Tribunal Statistics Quarterly, January to March 2021

Published 10 June 2021

1. Main Points

This publication gives tribunals statistics for the latest quarter (January to March 2021, Q4 2020/21), compared to the same quarter the previous year, alongside annual data for 2020/21. For technical detail about data sources, quality, policy changes and terminology, please refer to the accompanying Guide to Tribunal Statistics.

| The overall volumes of receipts and disposals have decreased, and caseload outstanding has increased | Her Majesty’s Courts & Tribunals Service (HMCTS) recorded a decrease of 19% and 21% in receipts and disposals respectively in January to March 2021 compared to the previous year. Caseload outstanding increased by 5%. |

| SSCS receipts, disposals and caseload outstanding all decreased | Social Security and Child Support (SSCS) receipts, disposals and caseload outstanding decreased (by 37%, 27% and 49% respectively). A 66% and 22% fall in Personal Independence Payment (PIP) and Universal Credit (UC) respectively mainly drove the fall in receipts. The decrease in disposals was driven by a 73% and 20% fall in Employment Support Allowance (ESA) and PIP respectively. |

| FTTIAC receipts and disposals decreased while caseload outstanding increased | First-Tier Tribunal Immigration and Asylum Chamber (FTTIAC) receipts and disposals fell (by 12% and 27% respectively) compared to the same period in 2020. Caseload outstanding rose, by 24%, over the same period. |

| Single ET claims received declined Multiple ET claims increased |

Single Employment Tribunal (ET) receipts and disposals decreased, by 13% and 14% respectively, compared to a year ago. Caseload outstanding increased, by 39%. Multiple ET receipts and caseload outstanding both increased by 14% and 13% respectively, over the same period. Disposals decreased, by 34%. |

| Decreases in adjournments and postponements | In 2020/21 the adjournments reported on decreased by 19%, compared to 2019/20, driven by SSCS, which makes up the majority of adjournments (80%), and FTTIAC. Postponements decreased 43% over the same period, driven mostly by SSCS and FTTIAC. |

For feedback related to the content of this publication, please contact us at CAJS@justice.gov.uk

2. Statistician’s Comment

Activity in the Tribunals continues to be driven by the impacts of policies put in place due to COVID-19.

Policies including the suspension of face-to-face assessments by DWP, introduction and subsequent extensions of the furlough scheme to support workers, and the relaxation of immigration and asylum criteria by the Home Office, all led to a dip in receipts across many Tribunals.

As these policies come to an end and restrictions are eased, we begin to see a rise in demand and a return to pre-COVID19 levels of receipts for these Tribunals.

SSCS data has now been verified and re-introduced in this release. It shows caseload outstanding has fallen by half compared to the same period last year, while disposals and receipts are still below pre-COVID baselines. This is in line with what was expected because as more people become eligible for Universal Credit their need to lodge SSCS appeals reduces. (We have not provided the SSCS venue level data as this requires further quality assurance.)

Immigration and Asylum receipts are at their highest since the pandemic - almost at pre-COVID19 levels. The Home Office has started hearing cases and we expect this increase to continue as travel restrictions are lifted and visa centres in the UK and abroad resume normal service.

Demand for Employment Tribunals is the only jurisdiction that remained substantially above pre-COVID19 level all through the pandemic months. However, this quarter shows receipts returning to their pre-COVID19 levels and close to disposals. This may be due to the continuation of the furlough scheme combined with the post-Christmas lockdown.

We continue to monitor the rise in receipts, due to the impact this has if court requirements are not eased as quickly as receipts rise. Linked to this risk, time taken to clear cases remains elevated as restrictions put in place due to COVID-19 have meant lower sittings volumes and reduced disposal rates. To support access to justice, audio and video technology capability has been increased, enabling judges to conduct remote hearings to a far greater degree.

3. Overview of Tribunals

72,000 receipts and 72,000 disposals recorded by HMCTS this quarter

In January to March 2021, HMCTS recorded a 19% and 21% decrease for receipts and disposals respectively, when compared to the same quarter in 2020. Caseload outstanding increased to 622,000 up 5% over the same period.

This summary bulletin focuses mainly on the three largest tribunals as they make up the majority (76%) of tribunal receipts in January to March 2021. These are:

-

Social Security and Child Support (SSCS) – 30% of receipts

-

Employment Tribunal (ET) – 33% of receipts

-

First Tier Tribunal Immigration and Asylum Chamber (FTTIAC) – 13% of receipts

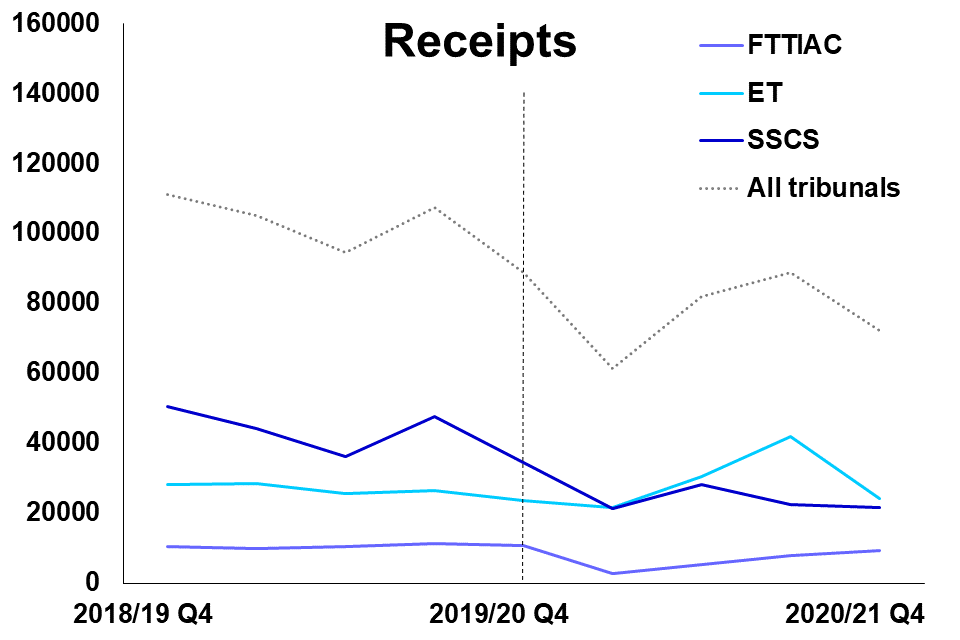

Figure 3.1: Receipts for all tribunals, Q4 2018/19 to Q4 2020/21 (Source: Tables S_2)

Figure 3.2: Disposals for all tribunals, Q4 2018/19 to Q4 2020/21 (Source: Tables S_3)

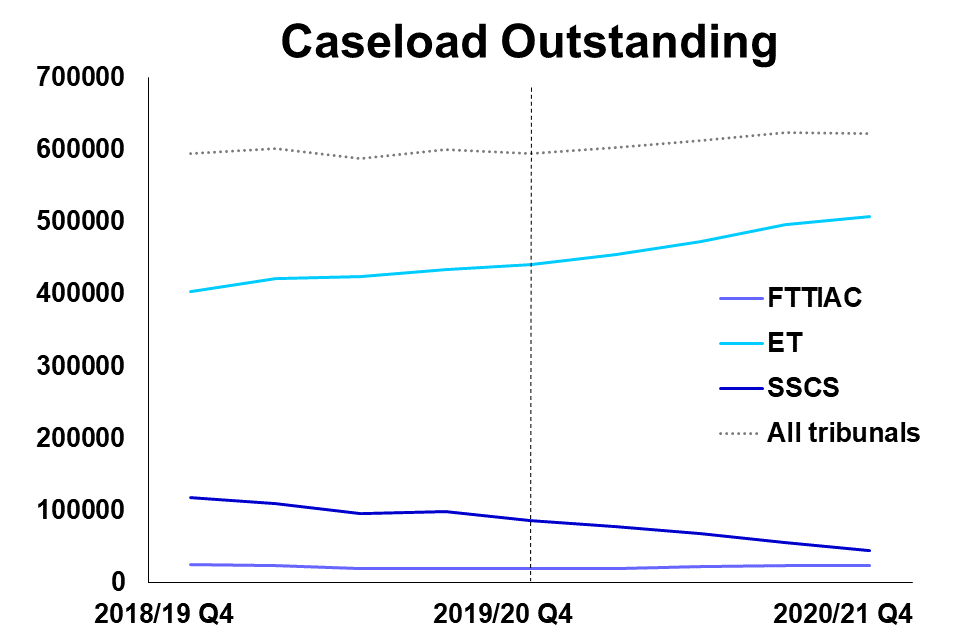

Figure 3.3: Caseload outstanding[footnote 1] for all tribunals, Q4 2018/19 to Q4 2020/21 (Source: Tables S_4)

The charts above show the trends in receipts, disposals and caseload outstanding over the last three years for the three main tribunals and all tribunals overall. In January to March 2021, overall receipts decreased 19% compared to January to March 2020, driven by decreases in FTTIAC, ET single cases and SSCS of 12%, 13% and 37%, to 9,400, 9,100 and 22,000 receipts respectively. This decline is largely due to the impact of the COVID-19 pandemic and related government actions to mitigate the effects on society.

