UK defence and security export statistics: 2020

Published 26 October 2021

Introduction

This statistical release comprises UK defence and security export performance data and analysis. The release principally focuses on 2020 data but includes historic data for context and trend analysis purposes.

UK defence export information is based upon data provided by UK companies via UK Defence and Security Exports (UK DSE) voluntary survey of defence export contracts. Rest of the World data is derived from open source reporting of other countries’ defence export contracts.

Security sector data is compiled by Frost & Sullivan and counts sales of security equipment and services.

This is the eighth year that UK DSE has published defence and security export figures as ‘Official Statistics’. This release has been compiled in conjunction with the Department for International Trade (DIT) statistics team, whose technical advice and support is acknowledged here.

Our defence statistics relate to exports to overseas Ministries of Defence and associated armed services.

Our security figures relate to sales. 2020 Security data is provided by a contractor called Frost & Sullivan. We have also included earlier data provided by Westlands Advisory.

Separate methodology papers for the defence and security statistics accompany this release on the gov.uk website.

All the information collected on the defence and security markets is vital to our understanding of the shape of the market and trends. It helps UK DSE target support to the defence and security industry.

Summary

On a rolling 10-year basis, the UK remains the second largest global defence exporter after the USA.

In 2020, the UK won defence orders worth £7.9 billion, compared to the previous year (£11 billion) and illustrative of the volatile nature of the global export market for defence.

The UK share of the global defence export market was estimated at 6% in 2020. (This was largely due to $62 billion USA F-16 export contract offsetting competitor shares.) The UK’s largest defence export markets were Europe, North America and the Middle East.

In 2020, the value of UK security export sales was £7.95 billion, an increase from 2019 (£7.2 billion), with the UK third place in the rankings.

The UK’s largest security export markets were Europe, North America and Asia-Pacific.

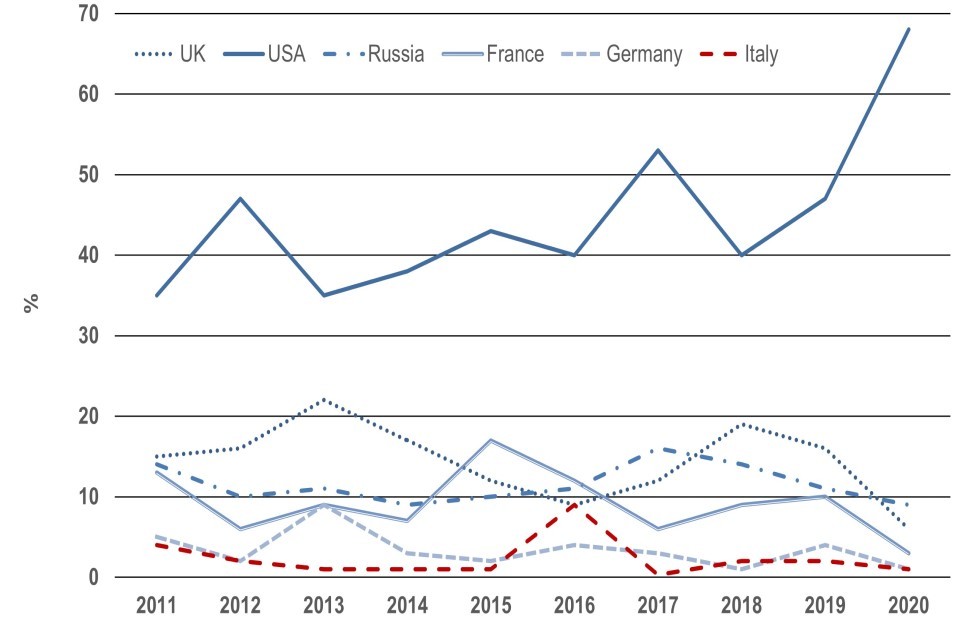

Chart 1: defence exports: estimated UK and competitor percentage market shares (2011 to 2020)

Source: UK DSE

Chart 1 highlights UK and competitor estimated defence export market-shares for the past decade. This provides a good barometer of the competitiveness of the leading exporters in the global market.

The most obvious point to note is that the USA has annually achieved the highest estimated percentage of the global defence export market between 2011 and 2020. Our European competitors have consistently had a lower percentage share than USA.

The UK and France have historically vied with Russia for second or third place behind the USA.

In 2020, the USA achieved market-share, estimated at 68% (predominately in the air sector), Russia 9%, UK 6% and France 3%.

Italy has traditionally enjoyed a relatively consistent level of defence exports. In 2016, the country rose to the sixth largest defence exporter for the period, partially as a result of a large naval contract with Qatar. In 2020, Fincantieri secured a contract for FREMM Frigates to Egypt totalling over $1 billion.

Germany saw its estimated market-share peak at 9% in 2013 but in 2017, it did secure a big naval contract that helped its overall ranking. In 2019, it secured a major contract with Egypt for Meko A-200 Frigates worth $1.68 billion.

Chart 2: annual value of UK defence exports 1983 to 2020 (£ billion)

Source: UK DSE

Chart 2 shows annual totals (in actual prices) for UK defence exports, with the variable nature clearly visible. 2018 had the highest exports ever (£14 billion), 2019 was in second place (£11 billion) but down to £7.9 billion in 2020.

