Consultation on delivering the Competition and Markets Authority (CMA) recommendation for trustee oversight of investment consultants and fiduciary managers

Updated 6 June 2022

Introduction

This consultation seeks views on the draft Occupational Pension Schemes (Governance and Registration) (Amendment) Regulations. These proposed regulations would integrate an Order produced by the CMA, following their investigation into the investment consultants market, into pensions law. The regulations set out the steps which trustees need to take when using investment consultant and fiduciary management (FM) services, and enable The Pensions Regulator (TPR) to oversee these responsibilities and ensure more joined-up and efficient compliance.

About this consultation

Who this consultation is aimed at

- pension scheme trustees

- pension scheme service providers, other industry bodies and professionals

- civil society organisations

- pension scheme members and beneficiaries

- any other interested stakeholders

Purpose of the consultation

This consultation seeks views on both the policy proposals described in this document and the draft regulations appended to them.

Scope of consultation

Pensions policy is a reserved matter in Scotland and Wales, this consultation therefore applies to England, Wales and Scotland. It is anticipated that Northern Ireland will make corresponding legislation.

Duration of the consultation

The consultation period begins on 29 July 2019 and runs until 2 September 2019. Please ensure your response to the draft regulations reaches us by that date as any replies received after that date may not be taken into account.

How to respond to this consultation

Please send your consultation responses to:

Vicky Bird

Department for Work and Pensions

Policy Group

Private Pensions and Arm’s Length Bodies Directorate

Third Floor South

Quarry House

Leeds

LS2 7UA

Email: pensions.governance@dwp.gov.uk

Government response

We will aim to publish the government response to the consultation on GOV.UK. Where consultation is linked to a statutory instrument, responses should be published before or at the same time as the instrument is laid.

The report will summarise the responses.

How we consult

Consultation principles

This consultation is being conducted in line with the revised Cabinet Office consultation principles published in March 2018. These principles give clear guidance to government departments on conducting consultations.

Feedback on the consultation process

We value your feedback on how well we consult. If you have any comments about the consultation process (as opposed to comments about the issues which are the subject of the consultation), including if you feel that the consultation does not adhere to the values expressed in the consultation principles or that the process could be improved, please address them to:

DWP Consultation Co-ordinator

4th Floor

Caxton House

Tothill Street

London

SW1H 9NA

Email: caxtonhouse.legislation@dwp.gov.uk

Freedom of information

The information you send us may need to be passed to colleagues within the Department for Work and Pensions (DWP), published in a summary of responses received and referred to in the published consultation report.

All information contained in your response, including personal information, may be subject to publication or disclosure if requested under the Freedom of Information Act 2000. By providing personal information for the purposes of the public consultation exercise, it is understood that you consent to its disclosure and publication. If this is not the case, you should limit any personal information provided, or remove it completely. If you want the information in your response to the consultation to be kept confidential, you should explain why as part of your response, although we cannot guarantee to do this.

To find out more about the general principles of Freedom of Information and how it is applied within DWP, please contact the Central Freedom of Information team: freedom-of-information-request@dwp.gov.uk.

The Central Freedom of Information team cannot advise on specific consultation exercises, only on Freedom of Information issues.

Read more information about The Freedom of Information Act.

Chapter 1: Background and overview

Background

1. This section summarises the CMA’s investigation and reports into the investment consultancy (IC) services industry which have led to these proposed regulatory changes.

The CMA’s IC market investigation

2. Following a reference from the Financial Conduct Authority (FCA)[footnote 1], the CMA carried out an investigation into IC and FM services to pension schemes. In broad terms, IC is the provision of advice to trustees on investment strategy and related matters. FM involves the delegation by trustees of some investment decisions to advisers. The CMA’s provisional decision report was published in July 2018[footnote 2].

3. The CMA found an adverse effect on competition and likely customer detriment for trustees, and in turn the employer sponsors of defined benefit (DB) schemes and the members of defined contribution (DC) schemes. They proposed remedies to encourage better trustee engagement when buying both services, and better disclosure of fees and performance.

4. On 12 December 2018 the CMA published its final report[footnote 3] on its market investigation. It confirmed their findings that for both services:

- there is a low level of engagement by trustees

- there is a lack of clear and comparable information to assess value for money

- customers are steered by consultants towards their own higher-cost FM services, giving them an incumbency advantage

5. The CMA is legally required to take such action as it considers to be reasonable and practicable to remedy, mitigate or prevent: the adverse effect on the competition concerned or any detrimental effects on consumers as a result[footnote 4]. In this case, the CMA has put in place an Order which was laid on 10 June 2019[footnote 5] and the remedy provisions of the order will come into force on 10 December 2019.

