Backgrounds and Definitions: Personal tax credits finalised award statistics - Small area data 2019 to 2020

Published 4 November 2021

Media contact:

HMRC Press Office

03000 585018

Statistical contact:

B Yao Seworde

benefitsandcredits.analysis@hmrc.gov.uk

KAI Benefits & Credits

HM Revenue and Customs

Albert Bridge House

Manchester

M60 9AF

1. A National Statistics Publication

National Statistics are produced to high professional standards as set out in the Code of Practice for Official Statistics. They undergo regular quality assurance reviews to ensure they meet customer needs and are produced free from any political interference.

The United Kingdom Statistics Authority has designed these statistics as National Statistics, in accordance with the Statistics and Registration Service Act 2007 and signifying compliance with the Code of Practice for Official Statistics

Designation can be broadly interpreted to mean that the statistics:

- meet identified user needs;

- are well explained and readily accessible;

- are produced according to sound methods;

- are managed impartially and objectively in the public interest;

- are produced to the highest standard, ensuring that data confidentiality has been maintained

Once statistics have been designed as National statistics it is a statutory requirement that the Code of Practice shall continue to be observed.

For general enquiries about National Statistics, contact the National Statistics Public Enquiry Service on:

Tel: 0845 601 3034

Overseas: +44 (01633) 653 599

Minicom: 01633 812 399

E-mail: info@statistics.gov.uk

Fax: 01633 652 747

Letter: Customer Contact Centre, Room 1.101, Government Buildings, Cardiff Road, Newport, South Wales, NP10 8XG.

You can also find National Statistics on the internet at www.statistics.gov.uk

2. HMRC Consultation on Official Statistics

HMRC launched a wide-ranging consultation on a range of statistics on 8 February 2021.

This includes changes to a number of tax credits statistics releases including a proposal to cease publication of the Child and Working Tax Credits statistics: small area data release due to the number of tax credit customers declining as they move to Universal Credit. More details are given in the consultation.

Following this consultation, HMRC has taken the decision to publish only the number of families benefiting from the tax credits and the number of children in these families at the regional, local authority and the lower super output area (LSOA) as at August 2019.

3. Introduction

These statistics focus on the number of families benefiting from tax credits in England, Scotland, Wales and Northern Ireland as at 31 August 2019. They are based on a snapshot of the 2019 to 2020 finalised award data, which in turn is based on 100% of tax credit administrative data available for that period, and so they are not subject to sampling error.

Within England, Wales and Northern Ireland, the number of families and children are broken down by Lower Super Output Area (LSOA), and within Scotland they are broken down by Scottish Data Zone.

This publication excludes any cases where the claimants live outside the UK or where we cannot locate a region or area.

4. Definitions

4.1 What are tax credits?

Tax credits are a flexible system of financial support designed to deliver support as and when a family needs it, tailored to their specific circumstances. Introduced in 2003, the system forms part of wider government policy to provide support to parents returning to work, reduce child poverty and increase financial support for families.

The system is designed flexibly so that as families’ circumstances change, (daily) entitlement to tax credits can change. Tax credits can respond quickly to families’ changing circumstances providing support to those that need it most.

Tax credits are based on household circumstances and can be claimed jointly by members of a couple, or by singles. Entitlement is based on the following factors:

- age

- income

- hours worked

- number and age of children

- disabilities

For further information about who can claim please refer to the HMRC website

Tax credits are made up of working tax credit (WTC) and child tax credit (CTC), as explained below.

4.2 Working Tax Credit (WTC)

Provides in-work support for people on low incomes, with or without children. It is available for in-work support to people who are aged at least 16 and:

- are single, work 16 or more hours a week and are responsible for a child or young person

- are in a couple responsible for a child or young person where their combined weekly working hours are at least 24, with one parent working at least 16 hours

- work 16 or more hours a week and are receiving or have recently received a qualifying sickness or disability related benefit and have a disability that puts them at a disadvantage of getting a job

- Work 16 or more hours a week and are aged 60 or over.

Otherwise, it is available for people who are aged 25 and over who work 30 hours a week or more.

WTC is made up of the following elements:

Basic element: which is paid to any working person who meets the basic eligibility conditions.

Lone Parent element: for lone parents

Second adult element: for couples

30 hour element: for individuals who work at least 30 hours a week, couples where one person works at least 30 hours a week or couples who have a child and work a total of 30 hours or more a week between them where one of them works at least 16 hours a week.

