CCS annual report and accounts 2021 to 2022: accessible version

Updated 19 July 2022

Presented to Parliament pursuant to Section 4 (6A) (b) of the Government Trading Funds Act 1973 (as amended by the Government Trading Act 1990). Ordered by the House of Commons to be printed on 18 July 2022.

HC476

Welcome to the Crown Commercial Service Annual Report and Accounts 2021/22

In 2021/22 the Crown Commercial Service, as a Trading Fund and an Executive Agency of the Cabinet Office, helped organisations across the entire public sector to save time and money on buying their everyday goods and services.

Performance highlights and commercial benefits including savings

-

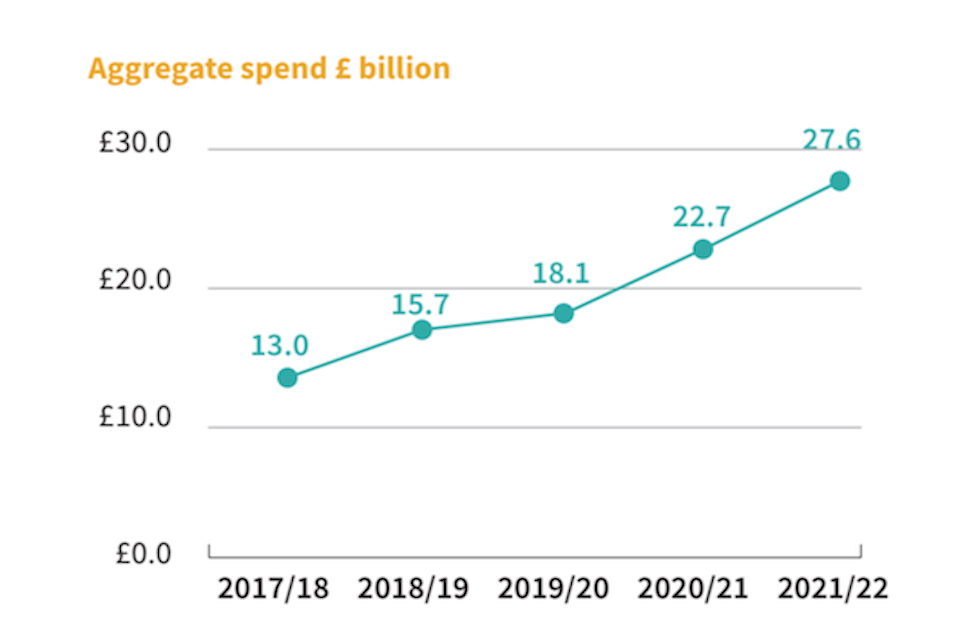

£27.63 billion of public sector spend was channelled through our commercial agreements, an increase of £4.9 billion from the year before

-

our employee engagement index, as measured by the civil service people survey is 71%, maintaining top quartile performance

-

£2.22 billion was spent directly with SMEs through our commercial agreements in 2021/22, an additional £687 million directly compared to 2020/21

-

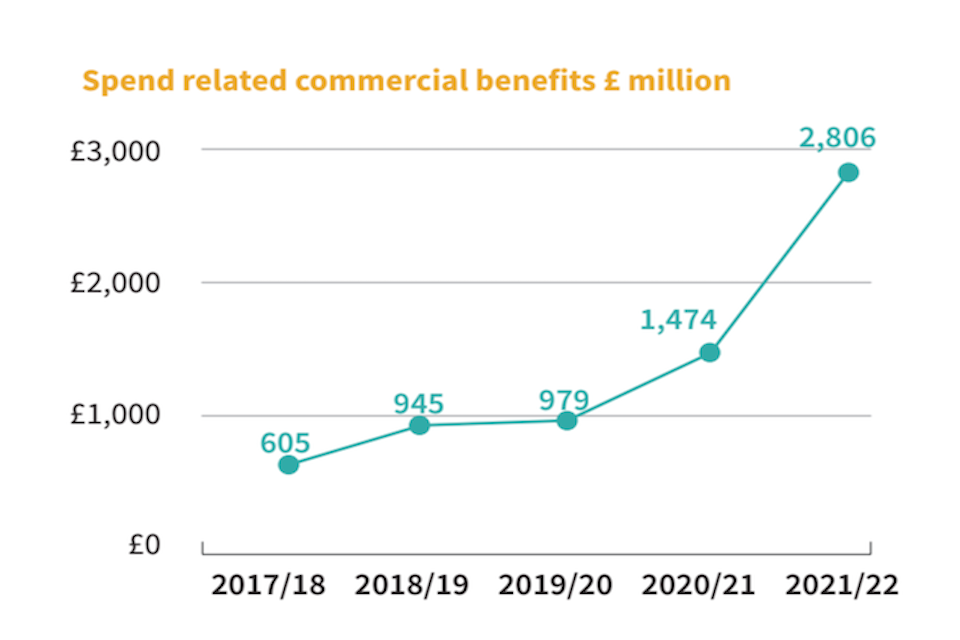

customers who have used our agreements have achieved commercial benefits equivalent to £2.8 billion

-

in line with government policy on prompt payment, we paid 99.9% of undisputed supplier invoices within 5 days and 100% of undisputed payments due within 30 days

-

we helped customers with procurements worth a total annual contract value of over £5 billion

-

our digital brochure, providing customers with the latest details of our products and services, was downloaded 2,268 times last year

-

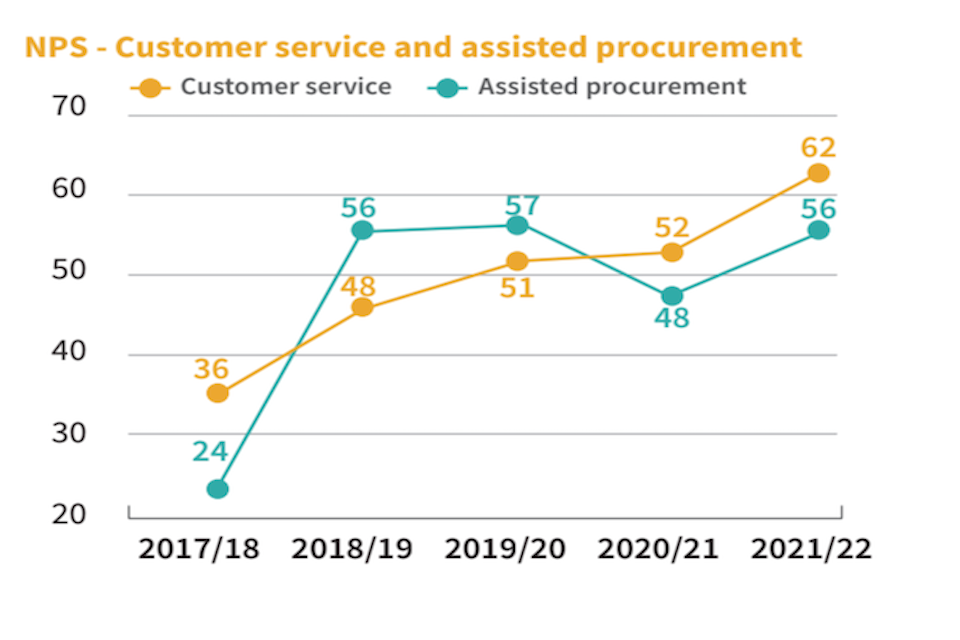

our net promoter scores for customer satisfaction over the year were +56 for customer service and +62 for assisted procurement

-

we helped 14 NHS trusts to save a total of £4 million on mobile voice and data services: an average saving of 70% against their previous costs

-

schools in Tower Hamlets are expected to save £250,000 on the cost of recruiting supply teachers through a managed service solution using our supply teachers and temporary staff commercial agreement

Year at a glance

April 2021

We negotiate the next iteration of a 3 year Memorandum of Understanding with Microsoft UK, to enable public sector organisations to continue to achieve better value for money on their technology procurement.

May 2021

We produce a video in support of Deaf Awareness Week to highlight the story of a colleague with hearing loss who, through the support of her line manager, was able to access the equipment she needed to help her at work.

June 2021

For the first time, we participate in Mind’s Workplace Wellbeing Index Awards. We receive a silver award in recognition of the work we’re doing to support the mental health of our colleagues.

July 2021

We launched our Carbon Net Zero working group - delivering expert advice on CNZ issues in the run up to COP 26.

August 2021

We support the repatriation of thousands of people during the Afghanistan crisis. We also set up a 24 / 7 service to procure 150,000 emergency essential items, including food, blankets and nappies, for Afghan evacuees arriving at UK airports.

September 2021

Staff complete the Civil Service People Survey, placing CCS in the top quartile of all Civil Service organisations.

October 2021

We launch our Procurement Essentials series of articles to help customers, who may not be procurement experts, overcome common hurdles, understand key concepts, and make their life as a buyer of common goods and services easier.

