Tribunal Statistics Quarterly: April to June 2023

Published 14 September 2023

1. Main Points

This publication presents tribunals statistics for the latest quarter (April to June, Q1 2023/24), compared to the same quarter of the previous year.

This publication does not include receipt, disposal and open caseload figures for the Upper Tribunal Immigration and Asylum Chamber (UTIAC) due to this tribunal being migrated to new case management systems. The data will be made available as soon as possible, and once the data is quality assured. The total of the remaining jurisdictions is referred to in this publication and accompanying tables as the ‘Interim Total’ and has been provided to allow like-for-like comparisons over time[footnote 1].

| The interim[footnote 1] overall volume of disposals and open cases have increased, while receipts have decreased | In April to June 2023 His Majesty’s Courts & Tribunals Service (HMCTS) recorded a 1% decrease in the interim[footnote 1] total for receipts, and a 9% increase in the interim[footnote 1] total for disposals, when compared to the same quarter in 2022. The interim[footnote 1] total for open cases increased by 6% to 649,000 over the same period. |

| SSCS disposals and open cases increased, and receipts decreased | Compared to the same period in 2022, Social Security and Child Support (SSCS) receipts decreased by 1%, disposals increased by 31% and open cases increased by 33%. The decrease in receipts was driven by decreases in Personal Independence Payment and Employment Support Allowance (by 7% and 16% respectively). The increase in disposals was driven by increases in Personal Independence Payment and Universal Credit (by 49% and 12% respectively). |

| FTTIAC receipts and open cases increased, and disposals decreased | FTTIAC receipts and open cases increased by 45% and 20% respectively in April to June 2023 compared to the same period in 2022. Disposals decreased by 4% over the same period. |

| Employment Tribunal receipts increased, while disposals and open cases decreased | Single Employment Tribunal (ET) receipts increased by 6%, while disposals and open cases decreased by 2% and 10% respectively in Q1 2023/24, compared to the same period a year ago. In Q1 2023/24 Multiple ET receipts and open cases increased by 24% and 2% respectively compared to Q1 2023/24. Disposals decreased by 30% over the same period. |

| Gender Recognition Certificates receipts, disposals and open cases increased | This quarter there were 370 Gender Recognition Panel (GRP) applications received, 264 disposals and an open caseload of 816. GRP receipts, disposals and open caseload increased (by 71%, 29%, and 89% respectively) in 2023, compared to the same period in 2022. |

For feedback related to the content of this publication, please contact us at CAJS@justice.gov.uk

We are considering streamlining the publication to include only the tables that are being used. We are therefore seeking to understand which tables our stakeholders use to help us prioritise improvements. You are invited to please complete the following online survey, by 31st March 2024. This should take 5-10 minutes.

2. Statistician’s Comment

This quarter’s overall trend shows a small decrease in receipts and increases in disposals and open caseloads. The decreasing trend in receipts was mainly driven by decreases in First-tier Tax Chamber and SSCS and the increasing trend in disposals driven by SSCS.

Gender Recognition Panel (GRP), FFTIAC and Residential property chamber tribunals which had some news coverage in the reporting quarter have all seen an increase in receipts.

Applications for gender recognition certificates increased by 71% compared to the previous year, likely due to the fee decrease (from £140 to £5 from May 2021) and possibly the media coverage of gender related issues. 89% of applicants were granted a full GRC this quarter.

FTTIAC receipts have increased 45% this quarter compared to the previous year, although this is still a 21% reduction from the previous quarter. Waiting times increased by 1 week compared to the same period last year, with the average age of a case by the time it’s cleared rising from 42 weeks to 41 weeks.

The First-tier tax chamber receipts have significantly decreased this quarter. In previous quarters, a rise in appeals relating to umbrella companies led to a significant increase in receipts. There were no additional appeals of this kind this quarter, hence the drop in receipts.

3. Overview of Tribunals

Receipts interim[footnote 1] total was 87,000 and disposals interim[footnote 1] total was 74,000

In April to June 2023, HMCTS recorded a 1% decrease in the interim[footnote 1] total for receipts, and a 9% increase in the interim[footnote 1] totals for disposals, when compared to the same quarter in 2022. The open cases interim[footnote 1] total increased by 6%, to 649,000, over the same period.

This publication does not include Upper Tribunal (Immigration and Asylum Chamber) data since Q2 of 2021/22 and Employment Tribunals data for Q1 2021/22 due to database migration as stated above. The total of the remaining jurisdictions is referred to in this publication and accompanying tables as the ‘Interim Total’ and has been provided to allow consistent year-on-year comparisons over time.

