FCDO Services Annual Report and Accounts 2020 to 2021

Updated 4 August 2021

-

Presented to Parliament pursuant to section 4(6) of the Government Trading Funds Act 1973 as amended by the Government Trading Act 1990

-

Laid in Parliament on 15 July 2021

-

Ordered by the House of Commons to be printed 15 July 2021

-

ISBN: 978-1-5286-2685-9

-

Crown copyright 2021. This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3. Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned. This publication is available at www.gov.uk/official-documents

-

Any enquiries regarding this publication should be sent to us at FCDO Services, Hanslope Park, Milton Keynes, England MK19 7BH FCDOServices.Comms@fcdo.gov.uk

Overview

The Overview section contains forewords by the Minister responsible for FCDO Services, the Chair of the FCDO Services Board and the Chief Executive Officer (and Accounting Officer). It also contains summary information about the organisation and a performance overview.

Foreword by Lord (Tariq) Ahmad of Wimbledon, Minister of State, FCDO

I’m delighted to introduce this year’s Annual Report and Accounts as the Foreign, Commonwealth and Development Office (FCDO) Minister responsible for overseeing the work and strategic objectives of FCDO Services.

I would like to start by thanking Danny Payne and FCDO Services staff for their phenomenal efforts over the past year. It has been an extraordinary year for the Trading Fund, which has had to navigate not only the effects of the COVID-19 pandemic, but also the merger of the Foreign and Commonwealth Office and Department for International Development (DfID) and the UK’s new relationship with the EU. On behalf of the Foreign Secretary and the FCDO staff around the world, I thank FCDO Services for continuing to maintain the diplomatic platform during a period of unprecedented change.

FCDO Services is an integral part of the FCDO, and I am pleased to see the relationship between the two grow from strength to strength. It has been a challenging year, but FCDO Services continued to deliver. It has worked effectively and efficiently, which is reflected in the feedback from customers. FCDO Services has played an integral role in the delivery of vaccines to the UK platform overseas; supported the Rapid Deployment Team in Beirut in August and helped the FCO and DfID join digital platforms during the merger. I am grateful to all FCDO Services staff for their continued efforts to support the FCDO and other departments on the overseas platform in their work in the UK and around the world.

This year the UK National Authority for CounterEavesdropping (UK NACE) celebrated its 75th Anniversary. UK NACE was established just after WW2 after the discovery of a number of eavesdropping devices installed in British Embassies across Communist Eastern Europe. Today, it continues to deliver services to protect our nation’s diplomatic, military and economic wellbeing and I thank our UK NACE colleagues who continue to deliver the excellent work started by our former colleagues.

The events of the past year have provided many learning experiences, from how we connect to each other to how we serve our partners. FCDO Services has demonstrated its ability and flexibility to adapt to change whilst continuing to meet its objectives. It continues to meet its Ministerial Targets and deliver customer satisfaction. When I look at the customer returns it speaks volumes about everyone across the organisation who help to achieve such great results, and its investment in the progression of its staff is commendable. The importance of investing in people cannot be understated, and FCDO Services staff should look forward to a year of new opportunities.

The Integrated Review has presented FCDO Services with the strategy on how it can work together with the FCDO and wider HMG to deliver on the government’s ambitions. FCDO Services is well placed to deliver in this space; I am pleased to see the organisation build on its excellent relationships with the Ministry of Defence (MOD) and Whitehall colleagues. With the launch of One FCDO Services and the creation of an Innovation unit, FCDO Services has positioned itself at the heart of the government’s push for greater research and development in science and technology.

Whilst the year ahead will continue to present us with challenges, as the world starts to open up we will have new opportunities. Build Back Better resonates for the whole organisation, not just our country, and I know the leadership and staff at FCDO Services are already looking ahead, developing the business and enhancing its operations. I look forward to my next visit to Hanslope Park and to meeting the staff at FCDO Services who are responsible for all the services the organisation continues to deliver.

Lord (Tariq) Ahmad of Wimbledon

Minister of State, FCDO

Foreword by Sir Simon Gass, Chair of the FCDO Services Board

As Chair of the FCDO Services Board I would like to congratulate Danny Payne and all FCDO Services staff for their contribution to the success of the Trading Fund. This has been a year full of challenge but also full of achievement. Whilst adapting the business to the new environment of the COVID-19 pandemic, the organisation also navigated the end of the transition period with the EU and the FCDO merger. Throughout this, the team continued to deliver excellent services to the FCDO and customers across Whitehall and the globe.

FCDO Services successfully adapted its strategy early in the pandemic to drive towards more wider-market business. The Board endorsed this approach and the end of year results show that the revised Grow, Save, Innovate strategy has worked. The careful balance of increasing widermarket business and making cost saving efficiencies has enabled the organisation to finish the financial year in a position of surplus: a significant achievement considering the challenges.

FCDO Services staff have continued to show their wide range of skills over the past 12 months. Throughout the COVID-19 pandemic staff have continued to support the FCDO and its partners overseas through our teams across the globe. From maintaining the diplomatic platform, to ensuring vital supplies (including vaccines) get to Posts via our logistics operation, staff have once again gone the extra mile to keep as many services as operational as possible.

In recent years, the Board has taken a close interest in the organisation’s Diversity and Inclusion strategy. We will take better business decisions if we have diverse ways of thinking about them. I am pleased with the progress made. Although reduced levels of recruitment as a result of the pandemic have had a bearing on progress in improving workforce representation, we are still moving in the right direction. We have seen an increase in the proportion of disabled staff we now employ and female representation in technical roles has also risen to our highest ever level.

The Board has met several times over the past year to discuss the revised strategy of FCDO Services and chart progress against the Corporate Plan. In my role as Chair of the Nominations Committee, I continue to support Danny and the executive team to nurture and promote talent. The Board is particularly pleased with the positive staff survey results FCDO Services achieved this year. The organisation saw significant improvements in the scores on ‘My Manager’ and ‘Leadership and Managing Change’. To do so in a year where staff members have had to adapt to significant change in their work and home lives is a testament to the leadership teams of FCDO Services. Our staff survey results also show that the continued focus on diversity and inclusion is having a positive impact on our culture with our inclusion score now at 80%.

We were delighted to welcome a new Non-Executive Director to the Board this year. Jenny Bates joined us as the FCDO representative, taking over from Sir Philip Barton. We also welcomed Juliette Wilcox onto the Audit Risk and Assurance Committee (ARAC). Both are very well qualified and are already bringing significant value to our organisation.

Finally, this has been Danny Payne’s last full year as CEO. I cannot overemphasise the impact Danny has made on the organisation since he joined in 2008. His drive and energy, the clarity of his thought and the warmth of his personality mean that he will be missed by the Board and staff of FCDO Services. The organisation is stronger, healthier and more successful because of his leadership. We wish Danny well for the future. We expect soon to announce Danny’s successor as CEO.

Sir Simon Gass

Chair of the FCDO Services Board

Foreword by Danny Payne CMG, Chief Executive FCDO Services

COVID-19 has meant we have had to learn how to navigate working with new and continually adapting challenges. The past year has demonstrated the incredible ability of FCDO Services staff, who have continued to deliver a world-class service despite the impact on operations. FCDO Services is a global organisation with a global footprint; the closure of international borders had huge implications for the way our organisation operates, but the experience and agility of our trusted teams has meant the organisation continued to deliver, ending the year in a much better position than we had forecast at the beginning of the financial year.

