Mortgage and landlord possession statistics: July to September 2023

Published 9 November 2023

1. Main Points

This publication provides mortgage and landlord possession statistics up to July to September 2023. In general, we have compared figures to the same quarter in the previous year. Should users wish to compare the latest outturn against previous years, they can do so using the accompanying statistical tables. For technical detail, please refer to the accompanying supporting document.

| Mortgage claims, orders and warrants increased and repossessions decreased. | Compared to the same quarter in 2022, mortgage possession claims increased from 3,681 to 4,185 (14%), orders from 2,480 to 2,923 (18%), warrants from 2,473 to 2,289 (7%) and repossessions by county court bailiffs decreased from 758 to 622 (18%). |

| Landlord possession actions have all increased. | When compared to the same quarter in 2022, landlord possession claims increased from 21,007 to 24,938 (19%), orders from 15,350 to 17,977 (17%), warrants from 8,573 to 9,753 (14%) and repossessions from 5,464 to 6,080 (11%). |

| Mortgage and Landlord possession claims rates have risen across all regions. | Increases in possession claims have been recorded in all regions. Private and social landlord claims remained concentrated in London (with 8 and 5 of the highest 10 claim rates respectively). |

| Mortgage median average time (from claim to repossession) has decreased. | The median average time from claim to mortgage repossession has decreased to 57.4 weeks, down from 60.1 weeks in the same period in 2022. |

| Median timeliness for landlord repossessions has increased. | The median average time from claim to landlord repossession has increased to 23.0 weeks, up from 22.3 weeks in the same period in 2022. |

A data visualisation tool has also been published that provides further breakdowns in a web-based application. The tool can be found here.

For feedback related to the content of this publication and visualisation tool, please contact us at CAJS@justice.gov.uk

2. Statistician’s Comment

The statistics this quarter shows all mortgage possession actions have continued their gradual upward trend. Claims and orders are 14% and 18% respectively above the previous year’s level, while warrants and repossessions are 7% and 18% respectively down from the previous year’s levels.

Landlord possession actions have followed a similar upward trend mainly driven by Accelerated and Private landlord possession claims which have continued to rise and are currently back to their pre-covid baseline. In the Accelerated procedure, the rise is across all the action types of claims (32%), orders (27%), warrants (29%) and repossessions (31%) when compared to the same quarter last year.

Both mortgage and landlord possession claims and orders are now at their highest levels since the pandemic.

3. Overview of Mortgage Possession

Mortgage possession actions: claims and orders are currently above the previous year’s levels, and warrants and repossessions have decreased.

Compared to the same quarter in 2022, mortgage possession claims (4,185) are up 14%. Mortgage orders for possession (2,923) are up 18%, warrants issued (2,289) are down 7% and repossessions (622) are down 18%.

