Crown copyright 2025. This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit Open Government Licence. Where we have identified any third-party copyright information you will need to obtain permission from the copyright holders concerned. This publication is available at Official documents - GOV.UK.

-

Any enquiries regarding this publication should be sent to us at: FCDO Services Hanslope Park Milton Keynes England MK19 7BH FCDOServices.Comms@fcdo.gov.uk.

-

ISBN: 978-1-5286-5022-9

Performance report

Performance Overview

The overview section contains forewords by the Minister responsible for FCDO Services, the Chair of the FCDO Services Board and the Chief Executive Officer (and Accounting Officer). It also contains summary information about the organisation and a performance overview.

Foreword by Minister Catherine West

In my first year as Parliamentary Under-Secretary of State at the Foreign, Commonwealth and Development Office and as minister responsible for FCDO Services, I am delighted to introduce this year’s Annual Report and Accounts.

As a government, we are committed to fostering strong international partnerships and enhancing the UK’s security and defence by promoting innovation and improving resilience. These priorities are central to the mission of FCDO Services.

This year, FCDO Services has continued to provide vital support for the FCDO’s crisis response, playing a crucial role throughout the ongoing war in Ukraine. FCDO Services has ensured the safe delivery of essential equipment, provided secure communications systems, and protected critical infrastructure. This reflects the government’s broader pledge to strengthen NATO as the cornerstone of European security. FCDO Services’ technical contributions have been instrumental in maintaining secure communications and protecting our diplomatic presence in the region during this critical time.

By building a more resilient and united Europe, we can better address shared challenges and promote collective security. FCDO Services has developed and rolled out secure communications platforms for the Joint Expeditionary Force across Northern Europe and between the UK, Japan and Italy in support of the Global Combat Air Programme (GCAP).

In 2024/25, FCDO Services has successfully delivered projects across the FCDO’s global network. This has included managing the refurbishment of the British High Commission in Nairobi, technical fitouts in Miami and Ottawa, and distributing new laptops, desktops and printers to over 24,000 colleagues across 195 countries.

Aligned with our broader Civil Service reforms, FCDO Services has undertaken a programme to modernise its operations and prepare its workforce for the future. I am eager to see these efforts continue in 2025/26, with further enhancements to its Logistics service and upskilling of the organisation’s managers. These reforms are designed to create a more efficient, responsive, and accountable Civil Service that better serves the public.

FCDO Services also represents British technical excellence on the global stage. By sharing expertise with friendly nations and international organisations, they contribute to our soft power and enhance the UK’s reputation as a trusted partner. Their work on technical and physical security, and secure communications, directly supports our commitment to countering hybrid threats and protecting democratic institutions.

I look forward to my first visit to Hanslope Park and to meeting the dedicated staff at FCDO Services. Their expertise and commitment are vital to maintaining critical services for His Majesty’s Government and contributing to global security. I wish the entire team at FCDO Services continued success in the coming year.

Foreword by Sir Simon Gass

As a Trading Fund, FCDO Services must work within commercial disciplines, public sector constraints, and still meet its core mission of high-quality support to the FCDO and UK foreign and security policy. This was sometimes challenging in recent years, as the budgets of our public sector customers have become increasingly strained while the cost of labour and materials has risen rapidly. The result was that FCDO Services’ margins were squeezed to a level that was making it hard to both maintain the responsiveness that our customers rightly expect and, critically, to invest in the future capability of the business.

I am glad to say that in FY2024/25 we took significant steps towards remedying this unsustainable position. In financial terms, FCDO Services delivered revenue of £262m and achieved an increased retained surplus of £11.6m, which is £5m above the previous financial year. Additionally, a statutory dividend of £2.9m was paid to the FCDO – the highest amount since the Trading Fund was established. We have continued to deliver exceptional services, ensuring the security and resilience of the UK’s diplomatic platform worldwide.

These results show the value of the Trading Fund and will enable reinvestment in modern systems and technologies which help us deliver value back to the FCDO. An example is that we are moving ahead with plans to develop a new logistics hub and IT system to replace the cramped and obsolete existing facility.

We have achieved this improved picture by tighter internal financial controls, further progress on operational efficiencies, and smarter commercial practices, as well as by starting to reshape the workforce. There is further to go, however these steps will position the organisation well for a future in which government customers will need to wring maximum value from their budgets.

In addition, we made significant progress in enhancing our partnership with our owner, the FCDO, fostering wider government collaboration, and continuing to build international partnerships. This has not only improved end customer satisfaction (88.5 in 2024/25, up from 86.1 in 2023/24) but also reinforced FCDO Services’ reputation as a trusted partner.

In 2024/25, the FCDO Services Board reviewed business updates from all directorates and signed off the new 2025-30 Strategy and 2025-28 Corporate Plan. The Strategy sets out our vision and purpose to be an exceptional delivery organisation, specialising in secure services across government, and delivering mission critical services that enable UK diplomacy and national security globally. The Corporate Plan sets out our goals to deliver cost savings and efficiencies, embed professional disciplines, and prioritise delivery and innovation. The board will work with the Executive Team to ensure that the strategic objectives are met, and greater value is created for the FCDO.

I am grateful to my non-executive colleagues for their expertise and enthusiasm. This year we bade farewell to Non-Executive Directors Bill McCluggage, Richard Gunning and Jenny Bates. We welcomed three new Non-Executive Directors, Sabah Carter, Greg Rubins and Jonathan Allen, the FCDO’s Director-General Defence and Intelligence, whose collective experience and insight is already proving a real asset to the organisation. Clare Pickin, Chief of Operations, and Tim Gall, Chief Financial Officer, also both joined the board this year. Tim was appointed substantively after covering the role on an interim basis in 2023/24.

Finally, I would like to acknowledge the immense contribution of Chief Executive Mike Astell, the leadership team and all staff in FCDO Services – it is the people who make this organisation so special; their individuality, expertise, and experience matter to us. Whether they work in engineering, finance, technology, project management, or HR, it all matters. They should take immense pride in the contribution they make to the delivery of the UK’s foreign policy and national security. That’s what we’re here for, and that’s what we do.

Foreword by Mike Astell

This year FCDO Services has made significant strides in operational delivery and performance. Transformation programmes have progressed well, and we have established a set of efficiency workstreams, setting a strong foundation for 2025/26. We have undertaken targeted work to improve pricing and margins, reduce overhead costs, and streamline our processes and organisational structures. These efforts are already delivering tangible benefits, enabling us to operate more efficiently and sustainably. By sharpening our commercial focus and simplifying how we work, we are better positioned to respond to customer needs and deliver even greater value. This has strengthened our ability to support government partners through complex, ground-breaking programmes in technology, security, and construction around the world.

Customer satisfaction remains a top priority, and my visit to the USA and Canada in September provided valuable insights into the projects delivered for the FCDO. Additionally, my visit to Australia and New Zealand highlighted how our teams’ expertise is being leveraged by foreign governments and partners to enhance global security.

Our people and their capabilities are at the heart of FCDO Services’ success, and I am proud of the determination and dedication of our staff. We have committed to improving the quality of leadership and management across the organisation through the launch of a 12-month programme to strengthen management capabilities – a brilliant opportunity that every manager, including the directors and I, will complete.

Technical skills programmes continue to thrive, including the continuation of engineering apprenticeships supported by strong outreach to raise FCDO Services’ profile as an employer of choice. The number of T Level placements has doubled and the first cohort for the Accelerated Technical Development Programme has been recruited, targeting applicants with relevant qualifications but limited experience. These initiatives are crucial for building a diverse talent pipeline.

I am pleased to report that seven of the ten indices measured in the 2024 Civil Service People Survey improved when compared to the 2023 results, with the other three remaining static. However, there is a great deal we can improve, which we will take forward through our Corporate Engagement Action Plan and Local Engagement Action Plans. At corporate level, Leadership and Managing Change, Respect at Work and Organisational Objectives are priority areas for improvement.

Last year, we said farewell to Nasrin Cobb, Director of Customer Relationships and Yvonne Laird, Chief Finance Officer. I would like to express my gratitude for their contributions to the success of FCDO Services. We also welcomed Clare Pickin as Chief of Operations and Lisa Elward as Director of Customer Relationships & Strategy.

