Digitalising Business Rates: connecting business rates and tax data

Updated 15 March 2023

Summary

Subject of this consultation

This consultation lays out and seeks views on options for the policy and IT design for the Digitalising Business Rates (DBR) project.

Scope of this consultation

In the Final Report of the Business Rates Review, published at Autumn Budget 2021, the government committed to modernise and digitalise the business rates system through the DBR project by:

- matching business rates data with central HMRC tax data

- displaying business rates information alongside other tax information in a standardised way

This consultation sets out and seeks views on how the government proposes (with options where relevant) to deliver that commitment.

It will not look at any wider reform of the system, although the data provided by DBR once it has been delivered may enable future reform of reliefs, DBR will not impact the rates retention process or change any funding model and local government will remain responsible for business rates billing, relief administration and collection.

As business rates are devolved, this consultation only considers DBR for English billing authorities.

Making business rates payments through a new DBR service is out of scope for current delivery.

Who should read this

The government is seeking views from ratepayers, their agents and representatives, billing authorities, and any others who have an interest in the business rates or wider tax system.

Duration

The consultation will run from 20 July 2022 to 30 September 2022.

Lead official

The lead official is Kerry Smith of HM Revenue and Customs (HMRC).

How to respond or enquire about this consultation

Respondents do not have to respond to all of the questions in this document. HMRC also welcomes partial responses, focussed on individual experiences and aspects of the subject that are most relevant to the respondent. You may respond by completing an online survey.

Alternatively, you can email your response to the questions in this consultation.

If you are responding in writing, please make it clear which questions you are responding to.

Written responses should be sent to:

DBR Team – Floor 10 area 10:14

Stratford Regional Centre

14 Westfield Avenue

Stratford

London

E20 1HZ

When you reply it would be very useful if you confirm whether you are replying as an individual or submitting an official response on behalf of an organisation and include:

- your name

- your position (if applicable)

- the name of organisation (if applicable)

- an address (including postcode)

- an email address and/or a contact telephone number

Additional ways to be involved

The government is keen to collaborate with a wide range of respondents and will hold a number of online discussions to ensure that as many views as possible are heard. Please contact HMRC if you would like to be involved. Representative bodies for relevant sectors might also invite their members to contribute views through their own meetings or other channels.

After the consultation

Responses to the consultation will inform how the policy and design of DBR are taken forward, and the legislative changes needed to enable the system to work. A summary of responses will be published.

Getting to this stage

In reforms first outlined at Budget 2016 and reaffirmed in the Final Report of the Business Rates Review in October 2021, the government highlighted its view that ‘modernisation and digitisation, as well as how data can be used to improve administration of relief where feasible, would be an effective way to support firms to navigate the business rates system’; with DBR representing a major step towards modernisation of the business rates system. The government has confirmed it will deliver DBR no earlier than 2024, with an estimated roadmap date of 2026 to 2027 onwards.

Previous engagement

In July 2020 the government published the ‘Business Rates Review: Call for Evidence’ inviting views from stakeholders on the future of billing and collection. The responses included challenges of the current billing process and complexities in the reliefs system, calling for a modern and centralised digital billing platform and simplification of reliefs, which would enable ratepayers to better understand business rates.

At the Budget on 3 March 2021, the government announced an initial allocation of funding for DBR. Alongside measures announced in the Final Report of the Business Rates Review and the Valuation Office Agency (VOA’s) IT Transformation programme, DBR represents a major step towards modernisation of the system, which would tackle many of the concerns raised by stakeholders in previous consultations.

This consultation is the main opportunity for stakeholders to provide views on potential design options for DBR. It sets out, for the first time, detail on how DBR might operate.

Foreword

The government wants to modernise the administration of business rates to make them fit for the 21st century. By joining up data held across government – billing authorities, the VOA and HMRC – it will be easier, simpler, and less burdensome for ratepayers to understand their business rates liability and improve the government’s ability to deliver an effective tax system and provide targeted support if needed.

The benefits of digitalisation for all stakeholders are becoming increasingly clear. DBR is one part of the government’s wider aims to drive modernisation and innovation in the tax system to help support businesses and individuals when most needed, and so support the nation’s economic resilience. By linking business rates and tax data across government, DBR will allow:

- opportunities to better target business rates policy, including reliefs, in the future by having access to more comprehensive data

- more effective compliance

- a better experience of the business rates and wider tax system for businesses, including the ability to better understand and review their tax liabilities in one place

The way the business rates system is currently set up makes it difficult for the government to precisely target support when responding to the needs of businesses. By bringing together businesses’ property data and tax information in one place, the government will be better able to design and apply reliefs to support businesses that are most in need, rather than having to rely on property information in isolation. The limitations of the current system have been apparent during more difficult economic periods, including during the COVID-19 pandemic. As well as the other benefits set out above, DBR will address this problem.

The government is accordingly in the process of exploring potential designs for the DBR systems and processes. This public consultation represents the next step in this process, by testing the options considered so far with stakeholders.

Despite clear benefits for all stakeholders, the government is determined that DBR will not unfairly burden businesses. Our ambition is for ratepayers to be able to provide their information quickly and easily, and as a result, benefit from easy access to their tax liabilities in one place, at a time and place convenient to them. This consultation therefore explores DBR in the context of the government’s wider business rates reforms, including the potential for integration with other business rates and wider tax processes where this might make most sense for businesses, whilst preserving the current responsibilities of billing authorities.

We look forward to receiving and reviewing input from those who would be engaging with DBR at every stage, to inform further policy development and system design.

The Rt Hon Lucy Frazer QC MP

Financial Secretary to the Treasury

1. Executive summary

1.1. Non-domestic rates – also known as business rates in England apply to all non-domestic properties, unless specifically exempt from rating. Bills are issued, and payment collected, by the relevant local authority in each area – known as Billing Authorities (BAs).

1.2. The government has committed to DBR, specifically:

- linking business rates information (held by BAs) to tax records (held by HMRC)

- enabling businesses to view a copy of business rates billing information for all their non-domestic properties in England in one place, alongside other tax information

1.3. This will provide a number of advantages compared with the current system, including:

- better use of data, enabling the government to better target financial support to the businesses that need it most

- improving the data available to BAs to determine the reliefs that individual ratepayers should benefit from

- allowing businesses (and other ratepayers) to monitor and understand their overall tax liabilities more easily, which might be of most value to businesses operating across multiple BA areas

1.4. To achieve this, the government will require ratepayers to provide or confirm small amounts of additional information to ensure that it can confidently match business rates to tax data. Chapter 3 explains what might be required and why and seeks to understand any scenarios where meeting this new requirement might be difficult.

1.5. Chapter 4 seeks views on options, from a customer perspective, for where and how information should be provided by ratepayers or their representatives. One option considers how to utilise the government’s planned new duty on ratepayers requiring them to supply certain types of information to the VOA, in order to support more frequent revaluations and improve the accuracy of rating lists. DBR could request any additional information needed when a ratepayer (or their agent) is undertaking a process to comply with that new duty. The document also explores 2 other options, where the government would welcome stakeholder reflections on the relative merits. In considering responses, the government is particularly keen to understand the potential costs to ratepayers and BAs of requiring additional information under each option, and which of the 3 options ratepayers are likely to find simplest.

1.6. Chapter 5 considers the exchange of data needed between central government and BAs about business rates bills, and how the linking of business rates and tax data can then be used to support ratepayers and BAs. The government would welcome evidence on opportunities to use DBR data and the potential scale of benefits that could be facilitated by DBR. It also seeks views from BAs on how to ensure that DBR presents correct billing information and the potential costs to BAs of adapting their IT systems to share billing information for DBR.

1.7. Chapter 6 explores the underlying need for a supporting compliance regime, sets out the government’s thinking on guiding principles for such a regime and explores a number of options for compliance regimes to underpin the 3 data-in options.

