Type C Post Public Review - Closure Notice Update - June 2023

Updated 5 September 2024

BDUK published an initial Type C Post Public Review Closure Notice Update in March 2023 with indicative information relating to the procurement of the Type C supplier framework and the initial two call-offs to be awarded through it. This document is an update to that initial document and was published in June 2023, and provides updated details on the procurement and call-offs 1 and 2.

In April 2024, Annex C was added to this document, noting preliminary details of additional indicative call-offs that BDUK intended to progress under the Type C supplier framework. A further update to Annex C was made in September 2024, providing additional detail on these call-offs (call-offs 3 to 7). Maps details call-offs 3 to 7 were also added at this time as Annex D.

1. Introduction

On 5 January 2023, Building Digital UK (BDUK) published a Prior Information Notice (PIN) reference number 2023/S 000-000266 informing stakeholders of the intention to procure a supplier for a cross-regional framework contract (“the framework”, also known as type C) to award call-off contracts over the proposed four (4) year term of the framework.

The cross-regional framework will complement the existing type A local supplier contracts (procured via a Dynamic Purchasing System) and the type B regional supplier contracts (procured via Restricted Procedure). This is ensuring BDUK’s commitment to deliver the roll out of gigabit-capable broadband across the UK. BDUK will continue to work with the devolved administrations to identify the best way to deliver Project Gigabit in their areas.

The framework is intended to appoint a single supplier for the Project Gigabit Programme, whose role would be to target premises in respect of which:

-

No or no appropriate market interest has been received through market engagement steps for proposed type A or type B procurement areas.

-

BDUK has not awarded a contract following a procurement for type A or type B areas.

-

Type A or type B contracts that cover these premises fail to be delivered by the supplier and are descoped or terminated.

-

Type C provides demonstrably better value for money or pace of build or coverage.

Call-off contracts awarded under the framework will subsidise the design, build and operation of gigabit-capable supplier networks. These networks will provide the long-term sustainable availability of wholesale gigabit broadband services in the hardest to reach parts of the UK.

For more information see the full PIN and section 8.3 of the Detailed Overview of the Gigabit Infrastructure Subsidy Scheme.

2. National Rolling Open Market Review

BDUK has now completed a mapping process for all areas in England and Wales through the Open Market Review (OMR) and Public Review (PR) process. BDUK also launched the National Rolling Open Market Review (NR OMR) cycle with the first round commencing in January 2022.

The purpose of the NR OMR, which operates on a 4-monthly basis (January, May and September), is to ensure that BDUK has the most up to date information about suppliers’ existing and planned build over the subsequent 3-year period. Further information on the NR OMR process can be found in our Open Market Review (OMR) and Public Review (PR) subsidy control classification guidance document.

This will support better strategic planning and prioritisation of procurement Intervention Areas (IAs), streamline the OMR process and minimise the risk of BDUK intervening in an area where there are viable commercial build plans.

BDUK runs the formal OMR and PR process ahead of procurements to give all suppliers the opportunity to submit their commercial build plans and ensure as far as possible that we are not applying subsidy where viable commercial plans for gigabit-capable infrastructure exist. We also undertake soft market testing and Pre-Procurement Market Engagement (PPME) to test market appetite and further shape IA design for our public investment plans.

The supplier submissions we review as part of the NR OMR will also assist us with understanding current and future plans for broadband infrastructure (whether Next Generation Access, ultrafast or gigabit-capable).

As of June 2023, BDUK has now completed the evaluation process of responses received from suppliers to the January 2023 NR OMR and published our findings. Further information on the January 2023 NR OMR can be found within the January 2023 NR OMR Closure Notice published 14 June 2023.

The latest iteration of the NR OMR (May 2023) launched on 19 May and closed for responses on 20 June 2023. If you have any questions on the May 2023 NR OMR process, please refer to the Request For Information GOV.UK page.

3. Post Public Review updates

As set out above and within section 2.2 of BDUK’s Open Market Review (OMR) and Public Review (PR) subsidy control classification guidance, we continue to process the data submitted to the NR OMR in the same way as that submitted to previous local OMRs.

The data outputs are being used to develop mapping categorisations of Unique Property Reference Numbers (UPRNs). This will generally be fed into a PR process for new areas. However, If BDUK receives new data for UPRNs which have been the subject of a previous PR determination, if it meets the evidential requirements, BDUK may use this data to update the previous areas by area PR determinations at our own discretion.

4. Geographic scope

BDUK will apply the outcomes of the NR OMR process to develop the design of IAs for the local supplier contracts (type A) or regional supplier contracts (type B) procurements. We are now also assessing the IAs that may form the scope of the planned framework (type C), in particular for the initial call-offs under the framework.