6. The report also made a number of recommendations to government (DWP and HM Treasury (HMT)) and to regulators (FCA and TPR) to facilitate the implementation of the remedies (see Annex A). The DWP recommendation was to pass the necessary legislation to enable TPR to oversee the duties on trustees.

7. It is government policy to accept CMA recommendations and respond within 90 days, unless there are strong policy reasons not to do so.

The government’s response to the CMA report

8. The government produced a joint response[footnote 6] from DWP, HMT and TPR which was published on 12 March 2019 accepting the CMA recommendations.

9. In the joint response, the government committed to take forward the recommendations put to DWP to pass legislation. This would bring the CMA Order into pensions law for remedies 1 (mandatory competitive tendering of FM services) and 7 (setting objectives for their IC services) and enable TPR to oversee the new duties on trustees rather than long term enforcement of a small aspect of the legislation applicable to occupational pension schemes by the CMA. TPR also accepted the recommendation to produce guidance to help trustees comply with the new procedures. It also acknowledged that HMT would consider their recommendation and consult in due course.

10. The FCA were obliged by law to respond separately as they made the original CMA referral and their response[footnote 7] was published on 26 February 2019. Their response confirmed that they supported bringing IC services into their perimeter and this would allow them to consult on rules to incorporate the CMA’s remedies into FCA’s regulation of the sector. Their response also confirmed that they would consult on introducing into the FCA Handbook the relevant rules for firms offering FM services. This consultation is anticipated by April 2020.

11. Similarly, it is expected that HMT will consult later this year on amendments to the Financial Services and Markets Act (Regulated Activities) Order 2001[footnote 8], in response to CMA’s recommendation to bring investment consultants within the remit of the FCA.

Overview of our regulations

12. We view the proposed remedies set out by the CMA as a positive step for improving ongoing trustee engagement and consequential improvements in the value for money of IC and FM services. Setting strategic objectives for ICs should empower trustees to monitor performance and value for money more closely. DWP regulations, like the CMA order, should increase competition, allowing smaller and specialist firms to enter the market.

13. Likewise, the mandatory competitive tendering on first adoption of FM or the continuation of historic FM may encourage trustees to become more engaged with their investment strategy and make more informed decisions about their schemes’ governance structure, and better decisions around both value and costs.

14. We have replicated parts 3 (FM tendering) and 7 (IC objectives) of the CMA order in the main, with slight differences in the policy approach as set out in Chapter 2. The monitoring and compliance parts of the order (parts 9 and 10) will also be brought into pensions law through our draft regulations, enabling TPR to carry out their regulatory function for these processes. Again further detail of the differences of approach are set out in Chapter 2.

15. TPR will shortly be consulting on their guidance so that stakeholders can review the regulations and guidance together.

Next steps

16. For the purposes of this consultation and the draft regulations we are aiming for a December 2019 or January 2020 laying date and we propose a coming into force date of 6 April 2020.

Chapter 2: Our proposals

Schemes in scope

1. The CMA order prescribes that all registrable DB and DC occupational pension schemes with 2 or more members are in scope of both remedy 1 and 7 with a number of exceptions including:

- relevant small schemes and executive pension schemes

- public service pension schemes (PSPSs) as defined by the Pensions Act 2004, although local government pension scheme (LGPS) are in scope for remedy 7

- schemes which are not tax registered

2. Our regulations do not exclude PSPSs as defined by the Pensions Act 2004, but instead limit scope to schemes with trustees. As PSPSs established under the 2004 Act are statutory schemes, they do not have trustees. Additionally, our regulations exclude all schemes which meet the PSPSs definition in the Pension Schemes Act 1993.

3. Our regulations do not therefore apply to the LGPS. In particular, we have made no provision for applying remedy 7 to the LGPS, as regulations and guidance in relation to the LGPS are a matter for Ministry of Housing, Communities and Local Government.

4. In addition, where the trustees are contracting authorities for the purposes of the Public Contracts Regulations 2015, they are excluded from remedy one under the CMA order. We have maintained that position.

