2021 HS2 land and property review proposals public consultation

Updated 8 February 2022

Introduction

High Speed Two – an overview

High Speed Two (HS2) is the new high-speed railway that will connect some of the major cities in Britain. It’s being built in phases:

-

Phase One will see a new high-speed line constructed from London Euston to the North of Birmingham, where it will join the existing West Coast Main Line (WCML)

-

Phase 2a is a 36-mile stretch of track between the West Midlands and Crewe, brought forward as a hybrid bill ahead of Phase 2b to bring the benefits of HS2 to the North sooner. The Hybrid bill received Royal Assent in February 2021

-

Phase 2b comprises 2 parts, the eastern and western legs: the eastern leg runs from the West Midlands to Leeds with connections to the Midland Main Line and East Coast Main Line; the western leg runs from Crewe to Manchester and will also join the WCML

The government remains committed to taking forward HS2 to:

- transform our national rail network

- bring our biggest cities closer together

- boost productivity and level-up opportunity across the country

HS2 Land and Property Review

Following his appointment as the Minister for HS2 in February 2020, Andrew Stephenson MP reaffirmed the government’s commitment to ensuring that people and businesses affected by the HS2 programme were:

- supported and fairly compensated

- treated with compassion, dignity and respect

The HS2 Minister commissioned a detailed review of the HS2 property buying programme seeking views and ideas on how to improve the experience of property owners and other residents affected by HS2 or who may apply to the HS2 property schemes.

This review supported the government’s wider commitment to look at its policies and practices throughout the HS2 project to make sure property owners continue to receive the best possible support.

The review examined 4 key areas:

- how to deliver an improvement in community engagement on the land and property buying programme

- how to protect the interests of those affected

- how to provide improved process efficiency / better delivery by HS2 Ltd

- how to create a better tone (conspicuous respect, courtesy and understanding)

The government:

- considered representations from HS2 line-of-route MPs

- conducted extensive interviews with key stakeholders

- commissioned a series of thorough investigations by the independent Residents’ and Construction Commissioners

The review also examined some of the compensation arrangements for other national and international infrastructure projects.

It generated 36 proposals intended to transform how people and businesses affected by HS2 are treated.

Engagement with affected communities is at the heart of our plans for HS2.

This consultation aims to seek views on the application of specific proposals.

We want to provide the opportunity for people affected by these proposals, as well as stakeholders, to provide feedback and inform future decisions by the Minister for HS2.

Process and timings

The consultation period began on 19 May 2021 and will run for 6 weeks until 30 June 2021.

Due to remote working for the foreseeable future, we cannot accept hard copies of responses. But please let us know if you’re unable to respond by using the survey or email. You can call the Department for Transport switchboard on 0300 330 3000 between 8:30am and 5:30pm or HS2LandandProperty@dft.gov.uk.

When the consultation has closed, the government will consider the responses and develop policy options based on the feedback.

Following a ministerial decision on the options proposed, a response paper will be published outlining the responses received and the next steps the government will take on the areas consulted on.

Streamlined residential blight scheme

Background

During the HS2 Land and Property Review 2020, some stakeholders raised the issue of the time taken to agree property valuations and disturbance compensation.

The review, therefore, proposed a series of measures to streamline and speed up the process for agreeing on compensation. This includes exploring the option for statutory blight cases to:

- use the property valuation method already used for non-statutory schemes

- implement arrangements for a fixed-sum payment to cover the costs associated with moving to a new house (such as removals and mail redirection), removing the need for lengthy discussions

The proposed streamlined residential blight (SRB) scheme was developed in response to these proposals about statutory blight cases.

It’s expected this scheme would allow compensation to be agreed on more quickly while compensating affected parties fairly and delivering value for money for the taxpayer.

When selling a property under the existing statutory blight process, negotiating the unblighted market value and the disturbance costs are 2 elements of the process which can take significant time and resource to negotiate, agree and approve.

The proposed SRB scheme could reduce the time and resource required by removing the need for negotiating property value and disturbance costs.

