Artificial Intelligence sector study 2024

Published 3 September 2025

Ministerial foreword

Artificial Intelligence (AI) is transforming economies, industries, and daily life at an unprecedented pace. The UK has long been a global leader in AI research, development, and adoption, and we remain committed to harnessing its potential to drive innovation, productivity, and economic growth.

Since the publication of the first AI Sector Study in 2022, the UK’s AI ecosystem has grown to now include more than 5,800 AI companies – an 85% increase over the past 2 years. Revenue is now at £23.9 billion, and the sector contributed £11.8 billion in Gross Value Added (GVA). This growth reflects the increasing integration of AI across the economy, from healthcare and finance to manufacturing and professional services.

To ensure the UK remains a global leader in AI, we launched the AI Opportunities Action Plan - a strategic roadmap designed to accelerate AI adoption, enhance infrastructure, and support talent development.

This 2024 AI Sector Study provides a comprehensive analysis of the UK’s AI landscape and will be critical to monitoring the implementation of the Action Plan. It also provides valuable insights into the opportunities and challenges ahead. The data and analysis contained within this report will continue to inform our evidence-based approach to AI policy development, allowing us to work to expand the UK’s AI sector, as well as realise the potential gains of widespread AI adoption for all.

Feryal Clark MP

Parliamentary Under-Secretary of State for AI and Digital Government

Executive foreword

A consortium led by Perspective Economics was commissioned in early 2025 to undertake research into the profile of AI activity in the UK, and its contribution to the UK economy[footnote 1].

Based on analysis of secondary data and qualitative research including responses from 298 AI companies and 52 in-depth interviews with AI businesses and strategic stakeholders, this report provides key findings regarding the size and scale of the UK’s AI sector.

1.1 Headline sector metrics

AI activity in the UK continued to see substantial growth between 2023 and 2024 across all core economic measures.

Figure 1.1 – AI sector study headline metrics (2022 – 2024)

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Employment | 50,040 | 64,539 | 86,139 (+33% since 2023) |

| Revenue (£m) | 10,600 | 14,200 | 23,900 (+68% since 2023) |

| GVA (£m) | 3,700 | 5,800 | 11,800 (+103% since 2023) |

| Firm Count | 3,170 | 3,713 | 5,862 (+58% since 2023) |

Source: Perspective Economics

1.2 Key findings

Market growth and scale

-

This research shows that the UK has a strong AI ecosystem, particularly at the early stages of company formation where research funding and early-stage capital is required.

-

There has been a 58% increase in the number of in-scope ‘dedicated and diversified’ AI companies compared to 2023, suggesting broad recognition of AI-related business opportunities across the economy, and particularly within diversified companies.

-

Record AI company registrations in 2023[footnote 2], and a 10 percentage point increase in the share of micro businesses in 2024 are indicative of a vibrant AI start-up ecosystem.

-

In 2024, total estimated AI revenue has increased by ~68% to ~£23.9 billion (+£9.7 billion), with most of the revenue increases generated by diversified AI companies (96%, £9.3 billion).

Revenue, employment and GVA

-

Dedicated AI company revenues rose by 9% between 2023 and 2024, from £4.4 billion to £4.9 billion, while AI related employment has increased by 34%, to a total of 86,139 in 2024 (+21,600).

-

Amazon, Google Deepmind, IBM, and Meta have added most to estimated revenue and employment in absolute terms, while frontier generative AI model providers Anthropic and OpenAI have seen among the largest percentage increases in estimated UK AI employment since 2023.

-

Estimated GVA among dedicated AI firms has almost doubled within the past year, from £1.2 billion in 2023 to £2.2 billion in 2024 (+83%, £1.0 billion).

Funding and investment

-

The value of investment in dedicated AI companies has rebounded to £2.9 billion – above the record high seen in 2022. Deal volumes have fallen slightly from 2022 levels, with higher average deal sizes in 2024, at ~£5.9 million (2022, £4.6 million).

-

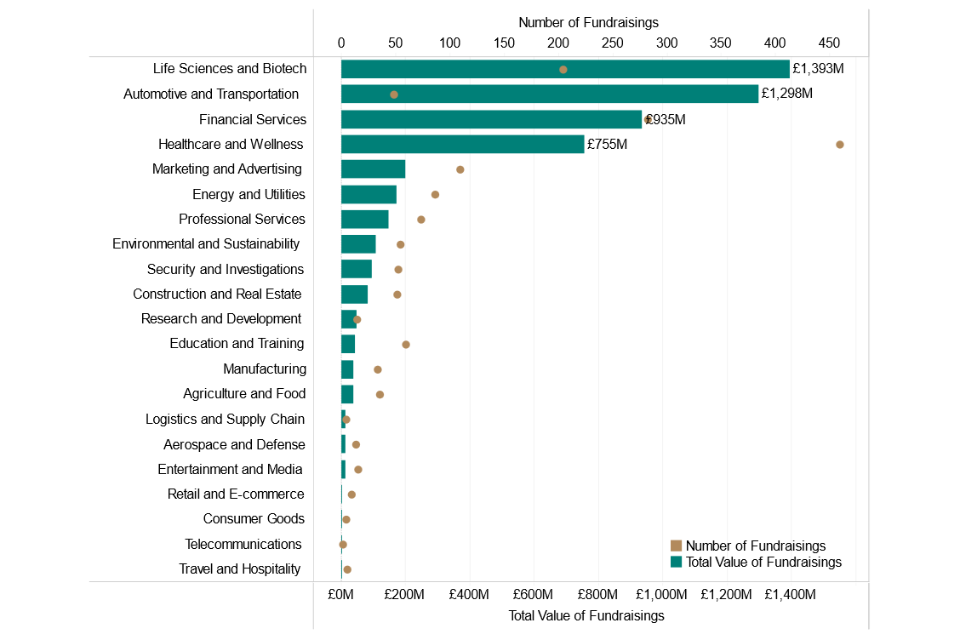

Outside of Information Technology the most substantive levels of investment have gone into dedicated companies involved in life sciences and biotech, automotive and transportation, financial services, and healthcare and wellness.

-

In 2024, there were 51 AI related inward investment projects into the UK, representing more than £15 billion in capital investment and expected to create more than 6,500 jobs.

Geographic distribution

-

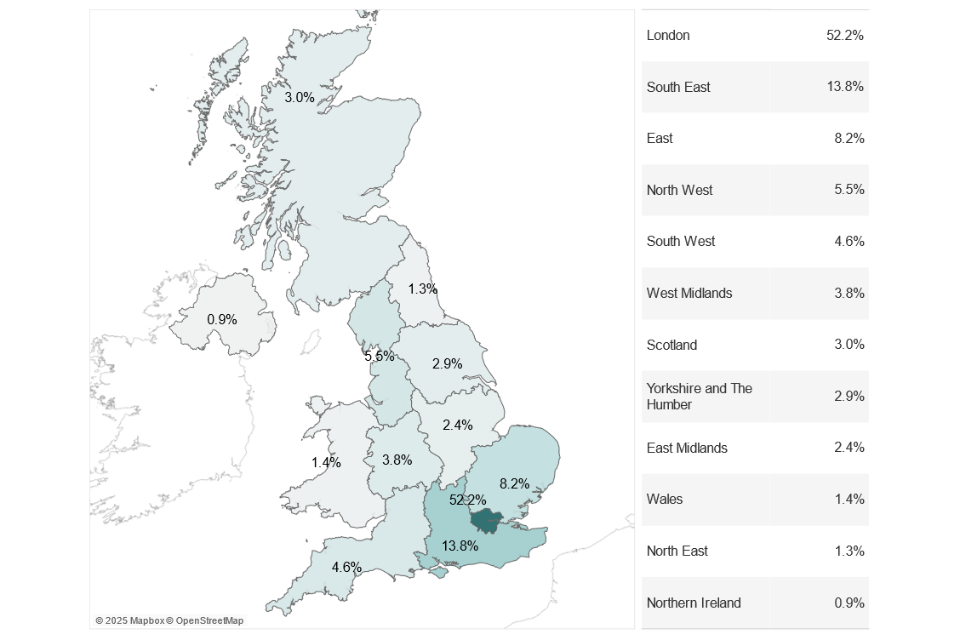

Since the sectoral analysis began in 2022, findings have shown high concentrations of AI companies in London, the South East and the East of England.

-

In 2024, London, the South East and the East of England still account for approximately 75% of registered office locations. However, the number of AI firms across other UK regions has been increasing year-on-year at annual growth rates of between 20% and 50%.

-

Compared to 2022, there are now at least double the number of AI companies in the West Midlands, North West, East Midlands, Wales and Yorkshire and Humber.

Growth enablers and barriers

-

Almost 90% of AI business representatives surveyed expect revenues to grow within the next 12 months, with 58% expecting revenue to grow by 50% or more — an increase of 6 percentage points from 52% expecting this level of growth in 2023. This indicates continued growth expectations across the economy, and a sense that UK businesses have a clearer view regarding the positive commercial potential of AI.

-

Interviews found that AI activity was becoming increasingly specialised, with new companies focussing on niche areas or industry-specific applications.

-

As in previous years, access to investment continues to present a significant challenge for many AI businesses. Fifty-three percent of survey respondents suggested that access to equity investment had significantly affected their ability to meet business goals in the past 12 months, with a further 36% citing access to other forms of external finance.

-

When asked which factors they expect to have an impact on future AI business activity, 58% of respondents cited the availability of growth funding.

-

When asked how their requirement for AI-related inputs has changed over the past 12 months, most respondents expected to see increases in the need for skills (71%), software and development tools (also 71%), and computing power (66%, n=196).

Strategic and geo-political considerations

-

Some UK AI businesses, particularly those working on more advanced or sensitive applications, raised concerns regarding their dependence on foreign technology and infrastructure. This reliance was noted to be especially pronounced in cloud infrastructure and LLMs, which form the backbone of certain AI applications and business models.