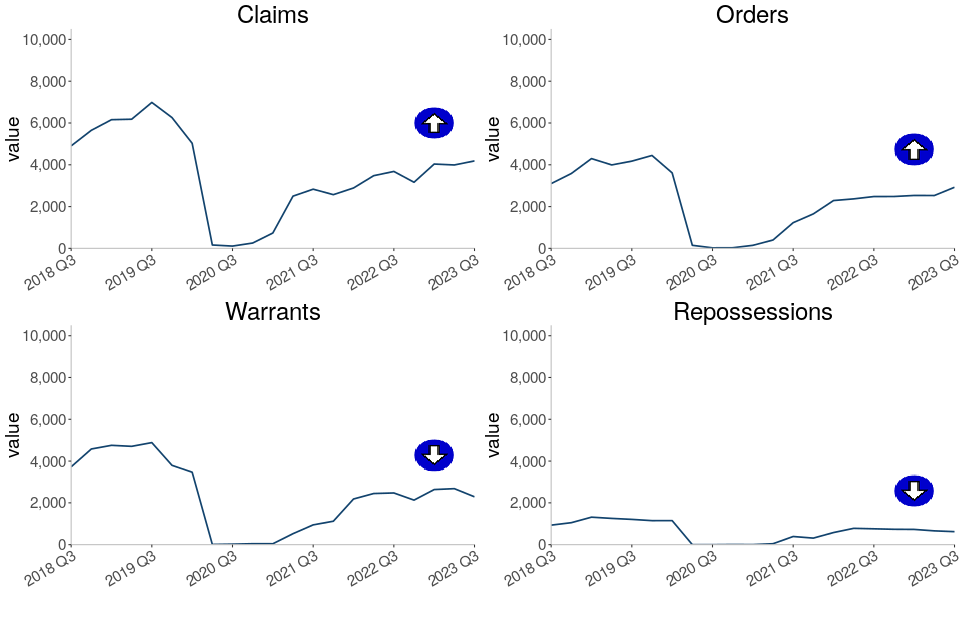

Figure 1: Mortgage possession actions in the county courts of England and Wales, July to September 2018 to July to September 2023 (Source: Table 1)

All mortgage possession case types have been steadily increasing since Q2 2021 (apart from a small dip in Q4 2021 and Q4 2022). However, these are showing early signs of stabilising in the current quarter, although it is not yet known if this trend will continue. Claims, warrants and repossessions volumes are now 40%, 53% and 49% below their pre-covid baseline. This is a significant increase when compared to the same quarters 2020 to 2022. However it is still short of the pre-covid 2019 baseline, although the levels are at their highest since the impact of the pandemic.

Mortgage possession claims fell from a peak of 26,419 in April to June 2009 (in the aftermath of the 2008 financial crash) before stabilising from April to June 2015 (4,849, see table 1). In the most recent quarter, July to September 2023, there were 4,185 claims for possession, up 14% from the same quarter in 2022.

Orders and warrants for possession followed a similar trend to mortgage claims, falling from a peak of 23,850 orders in July to September 2009 and 21,350 warrants in January to March 2009, and stabilizing around 2016/17. Compared to the same quarter in 2022, orders are up 18% to 2,923 and warrants are down 7% to 2,289 in July to September 2023.

Historically, repossessions by county court bailiffs fell from a high of 9,284 in Q1 of 2009 to 934 in Q3 of 2018, the lowest recorded level of the series at the time. Following the complete cessation of repossession proceedings from March to September 2020 where no repossessions took place, the FCA guidance advised mortgage lenders not to commence or continue possession proceedings until April 2021 (unless there were special circumstances). As a result, there were only 10 repossessions from April 2020 to March 2021 (Q2 2020 to Q1 2021), this increased consistently after the Covid measures came to an end, to a peak of 780 in Q2 2022. Since then, it has been declining and is at 622 this quarter, a fall of 18% compared to the previous year.

Before the impact of coronavirus, the historical fall in the number of mortgage possession actions since 2008 has generally coincided with lower interest rates, a proactive approach from lenders in managing consumers in financial difficulties and other interventions, such as the Mortgage Rescue Scheme and the introduction of the Mortgage Pre-Action Protocol. The trend seen in recent years mirrors that seen in the proportion of owner-occupiers.

4. Mortgage Possession Action Timeliness

Median timeliness figures have decreased for all actions; claim to orders, claim to warrant and claim to repossession for the second consecutive quarter.

The median average time from claim to repossession has decreased to 57.4 weeks, down from 60.1 weeks in the same period in 2022.