This summary bulletin focuses mainly on the Social Security and Child Support (SSCS) Tribunal, the First-tier Tribunal Immigration and Asylum Chamber (FTTIAC), and the Employment Tribunal as they made up the majority (77%) of tribunal interim[footnote 1] receipts in April to June 2023:

- Social Security and Child Support (SSCS) - 40% of receipts

- Employment Tribunal (ET) - 27% of receipts

- First-tier tribunal Immigration and Asylum Chamber (FTTIAC) - 10% of receipts

Figure 3.1: Receipts interim totals, Q1 2019/20 to Q1 2023/24 (Source: Table S_2)

Figure 3.2: Disposals interim totals, Q1 2019/20 to Q1 2023/24 (Source: Table S_3)

Figure 3.3: Open caseload [footnote 2] interim totals, Q1 2019/20 to Q1 2023/24 (Source: Table S_4)

The charts above show the trends in receipts, disposals and open cases over the last five years for SSCS, FTTIAC, ET, and all tribunals overall (using the Interim[footnote 1] Total measure).

In April to June 2023, overall interim[footnote 1] receipts decreased by 1% compared to April to June 2022. This was driven by decreases in First-tier Tax Chamber and SSCS (by 84% and 1% respectively).

Overall interim[footnote 1] disposals increased by 9% in April to June 2023 (to 74,000). The FTTIAC disposed of 4% less cases in Q1 2023/24 compared to Q1 2022/23. SSCS disposals increased by 31% over the same period.

4. Social Security and Child Support[footnote 3]

SSCS disposals and open cases increased, and receipts decreased

Compared to the same period in 2022, Social Security and Child Support (SSCS) receipts decreased by 1%. Disposals and open cases increased by 31% and 33% respectively.

In April to June 2023, 70% of disposals were cleared at hearing with a 63% overturn rate

Of the 31,000 disposals in Q1 2023/24, 70% were cleared at a hearing and of these, 63% had the initial decision revised in favour of the claimant (compared to 66% and 64% in the same period in 2022/23 respectively).

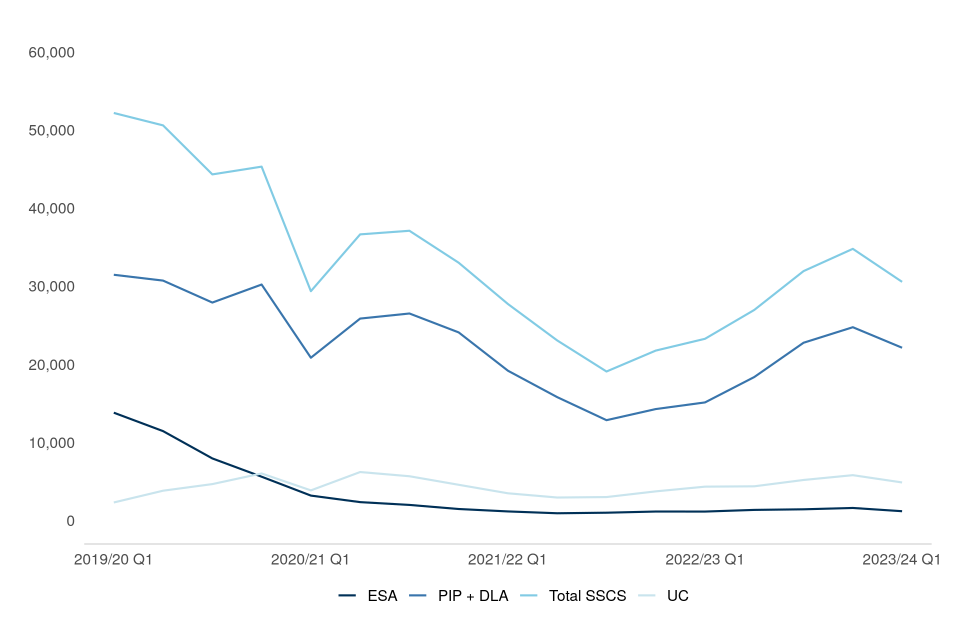

Figure 4.1: Social Security and Child Support receipts, Q1 2019/20 to Q1 2023/24 (Source: Tables SSCS_1)

Figure 4.2: Social Security and Child Support disposals, Q1 2019/20 to Q1 2023/24 (Source: Tables SSCS_2)