The scheme could deliver these aims partly through the introduction of a systematic method for determining property value, a method that is currently used on HS2’s rural support zone (RSZ) and need to sell (NTS) discretionary schemes, and partly through a fixed-sum payment for disturbances.

The proposed SRB scheme would not replace the existing statutory blight process. It will sit alongside it as an optional scheme. Once a blight notice has been accepted, eligible applicants would be able to choose to sell their property either using either the:

- SRB scheme

- existing statutory blight process

The proposed SRB scheme

It’s proposed that the scheme will apply to Phase Two (2a and 2b) of the HS2 route. The 2 key elements of the proposed SRB scheme are:

- Red Book property valuation method

- fixed-sum payment for disturbances (with some exclusions)

Red Book valuation method

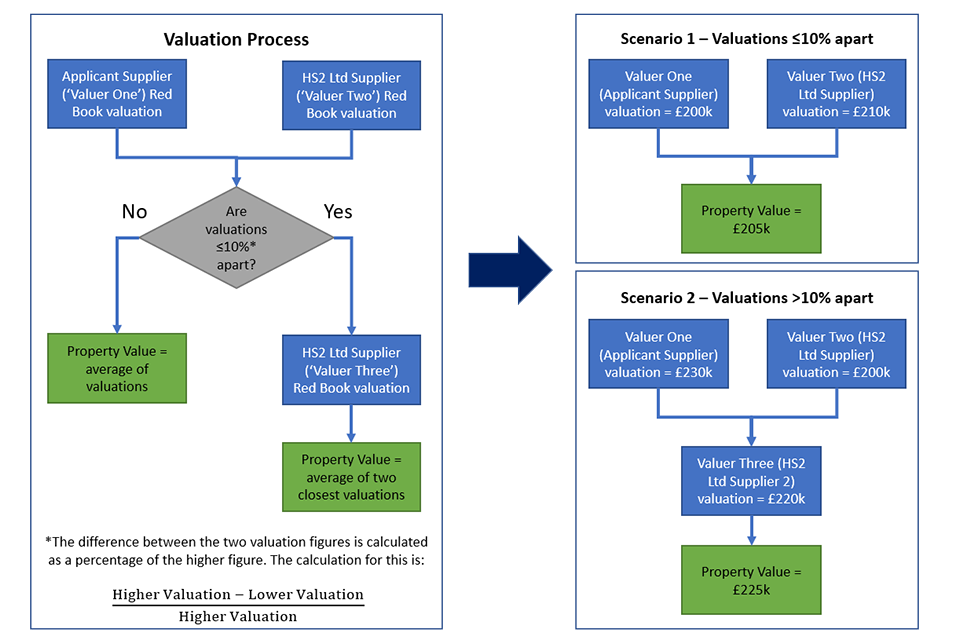

The proposed SRB scheme valuation method would comprise 2 independent Red Book valuations (and potentially a third Red Book valuation if the 2 initial valuations differ by more than 10%) to establish the unblighted market value of the property.

A ‘Red Book’ valuation is a formal valuation report that adheres to the Royal Institution of Chartered Surveyors (RICS) valuation professional standards, also known as the Red Book.

Applicants would choose the first valuer (who must be a RICS registered valuer), and HS2 Ltd would choose the second valuer from their pool of RICS registered valuers.

Applicants would be able to use any valuer who is registered with RICS if the valuer does not have any conflict of interest relating to the applicant’s home or household (or anyone else connected to their application). Parallel arrangements would be made for a building survey to be completed.

The information provided by the building survey is required to help establish the unblighted market value of the property, considering any factors that may influence the value of the property such as the general condition of its repair.

If the 2 valuations are within 10% of each other (calculated by taking the difference between the 2 values as a percentage of the higher value), the unblighted market value of the property would be determined to be the average of the 2 valuations.

If the valuations differ by more than 10%, a third valuation will be instructed. This would be carried out by a remaining valuer from the HS2 Ltd pool of RICS registered valuers. The applicant would select a preferred valuer from the list to undertake this valuation.