Overall, HMCTS disposals declined by 21% in January to March 2021 (72,000 disposals), compared to January to March 2020. The SSCS tribunal (which makes up almost half of the tribunal disposals), ET and FTTIAC disposed of 27%, 22% and 27% fewer cases in the same period respectively. This decline reflects the decrease seen in receipts and also the effects of COVID-19 restrictions on tribunal operations.

There were 622,000 cases outstanding at the end of March 2021, up 5% compared to a year ago. The 49% decrease in SSCS, was offset by an 24% and 15% increase in FTTIAC and ET caseload outstanding respectively (ET makes up over three quarters of all HMCTS outstanding caseload and has been increasing since the abolishment of ET fees).

4. Social Security and Child Support

SSCS receipts and disposals both decreased

SSCS receipts, disposals and caseload outstanding have all decreased when compared to January to March 2020, by 37%, 27% and 49% respectively.

66% of disposals were cleared at hearing with a 66% overturn rate

Of the 33,000 disposals in January to March 2021, 66% were cleared at a hearing and of these, 66% had the initial decision revised in favour of the claimant (down from 70% and 71% in the same period in 2020 respectively).

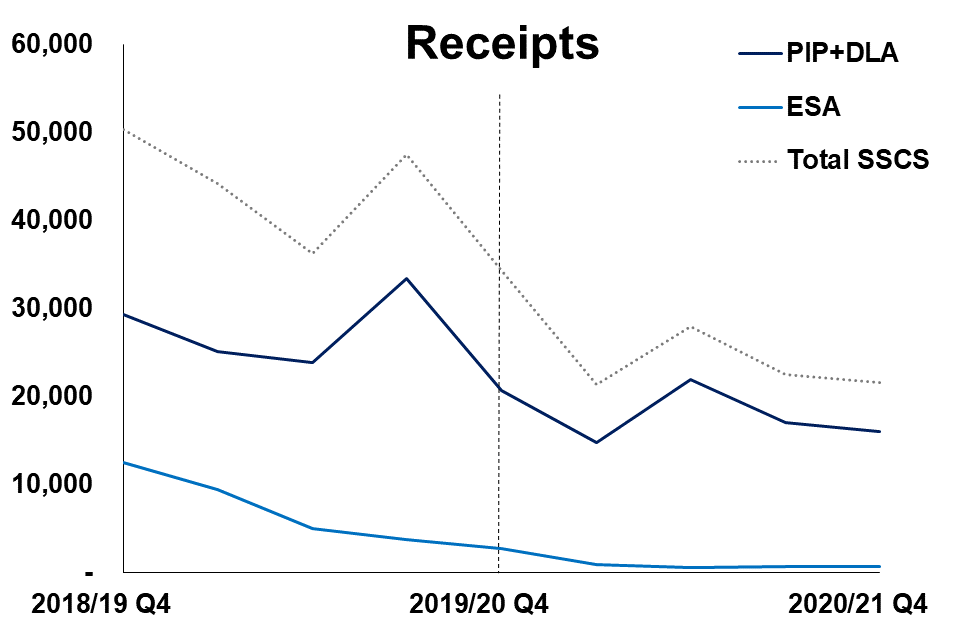

Figure 4.1: Social Security and Child Support receipts, Q4 2018/19 to Q4 2020/21 (Source: Tables SSCS_1)

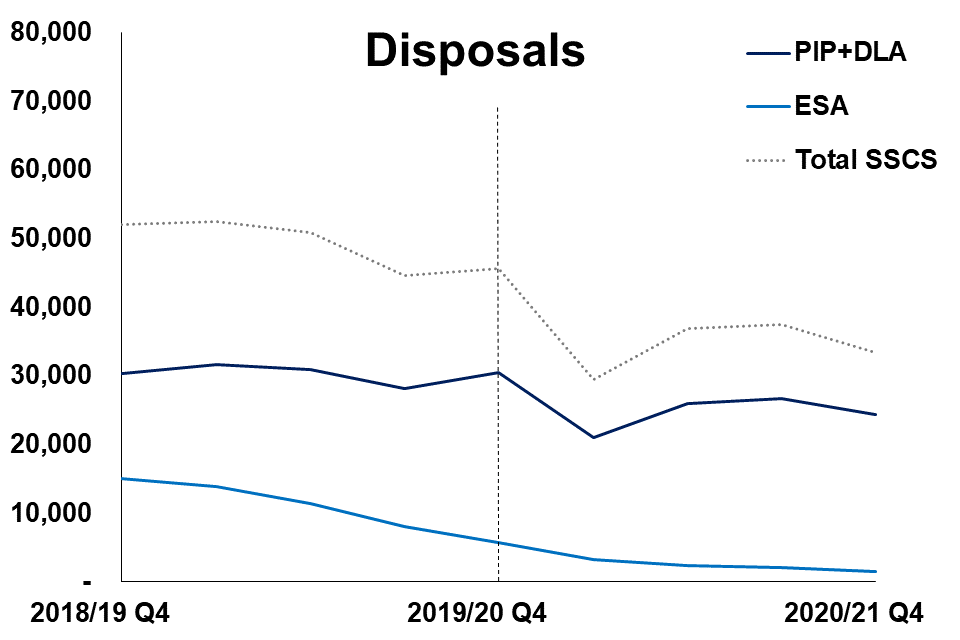

Figure 4.2: Social Security and Child Support disposals, Q4 2018/19 to Q4 2020/21 (Source: Tables SSCS_2)

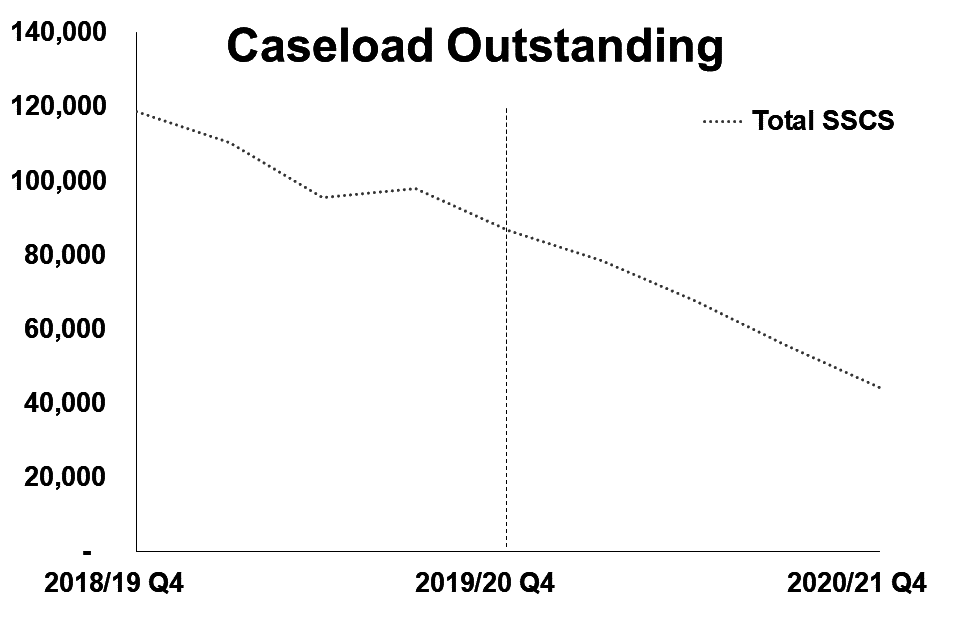

Figure 4.3: Social Security and Child Support caseload outstanding, Q4 2018/19 to Q4 2020/21 (Source: Tables S_4)

The economic impact of the COVID-19 pandemic has resulted in an increase in the number of people on Universal Credit.[footnote 2] The Department for Work and Pensions (DWP) changes to benefit processes in response to the COVID-19 pandemic, such as the temporary suspension of face-to-face assessments for health and disability-related benefits, will have contributed to a fall in SSCS tribunal receipts.

