Public reporting by charities in their trustees’ annual report and accounts

Published 20 December 2018

Why are we reviewing charities’ sets of accounts?

All registered charities must publish a trustees’ annual report and accounts. If the charity’s income is over £25,000, the trustees must also arrange for an independent scrutiny of the accounts. A set of accounts is the prime means by which trustees are accountable for the privilege of charitable status and for their stewardship of charitable resources.

How do we assess the quality of charities’ accounts?

The focus of our assessment was on whether each set of accounts met the basic requirements of the users of those accounts, rather than on strict technical compliance with the Charities Statement of Recommended Practice (SORP) and other reporting requirements. We based our view of the user’s requirements on the Populus survey of public trust and confidence (July 2018). Populus found that ‘ensuring that a reasonable proportion of donations make it to the end cause’ and ‘make a positive difference to the cause they work for’ remain the most important factors driving public trust and confidence in charities. This led us to focus on a set of criteria that provide a basic benchmark of accounts quality.

Our review was of the sets of accounts submitted by charities reporting incomes over £25,000. Our criteria assessed whether the set of accounts contained:

- a trustees’ annual report, explaining what activities the charity had carried out during the year to achieve its purposes

- the report of an independent scrutiny of the charity’s accounts, with an audit carried out if required due to the charity’s size

- the accounts themselves, prepared on an accruals (or SORP) basis if required due to the charity’s size or because it is a company. In addition, we checked whether the accounts were complete, containing both a statement of financial activities (SOFA), that analyses the charity’s expenditure, and a balance sheet (or the equivalent if receipts and payments accounts were prepared) and that these documents were consistent with each other

The assessment was more than a checklist exercise. In particular, sets of accounts that lacked transparency when viewed as a whole did not meet our benchmark.

How did we carry out the review?

In May 2018, we selected a random sample of 105 accounts submissions from the register of charities, covering accounting years ending during the 12 months to 31 December 2016. The sample size means that our findings are statistically representative of the sets of accounts filed with us for this period. All samples include a margin of error, so the percentage of sets of accounts in the register as a whole that meet our benchmark may be higher or lower than in our sample.

What did we find?

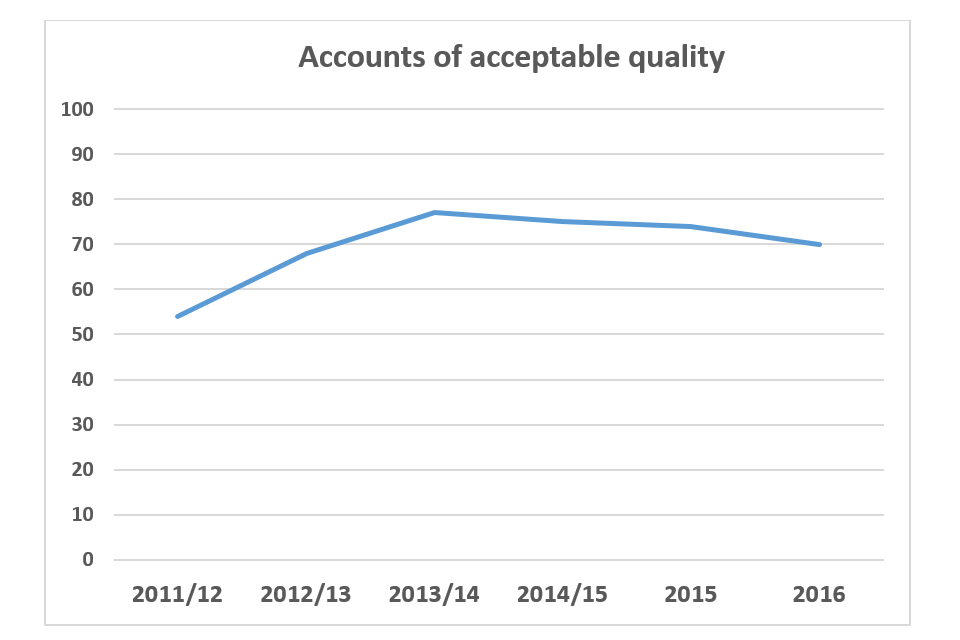

Graph showing the percentage of accounts of acceptable quality: around 54% in 2011-12, 68% in 2012-13, 78% in 2013-14, 75% in 2014-15, 74% in 2015 and 70% in 2016

70% of the sets of accounts that we reviewed met our basic benchmark, compared with last year’s 74%. The trend of improving accounts quality seen in our earlier reviews appears to have gone into reverse. The quality of the accounts in our samples fell slightly in each of our last two reviews, but this year is the first time we have found a significant deterioration since we began assessing accounts quality. The reasons why the other sets of accounts did not meet our benchmark are:

- all of the required documents were submitted, but one of them was inadequate (12% of charities). These charities’ sets of accounts met most of our criteria, but many of them provided little or no information on the charity’s purposes and/or activities carried out to achieve them

- all of the required documents were submitted, but at least two of them were inadequate (9% of charities). As with the first group of charities, most of these sets of accounts provided little or no information on the charity’s purposes and/or activities carried out to achieve them. However, this was coupled with other issues, such as incomplete accounts, an independent scrutiny report that did not have the required wording or an overall lack of transparency

- at least one of the required documents was missing (9% of charities). None of these charities submitted any form of independent scrutiny report. In addition, all of them were either missing at least one of the trustees’ annual report and accounts or the documents submitted were inadequate

What action did we take?

We have provided guidance to the trustees of all charities in our sample whose 2016 sets of accounts did not meet our benchmark, taking account of the content of more recent sets of accounts where these had been filed.

What are the lessons for other charities?

The trustees’ annual report and accounts provide an important opportunity for the trustees to reflect on what their charity has achieved and to demonstrate to the charity’s supporters, potential funders and the public that they have managed its resources effectively and are meeting its purposes.

We have produced extensive guidance to assist trustees and independent examiners on the preparation and scrutiny of the trustees’ annual report and accounts. This includes pro-formas for the trustees’ annual report, independent examiner’s report and both receipts and payments and accruals accounts. These provide a useful structure for preparing documents that meet the reporting requirements. Our guidance can be downloaded from GOV.UK.