How to use the employment intermediaries template

Updated 3 October 2016

You can use the CSV and ODS versions of the template with all recent spreadsheet software like Excel, LibreOffice and OpenOffice.

If you use an Apple Mac, you’ll only be able to use the CSV version of the template with Numbers.

1. Format and layout

You must use the report template to provide HM Revenue and Customs (HMRC) with workers’ details. You must enter the information in the correct format.

You should use a fresh template for each report submitted so that data from previous reports cannot corrupt your latest report.

You’ll be able to send reports that contain formatting errors and missing data but you may receive a penalty if your reports are late, incomplete or incorrect.

You must use the employment intermediaries service to upload and send your reports.

You can upload and send up to 13 reports at a time and as many reports as you need to throughout the reporting period. You can decide how frequently you upload and send your reports. This could be weekly, monthly, once for each period, or whatever fits in best with how you work.

Each report must:

- contain employment intermediary information and at least 1 record of worker information

- be an ODS or CSV file

- be smaller than 20MB - you can split reports into many files and upload them

- have a name that is 200 characters or less - there are no other rules on what to call your reports

- only contain 1 sheet

- not be password protected

You must not alter the layout of the template in any way that would change the order or content of:

- column A, rows 1 to 6

- row 7

- columns A to Y, row 8

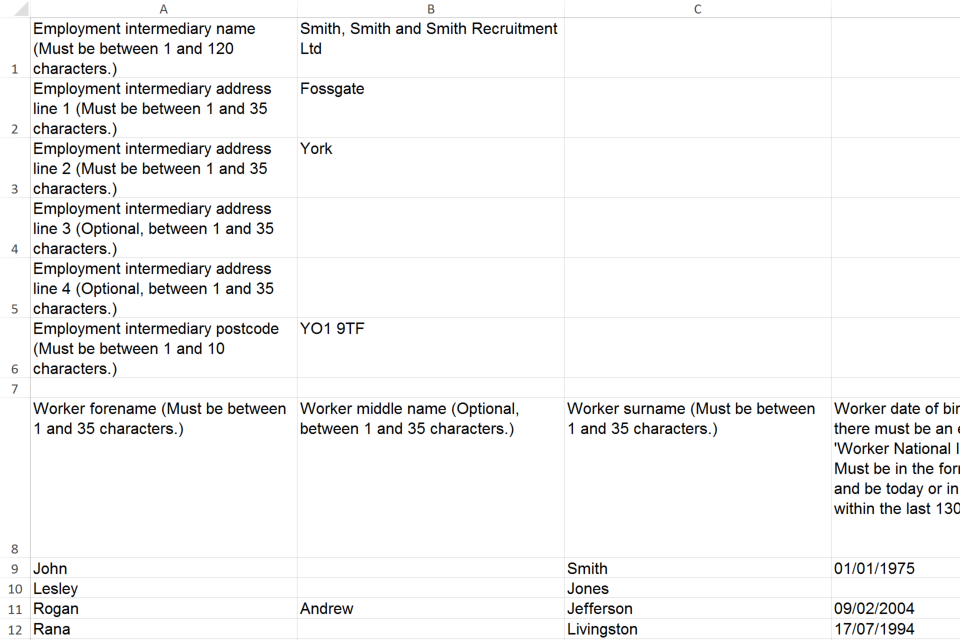

Image showing a section of a completed employment intermediaries report template.

2. Employment intermediary details

You must include your full name, address and postcode in column B, rows 1 to 6.

‘Employment intermediary name’ can include letters a to z, numbers, and any symbol except ` ¬ ¦ or a |, and must be between 1 and 120 characters.

The address lines can include letters a to z, numbers, and any symbol except ` ¬ ¦ or a |, and must be between 1 and 35 characters. Address lines 3 and 4 are optional.

‘Employment intermediary postcode’ can only include letters, numbers and a space, and must be between 1 and 10 characters.

3. Worker details

These are the personal details of the workers, including partners within a partnership and limited company directors, who personally provided their services to the client.

These details must be included no matter how many intermediaries are involved in supplying the worker to the client. The intermediary sending the report must get these details from the worker or from any other intermediary that supplied the worker.