1.8. Chapter 7 covers a number of cross-cutting considerations: the legislative changes needed to deliver DBR; how agents might best operate and interact under DBR on behalf of their clients; and what provisions might be needed where ratepayers are unable, or need assistance, to access digital services.

2. Introduction

Business rates

2.1. Business rates raise revenue to fund key local services in England. Approximately 2 million properties are liable for business rates in England.

2.2. Business rates apply to all non-domestic properties consisting of land or buildings that are not specifically exempt from rating. Some examples include shops, offices, factories, warehouses, stables, beach huts, market stalls, car parks and schools. In general, rates are paid by the occupiers of properties, rather than owners (although the 2 can be the same). Where properties are unoccupied, the liability for business rates sits with the person with the right of beneficial occupation – in many cases, the property owner.

2.3. The Final Report of the Business Rates Review, published by the government in October 2021, set out a number of changes to the business rates system, including reiterating the government’s commitment to deliver DBR to improve the business rates system and make managing business rates easier for ratepayers. Other changes include the new legal duty to be established requiring ratepayers to supply certain types of information to the VOA, in order to support more frequent revaluations and improve the accuracy of rating lists. DBR will need to work with the touchpoints that ratepayers (and their agents) will have with the business rates system following the implementation of that new obligation, which will in some instances be different from the touchpoints they have now.

Roles of different parts of government in the business rates landscape

2.4. DBR will not materially alter the established roles and responsibilities of different parts of government within the business rates system, as set out in the government’s initial Business Rates Review Call for Evidence. In particular, readers should understand that BAs will remain responsible for the administration of business rates, including billing, collection, and enforcement, and making decisions on the award of relief to businesses. DBR is concerned with ensuring that the tax system as a whole is more efficient and provides an improved experience for ratepayers by allowing business rates information to be viewed in one place, especially for those businesses operating in multiple BAs, as well as enabling the government to better target support to ratepayers and businesses where most needed. DBR will increase the currently minimal role of HMRC within the business rates system, as HMRC owns and holds wider tax information and will therefore need to play a role in connecting this data with business rates data and using it to support ratepayers, BAs and government functions. HMRC will continue to keep taxpayer information confidential, ensuring it only discloses information where there is lawful authority to do so, as stated in the Commissioners for Revenue and Customs Act 2005 (CRCA).

Business rates billing and collection – previous Call for Evidence

2.5. The 309 BAs in England generally issue bills annually for each individual property, as well as on each occasion when a change to circumstances is reported. Where a business occupies multiple properties in different locations, they will receive separate bills for each property from each relevant BA (as required by legislation) and make separate payments.

2.6. In July 2020, the government published the Business Rates Review Call for Evidence, inviting views from stakeholders on the future of business rates billing and collection, and how DBR could best deliver benefits that address the concerns of ratepayers.

2.7. In response to the Call for Evidence, several concerns and issues regarding the current business rates system were raised:

- a general expression of dissatisfaction with the existing billing process, with large numbers of respondents requesting a digital system that allows for electronic bills, with suggestions to centralise the non-discretionary elements of the business rates system

- concerns were raised, especially by larger firms, regarding the disparities in software and processes between BAs; the standardisation of bills across BAs was called for

- some respondents raised concerns about complexities in the reliefs system and suggested that its simplification would improve satisfaction with billing

- there was general support for a centralised online system and the associated benefits however, a small number of respondents opposed such a system due to fear of complicating the process further, potential poor user experience of a new system and/or because they felt the current system is effective and does not need changing

DBR Background

2.8. DBR was first announced in 2016 and formed part of the government’s conclusions to the Business Rates Review at Autumn Budget 2021. The government made a commitment that BA business rates systems will be linked to HMRC’s digital tax accounts.

2.9. DBR has 2 sets of deliverables. Firstly, it will connect business rates information held across BAs with HMRC tax data. Secondly, it will improve customer experience by displaying business rates information alongside other HMRC tax information and support application of reliefs where feasible. DBR also includes the potential to provide central and local government with additional data to better target and administer policies to support levelling up.

2.10. As a local tax, business rates information is held in 309 BA systems, and relates to individual properties. Though there are a number of BAs that have multilaterally developed joined up systems, there is no centrally connected view of all the rateable properties that one business might be using or of the reliefs it might be receiving. The lack of connection of this business rates data with data about individual businesses (for example around profitability) limits the ability for government to target support to businesses without relying on self-certification and manual compliance activity.

2.11. Matching property data held by BAs to taxpayer data (such as business turnover and profitability) held by HMRC should:

- create opportunities to better target business rates policy, including reliefs, in the future by having access to more comprehensive data

- support BAs as better data would help them determine the eligibility for relief, for example Small Business Rates Relief (SBRR) or cash cap limits in the Retail, Hospitality and Leisure Relief scheme

- allow business rates information and broader tax liability to be viewed in one place especially for those businesses operating in multiple BAs

- enable the government to better target support to businesses in response to economic shocks, to those who most need support, as experienced when the COVID-19 pandemic started, rather than simply basing it on rateable value and property use

The scope, design, and delivery of DBR

2.12. The government is open to views on how best to deliver DBR, with ratepayers and taxpayers at the centre of the design. It is worth noting that:

- the government’s current DBR commitment does not include providing functionality to make payments through the new DBR service (so billing information will be visible in one place, but separate payments will still need to be made to relevant BAs and responsibility for billing, and decisions on the award of relief will remain with BAs)

- HMRC, the VOA, and BAs operate various different IT systems, so IT design for DBR will need to enable data sharing across these different systems

- there are opportunities for DBR design to integrate with other government projects that are currently still in design or delivery – including work to bring data on different taxes relating to the same customer together within HMRC, work to bring HMRC services together for a customer in a single customer account, and processes to underpin the new duty requiring ratepayers to supply certain types of information to the VOA

- the government has previously said that planned implementation of DBR will be after 2024, with an estimated roadmap date of 2026 to 2027 onwards

2.13 This consultation therefore seeks views on high-level design concepts, but judgments on detail will need to be made as DBR moves into delivery alongside these other changes.

DBR and the devolved nations

2.14. Business rates are devolved across the United Kingdom. The DBR commitment applies to England only. However, the United Kingdom government is exploring the possibility of extending DBR to Wales.

2.15. Details and options will be considered after this consultation, once the design for DBR in England is clearer.

Question 1: How would Welsh local authorities, ratepayers, agents, and broader stakeholders feel about the possibility of DBR being extended to Wales?

3. DBR design and data matching

Elements of DBR design

3.1. For the government to connect business rates and HMRC tax data and deploy it to improve the system, DBR must effectively undertake 3 key steps:

- receive relevant business rates ‘data in’

- ‘data match’ that business rates data with tax data

- provide ‘data out’ to other parts of government and ratepayers

3.2. Chapter 4 outlines options for ‘data in’ steps, with questions for stakeholders to help inform the government’s understanding of the viability of these different options.

3.3. Chapters 5 and 6 then consider the provision of ‘data out’, both to other parts of government to improve the business rates system, and to ratepayers so they are able to see their business rates billing information digitally, in one place, alongside their other tax liabilities.

Data matching requirements

3.4. As highlighted in the previous chapter, the government considers that connecting business rates information to tax data will improve the customer experience by allowing business rates information and broader tax liability to be viewed in one place, supporting application of reliefs where feasible and enabling better targeted support to ratepayers and businesses when needed. To achieve these desired outcomes, DBR will need all properties relating to a ratepayer to be linked to their tax information. To do this, a high degree of confidence in the matched data is required to reassure customers their data is safe, ensure compliance with United Kingdom GDPR (General Data Protection Regulation) and give the government the ability to more effectively target reliefs in the future.

3.5. Whilst HMRC already currently receives some business rates data annually from BAs, the level of information received varies and is not validated, thus cannot be confidently matched to taxpayer data without checking against or asking for additional information. The most common unique reference numbers that HMRC currently receives from BAs are company registration numbers, but these are not required to be provided, nor are they applicable for all businesses, and are not validated. It could therefore be possible for a ratepayer to provide the wrong number, and if DBR relied on it, to incorrectly be matched to another taxpayer’s data. To confidently match data for DBR, it needs to be validated so it does not contain errors and is not mis-matched.

