Evaluation of the Cyber Runway programme

Published 4 August 2023

1. Executive summary

The Cyber Runway programme was initially funded by the Department for Digital, Culture, Media and Sport (DCMS) in 2021. It is delivered by Plexal as a bootcamp and accelerator programme for UK cyber sector businesses at different stages of the business lifecycle with three streams: Launch, Grow and Scale.

Launch: support to individuals to develop relevant entrepreneurial skills, meet potential co-founders, and establish new cyber businesses.

Grow: support to businesses to help them grow, access funding, and achieve commercial success.

Scale: support to help businesses grow rapidly in the UK and internationally.

The programme brought together three separate DCMS funded accelerators programmes - HutZero, Cyber101 and TechNation Cyber - into one single branded programme. This was enacted to enable a clearer application process for cyber companies; to deconflict the programmes and to maximise synergies and pathways between the cohorts.

In comparison to other challenge-based accelerator programmes the focus of Cyber Runway is providing entrepreneurs and cyber companies with the holistic skills, connections and development to launch, grow and scale their businesses. Cyber Runway also focuses on supporting both demographic and geographic diversity in the UK cyber sector to drive economic growth across the country.

The cohorts across the three streams demonstrated the diversity of the UK cyber sector with 40% of Launch, 42% of Grow and 65% of Scale companies having female co-founders and 55% of Launch, 55% of Grow and 40% of Scale having ethnic minority co-founders.

This evaluation report relates to the Cyber Runway programme in its initial year (2021/22).

Conclusions and recommendations against each of the core evaluation questions are outlined below.

1.1 Process evaluation

Was the programme delivered as intended? / How could it be improved?

The programme delivered the three phases of support as outlined in the contract between DCMS and Plexal. However, whilst there was sufficient demand for the Launch stream and overdemand for the Grow stream there was less demand for Scale. The higher numbers for Grow meant less tailored support was provided compared to Launch and Scale. This is reflected in participant survey feedback where more respondents in the Grow stream were dissatisfied with support in areas such as development of a personalised growth plan and indicated that the support provided was too general.

Recommendation 1:

We recommend that any future programme (1) limits Grow stream participants to a similar number as in Launch and Scale (approximately 20) or (2) re-designs this stream to provide more tailored support for participants.

While the programme was designed to be delivered virtually, it was impacted by COVID-19 which further limited the opportunity for face-to-face interaction and events. While virtual delivery generally worked well, participants felt they would have benefitted from face-to-face support which can be more intuitive, responsive, and personal. Participants emphasised that the opportunity to network with other businesses and with the mentors and experts provided them with the chance to exchange ideas and speak with those in similar positions.

What worked well, or less well, for whom and why? / Were there any unexpected or unintended issues in the delivery of the programme?

Several areas were identified as working well, including:

- the application process, which was assessed to be straightforward by participants

- the provision of opportunities for participants to engage with key industry figures and entrepreneurs (although more face-to-face needed – see below)

- meeting with a mentor and getting tailored advice from experts one-on-one

- the reporting arrangements – DCMS and the participating project teams were satisfied with the reporting arrangements, specifically monthly logframe reports which included data against the contractual key performance indicators (KPIs)

Several areas for development were identified, including the provision of:

- more mentoring and one-to-one support, including ensuring there is a consistent provision of quality mentoring and tutoring

- more access to potential investors and introductions to regional cyber hubs

- more face-to-face meetings with the programme team as well as the coaches and mentors

- an increased focus on internationalisation, and increased involvement of international partners

- greater clarity on timetables and content of each sprint, masterclass, or meeting

- more access to government stakeholders, to help businesses expand their network in the public sector

- better quality of information and planning in advance of mentor sessions, to help mentors better tailor their support

In relation to monitoring and data collection:

- targets were set for output measures in the Theory of Change (ToC), however the outcomes do not have targets and these should be developed

- Plexal collected data on the programme participants at the beginning and at the end of the programme via a participant survey, however this was not completed by all participants

Recommendation 2: we recommend that DCMS consider developing outcome targets for the programme with the delivery providers.

Progress should then be reported against these targets on a regular basis and should cover:

- enhanced business viability and short term investment (value of investments raised per company and total per cohort)

- increase in company revenue

- increase in productivity / revenue / profit

- self-reported changes in business knowledge / skills (both technical and business related)

- increased confidence, aspiration, and resilience to form and run businesses (such as using any business skills developed)

- additional measures to be developed for the individual Launch, Grow and Scale streams

Recommendation 3: we recommend a standardised monitoring template is provided by DCMS that includes the contractual KPIs, deadlines for delivery / achievement, and a RAG rating system to easily identify if KPIs and milestones are behind schedule.[footnote 1] These should be completed monthly by the delivery organisation and returned to DCMS, if possible, via an online system to make it efficient to complete and centrally recorded.

What were the benefits/disadvantages of the programme being delivered virtually? What can be learned from the delivery methods used?

The programme was more accessible to those outside of the South-East of England due to it being delivered virtually. However, this also limited participants’ ability to network effectively.

Participants also felt they did not develop relationships with the programme leaders and the project team as well as they could have done face-to-face, while some also felt overloaded with material because of the online learning environment.

Recommendation 4: we recommend that any new programme considers if there can be a higher number of in-person networking events / opportunities designed specifically to build relationships between the programme leaders and mentors and participants.

How knowledgeable were trainers and mentors? How was their teaching? Did they have the right information to support businesses?

Most participants surveyed (80%, n=20) felt that the business knowledge of trainers and mentors was either ‘helpful’ or ‘very helpful’ in providing the right information and supporting firms in the programme.

However qualitative feedback was mixed, as while some highlighted the “quality of mentors and masterclasses was really good” others were less satisfied and felt “none of the team had substantial experience in the start-up world”.

Recommendation 5: we recommend the delivery partner collects ongoing feedback on the coaches, tutors, and delivery partners to ensure that participants are satisfied with the support provided and the programme is sufficiently tailored to their cyber security company and context.

Was the expected investment in time and resources for Cyber Runway manageable for businesses? Was this a fair investment for the benefit received?

Participant survey respondents felt the time and resources dedicated to the Cyber Runway programme was manageable and beneficial in helping them meet their objectives. However, this result may only be indicative as the sample size is small. One survey respondent stated they were unable to match the expected time commitment as event dates were often announced at short notice.

How did external factors influence the delivery and functioning of the programme?

The main external factor influencing programme delivery was COVID-19 (see above). However, another key factor was the budget available which limited the number and quality of speakers, often relying on volunteers. Therefore, the budget should be sufficient to cover these costs in the future.

1.2 KPI evaluation

Monitoring data was collated in logframe reports which included all KPIs specified in the contract between DCMS and Cyber Runway. The logframes include all ToC outputs and two outcomes (employee growth and revenue growth), however while the outputs have specific indicators the outcomes do not. Consideration should be given to incorporating outcome targets in the logframe reports.

It is not possible to assess the success of each programme stream in meeting their KPIs due to a lack of data on some of these as indicated in Table 9. However, out of the KPIs which have targets and consistent data:

- Cyber Runway Launch is most successful, having met four of five KPIs (it did not achieve 100% attendance at sessions)

- Cyber Runway Grow has met three of five KPIs (it did not deliver on getting 50% of participants from outside the South-East of England or 100% attendance at sessions)

- Cyber Runway Scale has met two of five KPIs (it did not deliver on 50% of candidates from outside the South-East of England, meeting the minimum number of applicants (40 per cohort), or 100% attendance at sessions)

All three strands have met or exceeded the target number of participants and diversity KPIs.

Has the Cyber Runway programme met its commitment to have 50% of candidates from outside London and the South-East of England?

Regional representation outside London and the South-East of England was achieved for the Launch stream (80%) however not Grow (42%) or Scale (40%). However in addition to this four regional events were held in Belfast, Scotland, Cardiff, and Sheffield to help address the regional imbalance in participation geographies. The targets were not met due to:

- there being a short timeframe to recruit a large number of companies for each stream

- Launch companies being more likely to be signposted from universities which are more regionally spread, leading to higher regional representation

- companies at the level of Scale being more likely to be based in the South-East and an insufficient number of regional companies applying

Has the Cyber Runway programme met its commitment to have a minimum of 30% female co-founders and 15% ethnic minority co-founders?

This was achieved across all of the 3 streams:

| Launch | Grow | Scale |

| • Female co-founders: 40% • Ethnic minority co-founders: 55% |

• Female co-founders: 42% • Ethnic minority co-founders: 55% |

• Female co-founders: 65% • Ethnic minority co-founders: 40% |

Has the Cyber Runway programme achieved a 90% favourable score on participant feedback questionnaire?

The Plexal participant feedback questionnaire did not collect data on favourability scores and the data available within the Plexal final report suggests this target has not been met.[footnote 2] Specifically it outlines that:

- Cyber Launch presentations received an 8.2 out of 10 average “feedback score”

- Cyber Grow content “usefulness” was rated as an average of 5.6 out of 10

- Cyber Scale content “usefulness” was rated as an average of 8 out of 10 These figures reflect RSM participant survey feedback which found that 77% (n = 20) of 26 respondents were either “satisfied” or “very satisfied” with the overall structure of the programme, less than the 90% favourability target.

Did Cyber Runway achieve 100% attendance across the three streams?

This was not achieved in any month for any of the streams, however access to video recordings and materials was provided to all participants. This was not achieved in any month for any of the streams, however access to video recordings and materials was provided to all participants.

| Launch | Grow | Scale |

| • 98% in November • 67% in December (live attendance) • 65% in January (live attendance) • 60% in February (attendance at coaching sessions) |

• 88% in November • 42% in December (live attendance) • 40% in January (live attendance) • 60% in February (live attendance) |

• 80% in November • 80% in December (live attendance) • 50% in January (live attendance) • 40% in February (live attendance) |

While the RSM participant survey did not collect data specifically on reasons for non-attendance, a ‘mid-point’ participant survey completed by Plexal reported that Grow participants in particular thought the sessions were too general and would like more tailored content / material.[footnote 3]

Recommendation 8: we recommend that:

(a) the programme becomes more focused on delivering the outcomes in the ToC where it has had a negligible contribution to date, specifically: increased revenue, increased internationalisation, increased investment and progression to an initial public offering (IPO)

(b) funding is provided to track the outcomes and impacts from the programme. It should be a requirement within the delivery partner contract to provide evidence of the longer-term outcomes being achieved at regular checkpoints, for example 1 year, 2 and 3 years after they complete the programme to provide evidence of the longer-term benefits.