Looking forward, our world is changing rapidly but I am optimistic about the opportunities ahead. The challenging economic and geopolitical pressures facing the FCDO and our government partners are unprecedented. Budget constraints, supply chain disruptions, and evolving security requirements create complexities but also present opportunities to demonstrate our unique value.

For 2025/26, our focus turns to our new strategy, built across four pillars: Protect the Platform, Strengthen Value, Transform Partnerships, Accelerate Change. To deliver this strategy, we have launched a series of workstreams focused on process efficiency, people development, automation, and modernisation to evolve faster, serve smarter, and create a stronger, sustainable future for FCDO Services and its customers.

Who We Are and what We Do

Summary

FCDO Services is an Executive Agency and Trading Fund, owned by the Foreign, Commonwealth and Development Office (FCDO). Our work supports diplomacy, defence and development for the UK government and our global partners.

What we do

We provide secure services to the embassies and high commissions that underpin the FCDO’s diplomatic network and protect against terrorism and espionage.

We support a wide range of highly secure government facilities, providing ongoing maintenance and consultation, from design and construction.

We provide an end-to-end lifecycle of technology services within the digital sphere, at all tiers. From bespoke international collaboration solutions to our own multi-tenanted platforms, these are all industry accredited.

Our secure logistics service delivers diplomatic mail around the world for the UK and other governments and includes our renowned King’s Messengers.

Our services include regional technical support and protective security, translation and interpreting, and the provision of diplomatic and ministerial vehicles.

We offer project management and consultancy, testing, monitoring, product development, delivery and more.

The UK National Authority for Counter-Eavesdropping (UK NACE) is part of FCDO Services. As the National Technical Authority (NTA) for technical security, it protects the UK’s assets from technical attack. It does so in collaboration with its partner NTAs – the National Cyber Security Centre (NCSC) and the National Protective Security Authority (NPSA).

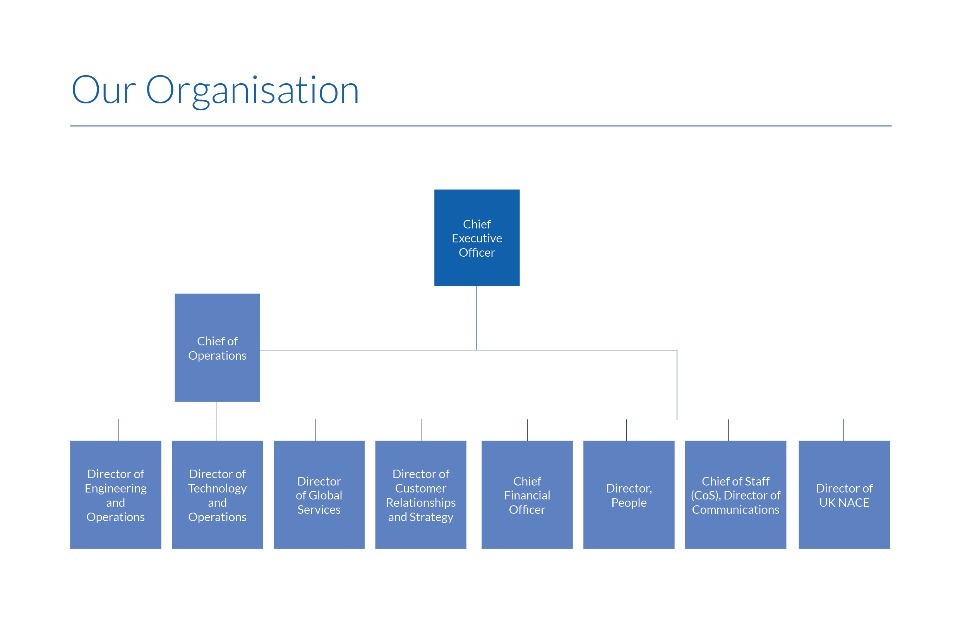

How we are organised

We deliver a global operation, working in more than 280 Missions across 178 countries.

Our staff are based in the UK and around the world, where they can offer the best support to customers. In the UK, staff are based at Hanslope Park, near Milton Keynes, and at the FCDO’s London Headquarters, King Charles Street. Our regional teams are based across the FCDO’s international network at posts, including hubs in the UK, USA, Middle East and Africa and Asia Pacific regions.

Our regional structure allows us to build local supply chains and alter our approach based on the needs of each region, responding quickly to customers.

Our Organisation

Our Services

- Consultancy and Advisory Services

- Secure Disposals

- Global Logistics

- Counter Eavesdropping

- Inspection and Assessments

- Diplomatic Vehicles

- Project / Programme Management

- Service Delivery

- Diplomatic Couriers

- Sensitivity Review Service

- Construction Management and Delivery

- Language Services

- Technical Security

- Architectural and Design Services

- IT Hosting

Our Partners

- Foreign, Commonwealth & Development Office

- Home Office

- Ministry of Defence

- Government Security

- Department for Business & Trade

- Cabinet Office

- UK Visas & Immigration

- HM Revenue & Customs

- UK National Authority for Counter-Eavesdropping

- Canadian Government

- Australian Government

- New Zealand Government

Performance Analysis

This section outlines our strategic vision and our objectives, including how we measure performance.

Performance summary 2024/25

We are in our seventeenth year as a Trading Fund of the FCDO, providing vital support to diplomatic missions and other government departments around the world.

| Our purpose | We provide trusted, secure and resilient services to support diplomacy, defence and development for the UK government and our global partners. |

|---|---|

| Our vision | Sustaining secure, global capability for the UK and its partners |

| Our ambition | To be the organisation of choice for innovation in protecting the people, assets and data of the government and its partners worldwide |

| Provider of choice | To be the FCDO’s preferred provider by delivering a service portfolio that builds on our strengths and meets customer needs, particularly in secure digital solutions, infrastructure and logistics. Our goal is to demonstrate to customers our proven ability to successfully implement large-scale, repeatable programmes over multiple years. |

| Ease of doing business | To deliver exceptional customer experience through streamlined processes that prioritise efficiency, transparency and collaboration. We will continuously improve our service to achieve transformative business benefits and greater operational efficiency |

| Security at the heart | Security underpins every aspect of our business. From operational delivery of innovative products and services that ensure customer confidence, to our corporate foundation built on security-cleared personnel with specialist skills. Our expertise leverages a world-class global diplomatic network, all supported by advanced secure IT infrastructure |

Organisational goals

FCDO Services has a clear vision to be a trusted government partner that is agile in deployment and global in scale.

Every three years we produce a comprehensive corporate plan which lays out our ambition, mission, and strategic plans, against the background political, economic and social environment, including financial forecasts for the period of the plan. This is revised each year to ensure it remains current.

To help us achieve our objectives in this final year of the strategy, three priorities were set.

Our strategic priorities for 2024/25 were:

- Stronger alignment with the FCDO

- Agility through modernisation

- Capability development

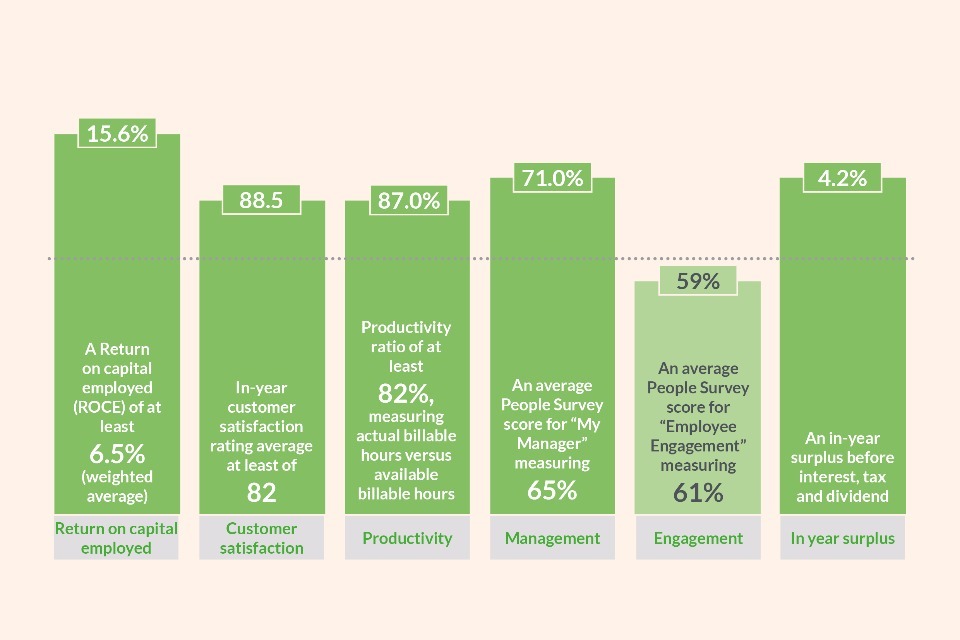

| Ministerial Target set | Result | |

|---|---|---|

| Return on capital employed | A Return on capital employed (ROCE) of at least 6.5% (weighted average). | 15.6% |

| Customer satisfaction | In-year customer satisfaction rating average at least of 82. | 88.5 |

| Productivity | Productivity ratio of at least 82%, measuring actual billable hours versus available billable hours. | 87.0% |

| Management | An average People Survey score for “My Manager” measuring 65%. | 71.0% |

| Engagement | An average People Survey score for “Employee Engagement” measuring 61%. | 59.0% |

| In year surplus | An in-year surplus before interest, tax and dividend. | 4.2% |

