Increasing the RTFO buy-out price to ensure continued greenhouse gas savings – outcome, summary of responses and cost-benefit analysis

Updated 25 September 2020

Executive summary

Consultation on increasing the renewable transport fuel obligation buy-out price

In July 2020, the UK government published a consultation on increasing the price fuel suppliers pay should they opt to ‘buy out’ of their obligations to supply renewable fuels under the renewable transport fuel obligation (RTFO). This consultation sought to ensure the continued decarbonisation of road transport fuels through the supply of renewable fuels under the RTFO.

Biofuels supported under the RTFO have successfully reduced greenhouse gas (GHG) emissions from transport over the last 12 years and are currently contributing a third of the required savings of the UK’s transport carbon budgets. In 2018, biofuels reduced carbon emissions from transport by over 3.5 million tonnes.

The consultation was in response to recent increases in the cost of biofuels relative to petrol and diesel, which means that there is a risk that suppliers will ‘buy out’ of their obligations to supply renewable transport fuel if changes to the buy-out price are not made. This would result in lost GHG savings and a gap in UK carbon budgets, as well as risking long-term impacts on the UK biofuels industry.

The consultation set out two options to increase the buy-out price for the main RTFO obligation from £0.30 per litre (l). These options were:

- increasing the buy-out price to £0.50/l (preferred)

- increasing the buy-out price to £0.40/l (alternative)

No changes were proposed to the development fuel obligation buy-out price.

If we do not increase the RTFO buy-out price, the UK risks losing carbon emission savings of up to 64 million tonnes of CO2 equivalent (MtCO2e) over the next 10 years. The monetised, discounted value of these maximum carbon savings is estimated at up to £665 million per year (based on the Department for Business, Energy and Industrial Strategy (BEIS)’s current carbon appraisal values).

The maximum additional cost of our preferred option (which is likely passed to the motorist) would be approximately £0.02/l including value-added tax (VAT).

The government thanks everyone who responded to the consultation. All responses to the consultation have been recorded and analysed. We value the evidence and opinions submitted and have taken these into consideration in developing the policy set out in this government response.

Summary of responses

In total, the government received 61 responses to the consultation. The majority were from renewable fuel suppliers:

Table 1: Types of responses received

| Type | Total |

|---|---|

| Private individuals | 0 |

| Organisations | 61 |

| Renewable fuel supplier/association | 42 |

| Fuel supplier/distributor | 8 |

| Other/unknown organisation | 11 |

| Overall | 61 |

Of these responses, the majority (44) agreed with the government’s preferred option to increase the main obligation buy-out price from £0.30/l to £0.50/l.

Those who supported this decision highlighted the importance of ensuring the buy-out price is set at a level that incentivises suppliers to supply renewable fuels and thereby prevents the loss of GHG savings.

They noted that if suppliers buy out of their obligation then this undermines the purpose of the RTFO (that is, to deliver GHG savings in transport fuels).

Government decision

The government is committed to the decarbonisation of transport fuels and renewable fuels have an essential role to play in the transition to net-zero. Therefore, the government decision is to proceed with the preferred option of increasing the RTFO buy-out price to £0.50/l from £0.30/l as this provides the greatest certainty in mitigating the risk of suppliers buying out of their obligation and the UK losing GHG savings.

We are preparing the necessary legislation and, subject to the Parliamentary process, are aiming to have the legislation in place for 1 January 2021.

If the legislation is delayed, this could mean that the increase to the buy-out price would not be applied until 1 January 2022.

The buy-out price options considered

We proposed to increase the buy-out price for the main RTFO obligation. This would reduce the risk of obligated suppliers choosing to buy out, thereby maintaining GHG savings and providing greater certainty of support to the UK renewable fuels industry. We put forward two options, the impacts of which are set out in further detail in the accompanying annex: cost-benefit analysis.

Note: in the consultation and associated cost-benefit analysis (CBA), we determined the maximum additional support provided by the Motor Fuel (Road Vehicle and Non-Road Mobile Machinery) Greenhouse Gas Emissions Regulations 2012 (GHG Regulations) for crop-derived bioethanol and used cooking oil (UCO)[footnote 1]-derived biodiesel to be £0.10/l and £0.21/l, respectively.

