Local authority packaging cost and performance (LAPCAP) worked examples

Updated 4 February 2026

Introduction

This document goes through some worked examples based on the Local Authority Costs and Performance (LAPCAP) model. In this document we are taking an example unitary authority to show how calculations are worked out at each stage. Some example calculations are also included that do not apply to unitary authorities, for example calculations regarding recycling credits. These are included to aid understanding. We explain which examples this applies to.

The numbers in the calculations are meant to represent realistic values but are not meant to be a perfect resemblance of a local authority. Furthermore, when a calculation is done multiple times, only one example calculation is used. For example, if a calculation is done for all materials in a local authority, only the calculation for plastic is shown.

You should note that:

- the numbers in the calculations are intended to represent realistic values but may not be fully accurate

- when a calculation is carried out multiple times to reach a final figure, only one example calculation is given, for example, if a calculation is done for all materials in a local authority (LA), only the calculation for plastic is shown

Sigma notation is used in many of the equations and means the sum for all values under a variable.

Sum of Value_variable. The sigma symbol appears with 'variable' written below it, indicating summation across all values of that variable.

For example, the total (or sum of all) households covered by a local authority’s 2 schemes (standard and communal) is the number of households covered by each scheme added together. This calculation can be shown by using the following equation.

Sum of households under the scheme equals standard households plus communal households, equals 80,000 plus 20,000, equals 100,000.

The purpose of this equation is to aggregate the weight waste tonnages across multiple collection schemes so you can then split out material specific tonnages. It’s a concise way to turn disparate scheme-level data into a single, material-broken-down tonnage for each authority.

Calculating tonnages

Variables used to calculate tonnages are:

-

composition tonnage - collection tonnages obtained from waste composition studies including WRAP Cymru 2023, WRAP Synthesis 2017 and Zero Waste Scotland 2023

- scheme households - the number of households on a scheme for a local authority, taken from the scheme data

- Waste Data Flow (WDF) collection tonnages - the collection tonnages reported in WDF

- waste from households factor - an estimated proportion of collected tonnages which are from households, depending on country and waste category

Calculations

To calculate tonnage, material proportion is multiplied by scheme proportion and household collection tonnage data from Waste Data Flow (WDF).

Equation: calculating collection tonnage

Collection tonnage = Material proportion × scheme proportion × Waste Data Flow household collection tonnage

Material proportion is the proportion of the total tonnage that is made up from a certain material. For example, plastic, paper, glass and metal.

Scheme proportion is the proportion of households that are on a certain scheme. For example, standard kerbside and communal collections.

WDF collection tonnage are tonnages reported in WDF which are determined to be from households by applying the waste from households factor.

Table 1 shows the data used to calculate collection tonnages.

Table 1: Variables used to calculate collection tonnages

| Local authority variable | Local authority values | External variables [1] | External values |

|---|---|---|---|

| Communal households | 30,000 | Waste from households factor for recycling | 0.5 tonnes |

| Sum of households across all schemes | 150,000 tonnes | Composition tonnage for plastic | 300,000 tonnes |

| WDF collection tonnage | 500,000 tonnes | Sum of material in composition tonnage | 6,000,000 tonnes |

[1] External refers to data from other sources and not provided by a local authority.

To calculate collection tonnages for each scheme type and material 4 separate calculations must be made.

- Calculate material proportion for each material (paper, plastic, glass) by dividing tonnage of each material by total tonnage.

- Calculate scheme proportion for each collection scheme by dividing number of households served by each scheme by total number of households across all schemes.

- Calculate collection tonnage for each waste type by multiplying WDF reported collection tonnage by the waste from households factor.

- Calculate collection tonnage for each scheme type and material by multiplying material proportion for each material by the scheme proportion for each scheme, then multiplying by the collection tonnage from households for each waste category.

Equation: calculating material proportion

Material Proportion_plastic equals Composition Tonnage_plastic divided by the sum over materials of Composition Tonnage_material. Equals 300,000 divided by 6,000,000, equals 0.05.

Equation: calculating scheme proportion

Proportion_communal equals Households_communal divided by the sum over schemes of Households_scheme. Equals 30,000 divided by 150,000, equals 0.2.

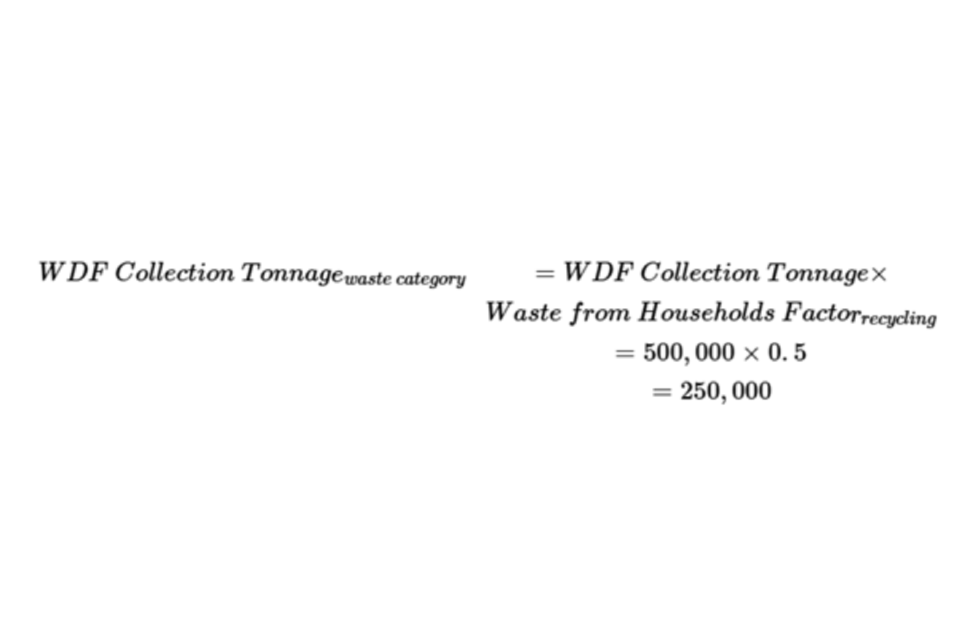

Equation: calculating WDF collection tonnage

Waste Data Flow Household Collection Tonnage_waste category equals Waste Data Flow Collection Tonnage multiplied by Waste from Households Factor for_recycling. Equals 500,000 times 0.5, equals 250,000.

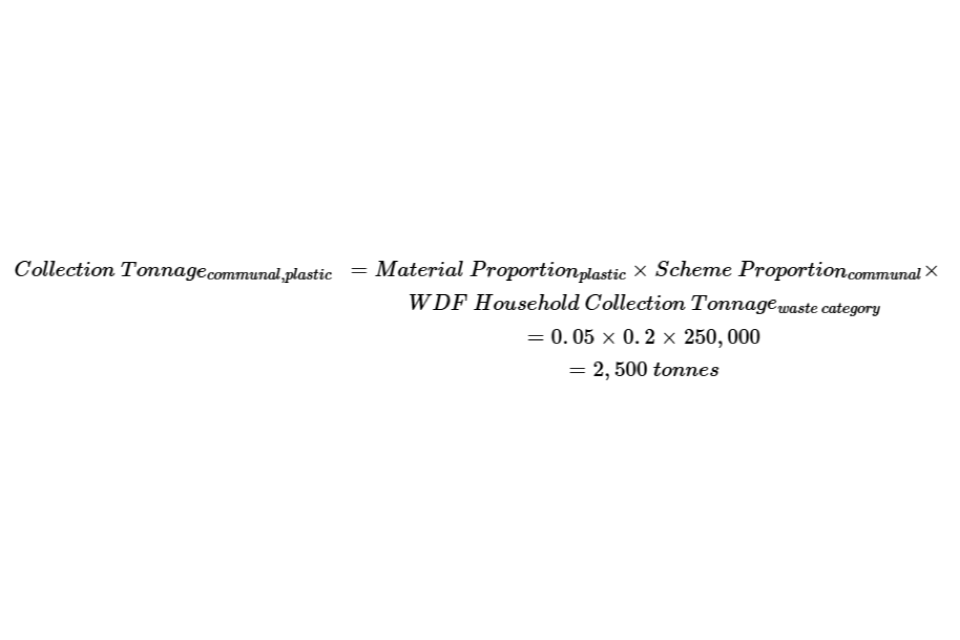

Equation: calculating collection tonnage

Collection Tonnage_communal,plastic equals Material Proportion_plastic times Scheme Proportion_communal times Waste Data Flow Household Collection Tonnage_waste category. Equals 0.05 times 0.2 times 250,000, equals 2,500 tonnes.

Calculating disposal tonnages

Disposal tonnages are calculated in a similar way to collection tonnages. The calculations use:

- disposal tonnage data from WDF (for England, Wales and Scotland only)

- facility proportion instead of scheme proportion (the proportion of tonnage going to each disposal facility)

For England and Wales, each authority’s “disposal” tonnages is used exactly as the data shows in the latest WDF return.

For Scotland data from the WDF disposal table (“disposed of by destination”) is used. The Scottish Environment Protection Agency (SEPA) no longer publishes a separate mass-balance at local authority level.

Northern Ireland tonnages are not included because WDF does not yet collect comparable facility-level data.

The facility proportion is then the share of a local authority’s total disposal tonnage that goes to each of the following outlet types:

- materials-recovery facility (MRF) handling comingled recyclate

- reprocessor – glass furnace, paper mill, plastics regrind plant, aluminium smelter, etc.

- mechanical-biological-treatment (MBT) or residual-MRF plant treating black-bag waste

- energy-from-waste incinerator (EfW) or advanced thermal facility (gasification, pyrolysis)

- landfill – inert, non-hazardous or hazardous landfill accepting municipal wastes

- refuse-derived fuel (RDF) exported overseas for energy recovery

- other – any remaining disposal outlet (for example, cement-kiln co-processing)

The calculation used to work out disposal tonnage for each facility - material combination is therefore the disposal tonnage for each facility multiplied by the proportion of total disposal tonnage sent to each facility.

Equation: calculating disposal tonnage

Facility Proportion_facility equals Waste Data Flow Disposal Tonnage_facility divided by the sum over facilities of Waste Data Flow Disposal Tonnage_facility. And Disposal Tonnage_facility,material equals Facility Proportion multiplied by Waste Data Flow Disposal Tonnage_material.

Calculating collection costs

Collection costs are cost per tonne (CPT) figures we attach to each waste stream (for example, residual, dry recycling, food, garden) so that every local authority can be paid for the packaging they collect. Data from the request for information (RFI) and Office for National Statistics (ONS) is used to create those cost figures.

Variables used to calculate collection costs

The following variables are used to calculate collection costs:

- RFI Variables

- household numbers

RFI variables

All variables under “RFI Authority Variables” are values that have been provided to us through RFIs from a select number of local authorities. These local authorities were selected to provide data on their waste programs to give a best representation of all local authorities in the UK. Respondents supplied the annual spend and tonnage for each of their operational services that collect household waste (waste programmes).