The first areas that have been identified for potential inclusion (as at June 2023) in the two proposed initial call-offs (Call-Off 1 and Call-Off 2) currently comprise premises in:

Call-Off 1 - West Berkshire, West and Mid Surrey, North Wiltshire and South Gloucestershire, Hertfordshire, Staffordshire and Lancashire

-

West Berkshire (Lot 13C)

-

West and Mid Surrey (Lot 22C)

-

North Wiltshire and South Gloucestershire (Lot 30C)

-

Hertfordshire (Lot 26C)

-

Staffordshire (Lot 19C)

-

Lancashire (Lot 9C)

Call-Off 2 - Wales and Devon

-

West and North Devon (Lot 6C)

-

North West Wales (Lot 42C)

-

Mid Wales (Lot 43C)

-

South East Wales (Lot 44C)

BDUK intends to procure the framework and two initial call-offs at the same time; and award subsequent call-offs under the framework to the successful tenderer in due course.

5. Type C Changes from March 2023

On 24 March 2023, BDUK published the following Type C Post Public Review - Closure Notice updates March 2023 document on GOV.UK which included a number of areas identified for potential inclusion in the initial call-offs to be procured at the same time as the framework.

These areas were selected based on the findings of the local PRs previously conducted along with information derived from the September 2022 NR OMR findings which can be found here.

Since March 2023, BDUK has developed the proposed IAs for the initial call-offs in more detail, reviewing the Lots that will comprise the initial call-offs scope. This has resulted in the following changes:

Inclusion of the following areas:

-

Lancashire (Lot 9C)

-

South East Wales (Lot 44C)

Removal of the following area:

- Cornwall and Isles of Scilly (Lot 32C)

Following the completion of the evaluation process of responses received from suppliers to the January 2023 NR OMR, the subsequent subsidy control classification results were overlaid and used by BDUK to design and create IAs for the initial call-off areas. Further information on the January 2023 NR OMR can be found within the January 2023 NR OMR Closure Notice published 14 June 2023.

BDUK is confident that integrating these NR OMR findings will ensure the best possible outcome for the two initial call-offs, maximising both coverage and value for money accordingly. Our interventions will always flex to respond to both changes in the dynamic marketplace, and the appetite for our procurements. Further information on the NR OMR process can be found in our Open Market Review (OMR) and Public Review (PR) subsidy control classification guidance document.

BDUK also proceeded to complete several rounds of PPME with suppliers to understand levels of interest from February to May 2023. As a result of the findings from these exercises, BDUK received credible feedback which indicated supplier appetite existed to deliver the suggested Cornwall and Isles of Scilly (Lot 32C) IA via a type A local supplier contract or type B regional supplier contract instead, as such this area has not been included in the initial call-offs.

In addition to this, some parallel type A local supplier contract and type B regional supplier contract PPME activities conducted by BDUK did not generate credible supplier interest in a number of Lots. As such, BDUK is now seeking to explore the possibility of their delivery via the framework. Therefore, the Lancashire (Lot 9C) and South East Wales (Lot 44C) areas have now been included in the initial call-offs.

As a result of the findings from these market engagement exercises, BDUK has decided to progress with the 10 geographic areas listed above for inclusion in the initial call-offs under the framework. Further details can be found below, and the draft IA maps are available to view in Annex B.

Please see full details of the January 2023 NR OMR outputs and the Welsh Government Public Review. (A preceding OMR was undertaken in 2021).

6. Forthcoming procurement

From February to May 2023, BDUK carried out market engagement activities to seek feedback from suppliers about the design of the proposed IAs and the suggested procurement type C - cross-regional supplier framework and also the capacity of the market to bid for a potential procurement.

The total public funding investment will be based on the final number of premises requiring subsidy. BDUK will confirm a budget drawn from public funding within the forthcoming tender documentation. Details of any restrictions on the use of public subsidy will be explained within the tender documentation.

The indicative number of UPRNs allocated to the two initial call-offs are as follows:

Call-Off 1 - West Berkshire, West and Mid Surrey, North Wiltshire and South Gloucestershire, Hertfordshire, Staffordshire and Lancashire

| Lot Name | Indicative number of UPRNs |

|---|---|

| Hertfordshire (Lot 26C) | 6,895 |

| Lancashire (Lot 9C) | 15,695 |

| North Wiltshire and South Gloucestershire (Lot 30C) | 13,345 |

| West and Mid Surrey (Lot 22C) | 8,018 |

| Staffordshire (Lot 19C) | 11,728 |

| West Berkshire (Lot 13C) | 1,860 |

| Total Premises | 57,541 |

| Indicative Contract Value | £149,700,000 |

Call-off 2 - Wales and Devon

| Lot Name | Indicative number of UPRNs |

|---|---|

| West and North Devon (Lot 6C) | 21,430 |

| North West Wales (Lot 42C) Mid Wales (Lot 43C) |

17,437 |

| South East Wales (Lot 44C) | 8,242 |

| Total Premises | 47,109 |

| Indicative Contract Value | £139,147,319 |

The type C cross-regional supplier framework will comprise two stages:

-

Plan and Build

-

Monitor and Clawback

BDUK will prioritise, where possible, building in areas which currently have the lowest speeds. The focus of each call-off contract will be interventions in final 20% (f20) premises in the UK that are not commercially viable for the market to build without government intervention. BDUK will carry out continuous coverage mapping to identify f20 premises. This will be updated regularly and in particular ahead of the start of the procurement process for each framework call-off.