SSCS tribunal receipts decreased by 37% this quarter, to 22,000 appeals, when compared to January to March 2020. This was driven by a 74%, 22% and 66% fall in Employment Support Allowance (ESA), Personal Independence Payments (PIP) and Universal Credit (UC) respectively. ESA, PIP and UC appeals accounted for 3%, 67% and 12% of all SSCS receipts respectively in January to March 2021.

PIP also made up over two thirds of SSCS disposals (67%), a proportion that has been steadily rising since July to September 2020. In January to March 2021, there were 33,000 SSCS cases disposed of, a fall of 27% when compared with the same period in 2020. SSCS disposals rose between Q1 2020/21 and Q3 2020/21 (from 30,000 to 37,000), then fell in Q4 2020/21.

Of the disposals made by the SSCS Tribunal, 22,000 (66%) were cleared at hearing, and of these 66% were found in favour of the customer (down from 70% and 71% on the same period in 2020 respectively). This overturn rate varied by benefit type, with PIP at 72%, ESA and Disability Living Allowance (DLA) 67%, and UC 54%. The PIP, ESA, DLA and UC overturn rates fell four, nine, three and 11 percentage points on January to March 2020 respectively.

There were 44,000 SSCS cases outstanding at the end of March 2021, down 49% compared to the same period in 2020. This continues the fall that began in Q4 2018/19 (when comparing to the same quarter in the previous year). Since Q4 2017/18, caseload outstanding has been gradually decreasing (from a peak of 125,000), only rising in Q3 2019/20, reversing the consistent rising trend seen since Q4 2015/16.

Of those cases disposed of by the SSCS tribunal in January to March 2021, the mean age of a case at disposal was 31 weeks, unchanged compared to the same period in 2020 (see tables T_2).

5. Immigration and Asylum

First-tier Tribunal Immigration and Asylum Chamber (FTTIAC)

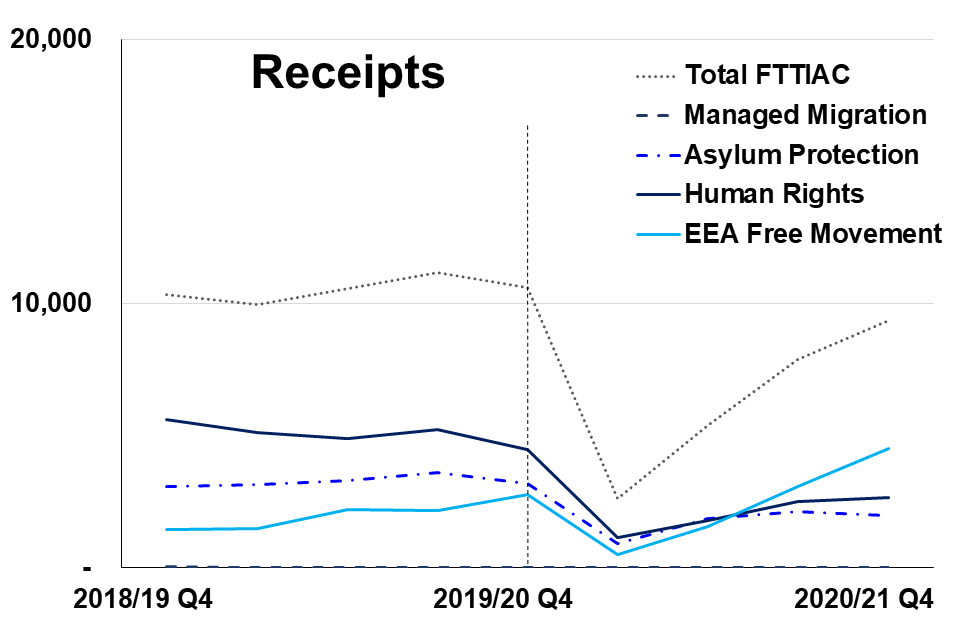

In January to March 2021, FTTIAC receipts and disposals decreased, by 12% and 27% (to 9,400 and 8,100) respectively, compared to the same period in 2020.

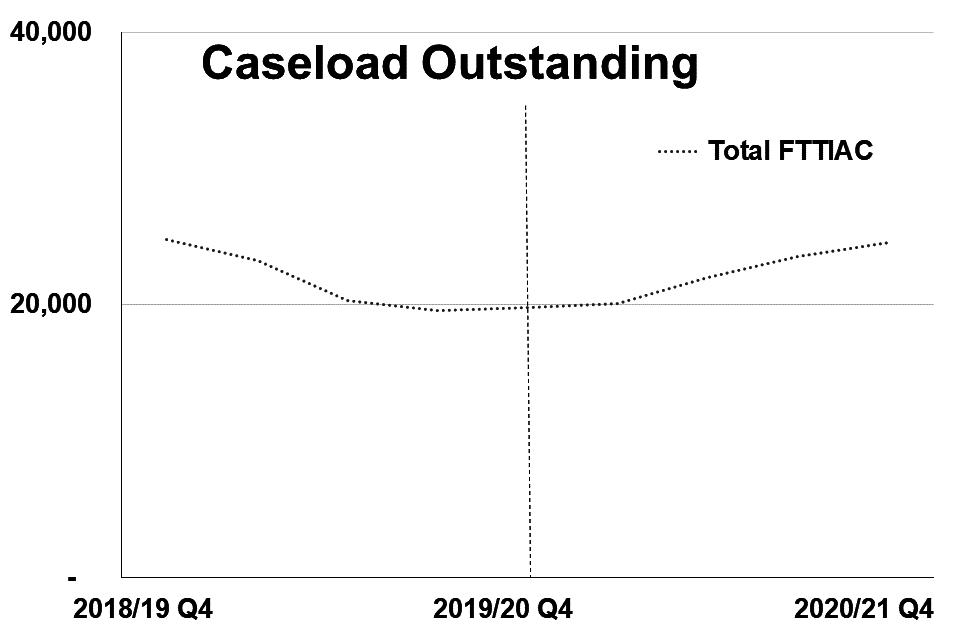

In the same period, caseload outstanding increased by 24% (to 25,000).

Figure 5.1: First-tier Tribunal Immigration and Asylum Chamber receipts, Q4 2018/19 to Q4 2020/21 (Source: Tables FIA_1)

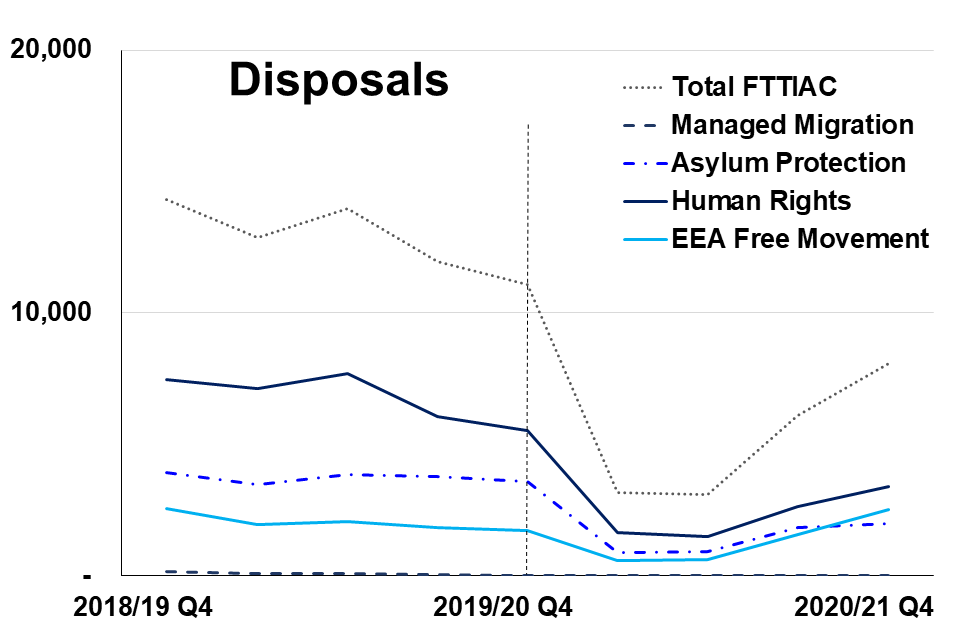

Figure 5.2: First-tier Tribunal Immigration and Asylum Chamber disposals, Q4 2018/19 to Q4 2020/21 (Source: Tables FIA_2)

