Homelessness Prevention Grant 2023/24 onwards: technical consultation

Updated 23 December 2022

Applies to England

Scope of the consultation

Topic of this consultation:

This consultation seeks views on the approach to the funding arrangements for the Homelessness Prevention Grant for 2023/24 onwards.

It covers the following areas:

- The case for change

- Overview of the consultation

- Amendments to the funding formula

- Introduction of transitional arrangements and timing of allocation announcements

- Introduction of an additional grant condition requiring local authorities to submit a spend declaration

- Introduction of tranche payments

Scope of this consultation:

This consultation seeks views on the approach to the funding for the Homelessness Prevention Grant provided to all local housing authorities in England, with the aim of determining new funding allocations based on current pressures for local authorities and enhancing data collection and assurance of how the grant is used. This applies to grant funding for 2023/24 onwards, with allocations calculated and announced in late 2022.

Geographical scope:

These proposals relate to England only.

Impact assessment:

No impact assessment is required for this consultation.

Basic information

Body/bodies responsible for the consultation:

Homelessness and Rough Sleeping Directorate within the Department for Levelling Up, Housing and Communities

Duration:

This consultation will last for 8 weeks from 1 July 2022 to 26 August 2022. All responses should be received no later than 11.45pm on 26 August 2022.

Enquiries:

For any enquiries about the consultation please contact the Homelessness and Rough Sleeping team: Homelessnesspolicy@levellingup.gov.uk.

How to respond:

Consultation responses should be submitted by online survey.

The online survey will allow you to save a draft response and return to the survey at a later time. You may also submit additional information or evidence to support your response to this consultation. Further advice on how to use these features is available on the home page of the online survey.

Alternatively, responses, as well as any further information or evidence may be provided by email to: Homelessnesspolicy@levellingup.gov.uk.

We will also be hosting a series of discussions with local authorities and stakeholders to understand views on this topic in more depth. We will be contacting a selection of local authorities in due course. If you would particularly like to be part of one of these conversations, please email us at: Homelessnesspolicy@levellingup.gov.uk.

We will be giving online, written and oral responses equal weight when responding to this consultation.

Written responses may also be sent to:

Homelessness and Rough Sleeping Team

Department for Levelling Up, Housing and Communities

2nd floor, Fry Building

2 Marsham Street

London

SW1P 4DF

When replying to this survey please confirm whether you are replying as an individual or submitting an official response on behalf of an organisation and include:

- your name

- your position (if applicable)

- the name of organisation (if applicable)

1. The case for change

1.1 The government is committed to preventing homelessness before it occurs wherever possible. The landmark Homelessness Reduction Act 2017 is ensuring that more people get help earlier, reducing the risk that households become homeless. Intervening at the earliest stage and helping people to resolve their situation before reaching crisis point is better for the households concerned and reduces costs to the state and wider society.

1.2 Our data shows that intervening when a person is at risk of losing their accommodation is overall more effective in tackling homelessness. Between October and December 2021, 54% percent of prevention duties – owed to households at risk of homelessness – ended in secured accommodation, as opposed to 45% of relief duties owed at the point a household is homeless. We want to see a shift further towards prioritising prevention activity among local authorities and partners.

1.3 In December 2021, there were 96,410 households in temporary accommodation (TA) in England, including 118,900 children. Whilst time spent in TA means households are getting help, it does not address the root causes of homelessness. The government is committed to making sure that households have their homelessness resolved without being placed in TA wherever possible.

1.4 TA can also be expensive, but the benefits of preventing homelessness before it occurs go further than just fiscal benefits. Enabling people to stay in their homes and remain in their communities – for example by helping them to develop the skills to sustain a tenancy or supporting them into gainful employment – has considerable long-term benefits on both community cohesion and individual health and wellbeing. Intervening early also minimises the impact homelessness has on wider public services – including (but not limited to) the courts system and public health services.

1.5 Alongside incentivising prevention, we are mindful of the context in which homelessness services are operating. We recognise housing market pressures are particularly acute in certain areas, and that we need to make sure that local authorities are funded for TA costs where these are outside their control.

1.6 In recent decades, homelessness services have been funded at various points through a combination of the general local government settlement, and bespoke grant funding.

1.7 Grant funding for homelessness was most recently reintroduced in 2017 with the Flexible Homelessness Support Grant (£186m in 2017/18), which replaced the Temporary Accommodation Management Fee in order to give local authorities more flexibility over their spend on homelessness and to support them to invest in prevention. This was accompanied by £73m in new burdens funding over 3 years (2017/18, 2018/19, and 2019/20) to support the implementation of the Homelessness Reduction Act.

1.8 £200m of funding through the Flexible Homelessness Support Grant was announced in 2020/21, and the Homelessness Reduction Grant was introduced to enable local authorities to continue meeting the costs of the Homelessness Reduction Act following the expiry of the original new burdens funding arrangements.

1.9 In 2021/22, the Flexible Homelessness Support Grant and the Homelessness Reduction Grant were combined into the Homelessness Prevention Grant (HPG) and were uplifted by £47m. HPG funding is provided to all local authorities with responsibility for housing, to support them to deliver their statutory obligations under the Housing Act 1996. It can be used flexibly to help deliver the authorities’ homelessness and rough sleeping strategies.

1.10 The Homelessness Prevention Grant totalled £310m in 2021/22 (excluding the exceptional £65m top-up announced in October 2021 to help vulnerable households with rent arrears)[footnote 1] and £315.8m in 2022/23 (including £5.8m in Domestic Abuse Act new burdens funding). For ease of comparisons throughout the document we use 2021/22 funding as the baseline year (totalling £310m).

Figure 1.1 – Components of the Homelessness Prevention Grant (2021/22)[footnote 2]

Flexible Homelessness Support Grant (£200m introduced in 2020/21) + Homelessness Reduction Grant (£63m introduced in 2020/21) + HRA uplift (£47m introduced in 2021/22) = HPG £310m in 2021/22

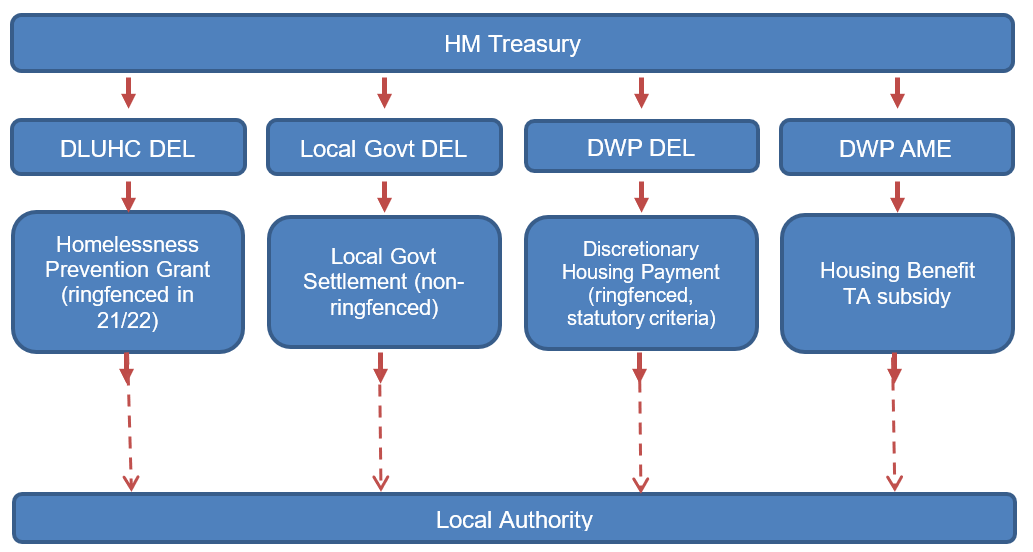

1.11 The Homelessness Prevention Grant is just one element of the funding local authorities can access to prevent homelessness, as shown in the diagram below.