Figure 4.3: Social Security and Child Support open caseload, Q1 2019/20 to Q1 2023/24 (Source: Tables S_4)

The economic impact of the COVID-19 pandemic resulted in an increase in the number of people on Universal Credit[footnote 4] as the employment rate decreased and economic inactivity increased. The Department for Work and Pensions (DWP) changes to benefit processes in response to the pandemic, such as the temporary suspension of face-to-face assessments for health and disability-related benefits, contributed to the general downward trend in receipts seen during the pandemic. However, as the policies put in place due to COVID-19 came to an end and restrictions were eased, we are now seeing SSCS receipts increasing significantly since Q2 2021/22 although they are still below pre-Covid19 levels.

SSCS receipts decreased by 1% this quarter, to 35,000 appeals, compared to April to June 2022. This was driven by decreases in Personal Independence Payment and Employment Support Allowance (by 7% and 16% respectively). PIP and UC appeals accounted for 66% and 18% respectively of all SSCS receipts in April to June 2023.

In April to June 2023, SSCS disposals increased by 31% when compared to the same period in 2022 (from 23,000 in Q1 2022/23 to 31,000 in Q1 2023/24). PIP made up two thirds of SSCS disposals (68%).

Of the disposals made by the SSCS tribunal, 21,000 (70%) were cleared at hearing, and of these, 63% were overturned in favour of the customer (up from 66% and down from 64% on the same period in 2022 respectively). This overturn rate varied by benefit type, with PIP at 68%, Disability Living Allowance (DLA) 62%, Employment Support Allowance (ESA) 52%, and UC 53%. The PIP, DLA, ESA and UC overturn rates mostly decreased compared with April to June 2022 (PIP down 4, DLA down 5, ESA down 6 and UC down 2 percentage points).

There were 73,000 SSCS open cases at the end of June 2023, an increase of 33% compared to the same period in 2022. Since Q4 2017/18, open cases have been gradually decreasing (from a peak of 125,000), only rising in Q3 2019/20. However, SSCS open caseload has started to rise again, increasing in each of the last four quarters (Q3 and Q4 2021/22, and Q1 and Q2 2022/23).

Of those cases disposed of by the SSCS tribunal in April to June 2023, the mean age of a case at disposal was 27 weeks, a 2 week increase compared to the same period in 2022 (see tables T_2).

5. Immigration and Asylum

First-tier Tribunal Immigration and Asylum Chamber (FTTIAC)

In April to June 2023, FTTIAC receipts increased by 45% to 9,100, compared to Q1 2022/23. Disposals decreased by 4% (to 10,000), over the same period.

In the same period, open cases increased by 20% (to 30,000).

Figure 5.1: First-tier Tribunal Immigration and Asylum Chamber receipts, Q1 2019/20 to Q1 2023/24 (Source: Tables FIA_1)

Figure 5.2: First-tier Tribunal Immigration and Asylum Chamber disposals, Q1 2019/20 to Q1 2023/24 (Source: Tables FIA_2)

Figure 5.3: First-tier Tribunal Immigration and Asylum Chamber open caseload, Q1 2019/20 to Q1 2023/24 (Source: Tables S_4)

Following on from a steep fall in 2020/21 due to the impact of the pandemic, FTTIAC receipts started to return to pre-Covid19 levels over the course of 2021/22. In 2021/22, FTTIAC receipts increased by 52% (to 40,000) compared to 2020/21. This quarter receipts increased by 45% (to 9,100) compared to the same period last year.

The proportion of European Economic Area/European Union Settlement Scheme (EEA/EUSS) receipts has been increasing steadily quarter on quarter since the EUSS route closed in June 2021. The EEA/EUSS receipts now make up 34% of all FTTIAC receipts, 22 percentage ppints below the peak of its share 2 years ago. In April to June 2023, there were 3,100 EEA/EUSS receipts, an increase of 18% compared to the same period last year.

Compared to Q1 2022/23, Human Rights (HR) receipts increased by 77% to 3,800. Asylum/Protection (AP) receipts increased by 49% compared to the same period in 2022 (to 2,100). HR and AP proportionally represented 42% and 23% of all FTTIAC receipts respectively (up 8 and up 1 percentage points respectively from a year ago).

In Q1 2023/24, FTTIAC disposals decreased by 4% to 10,000. This fall in disposals was driven by decreases in EEA Free Movement and Deprivation of Citizenship (by 22% and 40% respectively). EEA appeals made up the largest proportion (39%) of all FTTIAC disposals in April to June 2023, down from 49% a year ago.

