Museums and galleries tax relief consultation

Updated 5 December 2016

1. Introduction

1.1 Background

Budget 2016 announced that the government would introduce a new tax relief for museums and galleries from April 2017, following a consultation over summer 2016. Britain is home to a diverse range of museums and galleries and this tax relief will support them to develop creative new exhibitions and to display their collections to a wider audience.

This new tax relief, available on qualifying costs of both temporary and touring exhibitions, recognises the artistic importance and cultural value of museums and galleries in the United Kingdom. The tax relief will be available across the country. Its objective is to encourage the creation of more and higher quality exhibitions, as well as to support touring of the best exhibitions across the country and abroad, raising the UK’s profile internationally.

1.2 Aim of the consultation

The government aims to develop a museums and galleries tax relief that works well for the sector. The relief will be based on the other creative sector tax reliefs, though it may be adapted in key areas to reflect the particular way in which these institutions operate.

This consultation document sets out the details of the proposed tax relief and seeks views in key areas of its design. Views are invited from a wide range of respondents including individuals, charities, local authorities and representative and professional bodies. The government especially invites comments from those working directly in the museums and galleries sector. The government will take all responses into account before confirming the final policy design.

1.3 Structure of the document

The remainder of the document is set out as follows:

- Chapter 2 outlines the history of the creative sector tax reliefs and the key design points of the museums and galleries relief

- Chapter 3 explains the criteria that the government intends to use to evaluate proposals for the new tax relief

- Chapter 4 addresses key design features and definitions

- Chapter 5 includes details on other relevant issues

- Chapter 6 explains the consultation process

- Annex A provides an illustrative example from a previous relief

- Annex B provides an impact assessment for the new tax relief and makes a call for further evidence

- Annex C summarises the consultation questions presented in this document

- Annex D sets out the planned timeline for implementation

- Annex E sets out the general code of practice for consultation

1.4 Stage of consultation

The proposals in this document are at stage two (determining the best option and developing a framework for implementation including detailed policy design) of the government’s tax consultation framework.

1.5 Planned time frame

This consultation will run from 5 September to 28 October. Further detail is set out in annex D.

Further details about the policy, including the rates of relief, will be announced once this consultation has concluded.

1.6 How to respond

Please send comments by 28 October to:

Museums and Galleries Tax Relief Consultation

Enterprise and Property Tax Team

HM Treasury

1 Horse Guards Road

London

SW1A 2HQ

Or email: museumsandgalleriestaxrelief@hmtreasury.gsi.gov.uk

2. How do the reliefs work?

2.1 Creative sector tax reliefs

The government supports the creative industries through a number of different spending and tax measures. A museums and galleries tax relief joins a number of other creative sector tax reliefs that are offered by the government, including relief for films, high-end and children’s television, animation, video games, theatre and orchestral productions.

HMRC published official statistics in July 2016 showing that 210 films claimed the film tax credit from 2015 to 2016, with the relief supporting over £1 billion worth of UK expenditure in the sector. 50 high-end television programmes claimed the high-end television relief in that same period.

An illustrative example of how the existing creative sector tax reliefs work is set out in annex A.

2.2 Proposed key features

The government wants to design a tax relief that is simple to use and provides value to the sector. In addition, it is important to keep the model of tax relief as close as possible to the existing creative sector tax reliefs to ensure fairness. The following box sets out the relief’s key features.

Box 2.A: Key features of museums and galleries tax relief

- the institution must qualify as a museum or gallery as defined in chapter 4

- relief will take the form of an additional deduction for corporation tax purposes which can be surrendered for a payable tax credit

- to qualify for relief, the institution will therefore need to be within the scope of corporation taxes, for example a museum set up as a charitable company (or a charitable museum producing the exhibition through its trading subsidiary) or a museum set up as a subsidiary company under the control of a local authority

- from 1 April 2017, tax relief will be available for the creative and set-up costs of temporary or touring exhibitions but not for day-to-day running costs

- the government will announce the exact rate of relief after the consultation

3. Principles and criteria

The criteria that the government will use in evaluating proposals to support museums and galleries are set out below.

In deciding how best to proceed, it will be necessary for the government to consider and balance these, sometimes competing, factors.