Figure 1.2 – Homelessness funding: funding streams available to local housing authorities

- HM Treasury – DLUHC DEL – Homelessness Prevention Grant (ringfenced in 2021/22) – Local authority

- HM Treasury – Local Govt DEL – Local Govt Settlement (non-ringfenced) – Local authority

- HM Treasury – DWP DEL – Discretionary Housing Payment (ringfenced, statutory criteria) – Local authority

- HM Treasury – DWP AME – Housing Benefit TA subsidy – Local authority

1.12 The purpose of funding provided by the Department for Work and Pensions through Discretionary Housing Payments is not solely for homelessness, but we are aware that in practice some local authorities use this funding to help prevent homelessness to varying extents.

1.13 The use of these funding streams can overlap at various points - for example, the cost of temporary accommodation can be met through the Local Government Settlement or the Homelessness Prevention Grant, and payments to support vulnerable households with rent arrears can be funded from the Homelessness Prevention Grant, Local Government Settlement or via Discretionary Housing Payments. This intersection between the various streams has resulted in a complex funding landscape, and has made it challenging to understand if there are sufficient incentives to invest in prevention.

1.14 The most recent multi-year spending review, covering 2022-25, provides an opportunity to look again at the homelessness funding landscape and develop a longer-term ambition for the Homelessness Prevention Grant. We need to update our data sources to make sure funding continues to be fairly allocated according to current pressures, and we want to improve our understanding of how the grant is used. This improved understanding will enable us to identify effective interventions (including through prevention activity) in order to improve shared learning across local authorities, and make sure the grant is sustainable for the future. This will help to prevent homelessness and rough sleeping and support the government’s commitment to fully enforce the Homelessness Reduction Act.

1.15 Looking beyond 2025, we want to simplify the funding landscape and end the current mixed economy which can mean short-term pressures to fund temporary accommodation have to be traded off against the opportunity to invest in prevention. To do this, we must first understand what is working well and how current funding streams are being used. The proposals in this consultation are the first steps towards achieving this.

1.16 For the proposals in this consultation, we understand the need to make sure changes strike the right balance between achieving better outcomes for homeless households and improving accountability whilst not being too administratively burdensome for authorities. This will allow us to develop a sustainable approach to funding arrangements for the future.

2. Overview of the consultation

2.1 This consultation is seeking input from local authorities and other interested stakeholders on 5 key proposals:

- Updating the funding formula so that it reflects current TA pressures

- Introducing transitional arrangements for changes to funding allocations

- Determining the timing of the announcements of 2023/24 and 2024/25 allocations, including a possible 2-year funding allocation

- Adding a grant condition to require local authorities to submit additional spend declaration information under the categories of ‘prevention and relief’ and ‘TA’ and ‘main duty/other’

- Introducing tranche payments and requiring accurate H-CLIC statistics (Homelessness Case Level Information Collection - data returns submitted by local authorities to DLUHC) to be submitted to receive the second tranche of funding

2.2 The aims of this consultation are as follows:

- To make sure that funding is distributed fairly to local authorities and is driven by a current picture of need

- To make sure any changes to funding allocations can be incorporated into service delivery, continuing to enable local authorities to meet their statutory homelessness duties

- To improve government understanding of how the grant is spent and to help government understand what drives good performance, which should support the longer-term aim to focus the grant more on prevention activity

- To enhance shared learning across authorities in terms of maximising prevention activity, enabling local authorities to achieve better outcomes

- To improve government understanding of the impact of the funding, particularly in relation to temporary accommodation outcomes, by incentivising more consistent data reporting by local authorities

2.3 This consultation is reviewing the local allocation and conditions of the funding, rather than the overall level of funding available for the Homelessness Prevention Grant. Your input will help government to take an informed decision on the funding distribution model, allocations and grant conditions for 2023/24, 2024/25 and beyond. Your input will also help government to strike the right balance between enhanced scrutiny and accuracy of the funding model’s reflection of needs alongside sustainability of changes and the relative importance of each of these factors.

2.4 This consultation is open for response from 1 July to 26 August. We will also be holding focus groups with a selection of local authorities during the consultation period. We will publish our consultation response alongside the allocations in late 2022.

3. Amendments to the funding formula

Background: the current allocations formula

3.1 At present, the Homelessness Prevention Grant is allocated to local authorities based on a formula which aims to reflect relative homelessness pressures in each area. There are some elements of this formula which the government wants to update in order to ensure the formula continues to allocate funding in a fair way. We want to make sure that allocations are fair and can be updated regularly, in a way which reflects current demand in local areas.

