Debt Relief Orders: Consultation on changes to the monetary eligibility criteria

Updated 9 June 2021

Applies to England and Wales

General information

Summary

The UK’s personal insolvency regime seeks to balance the need to provide debt relief to individuals in inescapable financial difficulties, giving them a ‘fresh start’, whilst making a return to creditors from the assets and income of the individual.

There are a number of different options available to help individuals in financial difficulty, ranging from informal arrangements with creditors to solutions within the statutory framework (including individual voluntary arrangements (IVAs), bankruptcy and debt relief orders (DROs)).

DROs were developed and introduced in April 2009 following a consultation by Government in 2004 (“A choice of paths: better options to manage over-indebtedness and multiple debt”) that identified there were people in long term debt difficulty who had nothing to offer their creditors, such as assets or disposable income, and for whom bankruptcy would be a disproportionate response. Delivered in partnership with the debt advice sector, DROs provide low cost, easy access to debt relief for those with relatively low levels of unmanageable debt, and no means with which to pay their creditors, providing a fresh start for the most vulnerable. At the end of the DRO period (usually 12 months) the debts included within the order are written off (‘discharged’) and the individual is no longer responsible for paying them.

In order to be able to apply for a DRO, a person must meet strict monetary eligibility criteria and certain other conditions (for example that they have lived or worked in England or Wales in the last 3 years). The monetary eligibility criteria, which have been in place since 2015 are that a person must:

- have debts of £20,000 or less

- own assets that are not worth more than £1,000 in total (essential household items such as bedding, and furniture are excluded as are tools or other equipment that are essential for work. In addition, one domestic vehicle worth no more than £1,000 is excluded from the asset criteria)

- have no more than £50 surplus income each month, after paying tax, national insurance and normal household expenses

This consultation is seeking views on a proposal to increase the existing monetary eligibility limits of DROs. This will give more people with low-levels of assets and low income who are in problem debt access to a suitable and proportionate option for debt relief. As with any debt relief solution, however, it is important to balance the interest of both creditors (those that are owed money) and debtors (those who owe money).

Consultation details

Issued: 12 January 2021

Respond by: 26 February 2021.

Enquiries to:

Sam Roberts

Policy Team

The Insolvency Service

1 Westfield Avenue

London

E20 1HX

Tel: 0303 003 1403

Email: Policy.Unit@Insolvency.gov.uk

Consultation reference: Debt relief orders

Audiences:

We would welcome responses from those in the debt advice sector who act as authorised intermediaries, debtors, creditors and their representatives, debt charities, IPs, RPBs, trade bodies, and any other interested parties. We will be looking to set up meetings with intermediaries during the consultation period and are available should any other respondents wish to meet to discuss their responses and experiences of the DRO regime. Any requests for a meeting should be sent to the postal or email address below. Any meetings are likely to be virtual under the current social distancing rules.

We look forward to receiving your views.

Impact Assessment:

If changes are made, a final stage Impact Assessment will be published at the time the Regulations are laid in Parliament. The consultation document includes a summary of the initial impacts at Annex A.

Territorial extent:

This policy applies to England and Wales only.

How to respond

Responses can be emailed or sent to the following addresses

Email to: Policy.Unit@Insolvency.gov.uk

Write to:

Sam Roberts

Policy Team

The Insolvency Service

1 Westfield Avenue

London

E20 1HX

When responding, please state whether you are responding as an individual or representing the views of an organisation.

Your response will be most useful if it is framed in direct response to the questions posed, though further comments and evidence are also welcome.

Confidentiality and data protection

Information you provide in response to this consultation, including personal information, may be disclosed in accordance with UK legislation (the Freedom of Information Act 2000, the Data Protection Act 2018 and the Environmental Information Regulations 2004).

If you want the information that you provide to be treated as confidential please tell us but be aware that we cannot guarantee confidentiality in all circumstances. An automatic confidentiality disclaimer generated by your IT system will not be regarded by us as a confidentiality request.

We will process your personal data in accordance with all applicable data protection laws. See our privacy policy.

We will publish a summary of responses on GOV.UK. The summary will include a list of names or organisations that responded, but not people’s personal names, addresses or other contact details.

