Review of the Financial Ombudsman Service Consultation (Accessible)

Published 15 July 2025

Foreword

The UK’s financial services sector plays a vital role in enabling people and businesses to borrow, invest, insure against risk, and plan for their future with confidence.

To play that role successfully, it is essential that those who rely on financial services firms have trust and confidence in those firms and the regulatory system overseeing them. As the government’s Regulation Action Plan[footnote 1] set out, certainty and consistency of regulatory systems are crucial for attracting investment and supporting innovation and, in turn, delivering the best possible outcomes for consumers, businesses, and the wider economy.

The Financial Ombudsman Service (FOS) plays an important role within the financial services regulatory environment, helping consumers have confidence that they will be treated fairly when things go wrong. Throughout my recent review of the FOS and the framework in which it operates, I have heard strong support from all quarters for the important role the FOS often plays as a simple, impartial dispute resolution service which quickly and effectively deals with complaints against financial services firms.

However, the financial services landscape has evolved over the last 25 years since the FOS was established, with the introduction of new financial products, digitalisation and a shift towards outcomes-focused regulation which seeks to set high standards of care that firms must provide to consumers. For years, stakeholders have consistently raised concerns that some elements of the redress framework can generate problems and lead to inconsistent outcomes for consumers and uncertainty for firms. This has suppressed investment and innovation in UK financial services, which can lead to firms offering fewer, less innovative products for consumers due to concerns about potential future redress.

It is therefore right that the government reviews the redress framework to ensure that it continues to fulfil its intended purpose in an effective way. And that is why earlier this year, the Chancellor asked me to carry out a review of the FOS and the legislation that establishes it and sets out how it operates.

Today, I am setting out a package of proposed policy reforms to address these concerns and restore the FOS to its role as a simple, impartial dispute resolution service which can quickly and effectively deal with complaints against financial services firms – ensuring that it is no longer acting as a quasi-regulator. The updated redress framework will ensure coherence across the work of the FOS and the FCA and enhanced cooperation between them, to the benefit of consumers and firms.

I welcome the FCA’s and FOS’s joint consultation paper, published alongside this consultation, which sets out their response and next steps following their joint Call for Input on Modernising the Redress System. This includes an updated framework for dealing with mass redress events and the new FOS case process that will streamline case handling and ensure decisions are taken at the right level in the organisation. The FCA and the FOS will begin implementing changes from today, where they can – delivering meaningful improvements in advance of the legislation that will be needed to implement the government’s proposed reforms.

Together, these changes will provide greater certainty, predictability and efficiency for both the firms and consumers who use the FOS and the financial services redress system.

Emma Reynolds MP

Economic Secretary to the Treasury

1. Introduction

The Financial Ombudsman Service (FOS) plays an important role in helping consumers and financial services businesses resolve complaints. It is intended to be a simple, impartial dispute resolution service which quickly and effectively deals with complaints, as an alternative to these cases having to be resolved through the courts.

The FOS was established by the Financial Services and Markets Act 2000 (FSMA), which sets out its legislative framework. Under this framework, the FOS is operationally independent from both the Financial Conduct Authority (FCA) and the government. The framework sets out the core principles that govern the FOS’s activity, including:

- the requirement for determinations to be made according to what is fair and reasonable in all the circumstances of the case;

- final determinations, once accepted by the complainant, are binding on both the complainant and the respondent firm; and

- the ability to decide on an appropriate remedy, including a money award (up to a limit set by the FCA) or a direction to take alternative action in relation to the complainant.

FSMA provides for the making of rules to govern how the FOS should operate within this framework. The FCA makes rules about firms’ internal complaints handling, as well as the scope of the FOS’s jurisdiction. The FOS makes rules, which require FCA approval, that set out the detail of how it handles complaints. Both the FCA’s and the FOS’s rules are contained in the Dispute Resolution: Complaints (DISP) Sourcebook in the FCA Handbook.

In March, the government’s Regulation Action Plan[footnote 2] announced that the Economic Secretary to the Treasury (EST) would conduct a review of the FOS to examine whether it is delivering its role as a simple, impartial dispute resolution service, which quickly and effectively deals with complaints against financial services firms and which works in concert with the FCA, which regulates the sector. This consultation sets out the government’s conclusions to the review and seeks views on a package of reforms that will ensure the FOS meets the policy aims set by the review.

The review focused on a range of issues that were raised as part of the government’s consultation on the financial services growth and competitiveness strategy, including concerns around:

- the framework in which the FOS operates which has resulted in it acting, at times, as a quasi-regulator;

- whether the FOS is applying today’s standards to actions that have taken place in the past; and

- the practices that have grown up over time on compensation.

The review was launched in response to longstanding concerns raised by industry stakeholders. These suggested that the UK’s dispute resolution framework for financial services was creating uncertainty that was impacting investment in UK financial services and inhibiting innovation by firms, as well as having a knock-on impact on consumers as firms may offer fewer or less innovative products due to concerns about potential future redress. Consumer stakeholders have also raised the unpredictable redress outcomes as unhelpful to consumers.

The review has built on work the FCA and the FOS have undertaken to review the redress system, including the Call for Input published by the FCA and the FOS in November 2024.[footnote 3] HM Treasury has worked with the FCA and the FOS and has taken account of the feedback offered by stakeholders during the course of the review, as well as a summary of key issues raised in responses to the FCA/FOS Call for Input.

Feedback gathered has highlighted that, in the majority of cases, the FOS is fulfilling its intended role. Stakeholders were strongly in favour of having such a simple, impartial service, enabling consumers to resolve individual complaints with financial services firms quickly and effectively. They noted the importance of trust for consumers in the financial services sector and regulatory system that an effective scheme for resolving complaints can help support.

However, in a small but impactful minority of FOS cases, some stakeholders were concerned that the role of the FOS had expanded beyond its original remit. This gave rise to a lack of certainty around the regulatory standards that firms are required to meet, concerns about the predictability and consistency of FOS decisions, and a lack of alignment between the FOS and the FCA. These issues create an uncertain and unpredictable redress environment for both firms and consumers.

Stakeholders also highlighted the potential for strain on the redress system when the FOS is required to handle cases which are related to a mass redress event. This can lead to significant delays in the FOS’s ability to resolve its other cases and, in turn, consumers’ access to redress.