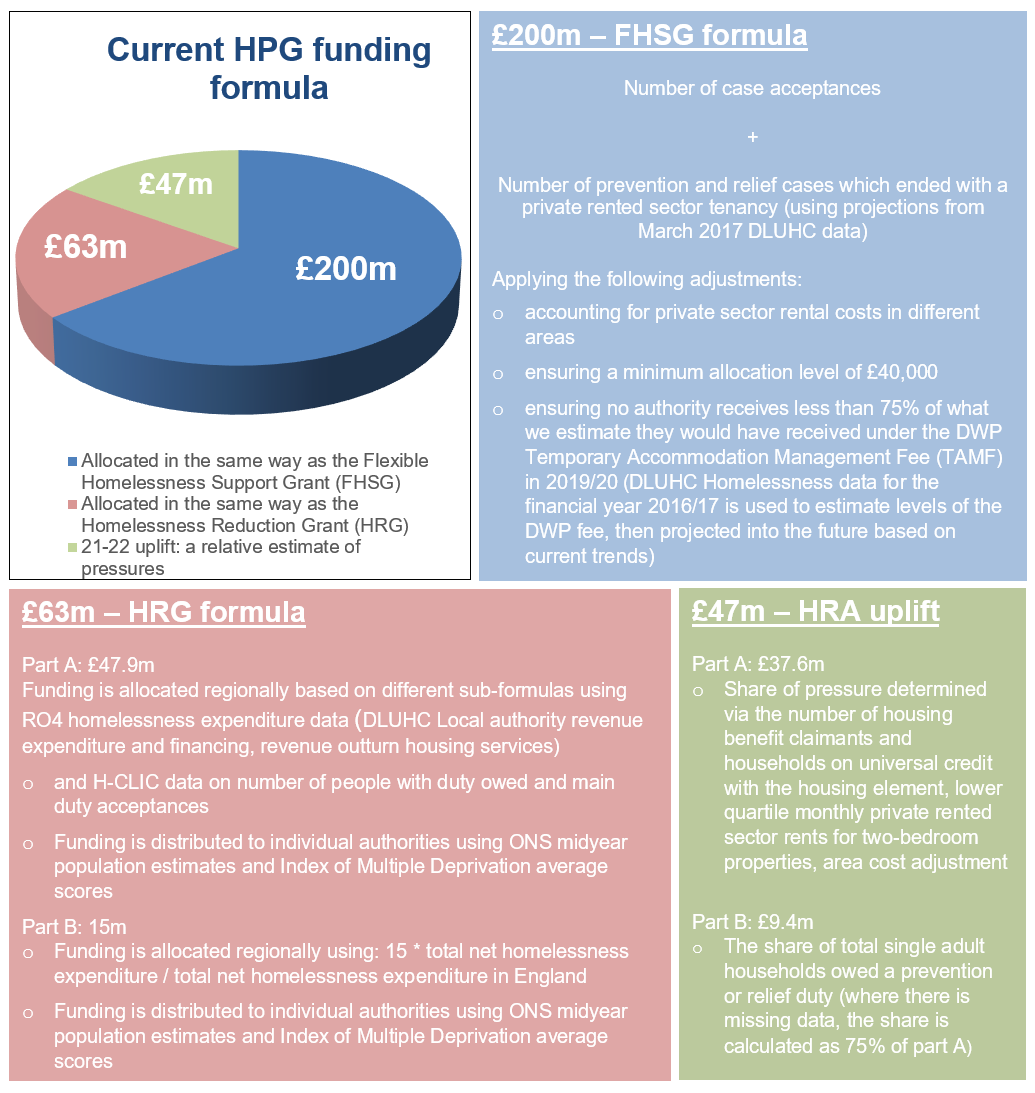

3.2 As referenced above, the overall funding provided in 2021/22 was £310m[footnote 3]. The current formula is split into 3 key calculations:

- £200m allocated in the same way as the former Flexible Homelessness Support Grant (FHSG)

- £63m allocated in the same way as the former Homelessness Reduction Grant (HRG)

- £47m, introduced as an uplift in 2021/22, allocated using a new formula that takes into account relative homelessness pressures

A full overview of the current formula can be found at Figure 1.3 below.

Figure 1.3 – Components of the current Homelessness Prevention Grant funding formula

Current HPG funding formula

- £200m - allocated in the same way as the Flexible Homelessness Support Grant (FHSG)

- £63m - allocated in the same way as the Homelessness Reduction Grant (HRG)

- £46m - 2021/22 uplift: a relative estimate of pressures

£200m – FHSG formula

Number of case acceptances + Number of prevention and relief cases which ended with a private rented sector tenancy (using projections from March 2017 DLUHC data).

Applying the following adjustments:

- accounting for private sector rental costs in different areas

- ensuring a minimum allocation level of £40,000

- ensuring no authority receives less than 75% of what we estimate they would have received under the DWP Temporary Accommodation Management Fee (TAMF) in 2019/20 (DLUHC Homelessness data for the financial year 2016/17 is used to estimate levels of the DWP fee, then projected into the future based on current trends)

£63m – HRG formula

Part A: £47.9m

Funding is allocated regionally based on different sub-formulas using RO4 homelessness expenditure data (DLUHC Local authority revenue expenditure and financing, revenue outturn housing services)

- and H-CLIC data on number of people with duty owed and main duty acceptances

- Funding is distributed to individual authorities using ONS midyear population estimates and Index of Multiple Deprivation average scores

Part B: £15m

- Funding is allocated regionally using: 15 * total net homelessness expenditure / total net homelessness expenditure in England

- Funding is distributed to individual authorities using ONS midyear population estimates and Index of Multiple Deprivation average scores

£47m – HRA uplift

Part A: £37.6m

- Share of pressure determined via the number of housing benefit claimants and households on universal credit with the housing element, lower quartile monthly private rented sector rents for 2-bedroom properties, area cost adjustment

Part B: £9.4m

- The share of total single adult households owed a prevention or relief duty (where there is missing data, the share is calculated as 75% of part A)

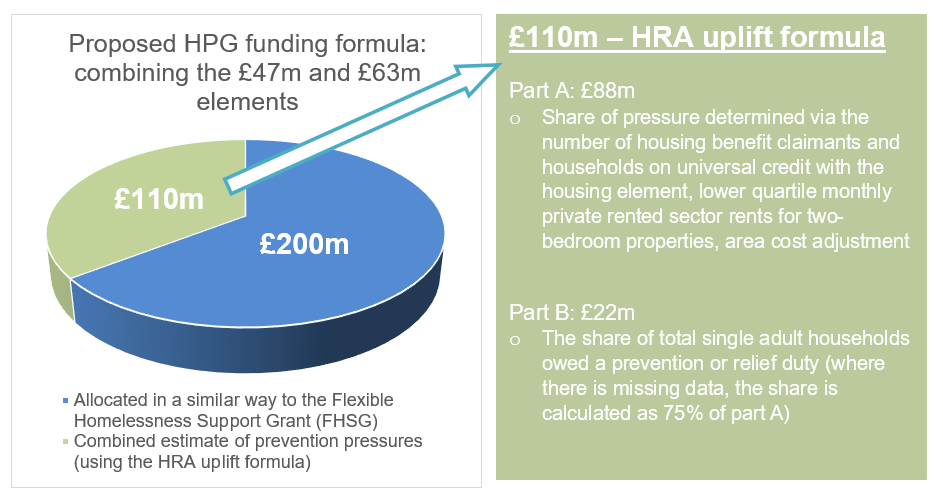

Combining the formulas used for the £47m and £63m elements

3.3 The HRG (£63m) and HRA uplift (£47m) elements of the formula have similar purposes – they both aim to predict and weight funding according to local homelessness prevention and relief pressures. Our modelling indicates that local authorities receive proportionately similar levels of funding across both formulas. We therefore perceive it to be unnecessarily complex to retain 2 separate formulas in this case, and that extending the formula used for one element to both would simplify the formula, making it easier to understand and administer.

3.4 The £63m HRG formula relies more heavily on local authority self-reported H-CLIC data. Whilst using H-CLIC data identifies local authorities who have undertaken Homelessness Reduction Act activity, it doesn’t identify earlier stage prevention work – for example, tenancy sustainment services, or establishing comprehensive supported housing pathways – i.e. prevention work that falls outside of the Homelessness Reduction Act duties. We therefore propose using the more up to date HRA uplift formula (which relies significantly less on H-CLIC data) for the entire £110m. This means that the HRG element of the formula, as set out above, will no longer be used within the calculation.