Disability element: for people who work at least 16 hours a week and who have a disability that puts them at a disadvantage in getting a job and who are receiving or have recently received a qualifying sickness or disability related benefit.

Severe disability element: for people who are in receipt of Disability Living Allowance (Highest Rate Care Component), Personal Independence Payment (Enhanced Daily Living Component) or Attendance Allowance at the highest rate.

Childcare element: for a single parent who works at least 16 hours a week, or couples who either (i) both work at least 16 hours a week or (ii) one of them work at least 16 hours a week but the other is out of work for being in hospital or in prison and who spends money on a registered or approved childcare provider. The childcare element of WTC can support up to 70% of childcare costs up to certain maximum limits.

Further information on childcare cost support can be found on GOV.UK

Tapering: is the amount of the award that will be reduced when the household income exceeds a given threshold. For example, the income threshold for claimants receiving WTC only and for combined WTC and CTC claimants is £6,420. After this threshold, the taper rate will be 41%. Tapering reduces WTC first and then CTC for claimants who receive both.

4.3 Child Tax Credit (CTC)

Provides income-related support for children and qualifying young people aged 16 to 19 who are in full time, non-advanced education or approved training into a single tax credit, payable to the main carer. Families can claim CTC whether or not the adults are in work.

CTC is made up of the following elements:

Family element: which is the basic element for families responsible for one or more children or qualifying young people.

Child element: which is paid for each child or qualifying young person the claimant is responsible for. From April 2017, this element is no longer payable in respect of the third or subsequent children who were born after this date. Certain exceptions to this rule apply and are set out at the CTC exceptions to the 2 child limit page on GOV.UK

Disability element: for each child or qualifying young person the claimant is responsible for if Disability Living Allowance (DLA) or Personal Independence Payment (PIP) is payable for the child, or if the child is certified as blind or severely sight impaired.

Severe disability element: for each child or qualifying young person the claimant is responsible for if DLA (Highest Rate Care Component) or PIP (Enhanced Daily Living Component) is payable for the child.

Out-of-work benefit families: some out-of-work families with children do not receive CTC but instead receive the equivalent amount via child and related allowances in Income Support or income-based Jobseeker’s Allowance (IS/JSA). These families are included in the figures, generally together with out-of-work families receiving CTC.

The vast majority of these claimants have now moved to tax credits and the remainder will be migrated either to tax credits or Universal Credit.

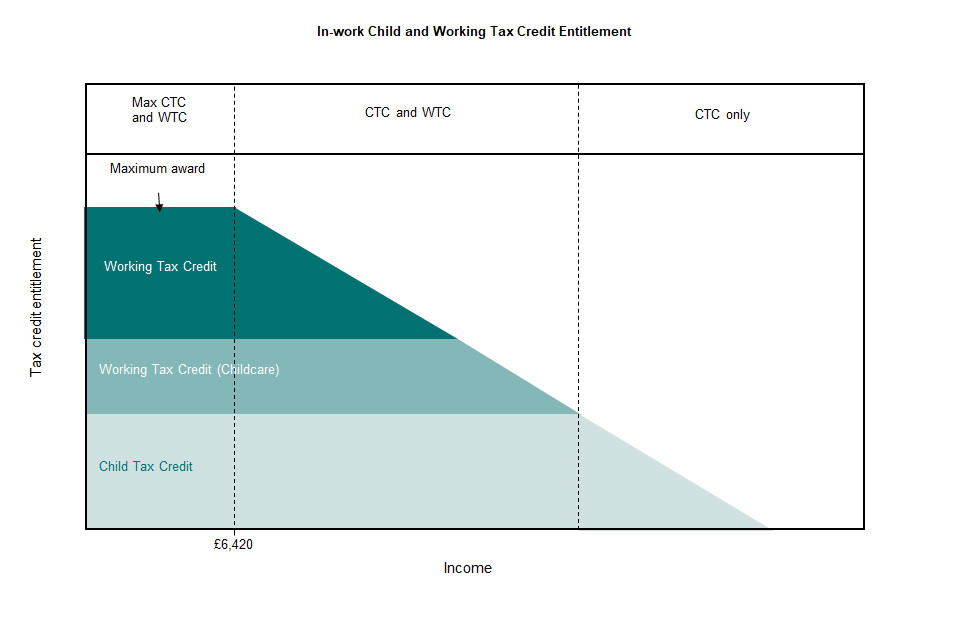

5. Child and Working Tax Credit Entitlement

The amount of support an eligible family can receive (known as their entitlement) varies depending on their income and their eligibility for specific tax credit elements. First, a family’s maximum possible entitlement is worked out by adding up all the different elements of CTC and WTC that they are eligible for (described on pages 3-4).