Box 3.A: Criteria for museums and galleries tax relief

- effective. Any proposed policy change must be effective in supporting institutions to deliver cultural benefits, encouraging the sector to develop creative exhibitions across the UK, and incentivising touring exhibitions to ensure that a wide range of audiences can enjoy them

- affordable. The proposed relief must represent value for money to the taxpayer and must be affordable in line with the government’s objective for long-term sustainability in the public finances

- simple and straightforward to administer. The government is committed to simplifying the tax system as well as modernising it through its Making Tax Digital programme. Any proposed change should not result in unnecessary burdens for companies, charities or other groups, for individuals or for the administration of the tax system

- sustainable. Any proposed change must be designed, as far as possible, to fit both the current and future states of the sector

- not open to abuse. Tax reliefs should not create any additional avoidance opportunities

- compliant with EU law. The UK must meet all obligations as a member of the EU whilst the exit from the European Union is negotiated. Because of this, any proposed policy change must be consistent with the principles of the Single Market and will need to be achievable in the context of EU rules on State aid

Question 1

Do you agree with the proposed criteria for assessing the options to provide support to the museum and gallery sector? Please provide any comments as appropriate.

4. Definitions and designs

4.1 The definition of a museum and a gallery

For the relief to be effective, properly targeted and correctly legislated for, the government must define what constitutes a museum and what constitutes a gallery. The government recognises that a wide range of different institutions make up this complex sector, and wants to structure a relief to target the widest possible range of appropriate museums and galleries.

The government wants the relief to provide support to museums and galleries with charitable or educational objectives. Across the country, these institutions play an important role in society by maintaining important objects and educating people about different cultures or local history. There is a well-established market failure in meeting these objectives as the positive externalities associated with them mean they would be under-provided without government intervention. The tax relief aims to help address this by providing support to such institutions and so, for this reason, commercial businesses will not be eligible for the relief.

However, charitable museums and galleries will be allowed to produce an exhibition through their trading subsidiary and use that to claim the relief, while those set up as a subsidiary company under the control of a local authority in relation to arts, culture or science will also be eligible. The relief will be available to art galleries that do not house their own collections as well as those that do.

Box 4.A: Proposed definitions of qualifying institutions for the purposes of tax relief

The proposed definition of a museum is “a building or place devoted to the conservation, exhibition and educational interpretation of collections having scientific, historical or artistic interest.”

The proposed definition of a gallery is “a building or place that is used for the exhibition and educational interpretation of a collection of objects having scientific, historical or artistic interest.”

Proposed exclusions

- commercial companies run on a for-profit basis other than trading subsidiaries of charities

Question 2

Would these definitions allow appropriate institutions to be in a position to claim the relief?

Question 3

Would adopting the definitions outlined above be an effective way of meeting the government’s objectives as set out in chapter 3?

Question 4

Is there an alternative definition of a qualifying institution that would more accurately permit the most appropriate range of museums and galleries to qualify for the relief? If so, please provide details.

4.2 The definition of an exhibition

As well as effectively defining which institutions should qualify for the relief, the government must also find definitions for a temporary and a touring exhibition that are workable in legislation, while also being recognised by and appropriate for the sector. The definitions should be broad enough to cover the range and diversity of exhibitions put on by museums and galleries across the country and should support a wide range of themes, from science to modern art.

In order to ensure that the relief meets the policy objective, some exhibitions will be excluded. These could include an exclusion for an art exhibition run purely to sell works of art or an exhibition that is not open to the general public. In addition, the definition must not be subject to abuse.

Box 4.B: Proposed definition of an exhibition for purposes of a tax relief

The proposed definition of an exhibition is “an organised and temporary display of a selection of works of art or items of interest held in a qualifying museum or art gallery. The exhibition must be open and accessible to the general public.” To qualify as temporary, the period between opening and closing the exhibition to the general public must not exceed one year at a single location.

An exhibition will not qualify for relief if:

- one of the main purposes is to advertise or promote goods or services

- it is not open and accessible to the general public

- it is exhibited in a museum or gallery that does not meet the definitions above

- the purpose is to sell the exhibit or exhibits

Question 5

Is there a more accurate definition of an exhibition that would allow qualifying institutions to claim relief for the most appropriate range of displays?