What are the additional or unintended benefits of the programme? (Brand boost for participating on a government approved scheme)

Participating companies highlighted a number of key unintended benefits including:

- developing an understanding of how to apply for government frameworks

- adding new services to their portfolio by connecting with other companies via the programme and building a trusted network

- collaboration opportunities with other cohort members to bring together technologies and ideas

To what extent has the programme delivery improved under the Cyber Runway brand

Cyber Runway compares favourably to the predecessor programmes (HutZero, Cyber 101, and Tech Nation Cyber) with 42% (n=5) of the 12 coach and mentor survey respondents describing it as better while 50% (n=6) felt that bringing programmes together under the Cyber Runway brand had improved either visibility, consistency, or quality. However, the low number of coach and mentor survey respondents limits the strength of this conclusion.

1.4 Data collection

The evaluation survey received a low response rate, in part due to the survey fatigue of participants who had already completed a programme survey delivered by Plexal as well as feedback for other programmes they were participating in. Furthermore, as contact details were not collected it was not possible to complete more targeted telephone follow-ups of non-respondents.

Recommendation 9: we recommend that any future delivery organisation is required under their contract to:

- report on baseline performance metrics and track progress throughout the programme (this would allow for a robust assessment of whether the scheme is meeting its objectives)

- collect contact details (such as telephone numbers) for programme participants and their consent to be contacted at the end of the programme and 6 months later to track outcomes and impacts, and make them aware this is a requirement of participating in the programme

- collect contact details for applicants who were not successful and their consent to be contacted

Consideration should also be given to harmonising delivery partner and any external evaluation activities.

Recommendation 10: we recommend definitions of KPIs need to be set to ensure data provided is equivalent across all participants.

2. Introduction, terms of reference and methodology

2.1 Introduction

RSM Consulting LLP were commissioned by the Department for Digital, Culture, Media and Sport (DCMS)[footnote 4] to undertake independent evaluations of the CyberASAP, Cyber Runway and UKC3 programmes. The evaluations will help DCMS to understand the impact of these programmes and the findings will be used to inform the development of future interventions. This evaluation report relates to the Cyber Runway programme in its initial year (2021/22).

The Cyber Runway programme was funded by DCMS as a bootcamp and accelerator programme for UK cyber sector businesses at different stages of the business lifecycle. It is delivered in a series of online sessions across three strands and supplemented by regional bootcamps. Its first year (cohort) of delivery took place from October 2021 to March 2022.

2.2 Terms of reference

The specification for this evaluation stated that comprehensive evaluations of the CyberASAP, Cyber Runway and UKC3 programmes are required. The aims of the three evaluations are to:

- establish the success of each programme in meeting programme aims

- capture learning that contributes to the institutional knowledge base in the cyber security growth and innovation space

- inform decision making on future iterations of the programmes and feed in options to our business planning process for the suite of programmes to be run by the DCMS in the next financial year

- identify gaps in programme delivery

- outline recommendations on how each programme could be improved further

- identify current policy restrictions or barriers to growth in this space

- identify appropriate metrics to define success in future years

Specific research questions for the evaluation are outlined in Appendix A – evaluation questions.

2.3 Methodology

The evaluation methodology was agreed with DCMS and includes the following stages:

Scoping phase

(1) Project initiation meeting: the project commenced with a project initiation meeting involving the evaluation team and DCMS to review and agree the stages of the work, approach and timetable, access to information, and finalise arrangements for project management and progress updates.

(2) Desk research and analysis: review of the strategic and delivery context for the programme and mapping was conducted to identify other sources of funding available to support cyber security companies at different stages of growth.

(3) Review of programme documentation setting out rationale for funding measures: review of the programme business case, contract between DCMS and Plexal, project initiation document, and previous research / theories of change relating to the Cyber Runway predecessor programmes (HutZero, Cyber 101 and Tech Nation Cyber) to identify the rationale for the intervention and the outputs and impacts expected from it. Based on this, an evaluation framework was developed using a ToC approach detailing the activities, outputs, outcomes, and impacts expected to be delivered.

(4) Development of ToC: an online workshop was facilitated with DCMS staff involved in both the business case for funding and the design and management of the programme, to test and refine the draft ToC and associated metrics. The final ToC (see Appendix B – Theory of Change was used to inform the research tools that were developed, specifically the participant, unsuccessful applicant and coaches / mentors survey guides for the delivery partner and case study interviews.

(5) Evaluation plans for each programme: an evaluation plan was developed detailing the design and approach being taken to address the evaluation questions.

Data collection phase

(1) Analysis of programme monitoring information / impact information and published data: to inform the assessment of programme performance against its core KPIs (as per the Invitation to Tender) and those in the agreed ToC.

(2) Surveys and consultations: this involved - a survey of participants with 26 responses (response rate = 24%) (see survey used in Appendix C – Participant Survey - a survey of coaches and mentors with 15 responses (response rate = 33%). The survey group was weighted towards mentors (12) rather than coaches (4)[footnote 5] (see survey used in Appendix D – Coaches and Mentors Survey) - an interview with delivery partner Plexal

Survey Methodology: the surveys were designed by RSM UK Consulting in collaboration with DCMS to collect evidence against the key evaluation questions and ToC metrics. Online survey links were distributed via Plexal, with three subsequent reminders by both Plexal and RSM.

Note: where ‘n=’ is used during survey analysis, it is signifying the number of respondents responding in a certain way / to a specific answer choice, rather than the entire respondent base. Where applicable, a base number has been provided in figure titles or in text to provide more general information on total number of respondents. This base number will occasionally vary from the overall survey participant number depending on relevance of the question and if respondents chose not to answer.

Participants survey profile:

Table 1: Cyber Runway participants respondents by region (base number = 26)

| Region | Sample of Cyber Runway participants survey respondents - frequency[footnote 6] | % of survey respondents |

| Scotland | 3 | 11% |

| Wales | 1 | 4% |

| Northern Ireland | 0 | 0% |

| North-West England | 5 | 19% |

| North-East England | 0 | 0% |

| Yorkshire and the Humber | 2 | 8% |

| West Midlands | 0 | 0% |

| East Midlands | 0 | 0% |

| East of England | 1 | 4% |

| South-West England | 2 | 8% |

| South-East England | 5 | 19% |

| London | 7 | 27% |

Table 2: Cyber Runway participants respondents by stream (base number = 26)

| Stream | Sample of Cyber Runway participants survey respondents - frequency | % of survey respondents |

| Launch | 4 | 15% |

|---|---|---|

| Grow | 14 | 54% |

| Scale | 8 | 31% |

Coaches and mentors survey profile:

The professional background of coaches and mentors is presented in figure 1, with the most common answers being technical experts (47%, n=7) and founders or co-founders of a start-up (40%, n=6). Examples of backgrounds listed by those who selected ‘other’ included investors, university staff, and advisory board members.

Figure 1: Professional backgrounds of surveyed Cyber Runway coaches and mentors (base number = 15)

Coaches and mentors were also asked to provide their reasons for becoming involved in the programme. The most common reasons, cited by 73% (n=11) of the 15 coaches and mentors surveyed, were the enjoyment of mentoring others and the belief they could support participants using the professional skills they had developed.

The least selected reasons for involvement were being asked to participate by their employer and wanting to develop their own mentoring / coaching skills, with both being selected by 13% (n=2) of the 15 coaches and mentors surveyed.

(3) Counterfactual: a survey was issued to companies that were unsuccessful in their application to the Cyber Runway Programme (see survey used in Appendix E – Unsuccessful Applicant Survey. Due to the low response rate there were no material findings to include within the report (n=5; response rate = 12%).

(4) Case Studies: 5 in-depth case studies were developed to provide qualitative insight into the benefits of participating in the programme. These were selected to provide a representative sample across regions, sectors, level of engagement with the training provided, and project idea.

Table 3: Case Studies

| Project | Sector | Engagement with training[footnote 7] | Project idea |

| Askari Blue | Cyber defence | Not known - monitoring data for Launch attendants does not include attendance per participant. | Idea uses nudges to help employees and individuals to avoid common cyber security pitfalls that attackers can exploit. They offer consultation, incident response, and various threat intelligence supports. |

|---|---|---|---|

| Cynalytica International Ltd | Internet of Things (IoT) / Operational Tech, Threat Intelligence, Security Ops and Incident Response | All four themes, 8 sessions.[footnote 8] | Cyber security and machine analytics technologies |

| Praeferre | Retail, travel, banking, insurance | All four themes, 13 sessions | App that enables individuals and businesses to manage the data they share and consent around this |

| CyberHive | Mobility, industrial IoT, Finance | 100% of training | Cyber security technology provider, including VPN |

| Secure Impact | Offensive, Defensive and Consulting cyber security services | 76% of training | Cyber security services: consulting, operations and incident response, threat intelligence |

Analysis and reporting phase

- monitoring data for each programme by sector, geography, and company size: to assess performance against targets and to identify variations between cohorts, universities, and cyber security sectors

- analysis of secondary data: to supplement analysis and validate findings – Plexal’s data on programme participants’ KPIs was cross referenced with data sets such as Beauhurst, which tracks the funds raised by Cyber Runway companies, and the Orbis database, which provides detailed financial information about participants (in addition, the validity of the data was cross-checked with that obtained from the participant survey responses)

- contribution analysis: this was completed as an experimental exercise to determine the feasibility of completing a full contribution analysis in future years. It involved 3 key steps:

(1) the evaluation team developed contribution which describe the outcomes the Cyber Runway programme intends to achieve, and how the Cyber Runway programme intends to achieve them. The statements are based on the ToC outcomes and impacts (2) based on the data collected in the previous stages the strength of evidence was assessed against each contribution statement, as well as evidence of any other factors that have contributed. The evaluation then identified how strong Cyber Runway’s contribution to each statement was.

