Accounts monitoring review: Telling your story well - public benefit reporting by charities

Published 3 September 2018

Why are we reviewing the quality of public benefit reporting?

Public benefit is at the heart of what charities are about. By reporting on public benefit, trustees identify that their charity is effectively doing what it was set up to do and is making a difference to its beneficiaries. Trustees have a legal responsibility to ‘have due regard to’ the Commission’s guidance on public benefit. All registered charities must publish a trustees’ annual report (annual report) and this must set out the charity’s activities for the public benefit.

How do we assess the quality of public benefit reporting?

We have based our assessments on the principles set out in our guidance ‘Public benefit: reporting’ (PB3). In particular, to demonstrate a clear understanding of the public benefit reporting requirement, an annual report must include both:

- an explanation of the activities undertaken by the charity to further its purposes for the public benefit (explains who benefits from its activities)

- a statement by the trustees as to whether they have had due regard to the commission’s guidance on public benefit (a public benefit statement)

How did we carry out the review?

In April 2017, we selected a random sample of 106 charity annual reports from the register of charities, covering accounting years ending during the 12 months to 31 December 2015. We did this because we base our published information about charities and accounts on the annual return cycle and AR 2015 was the most recent complete cycle at the time we selected the sample. In previous years, we sampled from accounting years ending on 31 March and so there is an overlap with last year’s review, which covered the 12 months ending 31 March 2015. The sample size means that our findings are statistically representative of the accounts filed with us for this period. However, as with all samples, there is a margin of error.

Charities with an income less than £25,000 are not required to file their annual reports and accounts with us (unless they are a charitable incorporated organisation) and so are not included in this review.

What did we find?

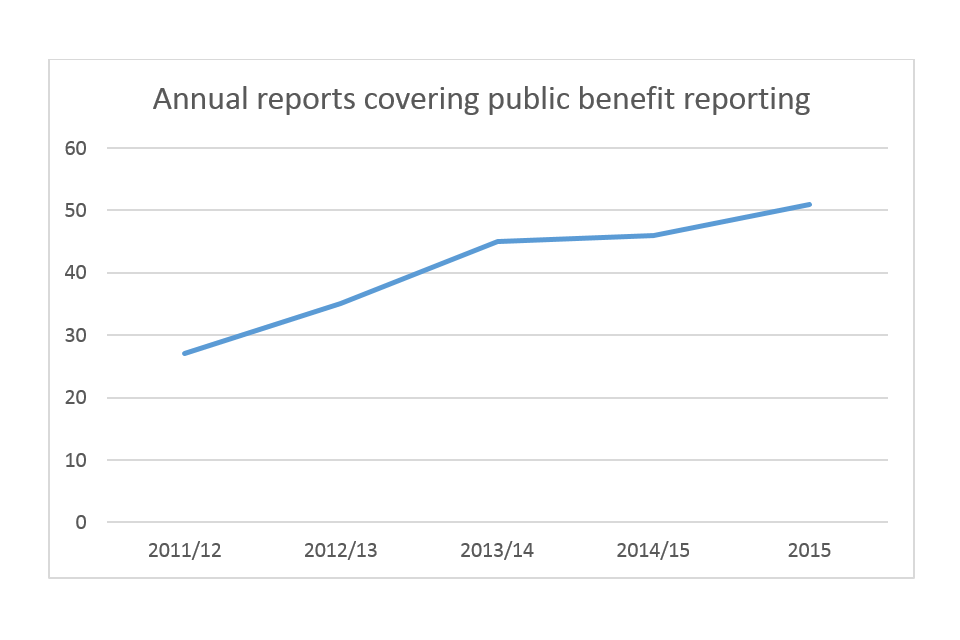

51% of the annual reports demonstrated a clear understanding of the public benefit reporting requirement. This is higher than last year’s 46%. Also, the majority of annual reports included at least one of the two aspects of public benefit reporting:

- 71% explained who benefited from the charity’s activities, and

- 62% included a public benefit statement

The annual reports that met the public benefit reporting requirements showed that the trustees had appreciated that public benefit reporting is more than simply including a standard statement that they have had due regard to our guidance. Some trustees expanded their charity’s public benefit statement to explain why they believed that the charity’s activities provided public benefit. Others went beyond simply describing their charity’s activities to explain the difference that they had made, in particular who had benefitted from those activities.

What action did we take?

Graph showing percentage of annual reports covering public benefit reporting: around 28% in 2011-12, 35% in 2012-13, 45% in 2013/14, 46% in 2014-15 and 51% in 2015

We have reviewed the following year’s annual reports for 45 of the 52 charities whose annual reports did not meet the public benefit reporting requirement. Of the other 7 charities, 4 no longer need to file because their incomes are now less than £25,000, 2 have been removed from the register and the other is now in default of its filing duties. The action that we have taken as a result is as follows:

- no further action is required (10 charities), usually because the more recent annual report does meet the public benefit reporting requirement

- providing guidance to the trustees (41 charities), to assist the trustees in preparing future annual reports that meet the public benefit reporting requirement

- requiring action from the trustees (1 charity), in the case of the charity that is in default.

What are the lessons for other charities?

The preparation of an annual report, of which public benefit forms an important part, is a statutory requirement. However, to see it solely in those terms is to miss the opportunity it provides for charities to ‘take stock’ of how well they are meeting their objectives and the difference that they have made to their intended beneficiaries. A good annual report can also help a charity ‘tell their story well’ to supporters, potential funders and the public. Our guidance on public benefit reporting includes a pro-forma annual report that provides a useful structure for preparing a document that meets the public benefit and other reporting requirements. This guidance, including the other documents referred to in this report, can be downloaded from GOV.UK.

About our accounts monitoring reports

Charities’ accounts are publicly available on GOV.UK. Each year, we develop a programme of reviews, based on issues of regulatory concern. We are publishing a series of reports on our findings, which will help trustees to manage the risks that their charity faces, improve reporting standards and enhance the accountability of charities to their donors, beneficiaries and the public.