You must include each worker’s:

- full name, address and postcode

- National Insurance number - if they have one and you don’t know their date of birth and gender

- date of birth and gender - if they don’t have a National Insurance number

3.1 Name

The worker forename, middle name (this is optional) and surname can only include letters a to z, a spaces, hyphens or apostrophes. Each entry must be between 1 and 35 characters.

3.2 Date of birth and gender

‘Worker date of birth’ and ‘Worker gender’ must be included if the worker doesn’t have a National Insurance number.

‘Worker date of birth’ must be in the format of dd/mm/yyyy, like 12/11/1980 for 12 November 1980. The date must be the day the report is uploaded or within the last 130 years.

‘Worker gender’ must be ‘M’ for male or ‘F’ for female. A worker may provide the gender that they identify with.

3.3 National Insurance number

‘Worker National Insurance number’ must be included if the worker has one. If they don’t have a National Insurance number, there must be a gender and date of birth. If there is a National Insurance number it must be formatted as 2 letters then 6 numbers then A, B, C, D or a space, without any spaces between the sections, like QQ123456C or QQ123456.

Don’t include a temporary National Insurance number like TN010190F for a female born on 1 January 1990. If the worker doesn’t have a National Insurance number, include their date of birth and gender in the suitable columns.

3.4 Address and postcode

The address lines can include letters a to z, numbers, and any symbol except ` ¬ ¦ or a |, and must be between 1 and 35 characters. Address lines 3 and 4 are optional.

‘Worker postcode’ can only include letters, numbers and a space, and must be between 1 and 10 characters.

If the worker’s address is not in the UK, enter the postal code for their address. If their address is in a country with no postal code system, like in the Republic of Ireland and Hong Kong leave the entry blank. You’ll be told that this is a formatting error, but you can send your report with errors and won’t receive a penalty if HMRC can see from the remainder of the address why it was left blank.

4. Engagement and payment details

Where there is more than one engagement with a client in a reporting period the payments should be combined into a single figure.

Where the worker’s services are provided on different occasions to more than one client in a reporting period, you can either:

- combine the engagements into a single record with a single payment

- provide a separate line and payment for each client

4.1 Why you didn’t operate PAYE on the worker’s payments

You must provide a reason why you or whoever has the contract with the worker didn’t operate PAYE on the worker’s payments. ‘Worker engagement details where the intermediary didn’t operate PAYE’ must be ‘A’, ‘B’, ‘C’, ‘D’, ‘E’ or ‘F’ where:

- ‘A’ is a self-employed contractor, like a sole trader

- ‘B’ is a self-employed contractor from a partnership

- ‘C’ is a self-employed contractor from a limited liability partnership

- ‘D’ is a worker from a limited company including personal service companies

- ‘E’ is a non-UK engagement for a worker supplied from a company, partnership or person from outside the UK

- ‘F’ is another party operated Pay As You Earn (PAYE) on the worker’s payments

If more than one option applies to a worker, select the one that best describes why PAYE wasn’t operated for the engagement.

For example, Fred is a web designer who runs his own limited company (D) and is also an employee of a design firm (F) who operate PAYE on his pay.

If Fred gets work through an intermediary and PAYE isn’t operated on his payments because he was engaged through his limited company, select D. You must include details of Fred’s limited company including the Companies House registration number. If Fred was engaged through his employer, select F. You don’t have to include details of his employer.

4.2 Unique taxpayer reference

You must include the ‘Worker unique taxpayer reference (UTR)’ when ‘Worker engagement details where the intermediary didn’t operate PAYE’ is ‘A’, ‘B’ or ‘C’. The UTR must be 10 numbers.

You don’t need to include a UTR for workers engaged through their own limited company or personal service company.

4.3 Start and end dates

You must include a ‘Start date of engagement’ and, if there is one, an ‘End date of engagement’. Both dates must be in the format of dd/mm/yyyy, like 10/04/2015 for 10 April 2015.

The start date is the first date that a worker provided their personal services to a client, for which they are paid. If engagements are combined into a single record, the start date included should be the start date of their first engagement.

The start date must always be included and be in the format of dd/mm/yyyy, like 10/04/2015 for 10 April 2015. The date must be the day the report is uploaded or in the past. The date may be before the start of the reporting period the report relates to if the engagement has never ended.