We have adjusted our calculations of the increase in RTFO buy-out price required from 2021 to achieve the same maximum overall support as the RTFO and GHG Regulations provide now. It previously did not take into account the double reward of renewable transport fuel certificates (RTFCs) for waste-derived biofuel. See Table 3 in the CBA for more information.

Option 1 – Increase the RTFO buy-out price from £0.30/l to £0.50/l (preferred)

By increasing the potential level of support to this level, it:

- future-proofs the scheme against increased costs

- provides greater certainty of delivering continued GHG savings in transport

- provides certainty to industry that investments in UK biofuel facilities will have a market – this will be necessary for continued decarbonisation as we progress on the path to net-zero

The maximum additional cost (which is likely passed to the motorist) would be £0.02/litre.

Option 2 - Increase the RTFO buy-out price from £0.30/l to £0.40/l (alternative)

This is broadly in line with the level the buy-out price would be if it had kept pace with inflation.

The maximum additional cost (which is likely passed to the motorist) would be £0.01/l.

This increase offers a lower level of protection for GHG savings and a lower level of certainty for UK renewable fuels industry.

Summary of responses and the government decision

This section summarises the responses to the questions in the consultation and provides the government’s response to points raised.

When responding to all questions, respondents were asked to provide reasoning for their answers and any evidence they may have to support their position.

Question 1: Do you agree that we should increase the buy-out price under the RTFO as soon as possible?

Summary of responses

| Total | 60 |

| Agree | 56 |

| Disagree | 2 |

| Other | 2 |

Fifty-six of the 60 respondents agreed with the proposal to increase the main obligation buy-out price in the RTFO. All obligated suppliers that responded supported an increase to the buy-out price.

The key reasons for supporting the proposal were that:

- buy-out needs to be avoided to maintain GHG savings – with RTFCs trading closer to the current buy-out price then it becomes more likely that suppliers will buy out, meaning renewable fuel will not be supplied, and GHG savings will be lost

- if suppliers were to buy out of their obligation then this would undermine the purpose of the RTFO (that is, to deliver GHG savings in transport fuels)

- the current buy-out price does not stimulate investment – a higher buy-out price would allow for RTFCs to trade at higher prices, giving more certainty to investors; not only would it help fund projects but it would also increase the extra source of income gained by selling RTFCs

- a higher buy-out price will likely lead to the UK being more competitive with European countries who also have renewable fuel mandates

It was noted by one respondent that, even though they are supportive of increasing the RTFO buy-out price, it could drive higher feedstock prices, and smaller producers may be particularly affected.

The government received several responses from vehicle operators and representatives who also supported the increase of the RTFO buy-out price. They would like to see the continued supply of renewable fuel to use in their fleets.

Four of the respondents did not agree with increasing the RTFO buy-out price. Reasons for this were that:

- it could increase the likelihood of fraudulent claims for RTFCs

- an increased buy-out price in the main obligation would lead to a reduced price differential between RTFCs and development fuel RTFCs

- an increase to the buy-out price could present an opportunity for fuel suppliers to increase their profits

Several respondents mentioned the current pandemic of COVID-19 and the influence it has had on increasing RTFC prices. They noted that the COVID-19 pandemic has led to a decrease in oil prices, but biofuel prices have remained high; this has resulted in a bigger price spread between the two. The price spread between fossil fuels and renewable fuels has an influence on determining the cost of RTFCs.

Government response

The government is pleased that most stakeholders agreed with the reasoning outlined in the consultation to increase the RTFO’s main obligation buy-out price. The government has, therefore, decided that the buy-out price will increase.

Regarding the point raised that increasing the level of incentive (through increasing the buy-out price) could lead to increased fraud, the government has checks in place to verify fuel. The RTFO unit (part of the Department for Transport) administers the scheme on behalf of the Secretary of State. The unit has a proportionate and risk-based system of compliance checks and system in place as part of the RTFC application process, and continually reviews the effectiveness of these measures within legislative constraints.

We noted some respondents were concerned that an increase in the buy-out price of the main RTFO obligation could lead to a smaller price differential between dRTFCs (RTFCs rewarded to eligible development fuel) and RTFCs. However, the development fuel target is still relatively new (since 2019) and limited dRTFCs have been awarded, therefore we do not expect to see a close price differential between the two types of RTFCs in the immediate future. We will, however, keep the current approach under review.