As well as an order of 38 Typhoon aircraft from Germany worth over £1 billion, UK core business remained strong in 2020. Aerospace remains the dominant sector for the UK and Europe was the biggest market

As we reported previously, the UK has won significant defence orders during the past decade, including:

- Typhoon aircraft to Kuwait

- Typhoon Aircraft and Brimstone Missiles to Qatar

- Hawk and Typhoon Aircraft to Oman

- Typhoon aircraft to Saudi Arabia

- Helicopters to Norway and South Korea

- Trent 700 aircraft engines to France

- Offshore patrol vessels (OPVs) to Brazil

- F-35 work and military bridging to USA

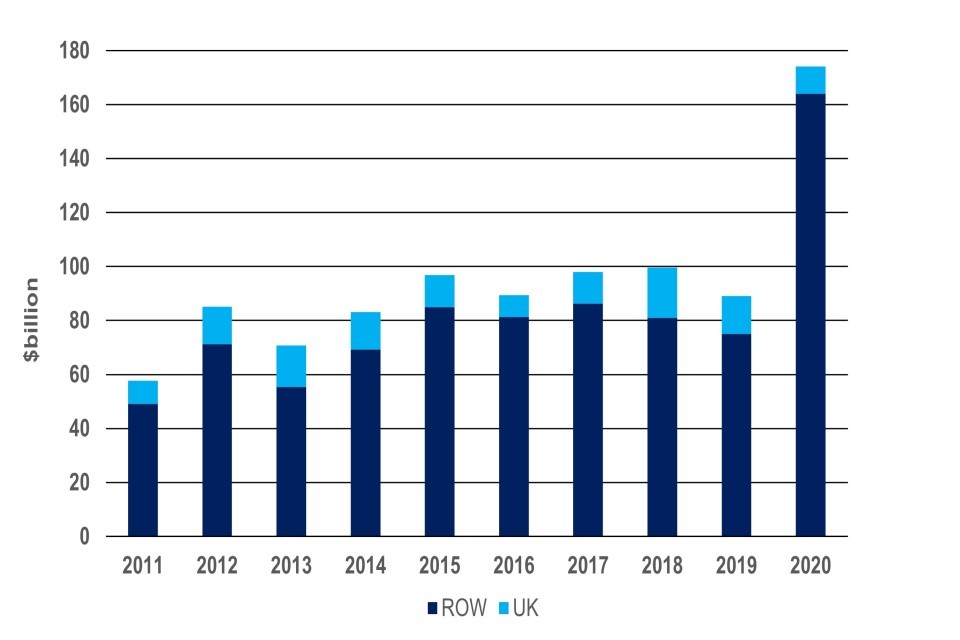

Chart 3: estimated global defence exports (based on orders/contracts signed): world market $ billion at actual prices

Source: UK DSE

Chart 3 shows the value of global defence exports annually over the last 10 years.

Year-on-year, the global defence export market experiences peaks and troughs in response to fluctuations in defence spending levels, threat perception and national requirements.

The global defence export market is estimated to have increased from $89 billion in 2019 to a record $174 billion in 2020. This increase is largely due to a £62 billion USA contract to cover all expected production of F-16 aircraft for foreign customers over the next decade.

Other major global defence export deals in 2020 included:

- Italy - FREMM Bergamini-class frigates to Egypt ($1.2 billion)

- Sweden - GlobalEye airborne early warning and control aircraft to UAE ($1.02 billion)

- USA - P-8A maritime aircraft to South Korea ($812 million)

- USA - MH-60R Helicopters to India ($792 million)

- Russia - Yak-130 advanced/lead-in fighter trainer aircraft to Vietnam ($350 million)

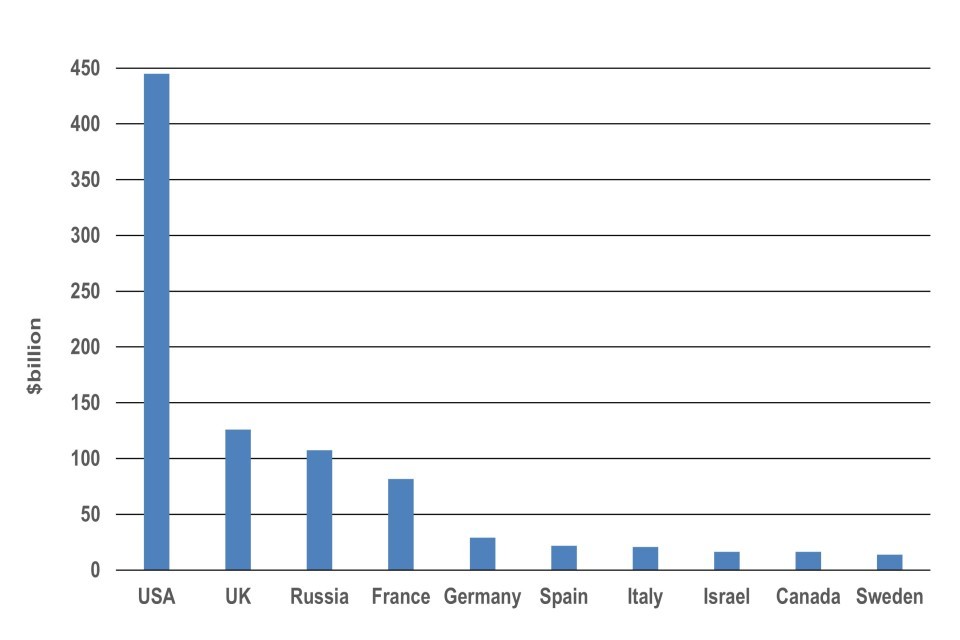

Chart 4: estimated top 10 defence exporters (based on orders/contracts signed): 2011 to 2020 ($ billion)