-

However, interviewees were also sceptical about the feasibility of developing fully sovereign AI capabilities due to high costs and availability of capital. Instead, interviewees suggested focusing on strategic areas of strength, maintaining international collaboration, and creating a regulatory environment that balances global innovation with safeguards for sensitive data.

1. Introduction

Perspective Economics, in collaboration with Beauhurst, Ipsos, glass.ai, and the AI Collaboration Centre (AICC) was commissioned by the Department for Science, Innovation and Technology in February 2025 to deliver an analysis of the UK’s artificial intelligence (AI) sector in 2024.

The aim of the study is to continue building a better understanding of the scale, profile, and economic contribution of UK’s AI Sector by updating previous data compiled in 2022 and 2023 to support government’s ongoing development and monitoring of key AI policies.

The emergence of consumer-facing generative AI tools in late 2022 and early 2023 radically shifted public conversation regarding the power and potential of AI. The 2023 sectoral analysis suggested that businesses across economic sectors were increasingly recognising the opportunities that AI could provide[footnote 3]. At the same time, policymakers and regulatory bodies were engaging with a range of important considerations regarding the future development and application of AI technologies, including risk and safety, regulation, and international cooperation.

In 2024, there has been a marked acceleration in the adoption of AI technologies[footnote 4], particularly generative AI. In response, government has introduced a more structured regulatory approach, building on its pro-innovation framework published in 2023. While still favouring a sector-specific model, regulators have begun issuing more detailed guidance and clarifications on the responsible use of AI, including transparency, accountability, and data protection[footnote 5]. The UK has also continued its international engagement, participating actively in global forums such as the AI Safety Summit[footnote 6] and contributing to international standards[footnote 7].

In addition to providing updated economic data, this report offers insights from UK AI businesses and stakeholders regarding the ongoing opportunities, challenges, enablers, and barriers to the continued growth of AI activity in the UK.

1.1. Methodology and sources

This study will form part of the broader DSIT evidence base on AI, building on similar studies conducted in 2022 and 2023. The study is required to measure the UK’s AI sector in terms of:

1. Number of companies and their sectoral specialisms, where they are located and identification of potential regional clusters.

2. The economic contribution of the UK AI sector including revenue, employment, investment, and Gross Value Added (GVA).

3. Products and services provided by the UK AI Sector, including a breakdown of dedicated and diversified AI companies and the sectors companies sell to.

4. Production inputs required, including staff numbers, finance and funding, level of compute.

5. The number of companies engaged in international trade and the key locations and value of that trade.

6. AI research and development (R&D) spending and output.

1.2. Approach

The study uses a mixed methods approach, combining desk-based review, qualitative and quantitative research and analysis (Figure 1.2).

Figure 1.2 – AI Sector Study 2023 method overview

A total of 52 stakeholder interviews were completed and 298 responses to the online survey were received. The 2023 company dataset was reviewed and updated using multiple sources to provide sector estimates for revenue, employment, and GVA in 2024.

The study refers to ‘dedicated’ and ‘diversified’ AI companies. For dedicated companies all activity is assumed to be AI related and therefore all revenue, employment and GVA for those companies is included in estimates. For diversified companies an estimated number of employees involved in AI activity is derived from web data provided by Glass.ai. AI related revenue and GVA is apportioned based on the estimated number of employees.

Key data sources used in the 2024 study are summarised in Table 1.1.

Table 1.1 – Summary of key data sources

| Purpose | Sources |

|---|---|

| Company Identification | Glass.ai (web) Bureau van Dijk Beauhurst Lightcast UKRI Gateway to Research Financial Times FDI Markets |

| Revenue, Employment, GVA | Bureau van Dijk Glass.ai (web) |

| Investment | Beauhurst |

1.3. Interpretation of data

Artificial Intelligence activity in the UK is not defined by a formal Standard Industrial Classification (SIC) code[footnote 8]. This study therefore uses experimental methods to identify and quantify AI activity across traditional economic sectors. The approach and methodology are consistent with those employed to produce analyses of the UK cyber security sector annually since 2018, and with the method used to create baseline evidence regarding the AI sector in 2022 and 2023[footnote 9]. The data used to inform the study includes:

-

Identification of AI firms according to an agreed taxonomy using multiple sources, including AI driven language models applied across websites, news, social media, academic and official sources.

-

Enrichment of web data using open and proprietary data sources including Companies House (company name, registration number, locations, incorporation date), Bureau van Dijk FAME (revenue, employment, profitability, remuneration, R&D spend) and Beauhurst (external grants, fundraisings, accelerator attendance, M&A activity).

1.3.1. Comparison to previous study

This 2024 study builds on the previous AI sectoral analyses. It uses the same approach and methodology to identify AI companies and produce headlines sector estimates of revenue, employment, and GVA.

As the sector continues to evolve, so do the analytical parameters used to produce lower-level analyses of the sector. The study team worked with DSIT representatives and external experts to update the taxonomy used to define and categorise the sector. The main changes in the 2024 taxonomy are:

- Further disaggregation of capabilities to reflect increasing specialisation.

- Grouping of unique AI capabilities into a new set of higher-level categories.

Further, the 2024 taxonomy includes reference to data centres as a new component within the AI Infrastructure category. These changes were made to support AI Growth Zones policy implementation and to provide more consistent categorisation of AI capabilities. All previous capability tags remain to enable consistent timeseries analysis.

The 2024 study uses the same LLM-enabled classification techniques to create capability tags based on comprehensive descriptive information. Improved coverage of web data means that more information is available regarding the products and services provided by companies included in this 2024. In turn, this has enabled better refinement and more comprehensive classification and tagging compared to previous studies. As with previous studies, headline estimates can be considered comparable, lower-level analyses regarding products, services and capabilities may not be entirely comparable because methods have continued to evolve.

It is important to note that, due to a proliferation of references to artificial intelligence within business websites and marketing material, this study has applied more stringent criteria to determine whether a company is in-scope, as set out in an accompanying methodology note.

1.4. Acknowledgements

The authors would like to thank members of the DSIT team for their input throughout the study. DSIT and the report authors would also like to thank all those who contributed to the research, including those who took part in in-depth strategic stakeholder interviews, responded to the business survey, or otherwise offered evidence and insights to the study.

2. UK artificial intelligence sector profile

According to the OECD, artificial intelligence (AI) is “a transformative technology capable of tasks that typically require human-like intelligence, such as understanding language, recognising patterns and making decisions”. In the UK, artificial intelligence is used by innovative companies across sectors to solve problems and improve processes that affect millions of lives every day, for example:

-

Google Deepmind is an AI research and development company that uses advanced machine learning capabilities to solve problems in healthcare, scientific research, digital transformation and more.

-

Darktrace is a cybersecurity company that uses AI for real-time threat detection and response by recognising abnormal network patterns. It provides a proactive approach to cyber resilience that helps keep data, networks, and systems safe.

-

Tractable uses computer vision and machine learning techniques to quickly and accurately assess damage in everything from road accidents to natural disasters, helping to make insurance claim processes faster and more accurate.

-

Limejump uses AI and machine learning across several key areas of energy management, including distributed network management, grid balancing and demand response, helping to support the transition to a more sustainable and efficient energy system.

This section explains how AI is defined for the purposes of the sectoral analysis, before providing key statistics regarding the profile of the AI sector in the UK.

Key takeaways

-

There has been a 58% increase in the number of AI companies identified compared to 2023.

- There is broad recognition of AI-enabled business opportunities across the economy, evidenced by the fact that:

- More than 90% of firms added in 2024 are SMEs.

- The share of micro businesses is 10 percentage points higher in 2024 compared to 2023 (n=4,114 and 2,150 respectively).

- The share of diversified companies continues to increase, from 41% of the total in 2023 to 44% of the total in 2024.

-

The number of AI company incorporations continues to trend upwards over time, peaking at ~650 new company registrations in 2023.

- Most in-scope companies are developing or applying perceptual systems i.e., computer vision and image processing, speech and audio processing, multi-modal integration, and anomaly / signal detection.

2.1. Defining the UK artificial intelligence sector

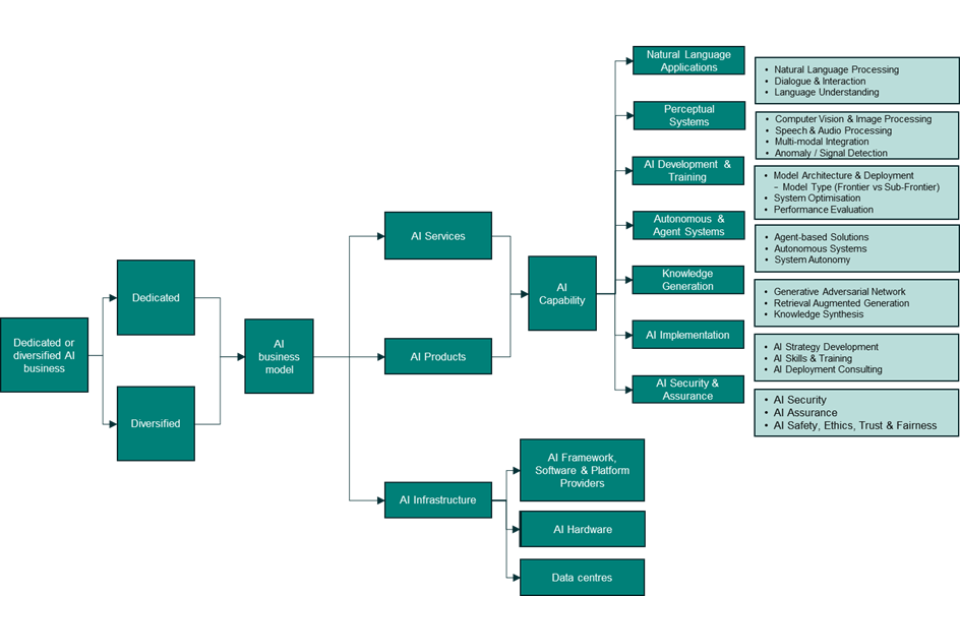

Given that Standard Industrial Classification (SIC) codes do not yet include a specific ‘artificial intelligence’ classification, the analyses contained in this report are based on a business-focussed taxonomy that can better reflect AI activity in the UK. The taxonomy used to describe AI activity in this study is illustrated in Figure 2.1.