Operational services include:

- kerbside

- communal

- residual kerbside

- communal dry recycling

- food waste collection

- garden waste collection

- bring sites or household waste recycling centre (HWRC), where applicable

The spend from each RFI authority is converted to CPT for each stream. Local authorities are then placed into cost driver groups. For example, the same country, rurality band, housing mix, predominant scheme.

Household numbers

ONS data is the primary source for household numbers and household type. The UK Office for National Statistics publishes annual mid-year household estimates for England and Wales, Scotland and Northern Ireland. ONS was not used for all local authorities.

The LAPCAP model uses the 2023 mid-year estimates (published spring 2024). Where ONS does not publish a figure (some small islands and newly merged councils), we use the 2022 estimate or use the authority’s own 2023 council-tax base.

Calculations for collection costs

Collection costs are calculated using RFI data. For each local authority that has submitted RFI data, a CPT value is calculated for residual, dry recycling, food and garden costs (although the EPR for packaging payment output for year one does not include food and garden waste).

All local authorities are grouped based on factors that drive collection costs and given a CPT figure. This is the mean of the local authorities which have provided RFIs in their group.

For local authorities who have submitted RFI data, the CPT is calculated by multiplying kerbside collection CPT by proportion kerbside plus communal collection CPT multiplied by proportion communal.

How to calculate RFI CPT:

Cost per Tonne = Kerbside Collection CPT × Proportion Kerbside + Communal Collection CPT × Proportion Communal

Kerbside and communal collection CPT is calculated from the RFI for collection from either kerbside or communal collections.

The proportion of kerbside and communal is the assumed proportion of properties that are served by kerbside or communal rounds. These are equivalent to the proportion of regular properties and flats respectively.

These proportions are assumed because many RFI returns report a single spend figure for the whole stream.

As a result, the single spend is split in line with the latest (2023) ONS household counts, treating the household mix as the best available proxy for how each waste collection schedule’s cost is shared.

Regular properties are detached, semi-detached, terraced houses and bungalows; anything served by its own wheeled-bin or sack collection. All high-rise and low-rise flats, plus other dwellings that present waste to shared bins, are classed as communal.

The 2 CPT rates are combined into one by weighting them to match how many properties each service covers.

The kerbside rate is multiplied by the amount of households on kerbside rounds, the communal rate by the share on communal rounds, and the two results are added together. That weighted average is the single CPT figure for the whole collection stream.

Table 2 shows the RFI unitary authority’s reported cost items, and the household data used to weight them.

Table 2: Variables used to calculate collection costs

| RFI authority variables | RFI authority values | Local authority variables | Local authority values |

|---|---|---|---|

| Residual kerbside collection costs | £900,000 | Regular (kerbside) properties | 80,000 |

| Total collection costs excluding overheads for all streams | £3,600,000 | Flats (communal) | 20,000 |

| Total overheads | £2,000,000 | Kerbside tonnes (residual) | 20,000 tonnes |

| Residual kerbside tonnages | 20,000 tonnes | Not applicable | 0 |

| Communal collection CPT | £50 | Not applicable | 0 |

RFI variables are the individual cost lines taken straight from the authority’s RFI return.

Local-authority variables are contextual data (households and tonnes) used to turn those costs into CPT and to weight kerbside and communal rates.

Overheads cover costs the local authority allocates to its collection service, including:

- depot costs

- vehicles

- management

- information technology (IT) and back-office

- any other indirect costs the authority allocates to its collection service

Steps on how collection costs are calculated

The following steps explain how collection costs are calculated.

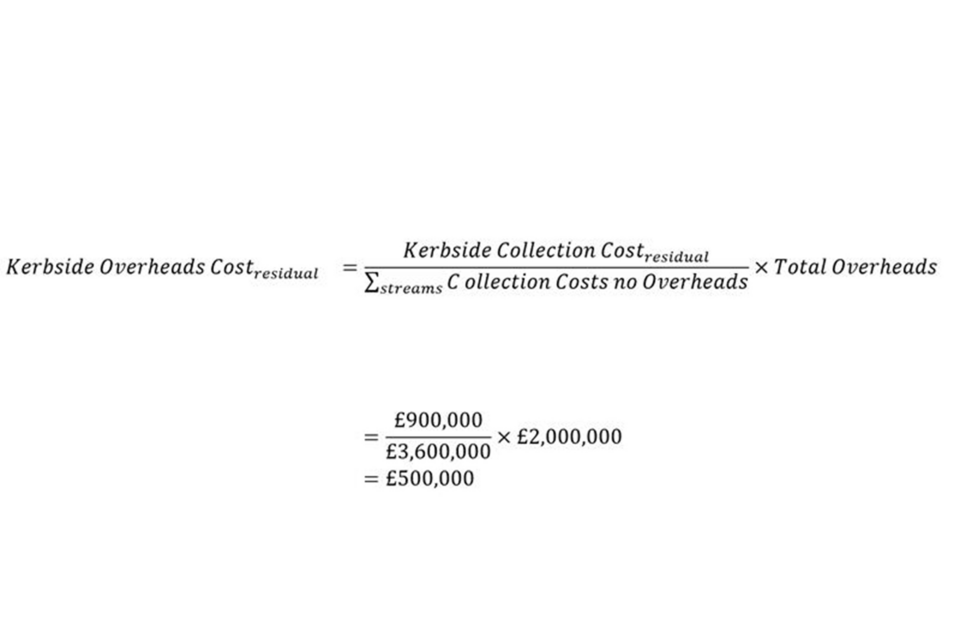

Step 1. Allocate overheads to the kerbside residual service

Total collection overheads (the figure of £2,000,000 in table 2) are split across kerbside and communal in proportion to their direct spend (in this example only kerbside collection costs are used – the same methodology is applied to kerbside and communal.

Equation: kerbside collection overheads (general equation)

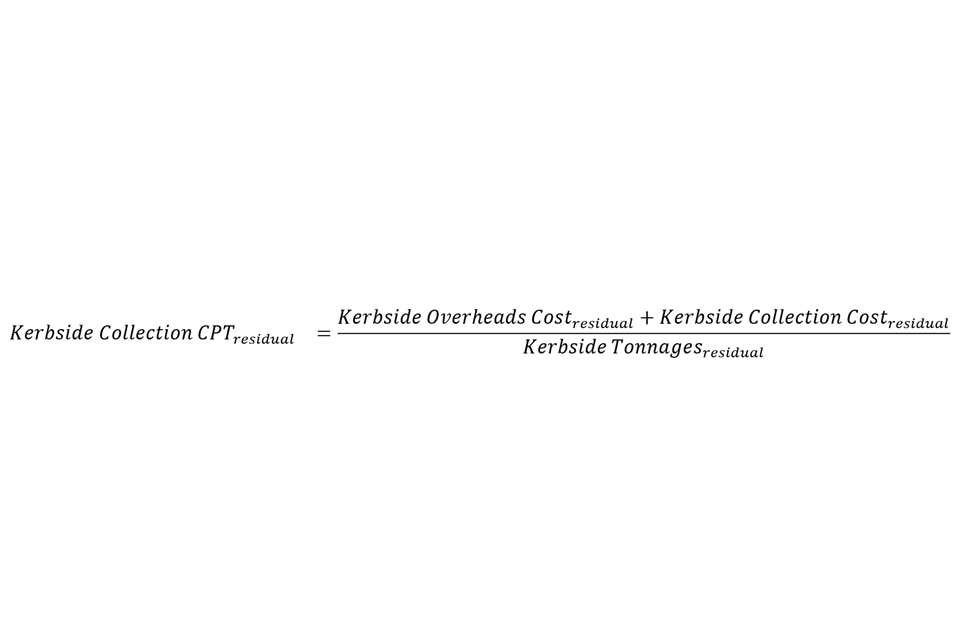

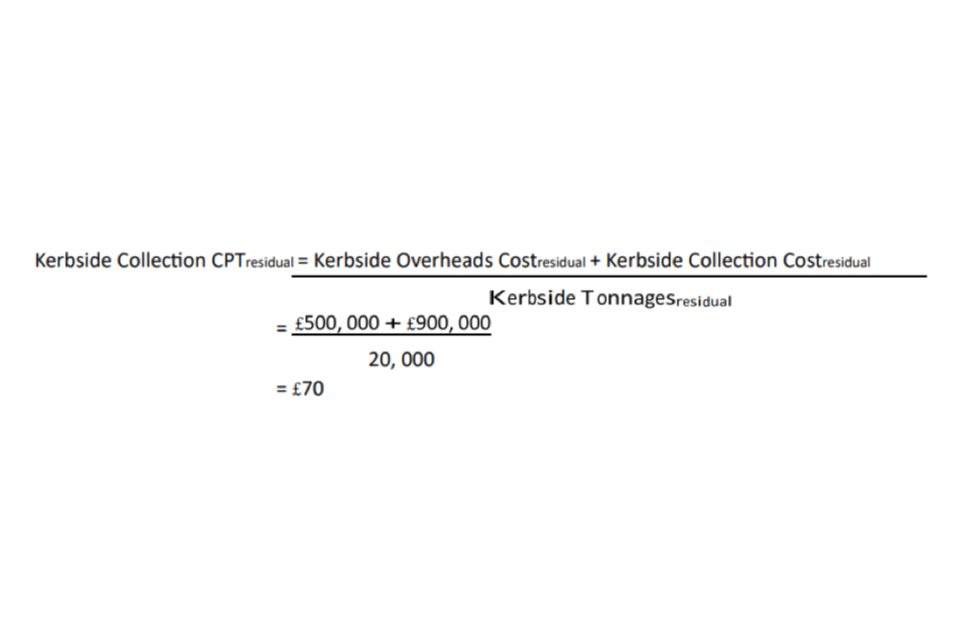

Kerbside Collection CPT_residual equals the sum of Kerbside Overheads Cost_residual and Kerbside Collection Cost_residual, divided by Kerbside Tonnages_residual.

Equation: kerbside collection overheads example

Kerbside Overheads Cost_residual equals Kerbside Collection Cost_residual divided by the sum over streams of Collection Costs no Overheads, multiplied by Total Overheads. Equals £900,000 divided by £3,600,000, times £2,000,000, equals £500,000.

Step 2. Derive the kerbside cost per tonne (CPT)

To find the kerbside CPT, the residual kerbside overheads cost is added to overall kerbside collection cost and divided by the kerbside tonnages.

Equation: residual kerbside CPT

Kerbside Collection CPT_residual equals Kerbside Overheads Cost_residual plus Kerbside Collection Cost_residual, divided by Kerbside Tonnages_residual. Equals £500,000 plus £900,000, divided by 20,000, equals £70.

(This same calculation is repeated for the communal service to get its £50 CPT.)

