Summary of digital markets competition regime guidance

Published 19 December 2024

Introduction

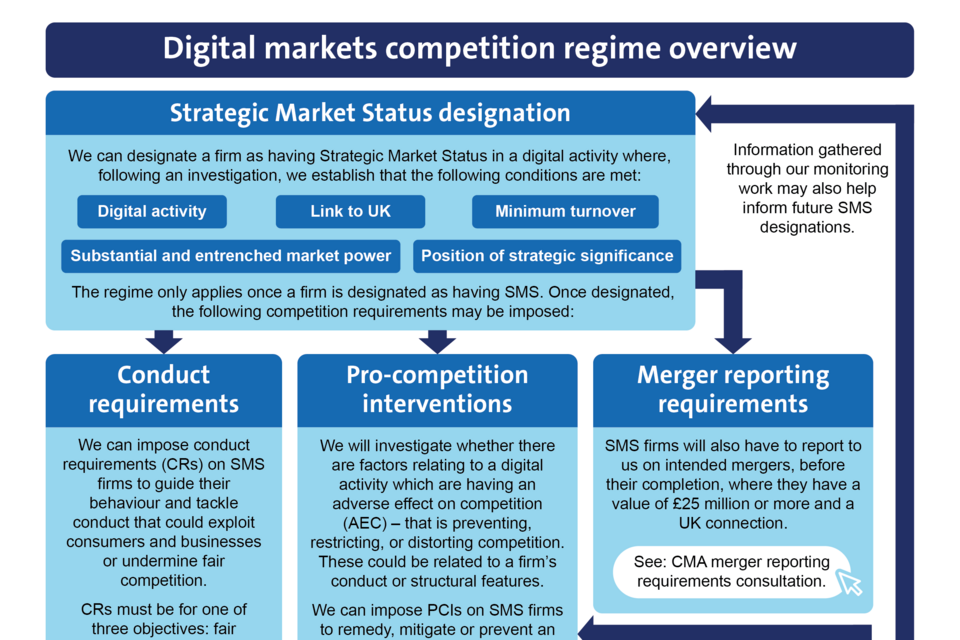

This document provides a summary of our guidance on how we will exercise our powers under the new digital markets competition regime.

Overview of the guidance

The Digital Markets, Competition and Consumers Act 2024 grants new responsibilities to the Competition and Markets Authority (CMA) to promote competition in digital markets through the new, forward-looking digital markets competition regime. These responsibilities will have effect from 1 January 2025.

We have published guidance on how we will exercise our new digital markets competition powers.

Key areas covered in the guidance include:

-

how we will assess whether a firm has strategic market status (‘SMS’) in respect of a digital activity and the steps we will follow in conducting our investigation

-

how we will impose conduct requirements (‘CRs’) on firms that have been designated as having SMS

-

how we will assess whether there is an adverse effect on competition (‘AEC’) and impose pro-competition interventions (‘PCIs’)

-

the investigatory powers we will use in our work, for example requesting information from firms, including in relation to algorithms

-

how we will monitor compliance with competition requirements imposed under the regime (such as CRs and PCIs) as well as how we will monitor their effectiveness and review and update them where necessary

-

how we will enforce breaches of competition requirements

-

our approach to imposing penalties

-

administrative matters related to the running of the regime

This guidance should be read alongside other relevant CMA guidance documents, in particular Administrative Penalties: Statement of Policy on the CMA’s approach (CMA4).

This summary document

This document summarises our guidance. To the extent there is any conflict between the summary set out here and the guidance, the guidance will prevail.

Strategic Market Status

SMS designation is the gateway into the regime. To be designated as having SMS a firm must meet certain conditions, including having substantial and entrenched market power and a position of strategic significance in respect of a digital activity. We will undertake an evidence-based SMS investigation to assess whether these conditions are met, consulting and engaging throughout with a wide range of stakeholders within the statutory 9-month timeframe.

What is the purpose of SMS designation?

Strategic Market Status (SMS) designation is the gateway into the digital markets competition regime. It is only once a firm is designated as having SMS in respect of a digital activity that we can impose interventions. SMS designation therefore ensures that the regime is focused on the most powerful firms and activities with the potential to cause most harm.

What tests must be met for a firm to be designated as having SMS?

We will investigate whether a firm has SMS in relation to a digital activity, and if we conclude it does, then it will be that activity which it is designated for. Any subsequent interventions will focus on that activity.

A digital activity is defined in the legislation as including the provision of a service by means of the internet or the provision of digital content. This might include, for example, the provision of internet search, app distribution or an online marketplace.

For a firm to be designated as having SMS in respect of a digital activity, the digital activity must be linked to the UK.

This test will be met, for example, if the activity has a significant number of UK users.

For a firm to be designated as having SMS it must also meet a turnover condition. This will be the case where we estimate that:

-

the total global turnover of the firm or group exceeds £25 billion for the relevant period, or

-

the total UK turnover of the firm or group exceeds £1 billion for the relevant period

The turnover threshold provides certainty to the vast majority of digital firms that they are not in scope of the regime.