Figure 5.3: First-tier Tribunal Immigration and Asylum Chamber caseload outstanding, Q4 2018/19 to Q4 2020/21 (Source: Tables S_4)

In January to March 2021, EEA Free Movement receipts proportionally represented 48% of all FTTIAC receipts (up from 26% a year ago). In Q4 2020/21 there was a 40% and 39% decrease in Human Rights (HR) and Asylum/Protection (AP) receipts respectively (to 2,700 and 2,000 respectively), compared to the same period in 2020. EEA Free Movement receipts increased by 62% (to 4,500) over the same period. HR and AP proportionally represented 29% and 21% of all FTTIAC receipts respectively (down 14 and 9 percentage points respectively from a year ago).

Lower volumes seen in FTTIAC may have be due to measures put in place by the Home Office in response to coronavirus. These include: extending visas until 31st July 2020 due to travel restrictions or self-isolation related to coronavirus; switching to long-term visas; extending visas for NHS workers; relaxing conditions for Tier 1 entrepreneur visas and sponsors duties; cancellation of face-to-face substantive asylum interviews and allowing further submissions for a new claim by post or email; and allowing asylum seekers and refugees to remain in government accommodation until end of June 2020. Now that the Home Office has ended these measures and EU exit negotiations have concluded, demand is increasing, with receipts rising quarter on quarter since Q2 2020/21.

The FTTIAC disposed of 8,100 appeals in January to March 2021, an 27% decrease on the same period in 2020. This fall was driven by an 44% and 39% fall in AP and HR respectively. EEA disposals rose 46% over the same period. Human Rights appeals continue to make up the largest proportion (42%) of all FTTIAC disposals in January to March 2021, down from 50% a year ago.

Of the disposals made in the FTTIAC this quarter, 61% were determined i.e. a decision was made by a judge at a hearing or on the papers; 21% were withdrawn; 5% were struck out for non-payment of the appeal fee, and 3% were invalid or out of time. Just over half (51%) of the 5,000 cases determined at a hearing or on the papers were allowed/granted, although this varied by case type (52% of Asylum/Protection, 57% of Human Rights and 41% of EEA Free Movement appeals were allowed/granted).

In the FTTIAC, the mean time taken to clear appeals across all categories has increased by 21 weeks to 49 weeks this quarter compared to the same period a year ago. Asylum/Protection, Human Rights and EEA Free Movement had mean times taken of 47 weeks, 53 weeks and 44 weeks respectively. Managed Migration, which had a mean time taken of 289 weeks, are older appeal categories, removed by the Immigration Act 2014. There are a small number of remaining appeals which have longer clearance times due to the circumstances of those individual appeals.

Upper Tribunal Immigration and Asylum Chamber (UTIAC)

In January to March 2021, UTIAC receipts and disposals decreased, by 56% and 27% respectively, when compared to the same period in 2020, while caseload outstanding rose 20%.

UTIAC judicial review receipts continue to fall - down 60%, to 440. Disposals and caseload outstanding also fell by 67% and 45%, to 460 and 650 respectively, compared to January to March 2021.

At the UTIAC, there were 420 appeal receipts in January to March 2021, down 56% on the same period in 2020. AP, HR and EEA receipts drove the decrease in receipts, falling 66%, 45% and 49% to 170, 190 and 27 appeals respectively.

Over the same period, UTIAC disposals decreased 27% to 590 (see table UIA_2).

At the end of March 2021, the UTIAC caseload outstanding stood at 1,600, a 20% increase on the end of March 2020.

UTIAC Immigration and Asylum Judicial Reviews

In January to March 2021, there were 440 Immigration and Asylum Judicial Review receipts and 460 disposals, down 60% and 67% respectively on January to March 2020.

Of the 460 Immigration and Asylum Judicial Reviews disposed of in the UTIAC in January to March 2021, 56% were determined and 1% were transferred to the Administrative Court. The remaining 43% were in the ‘Other’ category, which includes cases that were withdrawn or not served.

During January to March 2021, 270 UTIAC Judicial Review applications were determined by paper hearing, of which 15% were allowed to continue to the substantive hearing stage. A further 98 were reconsidered at an oral renewal, of which 34% were allowed to continue to the substantive hearing stage. There were 14 substantive hearings which were determined in January to March 2021, of which 71% were granted in favour of the appellant (see table UIA_3).

6. Employment Tribunals

Employment tribunal single cases

In January to March 2021, single claim receipts and disposals decreased by 13% and 14% respectively, while outstanding caseload rose by 39%, when compared to the same period in 2020. Mean age at disposal was 43 weeks, 5 weeks more than in January to March 2020.

Employment tribunal multiple cases

Receipts rose, by 14%, this quarter when compared to the same period in 2020. Disposals decreased, by 34%, while caseload outstanding increased by 13%. Mean age at disposal fell from 164 weeks to 122 weeks over the same period.

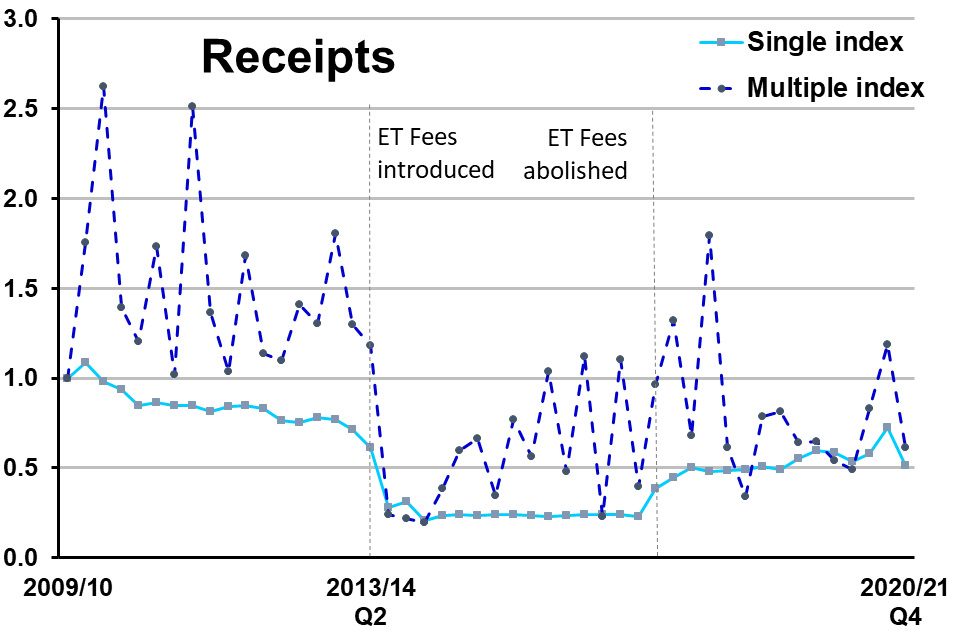

Figure 6.1: Index of Employment Tribunals single and multiple claim receipts, Q1 2009/10 – Q4 2020/21 (Source: Tables S_2)