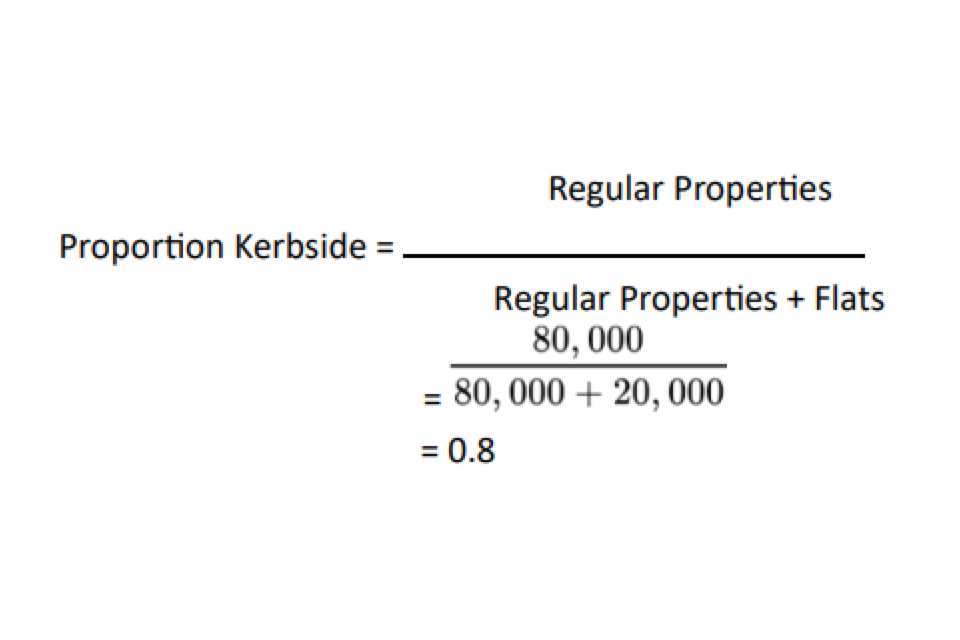

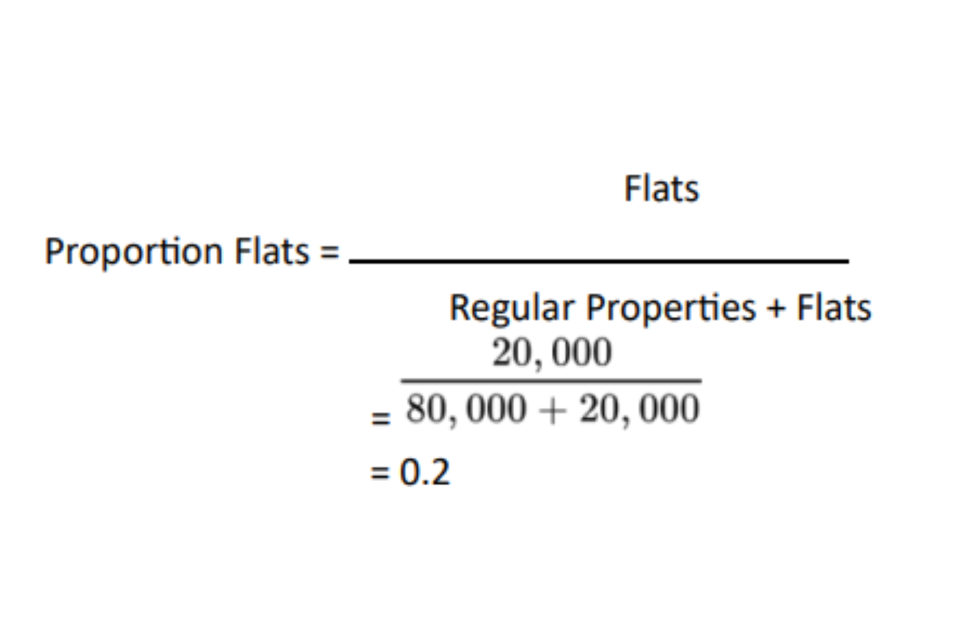

Step 3. Calculate the household split

Proportions of each property type are calculated by dividing the number of properties of that type by the total number of properties.

Equation: proportion of kerbside properties

Proportion Kerbside equals Regular Properties divided by Regular Properties plus Flats. Equals 80,000 divided by 80,000 plus 20,000, equals 0.8.

Equation: proportion of flats

Proportion Flats equals Flats divided by Regular Properties plus Flats. Equals 20,000 divided by 80,000 plus 20,000, equals 0.2.

Step 4. Combine the two CPTs into a single stream rate

Cost per Tonne_residual equals Kerbside Collection CPT times Proportion Kerbside, plus Communal Collection CPT times Proportion Communal. Equals £70 times 0.8 plus £50 times 0.2, equals £66.

Calculating disposal costs

In this example, we work out the CPT cost of sending each packaging material to each disposal outlet. These include:

- MRF

- reprocessor

- MBT

- EfW

- landfill

- RDF export

- other

Starting from the WRAP Gate Fee Survey we strip out the haulage element, deduct any material-value rebate paid by the outlet, and arrive at a net gate fee that feeds the payment model.

Variables used to calculate disposal costs

Variables used are the:

- gate fee – the price in CPT that a disposal facility charges a local authority to tip waste at its gate

- gross gate fee – the headline gate fee reported to WRAP, which still contains both haulage and any revenue the facility retains

- net gate fee – the gate fee after the facility has already taken haulage and material-sales income off the bill

- material value – a per tonne material value, taken from Let’s Recycle (price tracker 2023 to 2024) which is a typical CPT revenue the outlet receives for the recovered material

- local authority (including haulage) and local authority (excluding haulage) - the number of Gate Fee Survey responses that did or did not include haulage

- composition - taken from the calculating tonnages section of the model – the proportion of disposal tonnages going to a facility that are a material

- haulage - the per-tonne expense of transporting waste from a local authority’s transfer station or depot to the final disposal or processing facility – we calculate haulage for each facility type by averaging the difference between gross and net fees among the Gate Fee Survey responses, this which gives a representative haulage CPT for each facility, which we then deduct from the gross fee before applying any material value rebate

- rebate – the amount of material sales income passed back to the authority; calculated as the gross-net fee gap, apportioned across materials by (material value – haulage) composition share, applied only to MRFs and reprocessors

- net disposal cost (material gate fee) – the gross gate fee minus the material-specific rebate; this is the CPT cost that feeds into EPR payments

- MRF - plant that separates comingled recyclate into individual materials

- reprocessor - glass furnace, paper mill, plastics regrind plant, aluminium smelter, etc., that converts a single material into new feedstock

- net gate fee - the gate fee after the facility has already taken haulage and material-sales income off the bill

- MBT or residual MRF - mechanical-biological-treatment or residual MRF that extracts recyclables from black-bag waste

- EfW or thermal - energy-from-waste incinerator, gasifier or pyrolysis plant recovering energy from residual waste

- landfill - inert, non-hazardous or hazardous landfill accepting municipal waste

- RDF export - refuse-derived fuel shipped overseas for energy recovery

Calculations

Gate fees

A gate fee is the price a disposal site charges, per tonne, to accept waste at its gate. A material gate fee is that price after it has been adjusted for a specific material.

Gate fees are used to calculate the net disposal cost for each material sent to each facility by subtracting the rebate for each material facility combination from the gross gate fee for each material facility combination.

Equation: calculating net disposal costs for materials and facilities

Net Disposal Cost_material,facility equals Gross Gate Fee_facility minus Calculated Rebate_material,facility.

The resulting net disposal cost is equal to the gross gate fee minus the rebate, and is applied only to MRFs and reprocessors, as other outlets do not share sales income.

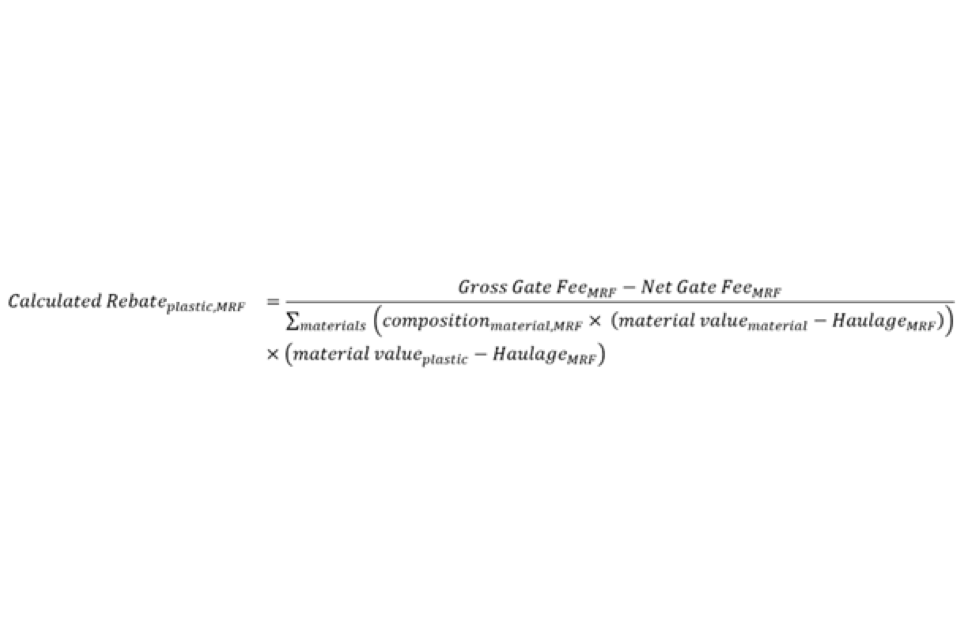

Equation: calculating the rebate value for materials and facilities

Calculated Rebate_material,facility equals the fraction: Gross Gate Fee_facility minus Net Gate Fee_facility, divided by the sum over materials of (composition_material,facility times the quantity material value_material minus Haulage_facility), all multiplied by (material value_material minus Haulage_facility).

The following table shows an example used to calculate disposal costs for a local authority.

Table 3: Variables used to calculate disposal costs

| External variables | External values | Local authority dependent variables | Local authority dependent values |

|---|---|---|---|

| MRF gross gate fee | £85 | Number of local authorities reporting gate fee including haulage | 200 |

| MRF net gate fee | £15 | Number of local authorities reporting gate fee excluding haulage | 150 |

| Plastic material value | £67.50 | Sum of MRF gross gate fees including haulage | £20,000 |

| Not applicable | £0 | Sum of MRF gross gate fees excluding haulage | £9,000 |

| Not applicable | £0 | Material value at MRF minus haulage, multiplied by composition, summed across materials | £100 |

Equation: calculating net disposal costs

Net disposal cost equals gross gate fee minus calculated rebate for plastic MRF.

The calculated rebate of plastic, MRF equals the gross gate fee, MRF minus net gate fee, MRF multiplied by a fraction: the sum of material composition rates, MRF multiplied by (material value minus haulage, MRF) divided by (material value plastic minus haulage, MRF.)