We would like to comment on the point raised about COVID-19. COVID-19 has had an impact on fuel prices; however, RTFC prices were approaching and exceeding the buy-out price at the end of 2019, before the pandemic.

Question 2: If you agree that we should increase the buy-out price under the RTFO, do you agree that it should be £0.50/l?

Summary of responses

| Total | 56 |

| Agree | 45 |

| Disagree | 8 |

| Other | 3 |

Forty-five of the 56 respondents agreed that the RTFO buy-out price should increase to £0.50/l. Four of the 5 obligated suppliers, including some members of trade associations, who responded to this consultation agreed that the RTFO buy-out price should be increased to £0.50/l.

Reasons included:

- a higher buy-out price allows for volatility of RTFCs in the market – a £0.50/l buy-out price future-proofs the scheme against the increased costs of renewable fuels

- biofuels are a global market commodity and if incentives are lower than other countries then the renewable fuels will likely not come to the UK

- with the GHG scheme not continuing in 2021, it is likely that RTFC prices will increase to the value of the combined level of support from both schemes – a higher buy-out price will disincentive suppliers from buying out of their obligations.

- the increase in the RTFO buy-out price demonstrates that the government is committed to and supportive of achieving net-zero

- the increase in the buy-out price protects investors who would like to invest in development fuels – for example, if there are excess supplies of development fuels then dRTFCs could be sold to those who need RTFCs to meet their main obligation.

Three respondents said they would support a buy-out price higher than £0.50/l, but also support the £0.50/l price.

One stated that there should not be a price ceiling.

Eight respondents disagreed that the RTFO should be increased to £0.50/l. Of these, one disagreed with increasing the RTFO buy-out price at all and three, including members of a trade association, thought that £0.40/l would be a more appropriate buy-out price – the reasons for this are set out under question 3.

The other four respondents commented that:

- the policy does not allow for price fluctuations – setting a buy-out price implies that the government can forecast the cost of biofuels

- the buy-out price increase is likely going to affect development fuels by decreasing the incentive differential between the main and development fuel obligations – this could lead to less investment in producing development fuels and a greater focus on producing fuels eligible to claim RTFCs

Government response

The majority of respondents agreed that the RTFO buy-out price should be increased to £0.50/l, which is in alignment with the government’s preferred option. There was agreement across the industry, including renewable fuel suppliers and obligated fuel suppliers. We will therefore increase the RTFO main obligation buy-out price from £0.30/l to £0.50/l.

Regarding the comment on allowing for price fluctuations – to clarify, the buy-out price does allow for price fluctuations up to the level of the buy-out price. In other words, the proposals will enable the RTFO to support the supply of renewable fuels that cost up to £0.50/l (and £1.00/l for waste-derived biofuels) more than the fossil fuels they are displacing. The buy-out price acts as a cap on the additional cost of biofuels (and other renewable fuels) relative to petrol and diesel, thereby protecting the motorist from excessive price increases.

As set out in the consultation, we consider that increasing the RTFO buy-out price to £0.50/l would help mitigate the risk of suppliers buying out of their obligation, which would lead to a loss of GHG savings. The GHG savings are necessary for continued decarbonisation as we progress on the path to net-zero. It also provides certainty to industry that investments in UK biofuel facilities will have a market.

Question 3: Would an increase to the RTFO buy-out price to £0.40/litre be acceptable to you?

Summary of responses

| Total | 53 |

| Yes | 20 |

| No | 29 |

| Other | 4 |

Fifty-three of the 61 respondents answered and provided comments on this question, of which 20 agreed that £0.40/l would be an acceptable buy-out price.

Of these 20 respondents, 3 thought that an increase to £0.40/l is the more appropriate increase to the buy-out price compared with £0.50/l.

The 3 respondents preferred an increase to £0.40/l because they felt it was enough to incentivise blending while also protecting the consumer. It also better reflects the combined GHG and RTFO incentives because the method that has been used to calculate the higher buy-out price did not factor in double counting.

One respondent commented on how the RTFO main obligation buy-out price should be increased to £0.40/l and then increase in line with inflation in future years.

The summary of responses provided by those who did not think that £0.40/l was an acceptable buy-out price and preferred the higher buy-out price of £0.50/l is set under question 2.

Government response

We note that there is less support to increase the RTFO buy-out price to £0.40/l compared with £0.50/l. We have set out in question 2 how we are going to proceed with increasing the RTFO buy-out price.

