Public consultation on trade negotiations with New Zealand: summary of responses (web/online version)

Updated 17 June 2020

Foreword from the Secretary of State for International Trade and President of the Board of Trade

The United Kingdom is on the cusp of a new era in our great trading history. For the first time in nearly 50 years, we will have the freedom to pursue an independent trade policy to build a stronger, fairer and more prosperous country, more open and outward-looking than ever before.

The government, led by my Department for International Trade, has been preparing for the United Kingdom to have an independent trade policy after we exit the European Union. We have made great strides forward. We have opened 14 informal trade dialogues with 21 countries from the United States to Australia to the United Arab Emirates. We have also been working closely with our existing trading partners to ensure the continuity of European Union trade deals. The United Kingdom’s trade with countries with which we are seeking continuity [footnote 1] accounted for £139 billion or 11% of the United Kingdom’s trade in 2018.[footnote 2]

We have already signed a number of these continuity agreements which replicate the effects of the existing agreements, as far as possible. This includes Switzerland, which is one of our key trading partners and worth 2.3%[footnote 3] of the United Kingdom’s total trade. Other agreements have been signed with Israel, the Palestine Authority, Chile, the Faroe Islands, Eastern and Southern Africa, Caribbean countries, Iceland and Norway, Fiji, Papua New Guinea, Colombia, Peru and Ecuador.[footnote 4] We have also agreed in principle an agreement with Korea which will be signed shortly. In addition to this, we have also signed Mutual Recognition Agreements with Australia, New Zealand and the United States. We will continue to work tirelessly to deliver the maximum possible continuity and certainty for when we leave the European Union.

In addition, we have made significant headway on the United Kingdom’s future independent membership of the World Trade Organization: we have submitted our proposed commitments on goods and services; established our own independent trade remedies system (the Trade Remedies Authority); and published the Export Strategy and launched 14 working groups and a number of trade reviews with key partners.

The government is determined to build a new economic relationship with the European Union. One which sees the United Kingdom leave the Single Market and the Customs Union to seize new trading opportunities around the world, while protecting jobs, supporting growth and maintaining security co-operation. We recognise that our Future Economic Partnership with the European Union will have considerable and immediate implications for the way the United Kingdom can develop its future trade policy, in terms of its trading agreements with the rest of the world. We will continue to listen and respond to our stakeholders’ views on this as we develop our own independent trade policy in parallel with the direction of the future relationship negotiations with the European Union.

An independent trade policy means we can negotiate trade agreements specifically tailored to the United Kingdom, building links with old friends and new allies, enabling the United Kingdom to take advantage of emerging sources of growth and to deepen ties with our established partners to create shared and sustainable growth.

In July last year, we launched consultations on new free trade agreements. The consultations demonstrated the United Kingdom’s intention to seek free trade agreements with the United States, Australia and New Zealand, as well as the United Kingdom potentially seeking accession to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP, a plurilateral agreement with 11 existing members).

We have engaged fully with the devolved administrations, and consulted extensively with stakeholders across the business community, civil society, academia and the general public on priorities for trade negotiations to ensure we represent the interests of the whole of the United Kingdom in any future negotiation.

We have received 601,121 responses to the four consultations on future trade agreements. I would like to thank all those who took the time to contribute to this consultation. The government is committed to an inclusive and transparent trade policy, so today, I am publishing a summary of the consultation responses we received across the 4 consultations.

The Rt Hon Dr Liam Fox

Secretary of State for International Trade and President of the Board of Trade

Introduction

Background

1. As the United Kingdom (UK) leaves the European Union (EU), we will have an independent trade policy for the first time in nearly 50 years. This will give us the opportunity to forge new and ambitious trade relationships around the world, and to enter into new Free Trade Agreements (FTAs) with other countries or groups of countries.

2. The government remains committed to building a deep and special trading partnership with the EU, but through our new independent trade policy, we can also take advantage of shifts in the global economy: According to the IMF, 90% of the world economic growth over the next 5 years is forecast to come from outside the EU[footnote 5]; and 54% of the UK’s exports of goods and services are now traded outside the EU[footnote 6], compared with only 46% in 2006.

3. Through negotiating FTAs, we can work with our trading partners around the world to break down barriers to trade in goods and services, ensure that UK businesses are treated fairly, and protect our right to regulate and maintain high standards, creating the conditions for individuals and businesses to prosper. Our ambition is to:

- increase economic growth and productivity, through increased trade and investment, promoting greater competition and innovation

- provide new employment opportunities, including higher-skilled jobs, from greater specialisation, increasing wages and opportunity across the UK

- deliver a greater variety of products for consumers at a lower cost while maintaining quality

Why this free trade agreement?

4. An early priority for the UK’s independent trade policy will be to negotiate a comprehensive FTA with New Zealand. New Zealand is one of our closest allies, sharing the same head of state, HM the Queen, and a country the UK already cooperates extensively with in a wide range of multilateral forums including the United Nations (UN), the World Trade Organization (WTO) and the Commonwealth. New Zealand has a reputation for negotiating high-quality FTAs. An FTA with New Zealand would be an opportunity to set an ambitious precedent for future agreements and to identify where we can collaborate to promote open markets around the world. It would also build on our strong trade relationship with current UK-New Zealand trade worth £2.8 billion in 2018.[footnote 7] The UK exported £1.4 billion worth of goods and services to New Zealand in 2018.[footnote 8]

A transparent and inclusive trade policy

5. As set out in the Trade White Paper Preparing for our future UK trade policy published in October 2017, the government is committed to pursuing a trade policy which is inclusive and transparent. To ensure that any future FTA works for the whole of the UK, the government is therefore committed to seeking views from a broad range of stakeholders from all parts of the UK. In July 2018, the government published DIT’s approach to engagement for the pre-negotiation phase of trade negotiations setting out its plan for pursuing new trade negotiations collaboratively by engaging with the widest range of stakeholder groups, as it takes forward its free trade agenda. For new FTAs, we have run broad open consultations. We will continue to engage as widely as possible as we look ahead to negotiations potentially starting soon.

6. On 20 July 2018, the Department for International Trade (DIT) launched four 14-week public consultations seeking views on potential FTAs with the United States (the US), Australia and New Zealand, and potential accession to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). To support this, the government ran a series of events around the UK to promote the consultations. All 4 consultations closed on 26 October 2018. This document sets out the findings from the responses received.

7. DIT welcomed feedback and comments from all interested parties to the consultations. Across the four consultations, the government received over 600,000 responses including those submitted by campaigns. They have been analysed and are informing the government’s overall approach to the 4 potential future trade deals. The consultation feedback will also support the government in meeting its commitment to delivering a UK trade policy which will benefit the UK economy, and businesses, workers, producers and consumers.

8. While many respondents welcomed the opportunities that an independent trade policy will bring as we leave EU, many respondents also mentioned the importance of the UK’s future economic relationship with the EU. We recognise that the UK’s future trade policy, including our ability to negotiate FTAs, will depend on the scope and substance of our future economic relationship with the EU. While comments on the UK government’s vision for the Future Economic Partnership (FEP) with the EU were outside the scope of the questions asked in this FTA consultation, they have, however, been included in our analysis.

What we asked

9. Each consultation was based on a series of questions concerning the respondent’s priorities and concerns regarding the relevant agreement. The questions were broad to ensure the consultation exercise was inclusive and would encourage participation from a wide range of stakeholders. We received responses from individuals, businesses, business associations, public sector bodies, trade unions and other non-governmental organisations (NGOs). The online survey covered a range of policy areas which are typically included in any comprehensive FTA.

These were:

- competition

- customs procedures

- digital

- government (public) procurement

- intellectual property (IP)

- investment

- labour and environment

- product standards, regulation and certification

- Rules of Origin (RoO)

- sanitary and phytosanitary (SPS) measures

- services

- small- and medium-sized enterprise (SMEs) policy

- tariffs

- trade remedies and dispute settlement

- other

Respondents were also able to submit additional comments not related to the areas listed above. A full list of all the questions asked during this consultation is available in Annex A.

This report

10. This document is a summary of what respondents said in the consultation on trade negotiations with New Zealand (the consultation). The evidence provided from the responses to this consultation (as summarised in this document), will inform the government’s overall approach to our future trading relationship with New Zealand, including our approach to negotiating any trade agreement. As we look ahead to finalising our negotiating objectives, we will continue to actively consider the consultation feedback to inform this work. Decisions made as a result of this consultation will therefore be published alongside our negotiating objectives before potential negotiations start. This report, therefore, does not set out government policy with respect to future trade policy, but simply provides a summary of what consultation respondents have told us. The government will take all responses to this consultation into account. A number of respondents raised points which fell outside the scope of this consultation. However, they have still been included in the statistical analysis.