Quality assurance

This consultation has been carried out in accordance with the government’s consultation principles.

If you have any complaints about the way this consultation has been conducted, please email: beis.bru@beis.gov.uk.

The need for reform

There are individuals who are unable to make contributions to their creditors and for whom bankruptcy is a disproportionate solution but who currently cannot access a DRO as they do not meet the monetary criteria with regard to debts, income or assets for obtaining one.

Evidence provided by the Office for Budget Responsibility suggests that the economic outlook as a result of the Coronavirus pandemic remains highly uncertain and depends upon many factors. As a result, we anticipate that there may be a greater need for people in financial distress to have access to an appropriate debt solution. Government will be introducing a new breathing space scheme in 2021, which will provide people in debt with a 60 day pause on creditor enforcement action. This, coupled with the potential impacts on personal indebtedness as a result of the coronavirus pandemic, means that it is appropriate to consider whether the current DRO limits need to be changed.

The monetary limits in the eligibility criteria for DROs were last changed in 2015 to:

- total debts of no more than £20,000 (changed from £15,000)

- total assets that are not worth more than £1000 (changed from £300). Note that essential household items such as bedding and furniture, and tools essential for work, have always been excluded. In addition, one domestic vehicle worth no more than £1,000 is also excluded from the asset criteria

- no more than £50 surplus income each month, after paying tax, national insurance and normal household expenses (this was not changed in 2015)

The 2015 changes were intended to enable more people to benefit from this type of debt relief. An internal review demonstrates that since 2015 around 35,000 individuals, who would not have been eligible under the earlier criteria, were able to obtain a DRO following the changes. The number of people obtaining a DRO so far in 2020 is lower than the same period in 2019, this coincides with greater forbearance being shown by the credit industry and Government financial support interventions as a result of the Coronavirus pandemic and is in line with reduced numbers of personal insolvencies generally.

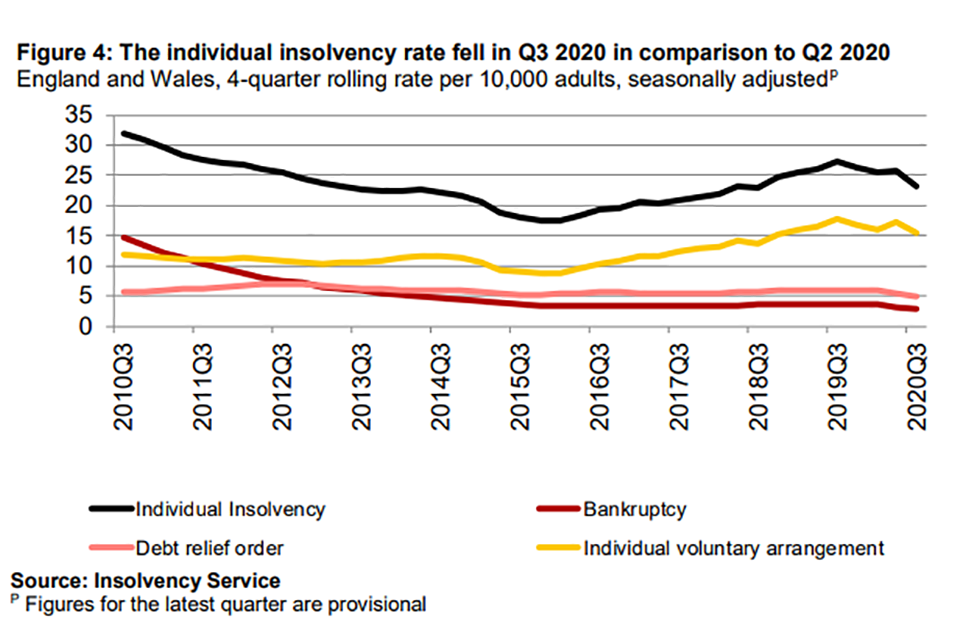

The rate of personal insolvency for the 12 months ending Q3 2020 (see figure 1) fell to 23.2 per 10,000 adults in comparison to the 12 months ending Q3 2019 when the rate was 27.4 per 10,000 adults.