Question 4: Additional comments

Summary of responses

Twelve of the respondents provided additional comments.

Four respondents asked the government to continue the 6% GHG reduction target for fuel supplied in 2021 as set out in the GHG Regulations.

Two of the respondents commented that the government should introduce E10 (petrol with up to 10% ethanol content) as soon as possible. Currently, petrol contains up to 5% ethanol (known as E5).

One respondent commented that the RTFO should be reformed as it is not suitable to deliver green initiatives. They consider that it is too complicated and not transparent to both industry and the public.

Government response

The government acknowledges the benefits of having a GHG target, but it is not possible to have a new GHG target in place for 2021. We will keep under review the reintroduction of the GHG target in the future.

The Department for Transport’s consultation on proposals to introduce petrol with a higher bioethanol content (E10) has now closed and we are analysing the responses at pace. A government response summarising those representations made as part of the consultation and setting out next steps will be issued as soon as possible.

Regarding the points made about the RTFO needing to be reformed and be more transparent, we regularly engage with stakeholders to seek feedback on the RTFO and are open to suggestions on how it might be improved. Since the RTFO started in 2008, it has successfully delivered GHG savings in transport fuels of 26.5 million tCO2e.[footnote 2] This is the equivalent to taking 12.7 million cars off the road.[footnote 3]

Next steps

The government thanks stakeholders for their responses to this consultation, as well as for their engagement during the development of it. The evidence provided during this consultation has been beneficial in helping us to finalise our policy proposals across the areas consulted on for this legislation.

We will introduce legislation to amend the Renewable Transport Fuels Obligations Order 2007 at the earliest opportunity with the intention of having in it in place by 1 January 2021. If the legislation is delayed, this could mean any increases to the buy-out price would not be applied until 1 January 2022.

We will continue to engage with stakeholders as we take the legislation through Parliament and finalise guidance on its operation to support its implementation and their preparation for it.

Annex: Cost-benefit analysis

Summary

As set out previously, recent increases in the cost of biofuels relative to petrol and diesel mean that there is a risk that suppliers will ‘buy out’ of their obligations to supply renewable transport fuel.

This cost-benefit analysis provides data which illustrates why the increasing cost of biofuels relative to petrol/diesel mean that buy-out could occur and consequentially, projected GHG savings of over 6MtCO2e/year could be lost. This would result in a gap in UK carbon budgets as well as risking long-term impacts on the UK biofuels industry.

We, therefore, proposed to increase the RTFO buy-out price to ensure the continued supply of biofuels and other renewable fuels, and the GHG savings they deliver.

We have analysed the impacts of increasing the buy-out price from £0.30/l to £0.40/l or £0.50/l. These increases could result in maximum increases in fuel prices of £0.01/l and £0.02/l of fuel, respectively, but could be as little as no additional cost, depending on the cost of biofuel relative to petrol/diesel.

Increasing the buy-out price to £0.50/l would provide greater certainty that renewable fuel will be supplied under the RTFO and, therefore, that the expected GHG savings will be delivered as well as providing greater certainty to the industry of a UK market.