Of the disposals made in the FTTIAC this quarter, 72% were determined i.e. a decision was made by a judge at a hearing or on the papers (compared to 72% in Q1 2022/23); 16% were withdrawn (compared to 16% in Q1 2022/23); 3% were struck out for non-payment of the appeal fee (compared to 4% in Q1 2022/23), and 3% were invalid or out of time (compared to 2% in Q1 2022/23). Around half (48%) of the 7,300 cases determined at a hearing or on the papers were allowed/granted, although this varied by case type (47% of Asylum/Protection, 51% of Human Rights and 45% of EEA Free Movement appeals were allowed/granted).

In the FTTIAC, the mean time taken to clear appeals across all categories is at 41 weeks this quarter, which is 1 week more than the same period a year ago. Asylum/Protection, Human Rights and EEA Free Movement had mean times taken of 48 weeks, 41 weeks and 39 weeks respectively.

Upper Tribunal Immigration and Asylum Chamber (UTIAC)

In Q1 2023/24 UTIAC Judicial Review receipts increased by 40%, to 740, compared to the same period a year ago. Disposals increased by 56% to 720 whilst open cases rose by 1%, to 1,300, compared to April to June 2022.

UTIAC Immigration and Asylum Judicial Reviews

In April to June 2023, there were 740 Immigration and Asylum Judicial Review receipts and 720 disposals, an increase of 40% and an increase of 56% respectively on April to June 2022.

Of the 720 Immigration and Asylum Judicial Reviews disposed of 52% were determined and 1% were transferred to the Administrative Court. The remaining 46% were in the ‘Other’ category, which includes cases that were withdrawn or not served.

During April to June 2023, 470 UTIAC Judicial Review applications were determined by paper hearing, of which 17% were allowed to continue to the substantive hearing stage. A further 23 were reconsidered at an oral renewal, of which 100% were allowed to continue to the substantive hearing stage. There were 17 substantive hearings which were determined in April to June 2023 of which 59% were granted in favour of the appellant (see table UIA_3).

6. Employment Tribunals

Employment Tribunal single cases:

In Q1 2023, the Employment Tribunal received 7,900 single claim receipts and disposed of 7,100 single claim cases. There were 35,000 single claim open cases at the end of June.

Employment Tribunal multiple cases:

This quarter there were 16,000 Multiple claim receipts, 6,700 disposals and open cases stood at 436,000 at the end of June.

Employment Tribunals transitioned to a new database (Employment Case Management) during March to May 2021. It has not been possible to provide full results from both databases during this migration period on a consistent basis. Therefore, Employment Tribunal (ET) data is not available for Q1 2021/22. Jurisdictional breakdowns for disposals, timeliness and outcome data are still undergoing more rigorous checks and will not be presented until the checks are complete. In addition, because of the operational differences between ECM and the previous database (Ethos), caution should be exercised when making comparisons in the statistical results before and after migration.

Again, from September 2022, the Employment Tribunal has moved some cases in specific areas to a new case management system (Reform ECM). A very small proportion of cases (less than 2,000) in the new system are not included in the statistics. The numbers involved are not large enough to impact on the trends seen in the statistics.

In Q1 2023/24, there were 24,000 Employment Tribunals (ET) receipts, 33% (7,900) of which were single claims receipts, and the remaining 67% (16,000) were multiple claims receipts. The ET disposed of 14,000 cases in Q1 2023/24. At the end of the quarter, 471,000 cases remained open.

Figure 6.1: Index of Employment Tribunals single and multiple claim receipts, Q1 2019/20 to Q1 2023/24 (Source: Tables S_2)

- Baseline 2019/20 Q1

Figure 6.2: Index of Employment Tribunals single and multiple claim disposals, Q1 2019/20 to Q1 2023/24 (Source: Tables S_3)

- Baseline 2019/20 Q1

Figure 6.3: Index of Employment Tribunals single and multiple open claims, Q1 2019/20 to Q1 2023/24 (Source: Tables S_4)

- Baseline 2019/20 Q1

Single claim receipts have returned to levels seen prior to the COVID-19 pandemic. Single claim open caseload (at 35,000) continues to rise having passed the peak levels seen in 2009/10 (when it was 36,000 in Q2 of that year), driven by disposals being continuously lower than receipts.

There were 16,000 multiple claims received this quarter. Multiple claims tend to be more volatile as they can be skewed by a high number of claims against a single employer.