* Baseline 2009/10 Q1

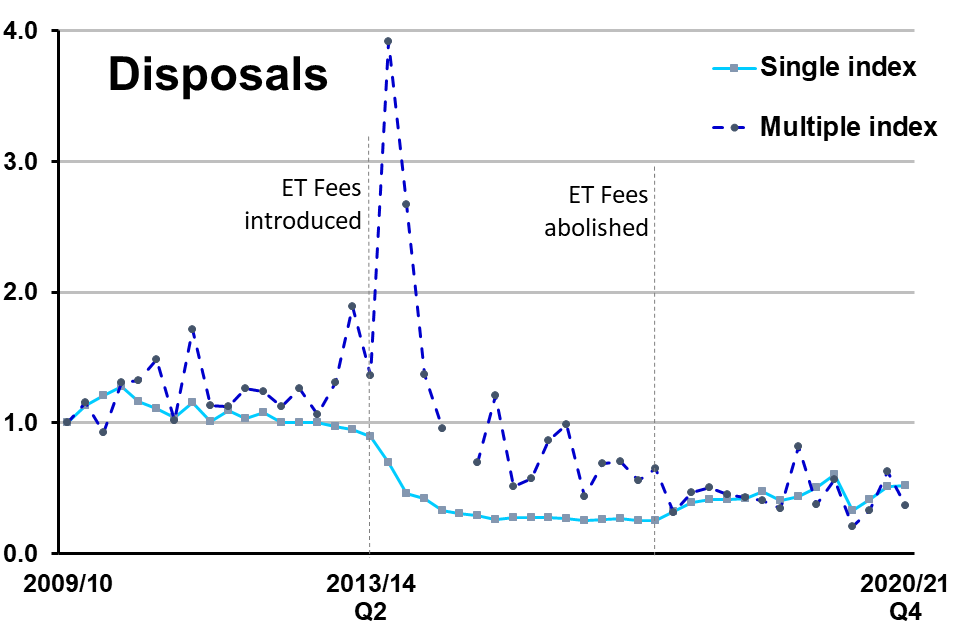

Figure 6.2: Index of Employment Tribunals single and multiple claim disposals, Q1 2009/10 – Q4 2020/21 (Source: Tables S_3)[footnote 3]

* Baseline 2009/10 Q1

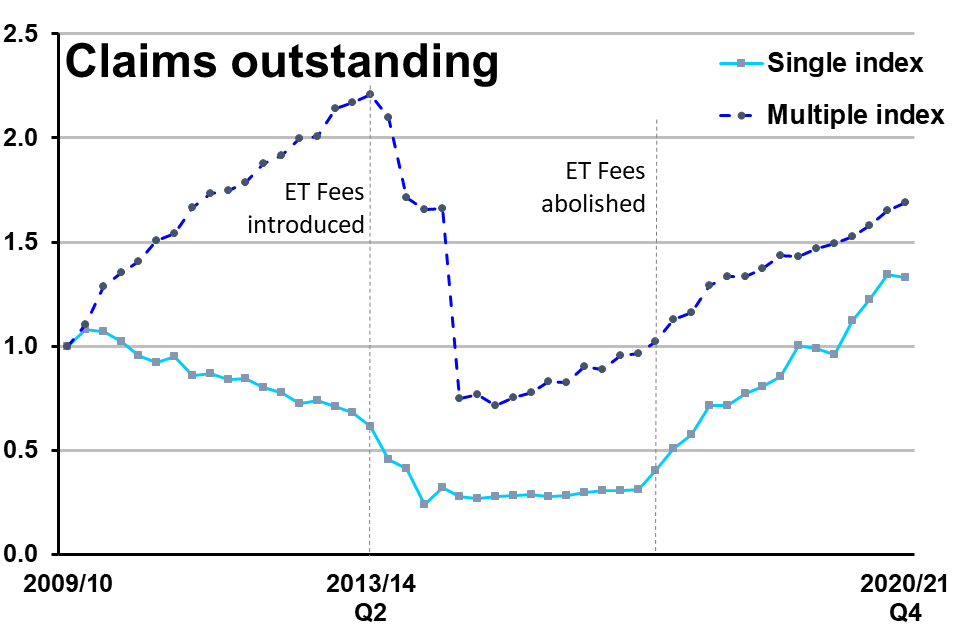

Figure 6.3: Index of Employment Tribunals single and multiple claims outstanding, Q1 2009/10 – Q4 2020/21 (Source: Tables S_4)

* Baseline 2009/10 Q1

The number of single claim receipts has decreased by 13% to 9,100 in the current quarter, when compared to the same period in 2020, and represents a tapering off following the large rise seen last quarter. Though there was a comparative fall this quarter, there has been an aggregate rise over the last few quarters which is most likely due to the rise in unemployment and changes to working conditions seen during the COVID-19 pandemic. Caseload outstanding (at 44,000) continues to rise having passed the peak levels seen in 2009/10 (when it was 36,000 in Q2 of that year) in the first quarter of the 2020/21 financial year, driven by disposals being continuously lower than receipts.

There were 15,000 multiple claims received this quarter, up 14% on the same period last year. Multiple claims tend to be more volatile as they can be skewed by a high number of claims against a single employer. The multiple claims received this quarter related to 480 multiple claim cases (averaging 30 claims per multiple case). This is down from 680 multiple cases in the same period a year ago, which had an average of 13 claims per case. This rise in Employment tribunal receipts is likely to continue as the economy has faced a severe shock following the impact of COVID-19 and could be further accelerated when the furlough scheme ends.

The Employment Tribunal disposed of 11,000 claims during January to March 2021, down 22% on the same period in 2020. This was due to a 14% and 34% decrease in single and multiple claim disposals respectively (to 7,300 and 4,000). The multiple claims disposed of relate to 480 multiple cases, down from 550 cases in January to March 2020.

In January to March 2021, 24% of disposals were ACAS[footnote 4] conciliated settlements (the most common outcome this quarter), 18% were withdrawn, 17% were dismissed upon withdrawal, 11% were successful at hearing and 9% were struck out (not at a hearing). The most common jurisdictional complaint disposed of between January to March 2021 was ‘Unfair dismissal’, whereas ‘Unauthorised deductions’ was the most common complaint in January to March 2020.

