Annual Plan 2024 to 2025

Published 14 March 2024

Foreword

In last year’s Annual Plan we set out a new long-term strategy for the CMA. We did this to ensure that as the UK’s primary competition and consumer protection authority we are set up to deliver the best outcomes for the people, businesses and economy of the UK in the face of a more volatile, economically challenging and technologically disruptive environment for all.

The strategy we set out last year explicitly takes a multi-year horizon. We set out our consistent purpose, which flows from the primary duty that Parliament has given the CMA; the tangible outcomes we aim to achieve for people, businesses and the UK economy over the long-term by fulfilling that duty; our priorities, the market spaces we will focus on, for the next 3 years; and how we will adapt our model and capabilities, again over the medium-term, in order to achieve those goals.

This 2024 to 2025 Annual Plan continues that strategy, builds on it, and updates our near-term areas of focus for the next 12 months as we take on the new responsibilities that Parliament has given us in the Digital Markets, Competition and Consumers Bill.

Over the past 12 months, guided by our strategy, both the range of the CMA’s work and the benefits it has delivered for consumers, fair-dealing businesses and the economy, have been stronger than ever. We have rigorously prioritised our pipeline and allocated resources in line with our priorities and, within those, focused on the areas where the CMA can deliver the most impact. We have become more agile in using the full range of our tools to bring insights, solutions and benefits to markets faster. We have updated guidance on how we exercise our functions. We have significantly stepped up our engagement with consumers and consumer groups, with the third sector, and with businesses, business groups and their advisors, while maintaining our continuous and productive interactions with Government. As we have stepped up our activity and impact, we have maintained the unrivalled evidence-based objectivity and absolute transparency that is the hallmark of the UK’s approach to competition and consumer protection. We have actively encouraged greater and more regular scrutiny by our national and devolved Parliaments and have listened, learned and communicated more than ever before.

This year’s update to our Annual Plan has been informed by our external environment, which has continued to be unsettled in many respects. People and businesses continue to grapple with the higher cost of living and cost of doing business, cumulative inflation pressures, and a higher cost of debt. The UK, like countries around the world, continues to strive for higher economic growth against a backdrop of stagnating productivity, pervasive debt, global geo-political and military conflict, and a deteriorating climate. Meanwhile, the accelerating technology revolution continues with landmark advances in artificial intelligence, matched by equally rapid development of business models and commercial alliances amongst the main players, with potentially transformative implications for our economies and societies in the near as well as the far future.

The CMA has been proactive in addressing the challenges that this shifting landscape creates for people and businesses and our plan for 2024 to 2025 continues that targeted approach. In today’s tough economic conditions, the proper functioning of markets is more critical than ever. We have redoubled our efforts to tackle the cost of living, focusing on the areas that matter most to people – such as having somewhere to live, feeding our families, looking after ourselves and others, and buying the goods and services we need online – and will continue to do so. Similarly, we have acted decisively to protect open, competitive market conditions so that the many fair-dealing businesses, challengers and innovators who seek to compete can access customers, markets and the inputs they need to operate without being held back by the anti-competitive actions of a few. And given the clear relationship between competition, innovation and growth, as well as the rapid pace at which new technologies develop and get adopted, we will continue to take an explicitly more forward-looking approach in nascent markets, to help these markets develop in a positive direction for competition and consumer protection, and therefore for further innovation, investment, and economic growth over the long run.

Looking ahead to 2024 to 2025, we have been preparing for the CMA’s new responsibilities and powers under the UK Government’s Digital Markets, Competition and Consumers Bill. The targeted ex-ante powers that the Bill provides in digital markets will enable the CMA to tackle competition and consumer protection problems swiftly, proportionately, and effectively, maximising opportunities for sustained innovation in these critical economic sectors. We also welcome the decision to place consumer protection law on a par with competition law through the new administrative enforcement model. Together with the ability to issue tougher fines, this considerably strengthens our ability to protect consumers from commercial harm and deter businesses which do not play by the rules.

For the near-term, therefore, we have made some targeted updates to our areas of focus for the 2024 to 2025 Annual Plan year to reflect these and other more immediate external developments. That way we can continue to prioritise our efforts where they are most needed and can deliver the greatest value.

From a longer term perspective, the fundamental forces that are shaping the external environment in which the economy operates, and that informed our strategy, have not materially changed; if anything, they have accelerated. As an independent body the CMA is able to maintain this objective, longer-term view of these more fundamental forces and set a longer-term strategy that provides stakeholders with a reasonable degree of stability and certainty around our three-to-five-year priorities. This Annual Plan accordingly makes only limited changes to that longer-term direction.

We care deeply about our responsibilities to protect consumers and promote competition and are constantly striving to maximise benefit of our work for those we serve. We are proud of the CMA’s strong track record in delivering value for the UK. Across the last 3 years alone, our work has delivered over £20 of direct financial benefit to consumers for every £1 of taxpayers’ money spent, while the total indirect benefit to the economy from our work – from more open, competitive markets, more innovation, and reduced anti-competitive behaviour – is multiples of that. However, there is always more to do. During the next 12 months all of us at the CMA will challenge ourselves to be even more effective and productive in how we execute our work, as well as experiment different ways to measure and demonstrate the impact of what we do.

Our consultation on the proposals set out in this Annual Plan formed a critical part of our thinking. We are, as ever, grateful for the breadth and diversity of views this process has brought, and for the opportunity to incorporate the insights of our stakeholders into our approach.

Marcus Bokkerink (Chair), Sarah Cardell (Chief Executive)

About the CMA

The CMA is an independent non-ministerial UK Government department and is the UK’s principal competition and consumer protection authority. We help people, businesses, and the UK economy by promoting competitive markets and tackling unfair behaviour.

We derive our powers from the Enterprise and Regulatory Reform Act 2013[footnote 1] and our work is overseen by a Board and led by the Chief Executive and senior team. Decisions in some investigations are made by independent members of the CMA Panel.

Our main functions are:

- investigating mergers that have the potential to lead to a substantial lessening of competition. If a merger is likely to reduce competition substantially, the CMA can block it or impose remedies to address such concerns

- investigating businesses to determine whether they have breached UK competition law and, if so, to end and deter such breaches. We achieve this by fining businesses and seeking the disqualification of directors of the companies involved, as well as pursuing individuals who commit the criminal cartel offence

- enforcing a range of consumer protection legislation, including in cases where the unfair treatment of consumers, or the challenges they face in making choices, suggests there may be a systemic market problem

- conducting studies, investigations or other pieces of work into particular markets where there are suspected competition and consumer problems. The CMA can take action – and recommend action be taken by others – in markets where competition may not be working well

- giving information or advice on matters related to any CMA functions to policymakers and ministers, including how they can design and implement policy in a way that harnesses the benefits of competition and protects and promotes the interests of consumers

- providing information and advice to people and businesses about their rights and obligations under competition and consumer law

- promoting stronger competition in the regulated industries (gas, electricity, water, aviation, rail, communications and financial services), working with the sector regulators

- conducting regulatory appeals and references in relation to price controls, terms of licences or other regulatory arrangements under sector-specific legislation

- providing advice, reporting and monitoring in relation to the UK internal market, through the Office for the Internal Market (OIM)

- providing advice, reporting and monitoring in relation to government subsidies, through the Subsidy Advice Unit (SAU)

- providing analysis and expertise on the issues of UK competition, consumer rights, innovation, productivity, and supply-side reforms through the Microeconomics Unit

The CMA has a UK-wide remit, with offices in Belfast, Cardiff, Edinburgh, London and Manchester, in addition to the new Microeconomics Unit based in Darlington. We adopt an evidence-based and integrated approach to our work, selecting the tools we believe will achieve maximum positive impact for people and businesses, wherever they live and operate in the 4 nations. These principles are reflected in our foundational requirements, which apply across our work and set out how we aspire to use our tools.