The peak seen in the disposal chart in Q3 2021/22 is due to a large spike in multiple claims. A dismissal judgment was issued in December 2021 for 48,000 British Airways claims covering 71,000 jurisdictions. These claims had been withdrawn over a number of years but given the volume and restrictions with the old case management system these had not been formally closed until now, hence the spike. As we continue to migrate between data systems there will be associated reconciliation work which may lead to revisions especially in open caseloads.

7. Employment Tribunal and Employment Appeal Tribunal, 2022/23

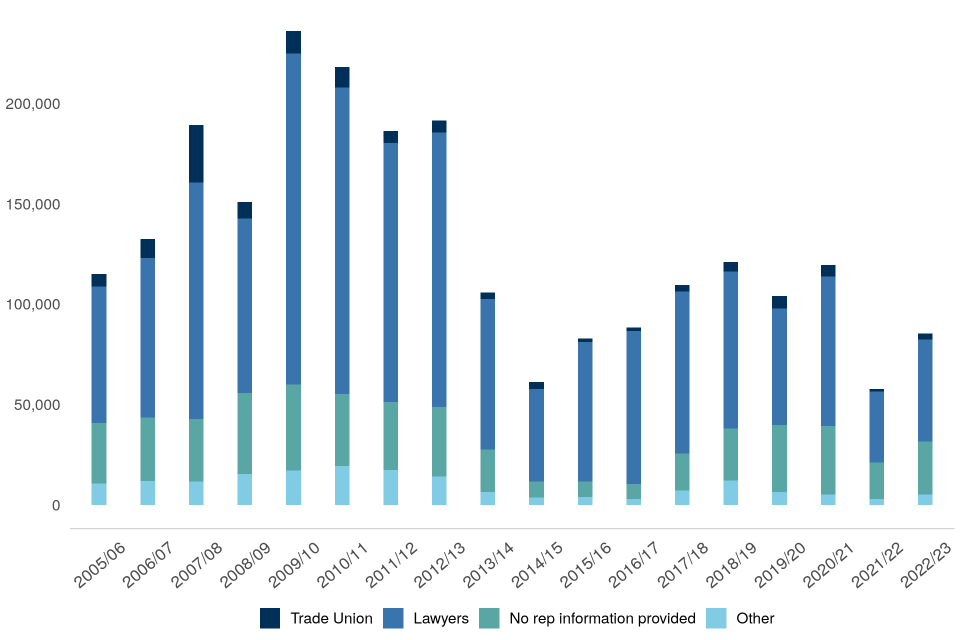

In 2022/23, 60% of claimants were represented by a lawyer[footnote 5], down from 61% in 2021/22. Similarly, 31% of claimants in 2022/23 had no representation recorded[footnote 6], down from 32% in 2021/22.

Costs and Compensation[footnote 7]:

In 2022/23, Disability Discrimination jurisdictions claims received the largest average award (£45,000) compared to other discrimination jurisdictions. The highest maximum award in 2022/23, was for Disability Discrimination, at £1,770,000.

Claimant representation is recorded at the time of application and may change as a case progresses. The proportion of claimants represented by a lawyer in 2022/23 was 60%, down 1 percentage points compared to 2021/22. Representation information was not provided for 31% of claims, down 1 percentage points compared to 2021/22.

The proportion of claims represented by a lawyer has remained relatively stable in the last 3 years after a period of decline between 2016/17 and 2019/20. Similarly, claims with no representation (or where no rep information is provided) have remained relatively stable in the last 2 years, yet this follows a gradual rise between 2016/17 and 2019/20. Since the introduction of the online system a number of improvements have been made and a direct link to the form can be found on Gov.uk website, improving accessibility.

Figure 7.1: Representation of claimants at Employment Tribunals, 2005/06 to 2022/23 (Source: Table E_1)

Centrally collated cost and compensation data is only published for Unfair Dismissal and each of the discrimination-based cases. In 2022/23, there were 790 claims that received compensation for Unfair Dismissal (an increase of 24% compared to 2021/22), where the maximum award was £184,000 and the average (mean) award was £12,000. The trend in number of unfair dismissal claims receiving compensation fell between 2010/11 and 2020/21, with a small increase recorded in 2018/19 (from 540 claims in 2017/18 to 660 claims). However, these have since increased in the latest 2 years from 630 claims in 2021/22 to 790 in 2022/23).

There were 300 discrimination cases where compensation was awarded in 2022/23; the maximum amount awarded (£1,770,000) was in the Disability Discrimination jurisdiction.