5. Finally, the CMA order also excludes certain other types of scheme from both remedies 1 and 7. These include:

- schemes where the principal or controlling employer of a scheme is themselves a provider of FM and/or IC services to the schemes

- master trusts for which an IC-FM firm (or an interconnected body corporate of the IC-FM firm) is the scheme strategist or scheme funder

6. We agree that it would be impractical in these circumstances to expect the scheme trustees to carry out a competitive tender for FM when they would have a clear and legitimate preference to use the services of the sponsoring employer. However, we believe it is reasonable for the trustee to set their IC objectives and monitor performance against them, regardless of whether the IC is connected with the sponsoring employer of the scheme. The member can suffer detriment if this is not done.

7. We are not proposing to make any changes to the treatment of schemes whose trustees own a provider of FM and/or IC services. Such schemes will remain out of scope of both remedies 1 and 7.

Question 1

a) Do you agree with our proposals for the scope of the regulations?

b) Do you agree that the draft regulations meet the policy intent?

Definitions

Definitions of IC services and FM services

8. As yet there are no definitions in pensions law for IC or FM services. For the purpose of the regulations it is important that trustees, the IC and FM markets and wider pensions industry have a joint understanding of what is meant by these services. Proposed definitions of both services are therefore introduced.

9. We have closely followed the definitions of IC and FM services in the CMA order, although we have made some relatively minor changes to align terminology with existing pensions legislation and simplify drafting in a small number of places.

10. In the section of the regulations that describe the meaning of ‘FM provider’ we have included a condition to set out that, a provider is also considered to provide an FM service where (subject to other conditions in the regulations) they are appointed to carry out asset management, up to 12 months prior to being appointed to provide IC. This is to ensure that the regulations provide clarity by covering all appointment scenarios or sequences, and avoid any potential misunderstandings or loopholes.

Question 2

The draft definitions for IC Service and FM Service are contained in the definitions section of the draft regulations.

a) Do you agree with our definitions?

b) Do you agree that the draft regulations meet the policy intent?

Use of group undertaking to identify whether bodies are connected

11. The CMA proposed the use of “interconnected body corporate of the FM provider or a partnership or joint venture with the FM provider” to determine whether organisations were connected for the purposes of identifying whether a scheme was sponsored by an IC/FM or connected body, or a service met the definition of FM.

12. The “interconnected body corporate” definition, which is typically used in CMA legislation, captures corporate bodies which are subsidiaries of the other, or subsidiaries of subsidiaries, and those with a common parent corporate body.

13. We are proposing to use group undertaking to capture the full range of relationships. The difference between the definitions of group undertaking and the interconnected body corporate lies in the kinds of bodies which are interconnected. Interconnected body corporate does not capture partnerships or unincorporated associations. So if a partnership or an unincorporated association were the parent of a body corporate, the two would form a group undertaking but not an interconnected body corporate. Interconnected body corporate is therefore a subset of group undertaking.

14. We anticipate that group undertaking will capture a broader range of ownership and control connections than interconnected body corporate – ownership relationships involving partnerships can still signify influence and control.

15. Unlike the CMA order, we do not propose to include the use of ‘joint venture’ in our regulations. This is because joint venture does not signify the same level of ownership and control, given that control will be shared with one or more other undertakings. We also believe that there could be an avoidance risk, so that where a scheme sponsor and an FM had a joint venture, they would not be required to run, or bid for, a competitive tender. This could inadvertently incentivise firms to create joint ventures to circumvent this duty. We therefore intend that even where sponsors and FMs are connected through a joint venture, there should still be a requirement to run a competitive tender.

16. The overall effect of these changes is that a small number of schemes which might under the CMA order have been in scope of both remedies would now be deemed as sponsored by an IC/FM provider and therefore now excluded from remedy 1, although still included in remedy 7. We do not have evidence to suggest that any schemes currently excluded in the CMA order from both remedies because of a joint venture connection will be now in scope of both remedies.

17. In addition, a very small number of services which might not have been defined as FM under the CMA order – because the firms providing advice did not form an interconnected body corporate with the provider of investment management – would meet the definition of FM if they form a group undertaking.

Question 3

a) Do you agree with our proposal to use group undertaking?

b) Do you agree that the draft regulations meet the policy intent?

Mandatory tendering for FM

18. The CMA proposed that trustees must, when entering into or continuing with a FM agreement, in certain circumstances, carry out a process they called a competitive tender process. This means a process by which pension scheme trustees, or another person appointed by them to act on their behalf, have invited or used reasonable endeavours to obtain bids for the provision of FM services from 3 or more unrelated FM providers and have evaluated the bids received.