Lastly, we must conclude that the firm has:

(a) substantial and entrenched market power

(b) a position of strategic significance in respect of that digital activity

How do we assess whether a firm has SMS in respect of a digital activity?

We conduct an evidence-based assessment to determine whether each of the SMS criteria are met.

Digital activity + link to UK + turnover condition met + substantial and entrenched market power + a position of strategic significance

= undertaking may be designated as having SMS in respect of a digital activity

Market power arises where an undertaking does not face effective competitive pressure and customers have poor alternatives to its offering or, even if they have good alternatives, they face barriers to shopping around and switching.

‘Substantial’ refers to the extent of market power, while ‘entrenched’ is a distinct element and ensures any such market power is not transient. However, they are not entirely separate as the assessment of each will typically draw on a common set of evidence on market power.

In order to assess whether a firm has substantial and entrenched market power in respect of a digital activity, the CMA must assess carry out a forward-looking assessment of at least 5 years – the length of the SMS designation. When undertaking this assessment our starting point will be market conditions and market power at the time of the SMS investigation. We will then consider any expected or foreseeable developments. In doing so, we will consider what the sources of the firm’s market power have been, and whether these are likely to remain in the future.

To find a position of strategic significance, we must conclude that the firm meets one of the following conditions in relation to the relevant digital activity:

(a) the firm has achieved a position of significant size or scale in respect of the digital activity. This can be assessed using a range of metrics depending on the activity, for example number of users, time spent using it, transactions made via it

(b) a significant number of other firms use the digital activity in carrying on their business. This can be assessed, for example, by assessing the number and range of a business’ products that are hosted on an SMS firm’s platform, or the proportion of other business’ sales the SMS firm facilitates

(c) the firm’s position in respect of the digital activity would allow it to extend its market power to a range of other activities. This assessment focuses on the firm’s status, rather than predicting its current or future conduct. Assessment might include considering whether the firm controls access to a product or service which is important for other firms or whether the firm can more easily enter other areas

(d) the firm’s position in respect of the digital activity allows it to determine or substantially influence the ways in which other firms conduct themselves, in respect of the digital activity. This could be assessed by considering whether the firm has a major role in setting standards, whether the firm makes decisions which relate to the application of regulatory frameworks or where the firm provides a content moderation or curation role

How do we conduct an SMS investigation?

The guidance includes full details of the SMS investigation procedure, including the main stages of engagement we expect typically to take place.

We can launch an SMS investigation where we have reasonable grounds to consider that a firm may meet the SMS conditions.

After deciding to launch an SMS investigation, we must issue an SMS investigation notice to the firm that will be subject to the investigation. As soon as reasonably practicable after this, we must publish a copy of the notice. At the beginning of the investigation, we will also invite comments from interested parties on the main avenues of our investigation.

We must complete an SMS investigation within 9 months, subject to a possible 3-month extension for special reasons. At the outset of an investigation we will publish a timetable outlining the key steps and engagement points in the process.

During the investigation, we will gather evidence from a range of sources, including using our formal information gathering powers as appropriate. We will also engage with a range of parties throughout the investigation. We will carry out a public consultation on our proposed decision on whether to designate a firm as having SMS. We will take account of written representations from the potential SMS firm and third parties received during the consultation before making a final decision. The potential SMS firm will also have the opportunity to make oral representations on the proposed decision.

If we decide to designate a firm, we will issue an SMS decision notice to the designated firm and publish a non-confidential copy of this notice.

How long does an SMS designation last?

An SMS designation period lasts for 5 years unless we decide to revoke the designation during that time.

At least 9 months before the end of a designation period, we must open a further SMS investigation to determine whether to:

-

designate the firm again in respect of the same digital activity

-

designate the firm in respect of a digital activity that is similar or connected to the relevant digital activity, or

-

revoke the firm’s designation in respect of the digital activity

If we do decide to revoke a designation, we may make provision for existing obligations, such as CRs, to continue on a transitional basis for the purpose of managing in a fair and reasonable way the impact of that revocation.

9-month standard period for SMS investigation

SMS investigation launch

The CMA may launch an SMS investigation where it has reasonable grounds to consider that it may be able to designate a firm as having SMS.

Information gathering and engagement

The CMA will issue a public invitation to comment at the beginning of the SMS investigation. The CMA will also gather evidence via a range of sources, including via statutory information gathering powers. The CMA will engage with a range of parties including through surveys, calls, meetings and workshops.

Consultation on proposed decision

The CMA must publicly consult on its proposed decision as to whether to designate a firm as having SMS in respect of a digital activity, taking account of written and oral representations made.

Decision on outcome of the SMS investigation

The CMA must send the firm an SMS decision notice setting out the outcome of the investigation and publish this notice on the CMA website.

Further SMS designation

An SMS firm will be designated for a maximum of 5 years. At least 9 months before the end of the designation period the CMA must conduct a further SMS investigation.

Further SMS Investigation

Imposing conduct requirements

Once a firm has been designated as having SMS in respect of a digital activity, we may impose CRs to guide how the firm must behave in relation to the digital activity. We will follow 3 steps in designing effective CRs and will engage with a wide range of parties during this process.