The Government introduced the Digital Markets, Competition and Consumer (DMCC) Bill in Parliament in April 2023. If enacted, this legislation will provide the CMA with new powers to regulate digital markets.

The Bill will also bolster our competition and consumer powers, including through the introduction of an administrative enforcement model for consumer protection. This will mean that the CMA is able to make decisions about when consumer protection law has been broken, and to impose fines on businesses responsible for these breaches.

Preparations to ensure our readiness to operate these new regimes are well advanced.

As the CMA expands to meet the demands of our evolving responsibilities and powers, we want to ensure that we are able to attract and retain the best talent. Our commitment to being a great place to work is enshrined in our core enablers. These set out what we are doing to upgrade our employee value proposition, as well as to adapt our business model and enhance our critical capabilities.

We remain steadfastly determined to build a diverse and inclusive workforce, including at senior levels, that reflects and understands the public we serve. This is the focus of our current Equality, Diversity and Inclusion (EDI) Strategy, which is supported by our current EDI Action Plan, both running to the end of 2024. We will launch a new EDI Strategy and Action Plan for 2025 onwards. We refreshed our CMA values (excellence, evidence-based, ambitious, collaborative, inclusive, respect) at the end of 2022 and are continuing to embed them into core activity.

Updating our strategy

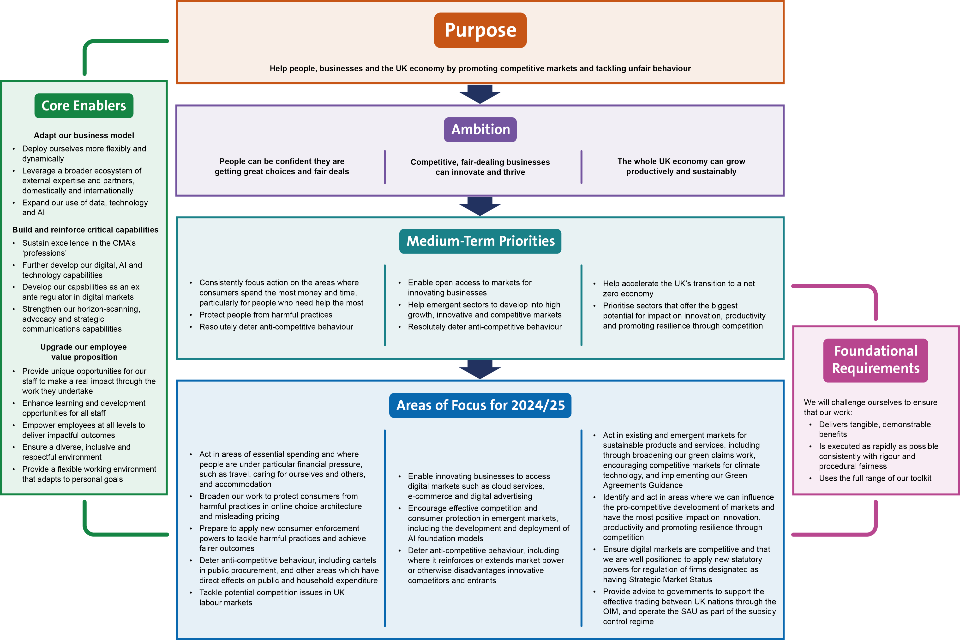

The CMA’s Annual Plan for 2024 to 2025 builds on the work that was undertaken last year to evolve our strategy, including the purpose, ambition, and medium-term priorities we set last year. The new strategic approach that we introduced in our 2023 to 2024 Annual Plan anticipated the major forces affecting the macroeconomic, technological, environmental, business and consumer context in which the CMA operates. It also reflected important changes within the organisation, including the appointment of a new Chair and Chief Executive and new responsibilities for the CMA following the UK’s exit from the European Union, as well as a need to adapt and evolve our ways of working. An overview of our strategic framework is below at Figure 1.

Figure 1: Overview of our strategic framework

Figure 1 shows how the CMA’s strategic framework is set out. It shows that:

- our purpose is our reason for existing

- our ambition flows from our purpose and consists of the outcomes the CMA wants to achieve for people, businesses, and for the whole UK economy

- our medium-term priorities are what the CMA will focus on over a three-year period in order to deliver the outcomes set out in our ambition

- our areas of focus for 2024 to 2025 are what we will progress over the next 12 months, as we work towards achieving our medium-term priorities

Our investment in a new strategic approach in 2023 was intended to establish a solid base on which to deliver the next decade of value for those we serve. We are mindful that the CMA’s position as an independent authority allows us to set our strategy over a longer period, and that there are benefits from continuity in our approach. Our strategy is therefore designed to provide stakeholders with a reasonable degree of stability and certainty around our foundational three- to five-year approach. This Annual Plan accordingly makes only limited changes to that trajectory.

We have carefully considered which elements of our medium-term strategy should be updated for 2024 to 25. The CMA’s overarching purpose to help people, businesses and the UK economy by promoting competitive markets and tackling unfair behaviour remains the same, as does our ambition in terms of the outcomes we seek to achieve for people, businesses and the UK economy over the medium and long-term. Our foundational requirements, which inform decisions about when and how to act to ensure they deliver tangible benefits as rapidly as possible and using the full range of our toolkit, remain as relevant as last year, and are also unchanged. More information on our purpose is set out in section 3, our ambition in section 4, and our foundational requirements in section 5.

In 2023 to 2024 we set our medium-term priorities for a three-year period. Notwithstanding the benefits of a consistent mid- to long-term direction of travel, it is also important that the CMA’s strategy is flexible enough to evolve with our external context. We are therefore taking this opportunity to update our medium-term priorities and core enablers to reflect developments since last year.

In 2023 to 2024 we also set our proposed areas of focus for the next 12 months. We have reviewed and refreshed these for 2024 to 2025, reflecting the progress of our recent and current interventions and the continued application of our medium-term priorities to anticipated areas of need. More information on our medium-term priorities and core enablers is set out in section 5 and areas of focus in section 6 (including the updates we have made this year).