Figure 2.1 – UK AI taxonomy

Source: Perspective Economics

Salient points regarding the sector taxonomy include:

-

Dedicated vs diversified AI companies: at the highest level, the taxonomy segments the business population according to whether they are a dedicated AI company, or whether AI activity makes up a smaller proportion of a much broader commercial business offering. Dedicated AI companies are businesses that provide a proprietary AI technical service, product, platform, or hardware as their primary revenue source. Whereas diversified companies provide AI products or services as part of a broader business offer.

-

AI business model: at a lower level, the taxonomy segments between creators of strategic AI infrastructure[footnote 10], developers of AI products[footnote 11] and AI service providers[footnote 12]. Adopters of AI products or services developed by others are outside the scope of this study. The distinction between using AI to produce a product or service (AI adoption) and building AI products and services on top of the AI technologies of others (AI product or service development) has become increasingly difficult to define. Consequently, in this years’ study more web data has been collated on in-scope companies, and processed using industry-leading language models to better understand and assess the product and service offer of companies included in the 2024 dataset.

-

AI capabilities: capabilities apply across business models, and an AI business may have more than one capability. Core capabilities have been updated following a taxonomy workshop comprising industry and academic experts and policy representatives. Changes include: further disaggregation of capabilities to reflect increasing specialisation in the market for AI products and services; and grouping of unique AI capabilities into a new set of higher-level categories.

These changes have been made in consultation with DSIT and sector experts to support AI Growth Zones policy implementation and to provide more consistent categorisation of AI capabilities. All previous capability tags remain to enable consistent time series analysis.

In addition, each in-scope company has been classified into industry sectors using a bespoke text classification model based on sectoral references contained within descriptive company information gathered from official accounts and websites. A total of 22 sectors are included in the 2024 study. A company may operate in one or more of the following sectors:

- Aerospace and defence

- Agriculture and food

- Automotive and transportation

- Construction and real estate

- Consumer goods

- Education and training

- Energy and utilities

- Entertainment and media

- Environmental and sustainability

- Financial services

- Healthcare and wellness

- Information technology

- Life sciences and biotech

- Logistics and supply chain

- Manufacturing

- Marketing and advertising

- Professional services

- Research and development

- Retail and E-commerce

- Security and investigations

- Telecommunications

- Travel and hospitality

2.2. Number of AI companies

A total of 5,862 firms have been identified within the scope of this 2024 study, an increase of 58% from 3,713 firms in 2023. Over 90% of this increase is additional SMEs, suggesting significant opportunities across the economy for new AI businesses to be funded and grow.

Size profile

The size profile of AI companies in 2024 remains largely consistent with previous years. Ninety-five percent of companies identified in 2024 are SMEs (2023 = 96%) and 5% are large companies (2023 = 4%, Table 2.1). 165 large firms have entered the scope of the analysis due to a combination of new AI service provision, how companies are now communicating their product offer (i.e., more common reference to AI).

Table 2.1 - Size profile of UK AI companies

| Business size | Percentage | |

|---|---|---|

| Micro | 70% | |

| Small | 15% | |

| Medium | 9% | |

| Large | 5% |

Additional large-sized firms fall predominantly within the Information Technology and Professional Services sectors (77%, n=126), and add substantively to total revenue and employment. Example companies include Fujitsu (multi-cloud data analytics solutions)[footnote 13], and the London Stock Exchange Group (AI-powered analytics tools)[footnote 14].

Comparison to wider business population estimates in Table 2.2 suggests that the AI sector has a smaller share of micro businesses than the general UK business population. Comparison to 2023 shares points to a combination of increased development of AI product and service offerings across the wider economy, and a proliferation of AI start-ups (the share of micro businesses is 10 percentage points higher in 2024).

Table 2.2 – AI size profile comparison

| Size | UK Business Population Estimates (2024) | % of Total | AI Sectoral Analysis 2024 (2023) | % of Total 2024 (2023) |

|---|---|---|---|---|

| Large (250+ employees) | 8,250 | 1% | 320 (159) | 5% (4%) |

| Medium (50–249) | 37,750 | 3% | 532 (357) | 9% (8%) |

| Small (10–49) | 219,900 | 15% | 896 (1,047) | 15% (28%) |

| Micro (1–9) | 1,161,265 | 81% | 4,114 (2,150) | 70% (60%) |

| All Businesses with at least 1 employee | 1,427,165 | 100% | 5,862 (3,713) | 100% |

Source: Department for Business and Trade, Perspective Economics

2.3. Dedicated and diversified AI companies

Of the 5,862 active companies identified through the study, 56% are dedicated and 44% are diversified (2023 = 59% and 41% respectively). The share of diversified companies continues to increase, pointing to ongoing integration of artificial intelligence across the entire economy (Table 2.3).

Table 2.3 – dedicated vs diversified companies over time

| Year | Dedicated | Diversified |

|---|---|---|

| 2022 | 60% (n= 1,909) | 40% (n=1,261) |

| 2023 | 59% (n= 2,204) | 41% (n=1,509) |

| 2024 | 56% (n=3292) | 44% (n=2,750) |

Source: Perspective Economics

Table 2.4 overleaf shows that additional large companies are mostly diversified (reflected by a 5 percentage point increase in the share of large, diversified firms compared to 2023). There are also higher shares of diversified firms across small and medium size bands – again pointing to widespread integration across the economy.

Table 2.4 – Dedicated and diversified AI companies by size

| Firm size | Dedicated | Diversified | Total |

|---|---|---|---|

| Large | 8% (n=24) | 92% (n=296) | 100% |

| Medium | 32% (n=171) | 68% (n=361) | 100% |

| Small | 43% (n=383) | 57% (n=513) | 100% |

| Micro | 66% (n=2,714) | 34% (n=1,400) | 100% |

Source: Perspective Economics (pp = percentage point)

2.4. AI company registrations

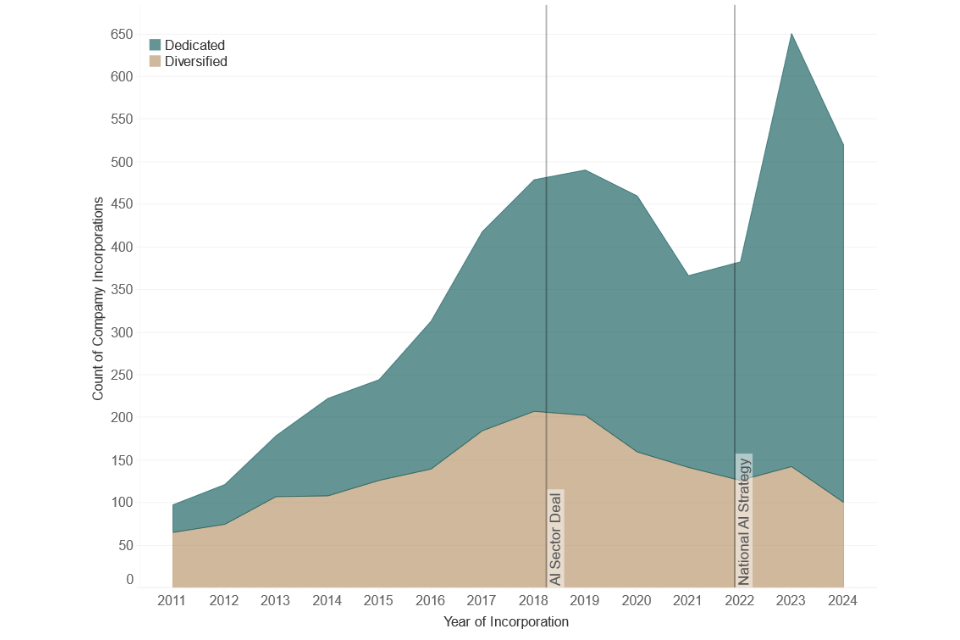

The number of AI company incorporations continues to trend upwards over time, to a new peak of ~650 new company registrations in 2023 (Figure 2.2). Note that there is a lag between the date at which new companies are registered and can subsequently be identified by the study through web presence and / or official accounts data. It is therefore likely that the total number of new company registrations in 2024 will be higher than the stated figure.

Figure 2.2 – AI company registrations

Source: Companies House (2011 - 2024 | n=4,942 incorporations since 2011)

2.5. AI business model

In the 2022 study, a greater proportion of dedicated AI companies primarily produced AI related products. In 2023, most dedicated AI companies remained focussed on developing AI products (69%, n=1,516), however the share of dedicated companies offering AI related services increased by 15 percentage points, from 16% in 2022 to 31% in 2023. The balance between product and service development among dedicated AI companies remained largely unchanged in 2024 (Table 2.6)[footnote 15].

Table 2.6 - AI business models (dedicated companies only)

| Offering Type | Percentage |

|---|---|

| Products | 71% |

| Services | 29% |

Source: Perspective Economics. Note: Products also include strategic infrastructure providers given they represent less than 1% of all dedicated firms.

2.6. AI capabilities

As outlined in Section 1, the sector taxonomy has evolved based on input from the study’s panel of academic advisors. AI capabilities are now defined at 2 levels to better delineate between application areas and specific technologies, and to accommodate technological developments such as agentic AI.