The strength of evidence was determined by reviewing:

- clarity

- frequency of a particular theme

- diversity of the stakeholders who provide the evidence (across cohorts, for example)

- emphasis placed on the evidence by stakeholders, for example if the stakeholder stressed that what they said was important to them

- the sources of evidence reported by stakeholders

- availability of the evidence across primary, monitoring, and monitoring information data

High strength of evidence includes:

- evidence that is articulated clearly and frequently, by different stakeholders without the need for probing

- where the survey findings show high rates of “strongly agree / disagree” and similar responses across different measures

(3) the contribution of the Cyber Runway programme to the expected results as described by each contribution statement was then assessed as strong, some, or negligible, with:

- strong contribution meaning that Cyber Runway programme activities contributed substantially to the observed results

- some contribution meaning that Cyber Runway programme activities contributed to the observed results but not substantially

- negligible contribution meaning that the Cyber Runway programme had no or minimal contribution to the result

The results are in Appendix F – Contribution Analysis, however as this is the first year of the programme and as the evidence on outcomes and impacts was not fully developed the contribution analysis results would not have provided an accurate measure of performance and therefore is not included within the findings.

- reporting: includes a progress presentation, interim and final reports, a final presentation, and a closing workshop with DCMS which will act as a learning event

Limitations

Participant survey challenges and limitations included:

-

the small number of respondents, in part due to survey fatigue amongst Cyber Runway participants as:

- Plexal had previously completed a separate survey of participants a few weeks prior to fieldwork commencing

- some participants were also involved in the London Office for Rapid Cybersecurity Advancement (LORCA) evaluation project, meaning that they would have received several survey requests within a short timeframe

Actions to increase response rates included Plexal sharing the survey link via the alumni Slack channel and RSM directly issuing a targeted reminder to participants (it was not possible for RSM to complete telephone follow-ups as participant telephone numbers were not collected by the delivery partner).

However, as a result of the small number of respondents, survey findings are indicative and should not be taken to be representative of the whole population of the programme participants.

Reporting on impacts was limited due to insufficient data. With the programme in its primary year substantial outcomes and impacts are yet to be realised.

3. Rationale and programme overview

This section details the rationale for the Cyber Runway programme, the strategy and delivery context as well as an overview of other programmes in this space.

3.1 Review of the strategic and delivery context

3.1.1 Policy

The Cyber Runway programme was expected to, or had the potential to, contribute to several key national strategies, as set out below:

Table 4: Strategic context

| Strategy | How the growth and innovation programmes are expected to contribute |

|

National Cyber Security Strategy (2016 - 2021) - supports the creation of a growing, innovative, and thriving cyber security sector in the UK National Cyber Strategy 2022 – focuses on strengthening the UK Cyber Ecosystem |

The Cyber Runway programme was expected to contribute to these strategies by supporting companies at each stage of their development and providing training and mentoring to entrepreneurs that will help to ‘create a cyber ecosystem in which cyber start-ups proliferate, get the investment and support they need to win business around the world [and], to provide a pipeline of innovation that channels ideas between the private sector, government and academia’. It was also expected to: • help improve the business skills and survival rate of early-stage cyber businesses and provide them with the skills to grow (pitching to investors, for example) • provide small and medium-sized enterprises (SMEs) with access to investors and national / international networks |

|---|---|

| DCMS UK Digital Strategy (2022) | The Digital Strategy has a core vision to ‘make the UK the best place in the world to start and grow a technology business’, with a focus on the acceleration of tech start-ups and scale-ups. The Cyber Runway programme can contribute to this by supporting entrepreneurs, start-ups, SMEs and scale-ups across the UK to grow their cyber businesses. In addition, the Digital Strategy includes a focus on spreading digital prosperity and levelling up which is also reflected in the UK government 2022 White Paper ‘Levelling Up the United Kingdom’. This includes a commitment to stimulate innovation and productivity growth outside of the South-East of England. Cyber Runway is contributing to this by supporting innovators and entrepreneurs outside London and the South-East to export, network, and grow. |

3.1.2 The UK cyber security sector growth and innovation space

The UK Cyber Security Sectoral Analysis published in 2022 suggests the UK cyber security sector is growing rapidly with:

- approximately 52,700 full time equivalents working in the cyber security sector (a 13% increase from the previous year), of which 64% work in large firms with over 250 employees

- an estimated revenue of £10.1 billion (an increase of 14% compared to the 2021 publication)

The UK has a reputation as a global leader in cyber security research, with 19 Academic Centres of Excellence in Cyber Security Research, four Engineering and Physical Research Council (EPSRC) - National Cyber Security Centre (NCSC) Research Institutes, four Centres for Doctoral Training, the Centre for Security Information Technologies (CSIT) and the PETRAS National Centre of Excellence in Cyber Security of Internet of Things. The 2022 UK Cyber Security Sectoral Analysis also notes that investment in cyber security firms has increased, with over £1.4 billion being raised in 2021 across 108 deals. In addition, the sector is playing a critical role in responding to emerging cyber threats and challenges, and the rapid proliferation of connectable products.

However, research in 2020 found that significant long-term investments in other nations, especially the USA, France, and Germany, are leading to the development of large clusters of research excellence. This can pose a threat to maintaining the UK’s position as a leading nation for research and innovation in cyber security, given a potential brain drain from the UK. It suggests a need for the UK to further invest in cyber security research in various forms, including clusters of research excellence in cyber security, doctoral research funding to train future research and development leaders in cyber security, and national research facilities.

Challenges within the sector and the innovation landscape include:

- investment being skewed to larger companies - start-ups and SMEs receive considerably less investment than larger, more established firms as the 2022 Sectoral Analysis found that 85% of the total 2021 investments targeted large-medium firms

- a regional divide in the cyber security sector – for example, 33% of job postings are in London, with only 2% in Wales and according to the 2022 Cyber Sectoral Analysis, 53% of Cyber Security firms are registered in either London or the South-East, with only 2% of the firms in Northern Ireland

- the UK no longer having access to EU cyber security funding - this would have amounted to approximately €1.65 billion (available across the entirety of Europe) over the period 2021 to 2027[footnote 9]

- difficulty commercialising academic research into cyber security – as it faces barriers related to access to funding, ability to dedicate time to market research and validation, and the need to balance teaching, research, and commercial activity[footnote 10]

- the sector not being diverse – the cyber security skills in the UK labour market report for 2022 highlights that 22% of the cyber security workforce is female (compared to 30% across the digital sectors as a whole), but ethnic minorities make up 25% of the cyber security sector workforce, which is higher than 12% in the overall workforce, and 15% in the digital workforce, that ethnic minorities represent[footnote 11]

3.1.3 Mapping of other programmes

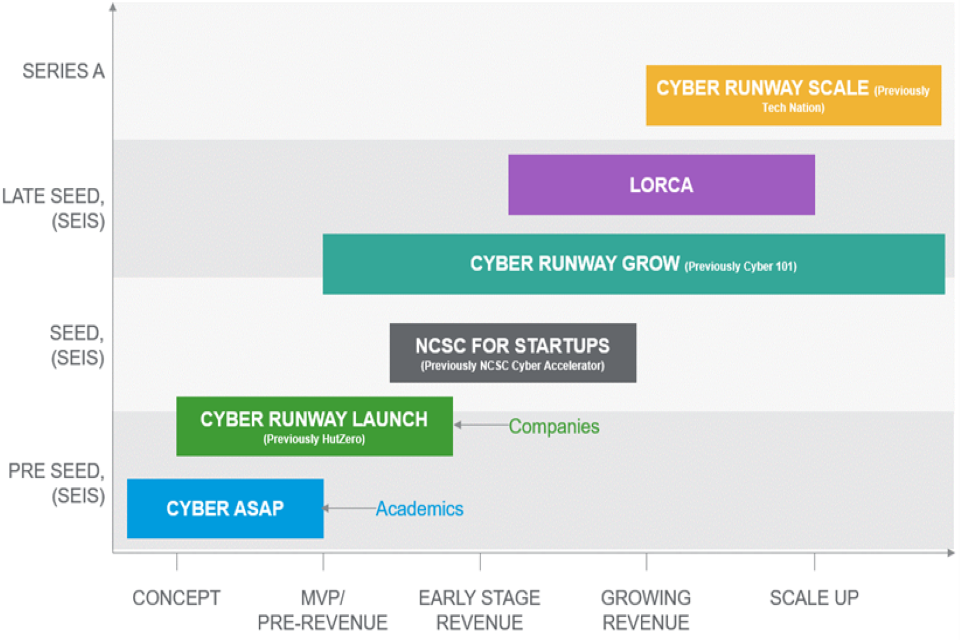

Cyber Runway is part of a wider ecosystem of cyber security growth and innovation programmes across different stages of the ‘innovation pathway’.

Figure 2: Cyber security growth and innovation programmes[footnote 12]

Cyber Runway supports companies at different stages of the business lifecycle through the Launch, Grow, and Scale strands. This follows the first stage of the innovation pathway, which focuses on pre-seed and proof of concept ideas. This area is covered by the CyberASAP programme, which supports the commercialisation of UK cyber security research into fully rolled-out commercial projects. Some participants of CyberASAP have moved on to Cyber Runway following completion of the programme. These interventions are also complemented by other government and private sector initiatives with a cyber security element, as illustrated in Table 5 below.