A full overview of our strategy can be found in the appendix.

Purpose

The CMA’s strategy flows from an overarching purpose: to help people, businesses and the UK economy by promoting competitive markets and tackling unfair behaviour.

We provide more detail on this and on our ambition, which sits beneath our purpose, in the following 2 sections.

Figure 2: The CMA’s purpose and ambition

Figure 2 has two images. The first shows an explanation of the CMA’s purpose: to ‘help people, businesses, and the UK economy by promoting competitive markets and tackling unfair behaviour’. The second shows an explanation of our ambition. The CMA’s ambition is to promote an environment where people can be confident, they are getting great choices and fair deals, competitive fair-dealing businesses can innovate and thrive, and the whole UK economy can grow productively and sustainably.

There are 2 key elements of our purpose:

Who we serve - People, businesses and the UK economy:

- the CMA’s work should benefit people not only in their capacity as consumers but also as taxpayers and stakeholders in our society

- where the CMA acts to ensure effective competition or prevent consumer harm, this benefits competitive and fair-dealing businesses, who play a vital role in the UK economy and our wider national life

- the CMA’s work helps drive innovation, productivity and growth across the economy and across all 4 nations of the UK. While some individual pieces of our work might directly focus on a specific group of people or businesses, our work also has broader, systemic benefits which are important in supporting the UK economy as a whole

How we serve them - Promoting competitive markets and tackling unfair behaviour:

-

as the UK’s competition authority, promoting competitive markets is at the heart of our work. The CMA’s primary statutory duty is to ‘promote competition, both within and outside the UK, for the benefit of consumers’. We use our merger control, market investigation and competition law enforcement powers to ensure competitive market outcomes. We also provide advice to policymakers and information to the public to encourage effective competition

-

beyond promoting competition, the CMA’s statutory functions also extend to protecting consumers from harms. The CMA has important enforcement and advocacy roles in tackling unfair behaviour covered by consumer protection legislation. We also consider adverse effects on consumers when conducting market studies

Ambition

We articulate the CMA’s ambition in terms of the outcomes we seek to achieve for people, businesses and the whole UK economy over the medium and long term. Each is set out below.

People can be confident they are getting great choices and fair deals

When people are buying goods and services, they should be able to rely on the competitive process and trust that businesses are dealing with them on fair terms. The CMA’s work should ensure that competitive markets provide choice and variety and drive lower prices. We will use our competition and consumer law powers – along with our advocacy role of giving advice to government and our public-facing campaigns – to ensure that people are empowered to make the choices that are right for them.

Competitive, fair-dealing businesses can innovate and thrive

In an effectively functioning market, the businesses that produce the most innovative products and services that best meet consumer needs should be able to thrive, with broader benefits to the economy and society. The CMA’s actions should empower competitive, fair-dealing businesses to compete, including by addressing the behaviour of a small minority of businesses that try to harm consumers, restrict competition or prevent markets from functioning properly.

The whole UK economy can grow productively and sustainably

The CMA’s work to promote competitive markets and tackle unfair behaviour should support productivity, innovation and growth across the whole of the UK economy. We will focus particularly on ensuring that competition supports a resilient economy that can grow sustainably. Our work should drive benefits across all 4 nations of the UK.

Parliament has also given us particular responsibilities for monitoring and reporting on the effective operation of the UK internal market. That responsibility is discharged through the OIM, which sits within the CMA. Separately, the SAU provides advice to public authorities when they are giving subsidies that have the greatest potential to lead to distortive effects on competition and investment.

Medium-term priorities

To deliver our purpose and ambition, we have set medium-term priorities linked to each of the strategic outcomes that make up our ambition. These cover a 3-year horizon and, in turn, inform our specific areas of focus for the year ahead. These priorities are broadly unchanged since we set them last year.

This year we have made a minor update to the medium-term priorities that relate to our ambition to help ensure the whole UK economy can grow productively and sustainably. When we set our strategy last year, the UK economy was still recovering from the effects of the COVID-19 pandemic and we had concerns about the effects of supply disruption for the resilience of key markets. We therefore included a priority specifically on promoting resilience through competition. Due to evolving challenges facing the UK economy, we have merged this with the medium-term priority on prioritising sectors that contribute to innovation and productivity. We summarise our medium-term priorities in Figure 3 below.

Figure 3: Medium-term priorities

| People can be confident they are getting great choices and fair deals | Resolutely deter anti-competitive behaviour. Consistently focus action on the areas where consumers spend the most money and time, particularly for people who need help the most. Protect people from harmful practices. Resolutely deter anti-competitive behaviour. |

| Competitive, fair-dealing businesses can innovate and thrive | Resolutely deter anti-competitive behaviour. Enable open access to markets for innovating businesses. Help emergent sectors to develop into high growth, innovative and competitive markets. |

| The whole UK economy can grow productively and sustainably | Help accelerate the UK’s transition to a net zero economy. Prioritise sectors that offer the biggest potential for impact on innovation, productivity and promoting resilience through competition. |

These priorities will principally inform the activities where we have a degree of discretion over the work we undertake, such as competition and consumer law enforcement, market studies and investigations, and our advocacy work.[footnote 2]

Within the priorities, when we take decisions about when and how to act, we will continue to apply the following foundational requirements.

Foundational requirements

We will challenge ourselves to ensure that our work:

- delivers tangible, demonstrable benefits

- is executed as rapidly as possible consistently with rigour and procedural fairness

- uses the full range of our toolkit

Each medium-term priority, and the foundational requirements are detailed further below.

People can be confident they are getting great choices and fair deals

Consistently focus action on the areas where consumers spend the most money and time, particularly for people who need help the most

The CMA wants to achieve real impact for the people we serve. It is therefore important that we are active across areas that are most important to people, such as:

- getting about and travelling

- caring for ourselves and others

- having somewhere to live

- feeding ourselves and our families

- learning, playing and socialising

We will have particular regard to consumers who need help the most. Vulnerability can be context-specific and can take a range of forms. When targeting our interventions, we will therefore take into account the specific context in which people may need particular help to protect them from harm and get a fair deal.

Protect people from harmful practices

We will use our competition and consumer law powers to protect people from harmful business practices. This benefits people directly, but also helps those businesses that do the right thing, and who should not be placed at a competitive disadvantage as a result. A clear theme running through our work in this area will be to ensure that people are able to make well-informed, genuine choices based on accurate information.

Resolutely deter anti-competitive behaviour

We must also take action against businesses that breach competition law. Such action is necessary not only to address the breach in question but also to help deter businesses that might otherwise be tempted to break the law. This ultimately benefits people in the form of lower prices and better choices.

Competitive, fair-dealing businesses can innovate and thrive

Enable open access to markets for innovating businesses

Competition through innovation drives productivity and improved customer choice. We will take action across both established and emergent markets to ensure that innovating businesses of all sizes can gain effective market access to drive the competitive process.

