Annex C: Technical notes

Published 9 August 2022

1. Classification of spending as ‘identifiable’ or ‘non-identifiable’

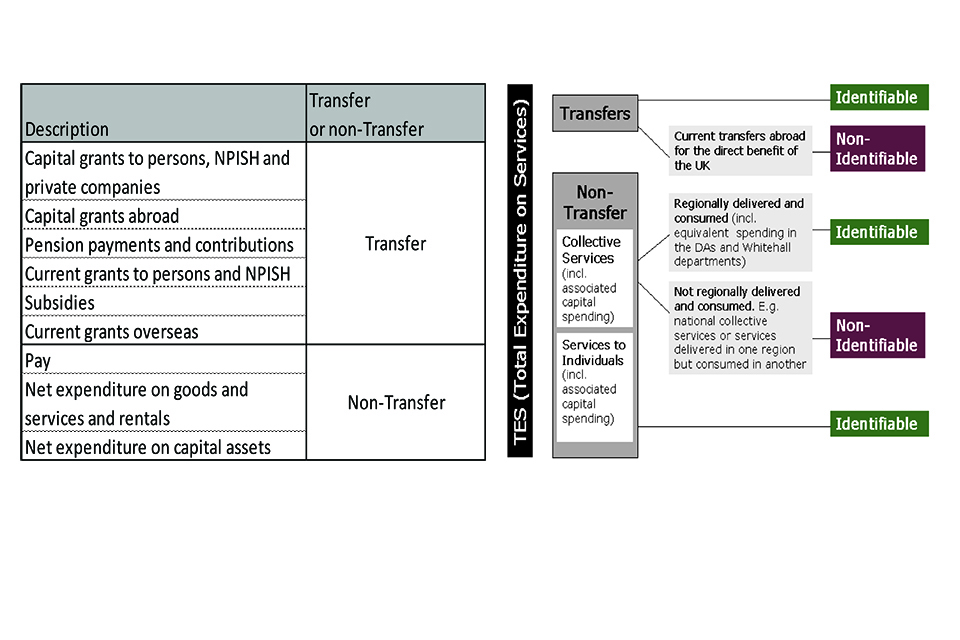

For the purposes of the CRA exercise, all departmental expenditure on services is classified as ‘identifiable’ (as for the benefit of a particular region) or ‘non-identifiable’ (i.e. cannot be identified as for the benefit of a particular region). This annex sets out the principles that the Treasury will use for the 2022 CRA data collection in classifying spending as identifiable or non-identifiable. The flow chart below illustrates how this split is derived.

Annex C chart

2. Individual versus collective

2.1 Transfers

All transfers (subsidies, current grants, capital grants) by all departments are identifiable and should be allocated by region of recipient. Current grants paid abroad should be classified to a 13th region, ‘outside UK’, with the exception of current grants paid abroad that are for the direct benefit of the UK. How to allocate this and other exceptions is discussed in detail in Annex B.

2.2 Other current spending

Other current spending (on goods and services, which includes employment costs) takes the form of spending on services that are either ‘services to individuals’, which are by definition identifiable; or ‘collective services’ which, where they are delivered nationally, are not identifiable as benefiting individual regions. The distinction between services to individuals and collective services is set out in the European System of Accounts (ESA2010), which sets the framework for the UK National Accounts.

ESA2010 (paragraph 3.104) states that, for goods and services provided by government, the borderline between individual versus collective goods and services is drawn on the basis of the classifications of the functions of government (COFOG). Expenditure on goods and services under the following COFOG functions is treated as services to individuals:

-

education

-

health

-

social security and welfare

-

sport and recreation

-

culture

-

provision of housing

-

collection of household waste

-

operation of the transport system (public transport)

Spending under other COFOG functions is generally treated as collective services.