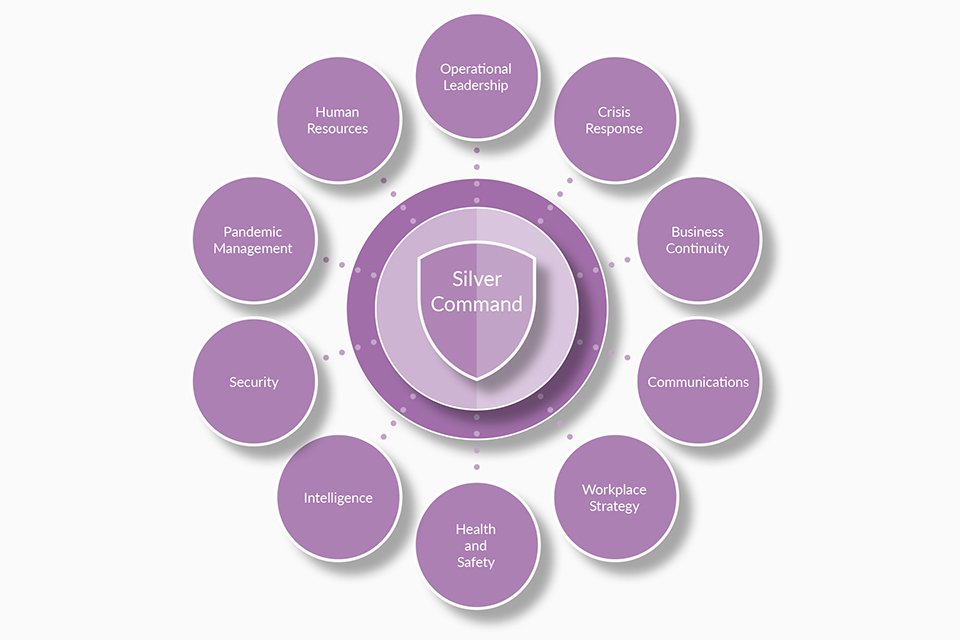

FCDO Services responded rapidly to a changing situation. The organisation adjusted its strategy and Corporate Plan to reflect the new operating environment. Very early on in the pandemic we launched our Business Continuity plan under Gold, Silver and Bronze leadership. A year on, we are still operating under this structure and I would like to give my heartfelt thanks to all those who have worked tirelessly to navigate the organisation through this period of unprecedented change.

As a Trading Fund, we continue to focus on retaining the trust of the FCDO to deliver services to its overseas platform and maintaining the FCDO estate. With the merger of the Foreign and Commonwealth Office and the Department for International Development, we look forward to the opportunities the merger has given us to support the D in FCDO, indeed we are now supporting Development and Aid for example: urgent logistics to ship oxygen generators to India using an Antonov 124 (see page 29). With the end of the Transition Period with the EU, our Frankfurt Hub and meticulous preparation for the EU Exit has enabled us to continue to provide support to the diplomatic platform and we have supported the FCDO with its distribution of vaccines to Posts and staff around the world.

With the closure of international borders and the disruption to global travel, the organisation has continued to grow its wider market work and nurture its portfolio of customers outside of the FCDO. Our Grow, Save, Innovate strategy has enabled us to grow this side of the business, working closely with other UK government departments including the MOD and international partners. The Integrated Review will help us build on our strategy and we are well placed to assist the FCDO and HMG to deliver on its ambitions.

We continue to invest in engagement with our staff and in their skills. I, and my executive team, remain committed to building and maintaining a diverse and inclusive workforce. Thanks to the passion and hard work from staff across the organisation, including our staff associations, I am pleased to say we are seeing improvements in the number of staff who feel comfortable declaring their status’ across all areas.

Though recruitment has been limited this year, we have also seen improvements in both disability and Black, Asian, Mixed or Other ethnic group representation so I am pleased to see our efforts are making an impact. I recognise we have more to do, and the improvements to date provide a strong platform to enable us to achieve this. We have also focused heavily on nurturing talent and developing our leadership team, and the great response rate and scores in our Your Say results are a testament to the important work being done across the organisation in building our workplace culture.

This year we celebrated 75 Years of the Diplomatic Wireless Service, established on 1 April 1946 by Ernest Bevin to provide direct wireless communication between the Foreign Office and its overseas Missions. FCDO Services continues this important work to this day, and for the past 75 years, we have continued to specialise in secure communications around the world. I also echo the Lord Ahmad’s tribute to the work of UK NACE, also celebrating their 75th year and continuing to build on the excellent work they’ve done in the past 12 months.

As we end the financial year, I reflect on how far the organisation has come since its inception and all it continues to achieve. The world in which we operate will keep changing and the next year will continue to be impacted by the COVID-19 pandemic, and will present us with new set challenges. However, FCDO Services has shown its ability to adjust rapidly and respond quickly to support our customers.

This is my last Annual Report and Accounts as I move on from FCDO Services to new opportunities. I feel privileged to have been able to steer the organisation and its staff through the past year. FCDO Services staff should be proud of all they have achieved and I wish the organisation all the very best for the future.

Danny Payne CMG

Chief Executive Officer, FCDO Services

Who We Are and What We Do

FCDO Services is an Executive Agency and Trading Fund, owned by the Foreign Commonwealth and Development Office. Our work supports diplomacy, defence and development for UK government and our global partners.

What we do

Our secure services underpin the diplomatic network. We provide aid to embassies and high commissions and protect against counter-terrorism and espionage.

-

We support a wide range of highly secure government facilities, from design and construction, to providing ongoing maintenance and consultation.

-

Within the digital sphere we provide data management and secure cloud hosting, IT advisory and professional managed services.

-

Our secure logistics service which includes our renowned Queen’s Messengers, delivers diplomatic mail around the world for the UK and other governments.

-

Other services include provision of diplomatic and ministerial vehicles, regional technical support and protective security and translation and interpreting.

-

Alongside these services we offer project management and consultation, testing, monitoring, product development, delivery and more.

The UK National Authority for Counter Eavesdropping (UK NACE) is part of FCDO Services and recognised as a national authority for technical security. Along with their partner National Technical Authorities – National Cyber Security Centre (NCSC) and Centre for the Protection of National Infrastructure (CPNI) – they protect UK assets from technical espionage.

How We Are Organised

We operate on a global scale, working in more than 250 Missions across 168 countries.

Our staff are based in the UK and around the world, where they can offer the best support to customers. In the UK, staff are based at Hanslope Park, near Milton Keynes and at the FCDO’s London headquarters, King Charles Street. Overseas, staff are based at our four regional hubs in Washington, Brussels, Pretoria and Bangkok, or at other Posts.

Our regional structure allows us to respond more quickly to customers, to build local supply chains and alter our approach based on the needs of each region. Each hub is headed by a Regional Services Director.

New organisational structure

The UK government has set out its aim for the UK to become a global leader in science and technology. Our owner, the FCDO, will be central in helping to deliver this and so to provide support to FCDO, we moved to a new streamlined organisational structure in September 2020 – One FCDO Services. The reorganisation will see an increased focus on science and innovation and improve our ability to grow our business while making careful savings. The new operating model will also improve our ability to be flexible and enhance customer service.

As part of the restructure, a new Operations function was created which includes Engineering and Operations, Technology and Operations, the Regions and Customer Relationships (formerly ETD, GDT, SGS and GGP, though these former directorates are referenced in the Accountability Report as 2020/21 is a transitional year). To strengthen the business-wide focus on digital technology and innovation, a new Chief Digital and Innovation Officer (CDIO) role was established. Read more about the work we are doing in Innovation on page 30.

Our Organisation

Our organisation covers many areas, including:

-

Middle East and Africa

-

Europe

-

Asia Pacific

-

Americas

-

Physical Security

-

Security Consultancy

-

Rapid Response

-

UK NACE

-

Technical Security

-

Secure Cloud Hosting

-

Digital Sensitivity Review

-

Secure Mobility Management

-

IT Advisory Services

-

Service Desk

-

Professional Managed Services

-

Unaccompanied Diplomatic Service

-

Queen’s Messengers

-

Secure Disposals

-

Diplomatic Vehicles

-

Logistics Consultancy

-

Translation and Interpreting

-

Advice and Consultancy

-

Secure Speech Environments

-

Maintenance

-

Design, Construction, Installation

-

Chief of Staff

-

HR

-

Business Services

Our Global Reach

We operate in more than 250 Missions across 168 countries.

Our History

This year marks 75 years since the department which ended up as FCDO Services became what was then a Foreign Office agency. The Diplomatic Wireless Service was born on 1 April 1946. On 23 April 1946, Ernest Bevin sent a Foreign Office circular to all Posts, stating: ‘From the 1st April, 1946, the wireless telegraph service hitherto described as “Government Wireless” which provides direct wireless communication between Foreign Office and those of His Majesty’s Missions in which transmitting and receiving stations have been installed is to be regarded as a regular Foreign Office organisation and to be described as “Diplomatic Wireless”.’ During the Second World War, Special Communications Units were set up to protect and maintain radio communications.

After the war, radio communications between the UK and Foreign Office Posts abroad were still extremely important. The Diplomatic Wireless Service was created as part of the Foreign Office because it was so important for their work. For the past 75 years, we have continued to specialise in secure communications. Today, we still work with secure radio, as well as electronic communications like emails and video calls.