Table 5: Mapping of other programmes

| Project name | Target group | Start and end date | Funders and funding | Expected outcomes |

| NCSC For Startups | Start-ups at all stages of maturity. Applicants must be registered as a UK company, with an active presence in the UK with technology and solutions that meet challenge areas. | The NCSC For Startups began receiving applications from 10 June 2021, and onboarded new companies over the course of 2021 and into 2022 | NCSC and Plexal in partnership with Deloitte, CyNam, Hub8 and QA. | The aim is to bring together innovative start-ups with NCSC technical expertise to solve some of the UK’s most important cyber challenges. This programme supports NCSC’s mission to make the UK the safest place to live and work online. Through a combination of technical and commercial mentorship and introductions, the programme works with start-ups to: • develop and communicate their core product or service • facilitate introductions to companies and investors • create commercial growth opportunities |

|---|---|---|---|---|

| Tech Nation rising stars | Early-stage businesses that meet certain criteria. | Ongoing (start date n/a). | Tech Nation | Businesses benefit from significant profile raising on both a national and international level, as well as the opportunity to put the business in front of leading investors, influencers, and corporates. The programme works with other businesses to ensure the business is investor ready (via training and support). |

| Upscale | Promising tech companies headquartered in the UK. | Ongoing (start date n/a). | Tech Nation | Helps the UK’s most promising (mid stage) tech companies to accelerate their growth and unlock the key to scaling successfully by providing coaching, content, community, and connections. |

| Innovate UK smart grants | UK based innovative businesses that are destined for early, successful commercialisation, growth and exports. | Competition opened on Monday 17 January 2022 and closed Wednesday 13 April 2022 | Funding is from Innovate UK, part of UK Research and Innovation - organisations can apply for a share of up to £25million. | Investing up to £25 million in the best game-changing and commercially viable innovative or disruptive ideas. All proposals must be business focused. |

| LORCA / LORCA Ignite | High potential British cyber start-ups. | LORCA was initially launched in 2018 and LORCA Ignite launched in 2021. The programme has now closed. | Launched by Plexal with funding from DCMS. | LORCA Ignite was an intensive scale-up programme aiming to accelerate the growth of a new wave of British cyber start-ups by combining government support with innovation expertise and access to investors/leaders to help businesses raise investment and generate revenue. |

Cyber Runway contrasts with other programmes due to the breadth of support across different strands, with support available from concept and pre-revenue up to growing revenue and scale up.

3.2 Programme overview and funding

3.2.1 History / background to the programme

Cyber Runway was preceded by three distinct programmes that were funded by DCMS (HutZero, Cyber 101 and Tech Nation Cyber). A brief description of each programme is provided below.

- HutZero - a bootcamp aimed at transforming early-stage ideas into viable propositions and potential new businesses

- Cyber 101 - targeted at cyber security start-ups and aimed to refine business skills and strategies, along with creating connections between start-ups, industry and investors

- Tech Nation Cyber - a national scaleup programme aimed at accelerating the growth of smaller cyber security firms

Cyber Runway combines the benefits and lessons learned from these programmes into a single scheme, with three strands: Launch, Grow and Scale. To inform development of the programme, the Cyber Runway design team:

- reviewed reports and programme evaluations from HutZero, Cyber101, Tech Nation Cyber, as well as other programmes such as LORCA and CyberASAP

- undertook desktop research and interviews with cyber security companies, investors, and stakeholders to produce an analysis of what budding entrepreneurs/start-ups/SMEs and scale-ups need and to get an understanding of the target audience, course content, and the delivery format that suits them

3.2.2 Key outcomes / impacts expected

After the completion of each cohort, immediate KPI outputs can be measured and stipulated in the business case as:

- regional representation – 50% of candidates from outside London and the South-East

- diversity – a minimum of 30% female co-founders and 15% ethnic minority co-founders

- minimum delivery of cohort size – Launch (20), Grow (120), Scale (20)

- 100% attendance and completion of the course

- 90% positive feedback from attendees

Qualitative outcomes expected include new networks of companies developed in and between cohorts, companies developing business skills to support product development, and connections from companies to mentors, government, and investors. These are shorter term outcomes that are expected to be observable in the months following completion of each cohort.

Over the longer term (1-5 years), there is expected to be an economic impact on the companies involved, including on:

- revenue

- growth

- investment

No specific targets were set for the longer-term metrics. However, they can be measured against the baseline of companies not taking part in the programme, along with the general growth of the cyber security sector.

4. Cyber Runway process evaluation

This section details the Cyber Runway programme governance structure, key stakeholders, the application process, how the programme was delivered, and reporting requirements. It focuses on assessing whether the programme was delivered as intended and what could be improved in delivery.

4.1 Governance structure

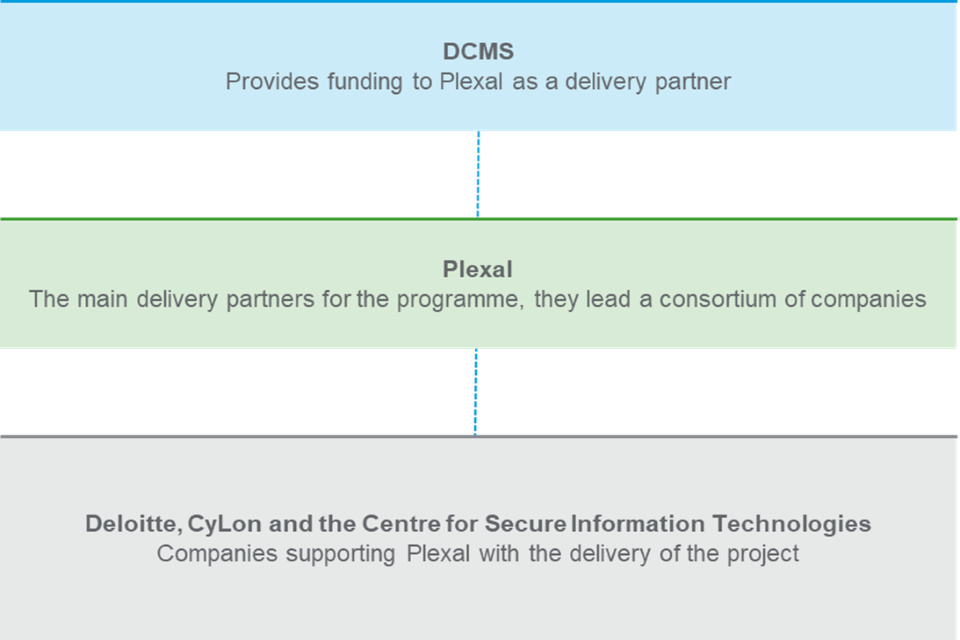

The governance structure for the programme is outlined below:

Figure 3: Cyber Runway governance structure

Roles and responsibilities

Table 6 below provides further detail on the roles and responsibilities of each organisation.

Table 6: Roles and responsibilities

| Stakeholder | Role |

| DCMS | • approval of course programme, structure and design • oversight management of the Cyber Runway programme, including regular logframe reviews, milestone evaluations and funding approval • participation in events and engagement with members to ensure strategic alignment with National Cyber Strategy |

|---|

Core delivery team

| Plexal | Plexal leads the delivery of Cyber Runway. Plexal Cyber is the digital platform used to deliver content and host events. As the supplier, they undertook research and consultations with cyber security stakeholders to understand and analyse needs of entrepreneurs, start-ups, SMEs and scale-ups. Drawing on the analysis, Plexal planned and then built a tailored programme; recruited participants; and delivered the programme. Plexal were also responsible for reviewing the programme’s impact. |

|---|---|

| Deloitte | In addition to the support Deloitte provided as a consortium member, they also provided access to their Ventures team and the 12 teams with specific Cyber domain expertise. This included Industrial (Operational Technology/IoT), Privacy/Data Security and Cloud/Infrastructure Security. |

| CSIT | A cluster of CSIT engineers provided automated and intimate sessions to Launch and Grow programmes to soundboard and test new initiatives in real time, advise on technical decisions and the direction of product development roadmap. CSIT also contributed to various areas across the Scale programme including academic masterclasses and value creation workshops. |

| CyLon | CyLon was a dedicated delivery partner for the Launch programme, delivering support to UK cyber entrepreneurs and early-stage businesses. The CyLon team worked with participants to identify who from within the global network would be best placed to help participants achieve their goals. Presenters were available to answer any questions during the session and after if/when needed through the CyLon team. |

Source: Cyber academy phase 2: build / Plexal (city) Ltd (2021): Cyber Growth and Innovation Programmes Limited Technical Response

Overall mobilisation and delivery was led by Plexal and supported by programme managers across all three strands. The Launch strand was delivered by CyLon and supported by CSIT’s cross-academy team led by their academic liaison in residence. The Grow and Scale strands were led by Plexal and supported by CSIT and Deloitte’s technical, engineering, and academic resource. Other stakeholders such as Specialisterne and Seidea supported the delivery of the programme, ranging from the provision of mentors to the delivery of workshops.[footnote 13]

Roles and responsibilities

The reporting structure and accountability mechanisms included:

- Plexal’s Cyber Advisory Board (formed from senior representatives of the previous LORCA Industry Advisory Board), which provided strategic advice and guidance and allowed alignment of approaches to aspects of the programme (such as equality diversity and inclusion content) with other Plexal initiatives and structures in place

- governance requirements (such as project delivery monitoring and risk mitigation, KPI reviews and participant feedback) being recorded and discussed as part of Logframe review meetings with DCMS, which took place monthly (this was in addition to bi-weekly project update meetings between Cyber Runway delivery team and DCMS)

- a Cyber Runway all-streams weekly check-in with representative leaders from Launch (CyLon and CSIT), Grow (Plexal) and Scale (Plexal)

4.2 Programme delivery

4.2.1 Key phases / stages

Table 7 below outlines the key phases of the Cyber Runway Programme.