Source: UK DSE

Chart 4 shows that for the most recent 10-year period (including 2020 performance), the UK is the second largest defence exporter globally, behind the USA.

The UK is also Europe’s leading defence exporter ahead of Russia (third) and France (fourth).

The USA is the world’s pre-eminent defence exporter, having secured more than treble the exports (by value) of second-placed UK during the 10-year period.

There are no Latin American or African countries in the top 10 global defence exporters list, and the Middle East is only represented by Israel, ranked eighth.

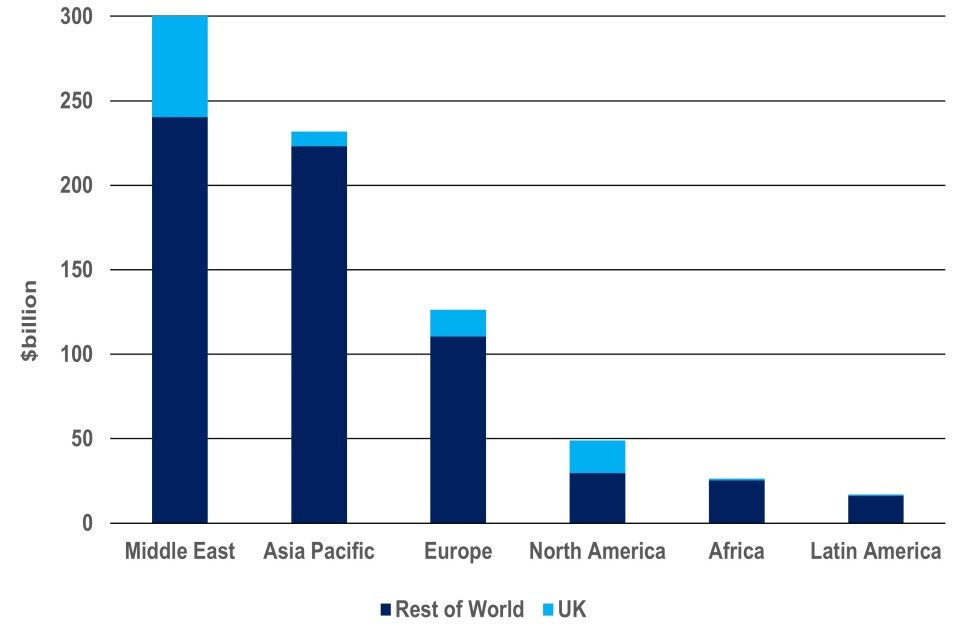

Chart 5: estimated value of defence import procurement by region 2011 to 2020, including the split between UK and rest of the world exports to each region ($ billion)

Source: UK DSE

Chart 5 shows that the Middle East is the largest regional importer of defence equipment and services, the same as reported last year. Saudi Arabia, Qatar, UAE and Egypt are major national importers, whilst the UK, USA and France are the major suppliers to the region.

The Asia-Pacific region has seen increased defence import activity in recent years, particularly in the aerospace and naval sectors. The UK has won major defence business in the region, including in 2013, when AgustaWestland won an AW159 helicopter contract with South Korea.

Europe is the third biggest regional importer, with the USA and local European industries strong.