Following the completion of the third valuation, the unblighted market value of the property would be the average of the 2 closest valuations. If the highest and lowest valuations are of equal distance to the middle figure, the middle valuation figure would be used as the unblighted market value.

This valuation approach is the same approach used in the RSZ and NTS schemes and is illustrated in the diagram below.

The diagram illustrates the application of the proposed valuation process and the two possible valuation routes.

The above diagram illustrates the application of the proposed valuation process and the 2 possible valuation routes. These are described below.

Scenario 1: Under this scenario, the initial Red Book valuations are undertaken by the applicant’s supplier of choice. ‘Valuer one’ and HS2 Ltd’s supplier, ‘valuer two’.

Valuer one produces a property valuation of £210k and valuer two produces a valuation of £200k, meaning there is a differential of 4.8%. This is calculated by dividing the difference between the two valuations (£10k) by the upper valuation (£210k).

As the lower valuation is within 10% of the upper valuation, the unblighted market value of the property is determined to be the average of the 2 valuations, equating to £205k. This value would constitute the government’s property purchase offer and is non-negotiable. Based on data from HS2 Ltd’s existing discretionary schemes, it’s expected that the majority of cases would pass through this route.

Scenario 2: Under this scenario, the initial Red Book valuations are undertaken by the applicant’s supplier of choice ‘valuer one’ and HS2 Ltd’s supplier ‘valuer two’.

Valuer one produces a property valuation of £230k and valuer two produces a property valuation of £200k, meaning there’s a difference of 13%.

Because the 2 valuations are more than 10% apart, a third valuation is required to provide an extra reference point against which to determine the property’s unblighted market value.

The applicant is asked to select one of HS2 Ltd’s suppliers to be ‘valuer three’. They would then be instructed by HS2 Ltd to carry out a third Red Book valuation.

‘Valuer three’ must be a different valuer to either of the suppliers that undertook the initial valuations. Once the third Red Book valuation has been undertaken, the property value would be determined to be the average of the 2 closest valuations.

In the above example, this would mean that valuation one (£230k) and valuation three (£220k) are the 2 closest valuations, and hence the unblighted market value of the property is determined to be the average of these 2 figures (£225k).

It’s expected that fewer than a third of cases would receive 2 valuations that differ by more than 10%.

Fixed-sum disturbance payment

Background and proposal

Under the SRB scheme, it’s proposed that applicants will be awarded a fixed-sum disturbance payment of £7,000 to compensate for:

- reasonable extra costs

- losses associated with moving home

Typically, disturbance costs include (but are not limited to) the following:

- removal expenses

- adaptations to the replacement property

- disconnection and reconnection of services

Through analysis of a sample set of disturbance claims on Phase 2b, the average disturbance claim was found to be 3.2% of the agreed property purchase price.

When applied to the average sample set purchase price of £224,855, this provides an average disturbance claim of £7,000 (to the nearest thousand pounds).

The Phase 2b dataset is considered to be the optimal comparator as this is the geography over which HS2 Ltd expects to receive the majority of future applications.

The analysis excluded properties with a value of more than £500k as these are considered exceptions, given the small number of cases expected.

Based on the sample set of existing Phase 2b data, it’s considered that the sum of £7,000 would provide reasonable disturbance compensation for the majority of properties along the Phase Two route.

Applicants who would be eligible for the SRB scheme would receive these funds on completion of the Secretary of State for Transport’s purchase of their property. No evidence or justification about how these funds will be spent would be required.

In addition to the fixed-sum disturbance payment, applicants will be able to claim separately for the following:

- a statutory home loss payment

- Stamp Duty Land Tax (SDLT) for their new property

- legal fees

- professional advisor fees (reasonable fees incurred before acceptance of the blight notice would be claimable: fees incurred for work completed following acceptance would be capped at £250) – this is considered to be reasonable for any professional advice received about helping the applicant to decide on the most appropriate scheme

Proposed eligibility criteria for the SRB scheme

It’s proposed that residential properties on Phase Two (both 2a and 2b) would be eligible for the SRB scheme. Applicants will not be able to claim for development value or hope value [footnote 1] under the proposed scheme. It’s considered that businesses and agricultural units will have significantly higher disturbances than residential properties, and so these still need to be negotiated on an individual basis.