November 2021

We published our first annual modern slavery statement – setting out the positive steps we’re taking to identify, prevent and mitigate the risks of modern slavery in our operations and supply chains.

December 2021

Two CCS colleagues are recognised in the Queen’s New Year honours list. Sal Uddin received an MBE for public and charitable services and Katrina Williams, received an OBE for public service. Philip Orumwense also collects his CBE, awarded in 2020, from Windsor Castle.

January 2022

We published our first SME action plan, outlining how we’re helping the public sector to meet the government’s aspiration to level the playing field for SMEs.

February 2022

Simon Tse appears on the cover of Civil Service World. In his interview he discusses public procurement reform, how CCS is enabling better outcomes for our public sector customers, and his work to ensure the Civil Service is representative of the UK.

March 2022

CCS partners with NHS England and NHS Improvement on a new construction framework agreement.

Who we are

Our values shape and drive everything we do. We listen, respect, collaborate and trust in order to deliver with confidence.

Our vision is to be the provider of choice for public sector organisations seeking commercial and procurement solutions. Crown Commercial Service (CCS) will be trusted and admired by buyers and suppliers for our expertise and the quality of the services we offer and the solutions we provide.

Our purpose is to help the UK public sector get better value for money from its procurement of goods and services.

Our goal is to focus on the customer by deepening the value CCS adds, extending our coverage and influence and enabling better outcomes.

Our ambition is to increase the value that we help the public sector achieve from procurement, by sustainably increasing the depth of our impact and the breadth of our coverage. We will aim to influence as much common goods and services public sector procurement spend as possible, and target spend through CCS commercial agreements of £30 billion by 2024.

Glossary

ALB: Arm’s Length Body, an organisation that delivers a public service, is not a ministerial government department, and which operates to a greater or lesser extent at a distance from ministers

CAAAB: Commercial Agreement Advisory and Approvals Board, this board oversees all new and replacement commercial agreements

CCS: Crown Commercial Service

CETV: Cash Equivalent Transfer Value

CG&S: Common goods and services, products and services that multiple organisations need to purchase, from locum doctors and laptops, to police cars and electricity. In CCS, we organise them into four pillars:

- Buildings

- People

- Technology

- Corporate

CIPS: Chartered Institute of Procurement and Supply

CG: central government, the ministerial departments

CO: Cabinet Office

Commercial benefits: The value that CCS drives for customers when purchasing through our commercial agreements. Our methodology allows for 2 routes for benefit calculations:

- ‘Spend Benefits’ are based on sampling all spend through a commercial agreement and calculating average benefit for all the customer population using the agreement compared to current comparator market prices.

- ‘Change Benefits’ are a specific measure applicable to an individual customer usually as a result of a business change influenced by CCS and signed off accordingly by the customer

CRM: Customer Relationship Management. Either the processes of managing customer relationships or the tools/software we use to manage customer information

DHSC: Department of Health and Social Care

DLUHC: Department of Levelling Up, Housing and Communities

DOS: Digital Outcomes and Specialists, CCS’s commercial agreement that helps the public sector buy, design, build and deliver digital outcomes by finding appropriate specialists to deliver agile software development

DPS: Dynamic Purchasing Systems

EPMO: Enterprise Portfolio Management Office. They advise, support and challenge internal projects

Executive Board: The Executive Board manages the delivery of CCS’s strategic aims and provides leadership to the organisation. The Executive Board is chaired by the Chief Executive and includes Director-level representation from the key directorates and functions in CCS

FAB: Finance and Approvals Board. The Finance and Approvals Board is a sub-committee of the Executive Board with responsibility for overseeing all aspects of spending within CCS

FM: Facilities Management

FReM: The Government Financial Reporting Manual, which is the technical accounting guide for the preparation of financial statements

FTEs: Full time equivalent, the hours worked by one employee on a full-time basis

GBS: Government Buying Standards

GCF: Government Commercial Function

G-Cloud: CCS’s commercial agreement for use by the UK public sector to buy cloud computing services covering hosting, software and cloud support on a commodity based, pay-as-you go service

GCO: Government Commercial Organisation

GDS: Government Digital Service

GIAA: Government Internal Audit Agency

GPA: Government Property Agency

KPI: Key Performance Indicator

LGBT+/LGBTQ+: Lesbian, Gay, Bisexual, Transgender, Queer/Questioning plus other communities

MoU: Memorandum of Understanding, a type of agreement between two or more parties

MPM: Managing Public Money, HM Treasury guidance for managing the spending of public funds

MSAT: Modern Slavery Assessment Tool

MVP: Minimum Viable Product

NAO: National Audit Office

Net Zero: The target for the UK to bring all greenhouse gas emissions to net zero by 2050. Any emissions would be balanced by schemes to offset an equivalent amount of greenhouse gases from the atmosphere, such as planting trees or using technology like carbon capture and storage

NHS BSA: NHS Business Services Authority

NHS FOM: NHS Future Operating Model, the programme to enhance procurement efficiency and effectiveness across the NHS

NHS SBS: NHS Shared Business Services

NPS: Net Promoter Score, a measure of customer satisfaction

OGSA: Operational Governance Self Assessment, part of CCS’s management assurance process

PAC: Public Accounts Committee, examines the value for money of government projects, programmes and service delivery. Drawing on the work of the National Audit Office the Committee holds government officials to account for the economy, efficiency and effectiveness of public spending.

PBOs: Professional buying organisations that put in place and manage contracts and frameworks for commonly purchased goods and services, which can be accessed by most UK public sector organisations

PPG: Public Procurement Gateway

PSC: Public Sector Contract, a shorter and simpler government contract developed and used by CCS

RMI: Report Management Information system, the new system for suppliers to submit their returns to CCS

ROCE: Return on Capital Employed

SAM: Strategic Account Management

SCS: Senior Civil Service

Smarter Working: Smarter working empowers Civil Servants to make the right decisions about where, when and how they work; optimising the use of workplaces and technology, and realising savings for the taxpayer. It improves productivity through a focus on outputs and enables a better work life balance for all

SMEs: Small and medium-sized enterprises (business of less than 250 employees)

SMT: Senior Management Team

Social value: Social value legislation requires buyers of public sector services to consider whether there are related social, economic or environmental benefits that can be delivered through the contract, for example, creating more apprenticeships or reducing carbon emissions

Spend types:

-

Direct spend represents spend where the commercial agreement/framework used for call off is owned and managed by CCS. This includes agreements originally let by other organisations and then transferred to CCS

-

Transacted spend represents spend through an agreement that is placed and owned by another organisation but for which CCS has offered significant buying advice or support or Spend where the CCS influence is focused on enabling a route to market for customers, who are then buying a secondary product

-

Public Sector Commercial Agreement spend are memoranda of understanding (MoU) with suppliers that set a maximum charge for goods or services that the supplier agrees to adhere to within/across the public sector

SRO: Senior Responsible Owner, the individual responsible for ensuring that a programme or project meets its objectives

WPS: Wider public sector, including local government, health and education, and third sector (charities)

Performance report

“This is another excellent set of results from Crown Commercial Service for 2021/22. CCS is crucial to the government’s drive for efficiency, by helping customers across the entire public sector get better value in terms of benefits, as well as value for money, from their spending on common goods and services. My sincerest thanks to CCS colleagues, the Executive and Non-Executive Boards, and in particular, departing Chairman Tony van Kralingen, for their excellent and continued delivery again.”

The Rt Hon Jacob Rees-Mogg MP,

Minister of State (Minister for Brexit Opportunities and Government Efficiency)

Overview

Chair’s statement

Tony van Kralingen

As I write my final statement for the Annual Report and Accounts, I have been reflecting on my time at CCS ahead of my tenure ending in 2022/23. In my six years I have been privileged to serve as Chair of the Board I have witnessed huge strides in all areas of the business. From a difficult start as an organisation, the leadership and teams within CCS have worked tirelessly to build an efficient and admired organisation, which is an enjoyable yet challenging place to work. It has been a tough yet rewarding journey.

The past two years have, of course, been undeniably, exceptionally difficult for everyone, particularly in the public sector who were at the forefront of the battle against COVID-19 and all the consequential issues. CCS was challenged to bring significant support and commercial assistance to many of the public bodies challenged by COVID-19. Proudly, CCS has risen to the challenge and as a result CCS’s reputation continues to grow both with central government customers and in the wider public sector.

In 2021/22 CCS again delivered over and above its targets, delivering commercial benefits of over £2.8bn for our customers and spend through commercial agreements exceeding £27bn. Not only in the headline numbers have we seen growth, but also with CCS’s operational and commercial maturity, improved reputation with customers in central government and the wider public sector and improved operational efficiency.