Review conclusions

The government has concluded that the FOS forms an essential part of the UK’s regulatory approach to financial services. In most cases, it provides a simple, impartial dispute resolution service which quickly and effectively deals with complaints against financial services firms. In doing so, it underpins public confidence in financial services and supports the vital contribution that the sector makes to the UK economy. The overall model of dispute resolution delivered through the FOS should therefore be preserved.

However, the review has exposed a drawback with the framework within which the FOS has to operate: there is not always coherence between the regulatory approach set by the FCA as the financial conduct regulator and the approach used by the FOS to settle complaints between consumers and firms. This potential for tension can, in a small but impactful number of cases, result in the FOS acting as a quasi-regulator. This can leave firms operating within an uncertain regulatory environment, with damaging consequences for the ability of firms to invest, innovate and grow, and can lead to unpredictable outcomes for consumers.

As set out in the government’s Regulation Action Plan,[footnote 4] predictability is an essential feature of any effective regulatory regime. The government therefore proposes to reform the legislative framework within which the FOS operates, to prevent the FOS acting as quasi-regulator and to provide greater regulatory coherence, with consistent standards of consumer protection set by the FCA and applied by the FOS in resolving complaints.

In summary, the government will use changes to legislation, when Parliamentary time allows, to deliver the following reforms:

- An adapted ‘Fair and Reasonable’ test – the FOS will be required to find that a firm’s conduct is fair and reasonable where it has complied with relevant FCA rules, in accordance with the FCA’s intent for those rules;

- A framework which formalises the roles of the FOS and the FCA in providing regulatory certainty – where there is ambiguity in how the FCA’s rules apply, the FOS will be required to seek a view from the FCA and the FCA will be obliged to respond. Where appropriate, a party to a complaint will be able to request that the FOS seeks the FCA’s view on interpretation of rules;

- A framework which provides clarity on the roles of the FCA and the FOS in relation to wider implications issues and mass redress events – the FOS will be obliged to refer potential wider implications issues or mass redress events to the FCA and the FCA will be obliged to consider those issues. Parties to a complaint will also be able to request the FOS refer such an issue to the FCA. It will be for the FCA to decide how those issues should be addressed;

- A more flexible mass redress event framework - the FCA will be able to investigate and respond to mass redress events more easily, ensuring that, when needed, mass redress events can be considered and dealt with quickly and effectively, providing consistent outcomes for consumers and avoiding disruption to markets; and

- An absolute time limit for bringing complaints to the FOS – consistent with the aim of providing a simple, impartial dispute resolution service which deals quickly and effectively with complaints, an absolute time limit in legislation will require complaints to be brought within 10 years of the conduct complained of. This will avoid the risk of the FOS having to deal with a high number of historic cases, which can be challenging to resolve quickly and effectively.

Alongside this consultation, the FCA and the FOS are publishing a response to their Call for Input [footnote 5] which consults on a number of changes to be made that are consistent with the government’s proposed reforms, including: an updated framework for the FCA to identify mass redress events and better cooperate with the FOS when wider implications issues or mass redress events are suspected; a proposed new FOS case process which seeks to operationalise some of the government’s reforms; as well as a new approach for understanding and dealing with new types of issues raised by complaints (known as lead complaints).

In addition to this, the FOS is introducing a new standard interest rate on compensation awards, which will be updated to ensure it better reflects market conditions.

Greater regulatory certainty will allow consumers to have confidence in fair and predictable redress outcomes when things go wrong, and it will contribute to a regulatory environment in which firms can compete, grow and invest for the long term.

This consultation sets out proposed changes to the legislative framework intended to enhance regulatory coherence and certainty while ensuring the role of the FOS stays true to the original policy intent of a simple, impartial dispute resolution service that quickly and effectively deals with complaints against financial services firms, and which works in concert with the FCA.

The government will set out its response and next steps for delivering reform in due course, including any transitional arrangements that may be needed.

2. The determination of complaints brought to the FOS

Fair and Reasonable Test

The overarching policy aims of this review have been to ensure that the FOS operates as a simple, impartial dispute resolution service that quickly and effectively deals with complaints against financial services firms, and which works in concert with the FCA which regulates the conduct of the sector.

FSMA requires that the FOS must determine complaints “by reference to what is, in the opinion of the ombudsman, fair and reasonable in all the circumstances of the case”. This very straightforward approach to determining complaints was judged to be consistent with the vision for simple and quick dispute resolution that offers an alternative to the legalistic approach of court proceedings. It was also consistent with the approach used by a number of existing ombudsman schemes.

This original vision for the FOS has, to a large extent, been successful. Feedback from consumer and industry stakeholders agrees that, in the majority of cases, the FOS enables quick and fair resolution of complaints. However, the concern that some decisions of the FOS can generate regulatory uncertainty has persisted over a number of years.

The government has concluded that the ‘Fair and Reasonable’ approach should be retained and adapted. Moving to a strict application of law and regulation, as some stakeholders have suggested, would not be desirable. It would duplicate the approach of the courts and move the FOS away from simple and quick dispute resolution toward a more formal tribunal model.

The government has concluded that a drawback of the original framework for the FOS, including the ‘Fair and Reasonable’ test, is that the work of the FOS was insufficiently linked to the rest of the regulatory framework for financial services. That framework includes a dedicated conduct regulator in the FCA, with a remit to set and apply high standards of consumer protection for regulated financial services. The work of the FOS and the FCA should be more closely aligned so that those high standards of consumer protection are applied consistently, both through the FCA’s work in regulating firms and through the FOS when consumers need help with resolving complaints made against FCA-regulated firms.

The government is therefore proposing to adapt the Fair and Reasonable test so that firms can have confidence that, where conduct complained of is in scope of FCA rules, compliance with those rules, in accordance with the FCA’s intention for what those rules should achieve, will mean that the FOS is required to find a firm has acted fairly and reasonably.

Adapting the Fair and Reasonable Test

Section 228(2) of FSMA currently provides that, “A complaint is to be determined by reference to what is, in the opinion of the ombudsman, fair and reasonable in all the circumstances of the case”. The DISP Rules (3.6.4R) set out further that, “In considering what is fair and reasonable in all the circumstances of the case, the Ombudsman will take into account: (1) relevant: (a) law and regulations; (b) regulators’ rules, guidance and standards; (c) codes of practice; and (2) (where appropriate) what he considers to have been good industry practice at the relevant time”.