Applications will be assessed and judged against the same published eligibility criteria as that of statutory blight (except for only applying to residential properties).

The 3 criteria against which applications for statutory blight are judged are:

-

qualifying interest – applicants must have a ‘qualifying interest’ in the property. This means that they must be an owner-occupier of the property as defined under section 149 of the Town and Country Planning Act 1990

-

location – the applicant’s property must be fully or partly within the current safeguarded area or Extended Homeowner Protection Zone (EHPZ)

-

efforts to sell – applicants must be able to show that they’ve made reasonable efforts to sell the property. If the property qualifies for express purchase (this is where more than 25% of the property or any part of the dwelling is within safeguarding), applicants will not need to show that they’ve made reasonable efforts to sell their property

Scheme’s process

Applicants would be required to commit to both the Red Book valuation and fixed sum disturbance elements if they wish to sell their property via the proposed SRB scheme.

Therefore, an applicant would not be able to opt for the fixed sum disturbance payment and opt out of the Red Book valuation process. Similarly, applicants would not be able to opt for the Red Book valuation process while opting out of the fixed sum disturbance payment.

An offer made under the SRB scheme would be non-negotiable. It would constitute HS2 Ltd’s final assessment of the unblighted market value of the applicant’s property, which the applicant may choose to accept or decline.

If the applicant has not accepted the offer and instructed their solicitor within 12 months of the date of the offer letter, the offer would expire. In addition, an applicant may choose to withdraw their application to the SRB scheme at any point prior to exchange of contracts.

If the offer has expired, and the applicant wishes to reapply to the SRB scheme, the applicant would be required to submit a new form of claim. This is because new valuations are required after a period of 12 months.

This must be accompanied by a valid Blight Notice acceptance; the Blight Notice is valid for 3 years and 2 months from the date that it was served. The applicant would be required to pay a contribution of £1,000 towards the cost of the new valuations. This contribution would apply if the applicant chooses to reapply for the SRB scheme, the statutory blight scheme or any of HS2 Ltd’s discretionary schemes.

If the applicant chooses to withdraw their application after the SRB scheme offer has been made and make a new application to either the statutory blight scheme or any other discretionary property purchase scheme, the existing offer made under the SRB scheme would remain as HS2 Ltd’s final offer for the applicant’s property. This would apply for the 12 month period from the date the offer was made. After this period, new valuations would be required.

While HS2 Ltd’s property purchase offer would remain fixed; an applicant would be able to negotiate upon their disturbance costs if they apply to the statutory blight scheme. An abortive fee of £1,000 would apply to any reapplications following a withdrawal. This is considered a reasonable abortive cost to cover the time and expense expended during the determination and valuation of a property value under the SRB scheme.

Streamlined residential blight questions

Do you agree that it is of benefit to applicants to have the option of selling their property via a streamlined residential blight scheme?

Do you agree with the eligibility criteria for the proposed scheme?

Do you have any suggested changes for the proposed scheme?

Do you see merit in trialling the SRB scheme for a set period of time or for a particular section of the HS2 route?

Are there any other aspects of the proposed scheme that you would like to comment on?

A variation to the need-to-sell scheme

Background

The ‘need to sell’ (NTS) scheme [footnote 2] is one of several non-statutory property compensation schemes available to property owners affected by HS2.

The scheme supports property owners who have a compelling reason to sell their property but, due to HS2, are unable to do so other than at a significant loss. Or, if they’re unable to sell their property, would face an unreasonable burden in the next 3 years.

If an application under the NTS scheme is successful, the government agrees to buy a property for its full, unblighted, open-market value.

In other words, the government will offer what the property would be worth if HS2 did not exist. It does not cover extra costs, such as legal fees or removal expenses.

