Demand for geospatial skills - Report for the Geospatial Commission - Executive summary

Published 7 June 2022

Background & Context

There is a growing interest from government and industry in how the UK can realise the full potential offered by the growth of data skills and capabilities. Previous studies have identified the benefits of embedding data skills into all sectors of the economy, but there are associated challenges with this including: a perceived skills gap, the need for greater availability of foundational training in data skills, and building a coordinated approach to data skills across all relevant parts of government. Geospatial data skills are an important subset of data skills, but to date, the demand for geospatial data skills in the UK has never been examined in-depth.

To help fill this gap, Frontier Economics was asked by the Geospatial Commission to analyse current demand for geospatial skills. We used job vacancy data collected by Burning Glass Technologies to examine the demand for geospatial data skills across all sectors and regions of the UK economy between 2014-2019.

The Geospatial Commission was established in 2018 within the Cabinet Office, to promote best use of geospatial data. Their recent UK Geospatial Strategy (2020) included four missions (Figure 1). As the digital and data revolution transforms the economy and society, data skills are in increasingly high demand. Developing these skills is a cross-cutting policy issue, articulated in the People pillar of the Government’s Industrial Strategy (2017). Mission 3 of the UK Geospatial Strategy states that the UK must develop more people with the right skills and tools to work with location data to meet future needs.

Figure 1: Geospatial Commission Missions

Mission 1: Promote and safeguard the use of location data

Mission 2: Improve access to better location data

Mission 3: Enhance capabilities, skills and awareness

Mission 4 Enable innovation

To achieve this vision, the Geospatial Commission requires an understanding of the dynamics of a fast-changing labour market and the interactions between geospatial skills and other science, technology, engineering and maths (STEM) capabilities, data and digital skills. The importance of geospatial skills is expected to increase over time, as more geospatial data is collected and shown to be useful, and where open source geospatial software packages make analysis of that data more accessible. This timely assessment of patterns and trends in demand for geospatial skills across the UK will be used by the Geospatial Commission to develop long term economy-wide initiatives and meet the UK’s future geospatial skills requirements.

Geospatial Skills

We identified a diverse list of geospatial skills that are called for by employers within job postings. This reflects the broad range of activity across the UK economy that can be considered geospatial. Required skills include the capability to work with specific software and scripting packages as well as those that correspond to earlier stages of the geospatial value chain such as collection and manipulation of data.

Figure 2: Examples of geospatial skills identified

Data Collection

- Remote sensing

- Topographic Survey

- LiDAR

- Field survey

Data interpretation and analysis

- GIS software

- Logistics analysis

- Geospatial intelligence

Sector Specific Capabilities

- Precision agriculture

- SLAM

- Hydrographic modelling

Spread of geospatial jobs across the economy

Geospatial jobs are not confined to one particular industry. Our data analysis identified a wide spread of sectors across the economy that require geospatial skills, for example retail (employers such as Asda), banking (employers such as JP Morgan Chase) and pharmaceuticals (employers such as Bayer AG). This pattern is in line with trends seen in the wider data science skills ecosystem and emphasises the importance of a targeted approach to expand the benefits resulting from the increasing uptake of geospatial skills across the UK.

Geospatial subgroups

We grouped similar geospatial postings together based on their skill mix, to highlight more granular subsets of geospatial activity. In addition, to distinct skill requirements subsequent analysis revealed that demand for these subgroups has evolved at different rates and the groups also differed in terms of their geographic concentration and educational requirements. We have illustrated the resulting six subgroups in Figure 3 below. For each subgroup we have noted the geospatial skill that appears most frequently as part of included postings. We have also included the most prevalent co-occurring skill and the number of postings within each group.

Figure 3 Illustration of geospatial occupational subgroups

| GIS Specialists | Programming/data management with GIS | Civil Engineering | SLAM & Robotics | Surveyors | Miscellaneous | |

|---|---|---|---|---|---|---|

| Most common geospatial skill | GIS software | GIS software | Building information modelling | SLAM | Land Surveys | Mapping |

| Most common co-occuring skill | Communication skills | SQL | AutoCAD | C++ | Communication skills | Project Planning |

| Number of postings | 18,672 | 8,529 | 7,625 | 4,845 | 16,661 | 15,783 |

Source: Frontier based on analysis of Burning Glass data

Note: For each subgroup we have noted: the most commonly occurring geospatial skill (e.g. the geospatial

skill which appeared in the highest proportion of postings in that group) and the most commonly

occurring non-geospatial skill. We have also sized according to the number of postings that are

included in each subgroup. We found that over the period 2014-19 71,300 postings called for a

geospatial skill. In addition, a further 700 had a clearly geospatial job title and role, but no geospatial

skills specified

-

We have called our first group GIS specialists. Job postings that fall into this category almost always specify a GIS capability including ArcGIS or QGIS. The most commonly occurring non-geospatial skill is communication.