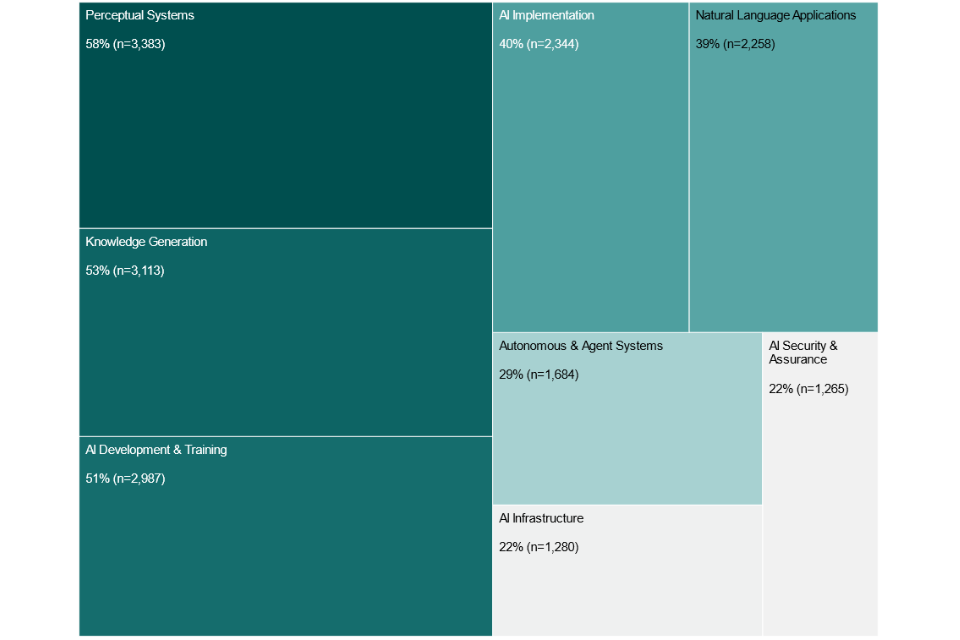

Figure 2.3 shows the number and proportion of businesses categorised into one or more of 8 higher level domains, namely:

- Natural language applications

- Perceptual systems

- AI Development and training

- Autonomous and agent systems

- Knowledge generation

- AI Implementation

- AI Security and assurance

- AI infrastructure

Most in-scope companies are developing or applying perceptual systems i.e., computer vision and image processing, speech and audio processing, multi-modal integration, and anomaly / signal detection. Over half are involved primarily in developing or applying generative technologies e.g., generative adversarial networks, retrieval augmented generation and / or knowledge synthesis. Smaller proportions are primarily involved in developing or applying autonomous and agentic systems, AI security and assurance products and services, or AI infrastructure.

Figure 2.3 – AI capabilities (high level domains)

Source; Perspective Economics

The study subsequently applied tailored LLM-enabled scripts to tag each company based on whether detailed web data evidenced the development or use of lower-level technologies. Table 2.7 below presents results of the tagging process, including the proportion of firms deemed to be developing or applying the technology.

Table 2.7 – AI capabilities (lower-level tools / technologies)

| Domain | Lower-Level Technology | % Firms with Tag |

|---|---|---|

| Natural Language Applications | natural language processing | 38% |

| Natural Language Applications | language understanding | 36% |

| Natural Language Applications | dialogue and interaction | 24% |

| Perceptual Systems | anomaly detection | 41% |

| Perceptual Systems | computer vision | 26% |

| Perceptual Systems | image processing | 25% |

| Perceptual Systems | signal detection | 19% |

| Perceptual Systems | multi-modal integration | 13% |

| Perceptual Systems | audio processing | 9% |

| AI Development and training | model training | 36% |

| AI Development and training | model development | 35% |

| AI Development and training | system optimisation | 28% |

| AI Development and training | sub-frontier models | 25% |

| AI Development and training | model deployment | 22% |

| AI Development and training | model performance evaluation | 16% |

| AI Development and training | model architecture | 5% |

| AI Development and training | llm development | 3% |

| AI Development and training | foundation model training | 2% |

| AI Development and training | frontier models | 1% |

| Autonomous and agent systems | agent systems | 23% |

| Autonomous and agent systems | agent-based solutions | 21% |

| Autonomous and agent systems | system autonomy | 16% |

| Autonomous and agent systems | autonomous systems | 15% |

| Autonomous and agent systems | agentic ai | 15% |

| Knowledge generation | knowledge synthesis | 51% |

| Knowledge generation | retrieval augmented generation | 17% |

| Knowledge generation | rag models | 9% |

| Knowledge generation | generative adversarial networks | 3% |

| AI implementation | AI deployment consulting | 37% |

| AI implementation | AI strategy development | 27% |

| AI implementation | AI skills training | 16% |

| AI Security and assurance | ai assurance | 15% |

| AI Security and assurance | AI security | 15% |

| AI Security and assurance | AI safety | 9% |

| AI Security and assurance | trust fairness | 9% |

| AI Security and assurance | AI ethics | 6% |

| AI infrastructure | cloud ai services | 14% |

| AI infrastructure | edge AI solutions | 8% |

| AI infrastructure | training infrastructure | 6% |

| AI infrastructure | AI compute platforms | 6% |

| AI infrastructure | AI hardware | 4% |

3. Economic contribution of UK AI companies

This section presents updated estimates of the economic profile and contribution of AI companies to the UK economy in 2024. Findings draw on modelled data based on reported company data (where available) and survey responses.

Key takeaways

-

In 2024, total estimated AI revenue has increased by ~68% to ~£23.9 billion (+£9.7 billion).

-

As in 2023, the vast majority (96%) of the increase in AI related revenues comes from diversified AI companies (n=£9.3 billion of £9.7 billion).

-

Dedicated AI company revenues increased by 9% between 2023 and 2024, from £4.4 billion to £4.9 billion.

-

AI related employment has increased by 33%, to a total of 86,139 in 2024 (+21,600).

-

Amazon, Google Deepmind, IBM, and Meta have added most to estimated revenue and employment increases in absolute terms, while frontier generative AI model providers Anthropic and OpenAI have seen among the largest percentage increases in estimated UK AI employment since 2023.

-

Estimated GVA among dedicated AI firms has almost doubled within the past year, from £1.2 billion in 2023 to £2.2 billion in 2024 (+83%, £1.0 billion).

3.1. Estimated revenue

Estimates produced for the 2023 study indicated that UK AI companies generated a total of £14.2 billion in revenues. This year total estimated AI revenue has increased by ~68% to ~£23.9 billion (+£9.7 billion). As in 2023, most of the increase in AI related revenues comes from diversified AI companies (£9.3 billion of £9.7 billion, 96%). While this increase inevitably includes an element of product and service relabelling (e.g., from software development and data analytics to artificial intelligence) it can still be considered indicative of AI product and service development across the economy. In contrast to the position in 2023, dedicated company revenues in 2024 have increased, from £4.5 billion to £4.9 billion (+9%). This increase comes despite the loss of ~100 dedicated companies from the 2023 dataset due to changes in status (see Section 2.7), and reduced revenues among some larger firms. Revenue growth is largely due to strong financial performance among larger UK AI companies such as Google DeepMind, Databricks, Wayve, and Featurespace[footnote 16].

Table 3.1 – Revenue estimates

| Type | Estimated AI Related Revenue (£ billion, 2022) | (£ billion, 2023) | (£ billion, 2024) |

|---|---|---|---|

| Dedicated | 5.2 (49%) | 4.5 (32%) | 4.9 (21%) |

| Diversified | 5.4 (51%) | 9.7 (68%) | 19.0 (79%) |

| Total | 10.6 (100%) | 14.2 (100%) | 23.9 (100%) |

Source: Bureau van Dijk, Perspective Economics

More than 3 quarters of estimated revenues have been generated by companies incorporated since 1990 (76%, £18.3 billion), and 40% by companies incorporated since 2005 (£9.7 billion).

A total of 2,116 companies have remained in the dataset since 2022. Estimated revenue among these companies has increased by 68%, from £9.2 billion in 2022 to £15.4 billion in 2024.

3.1.1. Revenue by company size

In 2023, approximately 80% of all UK AI revenues (£11.4 billion) were generated by large firms which made up 4% of all companies identified. Small and medium sized companies accounted for a smaller share of revenues in 2023 (18%, £2.7 billion) than they did in 2022 (26%, £2.8 billion). In 2024, inclusion of additional large, diversified firms means that this group of firms now account for 85% of total revenues, with micro, small and medium sized companies now accounting for 15% of total revenues.

Table 3.2 – Revenue estimates by firm size

| Firm Size | Estimated AI Revenue (£ billion) |

|---|---|

| Large | 20.4 (85%) |

| Medium | 1.9 (8%) |

| Small | 1.1 (5%) |

| Micro | 0.5 (2%) |

Source: Perspective Economics

3.2. Estimated employment

Since the study began in 2022, the number of Full Time Equivalent (FTE) employees employed across both dedicated and diversified AI companies has increased by 72%, from 50,040 in 2022 to 86,139 in 2024 (+36,099).

Approximately 36% of employment is within dedicated AI companies (47%, 2023) and 64% is within diversified companies (53%, 2023) (n=30,667 and 55,524 respectively). For diversified companies, figures are estimates of AI-related employment and suggest that the share of employment within diversified AI companies is 11 percentage points higher in 2024. Table 3.3 provides a summary of headline revenue and employment figures compared to 2022 and 2023.

Table 3.3 – Revenue and employment estimates

| Metric | 2022 | 2023 | 2024 |

|---|---|---|---|

| Revenue | £10.6 billion | £14.2 billion | £23.9 billion |

| Employment | 50,040 | 64,539 | 86,139 |

| Revenue Change (%) | 34% | 68% | |

| Employment Change (%) | 29% | 33% |

Source: Perspective Economics

3.2.1 Strategic AI provider activity

For the 2023 analysis, a new group of 25 strategic infrastructure providers was created (including companies such as Microsoft, Google, Meta, OpenAI and Anthropic) so that subsequent reports could track the UK activity of these strategically significant firms over time. These firms saw strong growth in AI related activity, with estimated UK AI-related revenues up by ~30% and estimated AI employment up by ~26%. Amazon, Google Deepmind, IBM, and Meta have added most to estimated revenue and employment increases.