Risk of buy-out under the RTFO has recently increased

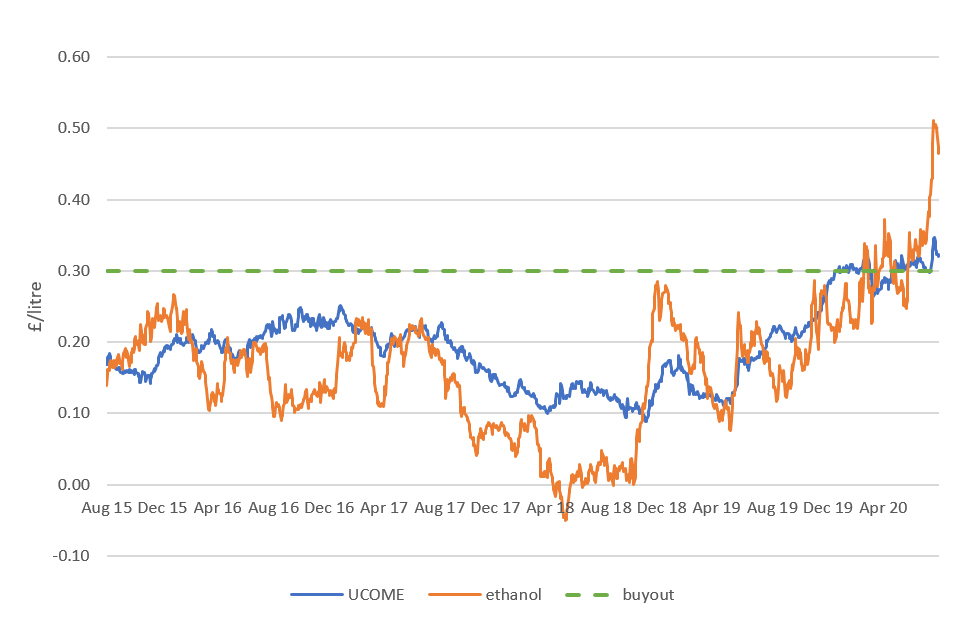

Recent increases in the cost of biofuels relative to petrol and diesel mean that there is a risk that suppliers will ‘buy out’ of their obligations to supply renewable transport fuel. The differential between the fossil fuel and biofuel price has been above the RTFO buy-out price recently – Figure 1 shows how the cost of supplying biofuel has come close to or even exceeded the RTFO buy-out price on several occasions since January 2020.

Figure 1: Biofuel supply costs relative to the RTFO buy-out price from 9 August 2015 to 18 August 2020

Line graph indicating price per litre for UCOME and ethanol and a constant horizontal line showing the 30p/l buy-out price. UCOME and ethanol start below 30p/l in 2015 and remain around 20p/l until 2019. UCOME finishes at 35p and ethanol at 50p.

Source: Argus biofuels cost data

Note: the cost of UCOME (biodiesel derived from used cooking oil) has been adjusted to take into account that wastes such as UCO are eligible for double reward (meaning the costs have been halved).

This is also reflected in the cost of RTFCs, which stakeholders tell us have been trading very close to or above the buy-out price since autumn 2019.

Indications are that suppliers are, so far, continuing to supply renewable fuel to meet their RTFO obligation rather than planning to buy out. This can be explained by the additional support provided by the GHG Regulations, which means that, currently, it still makes economic sense to supply the renewable fuel.

The GHG Regulations set GHG reduction targets on fuel suppliers of 4% and 6% for 2019 and 2020, respectively. Suppliers earn GHG credits for supplying biofuels and other lower-carbon fuels with one GHG credit awarded for every kg of CO2e saved above the target. The GHG credits are traded between suppliers in order for suppliers to cost-effectively meet their GHG reduction obligations.

Because GHG credits are awarded for each kg of CO2e saved, and RTFCs are awarded for each litre of renewable fuel supplied, their values cannot be directly compared. In order to assess the maximum level of support the GHG regulations can provide, we have taken the average GHG saving of a litre of the two most common fuel types, as shown in Table 2.

Table 2: Estimates of the maximum additional support that GHG credits provide for renewable fuels adjusted for a ‘typical’ litre of biofuel

| Biofuel | GHG Regulations maximum support level (£/tCO2e) | Energy content (megajoule (MJ)/l) | Average GHG saving (2019) (gCO2e/MJ | Average GHG saving (2019) (gCO2e/l) | GHG Regulations maximum support level (£/l) |

|---|---|---|---|---|---|

| Used cooking oil biodiesel | 74 | 33 | 84.2 | 2,779 | 0.21 |

| Crop bioethanol | 74 | 21 | 66.3 | 1,392 | 0.10 |

Biofuels derived from waste feedstocks are eligible for double the amount of support under the RTFO. This means that the maximum support available to a litre of biofuel from waste such as UCO is £0.60/l and for a biofuel derived from crops it is £0.30/l.