Measuring our performance

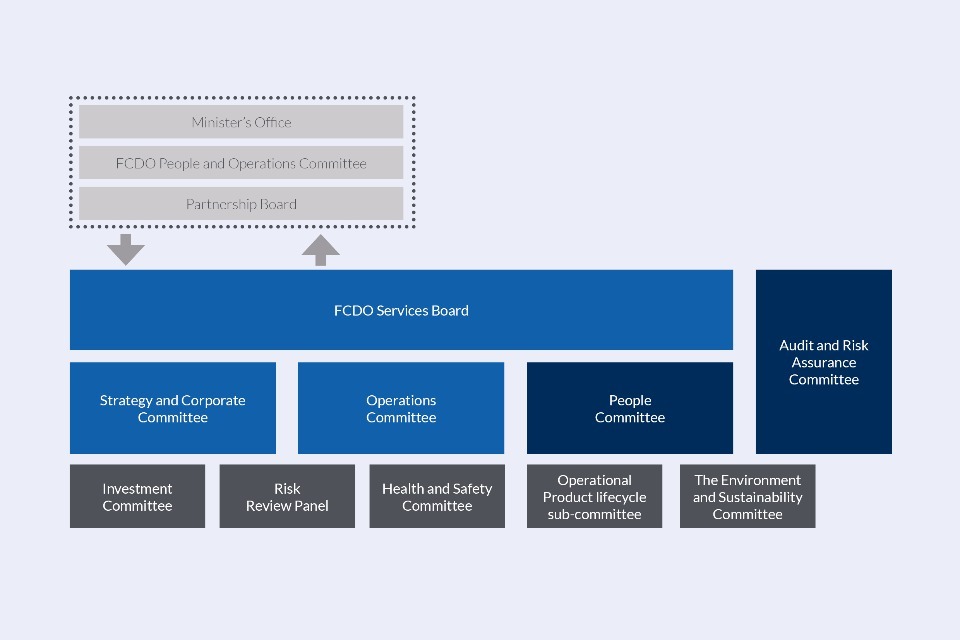

FCDO Services is accountable to the Secretary of State for the Foreign, Commonwealth and Development Office through an appointed Minister of State, alongside various boards and committees that direct the organisation.

The FCDO Services Board (The Board) is the principal governing body of FCDO Services. The Board is responsible for overall strategic management, setting corporate policy and monitoring performance and risks, in accordance with the FCDO Services Framework Document.

The Strategy and Corporate Committee (SCC) is a sub-committee of the FCDO Services Board and meets monthly to discuss HR, Communications, Business Services, Strategy and Customer Relationships matters and focuses on corporate decision making. This committee takes ownership of day-to-day management and strategic leadership, ensuring FCDO Services is following its strategic aims and policies. The Operations Committee is also a sub-committee of the FCDO Services Board and meets monthly to ensure the effective delivery of all operational decisions related to its People, Customers, Operational Safety, Finance and Security.

The SCC has two sub-committees, the Investment Committee and the Risk Review Panel. The Health and Safety Board was also a sub-committee of the SCC until December 2024 , after which it was moved under the Operations Committee. The Investment Committee meets to ensure all spend and investment across the organisation is in line with strategic goals and requirements to meet ministerial and organisational targets. The Risk Review Panel assesses the overall risk landscape and undertakes ad-hoc deep dive reviews.

The Operations Committee has two sub-committees, the Health and Safety Committee (from January 2025) and the Operational Product Lifecycle Sub-Committee. The Health and Safety Committee is the organisational level consultative and advisory body for health and safety matters affecting staff, contractors and those who may be affected by FCDO Services’ undertakings both in the UK and overseas. It discusses Health and Safety policy, strategy, safety performance review, operational safety planning, safety risk management, consultation and co-operation. The Operational Product Lifecycle Sub-Committee provides oversight, direction, and governance for operational product lifecycle management.

Ministerial Targets

All executive directors are invited to attend the SCC and Operations Committee and both committees are accountable to the FCDO Services Board, chaired by Sir Simon Gass.

A detailed explanation of our governance and oversight structures is set out in the Accountability Report.

Investing in our people

We have continued to deliver against our 2022-2025 ‘People Strategy’ which recognises that what we deliver is through the professionalism, expertise, resilience, and dedication of our people. Against a backdrop of continued social, economic, and environmental challenges, the strategy set out our vision of an inclusive workplace that empowers, engages, and enables our people to deliver and thrive, with a road map of how we intend to get there.

The ‘People Strategy’ is built around four pillars and reaffirms our commitment to our current and prospective staff.

- Our people offer – provides a compelling offer to ensure we attract and retain the right talent and showcase FCDO Services as a great place to work

- Building capability and capacity – develop professional, technical and engineering capability and capacity through effective workforce planning, development programmes and use of systems and technology

- Leadership and culture – develop leadership and management skills to effectively empower, engage, and support our colleagues and build a culture that promotes innovation and optimises performance

- Equality, diversity and inclusion – develop a truly diverse and inclusive organisation that looks after the wellbeing of all our people

This was the final year of the strategy, and our focus has been on ensuring future capability. Production of our Strategic Workforce Plan has identified the key skills we need to invest in and led into a review of our apprenticeship schemes to ensure alignment and identifying ways in which we can improve the quality and experience for this cadre. We have also developed and rolled out a new Strengthening Management Capability Programme, centred on equipping our managers with the skills and knowledge needed to manage the evolving needs of our staff, now and in the future. Other areas have been on streamlining our processes to improve capacity. Further highlights on how we have invested in our people are below.

Pay award

We made full use of the 5% increase available through Civil Service Pay Guidance, with eligible staff receiving a full 5% award. In line with our Reward Strategy, we adjusted our pay bands to ensure we remain competitive in the job market and moved to capability-based pay. We made non-consolidated performance bonus payments ranging from £700 to £3,150 and awarded a corporate bonus of £1,150 to eligible staff. This approach was well received by staff demonstrated by a 2% increase in the reward score of our people survey.

Diversity and inclusion

Our people make us who we are as an organisation. The skills and commitment of our staff who work around the world, and their breadth of experience and thinking, underpins our success as a business. We recognise that circumstances around the globe over the last year, as well as in the UK, continue to make it a more challenging environment for our people to be themselves and to be at their best.

Our approach remains committed to creating a workforce that reflects the societies in which we are located and increasing diversity of thought, supporting the UK government’s inclusion agenda, and to creating and maintaining a workplace where everyone can be at their best. We achieve this through working to remove barriers. Our recruitment and promotions remain merit based, so we are pleased that as at December 2024 representation of female, ethnic minority and disabled staff were at their highest levels. This positive increase also applied to senior female and ethnic minority staff, and technical female employees.

We were delighted to be upgraded to Disability Confident Employer status reflecting the ongoing actions to improve the experience of candidates and staff with disabilities.

As part of our commitment to creating an inclusive workplace we have held respect at work focus groups with ACAS , the output of which forms the basis for future improvement actions. We have introduced testing on respect at work for mid-senior level interviews and continue to host the positively received Active Bystander sessions.

We have benefitted from specific campaigns on neurodiversity, resilience, domestic abuse and male cancer ensuring our wellbeing approach is relevant to our people.

Outreach continued to have a strong focus in 2024/25 to raise FCDO Services’ profile as an employer of choice and to build our diverse talent pipeline, particularly in STEM careers. We have doubled our T level placement programme and recruited the first cohort of our Accelerated Technical Development Programme, for those applicants with relevant qualifications but not the experience.