Figure 1.4 – Impact of combining the £47m (HRA uplift) and £63m (HRG) elements

Proposed HPG funding formula: combining the £47m and £63m elements

- £200m - allocated in a similar way to the Flexible Homelessness Support Grant (FHSG)

- £110m - combined estimate of prevention pressures (using the HRA uplift formula)

£110m uplift formula

Part A: £88m

- Share of pressure determined via the number of housing benefit claimants and households on universal credit with the housing element, lower quartile monthly private rented sector rents for 2-bedroom properties, area cost adjustment

Part B: £22m

- The share of total single adult households owed a prevention or relief duty (where there is missing data, the share is calculated as 75% of part A)

Q1. Do you agree with our proposal to combine the HRG and HRA uplift elements of the formula, using HRA uplift formula for £110m of the grant? (Yes – No – Indifferent - Not sure)

Applying an Area-Cost Adjustment to the combined £110m

3.5 We currently apply an area-cost adjustment (ACA) to one part of the HRA uplift formula, as set out in Figure 1.3 above. The ACA aims to reflect the relative costs of staffing wages and providing frontline services. We propose to expand this ACA[footnote 4] for the wider £110m element of the formula for all local authorities. We propose this to recognise that it is more difficult to prevent homelessness in areas with high costs, in particular areas with acute housing market pressures that limit the supply of affordable properties and make prevention very challenging, in a way which can be difficult to capture through traditional datasets.

Q2. Do you agree with our proposal to apply an overall ACA in the £110m element of the formula? (Yes – No – Indifferent - Not sure)

Determining a new proxy for temporary accommodation pressures within the FHSG element (£200m)

3.6 We recognise that some areas have higher TA pressures than others and that this can be driven by factors outside of a local authority’s control – such as the affordability of housing in the local area. The FHSG element of the formula aims to estimate relative temporary accommodation (TA) pressures. It uses historic data from the defunct DWP Temporary Accommodation Management Fee (TAMF) – a grant specifically used to fund the administration of TA for local authorities, but which was discontinued in 2016. The formula uses DLUHC data to estimate levels of TAMF the local authority would have received in 2016/17, projected into the future, ensuring no authority received less than 75% of what we estimate they would have received under the TAMF (although cash allocations have been rolled over since 2019/20).

3.7 It is not reasonable to continue using this data source in future years, given it may not be representative of current pressures. We therefore propose to amend the element of the funding formula which is based on the historic FHSG formula, by updating the data source we use as an indicator for TA pressures. This will support a fair and sustainable way of allocating the funding. There are different data sources that can provide a reliable indicator of the drivers of TA pressures.

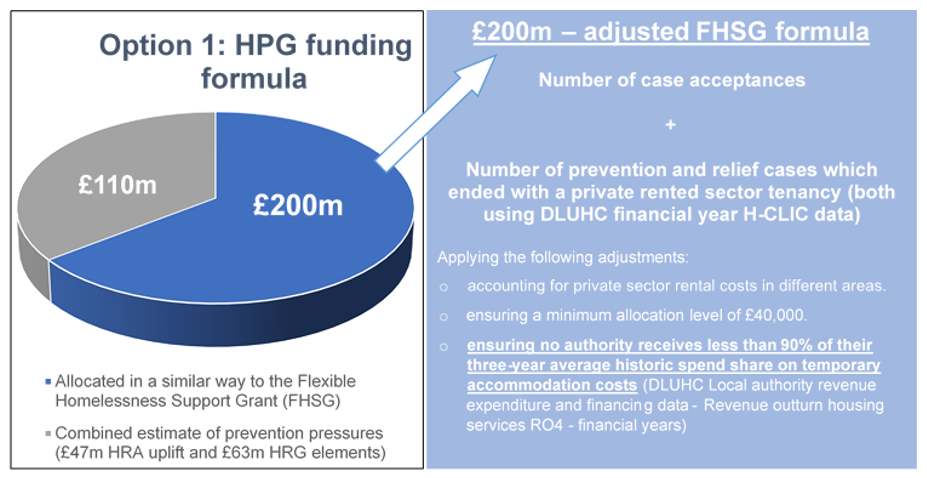

3.8 In light of the above, we have outlined 2 options which we consider to be reasonable and proportionate approaches to updating the FHSG element of the formula to remove the TAMF element for 2023/24 onwards (subject to funding decisions at subsequent Spending Reviews):

Option 1:

- Replace the TAMF element of the formula with 90% of 3-year average of historic temporary accommodation (TA) spend[footnote 5].

The FHSG element of the formula would still be calculated in the same way as before, but with 90% of historic TA spend now replacing the TAMF element of the formula. Local authorities would be allocated either the greater of their share of:

- The sum of their homelessness acceptances, prevention into the PRS, relief into the PRS, accounting for PRS rents data, or

- 90% of their historic TA spend data, or

- £40,000

whichever is the greatest in value.

Figure 1.5 – Components of the proposed Option 1: TAMF replacement with historic TA spend

Option 1: HPG funding formula

- £200m - allocated in a similar way to the Flexible Homelessness Support Grant (FHSG)

- £110m - combined estimate of prevention pressures (£47m HRA uplift and £63m HRG elements)

£200m - adjusted FHSG formula

Number of case acceptances + Number of prevention and relief cases which ended with a private rented sector tenancy (both using DLUHC financial year H-CLIC data).

Applying the following adjustments:

- accounting for private sector rental costs in different areas

- ensuring a minimum allocation level of £40,000

- ensuring no authority receives less than 90% of their 3-year average historic spend share on temporary accommodation costs (DLUHC Local authority revenue expenditure and financing data - Revenue outturn housing services RO4 - financial years)

Option 2:

- Replace the TAMF with a population-weighted area cost adjustment (ACA)[footnote 6]. The ACA is a tool used to measure the variation in the cost of delivering local government services for different local authorities in England.

The FHSG element of the formula would still be calculated in the same way as before, but with a population-weighted ACA now replacing the TAMF. Local authorities would be allocated either the greater of their share of:

- The sum of their homelessness acceptances, prevention into the PRS, relief into the PRS, accounting for PRS rents data, or

- A relative 75% share of their population-weighted ACA, or

- £40,000

whichever is the greatest in value.