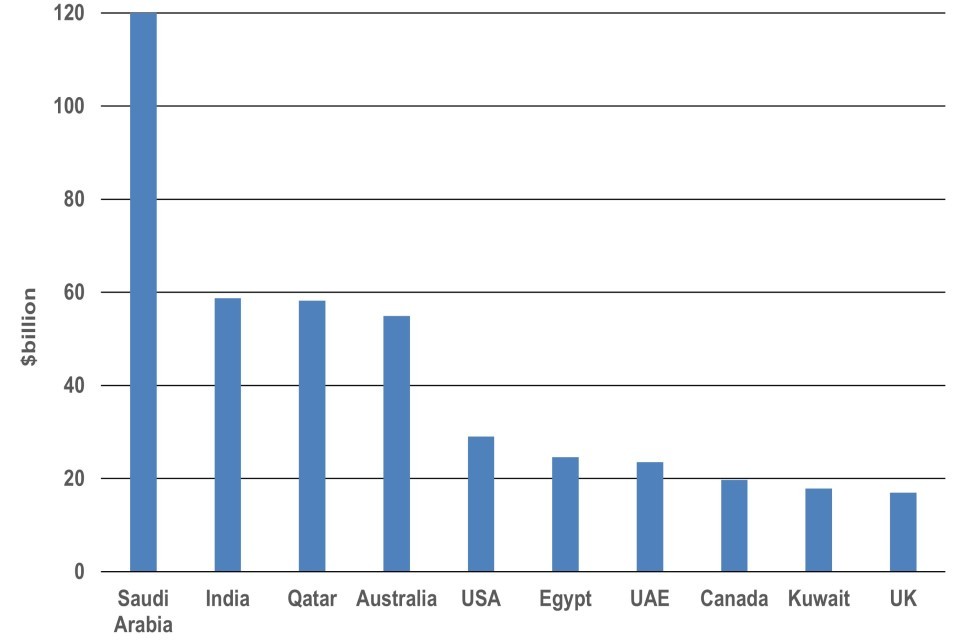

Chart 6: Estimated top 10 defence importer nations (based on orders/contracts signed): 2011 to 2020 ($ billion)

Source: UK DSE

Chart 6 shows the leading 10 global defence importers in the period 2011 to 2020.

The top 5 are the same rank as for the period 2010 to 2019.

The UK was the 10th biggest defence importer in the period.

The Middle East dominated global defence imports in the 2011 to 2020 period, with Saudi Arabia the world’s biggest importer.

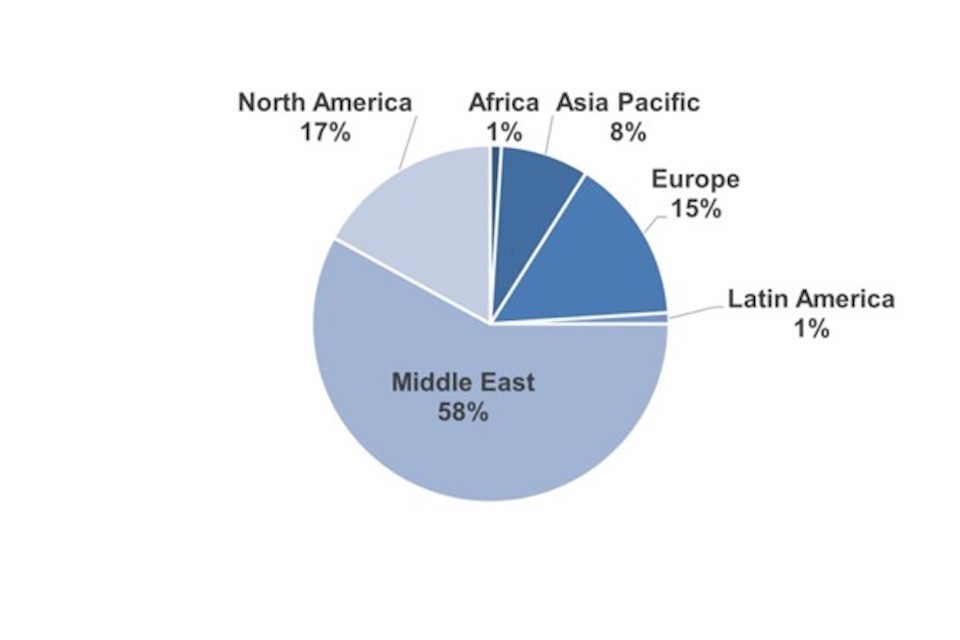

Chart 7: estimated total UK defence exports (based on orders/contracts signed) by region 2011 to 2020

Source: UK DSE

Chart 7 shows UK defence exports by region based on total 2011 to 2020 figures, the segments highlighting regional percentages.

The Middle East (58%) remains the dominant UK export destination reflecting the importance of the market to the UK (and note, to our competitors too).

North America was the second highest region for UK defence exporters, accounting for almost one fifth of total UK defence exports by customer destination. Europe and the Asia-Pacific were the next most important regional markets for the UK in this period.

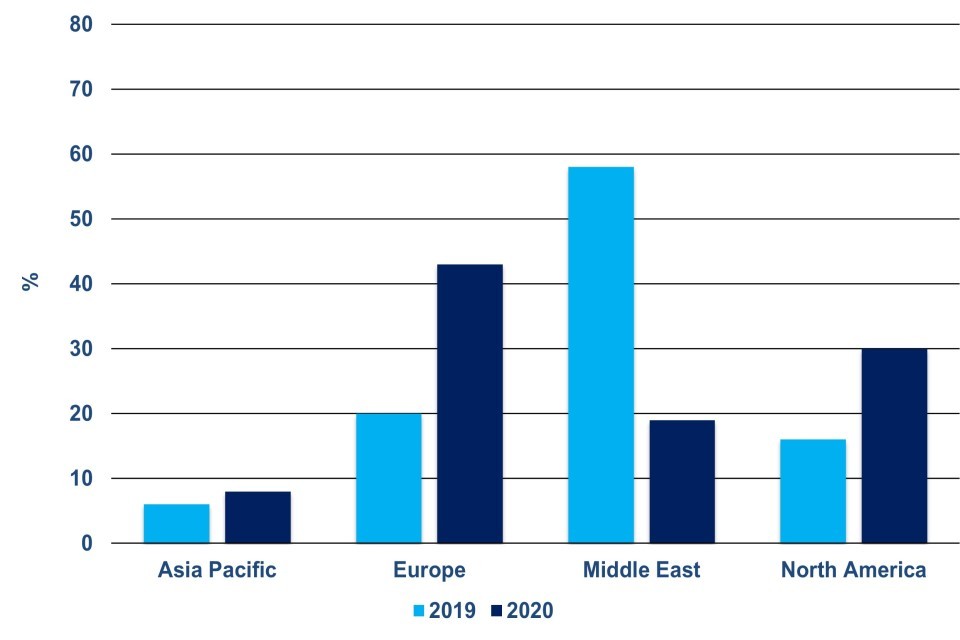

Chart 8: estimated percentage share of UK defence exports by region for the periods 2019 and 2020

