Freeports consultation: boosting trade, jobs and investment across the UK

Updated 7 October 2020

Ministerial foreword

In the Ancient World, Greek and Roman ships – piled high with traders’ wines and olive oils – found safe harbour in the free port of Delos, a small Greek island in the waters of the Aegean. Offering respite from import taxes in the hope of attracting the patronage of merchants, the Delosian model of a ‘free port’ has rarely been out of use since.

Because freeports still offer that same story of trade and prosperity across the modern world. From the UAE to the USA, China to California, global freeports support jobs, trade and investment. They serve as humming hubs of high-quality manufacturing, titans of trans-shipment and warehouses for wealth-creating goods and services. The UK will recreate the best aspects of international freeports in the brand-new, best-in-class, bespoke model set out in the following pages.

We want freeports to boost trade, jobs and investment. That’s why we’re cutting red tape by streamlining customs processes, exploring the use of planning measures to speed up planning processes and accelerate development and housing delivery in and around freeports, and consulting on a comprehensive set of tax breaks to support businesses.

We want freeports to act as hotbeds of innovation in order to form innovative business clusters that benefit the local area. That’s why we’re also looking at regulatory flexibilities, funding and challenges which will support innovators generating new ideas.

Most importantly, freeports will be a cornerstone of the government’s plan to level up opportunity across the country. So our criteria for allocating freeports will be geared towards areas of greatest need. This will allow us to drive forward investment and regeneration in some of the most deprived areas in the UK, delivering highly-skilled jobs for people across the country.

The Prime Minister made freeports one of the centrepieces of his recent election campaign because they capture the essence of this government’s ambition. Not afraid of globalisation, but always making sure it works for our less affluent communities. Setting our own trading arrangements in a way that works for all parts of our nation. Out of the EU and into the world.

Now we want to hear from you: from the businesses, ports and communities that make this nation great. How will these proposals help you? What else are you interested in? Come and let us know.

We have just turned the page on a great new chapter for this country. Freeports will let us sail onto our next, great, prosperous destination.

RT HON RISHI SUNAK MP Chief Secretary to the Treasury

RT HON ELIZABETH TRUSS MP Secretary of State for International Trade

RT HON ROBERT JENRICK MP Secretary of State for Housing, Communities and Local Government

RT HON GRANT SHAPPS MP Secretary of State for Transport

Chapter 1: Introduction

The government wants to level up the UK by ensuring that towns, cities and regions across the country can benefit from the opportunities that leaving the EU brings. Now we have left, the government aims to create up to 10 Freeports across the UK. These will be innovative hubs which boost global trade, attract inward investment and increase prosperity in the surrounding area by generating employment opportunities in some of our most deprived communities around the UK.

We have drawn on evidence from successful freeports around the world to develop an ambitious UK freeport model that could work for rail, sea and airports. We are considering a wide range of measures to make Freeports attractive to domestic and international investors looking to start or grow their UK operations. Tariff flexibility within freeports will encourage high-tech manufacturing and simpler customs processes facilitated by cutting-edge technology will support smoother international trading activity. Our model also includes tax measures to incentivise private business investment, carefully considered planning reforms to facilitate much-needed construction and additional targeted funding for infrastructure improvements in Freeport areas to level up communities and increase employment opportunities.

Moreover, freeports will also offer an exciting opportunity for innovative customs and transport technologies to be trialled in controlled environments. The government is committed to working in partnership with ports, businesses and local stakeholders to encourage innovation and creativity. Successful trials of processes and technologies could lead to their wider implementation across both other freeports and relevant sectors of the economy. We want all the nations of the UK to share in the benefits of freeports. As such, we are working with the devolved administrations to develop proposals that would enable the creation of freeports in Scotland, Wales and Northern Ireland, in addition to those in England. This will ensure that our model is flexible enough for the devolved administrations to take a bespoke approach.

As the first step in delivering this exciting agenda, we are consulting on our proposed freeport policy. We invite stakeholders to provide suggestions and comments on the policy set out in this paper. This includes our objectives and ambitions for freeports; the model we have developed and the measures we would include as part of it; and our plans for delivering this agenda, including how the location of freeports could be selected.

Chapter 2: What is a freeport

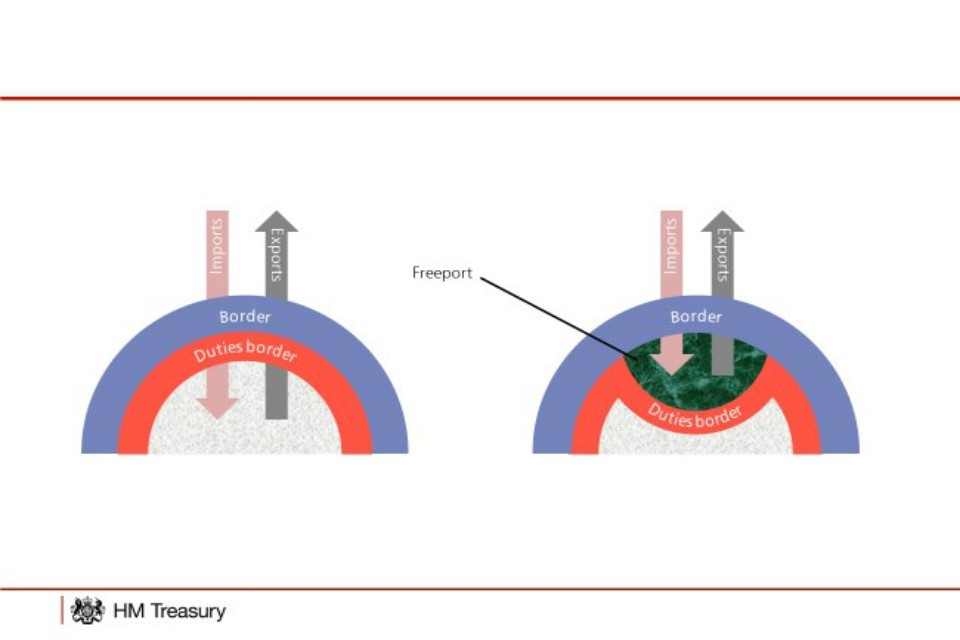

Freeports are secure customs zones located at ports where business can be carried out inside a country’s land border, but where different customs rules apply. They can reduce administrative burdens and tariff controls, provide relief from duties and import taxes, and ease tax and planning regulations.

Typically, goods brought into a freeport do not attract a requirement to pay duties until they leave the Freeport and enter the domestic market – and no duty at all is payable if they are re-exported. If raw materials are brought into a freeport from overseas and processed into a final good before entering the domestic market, then duties will be paid on the final good. Freeports may also offer simplifications to the normal customs administrative processes on imported goods.

Freeports diagram

Countries around the world have adapted this basic freeport model by adding different elements to create their own bespoke models based on the special economic zone (SEZ) model. SEZs can include tax incentives for investment within the geographical area of Freeports, regulatory flexibilities, and investment in infrastructure in the area.

The government is considering a bespoke UK freeport model which would include multiple customs zones located within or away from a port, to maximise flexibility for port operators and businesses, as well as an SEZ-style zone designated over or around the customs zones, to encourage the maximum number of businesses to open, expand and invest in our freeports.