19. The CMA order, and our regulations, set out the circumstances under which the trustees are required to carry out a competitive tender. These are outlined in the ‘historic’ and ‘ongoing’ tests. Both of these tests will need to be considered by trustees before deciding whether the competitive tender process is necessary.

20. The CMA order sets out that the assets of the scheme are the funds held by the trustees of the scheme, excluding any asset-backed contribution (ABC) arrangements and buy-in policies, although they do not define asset backed contributions and buy-in policies in either their Order or Explanatory Note. Our regulations only exclude buy-in policies from the calculation of assets, as we understand these arrangements are much more commonly used than ABCs. A very small proportion of DB schemes make use of ABC arrangements, and numbers of schemes adopting such arrangements does not appear to be significantly increasing.

21. Elsewhere, we have largely replicated the CMA order, although we have made some suggested changes to drafting to:

- use the group undertaking test to determine whether FMs are independent of one another and therefore able to compete

- changing and clarifying references in the definition of FM services means that the services from firms who are not an interconnected body corporate but are a group undertaking will fall into scope of an FM service (see paragraph 17 above)

- make clear that the service remains FM, even if no advice has been given in past 12 months. It was the CMA’s intention that the test for an FM service is a one-off test, so that where a service has met the definition of an FM service in relation to a particular scheme at a particular point in time, it should continue to meet the definition of an FM service – for as long as arrangements are still in place for the provision of that service

22. For the avoidance of doubt, it is our intention, as with the CMA order, that for sectionalised pension schemes, for example, hybrid schemes, the 20% threshold is calculated from the whole of the scheme not a section of the scheme.

Question 4

a) Do you agree with our proposals for FM tendering?

b) Do you agree that the draft regulations meet the policy intent?

Setting objectives for investment consultants

23. The CMA report set out its remedies for improving the IC services received by customers. The aim is that pension scheme trustees better monitor the performance of their IC provider by setting and measuring them against an appropriate set of strategic objectives. In addition to this it is the intention that trustees must not enter into an agreement for the provision of IC services unless strategic objectives have been set for the provider.

24. The CMA measure applies to anyone providing a service which meets the proposed legal definition of IC, whether that service is described or promoted as being IC. Where a scheme engages with its actuary, or an independent financial adviser or any service meeting this definition, it will be subject to the objective setting requirements.

25. We have largely replicated this, only making changes in some aspects so that the measure sits better with existing pensions legislation. We refer to “objectives” rather than “strategic objectives” to avoid the unintended perception that only objectives relating to investment strategy should be included. We have also dropped the exclusion of “high level commentary” by scheme actuaries from the definition of IC, as a service meeting the definition of one appears to have no practical possibility of meeting the definition of the other. We do not, however, intend that advice from the scheme lawyer(s) on investment matters is considered as IC and therefore we have specifically excluded from our regulations the duty for trustees to set objectives for them.

26. We expect trustees to:

a) set objectives for their IC service that have regard to the statement of investment principles

b) review the performance of each IC provider against their objectives at least every 12 months, and

c) review the objectives at least every 3 years and without delay after any significant change in investment policy

27. We have not made provision in law, but we expect that objectives:

(a) include a clear definition of the outcome expected to be delivered and the timescale over which it will be delivered

(b) should be relevant to the services provided

(c) should also enable the trustee to measure the performance of the IC services provided

28. Where trustees have existing arrangements with ICs which pre-date the coming into force of these regulations for which they have not yet set objectives, our draft legislation proposes that they should set objectives with immediate effect.

Question 5

a) Do you agree with our proposals for investment consultant objectives?

b) Do you agree that the draft regulations meet the policy intent?

Reporting compliance

29. The CMA proposed that pension scheme trustees would be required to submit compliance statements to the CMA confirming the extent to which they had complied with the articles of parts 3 and 7 of the CMA order which were in force during the reporting period.

30. Our regulations will enable TPR to oversee the remedies that apply to trustees and for them to carry out the appropriate monitoring, compliance and enforcement activity. Trustees will be required, within the existing scheme return process (through the exchange platform), to report compliance in relation to the new requirements outlined in the legislation. The compliance process follows the same processes as those currently in place for the automatic enrolment charges measures.