Quantum AI provider Quantinuum and frontier generative AI model providers Anthropic and OpenAI have seen among the largest percentage increases in estimated UK AI employment since 2023, each more than doubling their UK headcounts.

3.3. Estimated Gross Value Added (GVA)

Modelled data for 3,293 dedicated AI companies suggests that aggregate GVA has almost doubled within the past year, from £1.2 billon in 2023 to £2.2 billon in 2024 (+83%, £1.0 billon). This compares to wider GVA growth of 4.6% across the economy[footnote 17]. In 2024, revenue generated by dedicated AI companies has grown substantively across micro, medium, and large sized firms (small sized firms generated marginally lower revenues in 2024 compared to 2023). GVA among dedicated companies has grown across firms of all sizes. Table 3.4 provides a breakdown of 2024 revenues and GVA across dedicated AI firms of different sizes.

Table 3.4 – Dedicated company revenue and GVA by size

| Firm Size | Estimated AI Revenue (£m) | Estimated AI GVA (£m) |

|---|---|---|

| Large | 2,491 | 1,301 |

| Medium | 1,315 | 354 |

| Small | 755 | 235 |

| Micro | 339 | 282 |

Source: Perspective Economics

3.4. Summary of economic contribution

There has been a 58% increase in the number of companies that fall within the scope of the sectoral analysis compared to 2023 (n=5,862 and 3,713 respectively). Revenues generated by these companies are 68% higher than 2023 and employment is 33% higher. Among dedicated AI companies, there has been an 83% increase in GVA and 1.3 times the level of investment compared to 2023 (see Section 4).

4. Investment

This section provides findings from analysis of the investment raising activity of UK AI companies included in the study. It draws on investment data from the Beauhurst platform, which tracks announced and unannounced investments in high-growth UK companies, together with findings from qualitative interviews with AI investors and relevant AI survey business responses[footnote 18].

Key takeaways

-

Investment data for dedicated companies in 2024 shows that the value of investment has rebounded to £2.9 billion – above the record high seen in 2022.

-

Deal volumes have fallen slightly from 2022 levels (from 512 to 496), but the average deal size in 2024 was still notably higher than 2022, at ~£5.9 million (2022, £4.6 million).

-

Investment data continues to support qualitative views of a strong start-up landscape in the UK, yet also suggests scope for additional scale-up and later stage capital.

-

Outside of Information Technology the most substantive levels of investment have gone into dedicated companies involved in life sciences and biotech, automotive and transportation, financial services, and healthcare and wellness.

-

In 2024 there were 51 AI related inward investment projects into the UK, representing more than £15 billion in capital investment and expected to create more than 6,500 jobs.

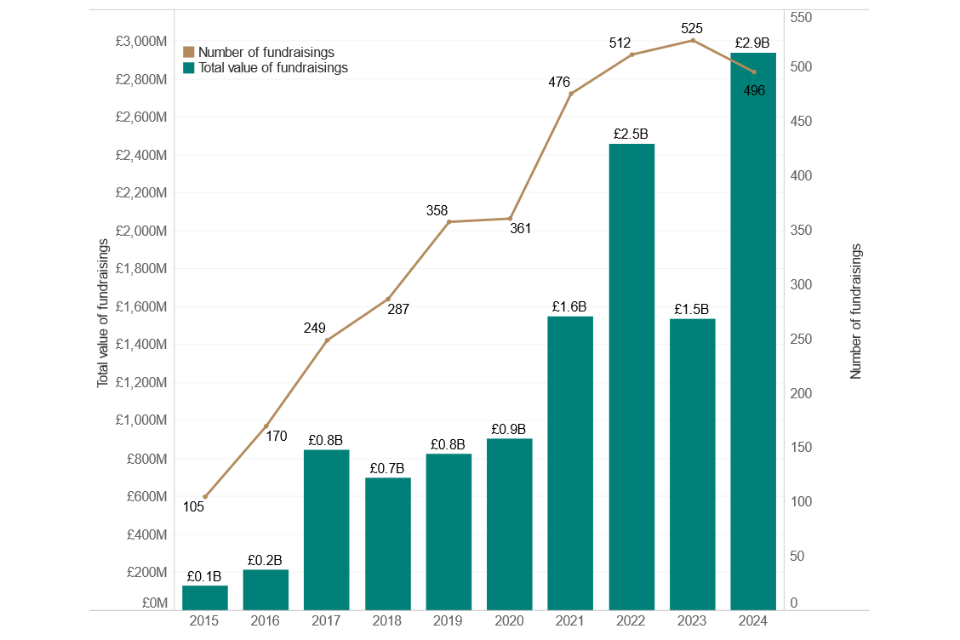

AI companies raised £2.4 billion in equity investment in 2022[footnote 19], with an average deal size of ~£4.6 million. These record highs in 2022 were driven by several large deals, including a £210 million deal raised by peer-to-peer lending platform Lendable in March – the largest single equity deal raised by an AI company between 2021 and 2023. In 2023, the value of investment in AI companies fell by ~40% to £1.5 billion, yet the volume of deals remained relatively stable.

Investment data for dedicated companies in 2024 shows that the value of investment has rebounded to £2.9 billion – above the record high seen in 2022. Deal volumes have fallen slightly from 2022 levels (from 512 to 496), but the average deal size in 2024 was still notably higher than 2022, at ~£5.9 million (2022, £4.6 million).

Figure 4.1 – Investment headlines (dedicated companies only)

Source: Beauhurst

International investors continue to provide the largest investment contributions, including Microsoft, Nvidia and Softbank. MMC Ventures was once again the largest UK contributor in 2024 (fourth highest investment value). Wayve, Synthesia, ElevenLabs and Stability AI secured the highest level of investment in 2024.

4.1. Investment profile

Businesses seeking investment can be classified into stages based on their growth and development: seed, venture, growth, and established. Seed-stage companies are generally newly formed start-ups with few employees and low valuations, often seeking their initial investment round. Venture-stage companies have typically spent years honing their business models and technologies, building an established reputation, and securing investment and valuation in the millions. Companies in the growth stage have been active for over 5 years, have regulatory approval, and are likely to bring in significant revenue and investment. Established companies have been trading for over 15 years and have a track record of profitability or significant annual turnover after more than 5 years.

The proportion of investment-raising firms at different stages of evolution (Table 4.1) continues to support qualitative views of a strong start-up landscape in the UK – more than half of the dedicated companies identified in 2024 are seed stage businesses, and that share has been increasing year-on-year.

A slight increase in the proportion of firms at venture and growth stages, from 37% in 2023 to 39% in 2024, offers some scope for optimism regarding the ability of dedicated AI companies to scale effectively. Investor consultations suggest that, as a sector, AI has attracted both old and new investors (individuals as well as funds) because of the scale of the opportunity, in terms of both potential value and concentration of AI companies. For existing investors seeking to slow down for liquidity reasons, the small number of new deals they do may be AI so that the portfolio has exposure. New equity investors have also been lured into the asset class given the scale and prevalence of the AI opportunity.

However, findings from qualitative investor interviews reiterated the need for continued focus on helping businesses to scale. Interviewees suggested that the UK is “very good at the start phase, but [that at] the scale up phase (beyond Series A), there's a missing piece there". Reasons offered for this scale-up challenge include a lack of larger scale growth capital, a degree of risk aversion among existing UK investors, and a lack of experienced investors in the UK.

One final thing I would say is the [Mansion House Reforms], you know, trying to get pension funds to invest in VC. The adoption has been pretty poor, I think a lot more needs to be done to get UK pension money into early-stage funds. In particular, those investing in UK businesses.

AI Investor

Table 4.1 – Dedicated AI company stage of evolution (vs 2022 and 2023)

| Funding Stage | 2022 | 2023 | 2024 |

|---|---|---|---|

| Seed | 44% | 51% | 52% |

| Venture | 34% | 29% | 30% |

| Growth | 11% | 8% | 9% |

| Established | 2% | 2% | 2% |

| Exited | 7% | 5% | 5% |

Source: Perspective Economics, Beauhurst

Of 327 dedicated investment raising companies included in the original 2022 dataset, 24% are either venture or growth stage businesses in 2024 (n=78) and 2% have exited (n=7).

4.2. Investment by sector and capability

Outside of Information Technology (the most commonly occurring sector classification) the most substantive levels of investment since Beauhurst tracking began in 2006 have gone into dedicated companies involved in life sciences and biotech, automotive and transportation, financial services, and healthcare and wellness (Figure 4.2). Large investments in companies such as Wayve and Five AI are reflected in high automotive and transportation investment values and relatively low deal numbers.

Figure 4.2 – Investment by sector (dedicated companies only | all time)

Source: Perspective Economics, Beauhurst

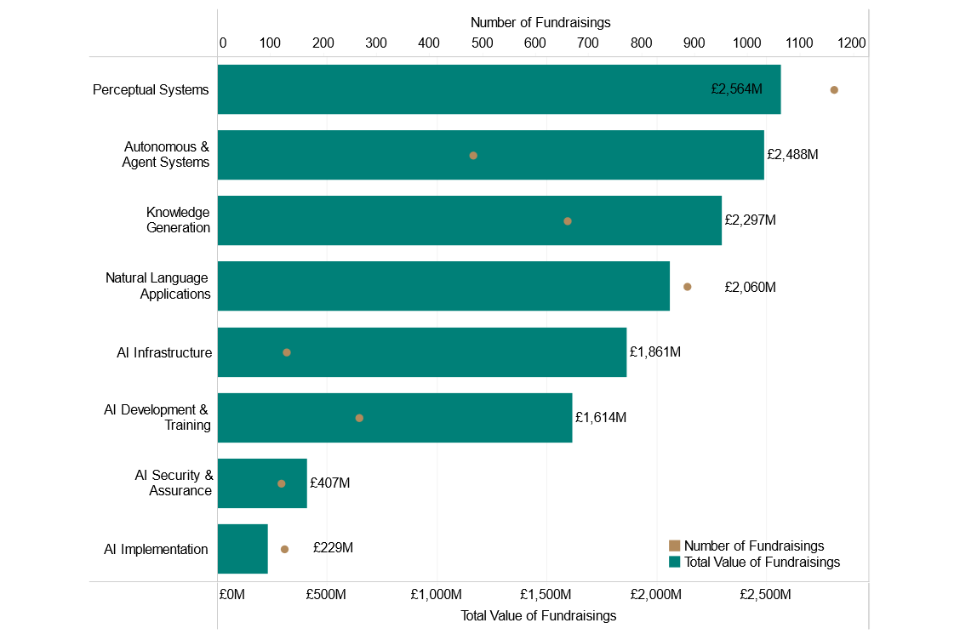

Similar analysis suggests that dedicated companies involved in developing or applying perceptual, autonomous, and agentic systems have secured the highest levels of funding to date (Figure 4.3). The number of deals secured by companies involved in developing AI infrastructure is lower, signifying higher individual deal values.