We continue to benefit from the breadth of the FCDO and Civil Service staff networks, as well as our own, to work more efficiently on activities and to emphasise messaging.

We have actively increased our interaction with other departments to increase insights and reduce duplication.

Recruitment and retention

We have remained focused on ensuring we have the right tools in place to help us attract and retain talent. As part of this, we have been working to embed our recently refreshed employee value proposition, which is centred on the concept, “it all matters”, and helps instil a sense of pride in the work we do and highlights our employment offer. We have also partnered with a new media supplier to enable us to build and deliver on our attraction strategy.

We have been working to embed a new approach to talent acquisition and have started to create talent pools. As part of our attraction strategy, we also participated in the SC/DV Expo and Armed Forces resettlement day.

During 2024/25 we implemented a new application tracking system. This was the centrally procured platform that enabled us to better align our recruitment activity with other civil service departments and has demonstrable benefits to the candidate journey. The system provides an opportunity for efficiencies in both time and resource for the recruitment processes.

Civil Service People Survey results

The Civil Service People Survey continues to provide meaningful feedback on how our staff view issues within our organisation.

With a solid response rate of 69%, the 2024 ‘Employee Engagement’ results increased by one point to 59% against a Ministerial target of 61%, when compared to last year. The ‘My Manager’ score also saw improvements at 71% against a target of 65%. The improvements are a step in the right direction, though we only met one of our people survey ministerial targets.

While the picture at a team level remained mixed, at an organisation level there was no reduction in scores when compared to 2023; seven of the ten indices improved, reflecting the work done to address concerns in those areas. We analyse results at all levels, and we will continue to deliver actions aimed at addressing staff concerns in key areas through our Corporate Engagement Action Plan and business level Local Engagement Action Plans.

Health and safety

At FCDO Services ensuring the safety and well-being of our staff, customers, contractors and delivery partners is our highest priority. Operating in diverse global environments our robust ISO 45001 accredited health and safety management systems are in place to prevent harm and illness.

We have successfully delivered year on year performance improvements measured by our actively monitored key performance indicators:

- Near miss reporting has increased by almost 90%, providing us with opportunities to improve our risk controls; these improvements have had a direct impact on harm control, reducing our lost time frequency rate by almost half.

- 99% of our incident investigations were completed within 15 days of the report being made. This has meant we were able to undertake swift and robust action to prevent recurrence.

- Our planned monthly inspections achieved an average completion rate of over 90%. This has provided more opportunity to proactively identify and manage any changes in risk profile within our operational areas.

- Within our internal H&S audits, we had no major findings raised, and 100% of actions were addressed and closed within their due date, demonstrating management focus and commitment to the continuous improvement of H&S.

- Over 95% of our staff undertook dedicated H&S training this year, helping us to ensure our people remain competent to undertake their job safely.

We are proud of the improvements we have achieved this year and will be focused on continuing this into next year.

Leadership, management and development

High quality development is available at all levels of the organisation, with more people taking up mentoring this year. Although some areas remain low, there were improvements to the Learning and Development score in the people survey (up two points) and staff continue to make good use of learning opportunities both at a corporate and local level.

We continue to be committed to improving the quality of leadership and management across the organisation, and we have provided our directors and other senior or high potential leaders with coaching opportunities. We recognise that strong management capability is essential to fostering a positive and supportive work environment, and helps to improve employee engagement and retention, productivity and overall organisational success. As such, we started rolling out our Strengthening Management Capability Programme, a twelve-month programme that will be completed by all managers. Working with both external facilitators and our own internal experts, sessions are delivered virtually so that all managers, irrespective of whether they are based in the UK or overseas at Post, will have access to this important development opportunity.

Last year, we continued to partner with a local college to deliver Chartered Management Institute qualifications. Four individuals achieved Level 3 qualifications, and more are expected to complete their Level 3 or Level 5 qualifications in the coming months.

Assessing our risks

The principal risks faced in achieving our ministerial targets and our corporate objectives are managed proactively within our ‘Risk and Control Framework’, set out in detail in the ‘Annual Governance Statement’ later in this report. Risk management activity is reinforced by a policy document, supporting processes and training.

Additional oversight is provided by the Audit and Risk Assurance Committee, which meets quarterly. Effective identification and management of risk is fundamental to the success of the organisation. This is managed via a register of principal and operational risks, periodically reviewed, and updated using our in-house bespoke Risk Management tool.

Business continuity and resilience

Over the past year, the FCDO Services’ approach to Business Continuity (BC) has been reviewed and has transitioned to focus on critical activities, crucial to the continuous delivery of services to customers and stakeholders, while maintaining a comprehensive incident response. When faced with externally controlled challenges, our Business Continuity framework has demonstrated its resilience and effectiveness. This allows us to effectively handle any unexpected disruptions thus ensuring the smooth delivery of services to our customers.

FCDO Services has aligned with FCDO and Partners Across Government (PAGs) by transitioning to a resilience focused BC management system that maintains alignment with ISO 22301 principles.

Our organisation’s resilience structure has proven to be highly effective and robust, enabling us to remain flexible and prepared during critical times, as we continue to support our customers and stakeholders affected by disruptive events worldwide. Through continuous dynamic planning, exercising, and delivery, we remain committed to achieving our goals and providing the highest level of service to both our staff and customers in the future.

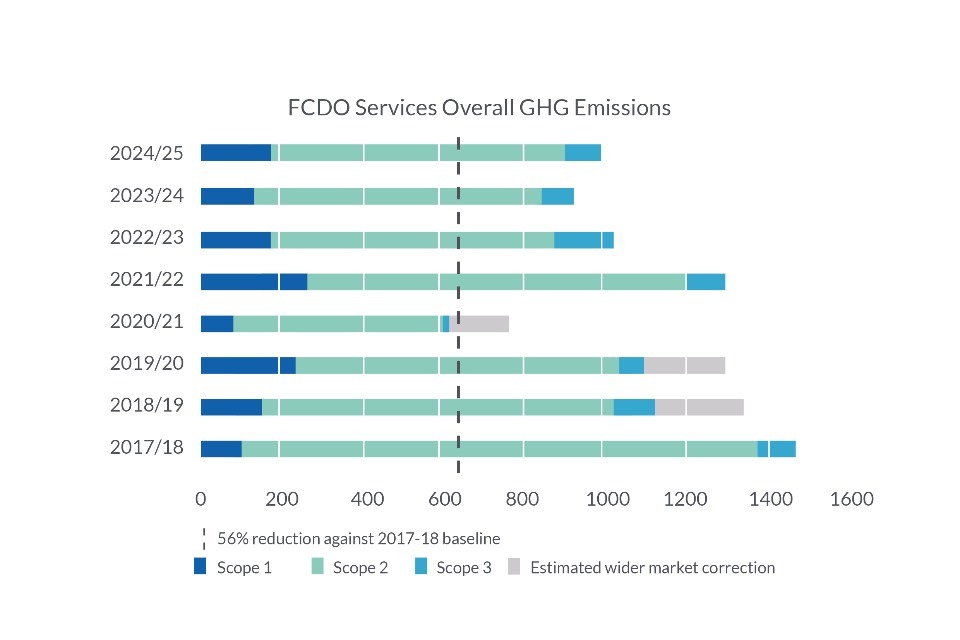

Sustainability

Operating as a Trading Fund of the FCDO, our sustainability initiatives are focused on improving environmental management, becoming ‘net-zero capable’ and producing greener products and services for all our customers. FCDO Services is part of the FCDO’s environmental footprint within the Greening Government Commitment (GGC) 2021-2025 framework. Through our Sustainability Strategy and Action Plan 2022-25, we work closely with the FCDO to reduce our organisational footprint to meet GGC targets and align with the FCDO’s certification to ISO 14001 (Environmental Management Systems) to ensure environmental compliance. A full sustainability performance chapter is included in this report with our current progress and approach to HM Treasury Task Force for Climate Related Financial Disclosures Phase 2.

Corporate security

FCDO Services continues to implement an effective security risk management model in line with Cabinet Office (CO) and National Protective Security Authority (NPSA) guidance. We work closely with the FCDO to ensure compliance with the Government Functional Standard GovS:007 Security, and the minimum physical, personnel and incident response Cabinet Office standards.