What are conduct requirements?

Conduct requirements (CRs) are intended to guide the practices of an SMS firm and tackle existing or future conduct where the firm seeks to take advantage of its substantial and entrenched market power and position of strategic significance in ways that could exploit consumers and businesses or undermine fair competition.

When will we impose CRs?

We will have regard to our Prioritisation Principles when considering whether and how to address issues in relation to a digital activity.

In considering whether to impose a CR or a PCI we will consider which is the most appropriate tool given the nature and scope of the issue to be addressed, the nature, scope and purpose of potential interventions and the statutory conditions which must be satisfied in relation to use of each tool.

How do we design CRs?

We may impose a CR or combination of CRs on an SMS firm where we consider doing so would be proportionate for one or more of 3 statutory objectives. CRs must also fall within the permitted types set out in legislation.

We expect CRs to vary across firms and designated activities – reflecting the variety of business practices across firms and the wide range of concerns that may arise.

Statutory objectives of CRs

The CMA may only impose a CR or combination of CRs where it considers it proportionate to do so for the purposes of one or more of the following objectives, having regard to what the CR is intended to achieve, as set out in s 19(5) of the Act.

Fair dealing – users or potential users of the relevant digital activity are treated fairly and able to interact with the SMS firm on reasonable terms.

Open choices – users or potential users of the relevant digital activity are able to choose freely and easily between the services or digital content provided by the SMS firm and services or digital content provided by other firms.

Trust and transparency – users or potential users of the relevant digital activity have the information they require to enable them to understand the services or digital content provided by the SMS firm and make properly informed decisions about whether and how to interact with the SMS firm in relation to the relevant digital activity.

Permitted types of CRs

All CRs imposed by the CMA must also fall within one or more of the permitted types set out in legislation which include:

Requirements for the purpose of obliging the SMS firm to do the certain things listed in s 20(2) of the Act, for example:

-

trade on fair and reasonable terms

-

have effective processes for handling complaints from users

Requirements for the purpose of preventing the SMS from doing the certain things listed in s 20(3) of the Act, for example:

- applying discriminatory terms, conditions or policies to certain users or potential users

We will typically follow 3 steps in designing CRs.

First, we will identify what the CR is intended to achieve. The aim of a CR will typically be more specific than the overarching statutory objectives(s) for which it is imposed.

Second, we will consider potential CRs within the permitted types to identify CRs that would be effective in achieving our aim. As part of this we will consider the appropriate form of the CR – including whether the CR is formulated as an outcome the SMS firm must achieve or include actions the firm must take to achieve that outcome. CRs may contain higher-level requirements, which firms may be able to comply with in a number of ways or, where necessary or appropriate, more detailed and directive requirements.

Third, we consider the proportionality of those CRs which we have identified as likely to be effective in achieving the intended aim. This includes ensuring the CR is no more onerous than necessary to achieve its aim.

What is our process for imposing CRs?

The guidance includes full details of the procedure for imposing CRs, including the main stages of engagement we expect typically to take place.

We may impose CRs on a designated firm at any point during the designation period. Our process for designing CRs may run in parallel with or follow an SMS investigation.

At the outset of any process we may publish an invitation to comment seeking views from interested parties on the types of issues we should address through CRs. We will also publish an overview of the process and timetable we expect to apply.

We will gather evidence from a range of sources, including using our formal information gathering powers as appropriate to inform our work on CRs. We will engage with a range of parties throughout the process and we must also carry out a public consultation before imposing a CR.

To impose a CR we must issue a notice to the firm which we will then publish. The notice must explain our reasoning for imposing the CR, including why we consider it proportionate to impose the CR, and the benefits we consider would likely result from it.

We may publish interpretative notes to accompany a CR. Interpretative notes will provide additional information about the CR(s), for the benefit of both the SMS firm and other industry participants. They may provide illustrative examples of types of conduct that we consider would likely comply with a CR and types of conduct that we consider would be unlikely to comply with a CR.

We may provide for an implementation period between the date we issue a notice imposing a CR and the date the CR comes into force, and ask the SMS firm to provide a written plan of how it intends to comply with the CR.

CRs will generally remain in force for the length of a designation period, unless we decide to vary or revoke a CR. We may vary or revoke a CR at any point it is in force, including in response to a change of circumstances, or where a CR is not effective in achieving its aim. We must carry out a public consultation before varying or revoking a CR.

Invitation to comment on issues to address through CRs

The CMA may publish an invitation to comment from interested parties on issues the CMA should address through CR(s) in respect of a (potential) SMS firm and relevant digital activity.

Information gathering and engagement

The CMA will gather evidence via a range of sources, including via statutory information gathering powers. The CMA will engage with a range of parties including through surveys, calls, meetings and workshops.

Consultation on proposed CR(s)

The CMA must carry out a public consultation before imposing CR(s).