3.6. Identifiers like business name and address are often stored in different formats across different organisations and systems. For example, full name, first name and surname, use of trading name vs ratepayer and taxpayer name. There are also inconsistences across BAs or within systems where, for example, one record shows J Smith Ltd, another John Smith and another J Smith.

3.7. There may also be numerous addresses linked to a business. For VAT purposes they may register their principal place of business, whereas for corporation tax purposes they may use their head office. Agents’ addresses exist on client records in some cases (often in relation to smaller businesses). This complexity means that DBR could not guarantee a confident match between taxpayer and ratepayer records without asking for additional information, which increases the risk of bringing poor data into the wider HMRC estate and GDPR risks in matching the wrong properties to the wrong tax record and so showing incorrect billing information.

3.8. Using unique reference numbers to match business rates and tax data provides a ‘golden thread’ to ensure matching is accurate and reliable. The government is keen to fully explore instances where it might be possible to achieve this using information that can be captured ‘behind the scenes’ without a requirement on ratepayers to provide a reference number (see Chapter 4, option A, para 4.3), but expects that in many (if not all) cases it will need to require the ratepayer to provide a relevant reference number, and possibly accompanying information for validation purposes. This reference number is likely to be a tax or property reference number depending on the process used to capture the data. Potential options for these are explored below. The next chapter considers options for processes in which this request could be made. In most cases this should be a one-off obligation. However, the government is keen to understand scenarios in which a change of circumstances could lead to a ratepayer’s tax reference information changing, and therefore a need for it to be updated.

3.9. Liability for business rates sits with the person in rateable occupation. This is usually the occupier (leaseholder, freeholder, or tenant for example), but will often be the owner where a property is empty. The information requested under DBR should relate to the person or entity with the legal responsibility for business rates for a property. This consultation looks to explore what tax reference(s) and/or taxpayer data and what property reference will be needed to enable a successful match.

Tax reference numbers

3.10. Various tax reference numbers are used across HMRC, including:

- Self Assessment Unique Taxpayer Reference (SA UTR)

- Corporation Tax Unique Taxpayer Reference (CT UTR)

- Partnership UTR

- VAT Registration Number (VRN)

- National Insurance Number (NINO)

- Pay as You Earn (PAYE) reference

- Company Registration Number (CRN)

- Registered Charity Number

3.11. When considering which tax reference to request from a ratepayer under DBR, one key consideration is how familiar and easy to find these are for ratepayers. For example, UTRs are commonly used to submit annual tax returns for individuals, partnerships, and companies and to make payments to their tax account. VAT registration numbers must be shown on receipts or invoices so are also commonly known and available to VAT registered customers.

3.12. If a customer enters a tax reference through a service using verified credentials (such as Government Gateway or its successor One Login) no further data may be required to authenticate the user. Where this is not possible, to be confident that the reference provided is correct and relates to that ratepayer, other data may be required to validate the reference provided. For example, if an individual provides a SA UTR, they may also be required to provide their NINO or date of birth; if a business provides their CT UTR, they may also be asked to provide their CRN or registered address postcode to enable HMRC to validate the information and accurately match the customer to a tax record.

3.13. The government is continuing to explore opportunities to match data without needing to ask for a reference number and will be exploring the feasibility of this further. For example, it might be possible to match business rates and tax data without requesting a tax reference for some of the target population under one of the options outlined in Chapter 4 (option A). The VOA’s new system is in early design stage, and it is not yet determined how ratepayers will access the system. However, the VOA and HMRC may use the same log-in service, if so and if a ratepayer uses the same verified credentials to log into both (GOV.UK) tax and business rates services, it might be possible to infer a match behind the scenes. This is less likely to be possible if DBR were collecting tax references through BAs given the different IT systems involved and absence of Government Gateway or similar sufficiently rigorous means of front-door validation. The government is interested to understand the extent to which ratepayers use (or would use) the same credentials across (GOV.UK) tax and business rates services and might therefore avoid the requirement to locate and enter tax reference numbers manually – this may be most likely among smaller businesses. Where different credentials are used for example, larger businesses with separate departments dealing with tax and business rates, with different credentials for each, or where the business uses an agent for their tax or business rates affairs, it would not be possible to make this link so the ratepayer or agent would still need to be asked to locate and provide a tax reference number.

3.14. The SA UTR, Partnership UTR or CT UTR are the optimum combination of reference numbers to identify a specific taxable person or entity, as most ratepayers will have at least one of them. A VRN could also be an alternative for ratepayers registered for VAT, as it may be more readily accessible.

Property reference numbers

3.15. Property reference numbers are used across BAs, the VOA, Land Registry and Ordnance Survey to identify an addressable location such as residential, commercial buildings and objects that may not have a typical postal address for example, land masts or advertising rights. The 2 main property reference numbers are:

- Unique Property Reference Number (UPRN)

- billing authority reference and code

3.16. DBR will need to use one of these as the lead identifier for the properties a ratepayer occupies. In options A and B in the next chapter, DBR would draw this from VOA or BA systems and the ratepayer shouldn’t have to specifically re-enter property reference numbers for DBR purposes, only a tax reference. In option C, ratepayers would not need to separately enter a tax reference number as DBR would draw this from HMRC systems but would instead need to identify the properties they are responsible for and enter appropriate references for them.

3.17. The BA reference appears on business rates bills and is used in all communications between BAs and the VOA. However, to make it unique it must be combined with a BA code, that can be found when a ratepayer inputs their BA name. It is understood a BA reference can change with every change to a hereditament, which can be multiple times a year if works are ongoing.

3.18. The UPRN is more easily recognised within current HMRC systems. However, research suggests the UPRN isn’t currently presented or known by the ratepayer. Ratepayers could supply their postcode and be prompted with a list of all properties/premises in that area, the ratepayer would then select their address from the list and the system would populate the full address. The system would have the correct UPRN at the point the ratepayer selects their address from the list. It could also be identified within a Find My Address Tool provided by GeoPlace.

If a ratepayer is not registered for tax or there is no clear alignment between their tax and ratepayer identities

3.19. Whilst the majority of ratepayers will have at least one of the tax references set out above, some ratepayers may not have a tax account or most relevant tax reference, such as:

- new businesses, who have registered for business rates but are yet to register for tax

- non-United Kingdom residents who do not have a tax account

- those ratepayers who are liable for business rates but are not otherwise business tax registered, for example individuals who occupy a non-domestic property (for example, a beach hut, stable or garages)

3.20. The government also needs to understand if there are scenarios in which, if a ratepayer correctly associated themselves with all their properties for business rates purposes, they might not all correctly connect to a single taxpayer reference number.

Tax reference numbers

Question 2: Do ratepayers know/can they find their SA/Partnership/CT UTR and VRN? If not, what would make this easier?

Question 3: Where ratepayers do not have one of these relevant reference numbers, would identifying themselves as a taxpayer by providing a NINO or CRN cause any issues? If so, what are they?

Property reference numbers

Question 4: If ratepayers alternatively needed to locate and provide property reference numbers, would it be easier for them to provide a) a BA reference number plus BA name or 4-digit BA code, or b) a UPRN?

Other questions to help build the government’s understanding

Question 5: Are there scenarios where ratepayers might not have any relevant reference number? Including any scenarios where a ratepayer may not be registered for tax purposes? If so, what are they?

Question 6: Are there scenarios where a person or entity’s identity in the tax system (with one tax reference number) may not precisely align with their legal responsibility as a ratepayer? for example, where multiple ratepayers share the same tax reference number, or multiple entities for tax purposes share one responsible legal identity in a business rates context?

Question 7: When might a taxpayer reference that is associated with a property portfolio under DBR change (for example, registration for self-assessment, incorporation or disincorporation, VAT-registration or de-registration, mergers and acquisitions)? Are there scenarios where the new reference number might not precisely assume the property portfolio associated with the previous number?