11. We also received a large number of responses from outside the UK. The views provided in these responses will be analysed carefully and considered.

12. This document does not contain a list of the respondents or contain any personal or organisational details of the respondents. Their views are summarised in the following sections of this report but are not attributed to any individual respondent or business. The figures in this document refer to those who responded to the consultation, so should not be treated as statistically representative of the public at large.

13. The government does not intend to publish any individual consultation responses it received. Many organisations have published their own responses independently.

14. DIT commissioned the research agency Ipsos MORI to analyse responses for all 4 consultations and produce statistical analysis with a summary of the overall findings. This analysis supplements the review of consultation feedback undertaken by the government. Ipsos MORI developed a code frame to allow for systematic statistical analysis of the responses. The codes within the code frame represent a ‘theme’ based on an amalgamation of responses submitted and are intended to comprehensively represent all responses. The code frame and methodology, produced by Ipsos MORI, have been published alongside this report.

Overview of the responses

15. On the closure of the consultation on a potential UK-New Zealand trade deal, the government had received 146,245 responses, submitted via the online survey and by email or post.

Table 1: A breakdown of the overall response numbers

| Type of response | Number |

|---|---|

| Number of emails, letters and online survey responses received | 146,245[footnote 9] |

| Post | 1 |

| Emails [non-campaign] | 68 |

| Emails [campaign] | 145,905 |

16. Respondents were categorised into one of the following 5 groups:

- an individual – responding with personal views, rather than as an official representative of a business, business association or another organization

- business – responding in an official capacity representing the views of an individual business

- business association – responding in an official capacity representing the views of a business representative organisation or trade association

- non-governmental organisation (NGO) – responding in an official capacity as the representative of a non-governmental organisation, trade union, academic institution or another organisation

- public sector body – Responding in an official capacity as a representative of a local government organisation, public service provider, or another public sector body in the UK or elsewhere

Online consultation portal

17. The consultation portal was hosted by Citizen Space (an online software tool) and contained an online survey with a total of 67 questions. This was tailored to each of the 5 respondent groups with additional questions for certain groups. The survey for each group asked what areas of an FTA respondents viewed as being priorities and concerns and offered respondents the opportunity to select from across 14 trade policy areas relevant to an FTA. Respondents were also given the opportunity to submit supplementary comments and to raise any other issues. In addition, business respondents and business organisations were asked to select their top priority area and top concern. Respondents could simply answer the online survey questions selecting from the 15 options for priorities and concerns with textboxes available for additional comments. While many respondents chose not to submit additional comments after filling in the questionnaire, these responses are still subject to the same analysis and will be taken into account in developing our policy.

18. Of the 67 questions, there were 5 general questions for all respondents to answer, 11 specific questions for individuals, 10 specific questions for NGOs, 17 questions for businesses, 15 specific questions for business associations and 9 specific questions for public sector bodies. See Annex A for the full list of questions asked.