UK Defence Exports to Latin America and Africa were 1% or less for each year

Source: UK DSE

Chart 8 shows percentage share comparison of UK defence exports by region for 2019 and 2020.

Europe was the UK’s biggest market, rising from 20% in 2019 to 43% in 2020, partly due to the export of Typhoon Aircraft to Germany.

North America (30%) is the second biggest market for the UK in 2020.

Total exports to the Middle East were down from 57% in 2019 to 19% in 2020, reflecting the economic impact of coronavirus (COVID-19) on regional defence budgets and the price of oil.

The Asia-Pacific region, rose from 6% in 2019 to 8% in 2020.

UK defence exports to Latin America and Africa were around 1% in 2020.

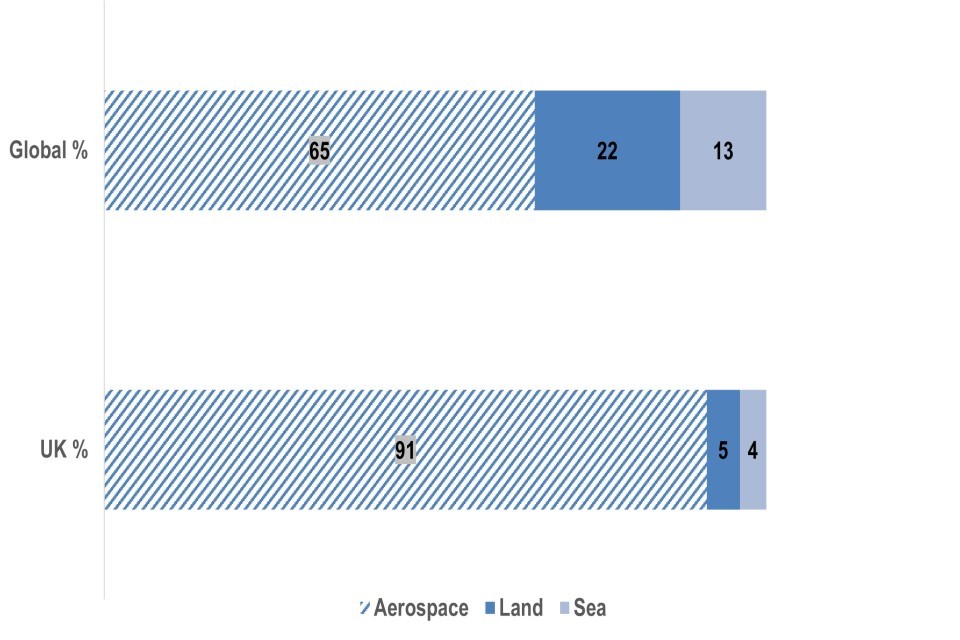

Chart 9: UK and global defence export market (based on orders/contracts signed) by sector 2011 to 2020

Source: UK DSE

Chart 9 depicts global and UK defence export performance by sector across the 2011 to 2020 period based on orders/contracts signed.

As is evident from the top bar (the global % position), the aerospace sector by value accounted for around two thirds (65%) of all defence exports. This is unsurprising given the fact that high value combat aircraft, transport aircraft, trainer aircraft and attack and transport helicopters reside in this domain. The land sector accounted for over a fifth (22%) of all defence exports globally. The sea sector (13%) is the lowest sector globally by value.

The UK is dependent (91%) on its aerospace sector, including platforms, equipment and support. As a leader in air sector technology and capability, it is exploiting its expertise. This strength is vital to securing the high value export opportunities in growth markets where securing air superiority is a key priority for nearly all nations.