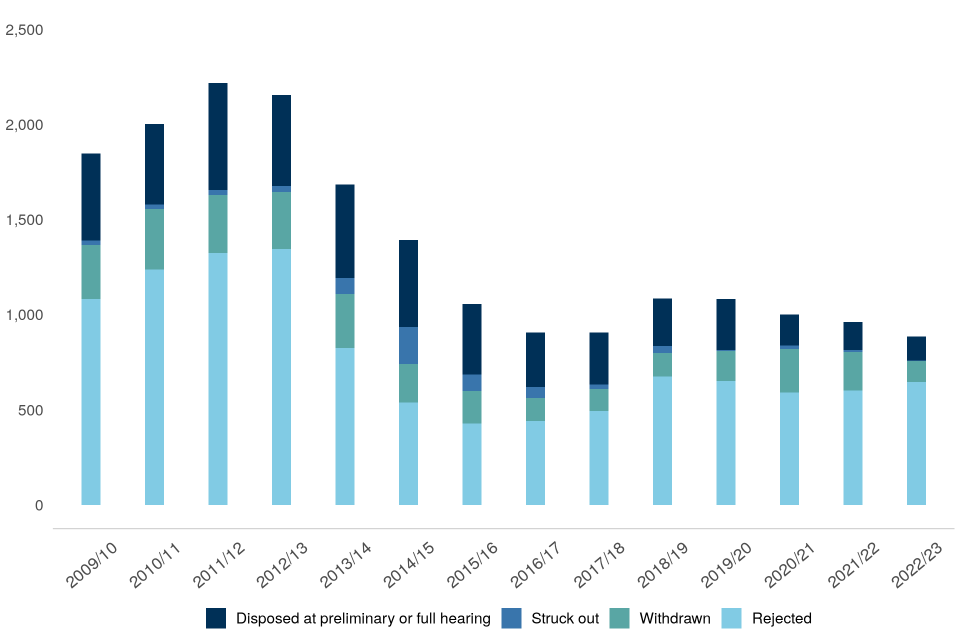

Employment Appeal Tribunals (EAT)

In 2022/23, the Employment Appeal Tribunal received 1,400 appeals (an increase of 10% compared to 2021/22) and disposed of 880 appeals (a decrease of 8% compared to 2021/22).

In 2022/23, 43% of appeals which dealt with at a preliminary hearing were dismissed (24 of 56 appeals). This proportion is higher for appeals brought by employers, where 55% of appeals were dismissed compared to 40% of appeals brought by employees which were dismissed.

Of those appeals that reached an EAT final hearing, 40% were dismissed at full hearing. Similarly to preliminary hearings, this proportion is higher for appeals brought by employers, where 44% of appeals were dismissed compared to 38% of appeals brought by employees which were dismissed.

Figure 7.2: Outcome of EAT Disposals, 2009/10 to 2022/23 (Source: Table E_11)

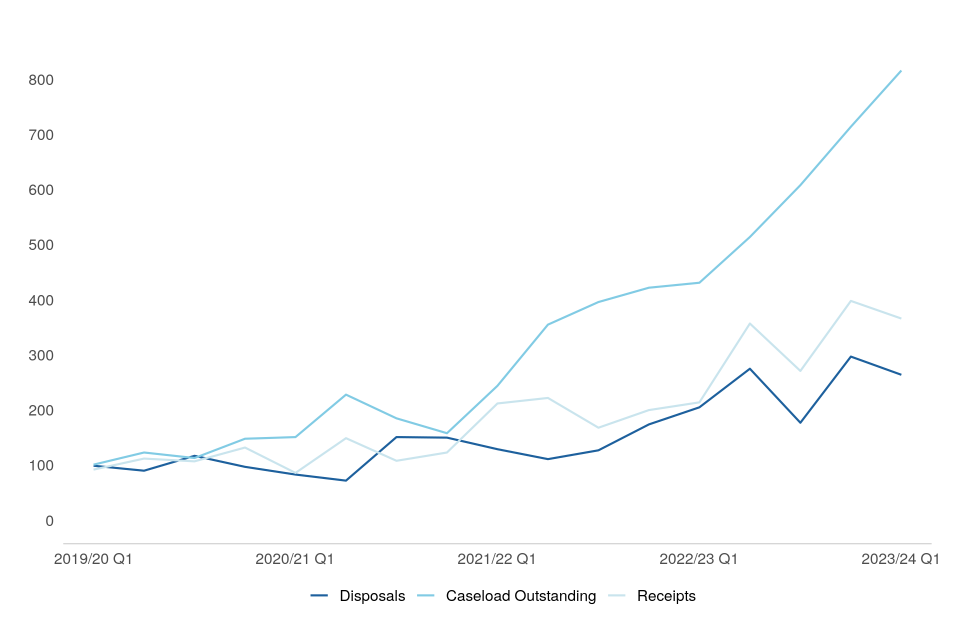

8. Gender Recognition Certificates

366 Gender Recognition Panel (GRP) applications were received and 264 were disposed of between April to June 2023; 816 applications were pending by the end of June 2023