Where collective services are delivered nationally, then they are non-identifiable. National collective services include:

-

management and regulation of society

-

provision of security and defence

-

economic development

-

tax collection

However, where collective services are delivered locally (within a region), and consumed for the most part locally (by the population of that region), then HM Treasury proposes to treat such local collective services as identifiable, since they clearly benefit the region in which the service is consumed. Examples of such local collective services, which are consumed locally and are therefore treated as identifiable, include:

-

all local authority spending

-

central government spending on regional development agencies

-

central government spending on police and local courts

-

overseas aid (delivered and consumed outside the UK)

Additionally, HM Treasury identifies collective services expenditure as identifiable where there is equivalent spending in the devolved administrations. Previously a small amount of this was treated as non-identifiable. Examples of such collective services are:

-

spending on high courts

-

spending on prisons

Examples of collective services that are delivered locally, but which are not consumed locally, and which are therefore treated as non-identifiable include:

-

spending on immigration and nationality

-

spending on the maritime and coastguard agency

HM Treasury proposes that spending on administration and corporate services, including policy formulation, should be classified in the same way as the service it supports. So, for instance, administration and corporate services spending on social security and welfare would be treated as identifiable and distributed pro-rata to the regional distribution of the delivery of social security and welfare. But administration and corporate service spending on tax collection would be treated as non-identifiable.

2.3 Other capital spending

Capital spending (other than capital grants, which are transfer payments) includes purchases of capital assets, net of asset sales, and a small amount of stock building. HM Treasury proposes that capital spending should be classified in the same way as the service it supports. This means that capital spending in support of collective services delivered nationally will be classified as non-identifiable, in the same way that current spending on these services is classified.

3. Summary

| Identifiable | Non-identifiable | |

|---|---|---|

| Transfer payments (subsidies, current grants and capital grants) | All transfer payments except some current transfers abroad. | Some current transfers abroad that are for the direct benefit of the UK. |

| Other current expenditure (spending on goods and services, including employment) | Services to individuals. Includes certain COFOG categories: education, health, social security and welfare, sport and recreation, culture, housing, household waste collection, public transport | National collective services. Includes certain COFOG categories: management and regulation of society, security and defence, economic development, tax collection |

| Collective services delivered locally and consumed locally, within regions. For example, LA spending, CG spending on police, local courts, overseas aid | Collective services delivered locally but not consumed locally, within regions. For example, spending on immigration and nationality, spending on the Maritime and Coastguard Agency | |

| Collective services delivered locally and consumed locally, within regions where there is equivalent spending by the devolved administrations: spending on high courts, spending on prisons | ||

| Admin and corporate services are classified as identifiable or non-identifiable in the same way as the service they support | ||

| Other capital spending (purchase of assets, net of sales of assets, and stock building) other than capital grants | Classified as identifiable or non-identifiable in the same way as the associated current expenditure |

4. (ITL1) Regions in the UK

Below is a list of counties included in each of the (ITL1) regions. Unitary counties are generally under their ‘parent’ county, rather than shown separately.

Map showing details of the coverage of the 12 ITL1 regions

Scotland

Wales

Northern Ireland

North East

-

Northumberland

-

Tyne and Wear

-

Durham

-

Tees Valley

North West

-

Cumbria

-

Lancashire

-

Merseyside

-

Greater Manchester

-

Cheshire

Yorkshire and the Humber

-

North Yorkshire

-

West Yorkshire

-

South Yorkshire

-

East Riding and North Lincolnshire (The Humber)

East Midlands

-

Derbyshire

-

Nottinghamshire

-

Leicestershire and Rutland

-

Lincolnshire

-

Northamptonshire

West Midlands

-

Herefordshire

-

Worcestershire

-

Shropshire

-

Staffordshire

-

West Midlands

-

Warwickshire

East of England

-

Cambridgeshire

-

Norfolk

-

Suffolk

-

Bedfordshire

-

Hertfordshire

-

Essex

London

- Greater London

South East

-

Berkshire

-

Buckinghamshire

-

Oxfordshire

-

Hampshire and Isle of Wight

-

Surrey

-

West Sussex

-

East Sussex

-

Kent

South West

-

Gloucestershire

-

Bristol

-

Somerset

-

Wiltshire

-

Dorset

-

Devon

-

Cornwall and Isles of Scilly