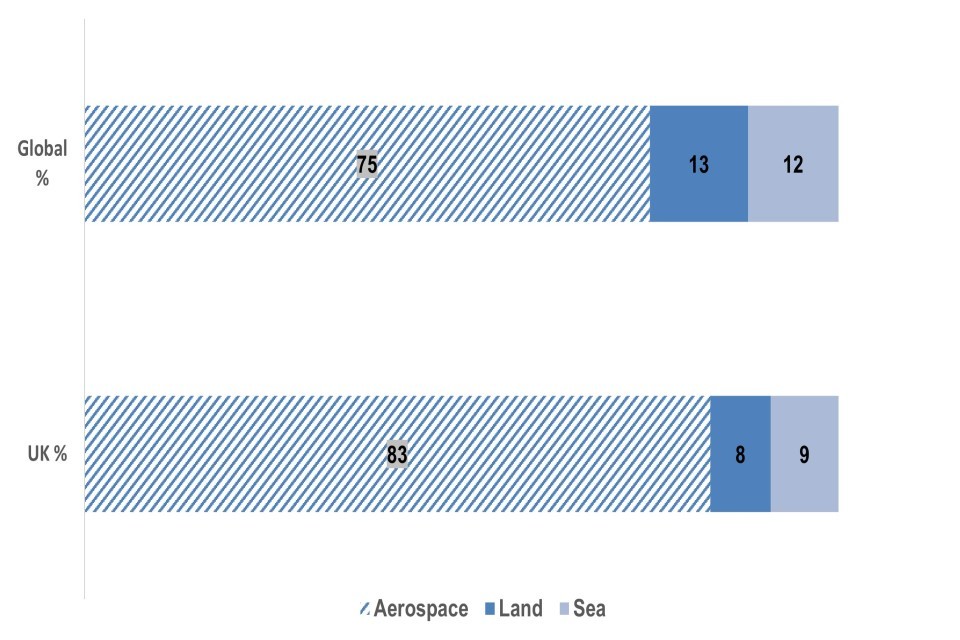

Chart 10: UK and global defence export market (based on orders/contracts signed) by sector 2020

Source: UK DSE

The aerospace sector by value in 2020 accounted for 75% of all defence exports globally (54% in 2019). Increase largely due to USA’s F-16 aircraft export contract.

The lower bar highlights the continuing significance of aerospace to the UK, equating to 83% (88% in 2019) of total UK defence exports.

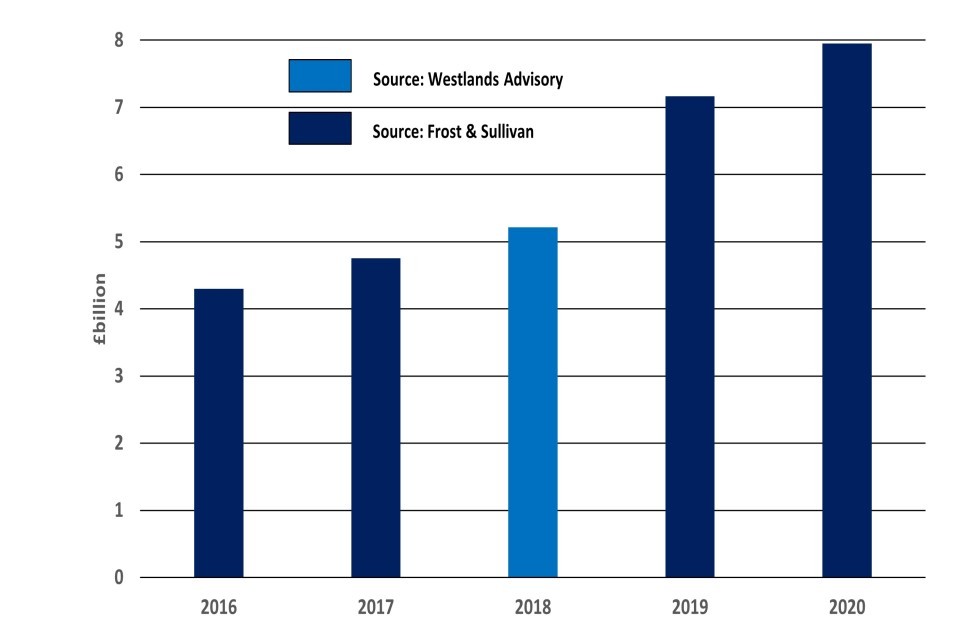

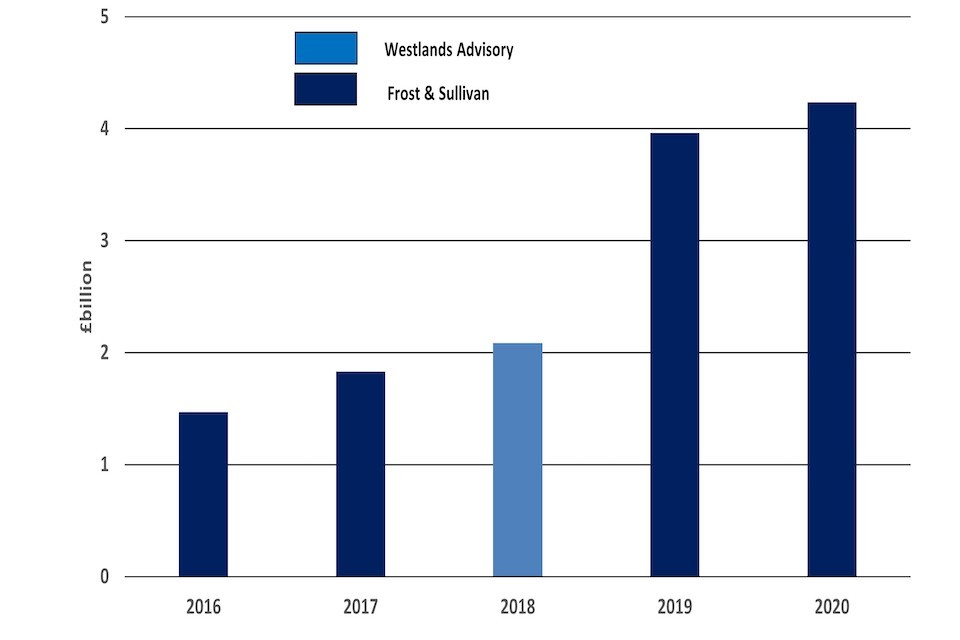

Chart 11: UK security exports 2016 to 2020 (£ billion)

Chart 11 shows UK security exports for each of the last 5 years.