A household’s actual entitlement is then determined by tapering this maximum amount according to different thresholds. As demonstrated within the diagram below, families eligible for the WTC receive the full entitlement until their annual household income reaches £6,420, after which the amount of tax credits they receive is reduced by 41 pence for each £1 they earn beyond this threshold.

If a household is out-of-work and therefore eligible for the CTC only, they will receive the full entitlement until their annual household income reaches £16,105 (2019 to 2020). After this point, the amount of tax credits they receive is again reduced by 41 pence for each additional £1 of income beyond this threshold (note that this is not shown on the diagram below).

Because of the range of possible eligibilities and interactions between the elements, both the maximum award and the shape of the above award profile will be different for every family with different circumstances.

Tax credits are based on the taxable income of adults within the family. The income used to calculate the award is based on the families’ income from the previous tax year, or on their most recently reported circumstances in-year. Up to £2,500 of any change in annual income between the previous or current year is disregarded in the calculation.

A family’s tax credits award is provisional until finalised at the end of the year, when it is checked against their final income for the year. This publication relates to a snapshot of tax credit support based on provisional incomes and other circumstances as reported at the date when the statistics were extracted.

6. Technical notes

6.1 What the publication tells us

The small area data is currently published during summer around one year following completion of the entitlement year in question. The delay in publication is the result of the finalisation process built into the Tax Credits system as well as the time taken to produce and quality assure the statistics. Most families have until 31 July following the end of the entitlement year to renew their award reporting their finalised income for the year in question.

However, families that report income from Self-Assessment (e.g., the self-employed) have until 31 January of the following year to finalise their income. As a result, the full picture is not known until at least February the year after the entitlement year ends.

The 2019 small area data is based on the 2019 to 2020 finalised awards data, but only awards live as at 31 August 2019 are selected for inclusion in this publication, therefore the estimates in this publication will not match exactly with the estimates from the 2019 to 2020 finalised annual awards.

The link to these National Statistics is: Child and Working Tax Credits Statistics: Finalised Annual Awards - 2019 to 2020

This series has been produced annually since 2005.

Awards data live as at 31 August 2019 are used in order to align this publication with the “Child Benefit: small area statistics” publication. The link to these National Statistics is: Child Benefit small area statistics: August 2019

6.2 LSOAs and Data Zones:

The standard geography used to report small area data in England, Wales and Northern Ireland is the LSOA. These are first built from groups of Output Areas used in the 2001 Census, and have been updated following the 2011 census. LSOAs are maintained as part of the 2011 Census Output Area (OA) maintenance and are split or merged where they breach predefined population and household thresholds. Therefore, LSOA boundaries may change from year-to-year.

Similarly, for Scotland the key small area geography is called the Data Zone and as with LSOA’s in England and Wales they nest within Local Authority boundaries. More information can be found at the Scottish Neighbourhood Statistics website

6.3 31 August 2019 reference date:

CTC and WTC are awards for tax years, but the entitlement level can vary over the year as families’ circumstances change. These tables are based on families’ entitlements at 31 August 2019, given the family size, hours worked, childcare costs and disabilities at that date, and their 2019 to 2020 incomes.

This date was selected because it is the reference date for published Child Benefit (CB) statistics for England and Wales, at LSOA level and for Scotland at Data Zone level. At this date most young people aged 16 were still “qualifying” for CB and CTC, although historically their numbers drop slightly over the period since May (normally one or two percent), this is mainly through them taking up permanent work.

6.4 Addresses used for geographical allocation:

To maintain comparability, where families appear in both the tax credits and Child Benefit data, they are allocated to the same LSOAs (which are created based on 2011 census) in both small area data publications. However, the published Child Benefit statistics for Data Zones in Scotland was based on 2001 census geography.

6.5 Recent policy changes

In the 2015 Summer Budget, the Government announced that the child element of CTC would be limited to two children for those born on or after 6 April 2017 unless certain exceptions apply. Prior to 6 April 2017, the child element of CTC was paid for each child or qualifying young person that the claimant (or his or her partner) was responsible for.

The change means that any family with two or more existing children do not receive any child element (worth up to £2,780 a year per child in 2019 to 2020) for children born on or after that date, subject to exceptions. The child element of CTC continues to be paid for all children born before 6 April 2017.

