Budget 2020: a GAD technical bulletin

Published 13 March 2020

Pensions taxation

The Chancellor announced a change to pensions taxation for higher earners, intended to support the delivery of public services. As background, the Annual Allowance (AA) is the maximum amount of pensions savings that can be accrued within a year without incurring a tax charge. The government introduced an AA taper with effect from 2016-17, such that those on the highest incomes are subject to a lower allowance – reducing from the full AA of £40,000 down to £10,000. Our Summer Budget 2015 bulletin describes how the taper operates in more detail.

Budget 2020 announced 2 significant changes to the taper:

- a £90,000 increase to the 2 threshold income levels used to determine when the taper applies - this means that, from 2020-21, individuals with an income below £200,000 will not be affected by the taper

- a fall from £10,000 to £4,000 in the AA applying to those on the highest incomes – this will only affect individuals with total income, including pension accrual, of over £300,000

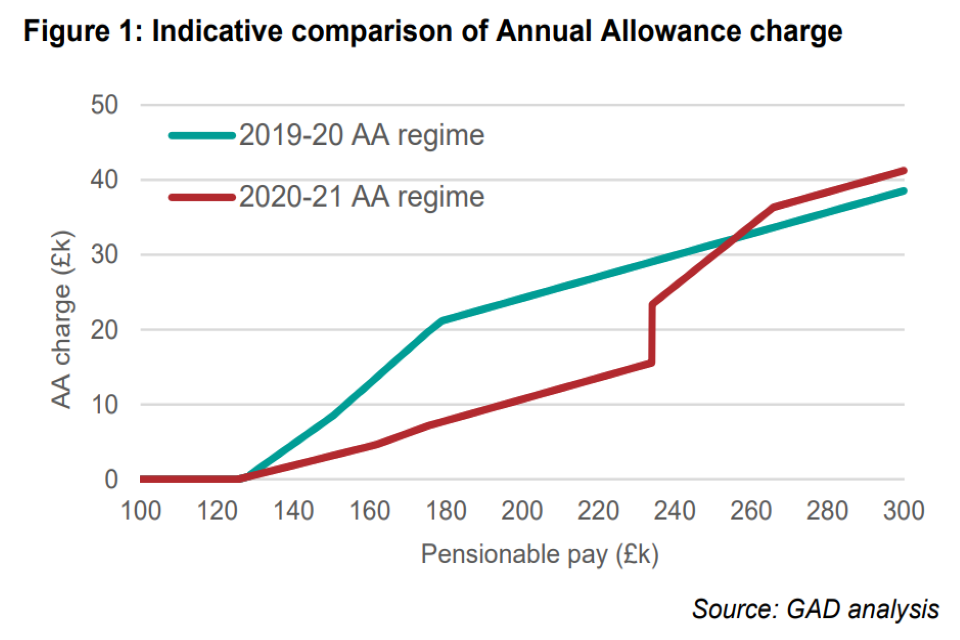

: A chart showing an indicative comparison of the 2019-20 Annual Allowance regime against the 2020-21 Annual Allowance regime. The chart plots the Annual Allowance charge against Pensionable Pay.

These amendments have been introduced to support the delivery of public services - particularly in the NHS - but they will apply to all taxpayers. Figure 1 shows how the changes might affect an indicative high-earning member of a public service pension scheme, illustrating the AA tax charge due at different levels of pensionable pay.

The changes address concerns that the pensions tax system is preventing doctors from taking on more hours. In his speech, the Chancellor said that around 98% of consultants and 96% of GPs would now be taken out of the taper. The government’s 2019 proposals to offer greater pay in lieu of pensions for senior clinicians in the NHS pension scheme will not be taken forward.

Budget 2020 made no policy changes to the Lifetime Allowance (LTA) - the maximum amount that someone can accrue in a registered pension scheme in a tax-efficient manner over their lifetime. As expected, the LTA will increase in line with the Consumer Prices Index to £1,073,100 for 2020-21. The Budget also announced that the government will shortly publish a call for evidence on pensions tax relief administration as differences can occur for low earners, depending on how their scheme is administered.

Managing the public finances

Launching the Comprehensive Spending Review 2020 (CSR), Budget 2020 sets out the overall level of public spending within which the CSR will be delivered. The CSR will conclude in July and will set out detailed spending plans for public services and investment, covering resource budgets for 3 years from 2021-22 to 2023-24 and capital budgets up to 2024-25. The Chancellor stated that total departmental spending is set to grow twice as fast as the economy over the CSR period.

The Green Book - which sets out how decisions on major investment programmes are appraised - will be reviewed, with a revised version published in July alongside the CSR. The review is intended to make sure that government investment spreads opportunity across the UK.

The Balance Sheet Review (BSR) will also conclude and report at the CSR. Launched at Autumn Budget 2017, this review aims to identify opportunities to dispose of assets that no longer serve a policy purpose, improve returns on retained assets, and reduce the risk and cost of liabilities. The BSR has developed proposals to improve the management of the government’s exposure to £192 billion of contingent liabilities, addressing a key balance sheet risk recognised by the OBR in its July 2019 Fiscal risks report. More detail on the newly announced policy approach is set out in a report published alongside the Budget.