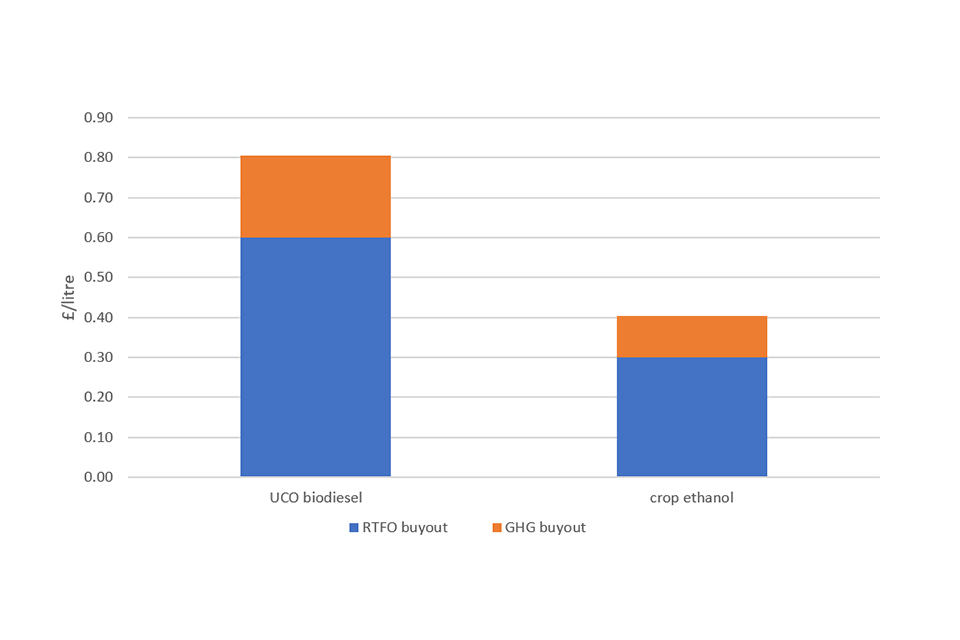

Taking account of this, the combined maximum support provided by the RTFO and GHG Regulations in 2020 is £0.81/l for biodiesel from used cooking oil and £0.40/l for crop derived bioethanol – see Figure 2.

Figure 2: Maximum combined support level for selected biofuels under the RTFO and GHG obligations

A stacked bar graph showing price per litre of UCO biodiesel versus crop ethanol. UCO biodiesel is at 80p with a 60p RTFO buy-out and a 20p GHG buy-out. Crop ethanol is at 40p with a 30p RTFO buy-out and a 10p GHG buy-out.

Based on the volumes of biodiesel and bioethanol supplied, we have estimated the total number of RTFCs issued in 2019 (based on one certificate per litre of bioethanol and two certificates per litre of biodiesel) (see Table 3. We have then calculated the potential support offered by the GHG Regulations (see Table 2) as a weighted average for each RTFC.

This gives us the increase in RTFO buy-out price required from 2021 to achieve the same maximum overall support as the RTFO and GHG Regulations provide now, which is an additional £0.10.

Table 3: Additional support provided by the GHG Regulations adjusted for each RTFC under the RTFO

| Bioethanol (million litres, 2019 volumes) | Biodiesel and off-road biodiesel (million litres, 2019 volumes) | Total no. of RTFCs (millions) | Weighted average support per RTFC (£) |

|---|---|---|---|

| 756.46 | 1,763.15 | 4,282.8 | 0.10 |

Options considered

We have decided to increase the RTFO buy-out price as there is a significant risk of buy-out occurring, leading to the RTFO not delivering its core objective to decarbonise transport. The risk of buy-out occurring and losing GHG savings increases from 1 January 2021 as the additional support to biofuels through the award of GHG credits from the GHG Regulations will not be available because there are no GHG reduction targets beyond 2020.

Option 1 – Increase the RTFO buy-out price from £0.30/l to £0.50/l (chosen)

By increasing the potential level of support to £0.50/l, it future-proofs the scheme against increased costs and provides greater certainty of delivering continued GHG savings in transport.

It also provides certainty to industry that investments in the UK biofuel facilities, which we need to continue decarbonising as we progress on the path to net-zero, will have a market.

Option 2 – Increase the RTFO buy-out price from £0.30/l to £0.40/l

The RTFO buy-out price has remained at £0.30/l since the introduction of the RTFO in 2008 and has not kept pace with inflation.

Based on HM Treasury’s gross domestic product (GDP) deflator, inflation between 2008 and 2021 is around 25.7%. Applying this to the current RTFO buy-out price would result in it being £0.38.

This proposed level of increase is therefore broadly in line with the level the buy-out price would be if it had kept pace with inflation.

This increase minimises the cost to the motorist but offers a lower level of protection for GHG savings and a lower level of certainty for the UK renewable fuels industry.