Being able to deliver such benefits for customers and ultimately for the UK taxpayer, demonstrates the value that CCS can add. Additionally, CCS continues to add enormous value for customers through its Assisted Procurement Service, as well as working to ensure that customers can deliver on the policy priorities to build back better and level up the country through using CCS’s agreements.

But while growth in commercial benefit and spend through commercial agreements shows the increased confidence and trust in CCS’s ability to deliver, there are still opportunities for improvements in operations and ensuring that CCS is truly customer focussed. CCS has a clear vision and strategy to do this over the next five years and I have every faith that the organisation will achieve its objectives and ambition.

The People Survey results demonstrate continued pride and engagement across the organisation. It is my expectation that this will continue to improve as the organisation continues to build capability in many areas, with particular focus on digital capability and improved understanding of, and value delivered to, the wider public sector.

I am delighted to be able to end my term as Chair of the CCS Board with such outstanding results and continued year on year improvement. I would like to express my appreciation to Simon and the Executive Board for their excellent leadership. Further thanks must go to my Non-Executive colleagues, past and present, for their continued support and challenge ensuring that CCS lives up to its potential. In particular, David Wakefield, as Chair of the Audit and Risk Committee, who has pursued significant improvements in operational governance with tenacity and charm during his tenure at CCS, which like mine, comes to an end this year.

I must record my sincerest thanks, one final time, to all CCS colleagues for their continued commitment to delivering value for customers and for UK taxpayers. Finally, thanks must go to all customers and suppliers who continue to work with CCS.

Tony van Kralingen

Chair

Chief Executive’s introduction

Simon Tse

2021/22 saw the continuation of many of the challenges that the COVID-19 pandemic presented. But it is not just the pandemic that has presented our customers and ourselves with challenges this year. It has been the first full year of operating post the UK’s exit from the EU. Last summer saw evacuations from Afghanistan, and as it drew to a close, another global crisis emerged following the Russian invasion of Ukraine. While these have undoubtedly been exceptional challenges, CCS has remained committed to supporting our customers with their commercial requirements in these trying circumstances.

We have been able to demonstrate once again how we can assist customers to deliver on their priorities, achieving £2.8bn of commercial benefits through use of our commercial agreements. We also continue to grow our Assisted Procurement Service, helping our customers with their higher value and more complex procurements. This year, we placed contracts with an Annual Contract Value of over £5bn of contracts through our Assisted Procurement Service. This is exceptional and is a true demonstration of the real value we can add to customers by saving them time and resources on running their own procurements. Our customer satisfaction also continues to remain high, with Net Promoter Scores of +62 and +56 for Assisted Procurements and Customer Service respectively. This continues to be an excellent vote of confidence for us as we launched 34 new commercial agreements into the market.

Because of all these improvements in our customer offering, we have exceeded our growth target this year with £27bn spent through our agreements. Four years ago, when I became Chief Executive, I set out a vision to more than double CCS’s commercial benefits and spend through our commercial agreements within 5 years. We have done that and more, dramatically changing the organisation in the process by putting our customers at the heart of what we do. Our significant improvement in NPS scores in that time has shown that we have been doing the right things. All of these improvements are a huge testament to the commitment of our colleagues in delivering for our customers.

In particular, we have started to see increased growth in our wider public sector (WPS) spend this year, after spending the last couple of years laying the foundations for our work with WPS customers. We continue to support colleagues with capability development in local government in partnership with DLUHC, and in offering commercial communities of practice, and I am delighted to see our hard work and investments in this area start to pay off. Our work on market segmentation and strategic account management will continue throughout next year.

Our People Survey results remained high in 2021, with an engagement score of 71% and a 96% response rate. After two years of our staff working mostly remotely these are incredibly positive results. We have continued our focus on wellbeing and this year participated in the MIND Workplace Wellbeing Index for the first time, achieving a Silver award. We have used the opportunity presented to us by not being in our office spaces to meet our Smarter Working ambitions by completing refurbishments across our sites. The newly reconfigured spaces are designed for collaboration and bringing colleagues together to share ideas, and allow colleagues to choose how and where to work to best suit the outcomes they will deliver. 2021 also saw us open a new office in Birmingham, bringing our main sites up to five across England and Wales.

In a further demonstration of our continued success, we had a great year in terms of awards. We hosted our first ever CCS Live Awards, with 145 nominations across eight categories. CCS had multiple other successes at external awards, winning the gongs for ‘Supplier Management’ and ‘Collaboration and Partnership’ at the Government Commercial Function (GCF) Leadership Awards. CCS won three further awards at the Cabinet Office Awards in December and one of our colleagues was also recognised with a Lifetime Achievement Award at the Civil Service Awards. And to round off an outstanding calendar year, we received the excellent news that two CCS colleagues received New Year’s Honours: Katrina Williams was awarded an OBE and Sal Uddin an MBE.

While all of these successes have been exceptional, we must not rest on our laurels and there have been additional challenges alongside the global challenges we have all faced. The collapse of Greensill Capital saw multiple investigations and reports, including by the NAO and Nigel Boardman, and a Public Accounts Committee hearing alongside colleagues from DHSC, NHS BSA and NHS SBS. Additional reports by Nigel Boardman were commissioned, looking at pandemic procurement, which resulted in a recommendation for CCS to review how best to broaden the scope of our products and services in a crisis situation to maximise the impact of its skilled resources. We are working closely with colleagues in the Government Commercial Function to take this forward. And as we move to living with COVID-19, we are of course beginning to prepare ourselves for the COVID-19 Inquiry and any role we will have to play thereafter.

We are also preparing ourselves for the upcoming Public Procurement Reform Bill and its implementation in 2023, having engaged closely with the Cabinet Office Commercial Policy team on the Green Paper and its subsequent response, including seconding colleagues to support the programme. The key priority is making sure that we understand and can support our customers’ needs throughout the implementation of the new regime. We have demonstrated how we can do this when supporting our customers with other key policy priorities, such as building back better, levelling up, delivering social value through procurement and moving towards carbon net zero.

Fundamental to delivery of all of our objectives is ensuring that our commercial agreements are simple and easy to access and use, increasingly through digital means. This remains complex when delivering the wide range of products and services that we do, but we have had notable successes this year including delivering a ‘guided match’ solution for our active commercial agreements, as well as launching the Low Value Procurement Solution and the complementary Tail Spend Framework. As part of our work to support Procurement Rules Reform, we will be launching the Public Procurement Gateway in 2022/23, a system that will make it much easier for customers and suppliers. This will create a single sign-on and a ‘tell us once’ approach to providing information and common documents for procurements.

We have demonstrated time and again the exceptional value and expertise that we can deliver at great pace. With some enhancements, we can achieve even more value for our customers. Our vision and strategy for the next five years are clear, with key areas of focus being Customer, Product and Services. Our strategy will enable us to operate on a greater scale and to have more impact, in a way that is efficient and sustainable, by prioritising and expanding the other activities we are uniquely well placed to deliver and which drive the most benefit for the public sector. The vision we have, for the organisation we want to be, is something that excites me tremendously.

CCS’s success is not ours alone and thanks must go to the commercial function, our suppliers and all our customers both in central government and across the wider public sector. Our Non-Executive Directors have provided great oversight, advice and guidance during another trying but successful year. Thanks must go to David Wakefield for his excellent service as Chair of the Audit and Risk Committee - CCS’s governance and operation has improved immeasurably under his tutelage. I must also extend my sincere gratitude to Tony van Kralingen for his challenge, guidance and counsel during his tenure as Chair of the Board. It is something that I have greatly appreciated personally as Chief Executive.

It was with great sadness that we lost our colleague Tracey Donaghy in June 2021. Tracey was a much-loved member of our CCS family and was a key part of the Contact Centre category team, working with customers and suppliers to deliver solutions to support national priorities including the COVID-19 response. She has been greatly missed across CCS and beyond.

The last few years have been incredibly difficult and I could not be more proud of how CCS colleagues have continued to deliver through all of these challenges, time and time again. To each and every colleague - thank you.

Simon Tse

Chief Executive and Accounting Officer

In memoriam

Tracey Donaghy

Tracey Donaghy

8 January 1967 to 25 June 2021

Statement of purpose, scope and strategy

Strategic objectives

CCS is a key constituent of the Government Commercial Function (GCF). We develop commercial solutions for the procurement of common goods and services to support the public sector in achieving value for money from spend with suppliers.