4. Receiving relevant business rates ‘data in’ to HMRC

4.1. As set out in Chapter 3, accurate matching of data will require a significant number of (if not all) ratepayers to provide a reference number. This chapter outlines and invites stakeholder views, on the options the government is currently considering for collecting this information.

4.2. The design principles around requesting ‘data in’ from ratepayers (or their agents) are to:

- minimise the burden on ratepayers as much as possible, by seeking opportunities to use processes that ratepayers will already be using, rather than introducing new ones

- work closely with BAs and the VOA to ensure the overall customer journey is seamless and feels coherent

- avoid asking for the same data through multiple routes

- look at opportunities for how the new matched data could also reduce burdens on ratepayers in other areas

Option A (lead option): Requesting information as part of the forthcoming business rates duty (and, if feasible, matching without ratepayer involvement where possible)

4.3. The VOA are responsible for compiling and maintaining non-domestic rating lists. DBR does not seek to disturb VOA’s core functions.

4.4. This option utilises the new duty for ratepayers announced by the government in England as part of The Business Rates Review.

4.5. Under this option an additional one-off step could be added to the VOA’s new duty processes, to gather the tax reference number(s) for DBR data matching and pass them to HMRC to validate. As design of the new processes associated with the new duty develops, the government would need to determine the best point in these processes to request the additional information for DBR.

4.6. HMRC will explore if it is feasible to obtain a relevant tax reference ‘behind the scenes’ without the ratepayer having to do anything in addition to complying with the new duty being introduced. The VOA’s new system is in early design stage and it is not yet determined how ratepayers will access the system. However, if ratepayers use the same verified credentials to access both HMRC-run tax and VOA-run business rates services (such as Government Gateway or its successor One Login), it is possible that this ‘behind the scenes’ matching will be feasible. This would be the preferred route under this option if it proves feasible, but it would only apply to some customers.

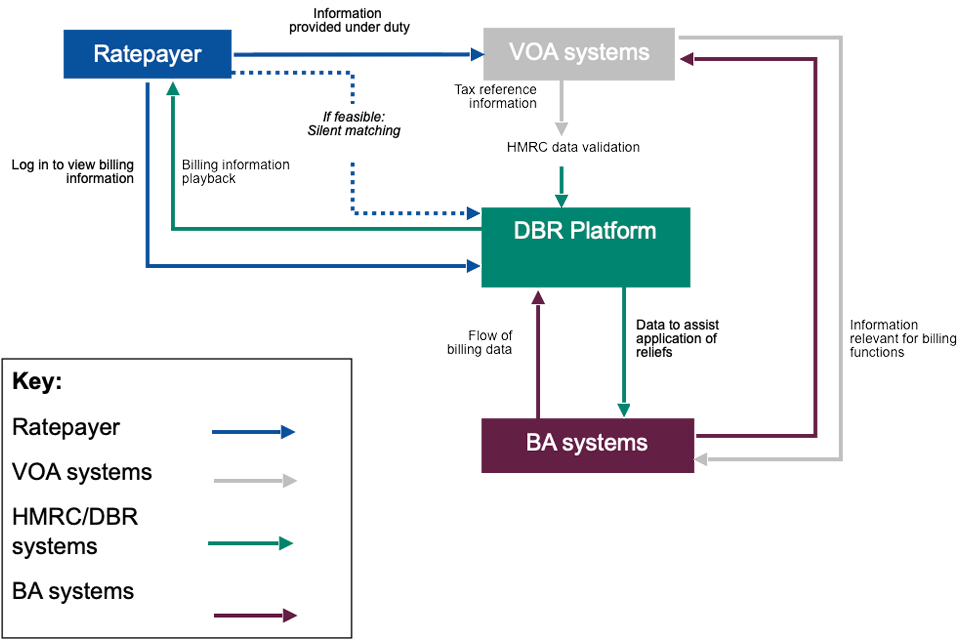

Figure A: Main information flows under option A

This diagram illustrates the possible journey a ratepayer or billing authority may take with option A.

4.7. Analysis to date suggests that option A may be the strongest option to deliver DBR, as it forms part of a process that all ratepayers or their agents will need to complete under the VOA’s new duty. It might therefore offer a good customer journey without placing significant additional burden on the ratepayer. In addition, and subject to further exploration, it might be possible to avoid some customers having to provide a reference number under this option, although this is yet to be fully determined and impacted. It is likely to be simpler to deliver compared to option B in IT terms, due to the potential for re-use of systems that will be in place. It would require ratepayers to share their tax reference(s) – which constitutes personal data in some cases – with the VOA.

4.8. However, as processes around the new duty are in design stage, and tax references constitute personal data in some cases, it is possible that difficulties with this option may not yet have been identified or fully understood. Moreover, as this is not the only point of ratepayer/government interaction for business rates and broader tax obligations, the government would also like to test with stakeholders 2 alternative high-level options where DBR ‘data in’ for matching purposes might be requested and received:

- Option B: to capture tax reference and validation information from ratepayers through their interactions with their BA(s)

- Option C: for ratepayers to provide references that identify their properties through HMRC’s online services

Option B: Requesting ratepayers provide tax reference information to their Billing Authority (BA)

4.9. Under this option, ratepayers would be required to provide a tax reference (and other information to allow the number to be validated) to the BA. The BA would then pass this to HMRC to validate and match to the ratepayer’s tax information.

4.10. The government would welcome views on the most appropriate point for BAs to request this information from ratepayers. One option would be to do so as part of the process of registering for business rates, however most ratepayers will already be registered for business rates with BAs. The government would therefore like to know if stakeholders would prefer an additional, one-off process hosted through BAs to capture references from existing customers, or the creation of a one-off obligation to provide a tax reference for DBR in existing processes when ratepayers are accessing or paying bills. If the latter, it would also welcome views on what the most appropriate point would be in existing processes to request this information.

4.11. Option B is considered to be most like the current processes for ratepayers, whose main, and in many case only, interactions with the business rates system are currently through their BA. However, some of these processes may change as the new VOA duty is implemented, and ratepayers are required to notify the VOA of relevant changes and complete an annual confirmation. It is likely to be the most costly and complex to deliver as it would require each BA to change their ratepayer-facing business rates services to collect a tax reference. It would also require ratepayers to share their tax reference(s) – which constitutes personal data in some cases – with the BAs.

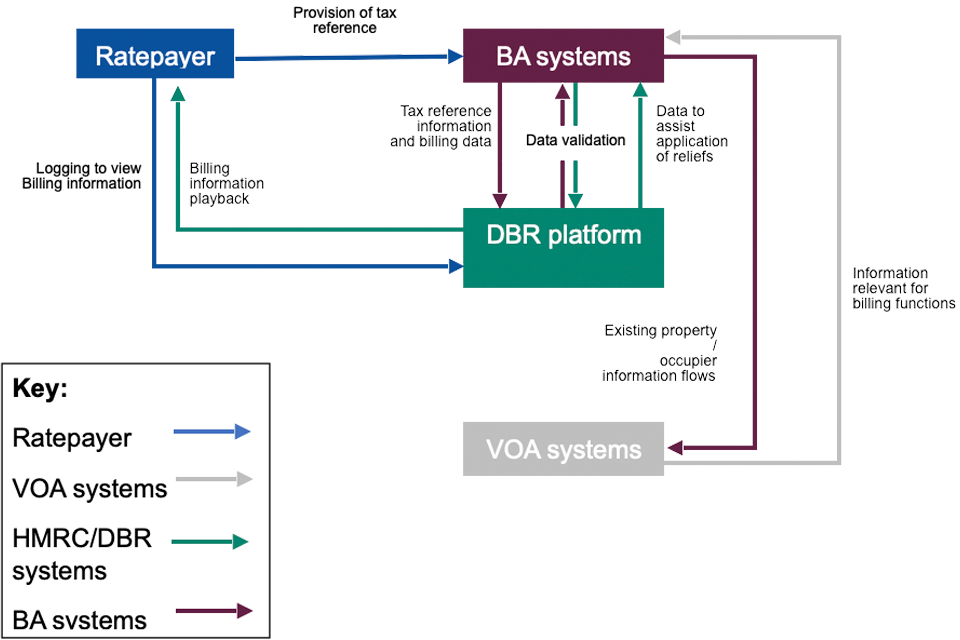

Figure B: Main information flows under option B

This diagram illustrates the possible journey a ratepayer or billing authority may take with option B.