Government as an insurer of last resort

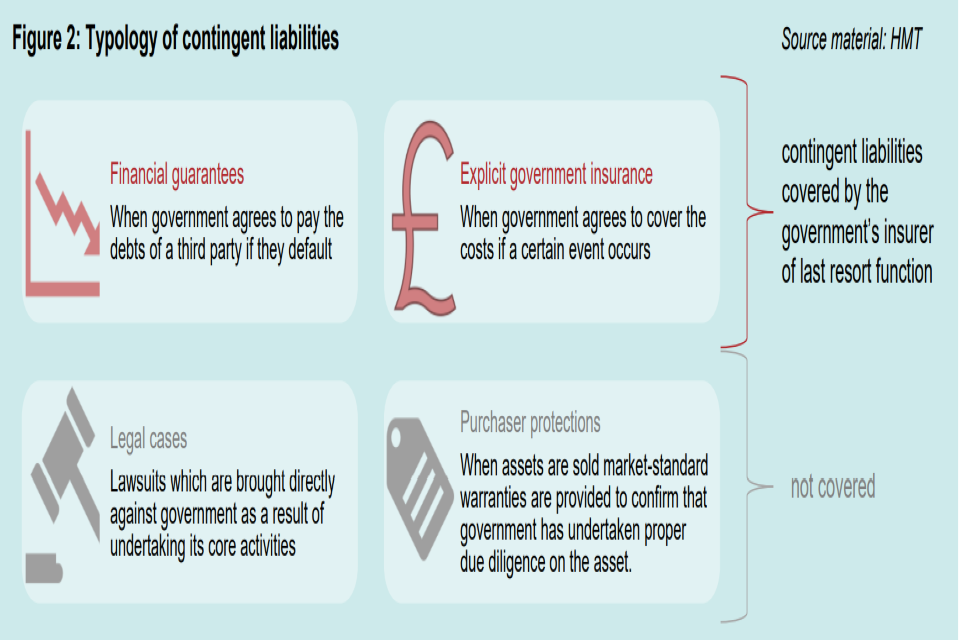

To protect the population and provide stability, the government may take on risks which others cannot. Taking on such risks creates liabilities – known as contingent liabilities - which are uncertain, but which might lead to future expenditure if specific conditions are met or specific events happen. HM Treasury’s (HMT) report on Government as insurer of last resort sets out a range of proposals designed to improve the management of certain contingent liabilities as shown in Figure 2. HMT’s policy approach, developed with support from GAD, builds on an approval framework introduced in 2017.

Diagram of the typology of contingent liabilities. Four categories: financial guarantees, explicit government insurance. The other two: legal cases and purchaser protections are not covered

The newly announced Coronavirus Business Interruption Loan Scheme is an example of the government offering financial guarantees. The scheme will provide lenders with a guarantee of 80% on each loan (subject to a per lender cap on claims), supporting businesses to access bank lending and overdrafts.

GAD has worked with a range of departments to help them to understand and quantify such risks to support their applications to HMT’s approval framework. GAD also advises some of government’s largest risk transfer programmes such as NHS Resolution, which provides professional indemnity cover against clinical negligence claims in the NHS and the Risk Protection Arrangement, which provides liability cover for academy schools in England.

HMT’s new proposals, which the government will now take forward and integrate into the CSR, include plans to:

- build a team of experts in government to quantify and price risk

- monitor and report on risk exposure across government

- where appropriate, charge fees for providing guarantees and other contingent liabilities

- establish the right incentives to reduce both the probability of a risk happening and the cost to the taxpayer if it does.

The Chancellor also announced a review of the UK’s fiscal framework, with the Budget report outlining key topics and guiding principles. One aim of this review is to ensure the framework remains appropriate for the current macroeconomic environment. This is in the context of the international debate around the fiscal implications of a prolonged period of low interest rates. This environment was reinforced by the Bank of England’s announcement on Budget day that it would reduce the bank rate by 0.50% to 0.25% a year, as part of a package of measures to respond to the economic shock from Covid-19. HMT’s review will report back by Autumn Budget 2020 to allow the government to update its Charter for Budget Responsibility and confirm its fiscal objectives for the Parliament.

Retail Prices Index

Historically, the Retail Prices Index (RPI) was the dominant inflation measure in the UK and is the reference inflation for many pension schemes, student loan repayments and repayments for index linked gilts. However, RPI’s status as a national statistic was revoked in 2013 due to various issues with the way RPI is calculated.

Following an exchange of letters last autumn between the then Chancellor and the UK Statistics Authority (UKSA), the government announced it would consult on proposals to address these shortcomings. Our January 2020 bulletin, Proposed changes to RPI, summarises the issues and potential impact of any changes.

The government and UKSA have now published their joint consultation alongside Budget 2020. UKSA are seeking views on technical proposals as to how RPI should transition to new methods and data sources. The Chancellor is seeking views on the potential impact on the index-linked gilt market and on the timing of any changes. The Chancellor’s consent is required if changes are to be implemented before 2030. The consultation closes on 22 April 2020.

Next steps

If you would like to discuss any of the topics covered in this bulletin or to learn more about the potential impact of other Budget 2020 announcements, then please get in touch with your usual GAD contact.

Disclaimer

The information in this publication is not intended to provide specific advice. For our full disclaimer, please see the GAD publications page.

The Government Actuary’s Department is proud to be accredited under the Institute and Faculty of Actuaries’ Quality Assurance Scheme.

QAS Logo