Help emergent sectors to develop into high growth, innovative and competitive markets

Sometimes, the CMA can be more effective when we intervene at an early stage of market development. In such cases our involvement can help ensure that the market develops in a competitive way. Our involvement can take different forms, including advocacy and market studies.

Resolutely deter anti-competitive behaviour

Our action to deter anti-competitive behaviour benefits people, for the reasons outlined above. Fair-dealing firms, who should not be put at a disadvantage for doing the right thing, also benefit when the CMA deals firmly with anti-competitive behaviour.

The whole UK economy can grow productively and sustainably

Help accelerate the UK’s transition to a net zero economy

The CMA will continue to take action to accelerate the transition to a net zero economy and promote environmental sustainability. We have already taken significant steps forward in this area and will build further on this action in the coming year.

Prioritise sectors that offer the biggest potential for impact on innovation, productivity and promoting resilience through competition

When considering what more we can do to support the growth of the UK economy, the CMA will prioritise action in sectors which may have a particularly positive impact on innovation, productivity and promoting resilience through competition – for example:

- markets at an early stage of development but with the potential for significant growth

- markets that appear to have significant productivity gaps and where competition appears muted; and

- markets that display an over-reliance on a limited number of suppliers, and where a lack of effective competition, particularly in strategic markets, may put the supply of essential goods and services at risk of disruption

Foundational requirements

Deliver tangible, demonstrable benefits

The work of the CMA must deliver tangible, demonstrable benefits for people, businesses and for the whole UK economy.

Execute our work as rapidly as possible consistently with rigour and procedural fairness

Often, to achieve successful outcomes we need to act quickly. This will be a relevant consideration as we choose when and how to act, recognising of course that we need to comply with due process when using our formal powers.

Use the full range of our toolkit

The CMA is able to act using a range of formal powers. We can also intervene on a more informal basis, for example through advocacy, informal engagement, and information campaigns. Our starting point is to consider a given issue before deciding on the most appropriate tool.

Core enablers

Executing these priorities effectively and consistently requires us to continue to strengthen and improve how we work. We have identified 3 core enablers to support this activity:

- adapt our businesses model

- build and reinforce critical capabilities

- upgrade our employee value proposition

As with our medium-term priorities, we are evolving some of our core enablers this year. In terms of adapting our business model, we will reinforce our ability to deploy resource flexibly and dynamically, extend our efforts to work with partners both domestically and internationally, and expand our use of new technologies in our work. In building and reinforcing our capabilities, we will increase our efforts to develop our capabilities as an ex ante regulator (in anticipation of new powers from the DMCC Bill), and in strategic communications. Finally, we will further strengthen our employee value proposition (critical to enabling us to attract and retain staff) through implementation of a range of initiatives. These include action to ensure that all our staff have access to the right development opportunities and are empowered to deliver. We have set out our core enablers in more detail below, including these changes.

Adapt our business model

In order to amplify our effectiveness, we are adapting our business model in 3 ways:

- deploy ourselves more flexibly and dynamically

- leverage a broader ecosystem of external expertise and partners, domestically and internationally

- expand our use of data, technology and AI

Build and reinforce critical capabilities

We will reinforce or build the following critical capabilities:

- sustain excellence in the CMA’s ‘professions’

- further develop our digital, AI and technology capabilities

- develop our capabilities as an ex ante regulator in digital markets

- strengthen our horizon-scanning, advocacy and strategic communications capabilities

Upgrade our employee value proposition

The CMA’s talented staff are the foundation of our success. The CMA is not generally able to match the salaries offered by private sector businesses that recruit from the same pool of staff, so providing a high-quality employee experience and value proposition that takes account of factors beyond salary is of critical importance in attracting and retaining them. We will prioritise the following steps in particular:

- provide unique opportunities for our staff to make a real impact through the work they undertake

- enhance learning and development opportunities for all staff

- empower employees at all levels to deliver impactful outcomes

- ensure a diverse, inclusive and respectful environment

- provide a flexible working environment that adapts to personal goals

Joining up our priorities and areas of focus with the CMA’s current Prioritisation Principles

The CMA recently updated its Prioritisation Principles, which it uses to guide its choice of work. Our Prioritisation Principles consist of 5 key considerations:

- strategic significance: does CMA action in this area fit with the CMA’s objectives and strategy?

- impact: how substantial is the likely positive impact of CMA action?

- is the CMA best placed to act: is there an appropriate alternative to CMA action?

- resources: does the CMA have the right capacity in place to act effectively?

- risk: what types of risks are associated with CMA action, and how significant are they?

The Prioritisation Principles should be read through the lens of this Annual Plan, which gives more specificity to the strategic significance principle and reinforces or underlines the other 4 principles.

The Prioritisation Principles reflect the fact that the CMA shares responsibilities with other bodies (such as sector-specific regulators and Trading Standards), and we recognise how vital it is for regulators to work in concert on common issues. The CMA continues to participate in the UK Competition Network (UKCN), which is an alliance of the Competition and Markets Authority (CMA) and UK sector regulators that have a specific role to promote competition within their sectors.[footnote 3] The CMA shares responsibility with these regulators for the promotion of competition and application of certain competition law powers in the regulated sectors. UKCN aims to encourage stronger competition across the economy for the benefit of consumers and to prevent anti-competitive behaviour in the regulated industries.

In addition, alongside the Information Commissioner’s Office (ICO), Ofcom and FCA, the CMA participates in the Digital Regulation Cooperation Forum (DRCF). The DRCF allows for enhanced cooperation between different regulators seeking to address the unique challenges posed by regulation of online platforms in a joined-up fashion. The DRCF has addressed a number of key developments in digital technology over the past year, publishing its thinking in areas such as Quantum Technologies and the issues that regulators should be thinking about now to prepare for a quantum-enabled world.

We will continue to look for ways to cooperate with other regulators and relevant authorities, particularly where such an approach would produce the best outcomes for people and businesses. For example, we signed a Memorandum of Understanding with the Bank of England in December explaining how the CMA and the Bank will cooperate proactively on areas of common interest, share appropriate information in support of our respective statutory functions, and more generally foster a culture of collaboration.

Areas of focus for 2024 to 2025

In this section we set out how we will focus our work in the near-term, during the 12-month reporting period starting on 1 April 2024, as we work towards achieving our medium-term priorities in a way that puts the embedding of our new strategy at the heart of what we do. First, we set out some of our achievements over the last year, organised against the 3 strategic outcomes of our ambition.