Option C: Requesting property reference numbers as part of a tax-related service

4.12. Under this option, ratepayers would be required to log on to HMRC’s online services and complete a process to provide references for each of their properties. These would then be linked to their tax reference(s).

4.13. There are a number of ways in which ratepayers might interact with the tax system at the moment, although no single process that all ratepayers are required to follow. Most will be required to submit regular tax returns (for example, for Income Tax Self-Assessment or VAT) although over time these will increasingly be done through third party software rather than HMRC’s online services. Those who don’t pay by direct debit may use HMRC’s online services to make tax payments, and some may log-on to their HMRC tax account to check their liabilities or access other information. The government would welcome views from stakeholders on whether it would be best to capture this information through an existing HMRC process or processes and if so which one(s), or through a new standalone service hosted by HMRC.

4.14. Whilst more straightforward to deliver than option B, this option might represent the most significant change for ratepayers as they would need to log-in and provide the information through a HMRC service. Depending on the service chosen, this might be part of an existing process or require logging in specifically to provide DBR information. Also, many business taxpayers are not liable for business rates, but HMRC do not know who is and so would need to target all business taxpayers with this service initially.

4.15. The government recognises option C would need careful design in relation to the forthcoming VOA duty, to prevent ratepayers from needing to associate themselves with their properties in 2 separate systems.

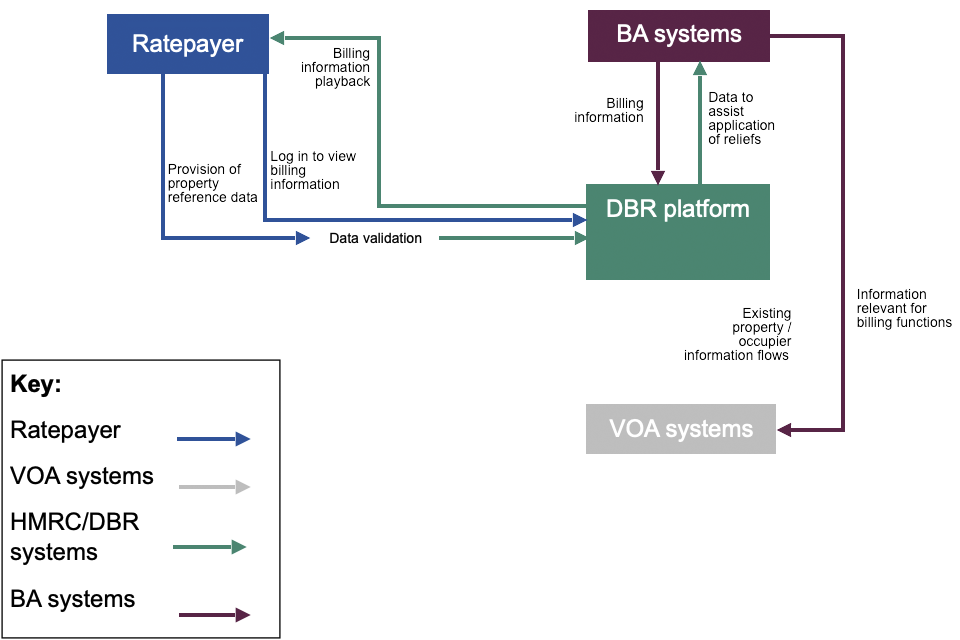

Figure C: Main information flows under option C

This diagram illustrates the possible journey a ratepayer or billing authority may take with option C.

How DBR will deal with changes of tax reference information

4.16. Most taxpayers will have a continuous identity as a taxpayer (for example, their UTR does not change from the point they start a business or enter self-assessment, until their business and any associated property use ceases). DBR would rely on this to form an initial connection between a taxpayer and the properties they use. If the properties linked to a particular ratepayer were to change, this would be updated through the new VOA duty processes and in turn, to the DBR system directly or indirectly.

4.17. However, the government needs to understand the scenarios in which a taxpayer reference that is associated with a property portfolio under DBR might change (for example, registration for self-assessment, incorporation or disincorporation, VAT-registration or de-registration, mergers and acquisitions), particularly if there are scenarios where the new reference number might not precisely assume the property portfolio associated with the previous number.

Receiving billing information ‘in’ to the DBR service from BAs

4.18. Alongside the additional information needed from some ratepayers to match records, HMRC will also need to receive new flows of data from BAs to support the display of billing information alongside tax information (more detail is set out below in chapter 5). BAs already provide some information to HMRC, annually through a BR-01 form, but more real time exchanges of information will be required with BAs to support the new DBR service, to ensure the billing information displayed by HMRC is accurate and doesn’t cause confusion for customers.

‘Data in’ from ratepayers

Question 8: In which type of customer journey would it be easiest to provide your reference number(s) (option A, B or C) and why? Would any of the options be particularly difficult?

Question 9: What are the main challenges presented with each ‘data in’ option and how could they be addressed?

Question 10: Under option B – what process would be best for ratepayers (or their agent) to provide their tax references to a BA and why? Or would a standalone process be preferable?

Question 11: Under option C – what process would be best for ratepayers (or their agent) to provide their property references to HMRC and why? Or would a standalone process be preferable?

Question 12: To what extent would ratepayers expect to log in themselves to provide tax or business rates information with a single set of verified credentials (rather than setting up multiple credentials or using an agent)?

Question 13: Other than those outlined in this document, are there any options for how DBR might collect data to enable matching of taxpayer and ratepayer information, that would work better to achieve the policy aims?

‘Data in’ from BAs

Question 14: What processes might ratepayers (or their agents) have to put in place to meet their obligations under each option and what costs might this bring?

Question 15: How much might you expect it to cost BAs to upgrade systems to export billing information to HMRC. Please provide the evidence or assumptions that support your estimate (this will help inform new burdens funding estimates)?

5. ‘Data out’ from HMRC: using DBR data

Displaying business rates information alongside other taxes

5.1. Following the Business Rates Review Call for Evidence, the government committed to providing business rates billing information, hosted digitally on a platform that shows the ratepayer’s business rates information, as issued by BAs in a standardised format, alongside other HMRC tax liabilities. However, the exact nature of what information would be displayed needs to be considered.

5.2. The key assumptions for DBR are as follows:

- only demand notices issued by the BA are enforceable, BAs will remain responsible for issuing a bill to each property, decisions on awarding relief and collecting payments due; DBR will merely present a consolidated view of business rates information, HMRC will not take any legal responsibilities to issue demand notices or collect payment of bills

- DBR will only display a statement for all the properties that it can reliably link to a taxpayer through the information that has been provided/confirmed

- the information available through DBR should mirror that in the bills issued by BAs; if this is not ‘real-time’ this could impact the accuracy of information displayed to ratepayers which could result in increased confusion and customer contact

- BAs will remain responsible for decisions on the award of business rate reliefs. Eligibility for the majority of reliefs rests on the use of the property, and BAs determine whether the use of the property satisfies the eligibility criteria

5.3. The exact way business rates information is displayed through DBR will be determined through extensive user research as part of delivery, to ensure it is clear and meets customers’ needs.

How better data could improve compliance with current reliefs criteria

5.4. DBR will provide opportunities to improve compliance with current reliefs criteria by providing BAs (who will remain responsible for assessing and applying reliefs), with joined-up property data across authorities, and potentially access to some tax information. This could improve their confidence when awarding reliefs by allowing them to check, for example, that a ratepayer in receipt of Small Business Rates Relief (SBRR) is not breaching the criteria through also using properties in other areas. This should help reduce the legal and administrative burdens for BAs to check compliance and could also reduce the administrative burdens for ratepayers that currently have to provide eligibility information to their BA(s).