Our security initiatives are focused on ensuring effective security measures, by implementing appropriate physical and personnel security controls deployed in effective layers to deter, detect and delay unauthorised access to our critical assets.

Our site perimeter and asset specific security assessments are supported by collaboration with the Protective Security Centre (PSC) and cross government security working groups. Comprehensive security education and a mandatory insider risk training for all staff has supported our security culture.

Compliance monitoring, measuring trends and the production of lessons learned has influenced our communications, levels of assurance and the direction of planning.

ISO Standards

During 2024/25 we managed and maintained:

- ISO 9001:2015 Quality Management Systems Standard

- ISO 27001:2022 Information Security Management Standard

- ISO 20000-1:2018 Service Management System Standard

- ISO 45001:2018 Occupational Health and Safety Standard

FCDO Services is also included within the scope of the FCDO’s ISO 14001 certified Environmental Management System and is subject to FCDO-led inspections and audits.

We completed regular internal compliance audits and managed external surveillance audits on all the standards. We successfully achieved re-certification and transition to the new standard for ISO 27001 from version 2013 to 2022. Using a continuous cycle of self-evaluation, correction and improvement of our operations and processes we ensure the effectiveness, continuing suitability and adequacy of the management systems.

Retaining these ISO Standards provides assurance to the organisation and our customers of the relevant systems of governance, risk management and controls and makes recommendations for improvement.

Personal data

There have been no significant lapses of protective security, or enforcements made by the Information Commissioner’s Office (ICO) in 2024/25.

Performance in responding to correspondence from the public

As a public organisation, FCDO Services is subject to the Freedom of Information Act (FOI) which creates a public “right of access” to information held by public authorities. Individuals also have the right to obtain a copy of their personal data held by the organisation, as well as other supplementary information-known as a Subject Access Request (SAR). Under this Act, FCDO Services must provide answers to the public when they submit an FOI request. In the 12 months ending 31 March 2025, FCDO Services received 28 FOI requests, 14 SARs, 1 right to erasure and 1 right to rectification.

Modern slavery

FCDO Services recognises that it has a responsibility to take a robust approach to combat modern slavery. The organisation is absolutely committed to preventing modern slavery in its corporate activities, and to ensuring that its supply chains are free from the practice of modern slavery. We have policies in place that cover the use of agency workers and best practice on monitoring services provided to us by suppliers.

A full statement is reviewed and updated annually by the Strategy and Corporate Committee and is made available on our website.

Ethics

Our Ethical Code sets the standards of behaviour and conduct expected of our people – employees and contractors.

The Ethical Code incorporates the Civil Service Code and its core values of integrity, honesty, objectivity and impartiality. The Ethical Code specifies:

- conduct

- declaration of gifts and interests

- how we work with our colleagues

- raising concerns

- respect at work

- how we handle information

- how we work to eradicate unethical practices from our organisation

- behaviour when undertaking procurement activities

Our Respect at Work Policy, and mandatory training programme, helps to ensure staff receive fair treatment and respect, no matter their background, and helps FCDO Services prevent discrimination in the workplace.

Whistleblowing, anti-corruption and bribery

FCDO Services is committed to ensuring high standards of conduct in all that it does. These standards are reinforced by the Civil Service Code and in Diplomatic Service Regulations (DSR) and Home Service Regulations (HSR). Our Raising a Concern Policy is designed to make it easy for workers to make disclosures, without fear of retaliation.

FCDO Services Strategic Review and Performance

This section outlines FCDO Services’ strategic performance and achievements during the reporting period. It details our engagement with the Spending Review process, expenditure priorities, progress against organisational objectives, and adaptations to changing government priorities. The information demonstrates how FCDO Services continues to deliver value as a Trading Fund while supporting the FCDO’s diplomatic objectives and broader government commitments.

Spending review outcomes and strategic objectives

FCDO Services has actively engaged in the FCDO’s Spending Review process while maintaining our unique position as a Trading Fund that receives no direct budget allocation. Through the Deloitte Strategic Review of the FCDO and FCDO Services relationship, we’ve proposed options to reduce duplication, improve working practices, and increase output—initiatives expected to make a material difference to FCDO expenditure, and these are reflected in the new strategy which is launching later in 2025. Additionally, we’re increasing revenue from the Five Eyes community and other external partners, bringing new funding into government while subsidising core HMG activities such as Logistics and building infrastructure resilience.

Main areas of spend linked to outcomes

Our staff represent our most significant direct cost, with our work centred on expertise in delivering, installing, and supporting security infrastructure that protects the UK’s most sensitive information. As a Trading Fund, we focus on enabling the FCDO to deliver diplomacy in secure, safe, and efficient environments. We’ve successfully reduced overhead staffing costs during the last financial year to meet Ministerial Targets without service disruption. Our most significant challenge remains the limited budget available to FCDO colleagues, requiring continuous engagement with external partners to meet our targets while ensuring FCDO can afford to deliver its diplomatic platform objectives.

Achievement against organisational objectives

FCDO Services functions as the delivery arm of the FCDO, working to the standards and outcomes set by our parent organisation while contributing to the delivery of public commitments. We have established an influential sustainability team focused on future-oriented outcomes and products, alongside a Health and Safety advisory group ensuring the safe delivery of all projects and programmes.

Changes in outcomes and cross-government priorities

Efficiency has been our primary focus, with overhead cost reductions representing a significant step toward eliminating unnecessary processes and increasing output. These efforts protect the FCDO from inflationary increases in Trading Fund prices, allowing more resources for frontline activities. Through the Deloitte Review, we’ve identified improved working methods across the FCDO family anticipated to generate savings of approximately £30 million over three years. As we transition following the 2024 general election, we remain aligned with the government’s priorities and preparations for Spending Review 2025.

Our Achievements

As part of the Foreign, Commonwealth and Development Office (FCDO), our work supports the department’s key priorities. These are: Growth, Security, Europe, Migration, Climate and Nature, and Development.

While protecting the UK’s core national interests of security, prosperity and sovereignty, we contribute to shaping an open and stable international order through delivering the FCDO’s strategic priorities.

With operations across more than 280 missions in 178 countries, FCDO Services delivers secure services which form the foundation of the FCDO’s diplomatic network. Our capabilities span project management, design and construction, secure logistics, IT hosting and technical security. Through these services, we maintain and protect both physical and digital FCDO assets, ensuring diplomatic and development work proceeds securely without compromising national security.

Beyond the FCDO’s headquarters in King Charles Street and East Kilbride, our regional hubs secure, equip, maintain and protect the FCDO’s global estate. This enables the UK’s diplomatic network to remain operational during crises, such as Russia’s aggression against Ukraine or natural disasters, allowing the FCDO to continue providing essential diplomatic, consular and development services.

We also collaborate closely with other government departments including the Ministry of Defence and Home Office to enhance national security. Our teams deliver critical projects like upgrading the Royal Air Force’s radar infrastructure and creating secure collaboration platforms with UK partners, strengthening both national security and international cooperation.

The following pages highlight projects with UK and international partners that demonstrate our commitment to supporting diplomatic, development and defence capabilities while maintaining our pledge to protect the UK.

Case study

Mobilising change: delivering Osprey

From 2022 to its conclusion in March 2025, FCDO Services successfully supported the international rollout of Osprey, the FCDO’s new cloud-based IT platform designed to enhance global collaboration. This began with moving ex-DFID colleagues to Osprey in 2022 and following the rollout to the entire FCDO estate around the globe, concluded with FCDO Services fully adopting Osprey in 2024/25. This brought all all ex-DFID, FCDO and FCDO Services colleagues onto one IT system.

Delivering Osprey successfully overseas

Every Osprey device required secure, reliable planning and logistics to ensure it reached users across the global FCDO network. The logistics team at FCDO Services played a crucial role in ensuring timely and secure delivery of devices to staff at Post. Across the rollout FCDO Services delivered 13, 743 Osprey devices overseas.

To ensure there were enough devices and kit to meet demand, the Osprey Programme devised a wave approach to the rollout, adapting to overcome transportation challenges and meet tight deadlines. FCDO Services’ logistics team was critical in meeting the Osprey programme’s wave deadlines and ensured that the rollout could continue at the rapid pace necessary.