Table 7: Cyber Runway key stages of design, development and delivery

| Phase | Date planned | Actual date |

| Design of programme | May – September 2021 | May – September 2021 |

|---|---|---|

| Sign off of design | August 2021 | August 2021 |

| Go live | September 2021 | October 2021 |

| Application Timings | August – September 2021 | August – October 2021 |

| Delivery | September 2021 – February 2022 | October 2021 – February 2022 |

| Completion | 25 February 2022 | 25 February 2022 (and graduation event on 1 March 2022) |

There were no delays to the design stages and, while the application window closed one month later than planned, delivery was completed on time. Plexal feedback indicates the reason for this delay was a slippage in the contracting timeframe, with this extra time being used to ensure Plexal could meet the recruitment targets.[footnote 14]

Plexal highlighted there were lessons throughout the process which were used to constantly update the programme design. For example, the introduction of more networking opportunities and one-to-one mentorship as a result of feedback received from participants. Specifically, more sessions were added for the cohort to meet each other and discuss their challenges, while the Cyber Runway team also added regular office hours to supplement that of the speakers to provide more one-to-one guidance.[footnote 15]

4.2.2 Communications and promotion

Plexal pre-programme promotion included:

- an ongoing recruitment campaign on their social media platforms (Twitter and LinkedIn)

- promotion and virtual events held on their website, in an internal and external newsletter, and on the cyber portal

- external channels such as PR and media being used to promote the programme via a press release while partner outreach promoted recruitment to their audiences

Cyber Runway was promoted to candidates outside London and the South-East of England by accessing the cyber security sectoral analysis database to identify target companies, working with CSIT to access university networks, engaging with other programmes in the cyber security ecosystem such as CyberASAP and UKC3, and by working with corporate partners.

During the programme, Plexal had a ‘spotlight on members’ featured on their social platforms; posted milestone moment news stories to their website, promoted milestones on their internal and external newsletter, and shared news and milestones on their cyber portal. External channels also promoted the programme, with partners also sharing Plexal content on their channels.

At the end of the programme, Plexal posted a project wrap-up: highlights on their social media channels, their website and on the cyber portal as well as a press release. Overall: the programme had 18 pieces of press coverage, the website received over 7,000 unique page views[footnote 16], and social media posts made over 45,000 impressions.

Cyber Runway participant findings:

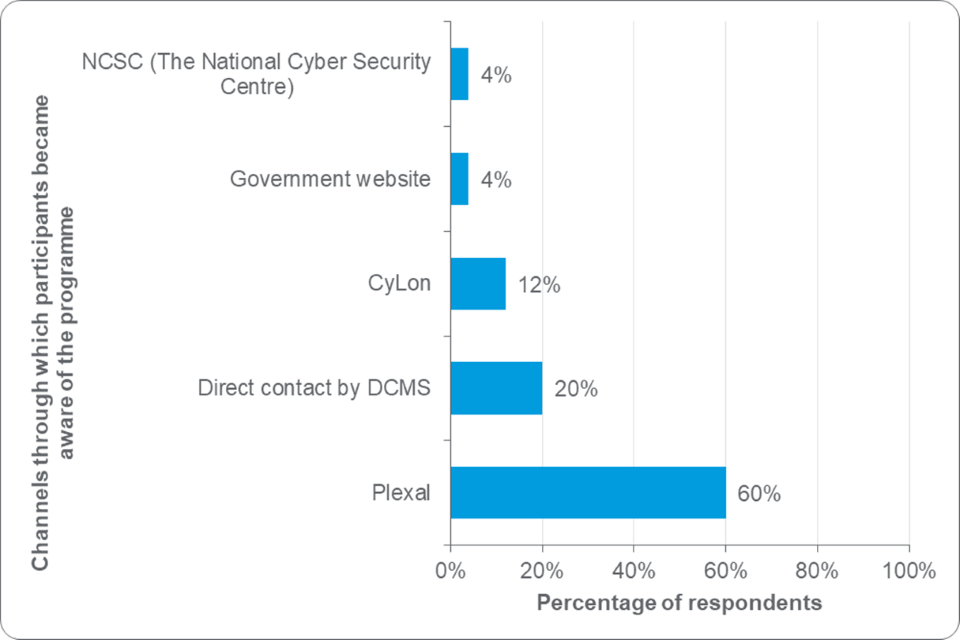

Awareness of the Cyber Runway programme

Data gathered from the programme participant survey indicates that Plexal’s pre-programme promotion and recruitment campaigns were effective in making cyber companies aware of the programme and attracting them to join. Most of the 25 respondents (60%, n=15) stated that their first introduction to Cyber Runway was through the delivery partner, Plexal. Other respondents (20%, n=5) were first made aware of the programme by DCMS and to a lesser extent (12%, n=3) by CyLon, whilst only 4% of respondents (n=1) were made aware directly from the government website and from the NCSC (National Cyber Security Centre).

Figure 4: How participants became aware of Cyber Runway programme (base number = 25)

4.2.3 Application process

Eligibility

Participant organisations must be a UK registered company or individuals with the right-to-work in the UK and have a commitment to grow their UK presence. Specific eligibility criteria applied to each programme is detailed below.

Launch criteria included:

- feasibility of the business idea / evidence to show it is worth pursuing

- skills and experience of the individual and team and how likely to deliver on the proposed idea

- programme fit relative to ability / desire to absorb support, attend sessions regularly, be coachable and contribute

- diversity of leadership team relative to the sector and other applications

Grow / Scale criteria included:

- how innovative relative to existing market solutions / how unique is the solution compared to competitors

- sustainability of the business relative to revenue generation and business model

- capacity relative to team strengths, ability to deliver solution and scale

- programme fit relative to ability / desire to absorb support, attend sessions regularly, be coachable and contribute

- diversity of leadership team relative to sector and other applications, especially underrepresented groups such as women and ethnic minority co-founders / executives

Other requirements for the Scale programme included:

- 10+ Employees

- revenue of £500,000 (n/a if seed funded)

- 2 Years, 20% Year-over-Year (YoY) growth

Application process

Recruitment emails were sent out to groups of potential participants including start-ups, investors, alumni, international cyber companies, and those who registered an expression of interest. These emails provided details on the programmes on offer, including deadlines and a hyperlink to book in a meeting to speak about their application.

Once application forms were received, they were scored based on agreed criteria and using the Monday.com platform. Recruitment for the Launch and Scale programmes involved follow up interviews while the Grow programme made selections based solely on the application process.

Selection criteria was applied using a scoring matrix to develop a shortlist of companies to take through to the assessment stage for each programme. The matrix assesses 5 core factors, including:[footnote 17]

- impact (relative to challenge area(s))

- innovation (relative to existing market solutions)

- sustainability (potential of business model/revenue)

- capacity (team, leadership, ability to deliver)

- programme fit (coachability, need and desire to engage)

Assessors reviewed applications and provided a score for each category on a one to five star rating (1 star = No, does not meet criteria. 3 stars = Maybe meets criteria or an average answer. 5 stars = Yes, definitely meets or exceeds criteria). Once the score threshold was met, the applicants would move to the next stage of the process. This next stage depended on the Runway programme stream, with:

- Grow applicants being subject to a final internal review amongst the team

- Scale and Launch applicants being subject to interviews with programme staff (through this process, the top 20 applicants progressed based on their combined interview and written application score)[footnote 18]

Participants had access to the digital platform at all times for content and communications. Office hours and coaching provided individual, tailored support to Cyber Runway members.

Launch: Entrepreneurs received support with launching their business, building a minimum viable product, and creating a network. Programme content was intended to support individuals to develop relevant entrepreneurial skills, meet potential co-founders, and establish new businesses.

Grow: start-ups and SMEs received business support to help them grow, access funding, and achieve commercial success. This programme provided local activity, working with influencers across the UK such as clusters, universities, local enterprise partnerships (LEPs), and Chambers of Commerce. It addressed the business basics and covered other areas that are essential to the growth of cyber security businesses including guidance on areas such as:

- market validation

- access to finance

- marketing

- pitching

- sales techniques

- technical support

- HR and culture building

Scale: Scale-ups accessed support (including 1:1 mentoring) to help them grow rapidly in the UK and internationally. This programme aimed to target potential high-growth cyber security firms for inclusion in a single cohort to support them to address barriers to growth nationally and abroad. The cohort, a virtual accelerator, provided peer-to-peer learning, masterclasses led by expert scale coaches, virtual meetups, and targeted introductions to international opportunities.

Alongside a core curriculum, the Plexal team worked with participants to identify who from within the global network was best placed to help them achieve their goals. Participants also had access to mentors, the CSIT cyber range and technical and engineering support.

Post-programme support will also be available for start-ups and there are defined pathways for alumni enabling ongoing collaboration and impact with DCMS and its partners. These pathways include:

- careers and employment support

- referral or extension

- regional collaboration opportunities and go to market support

- the alumni programme

Cyber Runway participant findings:

Programme satisfaction

Survey respondents in the Grow stream were less satisfied with the support provided than those in the Launch and Scale streams.

Cyber Grow

Respondents were asked to provide their level of satisfaction with key areas of the programme. As shown in the following table, the aspects with the highest and lowest satisfaction ratings are the business masterclasses and industry introductions respectively.

Table 8: Participant satisfaction in areas of the programme where support was provided (base number= 14. However, base number is lower in some categories due to participants skipping the question)

| Aspects of programme | % Not sure / not applicable | % Very dissatisfied | % Dissatisfied | % neither satisfied nor dissatisfied | % Satisfied | % Very Satisfied |

| Business masterclasses (base number= 14) | 0% | 7% (n=1) | 21% (n=3) | 21% (n=3) | 36% (n=5) | 14% (n=2) |

|---|---|---|---|---|---|---|

| Virtual events (base number= 13) | 23% (n=3) | 0% | 8% (n=1) | 46% (n=6) | 8% (n=1) | 15% (n=2) |

| Presentation practice (base number= 12) | 25% (n=3) | 8% (n=1) | 8% (n=1) | 33% (n=4) | 17% (n=2) | 8% (n=1) |

| Industry introductions (base number= 12) | 8% (n=1) | 33% (n=4) | 25% (n=3) | 8% (n=1) | 17% (n=2) | 8% (n=1) |

| Support to develop your personalised growth plan (base number= 13) | 8% (n=1) | 15% (n=2) | 15% (n=2) | 62% (n=8) | 0% | 0% |

| Commercial support (base number= 13) | 8% (n=1) | 15% (n=2) | 15% (n=2) | 38% (n=5) | 23% (n=3) | 0% |

Cyber Launch

Due to the small number of survey responses received from the Cyber Launch stream (n = 4) a detailed breakdown is not provided

Participants who responded to the survey were generally satisfied with all aspects of the programme. As per the analysis conducted on Cyber Grow respondents above, the three aspects of the programme with the highest level of satisfaction for Cyber Launch participants are:

- the one-to-one advice component of the programme (71% (n=5) were very satisfied and 29% (n=2) were satisfied)

- business masterclasses (57% (n=4) were very satisfied and 43% (n=3) were satisfied)

- the resource library (57% (n=4) were very satisfied)

Cyber Launch participants responding to the survey indicated no dissatisfaction on any aspects of the programme except for a respondent being dissatisfied with investor pitches.