Our freeports policy will be developed alongside discussions on our future relationship with the EU. Any UK freeport model will ensure that the UK’s high standards with respect to security, safety, workers’ rights, and the environment will not be compromised.

Freeport policy objectives

We want freeports to enhance trade and investment across the UK, boost growth and high-skilled jobs, and increase innovation and productivity in our port regions, particularly those situated in or near deprived areas. Freeports will send a strong signal that the UK is an attractive trade and investment location which is open for business. To do this, the government has the following objectives for freeports:

- establish freeports as national hubs for global trade and investment across the UK: intensify the economic impact of our ports by enhancing trade and investment and generating increased economic activity across the UK

- promote regeneration and job creation: create high-skilled jobs in ports and the areas around them, prioritising some of our most deprived communities to level up the UK economy

- create hotbeds for innovation: create dynamic environments, capitalising on new ideas and fostering the conditions that will attract new businesses, investors and innovations

How to respond

We are inviting stakeholders to provide responses to this paper to share their views on how the government can ensure that it makes a success of this policy.

Responses can be made online through our Consultation Portal. Responses should be submitted by 13 July 2020. When responding, please specify who you are responding on behalf of.

Alternatively, you can post responses to:

Freeports Team

Area D

Floor 5,

Department for International Trade

3 Whitehall Place

London, SW1A 2HP

Territorial scope

This consultation sets out the proposals we would like you to consider as we develop the UK’s freeports policy. This includes policies which relate to the whole of the UK, as well as some which are devolved. Where a policy is devolved, the proposals in this consultation apply to England; responsibility for policy development and implementation in Scotland, Wales and Northern Ireland lies with the devolved administrations. The UK government intends to work in partnership with the devolved administrations to develop proposals which enable the creation of freeports in all nations of the UK.

Tariffs and customs

Customs and tariffs policy is reserved to the UK government. The opportunity for customs and tariff benefits would be available UK-wide.

Tax

Some aspects of tax policy are devolved in Scotland, Wales and Northern Ireland. This section consults on tax policies which vary in scope, with some applying UK wide, some in England and Northern Ireland, and others in England only.

Planning

Proposals on permitted development rights and zonal planning relate to England only. Proposals on the National Policy Statement for Ports relate to England and Wales.

Regeneration

Infrastructure, skills and housing are devolved matters and the proposals cover England only. Trade and investment promotion is a “concurrent” power. This means that whilst the UK government has primacy over trade and investment promotion in the UK, the devolved administrations also pursue promotion activity on behalf of businesses in their nations.

Innovation

Innovation policy is UK wide; although some aspects of university funding are devolved matters, we hope to hear from stakeholders across the UK on these proposals.

Chapter 3: customs

Territorial scope

Customs and tariff policy is reserved to the UK government. The opportunity for customs and tariff benefits would be available UK-wide.

The government has designed an ambitious new customs freeport model, drawing on international best practice, to improve upon both the UK’s existing customs facilitations and the freeports the UK previously had until 2012. The proposed new model would allow businesses operating in freeport customs sites to access a range of benefits and new opportunities to boost their international competitiveness. The government’s vision is for freeports to become international hubs for manufacturing and innovation, with the tariff and customs benefits on offer incentivising businesses to locate manufacturing and processing of imported goods in the sites, and with streamlined customs procedures reducing administrative costs for businesses. Freeports will also be used to trial new technology and approaches to customs, further streamlining business requirements in the future. We would now like to hear how the model we are proposing could benefit your business and hear your feedback on the design.

The core customs and tariff benefits we propose to offer to businesses bringing goods into a freeport site are:

Duty suspension – no tariffs, import VAT or excise to be paid on goods brought into a freeport from overseas until they leave the freeport and enter the UK’s domestic market.

Duty inversion – if the duty on a finished product is lower than that on the component parts, a company could benefit by importing components duty free, manufacture the final product in the freeport, and then pay the duty at the rate of the finished product when it enters the UK’s domestic market.

Duty exemption for re-exports – a company could import components duty free, manufacture the final product in the freeport, and then pay no tariffs on the components when the final product is re-exported.

Simplified customs procedures – the government intends to introduce streamlined procedures to enable businesses to access freeports.

Operating a freeport site requires a balance between a facilitative environment for business and maintaining security and biosecurity. The government’s approach aims to create an environment which is both business-friendly and secure.

Declarations

Currently, businesses bringing goods into the UK from outside of the EU via a UK port need to submit entry summary declarations for safety and security purposes before arrival and submit manifest information to notify the customs authority that the goods have arrived at the port.

Under current standard arrangements, an importer (or their agent) submits a full customs declaration to HMRC’s CHIEF system and goods are then released from customs control.

Further information can be found at get UK customs clearance when importing goods from outside the EU: step by step.

Under the proposed model, declaration requirements would be simplified, reducing the administrative processes associated with moving goods into a freeport. A reduced amount of data would be provided using existing processes (form C21) to allow goods to be cleared to leave a port and businesses would need to complete a declaration into their own commercial records recording information about the goods that will be brought in to the UK. They would also need to provide adequate information to the freeport operator’s records management system so that a central record of all goods in the site can be maintained.

When businesses wish to remove goods from the site, they would need to complete import declarations as normal (if releasing the goods for sale on the domestic market) or export declarations (if exporting the goods for sale overseas). It will be possible for goods to be declared to another customs procedure on leaving the freeport site, for example transit.

Currently, businesses bringing goods into the UK from outside the EU via a UK port also need to submit entry summary declarations for safety and security purposes before arrival and submit manifest information to notify the customs authority that the goods have arrived at the port. These processes for goods entering a port will not differ in respect of freeports.

Q1: To what extent do you agree/disagree that the reduced declaration requirements for moving goods into a freeport represent a useful simplification of the administration of customs processes? Please explain your answer.

Q2: Please suggest any ways in which you think the administration of customs processes could be simplified further in freeports.

Freeport operators and freeport businesses

We propose that customs sites would be run by a freeport operator, who would be responsible for security and keeping records of goods which are in the site. The freeport sites must be secure areas, and under this design would have perimeter fences. Facilities must be available so that government agencies can inspect goods if necessary.

Goods entering and exiting a site would need to be tracked via a records management system which can be viewed remotely by government agencies. This must be capable of recording the transformation of goods through manufacturing processes that take place in the site. Many ports already operate accessible electronic inventory systems which could potentially be expanded or adapted for this.

Before a freeport can start operating, the government will need to complete checks to ensure that the freeport operator is able to comply with its requirements and obligations.

Businesses operating within freeports would need to have access to the freeport operator’s inventory system to ensure records are up to date. These businesses would need to be authorised by the government in a light-touch process, for example a basic check on their history of compliance and solvency, and a check to ensure they are capable of maintaining accurate records of their goods.

Q3: If you are a potential freeport operator, will you be able to adapt current processes you have to allow goods to be moved into a freeport? Please explain your answer.

Q4: Please provide any feedback you have on the requirement for perimeter fences.

Q5: Please highlight any alternative ways you think security could be maintained without a perimeter fence.

Q6: In your view, is the proposed split in responsibility between freeport operators and freeport businesses correct or incorrect? Please explain your answer.

