Accounts monitoring review: Do small charity annual reports and accounts meet the reader’s needs?

Published 3 September 2018

Why are we reviewing the accounts of small charities?

We are reviewing charities’ sets of accounts because they are the prime means by which the trustees are publicly accountable to donors, beneficiaries and the wider public for the charity’s activities and how they have used the charity’s money. Good reporting is important to public trust and confidence in both the reporting charity and the wider charity sector.

All registered charities are required to prepare the following documents within 10 months of their financial year end and make them publicly available:

- their trustees’ annual report (annual report)

- their accounts

Charities with incomes of less than £25,000 are not required to file their annual report and accounts with us (except for Charitable Incorporated Organisations), or to arrange for an independent scrutiny of their accounts.

Small charities, as we have defined them, account for only 1% of the sector’s income. However, they represent nearly 62% (104,000) of the charities on our register. We therefore want to check how well small charities are doing in meeting their public reporting responsibilities.

How do we assess whether accounts meet the needs of readers?

The focus of our assessment was on whether each set of accounts met the basic requirements of the users of those accounts rather than on strict technical compliance with the reporting requirements. We based our view of the user’s requirements on the Populus survey of public trust and confidence (June 2016). Since we carried out our review, the results of the 2018 public trust and confidence research have been published (July 2018). In both surveys, Populus found that ‘ensuring that a reasonable proportion of donations make it to the end cause’ and ‘make a positive difference to the cause they work for’ remain the most important factors driving public trust and confidence in charities.

This led us to focus on the following criteria:

- have the trustees produced both of the required documents that make up a set of small charity accounts (the annual report and the accounts)?

- does the annual report explain what activities the charity had carried out during the year to achieve its purposes (we assessed the content of the document provided, rather than what it was called)?

- do the accounts contain both an analysis of receipts and payments and a statement of assets and liabilities and are these consistent with each other (or the equivalent if the accounts were prepared on an accruals basis)?

How did we carry out the review?

In March 2017, we selected a random sample of 110 charities that had reported incomes less than £25,000 in their annual returns covering accounting years ending during the 12 months to 31 December 2015. We did this because we base our published information about charities and accounts on the annual return cycle and AR 2015 was the most recent complete cycle at the time we selected the sample. In previous years, we sampled from accounting years ending on 31 March and so there is an overlap with last year’s review, which covered the 12 months ending 31 March 2015.

We contacted the charities in our sample to obtain a copy of their annual report and accounts. We needed to send reminders and further guidance on the requirements in many instances. We therefore excluded documents prepared after we had contacted the trustees to ask for them. The sample size means that our findings are statistically representative of the annual report and accounts filed with us by small charities for this period. However, as with all samples, our results include a margin of error.

What did we find?

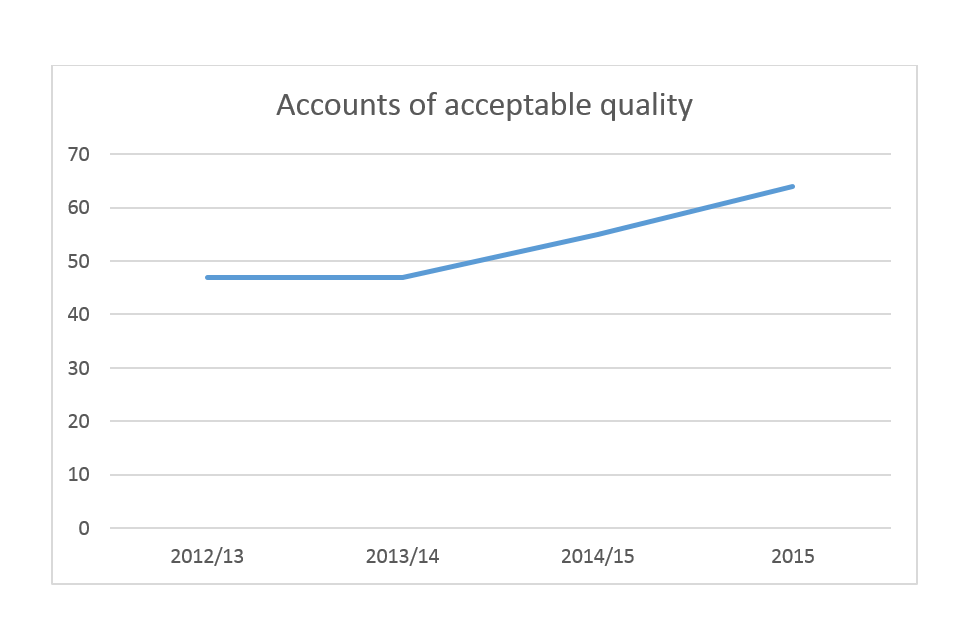

Graph showing the percentage of accounts of acceptable quality: around 48% in 2012-13, 48% in 2013-14, 75% in 2014-15, 55% in 2014-15 and 64% in 2015

64% of the charities provided sets of accounts of acceptable quality, in other words they met the basic standard that we had set. This means that the quality of reporting has improved in both of our most recent surveys.

The 36% that did not meet our basic standard can be split into 3 equal groups, as follows:

- both of the required documents were provided in some form but one, usually the accounts, or both of them were inadequate. The main flaws in the accounts were the lack of any information on the charity’s assets and liabilities or the accounts covering a different year end to the annual return

- only one of the required documents was provided, usually the accounts

- neither of the required documents was provided

As in previous years, the responses we received from trustees showed that some believed that the annual return and the accounts are the same thing and others thought that completing an annual return was all that they needed to do to meet their public reporting responsibilities. Other trustees felt that there was no need to produce an annual report and/or accounts because their charity did not carry out much activity.

What action did we take?

We have provided guidance to the trustees of the charities that did not submit sets of accounts of acceptable quality. We have also provided guidance on closing a charity to those charities that stated that they are no longer active.

What are the lessons for other charities?

We remind trustees that all registered charities must prepare an annual report and accounts and make them publicly available, even if they are not required to file them with us. More positively, the annual report and accounts provide an important opportunity for the trustees to take stock of what the charity has achieved over the last year and to demonstrate to its supporters, potential funders and the public that they have managed its resources effectively and are meeting its objectives.

We have produced guidance to assist trustees on the preparation of their charity’s annual report and accounts. This includes pro-formas of both the annual report and the accounts. These provide a useful structure for preparing documents that meet the reporting requirements. Our guidance can be downloaded from GOV.UK.

About our accounts monitoring reports

Charities’ accounts are publicly available on GOV.UK. Each year, we develop a programme of reviews, based on issues of regulatory concern. We are publishing a series of reports on our findings, which will help trustees to manage the risks that their charity faces, improve reporting standards and to enhance the accountability of charities to their donors, beneficiaries and the public.