Question 6

Does a period of up to one year accurately reflect the length of time a temporary exhibition would remain open to the public?

Question 7

In addition to those mentioned in box 4.B, are there any types or characteristics of an exhibition that you think should be excluded from the relief?

4.3 The definition of a touring exhibition

As well as encouraging the creation of more and higher quality exhibitions, the tax relief will encourage museums and galleries to tour their best exhibitions across the country and beyond.

To ensure the policy meets this objective, the government is keen to understand more about how touring an exhibition works in practice and would like to use this consultation to request more information. This information will be used confidentially to help ensure the relief is designed with the sector in mind.

Box 4.C: What constitutes a touring exhibition

An exhibition will only qualify as touring if the institution shows evidence at the beginning of the planning phase of the exhibition that it will present the exhibition in at least one other museum or gallery in a different location falling within the proposed definitions above. A museum or gallery that tours an exhibition to a different branch of that same institution will still be eligible for relief.

Question 8

Is there a more accurate definition of a touring exhibition that would allow institutions to tour their exhibitions to other museums and galleries?

Question 9

How soon in advance is it decided that an exhibition will be toured?

Question 10

What kind of model is most likely to be employed for touring, i.e. will it be led by one organisation, split between two institutions etc.?

Question 11

How are the costs split up between the touring institution and the institution that is hosting the tour and how do the two interact more widely?

Question 12

If an exhibition is toured internationally, when and where are the costs normally paid?

4.4 Qualifying ‘core’ expenditure

In order to qualify, expenditure must be directly incurred in the creation and development of either a temporary or touring exhibition, and must be integral to the creative process. Box 4.D sets out some examples of the eligible and ineligible costs. In line with other creative sector tax reliefs indirect expenditure, such as the costs of marketing or financing, will not be eligible for tax relief. In addition, speculative expenditure (where the exhibition does not go ahead) and running costs will be excluded from the relief.

Box 4.D: Some examples of core expenditure

Qualifying ‘core’ expenditure – to qualify, the cost must be directly linked to the exhibition:

- curator and research costs

- exhibition installation

- exhibit loan costs

- digital spending

- insurance and transportation costs

- exhibition specific venue costs (including set-up) and equipment hire

- administration that is linked directly to the exhibition

Ineligible costs:

- general museum costs and running costs of exhibition

- cost of financing

- fees, including legal and accounting fees

- acquisition costs

- storage costs

- marketing and advertising

- infrastructure costs not solely related to the new exhibition

Question 13

Which costs are integral to the exhibition process itself and should therefore be eligible for relief? Please explain your choices.

4.5 Claims process

Qualifying museums and galleries will be able to claim an additional deduction against their corporate taxable profits that can be surrendered for a payable tax credit if this results in a trading loss. Because this policy will take the form of a corporation tax relief, only entities that are within the charge of UK corporation tax and are directly involved in the development of an exhibition will be able to claim relief. ‘Directly involved’ means that the company is responsible for creating and developing the content of the exhibition and is actively involved in the decision making process to deliver it.

This relief is targeted at museums and galleries run as charities or owned by local government authorities, many of whom do not pay corporation tax. These institutions will still be able to claim the relief. For the existing reliefs, some institutions have decided to use a wholly owned trading subsidiary in order to claim tax relief, although this is not compulsory. For example, a charitable theatre company might claim the relief through the subsidiary they use for their restaurant or gift shop, or by setting up a new trading subsidiary company. In this situation, the subsidiary company must be the company directly responsible for producing the exhibition. Those that have not used these subsidiaries before should ensure that using this model would not impact on their charitable status and would not have any VAT implications. The process for setting up such a trading subsidiary is the same as it would be for establishing any other business. Guidance is available on GOV.UK and how this arrangement works for the theatre industry is explained.

Following the model for previous creative sector tax reliefs, the relief will be capped at the lesser of 80% of core expenditure, incurred in any country, or the total core expenditure occurred in the EEA. As with other creative sector tax reliefs for video games and theatre at least 25% of the qualifying core expenditure must be incurred in the EEA. This would be applicable for both the temporary and touring relief, including on any exhibitions that were aimed at being toured internationally.