Key achievements in 2023 to 2024

People can be confident they are getting great choices and fair deals

The CMA has consistently taken action to support consumers and help contain cost of living pressures in areas of essential spend. We understand the very real effects these pressures have on people’s lives, and the need in some cases to act quickly and impactfully to address issues. In the face of the cost of living crisis, we have not been afraid to act swiftly, and to complement our formal tools with informal action – for example, by undertaking rapid reviews of markets ahead of launching formal market studies. We have done this on a number of occasions, including in the case of the market study on road fuels that we concluded in July. This built on our initial rapid review in 2022, and has found that competition is not working effectively in this area. Following on from recommendations in our market study report, which included the introduction of a new statutory monitoring body and a real-time price data sharing scheme to hold the industry to account, we welcome the UK Government’s recent decision to give new powers to the CMA to monitor fuel prices and provide regular, public updates on the state of competition at a national and local level in the UK road fuels retail market. In the meantime, we have moved quickly to put in place a voluntary scheme for major fuel retailers to make available their daily prices and we continue to monitor developments in the market. This includes publication of road fuel monitoring update reports approximately every 4 months, with the first of these having been published in November.

Another important area of activity in relation to this part of our ambition has been our work in the groceries sector. In 2023, we conducted a review of unit pricing practices across large groceries retailers and examined whether weak or ineffective competition has been contributing to high inflation. Building on this extensive work, we launched a market study in relation to infant formula in February, resulting from concerns that consumers might be paying more than necessary for this essential product. This will consider whether suppliers have the right incentives to offer infant formula at competitive prices, and whether consumers have the right information, at the right time, to make effective choices. In addition, we have launched a review of loyalty scheme pricing by supermarkets which will consider whether any aspects of loyalty pricing are misleading.

Turning to a further aspect of our efforts to protect consumers, our work in online choice architecture (how the design of online environments affects our decision making and actions) has led to us taking firm action to avoid consumers being misled. For example, we have taken steps to address a number of concerns relating to potentially misleading online sales practices on the part of Emma Sleep, Wowcher, and Simba Sleep. These businesses have made use of countdown timers on their websites, as well as claims about products being in high demand or discounted, in ways that we are concerned may mislead consumers. We will continue to engage with these businesses with a view to addressing the CMA’s concerns. This work builds on the CMA’s earlier open letter that provided detailed guidance to online retailers to help them better understand and comply with consumer law as it applies in the rapidly evolving area of online choice architecture.

Checking that businesses are compliant with remedies we have previously imposed is another key part of our work to ensure that consumers get a good deal. An example is our work to increase the compliance of hospitals and consultants with the Private Healthcare Market Investigation Order 2014, which resulted from a CMA market investigation. As a result of enforcement action this year, 3 hospitals have agreed plans to become compliant with the Order and 88 consultants have also been targeted – enabling patients to effectively compare private healthcare facilities and services offered by consultants. We have also worked to reduce costs for the emergency services by introducing a charge control on the radio network used by the police, fire, ambulance and other emergency services to communicate securely. This will correct over-charging by Motorola of almost £200 million each year since 2020, protecting taxpayers, whilst allowing Motorola to continue to invest in the Airwave Network and so ensure that quality and safety are maintained.

Additional areas of work include our review of the vet sector, which is looking at whether pet owners are getting a good deal and receiving the information they need to make informed choices about treatment for their pets. The review gained significant coverage across print and broadcast media, with our call for information receiving responses from over 50,000 people including pet owners and those who work in the industry. We are consulting on making a Market Investigation Reference, which would enable us to consider further the extent of competition within the vet sector and whether consumers may be overpaying for some treatments and pet medicines.

We also continue to act in the housing sector. We concluded our housebuilding market study in February, setting out options on reforms that could be made to planning systems to support higher levels of housebuilding, as well as other measures to reduce consumer detriment from the private management of amenities on estates and quality issues in new homes. We will continue to engage with interested stakeholders in relation to our proposals and potential follow up action in the coming months. Furthermore, we have launched an investigation into 8 housebuilders in Great Britain having found evidence during the market study which indicated that some housebuilders may be sharing commercially sensitive information with their competitors in a way that could weaken competition and influence the build-out of sites and the prices of new homes. Beyond this, we have progressed a consumer research project in the private rented sector to investigate several important issues of concern identified by stakeholders. Over the coming year, we will publish updated guidance that will assist landlords, tenants and letting agents to understand their rights and obligations.

This part of our ambition is not solely focussed on consumers, but also on competition in labour markets, and an important area of focus for the CMA this year has been in relation to UK labour markets. In the last year we have launched 2 investigations in this sector. These both concern TV producers and broadcasters and practices relating to the employment of staff (one including and one excluding sport), as well as the purchase of services from freelance providers. We have built on this work by publishing a report on competition and market power in UK labour markets, which charts trends in UK labour market concentration and employer market power over the past 20 years, investigates how labour market concentration is related to worker outcomes, and spotlights how technologies and labour market institutions are shaping labour markets in the UK. A landmark piece of work, this is the first published report by the CMA’s recently established Microeconomics Unit, which provides independent analysis and expertise on matters including competition, innovation and productivity.

Our work on labour markets has complemented our broader efforts to deter anti-competitive behaviour in a range of areas, including those where there are direct effects on public finances and everyday expenditure for consumers. In May, for example, the CMA provisionally found that 5 major banks – Citi, Deutsche Bank, HSBC, Morgan Stanley and Royal Bank of Canada – broke competition law in the aftermath of the financial crisis by taking part in a series of one-to-one online exchanges of competitively sensitive information. This concerned pricing and other aspects of their trading strategies on UK bonds, which could have denied taxpayers, pension savers and financial institutions the benefits of full competition for these products, including the minimisation of borrowing costs. The CMA also found that JD Sports and Leicester City Football Club broke competition law by colluding to restrict competition in the sales of Leicester City-branded clothing, including replica kit, in the UK, meaning that fans of the club may have ended up paying more than they would otherwise have done.

Competitive, fair-dealing businesses can innovate and thrive

We have been steadfast in our efforts to support businesses across the economy. We have used our powers to deter anti-competitive behaviour and open up competition – particularly in emergent sectors such as digital markets. One of our most high-profile pieces of work to date has been our in-depth merger inquiry into Microsoft’s proposed acquisition of Activision, which we initially blocked because we were concerned that it would harm competition in the rapidly growing cloud gaming market. We eventually cleared a restructured version of the deal after Microsoft addressed our concerns by ensuring that the cloud streaming rights for Activision’s PC and console games produced over the next 15 years would be transferred to a strong independent competitor. By preserving open competition in the cloud gaming market, this approach has ensured that a range of innovative businesses can continue to thrive and people will get more competitive prices, better services, and more choice in the years to come.

In November, we accepted legally binding commitments from Amazon and Meta that will ensure fair competition on their retail platforms, benefiting sellers and consumers. Thousands of independent UK sellers that use Amazon Marketplace will be helped by commitments from Amazon that include giving them a fair chance of their offers being featured in the ‘Buy Box’, through which most sales on Amazon take place. Commitments secured from Meta, which include allowing competitors of Facebook Marketplace that advertise on Meta platforms to ‘opt out’ of their data being used to improve Facebook Marketplace, will mean the firm cannot exploit advertising customers’ data to give itself an unfair advantage.