Goods already in the UK

Under this model, freeport businesses would be able to bring goods which are already in ‘free circulation’ in the UK and not under customs control into the freeport, for example, if they are being used for a manufacturing process. These goods would require entries to be made into freeport businesses’ stock records and an update to the freeport operators’ records management system, in the same way as goods being brought in directly from a port.

Goods could be brought into a freeport when they are under another customs procedure, for example, customs warehousing or transit, while remaining under duty suspense.

Q7: How important is it for your business to be able to bring goods into the freeport from the UK, whether the goods are in free circulation or under another customs procedure? Please explain your answer.

Location of freeports

Freeports sites could be located inland as well as adjacent to ports, increasing the range of options for sites and potentially allowing existing manufacturing plants to be designated. Where a freeport site is located inland (that is not directly adjacent to a port), businesses wishing to move goods from a port to a freeport while the goods remain under duty suspense would need to get a customs guarantee, a form of insurance which covers the duty that would be owed if the goods never arrived at the inland site. The goods would be moved using the existing process for moving goods between temporary storage facilities and the guarantee would be released when the goods arrive.

No guarantees would be required for goods being brought into a port-adjacent freeport site.

Q8: What do you see as the advantages and/or disadvantages of an inland freeport site compared to a freeport site which is adjacent to a port?

Excluded goods and excise goods

Certain categories of goods, such as licensed products including weapons and controlled drugs, will be excluded from being brought into freeports. Excise goods (for example fuel, alcohol and tobacco) would be permitted to enter freeport sites with duties suspended. However, importers would be required to make customs declarations to HMRC when bringing in goods rather than following the streamlined freeports procedure for other goods described above.

Businesses importing excise goods for storage in a freeport will need to meet the current conditions for authorisation for excise warehousing and have the same controls apply. More details can be found at receiving, storing and moving excise goods.

Businesses importing goods for excise production or processing in a freeport will also need to meet the current conditions for authorisation and will be subject to the current controls.

We would like to hear your views on the following questions:

Q9: If you are considering becoming a freeport operator, how attractive would the proposed customs design be to your business? Please explain your answer.

Q10: If you are considering becoming a freeport business and would like to store imported goods or manufacture products using imported goods in the UK, how attractive would the proposed customs design be to your business? Please explain your answer.

Q11: To what extent would the suspension of import VAT be of value to your business? Please explain your answer.

Q12: How important would it be for your business to be able to buy and sell goods within freeports? Please explain your answer.

Trade remedies and countermeasures

Trade remedies allow WTO members to create a level playing field and protect their domestic industry from injury caused by unfair trading practices (for example the importation of goods sold below the costs of production in a foreign country - known as dumping - or subsidisation of goods coming onto the UK market) or unforeseen surges in the import of a particular product into the UK. Trade remedies usually take the form of additional duties on the dumped or subsidised imports. We recognise the crucial role which UK manufacturers and producers play in our economy and remain committed to ensuring that UK industry has the protections it needs when these situations arise.

WTO and FTA dispute settlement mechanisms allow for retaliatory trade measures (countermeasures) to be taken against the imports of a WTO member or FTA partner that has not brought itself into compliance with trade law following a WTO or FTA dispute. Authorisation to apply countermeasures may also arise in other specific contexts, including in relation to modifications to WTO schedules. Countermeasures usually take the form of additional import duties on that country’s imports.

We propose that the customs and tariff benefits that will result from using freeports should not undermine the effectiveness of the UK’s trade remedies system or any future trade remedies put in place to protect domestic industry from injury caused by dumped or subsidised imports sold onto the UK market. Similarly, the benefits of freeports should not be used to undermine the effectiveness of the UK’s countermeasures as retaliation in response to a trade dispute. This can be achieved through applying these additional tariffs to the relevant products when they enter or exit freeports, whether or not they are processed in the freeport and destined for either the UK domestic or foreign markets. However, the application of trade remedies and countermeasures needs to be balanced against the overall benefits of freeports.

Q13: To what extent do you agree or disagree that trade remedies or countermeasures should be applied to goods exiting freeports, whether or not they are processed in the freeports? Please explain your answer.

Q14: To what extent do you agree or disagree that trade remedies or countermeasures should be applied to goods exiting freeports, whether they are destined for consumption in the UK or exported to foreign markets? Please explain your answer.

General questions

Q15: In your view how does this freeport design compare to existing customs special procedures, such as customs warehousing or inward processing?

Q16: Please suggest any ways in which this customs design could be improved. For instance, could technology be used to streamline the requirements?

Q17: Please provide any other feedback you have relating to this customs design.

Chapter 4: tax

Territorial scope

Some aspects of tax policy are devolved in Scotland, Wales and Northern Ireland. This section consults on tax policies which vary in scope, with some applying UK wide, some in England and Northern Ireland, and others in England only.

Tax policy can help to stimulate economic growth by increasing investment and creating new jobs and economic activity in the freeports. Our objective is to promote economic activity by creating an ambitious and attractive tax offer that makes our freeports dynamic, innovative and growing hubs of global trade. At the same time, we must minimise the risk of increasing avoidance or evasion activity.

This consultation will enable us to gather views from a wide range of stakeholders to help us achieve this objective.

To design this freeport offer, we plan to draw on our experience of enterprise zones (EZs), which in England are designated geographical areas offering tax incentives and reduced regulation to encourage private sector growth through increased employment, innovation and productivity. The devolved administrations have responsibility for their own EZ strategy and policy.

Since 2012, 48 EZs have been established across England, with sites from Mersey Waters to Northampton Waterside. Businesses that locate in an English EZ can currently benefit from one of 2 tax incentives:

- business rates discount worth up to £55,000 per year for 5 years (£275,000 in total) for each new business starting up or relocating to the EZ

or

- for EZs located in certain areas, enhanced capital allowances for new companies making new investments in plant and machinery

In addition, currently all business rates growth generated in an EZ is kept by the relevant local enterprise partnership (LEP) and local authorities in the area for up to 25 years, to reinvest in local economic growth such as site development and other local initiatives.

The government is keen to draw on the evidence of the impact of existing tax incentives from EZs and learn from international evidence as it designs its freeport offer. The government also wants to consider other policies that could support its objectives for freeports. This includes understanding the extent to which tax incentives offered in a freeport could achieve the following objectives:

- create additional economic activity and investment

- encourage employment in the area

- stimulate clusters of innovation

- minimise any routes whereby tax avoidance or evasion could take place. For example, if reliefs are claimed on activities that have not actually taken place in the freeport area

The government will test options for tax incentives against these objectives and is particularly interested in policies that support them without displacing activity from other areas of the UK. As part of this, it will consider what mechanisms are needed to ensure tax incentives in Freeports are effective, for example by setting time limits on tax reliefs.

The government is considering the case for changes to the following tax policies which are under UK government control, some of which apply across the UK and others which do not, if there is sufficient evidence to show that they could be effective.

Tax measures under the UK government control

England only

- business rate discounts (currently available in EZs)

England and Northern Ireland

- Stamp Duty Land Tax

UK Wide

- research and development (R&D) tax credits

- employer National Insurance contributions

- facilitative solutions on VAT and Excise Duties for goods within freeports

- enhanced capital allowances (currently available in EZs)

The government will consider fully the fiscal implications of any potential changes to tax policies under the UK government’s control before making any final decisions.