Throughout the rollout, the logistics team delivered Osprey kit to some of the world’s most remote and challenging destinations. These included isolated locations such as Tristian Da Cunha, and Ascension Island. The team also navigated strict shipping restrictions to reach places, such as Cuba and Islamabad . They managed deliveries to geopolitically sensitive regions.

FCDO services also provided “Boots on the Ground” support – a crucial element where assistance was needed in deploying kit to users at larger Posts, addressing FCDO’s resource limitations. This resource assisted with deploying 5,028 devices to users at 39 overseas posts.

Adapting to challenges

To support large numbers of FCDO staff, the logistics team established a dedicated unit to address the challenges of this project. This team became experts at navigating supplier issues that threatened timely device delivery, and managing incorrect product descriptions. To maintain an efficient global delivery service for FCDO users, the team leveraged FCDO Services’ road freight lorries, ensuring deliveries were completed in the shortest possible time.

The team navigated key project challenges, including the shipment of new Osprey printers to FCDO locations. As the printers were too large for air transport, alternative shipping solutions were implemented. To protect the equipment in transit, the team designed a bespoke, eco-friendly cardboard crate that provided both security and sustainability.

UK Osprey rollout - The FCDO Services “Osprey Shops”

To deliver the Osprey rollout to FCDO colleagues based in the UK, our teams established the “Shop” initiative at both Hanslope Park and Kings Charles Street. Beginning in 2024, these “Shops” offered hands-on guidance, resolved technical queries, provided support to Ministers and senior Civil Servants, supported users with workplace adjustment requirements, and collected obsolete laptops.

This essential support enabled staff to transition smoothly to Osprey, minimising disruption and accelerating the platform’s impact across the global network.

This approach was similarly used for the adoption of Osprey by FCDO Services from November 2024-March 2025. Using the experience and knowledge from the rollout to UK FCDO staff, Osprey devices were rapidly deployed to over 1,200 UK-based FCDO Services staff, while ensuring that overseas FCDO Services staff also received Osprey devices.

UK Rollout Statistics (Main UK Rollout)

- KCS (Kings Charles Street):

- No. of Users: 5400

- No. of Laptops deployed: 5380

- No. of Desktops: 69

- HSP (Hanslope Park):

- No. of Users: 2300

- No. of Laptops deployed: 2220

- No. of Desktops: 181

UK desktop deployments and UK printer conversions

FCDO Services deployed Osprey desktops to replace existing obsolete desktops across the UK estate.

Our teams also played a crucial role in the conversion of the existing obsolete printers to Osprey compatible printers. They collaborated with the Osprey Programme Team, Computacenter, and third Line support to ensure that users could continue to print throughout the transition.

Collection of decommissioned laptops, desktops and infrastructure from UKVI sites

As a parallel project rolled out from the start of 2025, UK Visas and Immigration (UKVI) reduced their requirements for FCDO IT. FCDO Services teams worked to ensure that infrastructure and hardware was decommissioned and removed from key sites in Croydon, Liverpool and Sheffield. Our teams visited the sites in advance to scope the requirement, complete the decommissioning activity and prepare all the kit for transportation. Vehicles were then sent to remove all the kit and transport it to Hanslope Park where it was securely stored – a feat managed in just a few days.

Osprey Programme & Overseas Deployment Lead, FCDO

“With the Osprey overseas deployment rollout we had identified 4 week Waves that Posts would enrol in, so as a Programme we had to ensure that all equipment arrived at Posts one/two weeks before that enrolment Window began.

Without FCDO Services Logistics and the Diplomatic bag team’s knowledge and commitment to this programme we would never have met the agreed deadlines. We worked collaboratively throughout the process raising any concerns we had directly with them through our senior management teams or the Osprey Logistics manager. We took guidance from the knowledge the team had from previous experiences on transporting equipment to Post efficiently - without this we would’ve failed. They were without doubt an integral part of our deployment team, and we are indebted to them.

As deployment lead I had a selfish, but professional approach, to ensure we had all the necessary kit at Post and without the Logistics team and the equipment “buffer” arrangement we had in Hanslope Park, this would never have been possible. We ensured we had sufficient stock in HSP, and the Logistics team packaged it as requests were submitted. It was a great formalised process where everyone knew their responsibility and worked tirelessly to achieve success.

For me, it was a pleasure to work with them. Our logistics manager had a superb working relationship with everyone. It was a pleasure and many friendships were established

We succeeded due to your commitment, thank you all.”

Focus on

Translating foreign policy: Russian sanctions guidance

Main content:

In March 2024, the FCDO Services Translation and Interpreting team was commissioned by the Foreign, Commonwealth and Development Office (FCDO) Sanctions Directorate to translate eighteen pieces of sanctions guidance from English into seven different languages.

The scope of these documents was vast, covering topics including trade, maritime sanctions, professional and business services, imports and exports.

Initially, translation was requested into Russian and Turkish as a priority, and this was later expanded to include Armenian, Georgian, Kazakh, Uzbek and Kyrgyz. Just under 18,000 words were translated into seven languages, five of which have less than 40 million speakers worldwide.

To provide the most effective service, our team enlisted external translators to support the work, particularly for the lesser-known languages such as Georgian.

What are sanctions?

Sanctions are a vital tool of foreign and security policy that the UK uses to pursue a wide range of purposes. We use sanctions to deter and disrupt malign behaviour and to demonstrate our defence of international norms.

The Sanctions and Anti-Money Laundering Act 2018 (SAMLA) gives the UK autonomous powers to impose, implement, enforce and lift sanctions. The Act also allows us to uphold our international obligations in relation to United Nation sanctions. SAMLA provides a range of measures to deny malign actors the benefits of interacting with the UK economy. These measures can relate to finance, trade, transport or immigration.

The importance of accurate translations of sanctions

Sanctions must be understood by everyone that they may impact, both in the UK and abroad because they carry important messages and can act as a deterrent. Due to this, accurate translations are vital to ensure they’re effective.

As sanctions reflect the official position of the FCDO and the UK government, translations must convey the same message as the original document. Inaccurate translations could undermine the effectiveness of UK sanctions and increase the risk of non-compliance and circumvention of sanctions by industry. As an important tool used by our overseas network, inaccurate guidance could strain our diplomatic relationships, and risk damaging the reputation of the government on the international stage.

Difficulties in translating legal language

Translation is a complicated and iterative process with each change requiring a review of the whole document. This means that updating the translated sanction guidance with every change would be unfeasible and costly for the FCDO.

Due to this, legal caveats, that also needed translation, were added in each language to the sanction guidance. These explained that the translations were accurate as of a particular time and that the English translation always took precedence as the most up to date version.

The complex and specific wording in the guidance made conveying an identical message across seven languages a challenge.

To address this, translators were instructed to flag any uncertain text. These queries were raised with the FCDO Sanctions Directorate to ensure the correct message could be clarified. The correct messages were shared with all linguists to ensure consistency and accuracy, reducing the risk of inconsistent translations. It also maintained efficiency as queries were checked as they arose, helping to communicate the sanctions effectively.

Ensuring further consistency

All translations went through an additional quality check to assure their accuracy. This check was completed by a second individual, rather than the linguist that completed the first translation. Where possible, the review was conducted by our Translating and Interpreting team, with external linguists required for the smaller languages.

Offering continued support

Since completing the initial translation of eighteen pieces of sanctions guidance and nine legal caveats, the team has translated a further three updates into the seven languages.

As the political situation with Russia continues to develop, the FCDO Services Translation and Interpreting team will continue to support the FCDO Sanctions Directorate.

Quote from customer

“The UK Government prioritises preventing the circumvention of sanctions against Russia. We focus on ensuring third countries understand UK sanctions, their scope, and non-compliance consequences. Translation of guidance into multiple languages is essential as it makes sanctions information accessible beyond English-speaking networks, improving global understanding and compliance”

FCDO Sanctions Department

Case study

HERMES: Building continued capability in international secure communications

Main content:

Over the past year, FCDO Services has continued to support the Ministry of Defence (MOD) with international communication and collaboration.

To improve capability, the MOD required enhancements to the existing HERMES secure communication platform. This platform enables individuals to communicate and collaborate internationally with robust security assurance.

FCDO Services was selected to enhance the HERMES platform with additional video conferencing and collaboration services. With a history of successful secure technology delivery, into secure environments across a wide range of global locations, our teams had the expertise and experience to deliver the project.