Imposing CR(s)

To impose a CR the CMA must issue a notice to the SMS firm that sets out, among other things:

i) the objective for which the CMA considers it is proportionate to impose the CR

ii) the benefits the CMA considers would likely result from the CR

iii) the permitted type to which the CR belongs

The CMA will also publish the notice on its website.

Implementation period

The CMA may provide for an implementation period between imposing a CR and the CR coming into force. During this time, the CMA may expect the SMS firm to provide the CMA with a plan on how it intends to comply with the CR(s).

Pro-competition interventions

Once a firm has been designated as having SMS in respect of a digital activity, we may launch a PCI investigation. We must first consider whether there are factors relating to the digital activity which are having an adverse effect on competition. We can then impose PCIs to remedy, mitigate or prevent this. We can impose a wide range of possible interventions and may test and trial these. We will engage with a wide range of parties during the 9-month investigation.

What are pro-competition interventions?

Pro-competition interventions (PCIs) are interventions which can be used to remedy, mitigate or prevent a wide range of competition problems. These competition problems can stem from any factors which are preventing, restricting or distorting competition.

What sort of problems can PCIs be used to address?

To make a PCI, we must first undertake an investigation to determine whether we consider there are any factors or combination of factors relating to the digital activity that are having an adverse effect on competition (AEC).

This is the case where a factor or combination of factors prevents, restricts or distorts competition in connection with the relevant digital activity. A factor can be related to a firm’s conduct or may for example be a structural characteristic of a sector such as high barriers to entry or expansion.

If we find a factor or combination of factors relating to a relevant digital activity is having an AEC, we may make a PCI that we consider is proportionate for the purposes of remedying, mitigating or preventing the AEC itself or any detrimental effects on users as a result of it.

How do we design appropriate PCIs?

In order to identify an appropriate PCI we will follow 3 steps:

First, we will identify the purpose of a PCI, which must be to remedy, mitigate or prevent the AEC. We may additionally use the PCI to address any detrimental effects on users.

Second, we will identify potential PCIs which are likely to be effective in achieving that purpose. A PCI can take many forms. They can be behavioural (for example, requiring the SMS firm to make its service interoperable with a competitor’s) or structural (for example, requiring the divestment of an aspect of an SMS firm’s business). A PCI can also take the form of a recommendation for action to another public authority. We may consider a package of different types of remedies is appropriate.

Third, we will ensure the PCI is proportionate to the aim. This includes ensuring the PCI is no more onerous than necessary to achieve its aim.

What is our process for making PCIs?

The guidance includes full details of the procedure for PCI investigations, including the main stages of engagement we expect typically to take place.

We may begin a PCI investigation in relation to an SMS firm where we have reasonable grounds to consider that a factor or combination of factors relating to a designated digital activity may be having an AEC. We must give a notice about the PCI investigation to the SMS firm and publish the notice as soon as reasonably practicable.

We will publish an invitation to comment at the outset of a PCI investigation, seeking views on the issues we are investigating alongside potential interventions.

We must complete a PCI investigation within a 9-month timeline, which can be extended by 3 months for special reasons. At the outset of an investigation we will publish a timetable outlining the key steps and engagement points in the process.

During the investigation, we will gather evidence on how the market operates and factors leading to any competition problems. We will also gather evidence on whether an intervention is required, what it should be, and whether it would be effective and proportionate in dealing with the problem. We will also engage with a range of parties throughout the investigation.

We will publicly consult on our proposed decision, setting out our emerging findings and a description of any interventions we propose to make. We will consider written representations and will typically offer the SMS firm and key third parties impacted by the proposed decision the opportunity to make oral representations.

Where we decide that there is a factor or factors having an AEC, we may impose a PCI to remedy, mitigate or prevent the AEC. This can be done via a pro-competition order (‘PCO’). We may require the firm to undertake testing or trialling of potential remedies before imposing any on an enduring basis. If we decide to make a PCO, we must do so within 4 months of the end of our investigation.

We are required to keep PCOs under review. We can replace them where it is appropriate to do so, in order to ensure their continuing effectiveness. Any replacement PCO must be consulted on unless it is not materially different to the one it replaces. They can also be revoked and we must consult on any proposed revocation.

9-month standard period for PCI investigation

PCI investigation launch

The CMA may begin a PCI investigation into an SMS firm where it has reasonable grounds to consider that a factor or combination of factors relating to a relevant digital activity may be having an AEC. A PCI investigation notice must be issued to the SMS firm.

Information gathering and engagement

The CMA will issue a public invitation to comment at the beginning of the PCI investigation. The CMA will also gather evidence via a range of sources, including via statutory information gathering powers. The CMA will engage with a range of parties including through surveys, calls, meetings and workshops.

Consultation on proposed PCI decision

The CMA must publicly consult on its proposed decision on whether to make a PCI, taking account of written and oral representations made.

PCI investigation outcome issued

The CMA must give the SMS firm to which the PCI investigation relates a notice within 9 months of initiating the investigation setting out the findings of the investigation (for example, whether an AEC was found) and describing any PCIs the CMA intends to make. The notice will also be published on the CMA website.