19. Table 2 shows a breakdown of the number of consultation portal responses per respondent group.

Table 2: Total consultation portal responses broken down by respondent group

| Respondent group | Number of responses |

|---|---|

| Individual | 172 |

| Non-governmental organisation (NGO) | 27 |

| Business | 36 |

| Business association | 29 |

| Public sector body | 7 |

| Total | 271 |

Respondents’ demographic profile

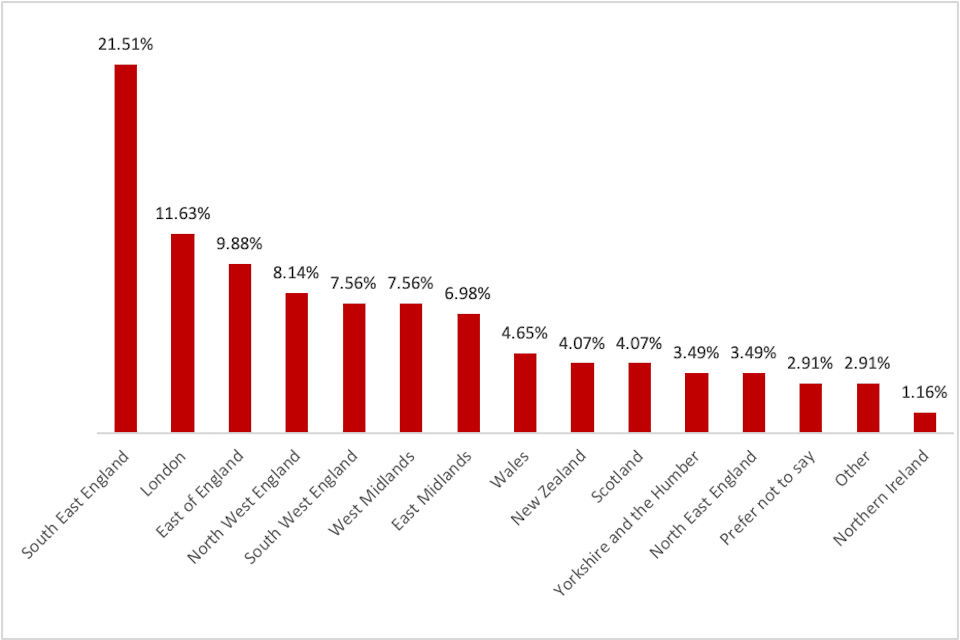

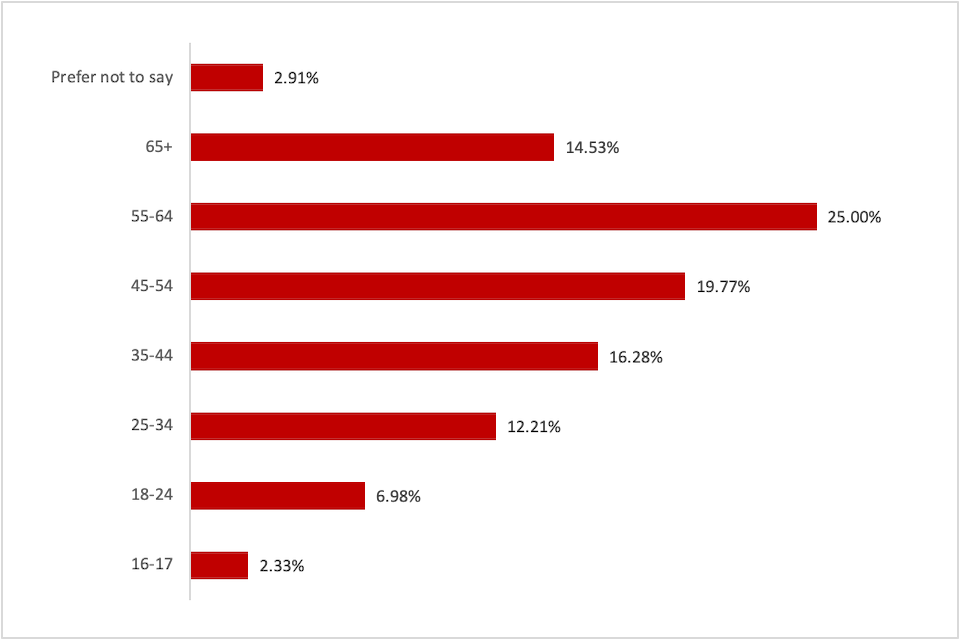

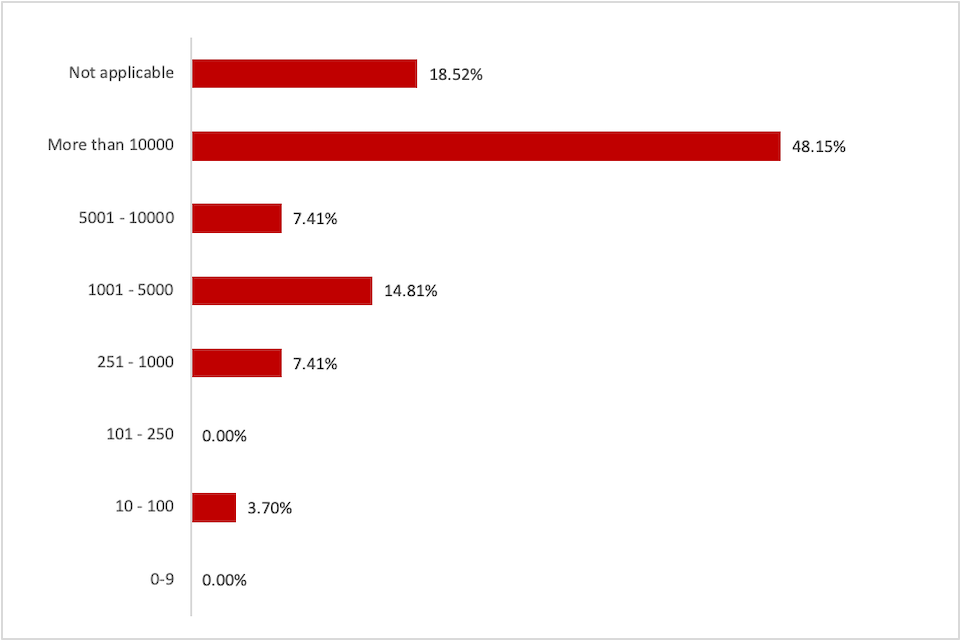

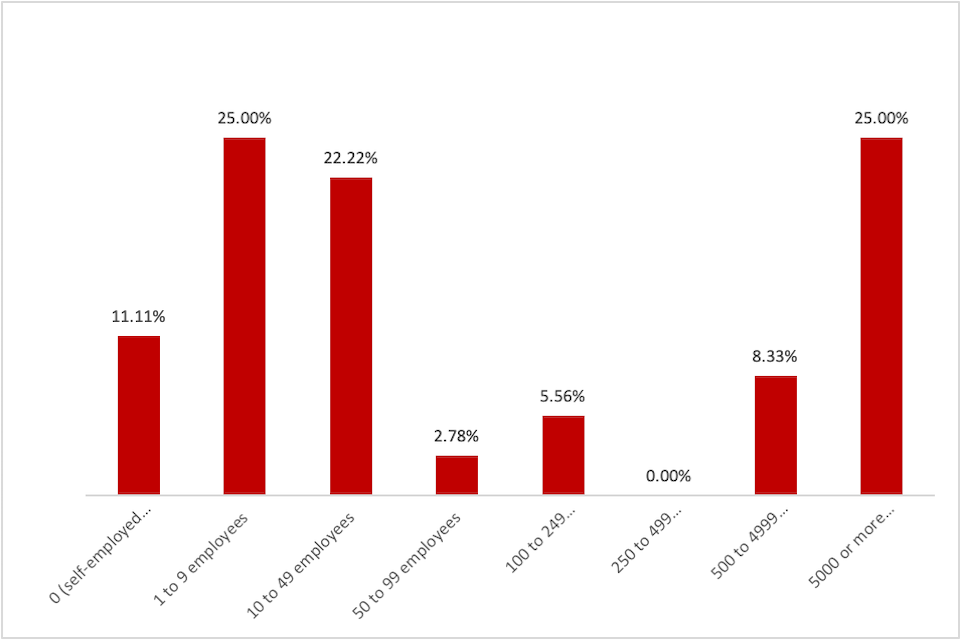

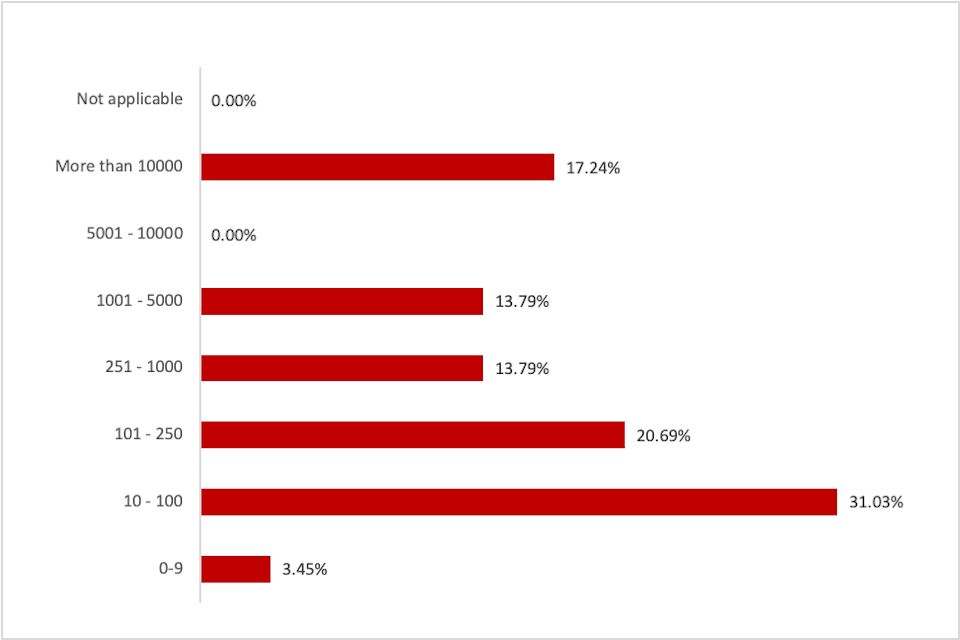

20. The online survey gave respondents the option to provide additional data about themselves or their organisation. This included questions such as their geographical location, age, gender, size of business and the number of businesses the business associations represent. Using this data, we have provided a detailed breakdown of respondents’ profiles in Annex B.

Responses via email and post

21. Some respondents opted to submit their responses to the consultation via email. On request, questions from the consultation portal survey were made available to respondents. In this case, the majority of respondents submitted a letter with specific comments tailored to the needs and circumstances of their organisation. The table below (see table 3) shows a breakdown of the number of responses by respondent group. Over two thirds of the responses sent via email were from business and industry.

Table 3: Total number of email responses broken down by respondent group

| Respondent group | Number of responses |

|---|---|

| Individual | 4 |

| Non-governmental organisation (NGO) | 10 |

| Business | 5 |

| Business association | 43 |

| Public sector body | 6 |

| Total | 69 |

22. One response was submitted by post from an NGO.

Campaign responses

23. A campaigning group (38 Degrees) organised and actively encouraged responses from its members to the consultation. Nearly 150,000 responses were submitted.

Table 4: Breakdown of the number of campaign responses

| Campaigning organisation | Number of responses | Title of campaign |

|---|---|---|

| 38 Degrees | 145,905 | Submission to DIT’s consultation on future trade deals |

24. We have not categorised responses in any way other than how they were received. In the summary of responses section of this document, which summarises the detailed comments received by respondents, responses have been considered in the relevant policy area where they would be in a typical FTA.

Consultation feedback

Consultation events

25. As part of DIT’s work to promote all 4 consultations, we held 12 ‘Town Hall’ and roundtable events across the UK, seeking views from a broad range of stakeholders. Additionally, the Minister of State for Trade Policy, George Hollingbery MP, chaired a webinar (openly advertised on Twitter) with over 100 people registering. The webinar was specifically designed to discuss FTAs with specific relevance to how small- and medium-sized enterprises (SMEs) operate.

Table 5: Location, date and partner organisation of each event

| Location | Date | Partner organization |

|---|---|---|

| Edinburgh | 5 September 2018 | The Scottish Council for Development and Industry |

| Manchester | 21 September 2018 | British American Business |

| Exeter | 28 September 2018 | Confederation of British Industry |

| Birmingham | 1 October 2018 | British American Business |

| Norwich | 3 October 2018 | Confederation of British Industry |

| Belfast | 4 October 2018 | Invest Northern Ireland |

| London | 5 October 2018 | Confederation of British Industry |

| Nottingham | 8 October 2018 | Geldards |

| Durham | 10 October 2018 | British Chambers of Commerce |

| Leeds | 12 October 2018 | Trades Union Congress |

| Cardiff | 15 October 2018 | British Chambers of Commerce |

| Reading | 17 October 2018 | Federation of Small Businesses |

| Webinar | 22 October 2018 | Federation of Small Businesses |

26. The events were intended to encourage individuals and businesses from all parts of the UK to participate in the consultations. We partnered with leading business associations and other representative organisations to host these events with each event adapting to meet the needs and interests of the registered attendees. In total, there were over 300 attendees with a broad spectrum of trade policy interests.