The GRP received 366 applications this quarter, an increase of 152 compared to April to June 2022. Of the 264 applications disposed of, a full Gender Recognition Certificate (GRC) was granted in 89% of cases (236 full GRCs), down 7 percentage points compared to the same period in 2022 (where 198 full GRCs were granted out of 205 disposals).

As expected, GRP receipts have increased annually since 2017/18, particularly more recently following a reduction in the application fee in May 2021 from £140 to £5, and the move to an online application process in July 2022. This has come at the same time as an increase in both the open caseload and refusals. Open caseload reached 816 cases in Q1 2023/24, while 5% of all disposals (12 cases) have been refused. Applications can be refused if they do not meet the required criteria. More information on the criteria can be found at the following link: Apply for a Gender Recognition Certificate - GOV.UK (www.gov.uk) (URL:https://www.gov.uk/apply-gender-recognition-certificate).

Since April 2005/06, when the Gender Recognition Act 2004 came into effect, 67% of interim certificates (171 of the 255 interim GRCs granted) have been converted to a full GRC, 52% of which were converted within 30 weeks. No interim certificates were converted to a full GRC between April to June 2023. Of the 236 full certificates granted in April to June 2023, 18 were for married applicants and 214 for single applicants. 124 (53%) of the individuals granted full certificates were registered male at birth while 112 (47%) were registered female at birth.

Figure 8.1: Applications for Gender Recognition Certificates received, disposed of and pending, Q1 2019/20 to Q1 2023/24 (Source: Tables GRP_1 and GRP_2)

Figure 8.2: Full Gender Recognition Certificates granted by year of birth, 2018/19 to 2022/23 (Source: Table GRP_4)

9. Other Tribunals

Decrease in First-tier tax Chamber receipts by 84% compared to the same quarter last year

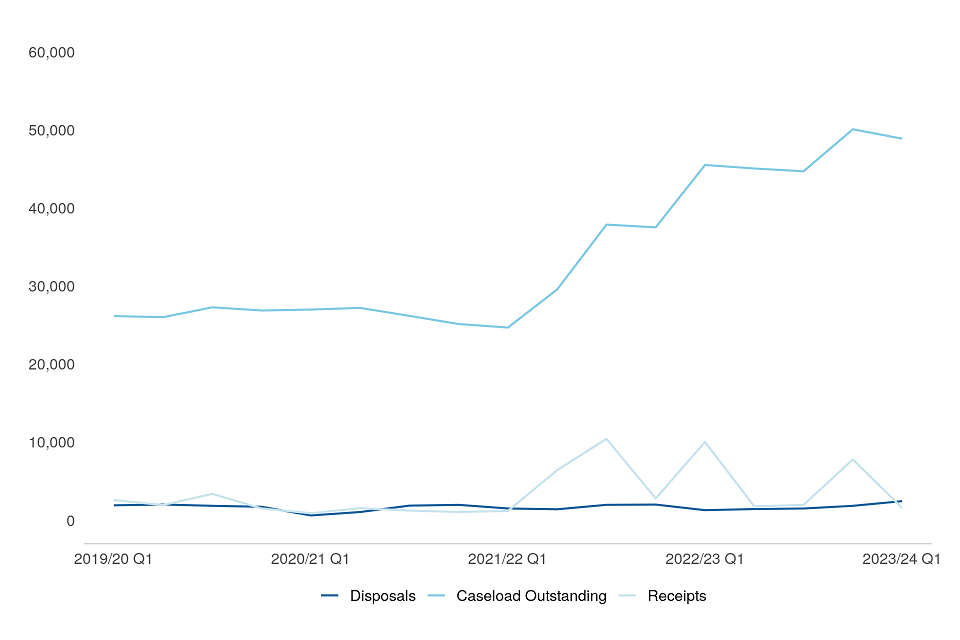

The First-tier Tax Chamber recorded 1,600 receipts this quarter, a decrease of 84% compared to the same quarter last year. In the same period, 2,500 appeals were disposed of and open cases increased by 7% (to 49,000).