In addition, any family having their first child born on or after 6 April 2017 do not receive the family element (worth up to £545 a year) of CTC. The family element was previously paid to all families. From 6 April 2017, it is only be paid where the claimant is responsible for at least one child or qualifying young person born before 6 April 2017. For further information, please visit the CTC exceptions to the 2 child limit page on GOV.UK.

Statistics related to this policy can be found on the Official Statistics page on GOV.UK.

6.6 Universal Credit

Universal Credit (UC) is a payment to help with living costs for those on a low income or out of work. UC was introduced in April 2013 in certain areas of North West England. Since October 2013, it has progressively been rolled out to other areas.

Claimants receive a single monthly household payment, paid into a bank account in the same way as a monthly salary and support for housing costs, children and childcare costs are integrated into UC.

CTC will be replaced as UC rolls out. Since December 2018 there have been no new tax credit claims (with the exception of a small number of families claiming the family premium).

Further information about UC, including making a claim, is available online on the UC page on GOV.UK.

Statistics related to UC are available online and can be found here on the UC statistics page on GOV.UK.

6.7 User Engagement

Bespoke analysis of tax credits data is possible although there may be a charge depending on the level of complexity and the resources required to produce. If you would like to discuss your requirements, to comment on the current publications, or for further information about the tax credits statistics please use the contact information at the end of this publication, or from the Statistics at HMRC page.

We are committed to improving the official statistics we publish. We want to encourage and promote user engagement, so we can improve our statistical outputs.

We would welcome any views you have using the contact us information on the Statistics at HMRC page. We will undertake to review user comments on a quarterly basis and use this information to influence the development of our official statistics. We will summarise and publish user comments at regular intervals.

6.8 User Notification

As mentioned in the previous publication, the Child Benefit Statistics have been removed from this publication as these statistics are available at Child Benefit: annual release

7. Revision policy

This policy has been developed in accordance with the UK Statistics Authority Code of Practice for Official statistics and Her Majesties Revenue and Customs Revisions Policy.

There are two types of revisions:

Scheduled revisions

This requires explanation of the handling of scheduled revisions due to the receipt of updated information in the case of each statistical publication. As this publication is based on finalised awards data, the figures presented in this publication are treated as ‘final’.

Unscheduled revision

HMRC aims to avoid the need for unscheduled revisions to publications unless they are absolutely necessary and put systems and processes in place to minimise the number of revisions. Where revisions is necessary due to errors in the statistical process, an explanation along with the nature and extent of revision is also provided. Also, the statistical release and the accompanying tables will be updated and published as soon as is practical.

8. Disclosure control

To avoid the possible disclosure of information about individual families, values have been supressed when underlying sample counts are low. An entry of “-“ in a table indicates that the data has been rounded down to 0 or has been withheld in line with HMRC’s Dominance and Disclosure policy.

9. Appendix A: Technical Note

9.1 Modelled tax credits awards:

Award entitlement at any date is based on the annual values shown in Appendix B expressed as a daily rate. It is calculated by summing the various elements to which the family is entitled to arrive at the “maximum award” and then reducing this amount if the family’s annual income, (see footnote 7 of Appendix B), less any income increase disregard (see footnote 8) exceeds the first income threshold.

The annualised rate of reduction is 41 per cent of the excess over the threshold. That is the award is reduced by 41 pence for every £1 of income over that threshold. Families where this reduces the annual award to £26 or less are excluded from the tables.

The tapering is deemed to reduce WTC first, so families shown as “CTC and WTC” are those for which the reduction is below the sum of the relevant WTC elements. For in-work families shown as “CTC only” the reduction is larger than this, but still leaving the entitlement above the family element.

10. Appendix B:Annual entitlement (£) by tax credit elements and thresholds:

| 2009-10 | 2010-11 | 2011-12 | 2012-13 | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Child Tax Credit | ||||||||||||

| Family element | 545 | 545 | 545 | 545 | 545 | 545 | 545 | 545 | 545 | 545 | 545 | |

| Family element, baby addition [footnote 1] | 545 | 545 | - | - | - | - | - | - | - | - | - | |

| Child element [footnote 2] | 2,085 | 2,300 | 2,555 | 2,690 | 2,720 | 2,750 | 2,780 | 2,780 | 2,780 | 2,780 | 2,780 | |

| Disabled child additional element [footnote 3] | 2,540 | 2,715 | 2,800 | 2,950 | 3,015 | 3,100 | 3,140 | 3,140 | 3,175 | 3,275 | 3,355 | |

