GVA of DCMS Sectors

Updated 14 September 2015

1. Background

This release provides an estimate of the contribution of DCMS sectors to the UK economy, measured by gross value added (GVA) at basic prices.

The release is being published to provide details of the basis for the estimate quoted by the Secretary of State for Culture, Media and Sport in the CMS Select Committee hearing on 9 September 2015.

The estimate is based on published data and definitions where possible. Where no previously published data are available additional analysis has been undertaken by DCMS using the Annual Business Survey (aGVA). There are differences in the time periods and definitions of estimates, as a result assumptions have been made to enable production of an estimate of total GVA for DCMS sectors. It is intended that further development work will be undertaken leading to an annual statistical release detailing the contribution of DCMS sectors to the UK Economy. The current estimate should be viewed as provisional and is subject to revisions.

2. Summary

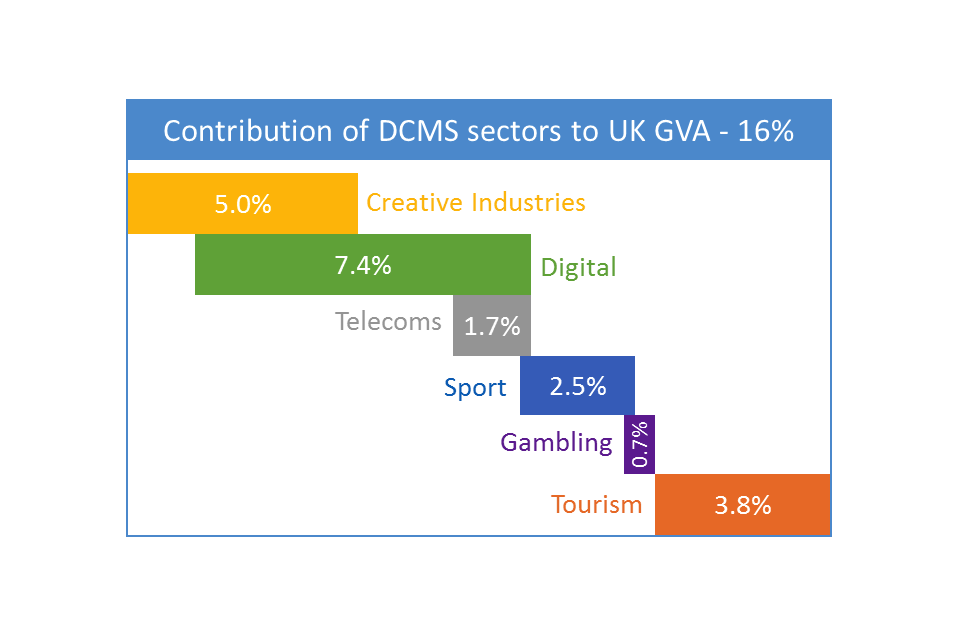

It is estimated that in 2013 the contribution of DCMS sectors to the UK economy (GVA) was 16 per cent, or £238bn.

GVA of “DCMS sectors” has been defined as the GVA for the sectors which DCMS has policy responsibility for. Estimates for each of these sectors are shown in table 1.

Table 1: GVA contribution by DCMS sector [footnote 1] [footnote 2]

| Sector | Year | Value (£m) | % UK GVA |

|---|---|---|---|

| Sport | 2012 | £38,891 | 2.5% |

| Tourism | 2013 | £58,700 | 3.8% |

| Gambling | 2012 | £10,635 | 0.7% |

| Telecoms | 2013 | £25,726 | 1.7% |

| Creative Industries | 2013 | £76,909 | 5.0% |

| Digital | 2013 | £113,216 | 7.4% |

| Total UK GVA | 2013 | £1,525,304 | 100.0% |

To calculate an estimate for the combined contribution of DCMS sectors the overlap between sectors has been taken into account, resulting in an estimate of 16 per cent. More details of the sources of data and assumptions made are provided in Annex A.

3. Annex A: Sources and assumptions

This Annex provides details of data sources and assumptions used to produce an estimate of GVA for DCMS sectors. The analysis is a best estimate and where possible makes use of Official Statistics. It has been supplemented by analysis of the Annual Business Survey. There are differences in time scales and methodologies for different sectors. Table A1 sets out the source of estimates for each sector.

Table A1: Source of GVA sector estimates

| Sector | Year | Value (£m) | % UK GVA | Source | Notes |

|---|---|---|---|---|---|

| Sport | 2012 | £38,891 | 2.50% | Published Official Statistics - DCMS commissioned Sport Satellite Account | • Latest published data relate to 2012. |

| Tourism | 2013 | £58,700 | 3.80% | Published Official Statistics - DCMS commissioned Tourism Satellite Account | • Now-casting used for published estimate for 2013. |

| Gambling | 2012 | £10,635 | 0.70% | Published Official Statistics - ONS Supply Use Tables (SIC 92, Gambling and Betting Activities) | • Latest published data relate to 2012. |

| Telecoms | 2013 | £25,726 | 1.70% | Analysis of Annual Business Survey (aGVA, SIC 61) | • Estimate produced for consistency with Digital (2013) estimate, which includes all of Telecoms. • ONS Supply Use Tables value for Telecommunications (SIC 61) 2012 GVA is £24,666m. |

| Creative Industries | 2013 | £76,909 | 5.00% | Published Official Statistics - DCMS Creative Industries Economic Estimates | • Based on analysis of Annual Business Survey (aGVA). |

| Digital | 2013 | £113,216 | 7.40% | Analysis of Annual Business Survey aGVA. | • Estimate produced by DCMS for this analysis. See Annex B for Definition of industries included in Digital. These are provisional and subject to change. |

| Total UK GVA | 2013 | £1,525,304 | 100.00% | ONS Blue Book (ABML) |

The separate sector estimates shown in table A1 have a number of areas of overlap. The most significant of these are:

- All of Telecoms (SIC 61) is included in the Digital.