Cyber Scale

- due to the small number of survey responses received from the Cyber Scale streams (n = 7) a detailed breakdown is not provided

Respondents expressed the highest level of satisfaction with:

- business masterclasses (of the 4 total responses, 75% were very satisfied and 25% were satisfied)

- the mentoring component (of the 4 total responses, 75% were very satisfied)

- the regional events (of the 4 total responses, 50% were very satisfied and 25% were satisfied)

Only one respondent from the Cyber Scale stream was very dissatisfied with the mentoring aspect of the programme.

However, it is important to note that the views expressed from responses to the survey questions above, while offering insight on satisfaction levels for the programme, should not be considered representative of the population of participants due to the small sample size of respondents.

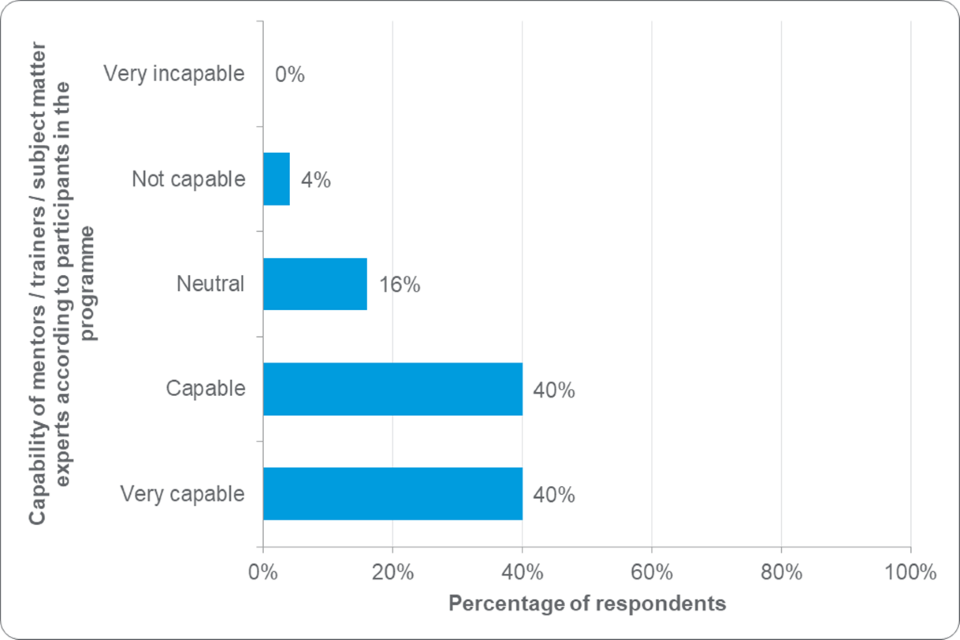

Participant assessment of the capability of trainers / mentors / subject matter experts to support them

As shown in figure 5, 80% (n=20) of participants from all three programme streams felt trainers / mentors / subject matter experts were either capable or very capable.

Figure 5: Participant description of the capability of mentors / trainers / subject matter experts in providing support (base number = 25)

Although most respondents (80%, n=20) felt mentors and trainers were capable of providing support during the programme, qualitative responses regarding the quality of support provided by the project leads and coaches / mentors were mixed:

Some respondents expressed positive views of the coaches / mentors involved in the programme, including: “1-2-1 mentorship was great because you get guidance tailored towards your specific situation”.

However, others were less satisfied and one respondent noted: “the programme leads were equally clueless. This is quite opposite to my experience [on other programmes] a couple of years ago where the whole organising team were giving out cyber security-specific, sound advice. They had also brought in mentors at the time whose advice works till this date. None of that over here.”

Cyber Runway coaches and mentors findings: In response to a survey question asking how satisfied they were with the experience of being a coach or mentor on Cyber Runway, 93% (n=14) of the 15 coaches and mentors stated they were either satisfied or very satisfied.

Qualitative feedback on how their experience could have been improved included developing a stronger framework for mentors involved in the programme (introducing guidelines and expectations) and increasing the amount of information available to mentors on participants prior to contact with them.

Having a set of guidelines and expectations from mentors and more up-to-date information/background of the programme participants.

– Cyber Runway coaches and mentors survey respondent

I would have liked to have had more information about the specific expectations and challenges facing the individual companies to be able to tailor the 121’s better.

– Cyber Runway coaches and mentors survey respondent

Quite inconsistent with the amount of information available in advance of meeting the innovators - this is largely up to them to provide - but I could do better if I was given more information in advance of the sessions.

– Cyber Runway coaches and mentors survey respondent

This suggests a need to improve the quality of information provided by participating businesses. According to survey respondents, this would have allowed for an increase in the effectiveness of their sessions and therefore improve the quality of the programme itself.

When asked if they were satisfied with the information provided about the role of coaches and mentors, 73% (n=11) of the 15 respondents indicated they were satisfied or very satisfied and the remaining 27% (n=4) of respondents felt neither satisfied nor dissatisfied. Mentors and coaches had similarly positive views when asked if they were satisfied with the support they received, with only 7% (n=1) of the 15 respondents feeling dissatisfied. However qualitative feedback suggests that one potential area for improvement is the provision of ongoing feedback during the programme. Quotes from coaches and mentors include:

It would be good to find out how useful the companies found the sessions and also to get feedback over time on their progress.

– Cyber Runway coaches and mentors survey respondent

Perhaps more in the moment feedback from the audience after each session.

– Cyber Runway coaches and mentors survey respondent

Case study insights

In case study interviews, Cyber Runway participants were asked if and how support provided by the programme could have been improved. Potential areas for improvement identified by the participants include (1) more face-to-face meetings while not losing the virtual element of the programme, (2) increased focus on internationalisation, for instance through involvement of more international partners, (3) greater clarity on timetables and content of each sprint, masterclass or meeting, and (4) Plexal could make more use of its connections within government to bring more government stakeholders to the programme. This would be beneficial to participating businesses as it would allow them to expand their network in the public sector as well as the private sector. They suggested these improvements could help companies access more potential clients / markets and help plan their attendance better.

4.2.5 Data and reporting

Plexal collected monitoring information on participants at the beginning, midway point, and end of the programme, including information about the participants and their goals for participating in Cyber Runway, as well as feedback data on the delivery of the programme after each session.

Monitoring data was collated in logframe reports which included all KPIs specified in the contract between DCMS and Plexal. As such, there are no apparent gaps in the level of monitoring data that is required to be collected. The logframes specify targets for these KPIs and assess success or failure based on achievement of these targets.

The logframes report on all ToC outputs and on two outcomes (employee growth and revenue growth), however while the outputs have specific targets the outcomes do not. Consideration should be given to incorporating outcome targets in the logframe reports and progress reported against these on a regular basis.

DCMS feedback suggests the logframe reports provided a satisfactory overview of delivery. Where underperformance in KPIs was identified, for instance lower participation rates in the Grow element of the programme, DCMS were able to discuss this with Plexal to identify causes and possible solutions. Participants were also engaged via a mid-point survey to identify remedial actions for the future delivery of the programme and DCMS staff attended sessions delivered as part of the programme to gain first-hand understanding of the quality of delivery. Feedback from Plexal indicates in this instance the solution was to decrease cohort size, enable more tailored sessions on key challenge areas and facilitate more networking. As well as this, a desire for ‘meet the buyer’ / investor sessions was highlighted, with all of these aspects intended to be implemented in the next iteration of Cyber Runway.[footnote 19]

Cyber Runway participant findings:

Reporting processes

Participant survey respondents were satisfied with the reporting arrangements for the programme, mirroring the results obtained for the questions about the application process.

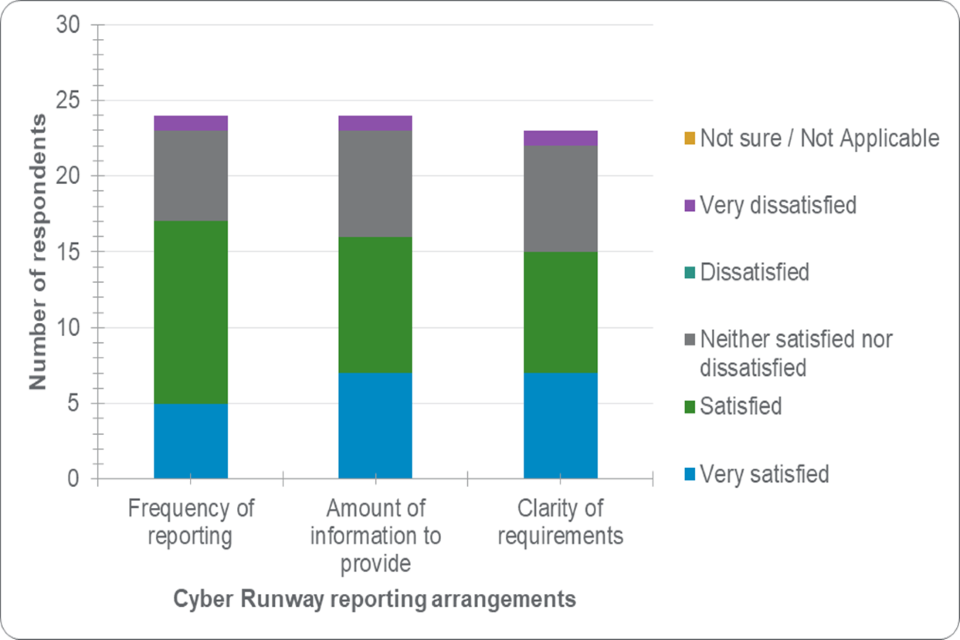

A majority of the 24 respondents provided positive feedback when asked to rate their satisfaction with the frequency of reporting, the amount of information required, and the clarity of reporting requirements. However, as illustrated in figure 6, several respondents did not express a positive experience of the reporting arrangements set out for the programme. This is shown by:

- 29% were ‘neither satisfied nor dissatisfied’ (n=6), or very dissatisfied (n=1) with the frequency of reporting

- 33% were ‘neither satisfied nor dissatisfied’ (n=7) or very dissatisfied (n=1) with the amount of information to be provided

- 35% were ‘neither satisfied nor dissatisfied’ (n=7) or very dissatisfied (n=1) with the clarity of requirements (note - 23 respondents provided answers to this option)

Figure 6: Participant satisfaction with the reporting arrangements of the programme (base number = 24)

4.2.6 Factors impacting on programme delivery

Views on the impact of COVID-19 on programme delivery were mixed, with 10 survey respondents indicating it had no impact, while 8 respondents felt it had at least a moderate impact. Although survey respondents reported satisfaction with the virtual delivery of programme content, they were less satisfied with the reduction in face-to-face interactions and networking. Views of the coaches and mentors were also mixed on the impact of COVID-19 on programme delivery as 33% (n=5) of the 15 felt it had impacted delivery to a moderate extent, 27% (n=4) felt there was no impact at all, and 7% (n=1) felt it was impacted to a small extent. The remaining 33% (n=5) were unsure.