We would like to hear your views in response to the following questions:

Q18: In your view, do the specific tax incentives provided in existing English enterprise zones (business rates discount and enhanced capital allowances) encourage increased business activity and employment in England? Please explain your answer, and support your response with evidence where possible.

Q19: How could the following policies be used to encourage employment and investment in business, infrastructure and innovation in a freeport or surrounding area? Please explain your answer, and support your response with evidence where possible.

- facilitative solutions on VAT and excise duties for goods within freeports (UK wide)

- Stamp Duty Land Tax (England and Northern Ireland)

- research and development (R&D) tax credits (UK wide)

- employer National Insurance contributions (UK wide)

Q20: Is there any evidence to suggest that changes in these tax policies would be the deciding factor in investment decisions? Please explain your answer.

Q21: In your view, are there any particular tax policies that you think could increase the risk of tax avoidance or tax evasion activity being routed through a freeport? Please provide details. If your answer is yes, please suggest ways in which the government could deter or prevent the tax avoidance or evasion risk you have identified.

Q22: In your view, would any of the potential tax policies set out in this document unnecessarily increase the administrative burden of business activity in the freeport? Please explain your answer. If your answer is yes, please explain which of the tax policies could be modified to reduce administrative requirements and how they could be modified.

Q23: Please provide any other feedback you have relating to tax incentives for freeports.

Chapter 5: planning

Territorial scope

Proposals on permitted development rights and zonal planning relate to England only. Proposals on the National Policy Statement for Ports relate to England and Wales.

Planning liberalisation can help bring more land forward for development, speed up the planning process and allow ports to respond more rapidly to new demands, for example by building new facilities. We believe that both the government and local planning authorities have a role to play in supporting the functioning of freeports and their ability to boost trade and investment through planning and development management, and we are considering a number of options to support this. The government wants to consider the role that planning freedoms, permitted development rights, zonal planning and National Policy Statement for Ports can play in supporting freeports. We also invite views on additional planning measures which could be used to support development in freeports.

Permitted development rights

Permitted development rights are a national grant of planning permission. The existing Part 8 Class B rights used by ports within Schedule 2 of The Town and Country Planning (General Permitted Development) (England) Order 2015, as amended, are limited to development for the purposes of shipping or in connection with the movement of passengers, goods, livestock or traffic. However, airport operators use their permitted development rights, as set out in Schedule 2, Part 8 Class F, for the development of ‘operational buildings’ for purposes connected with the provision of services and facilities. The government is aware of port operators’ interest in aligning the permitted development rights of airports and seaports and is considering reviewing the scope of seaports’ permitted development rights to allow the use of buildings for purposes connected with seaport services and other seaport-related activities.

We therefore invite views on amending the Town and Country Planning (General Permitted Development) (England) Order 2015, as amended, to align permitted development rights for seaport operators with airport operators by allowing the use of buildings on ports for purposes connected with the operation of the port. This will enable them to carry out a broader range of operational activities in line with airports. Rail undertakings already have permitted development rights to erect buildings on their operational land. We are also interested to hear views on whether there are any further permitted development rights specifically for freeports that would support their operation. These would be subject to statutory environmental considerations.

Following the consultation, the government would seek to bring forward any changes at the earliest legislative opportunity.

Q24: Do you agree or disagree that the permitted development rights for airports and seaports should be brought into closer alignment by allowing the use of buildings on ports for purposes connected with the operation of the port? Please explain your answer.

Zonal planning

Subject to statutory environmental considerations, we also want to further consider the use of zonal planning. There is a range of tools available to simplify the planning process through this route, including to support freeports.

These include the use of existing powers to introduce Local Development Orders (LDOs) which are made by local planning authorities subject to public consultation. LDOs give a grant of planning permission to specific types of development within a defined area. They establish a clear framework for development, giving certainty to applicants, businesses and communities. There are over 100 adopted LDOs in the country, including in the Hull Enterprise Zone that encompasses the local port.

Building on their use in EZs, and more widely, we are interested to hear views on the availability and take-up of LDOs, and how they are being used to support development. We are also interested to further understand what factors would encourage local planning authorities to establish LDOs to support freeports in particular. The government expects authorities to support Freeports through simplified planning, including the use of LDOs.

Q25: Are there suitable incentives in place that encourage the use of LDOs by local authorities to support faster development? Please explain your answer. If your answer is ‘no’, what more could be done to encourage their use?

National Policy Statement for Ports (NPSP)

The National Policy Statement for Ports, designated under the Planning Act 2008, as amended, sets out the need for new seaport infrastructure and provides the consenting framework for new nationally significant port developments in England and Wales. It is also considered to be a relevant consideration for the Marine Management Organisation when considering applications for harbour empowerment or revision Orders under the Harbours Act 1964, for local authorities (where considering relevant applications under the Town and Country planning system) and applies to relevant associated developments (such as road and rail links).

A large proportion of UK seaports are privately owned. Historically, the private sector has therefore largely driven proposals about the timing, location and type of new seaport infrastructure brought forward for approval and development. This approach has provided the seaport capacity the country needs to meet demand for trade in goods and movement of passengers, allowed for competition between ports serving similar markets, and has provided a degree of resilience.

As part of Maritime 2050, the government’s long-term strategy for the maritime sector, we have been clear that a presumption of support for new harbour development (as set out in the NPSP) should continue to apply. However, we have also committed to take into account potential changes to, for instance, the use of seaport land, and to look for potential further means to support the sector across planning, environment and connectivity issues.

The government will conduct a review of the Ports Master Plans guidance so as to better understand this challenge. Additionally, the government will consider reviewing the NPSP, and consideration may be given to whether further support for the sector is needed when the NPSP is next reviewed, in line with Maritime 2050. Any proposed amendments to the NPSP that materially affect the policy would be subject to statutory requirements for consultation, publicity and Parliamentary scrutiny under the Planning Act 2008.

Q26: Would it be appropriate or inappropriate to consider amending the National Policy Statement for Ports to allow for changes to planning process(es) for significant port development? If your answer is ‘appropriate’, what specific element(s) of the process or document could this focus on, and what potential benefits could this unlock?

Additional planning freedoms

Ports can serve a variety of functions, supported by a diverse range of developments. These different roles and schemes can demand different planning tools and routes to securing planning consent, and face different challenges.

Planning freedoms can play an important role in bringing forward development, including for new premises and supporting the provision of infrastructure, to support business and boost economic activity. They can provide a more streamlined planning process and greater planning certainty for types of development.

We will therefore consider additional planning freedoms to support freeports. Both the government and local authorities play a key role in planning and development management. Development in freeports could be influenced by a number of measures designed to increase the efficiency and effectiveness of the planning system.

The government has committed to publish a planning white paper, which will set out how more land can be brought forward for development and options for additional planning freedoms which could accelerate the end-to-end planning process. The white paper will be published later this year. We are interested to hear views and evidence (for example based on national and international best practice) on any other options for the increased use of existing planning freedoms or further reform to simplify or speed up the planning process and support the functioning of Freeports, and their ability to boost trade and investment.