4 months to make a PCI

Imposition of PCIs via a PCO

If the CMA seeks to make a PCI, it must be made within 4 months of giving the SMS firm the PCI decision notice.

Investigatory powers

We will use a range of mechanisms to gather information and engage with stakeholders as we administer the regime. We will use our statutory information gathering powers to obtain evidence to assist us to fulfil our functions and will protect the confidentiality of information we gather in line with our statutory duties.

How will we gather information?

We have a range of investigatory powers available to us, which we will use to ensure that we have appropriate information and evidence to support our work. Obtaining timely, complete, and accurate information will be critical to the effectiveness of the digital markets competition regime and our ability to fulfil our functions.

We will use our investigatory powers to obtain documents and information from businesses – including SMS firms and other parties.

The guidance sets out more information on the full range of our investigatory powers but these include:

Power to require information

We may issue a notice requiring a business or individual to give us specified information (including data and documents). We can also require a designated firm, or a firm subject to a breach investigation, to name a senior manager responsible for compliance with the notice and take enforcement action against this individual for failure to comply

Power to interview

Where we consider that an individual has information relevant to an investigation, we may give that individual a notice requiring them to attend an interview where we will ask them questions relevant to the investigation

Power to enter premises

As part of a breach investigation, we may exercise powers to enter domestic and business premises, where we have reasonable grounds to suspect that there is information which is relevant to the investigation on, or accessible from, the premises

Reports by skilled persons

We may appoint, or require the firm in question, to appoint, a skilled person to provide us with a report about a relevant matter. We may use this power in relation to a designated firm, or a firm subject to an SMS investigation or breach investigation. A ‘skilled person’ may be any external third party with relevant expertise, such as an accounting firm, management consultancy or an individual with technical expertise, such as a software engineer

How will we use our testing and trialling powers?

As part of an information notice, we may require the recipient to obtain or generate new information. This could include requiring the recipient to vary their usual conduct, in relation to some or all users of a service or digital content; and/or to perform a specified demonstration or test. We refer to these as ‘testing and trialling’ powers.

We may use these powers for the purpose of information gathering across the regime, including to gather technical evidence to support an investigation, to assess compliance with a regulatory requirement and/or to assess the effectiveness of our interventions.

For example, we may require a firm to demonstrate a technical process such as how an algorithm operates, or to undertake testing or field trials of its algorithm and report outcomes.

In deciding whether to use our testing and trialling powers to gather information across the regime, we will consider the value the information generated by the test would provide, and the feasibility and proportionality of carrying out the test.

How will we protect confidential information?

In carrying out our digital markets functions, we expect it will be necessary to request information from firms or individuals which may be of a confidential nature. We have statutory obligations to protect confidential information (including the identity of whistleblowers) and will follow the CMA’s well-established procedures to identify and protect such information.

For example, to protect sensitive information we may:

-

ask respondents to provide us with confidential and non-confidential versions of any submissions

-

ensure that information which must be shared with another party or published is non-attributable

-

take steps to redact, anonymise or aggregate confidential information

We understand that some stakeholders may have concerns about sharing information or experiences with us for fear of retaliation. We will take all reasonable steps to protect the identity of complainants (including whistleblowers) and the confidentiality of any information they provide to us.

Where required to disclose confidential information by law (for example as part of an enforcement investigation) we will consider the most appropriate mechanism. For example, we may establish ‘confidentiality rings’ to share information with only specified individuals (such as the SMS firm’s legal advisers rather than the firm itself).

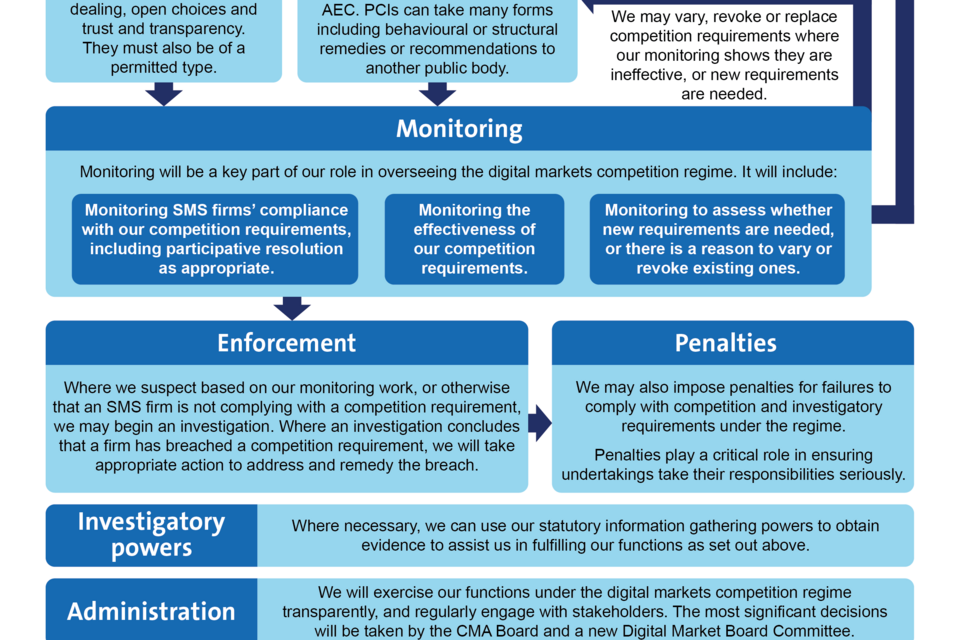

Monitoring

Monitoring will be a key part of our role in overseeing the digital markets competition regime. It will allow us to respond quickly where firms fail to comply with requirements under the regime, and to identify where new or varied interventions may be necessary. We will monitor our interventions to ensure that they are effective, avoid unintended consequences and are targeted to those areas that are the most impactful.