1199 - First written mention of Royal Messengers

The Royal Messengers are the oldest part of FCDO Services, dating back to at least the reign of King John. Over the centuries, they have served the King or Queen by carrying secret information and deliveries, making sure whatever they are taking arrives safely without being seen by our enemies. Over 800 years later, the Queen’s Messengers still help the UK send secret information and items to people abroad.

1824 - Foreign Office takes control of Royal Messengers

Operational control of the Royal Messengers was passed from the Royal Household to the then Foreign Office.

1939 - ‘Special Communications Unit No 1’ formed’

As the threat of war increased, so did the danger that enemy troops might cut telephone lines. To prevent this, the Foreign Office switched from relying on telephone to radio. The Foreign Office communications team combined with another government department to create a new unit. This specialist unit of radio technicians looked after radio equipment, intercepted enemy communications and developed new technology throughout World War 2.

1946 - Technical security teams created

We set up a team of specialists dedicated to protecting Missions from all forms of technical attack. This included making sure communication links were secure, equipment was designed with security in mind and counter eavesdropping (protecting British embassies from being spied on).

1957 - Trainee scheme launches

Due to the unique work and equipment involved, we started a trainee scheme for radio technicians. This scheme has continued ever since, although it constantly evolves to include the range of work we do. Today, the apprenticeship is in Technical Engineering, and sits alongside 16 other apprenticeships.

1958 - National Authority for Counter Eavesdropping

The team set up to deal with counter eavesdropping in 1945 became increasingly specialised and important. In 1958 they were recognised by the Cabinet Office as “the only UK department who have the authority, skill and knowledge to undertake the UK authority on counter eavesdropping”. Known today as UK NACE, they remain the UK experts for preventing and discovering enemy espionage.

2008 - Trading Fund

We became a Trading Fund in 2008, under the Government Trading Funds Act 1973, to allow us to provide services to other government departments and become more financially independent. Our Trading Fund status means that we are able to operate commercially, while continuing to be part of the UK government.

2020 - FCDO Services

On 2 September 2020, our parent organisation the Foreign and Commonwealth Office merged with the Department for International Development to become a new department – the Foreign, Commonwealth and Development Office. To reflect this change, we changed our name to FCDO Services.

Performance Analysis

The Performance Analysis section outlines our strategic vision and our objectives, including how we measure performance.

Performance summary

We are in our thirteenth year as a Trading Fund of the FCDO, providing vital support to diplomatic Missions and other government departments around the world.

Organisational goals

FCDO Services has a clear vision to be a trusted government partner that is agile in deployment and global in scale. Our strategic objectives for 2020/21 are to Grow, Save and Innovate. The restructure of our organisation to create a single, unified FCDO Services operating unit, will improve our ability to deliver on this.

Our Purpose (Mission)

We provide trusted, secure and resilient services to support diplomacy, defence and development for the UK Government and our global partners.

Our Ambition

The organisation of choice for innovation in protecting the people, assets and data of the Government and its partners worldwide.

Grow our business

We have begun working towards our goal to increase and improve on the amount of work we do outside of the FCDO. This approach will ensure we protect our revenues and broaden our customer base and is supported by the FCDO. The creation of the new FCDO, following the former FCO’s merger with the Department for International Development, also presents us with the opportunity to deliver different services which our new structure will allow us to achieve.

Save resource

We aim to save by streamlining our business to reduce costs, and increase agility, scalability, productivity, collaboration and teamwork. We have created a unified operations unit to lead all our delivery, projects and operations, this will help us make careful savings as we grow by maximising productive activity. We will continue to focus on improving our operational efficiency and delivering even better value for our customers.

Innovate for future growth

The Foreign Secretary has announced that our owner, the FCDO, will be a key department delivering the government’s ambitions for security and defence set out in the Integrated Review. In supporting the FCDO and delivering the innovation in technology needed, we are perfectly placed to be at the heart of that policy.

In order to better provide science and technology capability in the future for our customers in the UK and around the world, we have introduced a Digital & Innovation Office that will focus on innovation, science, technology and product development.

Measuring our performance

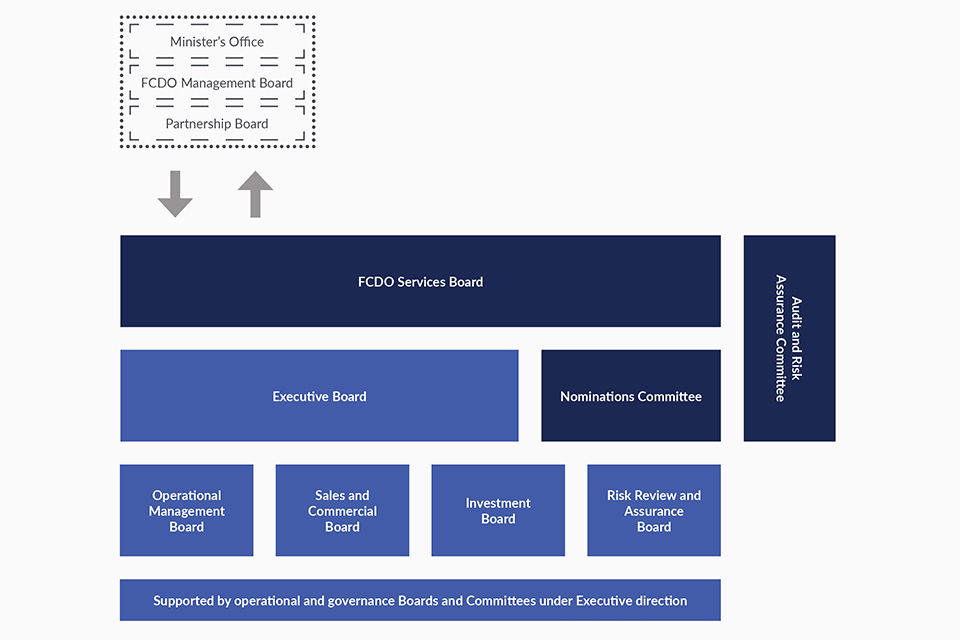

FCDO Services is accountable to the Secretary of State for Foreign, Commonwealth and Development Affairs, via an appointed minister and several boards which govern the organisation.

The Executive Board meets monthly to take ownership of the day-to-day management and strategic leadership, ensuring FCDO Services is following its key strategic aims and policies. The Board receives regular reports detailing financial performance, sales and marketing plans, HR statistics and service delivery issues. This board is accountable to the main FCDO Services Board chaired by Sir Simon Gass. Separately, the Investment Board meets to ensure all spend and investment across the organisation is in line with our strategic goals and required in order to meet our Ministerial and organisational targets. A detailed explanation of our governance and oversight structures are set out in the Accountability Report on page 58.

Assessing our risks

The principal risks faced in achieving our ministerial targets and our corporate objectives are managed proactively within our Risk Management Framework, set out in detail in the Annual Governance Statement (page 65). The framework, and risk landscape of FCDO Services, is supported by a Risk Review and Assurance Board which meets monthly. Additional oversight is provided by the Audit and Risk Assurance Committee, which meets quarterly. Effective identification and management of risk is fundamental to the success of the organisation, this is managed via a register of primary risks, reviewed and updated on a monthly basis.

Risks posed by the impact of COVID-19 upon our operational activities have been managed through careful crisis management and a sound Business Continuity Framework.

Table of performance against ministerial targets.

Investing in our people

The success of our organisation is dependent on our people and they are a trusted and valued part of the diplomatic family. It is our ambition to become a consciously inclusive employer of choice. An updated FCDO Services’ Diversity and Inclusion Strategy 2020-2023 has been agreed with a supporting action plan which incorporates actions in response to issues highlighted during 2020 by our colleagues from diverse groups.

Progress on improving workforce representation in 2020/21 was stalled by recruitment controls applied to manage the financial impact of the pandemic. As a result we saw a marginal dip in female, ethnic minority and LGBT+ representation, although there was an increase in disability representation. Overall, there has been a sustained upward trend since 2016 and we envisage levels returning and improving as external recruitment activities resume and we target campaigns to attract a diverse range of candidates.

We started to enhance outreach initiatives in schools and colleges to increase awareness of FCDO Services as an inclusive employer. This will be expanded as pandemic restrictions are lifted, including encouraging more females into STEM roles. The FCDO Services Executive Board has maintained gender balance. Apprenticeship recruitment was put on hold in 2020 due to the effects of COVID-19, but recruitment is underway for 42 apprentices across 12 schemes to start in September 2021.