Our three overarching strategic objectives during 2021/22 were:

- Focus on the customer

- Maximising commercial benefits

- Strengthening the UK economy through effective policy delivery

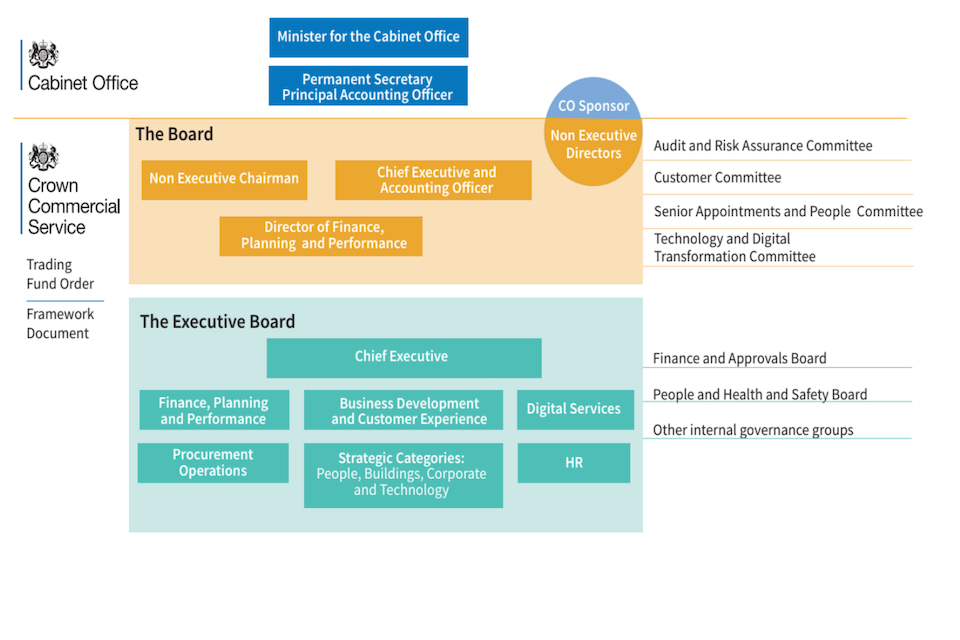

Organisational structure

Our organisational structure and governance arrangements are:

• Minister for the Cabinet Office

• Permanent Secretary and Principal Accounting Officer

• Cabinet Office Sponsor

• Trading Fund Order

• Framework Document

The Board:

• Non-Executive Chairman

• Chief Executive and Accounting Officer

• Director of Finance, Planning and Performance

• Non-Executive Directors

The Executive Board:

• Chief Executive

• Finance, Planning and Performance

• Business Development and Customer Experience

• Digital Services

• Procurement Operations

• Strategic Categories (People, Buildings, Corporate and Technology)

• HR

Board sub-committees:

• the Audit and Risk Assurance Committee

• the Customer Committee

• the Senior Appointments and People Committee

• the Technology and Digital Transformation Committee

Executive Board sub-committees:

• the Finance and Approvals Board

• the People and Health and Safety Board

• other internal governance groups

Organisational structure

Performance overview

1. Focus on the customer

Delivering a high quality customer service and continuing to make it easier for our customers to use and benefit from CCS products and services remains a key measure of our performance and success. This year our customer service satisfaction rating, as measured by our net promoter score surveys covering all customer enquiries, remained excellent with an NPS score of +56.

Our aim to ensure that customers can access the services they need at the first point of contact through our Customer Service Centre has continued this year. In supporting this aim our Customer Service Centre has fulfilled all customer requests for low value procurements at the first point of contact. This move to delivering those procurement events has enabled continued growth in the value of the CCS assisted procurement activity delivered by our procurement teams with a greater focus on carrying out more high value / high complexity procurements for our customers.

The transition and delivery of low value assisted procurement activities through our Customer Service Centre has contributed to the overall increase in the NPS score for Assisted Procurement, with the satisfaction for those undertaken in the Customer Service Centre increasing our overall assisted procurement NPS score of +62.

This year, 590 procurements were undertaken by our Procurement and Customer Service Centre Teams, delivering £5.06bn Annual Contract Value through CCS frameworks. The turnaround times service level agreement of 80% was exceeded and customers across central government and the wider public sector were supported. Our procurement teams continued to support major cross government initiatives including the COVID-19 response, Afghanistan repatriation and COP 26 and G7 conferences.

2. Maximising commercial benefits

By making use of CCS’s commercial expertise and procurement capability, we have continued to refresh our category strategies and optimise our portfolio of commercial agreements for common goods and services. We put in place 34 new commercial agreements in 2021/22, for use by our central government and wider public sector customers.

Over the course of the year, £27.6 billion was spent through our commercial agreements - an increase of £4.9 billion (22%) on the previous year. This has been driven by growth in central government departments, and their arm’s length bodies, increasing from £15.1 billion in 2020/21 to £18.0 billion in 2021/22, and the wider public sector, increasing from £7.6 billion in 2020/21 to £9.6 billion in 2021/22.

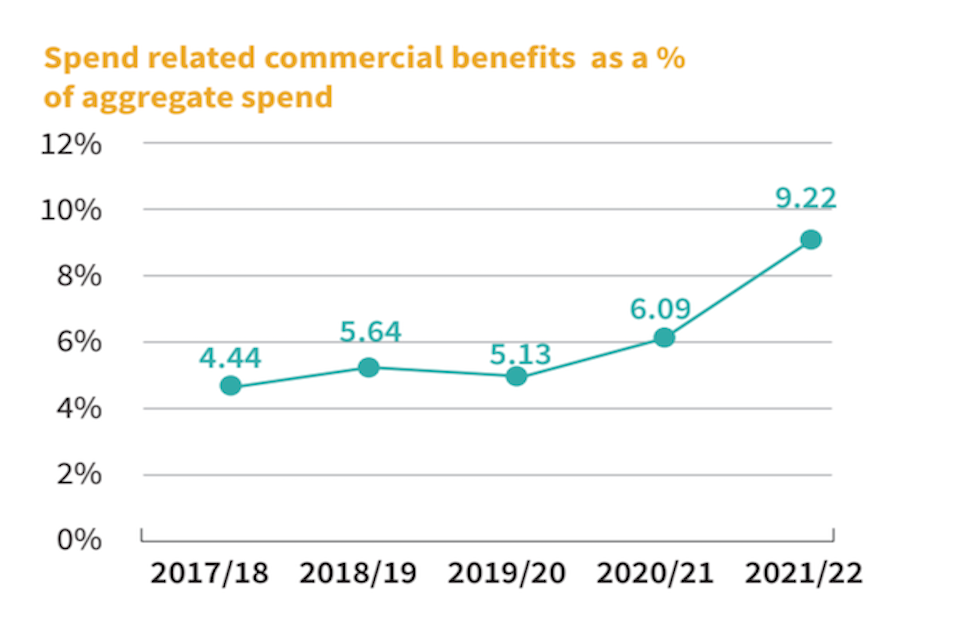

The more spend that is channelled through CCS, the more commercial benefits we are able to achieve for our customers. In 2021/22, we achieved commercial benefits worth £2.8 billion through the use of our commercial agreements compared to market rates.

In addition to the lower prices available on our frameworks, we achieved a further £206 million of benefits to our customers through implementing specific business change initiatives.

3. Strengthening the UK economy through effective policy delivery

Transition from the European Union and the resultant Procurement Reform Bill represents a huge opportunity for CCS. We worked closely with Cabinet Office colleagues in the lead up to and after the transition date passed. During this time, we were able to provide trusted advice on the Transforming Public Procurement Green Paper, provide analysis of the responses to the Green Paper and support the Cabinet Office to reform the public procurement regime. Through the next 12 months we will be working closely with the Cabinet Office to understand the impact that public procurement reform will have on CCS and establish a dedicated team to implement the required changes.

We are clear that effective implementation of procurement policy is a strong driver of national and local economic development. Markets that perform best are those that inspire confidence that they serve society’s needs and set high standards of behaviour amongst participants. Reputation matters in attracting public sector customers to make use of our commercial agreements, and public service organisations increasingly want to work from a principle that every pound spent is an investment in the quality of life in our society, and not just a financial transaction. Because of this, we are placing ever stronger emphasis on social value, sustainable procurement and modern slavery prevention in designing and developing our procurement agreements.

We have worked with the Cabinet Office and the National Social Value Taskforce to share best practice in social value and support the launch and implementation of Procurement Policy Note 06/20: Taking Account of Social Value in the Award of Central Government Contracts. Beyond this we have designed our category strategies to capture and reflect opportunities to deliver social value and we have built our new agreements in a way that allows customers to create tangible benefits in towns and cities across the UK, including an evaluation of suppliers’ approaches during the procurement stage. We will be doing more of this over the coming year, inspiring our people and customers to think of procurement as not just a ‘deal to be made’ but as a way to bring about meaningful change from a local to a global level.

We have also seen progress with our efforts to enable small and medium-sized enterprises (SMEs) to participate in our commercial agreements, with £2.22 billion (13.1%) of central government spend directly with 2,473 SMEs. This represents an increase of £687 million in spend compared to 2020/21. We continue to design our commercial agreements so that SMEs are able to benefit and that is why over 66% of the suppliers on CCS’s commercial agreements are either micro (36%), small (19%) or medium (11%) sized enterprises (as of March 2022).