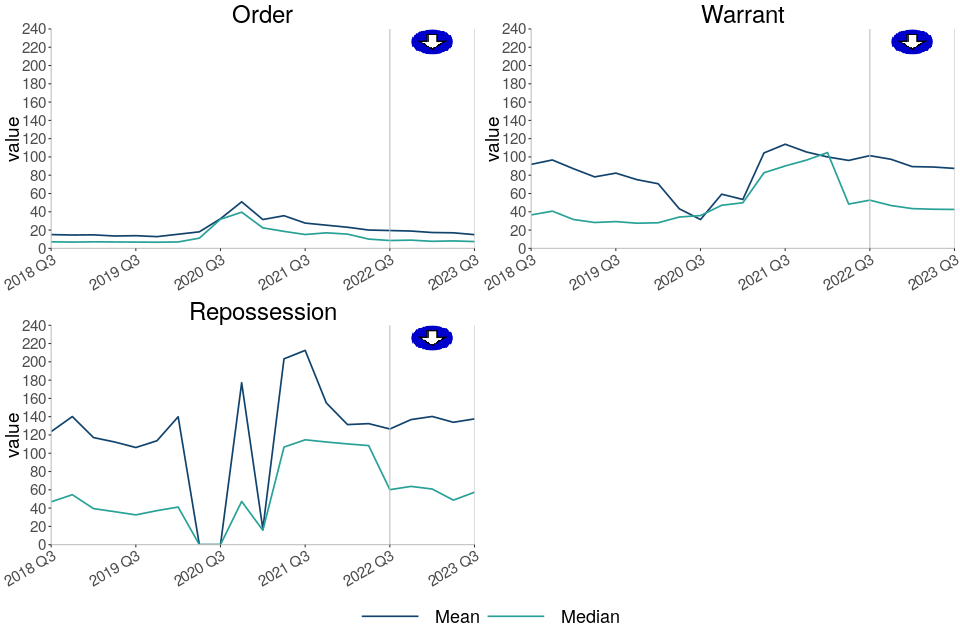

Figure 2: Average timeliness of mortgage possession actions, July to September 2018 to July to September 2023 (Source: Table 3)

Number of weeks taken from initial mortgage claim to…

Time taken to complete mortgage actions have all decreased again this quarter following a push from courts to reduce backlogs and ensure swift access to justice. This quarter;

-

Claims to order median timeliness has decreased to 7.4 weeks, down from 8.6 weeks in the same period in 2022.

-

Claims to warrant median timeliness has decreased to 42.6 weeks, down from 52.7 weeks in the same period in 2022.

-

Claims to repossession median timeliness has decreased to 57.4 weeks, down from 60.1 weeks in the same period in 2022.

The trend for mortgage possession timeliness is driven by outright orders, which make up over two thirds (70%) of all cases. In the most recent quarter, the median time taken from claim to repossession was 50.4 weeks for outright orders, and 261.4 weeks for suspended orders.

The above charts distinguish between the timeliness of possession claims at different stages of a case. Average time taken from claim to warrant or repossession can fluctuate and is affected by various factors. For example, the final two charts take account of the amount of time between the court order being issued and the claimant, such as the mortgage lender, applying for a warrant of possession.

The long-term increases in the mean average time from claim to warrant and claim to repossession are due to an increasing proportion of historic claims reaching the warrant and repossession stages respectively in recent quarters. This is possibly due to defendants recently breaking the terms of the mortgage agreements put in place at the start of the process. Although these historical outlying cases inflate the mean average, they have less effect on the median.

5. Overview of Landlord Possession

The number of landlord possession actions for all court stages have increased compared to the same quarter of last year.

Compared to the same quarter in 2022, landlord possession actions; claims (24,938), orders for possession (17,977), warrants (9,753) and repossessions (6,080) have increased by 19%, 17%, 14% and 11% respectively.