How better data could improve administration and targeting of reliefs

5.5. DBR data will improve HM Treasury’s ability to better design and target business rates reliefs in future. The government’s experience of designing and targeting COVID-19 reliefs and grants has made clear the value of better, more joined up information about local economic activity. Equipping BAs with additional data is anticipated to give them confidence when determining reliefs and grants (and make it quicker and easier to do so).

5.6. DBR has the following key objectives:

- pave the way for future redesign of business rates reliefs with better targeting of reliefs and easy access to robust data to support the government in responding to crises to support businesses with economic interventions

- reduce the administrative burdens on BAs to assess whether relief criteria are met

- reduce the need for the ratepayers to provide supporting information to prove their eligibility for SBRR or future reliefs

- improve ratepayers’ experiences by potentially enabling future reliefs to be applied quickly and easily

- enable targeting of policies to support levelling up

5.7. To ensure displaying billing information alongside tax information is of value to customers, the government would like stakeholders to consider the questions that follow.

Question 16: Would you use a service that allows you to view business rates information for all your properties across England in one place, alongside other HMRC tax liabilities? Yes/No

- If yes, how often and for what purposes?

- If yes, how useful would you find such a service – on a scale of 1 to 10, where 10 is extremely useful?

- If no, would being able to pay your bill(s) through the service change your response?

Question 17: When thinking about how often (your) bills change, how often should the business rates billing information be updated? (for example, weekly, daily, or through real time look-up whenever a ratepayer seeks to view their billing information through the DBR service). Options: real time look up/daily/weekly/monthly/quarterly/annually

The government would welcome views on the following questions on how data could be used to improve the reliefs system.

Question 18: Could DBR data help with targeting and administrating of reliefs? If so, for which reliefs would it be of most help and why?

Question 19: Is there any other data that DBR could provide to help billing authorities feel more confident when awarding reliefs and/or grants?

6. Compliance Regime

Penalties

6.1. To obtain the expected benefits of DBR, the government requires accurate data matching to connect business rates information with tax information. This would involve creating a new obligation on ratepayers to provide reference numbers, with accompanying sanctions for those customers who fail to meet the obligation. A well-designed penalty regime should primarily encourage and increase compliance and prevent non-compliance. It must be proportionate, administered fairly and consistently, and in a cost-effective manner. The government considers issuance of penalties to be a last resort; not to increase revenue, but to be used where necessary and where other measures such as reminders are ineffective.

6.2. Under the new duty to provide information to the VOA, a penalties regime is being introduced for ratepayers, which was recently subject to a technical consultation to gather stakeholder views. DBR would therefore generally seek to align with that new penalty regime where possible, to ensure consistency for ratepayers, and to minimise the need to add further steps and complexities to existing customer journeys.

6.3. The option selected to capture the data (set out in Chapter 4) influences the optimum design for a penalty regime from a ratepayer perspective. The Government is seeking to ensure that the customer journey for satisfying both the new duty to provide information to the VOA, and the obligation to provide a tax reference for DBR, is as simple as possible. However, it is important that customers provide information to satisfy both sets of obligations.

6.4. In the case of option A, there would be choices to be made about how compliance with the new DBR requirement could be enforced. A specific sanction – separate from the penalties for failure to provide information to the VOA – could be created for a failure to provide a tax reference (or property references) for DBR purposes (the information being collected is for a different purpose to the information required as part of the forthcoming VOA duty). This may result in a ratepayer receiving 2 separate penalties for failure to comply with 2 obligations for which information is captured through the same process. Or it might be possible to rely on a single penalty, whether a ratepayer failed to provide information needed for DBR, for rating purposes, or both. If it is possible to match data ‘behind the scenes’ for some ratepayers, and some ratepayers are not required to provide a reference number, we would need to explore what this would mean for a sanctions regime.

6.5. In the case of options B and C, the approach taken would also need to take account of the process being used to collect the tax or property reference needed. If it was added into an existing process then consideration would need to be given to any sanctions already associated with that process, as with option A.

6.6. Further work needs to be done to understand and finalise the design for how data is captured, which will then allow the government to set out what the penalties regime will look like.

Introduction period

6.7. Regardless of the design chosen, the government wants to ensure ratepayers have sufficient time to understand the new penalties framework before introducing sanctions for compliance failures, and that they can reasonably and efficiently provide the information the government is requiring. The government therefore proposes using a soft launch for the provision of DBR information penalties to take a proportionate approach. This will give customers time to get used to the new requirements and to ensure the system is working well. In particular, it will be important to ensure that if there are early issues providing a reference number, this does not stop people fulfilling their other responsibilities in the business rates system.

Conditionality

6.8. Conditionality is where access to certain services or benefits are conditional on having met specific requirements. It is used to incentivise positive behaviour in respect to the behaviours the conditionality is targeted at. For example, DWP’s sanction of reducing or stopping payment of jobseeker’s allowances incentivises recipients to apply and interview for suitable roles.

6.9. The government has considered, but is not currently minded to pursue, making access to existing business rates reliefs conditional on providing the information requested to deliver DBR. This could be an alternative to issuing a penalty in relevant cases. However, the government would like to understand stakeholders’ views on the merits and/or risks of any future new or redesigned reliefs only being available to ratepayers who have fulfilled their obligation to provide information needed for DBR (including if their tax information might be relevant to determining their eligibility for relief, to ensure only those entitled can access it).

Question 20: If option A for ‘data in’ is pursued, do respondents think DBR should be included within the sanctions regime for the new VOA duty or have a separate sanctions regime?

Question 21: If separate, or if options B and C are pursued, do ratepayers have views about adopting a similar penalty regime to the one proposed for the VOA’s new duty?

Question 22: What concerns do you have about a DBR sanctions regime?

Question 23: Do you envisage risks with applying the principle of conditionality to new or redesigned reliefs? If so, how can these be mitigated?

Question 24: Are there alternatives to penalties not explored in this document that the government should consider?

7. Other considerations

New legal gateways to support real time exchange of data needed to support the IT solution

7.1. The government will need to introduce new legal gateways to support the exchange of data (between ratepayers, billing authorities and relevant government bodies) needed to deliver DBR. It is expected that this would include the introduction of new primary legislation.

7.2. HMRC currently gathers information annually from BAs under its Schedule 23 data gathering powers. To support the policy objectives of DBR, more real time exchange of information will be required, this will be wider than the information currently received.

Potential changes to HMRC’s core function

7.3. HMRC would need to undertake new responsibilities and functions to deliver DBR. This may include:

- giving HMRC the legal authority to operate the digital service

- allowing ratepayers and BAs to use the new service

- obligating ratepayers to provide a reference number

- creating new data gateways between BAs, HMRC (and possibly the VOA)

- creating an accompanying proportionate penalty regime for failure to comply with the new obligation

Agent access

7.4. It is the government’s aspiration for ratepayers to be able to use agents to help them discharge their responsibility to provide the mandatory data-matching information needed for DBR, and to be able to authorise agents to view their business rates information through the new DBR service. The way the first of these might work will be dependent on the process used to collect the references needed for DBR and how agents interact with those services.

7.5. The second – an agent’s access to a ratepayer’s business rates billing information through DBR – could be developed in different ways. It could be incorporated into an existing service or delivered through a new service (for example, through GOV.UK), but in either case there needs to be the ability for a ratepayer to authorise a rating agent to see their business rates information through DBR. The government is exploring how this authorisation could be facilitated, including whether there are existing processes that could be used.