- There is considerable overlap between the industries included in the Digital and the Creative Industries (e.g. SIC 58 Publishing Activities and SIC 59 Motion picture, video and television programme production, sound recording and music publishing activities). See Annex B for further details.

- Sport betting (estimated to be £3,298m) is included in Sport and in Gambling.

- Telecoms is the second largest contributor to Sport (2012) after “Sporting Activities” (which includes sport betting), contributing £3,207m.

Taking account of these overlaps gives an estimate of 16 per cent (£238bn) for the overall contribution of DCMS sectors to UK GVA in 2013, see figure A1 and table A2.

Figure A1: GVA for DCMS sectors

The DCMS GVA breakdown and overlap

Table A2: Total GVA for DCMS sectors

| Sector | Value (£m) | % UK GVA | |

|---|---|---|---|

| Creative, Digital, Telecoms | 2013 | £135,862 | 8.9% |

| Sport (ex. sport telecoms) | 2012 | £35,684 | 2.3% |

| Gambling (ex. sport betting) | 2012 | £7,337 | 0.5% |

| Tourism | 2013 | £58,712 | 3.8% |

| Total DCMS Sectors | - | £237,595 | 15.6% |

| Total UK GVA | 2013 | £1,525,304 | 100.0% |

This estimate is provisional and subject to change following planned developments and revisions to source data. For example:

- There are differences in the time periods used in the estimates. Sector estimates based on 2012 are likely to be higher in 2013 (if they follow the trend of the wider economy). This would lead to a small increase in “DCMS GVA” for 2013.

- While the most significant areas of overlap across sectors have been addressed some smaller areas of overlap remain. DCMS will undertake further work to quantify these. This development would reduce the estimated “DCMS GVA”.

- The estimate includes GVA for the Creative Industries. DCMS is working to develop a measure of GVA for the Creative Economy (i.e. including creative work outside the creative industries). This change would increase “DCMS GVA”.

- There may be revisions to source data, for example the Tourism estimate for 2013 is based on modelled data (now-casting) and is therefore likely to be revised in 2016 when new data become available.

Any feedback on this publication and development plans would be welcome. Please email evidence@culture.gov.uk.

4. Annex B: Digital definition

The table below shows which Standard Industrial Classification (SIC) codes have been used to estimate GVA for Digital. It also shows which codes are also included in the Creative Industries or Telecoms.

| SIC | Description | Overlap with: | |

|---|---|---|---|

| Creative Industries | Telecoms | ||

| 26.11 | Manufacture of electronic components | ||

| 26.12 | Manufacture of loaded electronic boards | ||

| 26.20 | Manufacture of computers and peripheral equipment | ||

| 26.30 | Manufacture of communication equipment | ||

| 26.40 | Manufacture of consumer electronics | ||

| 26.80 | Manufacture of magnetic and optical media | ||

| 46.51 | Wholesale of computers, computer peripheral equipment and software | ||

| 46.52 | Wholesale of electronic and telecommunications equipment and parts | ||

| 58.11 | Book publishing | * | |

| 58.12 | Publishing of directories and mailing lists | * | |

| 58.13 | Publishing of newspapers | * | |

| 58.14 | Publishing of journals and periodicals | * | |

| 58.19 | Other publishing activities | * | |

| 58.21 | Publishing of computer games | * | |

| 58.29 | Other software publishing | * | |

| 59.11 | Motion picture, video and television programme production activities | * | |

| 59.12 | Motion picture, video and television programme post-production activities | * | |

| 59.13 | Motion picture, video and television programme distribution activities | * | |

| 59.14 | Motion picture projection activities | * | |

| 59.20 | Sound recording and music publishing activities | * | |

| 60.10 | Radio broadcasting | * | |

| 60.20 | Television programming and broadcasting activities | * | |

| 61.10 | Wired telecommunications activities | * | |

| 61.20 | Wireless telecommunications activities | * | |

| 61.30 | Satellite telecommunications activities | * | |

| 61.90 | Other telecommunications activities | * | |

| 62.01 | Computer programming activities | * | |

| 62.02 | Computer consultancy activities | * | |

| 62.03 | Computer facilities management activities | ||

| 62.09 | Other information technology and computer service activities | ||

| 63.11 | Data processing, hosting and related activities | ||

| 63.12 | Web portals | ||

| 63.91 | News agency activities | ||

| 63.99 | Other information service activities n.e.c. | ||

| 95.11 | Repair of computers and peripheral equipment | ||

| 95.12 | Repair of communication equipment |

More details of all SIC codes is available here.

-

More details of the industry codes used for the Digital estimate are available at Annex B. The estimate for Telecoms is based on analysis of the ABS aGVA (2013), not the ONS Supply Use Table (2012) value for Teleommunications (SIC 61). This is to allow consistency with the Digital which includes telecoms. ↩

-

Where the latest available estimates are for 2012 these have been included as the best available figure. No attempt has been made to model estimates for 2013. ↩