The NTS scheme for each phase of the railway will run until 12 months after that phase opens for public use.

The 2020 Land and Property review considered whether more could be done to improve the non-statutory property compensation schemes or to give the public more choice on the options open to them.

One area the government wants to explore is a suggested variation to the NTS scheme.

A property owner who applies to the NTS scheme is required to market the property for at least 3 months as part of the established qualifying criteria. If, by that means, they are able to obtain an unblighted price or get within 15% of an unblighted price, they should sell at that price. If not, their application to NTS proceeds.

Under the proposed variation, there would be 2 main differences:

A. The government would invite the successful NTS applicant to sell their property on the open market instead of to the government (unless an immediate and compelling need to sell was identified, in which case, the applicant may find it quicker to sell to the Secretary of State). If an offer at between 75% and 85% of the unblighted value or above was forthcoming, the sale would be concluded on that basis. And if no offers were forthcoming, even at a blighted price, the existing NTS scheme remains the route to a sale to the Secretary of State.

B. If a blighted offer (subject to valuation) were deemed to be the best offer available, the government would pay the vendor the difference between the blighted and unblighted price. A blighted offer here means one that is between 75% and 85% of the unblighted price. An offer that is within 15% of the unblighted price should simply be accepted. An offer at less than 75% of the unblighted price should proceed as a sale under NTS to the Secretary of State.

In either of the above 2 scenarios, a one-off payment (exact amount to be confirmed following consultation) would be paid to the vendor to incentivise them to sell their property on the open market rather than to the Secretary of State.

In determining the size of the one-off payment, consideration would have to be given to the costs involved in selling a property on the open market (such as estate agent fees) to ensure that the degree of incentive was enough.

The advantage to property owners is that they would achieve the full, unblighted, open-market market value of their property plus an incentivisation payment not available under the NTS scheme.

The advantage to the taxpayer is that the Secretary of State would no longer have to own and manage properties not needed for the construction or operation of the HS2 scheme.

The buyer of the property under the alternative arrangements would not be able to use the scheme if they, in turn, felt compelled to sell their property, as they would not be able to meet the ‘no prior knowledge’ criterion (unless there had been a material change to the impact of the scheme).

But we would expect that if they remained in owner-occupation until one year after HS2 began operating on the relevant phase of the route, they would be able to seek compensation under Part One of the Land Compensation Act 1973.

That provides compensation to people who own and occupy property that has been reduced in value by more than £50 by the physical effects of a scheme such as HS2.

Consideration needs to be given to the scheme’s potential application to the current rural support zone (RSZ) on the HS2 route. The RSZ is generally between 60 and 120 metres from the line of route.

Qualifying property-owners may opt for one of the two non-statutory property compensation schemes:

- the cash offer

- the voluntary purchase scheme

The latter allows eligible owner-occupiers to sell their property to the Secretary of State for the full, unblighted, open-market market value.

The government is not intending to make the variation to the NTS scheme available as an alternative to voluntary purchase, as the difference between the blighted and unblighted value of properties in the RSZ may be significant given the proximity of the property to the HS2 route.

The taxpayer’s long-term interest may be better served by the acquisition of such property.

The government is seeking views on the principle of the proposed variation to the NTS scheme and the practical points of detail that would need to be addressed if the variation was to be implemented.

A variation to the need to sell scheme questions

What is your view on the general principle of introducing a variation to the NTS scheme as described above?

If implemented, should the variation be applied to an individual phase of the HS2 route to test how it would operate in practice before any wider implementation decision was taken?

The government is minded to set a limit of 75% of the unblighted value of a property for the variation to the NTS scheme, after which it could be more appropriate for the government to acquire the property under the existing scheme. Do you agree?

Do you foresee any risks to the proposal and, if so, how might they be mitigated?

Do you think it reasonable for the government to limit the variation to NTS to beyond 120 metres and therefore outside of the RSZ?

Should the variation to NTS have an outer boundary to prevent applications from properties that are clearly too far from HS2 to experience any form of blight resulting from it? Note that the present NTS scheme has no geographic boundary.