Figure 1: The individual insolvency rate Q3 2020, England and Wales, 4-quarter rolling rate per 10,000 adults, seasonally adjusted

Graph showing how individual insolvency rate fell in Q3 2020 compared to Q2 2020

Research by Step Change Debt Charity (one of the UK’s largest free and independent debt advice providers) - conducted in May 2020 indicated that compared to the 2008-09 recession, households with low-to middle-incomes are entering the present Coronavirus situation more likely to be facing problem debt and struggling to pay for essentials.

In August 2020 Citizens Advice estimated that 6 million UK adults have fallen behind on at least one household bill during the pandemic, with 1 in 5 of those who have fallen behind on their bills unable to afford essentials.

The 2020/21 business plan published by the Money and Pensions Service forecasts a rise in the need for debt advice by the end of this financial year (March 2021), with the number continuing to increase by over 60% by the end of 2021. They estimate that around 3 million more people than before the pandemic will need support with their debt problems by the end of 2021. This is likely to lead to an increase in the need for debt relief. The Government has responded by additional funding of £38m to the debt advice sector which will ensure 1 million more people in England get debt advice in the next 12-18 months. We expect that some of this advice will flow through into increased demand for DROs. To support this increased demand, the Money and Pensions Service aims to continue to provide funding for DRO administrations in England, allowing debt advice agencies to focus their existing resource on providing broader debt advice. The Welsh Government will use its share of the 2021/22 UK Financial Levy to fund the provision of free debt advice services accessible by people in Wales, including services that assist people with applications for a DRO.

Given the likely increase in personal debt and the need to ensure the DRO regime continues to provide appropriate and proportionate debt relief for those that need it, we believe there is a case for changes to be made to the monetary eligibility criteria for obtaining a DRO

- Do you agree that changes to the eligibility criteria for DROs are necessary? Please state your reasons.

The Proposal

The proposal is to set new monetary limits on the criteria for obtaining a DRO that would:

- Increase the total amount of debt allowable to £30,000 (from £20,000);

- Increase the value of assets owned by the individual to £2,000 (from £1000). We are not proposing to change the items excluded from this calculation nor make any change to the £1,000 limit on the value of a domestic motor vehicle; and

- Increase the level of surplus income to £100 (from £50) per month.

We believe that increasing the current monetary eligibility criteria for DROs to the levels proposed above will help more vulnerable people facing financial difficulty access appropriate debt relief. If the statutory debt level is increased much above £30,000 there is only a marginal increase in those people eligible for a DRO, unless the asset level and/or surplus monthly income limits were also raised further, which would undermine the ethos that those that can pay should do so.

By increasing the asset, income and debt thresholds as proposed around 15,500 more people could be eligible for a DRO, representing a 58% increase on the number of individuals who obtained one in 2019/20.

Whilst the vast majority (over 90%) of the increase in demand is anticipated to come from individuals who will be seeking some form of debt relief for the first time, the remaining 10% are likely to be people for whom currently bankruptcy is the only option for obtaining debt relief.

-

Do you agree with the proposed increases to the debt (to £30,000), asset (to £2,000) and surplus income (to £100) levels? If not what do you think they should be? Please state your reasons.

-

Do the proposed changes strike the right balance between ensuring that the most vulnerable individuals are able to access low cost debt relief at the same time protecting the interests of creditors by maintaining the ‘can pay, will pay’ ethos? Would these levels of assets lead to a return to creditors under another debt relief solution? Please state your reasons.

Timing of changes

As the forecast published by the Money and Pensions Service suggests, significantly more people in 2021 will need debt advice than before the pandemic. By changing the eligibility criteria, more of these individuals will then be eligible to apply for a DRO. The Government is committed to helping people access the necessary support to get their finances back on track or to get the fresh start they need but is aware of the extra pressure this puts on the debt advice sector. An extra £37.8 million support package has therefore been made available to debt advice providers this financial year, bringing the budget for free debt advice in England to over £100 million in 2020-21.

It may be appropriate for the changes to coincide with the introduction of the new breathing space scheme for individuals in problem debt, expected in May 2021. This scheme will provide people in problem debt with 60 days of protections from creditor action, including enforcement or contact about a debt, whilst they access professional debt advice, thereby helping them to find the right solution. This is likely to have an impact on the number of people seeking a formal insolvency solution.