We have also begun an in-depth market investigation into public cloud infrastructure services, following an initial market study conducted by Ofcom. This is set to be a key focus for the CMA in the year ahead and a substantial intervention in a £7.5 billion market that underpins a whole host of online services – from social media to AI foundation models – making effective competition in this market essential. Moreover, following conclusion of litigation which found in favour of the CMA, we have also recently resumed our market investigation relating to web browsers on mobile devices and the distribution of cloud gaming services through app stores on mobile devices in the UK. This investigation will consider whether particular interventions are required to drive better outcomes for businesses and consumers.

Outside the digital sector, we have made it easier for drug firms to work together to develop vital treatments for use in the NHS by issuing a statement in November clarifying that certain types of engagements between competing drug firms will not be prioritised for investigation. These concern ‘combination therapies’, which combine 2 or more individual drugs into a single treatment that can provide better health outcomes for patients. Our statement responded to concerns from stakeholders that the CMA could intervene to stop these types of collaborations under competition law. The CMA worked closely with key stakeholders in the sector in delivering this work, including NHS England, the Association of the British Pharmaceutical Industry, and the National Institute for Health and Care Excellence.

The whole UK economy can grow productively and sustainably

The CMA has supported sustainable growth through a range of interventions this year. This includes by acting to help shape emergent markets to protect effective competition and support innovation. A case in point is our initial review of AI foundational models. This has helped to create an early understanding of the relevant market and how the use of foundation models could evolve, including the opportunities and risks this could bring. We proposed a set of principles in September to ensure that consumer protection and healthy competition are at the heart of responsible development and use of AI in future. Marking the beginning, rather than the conclusion, of work by the CMA, we will shortly be publishing an update on our thinking, including how the principles have been received and adopted.

More broadly in relation to digital markets, the CMA has taken forward extensive preparations in anticipation of getting new statutory powers to oversee a pro-competition regime for digital markets. A key feature of the new regime will be the use by the CMA of new ex ante tools to identify and address problems in digital markets, including the imposition of targeted and tailored requirements on the most powerful firms to fit their different businesses and activities. These are significant new powers, and we will ensure that we are well-placed to apply them, subject to the enactment of legislation, in the coming year. In January, we published an overview of our provisional approach to implement the new Digital Markets competition regime, which details the principles that will guide our approach. This includes how we will focus on where we can have the most impact for people, businesses and the UK economy, and operate with transparency and in a way that involves engagement with a wide range of stakeholders. The DMU continues to build relationships with a range of domestic and international stakeholders, is taking forward large-scale recruitment, and is developing more extensive draft guidance that will be consulted on before we start to operate the regime.

Also in relation to this part of our ambition, we have taken forward a range of work to protect consumers from misleading environmental claims, for example, in the green heating and insulation sector. Following a call for information, our initial findings report in May detailed a range of issues in the sector, including in relation to consumers’ experience of buying products and business practices such as greenwashing (making false or overstated claims about the product’s environmental credentials). Acting on these findings, we moved to support consumers looking to purchase green heating products and home insulation by issuing a consumer guide, launching a broader awareness campaign, and backing this up with a set of good practice principles for quality assurance bodies to raise standards in the sector. Furthermore, we have taken targeted action by launching an investigation into Worcester Bosch in relation to potentially misleading green claims about the use of hydrogen in its boilers and issued warning letters to 12 other businesses involved in similar practices.

Looking to future developments in markets that relate to sustainability, the CMA has acted to support businesses to co-operate on environmental goals in compliance with competition law. We issued our Green Agreements Guidance in October following extensive consultation. To build on this, we committed to operate an open-door policy where organisations can approach the CMA for informal guidance on proposed environmental sustainability initiatives. In December, we issued our first piece of informal guidance under this policy to the Fairtrade Foundation, which related to an environmental sustainability agreement concerning Fairtrade bananas, coffee and cocoa. We expect to publish more examples of our informal guidance over the coming year.

We have also assisted policymakers in government to identify how new policies or spending proposals might affect competition in markets by issuing a significant update to the CMA’s Competition Assessment Guidelines in July, which now have an added focus on innovation. The guidelines can be used by policy officials when conducting impact assessments for regulatory proposals, or when appraising policies, programmes, and projects. We are now working to promote these guidelines across government, including through offering training to government policy officials and economists.

The CMA has been provided with targeted responsibilities to provide advice to government on subsidies, through the SAU, and on intra-UK trade, through the OIM. The SAU began to carry out its functions in January 2023 and has published more than 30 reports this year in relation to subsidies that have been proposed by a range of public authorities across UK, devolved and local government. Whilst the SAU’s advice is non-binding, its reports provide independent evaluation and enable a public authority to refine its thinking, including whether it wishes to modify a subsidy prior to award, or proceed to award it at all. The SAU has also developed its approach to its statutory monitoring function, and launched a consultation on its proposals in February.

In November, the UK Government announced in a number of appointments to the OIM Panel – an independent panel of experts drawn from across the UK that will assist the OIM in discharging its statutory functions, including the provision of non-binding advice to governments across the UK on the economic impacts of regulatory proposals. The OIM will shortly publish its second annual report on the operation of the UK Internal Market, building on the first report it issued in 2023. An update to the OIM data strategy is also being developed, which seeks to promote the collection and publication of intra-UK trade data and act as a catalyst for improvements in the evidence base.

A further key function of the CMA is that we act as the appeal body for pricing decisions and other regulatory arrangements taken by certain other regulators under sector-specific legislation. In October, we issued our determination on a price control decision taken by the Civil Aviation Authority (CAA) following appeals by Heathrow Airport and 3 airlines. The CMA found that the CAA was not wrong on most of the issues that were appealed, but ordered the CAA to reconsider 3 parts of its decision. Our determination in this case will help ensure that the right balance is maintained between ensuring prices for passengers are not too high and encouraging investors to maintain and improve the airport over time.

The CMA also plays a broader role through sharing responsibility with the regulators for the promotion of competition and application of certain competition law powers in the regulated sectors. 2024 will mark 10 years since the existing concurrency arrangements were brought into being. These aim to strengthen co-operation between the CMA and sector regulators, increase competition law enforcement activity in the regulated sectors, and encourage pro-competitive outcomes in these sectors. This milestone presents an important opportunity for the CMA to lead a review of the overall operation and effectiveness of the concurrency arrangements. To that end, the CMA sought external feedback, publishing a call-for-inputs in August 2023, to help us understand the extent to which sharing competition law powers with the CMA is helping sector regulators achieve their objectives, and the extent to which it strengthens the competition regime as a whole. We will report on our findings later in the year.

How we will focus our work in 2024 to 2025

Building on the progress we have already made in delivering our medium-term priorities and areas of focus, and recognising the evolution of our operating environment, we are taking the opportunity to make some updates to our areas of focus for 2024 to 2025.

In relation to the ‘people’ element of our ambition, we have updated our area of focus on acting in areas of essential spend to include greater emphasis on travel. In particular, we will build on our work in the road fuels market. We will also retain specific reference to accommodation in this area of focus. In so doing, we will follow up our work on housebuilding and in the private rented sector. We will continue to engage with interested stakeholders in relation to the proposals set out in our market study and potential follow up action in the coming months. We will also publish updated guidance on the application of consumer protection law for lettings.