The cross-regional framework supplier contract only includes one category of intervention referred to as the Initial Scope, where the supplier should build as quickly as possible. We will always either descope Under Review premises or defer build to them and we will always descope Grey or Black premises.

The framework agreements are intended to be single supplier agreements and will primarily include eligible premises in locations identified with no effective competition, potentially covering a county or multiple counties. The frameworks will also include IAs that were not successfully procured through other procurements. Suppliers will be required to build to any premises called off under these frameworks.

As noted above, the procurement approach will include an ongoing continuous improvement cycle and this could include the use of other valid procurement procedures as set out in the Public Contracts Regulations 2015 (PCR2015).

The Authority, BDUK, reserves the right not to proceed to tender for these IAs and withdraw the procedure for the competitive sourcing process at any time. Any amendments will be done in line with the Procurement Regulations.

Suppliers acknowledge and accept that by issuing this document (Closure Notice) BDUK shall not be bound to progress or conclude any related cross-regional framework procurement activity.

Under no circumstances shall the Authority incur any liability in respect of the information contained in this Closure Notice or any supporting documentation.

7. Timescales

The following table summarises the indicative timescales for the procurement (subject to change):

| Area | Procurement start date | Estimated contract award date |

|---|---|---|

|

Call-Off 1 West Berkshire (Lot 13C) West and Mid Surrey (Lot 22C) North Wiltshire and South Gloucestershire (Lot 30C) Hertfordshire (Lot 26C) Staffordshire (Lot 19C) Lancashire (Lot 9C) |

July 2023 | April to June 2024 |

|

Call-Off 2 West and North Devon (Lot 6C) North West Wales (Lot 42C) Mid Wales (Lot 43C) South East Wales (Lot 44C) |

July 2023 | April to June 2024 |

See Project Gigabit quarterly updates for more information on procurement timelines.

8. Conclusion

BDUK would like to thank all suppliers who provided us with feedback regarding the proposed eligible areas for government intervention via the market engagement exercises.

The responses and outputs derived from these exercises have allowed us to gain further confidence that the proposed interventions are targeting the right areas for subsidy, ie areas which are not commercially viable and require government intervention to address market failure.

BDUK has developed the IAs which were proposed to the market during the PPME phase. Please see Annex B which sets out the draft IA maps at UPRN level. These maps identify the areas where premises are eligible for subsidy.

A full list of White and Under Review UPRN outputs from the January 2023 NR OMR are available on request to suppliers via ukgigabit@BDUK.Zendesk.com.

9. Annex A - Map indicating locations of eligible premises

Please refer to the January 2023 NR OMR outputs specific to the Lots and regions referenced above.

The postcode-level maps accessible via the above link indicate areas where those premises eligible for subsidy are located ie White areas. These eligible premises may be included within the IAs.

Black, Grey and Blue (Under Review) areas indicate where those premises ineligible for subsidy are located.

Please refer to the Welsh Government’s PR outputs specific to the regions referenced above (noting that BDUK has overlaid the January 2023 NR OMR outputs with the Welsh Government’s PR outputs).

BDUK has used the January 2023 NR OMR data to assess and evaluate supplier coverage claims to identify eligible Gigabit White premises in the proposed IAs. This aligns with the process as set out in BDUK’s Open Market Review (OMR) and Public Review (PR) subsidy control classification guidance document.