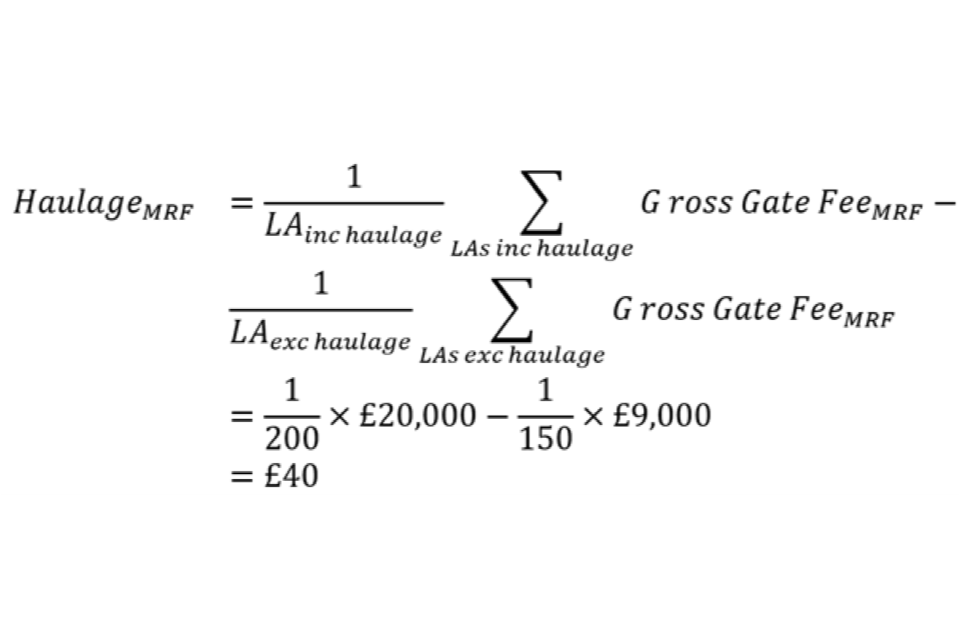

Step 1. Work out the haulage element for a MRF

To calculate the haulage element for a MRF the mean gross gate fee including haulage is subtracted from the mean gross gate fee excluding haulage.

Haulage_MRF equals 1 divided by LA_inc haulage, times the sum over LAs including haulage of Gross Gate Fee_MRF, minus 1 divided by LA_exc haulage, times the sum over LAs excluding haulage of Gross Gate Fee_MRF. Equals 1 over 200 times £20,000 minus 1 over 150 times £9,000, equals £40.

200 survey responses included haulage. Their average gross minus net gap is £20, 000 divided by 200, which equals £100 per tonne.

150 responses excluded haulage – their gap is £9, 000 divided by 150, which equals £ 60 per tonne.

The mid-point is used as our modelled haulage cost is therefore £40 per tonne.

Step 2. Calculate the rebate that the MRF pays back on plastic

The following examples use the below values:

- gross gate fee (includes haulage) equals £85 per tonne

- net gate fee (already minus haulage and any sales income) equals £15 per tonne

- gross – net gives a £70 per tonne or amount that the MRF returns to councils

This gives a total sales value of material of gross gate fee minus net gate fee (£85 − £15).

This gives a total sales value of material of gross gate fee minus net fee gate (£85 minus £15). This amount is shared across materials in proportion to the material composition and material values.

Equation: calculated rebate

Calculated Rebate_plastic,MRF equals Gross Gate Fee_MRF minus Net Gate Fee_MRF, divided by the sum over materials of (composition_material,MRF times material value_material minus Haulage_MRF), multiplied by (material value_plastic minus Haulage_MRF). Equals £85 minus £15, divided by £100, times £67.50 minus £40, equals £16.50.

The denominator £100 is the summed weighted value for every material at this facility.

Step 3. Derive the net disposal cost for plastic sent to MRF

Equation: net disposal cost of plastic

Net Disposal Cost_plastic,MRF equals Gross Gate Fee_MRF minus Calculated Rebate_plastic,MRF. Equals £85 minus £16.50, equals £68.50.

Calculating overheads

All local authorities are paid the same per household for overhead costs. These costs reflect the administration, contract management and other local authority costs of managing waste disposal functions, including local communication campaigns.

Variables used to calculate overheads

The variables used to calculate overheads are as follows.

- Disposal overheads cost or RFI Households – for every authority that filled out the RFI, we divided the total annual overheads allocated to disposal (for example, manager salaries, depots, fleet standing costs, IT) by the number of households it serves. We then average those per household figures within each cost-driver group (nation, urbanity, housing mix) so every authority in the same group starts with one common “cost per household”.

- Households - the number of households within a local authority. The primary data source is the ONS mid-2023 estimate (or NRS/NISRA 2023 for Scotland and Northern Ireland).

- Collection or disposal tonnes – taking from the calculating tonnages section. The estimated tonnages collected split by material and stream. Which is the model’s best estimate of how many tonnes of packaging each material moves through each part of the system. “Material” means the seven packaging categories we track: plastic, paper/card, glass, aluminium, steel, fibre-based composites, and “other”. “Stream” tells us how that material is handled: collection streams – for example, kerbside residual, kerbside dry recycling, food, garden, bring site recycling, HWRC recycling, HWRC residual.

Calculations for overhead costs

Overhead costs are calculated using outputs from the CPT module. This covers both disposal overheads and HWRC overheads.

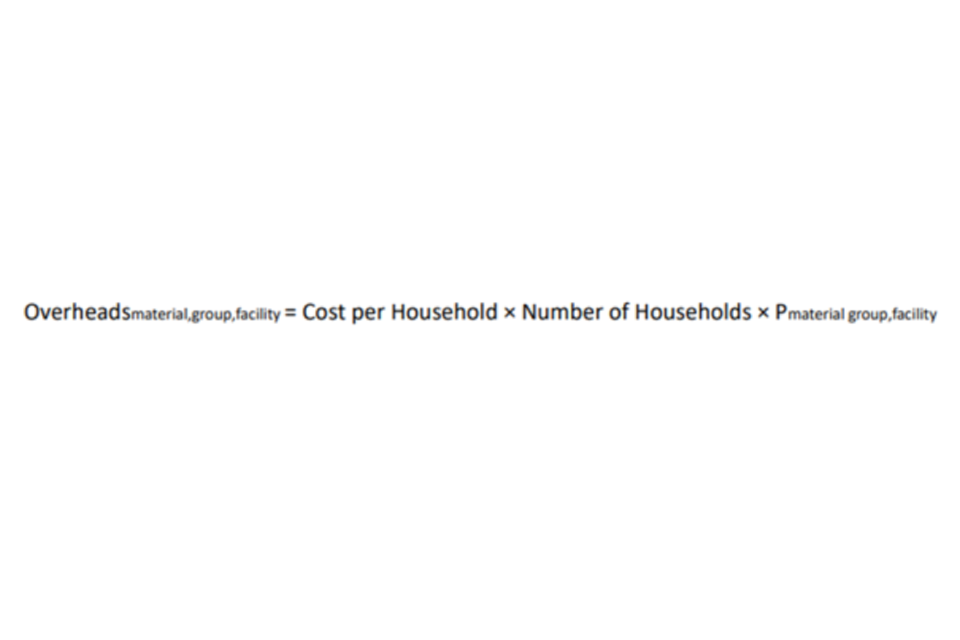

Equation: overhead costs

Overheads_material,group,facility equals Cost per Household times Number of Households times P_material,group,facility, where P is the proportion of total tonnage for that material routed to that facility.

The cost per household is the overhead cost per household, taken from the RFI data. This is the average cost per household for all RFIs. It is equal to Disposal Overheads cost divided by the number of RFI households. These cost-per-household figures are averaged within each group and that single average is applied to all authorities in the group, including non-RFI authorities.

Number of households is the number of households within a local authority.

‘P’ is the proportion of the local authority’s total tonnage (disposal and HWRC collection) of both material m and routed to facility f. Because it is a proportion, the overhead pot is split fairly: the more plastic that goes to MRFs, the higher the overhead assigned to “plastic, MRF”, and so on.

Table 4: Variables used to calculate disposal overheads

| RFI authority variables | RFI authority values | Local authority variables | Local authority values | Other module variables | Other module values |

|---|---|---|---|---|---|

| Disposal overheads cost | £550,000 | Households | 100,000 | Disposal tonnes of plastic sent to MRF | 350 |

| RFI households | 100,000 | Not applicable | 0 | Collection tonnes of plastic at HWRC | 17.5 tonnes |

| Not applicable | £0 | Not applicable | 0 | Sum of disposal tonnes of all materials at all facilities | 75,000 tonnes |

| Not applicable | £0 | Not applicable | 0 | Collection tonnes of all materials at HWRC | 12,500 tonnes |

Table 5: Example values for a local authority disposal overheads calculation

| Input | Value |

|---|---|

| Grouped average cost per household | £5.50 |

| Households in local authority (ONS 2023) | 100,000 |

| All disposal and HWRC tonnes | 87,500 |

| Disposal tonnes of plastic sent to MRF | 350 |

| Collection tonnes of plastic at HWRC | 17.5 |

Equation: the per tonne disposal overheads for plastic sent to MRF

Disposal Overheads_plastic,MRF equals £5.50 times 100,000 times 350 divided by 87,500, equals £2,200.

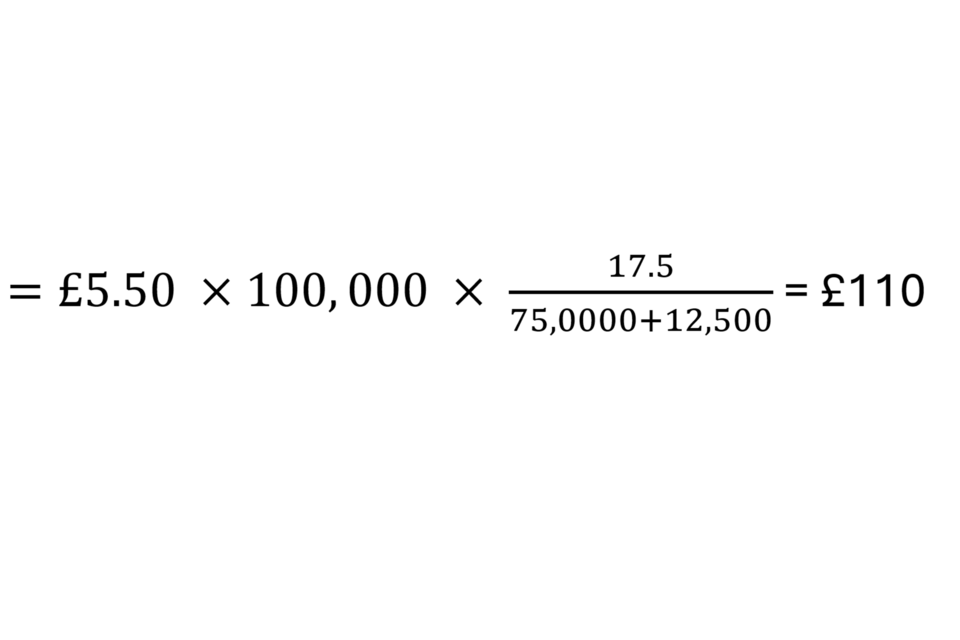

Equation: the per tonne collection overheads for plastic collected at HWRC

HWRC Overheads_plastic,MRF equals £5.50 times 100,000 times 17.5 divided by 87,500, equals £110.