Figure 4.3 – Investment by capability (dedicated companies only | all time)

Source: Perspective Economics, Beauhurst

4.3. Foreign Direct Investment

In 2023, data on inward investment into the UK shows that there were almost 200 AI-related investments (2019 – 2023). Half of these investments were by information technology companies (n=96) and of those, almost one fifth (19%, n=18) were made in 2023. At that stage, significant inward investment projects included Microsoft (£2.5 billion investment into new datacentres and AI safety and research activities)[footnote 20], C3.ai (relocation of EMEA headquarters to London)[footnote 21] and Lambda Automatica (expansion of R&D and new products)[footnote 22].

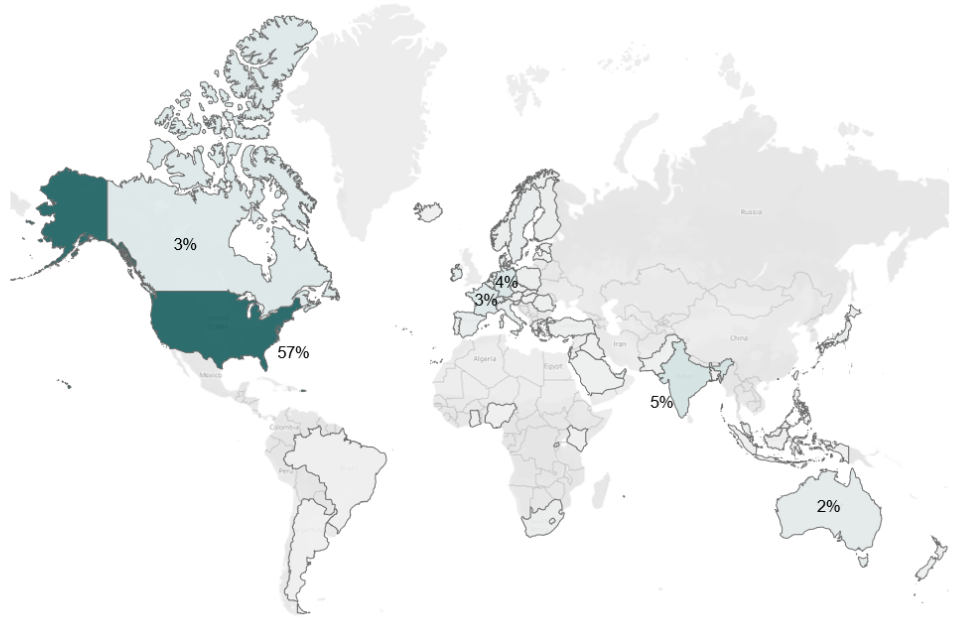

In 2024, there were a further 51 AI related inward investment projects into the UK. These projects represent more than £15bn in capital investment and are expected to create more than 6,500 jobs. Infrastructure investments by Amazon, Vantage Data Centres, CoreWeave, Google and Virtus Data Centres most of inflows announced in 2024. The US accounts for most of the inward investment, while substantive inflows also come from source markets including India and Europe.

5. Location of UK AI companies

Understanding the location of AI activity helps to identify and better understand notable clusters and regional strengths to inform policy making. This section presents findings regarding the location of AI companies identified in the 2024 study and draws comparisons with regional data from 2022 and 2023.

Key takeaways

-

Since the sectoral analysis began in 2022, findings have shown high concentrations of AI companies in London, the South East and the East of England.

-

In 2024, London, the South East and the East of England still account for approximately 75% of registered office locations.

-

The number of AI firms has been increasing year-on-year across all UK regions at annual growth rates of between 20% and 50%.

-

Compared to 2022 there are now at least double the number of AI companies in the West Midlands, North West, East Midlands, Wales and Yorkshire and Humber.

-

In 2024, 16% of the AI companies identified are internationally headquartered, compared to approximately 9% of AI companies in 2022 and 2023.

-

Approximately 26% of UK headquartered AI companies have established an international presence (n=1,500).

-

Forty-six percent of all international office locations operated by UK headquartered companies are in the US. India, Germany, Australia, and Canada also represent key trading locations for UK headquartered AI companies (accounting for between 3% and 8% of all UK headquartered international trading locations).

5.1. AI activity by UK region

Since the sectoral analysis began in 2022, findings have shown high concentrations of AI companies in London, the South East and the East of England. The regional profile of registered offices remained largely unchanged between 2022 and 2023. In 2024, London, the South East and the East of England still account for ~75% of registered office locations (Figure 5.1)[footnote 23].

The extent of AI activity in London has been perceived by several interviewees within qualitative research as a strength of the UK’s wider AI ecosystem. As one interviewee put it, London is "the third largest city in the world for starting AI companies" and the UK is "the third biggest player in AI globally, behind China and the USA".

We've built a tech ecosystem that is worth it for American and other international investors to scour for founders, we need a real plan to incentivise them to stay.

Strategic Stakeholder[footnote 24]

Alongside extensive activity in London, the number of AI firms has been increasing year-on-year across all UK regions at annual growth rates of between 20% and 50%. Compared to 2022 there are now at least double the number of AI companies in the West Midlands, North West, East Midlands, Wales and Yorkshire and Humber.

Approximately one fifth of new company incorporations in 2024 were outside of London, the South East and the East of England, a similar proportion to 2023. In both 2023 and 2024 the North West has accounted for the fourth highest share of new company incorporations, followed by the West Midlands, the South West and Yorkshire and the Humber.

Figure 5.1 – Registered offices by region

Source: Perspective Economics

5.2. Regional AI activity by sector

Previous analysis of company sector classifications suggested that outside of London, the South East and East of England, there is more regional activity in automotive and transportation, manufacturing, energy and utilities and agricultural technology.

In 2023, London, the South East and the East of England accounted for 84% of financial services AI companies and for approximately 80% of AI companies involved in R&D, marketing and advertising, and entertainment and media. These patterns of regional activity still broadly hold, i.e., there are still comparatively higher shares of automotive and transportation, manufacturing, energy and utilities and food and agriculture companies across other regions. However, the 2024 data may also provide an indication of strong levels of AI product and service development regionally, where wider sectoral strengths exist. This includes, for example, in telecommunications and agriculture and food[footnote 25] and within the travel and hospitality sector in London, the South East and East of England[footnote 26].

Table 5.1 – Firm counts by region (excluding information technology)

| Sector | London, South East, East of England | Other Regions | Total |

|---|---|---|---|

| Financial services | 85% | 15% | 100% |

| Travel and hospitality | 85% | 15% | 100% |

| Logistics and supply chain | 84% | 16% | 100% |

| Aerospace and defence | 78% | 22% | 100% |

| Marketing and advertising | 78% | 22% | 100% |

| Professional services | 78% | 23% | 100% |

| Education and training | 77% | 23% | 100% |

| Life Sciences and biotech | 75% | 25% | 100% |

| Retail and e-commerce | 74% | 26% | 100% |

| Entertainment and media | 73% | 27% | 100% |

| Environmental and sustainability | 72% | 28% | 100% |

| Research and development | 72% | 28% | 100% |

| Construction and real estate | 72% | 28% | 100% |

| Healthcare and wellness | 71% | 29% | 100% |

| Security and investigations | 68% | 32% | 100% |

| Consumer goods | 67% | 33% | 100% |

| Energy and utilities | 65% | 35% | 100% |

| Agriculture and food | 63% | 37% | 100% |

| Manufacturing | 61% | 39% | 100% |

| Telecommunications | 60% | 40% | 100% |

| Automotive and transportation | 57% | 43% | 100% |

Source: Perspective Economics

5.3. Internationally headquartered AI companies

In 2022 and 2023, approximately 9% of AI companies identified were internationally headquartered. In 2024, the share of internationally headquartered companies has increased to 16% (n=936).

UK-US cooperation on AI has been close in recent years, reflected in collaboration on AI safety, joint research initiatives and private sector ties. This cooperation is also reflected in location data, which shows that 57% of non-UK headquartered companies identified in the 2024 study have their headquarters in the US. Dozens of AI companies from India, Germany, Canada, and France have also established a presence in the UK (Figure 5.2).

Figure 5.2 – Presence of internationally headquartered AI companies

Source: Perspective Economics

5.4. Trade in services

The Office for National Statistics (ONS) gathers data on UK trade in services via the Annual Survey of International Trade in Services (AITIS) survey[footnote 27]. Respondent businesses are asked which services they import and export. Services categories are aligned to the Extended Balance of Payments Services Classification (EBOPS2010)[footnote 28] for use within wider Balance of Payments statistics. AI related services may fall under a number of EBOP classifications, including but not limited to:

-

8.3 Licences to reproduce and/or distribute computer software: Rights and licenses for reproducing and distributing computer software products, which may include AI software, algorithms, and trained models.

-

9.2 Computer services: Divided into computer software (9.2.1) including software originals, and other computer services (9.2.2). This category may include AI-as-a-Service platforms, cloud-based AI processing, and computational AI services.