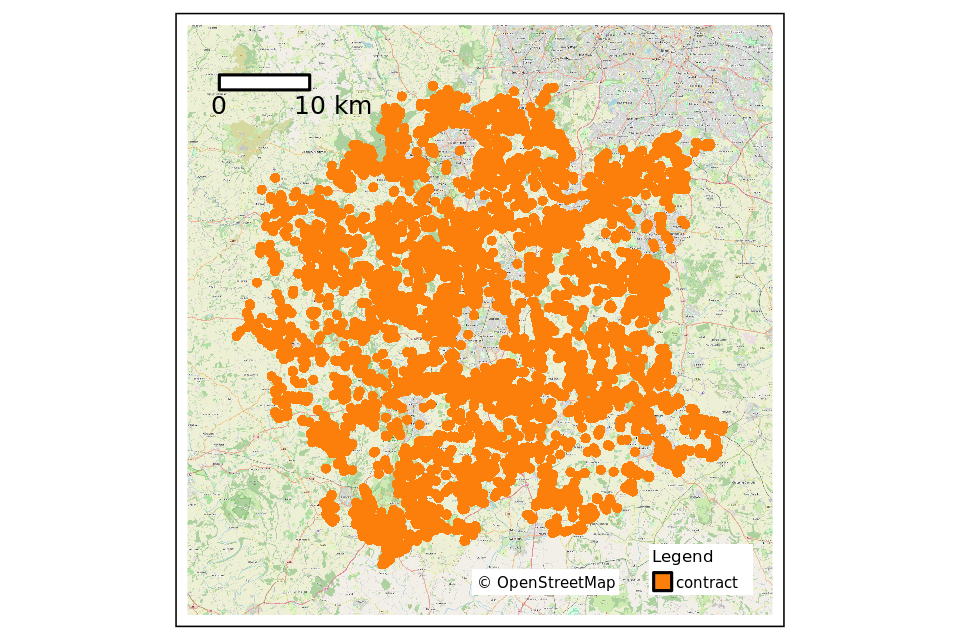

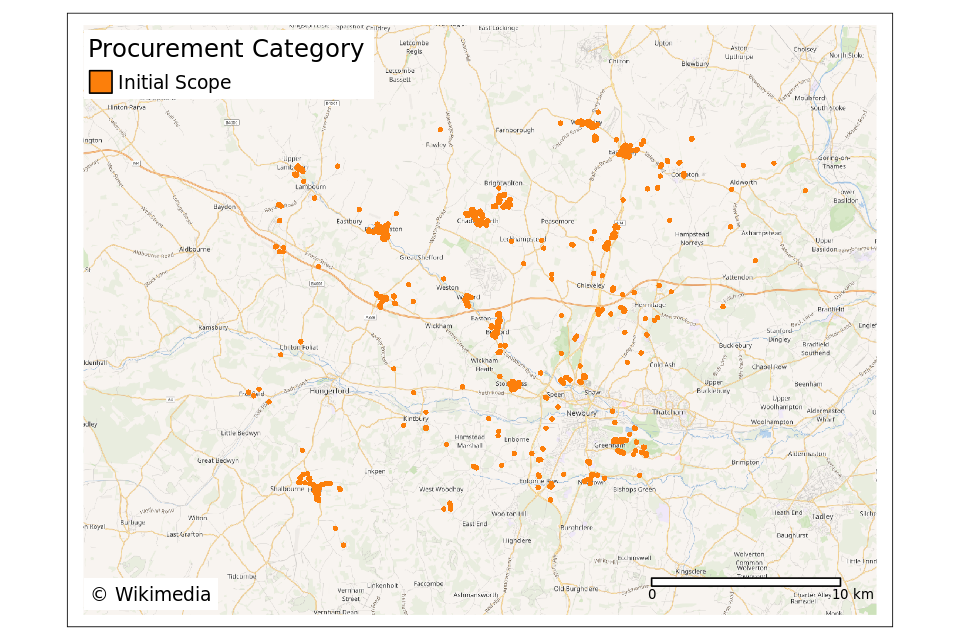

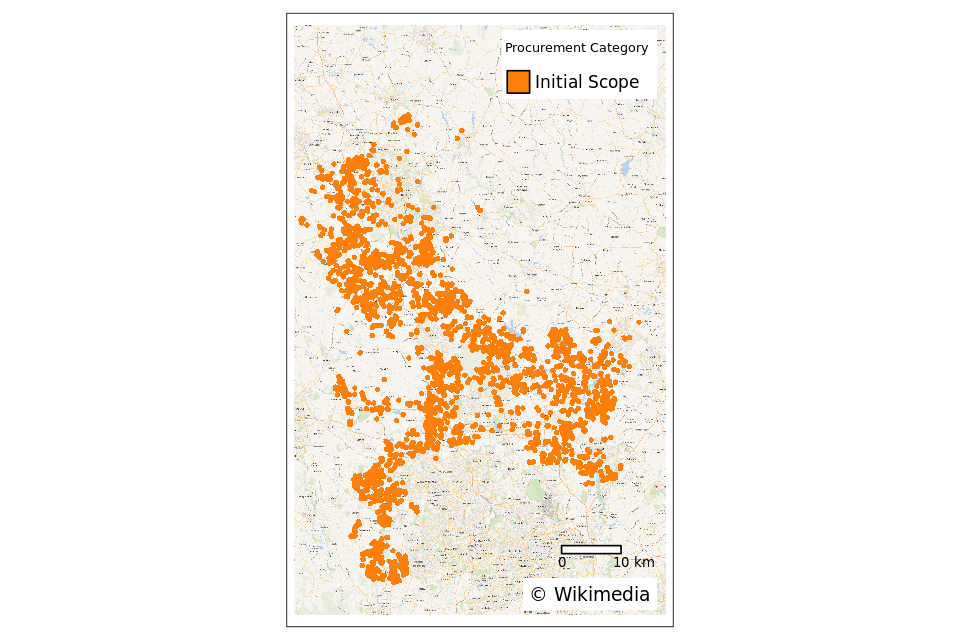

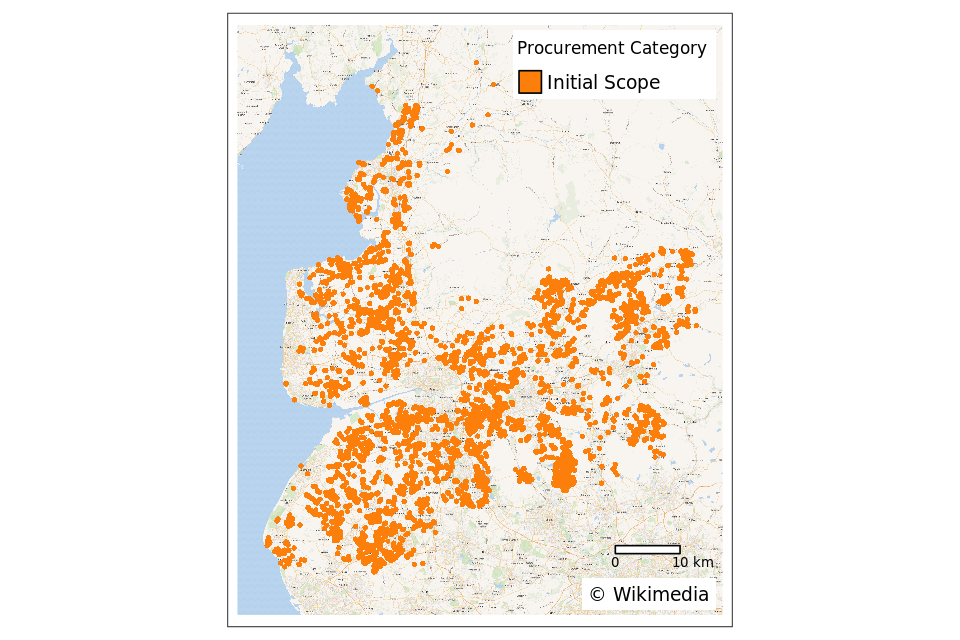

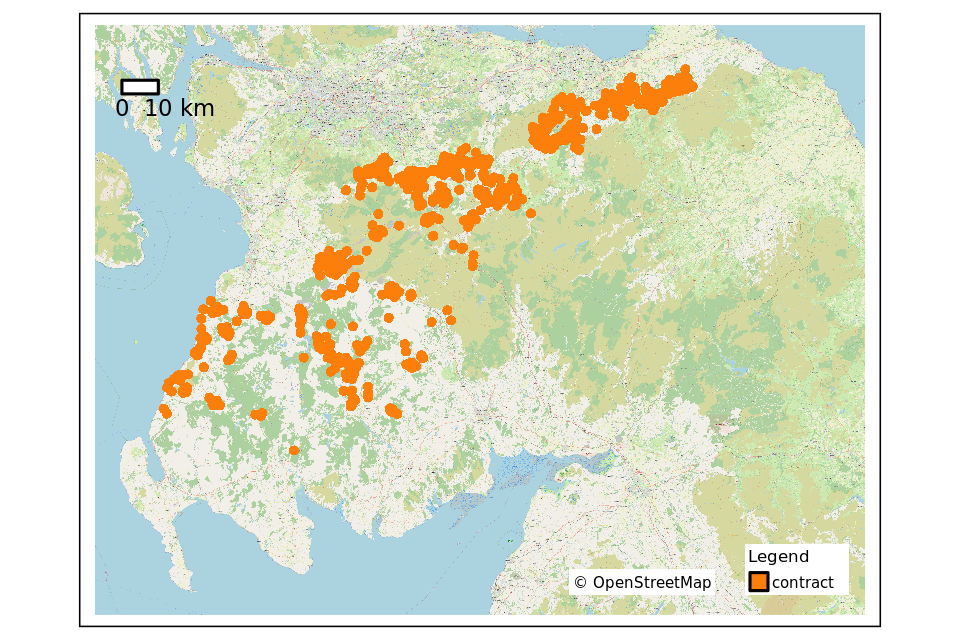

10. Annex B - Map of Proposed Intervention Areas

The maps below highlight the IAs that have been approved following the conclusion of the type C cross-regional framework PPME exercise.

The premises-level maps below indicate eligible premises that form the proposed IAs for the initial two call-off areas.

Those premises which are highlighted in orange are referred to as the Initial Scope premises that will be targeted for subsidy.

These nine maps are accompanied by a list of UPRNs that fall within the IAs, clearly demarcating which premises are within the Initial Scope which suppliers will be able to request via Atamis once the two initial call-off procurements are live. If you are unable to access Atamis, please contact the Supplier Mailbox suppliers@bduk.gov.uk.

10.1 Call-Off 1 - West Berkshire, West and Mid Surrey, North Wiltshire and South Gloucestershire, Hertfordshire, Staffordshire and Lancashire

West Berkshire (Lot 13C) 1,860 Initial Scope UPRNs

West and Mid Surrey (Lot 22C) 8,018 Initial Scope UPRNs

North Wiltshire and South Gloucestershire (Lot 30C) 13,345 Initial Scope UPRNs

Hertfordshire (Lot 26C) - 6,805 Initial Scope UPRNs

Staffordshire (Lot 19C) 11,728 Initial Scope UPRNs

Lancashire (Lot 9C) - 15,695 Initial Scope UPRNs

Call-Off 2 - Wales and Devon

West and North Devon (Lot 6C) 21,430 Initial Scope UPRNs

North West Wales and Mid Wales (Lots 42C and 43C) - 17,437 Initial Scope UPRNs

South East Wales (Lot 44C) 8,242 Initial Scope UPRNs

Please contact us at suppliers@bduk.gov.uk if you have any questions relating to the cross-regional framework.