31. Amendments to The Register of Occupational and Personal Pension Schemes Regulations 2005[footnote 9], will require TPR to ask additional questions on the scheme returns for trustees to complete. This is because it gives opportunity for schemes to certify compliance or non-compliance and to provide TPR with intelligence which it may be beneficial to investigate further. The scheme return will include:

For IC Services

(a) the name and address of the IC provider

(b) the most recent date on which the IC provider was appointed

(c) whether the trustees have set objectives for the IC provider, and if not, why not

(d) whether the trustees have reviewed the objectives set for the IC provider and if not, why not

(e) whether the trustees have reviewed the services provided by the IC provider and if not, why not

For FM Services

(a) the name and address of the FM provider, and

(b) (for schemes which are under the 20% threshold of scheme assets on the coming into force date)

i. the most recent date on which the FM provider was appointed

ii. whether the trustees carried out a qualifying tender process in connection with the appointment, and if not, why not

(c) (for schemes which are over the 20% threshold of scheme assets on the coming into force date)

i. the date on which the FM provider was first appointed

ii. whether the trustees have carried out a qualifying tender process in connection with the arrangements, and if not, why not

32. We are also proposing to remove the following requirements from the scheme return as these are unnecessary for most schemes or of limited usefulness for TPR:

- whether the scheme is a public service pension scheme[footnote 10]

- whether the scheme or any part of the scheme is protected by a Crown guarantee[footnote 11]

- the nature of the business of any relevant employer[footnote 12]

Question 6

a) Do you agree with our proposed approach to compliance?

b) Do you agree that the draft regulations meet the policy intent?

Penalties

33. The CMA approach is to give directions in writing for the purposes of carrying out, or ensuring compliance with their order. They may vary or revoke any directions so given.

34. Our regulations set out our approach to using a discretionary regime of compliance notices and penalties. This process is similar to the compliance provisions already required for the automatic enrolment charges measures which DC trustees will already be familiar with.

Question 7

a) Do you have any comments on the proposed approach to penalties?

b) Do you agree that the draft regulations meet the policy intent?

Other minor regulatory changes

35. A number of other minor technical changes are included in the regulations so that they better align with the terminology and style of existing pensions legislation.

Question 8

Do you have any comments on these or any other aspects of our proposals or the drafting of the regulations?

Impacts

36. A draft impact assessment estimating the direct and indirect financial impacts on business and on others has been published alongside this consultation. We are using the CMA order as the baseline and only the new legislative changes will contribute to the equivalent annual net direct cost to business of this package of regulations. We would welcome any evidenced comments on the impact assessment.

37. Specifically, we would welcome evidence of:

a) Competitive tender

Our assumptions about the use of group undertaking rather than interconnected body corporate to determine whether FMs are independent of one another and therefore able to compete. We do not know precisely how many organisations will be impacted by this policy change. We assume trustees would avoid more than one approach to firms which formed a group undertaking and would instead seek a different tender.

b) Definition of FM services

Our assumptions around changing the references in the definition to group undertaking rather than interconnected body corporate, and services therefore falling into scope of FM. We do not know precisely how many organisations will be impacted by this policy change. We assume the CMA captured all such schemes and that no firms are impacted by the change in the definition of FM services.

c) Schemes where the principal or controlling employer of a scheme is themselves a provider of FM services, and Master Trusts for which an IC-FM firm (or a group undertaking of the IC-FM firm) is the scheme strategist or scheme funder

Our assumptions around the number of schemes impacted and therefore required to set and monitor objectives.

d) Compliance reporting

Our assumptions around the resources to compile the information and complete the questions in the scheme return.

Question 9

Do you have any comments on these or other business burdens and benefits, and wider non-monetised impacts we have estimated in the draft impact assessment?