Table 5.2 shows that the total value of UK exports of software licensing and computer services has more than doubled since 2018, and grew by 33% between 2022 and 2023 (post-GPT). While it is not possible to attribute this export growth to AI related services, the substantive increase between 2022 and 2023 (in line with heightened interest in AI technology) suggests that AI related services are likely to account for a share of the increase. By comparison, other services (excluding manufacturing, maintenance and repair and government services) grew by 55% since 2018 and by just 13% between 2022 and 2023.

Table 5.2 – AI-related UK exports

| Year | Value (£ billion) (% Change Since 2018) |

|---|---|

| 2018 | 16.2 (0.0%) |

| 2019 | 17.4 (7.4%) |

| 2020 | 18.1 (11.6%) |

| 2021 | 20.8 (28.4%) |

| 2022 | 24.9 (53.6%) |

| 2023 | 33.1 (104.4%) |

| 2024 | 33.2 (104.9%) |

5.4.1. UK HQ AI companies with international locations

The setting-up of international offices can also serve as a proxy for understanding service export activity. Within the 2024 dataset, approximately 1,500 UK headquartered AI companies have established an international presence (26% of all companies identified). Forty-six percent of all international office locations operated by UK headquartered companies are in the US. India, Germany, Australia, and Canada also represent key trading locations for UK headquartered AI companies (accounting for between 3% and 8% of all UK headquartered international trading locations).

By using international office locations as a proxy for services trade, the 2024 AI study estimates that approximately 22% of dedicated, UK headquartered AI firms export services internationally (n=714). These firms operate approximately 1,000 offices internationally, of which 56% are in the United States.

5.5. Trade in AI-related goods

The value of AI related goods imports into the UK has increased by a third over 3 years, from £5.4 billion in 2021 to £7.2 billion in 2024. This increase has been driven by demand for processing units (CPUs and GPUs) which has more than doubled over the period.

The value of equivalent goods exports has fallen slightly over the same period. However, while the value processing unit exports has fallen, the value of general hardware exports has been sustained at ~£1.3 billion since 2021.

Table 5.3 – Trade in AI-related goods (2018 – 2024) - UK Imports

| Year | CPUs / GPUs | General Hardware | Memory and Storage | Total |

|---|---|---|---|---|

| 2018 | £2.6 billion | £3.3 billion | £0.9 billion | £6.8 billion |

| 2019 | £2.4 billion | £3.4 billion | £0.7 billion | £6.5 billion |

| 2020 | £2.3 billion | £3.1 billion | £0.7 billion | £6.1 billion |

| 2021 | £2.0 billion | £2.8 billion | £0.6 billion | £5.4 billion |

| 2022 | £3.7 billion | £2.8 billion | £0.7 billion | £7.2 billion |

| 2023 | £3.5 billion | £2.7 billion | £0.5 billion | £6.7 billion |

| 2024 | £4.2 billion | £2.5 billion | £0.6 billion | £7.3 billion |

Table 5.4 – Trade in AI-related goods (2018 – 2024) - UK Exports

| Year | CPUs / GPUs | General Hardware | Memory and Storage | Total |

| 2018 | £1.2 billion | £1.9 billion | £0.3 billion | £3.4 billion |

| 2019 | £1.5 billion | £1.7 billion | £0.3 billion | £3.5 billion |

| 2020 | £1.4 billion | £1.4 billion | £0.3 billion | £3.1 billion |

| 2021 | £1.5 billion | £1.3 billion | £0.2 billion | £3.0 billion |

| 2022 | £1.7 billion | £1.3 billion | £0.3 billion | £3.3 billion |

| 2023 | £1.4 billion | £1.2 billion | £0.3 billion | £2.9 billion |

| 2024 | £1.2 billion | £1.3 billion | £0.3 billion | £2.8 billion |

Source: UK Trade Info, Perspective Economics

5.5.1. Trading partners

Since 2018, Germany, the US, and Ireland have accounted for the highest value of AI-related goods exports. The Netherlands, the US, and China have supplied the highest value of AI-related imports.

Figure 5.3 – Goods trade partners

Source: HMRC UK Trade Info

5.5.2 Sector perspectives on trade

When asked about international trade, 59% of survey respondents indicated that they exported AI-related products or services and 21% suggested that they had imported specific components or technologies for AI-related purposes in the past 12 months (n= 149 and 64 respectively).

Despite a slight decline in the number of respondents reporting export activity (-6 percentage points compared to the 2023 survey), export activity continues to account for a significant proportion of turnover among exporting firms. Just over half (56%, n=83) of those that export reported that exports made up at least 40% of their AI-related revenue. Further, 15% of exporting firms stated that all their AI revenue came from exports, while 19% said exports accounted for between 80% and 99% of turnover (n= 22 and 28 respectively).

Among those reporting that they do not currently export (41%, n=104) two-thirds (67%) stated they intended to begin exporting AI products or services over the next 12 to 18 months. When asked about expected changes in their export activity over the coming year, the vast majority (85%, n=127) of respondents anticipated an increase. This aligns broadly with last year’s findings and indicates sustained optimism around future export performance.

This suggests a pipeline of potential new exporters within the sector. However, one third of non-exporting firms reported no intention to begin exporting in the near term, indicating that there may be persistent barriers or limited perceived opportunity in some cases.

When asked about barriers to exporting, the most cited issue was a lack of knowledge or networks for accessing international markets (29%), followed by issues with securing finance (20%) and competition from foreign exporters (18%). Companies also reported difficulties securing finance or insurance for export activity and issues with regulatory compliance costs. Therefore, while traditional trade barriers play a role, internal capacity, regulatory complexity, and informational gaps are also commonly cited obstacles to exporting among UK AI firms.

In this year’s survey, businesses were also asked whether they had imported specific components or technologies for AI-related purposes in the past 12 months. Around one in 5 respondents (21%, n=64) reported importing at least one relevant item. Among the most imported items were computers, and storage devices and microchips / processors (21%, 16% and 10% of respondents respectively). Smaller numbers also reported importing networking equipment, optical fibre, or components for data centre infrastructure such as power management. 65% of businesses that currently import AI-related technologies expect their import activity to increase over the next 12 to 18 months.

6. Market dynamics

This section draws primarily on findings from qualitative research to document a range of issues identified through the sector survey (298 responses) and depth interviews with 52 representatives from industry, academia, and the public sector.

Key takeaways

-

The UK has a strong AI ecosystem, particularly at the early stages of company formation where research funding and early-stage capital is required.

-

There is scope to further leverage vibrant research, innovation and start-up activity through targeted policies that encourage higher-value, later-stage capital investment, freer movement of top technical talent and continued focus on ensuring the right balance between regulation and innovation.

-

The UK has become increasingly attractive as a location for AI investment, with one fifth of the total number of inward investment projects since 2019 originating in 2024.

-

Many early-stage businesses are focusing on niche areas or industry-specific applications – seeking to develop deep expertise in specific sectors, create tailored solutions that addressed unique industry challenges.

-

Almost 90% of AI business representatives surveyed expect revenues to grow within the next 12 months.

6.1. Current state of the UK AI ecosystem

Interviewees were broadly of the view that the UK’s AI ecosystem remains strong. Policy support and funding at the early stages of company formation - research funding and early-stage capital – was viewed as being particularly strong. Recent policy developments – specifically the AI Opportunities Action Plan – were also broadly viewed as making a positive contribution to the UK AI ecosystem.

People like Demis Hassabis, with AlphaFold, saved the equivalent of a billion PhD years by solving protein folding. Now we’ve got companies like Isomorphic Labs designing new drugs with AI.

AI investor

On the state of the investment landscape, one interviewee noted that an increasing number of US investment funds now have at least one investor ‘on the ground’ in the UK. This increased interest in the UK as an attractive investment location is also supported in recent literature. For example, more than 20 substantive international investments into the UK were announced around the time of the International Investment Summit (October 2024)[footnote 29], and the US Department of State highlighted the UK as an attractive investment location in its 2024 Investment Climate Statements[footnote 30]. Analysis of FDI data presented in Section 4.3 also supports the assertion that the UK has become increasingly attractive as a location for AI investment, with one fifth of the total number of inward investment projects since 2019 originating in 2024 (51 of 251 projects).

The UK is perceived to be maintaining a leading position in Europe, with London described by one interviewee as "still the number one city ahead of Berlin, ahead of Paris, ahead of Stockholm".

Sequoia’s in London. Bessemer is in London. Insight are in London, Accel are in London. These are all great American firms, and I haven’t even started.

AI investor

As with previous iterations of the study, interviewees continue to view the UK's academic sector as a key strength. "Of the top 10 universities in the world, 3 are UK universities. There's always been a huge amount of talent there"[footnote 31]. Some investors believe that this academic excellence translates into innovation, and therefore commercial investment opportunities.

The best technologies we see are actually coming out of universities most of the time — from PhDs and from very strong software and tech engineers.

AI investor

London has been positioned as "the third largest city in the world for starting AI companies"[footnote 32] and the UK as being "the third biggest player in AI globally, behind China and the USA". (AI Investor)

Overall, interviewees painted an increasingly positive view of the UK’s AI activity, suggesting that “the combination of the mindset, the talent, and the capital is beginning to ramp up… there’s still a long way to go, but it’s certainly moving in the right direction.” (AI Investor)

6.2. Competition

Qualitative interviews revealed a complex and evolving competitive landscape within the UK's AI sector. While the market was generally perceived as increasingly competitive, there were also concerns about market fragmentation, the dominance of large international players, and the challenges faced by smaller UK-headquartered businesses.

Competition is accelerating faster than anyone realises, exponentially fast.

AI Business representative

The UK AI market has seen a significant increase in the number of new company incorporations in the past 12-18 months. Within this context businesses are finding success by focusing on niche areas or industry-specific applications – seeking to develop deep expertise in specific sectors, create tailored solutions that addressed unique industry challenges, and competed more effectively against larger, more generalist competitors. Table 6.1 provides an illustration of some of the sector specific companies established within the past 24 months.