-

Our second group is titled programming and data management with GIS. Job postings in this subgroup tend to require GIS skills but also specify database administration skills such as SQL, and/or data programming skills such as Python or Java.

-

Civil Engineering and design software capability is concentrated in our third group. Nearly 80% of these job postings require building information modelling (BIM) capabilities. This software is used to create digital representations of physical features. Typically, postings in this group also call for engineering and drafting software packages such as AutoCAD and Revit which allow users to design a building in 3D.

-

Our fourth group is defined primarily by simultaneous localisation and mapping (SLAM) capability. SLAM technology involves the use of cameras and/or sensors to capture 3D measurements and generate a map. Some autonomous vehicles systems use SLAM to navigate through an unknown environment. This group features a high prevalence of coding capability such as C++, machine learning and python skills.

-

The vast majority of surveyors and related professionals are included within the fifth group. 97% of postings in this group specify a skill from the ‘surveying’ skills cluster, which includes field surveys, topographic surveys and LiDAR.

-

Our final miscellaneous category includes a variety of smaller subgroups. Some postings in this group call for the application of geospatial skills in contexts such as meteorology or urban planning. This shows how pervasive geospatial skills are across the economy and emphasises the wide-uptake of geospatial insights. There is also a subset of roles within this group that call for remote sensing skills such Earth Observation. Another cluster of postings within this group specify generic ‘mapping’ capability, but do not tend to mention GIS skills.

In Figure 4 below we have collected detailed examples of roles that fall into each of our subgroups. These pen portraits help to illustrate the type of vacancy that tends to be classified into each cluster and allows us to see how geospatial skills are used in conjunction with a wide variety of supporting capabilities across multiple sectors of the economy.

Figure 4: Examples of roles that fall into each subgroup

| Subgroup | Role & Sector | Description of vacancy | Skills and qualifications |

|---|---|---|---|

| GIS Specialists | Data Scientist -public sector | Lead on data standardisation and development of a spatial framework and data observatory | Analysis of planning and data; data management; GIS spatial mapping tools; Strategic planning or place-making expertise; digital innovation. |

| Programming and data management with GIS | Senior Data Journalist - broadcasting | Working to bring together journalists, designers, developers and editors to provide compelling visual coverage of news stories. | Explore and summarise data for data-driven stories using GIS, SQL, Python and R; html and scripting for data visualisation or analysis; knowledge of QGIS and/or Tableau. Ability to visualise spatial patterns |

| Civil Engineering and design software | Senior Hydraulic Modeller - management consultant | Lead on the delivery of hydraulic modelling for a broad range of clients on flood risk, and integrating AI and statistical processes. | Requires MEng (Hons) Civil Engineering. Highly proficient in the use of modelling and GIS software. Experience with other software (e.g. InfoWorks) is desirable |

| SLAM and robotics | Artificial Intelligence Architect - PropTec | Establish data science function. Solution design, architecture, model performance, model currency and ultimate delivery | Understanding of Machine Learning and AI techniques, strong technical architecture, design, deployment and knowledge of AI platforms, and protocols |

| Surveyors and related expertise | Hydrographic Surveyor - renewable energy | Use of marine geospatial techniques and tools in offshore and marine environments. | Knowledge of geodesy, GIS, software, awareness of navigation on water. Experience of sensor technologies. |

| Miscellaneous | Consultant, Poverty and Equity– financial sector | Analytical and operational consultant aiming to end extreme poverty and boost shared prosperity | Knowledge of STATA, R, Python and ArcGIS; applied macroeconomics; quantitative skills. |

Source: Burning Glass data

Note: Included posts are illustrative examples and not necessarily fully representative of wider group in each case.