For CCS, doing policy well is good business and good for confidence-inspired growth, whether it is bringing a broader range of suppliers into a market, ensuring fair play by improving the promptness of payment behaviours or asking companies to work with us to create markets that work from a broad and public spirited view on the value they can create.

Financial performance

We exceeded our financial targets in 2021/22. Total income was £171.9 million and expenditure was £86.1million delivering a surplus before other operating costs of £85.8 million (2020/21: £55.8 million). Other operating costs of £2.4 million were also incurred relating to the NHS Future Operating Model, Digital and Data Services and the CCS Change Programme. After interest and dividends, the retained surplus was £68.5 million (2020/21: £37.8 million). The exceptional in-year surplus achieved was due, in the main, to exceptional trading conditions largely driven by the public sector’s collective response to addressing the wide-ranging challenges arising from the COVID-19 pandemic.

The opening General Reserve of £63.6 million increased to £132.1 million. Indexation of intangible assets resulted in a revaluation gain of £0.06 million. There was no change to Public Dividend Capital (£0.35 million) meaning that the total of taxpayers’ equity in CCS increased from £64.0 million to £132.6 million. More information is contained within the notes to the accounts.

The Dividend which the Cabinet Office receives from CCS was £15.0 million in 2021/22 (2020/21: £14.5 million). This covers the costs of the Complex Transactions, Continuous Improvement, Markets, Sourcing and Suppliers and Policy teams which were previously transferred from CCS to the Cabinet Office. The Dividend is also used to fund the expansion of commercial capability across government, including upskilling the commercial workforce, providing expertise on complex projects and managing relationships with strategic suppliers.

Where CCS achieves a significantly higher than expected level of surplus the Cabinet Office, as the sponsor department, can exceptionally require a higher level of dividend to ensure CCS reserves do not grow disproportionately. CCS will be working in 2022/23 to utilise elements of the surplus generated to develop commercial capability to enhance the benefits generated for customers. In 2021/22 CCS achieved a Return on Capital Employed of 84.% which was significantly above the 5% target as set out in the Treasury Minute.

The last five years of CCS’s income and costs are shown in the five year summary.

Our strategy of inward investment for the future, stimulating growth in customer spend and increased commercial benefits continued in 2021/22. CCS continues to invest to enhance internal systems, digitise online access to our commercial agreements and improve ways of working for both our customer users and suppliers.

We have continued our commitment to paying creditors in line with government policy on prompt payment. In 2021/22, CCS paid 99.9% of undisputed supplier invoices within 5 days and 100% of undisputed payments due within 30 days.

As a Trading Fund, CCS is expected to generate sufficient funds to meet its operating costs and prevent the need for recourse to the Cabinet Office or HM Treasury for financial support. Prudent financial management means that CCS should ensure sufficient cash reserves are in place to mitigate against financial risk arising from any sudden reduction in customer demand, unexpected increases in expenditure or inability to collect income through systems failure. CCS will continue to adopt prudent cash and working capital management to ensure it is able to continue to operate as a going concern.

Key issues and risks that could affect CCS in achieving its objectives

We manage risk across all activities carried out by the business at a strategic and operational level, focusing on achievement of our business plan objectives. Risk management is coordinated across a network of risk management champions and business managers representing each team within the business.

The Executive Board reviews the Strategic Risk Register and the effectiveness of mitigations on a monthly basis. The main Board and sub-committees also review the Strategic Risk Register. Operational risks are reviewed by the Operational Risk and Issue Group and a summary report is provided to the Executive Board on a monthly basis. The Audit and Risk Assurance Committee provides scrutiny of the overall system of governance, risk management and control and the Committee Chair provides an annual update to the Cabinet Office Audit and Risk Committee.

The areas of strategic risk that had the potential for preventing the business from achieving its objectives in 2021/22 are set out in the following table.

| Risk Topic | Risk ‘Failure to’ | Key mitigations applied | Impact of mitigations |

|---|---|---|---|

| 1 Products |

Establish, design, build, sell and service commercial agreements for products and services that meet the needs of customers – timely, easy to use, compelling and attractive | Extensive market engagement with customers to capture design requirements along with demand across sectors in partnership with the Customer Experience Directorate. Communities of practice in place to secure customer buy-in and continuous improvement as part of a product and resource prioritisation approach. Review and analysis of pipeline commercial agreements through newly established governance (Product Portfolio Authority) to review all aspects of product performance, customer demand including digital requirements and lessons learned from existing / prior agreements. Establishment of a market segmentation approach to better determine the current and future needs of customers and the products to be designed to meet those needs. |

The level of risk has been reduced significantly with reductions in both likelihood and impact. Product-related risks will continue to require management attention in the future as part of the implementation of our business growth strategy. |

| 2 Business Development |

Identify, generate, manage and convert business development opportunities efficiently and effectively | Continuously improve the opportunity management pipeline tool as part of the customer relationship management system. Embedding of customer relationship management and strategic account management. Development and implementation of 7 customer sector strategies focusing on Government & Policy, Culture, Media & Sport, Defence & Security, Education, Health, Local Community & Housing and Infrastructure. |

The level of risk has been reduced significantly with a reduction in likelihood. Business development-related risks will continue to require management attention in the future as part of the implementation of our business growth strategy particularly in customer markets where current levels of business are low. |

| 3 Partnerships |

Establish and implement an effective Partnerships strategy | Continue to oversee new and existing Partnerships through the Partnerships Steering Committee. Continuous improvement of performance measurement of Partnership arrangements along with robust stakeholder management. |

The level of risk has been reduced with a reduction in likelihood. Partnership-related risks will continue to require management attention in the future as part of the implementation of our business growth strategy particularly in customer markets where current levels of business are low. |

| Risk Topic | Risk ‘Failure to’ | Key mitigations applied | Impact of mitigations |

|---|---|---|---|

| 4 Digital |

Deliver digital solutions that meet customer and business requirements & align to business strategy | Completion of a digital review and planned implementation of recommendations. Continuous improvement of early engagement process as part of commercial agreement design via the Product Portfolio Authority to establish digital requirements at earliest possible opportunity. Improve resource capability and to address shortfalls in capacity. |

The level of risk has been reduced significantly with reductions in both likelihood and impact. Digital-related risks will continue to require close management attention in the future as part of the implementation of our business growth strategy particularly where digital solutions are integral to enabling customers to self-serve from our product portfolio. Digital capability also requires close attention. |

| 5 Strategy |

Have a clear and justifiable strategy that will deliver CCS’s purpose and future ambition | Implement the portfolio of projects that are set out in the new business strategy. | The level of risk has been reduced with a reduction in impact. This is not a risk that will require significant management attention in the future and have a material impact on organisational performance. |

| 6 Investment |

Invest in the right things which drive business growth, transformation and risk reduction | Continuous improvement of governance and assurance delivered through the Enterprise Portfolio Management Office which advises, supports and challenges project business cases prior to scrutiny from the Finance and Approvals Board. Portfolio progress reporting including dependency management and benefits management carried out as part of gated assurance reviews, with performance reported to and discussed by the Executive Board on a monthly basis. |

The level of risk has been reduced significantly with reductions in both likelihood and impact. This is not a risk that will require significant management attention in the future and have a material impact on organisational performance. |

| 7 People |

Attract and retain the best people, develop existing capability and strengthen leadership throughout the organisation as part of organisational transformation | Continued alignment of pay and reward to government professional framework structures. Ongoing simplification of job roles with use of clearer terminology to attract the right calibre of candidates through the recruitment process. Workforce planning along with the continued rollout of talent management, leadership development, management capability and apprenticeship programmes. |

The level of risk has been reduced significantly with a reduction in likelihood. Capability and capacity-related risks will continue to require close management attention in the future as part of the implementation of our business growth strategy which is based on an approach which is significantly more output for the same / fixed level of resources . |

| Risk Topic | Risk ‘Failure to’ | Key mitigations applied | Impact of mitigations |

|---|---|---|---|

| 8 Safety & Wellbeing |

Keep our people and business safe and secure from a health & safety perspective | Continuous review of business resilience plans. Mandatory health and safety training for all staff. Health and safety intranet hub supported by regular communications and a health and wellbeing events programme. Implementation of health and safety compliance work plan. |

The level of risk has been reduced with a reduction in likelihood. This risk will continue to be monitored at an operational level. |

| 9 Suppliers |

Manage suppliers effectively as part of an integrated and joined up approach for customers with Cabinet Office Central Commercial teams and customers team, including Commercial agreement management, Supplier failure / assurance, Supplier / market reputation, attracting the right suppliers and Innovative Supplier solutions | Embed supplier relationship management, supplier performance management and strategic supplier relationship management model in line with CCS policies. Rollout new standard operating procedures and further improve capability through targeted training. Completeness of income and supplier assurance audit programme. |