Table 6.1 – Industry specific applications (Illustration)

| Company (Incorporated) | Sector | Description |

|---|---|---|

| Arondite (2023) | Aerospace and Defence | Defence technology company building foundational software and AI for autonomous systems. Main product is an AI software platform that connects and manages various autonomous systems, sensors, and robotic platforms while enabling AI deployment at scale. |

| ACTR-AI (2024) | Public Sector | Develops AI-powered simulation and roleplaying scenarios for training professionals who work with vulnerable individuals, combining safeguarding expertise with AI technology to improve frontline service delivery. |

| Windscope (2023) | Energy and Utilities | Provides advanced wind turbine health monitoring and predictive maintenance solutions for windfarm operators. Offers a software platform that integrates turbine data streams to enable condition-based maintenance, predict failures, and optimise maintenance scheduling. |

| FilmTailor AI (2024) | Entertainment and Media | Technology company focused on providing AI-powered tools for the film and entertainment industry. Platform offering AI script analysis, moodboard generation, and costume design assistance for film production professionals. |

| Orca AI Limited (2024) | Logistics and Transportation | Maritime technology company that develops AI-powered navigation and collision avoidance systems for ships. Combining AI, computer vision, and thermal imaging to enhance maritime safety and enable autonomous shipping capabilities. |

Source: Perspective Economics

This approach was seen as offering a potential competitive advantage for UK businesses, allowing them to develop tailored AI solutions that addressed specific industry needs and regulatory requirements, particularly where the UK has internationally recognised sectoral strengths.

Interviews also noted significant challenges for smaller AI businesses when competing for public sector contracts. The issues that were highlighted included procurement processes that favoured larger, more established businesses, difficulty in demonstrating the required experience or scale for government contracts, and subcontracting arrangements that could be disadvantageous for smaller, innovative businesses. This suggested that, while smaller UK AI businesses might have had valuable expertise and innovative solutions, they often struggle to secure government contracts directly, potentially limiting their growth opportunities and the public sector's access to cutting-edge AI technologies.

In terms of international competition in AI, UK AI businesses were seen as significant players, but increasingly facing challenges from large global players, in particular the US and China. The businesses interviewed consistently highlighted the dominance of these 2 countries in the global AI market, citing their advantages in funding, talent pools, and technological infrastructure.

6.3. Sovereign AI capability

Some UK AI businesses, particularly those working on more advanced or sensitive applications, raised concerns regarding their dependence on foreign technology and infrastructure, especially from the US. This reliance was noted to be especially pronounced in cloud infrastructure and LLMs, which form the backbone of certain AI applications and business models. Interviewees flagged concerns about the potential risks of relying on US technologies and infrastructure including, for example, the impact of protectionist policies and trade disputes, access to cloud infrastructure, or pricing rates for services set by the major providers. The level of concern appeared to correlate more with factors such as the scale of operations, the sensitivity of the data being processed, and the strategic importance of the AI applications being developed[footnote 33].

If there’s a trade war, I don’t know if I want my core system to be reliant on American systems.

AI business representative

In light of these concerns raised during the interviews, some businesses advocated for the development of sovereign AI capabilities within the UK, particularly in critical areas such as LLMs and compute capacity. They argued that having domestic alternatives to foreign-owned technologies would not only reduce dependence but also enhance national security and potentially create new opportunities for UK tech businesses. However, opinions were divided on the best approach to achieving greater AI sovereignty. While some pushed for significant investment in developing UK-based alternatives to major US technologies, others suggested that this might not be the most efficient use of resources given the UK's more limited funding and infrastructure compared to the US and China.

There’s no reason why DeepSeek could not have come out of the UK. But if the UK wants to play, it needs to strategically support key technologies.

Leveraging UK strengths in academia and responsible technology use could help reduce reliance on international inputs in the long term.

AI business representatives

Businesses also highlighted the importance of maintaining international collaboration in AI development, even while pursuing greater sovereignty. They emphasised that complete technological independence might not be feasible or desirable in the rapidly evolving field of AI, especially in relation to innovation and skills.

Overall, the interviews revealed diverse views on UK AI sovereignty, while many recognised the risks of over-reliance on foreign technology, particularly from the US, there was widespread scepticism about the feasibility of developing fully sovereign AI capabilities. Instead, interviewees suggested focusing on strategic areas of strength, maintaining international collaboration, and creating a regulatory environment that balances global innovation with safeguards for sensitive data.

6.4. Future focus areas

Despite the broadly positive sentiment returned in qualitative research, interviewees also highlighted a number of key issues for policy makers to consider if the UK is to maintain its place within the global AI landscape. The most commonly referenced issues included increasing the availability of scale-up and later stage capital, a focus on security of AI systems, further clarity regarding AI regulation, competition for talent, and a continued focus on aspects of trust, transparency and explainability.

1. Scale-Up and Later-Stage Capital: Interviewees suggested that the UK faces a scaling challenge: it is "very good at the start phase, but the scale up phase (beyond Series A), there\'s a missing piece there". Reasons offered for this scale-up challenge include a lack of larger scale growth capital, a degree of risk aversion among existing UK investors, and a lack of experienced investors in the UK. These assertions are supported in wider research with UK AI start-ups, which provides insight into the mindset of leading UK founders, and the potential implications for the UK's AI sector. Founders highlighted:

My advice to founders right now is to incorporate in the US with a UK subsidiary as you get better access to capital, while getting benefits of UK talent at a much lower [hiring] cost… The UK is a great place to start a business, but we need to see changes, such as encouraging pension funds to invest in venture capital, to encourage further start-up growth.

AI business representative

Both investors and strategic stakeholders frequently referred to a need for higher-value, later stage funding (follow-on funding) to help increase the UK's stake in growth stage companies. Several options are available including encouraging more engagement from pension funds, and increasing the incentives for high-net worth individuals to invest in targeted technologies through Enterprise Investment Schemes (EIS).

To change the landscape, pension authorities need to put a percentage back into the funding pool. Central government can't just force that — Greater Manchester is a good example of where pension monies have gone back in, but that was [driven locally]. Elected Majors should be doing a lot more to try and change that.

AI stakeholder

2. Security of AI systems: Interviewees pointed to a pressing need for AI security that can underpin implementation at scale.

I think a huge element is going to be security… how do you make sure that you're not able to access your boss's emails because you're both plugged into some version of the same model and there's no firewall. People don't know how these models actually work. And if you don't know what's actually happening under the hood, having these guardrails in place is quite difficult.

AI investor

3. Regulatory clarity: Some interviewees perceived a need for the UK to refocus on its regulatory approach, suggesting that the status quo leaves UK AI businesses in limbo. Some interviewees suggested that there is now more clarity regarding the EU AI Act. For example, the Irish government is working to provide further guidance on compliance with the Act which is seen as offering more certainty about how that is being applied[footnote 34].

We need to bring in the right talent and decide on a clear regulatory stance. If we're going to be a relaxed regulator, say so. If we're going to be strict, say that instead — just be honest. And that honesty has to come from people who actually know what they're talking about.

AI investor

There's a huge need for oversight and a bank of people who understand governance requirements to deal with the tsunami of regulatory approvals and / or recourse that's coming across sectors.

Strategic stakeholder

4. Competition for talent: Interviewees consistently highlighted the challenge of talent acquisition and retention, citing more technically challenging and highly renumerated roles internationally (particularly the US). Several interviewees emphasised a need to make the UK a more attractive location for international talent. Specifically, investors pointed to a need for better migration policies and a wider range of visas to attract top-tier engineers to the UK who might [now] be put off by going to the US, and more generally to support policies that encourage acquisition of from countries with strong technical talent pools. Linked to talent acquisition and retention, interviewees pointed to knock-on effects of securing high quality talent, in the form of employees-turned-entrepreneurs and the investment they attract. The US was still seen as being the top strategic location for this wider talent ecosystem.

A lot of talent ends up going to the US, where there are more opportunities and higher salaries.

AI investor

No competition means no market and nothing to look at as examples of success. You need one or 2 winners to come out so that founders come back into the sector in some capacity. That starts to create an ecosystem, like SkyScanner in Scotland, or the host of start-ups founded by ex-Google or ex-Facebook employees.

AI stakeholder

5. Trust, transparency and explainability: interviewees broadly agreed that there is less focus on AI safety and ethics now than there had been previously. The emphasis has shifted to security, which is also important. However, safety, trust and transparency were still deemed to be vitally important for longer-term sustainability of AI technologies.

Explainability is the important bit — the danger is that you're handing this over, it's giving you an answer and the justification might not be transparent. We need to establish who is in control of the data — there's more pushback now about doing something that we don't understand.

Strategic stakeholder

In addition to these commonly cited topics, interviewees also identified a range of other future policy considerations including, for example, prioritising a set number of actions within the AI Opportunities Action Plan, developing clearer and more positive national messaging on AI, continuing to offer support for development of new AI products and services among lower technology businesses, supporting AI education and skills, bringing more AI expertise into policy and regulatory decision-making, and securing the UK's sovereign AI capability. Further details regarding these future policy considerations are available in the report appendices.

6.5. Growth sentiment

Survey respondents were asked about their expectations for AI-related business revenue over the next 12 months. Overall, growth expectations remain strong, and broadly consistent with the previous year.

Almost 3 fifths (58%, n=166) of businesses expected revenue to grow by 50% or more — an increase from 52% in 2023. A further 30% of respondents expected more moderate growth, with 16% anticipating increases of 25–50% and 14% expecting growth between 10–25% (n=41 and 45 respectively).

These findings highlight continued growth expectations across the economy, and a sense that UK businesses have a clearer view regarding the positive commercial potential of AI.

Table 6.2 - Growth sentiment

| Description | % of Firms |

|---|---|

| Grow by 50% or more | 58% |

| Grow between 10% and 25% | 16% |

| Grow between 25% and 50% | 14% |

| Stay around the same size | 5% |

| Grow by up to 10% | 4% |