7.6. One option could be to consider authorisation via HMRC’s Agent Services Account, but this service was designed for tax agents rather than rating agents. Tax agents must be authorised to access HMRC services on behalf of their clients, and they must be registered for Anti-Money Laundering supervision (AMLS) on an annual basis (the annual renewal fee for AMLS registration is £300). Therefore, HMRC’s Agent Services Account has been designed such that it is only possible to authorise an agent who is registered for AMLS. However, many rating agents do not need to be registered for AMLS for the purposes of discharging their ordinary duties, so it would be necessary to explore the scope for changing the Agent Services Account to allow tailored or limited access for certain types of intermediaries including rating agents if it were to work fully in a DBR context. Since September 2019, guidance from the Royal Institute of Chartered Surveyors for its members explains that members must be registered for anti-money laundering as part of their mandatory requirements if they are involved in work where there is potential for money laundering to exist.

7.7. An alternative option could be to rely on agent authorisation provided through the online service that the VOA use to allow ratepayers to authorise a rating agent to act on their behalf when using VOA services to check or challenge the rateable value of a property. Once authorised, agents would then be able to use the separate DBR service to view business rates billing information.

7.8. The overarching aim is to minimise pain points for the rating agent (and ratepayer) and ensure a seamless but secure experience to facilitate their ability to act on behalf of their client. The government wants to use this consultation, together with additional user research with rating agents, to understand their needs in the context of DBR design.

Digital accessibility needs

7.9. A key element of the government’s vision is improving and increasing digital services and digital channels. It recognises that a small minority of ratepayers might not be able to engage digitally with their business rate obligations.

7.10. In line with its wider digital by default strategy, the government is exploring what assistance could be provided to ratepayers with digital accessibility needs to engage with DBR, as well as exploring alternative solutions for ratepayers who are digitally excluded in line with other services offered.

Question 25: What are ratepayers’ and agents’ views on whether ratepayers will want their agents to discharge their duty to provide the mandatory reference numbers needed for DBR?

Question 26: Where a ratepayer wants an agent to discharge their duty to provide the mandatory reference numbers needed for DBR, do agents know/can they easily obtain the tax and property references set out in Chapter 3? Are any more or less easily accessible?

Question 27: What are agents’ views on the benefits and any drawbacks of agents being able to access the ratepayer’s business rates billing information through DBR?

Question 28: Do tax agents foresee any change in their clients’ expectation of them as a result of being able to access their business rates billing information alongside their other tax information? If so, how and what are their views on the benefits and disbenefits of that change?

8. Summary of consultation questions

Chapter 2 questions

Question 1: How would Welsh Local Authorities, ratepayers, agents and broader stakeholders feel about the possibility of DBR being extended to Wales?

Chapter 3 questions

Question 2: Do ratepayers know/can they find their SA/Partnership/CT UTR and VRN? If not, what would make this easier?

Question 3: Where ratepayers do not have one of these reference numbers, would identifying themselves as a taxpayer by providing a National Insurance Number or Company Reference Number cause any issues for them? If so, what are they?

Question 4: If ratepayers alternatively needed to provide property reference numbers, would it be easier for them to provide a) a Billing Authority (BA) reference number plus BA name b) a BA reference number plus 4-digit BA code, or c) a Unique Property Reference Number?

Question 5: Are there scenarios where ratepayers might not have any relevant reference number? Including where a ratepayer may not be registered for tax purposes? If so, what are they?

Question 6: Are there scenarios where a person or entity’s identity in the tax system (with one tax reference number) may not precisely align with their legal responsibility as a ratepayer? EG, where multiple ratepayers share the same tax reference number, or multiple entities for tax purposes share one responsible legal identity in a business rates context?

Question 7: When might a taxpayer reference that is associated with a property portfolio under DBR change? (eg, registration for self-assessment, incorporation or disincorporation, VAT-registration or de-registration, mergers and acquisitions). Are there scenarios where the new reference number might not precisely assume the property portfolio associated with the previous number?

Chapter 4 questions

Question 8: In which type of customer journey would it be easiest to provide your reference number(s) (option A, B or C) and why? Would any of the options be particularly difficult?

Question 9: What are the main challenges presented with each ‘data in’ option and how could they be addressed?

Question 10: Under option B – what process would be best for ratepayers (or their agent) to provide their tax references to Billing Authorities and why? Or would a standalone process be preferable?

Question 11: Under option C – what process would be best for ratepayers (for their agent) to provide their property references to HMRC and why? Or would a standalone process be preferable?

Question 12: To what extent would ratepayers expect to log in themselves to provide tax or business rates information with a single set of verified credentials (rather than setting up multiple credentials or using an agent)?

Question 13: Other than those outlined in this document, are there any options for how DBR might collect data to enable matching of taxpayer and ratepayer information that would work better to achieve the policy aims?

Question 14: What processes might ratepayers (or their agents) have to put in place to meet their obligations under each option and what costs might this bring?

Question 15: How much might you expect it to it cost BAs to upgrade systems to export billing information to HMRC? Please provide the evidence or assumptions that support your estimate. This will help inform new burdens funding estimates.

Chapter 5 questions

Question 16: Would you use a service that allows you to view business rates information for all your properties across England in one place, alongside other HMRC tax liabilities? Yes/No

- If yes, how often and for what purposes?

- If yes, how useful would you find such a service – on a scale of 1 to 10, where 10 is extremely useful?

- If no, would being able to pay your bill(s) through the service change your response?

Question 17: When thinking about how often (your) bills change, how often should the business rates billing information be updated? (eg daily, weekly or whenever a ratepayer seeks to view their billing information). Options: real time look up/daily/weekly/monthly/quarterly/annually.

Question 18: Could DBR data help with targeting and administering reliefs? If so, for which reliefs would it be help most and why?

Question 19: Is there any other data that DBR could provide to help billing authorities feel more confident when awarding reliefs and/or grants?

Chapter 6 questions

Question 20: If option A for ‘data in’ is pursued, you think DBR should be included within the sanctions regime for the new VOA duty or have a separate sanctions regime?

Question 21: If separate, or if options B and C are pursued, do ratepayers have views about adopting a similar penalty regime to the one proposed for the VOA’s new duty?

Question 22: What concerns do stakeholders have about a DBR sanctions regime?

Question 23: Do you envisage risks with applying the principle of conditionality to new or redesigned reliefs? If so, how can these be mitigated?

Question 24: Are there alternatives to penalties not explored in this document that the government should consider?

Chapter 7 questions

Question 25: What are ratepayers’ and agents’ views on whether ratepayers will want their agents to discharge their duty to provide the mandatory reference numbers needed for DBR?

Question 26: Where a ratepayer wants an agent to discharge their duty to provide the mandatory reference numbers needed for DBR, do agents know/can they easily obtain the tax and property references set out in chapter 3? Are any more or less easily accessible?

Question 27: What are agents’ views on the benefits and any drawbacks of agents being able to access ratepayer’s business rates billing information through DBR?

Question 28: Do tax agents foresee any change in their clients’ expectation of them as a result of being able to access to their business rates billing information alongside their other tax information? If so, how and what are their views on the benefits and disbenefits of that change?