Benefits

Monetised benefits: GHG savings from renewable fuels are maintained

When suppliers buy out, they are no longer supplying renewable fuel to meet their obligation and the associated GHG savings are lost.

Table 4 shows the amount of CO2e that we expect to be saved through renewable fuels being supplied under the RTFO. This shows GHG savings of between 6.3 and 6.6MtCO2e/year between 2021 to 2030.

Increasing the buy-out price ensures these renewable fuels continue to be supplied, and the cost to the motorist is capped at the new buy-out price. Without this increase, we risk losing annual GHG savings of up to 6.6MtCO2e.

Table 4: Estimated GHG savings from the RTFO

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Estimated GHG savings (MtCO2e) | 6.3 | 6.3 | 6.4 | 6.4 | 6.4 | 6.4 | 6.4 | 6.5 | 6.5 | 6.6 | 64 |

The carbon value of these volumes is shown in Table 5.

The monetised, discounted value of these maximum carbon savings is estimated at between £391 million and £665 million per year (based on the BEIS’s current carbon appraisal values).

Table 5: Monetised, discounted value of GHG savings set out in Table 4

| Monetised, discounted value of GHG savings | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|---|---|---|---|---|

| Central | 443 | 439 | 435 | 428 | 421 | 413 | 403 | 403 | 398 | 391 |

| High | 665 | 658 | 652 | 641 | 631 | 619 | 605 | 605 | 597 | 586 |

Non-monetised benefits: UK industry

While the renewable fuels and feedstocks supplied in the UK come from across the world, there is also an important UK production base, notably situated in the north of England and Scotland.

The UK renewable fuels industry is reliant on the support delivered by the RTFO. If UK demand for renewable fuels drops significantly due to fuel suppliers buying out, these fuel producers will risk losing a significant market for their products. Reduced certainty of a market will also risk future investments.

Costs

Impact of increasing the RTFO buy-out price

Since the RTFO began in 2008, the cost of supplying biofuel has increased due to factors including inflation and increased competition for biofuels and biofuel feedstocks across sectors and countries.

Since the markets for fossil fuels and renewable fuels are highly volatile, it is impossible to predict the actual impact of an increased RTFO buy-out price between 2021 and 2030; however, we can estimate the range of possible impacts under different scenarios:

- Scenario 1: No impact – GHG emissions continue to be delivered by the RTFO at no additional cost to the motorist

This means that no buy-out takes place because the spread between fossil fuel and biofuel supply costs is below the original buy-out price of £0.30/l (which provides support of up to £0.60/l for wastes eligible for double reward).

An increased buy-out price in this scenario therefore has no impact on costs or GHG emission savings.

- Scenario 2: GHG emission savings continue to be delivered by the RTFO but at an increased cost to motorists

If the spread is between £0.30/l and the new increased buy-out price, it makes better economic sense for a supplier to continue to supply biofuels than to buy out of their obligation. This means that GHG savings continue when they otherwise would not have – albeit at a greater cost.

- Scenario 3: No GHG savings and high cost

In this scenario, the spread between fossil fuel and biofuel costs is above the new buy-out price. This would likely result in biofuels not being supplied under the RTFO as fuel suppliers would choose to buy out of their obligation. This cost of buying out would likely be passed on to motorists.

The consequences are that no GHG emissions would be saved and the motorist would also still be facing higher costs.

We intend to set the buy-out price such that this scenario has a low likelihood of occurring. To avoid this scenario, it is important that the buy-out price is kept under review.

The maximum costs of different buy-out price options

This section explains the potential impacts of an increase in the RTFO buy-out prices under scenario 2 and scenario 3 above.

At any buy-out price, there is a risk that the full obligation will be bought out and that no carbon is saved while high costs are still passed on to motorists. The buy-out price acts as a cap on the costs of the RTFO by effectively setting a maximum price that an obligated supplier will pay for an RTFC.

Table 6 presents our estimates of the maximum cost of buy-out under the proposed new buy-out prices, relative to the maximum cost of buy-out under the current price.