27. The events were chaired by either the Secretary of State, a minister or a senior official from DIT. Leading country and policy team experts from the department were also available to answer questions. These events allowed us to hear first-hand from a range of experts from across business, trade unions, NGOs, consumer groups and other civil society representatives. Events were held under the Chatham House Rule, with comments not attributed to stakeholders. This facilitated an open and honest discussion. Feedback from attendees was positive with the events being reported as informative and valuable.

28. From these events, we gathered the following feedback to all 4 consultations:

- appetite for engagement was high. Stakeholders valued the opportunity for a genuine dialogue with ministers and senior officials, an opportunity to exchange views, gather information and to be involved in the policy-making process

- stakeholders welcomed the government’s commitmegt to an inclusive and transparent trade policy and asked for this transparency to continue throughout the negotiation process. They requested more digital content on trade to be made available, and for the department to signpost main issues to assist them accessing pertinent information

- levels of general knowledge of FTAs were mixed

- many businesses were engaged but were open about the fact that the FEP with the EU and EU-Exit contingency planning was their main focus. This was consistently seen as the more immediate priority for business

29. Understanding of FTAs varied across different stakeholder groups, with there being mixed levels of awareness about the impact of trade deals and their wider benefits to the general public. DIT recognises the need to raise awareness of future FTAs and their impact at both local and national level. The insights gained from these events will inform DIT’s stakeholder engagement plans for any future stakeholder consultation exercises and for any future engagement during potential trade negotiations. The government will continue to build upon its commitment to deliver an informed, inclusive and transparent trade policy.

Engagement with devolved administrations, Crown Dependencies and Overseas Territories

30. As set out in the Trade White Paper Preparing for our future UK trade policy the government is committed to ensuring the devolved administrations (DAs) have a meaningful role in trade policy after we leave the EU. To develop and deliver a UK trade policy that benefits businesses, workers and consumers across the whole of the UK we will take into account the individual circumstances of England, Scotland, Wales and Northern Ireland. Working closely with the devolved administrations to deliver an approach that works for the whole of the UK continues to be a priority for DIT.

31. During the consultation, we took steps to engage widely in Scotland, Wales and Northern Ireland, including holding round tables in Edinburgh, Cardiff and Belfast.

32. The Scottish and Welsh Governments have provided views on the potential UK-New Zealand FTA via written responses and during discussion with DIT ministers and officials. We welcome and thank both governments for these views.

33. The Northern Ireland Civil Service has published technical data in relation to New Zealand and trade and discussed this data with DIT officials. We thank them for this information.

34. DIT will continue to actively engage with the devolved administrations regarding any new potential trade deal with New Zealand through a new DIT/DA Ministerial Forum and our regular Senior Officials Group and policy roundtables.

35. We recognise the interest in potential UK FTAs from the Crown Dependencies and Overseas Territories, including Gibraltar, and remain fully committed to engaging with them as we develop our independent trade policy for the UK. The Secretary of State for International Trade made this commitment clear in his letter to the Chief Ministers of the Crown Dependencies and Overseas Territories at the launch of the consultations in July 2018. Discussions between DIT and the Crown Dependencies continue on a range of trade policy topics.

36. We will continue to seek views from the Crown Dependencies and Overseas Territories, including Gibraltar, during any potential future FTA negotiations to ensure that their interests and priorities are properly taken into account.

Engagement with Parliament

37. The government is committed to providing Parliament with the ability to inform and scrutinise new trade agreements as we progress with developing our future trade policy. The Secretary of State for International Trade, Minister of State for Trade Policy and the government’s Chief Trade Negotiation Adviser held a briefing session on the FTA consultations, open to all Members of Parliament (MPs), on 12 September 2018. Twenty-four MPs attended, and the questions were-wide ranging, covering all four consultations. Comments sent to DIT by MPs on behalf of their constituents were also considered as part of our analysis of the consultation feedback. The House of Commons International Trade Committee also published a report on UK-US Trade Relations, to which the government responded on 10 July 2018. We will consider the Committee’s conclusions from its inquiry on Trade and the Commonwealth: Australia and New Zealand.

38. On 21 February 2019 there was a debate in government time in the House of Commons on the 4 potential new FTAs. The purpose of this was to help the government to understand parliamentarians’ priorities for the new FTAs before formulating our negotiating objectives.

39. On 28 February 2019 we published a paper, Processes for making a free trade agreement after the United Kingdom has left the European Union, which sets out proposals on public transparency for future FTAs and the role of Parliament and the devolved administrations. This included confirmation that at the start of negotiations, the government will publish its Outline Approach, which will include our negotiating objectives, and an accompanying Scoping Assessment, setting out the potential economic impacts of any agreement. The government stands by its commitment to ensure that Parliament has a role in scrutinising these documents so that we can widen the range of voices heard and ensure that as many views as possible are taken into account before commencing negotiations.

40. The government plans to draw on the expertise and experience of Parliamentarians throughout negotiations, working closely with a specific parliamentary committee, or alternatively one in each House. We envisage that the committee would have access to sensitive information that is not suitable for wider publication and could receive private briefings from negotiating teams. This would ensure that the committee(s) was able to follow negotiations closely, provide views throughout the process and take a comprehensive and informed position on the final agreement.

Summary of responses

General themes

Respondents across all stakeholder groups provided a wide range of comments on their priorities and concerns regarding a future UK-New Zealand Free Trade Agreement. More detailed analysis can be found in the ‘Analysis of responses by policy area’ section. The summary below sets out the key themes raised within the 5 policy areas which received the greatest volume of substantive comments. We also received a large volume of campaign responses, not all of which included individual comments. These are summarised in the ‘Summary of campaign responses’ later in this document.

The UK’s existing labour standards and environmental protections should not be reduced or negatively impacted by any future FTA with New Zealand

Across all stakeholder groups, respondents called for the UK to maintain its high labour and environment standards through an FTA with New Zealand. There were concerns that increased trade between both countries would have negative environmental impacts due to increased carbon emissions and potential ramifications for conservation and biodiversity. A number of respondents requested that as part of an FTA, existing climate change objectives should be respected, and current levels of transport emissions should be maintained or lowered rather than increased. Respondents set out that workers’ rights and pay should not be undermined or adversely affected through a UK-New Zealand trade deal (with particular reference to those in the sheep and lamb industry); with some requesting a level playing field in relation to labour rights and environmental standards.

There could be benefits to the UK from lowering or removing tariffs with New Zealand, but there may be some industries that would be best supported by maintaining existing tariffs.

The majority of respondents highlighted that the reduction or removal of tariffs and Tariff Rate Quotas (TRQs) between the UK and New Zealand could increase bilateral trade between both countries. Stakeholders also raised the need to balance tariff reduction or liberalisation with the potential negative consequences to the UK’s industries such as those in the meat and dairy sectors. It was therefore suggested by some respondents that these and other sectors that were perceived to be sensitive should be protected by maintaining existing tariffs. Some stakeholders also highlighted concerns that removing tariffs could undermine the preferential access to the UK market that some developing countries currently benefit from.

Any UK-New Zealand FTA should ensure a level playing field for UK businesses

Respondents highlighted that an FTA could increase competitiveness for UK products in New Zealand, but that it was important it did not negatively impact UK producers and businesses by exposing them to increased competition. They also noted that it may increase consumer choice and access to New Zealand goods and services. Respondents raised concerns that there could be job losses in certain industries resulting from increased competition, or that a reduction in standards would make UK businesses more open to unfair competition and practices. In relation to lamb and sheep meat, there was a perception that an FTA could lead to a flooding of the UK market with New Zealand imports, which could have an adverse effect on UK businesses.

The UK’s existing product standards should be maintained through any future UK-New Zealand FTA

Stakeholders identified the importance of ensuring the UK’s high standards were not reduced or compromised through an FTA with New Zealand. Some identified the importance of ensuring that standards continue to be aligned with those applied in the EU and those of other trading partners. Protecting the UK’s standards was regarded as important to ensure the quality of goods and to safeguard consumers. It was also viewed as playing a role in ensuring that the UK businesses were not undercut by products of an inferior standard.

The UK’s current health, safety and food standards should be maintained and aligned with the EU’s Sanitary and Phytosanitary (SPS) measures

Respondents highlighted the importance of ensuring that the UK’s high level of animal welfare, food, and health and safety standards were maintained or improved upon as part of an FTA with New Zealand. Stakeholders also reflected on the value of ensuring alignment with current standards applied in the EU. Concerns were raised in relation to the lowering of standards, and the possible detrimental impact on consumer health of accepting goods that did not meet the UK’s current standards. Examples of this included accepting produce treated with growth hormones and antibiotics.