The level of risk has been reduced significantly with a reduction in impact. Supplier-related risks will continue to require close management attention in the future as part of the implementation of our business growth strategy. The economic and market conditions have the propensity to increase the risk of supplier failure. |

| 10 Safety/ Security (Technology) |

Keep our people and business safe and secure from a technology perspective | Continuous improvement of information assurance policies and processes. Monitor the effectiveness of ‘detect and response’ service provided by a managed security service provider and act rapidly to address any threats and/ or issues. Continued rollout of Cyber Security Awareness campaign underpinned by mandatory training (Cyber Essentials) for our people. |

The level of risk has been reduced significantly with reductions in both likelihood and impact. Cyber-related risks will continue to require close management attention in the future as part of the implementation of our business growth strategy particularly as we increase the rollout of digital solutions for our customers. |

| Risk Topic | Risk ‘Failure to’ | Key mitigations applied | Impact of mitigations |

|---|---|---|---|

| 11 Well Run Organisation |

Maintain CCS as a well run, efficient, sustainable and prosperous organisation | Continuous Operational Governance Self Assessment exercise to identify areas for improvement. Annual internal audit assurance plan overseen by the Audit and Risk Assurance Committee. Corporate risk and issue management policy and supporting processes in place. Second line assurance service provided by the Business Assurance Services Team focusing on business resilience, counter fraud, bribery and corruption, supplier assurance and completeness of income. Monthly review of organisational performance carried out by the Executive Board. |

The level of risk has been reduced significantly with a reduction in likelihood. Organisational effectiveness will continue to require close management attention in the future as part of the implementation of our business growth strategy which is based on an approach which is significantly more output for the same / fixed level of resources. |

| 12 Procurement Reform |

Identify the risks and opportunities presented by the proposals for procurement rules reform and putting measures in place | Ongoing engagement with CO procurement rules reform team to understand all the opportunities and risks. Implementation of the CCS Procurement Reform programme to ensure readiness of the organisation and our portfolio of products, solutions and services to meet the requirements. |

The level of risk has been reduced with a reduction in likelihood. The implementation of Procurement Reform will continue to require close management attention in the future to ensure that our products and services are fully aligned with new legislation and customer expectations. |

| 13 Business Resilience (COVID-19) |

Establish mechanisms which enable the organisation to effectively deal with the impact of COVID-19 on business operations | Command chain established and business resilience plans refreshed. Continued use of an operations control centre to coordinate organisation response to business critical issues (including COVID-19) with weekly reporting to the Executive Board. |

The level of risk has been reduced significantly with reductions in both likelihood and impact. This is not a risk that will require significant management attention in the future and have a material impact on organisational performance |

| 14 Smarter Working |

Ensure that smarter working meets the needs of CCS as well as its staff | Implement the 3 year wellbeing strategy and action plan. Continue to roll out the management capability programme and a focus on culture and collaboration. Embed the enhanced functionality of Workday Learning. Implement a technology enhancement plan to support smarter working. Continue to make available all learning and development in a virtual format. |

The level of risk has been reduced significantly with reductions in both likelihood and impact. This is not a risk that will require significant management attention in the future and have a material impact on organisational performance. |

| Risk Topic | Risk ‘Failure to’ | Key mitigations applied | Impact of mitigations |

|---|---|---|---|

| 15 Data Governance |

Embed data governance at an enterprise level across CCS | Implement and embed all the recommendations from the Government Internal Audit Agency (GIAA) audit. | This is a risk that will require some management attention in the future to ensure that the organisation has improved its capability. |

Performance analysis

How CCS measures its performance

Organisational performance has been measured on a monthly basis through a corporate dashboard, which tracks progress against business plan objectives and the business strategy and forms the basis of a formal monthly review at the Executive Board.

Organisational performance has been a standing agenda item at Board meetings. A summary performance report has been produced for this, drawing upon the corporate dashboard. Additionally, a monthly summary performance report has been issued to the Board and for use by staff.

Key elements of CCS performance information and inter-relationships

The value of public sector spend that is channelled through CCS’s commercial agreements is core to the success of the business and our ability to drive value for money for the taxpayer. Spend through our agreements generates commercial benefits for customers and income through supplier levies to cover CCS’s operating costs.

Commercial agreements are designed to reflect ministerial procurement policy priorities, for example to support achievement of social value, carbon net zero, eradicating modern slavery and supporting growth in opportunities for SMEs to do business with government.

CCS provides central government customers with a procurement service in the form of running competitions under its commercial agreements. Wider public sector customers use the commercial agreements on a self or assisted service basis. Commercial agreements that are both easy to use and deliver value to customers help to support the achievement of government policy objectives.

Category strategies shape the current and future portfolio of commercial agreements and the way in which they are designed to bring customers and suppliers together, increasingly through technology enabled or digital channels.

Key areas of risk to the organisation and the associated ongoing mitigation action that is taken, is aligned to key elements of organisational performance and that which is key to achieving organisational success.

Non-financial information

CCS complies with government policy in support of modern slavery, human rights, anti-corruption and anti-bribery matters. We have established appropriate governance and risk management policies and processes to monitor and manage compliance and ensure action is taken where necessary.

We continue to focus on ensuring CCS is a great place to work and operates in accordance with our values. Staff are consulted and engaged in taking the organisation forward, through regular All Staff Events, as well as through our Senior Leadership Team and Regional Leadership Groups. We track staff engagement through the annual People Survey and our engagement score in 2021/22 was 71%, maintaining our position within the top quartile across the Civil Service.

Performance against Business Plan objectives

Below we have set out the performance measures and the resulting assessment and achievements mapped against the key components of the organisation’s business strategy and strategic objectives. CCS operates a set of strategic Key Performance Indicators (KPIs) and these are set out beneath the performance tables.

Focus on the customer

| Performance measure | Assessment and achievements |

|---|---|

| Net Promoter Scores Customer Service: +55 Assisted Procurement: +55 Customer Service Centre Resolve 90% of customer enquiries at the first point of contact Resolve 90% of first line enquiries within 24 hours Resolve 85% of second line enquiries within 72 hours Customer Engagement Implement our customer engagement and business development plans to support business growth and deliver commercial benefits to our customers Assisted Procurement Provide a high quality assisted procurement service, with an Annual Contract Value of £1.5 billion (with a £1.7 billion stretch), 80% delivered within agreed timescales |

Fully achieved Customer service: +56 Assisted procurement: +62 Partially achieved 89% of customer enquiries resolved at first point of contact 73% of first line enquiries resolved within 24 hours 92% of second line enquiries resolved within 72 hours Fully achieved £5.15 billion Annual Contract Value of opportunities were tracked successfully through the business development pipeline contributing to the overall spend value of £27.63 billion and spend related commercial benefits of £2.81 billion Fully achieved £5.09 billion Annual Contract Value with 80% delivered within agreed timescales |

Maximising commercial benefits

| Performance measure | Assessment and achievements |

|---|---|

| Target £1,496 million of spend related commercial benefits representing a target gross margin 5.8% on £24.21 billion. This comprises: £1,031 million for CG with a target gross margin of 6.3% on £15.29 billion of spend £465 million for WPS with a target gross margin of 5.0% on £8.92 billion of spend Target £76 million of business change related benefits |

Fully Achieved Total £2,806 million of spend related benefits representing a gross margin of 9.22% on £27.63 billion comprising: £1,902 million for CG with a gross margin of 9.55% on £18.02 billion of spend £904 million for WPS with a gross margin of 8.60% on £9.61 billion of spend £206 million of business change related benefits were also signed off by customers |

Strengthening the UK economy through effective policy delivery

| Performance measure | Assessment and achievements |

|---|---|

| Implement mechanisms within our commercial agreements to support government policies to address Modern Slavery, Social Value, Sustainability and Prompt Payment | Fully achieved All 34 commercial agreements awarded in year were subject to policy review and assurance through the Commercial Agreement Advisory and Approvals Board |

| Grow spend directly with SMEs and increase the proportion of SMEs featuring on our agreements through new contracting vehicles | Fully achieved The total value of spend with SMEs has increased by £688 million in CG compared to 2020/21 |

| Publish the CCS SME plan in line with CO timetable | Fully achieved The action plan was published using gov.uk on 30 November 2021 |

| Improve the Public Sector Contract (PSC) through implementation of market/category specific schedules, a digital contract building capability and maintain alignment with government policy on playbooks for sourcing, construction and technology | Partially achieved The PSC is subject to ongoing refinement. Requirements of playbooks have been taken into account within the design and build of commercial agreements awarded within the year |

| Achieve evidenced based improvements against Government Commercial Standards on 2020/21 and 2021/22 assessed level | Partially achieved An assessment has been carried out against the new iteration of commercial standards. An improvement plan has been developed and is being implemented |