Table 6: Maximum additional discounted cost of a higher buy-out price (£ million)

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | Total | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Actual costs | Buy-out price of £0.30/l | 1,433 | 1,394 | 1,357 | 1,312 | 1,269 | 1,225 | 1,179 | 1,170 | 1,152 | 1,129 | 12,619 |

| Additional costs | Buy-out price of £0.40/l | 1,911 | 1,858 | 1,809 | 1,750 | 1,692 | 1,633 | 1,571 | 1,560 | 1,536 | 1,505 | 16,826 |

| Additional costs | Difference from £0.30/l | +478 | +465 | +452 | +437 | +423 | +408 | +393 | +390 | +384 | +376 | +4,206 |

| Additional costs | Buy-out price of £0.50/l | 2,389 | 2,323 | 2,261 | 2,187 | 2,115 | 2,041 | 1,964 | 1,950 | 1,920 | 1,882 | 21,032 |

| Additional costs | Difference from £0.30/l | +955 | +929 | +905 | +875 | +846 | +816 | +786 | +780 | +768 | +753 | +8,413 |

Note: the figures for buyout at £0.30/l represent the estimated costs of the current scheme (the baseline against which the increases are being compared).

It is likely that the additional costs of supplying renewable fuel are passed on to the motorist through an increase in fuel prices at the pump. The maximum additional cost (which is likely passed to the motorist) equates to £0.012/l and £0.023/l at buy-out prices of £0.40/l and £0.50/l, respectively, including VAT – see Table 7:

Table 7: Maximum additional discounted cost of a higher buy-out price (pence per litre)

| Buy-out price | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|---|---|---|---|---|

| £0.40 (incl. VAT) | 1.2 | 1.1 | 1.1 | 1.0 | 1.0 | 1.0 | 0.9 | 0.9 | 0.9 | 0.8 |

| £0.50 (incl. VAT) | 2.3 | 2.2 | 2.2 | 2.1 | 2.0 | 1.9 | 1.9 | 1.8 | 1.7 | 1.7 |

| £0.40 (excl. VAT) | 1.0 | 0.9 | 0.9 | 0.9 | 0.8 | 0.8 | 0.8 | 0.8 | 0.7 | 0.7 |

| £0.50 (excl. VAT) | 1.9 | 1.9 | 1.8 | 1.7 | 1.7 | 1.6 | 1.6 | 1.5 | 1.5 | 1.4 |

Based on the current obligation, we estimate that raising the buy-out price from its current level to £0.40/l would result in a maximum additional discounted cost of £376 million to £478 million per year, whilst raising it to £0.50/l would result in a maximum additional discounted cost of £753 million to £955 million per year.

It is possible that the motorist would still be paying these additional costs and not receiving the GHG benefits if suppliers bought out of their obligations – although this is unlikely given the historical trend of the spread between the cost of biofuels and petrol or diesel.

These are the additional costs that would be incurred under scenario 3 above. Under scenario 2, where spreads are below the buy-out price, the costs incurred by businesses would be lower (and lie somewhere between the costs presented and zero). These costs, therefore, reflect the upper bound of potential costs from the higher buy-out prices.

Suppliers buying out of the RTFO would also adversely impact the UK renewable fuels and feedstocks industry – see UK industry.

Abatement cost per ton of carbon

Using the cost estimates in Table 6 and estimated RTFO carbon savings, we can present these carbon savings in terms of the cost of carbon – see Table 8:

Table 8: Discounted maximum abatement cost per ton of carbon (£/tCO2e)

| Buy-out price | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|---|---|---|---|---|

| £0.30 | 229 | 221 | 213 | 205 | 198 | 191 | 185 | 180 | 176 | 172 |

| £0.40 | 305 | 294 | 284 | 274 | 264 | 255 | 246 | 240 | 234 | 229 |

| £0.50 | 381 | 368 | 355 | 342 | 330 | 319 | 308 | 300 | 293 | 287 |

Based on the current obligation and different potential buy-out prices, we estimate the maximum discounted abatement cost would be between £172/tCO2e and £381/ tCO2e million.

Conclusion

If suppliers were to buy out of their obligation, the maximum GHG savings lost would be an estimated 64MtCO2e between 2021 and 2030 as shown in Table 4. At the current buy-out price, this would result in a maximum discounted cost to the motorist over the period of £12,619 million with no GHG savings.

Based on our analysis, if we increased the buy-out to £0.50/l, the maximum discounted cost to the motorist would increase to £21,032 million over the period.

These are the maximum costs, but the additional costs may be significantly lower, and (even) as low as zero should the additional cost of supplying biofuels relative to petrol/diesel fall and remain below £0.30/l.