We also took positive steps forward this year in developing a job family framework, core role profiles and skills matrices covering the whole business and these are being used to underpin implementation of a skills-based pay structure in 2021/22.

We seek feedback from our staff in a number of ways, with the most measurable being the annual civil service Your Say survey. Overall, the Your Say feedback 2020 was the most positive since becoming a Trading Fund in 2008, with improvements against nine of the ten indices. These included staff engagement of 65% (+2%) and significant improvement in the ‘my manager’ index to 73% (+7%) that exceeded our ministerial target, and leadership and change also rose by 7% to 51%.

The survey included additional questions covering staff mental health and wellbeing. The responses compared favourably with civil service benchmarks and was indicative of the good practices we implemented and the focus on these during the pandemic. There was marginal improvement in bullying, harassment and discrimination feedback and this continues to be a priority area this year. The sustained improvement in Your Say feedback in recent years has been underpinned by our Culture 2020 initiatives, including investment in improving leadership and management capability. In 2020/21 we implemented a new talent management process to identify and develop high potential leaders, and designed a new leadership and management development framework for launch in 2021/22.

Regular updates on our policies and organisational news are shared via a weekly bulletin, and during the COVID-19 period regular Silver Command emails. A weekly wellbeing email containing content supporting physical and mental health has also been introduced, with more information contained on the FCDO Services intranet, The Hub. Staff forums have been made more accessible, with a move towards holding them virtually over MS Teams now happening across the organisation. This allows greater engagement through accessibility tools like subtitles and recording. MS Teams has enabled a much greater flexibility in the workplace and its introduction made the move to Business Continuity during the pandemic much easier for staff.

Board meeting frequency graphic.

-

Nominations Committee meets annually

-

Audit and Risk Assurance Committee meets four times a year

-

FCDO Services Board meets 6 times a year (every other month)

-

Risk Review and Assurance Board, Operational Management Board, Sales and Commercial Board, Investment Board and Executive Board all meet monthly

Business continuity

During the COVID-19 pandemic, our structured and comprehensive Business Continuity approach has enabled us to continue activities which support our delivery to our customers and safeguard our staff. Although at times challenging, due to global pandemic restrictions, our commitment to effective and comprehensive Business Continuity structure has helped us maintain resilience during critical times. We have worked hard across the whole organisation to retain and be recommended for transition to the new 2019 version of ISO 22301, the international standard for Business Continuity. Our continued focus reflects this with ongoing Business Continuity planning, exercising and delivery which underpins our commitment to our staff and customers.

Health and Safety

FCDO Services recognises the importance of keeping our staff, customers, contractors and delivery partners safe in their work. Through safety focussed planning, design and delivery we work to keep all involved in the delivery of our projects, products and services safe. Following the internal organisation restructure, the health and safety function now reports directly to the Chief Operating Officer, strengthening our safety culture and behaviours through direct collaboration between our operations and our leadership.

In response to the challenges of the pandemic we have integrated our COVID-19 controls into our existing safety tools and processes to deliver cohesive safety risk management in our activities. Collaborating across our delivery teams in the UK and overseas, we continue to provide a flexible but effective risk management approach to COVID-19. Safety learning, reporting, audit and inspection have been moved to virtual platforms to effect continuing performance review and development. Our new safety reporting tool facilitates quicker and clearer reporting resulting in improved safety risk management activities.

How staff have been kept informed during the COVID-19 period graphic.

-

FCDO Services intranet

-

Weekly Bulletin

-

Daily Silver Command email

-

The Hub

-

Weekly Wellbeing email

-

Staff Forums

Security

We have further enhanced our security culture through combining our internal security teams. Collaborative working and a dedicated security education function has been established to support continuous aligned improvements. Performance and compliance monitoring and measurement influences both proactive and reactive training, education and communications amongst our workforce. Collaboration between departments during the COVID-19 pandemic helped to create a range of efficient and agile processes including remote eLearning modules to ensure our important security function and training could continue to be delivered.

Further to ongoing ISO 27001 and Cyber Essentials Plus compliance, we have continued to implement the Information Security Strategy. We have continued to expand the full project governance board across the organisation to ensure security and standards are met. We have carried out and established a routine number of checks and tests to ensure risks are reported regularly and, working with colleagues across the organisation, established action plans to reduce any risks and issues found.

Risk management and governance, in conjunction with cyber defence, security health checks and new major systems security initiatives, are contributing to safeguarding our staff, information, technology and other assets proportionate to organisational risk. At the same time, our understanding of threat and opportunity has grown through sustained external engagement with the FCDO and our Partners Across Government.

Personal data

There have been no significant lapses of protective security, or referrals to the Information Commissioner’s Office (ICO) in 2020/21.

Performance in responding to correspondence from the Public

As a public organisation, FCDO Services is subject to the Freedom of Information Act (FOI) which creates a public “right of access” to information held by public authorities. Individuals also have the right to obtain a copy of their personal data held by the organisation as well as other supplementary information, known as a Subject Access Request (SAR). Under this Act, FCDO Services must provide answers to the public when they submit an FOI request. In the last 12 months, FCDO Services received 11 FOI requests and 1 SAR.

Modern slavery

FCDO Services recognises its responsibility to take a robust approach to modern slavery and human trafficking and is absolutely committed to preventing modern slavery in its corporate activities, and to ensuring that its supply chains are free from modern slavery. A full statement can be found on our website.

Ethics

Our Ethical Code sets the standards of behaviour and conduct expected of our people, employees or contractors. They must carry out their duties ethically, with integrity and in strict accordance with our Code, which incorporates the Civil Service Code and covers conduct, declaration of gifts and interests, how we work with our colleagues, raising concerns, dignity at work and how we handle information and work to eradicate unethical practices from our organisation. The Dignity at Work Policy explains how we ensure our people receive fair treatment and respect, no matter their background and enable them to fulfil their potential and avoid discrimination in the workplace.

FCDO Services also has policies in place covering the use of agency workers and best practice on monitoring the services provided to us by suppliers.

Whistleblowing, anticorruption and bribery

FCDO Services is committed to ensuring high standards of conduct in all that it does. These standards are reinforced by the Civil Service Code, Diplomatic Service Regulations (DSR) and Home Service Regulations (HSR). Our Raising a Concern Policy, aligned with the Foreign Commonwealth and Development Office, is designed to make it easy for workers to make disclosures, without fear of retaliation. Details are available for staff on FCDO Services’ intranet site.

Our highlights

In this section we focus on our work with the FCDO and our Partners Across Government. We look back at our achievements over the past year measured against our key strategic objectives: Trusted, Agile and Global.

Trusted

Being a trusted part of government is central to the FCDO Services core offering. Throughout the last 12 months we have continued to serve our customers and partners around the world, maintaining our broad range of critical services at the highest tier of security. Our teams have delivered secure programmes for the MOD of vital importance to national security and finished complex construction programmes in remote parts of the world.

Earlier this year, we supported the FCDO in transporting lifesaving equipment to India to help in the fight against COVID-19.

More than 600 pieces of vital medical equipment, including ventilators and oxygen concentrators were packed at the FCDO Services site near Milton Keynes and shipped to India. Our Logistics teams in the UK and the regional team in India worked collaboratively to ensure the seamless transportation of the equipment. In total, nine airline container loads of supplies, including 495 oxygen concentrators, 120 non-invasive ventilators and 20 manual ventilators were sent.

Vaccinations

Our network has helped deliver the vaccination programme for UK government staff around the world, in some of the most challenging locations. This required quickly setting up a completely new supply chain which could deliver the vaccines to over 140 overseas Posts while maintaining the correct temperature with a collective team effort involving staff in the UK and at Post. The complication of a volcanic eruption in Guatemala and the disruption that caused to the planned route did not stop our team delivering the supplies to our colleagues and dependents in diplomatic Missions across the globe. As the financial year drew to a close, our staff had either delivered or had detailed plans in place to deliver 93% of the total rollout of vaccines.

Live services

Our live services have been maintained, enhancing the government’s capabilities at Secret and on bespoke applications. We have migrated government departments onto new digital platforms and delivered the rollout of Microsoft 365 for the FCDO, helping connect our Posts around the world when communication was needed most. The support our technical teams have provided during this period, including the monitoring of the FCDO digital platform, has helped deliver the use of MS Teams, which has been critical for our work. During the merger of the FCO and DfID, we worked to join the two legacy departments’ IT systems, helping to bring the organisation together as one.