Where a freeport is established at an existing air, rail or seaport it would be able to use the permitted development rights in place for that mode of port. However, freeports will have the potential to drive innovative development and may accommodate a range of different uses. We want to explore whether there are further planning flexibilities that would allow freeports to respond to the demands of the market and facilitate diverse development.

Q27: Please tell us about any additional planning freedoms related to planning powers and/or increasing the efficiency and effectiveness of planning that you think could be used to support development in freeports.

Regulatory impacts

These proposals on planning are intended to reduce or remove the need for planning applications in more cases, and/or streamline the existing processes, thereby benefitting individuals and businesses by providing greater planning certainty and reducing costs. Local authorities are also intended to benefit, as streamlined planning would free up their resources to be used where they are most needed. An impact assessment will be prepared prior to the laying of secondary legislation to introduce a new permitted development right.

Your views on the potential impacts of all the proposed changes would be helpful in understanding the range of issues and scale of impacts. We would be interested in your assessment of the short-term and long-term impact of aligning seaports’ and airports’ permitted development rights.

Q28: Please provide any comments you have on the regulatory impact of the planning measures set out in this consultation. For example, do you have any information on the costs and benefits to business of these measures?

Chapter 6: regeneration

Territorial scope

Infrastructure, skills and housing are devolved matters and cover England only. Trade and investment promotion is a ‘concurrent’ power. This means that whilst the UK government has primacy over trade and investment promotion in the UK, the devolved administrations also pursue promotion activity on behalf of businesses in their nations.

Freeports can help to revive some of our most disadvantaged towns and cities by attracting new investment, supporting enterprise and innovation, and ultimately creating new, skilled jobs that local people can benefit from. Alongside the National Infrastructure Strategy, they will be a key part of delivering our ambition to level up the economy across the country.

The opportunities from freeports will differ depending on the specific nature of each local economy. We want local areas, working with businesses and ports, to consider the unique opportunity freeports represent for their region, so that we ensure that communities around the country benefit from economic growth.

We will ask local areas for proposals setting out how becoming a freeport could enable them to maximise regeneration benefits and complement other investment. Specifically, some areas that may be suitable to become freeports are also potential areas for investment from the £3.6 billion Towns Fund and could benefit from investments from the Coastal Communities Fund.

Infrastructure

Infrastructure is a top priority for the government. We are focused on ensuring every part of the UK has modern and efficient infrastructure to support economic growth, unleashing Britain’s potential by levelling up and connecting every part of the country. We intend to publish a major National Infrastructure Strategy to set out further details of the government’s plans to increase investment and transform the UK’s infrastructure.

We recognise infrastructure investment will play an important role in freeports, both in facilitating access between ports, customs zones, nearby industrial clusters and the wider transport network, and in maximising freeports economic impact on the wider area in which they are located. The Port Connectivity Study demonstrated the value that seaports add to the economy at a local and national level, and set out a vision for future port connectivity with key recommendations to enhance connectivity. A number of the schemes identified in the study are being delivered through the current Road Investment Strategy, Local Growth Fund, Large Local Majors and Control Period 6.

The government has also recently announced a review of regional air connectivity to ensure all nations and regions of the UK have the domestic transport connections local communities rely on – including regional services from local airports. This review, led by the Department for Transport (DfT), will consider all options to ensure we continue to have good regional connectivity. DfT will work closely with industry, local regions and devolved nations to identify how we can support connectivity.

In addition, in the last year, we have invested £30 million to help ensure the country’s seaports continue to thrive post-Brexit. This included funding for updates to port infrastructure, improvements to road and rail links and building resilience within local government.

The above provides an indication of the types of infrastructure projects that may support freeports, both in the transition phase as well as in realising longer-term growth opportunities, and we are considering making investment available to enable the delivery of such projects.

We would like to hear your views on the following questions:

Q29: What infrastructure could encourage increased business activity in a freeport? Please support your response with evidence where possible.

Q30: What infrastructure could support wider regeneration opportunities and promote job creation in the areas around a freeport?

Q31: Please provide any additional feedback you have on the issue of infrastructure for freeports not specifically addressed by any of the questions in this section.

Business support

Dedicated trade and investment support could be made available to provide advice and guidance to help maximise the positive impact of freeports. This could be delivered through a number of channels, including face-to-face advisors located within freeports and wider support and guidance that encourages UK businesses and overseas investors to access the benefits of freeports.

Q32: What dedicated trade and investment support, advice and guidance would best enable your business to take advantage of the opportunities freeports would create?

Skills

We would like freeports to lead to new, skilled jobs in and around the port to support the creation of innovative industrial clusters that drive growth and prosperity to the area. Ensuring that local people have the right skills to match the needs of employers locating in the freeport area will be essential to capturing the benefits that freeports could potentially deliver. We would like to hear how local partners and businesses involved in freeports can support further education (FE) colleges and universities to derive maximum benefit from this opportunity.

Q33: Working with mayoral combined authorities (MCAs), combined authorities (CAs) and local enterprise partnerships (LEPs) (which will be informed by their newly established Skills Advisory Panels), how might a freeport contribute to the skills offer in your area?

Q34: How could employers involved in freeport applications demonstrate their commitment to engagement with, and support for, local FE and skills providers?

Housing

The economic growth that freeports will bring could require further provision of quality homes in order to attract and retain workers. We want to work with local areas around freeports to ensure housing provision is geared to meet this need, in order to realise potential and regenerate areas. Given the differing characteristics of areas with ports, we would like to understand what the particular housing needs are for these areas, and how local areas will align their housing priorities with the wider freeports agenda. We are also interested in the role that zonal planning, including the use of LDOs, could play in supporting planning of residential and commercial development in local areas around freeports.

Q35: What are the main housing needs of the local economies which surround ports (suitable for freeport status), both now and in the future?

Q36: How can local areas align their housing interventions with the wider regeneration agenda to make freeports a success?

Q37: What role could zonal planning, including the use of LDOs, play in delivering the wider regeneration of local areas around freeports?

Chapter 7: innovation

Territorial scope

Innovation policy is UK wide; although some aspects of university funding are devolved matters, we hope to hear from stakeholders across the UK on these proposals.

The establishment of freeports as hotbeds for innovation is a key objective for freeports policy. The government intends for freeports to be dynamic environments which enable innovators, start-ups, businesses and regulators to generate and test new ideas and technologies across a range of sectors, from customs, to the aviation, rail and maritime sectors. This agenda could also see innovative solutions developed which could regenerate local areas or help deliver the UK’s decarbonisation agenda.

To do so, our freeport policy aims to combine regulatory flexibilities, collaborative approaches and potential funding in order to target and remove key barriers to testing and delivering new technologies and processes, and to promote innovative activity by businesses. At ports themselves, freeport status could allow port operators and businesses to build on the thinking outlined in the Maritime 2050 strategy and Aviation 2050 consultation to generate technological solutions which could subsequently be implemented in other freeports, ports and other areas across the country. In addition, industrial clusters forming part of a freeport could use the flexibilities and reduced administrative processes provided by freeport status to generate new ideas and conduct trials across a broad range of sectors.

Through this consultation, we would like to hear suggestions from developers, regulators, local stakeholders, investors and others detailing how freeports might function as innovative hubs, and why and how you think this type of environment would help businesses to trial and implement new products and processes. We are interested in hearing about how ports are already working with businesses, universities and other stakeholders around the UK to solve operational issues or increase their capability by harnessing new and emerging technological solutions. We would also like detailed information from port operators and other stakeholders on key operational barriers facing UK ports, and how far you think the options described below would assist you in solving these problems.