What will we monitor?

There are 3 key areas of monitoring:

-

monitoring SMS firms’ compliance with competition requirements and appropriateness of taking further action (for example participative resolution and/or enforcement)

-

monitoring the effectiveness of existing competition requirements to determine if they are having the intended impact

-

monitoring to assess whether new requirements are needed or there is a need to vary or revoke existing ones

Key areas of monitoring:

-

monitoring compliance

-

monitoring effectiveness

-

monitoring other market developments

What information will we use to monitor markets?

We will gather a range of qualitative and quantitative information and evidence to inform our monitoring work. For instance, looking at a range of market intelligence and research, as well as the outputs of our horizon scanning function.

Market participants will be an important source of information for us in our monitoring work. We will engage widely with businesses, consumers, and other interested parties (for example, industry associations and consumer groups) to ensure we are aware of and understand their concerns. We encourage all stakeholders to contact us in relation to competition and consumer concerns and complaints in digital markets.

We may receive submissions from SMS firms and market participants on a number of issues we are monitoring such as compliance, effectiveness and/or whether to vary or revoke interventions. Submissions should be reasoned and, where possible, accompanied by supporting evidence. This will assist us in deciding which issues to prioritise for further review.

How will we monitor compliance under the regime?

It will be the responsibility of an SMS firm to demonstrate that it is complying with the competition requirements to which it is subject. As part of this, SMS firms will be required to submit periodic compliance reports to us. We will require SMS firms to publish a copy or summary of these reports so that other market participants can also monitor and verify SMS firms’ compliance with the regime.

SMS firms must also appoint ‘nominated officers’ who will be responsible for monitoring compliance with competition requirements, co-operating with the CMA to secure compliance and compliance reporting. We may impose penalties on nominated officers in some circumstances where we consider the individual has failed without reasonable excuse to prevent the SMS firm from failing to comply with compliance reporting obligations.

In addition to formal compliance reporting requirements, we expect SMS firms to proactively report any compliance issues to us as quickly as possible as they arise and work constructively with us to resolve these issues.

How will we respond to compliance concerns?

We expect SMS firms to directly engage their users and other stakeholders to seek to resolve compliance concerns in the first instance. Where this does not occur or is not effective, we may intervene.

Where possible and appropriate, we will seek to achieve participative resolution of compliance concerns – involving regular and informal engagement with SMS firms and other market participants.

We are more likely to seek participative resolution of compliance concerns where we consider that resolution without enforcement action will more quickly and effectively achieve meaningful changes in conduct and positive outcomes for market participants. Our approach will also be driven by the extent and nature of any cooperation with us by the SMS firm such as whether it promptly informed us of the compliance concerns and the extent to which it engages openly and constructively in resolving our concerns.

We can take enforcement action in relation to breaches of competition requirements where appropriate to do so. This may include where we consider it is not appropriate to address a concern through participative resolution or where participative resolution fails, does not progress swiftly enough, or where a firm does not adhere to the agreed resolution.

How will we monitor and review the effectiveness of our interventions?

Monitoring effectiveness will allow us to understand whether our interventions are working as intended or if they need changing. It will also help us to iterate our approach, learning from these cases.

We may decide to carry out an assessment of the effectiveness of our interventions at the point of conducting a further SMS investigation, or before if our monitoring work suggests this is necessary.

We will only impose competition requirements that we deem to be effective and will review their effectiveness by referring back to their original aim/purpose.

We will rely on a mix of qualitative and quantitative evidence to inform any review and our approach will depend on the specifics of the case. Given digital markets develop at pace and there will be various factors driving market and consumer behaviours we will assess the evidence on effectiveness in the round.

As a result of our effectiveness reviews, we will either retain competition requirements without change, vary them to make them more effective, or revoke them.

How will we monitor whether to vary or revoke competition requirements?

Ongoing monitoring will help us identify whether we need to launch new SMS investigations, impose new CRs or launch new PCI investigations. It will also help us decide whether we need to vary or revoke existing competition requirements.

To identify whether a competition requirement should be varied or revoked we are likely to consider, amongst other things, whether there has been a change of circumstances since the intervention was imposed. For example, we might decide to change or remove requirements in response to changes in the market (including changes in technology) or new legislation.

Enforcement of competition requirements

Taking necessary enforcement action is vital to address harm arising from failures to comply with requirements under the regime. Where the CMA concludes that a firm has breached a competition requirement, we will take appropriate action to address and remedy the breach.