9. Assessment of impacts

Summary of impacts

| Year | 2022 to 2023 | 2023 to 2024 | 2024 to 2025 | 2025 to 2026 | 2026 to 2027 | 2027 to 2028 |

|---|---|---|---|---|---|---|

| Exchequer impact (£m) | +/- | +/- | +/- | +/- | +/- | +/- |

Exchequer Impact Assessment

Any Exchequer impact will be estimated following consultation, final scope and design of the policy, and will be subject to scrutiny by the Office for Budget Responsibility.

| Impacts | Comment |

|---|---|

| Economic impact | The economic impacts will be identified following consultation and final design of the policy. |

| Impact on individuals, households and families | There is impact on individuals who are subject to non-domestic rating on certain hereditaments such as beach huts and stables. This may create an additional burden on ratepayers. The measure is not expected to impact on family formation, stability, or breakdown. One beneficial impact for individuals is that they will be able to see their business rates billing information alongside the rest of their tax liabilities. |

| Equalities impacts | It is not anticipated that there will be disproportionate impacts for those in groups sharing protected characteristics. Equality impacts will be further considered following this consultation. A full equality impact assessment is not recommended at this point. HMRC will consider alternative provisions for those who are digitally excluded or need digital assistance. |

| Impact on businesses and Civil Society Organisations | Businesses and organisations who use non-domestic property will face a normally one-off requirement to provide a reference number to enable HMRC to connect their business rates information to their tax information. Some may benefit from reduced administrative burdens as a result of no longer needing to provide supporting information to prove their eligibility for small business rates relief. |

| Impact on HMRC or other public sector delivery organisations | The government will consider the responses to the consultation when deciding how to proceed. The resulting IT design and requirements will determine the resource impacts on both HMRC and other public bodies. This proposal will impact the 309 billing authorities in England with responsibility for business rates billing, who will need to amend their IT systems in order to provide the data needed for DBR (and potentially receive data to support their processes). One beneficial impact of DBR on BAs is that it is likely to reduce the administrative burdens on BAs to assess whether eligibility criteria for certain reliefs are met. |

| Other impacts | Responses to the consultation will help the government assess any other impacts as a result of this initiative. |

10. The consultation process

This consultation is being conducted in line with the Tax Consultation Framework. There are 5 stages to tax policy development:

Stage 1: Setting out objectives and identifying options Stage 2: Determining the best option and developing a framework for implementation including detailed policy design Stage 3: Drafting legislation to effect the proposed change Stage 4: Implementing and monitoring the change Stage 5: Reviewing and evaluating the change

This consultation is taking place during stage 2 of the process. The purpose of the consultation is to seek views on the detailed policy design and a framework for implementation of a specific proposal, rather than to seek views on alternative proposals.

How to respond

A summary of the questions in this consultation is included at chapter 8.

Responses should be sent by 30 September 2022.

You may respond by completing an online survey.

Alternatively, you can email your response to the questions in this consultation.

If you are responding in writing, please make it clear which questions you are responding to.

Written responses should be sent to:

DBR Team – Floor 10 area 10:14

Stratford Regional Centre

14 Westfield Avenue

Stratford

London

E20 1HZ

Any queries or questions should be directed to Kerry Smith using email address above.

Paper copies of this document or copies in Welsh and alternative formats (large print, audio and Braille) may be obtained free of charge from the above address. All responses will be acknowledged, but it will not be possible to give substantive replies to individual representations.

When responding please say if you are a business, individual or representative body. In the case of representative bodies please provide information on the number and nature of people you represent.

Confidentiality

HMRC is committed to protecting the privacy and security of your personal information. This privacy notice describes how we collect and use personal information about you in accordance with data protection law, including the UK General Data Protection Regulation (UK GDPR) and the Data Protection Act (DPA) 2018.

Information provided in response to this consultation, including personal information, may be published or disclosed in accordance with the access to information regimes. These are primarily the Freedom of Information Act 2000 (FOIA), the Data Protection Act 2018, UK GDPR and the Environmental Information Regulations 2004.

If you want the information that you provide to be treated as confidential, please be aware that, under the FOIA, there is a statutory Code of Practice with which public authorities must comply and which deals with, amongst other things, obligations of confidence. In view of this it would be helpful if you could explain to us why you regard the information you have provided as confidential. If we receive a request for disclosure of the information, we will take full account of your explanation, but we cannot give an assurance that confidentiality can be maintained in all circumstances. An automatic confidentiality disclaimer generated by your IT system will not, of itself, be regarded as binding on HM Revenue and Customs.

Consultation Privacy Notice

This notice sets out how we will use your personal data, and your rights. It is made under Articles 13 and/or 14 of the UK GDPR.

Your data

We will process the following personal data:

Name

Email address

Postal address

Phone number

Job title

Purpose

The purpose(s) for which we are processing your personal data is: Digitalising Business Rates: connecting business rates and tax data.

Legal basis of processing

The legal basis for processing your personal data is that the processing is necessary for the exercise of a function of a government department.

Recipients

Your personal data will be shared by us with (provide details of recipients of the personal data, if applicable for example, HM Treasury).

Retention

Your personal data will be kept by us for 6 years and will then be deleted.

Your rights

You have the right to request information about how your personal data are processed, and to request a copy of that personal data.

You have the right to request that any inaccuracies in your personal data are rectified without delay.

You have the right to request that any incomplete personal data are completed, including by means of a supplementary statement.

You have the right to request that your personal data are erased if there is no longer a justification for them to be processed.

You have the right in certain circumstances (for example, where accuracy is contested) to request that the processing of your personal data is restricted.

Complaints

If you consider that your personal data has been misused or mishandled, you may make a complaint to the Information Commissioner, who is an independent regulator. The Information Commissioner can be contacted at:

Information Commissioner’s Office

Wycliffe House

Water Lane

Wilmslow

Cheshire

SK9 5AF

0303 123 1113 casework@ico.org.uk

Any complaint to the Information Commissioner is without prejudice to your right to seek redress through the courts.

Contact details

The data controller for your personal data is HMRC. The contact details for the data controller are:

HMRC

100 Parliament Street

Westminster

London

SW1A 2BQ

The contact details for HMRC’s Data Protection Officer are:

The Data Protection Officer

HMRC

14 Westfield Avenue

Stratford

London

E20 1HZ

Consultation principles

This call for evidence is being run in accordance with the government’s Consultation Principles.

The Consultation Principles are available on the Cabinet Office website.

If you have any comments or complaints about the consultation process, please contact the Consultation Coordinator.

Please do not send responses to the consultation to this link.

Glossary of terms

| Acronym | Term | Explanation/Definition |

|---|---|---|

| AMLS | Anti-Money Laundering supervision | If a firm or sole practitioner provides audit, insolvency, accountancy services, tax advice and trust or company services, it must be registered for anti-money laundering (AML) supervision. |

| BA | Billing authority | Statutory body responsible for the collection of taxation. eg, a local authority empowered to collect non-domestic rates. In England – shire and metropolitan districts, the Council of the Isles of Scilly, unitary authorities, London boroughs and the City of London are billing authorities. In 2022 there are 309 billing authorities in England. |

| BR | Business rates | See under Non-Domestic rates |

| CRN | Company registration number | Registration number for all companies in the UK |

| CT | Corporation Tax | Tax paid by limited companies. Managed on COTAX |

| DBR | Digitalising Business Rates | |

| UK GDPR | General Data Protection Regulation | The United Kingdom General Data Protection Regulation is the United Kingdom’s data privacy law that governs the processing of personal data from individuals inside the United Kingdom. |

| HMRC | Her Majesty’s Revenue and Customs | |

| Hereditament | Hereditament | The legal name for the unit of non-domestic property that is, or may become, liable to non-domestic rates, and thus appears on a rating list. The lists are compiled and maintained by the Valuation Office Agency (VOA). |

| LA | Local authority | An administrative body in local government. |

| NINO/NI number | National Insurance number | Identification number required to work or claim benefits in the United Kingdom. NINOs are automatically given to all United Kingdom residents shortly before their sixteenth birthdays. |

| NDR | Non-Domestic Rates | Often referred to as ‘business rates’ is a local tax on the occupation of non-domestic property in England (and Scotland, Wales and Northern Ireland), and is based on the notional annual rent for a property on the open market, known as the Rateable Value. |

| OS | Ordnance Survey | Data held on addresses linking to unique property reference numbers (UPRNs) in Connect |

| RV | Rateable value | The amount equal to the rent at which it is estimated that a property might reasonably be expected to let on an annual basis based on a set of assumptions and at a standard date (Antecedent Valuation Date – AVD). The AVD is 2 years before the rating lists come into force. |

| Ratepayer | Ratepayer | The person required to pay the non-domestic rates bill for the property. This is the occupier (unless other arrangements are agreed). If a property is empty the owner is generally liable. |

| SA UTR | Self-assessment Unique taxpayer reference | A unique identifier for individuals or partnerships registered for self-assessment |