| Severely disabled child element [footnote 4] | 1,020 | 1,095 | 1,130 | 1,190 | 1,220 | 1,255 | 1,275 | 1,275 | 1,290 | 1,325 | 1,360 | |

| Working Tax Credit | ||||||||||||

| Basic element | 1,800 | 1,920 | 1,920 | 1,920 | 1,920 | 1,940 | 1,960 | 1,960 | 1,960 | 1,960 | 1,960 | |

| Couples and lone parent element | 1,770 | 1,890 | 1,950 | 1,950 | 1,970 | 1,990 | 2,010 | 2,010 | 2,010 | 2,010 | 2,010 | |

| 30 hour element | 735 | 790 | 790 | 790 | 790 | 800 | 810 | 810 | 810 | 810 | 810 | |

| Disabled worker element | 2,405 | 2,570 | 2,650 | 2,790 | 2,855 | 2,935 | 2,970 | 2,970 | 3,000 | 3,090 | 3,165 | |

| Severely disabled adult element | 1,020 | 1,095 | 1,130 | 1,190 | 1,220 | 1,255 | 1,275 | 1,275 | 1,290 | 1,330 | 1,365 | |

| 50+ return to work payment:16 but less than 30 hours per week [footnote 5] | 1,235 | 1,320 | 1,365 | - | - | - | - | - | - | - | - | |

| 50+ return to work payment: at least 30 hours per week [footnote 5] | 1,840 | 1,965 | 2,030 | - | - | - | - | - | - | - | - | |

| Childcare element: Maximum eligible costs allowed (£ per week) | ||||||||||||

| Eligible costs incurred for 1 child | 175 | 175 | 175 | 175 | 175 | 175 | 175 | 175 | 175 | 175 | 175 | |

| Eligible costs incurred for 2+ children | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 300 | 300 | |

| Percentage of eligible costs covered | 80% | 80% | 70% | 70% | 70% | 70% | 70% | 70% | 70% | 70% | 70% | |

| Common features | ||||||||||||

| First income threshold [footnote 6] | 6,420 | 6,420 | 6,420 | 6,420 | 6,420 | 6,420 | 6,420 | 6,420 | 6,420 | 6,420 | 6,420 | |

| First withdrawal rate | 39% | 39% | 41% | 41% | 41% | 41% | 41% | 41% | 41% | 41% | 41% | |

| Second income threshold [footnote 7] | 50,000 | 50,000 | 40,000 | - | - | - | - | - | - | - | - | |

| Second withdrawal rate | 1 in 15 | 1 in 15 | 41% | - | - | - | - | - | - | - | - | |

| First income threshold for those entitled to Child Tax Credit only [footnote 8] | 15,575 | 16,190 | 15,860 | 15,860 | 15,910 | 16,010 | 16,105 | 16,105 | 16,105 | 16,105 | 16,105 | |

| Income increase disregard [footnote 9] | 25,000 | 25,000 | 10,000 | 10,000 | 5,000 | 5,000 | 5,000 | 2,500 | 2,500 | 2,500 | 2,500 | |

| Income fall disregard [footnote 9] | - | - | - | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | 2,500 | |

| Minimum award payable | 26 | 26 | 26 | 26 | 26 | 26 | 26 | 26 | 26 | 26 | 26 |

-

Payable to families for any period during which they have one or more children aged under 1. Abolished 6 April 2011. ↩

-

Payable for each child up to 31 August after their 16th birthday, and for each young person for any period in which they are aged under 20 (under 19 to 2005-06) and in full-time non-advanced education, or under 19 and in their first 20 weeks of registration with the Careers service or Connexions. ↩

-

Payable in addition to the child element for each disabled child. ↩

-

Payable in addition to the disabled child element for each severely disabled child. ↩

-

Payable for any period during which normal hours worked (for a couple, summed over the two partners) is at least 30 per week. ↩ ↩2

-

Payable for each qualifying adult for the first 12 months following a return to work. Abolished 6 April 2012. ↩

-

Income is net of pension contributions, and excludes Child Benefit, Housing benefit, Council tax benefit, maintenance and the first £300 of family income other than from work or benefits. The award is reduced by the excess of income over the first threshold, multiplied by the first withdrawal rate. ↩

-

Those also receiving Income Support, income-based Jobseeker’s Allowance or Pension Credit are passported to maximum CTC with no tapering. ↩

-

Introduced from 6 April 2012, this drop in income is disregarded in the calculation of Tax Credit awards. ↩ ↩2