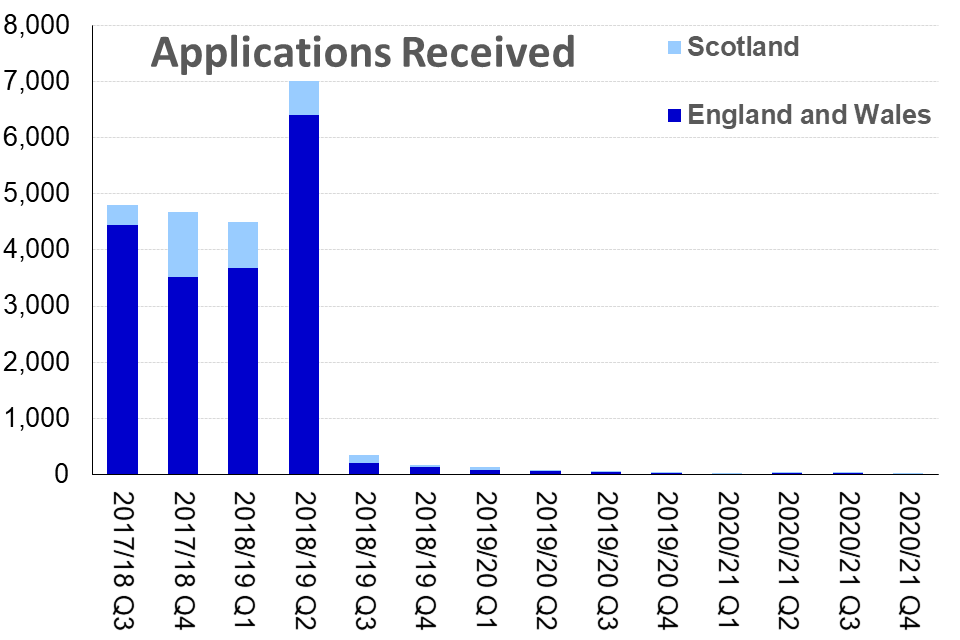

Employment Tribunal Fee (ET) Refunds

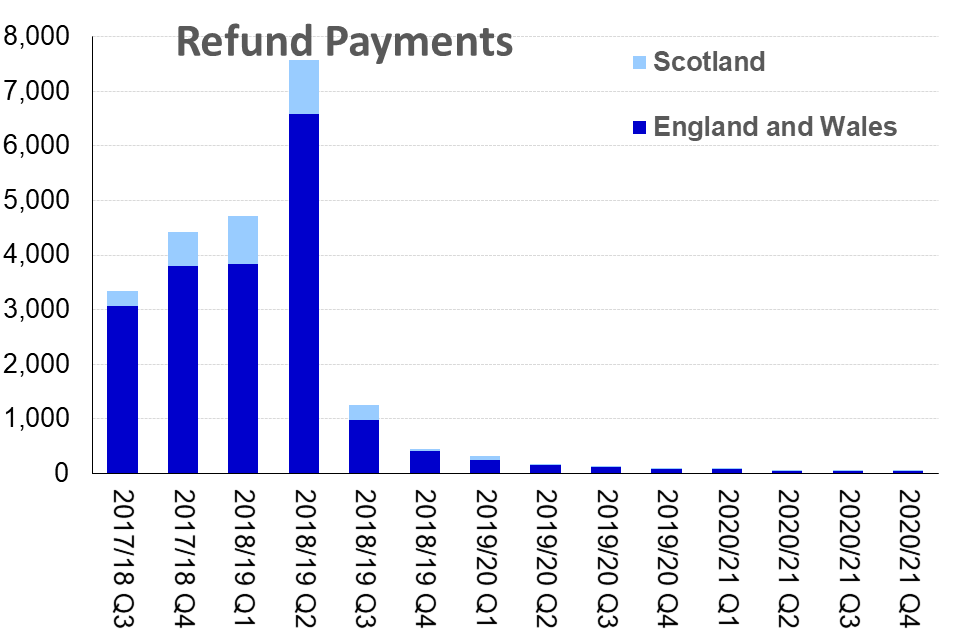

From the launch of the ET fee refund scheme in October 2017 to 31 March 2021, there were 22,000 applications for refunds received and 23,000 refund payments made, with a total monetary value of £18.5 million.

Between 1 January 2021 and 31 March 2021, seven refund applications were received (down from 22 in Q3 2020/21) and 42 refund payments[footnote 5] were made with a total value of £24,000.

The ET fee refund scheme[footnote 6] was introduced as a phased implementation scheme in October 2017 following the abolition of ET fees on 26 July 2017. Since the introduction of the scheme, a total of 22,000 applications for refunds have been received and 23,000 payments have been made, with a total value of £18,527,000 as at 31 March 2021.

The cumulative number of payments is higher than the number of applications because online applications that are processed without manual input are not included in these figures. The number of applications will be updated to include both online and manual application in a later publication.

Of the applications received between January to March 2021, 57% (four applications) related to cases initially brought in England and Wales, down from 95% in the quarter to 31 December 2020. The remaining 43% of applications received this quarter (three application) related to cases initially brought in Scotland.

In the quarter January to March 2021, 42 refund payments were made by the MoJ, with a total monetary value of £24,000. Of these:

-

95% (40 refunds) related to England and Wales, 5% (two refunds) to Scotland.

-

83% (35 refunds) related to single claims, 17% (seven refunds) related to multiple claims.

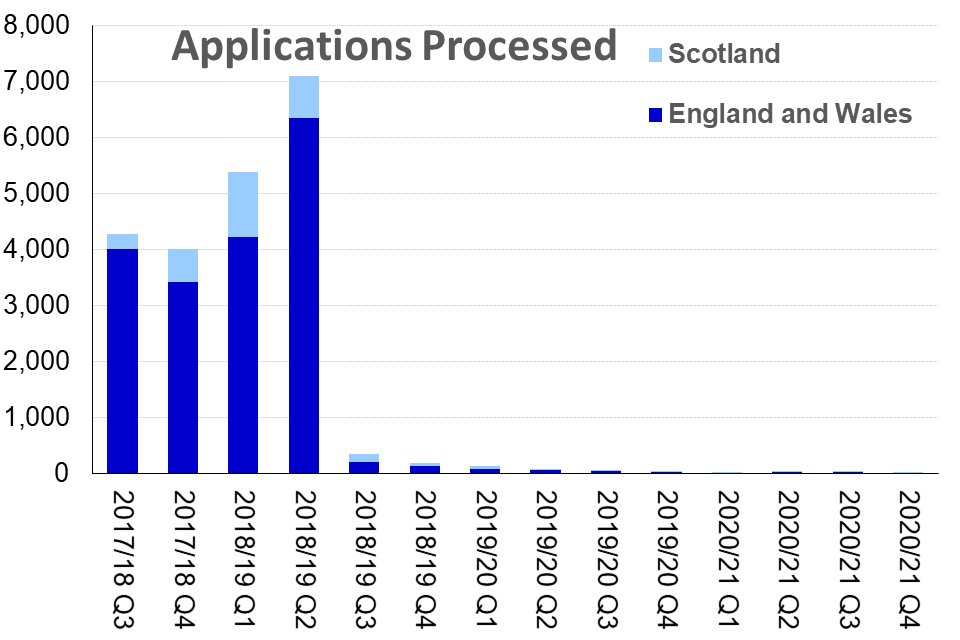

Figure 6.4: Employment Tribunal fees – refund applications received, Q3 2017/18 – Q4 2020/21 (Source: Tables ETFR_1)

Figure 6.5: Employment Tribunal fees – refund applications processed, Q3 2017/18 – Q4 2020/21 (Source: Tables ETFR_1)

Figure 6.6: Employment Tribunal fees – refund payments made, Q3 2017/18 – Q4 2020/21 (Source: Tables ETFR_2)

The large drop seen between Q2 and Q3 2018/19 follows the mailshot campaign which ended in July 2018 and resulted in exceptionally high receipts initially, particularly in England and Wales.

Due to the low volumes of ET fee refund applications and payments, these figures will be reported annually after this financial year. The next publication of these figures will therefore be in June 2022.

7. Gender Recognition Certificates

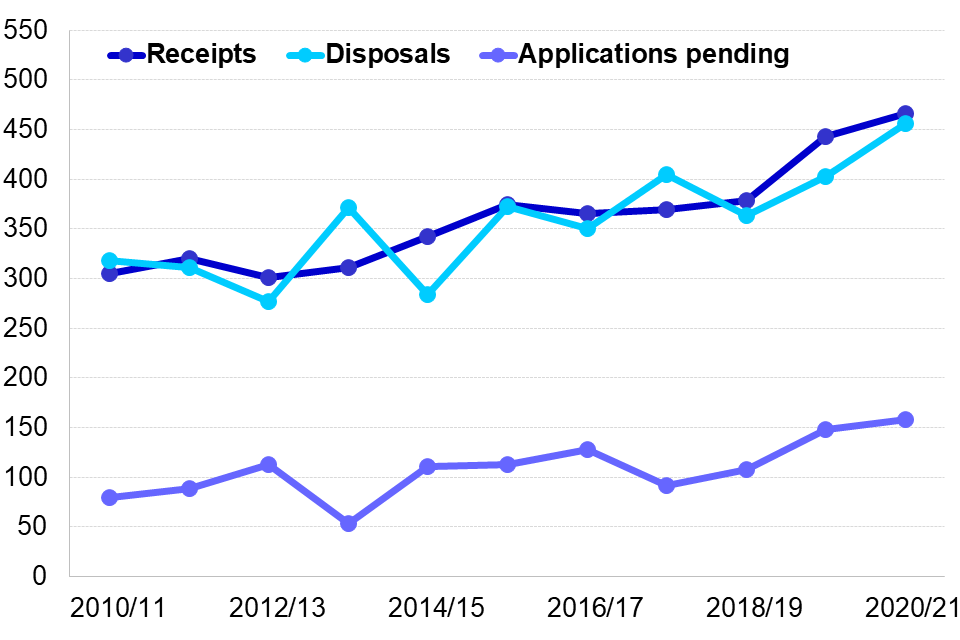

120 Gender Recognition Panel (GRP) applications were received and 150 were disposed of between January to March 2021; 160 applications were pending by the end of March 2021