Change Programme

| Performance measure | Assessment and achievements |

|---|---|

| Implement the Strategy Delivery Programme and inform people and organisational change through: development of blueprints for future service (advisory and operational) delivery, product and solution design and customer access (digital and self serve) market segmentation and identification of enhancements to customer service creation of an organisational wide blueprint and operating model to support future business growth and improved operational efficiency a plan to deliver the required organisational change with associated governance provided through a Business Design Authority through 2022/23 |

Partially achieved Initial service definition blueprints have been developed to inform development of CCS strategy. Sector strategies are being developed and will be completed by the end of June 2022. The operating model has been developed in outline and is being refined through a series of reviews, which are due to be completed and implemented by December 2022. The Business Plan for 2022/23 to 2023/24 sets out clear objectives and targets to support strategy implementation. Strategy implementation is being overseen by the Strategy Implementation Group |

| Implement the Scale platform for commercial agreements: pass GDS assessments for Find My Needs service, Shopping services and Contract services full minimum viable products for Shopping services and Contract services in place for public Beta by January 2022 Incremental development and enhancement of each Scale service from March 2021 Establish and implement a prioritised 2021/22 plan for onboarding new agreements to the three Scale services |

Partially achieved Progress has been made on implementing the Scale platform. Further development is subject to the outcome of a review of our Data and Digital strategy and current operating model During the Financial Year, in accordance with the relevant accounting standard IAS 36, which mandates the requirement to carry out an annual impairment review of intangible assets, the Shopping Service element of the Scale asset has been impaired as it is no longer part of the asset which will be brought into use in 2022/23. (See notes 5 and 8 of the notes to the accounts) |

Effective Category Strategies

| Performance measure | Assessment and achievement |

|---|---|

| Develop and maintain highly effective category strategies. Complete and secure endorsement of the category strategies that remain from 2020/21 and make the summaries available for our customers | Fully achieved 76 (100%) category strategies endorsed by customers with 8 new strategies under development |

| Use our category strategies, in conjunction with the output from our market segmentation work, to focus more on the creation of new customer and sector channels, digital products, and go to market strategies to enable future business growth | Partially achieved Sector strategies are under development as part of the market segmentation initiative. The first strategy developed (Health) is being used to shape future product design and the go to market strategy |

Growth from increased spend through our solutions / products

| Performance measure | Assessment and achievement |

|---|---|

| Direct Spend of £18.08 billion (+£20 million on 2020/21) |

Fully Achieved Direct Spend of £23.20 billion |

| Public Sector Commercial Agreement Spend of £2.23 billion (+£350 million on 2020/21) |

Fully Achieved Public Sector Commercial Agreement Spend of £2.48 billion |

| Transacted Spend of £3.90 billion (+£1.24 billion on 2020/21) |

Not achieved Transacted Spend of £1.95 billion. The shortfall against the target was due to the suspension (in March 2021) and subsequent withdrawal of the Supplier Early Payment Solutions product |

| Aggregate spend of £24.21 billion (+£1.50 billion on 2020/21) comprising: £15.29 billion in CG (+£200 million on 2020/21) £8.92 billion in WPS (-£1.30 billion on 2020/21) |

Fully Achieved Aggregate spend of £27.63 billion comprising: £18.02 billion in CG £9.61 billion in WPS |

| Pillar | Aggregate spend | ||

|---|---|---|---|

| 2020/21 Result | 2021/22 Result | Growth | |

| £ billion | £ billion | £ billion | |

| Buildings | 3.56 | 5.83 | 2.27 |

| Corporate | 6.24 | 6.80 | 0.56 |

| People | 4.78 | 5.59 | 0.81 |

| Technology | 8.13 | 9.41 | 1.28 |

| Total of which: | 22.71 | 27.63 | 4.92 |

| CG | 15.09 | 18.02 | 2.93 |

| WPS | 7.62 | 9.61 | 1.99 |

| Performance measure | Assessment and achievement |

|---|---|

| Award up to 30 new and or refreshed commercial agreements | Fully achieved 34 commercial agreements were awarded - 24 replacement and 10 new |

| Pillar | Plan for 2021/22 | Actual | ||

|---|---|---|---|---|

| Replacement | New | Replacement | New | |

| Buildings | 3 | 2 | 4 | 1 |

| Corporate | 11 | 1 | 11 | 3 |

| People | 7 | 1 | 7 | 3 |

| Technology | 2 | 3 | 2 | 3 |

| Total | 23 | 7 | 24 | 10 |

Central Government and Wider Public Sector strategies

| Performance measure | Assessment and achievement |

|---|---|

| Convert at least 33% of the value of opportunities in the 2021/22 pipeline at stages 2 to 4 into ‘closed won’ | Fully Achieved The approach to measuring conversion was adjusted from value to volume within the first two months of the year. 70% of the volume of opportunities at stages 2 to 4 were converted into ‘closed won’. The Annual Contract Value of ‘closed won’ was £5.1 billion |

| Populate the 2022/23 pipeline (all stages) to support achievement of targeted incremental growth of £4.05 billion compared to 2021/22 |

Fully achieved The value of the 2022/23 pipeline has an estimated Annual Contract Value of £8 billion with an estimated full contract value of £31 billion |

| Develop and implement a partnerships strategy and delivery plan and integrate with go to market strategies by March 2022 | Fully achieved Partnerships strategy, guidance and operational delivery plan developed and endorsed. A new Partnerships Board approved by the Executive Board has financial decision-making authority and oversight of strategies for non-commercial and commercial partnerships. Our partnerships portfolio is valued at £2.5 billion per annum across CG and WPS |

| Increase spend in CG ALBs to £2.50 billion | Fully achieved Direct spend increased by 37% to £2.9 billion (+£577 million compared to 2020/21). Aggregate spend reduced from £3.9 billion to £3.1 billion due to the suspension (in March 2021) and subsequent withdrawal of the Supplier Early Payment Solutions product |

| Implement market segmentation pilots across target sectors and operationalise within go to market strategies across CCS to drive new customer products in 2021/22 | Partially achieved. Sector strategy for Health is complete and being implemented. The remaining six strategies are set to be developed by the end of June 2022 |

| Achieve 30% of customers across English regions, spending over £3 million, spending more with CCS (excluding energy, payment cards, pandemic affected spend and large one-off procurements) than 2020/21 | Partially achieved 28% of those customers spending £3 million+ in 2020/21, spent more in 2021/22. The top 100 WPS customers spent £2.9 billion through CCS agreements which is £0.6 billion higher than the previous year |

Digital

| Performance measure | Assessment and achievement |

|---|---|

| Establish a design function (user research, product management, business analysis and service design) to support the delivery of our projects and commercial agreements by September 2021 | Fully achieved Design function in place, operating plan and roadmap presented to the Technology and Digital Transformation Committee. Ongoing work plans in place |

| Develop a product and service roadmap in response to Transforming Public Procurement by June 2021 | Fully achieved Approach and Roadmap presented to the Technology and Digital Transformation Committee |

| Establish central project delivery capability and resource pool with associated business partnering model by March 2022 | Partially achieved Project delivery resources identified and a paper submitted to ‘foundation for change’ project board through the digital and project delivery workstream. Will be implemented once approved |

| Scale: deliver Guided Match Light by May 2021, Shopping Service - Full MVP in place for public Beta by January 2022 and Contract Service - Full MVP in place for public Beta by January 2022 | Partially achieved Guided match service in operation. Shopping Service currently paused and Contract Award Service is still in development |

| Conclave: deliver Alpha by 30 April 2021, elements to private Beta by October 2021, and public Beta by January 2022 | Partially achieved Conclave delivery was split into Public Procurement Gateway (PPG) and Buyer and Supplier Information after the March Alpha Service Assessment. PPG Scheduled for public beta 20 April 2022 (Achieved). Buyer and Supplier Information is scheduled for public Beta autumn 2022 Later delivery reflects complexity in achieving GDS service assessment standards |

| Build out supply chain analysis across the top 25 suppliers for each of the four pillars by December 2021 | Fully achieved Public domain information researched, collated and shared with categories |

| Establish a plan to migrate spend analytics platform into a strategic solution aligned with system requirements of CCS and the GCF by March 2022 | Partially achieved Mandate submitted and DOS opportunity for discovery work has been developed |

| Establish machine learning and analytics capability; building insight into customer segment profiles and performance characteristics across pillars, sectors and digital solutions by March 2022 | Fully achieved Team established and has implemented a number of big data analytics and machine learning initiatives. These include supporting customer buying prediction, customer enquiries categorisation and analysis which have been shared with wider CCS users groups. Further work continues now as business as usual for the team |

| Implement a capability to measure performance of digital services, customer behaviour and impact on business performance and expand across all Dynamic Purchasing Systems and hosted services by December 2021 | Fully achieved Analytics is now on all current Dynamic Purchasing Systems (DPS) solutions. Contract Award Service implementation is in place for analytics on their product ahead of launch. Proof of concept finalised for PPG reporting. Guided Match Business Benefits report published and available in Microsoft Power BI |

| Migrate common platforms, technology and security into the new Cabinet Office Technology organisation by March 2022 | Not achieved Gov.uk are planning to move away from Cloud Foundry within the next couple of years and are now exploring other options. Planning to migrate applications currently hosted on Amazon Web Services should resume when details of the alternative platform are announced by CO Chief Digital Information Officer |

| Establish a new Acceptance into Service function to ensure protection of existing live services and any new transitioned services by October 2022 | Partially achieved Review of the Digital Services Gateway completed and the Acceptance into Service framework has been drafted. The full design and launch of the Digital Service Gateway, incorporating Acceptance into Service will continue in the new reporting year aligned to the Governance, Data and Reporting workstream |

| Improve digital vendor management through establishment of a supplier management function by December 2021 | Partially achieved Better understanding of the critical suppliers for the Digital and Data Services directorate but the Supplier Management Function is still in its infancy and therefore not established |

| Enhance the information security management system and embed security controls within digital business units by March 2022 | Fully achieved Additional risk based Cyber and Technical Security guidance has been added to the Information Security Management System (ISMS) to support, educate and enable the workforce to protect its data Security controls have been designed and created to support the Delivery and Service functions in relation to the implementation of ongoing digital programmes |