11. Annex C - Update September 2024

BDUK has established a Cross-Regional Supplier Framework, known colloquially as Type C, to award call-off contracts over the life of the GIS Programme.

Call-off contracts awarded under the Cross-Regional Framework will subsidise the design, build and operation of gigabit-capable supplier networks providing long-term, sustainable availability of wholesale gigabit broadband services in the hardest to reach parts of the UK.

All lots proposed for the Type C procurement in England have been part of a previous Public Review (PR), open to all stakeholders, and published on both BDUK’s website and that of neighbouring Local Bodies - Scotland PR website and Wales PR website.

BDUK has awarded the Type C framework to a single supplier.

There are 11 Intervention Areas (IAs) being considered for call-offs - these may be split across call-offs three, four, five, six and seven with the supplier being expected to deliver all call-off contracts awarded within the agreed Cross-Regional Supplier Framework build timelines:

Call-Off 3

-

East and South Shropshire (Lot 25C)

-

North Herefordshire (Lot 15C)

-

North Wales (Lot 42C)

-

Southwest Wales (Lot 45C)

Call-Off 4

-

Mid Devon (Lot 6C)

-

North Somerset (Lot 6.02C)

-

South Devon (Lot 6.01C)

Call-Off 5

-

Essex (Lot 21C)

-

North East England (Lot 4C)

Call-Off 6

- Rest of Scotland

Call-Off 7

- Worcestershire (Lot 24C)

11.1 Type C Changes From April 2024

On 16 April 2024, BDUK updated the Type C Post Public Review - Closure Notice Update - June 2023 document on GOV.UK which included a number of areas identified for potential inclusion in additional call-offs to be awarded through the Type C Framework.

These areas were selected based on the findings of the local PRs previously conducted along with information derived from the September 2023 NR OMR findings.

Since April 2024, BDUK has developed the proposed IAs for these call-offs in more detail, reviewing the Lots that will comprise the call-offs’ scope. This has resulted in the following changes:

-

Addition of call-off 7 – this includes Worcestershire (Lot 24C), previously included under Additional Lots

-

Cornwall and Isles of Scilly (Lot 32C) has been removed from list of Additional Lots and is not included in call-offs progressing to award under the framework

Following the completion of the evaluation process of responses received from suppliers to the January 2024 NR OMR, the subsequent subsidy control classification results were overlaid and used by BDUK to update IAs for call-off areas 3 to 7. Further information on the January 2024 NR OMR can be found within the January 2024 NR OMR Closure Notice published 5 July 2024.

BDUK is confident that integrating these NR OMR findings will ensure the best possible outcome for call-offs 3 to 7, maximising both coverage and value for money accordingly. Our interventions will always flex to respond to both changes in the dynamic marketplace, and the appetite for our procurements. Further information on the NR OMR process can be found in our Open Market Review (OMR) and Public Review (PR) subsidy control classification guidance document.

BDUK also proceeded to complete several rounds of market engagement with suppliers to understand levels of interest from March to July 2024. As a result of the findings from these exercises, BDUK has decided to progress with the 11 geographic areas listed above for inclusion in call-offs 3 to 7 under the framework. Further details can be found below, and the draft IA maps are available to view in Annex D.

Please see full details of the January 2024 NR OMR outputs and the Scottish Government Public Review and relevant Scottish Government Rolling OMR outputs.

11.2 Indicative Call-Off Values

From March to July 2024, BDUK carried out market engagement activities to seek feedback from suppliers about the design of the proposed IAs.

The total public funding investment will be based on the final number of premises requiring subsidy. BDUK will confirm a budget drawn from public funding within the forthcoming call-off documentation, which will also include details of any restrictions on the use of public subsidy.

The tables below give a breakdown of the indicative UPRNs and contract values for each Intervention Area:

Call-Off 3 - East and South Shropshire, North Herefordshire, North Wales, Southwest Wales

| Lot Name | Indicative Number of UPRNs |

|---|---|

| Lot 25C East and South Shropshire | 8,628 |

| Lot 15C North Herefordshire | 3,304 |

| Lot 42C North Wales | 22,167 |

| Lot 45C Southwest Wales | 21,869 |

| Total Premises | 55,968 |

| Indicative Contract Value | £108,937,244 |

Call-Off 4 - Mid Devon, South Devon, North Somerset

| Lot Name | Indicative Number of UPRNs |

|---|---|

| Lot 6C Mid Devon and Lot 6.02C North Somerset | 27,968 |

| Lot 6.01C South Devon | 13,636 |

| Total Premises | 41,604 |

| Indicative Contract Value | £77,055,269 |

Call-Off 5 - Essex, North East England

| Lot Name | Indicative Number of UPRNs |

|---|---|

| Lot 21C Essex | 11,032 |

| Lot 4C North East England | 16,227 |

| Total Premises | 27,259 |

| Indicative Contract Value | £61,300,000 |

Call-Off 6 - Rest of Scotland

| Lot Name | Indicative Number of UPRNs |

|---|---|

| Rest of Scotland | 76,444 |

| Total Premises | 76,444 |

| Indicative Contract Value | £157,105,290 |

Call-Off 7 - Worcestershire

| Lot Name | Indicative Number of UPRNs |

|---|---|

| Lot 24 Worcestershire | 23,821 |

| Total Premises | 23,821 |

| Indicative Contract Value | £41,900,000 |

See Project Gigabit quarterly updates for more information on procurement timelines.