HWRC collection overheads

Local authorities incur two kinds of costs at their HWRCs:

- the day-to-day cost of running the sites (staff, containers, site management)

- the back-office overheads that support the service (depot rents, vehicles held on standby, IT, management time)

LAPCAP builds both elements into the payment model.

Cost per household: this calculation shows how the cost per household is calculated from each RFI. These costs per households are averaged over all RFI local authorities, and the same cost per household is applied to all local authorities.

Equation: cost per household

Cost per Household equals Disposal Overheads Costs divided by RFI households. Equals £114,000 divided by 100,000, equals £1.14.

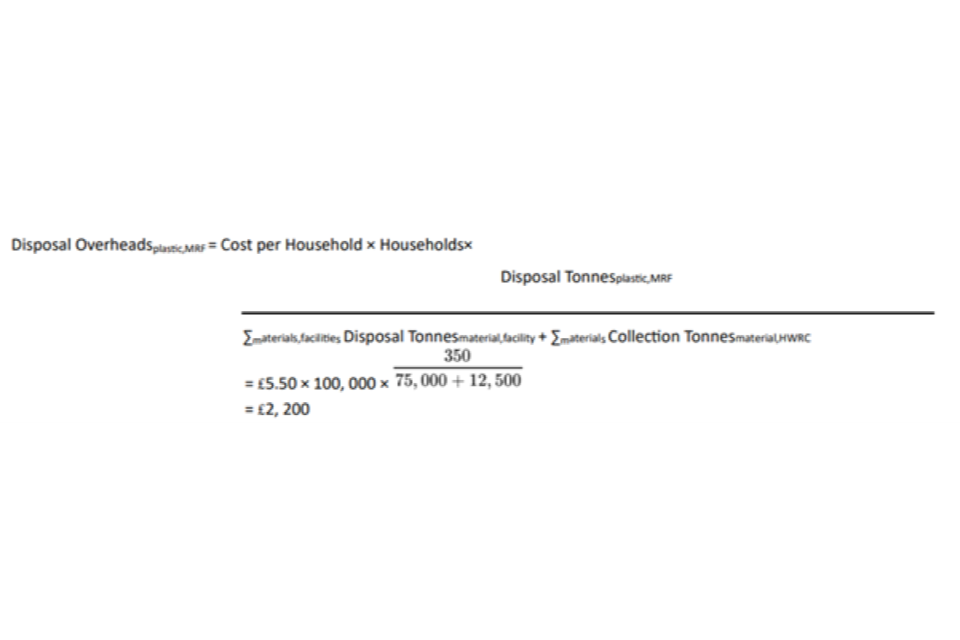

Disposal overheads

Equation: How disposal overheads are calculated

Disposal Overheads_plastic,MRF equals Cost per Household times Households times the fraction: Disposal Tonnes_plastic,MRF divided by (the sum over materials and facilities of Disposal Tonnes_material,facility plus the sum over materials of Collection Tonnes_material,HWRC). Equals £5.50 times 100,000 times 350 divided by (75,000 plus 12,500), equals £2,200.

The RFI returns also list total disposal overheads. We turn these into a cost-per-household (overhead cost divided by households served) and again average by group.

For an individual council we multiply that CPT by its latest household count (ONS mid-2023, or NRS/NISRA for Scotland and Northern Ireland). We then allocate part of the resulting pot to HWRCs in proportion to how much of the council’s waste passes through them and finally split that HWRC share across materials according to each material’s share of HWRC tonnage.

In the worked example this adds about £110 of overhead to the small amount of plastic delivered via HWRCs, on top of the direct CPT described above. By combining a representative CPT with a fair share of overheads, the model captures the full, real-world cost of managing packaging waste that residents bring to HWRC sites.

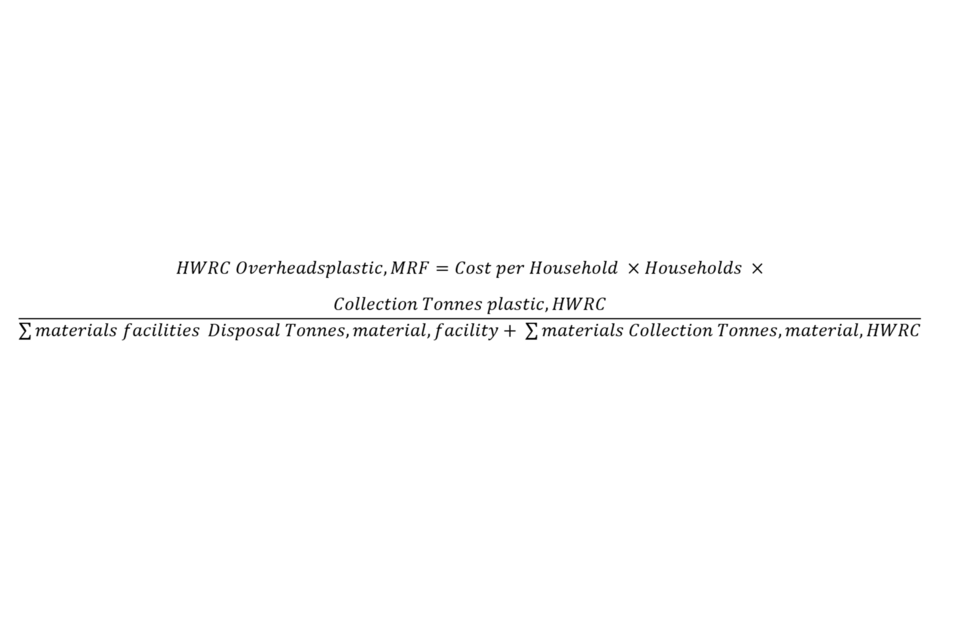

Equation: HWRC collection overheads

HWRC Overheads_plastic,MRF equals Cost per Household times Households times the fraction: Collection Tonnes_plastic,HWRC divided by (the sum over materials and facilities of Disposal Tonnes_material,facility plus the sum over materials of Collection Tonnes_material,HWRC).

Equals £5.50 times 100,000 times 17.5 divided by (75,000 plus 12,500), equals £110.

Each tonne of plastic is £110 of HWRC overhead (on the small amount delivered via HWRCs) and £2200 of disposal overhead (on the bulk sent to the MRF). The same method is repeated for every other material and facility.

Combining costs

Table 6: Variables used to combine costs in this section

| Variable | What it covers | Data source and year | Why this is included |

|---|---|---|---|

| Density | Kilograms-per-cubic-metre used to convert tonnes into volume when apportioning mixed costs | WRAP Bulk Density Report 2021 | Volume is needed to share some costs (e.g. communal-bin collections) fairly across materials |

| Overheads | The “back-office” costs calculated in the previous section (management, depots, fleet standing charges, IT, etc.) | RFI survey 2023-24, scaled by 2023 household counts | HWRC overheads are £0 in the residual-waste example because no residual tonnes enter HWRCs; they would be >0 for recycling streams that do |

| Collection/Disposal cost adjustment | Extra £/t given to councils that joined the 2024-25 Flexible Plastics Trail to cover additional handling costs | Defra notification letters 2024-25 | Applied only to participating local authorities |

| Net Gate Fee | The disposal cost after deducting haulage and material value rebates. Non-zero for Material Recovery Facilities and reprocessors, zero for EfW, landfill, MBT, RDF export and “Other” | WRAP Gate-Fee Survey 2023-24 (plus Defra/Welsh Government supplements for reprocessors & MBT) | Only MRFs and reprocessors share sales income with councils, so only they need a net-of-rebate figure |

| MF operational CPT & regulator CPT | Operational CPT – average cost per tonne to run a material facility (staff, maintenance, energy) taken from industry accounts and RFI returns (FY 2023-24). Regulator CPT – per-tonne fee that MFs must pay the new packaging regulators (England £2,240, Wales £2,310, Scotland £2,310, NI £2,310 per site, converted to a £/t rate using national MF tonnages) | Industry financials 2023-24 and Scottish/English regulator impact assessments 2023 | Covers the admin side of running and regulating MFs so the model pays the full economic cost, not just the gate fee |

| Recycling Credit (RC) | The statutory payment that Waste Disposal Authorities (WDAs) make to their Waste Collection Authorities (WCAs) for dry recycling tonnage, equal to avoided disposal cost | Calculated with the standard formula in the Environmental Protection Act 1990 using 2023-24 cost data | Shown as a positive figure for WCAs (receiving funds) and a negative figure for WDAs (deducted funds), keeping the system revenue-neutral overall |

Equation: how total net cost is calculated

Total Net Cost = (Collection Cost + HWRC Overheads + adjustment) + (Net Disposal Cost + Disposal Overheads + MF Operational and Regulator Costs + adjustment) ± Recycling Credit.

Calculations for the total net cost including recycling credits

Local authorities are paid the sum of the total net cost, including recycling credits, for all materials that are in scope for EPR for packaging. This is done by adding or subtracting the recycling credit payment, dependent on whether the local authority is a WCA or WDA, from the total net cost (total collection cost plus total net disposal cost).

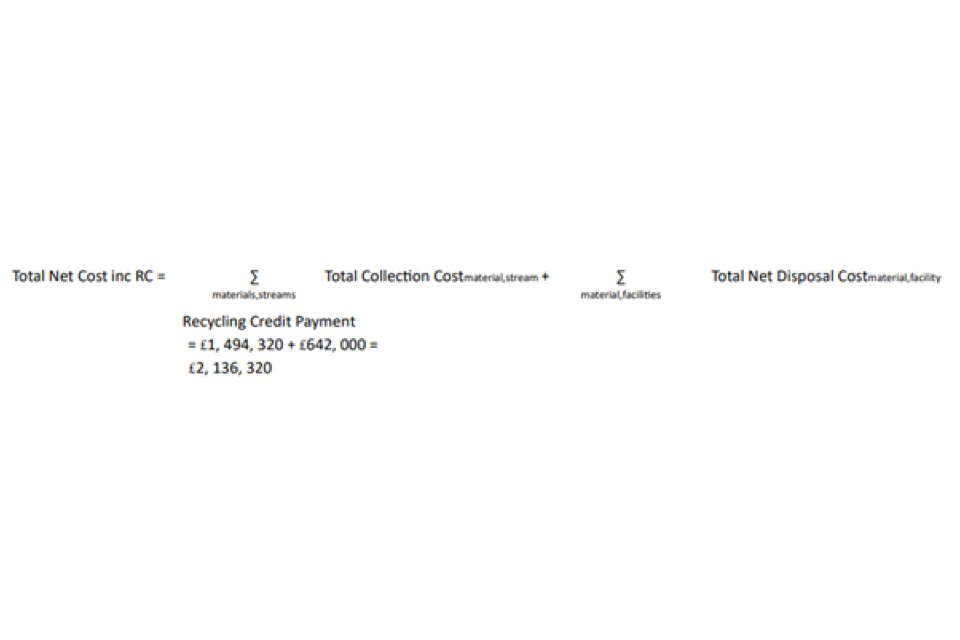

Equation: how the total net cost, including recycling credits, is calculated

Total Net Cost including Recycling Credit equals the sum over materials of Total Collection Cost_material, plus the sum over materials and facilities of Total Net Disposal Cost_material,facility, plus Recycling Credit Payment.