Are there any other aspects of the proposed scheme that you would like to comment on?

Safeguarding policy changes: airspace above properties

Background

Safeguarding is a planning tool used to protect land which may be needed for future infrastructure from potentially conflicting development.

The safeguarding directions need local planning authorities to consult the infrastructure promoter on planning applications to minimise development that potentially conflicts with the project.

The process also encourages parties to explore all available development options.

Issuing safeguarding directions also triggers statutory blight. This means property owner-occupiers within the safeguarded area may be eligible to serve a blight notice asking the Secretary of State to buy their property before it’s needed for construction.

Prospective buyers would be informed by the local authority search process that there are safeguarding directions in place on the property.

Safeguarding directions are kept under review and updated periodically to make sure they reflect the latest route design as closely as possible.

They can be removed immediately if necessary (subject to the ‘Extended home owner protection zone’ scheme) and can apply route-wide or in specific locations.

The issue

Currently, there are 2 types of safeguarding:

- surface

- sub-surface

Recent experience has shown that it would be beneficial to have further clarity about requirements, as cases have been identified where only access to the airspace above a property is needed for cranes to operate (also known as ‘oversailing’ of cranes).

Oversailing of cranes is where the airspace above a property is needed to move a crane over the property. But, otherwise, construction work does not impact the property.

Currently, such cases fall into surface safeguarding. But surface safeguarding of property that’s only needed for oversailing makes it more difficult for an owner-occupier to sell their property due to the property’s status of being ‘safeguarded’ and so ‘blighted’.

The government is considering introducing a third category of safeguarding like sub-surface safeguarding, to protect only the airspace above a property from developments that might impact the HS2 construction programme.

Therefore, statutory blight would not apply, and a fixed payment would be paid instead, in the same way as for subsurface safeguarding.

This proposed approach provides more appropriate help to such owner-occupiers. It could avoid negatively impacting property values as the market would be more likely to function normally where there would be no safeguarding suggesting the land would be bought for construction.

Provisions for an impacted owner-occupier

Currently, being placed into safeguarding can affect the ability of an owner-occupier to sell a property on the unblighted open private market.

This new type of safeguarding would aim not to blight the property in the way that surface safeguarding would, enabling the market to function normally.

If the owner-occupier had a compelling reason to sell the property, but could not do so (other than at a substantially reduced price) due to the impact of HS2, they would be able to request consideration of any special circumstances, or of the atypical nature of their property.

Alternatively, they could apply to the need to sell scheme (but would need to meet the qualifying criteria).

Airspace above properties questions

Is there anything we should factor into our considerations when introducing a third type of safeguarding? Is there anything we can do to help reduce an owner-occupier’s concerns at being placed into oversailing safeguarding?

If the owner-occupier had a compelling reason to sell the property but could not do so (other than at a substantially reduced price) due to the impact of HS2, they would be able to request consideration of any special circumstances, or of the atypical nature of their property.

Or, they could apply to the need to sell scheme (but would need to meet the qualifying criteria). Does this help to strike a fair balance between adequately supporting the affected owner-occupier and maintaining value for money for the taxpayer?

Currently, being placed into safeguarding can affect the ability of an owner-occupier to sell a property on the unblighted open private market. In your view, would introducing a category of safeguarding for crane oversailing: a) give you the confidence to buy a property, on the basis that the only construction effects would be the oversailing of cranes? b) help you to put your property on the market if you were in that situation, and to feel you were being fairly treated?

Are there any other aspects of this proposal that you would like to comment on?

Glossary

Blight claim: A term used to describe the claim form that you will submit to the Secretary of State (via HS2 Ltd) for compensation for selling your property to the Secretary of State. A Blight Claim can only be served once the Secretary of State has confirmed acceptance of your blight notice.

Blight notice: This is the statutory notice that you can serve on the Secretary of State (via HS2 Ltd), if you are eligible, in order to seek acceptance that the Secretary of State is willing to purchase your property.