Many complaints that come to the FOS relate to simple maladministration or poor service from firms arising in individual situations, where FCA rules or law will not be material. The government considers that the Fair and Reasonable test works well for such cases. As now, the FOS will be able to use the Fair and Reasonable test to determine what is fair and reasonable conduct in the individual circumstances of the case. The government wishes to clarify, for the avoidance of doubt, that the Fair and Reasonable test requires the FOS to consider what is fair and reasonable to all parties – in determining what is fair and reasonable, the FOS should assess what is fair and reasonable for both the complainant and the respondent.

Where FCA rules are material to the resolution of a complaint, the government will align the Fair and Reasonable test with the overall regulatory approach for financial services. The government will legislate to make clear that, where conduct complained of is in scope of FCA rules, compliance with those rules, consistent with the FCA’s intention for what those rules should achieve, will mean that a firm has acted fairly and reasonably. The FOS will need to consider the FCA rules that applied and should have been complied with at the time the alleged misconduct took place, as the FCA intended. This will operate so that there can be no retrospective application by the FOS of contemporary FCA rules. This approach will avoid the potential for misalignment between FOS determinations and FCA rules, resulting in more consistent and predictable resolution of complaints for consumers and firms.

In some cases, provisions in law, which the FCA does not make, may be material to assessing what is fair and reasonable conduct in the circumstances of the case, such as consumer protections provided for in legislation or contract requirements in common law. Where FCA rules reflect the law, or where the FCA has issued guidance on how relevant law applies to regulated firms (such as FCA guidance on the duty to give information under the Consumer Credit Act 1974), the adaptation of the Fair and Reasonable test will mean that fair and reasonable conduct should be determined by reference to the FCA’s rules and/or guidance.

Where relevant law is not addressed by FCA rules or guidance, the FOS, as now, will be able to take that law into account when assessing what is fair and reasonable conduct in the circumstances of the case. If the FOS taking into account relevant law to determine what is fair and reasonable in a particular case raises an issue which has the potential to result in wider implications for consumers or firms, the FOS will be required to refer the issue to the FCA for consideration. The government has concluded that any issue of law or regulation which has wider implications for consumers and firms is a regulatory issue and should be given due consideration by the regulator – particularly as in such cases a regulatory intervention (which would have general application) may be more appropriate than awarding redress in respect of individual complaints. The FCA may request that the FOS pause the handling of affected complaints while it determines an appropriate response.

If the FOS refers an issue to the FCA on law relevant to a complaint which the FCA determines may have wider implications for consumers or firms, and the FCA considers that it would be beneficial to obtain legal certainty from the courts on the application of that law, the government will ensure that the FCA is able to refer the matter to the courts as a test case (as the FCA has done in the past using the High Court’s Financial Markets Test Case Scheme). In this circumstance, once the courts have provided a ruling, it will be for the FCA to consider whether any changes to FCA rules or guidance are needed to take account of the court ruling.

Cases where alternative proceedings may be more appropriate

The government considers that there may be individual cases where the FOS is not the appropriate body to determine whether a firm has complied with its obligations and whether compensation is payable to a consumer, due to the complexity of the issues and particularly where a disputed requirement in law is central to those issues. In order to safeguard the FOS’s core purpose and to ensure that it can provide a good service, it may be more appropriate for the courts to consider these cases.

Prior to 2015, the FOS had the ability to dismiss a case directly, without considering it on its merits, for a range of reasons, including where “it would be more suitable for the subject matter of the complaint to be dealt with by a court, arbitration or another complaints scheme”. This ground for dismissal, and others, were no longer applicable to cases from 2015 onward, once the UK implemented EU Directive 2013/11/EU on alternative dispute resolution for consumer complaints through the Alternative Dispute Resolution for Consumer Disputes (Competent Authorities and Information) Regulations 2015 (“the ADR Regulations”)[footnote 6].

The government has confirmed that, when it replaces the ADR Regulations in Spring 2026, it will remove the FOS from the scope of that legislation. This will open up greater flexibility for the FOS to consider grounds for dismissing a case for it to be dealt with more appropriately by an alternative channel.

Questions

Question 1: Do you agree that, where conduct complained of is in scope of FCA rules, compliance with those rules will mean that the FOS is required to find a firm has acted fairly and reasonably?

Question 2: Will the aligning of the Fair and Reasonable test with FCA rules still allow the FOS to continue to play its relatively quick and simple role resolving complaints between consumers and businesses?

Question 3: Do you agree with the proposed approach for dealing with law which may be relevant to a complaint before the FOS?

Question 4: Do you consider that there are some cases that are not appropriate for the FOS to determine, bearing in mind its purpose as a simple and quick dispute resolution service? How should such cases be dealt with?

Referrals to the FCA on the interpretation of FCA rules

The proposal set out above, for fair and reasonable conduct to be determined in accordance with relevant FCA rules, will require the FOS to have a thorough understanding of what the FCA intends those rules to achieve. There is already cooperation between the FOS and the FCA, which includes work to ensure there is a shared understanding of regulatory requirements across both organisations. However, feedback received has highlighted concerns that the approaches of the FOS and the FCA do not always align and that there is a lack of understanding and transparency around how the FOS and FCA work together to ensure consistent application of FCA standards.

In order to facilitate enhanced collaboration between the FOS and the FCA, the government will introduce a dedicated mechanism that will support the FOS in applying FCA rules in accordance with the FCA’s regulatory intent.

The FCA, as the UK’s dedicated conduct regulator for financial services, is responsible for regulating the sector in accordance with its statutory objectives: protecting consumers, the integrity of markets, promoting competition in the interests of consumers, and its secondary growth and competitiveness objective. It sets the rules and standards that firms are required to meet and holds them to account for doing so through its authorisation, supervision and enforcement activities. In carrying out those functions, the FCA is obliged to decide what those standards require of firms, so that they produce good outcomes for consumers. It is therefore appropriate that the FOS, in determining whether a firm’s conduct has been fair and reasonable, should establish whether a firm has complied with relevant FCA rules, in accordance with the FCA’s view of what those rules are intended to achieve. Where a firm has complied with relevant FCA rules in this way, it will be regarded as having acted in a fair and reasonable way.

The government therefore proposes that, where the FOS is making determinations that rely on the interpretation of FCA rules, and where the FOS considers there is ambiguity in how those rules apply to the types of issues raised by a case, there should be a formal mechanism requiring the FOS to request a view from the FCA on the interpretation of its rules as they pertain to those issues. This would not require the FCA to consider the merits of any individual case, nor to allow a direction to the FOS on how any individual case should be determined, but it would require the FCA to provide a clear view on what its rules are intended to achieve in certain types of case within a prescribed timescale.