Sensitivity Review Service

Our Sensitivity Review Service (featured in-depth in last year’s report) is increasing the pace on FCDO digital records for transfer to The National Archives. The team has also started implementing solutions for a variety of other legacy microform media requiring digitisation, in addition to other digital file formats. The reviewers are increasingly helped by our assistive technology, using Artificial Intelligence techniques to speed up the process of sensitivity review, which is vital to deal efficiently with the large volume of digital records.

We continue to work with specialist companies and organisations within our “Cicero Trusted Community” to enhance our efficiency technologies. We have also completed a Digital Sensitivity Review feasibility study with HM Treasury in order to demonstrate the application of the service to them, and to other government departments.

UK NACE

As it celebrates its 75th year, UK NACE, the National Technical Authority (NTA) for technical security, has performed over 125 inspections and evaluations of government and industry sites. This has included eight major building projects, seven of which were overseas. UK NACE has strengthened its place in the UK security community by playing a central role alongside the other NTAs - the CPNI and the NCSC - in the Government Security Group, which develops policies, strategies and advice for the government.

The Government Security Function Strategy launched this year, setting out a five-year plan. UK NACE will provide expertise, advice and services to government departments, agencies and Arm’s Length Bodies. UK NACE already works with around 100 different organisations across government and industry. In September 2020, UK NACE was added to Schedule 4 of the Investigatory Powers Act 2016. It joins a range of security agencies in the authority to gain access to certain types of communications data in the interests of national security.

While the very nature of its work demands a covert approach, this year UK NACE has taken deliberate steps to raise its own profile to encourage greater understanding of the work it does across government and to demonstrate the benefit it provides to our partners in the Five Eyes community. Promoting news and stories which demonstrate the strength, expertise and broad capabilities of UK NACE, will also act as a deterrent to those who wish to attack the UK’s critical infrastructure.

A new website www.uknace.gov.uk was created and went live in March 2021. The site contains information about its history, operations and training academy and helps visitors understand the full scope of the vital work it does. In addition, UK NACE has secured a page on the gov.uk site and launched a new LinkedIn page to broaden awareness and engage with the security community more widely.

A new FCDO Services website

Case Study

On 23 March 2021 we launched our new corporate website.

The site is designed to be easy to use and contains more information about us.

We developed our new website because we became FCDO Services in September 2020. We wanted to use our new brand to give our website a fresh, contemporary look. Plus, we knew customers were not using our old website.

What did we do?

We made it easier to find information about our products and how we work. We talk about our services clearly, and showcase key case studies and projects we’ve been involved in and how we’ve helped our customers and Partners Across Government. Our website now contains more detail about our leadership, regional structure and what makes our organisation unique.

UK NACE, the National Technical Authority for technical security, is a key part of FCDO Services. For the first time in their 75 year history, they now have a dedicated space to explain the important work they do and publish their latest news. This allows them to reach more people interested in technical security. In order to support our global customers and partners, our overseas work sits within a regional structure. We’ve created new pages to explain the work our regional teams do and outline how they operate.

We designed the website with accessibility and mobile devices as our top priority. We want to be sure that however you use or access our website, you can easily find what you need. This included disposing of PDFs and simplifying certain parts of the website.

“I am excited to launch our brand new website, a really collaborative effort from teams across the organisation. It showcases the range of work we do and our new brand, building greater awareness of our organisation. It’s also hosted and supported by our own secure digital teams.”

Danny Payne CMG

Chief Executive Officer, FCDO Services

IT Rapid Response Support

Case Study

When the Coronavirus pandemic hit at the start of last year, the Foreign, Commonwealth and Development Office (FCDO) needed to urgently bolster communications systems to support their global consular response.

Coronavirus restrictions started to be rolled out in the UK and on 23 March 2020 the first official lockdown began, with the UK Government’s message to the population to stay at home. This provided a significant number of challenges for the FCDO at a time when consular support across the globe was in higher need than ever. We were commissioned to provide vital IT support so that FCDO colleagues could provide critical crisis response.

Vital communications support

As other countries also began going into lockdown, we needed to find a way for consular staff at our centres in Ottawa and Malaga to work from home and take calls while Posts were closed. The right kind of equipment was required, this wasn’t simply a case of ordering from an online supplier due to the security requirements of the system. Working closely with our supply chain we supplied headsets and phones to a number of Posts, and made needed changes to the phone system to reroute inbound and outbound calls.

One of our critical challenges was working to a tight timescale to get the equipment out to staff in time while shipping restrictions were in place. Thanks to the tireless work of our logistics team, delivery was successful, swift and efficient.

Network support

Additional capacity to the IT network was also required to support working from home globally. We worked with the FCDO to ensure staff could log into the VPN by assisting in implementing additional network capacity and Firewall changes. This work was delivered within 3 weeks with our teams working extra hours to ensure limited disruption to business as usual.

We also implemented bespoke changes to enable additional conferencing applications for the FCDO, this enabled its key officials to attend daily No.10 Downing Street calls and important international conferences remotely.

Customer response

Key to the success of this work was our agility, our speed of response, and collaboration with our supply chain. These behaviours enabled us to bolster the IT and comms systems, supporting the FCDO’s crisis response.

“When FCDO needed to embrace remote working globally as COVID-19 restrictions came into force, FCDO Services provided trusted logistical support to distribute essential IT equipment quickly and, working in partnership with other suppliers, enabled speedy changes to infrastructure, increasing capacity for virtual meetings and hybrid working practices.”

Head of IT Delivery

FCDO

HYDRA: Critical National Infrastructure upgrades to Remote Radar Heads

Case Study

The RAF needed to install new state of the art communications buildings, radar towers and bespoke perimeter security to upgrade three of their radar sites.

In July 2017, FCDO Services sought to develop a new concept for UK Air Defence Radar sites: a fully secure, remotely monitored Air Defence radar site footprint. Project Tartarus, as it became known, was the first of its kind.

Due to the successful completion of Tartarus, in June 2019 we were commissioned to deliver three new Remote Radar Head (RRH) rationalisation projects under the banner of Programme HYDRA. The sites included RRH Buchan (Aberdeenshire), RRH Brizlee Wood (Northumbria) and RRH Benbecula (Outer Hebrides). We took on the role of Principal Contractor, Principal Designer and Project Management specialist to deliver these works.

COVID-19 challenges

Due to the emerging threat of the COVID-19 pandemic in March 2020, HYDRA Benbecula was deferred until 2021. However, HYDRA Buchan and Brizlee Wood saw just a three week pause for COVID-19 risk mitigation planning prior to recommencing works at pace.

We used this time to create bespoke, comprehensive Site Operating Procedures and Risk Management Strategies. These included the sole-hire use of two hotels for our teams, and specialist COVID-19 nurse-led weekly testing of all personnel involved. We operated in isolated ‘bubbles’ away from the rural local communities to prevent any risk of infection and transmission.

The delivery phase

Construction work commenced in April 2020, and with robust COVID-19 mitigations in place we could focus on delivering phase one of this programme in a necessarily tight timescale to meet RAF requirements.

As Principal Designer, we provided a small, highly-skilled core team of specialist designers including architects, structural engineers, mechanical & electrical engineers and security engineers. The team created the concept designs for the sites, and led on developing detailed designs ensuring cost, quality and security standards were robustly maintained during the design and build phases.

In our Principal Contractor role we were the lead delivery agent for the Client for all secure infrastructure, radar and radome move, and construction works on site. Through our frameworks, we tendered and procured all sub-contractors, and worked closely with RAF and MOD specialist teams to support their radar and communications-related activities.

We coordinated the construction phase, with a Senior Site Manager on-site, ensuring the works ran smoothly and to schedule. We managed every aspect of the projects including procurement, finances, project reporting, risks and issues, COVID-19 mitigation measures, handover documentation and through-life Health and Safety support.

Despite the challenges posed by the pandemic, the projects at RRH Buchan and Brizlee Wood were both completed to the time and quality parameters set, with zero COVID-19 infection transmission at either site or within the project personnel team involved. Our team worked diligently and collaboratively to ensure both projects were delivered smoothly and to the satisfaction of our customer.

“While numerous other programmes stalled in 2020 as a consequence of COVID-19, FCDO Services adopted class-leading workarounds to deliver Programme HYDRA both to schedule and exactly in line with user requirements; the results are striking.”

Group Captain Iain Lunan

RAF

Global deployment of COVID-19 vaccines for HMG

Focus On

With staff at 182 Posts around the world, covering 68 different UK government agencies, an ambitious international vaccine rollout programme was designed to run in sequence with the NHS vaccination timetable. The FCDO approached FCDO Services in November 2020 to provide assistance with the planning and delivery.