Table 7: Variables used to calculate total collection costs

| Value | How the value is calculated | What the value means |

|---|---|---|

| Total Collection Cost | Collection costs + HWRC overheads + Collection cost adjustment | Gives the full cost of collecting EPR eligible packaging waste e.g. at kerbside, HWRCs and bring sites |

| Total Net Disposal Cost | Net Gate Fee + Disposal Overheads + MF Operational costs + MF Regulator costs + Disposal cost adjustment | Gives the full costs of processing and treating EPR eligible packaging waste after collection |

| Recycling Credit payment | Standard EPA 1990 methodology, where WCAs receive the credits while WDAs pay them | Ensures two-tier areas are revenue-neutral between WCAs and WDAs |

Table 8: Example local authority with variables

| Local authority variables | Local authority values | Other module variables | Other module values | External variables | External values |

|---|---|---|---|---|---|

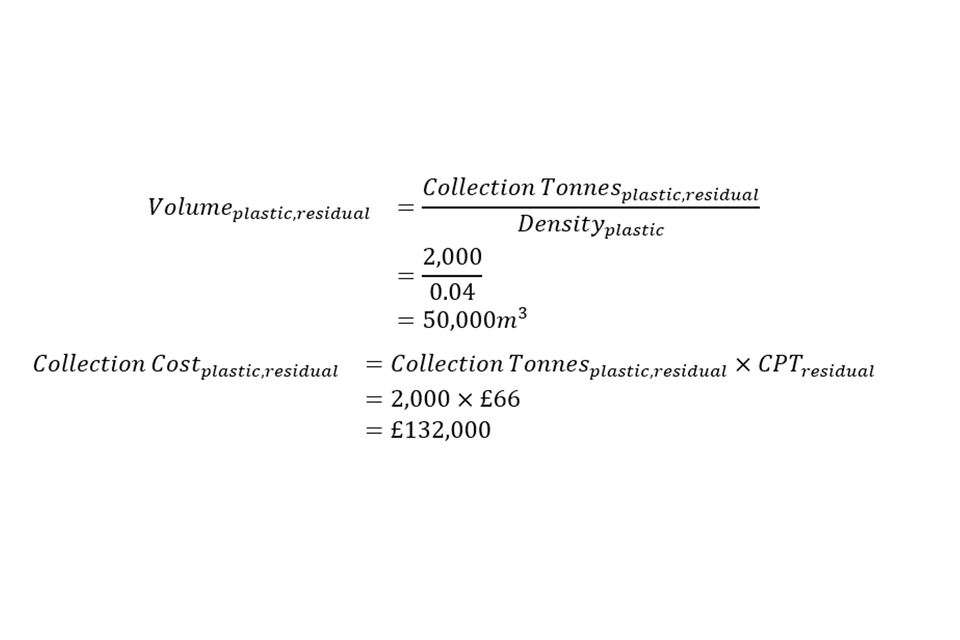

| Households (ONS 2023) | 100,000 | Collection tonnes plastic, residual | 2,000 tonnes | Density plastic (WRAP 2021) | 0.04 T/m3 |

| Sum residual collection cost materials,streams | £1,860,000 | Collection cost Adjustment plastic (2024-2025 grant for flexible plastics) | £1,580 | CPT residual | £66 |

| Not applicable | 0 | HWRC collection costs plastic | £0 | Sum Volume material for Residual materials | 250,000m3 |

Equation: calculation of total collection cost for residual plastic

Total Collection Cost_plastic,residual equals Collection Cost_plastic,residual plus HWRC Collection Overheads_plastic,residual plus Collection Cost Adjustment_plastic.

Equation: calculation of volume plastic residual cost

Volume_plastic,residual equals Collection Tonnes_plastic,residual divided by Density_plastic. Equals 2,000 divided by 0.04, equals 50,000 cubic metres. Then Collection Cost_plastic,residual equals Collection Tonnes_plastic,residual multiplied by CPT, residual. Equals 2,000 multiplied by £66, equals £132,000.

Assuming that the following equation is the case.

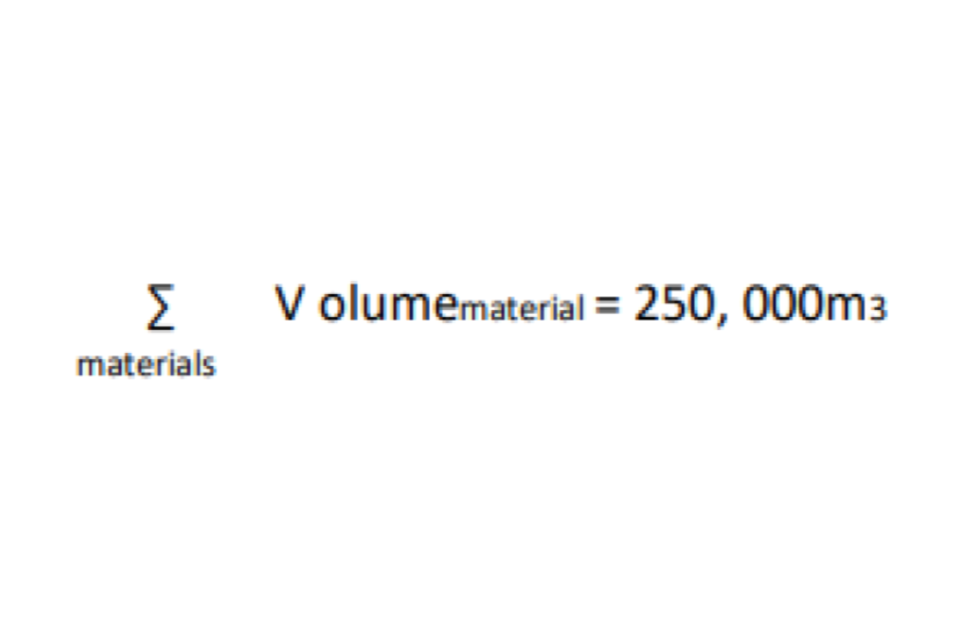

Sum over materials of Volume_material equals 250,000 cubic metres.

The above is approximately the volume of waste from an average medium-sized local authority collected ~10, 000 tonnes of residual waste at an overall density of 0.04 tonnes per metre³.

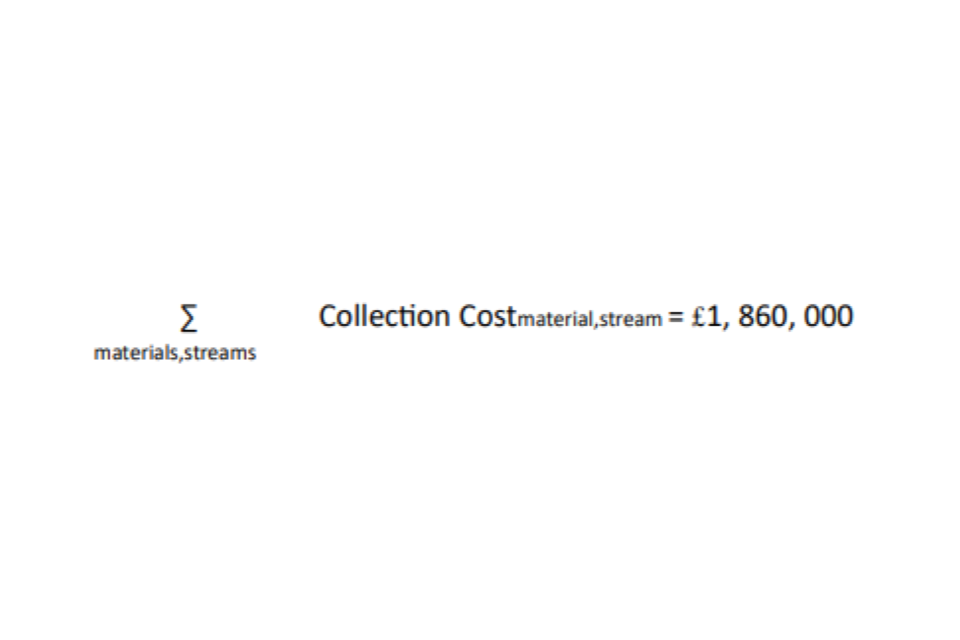

Equation: collection cost of material and streams

Sum over materials and streams of Collection Cost_material,stream equals £1,860,000.

The equation reflects a realistic residual collection cost taken from the mid-range of the 2023 to 2024 RFI returns. Because this amount could not split by material, we assume the fairest proxy is each material’s share of the volume on the vehicle. Plastic accounts for 20% of residual volume and so receives 20% of the mixed amount.

Total collection costs for each material are then calculated by summing the collection costs for the material across all streams, HWRC overheads for the material and any collection cost adjustment for the material.

Equation: example apportionment of collection costs by material and streams

Collection Cost_plastic,residual equals Volume_plastic,residual divided by the sum over materials of Volume_material,residual, times the sum over materials and streams of Collection Cost_material,streams. Equals 50,000 divided by 250,000, times £1,860,000, equals £372,000.

Equation: calculation of total collection costs

Total Collection Cost_plastic equals Collection Cost_plastic plus HWRC Collection Overheads_plastic plus Collection Cost Adjustment_plastic. Equals £372,000 plus £0 plus £1,580, equals £373,580.

In this example, the HWRC overheads costs are £0 as there are no HWRC collection costs for a residual stream.

Table 9: Variables used to calculate total disposal costs

| Local authority variables | Local authority values | Other module variables | Other module values | External variables | External values |

|---|---|---|---|---|---|

| Households | 100,000 | Disposal tonnes for plastic sent to MRF | 350 tonnes | MF Operational cost per tonne (CPT) | £0.60 |

| Not applicable | 0 | MRF Net Gate Fee for Plastic | £12 | Regulator cost per tonne (CPT) | £0.04 |

| Not applicable | 0 | Disposal overheads for plastic | 87,500 tonnes | Disposal cost adjustment for plastic | £1,540 |

Equation: example calculation of total net disposal costs for a local authority

Total Net Disposal Cost_plastic,MRF equals Net Disposal Cost_plastic,MRF plus Disposal Overheads_plastic,MRF plus MF Costs_MRF,plastic plus Disposal Cost Adjustment_plastic.

Equation: example of net disposal cost of plastic

Net Disposal Cost_plastic,MRF equals Disposal Tonnes_plastic,MRF times Net Gate Fee_MRF,plastic. Equals 350 times £12, equals £4,200.

The Net Disposal cost is the gate fee the local authority pays post-haulage minus the material value rebates. This calculation is shown in the following equation.

MF Costs_MRF,plastic equals Disposal Tonnes_MRF,plastic times the sum of MF Operational CPT and Regulator CPT_country. Equals 350 times (0.6 plus 0.04), equals £224.