Making the proposed changes at the same time breathing space becomes available will give individuals more choice when considering their debt options and will also ensure that the sector is ready to deal with any increase in demand as a result of the economic effects of the Coronavirus pandemic.

DROs are delivered in partnership with the debt advice sector and this consultation seeks views on when the proposed changes should be introduced in order to strike the right balance between ensuring that those charged with helping to administer the regime are ready and ensuring that people in need of debt relief can access it as quickly as possible.

- Do you think that Government should aim to implement and commence any changes to the monetary limits for DROs to align with the introduction of breathing space in 2021? Please state your reasons.

Costs and benefits

There are costs and benefits attached to any policy change; if the proposed changes go forward, a full impact assessment will be published alongside the Regulations. A summary of the impacts that are being considered are set out in Annex A.

- Do you think there are any other impacts that should be considered? Please state your reasons.

Consultation Questions

- Do you agree that changes to the eligibility criteria for DROs are necessary? Please state your reasons.

- Do you agree with the proposed increases to the debt (to £30,000), asset (to £2,000) and surplus income (to £100) levels? If not what do you think they should be? Please state your reasons.

- Do the proposed changes strike the right balance between ensuring that the most vulnerable individuals are able to access low cost debt relief at the same time protecting the interests of creditors by maintaining the ‘can pay, will pay’ ethos? Would these levels of assets lead to a return to creditors in another debt relief solution? Please state your reasons.

- Do you think that Government should aim to implement and commence any changes to the monetary limits for DROs to coincide with the introduction of breathing space in 2021? Please state your reasons.

- Do you think there are any other impacts that should be considered? Please state your reasons.

- Are there any other comments you would like to make?

Annex A: Considered Impacts

As with the changes to DRO eligibility in 2015, a full impact assessment will accompany any changes to legislation. For this consultation, the individual (rather than net) impacts considered have been outlined below:

Business impacts

Costs

- Familiarisation costs to approved intermediaries that are authorised to process DRO applications. This may include costs to train staff, disseminating information and to update any processing systems.

- Cost to approved intermediaries from increased DRO demand. Changing the eligibility criteria for DROs to make more people eligible should lead to an increase in demand from debtors for DROs. Approved intermediaries would therefore have to service this additional demand and where necessary invest to increase capacity.

- Cost to creditors from a limited number of cases where an individual is now able to access debt relief compared to an alternative solution which would have provided a distribution. In a DRO the debts of the debtor are completely written off and so no distribution is made to creditors. This differs to other solutions for example an Individual Voluntary Arrangement (IVA) or Debt Management Plan where debts are repaid to creditors over a period of time.

- Insolvency Practitioners (IPs) are involved in certain procedures and charge fees to cover their remuneration. A limited number of IP led procedures, such as IVAs, may be impacted by the measure in a loss of IP fee income from these debtors entering a DRO instead.

Benefits

- Benefits to creditors from reduced administration and recovery costs. In low asset and debt cases the actual debt recovered is likely to be very small and would generally exceed the cost of recovery. Writing off debt in these cases can result in a net benefit for creditors against the status quo.

Debtor impacts

Benefits

- Benefit to debtors from having access to a DRO for the first time, enabling write off of their debts.

- Benefits to debtors from improved social outcomes. There is a consensus of opinion amongst academics and debt advice agencies on the link between financial distress and productivity, relationships, physical and mental health.

- Benefit to debtors from lower fees. It is anticipated some debtors will transfer from bankruptcy to DROs. The fees for DROs are lower than that for bankruptcy, which will result in a cost saving for the debtor.

Public sector impacts

Costs

- Reduced official receiver service fee (ORS) income. There will be a cost to the Insolvency service from the transfer of bankruptcy cases to DROs in the form of reduced income.

- Staffing costs to deal with increased demand for DROs. There will be a cost to the Insolvency Service to service additional demand.

- Cost to public sector creditors. The public sector is a significant creditor in insolvency and therefore the cost to creditors from individuals accessing debt relief and their debts being written off will have an impact.

Benefits

- Savings for the Insolvency Service ORS function due to the transfer of bankruptcy cases to DROs.

- Additional fee income from DROs. The increased demand for DROs may result in a small increase in fee income.