While 80% (n=12) of the 15 coaches and mentors were either satisfied or very satisfied with virtual programme delivery, it was also highlighted that interactive and networking-focused elements of the course were negatively impacted by virtual delivery:

Lack of emulation among entrepreneurs and networking opportunities to mingle and share experiences (moral support).

– Cyber Runway coaches and mentors survey respondent

More difficult to gain interaction between different members of the group.

– Cyber Runway coaches and mentors survey respondent

Less able to get to understand the personalities of the individual entrepreneurs

– Cyber Runway coaches and mentors survey respondent

What worked well in programme delivery

Participants valued the opportunity to engage with key industry figures and entrepreneurs as well as meeting with a mentor and getting tailored advice from experts one-on-one. Qualitative feedback highlights that those who accessed these supports felt they benefited from engagement with industry and discipline experts, as well as participating in networking events and masterclasses, for example:

The mentoring sessions and masterclasses. The founders speaking to us were clearly speaking from experience. And they are very willing to help when you reach out to them. 1-2-1 mentorship was great because you get guidance tailored towards your specific situation.

– Cyber Runway survey respondent

In person meet-ups gave by far the best opportunity to meet new people and establish business relationships

– Cyber Runway survey respondent

Feedback from the delivery partner suggests that, because of virtual delivery in response to COVID-19, the programme was able to reach people in the north of Scotland, Northern Ireland, Wales, and international participants, noting “reaching people and for diversity and inclusion, getting people who don’t need to come to London to participate made a big difference”.

What worked less well in programme delivery

Participant survey respondents suggested the virtual delivery of the programme worked less well, noting that it limited the opportunity to develop relationships with the delivery team and meant there was a lack of human interaction and connections. Qualitative feedback included issues around a lack of awareness from programme leads on issues facing the coaches and mentors as well as a lack of person-to-person interaction, for example:

…In a real life environment, maybe the programme leads would have picked up that we are having difficulties. In a virtual setting, we haven’t really managed to develop any relationship with the programme leaders and project team.

– Cyber Runway survey respondent

Too much screen time. Not enough person to person interaction and networking.

– Cyber Runway survey respondent

In addition, 92% (n=12) of the 13 coaches and mentors who answered this question felt there were no gaps in the delivery process for the programme.

What improvements could be made to programme delivery

Areas for improvement highlighted by participant survey respondents included the need for more fundraising, marketing, one-to-one mentoring, and networking support. Qualitative feedback included:

Fundraising is one of the most important issues for start-ups in their quest for growth. This was not a priority of the program…

– Cyber Runway survey respondent

I think there was a lack of networking participation or introductions to potential prospects who might have been interested in our company and solutions. The programme seemed to be geared towards start-ups with an engineering or product focus that could be capitalised on by investors.

– Cyber Runway survey respondent

…I think the content of the programme could have reflected the specific difficulties minority founders are struggling with, even if this would have meant that speakers would have been recruited from the minority founders community, who share our experiences…

– Cyber Runway survey respondent

However, areas highlighted by the coaches and mentors survey respondents included an increased emphasis on engineering in future versions of the programme, and an expansion of its focus beyond the ‘Scale’ element of Cyber Runway:

Engineering support offered to more than just Scale - one company I mentored on another programme would have really benefited from it

– Cyber Runway coaches and mentors survey respondent

4.2.7 Delivery of predecessor programmes[footnote 20]

Cyber Runway was preceded by three distinct programmes that were funded by DCMS: HutZero, Cyber 101, and Tech Nation Cyber.

HutZero

Delivered by CyLon in partnership with CSIT, HutZero supported cyber security start-ups and projects with week-long bootcamps including workshops and mentoring from 2016 to 2021. Following the bootcamp, participants were supported with three months of mentoring from experts in academia, business, government, and investors.

Cyber 101

Cyber 101 was delivered by Digital Catapult in partnership with Inogesis, CSIT, and The Accelerator Network. It ran from 2017 to 2021 and supported small to medium sized cyber security companies to help them improve their financial strategies, go-to-market approach, and to build their networks. Support offered to participating companies in each programme year included business skills bootcamps, deep dives, mentoring and expert time to build and share knowledge, and demo days for selected participating companies to pitch their solutions.

Tech Nation Cyber

Tech Nation Cyber was designed and delivered as a six-month programme for cyber security companies that already had over 10 employees and a minimum revenue of £500,000 or existing seed funding. The programme was run in two years, 2019 and 2020. Each year, Tech Nation Cyber identified and encouraged companies that met the criteria to apply. Following application, the most promising – those with the potential to grow fastest – were selected to take part. The programme itself consisted of workshops, meetups, cohort trips in the UK and internationally (albeit delivered virtually in 2020 due to COVID-19), and networking opportunities. The content of the events was determined by a ranking of challenges that participants said they faced, so that the programme’s offer was tailored to the actual needs of companies.

Cyber Runway coaches and mentors feedback

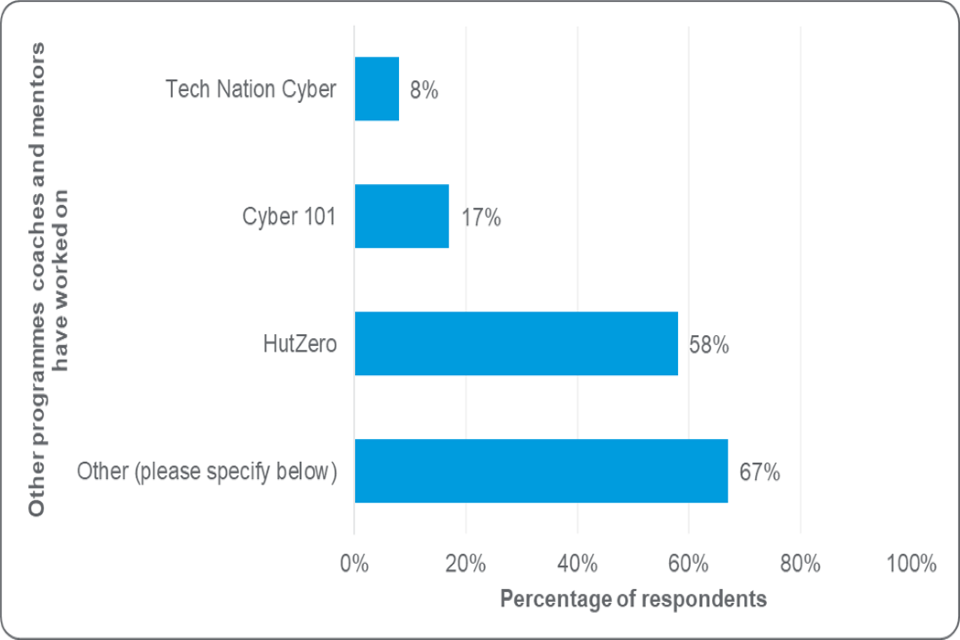

As shown in figure 7, 58% (n=7) of coaches and mentors surveyed for this question had worked on HutZero, 17% (n=2) had worked on Cyber 101, and 8% (n=1) had worked on Tech Nation Cyber. In addition, 67% (n=8) had also participated in other programmes. The most common answers include:

- London Office for Rapid Cyber Security Advancement (LORCA)

- CyLon

- National Cyber Security Centre Accelerator

Figure 7: Which programmes these coaches and mentors worked on outside of Cyber Runway (base number=12)

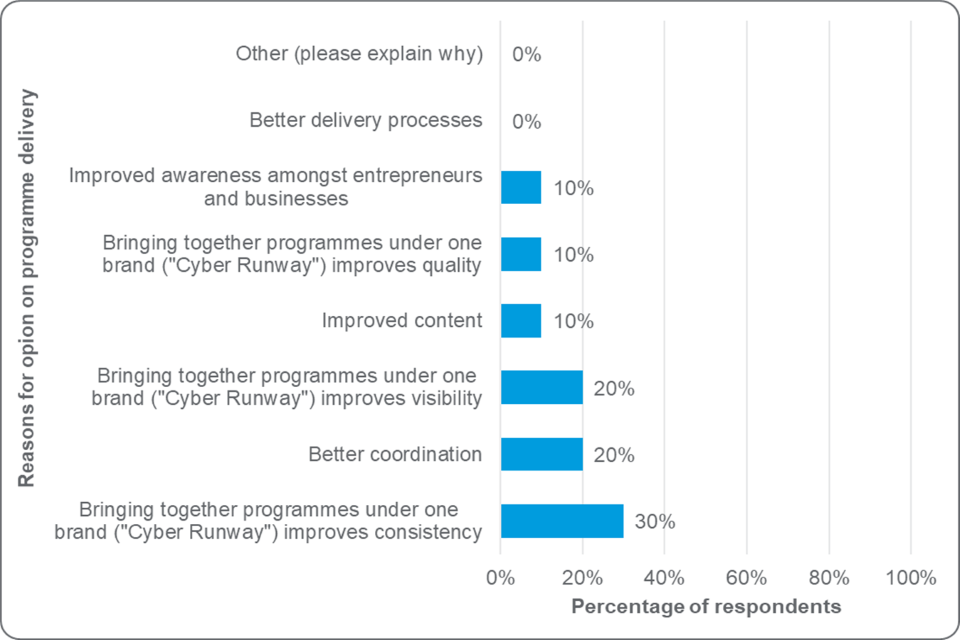

Reviews of how Cyber Runway compared to the other programmes were relatively positive, with 8% (n=1) describing it as much better and 42% (n=5) of the 12 respondents for this question describing it as better. However, it is important also to recognise that 42% (n=5) felt that Cyber Runway was neither better nor worse than the other programmes.