The government will also legislate to ensure that parties to a complaint have the ability to request that the FOS refers an issue of rule interpretation to the FCA. The new end-to-end case process proposed by the FOS reflects this. The process will include a stage where the FOS’s provisional assessment on the determination of a complaint will be presented to the parties to seek their views. If, at this stage, a party is concerned about the interpretation of FCA rules applied by the FOS, the party will be able to request that the FOS seeks a view from the FCA on interpretation of those rules in relation to those issues. Where an FCA view is provided, the FOS can then apply that view before making its final determination.

The detailed grounds for a party being able to make this request will need to be set out in the FCA’s Handbook and the FOS will need to check that the grounds have been met before granting the request. The grounds would include:

- That FCA rules must be material to the complaint

- There must be ambiguity or room for interpretation in how relevant rules should apply to the types of issues raised by the complaint

- The FCA has not previously given the FOS a view on interpretation of those rules

When requested, the FCA would be required to provide a view to the FOS within a set period of time, so as to enable the FOS to continue providing prompt resolution of complaints. This will be set at 30 days, in line with the planned rule interpretation referral process that the FCA and the FOS have set out in their consultation document. In exceptional circumstances, where the importance or complexity of the issues raised merits more in-depth consideration by the FCA, such as where an important wider implications issue is involved, the FCA may need more time and will notify the FOS accordingly.

Referrals to the FCA on wider implications issues

The proposals set out above are intended to provide that fair and reasonable conduct in FOS cases is determined, where relevant, by reference to FCA rules, in accordance with the FCA’s intent for those rules. Where a view on interpretation of FCA rules is needed to ensure FCA rules are considered in line with the FCA’s intent, the referral mechanism proposed above will provide for that to happen.

However, the government recognises that, in a small minority of cases, the subject matter of a complaint may raise issues that could have wider implications for other consumers and/or firms. The government has concluded that dealing with wider implications issues is a regulatory responsibility, and that the FCA should be fully responsible for considering whether a wider implications issue exists and what the regulatory response to such an issue should be. The government will legislate to ensure that the redress framework makes this clear and to provide that the handling of complaints before the FOS is consistent with this approach.

Where the FOS judges that the subject matter of a complaint may raise a wider implications issue, legislation will oblige the FOS to refer that issue to the FCA, and the FCA will be obliged to consider the issue. Legislation will also be used to provide parties to a complaint with the ability to request that the FOS refer such an issue to FCA where appropriate. Where the FCA judges it necessary, the FCA will be able to direct the FOS to pause relevant complaints while it considers the issue.

This approach is reflected in the new end-to-end case process being proposed by the FOS. Through its new triage stage, the FOS will check to see whether a wider implications issue being considered by the FCA is relevant to a complaint. During the review stage of a complaint, if the FOS judges that an issue has potential to have wider implications, it will refer the issue to the FCA to consider. These steps built into the FOS complaint handling process will facilitate an early regulatory response, where appropriate, to issues which have potential to put consumers at risk or disrupt markets.

In order to help firms and consumers play their part in identifying potential wider implications issues, the government will provide for parties to a complaint to be able to request that the FCA consider an issue raised by a case which may have wider implications or the potential to be a Mass Redress Event.

If, at the stage where the FOS has presented its provisional assessment on determination of a case, a party believes the case raises issues which may affect consumers or firms more broadly, the party will be able to request that the FOS refers the issue to the FCA.

Where the FOS refers a potential wider implications issue to the FCA, either of its own volition or at the request of parties to a complaint, the FCA will have a statutory obligation to assess whether it does indeed raise an issue which will impact consumers or firms more broadly, and to respond as necessary.

In making its assessment, the FCA will be required to consult its statutory consumer and industry panels. Once those panels have had the opportunity to contribute views, the FCA will determine what its response should be, which may include giving a view to the FOS on interpretation of any relevant FCA rules or law; seeking clarity from the courts on an issue of law; or deciding that the issue warrants a change to FCA rules or guidance. Should the FCA decide that the complaint involved is, or may be, part of a Mass Redress Event, the FCA will, if appropriate, be able to direct the FOS to pause handling of this and other related complaints (see chapter 4 on Mass Redress Events).

The FCA should not be involved in determining individual complaints before the FOS

The government is mindful that the ability of parties to request a referral to the FCA, (whether on the interpretation of FCA rules or for the consideration of a wider implications issue) will need to be managed carefully to ensure it is only used where necessary. The process for a party to request a referral to the FCA, and the grounds that a party will need to meet to demonstrate that a referral is needed, will be set out by the FCA in its Handbook.

It is important to note that the ability of parties to a complaint to request a view on interpretation of FCA rules or FCA consideration of a potential wider implications issue is not intended to act as an appeals mechanism to the FCA for parties who may be dissatisfied with FOS determination of an individual case.

The government has concluded that it would not be appropriate for the FCA to have a role in settling individual complaints. The FCA’s role is to ensure it supports the ability of the FOS to apply a correct understanding of FCA rules to the circumstances of each individual complaint. It is also the proper role of the FCA to consider, and respond as necessary, to issues of wider implication raised by individual cases – for example, considering whether it is necessary to clarify its rules or otherwise make a regulatory intervention.

The role of the courts

As set out above, the government will ensure that the FOS is able to dismiss cases that would be dealt with more appropriately by the courts. The government will also ensure that the FCA is able, where necessary, to seek a view from the courts on an important point of law that has wider implications for consumers and/or firms. But the government has concluded that a greater role for the courts in examining individual FOS determinations would not support the policy aims of the redress framework and would result in greater pressure on the courts system without providing any benefit to consumers or firms.

Some stakeholders have suggested that an appeals mechanism to the courts should be available to parties in individual cases once the FOS has made a final determination. While consumers have the option of rejecting a final FOS determination (for example, to instead pursue the matter through the courts), firms have no right to reject a FOS determination and no route of appeal. An application for judicial review is an option that is available to any party to a FOS determination, but judicial review will not deal with the merits of an individual case, it will only examine the lawfulness of a FOS determination, such as whether the FOS followed correct procedure in arriving at its determination.

The government has considered this and concluded such a mechanism would not be appropriate for a number of reasons. Introducing a formal link to the courts and tribunal system risks moving the FOS away from its core purpose, which is to provide a simple, impartial dispute resolution service that quickly and effectively deals with complaints. It is difficult to see how more financial services disputes reaching the courts, with the additional cost and time that court cases involve, would be in the interests of firms or consumers. This would also put additional pressure on the court system, with no clear benefit to users or providers of financial services.