To claim the relief, a qualifying institution will need to submit an end of year tax return to HMRC, disclosing all expenditure that would qualify for the tax relief (details of qualifying and ineligible expenditure can be found in box 4.D). HMRC will then aim to pay out successful claims within 40 days.

As with theatre tax relief, institutions will be required to treat each exhibition as a separate trade and must make a separate claim for relief for each one.

Question 14

Does the requirement to be incorporated and operate separate trades within the company cause significant administrative burdens for museums and galleries? Please explain in what way.

Question 15

Would the requirement to be incorporated affect current funding or subsidies/exemptions that are received by some museums? If so, please explain how?

Question 16

Are there any other specific design points which need to be addressed?

5. Other issues

5.1 Commencement

The government wants to provide institutions with the time to make any necessary arrangements so they are in a position to claim the relief once it becomes available. Museums and galleries tax relief will therefore have a commencement date of 1 April 2017.

The government will provide relief on qualifying expenditure that is incurred on or after 1 April 2017. Where an accounting period straddles that date, expenditure arising in that period must be apportioned between the period on or before 31 March 2017 and the period on or after 1 April 2017.

5.2 State aid

The British people have voted to leave the European Union but while this exit is negotiated, the country remains a full member of the EU and must meet its obligations as a member of the EU, including in relation to State aid. This relief is intended to fall under revised General Block Exemption Regulation rules, which allow for an exemption from notification when aid is for culture and heritage. The rules can be found here.

Under these rules, the maximum relief available per company is €50 million a year, and the maximum aid intensity should not exceed 100% of eligible costs. Aid intensity includes all sources of government funding including, for example, some grants and lottery funding. Companies in receipt of other funding may need to declare all sources of funding to HMRC and confirm that they do not exceed this limit. Should companies receive excessive aid, then this aid could be clawed back for a period of up to 10 years.

Question 17

Can you give examples of other sources of funding that you receive for exhibitions?

5.3 Claiming tax relief from HMRC

Claims for the museums and galleries tax relief will need to be included in a company’s corporation tax return for an accounting period. This model is generally expected to provide businesses with enough certainty to be able to self-assess without the need for a formal clearance process.

5.4 Interaction with other reliefs

Where a company claims the museums and galleries tax relief, it will not be able to claim relief under another tax credit scheme such as theatre tax relief or the research and development tax credit on the same expenditure. A company will not be able to claim both the temporary and touring tax relief on the same ‘core’ expenditure.

5.5 Expenditure incurred but unpaid

Any amount of costs incurred but unpaid within 4 months of the end of a period of account will not qualify for the tax relief for that period. Costs paid outside this period will be eligible for claims if they are paid in later accounting periods.

5.6 Openness to abuse

One of the key design criteria for the tax relief is that it should not be open to abuse. An effective strategy to prevent abuse at the outset is a key requirement to maintain the long term sustainability of this relief and to ensure that it remains effective and sufficiently targeted. The government will, in particular, consider whether rules are required to prevent:

- artificially inflated claims for tax credit or transactions not entered into for genuine commercial reasons

- wrongful disclosure

- tax avoidance arrangements relating to the exhibition

It is important for businesses as well as the government to ensure that the new tax relief does not create new avoidance risks, otherwise this will create uncertainty for business as the regimes may be subject to change. In extreme situations where substantial avoidance risks are created, such as the old film tax scheme, the regime was entirely replaced.

Question 18

Would the strategy outlined above be an appropriate way of preventing abuse of the new tax relief?

Question 19

Are there specific areas in addition to those mentioned above that create the opportunity for abuse?

6. The consultation process

6.1 Responding to the consultation

The closing date for this consultation is 28 October.

Responses to the consultation should be sent either by post to:

Museums and Galleries Tax Relief Consultation

Enterprise and Property Tax Team

HM Treasury

1 Horse Guards Road

London

SW1A 2HQ

Or by email to: museumsandgalleriestaxrelief@hmtreasury.gsi.gov.uk

This document can be found on the HM Treasury website. When responding, please state whether you are responding as an individual or as part of an organisation. If responding on behalf of a representative body please make it clear who the organisation represents and, where applicable, how the members’ views were assembled.