Our operational teams in logistics and regions, both in the UK and abroad, joined the vaccination taskforce. They helped develop plans to deploy the vaccine to the FCDO and other government colleagues across the globe.

A questionnaire was sent to Posts to identify how many vaccines were required based on the age and health demographic at the Post. The total requirement was approximately 64,000 doses. We worked closely with the Ministry of Defence (MOD), with FCDO Services delivering 70% of the doses and the MOD delivering 30%.

Two phase approach

The UK’s overseas network includes many remote and vulnerable Posts. Disruption to delivery is always built into our planning, and prompted a different approach to the vaccination distribution. The rollout had to be delivered in line with the UK’s Joint Committee on Vaccination and Immunisation (JCVI) programme, with the same priority groups. However, to minimise the potential impact of travel disruption, two doses were shipped simultaneously to ensure each colleague was guaranteed to receive full coverage.

This happened in two phases. Phase one included both doses of the vaccination for the over 50s and those classed as clinically at risk. Phase two included the two doses for the remaining personnel under 50.

The rollout of the vaccines started on 1 March 2021. In the first week we tested the rollout process on just four Posts. After successful delivery in week one, we ramped the programme up to 18 Posts in the following week. By 12 April 2021, the team had planned the delivery of 91% of the total number of vaccines, equating to more than 22,000 overseas staff in some of the most remote locations in the world.

A variety of challenges to navigate

Along with the remote nature of some of the Posts overseas, there have been other challenges to overcome along the way. Differing time zones required our teams to work round the clock to ensure successful delivery to all locations. We adapted by setting up shift patterns to ensure staff were able to rotate. The constantly changing environment affected the planning and operations of the various shipments. Factors included COVID-19 levels, Red Listed countries, Frankfurt logistics hub usage, Resource track and trace, VISA and border restrictions and flight reliability.

In addition, we had to ensure we could effectively support the temperature controlled vaccines in transit. Appropriate storage and continuous temperature monitoring was in place, taking into consideration the wide variety of climates we had to travel through.

Ashgabat

Temperatures in Ashgabat, Turkmenistan in April reach the mid-30s, and logistics options were very limited to this location, so delivery required careful planning. The vaccines were needed urgently due to the rapidly rising COVID-19 infection rates in the country.

There was a chartered flight available to Türkmenabat airport, however, given the uncertainties regarding this flight we decided to take a different approach, even though this required more planning and involved more people. It turned out to be a good decision as the chartered flight was cancelled at the last minute.

On 8 April one of our Queen’s Messengers flew to Tashkent, via Istanbul with the vaccinations. They arrived in Tashkent on 9 April at 0100 local time, where they were received by the Regional Overseas Security Manager (ROSM). The ROSM secured the vaccines until they were handed over to British Embassy (BE) Tashkent Reps for onward journey via car and train to Farab on the Uzbek/Türkmenabat border.

At the border the reps from BE Tashkent were met by reps from BE Ashgabat. From the border the vaccines were taken via a flight from Türkmenabat to Ashgabat, and were successfully delivered and stored with the medical provider on 10 April.

Our expertise and experience in global logistics enabled us to navigate the challenges both in the planning and delivery stages of the rollout. Staff at Post were able to provide on the ground support, and their local knowledge was crucial to the success of this programme. Collaboration has been crucial throughout. Our teams based in the UK, at the Frankfurt logistics hub and in region worked tirelessly, putting in extra hours and working night shifts to ensure that Posts received the vaccinations.

The total time taken to deliver the vaccinations from start to finish was three months and involved more than 100 staff across FCDO Services.

“I want to say a huge thanks to everyone in the team that contributed. It is hard to express quite how much difference the vaccines are making here. The boost that this programme is bringing – and the palpable sense of the UK Government valuing its staff – is hard to put into words.”

Deputy Head of Mission (DHM)

Brasilia

“I want to send my personal thanks to all of you for what has been a remarkable programme of work. I have followed the progress of the vaccination programme closely. Delivering the COVID-19 vaccine to over 200 Posts and making vaccines available to more than 30,000 FCDO colleagues and dependents across the globe is a huge achievement.”

Sir Philip Barton

Permanent Under-Secretary, FCDO

Agile

Business Continuity

The last 12 months have underlined the ability of FCDO Services to adapt to meet the needs of our customers, alongside the determination of our staff in delivering services in challenging circumstances.

With travel restrictions limiting the ability for some of our teams to work as normal, it was imperative that the customers continued to have access to our expertise and guidance. For our Technical Works Officers and our Secure Technical Services Officers who are usually based overseas, a change of approach was needed.

As part of our response to restrictions on overseas work we focused on increasing our activity in engineering and security works for our UK based clients such as the MOD. This enabled our staff to continue working and using their skills whilst they were unable to travel overseas.

Delivering the support and assistance they usually give faceto-face was a new challenge, and required a new way of working. They quickly developed a new set of protocols enabling them to provide risk assistance, estates and facilities advice, including online ‘tool talk’ sessions with Posts around the world.

EU Exit

Planning ahead is built into the culture of FCDO Services, exemplified in the critical support our officers provided to the UK’s negotiation teams and our FCDO colleagues during the trade negotiations with the European Union.

As part of our Business Continuity plans, established after the EU Referendum in 2016, we made a long term plan on how to prepare for the changes ahead. This included assessing the potential impact on the way we operate and we worked tirelessly to predict multiple scenarios. All projects in EU countries were factored into the planning process, ensuring we were able to deliver all planned works.

We established a dedicated logistics hub in Frankfurt to mitigate any potential issues with border access. The hub was up and running by the start of the financial year in April 2020, and we have delivered at least 50% of our European work through this channel. The team in Berlin have been invaluable.

As a key member of the FCDO’s D20 group, we worked very closely with our partners on the planning process throughout the last year. Being embedded within the wider FCDO team enabled us to share any operational concerns in meetings, and work collaboratively on solutions.

As last year progressed we merged the EU Exit planning with Silver Command to make sure it went through the Transition Command process (read more about Silver Command on page 38). Merging it into the same risk preparation channel as COVID-19, meant we could assess everything in its totality in order to pick up on any issues.

In the run up to the end of December 2020, priority work in the EU area was planned well in advance of the end of the transition period, ensuring a smooth transition - whatever the outcome of the negotiations. Our teams in Brussels and across Europe worked collectively with the Regional Hub, the FCDO and our Partners Across Government.

The meticulous planning meant that the transition out of the EU went off without any issues, and was a tremendous success. We continue to support the FCDO’s ambition to project a Global Britain which is ambitious, self-confident and global in its outlook. Read more about Global Britain on page 36 in our case study about a new Mission in the Maldives. We recognise the hard work of the many people across our organisation involved in the extremely diligent and cautious preparation over the last four years. It is down to not just the work of one team, but a collaborative effort, that we have successfully adapted and developed our processes in response to the changing circumstances throughout the transition period.

UKVI

Despite travel into and out of the UK reducing dramatically, the need for UK Visa and Immigration (UKVI) to maintain its systems was critical. The technology capturing biometric data of visa applicants wanting to travel to the UK relies on very secure passes produced by FCDO Services, which are sent around the world. Maintaining a supply of these passes to the Home Office was essential to the continued operation of the technology, and new processes and logistical operations were developed, involving multiple parts of our organisation. Working closely with colleagues in other government departments, including the MOD, meant we maintained supply and the integrity of the system.

Logistics

Our logistics operation has understandably had an exceptionally busy year. Staff have been on our secure sites throughout the last 12 months, running the diplomatic bag and Queen’s Messenger services alongside the private mail service for the FCDO, which has been so vital in keeping our colleagues in contact with their loved ones at home.

Multi-language translation for HGV app

Case Study

After the UK’s exit from the EU, the Cabinet Office identified the need to create an app for Heavy Goods Vehicle (HGV) drivers. This app would deliver clear and easy to follow steps on the new rules for entering and leaving the UK.

In October 2020, the Cabinet Office commissioned us to work on the translations for their HGV app. The multiple-choice app gives a step by step guide on entering and leaving the UK. The app needed to be translated into eight languages: Bulgarian, Dutch, French, German, Polish, Romanian, Spanish and Welsh.

We translated the English and reviewed the text on a ‘pre-live’ site to make sure it made sense in context. The app went live in January 2021, and we have since supported the team with small tweaks to align with changes in the law, feedback from stakeholders and changing COVID-19 guidelines.