Building capability

| Performance measure | Assessment and achievement | |

|---|---|---|

| Develop a strategic workforce plan by March 2022, including influence and consideration of business needs, organisational redesign, existing skills and commercial market conditions | Partially achieved Foundation work is largely complete. Job profiles and the assignment of job families are complete for all directorates except for the Pillars. Competency Assessment Tool has been rolled out in Workday. Identification of critical roles and associated succession planning is continuing. Organisational design is subject to the conclusion of organisational review workstreams |

|

| Embed CCS Inclusion and Diversity Strategy 2020-25 from April 2021 to drive change throughout the business and promote a more inclusive working environment. Road map developed and implemented to support improvement covering: Culture of inclusivity Workforce diversity Data and representation |

Fully achieved Roadmap developed with Inclusion and Diversity dashboard in place to measure progress. Annual gender and ethnicity pay gap reports complete. Equality Impact Assessment process and guidance in place. General training programme for allyship in place. Achievement of Carers Confident accreditation level one. Publishing of the Annual gender and ethnicity pay gap reports. Equality Impact Assessment piloted, applying the process to a number of key CCS projects. New Social Mobility staff network launched, bringing the total number to seven |

|

| Maintain top quartile staff engagement scores in 2021/22 People Survey | Fully achieved 71% engagement (top quartile) |

|

| Implement a management development programme incorporating coaching and apprenticeship initiatives, with all managers completing by March 2022 | Partially achieved More than 70 managers have either completed or are in the process of completing the management development programme which incorporates coaching. Apprentices are in place |

|

| Implement and embed a wellbeing strategy that supports staff to transition to Smarter Working by March 2022 | Fully achieved Wellbeing Strategy and associated action plan covering 2021-2024 published which fully supports transition to Smarter Working. Strategy and plan actively promoted to our people through team meetings |

|

| Design and implement Smarter Working designs for our CCS sites by March 2023 | Fully achieved Fully implemented in Liverpool, London, Newport and Birmingham offices. Implementation is near completion in Norwich |

|

| Develop and implement Smarter Working routines through new policies and principles to maximise CCS productivity by March 2022 | Fully achieved Policies and principles launched and a new Smarter Working approach has been implemented as part of the phased return to offices plan following office refurbishments |

|

| Develop an estate strategy which encompasses the Publicly Available Specification Guidelines for Smarter Working and the Government Hub programme by March 2022 | Partially achieved Revisions to the Estates strategy has been delayed due to a priority focus on office refurbishments and implementation of Smarter Working. Final decisions on specific locations were agreed with directors in February and will be included in the updated strategy |

|

| Develop and implement CCS Blueprint in line with Government Commercial Function requirements by March 2022 | Partially achieved Key elements are being implemented through the new business strategy and corporate plan for 2022/23 to 2023/24. Capability assessed against Government Commercial Function standards with an improvement plan agreed and being implemented |

|

| Develop and implement a capability support plan for commercial functions, primarily in the WPS using the capability budget by March 2022 | Fully achieved Contract Management Pioneer Programme established in partnership with the Department for Levelling Up Housing and Communities and the Local Government Association. We have provided funding to enable 180 commercial colleagues drawn from over 32 local authorities to receive either Practitioner or Expert level training through the Cabinet Office capability team and Government Commercial College |

Effective Governance, Risk Management and Efficiency

| Performance measure | Assessment and achievement |

|---|---|

| Implement the recommendations from the Tailored Review of CCS (June 2021) and review and support implementation of any other recommendations of reviews on behalf of the government | Partially achieved All recommendations were accepted and are largely complete. Those that are not fully complete (Customer Segmentation, Advisory Services and Data Exchange) are being taken forward as part of the implementation of our new business strategy and underpinning a two year Business Plan covering 2022/23 to 2023/24 |

| Deliver a compliant 2020/21 and 2021/22 CCS Annual Report and Accounts (July each year). Maintain our overall ‘moderate’ annual Internal Audit Opinion whilst continuing to improve | Fully achieved Internal Audit assessment maintained at ‘moderate’ and showing continuous improvement |

| Achieve Prompt Payment targets of undisputed invoices (90% of valid and undisputed invoices from SMEs in 5 days and 100% within 30 days) | Fully achieved >99% of invoices were paid in 5 days and 100% within 30 days |

| Manage CCS’s parliamentary business and respond within specified deadlines | Fully achieved All specified deadlines were met |

| Implement and embed financial risk strategy including assessment of impact of DPS+ by July 2022 | Not achieved Finance risk strategy superseded by adoption of Playbook Economic and Financial Standing. Further clarity required regarding CCS supplier assurance service offering, subsequent strategy/process amendments to be devised following the outcome |

| Implement enterprise wide portfolio management (total view of change) by June 2021 | Fully achieved Enterprise Portfolio Management function in place providing second line assurance. Total view of change established and being used to inform decisions on resource allocation and organisational efficiency |

| Maintain the commercial benefit methodology standard and embed in the Commercial Agreement Advisory and Approval Board process. Rollout to an increased number of commercial agreements. Target 80% of in year forecast spend covered by benefit methodologies (March 2022) | Fully achieved 90.5% of in year forecast spend was covered by benefit methodologies |

Strategic Key Performance Indicators

A review of the strategic KPIs was carried out in consultation with the Board. The following refinements were agreed in-year:

-

re-baseline of the addressable spend in the market reflecting a more comprehensive data source drawn from transparency data

-

spend related commercial benefits should not be added together with business change benefits

-

core cost should be used in any ratios relating to aggregate spend or spend related commercial benefits

These changes resulted in the establishment of a set of revised targets which are set out in the table below.

| Headline measure | 2021/22 target | 2021/22 result | ||

|---|---|---|---|---|

| Business growth - The extent to which we are growing our business | 1 | Direct spend as a percentage of total spend on CG&S | Increase market share to 15.82% | Fully achieved A market share of 20.29% in relation to the re-baselined target |

| Business efficiency - Our cost in relation to our outputs | 2 | Core cost as a percentage of aggregate spend | To achieve a cost ratio of 0.35% | Fully achieved A cost ratio of 0.29% |

| 3 | Core cost as percentage of spend related commercial benefits | To achieve a cost ratio of 4.72% | Fully achieved A cost ratio of 2.85% |

|

| Business effectiveness - How effective we are in achieving benefits for our customers | 4 | Spend related benefits as a percentage of aggregate spend | To achieve an effectiveness ratio of 5.76% | Fully achieved An effectiveness ratio of 9.22% |

| 5 | Income as a percentage of aggregate spend | To achieve an effectiveness ratio of 0.54% | Fully achieved An effectiveness ratio of 0.62% |

|

| Customer - What our customers think of our services | 6 | Customer Service Net Promoter Score | +55 | Fully achieved +56 |

| 7 | Assisted Procurement Net Promoter Score | +55 | Fully achieved +62 |

|

| People - How engaged are our people | 8 | Engagement score | Maintain top quartile | Fully achieved +71 |

| Financial - Our effectiveness in financial management | 9 | Income less expenditure (P&L) / Net surplus (deficit) | Target of £(5.3)m | Fully achieved Surplus of £68.5m |

| 10 | Percentage rate of increase in income versus rate of increase in core cost | Target of 126.9% | Fully achieved 175.7% |

Key measures of success

Commercial benefits - The value that CCS drives for customers when purchasing through our commercial agreements. Our methodology allows for two routes for benefit calculations:

- ‘Spend Benefits’ are based on sampling all spend through a commercial agreement and calculating average benefit for all the customer population using the agreement, compared to current comparator market prices