041/19 ESF Direct Staff Costs – Clarifications on the correct use and updating of 1720

Updated 25 April 2025

| Date Issued | 13 November 2019 |

| Review Date | 31 December 2022 |

Who should read

ESF Applicants, ESF Grant Recipients, including Co-Financing Organisations, ESF Managing Authority, Greater London Authority, IBs.

Purpose

This action note provides clarification on the use of ESF Direct Staff Costs based on the 1720 Hourly Rate Calculation, including the process of calculating and agreeing the hourly rates per individual ESF Project and the processes to review these rates during the life of an ESF Project.

Background

This Action Note has been published in response to a recent ESF Programme audit and also a number of requests for clarification around the 1720 Hourly Rate Calculation rules.

The clarifications in this Action Note sit alongside the existing mainstream ESF guidance and apply both to existing Grant Recipients and new applicants to the ESF Programme.

Use of 1720 Hourly Rate – Initial Agreement in Principle

At the Full Appraisal stage for each ESF Full Application, the Managing Authority undertakes a full review of all ESF Direct Staff Costs proposed by an ESF applicant and the methodologies they intend to use in support of those costs – this includes the use of any 1720 Hourly Rate Calculations.

It is a mandatory requirement that each ESF applicant sets out the details of these costs in their Granular Budget document, submitted to the ESF Managing Authority as part of their Full Application.

The ‘Staff Costs Master List’ tab in the ESF Granular Budget Sample Template on GOV.UK sets out the details required in support of ESF Direct Staff Costs - https://www.gov.uk/government/publications/european-social-fund-online-full-applications

An applicant may choose to use their own Granular Budget template, however the same level of detail must be provided, as per the Staff Costs Master List tab, in such cases.

As part of the wider Full Appraisal, the Appraiser will check to ensure the proposed ESF Direct Staff Costs are eligible, have been calculated correctly and are based on the correct calculation methodology. If the Full Application is approved, the ESF Direct Staff Costs – including any associated 1720 Hourly Rate costs – will then be agreed in principle as part of that approval.

In addition, for each approved Full Application where 1720 Staff Hourly Rate costs are included, there will also be a standard post-Funding Agreement condition. This condition will confirm that the ESF Direct Staff Costs included in the ESF Project granular budget have been approved in principle as part of the Full Appraisal and this includes any hourly rate or fixed rate information set out in your granular budget. However, the Grant Recipient must ensure that, when their Project Inception Visit is undertaken by ESF Managing Authority, they must confirm whether there have been any changes to any of the staff costs recorded in their granular budget at the application stage.

If there have been any changes to any of the ESF Direct Staff Costs listed in their granular budget, they must provide an updated ‘Staff Costs Master List’ to the Contract Manager in advance of the Project Inception Visit to ensure accurate, timely checks can be undertaken prior to submitting their first financial claim to the ESF Managing Authority. The ESF Contract Manager can provide a standalone ‘Staff Costs Master List’ template for the Grant Recipient to complete in such cases.

Clarification of information to support the 1720 Staff Costs Hourly Rate ‘numerator’.

As set out in the ESF Programme Guidance and Action Note 038/19, some ESF Projects who have staff who are required to work less than 100% of their contracted hours on an ESF operation - but whose hours of work on ESF will vary each month should have their hourly wage rate calculated based on a set annual gross employment costs figure, using the 1720 calculation method set out in the Programme Guidance and ESF National Eligibility Rules published on GOV.UK.

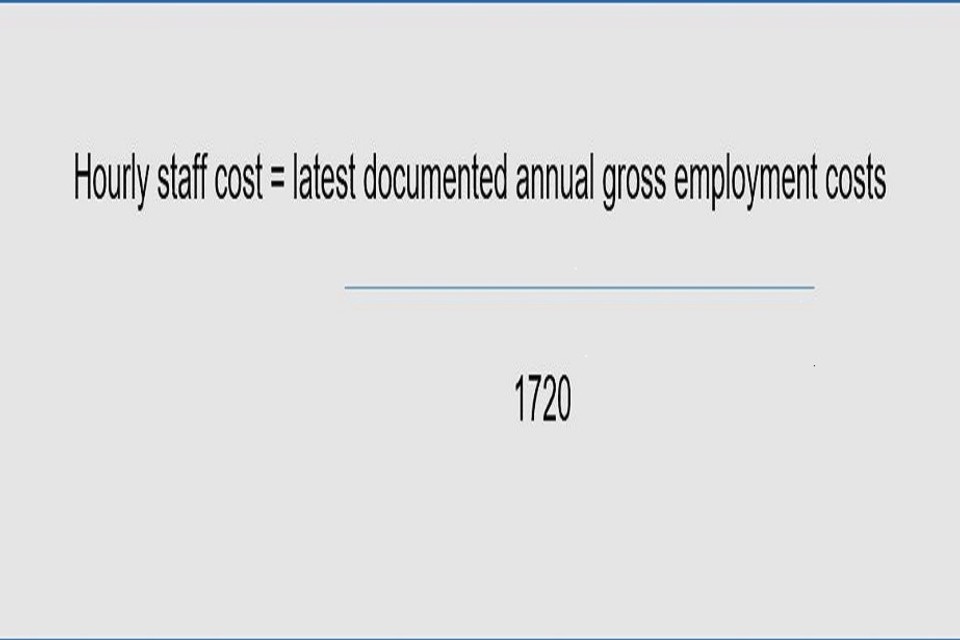

The 1720 calculation method is:

Image showing how to calculate the hourly staff cost

-

Gather evidence of individual’s latest documented annual gross employment costs. The evidence for this may include letter of appointment, contract of employment, job description, pay scales, payroll system reports or similar HR document.