Finally, a courts appeal mechanism does not fit with the government’s overarching policy aim, which is to provide a more coherent regulatory regime for financial services, with consistent standards of consumer protection set by the regulator and applied by the FOS to individual complaints. The government considers that the package of proposals set out above will most directly support this aim.

Questions

Question 5: Do you agree that there should be a mechanism for the FOS to seek a view from the FCA when it is making an interpretation of what is required by the FCA’s rules?

Question 6: Do you agree that parties to a complaint should have the ability to request that the FOS seeks a view from the FCA on interpretation of FCA rules where the FCA has not previously given a view?

Question 7: Do you agree that parties to a complaint should have the ability to request that the FCA considers whether the issues raised by a case have wider implications for consumers and firms?

Question 8: As part of implementing the proposed referral mechanism, do you think there are any issues which should be considered in order to ensure the mechanism works in the interests of all parties to a complaint?

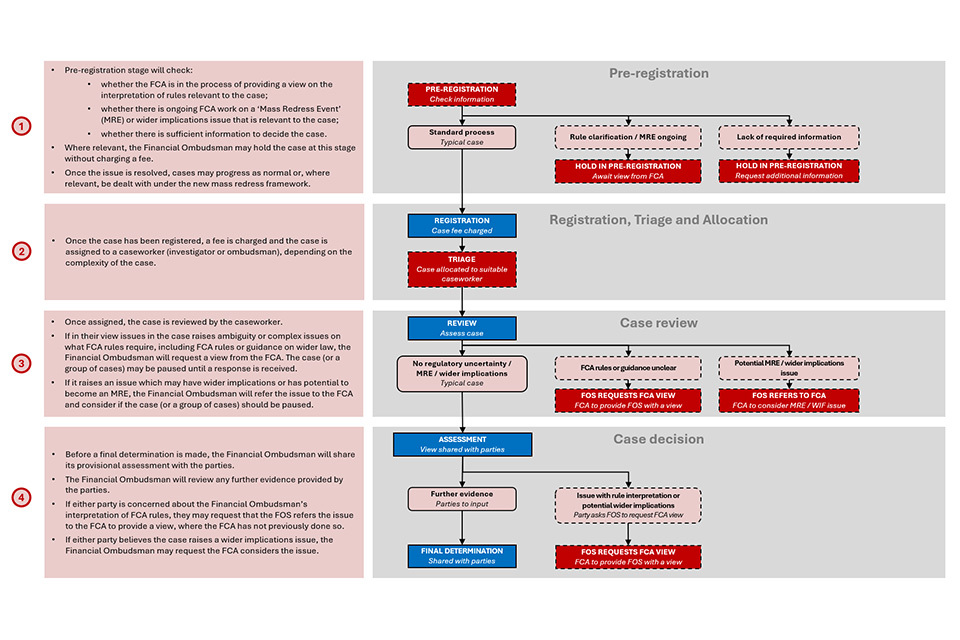

New end-to-end FOS case journey flow chart

New end-to-end FOS case journey flow chart

Consistency across FOS determinations

As well as ensuring consistency of approach between the FOS and the FCA, the government wants to ensure that the legislative framework supports consistency of approach within the FOS itself. FSMA currently provides for determinations to be made by any member of the panel of ombudsmen that deal with FOS cases, with there being no overall point of responsibility for determinations within the FOS.

In order to facilitate overall strategic management of the caseload and consistent case determinations, the government intends to adapt the statutory basis for the FOS so that the function for determining cases rests with the Chief Ombudsman. While ultimate authority would then rest with the Chief Ombudsman, they will be able to delegate the carrying on of that function to their team working within the FOS, according to the parameters they set.

By giving the Chief Ombudsman overall authority for all FOS determinations, the holder of that post will be expected to ensure that the FOS produces determinations which are consistent, contributing to the government’s overall policy aim of complaint determinations which offer regulatory certainty and predictable outcomes for both consumers and firms.

Questions

Question 9: Do you agree that the Chief Ombudsman should have overall authority for determinations made by FOS ombudsmen, and through that authority, should be responsible for ensuring consistent FOS determinations?

Transparency around the approach to FOS determinations

The government views meaningful transparency as important to underpinning confidence in the work of the FCA and the FOS to ensure consistent application of FCA rules in accordance with the FCA’s intent.

The key existing transparency requirement applying to the FOS is a statutory obligation for the FOS to publish each individual determination made by an ombudsman.

The government is concerned that this requirement is not necessarily the most helpful way of providing a clear view to consumers and firms on what to expect when certain types of complaint are brough to the FOS. The FOS publishes over 20,000 decisions a year, and it is not reasonable to expect consumers or firms to scrutinise this volume of decisions and extrapolate the FOS’s approach to certain types of complaint.

We are interested in views on what transparency arrangements would be most helpful in providing an accessible way for consumers and firms to understand what to expect when a case is brought to the FOS.

In particular, the government is considering placing a requirement on the FOS to publish quarterly thematic guidance documents on how particular types of case are investigated and how the FOS would expect to see the relevant FCA standards applied to such cases. These reports could either replace the requirement to publish individual decisions or sit alongside it.

The government is also interested in views on how transparency arrangements can be used to demonstrate to consumers and firms that the FOS has worked with the FCA to ensure it has a thorough understanding of relevant FCA standards and how the FCA intends those standards to be followed by firms. So, for example, the case guidance documents referred to above could be jointly developed and issued by the FCA and the FOS, or the FOS could be required to seek FCA approval before such guidance documents are published.

Questions

Question 10: What approach to transparency arrangements would provide the most accessible way for consumers and firms to understand what outcomes to expect for particular types of cases that the FOS deals with?

All of the proposed reforms set out above are designed to work as a package of measures to set the optimal framework within which the FOS will be well placed to fulfil its original purpose as a simple, impartial dispute resolution service which quickly and effectively deals with complaints, and which works in concert with the FCA.

Questions

Question 11: Do you think the package of reforms outlined above, taken together, will be sufficient to address the problems identified by the review and ensure the FOS fulfils its original purpose?

Institutional arrangements for the FOS

Central to the package of reforms being proposed is a much more coherent and clearer set of functions across the FOS and the FCA. But we want to use this consultation to test views and consider whether institutional changes are also needed to address the concerns raised.