In terms of other updates relating to ‘people’, we are updating our area of focus that deals with protecting consumers from harmful practices to reflect progress in our work on harmful online choice architecture and misleading pricing practices. We have also added a new area of focus on preparing for new consumer enforcement powers that will be provided by the DMCC Bill. Subject to the enactment of this legislation by Parliament, the introduction of a new administrative enforcement model will transform the impact of the consumer enforcement action we take – empowering us to decide when consumer law has been broken, rather than having to take each case to court, and giving us the ability to directly impose significant financial penalties. Finally, we have amended the area of focus on UK labour markets to show that we have progressed from identifying to tackling issues.

Turning to the ‘business’ element of our ambition, we have updated our area of focus on access to digital markets by adding a specific reference to cloud services to reflect the significance of this work in the year ahead, following referral of the market to us by Ofcom for an in-depth market investigation.

We have also expanded our area of focus on encouraging competition in emergent markets to encompass consumer protection and have made specific reference to the development and deployment of AI foundation models, building on the initial review we conducted in 2023. Finally, for our area of focus on deterring anti-competitive behaviour, we have provided an illustrative example of where this work might centre – on preventing the extension of market power, particularly where this would disadvantage innovative competitors and entrants.

We have also made updates to the areas of focus related to the ‘economy’ element of our ambition. We have updated the area of focus on sustainable products and services to reflect progress in our work since last year – including our significant programme of work on misleading green claims, work to encourage competitive markets for climate technology, and the implementation of our Green Agreements Guidance for business. We have also brought together the areas of focus on supporting innovation, productivity, and promoting resilience through competition, in order to align with corresponding updates to our medium-term priorities.

As we have done with prospective consumer powers, we have emphasised our preparations for new statutory regulatory powers under the DMCC Bill in the area of focus on digital markets. Again, the introduction of these new powers, subject to the will of Parliament, will mark a step-change in our work. They will enable us to intervene more effectively in digital markets, using new and targeted powers to regulate firms that we designate as having ‘Strategic Market Status’ to ensure effective competition and support innovation. We are committed to ensuring our readiness to make full use of them, once granted.

We summarise our proposed areas of focus for 2024 to 2025 in Figure 4.

Our proposed areas of focus are necessarily non-exhaustive. The CMA is likely to undertake a considerable amount of non-discretionary work over the next 12 months – for example, reviewing mergers and working on regulatory appeals. This is important work and contributes significantly to our ability to deliver strong outcomes for people, businesses and the UK economy – often with direct relevance to our areas of focus.

In addition, we recognise that we will also need to be flexible in responding to unforeseen developments during the course of the year that require us to take action to help people, businesses and the UK economy.

Figure 4: Areas of focus

| People can be confident they are getting great choices and fair deals | Act in areas of essential spending and where people are under particular financial pressure, such as travel, caring for ourselves and others, and accommodation. Broaden our work to protect consumers from harmful practices in online choice architecture and misleading pricing. Prepare to apply new consumer enforcement powers to tackle harmful practices and achieve fairer outcomes. Deter anti-competitive behaviour, including cartels in public procurement, and other areas which have direct effects on public and household expenditure. Tackle potential competition issues in UK labour markets. |

| Competitive, fair-dealing businesses can innovate and thrive | Enable innovating businesses to access digital markets such as cloud services, e-commerce and digital advertising. Encourage effective competition and consumer protection in emergent markets, including the development and deployment of AI foundation models. Deter anti-competitive behaviour, including where it reinforces or extends market power or otherwise disadvantages innovative competitors and entrants. |

| The whole UK economy can grow productively and sustainably | Act in existing and emergent markets for sustainable products and services, including through broadening our green claims work, encouraging competitive markets for climate technology, and implementing our Green Agreements Guidance. Identify and act in areas where we can influence the pro-competitive development of markets and have the most positive impact on innovation, productivity and promoting resilience through competition. Ensure digital markets are competitive and that we are well positioned to apply new statutory powers for regulation of firms designated as having Strategic Market Status. Provide advice to governments to support the effective trading between UK nations through the OIM, and operate the SAU as part of the subsidy control regime. |

Measuring our impact

As a public body, it is important that we show how we are delivering on the mandate entrusted to us by Parliament. Given we are funded by the taxpayer, we are also acutely aware of our responsibility to show that we are delivering real impact and value for the benefit of those we serve. We aim to provide this transparency and accountability by regularly evaluating and communicating the impact of our work through our annual Impact Assessment, Annual Plan, and Annual Report and Accounts. Our annual Impact Assessment sets out the direct monetised benefit to consumers of our work over a three-year rolling period, in response to a requirement set by the UK Government. This demonstrates that the CMA consistently delivers strong value for money across the range of our functions: over £20 for every £1 of taxpayer money spent, well in excess of the target of £10:1 set by government.

Although this calculation gives a tangible sense of the impact the CMA is having, it has a number of limitations. Most importantly, our Impact Assessment only takes account of direct financial benefits where it is practicable to measure or estimate them. It does not take account of the impact of work where the CMA’s intervention is likely to generate considerable benefits, but these benefits are difficult to quantify in a sufficiently robust manner (for example our work on compliance, regulatory appeals, or advising government). Nor does it include potentially very significant indirect benefits from, for example, deterrence of anti-competitive behaviour. As such, it only provides a partial view of the benefits the CMA is delivering for people, businesses and the UK economy, which in reality are likely to be more substantial than those reported.

In our Annual Plan and Annual Report, we provide an overview of the work we have undertaken and why. As our role and responsibilities evolve, it is even more important for us to actively build and enhance understanding of our functions and the positive impact of our work for people, businesses and the UK economy. As we have put into practice the elements of our 2023 to 2024 strategic approach, we have considered how best to achieve this enhanced transparency and accountability, including consulting with our Board.

Going forward, we propose to complement our annual Impact Assessment with a fuller picture of our impact. This might include drawing from observable, measurable outcomes in areas where the CMA has acted (our case work, market studies and investigations, external engagement activities, for example); indicators of how stakeholders view us and our work (surveys and other research data); academic studies that provide insights into the impact of our deterrence; and broader, long-term and market-wide outcomes (through, for example, our State of Competition Report). Not all of this is directly quantifiable. Nonetheless, we think it will contribute to a clearer understanding of our work and the positive external outcomes the CMA is delivering.

Although it will take some time to fully refine this more holistic approach to measuring and reporting on our impact, we will aim to begin introducing new elements into our annual reports over the coming year, and to continuously refine them going forward.

Resources

The Spending Review 2021 allocated the CMA’s budget for 2024 to 2025 as a Resource Departmental Expenditure Limit budget (excluding depreciation) of £126.3 million and a Capital Departmental Expenditure Limit budget of £5.12 million. This settlement delivers the CMA’s existing functions as well as supporting the CMA in taking on new responsibilities and powers that have been given by the UK Government under the Digital Markets, Competition and Consumer Bill.