Challenge-based initiatives

Challenge-based initiatives can be successful in generating innovative solutions to a range of issues. A challenge-based initiative would identify and target specific operational or technological issues faced by a freeport, and set local start-ups and innovative firms a challenge to solve the issue by working with freeport operators, businesses, universities and other innovative stakeholders to develop technological solutions to that issue. Challenges could include, for example, issues relating to security, storage and tracking of cargo, process efficiency, energy efficiency and reducing waste. Funding could be provided for freeports to run challenge-based initiatives in their areas, so that prizes could be offered for the most effective solutions to the challenge. Innovators could also be offered the opportunity to implement their solutions within the freeport.

We would like to hear from port operators and the innovation community about the technological obstacles faced in running ports efficiently, and the types of support that could encourage innovative approaches to addressing these – for example, innovation grants, innovation prizes, or national competitions.

We are also interested in hearing from trading businesses about aspects of customs administration which create challenges for your business, and how innovation could be used to overcome these issues.

Q38: What specific operational barriers to efficiency exist in ports that could be addressed through the development of innovative technology and processes?

Q39: What specific aspects of customs administration present barriers to business efficiency? How could the development of innovative technology and processes be used to address these, and maintain a secure environment?

Freeports and academic collaboration

Universities and other academic institutions have an important role to play in driving innovation in partnership with industry, as well as contributing research on social and technological improvements.

We are interested in hearing about ways in which universities, academic institutions and other such stakeholders have successfully engaged with ports and businesses, and how they might engage further with freeport operators under our model.

Q40: How can ports collaborate with public agencies - including universities and other academic institutions, businesses, and local government - to develop and adopt new technologies?

Regulatory sandboxes

The creation of regulatory sandboxes can help to facilitate the trialling and testing of new technology and processes. Allowing for specific regulatory flexibilities within areas where businesses or ports and their consumers want to trial new technologies could remove barriers to implementation of these technologies, creating an optimum environment for the development of new technological solutions and broader innovative activity.

We would like to hear about regulatory challenges which firms face in trialling or introducing new products and processes, and suggestions for how these could be overcome.

This could include changes to customs processes, such as incorporating new technology, which could make the customs system more streamlined, efficient and business friendly.

Q41: How could challenge-based initiatives and innovative procurement opportunities help ports and local partners work together to innovate?

Data availability and usability

Limited access to data can pose challenges for innovators looking to identify or contextualise challenges and develop solutions to them.

We are keen to hear about these challenges posed by data availability in the transport and customs sectors, and proposals for how freeports could bring together the right stakeholders to facilitate greater sharing and analysis of data relating to these sectors, as well as, more broadly, how data generated within freeports could be used to support effective innovation by businesses both within freeport areas and further afield.

Q42: What obstacles are there to greater data availability in the customs and transport sectors?

Q43: What opportunities are there for data generated within freeports to support innovation by businesses and innovation stakeholders? What changes would be needed to facilitate this?

Contribution to the decarbonisation agenda

Establishing freeports as innovative hubs presents an opportunity to drive the decarbonisation agenda and enable business and industry located in freeports to invest further in low-carbon technologies by testing new ideas and green technologies within freeport sites. Freeports could therefore support decarbonisation in line with the UK’s legislative target of net zero emissions by 2050.

We would like to receive views on how freeports could be used to test new ideas and support business and industry to decarbonise, which could then be implemented nationally, while simultaneously improving port efficiency.

We would like to hear your views on the following questions:

Q44: How could regulatory flexibility within freeports help businesses to trial and implement new products and processes?

Q45: How could freeports be used to test new ideas and support business and industry to decarbonise in line with the UK’s net zero target?

Q46: Please provide any additional feedback you have on the issue of innovation in freeport policy not specifically addressed by any of the questions in this section.

Chapter 8: additional policy considerations

Preventing illicit activity

International organisations have previously expressed concerns about links between freeports and a number of illicit cross-border activities, including smuggling (the illicit importation of goods) and circumvention. Border Force plays an important role in tackling cross-border illicit activity and is actively seeking to learn from existing ports to build on our current expertise and ensure any illicit cross-border activities - such as smuggling, money laundering and trafficking (this means to trade in something which is illicit) activity - are prevented. The government has taken robust action over recent years to clamp down on illicit finance in order to protect our citizens and help legitimate businesses to thrive. The government will ensure all the necessary safeguards are in place and will continue to meet international standards and take best practice into account when considering the risks in a UK context.

The Organisation for Economic Co-operation and Development has developed guidance on Countering Illicit Trade and Enhancing Transparency in Free Trade Zones, grounded in 6 years of research and expert consultation. The Fifth Anti-Money Laundering Directive, implemented through amendments to the Money Laundering Regulations 2017, brings art market participants into scope of the Money Laundering Regulations for transactions exceeding EUR 10,000. Freeport operators are also considered to be art market participants when works of art exceeding the threshold are stored in a Freeport and would be required to abide by the regulations and register with HMRC for anti-money laundering supervision if they conduct this regulated activity. The government does not, however, intend to designate freeports for the purposes of high value luxury storage.

The government remains committed to tackling tax avoidance and evasion, aggressive tax planning and non-compliance. We will consider carefully how anti-tax-avoidance rules and measures to counter risks of evasion and fraud can be best applied within freeports.

Q47: In your view, what is the level of risk of illicit activity in freeports? Please explain your answer.

Q48: What additional measures should be implemented to mitigate such activities?

Q49: Please provide any other comments you have on the issue of preventing illicit activity within freeports.

Business impacts

A full assessment of the regulatory impacts on businesses caused by changes proposed here will be prepared prior to decisions being made about the final policy.

Changes to regulations are proposed in the planning section of this document. In addition to the regulatory impacts discussed in that section, we would also like to hear your views on the potential impacts on businesses of the other proposals in this document, including on customs and tax.

Q50: Please provide any comments on the impact on businesses of the measures set out in this consultation.

Please provide any information on the costs and benefits to businesses of these measures.

Equality impacts

When formulating a policy proposal we are required to have due regard to the Public Sector Equality Duty in the Equality Act 2010. The duty requires public bodies to have due regard to the need to eliminate discrimination, advance equality of opportunity and foster good relations between people with different protected characteristics when carrying out their activities.

We would like to know your views as to whether any of the measures mentioned throughout this document might have any negative impacts under the Public Sector Equality Duty including through displacing economic activity from one area to another. There is evidence in some cases that zone-based policy can have a displacement effect, leading to reduced job opportunities in areas which are not freeports. We welcome your views on the risk of this, and ways to mitigate it.

Q51: Please provide any views about the implications of our proposals on people with protected characteristics as defined in section 149 of the Equality Act 2010. Please provide any evidence you have to support your views. Is there anything that could be done to mitigate any impact identified?

Q52: If you are a business owner, what actions would you take if a freeport was established in your local area? Please explain your answer.

Q53: In your view, what is the level of risk of economic displacement? What should the government do to mitigate these risks? Please explain your answer.