Annex A: CMA remedies and recommendations

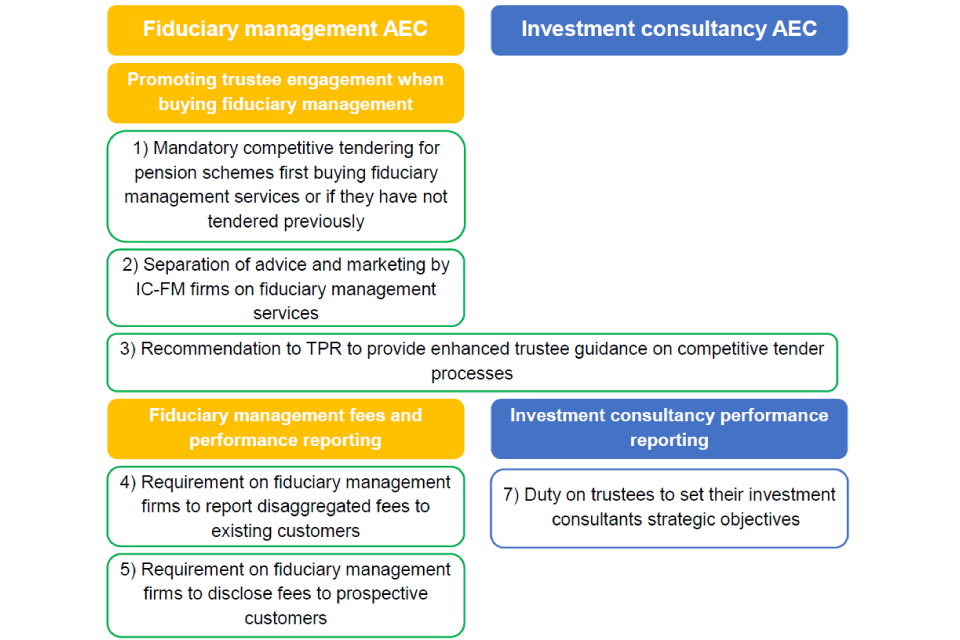

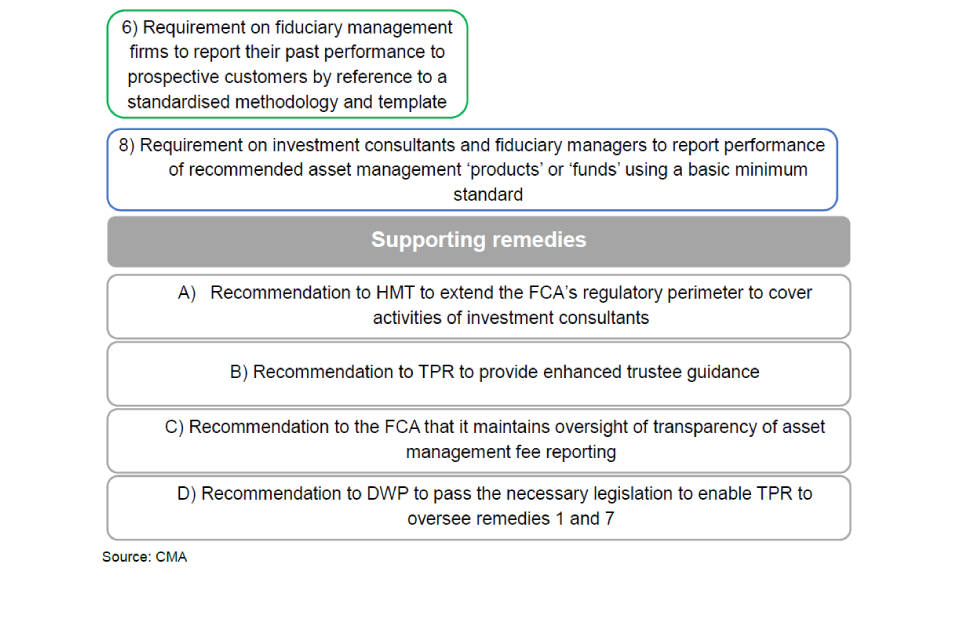

Diagram showing the Competition and Markets Authority's remedies and recommendations, including mandatory competitive tendering for pension schemes first buying fiduciary management services or if they have not tendered previously.

Diagram showing the Competition and Markets Authority's supporting remedies, including a recommendation to HM Treasury to extend the Financial Conduct Authority's regulatory perimiter to cover activities of investment consultants.

-

Asset Management Market Study: Final Decision: Market Investigation Reference (MIR) on investment consultancy services and fiduciary management services ↩

-

CMA Market Investigation: Investment Consultancy and Fiduciary Management Services ↩

-

The Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 ↩

-

The Register of Occupational and Personal Pension Schemes Regulations 2005 ↩

-

SI 2005/597 The Register of Occupational and Personal Pension Schemes Regulations 2005, reg 3(1)(a)(ii) ↩

-

SI 2005/597 The Register of Occupational and Personal Pension Schemes Regulations 2005, reg 3(1)(a)(iii) ↩

-

SI 2005/597 The Register of Occupational and Personal Pension Schemes Regulations 2005, reg 3(1)(e)) ↩