Developing the enhancements

To understand the additional requirements, our teams worked closely with stakeholders in the MOD to identify the specific enhancements required. This enabled our teams to develop a plan that would ensure the enhancements were delivered on time, without affecting the security assurance of the existing platform.

As a result of these early discussions, the decision was taken to select a commercial off the shelf conferencing technology to integrate onto the platform. Throughout the build phase, our teams then developed the technology to uplift and improve security built into the platform to meet requirements.

The MOD needed these enhancements delivered rapidly and efficiently. To achieve this, alongside thorough stakeholder consultation, our teams temporarily worked additional hours to meet deadlines.

Delivering the platform

Following extensive development and collaboration, new capabilities were introduced to enhance the HERMES experience. Enabling faster and more agile ways of working, additional collaboration tools are necessary to develop and deploy new capabilities between the UK and its international partners.

These capabilities enhanced real time video conferencing and cooperation across the UK and international government and industry partners. They also reduced the time and cost associated with travel, sometimes required for meetings around secure topics, which has resulted in decreased costs involved in project delivery.

The global rollout of this uplift capability was supported by secure logistics delivered through our King’s Messenger service. Additional in country technical support was then provided by our Regional Technical Support Services.

Providing continued support

After successful implementation, FCDO Services has continued to collaborate with the MOD, expanding the availability of the HERMES platform to address secure communications and collaboration challenges throughout the MOD.

Quote from customer

“Rapidly building and deploying this additional secure collaboration capability is integral to ensuring the success of FCAS. Engineering teams can now engage frequently through this secure platform to maintain a rapid pace of programme delivery.”

Future Combat Air Systems, Ministry of Defence

Case Study

Future proofing the British Embassy in Luanda

In November 2023, FCDO Services began a comprehensive infrastructure upgrade at the British Embassy (BE) in Luanda, Angola. Commissioned by the FCDO, the project aimed to address critical security and operational needs identified through structural surveys.

The scope of the work initially encompassed the construction of a secondary gatehouse, reinforcement of perimeter walls and the installation of a modern sewage treatment system. Later, the refurbishment of a residential property on the compound was added.

Upgrading the site’s infrastructure

Following site surveys, it was determined that a new gatehouse was required in the BE’s lower compound. The gatehouse is a secondary entrance and provides access to residential properties and service vehicles.

As part of this upgrade, the lower compound’s west elevation perimeter wall was rebuilt. Additional repairs also addressed cracks in other sections of the perimeter and retaining walls to reinforce security.

The reconfiguration of the lower compound also included curb adjustments to address health and safety concerns. This created more space for individuals waiting to enter, which reduced the health and safety risk as the entrance is adjacent to a highway.

Installing a new sewage and drainage system

The project resolved longstanding drainage issues, as the existing septic tank was outdated and insufficient for the site’s capacity needs.

Working with the local authorities, our teams explored suitable solutions, deciding on a modern water treatment system to resolve this issue. With proven success in Angola, this system, was specially designed based on maximum occupancy requirements, considering additional flex for large scale diplomatic functions and future site requirements.

Unlike the septic tank, the water treatment solution connects to the existing mains services reducing the regular waste pump lorry visits and offering cost savings. In the new system, foul waste is treated and discharged into existing rainwater infrastructure.

Managing last minute requests

When a residential property refurbishment was added during the late design phase, the team rapidly developed a comprehensive brief within just 2-3 weeks to avoid delays. This included detailed mechanical, electrical and architectural specifications that enabled the contractor to provide accurate pricing quickly - a process that typically requires several months.

This rapid response was challenging due to the absence of measured drawings and furniture in the property impeding proper inspection. Most critically, our teams identified health and safety risks with outdated electrical systems, which required complete rewiring to meet UK regulations.

Nonetheless, our teams overcame these challenges by leveraging their expertise and extensive knowledge of the compound. The customer expressed strong satisfaction with this responsive approach, demonstrating their trust by requesting a specific Project Manager, and Building and Quantity Surveyors that they’d worked with previously.

Delivering an upgraded British Embassy

By working closely with the customer and integrating these diverse infrastructure projects into a single coordinated project, our teams delivered substantial benefits to the BE Luanda.

The combined approach minimised operational disruption to staff by confining construction activities to one area during a single period. This avoided repeated excavation, streamlined the permit process and employed labour efficiencies by using the same skilled subcontractors across similar trades.

Most importantly, the modern water treatment system reduces long-term expenses, while the enhanced gatehouse and strengthened perimeter walls improved the compound’s security and functionality.

Providing continued support

Our teams continue to support upgrades at BE Luanda beyond the initial project, with the customer commissioning the internal refurbishment of a second residential property. This demonstrates FCDO Services’ commitment to supporting the FCDO’s global estate, ensuring that the BE Luanda remains secure, functional and representative of UK values abroad.

Quote from customer

“The FCDO Services team visited regularly and kept us up to date of any issues throughout the project. We’re happy to have had this oversight as any issues that were raised were dealt with quickly and professionally. The Clerk of Works particularly stood out, becoming an integral part of the Embassy team. They consistently worked with us to minimise disruption and maintain high health and safety standards, with their pride in their work clearly evident. Through their dedicated teamwork, we now have a lovely, safe and secure house, one key output of the project, that we’re proud to have families living in. We thank the team for their hard work; they’ve been great colleagues, and we’ll miss them when the project is completed! “

British Ambassador to Angola

Case study

JEFNet: Securing international defence communication

Main content:

The JEFNet platform for the Ministry of Defence’s (MOD) Joint Expeditionary Force (JEF) has continued to be operated and developed throughout 2024-25.

Originally developed as a secure IT network with connected infrastructure and devices, JEFNet was designed to enable ten like-minded partner nations—the United Kingdom, Denmark, Estonia, Finland, Iceland, Latvia, Lithuania, Netherlands, Norway, and Sweden—to collaborate securely at a higher classification level.

This system provides a robust backbone for sensitive political, military, and policy communication in an increasingly complex European security environment, allowing the JEF partnership to strategically address military, security and political challenges across the High North, Northern Europe, and Baltic Sea Region.

Making JEFNet transportable

Throughout 2024-25, FCDO Services’ work on JEFNet delivered comprehensive service operation and strategic enhancement. Our teams deployed transportable JEFNet capabilities for the first time, while ensuring uninterrupted connection across all JEF nations at all times throughout the year.

A significant breakthrough was the use of this transportable capability in a joint exercise, marking the first time the system was used in field operations. With this increased capability, JEFNet operations maintained secure, real-time communication with political, military and policy leadership across all partners, complementing national and NATO strategies. This supported a successful exercise which fostered a greater understanding of threats, facilitated discussions among allies and provided an opportunity to test responses in various scenarios.

Throughout the development of capability, our teams worked closely in line with rigorous security protocols to ensure that the security of the platform was maintained. With JEFNet deployed to all JEF partner nations, FCDO Services used our secure Kings Messenger Service and security cleared personnel to deliver platform support for all deployed equipment across partner nations.

Ensuring maximum value

Operating JEFNet within constrained MOD budget parameters presented significant challenges throughout the year. To ensure we provided the best service despite this, we implemented innovative approaches to service delivery, focusing on efficiency without compromising security or reliability.

Due to the mission critical nature of communications conducted through JEFNet, maintaining near-perfect system availability was paramount. This required establishing rapid response protocols for system incidents, with technical teams ready to deploy either remotely from the UK or in-person to partner nations at short notice.

The strategic importance of the communications flowing through JEFNet meant that even brief service interruptions could impact critical defence coordination efforts. Our teams developed enhanced resilience measures and proactive monitoring systems to identify and address potential issues before they affected operational capabilities. These efforts ensured that despite financial and operational challenges, JEFNet remained a dependable foundation for the JEF partnership’s collaborative security efforts.

Delivering a successful service

As security challenges continue to evolve across the region, JEFNet provides the secure foundation needed for effective multinational cooperation, strengthening collective defence capabilities and enhancing the UK’s leadership role in international security partnerships.

Quote from customer:

“UKStratCom have enjoyed a fully-engaged relationship with FCDO Services, providing the JEFNet solution to MOD as a fully managed IT service outcome. The team have worked diligently towards reaching Full Operating Capability (FOC) in May 25, while continuing to support the live service. Notably, JEFNet has been utilised to support Strategic engagement across the JEF partner nations, enabling UK leadership to securely communicate regards geopolitical and diplomatic incidents at Secretary of State level.”