-

Using the information detailed above, identify the latest documented annual gross employment costs for the individual. This should include basic pay, employer’s national insurance contributions, employers pension contributions, non-consolidated pay awards and other costs directly linked to salary payments in line with the employer’s usual employment policies.

-

Once the latest documented annual gross employment (numerator) amount is identified, divide this amount by 1720 to calculate the hourly rate. Evidence to support the hourly rate calculation should be retained for verification and audit purposes. This hourly rate amount should be used to calculate direct staff costs. Annual salary increases will be taken into consideration at the review point, the date of which should be agreed with the Managing Authority at the Project Inception Visit.

-

Records documenting the member of staff’s time spent working on managing, delivering or administering the project should be used to establish the number of hours to be claimed for the individual. Evidence should be retained for verification and audit purposes.

-

To calculate the amount to be claimed, multiply the hourly rate by the hours worked. It is important to remember that any annual leave should not be claimed as direct staff costs in these circumstances.

Latest Annual Gross Employment Costs

In addition, the Managing Authority would like to clarify that – from the date of publication of this Action Note - the latest annual gross employment costs for ESF 1720 hourly rate calculations should be the actual, latest annual gross employment cost figure in place for a given individual at the time the 1720 Staff Hourly Rate calculation is undertaken by the applicant/Grant Recipient, including any relevant oncosts listed in paragraph 18 below.

For example, this could be the latest actual annual salary figure for that individual or their latest monthly gross salary, plus the current monthly on-costs figure for that individual which is then multiplied by 12 to give an annual, total gross employment cost figure.

Whichever approach is used, there must be payroll related evidence which demonstrates how the annual gross employment figure has been determined.

Please note, bonus and commission payments should not be included in this calculation.

Where the 1720 Staff Hourly Rate Calculation is being applied, there is no longer a requirement to average out the salary of an individual over the previous 12 months or any other period to inform the calculation.

The ESF Programme Guidance will be updated to reflect this position in due course – in the meantime, this Action Note should be used when undertaking any new or updated 1720 Hourly Rate Calculations.

Also, for clarity, ‘Gross Employment Costs’ in the ESF Programme can include the following:

-

basic pay

-

employer’s national insurance contributions (the Employment Allowance should not be included in the Gross Employment Costs calculation if an employer is in receipt of it. Further details about the Employment Allowance

-

employers pension contributions

-

non-consolidated pay awards and

-

other taxable costs, included in the employees contract of employment, which directly link to salary costs.

Please also see Pension Contributions and Direct Staff Costs Action Note 040/19 issued 16 October 2019

Annual Review of 1720 Staff Hourly Rate Costs

1720 Staff Hourly Rate costs will be reviewed on an annual basis by the ESF Managing Authority.

As part of the Project Inception Visit, the ESF Managing Authority will agree and set a first ‘Staff Costs Annual Review’ date with the Grant Recipient – this first review should be arranged to coincide with any expected annual wage increases for the Grant Recipient organisation and any associated Delivery Partners - even if this is less than 12 months ahead. The date of the first review will be agreed with the Grant Recipient and will be documented in the final Project Inception Visit report.

Subsequent review dates will then be set on an annual cycle, allowing the Grant Recipient to revise their 1720 Staff Cost Hourly Rate calculations to take account of any newly increased annual gross employment costs. As part of each Annual Review, any new Staff Cost Hourly Rates will be checked by the ESF Contract Manager and, once agreed, will apply to any ESF Direct Staff Costs incurred from the annual review point onwards.

The outcome of each Annual Review and the next annual review date will be recorded in a “Staff Costs Annual Review Record” document by the ESF Contract Manager – this document will then be made available to the Grant Recipient via ECLAIMS.

As Grant Recipients submit their financial claims to the ESF Managing Authority in arrears, it is critical that they ensure the correct 1720 Staff Cost Hourly Rate figures are used in each financial claim – particularly if a single claim includes expenditure incurred both pre- and post a Staff Costs Annual Review point.

For example:

-

A Grant Recipient submits a financial claim to the ESF Managing Authority in November, covering expenditure incurred between 1st July and 30th September. However, the Grant Recipient’s annual round of pay increases took effect from 1st August 2019 and the revised 1720 Staff Cost Hourly Rate figures were agreed at the time with the ESF Contract Manager.

-

The Grant Recipient should ensure that any ESF Direct Staff Costs up to 31st July 2019 are claimed based on the 1720 Staff Cost Hourly Rates in place up to and including this date. Only staff costs incurred since 1st August 2019 should be claimed at the revised, increased 1720 Staff Costs Hourly Rate.

-

1720 Staff Hourly Rates should not be updated outside of the Annual Review cycle however, in exceptional circumstances, a Grant Recipient may request an interim review setting out their rationale – for example, an ESF Project vacant post is filled after the Project Inception Visit but before the first, scheduled staff costs review point and the annual gross employment costs for the new recruit are significantly different to the costs confirmed for that post at the Project Inception Visit or there is a promotion or re-grading of an individual’s salary which significantly changes the numerator used for the current 1720 Staff Costs Hourly Rate calculation.

In all cases, the decision on whether to accept the Grant Recipient request for an interim review will be for the Contract Manager to make.

Action

Applicants, Grant Recipients and ESF Managing Authority staff, including Intermediate Bodies to be aware of the revised process when proposing, agreeing or reviewing 1720 Staff Cost Hourly Rates.

Contact

If you have any questions about this Action Note please contact esf.2014-2020@dwp.gov.uk