When can we take enforcement action?

We can enforce for breach of a range of competition requirements, including breach of CRs and PCOs. Where we have compliance concerns in relation to a competition requirement, we may carry out an initial assessment to determine whether to open an investigation. This may follow prior engagement with the firm in the context of our monitoring work, and any attempts to resolve concerns through participative resolution.

We may open an investigation under the regime where we suspect that a competition requirement has been breached.

How will we carry out investigations into breaches of competition requirements under the regime?

The guidance includes full details of the procedure for enforcement investigations, including the main stages of engagement we expect typically to take place.

When we launch an investigation, we will give notice to the firm under investigation. This will (in addition to other factors as relevant) state the competition requirement which we suspect has been breached and describe the relevant conduct.

We will publish the commencement of investigations, as well as an administrative timetable outlining the key steps and engagement points in the process.

Where appropriate, we will also publish an invitation to comment at the outset of the investigation, inviting submissions on topics where we would welcome views.

Following the launch of an investigation, we will conduct evidence gathering and review to assess whether the firm is in breach.

We will notify the firm under investigation of our provisional findings, which will include the reasons on which these are based. We will also provide appropriate disclosure to enable the firm to respond to those findings. We will typically publish an update on our website when we issue provisional findings.

The firm under investigation will have an opportunity to make representations in response to provisional breach findings. For suspected CR breaches we will offer the firm the opportunity to make any representations orally to decision makers and we will typically do so in other investigations, unless we consider there is reason not to do so. In appropriate cases, we may also seek representations on provisional findings directly from third parties.

We will communicate our final decision by issuing a notice of findings to the firm, which will state whether or not we have found that a breach of the competition requirement has occurred. We will publish the outcome of breach investigations on our website.

Initial assessment

The CMA may carry out an initial assessment in relation to compliance concerns with competition requirements, to determine whether to open an investigation.

Investigation launch

Where the CMA suspects a breach, it may launch an investigation. The CMA will issue a case opening notice to the firm suspected of the breach. Commencement of the investigation will be made public.

Evidence gathering and assessment

The CMA will conduct evidence gathering and review, making use of its statutory investigatory powers as appropriate. Where appropriate, the CMA will also publish an invitation to comment at the outset of an investigation.

Provisional findings

Before reaching its final findings, the CMA will notify the firm of its provisional findings and will provide an opportunity for the firm to respond taking account of written and oral representations and make appropriate disclosure.

Final findings

Unless it has closed the investigation or (for conduct investigations) accepted commitments, the CMA will issue its final findings to the firm on whether a breach has occurred. Outcomes of investigations will be published on our website.

Further enforcement outcomes

Where appropriate, the CMA may impose penalties or seek a court order requiring compliance. For CR and PCO breaches respectively, it may issue an EO or directions addressing the breach.

How will we enforce conduct investigations?

Conduct investigations (CRs) are investigations into whether a firm has breached a CR. Our approach to conduct investigations broadly follows that outlined above for investigations into breaches of other competition requirements. However, there are some key differences. These include that we must complete such investigations within 6 months with a possible 3 month extension for special reasons.

We must also close a conduct investigation where representations made by the firm under investigation lead us to consider that the ‘countervailing benefits exemption’ (‘CBE’) applies. This might be the case where the conduct we are investigating gives rise to wider benefits to consumers like privacy. There are 5 conditions which must be met for the CBE to apply and we will require clear and compelling evidence in order to consider that these are satisfied.

Countervailing benefits exemption (CBE) conditions

Section 29(2) of the Act sets out the following exemption conditions:

-

the conduct to which the investigation relates gives rise to benefits to users or potential users of the digital activity in respect of which the CR in question applies

-

those benefits outweigh any actual or likely detrimental impact on competition resulting from a breach of the CR

-

those benefits could not be realised without the conduct

-

the conduct is proportionate to the realisation of those benefits

-

the conduct does not eliminate or prevent effective competition

As part of a conduct investigation we may impose an interim enforcement order (‘IEO’). We can do this where we have begun a conduct investigation and consider that it is necessary to take action on an interim basis, pending the conclusion of our investigation. We can do this for 3 reasons, including to prevent significant damage to firms impacted by the potential infringing conduct.

At the end of our investigation, where we find that a firm has breached a CR, we can make an enforcement order (‘EO’), imposing on the firm appropriate obligations to:

(a) in a case where the breach is ongoing, stop the breach

(b) prevent the breach from happening again

(c) address any damage caused by the breach

When can we adopt the final offer mechanism?

For breaches of CRs relating to payment terms between an SMS firm and a third party or parties, we can ultimately resolve the breach through use of the final offer mechanism (‘FOM’).

The FOM seeks to resolve such breaches by obtaining binding final offers from each party, from which we will choose one of the offers and make an order giving effect to its terms.

We can only adopt the FOM where the SMS firm fails, in breach of a CR, to agree fair and reasonable payment terms for a transaction(s), we take enforcement action and impose an EO that is also breached by the firm, and we could not satisfactorily address the breach within a reasonable time frame by exercising any of our other digital markets functions.