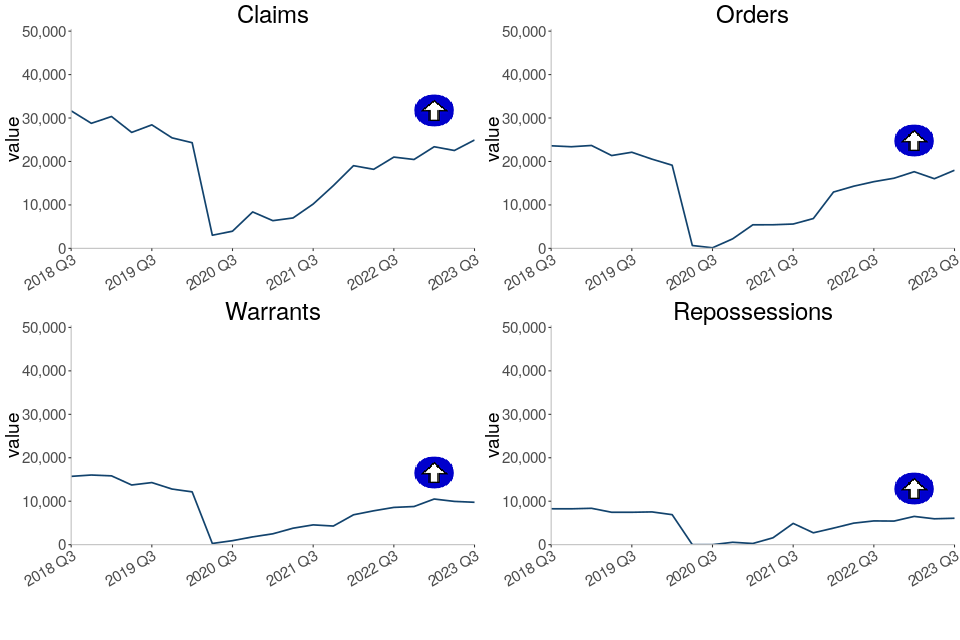

Figure 3: Landlord possession actions in the county courts of England and Wales, July to September 2018 to July to September 2023 (Source: Table 4)

Landlord possession actions have been increasing since Q2 2021 and they are now at their highest levels since the pandemic. Claims, orders and warrants volumes increased by 19%, 17% and 14% respectively while landlord repossessions in the county courts rose by 11% when compared to the same quarter in 2022.

Within the landlord possession actions, the Accelerated procedures have particularly risen across all claims (32%), orders (27%), warrants (29%) and repossessions (31%). This increase is driven by accelerated procedures in England. Volumes in Wales are starting to decline.

Accelerated procedures numbers for England have increased across all actions – claims (38%), orders (32%), warrants (31%) and repossessions (29%).

In Wales, accelerated procedures numbers have decreased after reaching a peak in Jan to March 2023. Accelerated claims and orders decreased by 34% each while warrants decreased by 9%. Accelerated repossessions however, increased by 70%, this is to be expected due to the longer time taken for repossessions to work through the system.

In July to September 2023, 35% or 8,789 of all landlord possession claims were social landlord claims compared to private landlord claims (30% or 7,402). 35% (8,747) were accelerated claims. This contrasts with pre-covid proportions when a majority of claims (around 60%) were social landlord claims.

The rise in claim and orders volumes is observed across most geographical regions. As in previous quarters, a concentration was seen in London, with 8,014 landlord claims and 5,528 landlord orders at London courts in July to September 2023, accounting for 32% and 31% of the respective totals. In London, there was an increase of 35% (from 5,915 in July to September 2022) for landlord claims and an increase of 52% for landlord orders (from 3,637 in July to September 2022).

The 14% increase in landlord warrants compared to July to September 2022, was accompanied by increases across all regions. The largest regional number (2,657) was again found in London, making up 27% of all landlord warrants. There was an increase of 22% for landlord warrants in London (from 2,175 in July to September 2022 to 2,657 in July to September 2023).

A new Housing Loss Prevention Advice Service (HLPAS) was launched on 1 August to provide advice to tenants and homeowners as soon as they are served with a written notice asking them to leave their home. Individuals who require the service do not need to meet legal aid financial eligibility rules as the service is not means tested but they are required to show evidence that they are at risk of losing of their home. For more information see the Supporting document’.

6. Landlord Possession Timeliness

Median timeliness figures have decreased for landlord orders and warrants returning to pre-Covid levels.

The median average time from claim to repossession has increased by less than a week to 23.0 weeks, up from 22.3 weeks in the same period of 2022.