First-tier Tax Chamber

There has been a decrease in all case types in the First-tier Tax Chamber this quarter. Receipts decreased by 84%, to 1,600, compared to the same quarter last year. Disposals and open cases also increased by 89% and 7% to 2,500 and 49,000 respectively. This decrease in receipts shows a return to normal rates of receipts. In previous quarters, a rise in appeals relating to umbrella companies were responsible for the significant increase in receipts, however this quarter, no additional appeals were received to continue the trend.

Figure 9.1: First-tier Tax Chamber receipts, disposals and open caseload Q1 2019/20 to Q1 2023/24 (Source: Tables S_2, S_3, and S_4)

Residential Property

Residential Property tribunal figures have increased in the last 2 quarters, recording its highest receipts last quarter. This quarter, April to June 2023 receipts have increased by 41% (to 3,182) compared to the same period in 2022. The tribunal had 2,396 disposals in Q1 2023/24, an increase of 33% compared to the Q1 2022/23. There were 8,446 residential property open cases at the end of June 2023, an increase of 54% compared to the same period in 2022.

10. Further information

Rounding convention

Figures greater than 10,000 are rounded to the nearest 1,000, those between 1,000 and 10,000 are rounded to the nearest 100 and those between 100 to 1,000 are rounded to the nearest 10. Less than 100 are given as the actual number.

Accompanying files

As well as this bulletin, the following products are published as part of this release:

-

A supporting document providing further information on how the data is collected and processed, as well as information on the revisions policy and legislation relevant to trends and background on the functioning of the tribunal system.

-

The quality statement published with this guide sets out our policies for producing quality statistical outputs for the information we provide to maintain our users’ understanding and trust.

-

A set of overview tables, covering each section of this bulletin and one additional set of tables on Employment Tribunals (for ET Management information – Annex C).

-

A set of CSV files including data on overall receipts and disposals CSV, covering all tribunal types.

-

Additional releases this quarter:

- Update to the statistical notice on Immigration and Asylum (I&A) Detained Immigration Appeals (DIA) to include data to Q1 2023/24.

Future publications

Our statisticians regularly review the content of publications. Development of new and improved statistical outputs is usually dependent on reallocating existing resources. As part of our continual review and prioritisation, we welcome user feedback on existing outputs including content, breadth, frequency and methodology. Please send any comments you have on this publication including suggestions for further developments or reductions in content.

Contact

Press enquiries should be directed to the Ministry of Justice or HMCTS press office:

Press Office - email: pressofficecourtslaw@justice.gov.uk

Other enquiries and feedback on these statistics should be directed to the Data and Evidence as a Service division of the Ministry of Justice:

Rita Kumi-Ampofo or Maisie Terry - email: CAJS@justice.gov.uk

Next update: 14 December 2023 (URL: www.gov.uk/government/collections/tribunals-statistics)

© Crown copyright Produced by the Ministry of Justice

For any feedback on the layout or content of this publication or requests for alternative formats, please contact CAJS@justice.gov.uk

-

The interim totals for the overall volumes of tribunal receipts, disposals and open caseload exclude the Upper Tribunal (Immigration and Asylum Chamber) for which the data is currently not available. See the main tables S_2, S_3 and S_4 for more information ↩ ↩2 ↩3 ↩4 ↩5 ↩6 ↩7 ↩8 ↩9 ↩10 ↩11 ↩12 ↩13 ↩14

-

Open caseload is based on a snapshot in time based on the last day of each quarter. ↩

-

From April 2023 the SSCS Tribunal started to list cases using a new Scheduling and Listing solution. This, alongside HMCTS migrating to a new Strategic Data Platform, has resulted in some cases heard and decided using this new listing solution not currently being included in the data above. Revised data will be published as soon as they are available. ↩

-

Official statistics overview: Universal Credit statistics - GOV.UK (www.gov.uk) ↩

-

Includes: represented by Solicitors, Law Centres and Trade Associations. ↩

-

For those individuals representing themselves, there is no need to provide information on representatives. Therefore, all cases where the representative information was left blank are included here. ↩

-

Cost and compensation are awarded per claim, not per jurisdiction. The compensation is usually allocated to the lead jurisdiction in the ET claim only. However, if it is not possible to show which jurisdiction type is the lead, the amount is divided equally for each type. ↩