Environmental impacts

We want to make sure that freeports are designed in the best possible way to facilitate business activities while suitably protecting the public and the environment.

Q54: Please provide any comments on any potential environmental impacts which may arise as a result of the considerations in this consultation.

Other impacts

Q55: Please provide any other feedback on the impacts of the development of freeports in the UK not specifically addressed by any of the questions in this section.

Chapter 9: allocation and governance of freeports in England

Territorial scope

This section outlines our proposals for the allocation and governance of freeports in England only.

We are committed to running a fair, transparent and robust allocation process to select up to 10 freeports across the UK. We want all the nations of the UK to be able to share in the benefits of freeports. As much of the policy is devolved, the UK government will work closely with the devolved administrations to develop a distinct allocation and governance process for each of Scotland, Wales and Northern Ireland.

We have set out the proposed allocation and governance process for England below. We are clear that successful freeports can only act as national hubs for global trade, and support deprived communities, by working together with local partners, across the public and private sectors.

Port modality

We believe that airports, rail ports and seaports all have the potential to act as credible freeports. We are therefore not proposing to exclude any mode of port.

However, each mode of port will have its own nuances, and we need to understand how to accommodate these in our allocation process.

We also believe that a credible freeport may be based on a collaboration between 2 or more ports, including ports of different modalities. For example, two seaports in close proximity may wish to become a single freeport; or an inland rail port (terminals and interchanges) may wish to become a Freeport with either a connected seaport or a nearby airport.

Q56: What factors do we need to consider to support different port modes becoming freeports?

Q57: Do you agree or disagree that a freeport could include multiple ports? Please explain your answer.

Q58: What factors do we need to consider in order to support applications from multiple ports?

Competitive bidding

Our proposal is that applications for freeport status will be invited through a competitive bidding process. We consider that this will encourage early collaboration between relevant local partners across the public and private sectors. It will also allow potential freeports to clearly set out their unique offer.

Objectives and criteria

The government expects that successful freeports will fulfil the policy objectives set out in Chapter 2. We want proposals to demonstrate how they will:

- establish freeports as national hubs for global trade and investment across the UK, assessed against:

- economic potential (quantitative data about the local economy, FDI suitability, trade value; and qualitative data about local sectoral strengths, port operations and the interaction between the 2)

- commitments of private sector investment

- economic vulnerability, and risk of displacement from port and local area

- effective local leadership

- robust and appropriate governance arrangements which encourage strong collaboration across the public and private sectors

- geographic location of ports

- promote regeneration and job creation, assessed against:

- deprivation of the area surrounding freeport locations

- the strength of local relationships and alignment with existing economic strategies, such as local industrial strategies where they are agreed

- how ready sites are for development (including land availability, planning and other permissions, environmental impact and site preparation)

- credibility of proposals

- create hotbeds for innovation, assessed against:

- demonstration of how they will enable ports and local businesses to generate and test innovative ideas, including technological solutions for port operations and logistics, and ideas which support the decarbonisation of business and industry

Successful applications will also have to demonstrate how they will deliver against these objectives. To assess this, we will look for evidence of:

- strong leadership

- clear evidence of collaboration between all stakeholders; and

- demonstrable willingness from all partners across the public and private sectors to commit resource to support their plan

Freeport applications will also need to satisfy HMRC, working with Border Force, that their customs zone proposals are compliant with the necessary security requirements.

Q59: In your view, how appropriate are the proposed criteria for assessing how potential freeport applications can meet the stated policy objectives? Please explain your answer.

Q60: Please suggest any other criteria that we could use to effectively assess potential freeport applications.

Public and private sector partnerships

We believe that to be successful freeports will be well-integrated into the local economy, with the private sector working closely with local economic partners. We are interested in receiving feedback on the most effective model for partners to come together to develop and submit strong applications.

Many of the policy measures we are consulting on are administered by local authorities. Where MCAs or CAs exist, they could submit a freeport application on behalf of partners. Where they do not exist, the application could be submitted by the LEP and the upper-tier authority(s) in which the freeport site is located.

Within this model, MCAs/CAs/LEPs could be asked to prioritise one application for freeport status from within their geography. This could have a number of advantages:

- functional fit: MCAs / CAs / LEPs have the personnel and geographic coverage to decide local economic priorities. Any effective freeport application will require strong collaboration between the port, the relevant MCA/CA/LEP and local businesses.

- local knowledge: MCAs / CAs / LEPs understand the challenges and opportunities experienced by their local economies and are therefore well-suited to make decisions regarding which ports will support key objectives in their area

- regional allocation: One of the key potential benefits of a freeport is the clustering of related businesses. This effect will be muted if multiple ports in the same local economic area gain freeport status.

Where LEP boundaries overlap, affected ports could choose which LEP they bid with. Multiple MCAs / CAs /LEPs could support one freeport application.

An alternative model would be to allow ports to submit applications for freeport status directly to central government and we welcome feedback on the merits and drawbacks of this approach. Given the policy levers under consideration, we expect that any application would require the support of a named local authority. We also expect that under any model, the port, upper-tier authority, LEP, and other local partners, including the private sector, would form a joint board to support the application for freeport status and collaborate on matters relating to the freeport.

Whilst we do not anticipate that local partners would need to enter into a specific legal relationship (for example incorporate) to support this, or that the precise nature of this partnership should be prescribed, we would welcome views on which approaches may be particularly effective.

Setting the boundary of the freeport customs zone will involve discussions between the port and government. However, HMRC and Border Force will assure that proposed boundaries are compatible with maintaining border security.

Q61: What are the advantages and/or disadvantages of asking MCAs / CAs where they exist, or LEPs and upper tier local authorities where they do not, to lead on submitting applications?

Q62: What are the advantages and/or disadvantages of asking MCAs / CAs where they exist, and LEPs where they do not, to support a single application in their local area? In what circumstances should this be flexed to allow for more than one application?

Q63: What are the advantages and/or disadvantages of enabling ports to submit applications for freeport status directly to the central government?

Q64: Please outline the most effective models for partnership between private, public sector and local economic partners to design and submit applications.

Q65: Please provide any other comments you have on the allocation of freeports not specifically addressed by any of the questions in this section.

Measuring impact

We need to know whether and how freeports are fulfilling their objectives. We also need to learn from best practice across different freeports, to understand what works and why.

Previous experience of delivering similar interventions shows that measuring impact is complex. Freeports are likely to affect the long-term structural economic situation across the country, with the possibility of immediate impacts.

Freeports themselves will have a role in collecting data and assessing impact. The government will draw on this to undertake a national evaluation. Robust measures will be put in place in advance of implementation of freeports to enable effective evaluation. We expect that local institutions will be assessed against their progress in achieving the outcomes for investment they identified in their application.

Based on location, eligibility and the local freeport board’s choices, freeports may emerge with different policy bundles. For example, different ports could choose to incentivise innovation in different ways; some may be eligible for other government funding that supports the objectives of this policy and others may not. We will be particularly interested to evaluate the impact of these differences between freeports.

We believe that to be successful freeports will be well-integrated into the local economy working closely with the private sector. We expect to see commitments from businesses and investors to support the freeport including direct investment, both in the port area and in related businesses. We recognise that a long-term commitment to the freeports model from the government will make it easier for places to work with business and investors. This will need to be balanced against the need to show that freeports are delivering positive outcomes.