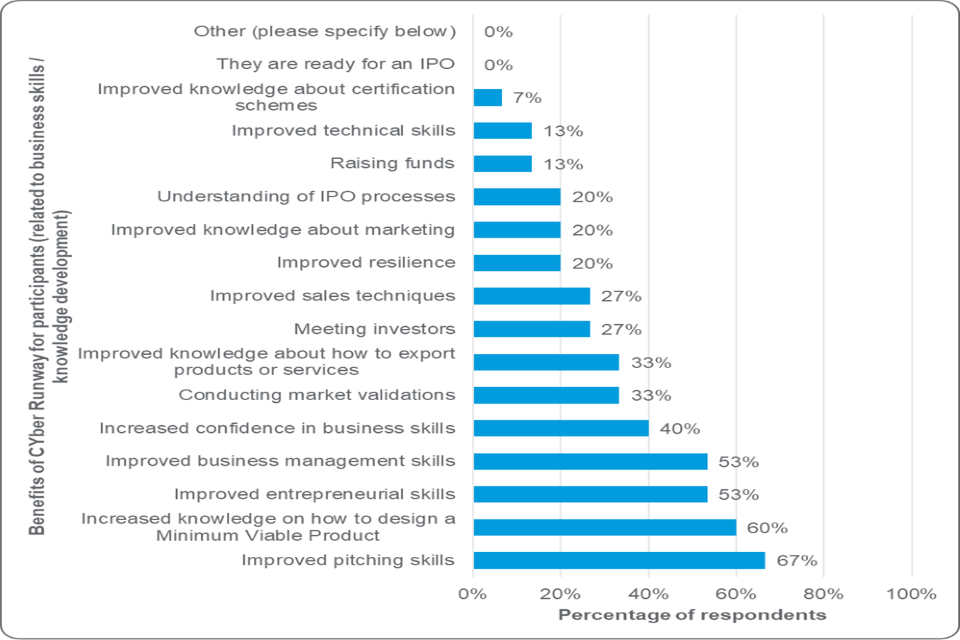

As shown in figure 8, respondents were asked to provide reasons for their response, with the results from the 10 survey respondents demonstrating that:

- 60% (n=6) of respondents felt that bringing programmes together under the Cyber Runway brand improved either visibility, consistency, or quality

- selections outside of these improvements listed above were rather dispersed, with better coordination at 20% (n=2) as well as improved content and improved awareness amongst entrepreneurs and businesses both at 10% (n=1)

Figure 8: Reasons for the coaches and mentors’ opinion on Cyber Runway programme delivery (base number= 10)

4.3 Summary of key findings

The programme has been delivered effectively with positive feedback from participating businesses and from mentors and coaches. In particular, participants valued masterclasses and mentoring support which provided practical advice founded in experience. Participants also stressed that the opportunity to network with other businesses, and with the mentors and experts, provided them with the chance to exchange ideas and speak with those in similar positions.

The main external factor affecting delivery was COVID-19 which limited the opportunity for face-to-face interaction and events. While virtual delivery generally worked well, participants felt they would have benefitted from face-to-face support which can be more intuitive, responsive, and personal.

Minor improvements to the programme delivery include an even stronger focus on mentoring and one-to-one support as well as more access to potential investors and introductions to regional cyber hubs.

5. Cyber Runway impact evaluation - performance

This section provides an overview of the performance of Cyber Runway against its KPIs, delivery objectives, and outputs as specified in the programme ToC. The sources used are based on monitoring information which Plexal submitted to DCMS, including logframe reports as well as survey, interview, and case study data.[footnote 21]

5.1 Performance against key performance indicators

The programme logframe and wider data provided by DCMS suggests that Cyber Runway’s performance is varied across its three component parts, Launch, Grow and Scale. The number of participants and their diversity are as expected or better, while regional representation and attendance rates are below levels initially targeted. The following table assesses performance against the delivery partner contracted KPIs based on data submitted in the logframes to DCMS.

Table 9: Performance against KPIs (2021/22)

| Indicator | Launch | Grow | Scale |

| 1) Regional representation – 50% of candidates from outside the South-East of England | 80% | 42% | 40% |

|---|---|---|---|

| 2) Minimum number of applicants – 40 per cohort | 45 | 75 | 32 |

| 3) Minimum number of individuals in each cohort | Target: 20 Actual: 20 |

Target: 15 Actual: 67 (digital / virtual) Target: 60 (at national events / not part of the virtual cohorts)[footnote 22] Actual: 71 (across the 4 events and not part of the virtual cohorts) |

Target: 20 Actual: 20 |

| 4) Diversity – minimum 30% female co-founders and 15% ethnic minority co-founders | Female co-founders : 40% Ethnic minority co-founders: 55% |

Female co-founders: 42% Ethnic minority co-founders : 55% |

Female co-founders: 65% Ethnic minority co-founders: 40% |

| 5) 100% attendance at sessions | 98% in November 67% in December (live attendance) 65% in January (live attendance) 60% in February (attendance at coaching sessions) |

88% in November 42% in December (live attendance) 40% in January (live attendance) c. 60% in February (live attendance) |

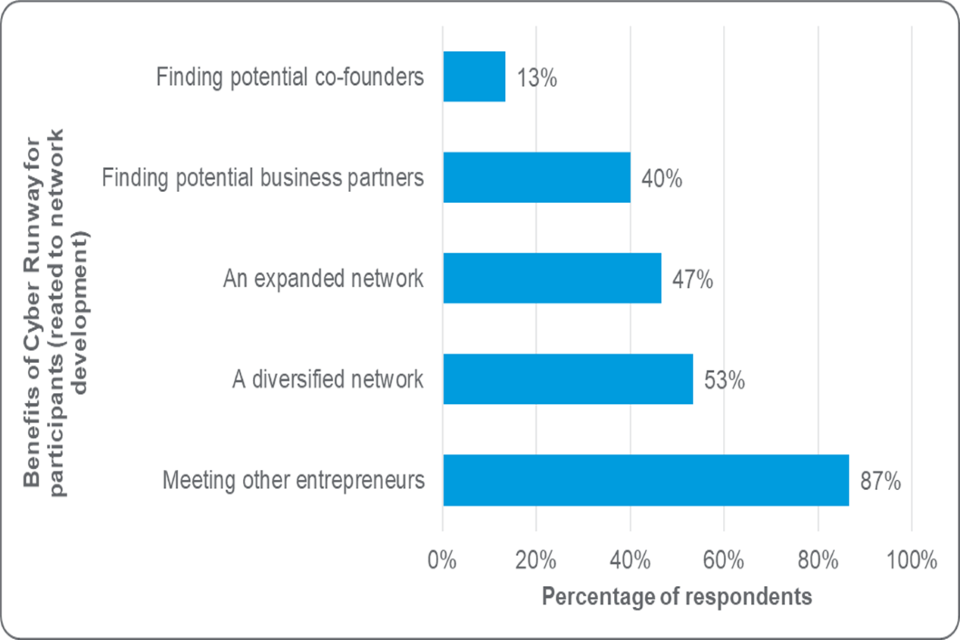

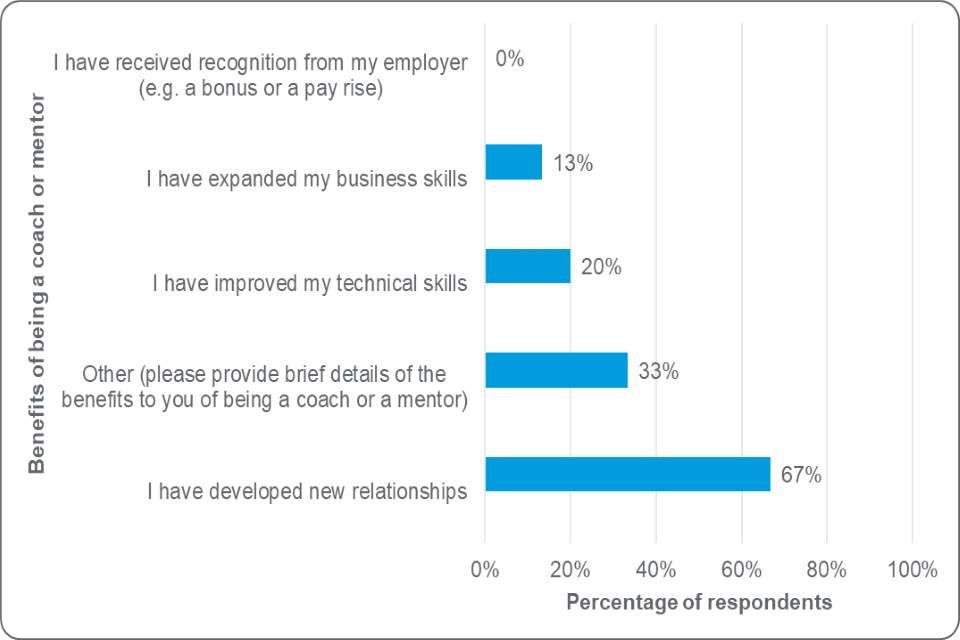

80% in November 80% in December (live attendance) 50% in January (live attendance) c. 40% in February (live attendance) |