Other main themes:

In addition to the above, a number of key themes were reiterated through the responses to the consultation. A significant number of stakeholders raised the importance of protecting public services, with particular reference to the National Health Service (NHS). This was mirrored in the responses received through the 38 Degrees’ organised campaign. The government has made clear that decisions about public services will continue to be made by UK governments, including the devolved administrations and not future trade partners.

Other key messages included the potential for a UK-New Zealand trade deal to increase services trade between both countries, especially through the inclusion of provisions to support Mutual Recognition of Professional Qualifications (MRPQs) and greater movement of people. In addition, stakeholders raised the importance of protecting the UK’s Intellectual Property through any future UK-New Zealand FTA and ensuring that more widely, FTA provisions helped reduce the administrative and financial burdens of trade between both countries.

Stakeholders were positive about the potential for a UK-New Zealand FTA but highlighted that it should not compromise or negatively impact on the FEP with the EU.

Overview of priorities

Respondents who completed their consultation response via the online survey, were classified into different respondent groups (Individual, NGO, Business, Business Association and Public Sector Body) and asked a series of questions (set out in Annex A).

All respondent groups were asked what they wanted the UK government to achieve through a UK-New Zealand trade agreement and which of the 14 policy areas provided (as set out below) best described the priorities outlined in their previous answer. Business and business association respondents were also asked what they wanted the UK government to achieve by reference to the 14 policy areas, and were provided with a supplementary question, asking which of these policy areas is their top priority.

The table below shows the top 3 policy areas selected as a priority for each of the different respondent groups.

Table 6: Top priorities selected by different respondent groups

| Type of respondent (total number) | First most selected priority (total selected by) | Second most selected priority (total selected by) | Third most selected priority (total selected by) |

|---|---|---|---|

| Individuals (167) | Tariffs 105 | Product standards, regulation and certification 96 | Customs procedures 82 |

| Businesses (32) | Tariffs 8 | Services/Customs procedures 4 | SMEs/Other comments 4 |

| Business associations (26) | Tariffs 8 | Product standards, regulation and certification 4 | Intellectual property 4 |

| NGOs (26) | Product standards, regulation and certification 16 | Tariffs 15 | Labour and environment 13 |

| Public sector bodies (7) | Tariffs 5 | Competition 5 | Investment/sanitary and phytosanitary measures 3 |

Overview of concerns

All respondent groups were asked what concerns they had about a UK-New Zealand trade agreement and which of the 14 policy areas provided (as set out below) best described the concerns outlined in their previous answer.

Business and business association respondents were also asked about their concerns by reference to the 14 policy areas, and were provided with a supplementary question, asking which of these policy areas was their top concern.

The table below shows the top 3 policy areas selected as a concern for each of the different respondent groups.

Table 7: Top concerns selected by different respondent groups

| Type of respondent (total number) | First most selected concern (total selected by) | Second most selected concern (total selected by) | Third most selected concern (total selected by) |

|---|---|---|---|

| Individuals (140) | Labour and environment 54 | Product standards, regulation and certification 53 | Tariffs 50 |

| Businesses (25) | Tariffs 6 | Services 4 | Customs procedures 4 |

| Business associations (25) | Tariffs 7 | Product standards, regulation and certification 4 | Intellectual property 4 |

| NGOs (22) | Product standards, regulation and certification 10 | Tariffs/labour and environment/trade remedies and dispute settlement 9 | Sanitary and phytosanitary measures/intellectual property 9 |

| Public sector bodies (5) | Tariffs 3 | Competition 3 | Rules of Origin/sanitary and phytosanitary measures/product standards, regulation and certification 2 |

Analysis of responses by policy area

This section contains a detailed analysis of the free text comments submitted. The feedback has been summarised with reference to the 14 policy areas and other comments provided and grouped by respondent type: (1) Individuals (2) Businesses (3) Business Associations (4) NGOs (5) Public Sector Bodies. Please note that where respondent feedback from across these different groups reflected similar views, comments or issues highlighted might overlap. Technical terms can be found in the glossary located in Annex C.

Tariffs

Overall, respondents were positive about the potential opportunities an FTA with New Zealand could bring, with many stating they would like to see a reduction or removal of tariffs. Several respondents suggested that protecting the UK market should be a priority with no reduction of tariffs on food and agricultural products imported from New Zealand.

Individuals

Fifty-five individual respondents viewed tariffs as a priority in their comments, with most of these respondents calling for a reduction or removal of tariffs. Thirty-seven individuals called for zero tariffs on goods and services. The need to balance tariff reduction, in order to promote an FTA with New Zealand, with the potential negative impacts on the UK’s meat and dairy sectors was a point repeatedly made. One respondent noted that low tariff barriers might enhance ties with New Zealand. The ability of New Zealand to impose tariffs to protect its domestic industry if needed, was also raised as a concern by respondents. Respondents also expressed concerns over third countries being able to export their products to the UK via New Zealand in order to benefit from tariff reductions. Other concerns flagged pointed to the potential negative impacts to the UK farming industry from tariff reductions for agricultural products imported from New Zealand. Thirteen individuals raised concerns on tariffs, including protectionism and increased administrative burdens.

Businesses

Twenty-five businesses made comments in relation to prioritising tariffs in an FTA, with 14 respondents stating that they would like to see the removal or reduction in tariffs, highlighting the opportunity this would bring for enhancing trade between both countries. One business respondent stated that they saw tariff reduction or its elimination as having the potential to promote electronic commerce (e-commerce). Two business respondents called for a reduction in tariffs on grain products, albeit without compromising UK agricultural outputs. A need to respect the WTO Pharmaceutical Tariff Elimination Agreement was also raised. One respondent asked for the import of animal skins to remain tariff free after the UK leaves the EU. Ten businesses raised concerns on tariffs, with comments focusing on the affordability of goods, and the impact of removing tariffs on the UK dairy industry.

Business associations

Forty-two business associations submitted comments prioritising tariffs. Nine of these responses stated that they would welcome tariff-free trade, which could greatly benefit the sectors they represent, with several respondents requesting reciprocal tariff arrangements. The request for tariff free trade was mentioned in relation to goods most commonly but there were also comments covering specific sectors: cosmetics, spirits, books or journals. Some respondents also commented on protecting the meat and salmon industry, by ensuring the protection of Geographical Indications (GIs). Twenty-five business associations raised concerns on tariffs. Feedback included comments on the potential impact of tariff reduction on UK industries. Some respondents also suggested that tariff-free trade might cause an increase in competition or undermine preferential access to the UK market for developing countries. There were several calls for continued tariffs on food or agricultural products imported from New Zealand.

NGOs

Nine NGOs responded with comments citing tariffs as a priority in a free trade agreement, with 7 NGOs raising tariffs as a concern. Several respondents stated that they would like to see the elimination or reduction of tariffs and the elimination of TRQs, with one respondent against any additional TRQs over and above the current arrangements through the EU. One NGO suggested that while opportunities would flow from tariff reductions, cheap imported products may become more competitive, putting pressure on UK produce, limiting the availability of UK products for consumers. Several NGO respondents remarked that a removal of tariffs would erode the margin of preference enjoyed by some developing countries. The point was made that preferential access in the UK for products from developing countries might partly lose its value, as those products would need to compete in the UK market with similar products from New Zealand, once the latter also receive preferential treatment. Potential trade diversion arising from tariff liberalisation on wine was also raised as a concern by NGO respondents.

Public sector bodies

Six public sector bodies commented on tariffs as a priority. They focused more on non-tariff barriers, rather than tariffs. Four respondents raised concerns around tariffs, including the impact of removing tariff barriers on UK businesses. One respondent stated that an FTA would not significantly improve tariff conditions for exporters, but they did note that a reduction in tariffs could make seafood imports from New Zealand more accessible to UK processors and consumers, for example, ensuring that blue grenadier (a fish species) continues to enter the UK duty free.

Rules of Origin (RoO)

Overall, there were few substantive responses on RoO, with the focus, particularly for business and business associations, being on the simplification of RoO. Respondents from across the stakeholder groups referenced local content requirements (with one respondent suggesting at least 75% local content to achieve UK or New Zealand origin) and the need to be aware of global supply chains. There were suggestions for harmonising RoO across all future UK FTAs and ensuring they are similar to those in the EU-Canada Comprehensive Economic and Trade Agreement (CETA) and the EU-Japan Agreement. One business association recommended CPTPP’s model of self-certification as the least cumbersome for business. Comments were also raised by respondents in this section on GIs, however, in an FTA, GIs are contained within the IP chapter and therefore we have considered the relevant comments within that section.