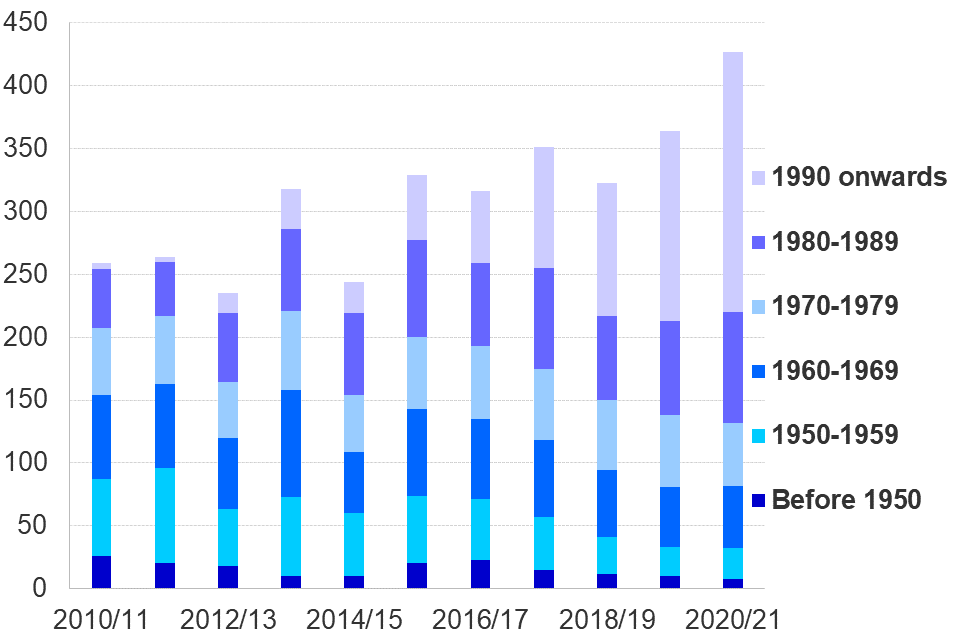

Nine fewer application was received by the GRP this quarter, compared to January to March 2020. Of the 150 applications disposed of, a full Gender Recognition Certificate (GRC) was granted in 93% of cases (140 full GRCs), less than one percentage point lower than in the same period in 2020 (where 90 full GRCs were granted out of 97 disposals).

GRP receipts have increased annually since 2017/18 and we expect this tend to continue follow a reduction in the application fee in May 2021.

Since April 2005/06, when the Gender Recognition Act 2004 came into effect, 72% of interim certificates (170 of the 240 interim GRCs granted) have been converted to a full GRC, 52% of which were converted within 30 weeks. Three interim certificates were converted to a full GRC between January to March 2021.

Of the 140 full certificates granted in January to March 2021, 13 were for married applicants and 130 for single applicants. 81 (58%) of the individuals granted full certificates were registered male at birth while 58 (42%) were registered female at birth.

Figure 7.1: Applications for Gender Recognition Certificates received, disposed of and pending, 2010/11 to 2020/21 (Source: Tables GRP_1 and GRP_2)

Figure 7.2: Full Gender Recognition Certificates granted by year of birth, 2010/11 to 2020/21 (Source: Table GRP_4)

8. Adjournments and Postponements

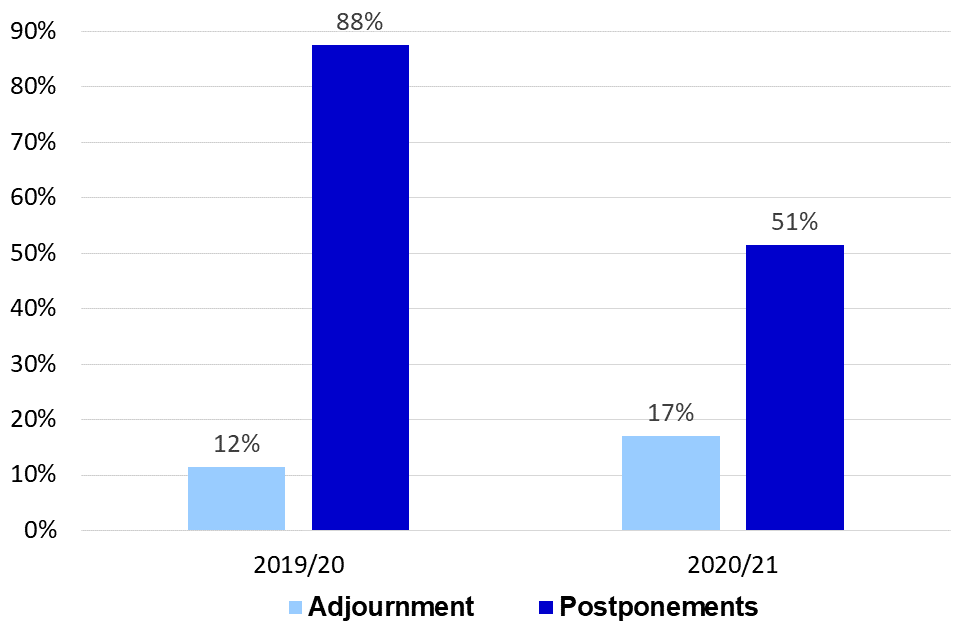

Adjournments reported on have decreased by 19% in 2020/21 compared to the previous year, driven by a 12% and 69% fall in SSCS, which represent the majority (80%) of adjournments in 2020/21, and FTTIAC adjournments respectively.

SSCS adjournments decreased from 38,000 in 2019/20 to 33,000 in 2020/21; making up 80% of the 42,000 adjournments in the year. FTTIAC adjournments decreased from 8,300 to 2,600 over the same period.

Postponements reported on decreased by 43% in 2020/21, driven mostly by FTTIAC and SSCS tribunals which represent 11% and 45% of all postponements reported in 2020/21 respectively.

The number of tribunal postponements decreased 43% to 26,000 in 2020/21, driven mostly by an 71% and 44% fall in FTTIAC and SSCS tribunal postponements respectively.

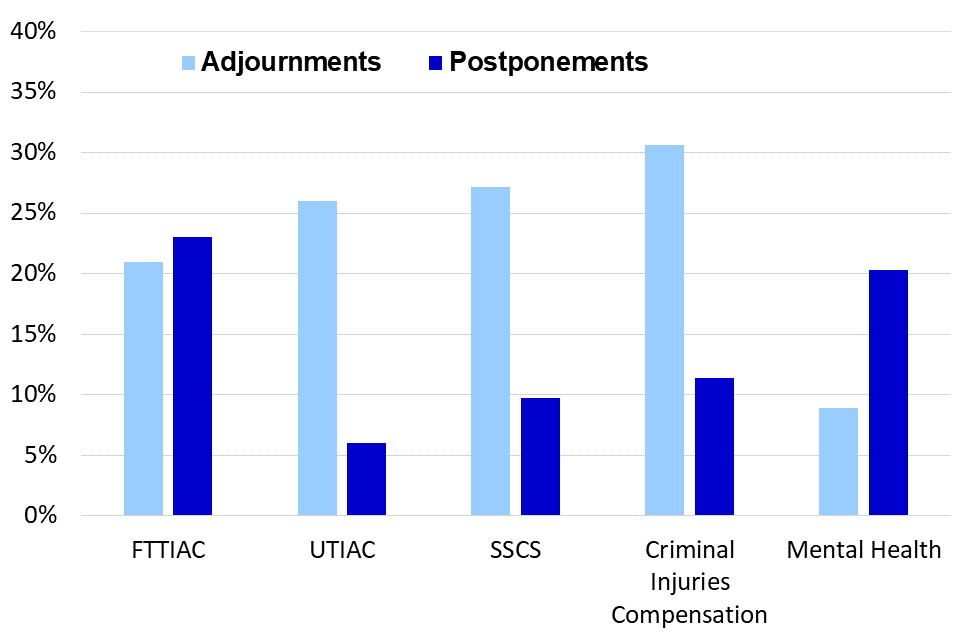

Social Security and Child Support tribunals had the largest number of adjournments (33,000) which accounted for 27% of SSCS listed hearings (up seven percentage points on 2019/20). Mental Health tribunals had the smallest proportion of listed hearings that were adjourned – 9% of all Mental Health hearings listed in 2020/21, up two percentage points on 2019/20.

Prior to the commencement of the hearing parties to an appeal can apply to have the hearing postponed and the Tribunal decides if the application can be granted. The Tribunal can also postpone a case on its own volition.