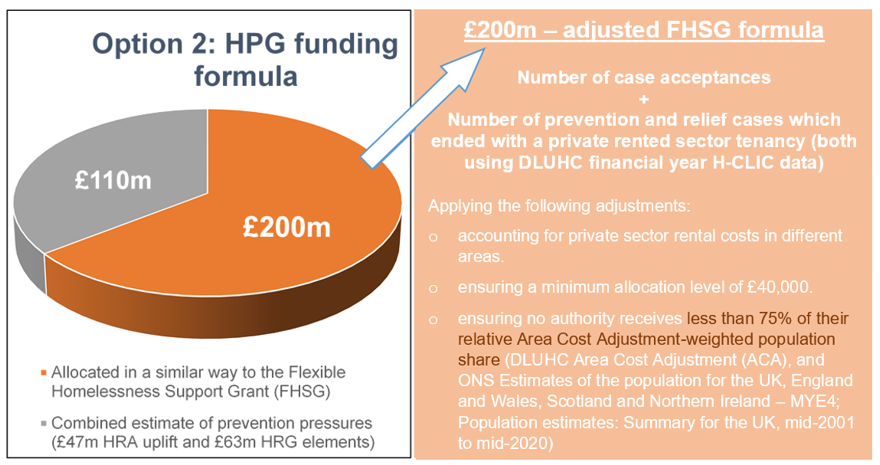

Figure 1.6 – Components of the proposed Option 2: TAMF replacement with population-weighted ACA

Option 2: HPG funding formula

- £200m - allocated in a similar way to the Flexible Homelessness Support Grant (FHSG)

- £110m - combined estimate of prevention pressures (£47m HRA uplift and £63m HRG elements)

£200m - adjusted FHSG formula

Number of case acceptances + Number of prevention and relief cases which ended with a private rented sector tenancy (both using DLUHC financial year H-CLIC data).

Applying the following adjustments:

- accounting for private sector rental costs in different areas

- ensuring a minimum allocation level of £40,000

- ensuring no authority receives less than 75% of their relative Area Cost Adjustment-weighted population share (DLUHC Area Cost Adjustment (ACA), and ONS Estimates of the population for the UK, England and Wales, Scotland and Northern Ireland - MYE4; Population estimates: Summary for the UK, mid-2001 to mid-2020)

Q3. Of the options presented to replace TAMF in the formula, which is your first preference? (Option 1 - Option 2 - Not sure – Indifferent - Neither) Please explain why. (300 word limit)

Q4. Are there other indicators of TA pressures you recommend we consider? (300 word limit) Please explain why. (300 word limit)

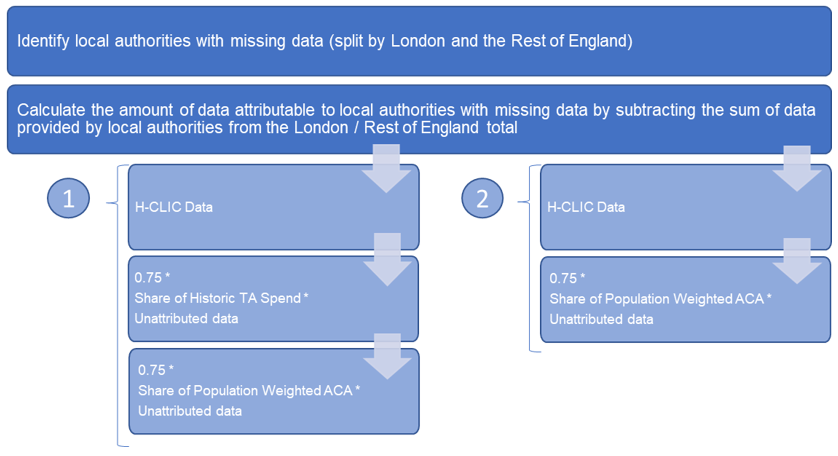

Missing data

3.9 The H-CLIC data needed to run the formula is not always available. This can be the case where accurate data for all 4 quarters in a given year was not provided.

3.10 Where accurate data was not provided, local authority-level estimates are calculated by apportioning published regional figures. Using the total figures for London and the Rest of England, we calculate the amount of data within a given dataset that is attributable to local authorities with missing data. We do this by subtracting the sum of data provided by local authorities from the total figure.

3.11 To distribute the remaining data to local authorities with missing data, we propose 2 options:

Option 1:

- Distribute the data to local authorities with missing data using their percentage share of a 3-year average of historic TA spend.

- If historic TA spend is not available for a given local authority, instead calculate their share using a population-weighted ACA.

- The data is then distributed using either of these shares, and is adjusted using a missing data multiplier of 0.75 (this ensures local authorities cannot gain by not providing data). For example, if there were 4000 units of missing data to be allocated and a local authority had a share of 10%, they would be allocated 300 units (= 4000 * 0.1 * 0.75).

Option 2:

- Allocate the data to local authorities with missing data using their percentage share of population weighted area cost adjustment (ACA). A population weighted ACA is available for all local authorities, so a share would be able to be produced for any local authority with missing data under this method.

- The data is then distributed using these shares, and is adjusted using a missing data multiplier of 0.75 (this ensures local authorities cannot gain by not providing data). For example, if there were 4000 units of missing data to be allocated and a local authority had a share of 10%, they would be allocated 300 units (= 4000 * 0.1 * 0.75).

Figure 1.7 – Summary of our proposed options to account for missing data

Identify local authorities with missing data (split by London and the Rest of England)

Calculate the amount of data attributable to local authorities with missing data by subtracting the sum of data provided by local authorities from the London / rest of England total

1. H-CLIC data

0.75 *

Share of historic TA Spend *

Unattributed data

0.75 *

Share of Population Weighted ACA *

Unattributed data

2. H-CLIC data

0.75 *

Share of Population Weighted ACA *

Unattributed data

Q5. Of our proposed options in relation to missing data, which is your first preference? (Option 1 – Option 2 – Not sure – Indifferent - Neither) Please explain why. (300 word limit)

The other data sources used in the FHSG element (£200m)

3.12 As outlined in figure 1.3, prior to adjustments, the FHSG element of the formula currently calculates pressures using:

- Homelessness case acceptances (H-CLIC)

- The number of prevention and relief cases which ended in securing a PRS tenancy (H-CLIC)

- Private rented sector costs data[footnote 7]

3.13 We are still considering these elements of the formula and are seeking views as to whether these still represent an accurate reflection of homelessness pressures. In particular, we are considering the metric of ‘the number of prevention and relief cases which ended in securing a PRS tenancy’, as we are mindful that the ability of certain authorities to secure tenancies in the PRS has reduced in recent years (such as those with particular housing market pressures limiting availability of affordable PRS properties). The illustrative allocations provided alongside this document are based on the current method, i.e. the number of prevention and relief cases which ended in securing a PRS tenancy.

Q6. Do the listed data sources used in the FHSG element represent an accurate reflection of homelessness pressures? (Yes - No - Partially - Not sure) Please explain why. (300 word limit)

Q7. Do you have any alternative suggestions for data sources that could be used as indicators of homelessness pressures in the formula? (500 word limit)

The overall allocations formula and illustrative allocations

3.14 As you can see from the options above, there are multiple variables we can alter in the formula. Illustrative allocations are included alongside this document, showing the potential funding allocations combining the “Option 1” approaches, as well as the impact of combining the “Option 2” approaches. We have produced these to help inform the consultation and show the impacts of different combinations. We will not necessarily take forward the options above and will use feedback from the consultation to inform our final allocations formula.