Timeliness figures are higher than the legal guidelines. The law requires at least 4 and no more than 8 weeks between claim and court hearing. Possession orders stipulate when a tenant must vacate the property - typically within 4 weeks from the date the order was made. Landlords cannot issue a warrant until after this period (if the tenant has failed to comply).

Figure 4: Mean and median average timeliness of landlord possession actions, July to September 2018 to July to September 2023 (Source: Table 6)

Number of weeks taken from initial landlord claim to…

The median time taken to complete landlord actions decreased for orders and warrants this quarter following a general downward trend since Q3 2021 and is now very close to what it was before the pandemic.

-

Claims to order median timeliness has decreased to 7.3 weeks, down from 8.0 weeks in the same period in 2022.

-

Claims to warrant median timeliness has decreased to 13.3 weeks, down from 15.0 weeks in the same period in 2022.

-

Claims to repossessions median timeliness has increased to 23.0 weeks, up from 22.3 weeks in the same period in 2022.

As shown by Figure 4, median figures are generally considerably lower than mean figures, demonstrating that on average, the progression from claim to successive stages can be positively skewed by outlying cases.

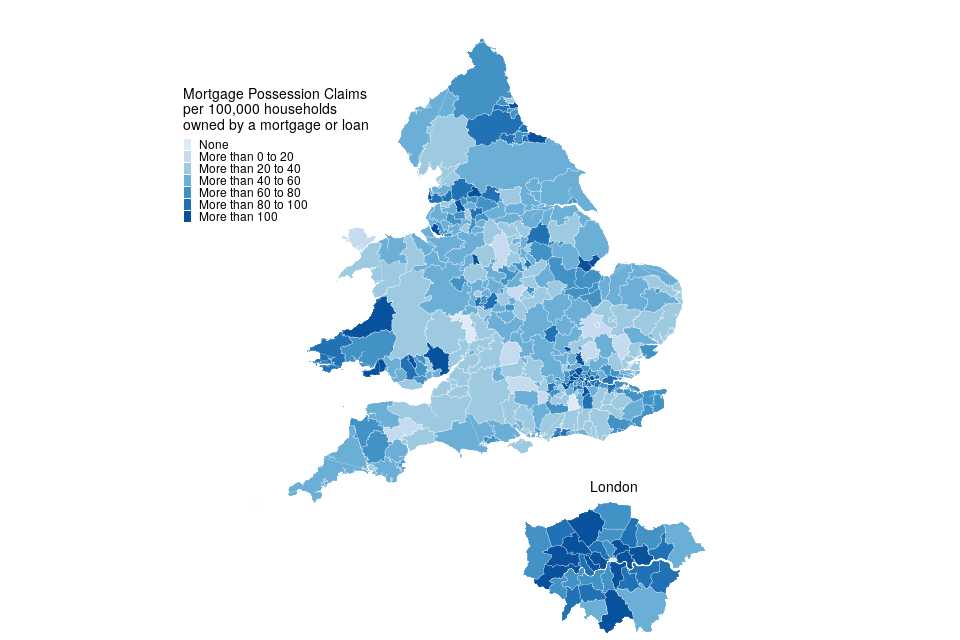

7. Regional Possession Claims

Since Q4 2022, the methodology used for calculating the rates of possession claims and repossessions had been modified to take into account the variation in proportions of tenure types in each local authority (LA) as measured by the 2021 census. The previous methodology (in place prior to Q4 2022) used total household figures as the denominator for all claims and repossessions rates. Since Q4 2022, this has now been modified to use household volumes by tenure[footnote 1]; mortgage, social and private landlord volumes for each local authority. For example, the rate of mortgage claims is now calculated as the number of mortgage claims divided by the number of households owned by a mortgage or loan in each LA. Similarly, rates for private and social landlord claims and repossessions have now been calculated separately[footnote 2] as a rate of households in each LA owned by a private or social landlord respectively. More information on this change is provided in the accompanying guide here.