6.2 Confidentiality and disclosure

All written responses may be made public on the Treasury’s website unless the author specifically requests otherwise in writing.

Information provided in response to this consultation, including personal information, may be published or disclosed in accordance with the access to information regime. These are primarily the Freedom of Information Act (FOIA), the Data Protection Act (DPA) and the Environmental Information Regulations 2004.

If you would like the information that you provide to be treated as confidential, please be aware that, under the FOIA, there is a statutory code of practice with which public authorities must comply and which deals, amongst other things, with obligations of confidence. In view of this, it would be helpful if you could explain to us why you regard the information you have provided as being confidential. If we receive a request for disclosure of information we will take full account of your explanation, but we cannot give an assurance that confidentiality will be maintained in all circumstances.

In the case of electronic responses, general confidentiality disclaimers that often appear at the bottom of emails will be disregarded for the purpose of publishing responses unless an explicit request for confidentiality is made in the body of the response.

Subject to the previous two paragraphs, if you wish part (but not all) of your response to remain confidential, please supply two versions, one for publication on the website with the confidential information deleted, and another confidential version for use by the Treasury.

Any FOIA queries should be sent by post to:

Correspondence and Enquiry Unit

Freedom of Information Section

HM Treasury

1 Horse Guards Road

SW1A 2HQ

7. Annex A: How the relief works in practice

7.1 Illustrative museums and galleries example timeline

Chart illustrating the museums and galleries example timeline

January 2018: Museum directors get together to discuss ideas around future exhibitions – speculative expenditure not allowed unless exhibition is green-lit.

March 2018: Museum agrees that an exhibition on a given topic will run from January-March 2019. The museum’s subsidiary company (which must be in existence at the development stage) will take direct responsibility for putting on the exhibition – all qualifying expenditure that is directly linked to the exhibition is now eligible for relief as trade has commenced.

March – December 2018: Museum Company plans, curates and sets-up exhibition – directly incurred costs for planning and setting-up the exhibition are claimable.

January – March 2019: Exhibition runs – general running costs excluded from the relief.

31 March 2019: End of year accounts date for museum’s trading subsidiary (31 March is the usual year end date for charities, but this could be any date).

April 2019: Museum closes and takes down exhibition – removal costs and curating for storage are claimable where these directly relate to the exhibition.

June 2019: Museum’s trading subsidiary files return with HMRC, including all qualifying expenditure up until its end of year return date of 31 March (note if an exhibition straddles this date, the company can claim qualifying costs in two separate claims, one relating to the accounting period to 31 March 2019 and one relating to the subsequent accounting period). HMRC aims to pay out on legitimate claims within 40 days.

Examples of qualifying and ineligible costs can be found in box 4.D.