The MF Costs are the MRF’s operating costs plus the new regulator levy.

The following equation shows how the calculations are combined into total net disposal costs.

Total Net Disposal Cost_plastic,MRF equals Net Disposal Cost_plastic,MRF plus Disposal Overheads_plastic plus MF Costs_MRF plus Disposal Cost Adjustment. Equals £4,200 plus £2,200 plus £224 plus £1,540, equals £8,164.

Equation: the final total net cost calculation

Total Net Cost including Recycling Credit equals the sum over materials and streams of Total Collection Cost_material,stream, plus the sum over materials and facilities of Total Net Disposal Cost_material,facility, plus Recycling Credit Payment. Equals £1,494,320 plus £642,000, equals £2,136,320.

This shows recycling credit payment as 0 as the example local authority is a unitary authority so recycling credits do not apply. This is the final figure that a local authority is paid.

Example: how a Recycling Credit transfer between a WCA and WDA works

Under Section 52 of the Environmental Protection Act 1990 the credit equals the WDA’s avoided residual-disposal cost, when the WCA retains waste for recycling. This avoided cost is included in the WDA’s total payment, who then need to pay the Recycling Credit amount to the appropriate WCA.

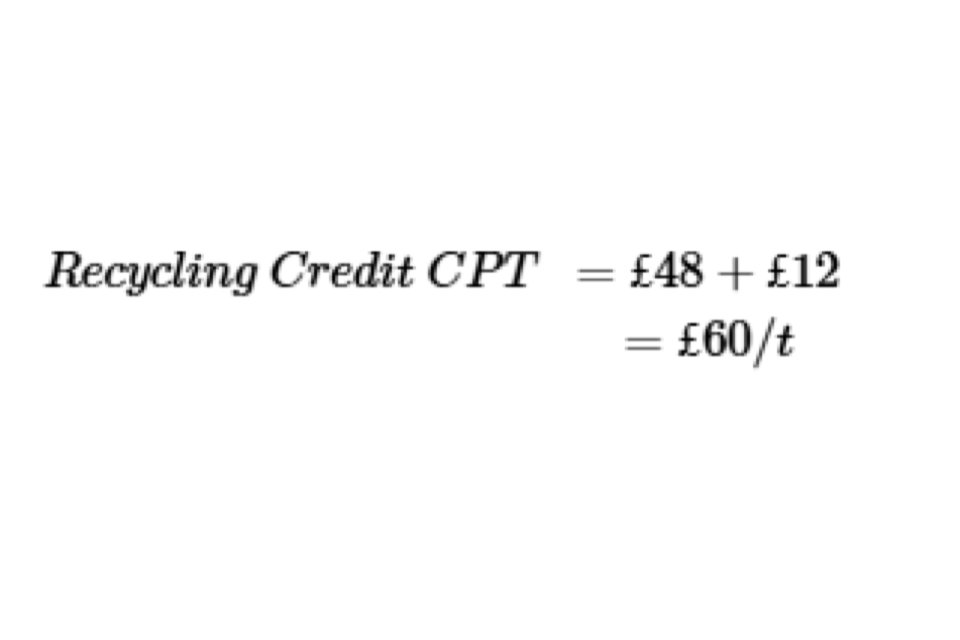

Step 1. Work out the recycling credit CPT

In this example we assume the WDA’s most recent audited figures show:

- residual net gate fee (EfW + landfill) equals £48 per tonne

- disposal overhead allocated to residual stream equals £12 per tonne

Recycling Credit CPT equals £48 plus £12, equals £60 per tonne.

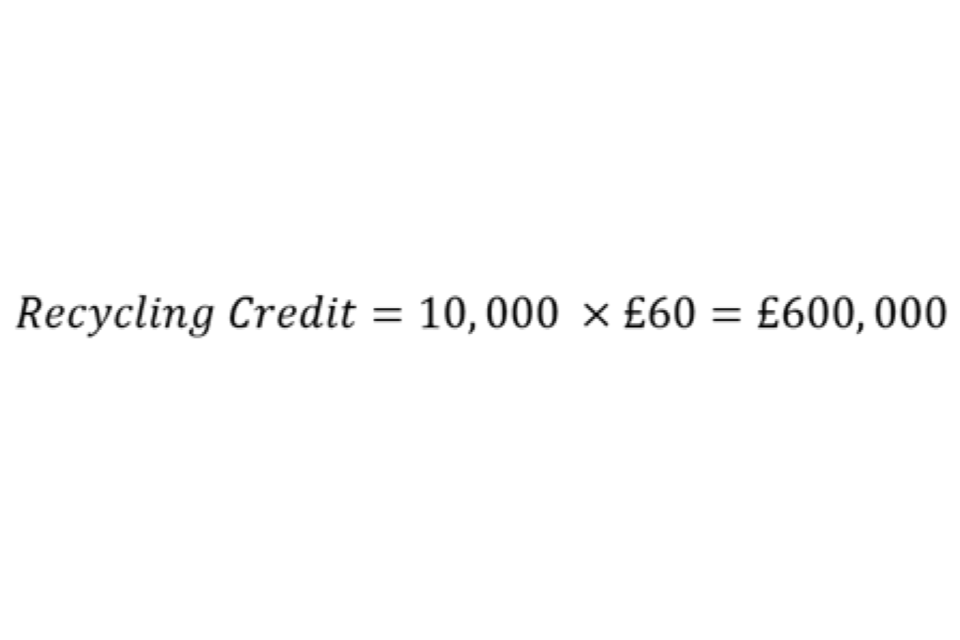

Step 2. Apply the Recycling Credit to the WCA’s dry recycling tonnage

An example WCA collects 10,000 tonnes of packaging via its kerbside dry recycling scheme, shown in the following equation.

Recycling credit is 10,000 multipled by £60, which equals £600,000.

Step 3. Apply the credit to the WCA and WDA’s payment formula

Table 10: Example values for the allocation of recycling credits

| Payment Element | WCA | WDA |

|---|---|---|

| Sum of collection costs | £1,200,000 | £0 |

| Sum of net disposal costs | £120,000 | £3,600,000 |

| Recycling credit | -£600,000 | £600,000 |

| Total payment | £720,000 | £4,200,000 |

The WDA’s payment increases by the full £600,000 because the WCA has removed that quantity of packaging from the residual stream, and the WDA will need to pay the WCA this amount. This amount payable by the WDA is deducted from the WCA.

Nationally these two cashflows cancel out, keeping the overall EPR for packaging budget neutral while still giving WCAs a clear financial incentive to recycle.

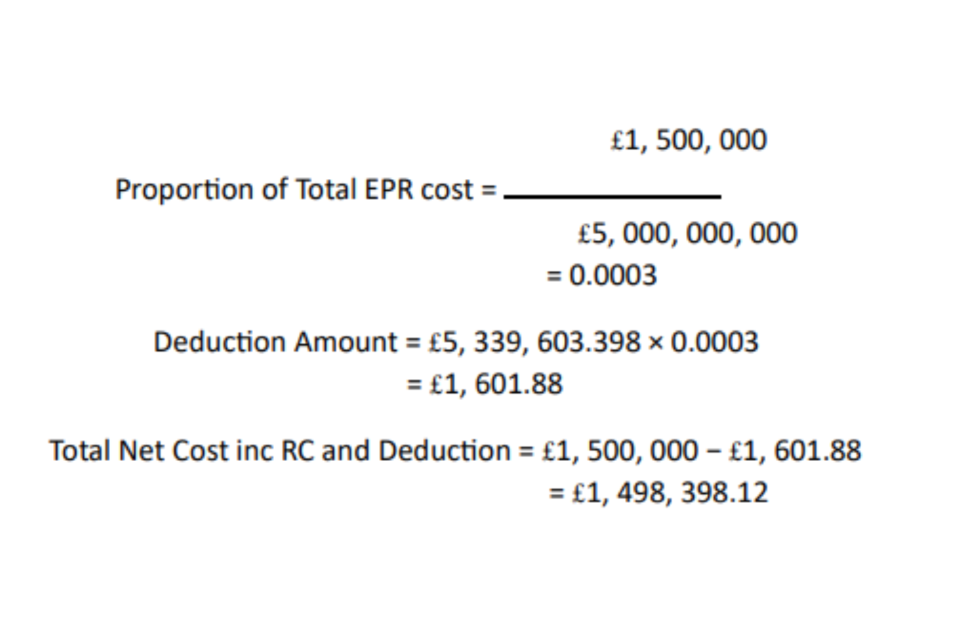

Deductions in line with regulation 62 of the Producer Responsibility Obligations Regulation 2024

A very small deduction (averages less than 0.4%) has been applied to all LAs to ensure that total payments do not exceed the amount we are able to recover from producers using the fee formula in regulation 62 of the Producer Responsibility Obligations Regulation 2024.

This formula is currently being amended so that a deduction is not required in future assessment years.

Deductions have been allocated across LAs in proportion to their existing costs of managing material from each material category. This means a total of £5,339,603.398 will be deducted across all local authorities.

Equation: how the deduction has been applied to each local authority

Proportion of Total EPR cost equals Total Net Cost including Recycling Credit divided by the sum over Local Authorities of Total Net Cost including Recycling Credit for each Local Authority. Deduction amount of £5,339,609.398 multiplied by the Proportion of Total EPR Cost. Total Net Cost including RC and Deduction amount equals Total Net Cost including RC minus Deduction Amount.

In the following example, the local authority Total Net Costs, including recycling credits (£1,500,000) are divided by the sum of all local authorities Total Net Costs, including Recycling Credits (£5,000,000,000).

The deduction amount is found by multiplying £5,339,603.398 by the resulting figure (0.0003). The final payment is the total net cost including recycling credits minus the deduction amount.

Equation: calculating payment after deduction has been applied

Proportion of Total EPR cost equals £1,500,000 divided by £5,000,000,000, which equals 0.0003. The Deduction Amount equals £5,339,603.398 multiplied by 0.0003, which equals £1,601.88. The final Total Net Cost, including RC and Deduction is £1,500,000 minus £1,601.88, which equals £1,498,398.12.

Supplementary calculation to account for statutory recycling target in Wales

Step 1. Calculate the total provisional amount payable to all local authorities in Wales

The following equation is calculated using the methodology in LAPCAP.

Equation: example sum of a provisional local authority payment in Wales

Sum of Provisional local authority payments in Wales, which equals £90,735,276.71.

The example given here is a provisional total and may change.