HM Treasury are committed to ensuring that the CMA is appropriately resourced to take forward its additional responsibilities in monitoring the road fuels market from 2024 to 2025 onwards.

The CMA’s Capital Departmental Expenditure Limit budget will continue, amongst other things, to support the CMA’s expansion in the nations and regions of the UK, as well as investment in technology and digital transformation.

Funding provided for 2024 to 2025 will ensure that the CMA can continue its vital work in helping people, businesses, and the UK economy by promoting competitive markets and tackling unfair behaviour. As Principal Accounting Officer, the CMA’s Chief Executive is personally responsible for safeguarding the public funds for which she has charge, for ensuring propriety and regularity in the handling of public funds and the day-to-day operations and management of the CMA. The Principal Accounting Officer is supported in discharging these duties by an additional Accounting Officer, the Chief Operating Officer.

As in previous years, we expect to enter 2024 to 2025 with a substantial volume of ongoing work. At the time of writing, we have 24 merger investigations (including one live Phase 2 review), 11 competition enforcement cases, 9 consumer protection cases, one market study and 2 market investigations underway. Since April 2023, we have issued one infringement decision, imposing £0.88 million in fines, as well as 2 commitments decisions. In addition, 4 of our decisions are currently under appeal to the Competition Appeal Tribunal. All our cases can be found on our CMA cases page.

Figure 5 below illustrates how CMA staff time has been split across different types of work over the past 2 years. This includes resources allocated to the DMU, OIM and SAU functions and our pipeline, policy and advocacy work.

Resource will be allocated in 2024 to 2025 in order to ensure that the CMA is able to deliver its areas of focus for the year – whilst also ensuring that we are able to undertake the considerable amount of non-discretionary work (e.g., mergers) that we expect in the year ahead. The CMA will also ensure sufficient flexibility in its resource allocation to enable it to undertake any additional work as required, including to respond to any unexpected developments.

Figure 5: Distribution of staff time by type of work over the last 2 years

Figure 5 is a bar chart that details the distribution of staff time by type of work over the last 2 years. The two types of bars show January to December 2022, and January to December 2023. The X-axis shows the different departments of the CMA, including Antitrust, Cartels, Consumer, Mergers, Markets and regulatory appeals, DMU, OIM, SAU, Litigation, Pipeline, Policy, Advocacy, and Other.

Glossary

| Digital Markets Unit (DMU) | The DMU has been established within the CMA to begin work to operationalise the future pro-competition regime for digital markets, subject to the enactment of the Digital Markets, Competition and Consumers Bill by Parliament. |

| Office for the Internal Market (OIM) | The OIM is part of the CMA and supports the effective operation of the UK internal market. It assesses whether the internal market is operating effectively and provides expert and independent advice to the UK and devolved governments. |

| Subsidy Advice Unit (SAU) | The SAU sits within the CMA. It is a function created by the Subsidy Control Act 2022, which provides a regime for governing the provision of subsidies within the UK following its exit from the EU. |

Appendix

The appendix graphic shows the CMA’s strategic framework and each element in detail.

Our purpose is to help people, businesses and the UK economy by promoting competitive markets and tackling unfair behaviour.

Our ambition is to ensure that People can be confident they are getting great choices and fair deals; competitive, fair-dealing businesses can innovate and thrive; and the whole UK economy can grow productively and sustainably.

Our medium-term priorities are to:

- consistently focus action on the areas where consumers spend the most money and time, particularly for people who need help the most

- protect people from harmful practices

- resolutely deter anti-competitive behaviour

- enable open access to markets for innovating businesses

- help emergent sectors to develop into high growth, innovative and competitive markets

- resolutely deter anti-competitive behaviour

- help accelerate the UK’s transition to a net zero economy

- prioritise sectors that offer the biggest potential for impact on innovation, productivity and promoting resilience through competition

Our areas of focus for 2024 to 2025 are to:

- act in areas of essential spending and where people are under particular financial pressure, such as travel, caring for ourselves and others, and accommodation

- broaden our work to protect consumers from harmful practices in online choice architecture and misleading pricing

- prepare to apply new consumer enforcement powers to tackle harmful practices and achieve fairer outcomes

- deter anti-competitive behaviour, including cartels in public procurement, and other areas which have direct effects on public and household expenditure

- tackle potential competition issues in UK labour markets

- enable innovating businesses to access digital markets such as cloud services, e-commerce and digital advertising

- encourage effective competition and consumer protection in emergent markets, including the development and deployment of AI foundation models

- deter anti-competitive behaviour, including where it reinforces or extends market power or otherwise disadvantages innovative competitors and entrants

- act in existing and emergent markets for sustainable products and services, including through broadening our green claims work, encouraging competitive markets for climate technology, and implementing our Green Agreements Guidance

- identify and act in areas where we can influence the pro-competitive development of markets and have the most positive impact on innovation, productivity and promoting resilience through competition

- ensure digital markets are competitive and that we are well positioned to apply new statutory powers for regulation of firms designated as having Strategic Market Status

- provide advice to governments to support the effective trading between UK nations through the OIM, and operate the SAU as part of the subsidy control regime

Our core enablers are to:

- adapt our business model

- deploy ourselves more flexibly and dynamically

- leverage a broader ecosystem of external expertise and partners domestically and internationally

- expand our use of data, technology and AI

- build and reinforce critical capabilities

- sustain excellence in the CMA’s ‘professions’

- further develop our digital, AI and technology capabilities

- develop our capabilities as an ex ante regulator in digital markets

- strengthen our horizon-scanning, advocacy and strategic communications capabilities

- upgrade our employee value proposition

- provide unique opportunities for our staff to make a real impact through the work they undertake

- enhance learning and development opportunities for all staff.

- empower employees at all levels to deliver impactful outcomes

- ensure a diverse, inclusive and respectful environment

- provide a flexible working environment that adapts to personal goals

Our foundational requirements mean we will challenge ourselves to ensure that our work:

- delivers tangible, demonstrable benefits

- is executed as rapidly as possible consistently with rigour and procedural fairness

- uses the full range of our toolkit

-

The powers of the Office for the Internal Market are set out in the UK Internal Market Act 2020. The CMA also has powers linked to the Subsidy Advice Unit which derive from the Subsidy Control Act 2022. More information can be found on the CMA governance page. ↩

-

In merger control our caseload is affected principally by which mergers are announced in a given period. ↩

-

These are the Civil Aviation Authority (CAA), Financial Conduct Authority (FCA), Gas and Electricity Markets Authority (Ofgem), Northern Ireland Authority for Utility Regulation (NIAUR), Office of Communications (Ofcom), Office of Rail and Road (ORR), Payment Systems Regulator (PSR), and Water Services Regulation Authority (Ofwat). ↩