3.15 The allocations provided alongside this document are to be treated as illustrative only – they have been calculated using historic data and are subject to any newly released data in 2022. The illustrative allocations are based on the 2021/22 overall HPG amount of £310m. This does not mean that the overall amount of the grant will be £310m in 2023/24 or any future years. Decisions on overall funding for those years will be taken in due course. Allocations are very likely to change prior to confirmation.

4. Transitional arrangements for 2023/24 and 2024/25

Introducing transitional arrangements to minimise the impact of changes in allocations following a refreshed formula

4.1 The proposed updates to the formula used to distribute funding will increase or decrease the funding available to each local authority. These changes will ensure that distribution of funding continues to represent current pressures. However, the changes to allocations have the potential to be significant, depending on the extent to which the new formula for determining TA pressures differs from historical data.

4.2 To provide stability to local services, and to mitigate against significant changes from previous allocations in the short-term, we propose to introduce transitional arrangements by capping the percentage change in funding for each local authority. This would prevent sudden and unsustainable shifts in funding, and associated risks to local service delivery, by reducing the impact of significant funding changes. We propose this as a temporary, transitional measure, with the aim of giving services time to adjust to the changes in their funding.

4.3 We propose to limit the change in funding allocation to 5% in 2023/24 and 10% in 2024/25, when compared to the authority’s allocation for 2022/23. This means that the percentage change in allocation for each authority will be capped at 5% in 2023/24 and 10% in 2024/25. This will apply irrespective of whether the percentage change is an increase or decrease. In order to facilitate this, funding allocations will be adjusted across areas, including areas which have an unadjusted percentage change below the cap. We would review this approach for 2025 onwards.

4.4 We plan to allocate funding for 2023/24 and 2024/25 in late 2022. This means that we would be able to announce the next 2 financial years of funding this year, providing early certainty to local authorities and allowing them time to plan and structure their homelessness services.

Example 1:

Area A has a funding allocation of £865,000 in 2022/23. Under the updated funding formula, they have a funding allocation of £1,113,000 for 2023/24, and £1,113,000 for 2024/25.

Transitional arrangements are then applied, which caps the percentage change at 5% between 2022/23 and 2023/24, and at 10% between 2022/23 and 2024/25. Area A’s adjusted allocations are as follows:

2023/24: £865,000 x 1.05 (5% cap) = £908,250

2024/25: £865,000 x 1.10 (10% cap) = £951,500

Example 2:

Area B has a funding allocation of £400,000 in 2022/23. Under the updated funding formula, they have a funding allocation of £320,000 for 2023/24, and £320,000 for 2024/25.

Transitional arrangements are then applied, which caps the percentage change at 5% between 2022/23 and 2023/24, and at 10% between 2022/23 and 2024/25. Area B’s adjusted allocations are as follows:

2023/24: £400,000 x 0.95 (5% cap) = £380,000

2024/25: £400,000 x 0.9 (10% cap) = £360,000

4.5 We are seeking views on the percentage proposed for transitional arrangements, recognising the need to balance accurately allocating funding to the most acute pressures whilst also ensuring service delivery sustainability. While not introducing transitional arrangements would allow for the most accurate reflection of need in our funding model, it is also important to ensure any changes to funding year-on-year are sustainable and any impacts on service delivery are minimised. A larger cap would carry an increased risk of jeopardising sustained service delivery and infrastructure in some local authorities if there are sudden notable reductions in funding.

Q8. Do you want to see transitional arrangements introduced for 2023/24 financial year? (Yes – No – Indifferent - Not sure)

Q9. Do you want to see transitional arrangements introduced for 2024/25 financial year? (Yes – No – Indifferent - Not sure)

Q10. What percentage cap would you prefer to see? (5% in 2023/24 and 10% in 2024/25 as proposed – 2% each year - 5% each year - 10% each year – 20% each year – None - Indifferent - Other - Not sure)

Q11. Please explain the reasons for your answers to the questions in this chapter, and provide any other thoughts or comments on this proposal. (500 word limit)

Announcement of 2023/24 and 2024/25 allocations

4.6 In recent years, the Homelessness Prevention Grant has been announced on an annual basis. This has been in line with single year spending reviews and enabled us to adjust allocations each year to reflect changing circumstances, such as the uplift in 2021/22 to support the full enforcement of the Homelessness Reduction Act. We recognise though that this limits the ability of local authorities to plan services more strategically and commission specialist services and can make it harder to recruit and retain staff. The most recent multi-year spending review provides the option of announcing both the 2023/24 and 2024/25 allocations in late 2022. We plan to do this to give early certainty to local authorities of their funding over the next 2 years to support them to plan and deliver specialist services via the grant funding, as well as improve staff retention rates.

4.7 This carries the risk that, if homelessness pressures shift significantly between 2023 and 2024, allocations for the 2024/25 financial year may not reflect the most up-to-date pressures. Alternatively, the allocations could be announced on a single year basis.

Q12. Do you agree that funding allocations for 2023/24 and 2024/25 should be announced this year, providing the earliest funding certainty possible? (Yes – No – Indifferent - Not sure) Please explain why. (300 word limit)

5. Additional spend declaration: assigning spend to categories

Background: current spend reporting requirements

5.1 At present, the Homelessness Prevention Grant can be spent flexibly by local authorities to meet their homelessness and rough sleeping objectives. The grant conditions require that the funding be spent in adherence with certain principles and requirements, including fully enforcing the Homelessness Reduction Act, maximising homelessness prevention, and ensuring the financial viability of services. At the end of the financial year, a declaration from the local authority must be submitted, confirming that the grant has been spent in line with these conditions.

5.2 Whilst this provides assurance that the grant is being used in line with the government’s wider homelessness and rough sleeping objectives, it does not give a comprehensive picture of how funding is spent by local authorities. We do not know, for example, how much of the grant is spent on TA, versus prevention or other spend.

5.3 Performance on homelessness prevention varies significantly across local authorities, even when comparing economically and demographically similar areas. This means that there are inconsistent outcomes for homeless households across the country, including between authorities with similar funding levels. Our lack of data on grant spend makes it more difficult to link interventions to homelessness outcomes and restricts shared learning across local authorities. It also prevents us from being able to fully understand how the current funding arrangements influence spending decisions at a local level.

An additional requirement to report spend as ‘prevention and relief’, ‘TA’ or ‘main duty/ other’

5.4 In order to enhance overall understanding of how the grant is used, and to drive performance on prevention, we are proposing to add a condition to the grant determination requiring local authorities to report the value of grant funding which has been spent within the categories of ‘prevention and relief’, ‘TA’ and ‘main duty/ other’ at the end of the financial year (as well as a forecast part way through the year). This will be purely an information gathering exercise and will not be used to influence any aspect of the allocations formula.