Project success

Two key actions were crucial to producing quick, accurate translations.

First, we recommended that the English content for the app was finalised and signed off before we started translating. This meant the Cabinet Office had to set an early deadline for the wording to be completed, however it saved time and money later in the project.

The second was reviewing translations in a ‘pre live’ site. This meant our translators were able to work with the wording in situ, ensuring accuracy and clarity for drivers.

We worked closely and collaboratively with the Cabinet Office throughout the process. We provided a single point of contact to ensure clear communication, transparency and ultimately the smooth delivery of this project.

The main challenge of this project was the tight deadline we were working to, but we completed the work on time and to great satisfaction from the Project Team at the Cabinet Office.

“On behalf of the Cabinet Office, Future Borders and the C-HGV team, I would like to pass on our gratitude to you and your team for the support you have given to the Check-an-HGV service. Your particular unwavering commitment and dynamic response to meet all of our demands, has been recognised by the team as exceptional. Your reliable and quick turnaround reduced risk to delivery, and created a high level of trust between departments and contributed to the success of the Check-an-HGV service.”

Eliza Beattle

Deputy Director, Project Director for C-HGV and Supplier Chain Visibility

Reconfiguration of the King Charles Street reception

Case Study

As the home of the Foreign, Commonwealth and Development Office (FCDO), King Charles Street welcomes hundreds of visitors and guests on a daily basis.

In its previous state, the King Charles Street reception area was deemed as feeling cramped, and in need of significant improvement.

The FCDO initiated The King Charles Street Reception Refurbishment Project to address these issues. And, in 2018, they commissioned FCDO Services to deliver this project. Our role was to design a new space to welcome visitors to the FCDO, and project manage the works which includes managing all contractors, and supervising the construction activities on site.

The original reception was on the ground floor, with guests entering and exiting via the same door. The new reception is spread over two floors with guests entering from King Charles Street, climbing a new bespoke staircase to the new reception located on the first floor.

The works involve a full strip-out of the existing space, installation of structural elements including a new staircase, construction of new bathroom facilities, decorating and furniture and fittings and managing the installation of all necessary mechanical and electrical infrastructure. We oversaw the construction of a temporary reception for use while works are ongoing, ensuring business as usual for anyone visiting King Charles Street.

Project Challenges

After the design phase, the works commenced on site in December 2019 but were put on hold in January 2020 due to planning limitations. King Charles Street’s Grade I listing adds to the complexity of this project, and stakeholder engagement and liaison with all key parties is crucial.

Throughout 2020 the team managed the works site and temporary King Charles Street reception, as well as working closely with the FCDO, Heritage England and Westminster City Council successfully managing the re-design works required to obtain all necessary planning approvals. Works recommenced in January 2021 and are planned to complete in Summer 2021.

Logistics

Focus On

FCDO Services’ logistics service ensures diplomatic mail and materials get where they need to be, when they need to be there – securely and without compromise.

Our Service

We are the only secure overseas delivery service for UK government departments. Our Diplomatic Bag Service transports diplomatic mail at two levels of security: accompanied (ADB) and unaccompanied (UDB).

The Queen’s Messengers escort Accompanied Diplomatic Bags to Posts globally and ensure their safe arrival. The rich history of the Queen’s Messenger Service dates back over 800 years, and whilst the modes of transport have changed, its core purpose has not. A more detailed explanation of the Queen’s Messengers is given on the new FCDO Services website: fcdoservices.gov.uk.

We also transport private mail to staff based at Post, making it more affordable for the overseas network and helping them keep in contact with their families and friends in the UK.

When the pandemic hit, it came with international border closures and travel bans for many countries. With country guidelines changing regularly, it was extremely challenging to get mail to Post.

What did we do?

The Logistics team continued working on-site in the UK throughout the pandemic to ensure the service continued, adhering to all necessary government guidelines in place.

We supported Posts overseas by ensuring business critical and urgent deliveries arrived safely. We also provided an Accompanied Bag Service across government within the UK, supporting our government colleagues with their vital logistics requirements.

“Despite serious disruption caused by the Pandemic, FCDO Services has managed to keep the Accompanied and Unaccompanied Diplomatic Bag Services running. These provide a vital link to the UK for our Posts and staff overseas and FCDO Services should be congratulated on what it has managed to achieve in very difficult circumstances.”

Head of Knowledge Management Department

Information and Digital Directorate

Private Mail

We continued to deliver private mail to staff around the world throughout the pandemic. Demand for our overseas Private Mail Service rose by an unprecedented 30% in the run up to Christmas last year. Our on-site team worked hard to make sure staff isolated at Posts across the globe still had that vital connection with family and friends in the UK.

“At this time, we feel very far away from family and friends in the UK. The service you provide connects us to our loved ones, you can’t put a price on that.” Her Majesty’s Consul and Consular Regional Operations Manager for Greece and Cyprus, British Embassy, Athens, FCDO

Helpdesk

During this uncertain period, our logistics helpdesk kept longer hours to support customers, as volume increased, and timely communication was crucial during this time.

Our Logistics Helpdesk Survey conducted in January 2021 demonstrated the positive impact the team had during the pandemic. The average satisfaction score for the Logistics Helpdesk remained significantly above the ministerial target, and there was a substantial increase in Helpdesk activity.

We measure our customer experience against our 3Rs framework: Reliability, Responsiveness and Relationships. The survey shows that customers have been pleased with the way that we have handled COVID-19 impacts through the Helpdesk and see the service as a lifeline during this time. Feedback from the survey showed that the professionalism of our staff was the highest scoring question.

“I have always experienced extremely prompt communications whenever I have contacted this service. If the person in question was not sure of the answer to my query, they would go and research and come back with a solution in a timely fashion.”

Country Director/TCM

Oman, British Council

Building on 2020/21

Our Logistics team has continued to support the FCDO in the pandemic effort, working round the clock to ship ventilators to India, and continuing to support the global vaccination programme.

Innovation

Focus On

FCDO Services is on a mission to drive and develop a culture of innovation in the organisation. We recognise that innovation does not simply ‘happen’ but needs to be nurtured and grown. Our newly created Digital and Innovation Office (DIO) which encompasses: Innovation, Digital Sensitivity Review Service, information security and cyber security and UK NACE will enable us to pursue this goal.

We are aligned with the UK government’s National Data Strategy which aims to unlock the power of data in order to drive growth within the digital sector and across the economy.

Key areas of focus for DIO are:

-

Capture of data from remote locations to allow monitoring, with consolidated data fusion analytics to underpin decision making and fidelity of virtual environments;

-

Automated logistics and prognostics to drive efficient supply chains and maintenance of the diplomatic platform;

-

Carbon neutral technologies – monitoring (linking to data fusion) and Global Utility Management;

-

Micro-grid, local power management, renewables (PV, wind, micro-hydro, thermal);

-

Remote working and virtual presence technologies to support new agile ways of working along with remote maintenance support

Work throughout the pandemic

We are proud to be a government organisation which has its own in-house manufacturing and production department. This has enabled our teams to continue their work and create novel solutions to business problems despite restrictions brought about by the pandemic.

Unique solutions

Helping to maintain the security of the global overseas estate is a key priority for FCDO Services, and our Innovation team has continued the long history of creating specialist and bespoke security solutions and systems for our customers. This can be anything from bespoke software development to rapid prototype capabilities, and our close relationship with user communities allows us to quickly develop solutions which work for our partners.

Customers engage our teams because the services we provide simply don’t exist in the commercial space. Our security cleared staff and our extensive knowledge of overseas operations allows us to create solutions by reaching into specialist vendors and modifying and adapting unique security applications. We have a dedicated team whose specialist knowledge and tools allow them to produce prototypes and develop new solutions for problems like these in an efficient and cost effective way.

We use a process called Design Thinking, and Agile methodologies to convert a customer problem into engineered design solutions. We’re used to supporting Proof of Concepts, which are then refined, built into internal pilots and then designed into a final prototype, which may not always be the solution which was predicted at the beginning of the process.

Support from beginning to end

We have the ability to tap in to live in-service performance and make engineering interventions and adjustments to refine our product’s capabilities. This is as true in software and digital infrastructure as it is in the physical products we manufacture. We take a collaborative approach with subject matter experts and in academia, whether with our Digital Sensitivity Review Service (see page 18) or UK NACE’s research see 2019/20 Annual Report and Accounts.