Information on UK security exports is currently provided by Frost & Sullivan (F&S). The company’s methodology is provided in a separate document published on the GOV.UK website with this release. F&S also provided the data for 2016 and 2017 with Westlands Advisory providing data for calendar year 2018.

According to F&S’s analysis, UK security companies achieved another increased set of export results in 2020, up to £7.95 billion from £7.2 billion in 2019. (**see note at Chart 16)

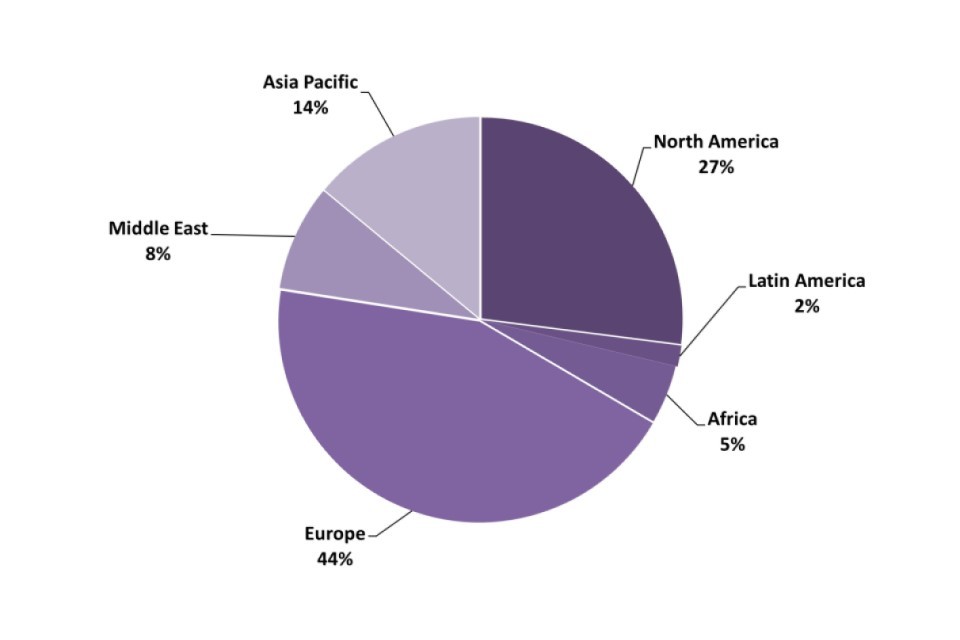

Chart 12: UK security export destinations by region (based on sales) for 2020

Source: Frost & Sullivan

Chart 12 shows UK security exports by region in 2020.

Europe is the largest export market for the UK’s security industry with 44% of sales, with North America (27%) taking the second spot. Asia Pacific (14%) is also a notable market to focus on.

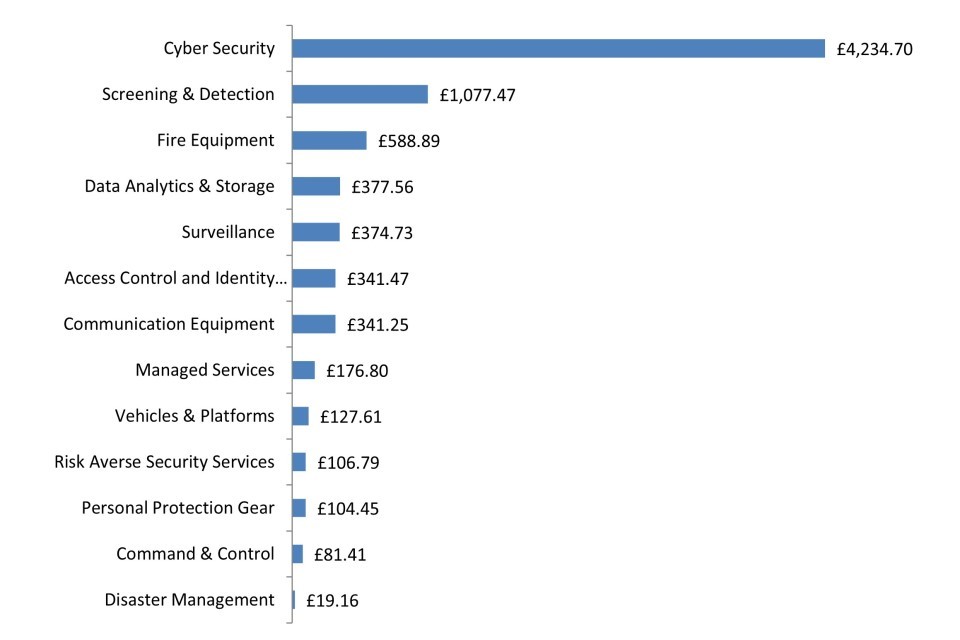

Chart 13: UK security exports by technology segments 2020 (£ million)

Source: Frost & Sullivan

Chart 13 shows UK security exports by technology segments in 2020.