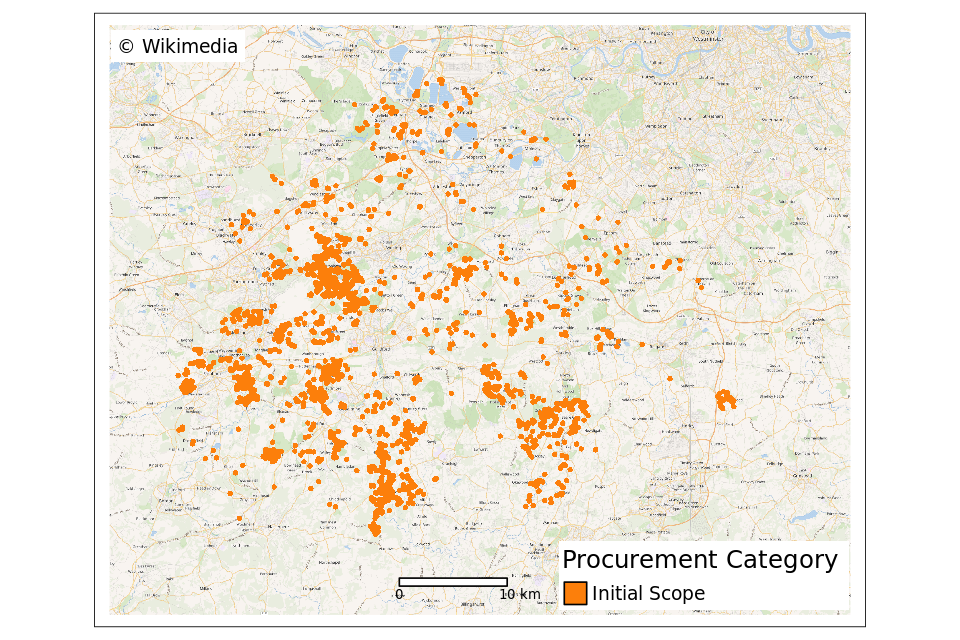

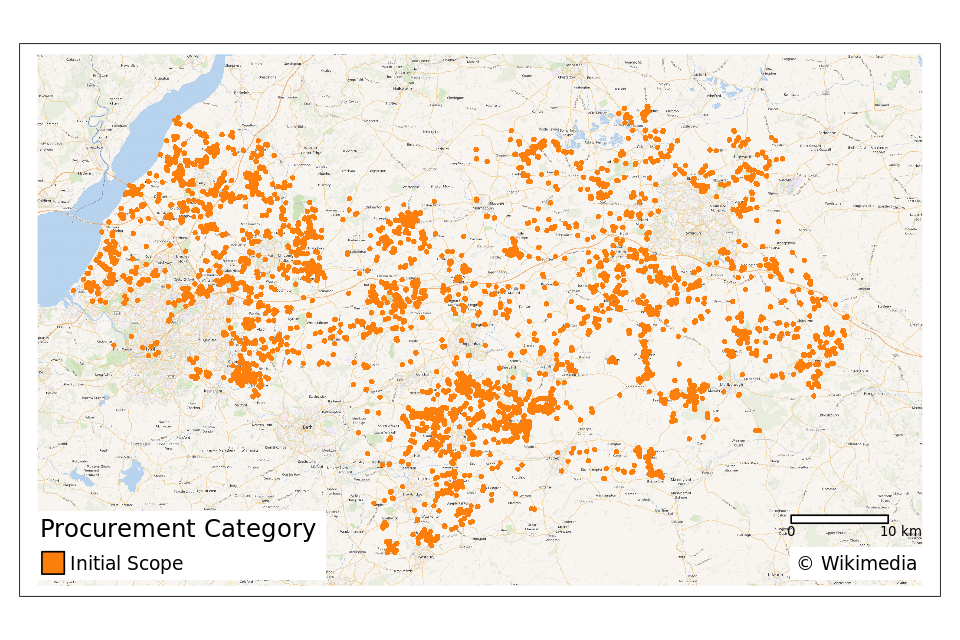

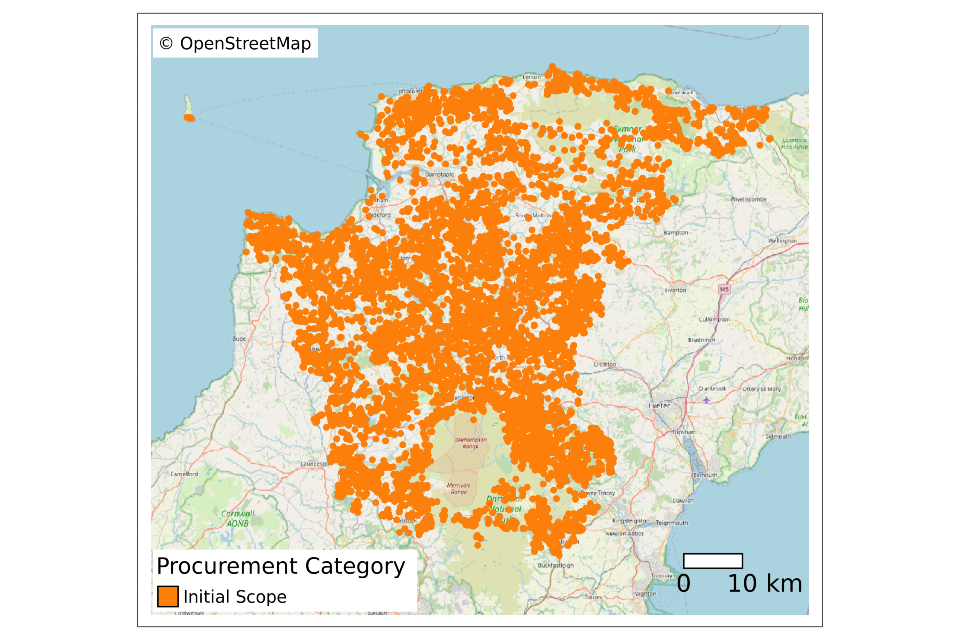

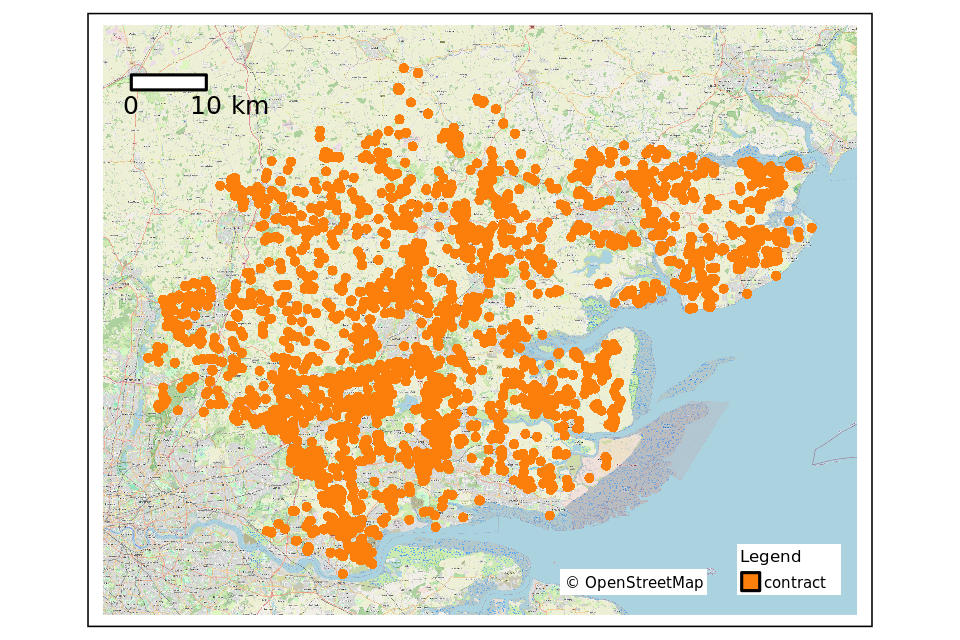

12. Annex D – Map of proposed Intervention Areas

The maps below highlight the IAs that have been approved following the conclusion of the type C cross-regional framework Market Engagement exercises.

The premises-level maps below indicate eligible premises that form the proposed IAs for the initial two call-off areas.

Those premises which are highlighted in orange are referred to as the Initial Scope premises that will be targeted for subsidy.

Further details can be requested by contacting the Supplier Mailbox suppliers@bduk.gov.uk

Call-Off 3 - East and South Shropshire, North Herefordshire, North Wales and Southwest Wales

East and South Shropshire (Lot 25C) 8,628 Initial Scope UPRNs

North Herefordshire (Lot 15C) 3,304 Initial Scope UPRNs

North Wales (Lot 42C) 22,167 Initial Scope UPRNS

Southwest Wales (Lot 45C) 21,869 Initial Scope UPRNS

Call-Off 4 - Mid Devon, South Devon and North Somerset

Mid Devon (Lot 6C) & North Somerset (Lot 6.02C) 27,968 Initial Scope UPRNs

South Devon (Lot 6.01C) 13,636 Initial Scope UPRNS

Call-Off 5 - Essex, and North East England

Essex (Lot 21C) 11,032 Initial Scope UPRNs

North East England (Lot 4C) 16,227 Initial Scope UPRNs

Call-Off 6 - Rest of Scotland

Rest of Scotland 76,444 Initial Scope UPRNs

Call-Off 7 - Worcestershire

Worcestershire 23,821 Initial Scope UPRNs