Individuals

Three individual respondents raised RoO as a priority in their comments, while one individual expressed concerns on RoO. Individual respondents raised concerns around low quality goods finding their way into the supply chain. Many individuals referenced RoO indirectly, with respondents highlighting the role RoO will play in preventing goods from third countries being shipped to the UK via New Zealand and benefiting from preferential tariffs.

Businesses

Sixteen businesses prioritised RoO, with comments including minimising regulations and bureaucracy, cost reductions and ensuring transparency. Eight businesses raised concerns with respect to RoO. Two business respondents called for RoO to be simplified and harmonised across all future UK FTAs and similar to those in EU-Canada CETA and EU-Japan FTA with the suggestion that these rules be reviewed to keep up with innovation. One business called for clear labelling of origin and full traceability of products, although this is not an issue that is covered by RoO provisions in FTAs.

Business associations

Thirty-one business associations prioritised RoO in their comments. Seven comments were made on customised cumulation or diagonal cumulation, which respondents suggested would enable a UK producer to import a good from New Zealand and treat it as if it was of UK origin no matter whether the product was changed in the UK. Respondents also suggested that the UK should negotiate additional cumulation options in a trade agreement. Ten business associations raised concerns and called for the RoO administrative burden to be simplified and minimised. Some respondents also had a number of specific sectoral asks. For example, the automotive industry suggested cumulation with the EU; co-operation with EU counterparts involved in negotiations with New Zealand; staging periods in application of RoO and that embedded services such as design should be countable in Regional Value Content (RVC) calculations.

NGOs

Three NGOs viewed RoO as a priority, with three raising concerns on RoO. These respondents focused on the lack of transparency and the impact of low-quality imports. One respondent suggested the RoO cumulation requirements or ‘cumulative rules of origin’ should be set at 25%.

Public sector bodies

Three public sector bodies prioritised RoO in their comments. The feedback focused on the impact of low-quality imported products and the need for transparency. Two public sector bodies expressed concerns. Comments included the impact on the UK fishing industry and lack of alignment to EU regulatory standards.

Customs procedures

Feedback from across different respondent groups focused on the importance of keeping administrative burdens at UK borders as low as possible while prioritising frictionless trade. The need to keep new administrative requirements at borders to a minimum was cited repeatedly in the feedback as a priority for any future UK customs system, with the impact on SMEs highlighted. Respondents also asked for customs procedures to be standardised to harmonise pre-shipment notifications and reporting requirements.

Individuals

Six individual respondents referenced customs procedures as a priority in their comments, with the focus being on the need to minimise or reduce the administrative burden. Suggestions were made for the necessary controls that should be in place. Four individuals raised concerns, with comments raised around the potential for increased administrative burdens and concerns raised around potentially illegal or counterfeit goods entering the UK.

Businesses

Nineteen businesses in their comments viewed customs procedures as a priority in a trade agreement with New Zealand. A recurring theme from the feedback was the need to reduce the administrative burden. Harmonising standards with WTO or the Organisation for Economic Co-operation and Development (OECD) rules was also raised. Ten businesses raised concerns with the focus being on the increased administrative bureaucracy. The implications for businesses exporting or importing perishable commodities was highlighted. Many businesses shared their experiences around origin declarations on invoices and import permits. It was suggested that a pre-entry system should be available at customs.

Business associations

Twenty-three business associations viewed customs procedures as a priority, with a focus on minimising bureaucratic processes and avoiding long delays through ineffective or inadequate border controls. Speed and simplicity were viewed as being essential to custom procedures. It was suggested that the minimum provisions in WTO agreements could be used as a starting point in a trade negotiation, to facilitate a smooth transit of goods. Twelve business associations raised concerns, with a focus on the supply chain consequences and higher costs. One business association requested minimising additional and duplicative administration burdens with no expectation of a reliance on an Authorised Economic Operator (AEO) certification.

NGOs

Four NGO respondents commented that customs procedures were a priority, with points made around the need for stringent customs checks for imported food products. Other respondents flagged the need to prevent illegal or counterfeit products from entering the UK, as well as fraud prevention and retaining current procedures or standards. One respondent favoured streamlined customs procedures and higher thresholds for checks. Four NGOs raised concerns in this area, with comments on trade restrictions or inadequate border controls mentioned.

Public sector bodies

One public sector body provided comments on priorities for customs procedures, with a comment made on agreeing systems of equivalence in standards for cross-border trade in the healthcare sector. Two public sector bodies raised concerns on customs procedures, with comments on trade restrictions and the potential for increased administrative burdens.

Services

Overall, respondents focused on the importance of professional and financial services as priority sectors. MRPQs, mobility and visas were also key considerations raised by respondents. Respondents also recognised the importance of other areas of any agreement related to services, including digital, IP, investment, environment, SME provision, and access to public procurement. More specific commitments such as visas and the environment were also mentioned by respondents as well as legal and financial services, along with MRPQs. Relevant comments on public services, including the NHS, were also raised in the consultation sections on investment and government procurement but have been considered in this section. For financial services, respondents covered a broad range of sub-sectors which included asset management, banking, insurance, and financial technology (FinTech). Relevant comments on MRPQs, mobility and the visa system that were raised in the consultation section on labour and environment have been considered in this section.

Individuals

Fifteen individual respondents referenced services as a priority in an FTA with New Zealand and four raised concerns. A recurring theme of the feedback was the call to protect the UK public services sector. Individuals also called for a need to protect the NHS and other public services from foreign investors forcing the UK into unrestricted open competitive tendering for public services. Several respondents welcomed addressing services regulation, including increased mobility of skilled workers and students, with one respondent stating that an FTA should encourage the movement of people for business purposes. Another respondent called for the UK to focus on softening the restrictive movement requirements for key personnel linked to investment as part of an FTA with New Zealand. One respondent suggested that the UK be a part of the Trans-Tasman Travel Agreement (TTTA) to enable easier intra-corporate transfers in areas of mutual benefit to our economies. Two individuals stated that an FTA must include financial services and highlighted the opportunities that a UK-New Zealand FTA would bring to the financial services sector. However, several individuals raised concerns that an FTA focused on trade in financial services would not benefit the UK outside of London.

Businesses

Ten businesses called for services to be prioritised in any future bilateral trade agreement with New Zealand, with two raising concerns. One respondent called for the removal of visa barriers which would allow workers to temporarily move between UK and New Zealand to provide services. Ensuring that MRPQs and the harmonisation of rules and regulations were included in an agreement was also highlighted as being important.

Business also raised concerns over restrictive foreign investment screening practices. On financial services, businesses identified an interest in removing any remaining restrictions on the provision of banking services. Several businesses raised FinTech as a key interest, with respondents stating that New Zealand’s smaller market is known for early adoption of technologies which offers opportunities for UK financial technology (FinTech) seeking to enter the market. Insurance was also a key interest, with respondents identifying strong trade links in the insurance and reinsurance sectors. Ensuring regulatory co-operation on financial services was also mentioned as a key priority. Two businesses raised concerns over the privatisation of public services and the postal services.

Business associations

Twenty-four business association respondents prioritised services trade in their comments. One business association stated that trade in services particularly mattered to small exporters, as SMEs starting to export are more likely to trade in services. Some respondents stated that an FTA should also facilitate the movement of skilled workers and called for a greater recognition of professional qualifications. Respondents noted that this would enable UK businesses to gain access to the best global talent. One business association had concerns about the potential for unrestricted freedom of movement but was of the view that there was a need for a targeted approach where there is a need for specific types of labour. There was a suggestion of a professional mobility programme within the General Work Visa (Tier 2) to facilitate the compliant entry of professionals to the UK, creating a category of UK working visa for which only professional New Zealand citizens working in certain occupational categories are eligible.

Respondents also called for the government to consider the impact of any visa processing requirements resulting from an end to the freedom of movement for European Economic Area (EEA) nationals. Several respondents emphasised that the UK’s high standards in relation to services should be maintained and promoted in an FTA with New Zealand. Several respondents identified potential for exploring wider tools to achieve market access and regulatory coherence in financial services. Some business associations identified that New Zealand’s asset management industry is growing rapidly, and respondents were of the view that this growth would provide important opportunities for UK firms. Two comments were made regarding the protection of consultancy services and service design. Eleven business associations raised concerns which included: privatisation of public services, litigation, barriers to services trade and the lack of recognition of standards.