5.5 We have outlined what we believe constitutes prevention and relief, TA and main duty/ other spend below:

Prevention and relief

Staffing:

- Prevention and relief officers and management

- Triage officers

- Link/ liaison/ partner (duty to refer) roles

- Tenancy sustainment staff

- Housing advice staff

Incentive schemes - payment to a new landlord:

- Incentive payment (prevention/ relief duty)

- Payment of upfront costs (prevention/ relief duty)

Incentive schemes - payment to an existing landlord:

- Incentive payment to retain household

- Payment of rent arrears

- Payment for repairs/improvements (prevention/ relief duty)

Incentive schemes - payment to a household:

- Reimbursement of upfront costs (prevention/ relief duty)

Other services:

- Externally commissioned homelessness prevention services/ staff

- Purchasing household goods (prevention/ relief duty)

TA

Actual TA costs:

- All types - nightly-paid, B&Bs, local authority stock, refuges etc

TA administration:

- Procurement

- Maintenance

- Rents teams

Main duty/ other

Other staffing (can be classed as ‘prevention and relief’ if a more than 50% of their role consists of work undertaken under the prevention and/or relief duties, or other prevention/relief work):

- Procurement teams

- Finance teams

- Legal teams

- Review officers

- Strategy staff

- Commissioners

- Private housing enforcement

- Outreach staff

- Healthcare staff

- Any other specialist roles

- Staff training/ expenses

Incentive schemes - payment to a new landlord:

- Incentive payment (main duty)

- Upfront costs (main duty)

- Other incentive schemes including administration – rent deposit schemes etc (main duty)

Other services:

- Externally commissioned homelessness services/ staff

- Purchasing household goods (main duty)

5.6 Costs arising from work undertaken during the main housing duty would be classed as ‘main duty/other’ spend for these purposes. We are aware that staff will often have roles spanning across various types of homelessness support – in this case, staffing costs can be categorised as ‘prevention and relief’ spend if more than 50% of their role consists of prevention and/or relief work (we recognise that in some cases, this will be determined via an estimate). TA spend will encompass TA costs net of Housing Benefit, including costs associated with the administration, inspection, or procurement of TA.

5.7 This change will give us the data we need to understand how much is spent on TA across government and from which funding streams. It will also allow us to identify the authorities which are able to maximise prevention spend through the grant, as a first step toward identifying effective interventions to improve shared learning across authorities.

5.8 We are keen that this change is implemented in a proportionate way, which minimises the potential administrative impact on authorities. We are interested to hear views on whether the definition of these categories are workable, whether there are other types of spend we have not listed above, the ability of local authorities to categorise spend in this way and any anticipated impacts this may have on homelessness teams.

Q13. To what extent do you feel confident that local authorities would be able to provide a yearly spend declaration of HPG categorised under ‘prevention and relief’, ‘TA’ and ‘main duty/other’? (Very confident – Quite confident – Neutral – Slightly doubtful - Very Doubtful – Not sure)

Q14. Please use this space to provide reasons for your answer and any further thoughts or comments on this proposal. For example, whether you think the above definition of ‘prevention and relief’ spend (as set out in para 5.5) is workable, if there are other spend categories which could constitute ‘prevention and relief’ that we have not listed above, whether you have views on the local authority’s ability to provide this information, or any additional impact this extra reporting requirement may have? (500 word limit)

Q15. Would it be possible for local authorities to provide a more granular breakdown of spend than those proposed – for example, reporting the amount spent on staffing/incentive payments for a new tenancy/clearing rent arrears? (Yes – No – Maybe – Not sure) Please explain why. (300 word limit)

6. Introducing tranche payments with conditions

Background: H-CLIC data collection

6.1 Local authorities in receipt of the Homelessness Prevention Grant are currently asked to submit data returns to DLUHC via the Homelessness Case Level Information Collection (H-CLIC), which inform the statutory national homelessness statistics. This data provides invaluable insight into homelessness trends across England, providing case-level data on homeless households, including those in temporary accommodation. The statistics are used to track national and local progress on reducing homelessness, to drive performance, and to inform government policy.

6.2 The homelessness performance dashboard shows statistics indicating local authority homelessness performance and shows an overall RAG rating of the H-CLIC data provided: Homelessness Performance Dashboard.

6.3 Most local authorities consistently provide high-quality H-CLIC returns on time. However, there is room for improvement - a small but nonetheless sizeable proportion of authorities fail to provide complete or accurate returns, or do not provide the returns on time. In October – December 2021, 8% of local authorities failed to submit accurate TA data (estimated to account for 21% of households in TA in England), and 2% of local authorities supplied low quality H-CLIC data with over 15% of cases submitted with errors. This affects the overall quality of England’s homelessness statistics, and also risks the Homelessness Prevention Grant funding allocations not fully reflecting local pressures. Poor data reporting is particularly acute for certain datasets – such as for TA figures.

6.4 Upon the implementation of H-CLIC, the government recognised that the change to reporting via H-CLIC was significant, and has taken a phased approach over a number of years for this reason. The Homelessness Advice and Support Team (HAST), including expert advisers from local authorities and the sector seconded to DLUHC, have worked closely with local authorities to quality check data returns, and local authorities have been provided with £3m in targeted funding to support them to update their IT systems and comply with the data requirements. Given these measures, and the fact that H-CLIC reporting requirements have now been in place for the past 5 years, we do not consider it reasonable that some local authorities are still failing to submit data appropriately.

Introduction of tranche payments to drive better H-CLIC data reporting

6.5 In order to drive the performance of consistent H-CLIC reporting, we propose to introduce tranche payments for the Homelessness Prevention Grant. This would be a change from the current system, whereby the entire year’s funding is paid upfront in April. This proposal would mean that 75% of the funding would be released at the beginning of the financial year (tranche 1), and the remaining 25% would be released later in the financial year (tranche 2), on the condition that the local authority in question:

a. Has completed their Q2 H-CLIC return, including full TA figures, and

b. The data submitted is publishable (as defined by the fourth quality measure on the performance dashboard[footnote 8]

6.6 Under this proposal, in order to receive the second tranche payment on time, the authority must have submitted their H-CLIC return by the required deadline (within 6 weeks of the Q2 H-CLIC collection opening). If an authority misses the initial deadline but meets the above conditions in sufficient time to release payment before the end of the financial year, the authority would receive the second tranche payment after a period of delay. The local authority would not receive the second tranche of funding without meeting the conditions specified above.

Q16. What is your view on our proposal to introduce tranche payments for the Homelessness Prevention Grant in order to incentivise better H-CLIC data reporting? (Strongly Agree – Agree – Neutral – Disagree – Strongly Disagree – Not sure)

Q17. If we were to introduce tranche payments, what percentage of the funding would you recommend be released in tranche 2 (later in the financial year)? (50% - 25% - 10% - 5% - None – Other – Indifferent - Not sure)

Q18. What is your view on the proposed conditions – publishable H-CLIC returns with full TA data - in order to receive tranche 2 of the grant? (Strongly Agree – Agree – Neutral – Disagree – Strongly Disagree – Not sure)

Q19. Please explain the reasons for your answers to the questions in this chapter, and provide any other thoughts or comments on this proposal. (500 word limit)

About this consultation

This consultation document and consultation process have been planned to adhere to the Consultation Principles issued by the Cabinet Office.