There is already close working between the FOS and the FCA designed into the regulatory architecture, which will be reinforced through the package of measures proposed above.

Central to the government’s Regulation Action Plan[footnote 7] published in March is the drive to streamline processes and ways of working to improve the effectiveness of public bodies that interact with businesses and consumers. Consistent with the Regulation Action Plan, the government wants to consider whether the current institutional arrangements for the FOS will continue to support the reforms set out in this consultation by facilitating more effective collaboration and greater coherence between the FOS and the FCA, or whether an alternative approach would better advance the objectives of this consultation.

One option the government is seeking views on is whether there would be benefits to making the FOS a subsidiary of the FCA, so that both organisations become part of the same corporate group.

Such an approach may have the potential to bring benefits to how the FCA and the FOS work together. For example:

- A strategic management function across both organisations may enable relevant, key functions across the FCA and FOS to be managed together. This could facilitate better understanding of FCA rules by FOS staff. Cross-membership of FCA and FOS boards could be used to oversee these shared management approaches at the top of both organisations.

- A closer institutional relationship to further enhance the exchange of information between the FOS and the FCA. While there are limited legal barriers to the sharing of information at the moment, this could help to streamline processes and speed up the sharing of information. It may also assist in more efficient sharing of trend information from cases with the FCA at the earliest possible opportunity, enabling earlier FCA intervention on appropriate issues.

However, making the FOS a subsidiary of the FCA may also bring potential risks and drawbacks. These include:

- The potential to be perceived as compromising the operational independence and impartiality of the FOS and the FCA. Particularly in contentious or high-profile cases, this may risk complaints adjudication no longer being seen as completely independent from regulatory oversight.

- Potential implementation challenges. The legal, operational and staffing changes required for such a move could require significant time and investment and could divert resources from current FCA/FOS priorities, including potentially distracting from the wider reforms proposed to the redress framework in this consultation.

Questions

Question 12: Taking into account the other reforms proposed in this consultation, do you think that the FOS should be made a subsidiary of the FCA? If so, what are your views on the appropriate institutional arrangements?

3. Time limits for referring complaints to the FOS

Both the courts and the various alternative dispute resolution schemes available in the UK operate with some form of time limit to bringing complaints. It is a well-established principle of law that the bringing of claims should not be possible in perpetuity.

The government wants to ensure that the time limits which operate for complaints are consistent with the core purpose of the FOS as a simple and cost-effective alternative to the courts for resolving complaints. The government believes that an appropriate time limit on FOS complaints should:

- be fair to consumers and firms

- be clear and straightforward to understand and apply

- not run the risk of the FOS having to deal with a high number of historic cases, which can be challenging to resolve quickly and effectively using quick and simple dispute resolution methods

The DISP Rules (2.8.2R) set out that the FOS cannot consider a complaint that is referred to the FOS “more than: (a) six years after the event complained of; or (if later) (b) three years from the date on which the complainant became aware (or ought reasonably to have become aware) that he had cause for complaint”, with limited exceptions, such as where the failure to comply with the time limit was as a result of exceptional circumstances. In applying these rules, the FOS must determine what constitutes “reasonable awareness” of a cause to complain and when the “event” giving rise to a complaint occurred.

The government recognises there are concerns that these limits, without any overall absolute time limit, create uncertainty for firms about unpredictable, historic redress liabilities which has, in some cases, deterred investment in UK financial services firms.

The limits also place firms in a difficult position of having to consider whether to retain personal data that may be needed to respond to potential historic complaints, whilst also complying with the data handling requirements under the General Data Protection Regulations (GDPR), where organisations must not hold personal data for longer than is necessary for the purposes for which it was collected.

Historic cases are also challenging for the FOS to resolve in a simple and quick manner, as the passage of time often means that relevant information is not available in order to make a decision.

Any limits must be balanced with protecting consumers’ ability to access simple and quick redress through the FOS, particularly in relation to longer-term products, such as pensions, mortgages and long-term investments, where knowledge of the cause to complain may not emerge until a significant amount of time after the event.

The government considers that setting out an absolute time limit in legislation would provide greater certainty for all parties around the maximum time within which a complaint can be brought to the FOS. However, it also recognises that there may need to be limited flexibility to depart from this in exceptional circumstances where longer timeframes are justified, for example, longer-term products such as pensions, mortgages and long-term investments.

In keeping with the objective for the FOS to operate as a simple dispute resolution service that quickly and effectively deals with complaints, the government proposes to introduce an absolute time limit of 10 years for bringing cases to the FOS. This means that a complaint must be brought:

- within six years from the event complained of

- if later than six years, three years from the date the complainant became aware, or ought reasonably to have become aware, of the event complained of

- within an absolute limit of no later than 10 years since the event occurred

The government views this to be a proportionate and fair limit for most regulated financial services. However, to ensure appropriate treatment of long-term products, the government proposes giving responsibility to the FCA for setting out certain exceptions, where some services or issues will be subject to a longer limit. The FCA will set out these exceptions and the appropriate time limit through its DISP rules.

From the date of its implementation, the new absolute time limit would apply to all new complaints brought to the FOS. Any complaints submitted to the FOS before implementation would be considered by the FOS in accordance with the time limit rules currently set out in DISP rules.

This absolute time limit is intended to support the remit of the FOS as a simple and quick dispute resolution service. For any cases that fall outside of the FOS absolute time limit, but within other statutory limitations, the claimant would retain the option of seeking redress through the courts.

Questions

Question 13: Do you agree that 10 years is an appropriate absolute time limit for complainants to bring a complaint to the FOS?

Question 14: Do you agree that the FCA should have the ability to make limited exceptions to this time limit?

4. Mass Redress Events

Mass redress events (MREs) are those where a particular issue, or set of issues, leads to a large number of complaints with the potential for a significant amount of compensation to be owed, and which therefore have significant impact on consumers and/or firms. It is the government’s view that, as the financial services conduct regulator, the FCA should be fully responsible for investigating these events and, where necessary, for setting the regulatory response to such events, to ensure consumers are protected with minimal disruption to markets.

As explained in previous chapters, the government is committed to the original vision of the FOS as a simple, impartial dispute resolution service which quickly and effectively deals with complaints against financial services firms. The FOS was never intended to have responsibility for addressing broader regulatory issues and it is not equipped to deal with these events. The current framework for MREs can leave the FOS in the position of having to deal with challenging complaints that could be part of an MRE, while the FCA is investigating the potential MRE and before it has decided on the appropriate regulatory response. Such an approach can result in an inefficient and uncertain approach to complaints, with inconsistent outcomes for consumers.