Step 2. Calculate the difference between the 70% statutory requirement and each local authority’s actual recycling rate

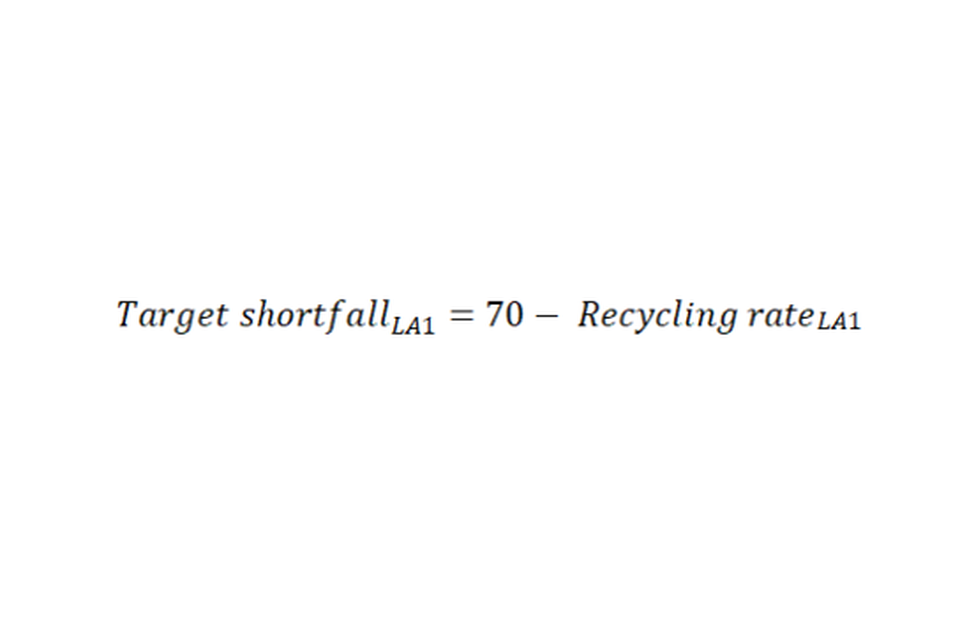

Equation: example, for a hypothetical local authority, called LA1, with a recycling rate of 65%

Target shortfall in example local authority equals 70 minus recycling rate for the example local authority.

The following sum takes the statutory recycling rate of 70%, minus the example local authority recycling rate of 65%, this will equal the target shortfall of 5%:

=70.0 – 65.0 = 5.0

Step 3. For local authorities that have met the statutory target recycling rate (70%)

The efficient disposal costs are assumed to be equal to the estimated cost data provided to WLGA (after adjusting for inflation).

Equation: assumption that a hypothetical local authority called LA2 has a recycling rate of 71%

Net efficient disposal costs for LA2 equals the WLGA cost estimate of LA2.

Step 4. Calculate the sum of payments allocated to all local authorities achieving their statutory recycling target

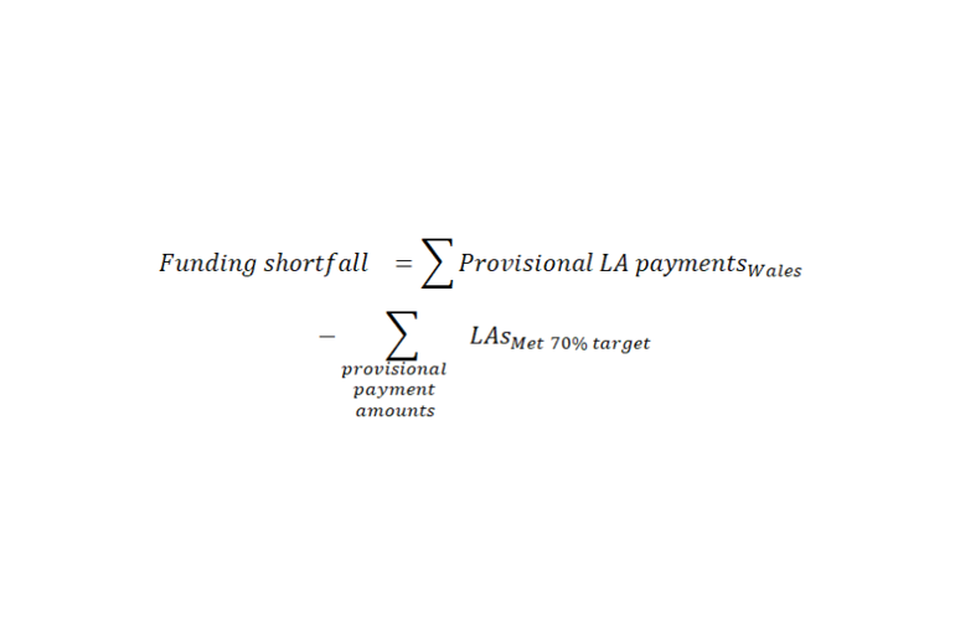

Calculated the sum of payments allocated to all local authorities achieving their statutory recycling target. Then determine the remaining amount of funding (“funding shortfall”) that can be distributed amongst those local authorities not achieving their statutory recycling target.

In the following example, the sum of payments allocated to all local authorities achieving their statutory recycling target is £30,931,511.74.

Equation: example calculation for funding shortfall

The funding shortfall is the sum of the Provisional local authority payments in Wales minus the sum of the provisional payment amounts of the local authorities that have met the 70% target.

The following sum takes the provisional local authority payments in Wales (£90 million), minus the sum of payments allocated to all local authorities in Wales who have achieved their statutory recycling target of £30 million. This equals the funding shortfall:

= £90,735,276.71 - £30,931,511.74

= £59,803,764.97

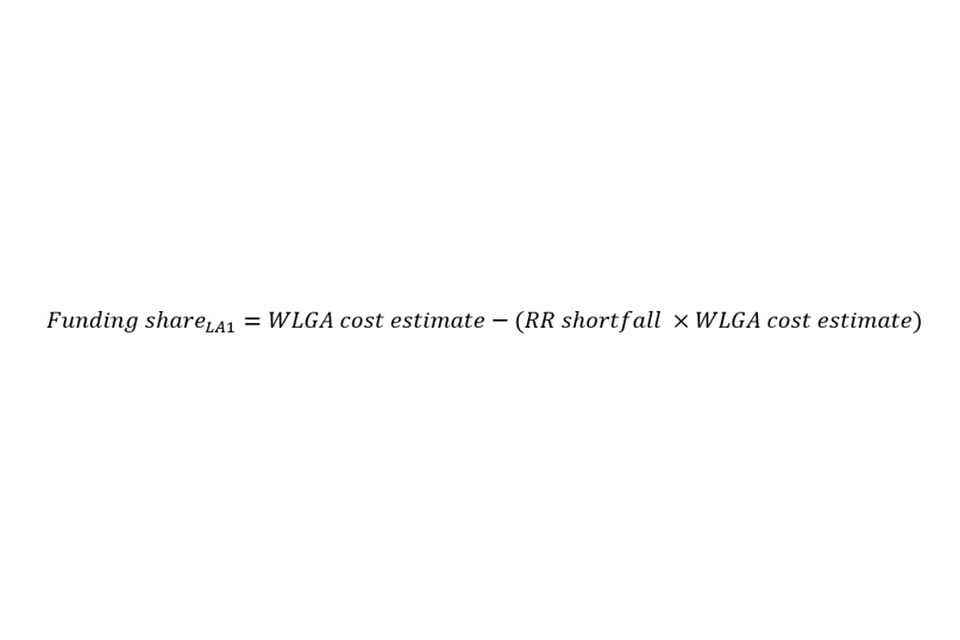

Step 5. For local authorities that have not met the statutory target recycling rate (70%)

Payments are calculated as their WLGA costs minus a share of the funding shortfall, which is proportional to both their original WLGA estimate and their shortfall in actual municipal recycling rate in 2023/24 when compared to the statutory target.

For example, assume the hypothetical local authority called LA1 has a recycling rate of 65%, and the WLGA cost estimate was £4,785,373.51.

First calculate, for each local authority below the target, their share of the funding shortfall. Then repeat for each local authority below the 70% target.

Equation: funding share of LA1

Funding share of LA1 is the WLGA cost estimate minus (Recycling Rate shortfall multiplied by WLGA cost estimate).

The following sum is the Welsh Local Government Association (WLGA) cost estimate minus the recycling rate shortfall, multiplied by the WLGA cost estimate. This equals the funding share for the example local authority (LA1):

= £4,785,373.51- (5 × £4,785,373.51)

= £3,861,588.30

All of the numbers used in this example are rounded and so the results may differ slightly if reproduced manually with a calculator.

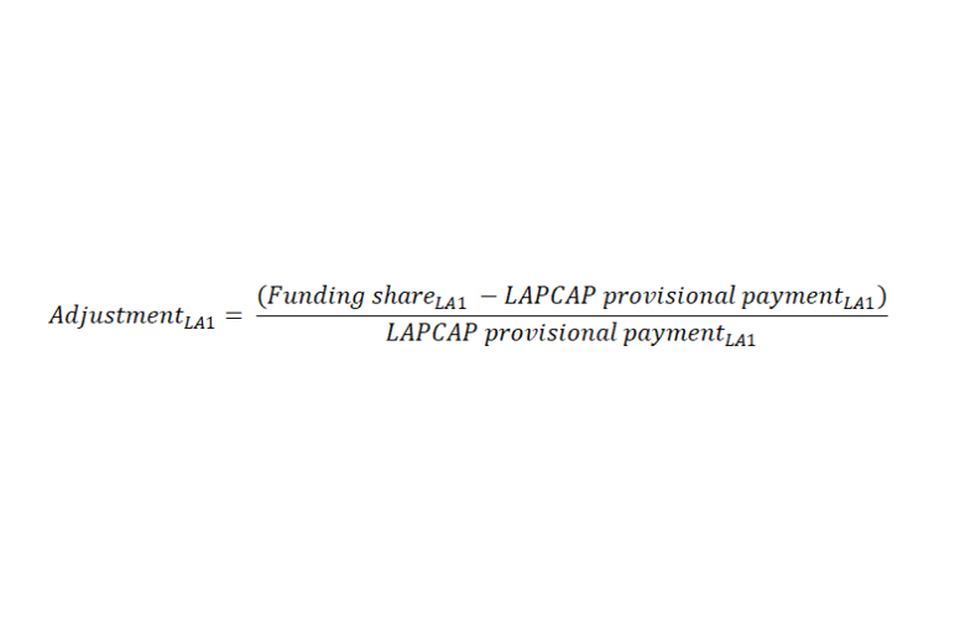

Step 6. The revised payment total for each local authority in Wales is then compared to the total provisionally calculated in LAPCAP

This determines a percentage adjustment to be made. For example, for LA1,the provisional total calculated by LAPCAP was £4,124,330.76.

Equation: example adjustment for LA1

Adjustment for LA1 is the (Funding share of LA1 minus the LAPCAP provisional payment of LA1) divided by the sum of LAPCAP provisional payment for LA1.

The following sum is the funding share for the example local authority minus the LAPCAP provisional payment to the example local authority), divided by the LAPCAP provisional payment to the example local authority. This equals the percentage adjustment to the payment to the example local authority:

= (£3,861,588.30 - £4,124,330.76) ÷ £4,124,330.76

= -£262,742.46 ÷ £4,124,330.76

= -6.37%

In the example above for LA1, a deduction of -6.37% is made to each subtotal.

The percentage adjustment is made to the subtotal

This is calculated through LAPCAP for:

- collection costs

- disposal costs

- material income

These totals are then used to calculate the net efficient disposal costs to give the final total payment amount.