Representative groups are asked to give a summary of the people and organisations they represent, and where relevant who else they have consulted in reaching their conclusions when they respond.

Information provided in response to this consultation may be published or disclosed in accordance with the access to information regimes (these are primarily the Freedom of Information Act 2000 (FOIA), the Environmental Information Regulations 2004 and UK data protection legislation. In certain circumstances this may therefore include personal data when required by law.

If you want the information that you provide to be treated as confidential, please be aware that, as a public authority, the Department is bound by the information access regimes and may therefore be obliged to disclose all or some of the information you provide. In view of this it would be helpful if you could explain to us why you regard the information you have provided as confidential. If we receive a request for disclosure of the information we will take full account of your explanation, but we cannot give an assurance that confidentiality can be maintained in all circumstances. An automatic confidentiality disclaimer generated by your IT system will not, of itself, be regarded as binding on the Department.

The Department for Levelling Up, Housing and Communities will at all times process your personal data in accordance with UK data protection legislation and in the majority of circumstances this will mean that your personal data will not be disclosed to third parties. A full privacy notice is included below.

Individual responses will not be acknowledged unless specifically requested.

Your opinions are valuable to us. Thank you for taking the time to read this document and respond.

Are you satisfied that this consultation has followed the Consultation Principles? If not or you have any other observations about how we can improve the process please contact us via the complaints procedure.

Personal data

The following is to explain your rights and give you the information you are entitled to under UK data protection legislation.

Note that this section only refers to personal data (your name, contact details and any other information that relates to you or another identified or identifiable individual personally) not the content otherwise of your response to the consultation.

1. The identity of the data controller and contact details of our Data Protection Officer

The Department for Levelling Up, Housing and Communities (DLUHC) is the data controller. The Data Protection Officer can be contacted at dataprotection@levellingup.gov.uk or by writing to the following address:

Data Protection Officer

Department for Levelling Up, Housing and Communities

Fry Building

2 Marsham Street

London

SW1P 4DF

2. Why we are collecting your personal data

Your personal data is being collected as an essential part of the consultation process, so that we can contact you regarding your response and for statistical purposes. We may also use it to contact you about related matters.

We will collect your IP address if you complete a consultation online. We may use this to ensure that each person only completes a survey once. We will not use this data for any other purpose.

3. Our legal basis for processing your personal data

The collection of your personal data is lawful under article 6(1)(e) of the UK General Data Protection Regulation as it is necessary for the performance by DLUHC of a task in the public interest/in the exercise of official authority vested in the data controller. Section 8(d) of the Data Protection Act 2018 states that this will include processing of personal data that is necessary for the exercise of a function of the Crown, a Minister of the Crown or a government department i.e. in this case a consultation.

Where necessary for the purposes of this consultation, our lawful basis for the processing of any special category personal data or ‘criminal offence’ data (terms explained under ‘Sensitive Types of Data’) which you submit in response to this consultation is as follows. The relevant lawful basis for the processing of special category personal data is Article 9(2)(g) UK GDPR (‘substantial public interest’), and Schedule 1 paragraph 6 of the Data Protection Act 2018 (‘statutory etc and government purposes’). The relevant lawful basis in relation to personal data relating to criminal convictions and offences data is likewise provided by Schedule 1 paragraph 6 of the Data Protection Act 2018.

4. With whom we will be sharing your personal data

DLUHC may appoint a ‘data processor’, acting on behalf of the Department and under our instruction, to help analyse the responses to this consultation. Where we do we will ensure that the processing of your personal data remains in strict accordance with the requirements of the data protection legislation.

5. For how long we will keep your personal data, or criteria used to determine the retention period

Your personal data will be held for 2 years from the closure of the consultation, unless we identify that its continued retention is unnecessary before that point.

6. Your rights, e.g. access, rectification, restriction, objection

The data we are collecting is your personal data, and you have considerable say over what happens to it. You have the right:

a. to see what data we have about you

b. to ask us to stop using your data, but keep it on record

c. to ask to have your data corrected if it is incorrect or incomplete

d. to object to our use of your personal data in certain circumstances

e. to lodge a complaint with the independent Information Commissioner (ICO) if you think we are not handling your data fairly or in accordance with the law. You can contact the ICO at https://ico.org.uk/, or telephone 0303 123 1113.

Please contact us at the following address if you wish to exercise the rights listed above, except the right to lodge a complaint with the ICO: dataprotection@levellingup.gov.uk or

Knowledge and Information Access Team

Department for Levelling Up, Housing and Communities

Fry Building

2 Marsham Street

London

SW1P 4DF

7. Your personal data will not be sent overseas

8. Your personal data will not be used for any automated decision making

9. Your personal data will be stored in a secure government IT system

We use a third-party system, Citizen Space, to collect consultation responses. In the first instance your personal data will be stored on their secure UK-based server. Your personal data will be transferred to our secure government IT system as soon as possible, and it will be stored there for 2 years before it is deleted.

-

In October 2021, DLUHC announced a one-off exceptional £65m top-up to the Homelessness Prevention Grant for 2022/23, to help households who were in rent arrears and struggling due to the impact of the pandemic. This additional funding was provided to local authorities in December 2021. ↩

-

Some homelessness funding is subject to departmental expenditure limits (DEL). Local authorities can also access AME funding (annually managed expenditure which is generally spending that is demand-led and therefore harder to predict, and so not subject to firm limits) from Housing Benefit to help meet TA costs. ↩

-

In this consultation, for ease of comparison we are using the core funding amount for 2021/22 of £310m to explain the funding formula and to demonstrate the impact of the proposals. This excludes the domestic abuse new burdens funding which in 2022/23 was paid as part of the Homelessness Prevention Grant but is expected to increase over time, which makes comparisons more challenging. ↩

-

Lower Tier Local Authority Area Cost Adjustment, as used in the COVID-19 Relative Needs Formula (PDF, 307KB). ↩

-

Historic temporary accommodation spend is sourced from DLUHC Local authority revenue expenditure and financing, Revenue outturn housing services (RO4). ↩

-

Local authority population data is sourced from ONS Estimates of the population for the UK, England and Wales, Scotland and Northern Ireland. Area cost adjustment data is sourced from DLUHC Area cost adjustment. ↩

-

Lower quartile monthly private rented sector rents for 2-bedroom properties: Table 2.4. ↩

-

In order to assess whether data is publishable, DLUHC check that local authorities have signed off their quality assurance reports and, in some cases, ask the local authority to provide an explanation of large quarter on quarter changes. ↩