FCDO Services has the unique ability to provide a service from the beginning to the end. We can go from design, to rollout to global support. Our customers often know the threats they face, but in an ever more complex world with a variety of fluid risks, we are able to help build engineering solutions which protect their most secure assets.

Our Innovation team can be contacted via the FCDO Services website: www.fcdoservices.gov.uk.

Global

FCDO Services’ core purpose is to provide a range of integrated, secure services worldwide to support diplomacy, development and defence for the UK Government. We also offer services and expert advice to foreign governments and international organisations closely linked to the UK.

Delivering our services

Maintaining the service we provide to our customers and partners has been one of our main priorities, alongside the safety of our teams around the world who carry out vital work for our colleagues across government. Across the four regions, the impact of COVID-19 could have halted all service operations. However, collectively, the teams established a new strategy and ways of working to ensure Posts were predominantly supported remotely, with any opportunities for delivery visits taken whenever possible.

This new approach ensured that Base Posts (Posts where we are resident around the world) continued to receive an almost normal service with our teams observing appropriate COVID-19 mitigations, including staggered shift patterns and alternate working days. For our remote Posts, an extensive outreach service was provided by the Estates and Customer contact team ensuring that questions and requirements were answered and addressed. For example, in the Americas, our teams went the extra mile making visits to various Posts (including New York, Ottawa, Santiago and Quito) whilst having to endure long but necessary self-isolation periods. Our teams have looked to add additional value and their contribution to the Washington Project has been important in ensuring the IT and other installations have kept pace with plans.

Global partnerships

Our relationship with our international partners has gone from strength to strength. With Global Affairs Canada, we have been actively working on numerous joint projects delivering outcomes in difficult places in difficult circumstances to achieve mutual benefits. Our joint collaborative approach will continue and with more vigour once the fluctuating restrictions from COVID-19 are relaxed. Our team in Australia have been working closely with the Department of Foreign Affairs and Trade (DFAT) (see case study on page 34) with further work in development.

Supporting the consular effort overseas in a time of crisis is something FCDO Services teams are well prepared for. Our teams came together to respond quickly in support of the FCDO following the devastating explosion which killed 200 people in Beirut in August 2020 (see case study on page 35). Our teams quickly made areas safe and carried out inspections to damaged properties, including the embassy. We’ve continued to deliver new Missions and embassies for the UK government, including the completion of the Bangkok embassy in Thailand (as seen in last year’s report) and the final GB12 portfolio of new Missions were completed in March 2021, including Malé in the Maldives.

Perimeter upgrade for the Australian High Commission in Pretoria

Case Study

The Australian Department of Foreign Affairs and Trade (DFAT) needed a perimeter security upgrade at their High Commission in Pretoria, South Africa.

FCDO Services has undertaken projects for DFAT since our earliest days as a Trading Fund, delivering works of varying size and scope, for this valued and trusted ‘Five Eyes’ partner.

Our Asia-Pacific hub was approached in February 2020 with a requirement to replace the perimeter infrastructure at the Australian High Commission in Pretoria. A site visit was quickly arranged, where scopes of work and plans were then passed for review and developed by our team of engineers.

The construction process was coordinated by our UK-based Project Manager, inviting local companies to bid in a competitive tender, with DFAT’s Project Director in Canberra acting as ultimate approver. Australian building codes and in-house security standards were incorporated into designs and specifications, to ensure full compliance with DFAT’s technical and security requirements.

The project was reviewed at preagreed milestones, with the help of our team on the ground in Pretoria communicating with our teams in London and Canberra.

Through dynamic collaboration of expert personnel in Africa, Asia-Pacific and the UK, FCDO Services delivered a robust, long-term solution for our valued partners at DFAT.

Impact of COVID-19

The worsening COVID-19 situation in South Africa presented unforeseen complications to the project. These challenges were handled by various teams working together, adjusting timelines and resetting project milestones, all in consultation with the DFAT Project Director in Canberra. This responsiveness was central to achieving timely delivery, minimising delays and delivering full completion and handover in December 2020.

“The complexities of working remotely, as well as in a COVID-19 environment, created a number of challenges which the FCDO Services team along with local support were able to manage to a successful completion. The project management team were responsive, providing excellent advice and recommendations. The team was able to drive the project to a successful conclusion encompassing all of the project deliverables including time, cost and quality. I look forward to working with FCDO Services to deliver more projects in the future.”

Project Manager

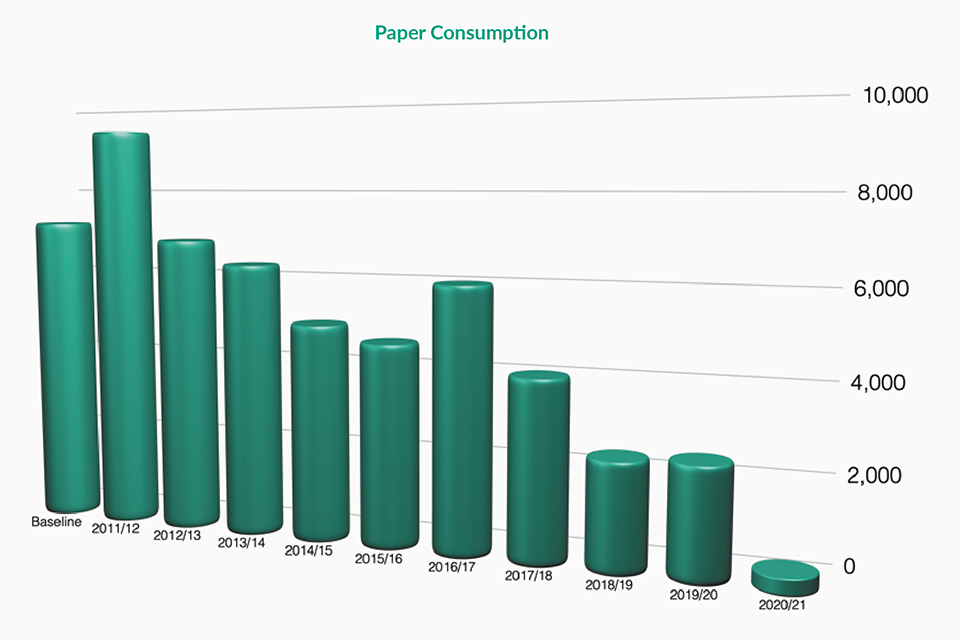

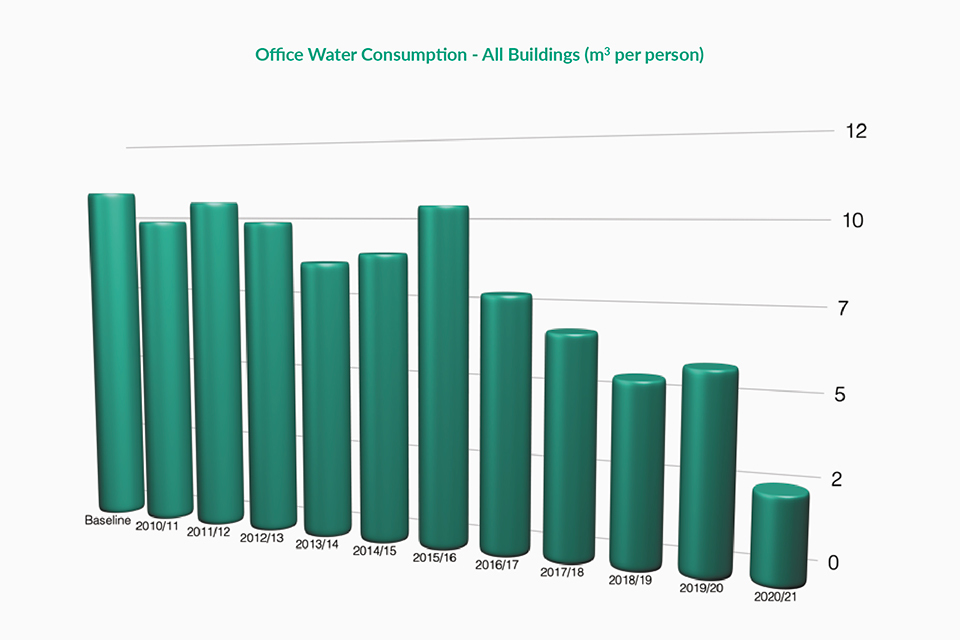

Australian Department of Foreign Affairs and Trade (DFAT), Pretoria