Compensation code: This is the collective term used to describe the principles for the assessment of compensation. It is a mixture of Acts of Parliament, court cases (‘case law’) and government guidance relating to compensation for compulsory acquisition. It can also be referred to as the ‘Compulsory Purchase Code’.

Conveyance: The legally binding document that transfers property ownership from the seller of a property to the purchaser. It is also known as the ‘Transfer’.

Department for Transport (DfT): DfT works with its agencies and partners to support the transport network that helps the UK’s businesses and gets people and goods travelling around the country. The DfT plans and invests in transport infrastructure to keep the UK on the move. DfT is a ministerial department, supported by 24 agencies and public bodies, including High Speed Two Limited.

Development value: This is the value of a property for an alternative use with existing full planning permission.

Disturbance compensation: Usually only available to the occupiers of the properties, it means compensation for reasonable additional costs and losses incurred as a result of being required to move (for example, removal expenses).

Extended homeowner protection zone (EHPZ): An area that is no longer safeguarded by the Secretary of State but within which people can still apply for Express Purchase for five years from the date safeguarding was removed.

High Speed Two Limited (HS2 Ltd): The company responsible for developing and promoting the UK’s new high speed rail network. It is funded by grant-in-aid from the government. HS2 Ltd is an executive non-departmental public body, sponsored by the Department for Transport.

Hope value: If land is perceived to have a higher value than its market value, based not on fact but on judgment, then this additional value may be referred to as Hope Value.

Need to sell (NTS): A discretionary scheme for property owners who believe they have a compelling reason to sell their property.

Non-statutory schemes: These schemes are non-statutory schemes available outside of statutory blight claims, and as a result have their own set of requirements dependant on the scheme. They include schemes such as need to sell and are available along the line of route ahead of construction beginning.

Owner-occupier: An owner-occupier is anyone who owns a property (either outright or with a mortgage) as a freehold or on a certain term of years lease (with at least three years unexpired) and has it as their principal residence or place of business. The full definition of ‘owner-occupier’ can be found through reference to Chapter 2, Part 6 of the Town and Country Planning Act 1990.

Phase Two: The ‘Y’-shaped HS2 route from the West Midlands to Manchester and Leeds. Other commonly used terminology in relation to Phase Two includes Phase 2a (the route from the West Midlands to Crewe); Phase 2b Western Leg (the route from Crewe to Manchester) and Phase 2b Eastern Leg (the route from the West Midlands to Leeds).

Rural support zone (RSZ): The area outside the safeguarded area and up to 120m from the centre line of the HS2 railway in rural areas. Two discretionary schemes are available in the RSZ – Voluntary Purchase and the Cash Offer.

Safeguarding directions: These are the directions issued by the Secretary of State that establish the land that is safeguarded.

Safeguarding: Safeguarding is an established part of the planning system, designed to protect land which has been earmarked for major infrastructure projects from conflicting developments that might otherwise occur. From the date Safeguarding Directions are issued, local planning authorities must consult with the authority which issued the Directions on planning applications they receive that fall within the safeguarded area. Safeguarding also triggers ‘statutory blight’. This means that property owners within the safeguarded area may be eligible to serve a blight notice asking the acquiring authority to buy their property in advance of any compulsory purchase.

Statutory blight: This is the term used to describe a situation where a property is blighted in a legal sense, such as where it is in a development plan or within land safeguarded for a specific purpose such as HS2 or included within a compulsory purchase order.

Subsurface safeguarding: In locations where subsurface safeguarding applies, local authorities do not usually have to consult on applications for planning permission, unless the proposed development would extend below ground level. For HS2, subsurface safeguarding is usually put in place when the proposed line of route is in a bored tunnel.

Surface safeguarding: In locations subject to surface safeguarding, local planning authorities must consult on all planning applications they receive that fall within this area. For HS2, the land that is identified for surface safeguarding typically involves surface works and structures associated with the railway.

Unblighted open market value: This is the value that a property would have on the open market if the cause of blight were removed – in the context of this consultation, if there were no plans for HS2.