NGOs

Sixteen NGO respondents prioritised services trade in their comments. The feedback was generally optimistic about the potential benefits, with several respondents requesting for MRPQs between the UK and New Zealand. The engineering sector in particular recognised the value of MRPQs and noted the opportunities available to deliver frictionless movement of services. The inclusion of the technology and innovation services in an FTA was also raised by one respondent as being important. Ten NGOs expressed concerns with points made around the impact that an FTA might have on local government services, legal services and financial services. NGO respondents also identified that the UK is a leader in financial services and called for the UK’s high regulatory standards to be protected. One NGO stated that the UK’s high educational standards must be maintained. Some NGO respondents were concerned that any trade agreement between the UK and New Zealand might pose a threat to public services, emphasising the need to include rigorous protections for public services in any future FTA. A common suggestion was that the healthcare sector should be exempt from any commitments that could lock-in competitive procurement of publicly funded healthcare services in England or impose competitive procurement in the devolved administrations. Several respondents suggested that to protect public services, including the NHS, they should be excluded from the scope of an FTA. One NGO respondent asked that FTAs with other countries do not limit the digital services already available between the UK and New Zealand.

Public sector bodies

Four public sector bodies prioritised services trade in their comments. Most of these respondents were keen for the UK to sign an FTA with New Zealand as they recognised potential opportunities. This included adding to the ease at which financial and related professional services are able to operate their businesses in these markets and use their expertise in New Zealand and across the region. The potential growth to UK businesses that the New Zealand market would bring was also noted.

Several public sector bodies also identified the benefits of free movement of financial services employees and welcomed strong financial services elements in any future FTA. Respondents also identified that cross-border trade in financial services supports competition across financial markets and provides a wide range of choice to customers. One respondent maintained that any new MRPQ regime would need to ensure that the relevant qualification for nursing or midwifery is equivalent to the strong standards of the UK qualification, in order to maintain patient safety. Only one public sector body raised concerns, stating they would not want concessions made in any trade agreement to impact adversely on public health, or place an additional burden on health and social care services. There was also a comment about excluding public services, including the NHS, from the scope of FTA negotiations.

Digital

Overall, respondents asked for a trade agreement with New Zealand to ensure the free flow of data in line with the EU General Data Protection Regulation (GDPR). Respondents also noted that it is important to consider an adequacy agreement with New Zealand. The importance of preventing data localisation was also a point repeatedly made. Respondents were generally against changes to current EU platform liability rules.

There was general support for global rather than national responses to the tax challenges of digitisation and for rules on digital goods not being a barrier to trade. Some respondents asked for non-discrimination clauses to be enhanced to protect ‘net-neutrality’, as well as guaranteeing better market competition. Many respondents were of the view that New Zealand businesses can already access the Audio Visual (AV) market.

A number of comments focused on how an FTA might adversely affect the UK’s AV ecosystem, with one respondent making particular reference to the positive impact of the UK’s Public Service Broadcasting (PSB) system to the success of UK businesses abroad. Maintaining ‘cultural heritage’ was also a consideration. Respondents from the newspaper industry called for there to be no unjustified restrictions on the cross-border publication dissemination of UK newspapers, in print and online, or news brands subscriptions and advertising services. Respondents from the gaming sector emphasised the need to maintain frictionless trade and suggested the focus should be on breaking down barriers where these existed with trading partners. Some respondents also raised the issue of safe harbours, copyright and online infringement. However, in a typical FTA, these are contained within the IP chapter and therefore we have considered these comments in that section of this document.

Individuals

Four individual respondents referenced digital as a priority in their comments. Points raised included, support for existing data privacy protection and sharing, particularly the control of the movement of data and the need for it to be maintained or strengthened. Two respondents called for the harmonisation of standards between trading partners. One comment included a request for there to be no barriers at all to digital trade. Three individual respondents raised concerns with comments focusing on data protection and privacy.

Businesses

Fifteen business respondents prioritised digital services in their comments. Three businesses called for free flow of data exchange (in line with GDPR). A further three respondents called for data protection standards to be harmonised. Two businesses asked for an open market, without barriers for digital services. One respondent requested a replacement to the UK’s participation in the EU-New Zealand mutual adequacy agreement for personal data (however, there was a view that adequacy with the EU is potentially more important). Seven business respondents expressed concerns related to digital services with the main focus, raised by five respondents, being around data protection. A small number of business respondents expressed concerns on the consequences of harmonising standards and flagged misuse of data concerns. Other points made included calling for data localisation to be prevented and for cross border data flows to be enabled, subject to reasonable safeguards.

Business associations

Seventeen business associations referenced digital services as a priority in their comments. Seven business associations called for the free flow of data to be in line with GDPR requirements. Four business associations suggested that any future agreement should benefit both trading partners equally, with three of these respondents asking for greater harmonisation of standards, including a request to retain existing European standards set by the European Telecommunications Standards Institute (ETSI). Respondents from the creative industries had specific requests. These included asking for a UK-New Zealand FTA to go further than the United States-Mexico-Canada Agreement (USMCA) and ensure Value Added Tax (VAT) is removed on digital products. They also suggested greater collaboration through FTAs on anti-trust issues, for example, monopolisation of e-book platforms. Co-operation was also seen as being important to data ethics and Artificial Intelligence (AI).

Ten business associations raised concerns around digital services. Similar to business respondents, these tended to relate to data protection and privacy (four comments). Other points made included the burden to business of adding any extra administrative requirements. A business association raised concerns that FTAs might predominantly favour large technological companies. There was also a request for the UK government to consult at a detailed sectoral level throughout the negotiation process.

NGOs

Three NGOs referenced digital services as a priority in a UK-New Zealand FTA. Comments ranged from calls for digital trade to remain untaxed and include provisions to stop governments from imposing requirements that limit digital services, to requests to maintain current levels of data protection. Three NGO respondents expressed concerns related to digital services. These included a lack of transparency on complex data issues in negotiations, concerns over the compatibility of an FTA’s data provisions with commitments to GDPR, worries about restriction of content, with one comment raised on the influence of big tech companies and another on data protection.

Public sector bodies

Four public sector bodies referenced digital services as a priority in a UK-New Zealand FTA. They suggested that any FTA covers the latest cutting-edge technology, that both partners increase co-operation around digital issues and that access to international markets was key for digital services. No public sector bodies raised concerns on digital.

Product standards, regulation and certification

This policy area covers technical regulations, voluntary product standards and the procedures to ensure that these are met. Standards and measures to protect humans, animals and plants as well as to regulate food, animal and plant safety are discussed under the SPS section of this report.

The terms ‘standards’ and ‘technical regulations’ are used frequently in trade agreements when addressing ‘technical barriers to trade’. While the word ‘standard’ is used informally to mean a level of quality or attainment, in the context of trade agreements ‘standards’ have a formal technical meaning. ‘Standards’ in this sense are voluntary documents developed through consultation and consensus which describe a way of, for example, making a product, managing a process, or delivering a service. While standards are voluntary, when cited in a regulation, their use can become compulsory. Standards are not set or controlled by the government. ‘Technical regulations’ are mandatory requirements set out in the legislation and they are controlled by governments and legislators (Parliament in the UK). For regulated products and services, standards can be used to support compliance.

The importance of maintaining the UK’s current high standards and continuing to align these with standards used across Europe was highlighted in comments from all respondent groups. A number of sector specific international standards were outlined in responses with a request for these regulations to be maintained or improved upon. Relevant comments on standards and levels of protection that were submitted to the consultation section on labour and environment have been considered in this section.

Individuals

Twenty individuals prioritised product standards, regulation and certification in their comments. Nine individuals advocated in their response that European standards be retained or improved upon in any FTA with New Zealand. Other comments included ensuring alignment of UK product standards with both European and non-European trading partners. Fourteen individuals raised concerns about product standards, regulation and certification, with many of these comments centred around the implications of having unaligned standards.