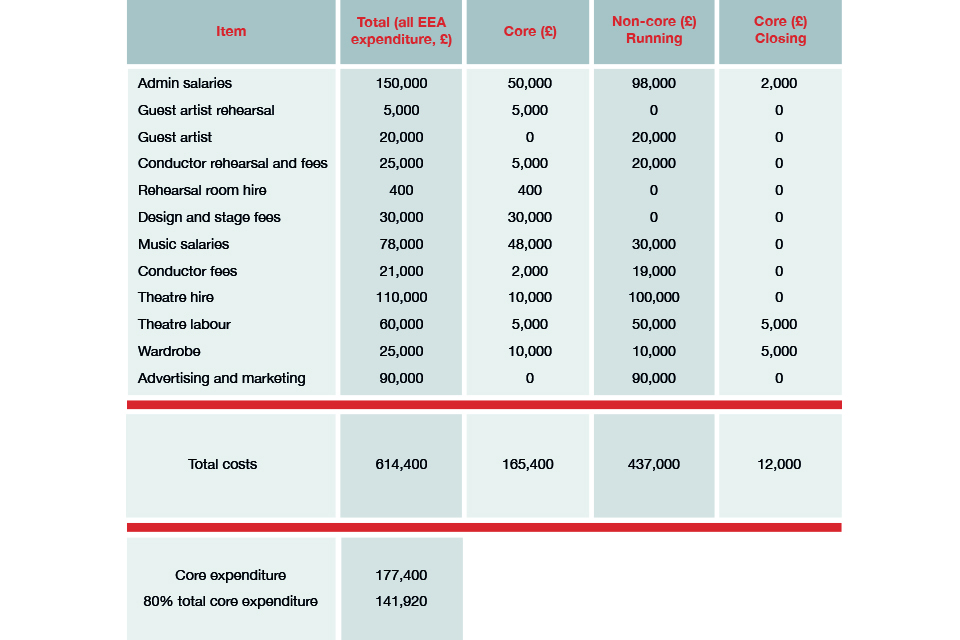

7.2 Illustrative theatre example

The following example is loosely based on an anonymous theatre company who claimed the theatre tax relief on the below production. It is included for illustrative purposes to draw attention to the types of costs that may qualify for the museums and galleries tax relief and to provide an example of how the amount of relief is calculated. It should be noted that all qualifying costs and rates for the museums and galleries tax relief will be decided after the consultation period.

For the purposes of the illustration, the company earned £600,000 in income from the production, and spent £614,400 on costs of which £177,400 met the qualifying core expenditure criteria (including £12,000 closing costs).

Table illustrating theatre example

The company therefore had a pre-tax relief loss of £14,400. It was able to add up to 80% of its qualifying core expenditure to that loss (£141,920) giving it an overall post-tax relief loss of £156,320.

Table showing pre-tax relief loss amount

The theatre was then able to surrender the lesser of the post-tax relief trading loss (£156,320) and the expenditure enhanced for the calculation of the relief (£141,920). It chose to surrender the full amount of £141,920 and was given a payable credit from HMRC worth 20% (note this rate has still to be confirmed for the museums and galleries tax relief) of this figure: £28,384.

8. Annex B: Tax impact assessment and call for further evidence

8.1 Summary of impacts

Table B.1: Museums and galleries tax relief impact assessment

| Impact | Effect |

|---|---|

| Economic impact | This measure is expected to have a positive impact on the museum sector. It is not expected to have significant wider macroeconomic impacts. |

| Impact on individuals, households and families | Tax relief will only be available to museums and galleries that are directly involved in the creation and production of qualifying exhibitions and so is unlikely to impact on individuals and households. This policy is not expected to have any impact on family formation, stability or breakdown. |

| Equalities impact | The government has carefully considered whether this measure impacts on people with protected characteristics and has not identified any equalities impacts. |

| Impact on business including civil society organisations | Tax relief for museums and galleries will allow qualifying companies to claim an additional deduction on their corporate taxes or a payable tax credit, supporting the museum sector. Because this is a new tax relief, some eligible companies may face one-off costs associated with familiarisation with new legislation, processes and requirements. The ongoing costs include the costs of calculating and claiming the relief. |

| Operational impact (£m) (HMRC or other) | It is expected that HM Revenue & Customs will incur additional annual costs to administer the new tax relief. Training and familiarisation with the new legislation will be required. |

| Other impacts | Competition assessment: this relief is targeted at a specific sector. All companies in this sector are eligible so introduction is unlikely to affect competition within the sector. There should not be any significant impact on competition with other business sectors. Small and micro business assessment: the government recognises that there may be some increase in administration impacts on small businesses. However, overall the tax relief will impact positively on qualifying small companies. The existing creative industry specialist unit will help to facilitate claims. Other impacts have been considered and none have been identified. |

8.2 Request for further supporting evidence

The government is grateful to the museum sector for providing the evidence which has supported this policy’s development to date. The government now asks for interested parties to provide further evidence as requested below. This information is requested from all types of museums and galleries in scope of this relief, including: national museums, non-national museums (including independent and local authority museums), non-commercial art galleries and qualifying heritage properties that display exhibitions.

The evidence provided will be used only for analytical purposes, to help the government further develop this policy and to examine its potential impact on the sector and Exchequer revenues. Any information provided will not be publicly disclosed.

