Public benefit reporting by charities

Published 20 December 2018

Why are we reviewing the quality of public benefit reporting?

All registered charities must publish a trustees’ annual report. Public benefit reporting is about charities showing in their trustees’ annual reports that they are being true to their own purposes and demonstrating the difference they’re making. Public benefit is therefore at the heart of what charities are about.

How do we assess the quality of public benefit reporting?

The focus of our assessment was on whether each trustees’ annual report demonstrated a clear understanding of the public benefit reporting requirement. We based the assessments on our guidance Public benefit reporting (PB3).

We assessed whether the trustees’ annual report contained:

- an explanation of the activities undertaken by the charity to further its purposes for the public benefit

- a statement by the trustees as to whether they have had due regard to the Commission’s guidance on public benefit, known as ‘the public benefit statement’

How did we carry out the review?

In May 2018, we selected a random sample of 105 trustees’ annual reports from the register of charities, covering accounting years ending during the 12 months to 31 December 2016. Our sample comprised charities reporting incomes above the main filing threshold of £25,000. The sample size means that our findings are statistically representative of the sets of accounts filed with us for this period. All samples include a margin of error, so the percentage of trustees’ annual reports in the register as a whole that meet the public benefit reporting requirement may be higher or lower than in our sample.

What did we find?

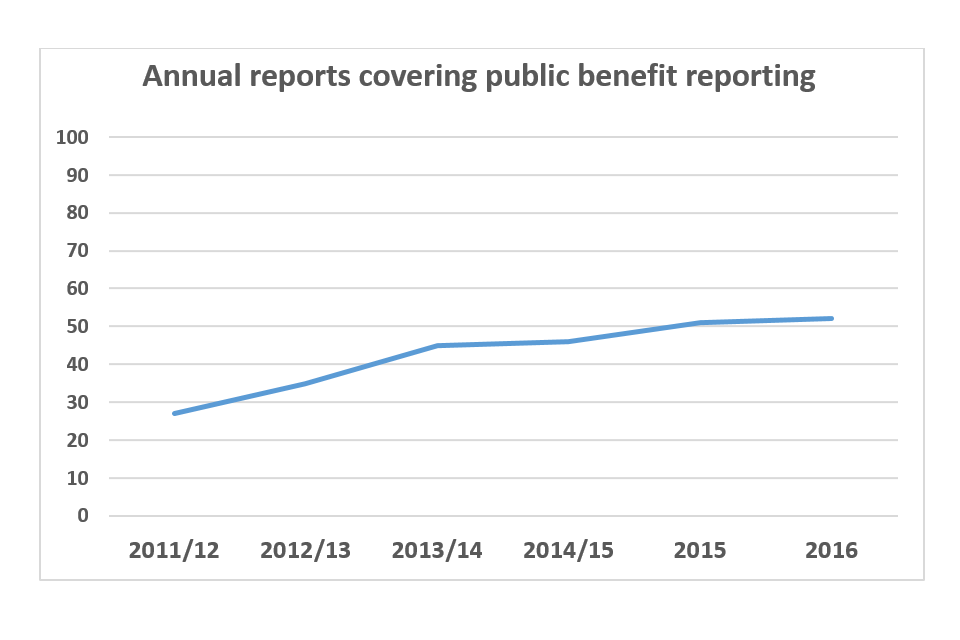

Graph showing percentage of annual reports covering public benefit reporting: around 28% in 2011-12, 35% in 2012-13, 45% in 2013-14, 46% in 2014/15, 51% in 2015 and 52% in 2016

52% of the trustees’ annual reports demonstrated a clear understanding of the public benefit reporting requirement, similar to last year’s 51%. While this continues the trend of improvement seen in our reviews, the difference is marginal. It is disappointing that all too many charities do not explain the activities they undertake to improve the lives of their beneficiaries and make a difference.

As in previous years, the majority of trustees’ annual reports met at least one of the two aspects of public benefit reporting:

- 66% explained the activities undertaken by the charity to further its purposes for the public benefit, compared with 71% last year

- 66% included a public benefit statement, compared with 62% last year

The trustees’ annual reports that met the public benefit reporting requirement were those where the trustees had appreciated that public benefit reporting is more than including a standard statement. What we were looking for in addition to the public benefit statement was evidence of some reflection on the difference that the charity’s activities had made. The main examples of the approaches taken by trustees to meet this requirement were:

- expanding the public benefit statement to explain why the trustees believed that the charity’s activities provided public benefit

- explaining who had benefitted from what the charity had done, whether a particular group of beneficiaries or the wider public

- explaining the impact of what the charity had done, such as examples of how the charity’s services had led to improvements in people’s lives

What action did we take?

We have provided guidance to the trustees of all charities in our sample whose 2016 trustees’ annual reports did not meet the public benefit reporting requirement, taking account of the content of more recent trustees’ annual reports where these had been filed.

What are the lessons for other charities?

The trustees’ annual report is the key means by which the trustees of a charity are publicly accountable for the work that they have done to make a difference to the charity’s beneficiaries. Public benefit reporting encourages trustees to reflect on how well they are doing and to communicate this to their supporters, potential funders and the wider public.

Our guidance on charity reporting includes accounts packs that incorporate pro-forma trustees’ annual reports. These pro-formas provide a useful structure for preparing a trustees’ annual report that meets the public benefit and other reporting requirements. Our guidance can be downloaded from GOV.UK