Businesses

Twenty-one businesses prioritised product standards, regulation and certification in their comments. Most respondents focused on ensuring the alignment of standards between trading partners and the use of international standards. Maintaining or improving existing standards between the UK and New Zealand was also emphasised as being important by business respondents, with one referring to the need to maintain current CE marking requirements. There was also a request from one respondent to include sectoral annexes in an FTA which would help promote international regulatory convergence. Six businesses raised concerns around product standards, regulation and certification, with one respondent highlighting their concern over the impact on standards relating to product labelling, for example on alcoholic beverages which could be covered in individual sector annexes of an FTA. A lack of harmonisation of standards was also highlighted as a primary concern by business respondents, as some were of the view that a lack of harmonisation might result in unnecessary costs to industries.

Business associations

Thirty-three business associations prioritised product standards, regulation and certification in their comments. Seven of these respondents highlighted the importance of international regulatory harmonisation. The importance of maintaining the UK’s current high standards and ensuring that these align with European standards was also emphasised in feedback from business associations. Continued alignment with standards and regulations applied in the EU, including future co-operation with the European Medicines Agency (EMA), was expressed as a top priority by pharmaceutical industry associations. Fourteen business associations raised concerns in relation to product standards, regulation and certification. One business association called for the UK government to protect UK farmers from competitive pressures from importers who are potentially not subject to the same high standards. There was an expectation that UK farming might need to be protected by government from any damage due to increased imports from New Zealand.

NGOs

Fourteen NGOs viewed product standards, regulation and certification as a priority in their comments. Eight respondents were of the view that existing standards should be maintained or improved with four respondents talking of the need to protect consumers. Two respondents called for greater harmonisation with international standards. One respondent asked for the UK’s current approach to be maintained regarding the precautionary principle, with respondents highlighting New Zealand’s differing approach to this. The different regulatory regime operated by New Zealand was also flagged by one NGO respondent. Another respondent also suggested that it should be a priority for the UK to implement the EU-New Zealand Mutual Recognition Agreement (MRA). Twelve NGOs raised concerns about product standards, regulation and certification, with five of these respondents concentrating on the impact that an FTA could have on standards, levels or protection and consumer rights. Other issues raised by NGOs included traceability and the quality of imported products.

Public sector bodies

Two public sector bodies viewed product standards, regulation and certification as a priority in their comments. One respondent requested high standards be maintained to protect consumers, as well as maintaining or improving standards related to product labelling, particularly on standards for pharmaceutical and medical products. Two public sector bodies had concerns with points made around the lack of mutual recognition of standards, lack of alignment or harmonisation of standards between trading partners, and concerns about sustainability.

Sanitary and phytosanitary measures (SPS)

This policy area covers standards and measures to protect humans, animals and plants as well as to regulate food, animal and plant safety. Voluntary product standards and the procedures to ensure that these are met are discussed under the product standards, regulation and certification section of this document.

A range of issues on SPS were highlighted across the different respondent groups. A key focus was animal welfare and the concerns around the potential lowering of food standards. Business respondents were generally of the view that the existing SPS agreements in place with New Zealand and the EU should be used and built upon. Maintaining regulatory alignment with the current EU standards was a recurring theme in the consultation feedback.

Individuals

Twenty-two individuals viewed SPS as a priority, with many emphasising the importance of maintaining or improving animal welfare standards. Health and safety and standards for agricultural products and food were also raised. Ten individual respondents expressed concerns with comments including the potential risk from chemicals in food and uneasiness around ‘hormone injected beef’, antibiotics in meat and additives or preservatives in food.

Businesses

Fifteen businesses commented on SPS as a priority with the focus being on the need to align standards between trading partners and maintaining existing EU standards. One business respondent suggested that tariffs should only be removed when SPS measures are materially equivalent. Comments were also made around the need for rules applying to grain and non-grain feed to not be more stringent than existing EU requirements. Three businesses expressed concerns about the potential impact on the UK diary industry, as well as on UK food standards and animal welfare.

Business associations

Twenty-three business associations viewed SPS as a priority in their comments, with respondents focused on the need to maintain high food and animal welfare standards and agricultural and farming practices. Eleven business associations raised concerns around animal welfare and the potential impact on food standards was a recurring theme of the feedback. Restrictions on poultry imports applied by New Zealand due to the impact of Infectious Bursal Disease was also raised as being a potential regulatory barrier which needed to be addressed in the negotiations. Biosecurity Risk Screening Levy and the Import Entry Transaction Fee were other barriers to trade highlighted by business association respondents.

NGOs

Fourteen NGO respondents raised SPS as a priority, with 14 raising concerns. NGO respondents were against imports of food stuffs that fell below the UK or EU standards, hormone treated beef and the use of antibiotics. Representatives of the farming sector shared evidence about the causal factors behind recent outbreaks of Mycoplasma bovis cattle disease. Respondents also called for greater harmonisation between trading partners. The importance of protecting the WTO precautionary principle was also raised. The Cartagena Protocol on Biosafety (under which the UK and New Zealand share international obligations regarding risk assessments) was raised as being important in addition to maintaining Genetically Modified (GM) food labelling. The UN World Health Organization (WHO) Food and Agriculture Organization (FAO) One Health Antimicrobial Resistance (AMR) strategy was also flagged as being important.

Public sector bodies

Two public sector bodies referenced SPS as being a priority in their comments with two raising concerns about SPS. One respondent focused on the potential impact on public health. A local authority was concerned about the impact of a greater volume of imported produce from New Zealand on the farming industry in their county, at a time of transition for the sector.

Competition

Although the terms ‘competition’ and ‘competitiveness’ are sometimes used interchangeably, they have distinct technical meanings. Competition policy covers the rules and regulations concerning the way businesses operate within a market and the enforcement of such rules. Competition laws, for example, typically cover anti-competitive agreements between firms, abuse of a dominant position and merger control. Competitiveness refers to the general ability of a firm to operate in a market compared to other firms that operate in the same market, or the strength of a whole industry or economy relative to another.

Overall, most respondent groups focused on the impact of FTAs on competitiveness, not on competition policy or legal regimes. There were detailed comments regarding competition within responses across the stakeholder groups.

Individuals

Twenty-eight individual respondents referenced competition as a priority in their comments. The feedback was focused on the importance of protecting the competitiveness of UK industries. Respondents also called for the protection of current health and safety regulations to ensure that British producers and businesses can compete. Ten individual respondents stated that UK agriculture and farming should be protected, noting agriculture as being a key sector which could be impacted. Four respondents had specific concerns around the import of New Zealand meat, particularly lamb. Some respondents were concerned that liberalising markets might lead to increased international competition, resulting in job losses in certain industries. However, seven respondents were positive about the increase in choice of goods and services that would follow from markets being more opened-up. Twenty-eight individual respondents raised concerns around competition, with 13 comments made on the potential negative impact on the UK agriculture sector.

Businesses

Nineteen business responses prioritised competition in a UK-New Zealand trade agreement. Points made included the opportunity for the UK-New Zealand FTA to become a benchmark agreement in digital, services, and telecommunications sectors by ensuring market competition and greater liberalisation. Two respondents called for UK businesses to be protected from foreign competition, with references to ‘demolishing corporate monopolies’. Twelve businesses raised concerns around competition, which focused on perceived unfairness. Respondents were also concerned about the potential negative effects importation of food into the UK would have on the dairy industry and local businesses.

Business associations

Twenty-eight business associations prioritised competition in their comments. Feedback included suggestions that an FTA might lead to the removal of current import duties, making UK exports more competitive in New Zealand. Some respondents also highlighted the impact for counter-seasonal industries. Respondents recognised that the need to ensure no unfair competition for UK businesses must be appropriately balanced against allowing greater access to more competitively priced goods and services. Several business associations were of the view that allowing greater mobility of skilled workers might attract and retain the right talent to the UK which would ensure that UK businesses and industries would remain competitive. Twenty-four business associations raised concerns on competition, with many comments focusing on the competitiveness of agri-food (specifically relating to the import of lower-standard produce). There was a request for an impact assessment on the UK domestic market to be carried out. A point was made around the opportunity to create better product definitions (for example ‘whisky’) to ensure consumers are not deceived or misled.

NGOs

Ten NGOs prioritised competition in their comments. For some of these respondents, protection of public healthcare services and the farming industry was of paramount importance. Several respondents also called for competition to be encouraged and protected with increased consumer choice being a potential result. Eleven NGOs raised concerns on competition, with respondents highlighting the potential increased competition for developing countries. Some NGOs also flagged the efforts of UK farmers and fisheries to protect the environment and had reservations about the impact increased competition for the meat, dairy and egg industries might have on this.

Public sector bodies