Changes in demand over time

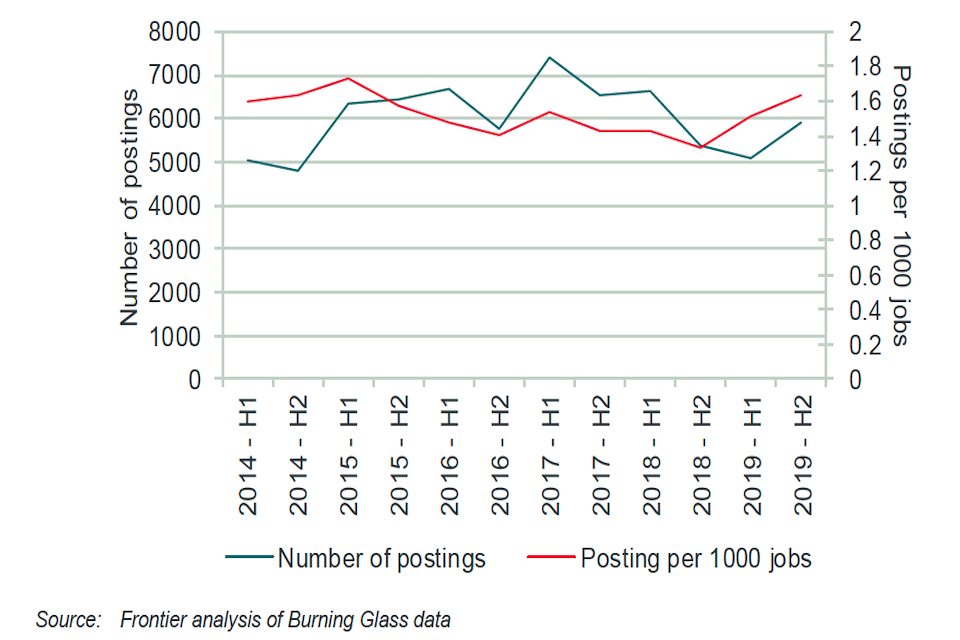

We found that over the period 2014-19 71,300 postings called for a geospatial skill [footnote 1]. This corresponds to 1.6 geospatial postings per thousand job adverts.

There is no consistent trend in the number of geospatial postings over the entire period although there may be early evidence of a rise in the rate of geospatial postings from the first half of 2018 to the end of 2019.

Figure 5: Monthly rate and number of Burning Glass postings that call for any geospatial skills (2014-19)

Monthly rate and number of Burning Glass postings that call for any geospatial skill (2014-19)

However, demand for different subgroups of postings has evolved differently. For example, both the surveying and related expertise subgroup and the civil engineering and design software group experienced material increases in the number of included postings between 2014-19. Finally, specific geospatial skills and co-occurring skills which appear on geospatial postings are in higher demand now relative to 2014. For example, specific GIS software packages are now more commonly required. The rapid rise in popularity of QGIS in particular suggests that open source geospatial software is becoming more prevalent. In addition, expertise relating to sensor technologies has also become more prevalent. In terms of co-occurring skills Python has seen the largest proportional increase and is now frequently called for in conjunction with geospatial skills. Python has been highlighted previously as an increasingly important component of data science roles. Other more generic data skills such as Big Data and Data Analysis also appear slightly more frequently on geospatial postings relative to 2014. Notably several variants of SQL now appear less frequently.

Regional Patterns of demand

London [footnote 2] contains the highest number of geospatial postings. However, a distinctly different pattern emerges if we examine the proportion of all postings within a region that call for a geospatial skill. Scotland and Northern Ireland have the highest rates of geospatial intensity. GIS skills are demanded at above average rates in Scotland and Northern Ireland with cities such as Edinburgh, Glasgow and Belfast driving this pattern. The lowest rates of geospatial intensity are observed in the North West and North East.

Figure 6: Location of Burning Glass postings that call for any geospatial skill and geospatial intensity of each region (2014-19)

| Region | Jobs |

|---|---|

| Scotland | 5,462 (2.10 per thousand) |

| Northern Ireland | 1,339 (1.92 per thousand) |

| West Midlands | 6,911(1.50 per thousand) |

| Wales | 1,640 (1.55 per thousand) |

| South West | 6,135 (1.68 per thousand) |

| North East | 1,140 (1.19 per thousand) |

| North West | 4,643 (1.17 per thousand) |

| Yorkshire | 3,643 (1.31 per thousand) |

| East Midlands | 3,188 (1.19 per thousand) |

| East | 5,484 (1.35 per thousand) |

| London | 13,495 (1.40 per thousand) |

| South East | 12,454 (1.74 per thousand) |

Source: Frontier