In determining whether the FOM is an appropriate way of addressing the breach, we will also consider whether payment terms are the key terms under dispute, and the complexity of the transaction in question.

What actions can we take if a firm has breached a competition requirement?

Where we find a firm has breached a competition requirement we can (depending on the requirement breached) impose an order or directions addressing the breach, financial penalties and/or apply for a court order requiring compliance. We can also pursue enforcement action against individuals at the firm. We can take action against the senior manager or nominated officer. In certain circumstances we can also seek a competition disqualification order, or accept a competition disqualification undertaking, in relation to a director.

-

CMA imposes CR on the firm to trade on fair and reasonable terms

-

CMA finds firm in breach of a CR and issues an EO to trade on fair and reasonable payment terms

-

firm does not comply with the EO

-

CMA assesses whether to instigate the FOM

Penalties

We may impose penalties for failures to comply with competition and investigative requirements under the regime. Penalties play a critical role in ensuring undertakings take their responsibilities seriously and in avoiding harm to competition and consumers from non-compliance. The size of penalties for competition infringements covered by the digital markets competition regime guidance will be calculated using a 4 step approach.

When can we impose penalties?

We can impose penalties where we find a firm has failed to comply with a competition or investigative requirement without reasonable excuse. The threat and imposition of penalties is key to deterring future non-compliance.

The relevant type (fixed and/or daily) and maximum size of penalties varies depending on the type of breach. However, these can be significant. For example, in the case of a breach of a CR we can impose a fixed penalty up to a maximum of 10% of an SMS firm’s worldwide turnover.

The guidance on the digital markets competition regime covers penalties for breach of competition requirements like breaches of CRs and PCOs. Penalties for breach of investigative requirements, like failure to respond to an information request and IEOs, and penalties imposed on senior managers and nominated officers are set out in Administrative Penalties: Statement of Policy on the CMA’s Approach (CMA4).

How do we assess the appropriate size of penalties?

We will follow a 4 step approach in assessing the appropriate amount of a penalty for breach of competition requirements:

-

we start by taking a percentage of the SMS firm’s UK turnover in the relevant period. This percentage will be between 0-30% depending on the seriousness of the breach

-

we may increase the penalty to ensure it is large enough to deter the SMS firm and other firms from future non-compliance as well as ensuring the SMS firm has not gained or profited from non-compliance

-

we may increase the penalty for aggravating factors, such as the SMS firm retaliating against any third party, and/or decrease the penalty for mitigating factors, such as the SMS firm co-operating with the investigation

-

we ensure the penalty is proportionate and does not exceed the statutory maximum

Administration of the regime

We will exercise our functions under the digital markets competition regime transparently. The most significant decisions in the regime will be taken by the CMA Board and a new Digital Markets Board Committee. We will coordinate with other regulators and set out arrangements for doing so in published memoranda of understanding. We will also levy SMS firms for the costs of the regime and consult on levy rules on how this will be calculated and collected.

How will we ensure our work is transparent?

We will exercise our functions under the digital markets competition regime transparently by providing appropriate information about our activities and decisions to the range of stakeholders with an interest in and who are affected by our work, whilst working to protect the confidentiality of those who provide us with sensitive information.

How will we take decisions?

Certain decisions in the digital markets competition regime must be taken by the CMA Board. These include the decision to begin an SMS investigation and the decision to begin a PCI investigation.

Other decisions can be delegated by the CMA Board to a committee or sub-committee of the Board. We have established a Digital Markets Board Committee to take these decisions. These include the decision to make an SMS designation, impose CRs and PCOs and some enforcement decisions including the decision to impose a penalty.

Further details on the Digital Markets Board Committee are set out in the Terms of Reference that are published on our website.

All other decisions can be delegated by the CMA Board to staff, as set out in the published CMA Board authorisations.

How can relevant parties raise procedural complaints?

Where certain procedural issues cannot be resolved between a firm and the relevant CMA case team, the firm will be able to ask for the issue to be considered by an adjudicator independent of the case team. Broadly, this mechanism is available for:

-

disputes over timings and deadlines associated with investigations into suspected breaches of a competition requirement or investigative requirement, and

-

for those investigations and other aspects of the digital markets competition regime, disputes over confidentiality issues

How will we coordinate with other regulators?

We will consult Ofcom, the Information Commissioner’s Office, Financial Conduct Authority (‘FCA’), Bank of England and Prudential Regulatory Authority in certain cases where their remits and responsibilities might be impacted by the exercise of our functions. Ofcom and the FCA can also make recommendations to us in relation to exercise of our functions.

We set out how we propose to coordinate with the other regulators in published bilateral Memoranda of Understanding.

This coordination will complement existing cooperation mechanisms including through the Digital Regulation Cooperation Forum (‘DRCF’).

How will we recover the costs of the digital markets regime?

We will require SMS firms pay a levy to cover the costs of the regime. The rules for the digital markets competition regime levy establish how the levy will be calculated and collected, and we will consult on these rules before they are made, amended or replaced.