The postponement process is different for each tribunal, as such, care must be taken when comparing the postponement figures. As an example, in the SEND tribunal, the case is listed for hearing when the appeal is registered without confirming availability of the parties to attend on that date, whereas in SSCS the date is only set when the parties agree a date. This results in a high number of postponements for the SEND tribunals as the parties may not be able to attend on the scheduled date. This can be for various reasons. These may include holidays; illness; key witnesses unavailable on the date of the hearing; the case simply not ready for hearing or where the tribunal is able to hear an appeal sooner with parties’ consent.

Figure 8.1: Percentage of listed hearings Adjourned and Postponed – SEND, 2019/20 to 2020/21 (Source: Table APJ_1)

This difference in the process of scheduling involved in the SEND tribunals leads to a relatively large proportion of its listed hearings being postponed - 51% in 2020/21 (88% in 2019/20). The number of SEND postponements increased year-on-year, from 620 in 2013/14 to 4,500 in 2019/20. In 2020/21 this number fell to 3,200. This decline is due to the use of remote hearings during the pandemic making attending hearings easier for participants.

Figure 8.2: Percentage of listed hearings Adjourned and Postponed – by jurisdiction, 2020/21 (Source: Table APJ_1)

The percentage of SSCS tribunals with postponements has fallen slightly, down from 11% of listed hearings in 2019/20 to 10% in 2020/21. The absolute number of SSCS postponements decreased, by 44% to 12,000 in 2020/21. SSCS represented the largest proportion (45%) of postponements. FTTIAC (decreasing by 71% to 2,900) and SSCS (decreasing by 44%) mostly drove the overall decrease in postponements.

The smallest proportion of postponements in 2020/21 was at the UTIAC, where 6% of listed hearings were postponed (unchanged compared to 2019/20).

9. Tribunal Judicial Salaried and Fee-paid sittings by Jurisdiction

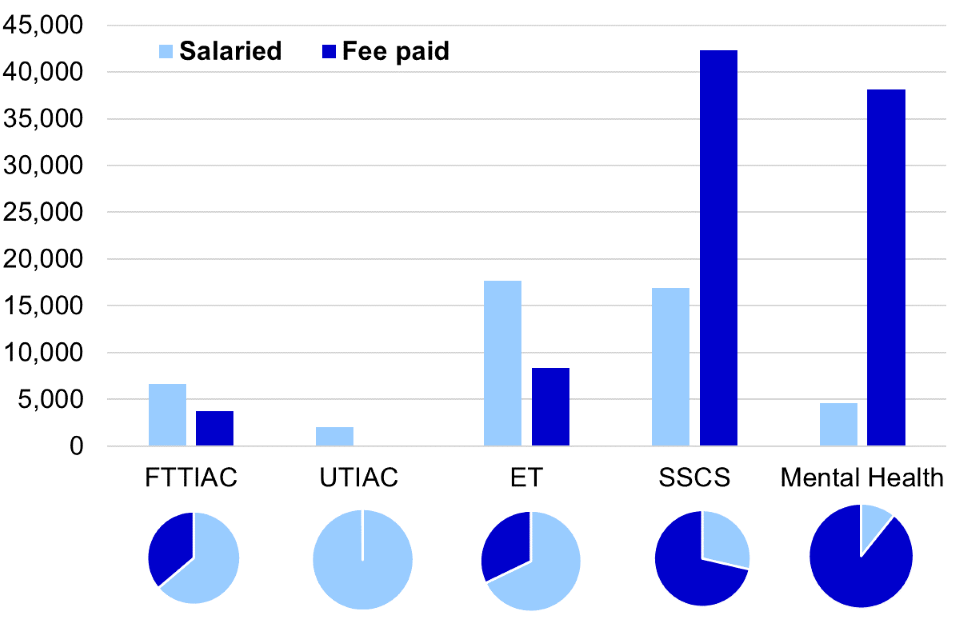

SSCS (34%) and Mental Health (24%) judicial sittings[footnote 7] continue to make up a large proportion of all sittings

In 2020/21, there were 59,000 SSCS judicial sittings, down 18% (from 72,000) on 2019/20. In the same period, Mental Health judicial sitting days fell 14% to 43,000.

The vast majority of sittings in the Mental Health and SSCS tribunals were fee-paid, whereas the majority of sitting days in the Employment tribunal were salaried.

Fee Paid sittings accounted for 65% of all tribunal judicial sittings in 2020/21, while salaried sittings accounted for 35%. Of the 115,000 fee-paid judicial sittings in 2020/21, 70% were for the Mental Health and SSCS tribunals.

The number of Employment Tribunal sittings has fallen by 2%. In contrast, the number of ET fee-paid sittings has increased by 20%, from 7,000 in 2019/20 to 8,400 in 2020/21. This highlights the increased receipts noted for ET cases and the focus on handling these cases in a timely manner.

The number of judicial sitting days at the FTTIAC decreased by 45% to 10,000 in 2020/21. The number of UTIAC sitting days also decreased, by 42% from 3,600 to 2,100 in the same period. The proportion of salaried judicial sittings at the FTTIAC increased, up 39 percentage points to 64% in 2020/21.

Figure 9.1: Judicial Salaried and Fee-paid Judicial Sittings, 2020/21 (Source: Tables JSFP_1 & JSFP_2)

10. Further information

Rounding convention

Figures greater than 10,000 are rounded to the nearest 1,000, those between 1,000 and 10,000 are rounded to the nearest 100 and those between 100 to 1,000 are rounded to the nearest 10. Less than 100 are given as the actual number.

Accompanying files

As well as this bulletin, the following products are published as part of this release:

-

A supporting document providing further information on how the data is collected and processed, as well as information on the revisions policy and legislation relevant to trends and background on the functioning of the tribunal system.

-

The quality statement published with this guide sets out our policies for producing quality statistical outputs for the information we provide to maintain our users’ understanding and trust.

-

A set of overview tables, covering each section of this bulletin and two additional sets of tables on Employment Tribunals (for ET Fee Refunds and ET Management information – Annex C).

-

A set of CSV files including data on two of the three large tribunals (Employment and Immigration and Asylum) and an overall receipts and disposals CSV, covering all tribunal types.

-

Additional releases this quarter:

- Annual supplementary tables providing the SEND Tribunal rate of appeal at both a national and Local Authority level, calculated as a ratio of appeals submitted to the Tribunals to ‘appealable decisions’.

- Update to the statistical notice on Immigration and Asylum (I&A) Detained Immigration Appeals (DIA) to include data to Q4 2020/21.

Future publications

Our statisticians regularly review the content of publications. Development of new and improved statistical outputs is usually dependent on reallocating existing resources. As part of our continual review and prioritisation, we welcome user feedback on existing outputs including content, breadth, frequency and methodology. Please send any comments you have on this publication including suggestions for further developments or reductions in content.

Contact

Press enquiries should be directed to the Ministry of Justice or HMCTS press office:

Daniel Mulloy - email: Daniel.Mulloy@Justice.gov.uk

Other enquiries and feedback on these statistics should be directed to the Justice Statistics Analytical Services division of the Ministry of Justice:

Rita Kumi-Ampofo or Matteo Chiesa - email: CAJS@justice.gov.uk

Next update: 9 September 2021 (URL: www.gov.uk/government/collections/tribunals-statistics)

© Crown copyright Produced by the Ministry of Justice

For any feedback on the layout or content of this publication or requests for alternative formats, please contact CAJS@justice.gov.uk

-

Outstanding caseload is based on a snapshot in time based on the last day of each quarter. ↩

-

Universal Credit statistics, 29 April 2013 to 8 April 2021 - GOV.UK (www.gov.uk) ↩

-

The Q3 2014/15 disposals data point is not included for disposals, in order to aid comparability. This figure was a disproportionately high outlier (index: 24.2) due to the disposal of a large multiple claim against an airline. ↩

-

Advisory, Conciliation and Arbitration Service (ACAS) ↩

-

Note that refund payments may relate to applications made in previous quarters. ↩

-

More information on the scheme is available here https://www.gov.uk/government/news/opening-stage-of-employment-tribunal-fee-refund-scheme-launched ↩

-

For SSCS, judicial sittings relate to half-day sessions and therefore the SSCS figures are not comparable to the other tribunal sitting days ↩