-UK Strategic Command

Case Study

Proviso Central, a cloud-hosted application is launched

Faced with a critical deadline to replace a legacy visa processing system, FCDO Services launched Proviso Central – a secure, cloudbased solution for the Home Office – in February 2025. The team delivered at pace, taking wellmanaged risks and demonstrating innovation to adapt the system for a new platform. Despite the scale of the service, the transition was seamless, safeguarding operations and enabling strategic outcomes: improved security, efficiency and user experience. Used by over 3,000 staff and supporting £5.4 million in savings, Proviso Central exemplifies the professionalism and partnership required to deliver high-impact public sector technology.

Modernising visa applications

In February 2025, FCDO Services launched Proviso Central, a cloud-hosted application developed to modernise and secure the processing of visa applications made from outside the UK. Created by the Technology and Operations team, this new platform replaced a legacy IT system under significant time pressure, safeguarding the continuity of a critical front-line service.

There was a pressing need to deliver at pace due to the impending decommissioning of the old infrastructure. Failure to migrate in time would have risked disruption to a vital Home Office operation. Recognising this, the team worked at exceptional speed – taking carefully managed risks to accelerate delivery while maintaining system integrity, security and performance.

Innovation in action

Innovation was at the core of this achievement. The team adapted the original Proviso system to function seamlessly on a novel, private cloud-based platform hosted by FCDO Services. This required technical ingenuity and flexibility, all under tight deadlines and within a complex multi-stakeholder environment.

Operational impact and strategic benefits

Over 3,000 Home Office users now rely on Proviso Central, which is expected to process 3 – 4 million visa applications annually. The system not only ensures operational continuity, but also delivers strategic benefits: reducing cyber risks, driving efficiencies and significantly improving the user experience.

Value delivered

The successful delivery of this project underpinned cost savings of £5.4 million. It also set a benchmark for collaborative working, with exceptional partnered behaviours and a high level of candour and trust evident throughout. The smooth transition, executed on an accelerated timeline, is a testament to the professionalism and commitment of the FCDO Services team.

Quote from customer

“At the start of 2024, The Home Office were faced with an enormous challenge to migrate from the aged FCDO infrastructure and the use of localised servers at seven key locations whilst maintaining service in high volume routes. This IT service (Proviso - used for Overseas Case working) was transformed initially to be accessed via a web-based portal and then to a full cloud solution hosted by FCDO Services. The programme was run at pace to meet a deadline of the 31st of March 2025. This would not have been achieved without the collaborative working across stakeholders from the Home Office Business, DDaT and our FCDO and FCDO Services colleagues. The people concerned are praised for their dedication, resilience, and flexibility to work long hours, evenings, and weekends to deliver a massive success for all parties. It has been a huge effort from all involved in managing both the migration alongside the BAU activity, we would like to thank everyone involved in achieving not only the transformation of the IT service but also ensuring live IT operations experienced minimal interruption throughout the last twelve months.” “The service was transitioned exceptionally smoothly – an impressive feat given the scale and critical nature of this operation. I was particularly struck by the high degree of grip and professionalism shown by the team, and the open, trusted relationships built across departments.”

Paul Dunlop, Customer Services Group, UK Visas and Immigration

Case study

Transforming skills development: T-Levels at FCDO Services

Main content:

Over the past two years, FCDO Services has successfully implemented a T-Level industry placement programme, the first secure government department to do so, providing students with valuable work experience whilst developing future talent. Beginning with a single digital student in 2023 and expanding to include engineering placements in 2024, the programme has created meaningful learning opportunities for students whilst benefiting the organisation’s skill pipeline. These placements were designed not just to develop students’ practical skills in their subject areas but also to support them in developing the all-important employability skills that employers value.

Establishing our T-Level programme

Our pilot year began with consultation with local colleges, carefully selecting providers based on T-Level offerings, student diversity, and proximity to our site. We undertook a planning process to address the security requirements of our environment whilst ensuring meaningful student experiences.

To support student selection our teams developed a comprehensive selection process, including student presentations at the college, anonymous application reviews, and professional interviews giving students a valuable experience. For the successful candidate, a thorough security clearance process was required, and we maintained regular contact throughout the summer before the placement.

The student experience was carefully structured with a three-day induction block to help integration. To address the challenge of creating meaningful work with students attending just one day per week, we implemented a rotation model where they worked in different teams each term. This scheduling allowed students to complete discrete project components while experiencing diverse aspects of our operations. We enhanced their experience by pairing them with apprentice buddies and creating opportunities to participate in relevant events and work trips, developing a holistic understanding of FCDO Services.

Improvements in year two

Building on insights from our pilot year, we refined the programme for our second cohort, expanded to include both digital and engineering students. Based on feedback, the recruitment process was adjusted to give students more time for their applications, while reducing their waiting time between selection and start date.

A major enhancement came through integrating T-Level students into our established apprenticeship programme. This created immediate networking opportunities and a deeper introduction to FCDO Services. We adopted a more responsive approach to learning goals, setting these during the first review rather than before placement started, allowing students to understand our workplace before committing to specific objectives.

We significantly enhanced our buddy system by pairing T-Level students with current apprentices who had recent experience balancing work and study. These apprentice buddies provided unique support that experienced staff couldn’t offer—helping to translate technical theory into practical applications and sharing insights into navigating the organisation as a newcomer. This peer mentoring approach proved particularly effective at helping students apply their college learning in a real-world environment.

Challenges encountered

As the first secure government department to implement T-Level placements, security requirements presented our most significant hurdle. We had to build extended timelines into our planning and maintain regular contact with students during the recruitment pre-approval process to keep them engaged.

Our rural location at Hanslope Park, with limited public transport options, also created accessibility barriers that wouldn’t affect most employers. We addressed this by providing dedicated transport support and carefully adjusting working hours to align with available bus schedules, ensuring students could reliably attend their placements without undue hardship.

Success and benefits to the organisation

The T-Level programme has established a valuable early talent pipeline for FCDO Services. It has enhanced our reputation as an employer committed to skills development and strengthened community relationships. Students have brought fresh perspectives to teams, while the programme has bolstered our apprenticeship culture by giving current apprentices mentoring opportunities. We plan to build on these successful foundations in future years.

Quote from customer

“T-Levels for us are all about talent. We want to interest and inspire young people in the work we do so they can explore opportunities from early on. The question is, ‘How do we give young people the skills that equip them for a career?’ We don’t want to lose them while they go away and do something else. We want them to see straightaway the depth of technology and its application throughout our organisation. The acid test is that we know placements are working when they generate the kind of interest we’re seeing today.”

Mike Astell, CEO, FCDO Services

“I picked the T-Level because of how I can apply my skills. It’s showing me not just what I know but how it’s used, so I’m seeing everything from a work perspective. I’m seeing different teams and infrastructure, which is giving me an overview of what the organisation does, and I get the chance to network as well.”

Chloe, Digital T-Level student

Case study

Securing and enabling political collaboration at the European Political Community Summit

Main content:

In July 2024, the United Kingdom (UK), hosted the fourth European Political Community (EPC) Summit at Blenheim Palace. Involving more than 46 Heads of State, it was the first event held by the new British government who had come into power just two weeks prior.

The summit aims to foster political dialogue and cooperation to address issues of common interest, and strengthen the security, stability and prosperity of the European continent. With important topics like migration, energy, connectivity and continued support for Ukraine on the agenda, security was a key concern for everyone involved.

As specialists in technical security, the UK’s National Authority for Counter-Eavesdropping (UK NACE) were commissioned to keep conversations secure. The FCDO Services Translation and Interpreting team was also commissioned to ensure conversations could be held effectively across language barriers.

Preparing for the summit

In advance of the summit, teams from UK NACE worked with colleagues in the FCDO’s Protocol Department, Cabinet Office, Thames Valley Police, No 10 Downing Street, and others to coordinate the security arrangements for the event and develop a plan.

UK NACE provided critical technical security advice for the event. Creating a policy standard, our teams implemented guidance on the use of personal electronic devices (PEDs), in addition to ensuring all appropriate formal governance procedures were in place and adhered to.

Outside of technical security advice, UK NACE officers also conducted a survey in advance. They created plans for various scenarios in preparation for the event.

Setting up the event

In the days before the event, UK NACE teams worked to secure the summit location. They carried out inspections of the required areas and set up equipment that would maintain the technical security once the inspections were complete.