Feedback has highlighted that existing tools and processes for handling MREs are not always clearly distinct from those for individual case handling by the FOS. Stakeholders also broadly agreed that the FOS is not equipped to handle MREs.

The government wants to ensure that the FCA has the right tools to investigate and declare MREs quickly; to implement any appropriate market-wide response efficiently; and to ensure there is minimal disruption for consumers and firms throughout the process.

Investigation of potential MREs

Investigating a potential MRE is the responsibility of the FCA. In its consultation published today, the FCA has set out its proposed approach to identifying and investigating potential MREs, including how it will define these events and how it will manage the ‘redress pathway’ with firms and consumers while the FCA is investigating a potential MRE and developing any mass redress response.

In the government’s view, it is the role of the regulatory framework to ensure that the FCA can intervene effectively to minimise any market disruption and to protect consumers during the period through which it is investigating a potential MRE.

The FCA currently relies on its general rule-making powers to make rules that disapply some rules set out in DISP on the time limits for firms to resolve complaints, but the FCA has no special power to do so where there is clear evidence of an MRE emerging and it is in the public interest for the FCA to act quickly. Where appropriate, the government considers that it is in the interests of consumers and firms to pause the handling of complaints until the FCA can provide clarity on the nature of the problem giving rise to those complaints and on any necessary regulatory or redress response. Dealing with complaints once the FCA is able to provide that clarity ensures complaints can then be resolved in accordance with the FCA’s findings, resulting in greater certainty and more orderly management of complaints than would otherwise be the case.

The government has identified limitations with the FCA’s existing powers, which it proposes to address to increase the effectiveness of the FCA’s ability to handle MREs. First, the FCA is obliged to consult on rules which pause the handling of cases with firms, which means this intervention cannot always be made quickly. Second, while FSMA provides for the FCA to be exempt from the requirement to consult on rules where a consultation would be prejudicial to the interests of consumers, meeting this test before the FCA has fully investigated a potential MRE can be challenging for the FCA. Third, the FCA is not able to require the pausing of similar complaints which have already reached the FOS.

The government will amend FSMA so that, where the FCA judges that immediate pausing of the complaint handling process is in the interests of affected consumers and firms, the FCA will be exempt from the usual obligation to consult before making rules.

The FCA will also be able to pause the handling of relevant complaints which have reached the FOS where it considers it appropriate to do so. Where needed, this will ensure that all relevant complaints are paused with immediate effect, until the FCA is in a position to provide clarity on the nature of the problem and to set out any necessary redress response. This will give consumers and firms greater certainty and provide for more orderly and consistent handling of complaints where an MRE has taken place.

The government is interested in considering further tools that the FCA could use to help stabilise a potentially disruptive situation for consumers while an MRE is being investigated, and in advance of any redress solution being put in place. For example, the nature of some MREs can have an adverse impact on the stability of affected firms and their ability to provide redress to consumers once the FCA has completed its investigation. The government would be interested in views on whether the FCA’s general powers in relation to regulated firms are sufficient to intervene and help support the stability of firms affected by an MRE, or whether specific powers should be considered for this purpose.

Industry-wide redress schemes

Once the FCA has completed an investigation and judged an MRE to have taken place, it may then consider whether an FCA intervention would be appropriate or necessary, either in the form of guidance to support firm-led complaints handling, or through firm-specific redress schemes, or section 404 FSMA industry-wide redress schemes.

Section 404 of FSMA is one of several important tools available for delivering appropriate and consistent market-wide redress following an MRE. Schemes established under section 404 require firms to review their past business, in order to identify instances of misconduct relevant to an MRE declared by the FCA, and to determine redress for affected consumers in accordance with the terms of the section 404 scheme.

Currently, the FCA can only introduce a scheme under section 404 if:

- it appears to the FCA that there may have been widespread or regular failure by firms to comply with relevant requirements

- it appears to the FCA that consumers have, or may, suffer loss for which there would be a remedy available in court proceedings

- it considers it is desirable to make rules for a scheme to secure redress for the affected consumers

The government is concerned that the legislative test which determines whether the FCA is able to introduce a section 404 scheme is overly complex and not necessarily appropriate for all types of MRE; for example, an MRE could involve a small number of firms or consumers, and therefore the FCA could be required to investigate further whether this situation qualifies as sufficiently “widespread” or ‘”regular” to meet the test. This risks significant delay to consumers getting the redress they need, or even the FCA being prevented from introducing a scheme at all.

The requirement for the FCA to identify loss which appears to the FCA has, or may have, been suffered by consumers that would be subject to a remedy in court proceedings, may also be inappropriate in some circumstances. Serious breaches of FCA standards may take place where it is not clear that those breaches would be subject to remedy before the courts, a significant breach of the FCA’s Consumer Duty being an example. Under FSMA, breach of the Consumer Duty is not something which is actionable through the courts and so breach of the Duty would not be subject to a remedy from the courts.

The government is therefore considering whether changes to the test set out in section 404(1) of FSMA are necessary, to ensure that the FCA has greater flexibility on when to introduce a section 404 scheme and is able to perform a more proportionate assessment of whether a section 404 scheme is appropriate. For example, a modified test could be based on whether the FCA has identified an MRE that is consistent with the new definition of an MRE that the FCA has proposed in its consultation;[footnote 8] and whether the FCA judges that a section 404 redress scheme is appropriate to respond to an MRE in a way which is necessary to meet any of its statutory objectives.

Section 404B of FSMA sets out how the FOS must deal with complaints where the subject matter of those complaints is covered by a consumer redress scheme introduced under section 404 of FSMA. It requires the FOS to determine such complaints in accordance with the terms of the redress scheme.

The government proposes to use legislation to help provide for consistent and orderly responses to MREs more generally. Where the subject matter of complaints received by the FOS is covered by FCA guidance to support firm-led complaints handling, or firm-specific redress schemes, or a section 404 scheme, the government believes that the FOS should determine those complaints in accordance with the terms of the relevant scheme. The government also proposes to give the FCA the ability to direct that any unresolved FOS complaints involving subject matter which is covered by either a firm-led redress scheme or a section 404 scheme are referred back to the relevant firm, to be dealt with under the terms of the relevant redress scheme. These measures will help provide consistent approaches to mass redress that are delivered in an orderly way in the interests of consumers and firms.