Box B.2: Request for supporting evidence

1. Existing exhibitions and behavioural effects

Please provide information for both temporary and touring exhibitions, where applicable, on:

- the types of museums and galleries likely to fall under the proposed definitions and any that would not

- examples of exhibitions likely to fall under the proposed definition

- any estimates you might have on the size of the sector and the effect a tax relief might have, ideally with supporting numbers but anecdotal if necessary

- the cost of a temporary or touring exhibition, including a breakdown of where the major costs are incurred

2. Case studies for the development of exhibitions

Please provide individual case studies, including information on:

- how an exhibition is thought up and followed through on, including a timeline and breakdown of costs if possible

- how other government reliefs and spending programmes support the museum sector, including business rates and VAT exemptions, charitable tax reliefs and insurance guarantees

- what the administrative cost of claiming the relief would be

- any limitations museums and galleries might face when looking to create new exhibitions, for example lack of space or capacity

9. Annex C: Summary of questions

Chapter 3: Principles and criteria

Question 1: Do you agree with the proposed criteria for assessing the options to provide support to the museum and gallery sector? Please provide any comments as appropriate.

Chapter 4: Definitions and design

Question 2: Would these definitions allow appropriate institutions to be in a position to claim the relief?

Question 3: Would adopting the definitions outlined above be an effective way of meeting the government’s objectives as set out in chapter 3?

Question 4: Is there an alternative definition of a qualifying institution that would more accurately permit the most appropriate range of museums and galleries to qualify for the relief? If so, please provide details.

Question 5: Is there a more accurate definition of an exhibition that would allow qualifying institutions to claim relief for the most appropriate range of displays?

Question 6: Does a period of up to one year accurately reflect the length of time a temporary exhibition would remain open to the public?

Question 7: In addition to those mentioned in box 4.B, are there any types or characteristics of an exhibition that you think should be excluded from the relief?

Question 8: Is there a more accurate definition of a touring exhibition that would allow institutions to tour their best exhibitions to other museums and galleries?

Question 9: How soon in advance is it decided that an exhibition will be toured?

Question 10: What kind of model is most likely to be employed for touring, i.e. will it be led by one organisation, split between two institutions etc.?

Question 11: How are the costs split up between the touring institution and the institution that is hosting the tour and how do the two interact more widely?

Question 12: If an exhibition is toured internationally, when and where are the costs normally paid?

Question 13: Which costs are integral to the exhibition process itself and should therefore be eligible for relief? Please explain your choices.

Question 14: Does the requirement to be incorporated and operate separate trades within the company cause significant administrative burdens for museums and galleries? Please explain in what way.

Question 15: Would the requirement to be incorporated affect current funding or subsidies/exemptions that are received by some museums? If so, please explain how?

Question 16: Are there any other specific design points which need to be addressed?

Chapter 5: Other issues

Question 17: Can you give examples of other sources of funding that you receive for exhibitions?

Question 18: Would the strategy outlined above be an appropriate way of preventing abuse of the new tax relief?

Question 19: Are there specific areas in addition to those mentioned above that create the opportunity for abuse?

10. Annex D: Planned timeline

16 March 2016 (Budget): The government announced its intention to introduce a new tax relief for museums and galleries following consultation.

5 September to 28 October: The government commenced a formal 8 week consultation to test the proposal with the sector.

Consultation period: The government will work with the sector to finalise the definitions proposed in this consultation.

Autumn 2016: Draft legislation will be published.

April 2017: The new relief will take effect and will be legislated for in Finance Bill 2017.

11. Annex E: The code of practice on consultation

This consultation is being conducted in line with the code of practice for written consultation, which sets down the following criteria:

- formal consultation should take place at a stage when there is scope to influence the policy outcome

- consultations should normally last for at least 12 weeks with consideration given to longer timescales where feasible and sensible

- consultation document should be clear about the consultation process, what is being proposed, the scope of influence and the expected costs and benefits of the proposals

- consultation exercises should be designed to be accessible to, and clearly targeted at, those people the exercise is intended to reach

- keeping the burden of consultation to a minimum is essential if consultations are to be effective and if consultees’ buy-in to the process is to be obtained

- consultation responses should be analysed carefully and clear feedback should be provided to participants following the consultation

- officials running consultations should seek guidance in how to run an effective consultation exercise and share what they have learned from the experience

If you feel that this consultation does not fulfil these criteria, please contact:

Consultation Coordinator

HM Revenue & Customs

100 Parliament Street

London

SW1A 2BQ