Cyber security is again the biggest sector (£4.2 billion) for UK security exports in 2020.

Screening and detection (£1.1 billion) and fire equipment (£589 million) make up the top 3. (In 2019 it was cyber, screening and detection and communication equipment.)

Chart 14: UK cyber exports 2016 to 2020 (£ billion)

Chart 14 shows UK cyber exports for each of the last 5 years.

Cyber security remains the largest UK HMG security sub-sector and has grown from £3.96 billion in 2019 to £4.2 billion in 2020.

Part of the increase in cyber security exports since 2018 can be attributed to the new registration of UK subsidiaries of US companies. This could be the channelling of a proportion of their global revenues through their UK accounts or the better reporting of the proportion of overall turnover that represented exports.

Chart 15: UK cyber security exports by region 2020 (%)

Source: Frost & Sullivan

Chart 15 is an assessment of the export regions for UK cyber exports. It shows Europe with a substantial share of exports (44%) followed by North America (22%). Europe will remain very important for cyber security exports in the future.

Whilst UK brands are strong in the USA, these are usually USA registered companies with operations in country and so do not count as export sales.

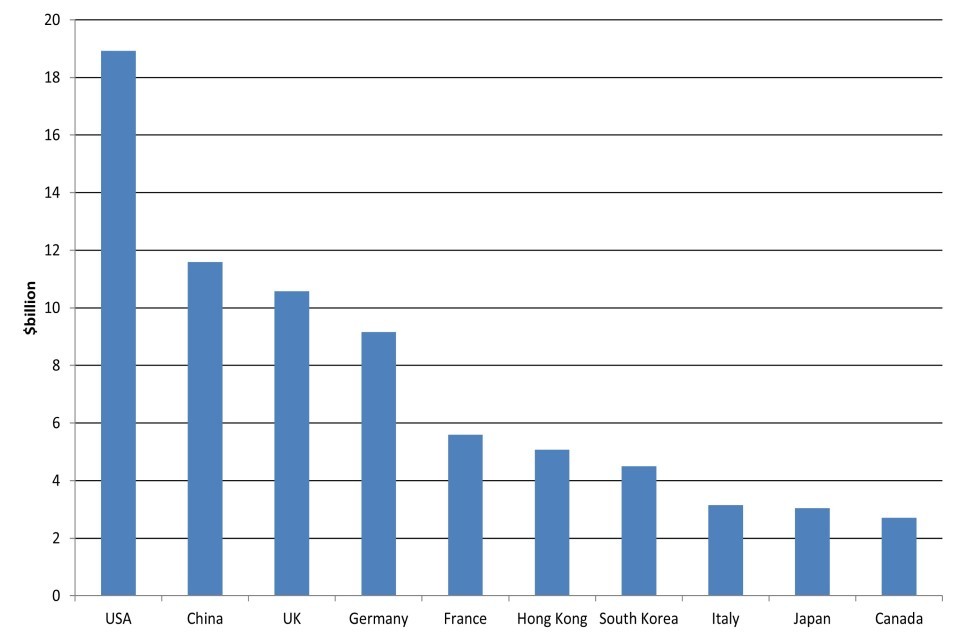

Chart 16: global security exports by country 2020 ($ billion)

Chart 16 shows that in 2020, the UK retained 3rd place in the global security export rankings, with exports worth $10.58 billion (**see note below), behind USA and China

**: Frost & Sullivan has estimated the 2020 UK security exports market using 2 different methodologies.

In the first methodology, they followed a rigorous primary and secondary analysis approach to validate the company’s reported financial and exports revenues. The UK security exports estimate derived from the first methodology is £7.95 billion. In the second approach they leveraged and analyzed parameters like political, economic, social and technological (PEST) analysis. They also looked at export strength of the country, country security industrial base and high tech exports. The UK security exports estimate derived from the second methodology is $10.58 billion (~£7.48 billion). The variance in the market estimates is due to different parameters used in both approaches. Both figures are close and either can be used to understand the UK security exports market.

Notes

This UK defence and security exports statistical release contains UK defence and security export performance data and analysis. UK defence figures are derived from a survey of UK defence companies to capture new orders data. Rest of the World figures are derived from open source reporting and capture competitor contracts signed. Security export data is based on sales. It is not advisable to combine the defence and security export figures as they are recorded via a different methodology and report on a different metric (orders/contracts vs sales).

Where ‘$’ values are expressed for rest of the world activity or global totals, these are presented in US dollars for consistency. Figures quoted are actual prices, not adjusted for inflation.

All figures are subject to revisions due to definitional and methodological changes that will be notified to users via the gov.uk website.

Regular users of our data will be aware that KMatrix provided security export data to UK Defence & Security Exports under a multi-year contract that expired in 2016. Frost & Sullivan was awarded a 2-year contract to supply security export data covering the 2016 and 2017 calendar years. More recently, Westlands Advisory was awarded the contract to provide the 2018 security export statistics and Frost & Sullivan has again provided figures for 2019 and 2020.

UK DSE statistical contact

Contact dit-ukdse.enquiry@trade.gov.uk.