Questions

Question 15: Do you agree that the FCA should have more flexibility, when investigating a potential MRE, to take steps that are designed to avoid disruption and uncertainty for consumers and firms? In addition to the proposals made above, do you think there are other tools for the FCA which should be considered?

Question 16: Do you agree that there should be a simpler legal test for the FCA to satisfy in deciding that a section 404 redress scheme is needed to respond quickly and effectively to an MRE?

Question 17: Do you agree that the FCA should be able to direct the FOS to handle complaints consistently with relevant redress schemes, or to direct the FOS to pass related complaints back to firms, to be dealt with by those redress schemes?

5. Consultation Questions

List of questions

Question 1: Do you agree that, where conduct complained of is in scope of FCA rules, compliance with those rules will mean that the FOS is required to find a firm has acted fairly and reasonably?

Question 2: Will the aligning of the Fair and Reasonable test with FCA rules still allow the FOS to continue to play its relatively quick and simple role resolving complaints between consumers and businesses?

Question 3: Do you agree with the proposed approach for dealing with law which may be relevant to a complaint before the FOS?

Question 4: Do you consider that there are some cases that are not appropriate for the FOS to determine, bearing in mind its purpose as a simple and quick dispute resolution service? How should such cases be dealt with?

Question 5: Do you agree that there should be a mechanism for the FOS to seek a view from the FCA when it is making an interpretation of what is required by the FCA’s rules?

Question 6: Do you agree that parties to a complaint should have the ability to request that the FOS seeks a view from the FCA on interpretation of FCA rules where the FCA has not previously given a view?

Question 7: Do you agree that parties to a complaint should have the ability to request that the FCA considers whether the issues raised by a case have wider implications for consumers and firms?

Question 8: As part of implementing the proposed referral mechanism, do you think there are any issues which should be considered in order to ensure the mechanism works in the interests of all parties to a complaint?

Question 9: Do you agree that the Chief Ombudsman should have overall authority for determinations made by FOS ombudsmen, and through that authority, should be responsible for ensuring consistent FOS determinations?

Question 10: What approach to transparency arrangements would provide the most accessible way for consumers and firms to understand what outcomes to expect for particular types of cases that the FOS deals with?

Question 11: Do you think the package of reforms outlined above, taken together, will be sufficient to address the problems identified by the review and ensure the FOS fulfils its original purpose?

Question 12: Taking into account the other reforms proposed in this consultation, do you think that the FOS should be made a subsidiary of the FCA? If so, what are your views on the appropriate institutional arrangements?

Question 13: Do you agree that 10 years is an appropriate absolute time limit for complainants to bring a complaint to the FOS?

Question 14: Do you agree that the FCA should have the ability to make limited exceptions to this time limit?

Question 15: Do you agree that the FCA should have more flexibility, when investigating a potential MRE, to take steps that are designed to avoid disruption and uncertainty for consumers and firms? In addition to the proposals made above, do you think there are other tools for the FCA which should be considered?

Question 16: Do you agree that there should be a simpler legal test for the FCA to satisfy in deciding that a section 404 redress scheme is needed to respond quickly and effectively to an MRE?

Question 17: Do you agree that the FCA should be able to direct the FOS to handle complaints consistently with relevant redress schemes, or to direct the FOS to pass related complaints back to firms, to be dealt with by those redress schemes?

6. Responding to the consultation

This consultation will remain open for 12 weeks, closing on 8 October 2025. We are inviting stakeholders to provide responses to the questions set out above.

Who should respond?

The government is interested in receiving representations from all interested parties and stakeholders.

How to submit responses

Please submit responses via email to:

Or post to:

Financial Services Strategy

HM Treasury

1 Horse Guards Road

SW1A 2HQ

Processing of personal data

This section sets out how we will use your personal data and explains your relevant rights under the UK General Data Protection Regulation (UK GDPR). For the purposes of the UK GDPR, HM Treasury is the data controller for any personal data you provide in response to this consultation.

Data subjects

The personal data we will collect relates to individuals responding to this consultation. These responses will come from a wide group of stakeholders with knowledge of a particular issue.

The personal data we collect

The personal data will be collected through email submissions and are likely to include respondents’ names, email addresses, their job titles and opinions.

How we will use the personal data

This personal data will only be processed for the purpose of obtaining opinions about government policies, proposals, or an issue of public interest.

Processing of this personal data is necessary to help us understand who has responded to this consultation and, in some cases, contact respondents to discuss their response.

HM Treasury will not include any personal data when publishing its response to this consultation.

Lawful basis for processing the personal data

Article 6(1)(e) of the UK GDPR; the processing is necessary for the performance of a task we are carrying out in the public interest. This task is consulting on the development of departmental policies or proposals to help us to develop effective government policies.

Who will have access to the personal data

The personal data will only be made available to those with a legitimate business need to see it as part of consultation process.

Consultation responses, including personal identifiers, will be shared with other government departments where relevant for the purposes of this policy development.

As the personal data is stored on our IT infrastructure, it will be accessible to our IT service providers. They will only process this personal data for our purposes and in fulfilment with the contractual obligations they have with us.

How long we hold the personal data for

We will retain the personal data until work on the consultation is complete and no longer needed.

Your data protection rights

Relevant rights, in relation to this activity are to:

- request information about how we process your personal data and request a copy of it

- object to the processing of your personal data

- request that any inaccuracies in your personal data are rectified without delay

- request that your personal data are erased if there is no longer a justification for them to be processed

- complain to the Information Commissioner’s Office if you are unhappy with the way in which we have processed your personal data

How to submit a data subject access request (DSAR)

To request access to your personal data that HM Treasury holds, please email: dsar@hmtreasury.gov.uk

Complaints

If you have concerns about Treasury’s use of your personal data, please contact our Data Protection Officer (DPO) in the first instance at: privacy@hmtreasury.gov.uk

If we are unable to address your concerns to your satisfaction, you can make a complaint to the Information Commissioner at casework@ico.org.uk or via this website: https://ico.org.uk/make-a-complaint.

-

A new approach to ensure regulators and regulation support growth ↩

-

A new approach to ensure regulators and regulation support growth ↩

-

A new approach to ensure regulators and regulation support growth ↩

-

The Alternative Dispute Resolution for Consumer Disputes (Competent Authorities and Information) Regulations 2015 ↩

-

A new approach to ensure regulators and regulation support growth ↩