Q66: How can the government best monitor and evaluate freeports?

Q67: Are there ways that we could ensure a counterfactual impact evaluation is feasible and deliverable for all freeport areas? Please explain your answer.

Q68: For the freeport model described in this consultation, what might be an appropriate time period for incentives to initially operate for to give certainty to investors and businesses and provide an opportunity for the government to evaluate their effectiveness? If you think the appropriate period could differ for different incentives within the freeports model, then specify a different time period for each incentive.

Chapter 11: Summary of questions

Customs

Declarations

Q1: To what extent do you agree / disagree that the reduced declaration requirements for moving goods into a freeport represent a useful simplification of the administration of customs processes? Please explain your answer.

Strongly agree / Somewhat agree / Neither agree nor disagree / Somewhat disagree / Strongly disagree

Q1.i: Please explain your answer.

Free text box

Q2: Please suggest any ways in which you think the administration of customs processes could be simplified further in freeports.

Free text box

Freeport operators and freeport businesses

Q3: If you are a potential freeport operator, will you be able to adapt current processes you have to allow goods to be moved into a freeport?

Yes / No / Don’t know / Not applicable

Q3.i: Please explain your answer.

Free text box

Q4: Please provide any feedback you have on the requirement for perimeter fences.

Free text box

Q5: Please highlight any alternative ways you think security could be maintained without a perimeter fence.

Free text box

Q6: In your view, is the proposed split in responsibility between freeport operators and freeport businesses correct or incorrect?

Correct / Incorrect / Don’t know

Q6.i: Please explain your answer.

Free text box

Goods already in the UK

Q7: How important is it for your business to be able to bring goods into the freeport from the UK, whether the goods are in free circulation or under another customs procedure?

Essential to my business / Very important to my business / Moderately important to my business / Slightly important to my business / Not important to my business / Not applicable

Q7.i: Please explain your answer.

Free text box

Location of freeports

Q8: What do you see as the advantages and/or disadvantages of an inland freeport site compared to a freeport site which is adjacent to a port?

Free text box

Excluded goods and excise goods

Q9: If you are considering becoming a freeport operator, how attractive would the proposed customs design be to your business?

Very attractive to my business / Attractive to my business / Unattractive to my business / Very unattractive to my business / Not applicable

Q9.i: Please explain your answer.

Free text box

Q10: If you are considering becoming a freeport business and would like to store imported goods or manufacture products using imported goods in the UK, how attractive would the proposed customs design be to your business?

Very attractive to my business / Attractive to my business / Unattractive to my business / Very unattractive to my business / Not applicable

Q10.i: Please explain your answer.

Free text box

Q11: To what extent would the suspension of import VAT be of value to your business?

Very valuable to my business / Moderately valuable to my business / Not very valuable to my business / Not at all valuable to my business / Not applicable

Q11.i: Please explain your answer.

Free text box

Q12: How important would it be for your business to be able to buy and sell goods within freeports?

Essential to my business / Very important to my business / Moderately important to my business / Slightly important to my business / Not important to my business / Not applicable

Q12.i: Please explain your answer.

Free text box

Trade remedies and countermeasures

Q13: To what extent do you agree or disagree that trade remedies or countermeasures should be applied to goods exiting freeports, whether or not they are processed in the freeports?

Strongly agree / Somewhat agree / Neither agree nor disagree / Somewhat disagree / Strongly disagree

Q13.i: Please explain your answer.

Free text box

Q14: To what extent do you agree or disagree that trade remedies or countermeasures should be applied to goods exiting freeports, whether they are destined for consumption in the UK or exported to foreign markets?

Strongly agree / Somewhat agree / Neither agree nor disagree / Somewhat disagree / Strongly disagree

Q14.i: Please explain your answer.

Free text box

General questions

Q15: In your view how does this freeport design compare to existing customs special procedures, such as customs warehousing or inward processing?

Free text box

Q16: Please suggest any ways in which this customs design could be improved. For example, could technology be used to streamline the requirements?

Free text box

Q17: Please provide any other feedback you have relating to this customs design.

Free text box

Tax

Q18: In your view, do the specific tax incentives provided in existing English enterprise zones (business rates discount and enhanced capital allowances) encourage increased business activity and employment in England?

Yes / No / Don’t know

Q18.i: Please explain your answer and support your response with evidence where possible.

Free text box

Q19: How could the following policies be used to encourage employment and investment in business, infrastructure and innovation in a freeport or surrounding area? Please explain your answer, and support your response with evidence where possible:

- facilitative solutions on VAT and excise duties for goods within freeports (UK wide)

- Stamp Duty Land Tax (England and Northern Ireland)

- research and development (R&D) tax credits (UK wide)

- employer National Insurance contributions (UK wide)

Free text box

Q20: Is there any evidence to suggest that changes in these tax policies would be the deciding factor in investment decisions?

Yes / No / Don’t know

Q20.i: Please explain your answer.

Free text box

Q21: In your view, are there any particular tax policies that could increase the risk of tax avoidance or tax evasion activity being routed through a freeport?

Yes / No

Q21.i: Please provide details.

Free text box

Q21.ii: If your answer is yes, then please suggest ways in which the government could deter or prevent the tax avoidance or evasion risk you have identified.

Free text box

Q22: In your view, would any of the potential tax policies set out in this document unnecessarily increase the administrative burden of business activity in the freeport?

Yes / No / Don’t know

Q22.i: Please explain your answer.

Free text box

Q22.ii: If your answer is yes, then please explain which of the tax policies could be modified to reduce administrative requirements and how they could be modified.

Free text box

Q23: Please provide any other feedback you have relating to tax incentives for freeports.

Free text box

Planning

Permitted development rights

Q24: Do you agree or disagree that the permitted development rights for airports and seaports should be brought into closer alignment by allowing the use of buildings on ports for purposes connected with the operation of the port?

Agree / Disagree / Don’t know

Q24.i: Please explain your answer.

Free text box

Zonal planning

Q25: Are there suitable incentives in place that encourage the use of LDOs by local authorities to support faster development?

Yes / No / Don’t know

Q25.i: Please explain your answer.

Free text box

Q25.ii: If not, what more could be done to encourage their use?

Free text box

National Policy Statement for Ports (NPSP)

Q26: Would it be appropriate or inappropriate to consider amending the National Policy Statement for Ports to allow for changes to planning process(es) for significant port development?

Appropriate / Inappropriate / Don’t know

Q26.i: If your answer is ‘appropriate’, what specific element(s) of the process or document could this focus on, and what potential benefits could this unlock?

Free text box

Q26.ii: If your answer is ‘inappropriate’, please explain why.

Free text box

Additional planning freedoms

Q27: Please tell us about any additional planning freedoms related to planning powers and/or increasing the efficiency and effectiveness of planning that you think could be used to support development in freeports.

Free text box

Regulatory impacts

Q28: Please provide any feedback you have on the regulatory impact of the planning measures set out in this consultation. For example, do you have any information on the costs and benefits to business of these measures?

Free text box

Regeneration

Infrastructure

Q29: What infrastructure could encourage increased business activity in a freeport? Please support your response with evidence where possible.

Free text box