The end date must be included if the engagement has ended. This must be in the format of dd/mm/yyyy, like 08/05/2015 for 8 May 2015. The date must be:

- the same as or after the start date

- in the reporting period the report relates to

If you upload a report on or before a reporting period’s deadline, the date must be the day you upload the report or in the past.

If you pay the worker in a different period to when they worked, you can either include their details on the report about the period:

- they worked in - if it’s before the deadline for sending your report

- the payment was in and leave the end date blank

4.4 Payment and third party details

If ‘Worker engagement details where the intermediary didn’t operate PAYE is ‘A’, ‘B’, ‘C’, ‘D’ or ‘E’ you must include:

- ‘Amount paid for the worker’s services’

- ‘Currency’

- ‘Is this amount inclusive of VAT?’

- ‘Name of party paid by intermediary for worker’s services’

- ‘Address line 1 of party paid by intermediary for worker’s services’

- ‘Address line 2 of party paid by intermediary for worker’s services’

If ‘Worker engagement details where the intermediary didn’t operate PAYE’ is ‘F’, you don’t need to include this information.

For example, you have a contract with a client to supply 100 workers where:

- 20 workers are your employees - you operate PAYE on their payments

- 30 workers are from limited companies - you pay the limited company

- 50 workers are paid through an umbrella company

Your report to HMRC doesn’t include the 20 workers who are your employees. You operate PAYE on their payments and they’ll be on your Real Time Information submission.

Your report must include the other 80 workers details because you didn’t operate PAYE on their payments.

The 30 limited company workers are option ‘D’ so you must include the payment and third party details and Companies House registration number. The 50 workers paid through an umbrella company are option ‘F’ so you don’t need to include this information.

Amount paid

‘Amount paid for the worker’s services’ is the total payment that you paid for the worker’s services in the period your report is for. This includes any expenses directly related to them providing their services and VAT.

The amount must:

- be a positive value with 0, 1 or 2 decimal places, like 500, 500.1 or 500.10 or 0, 0.0 or 0.00 for zero pay

- not include commas if 1000 or more, like 1789, 1789.4 or 1789.45

Amounts that have 0 or 1 decimal place will be edited so they have 2 decimal places. For example, 100 and 100.1 will become 100.00 and 100.10.

You may not know how much money the worker actually gets, but you will know how much money you paid to whoever supplied the worker to you. This may be another intermediary, limited company or personal service company, or the worker themselves.

Currency

‘Currency’ must be Great British pounds (‘GBP’) or euros (‘EUR’), even if you paid the worker in another currency. You must convert the amount into one of the accepted currencies using HMRC’s latest exchange rates.

VAT

‘Is this amount inclusive of VAT?’ must be ‘Y’ for yes or ‘N’ for no. This is whether VAT has been charged on the payment.

If the worker’s organisation registers for VAT during a reporting period you can either:

- enter ‘Y’ even though it wasn’t for the whole period

- have the worker on your report twice - once where VAT is ‘N’ and once where VAT is ‘Y’ with the suitable start and end dates

Third party details

‘Name of the party paid by intermediary for worker’s services’ is the full name or trading name of who you paid for the worker’s services. This may be the worker’s company or partnership.

If a payroll bureau (someone who compiles your payroll for you) is used to pay another party on the worker’s behalf, the name of the company or partnership should be reported, not the bureau.

The name of the party paid can include letters a to z, numbers, and any symbol except ` ¬ ¦ or a |, and must be between 1 and 120 characters.

The address lines can include letters a to z, numbers, and any symbol except ` ¬ ¦ or a |, and must be between 1 and 35 characters. Address lines 3 and 4 are optional.

‘Postcode of party paid by intermediary paid for worker’s services’ is optional but can only include letters, numbers and a space, and must be between 1 and 10 characters.

4.5 Companies House registration number

‘Companies House registration number of party paid by intermediary for worker’s services’ must have an entry if ‘Worker engagement details where the intermediary didn’t operate PAYE’ is ‘D’. You don’t need to include this if ‘Worker engagement details where the intermediary didn’t operate PAYE’ is ‘F’.

The entry must be 2 letters and 6 numbers, or between 6 and 8 numbers, like:

- AA123456

- 123456

- 1234567

- 12345678