Westminster, in the London region, had the highest rate of mortgage possession claims at 233 per 100,000 households owned by mortgage or loan, followed by Tower Hamlets (London region) and Welwyn Hatfield (East of England region); with 130 and 126 claims per 100,000 respectively.

The highest private landlord possession claim rates were found in London, with 8 of the 10 highest rates occurring in this region. Newham had the highest rate for private landlord claims (535 per 100,000 households owned by a private landlord).

The highest social landlord possession claim rates were also found in London with 5 of the 10 highest rates occurring in this region. Redditch had the highest rate for social landlord claims (668 per 100,000 households owned by a social landlord).

Figure 5: Mortgage possession Claims per 100,000 households owned by a mortgage or loan, July to September 2023 (Source: map.csv; see supporting guide)

| Local Authority | Rate (per 100,000 households owned by a mortgage or loan) | Actual number |

|---|---|---|

| Westminster | 233 | 25 |

| Tower Hamlets | 130 | 24 |

| Welwyn Hatfield | 126 | 17 |

4 local authorities had no mortgage possession claims during this period. Excluding these, Mid Devon had the lowest rate of mortgage claims (10 per 100,000 households owned by a mortgage or loan).

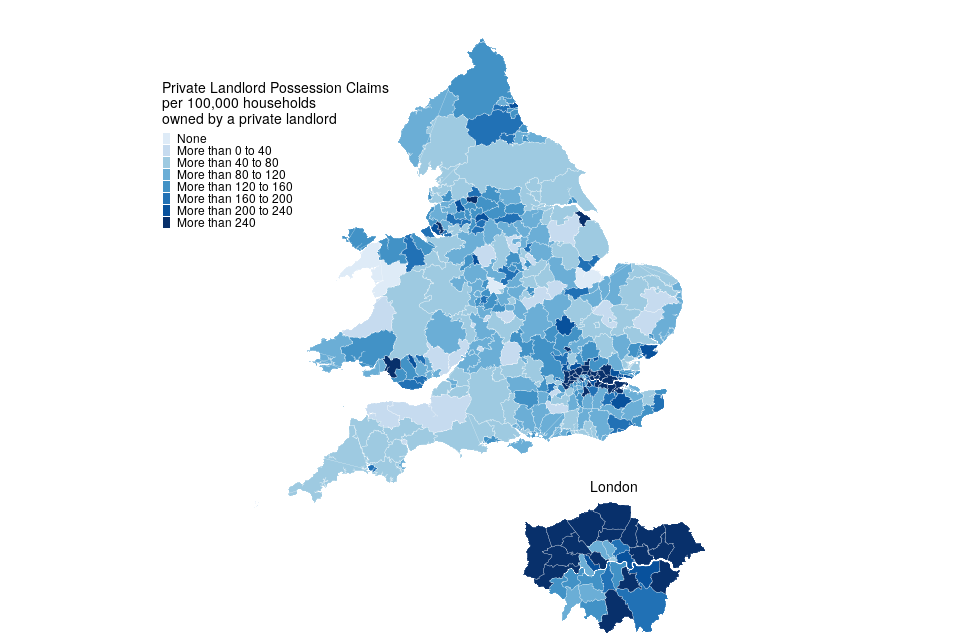

Figure 6: Private landlord possession Claims per 100,000 households owned by a private landlord, July to September 2023 (Source: map.csv; see supporting guide)

| Local Authority | Rate (per 100,000 households owned by a private landlord) | Actual number |

|---|---|---|

| Newham | 535 | 238 |

| Burnley | 433 | 42 |

| Barking and Dagenham | 419 | 75 |

London boroughs accounted for 8 of the 10 local authorities with the highest rate of private landlord claims.

4 local authorities had no private landlord claims during this period. Excluding this, South Norfolk had the lowest rate of private landlord claims (11.7 per 100,000 households owned by a private landlord).

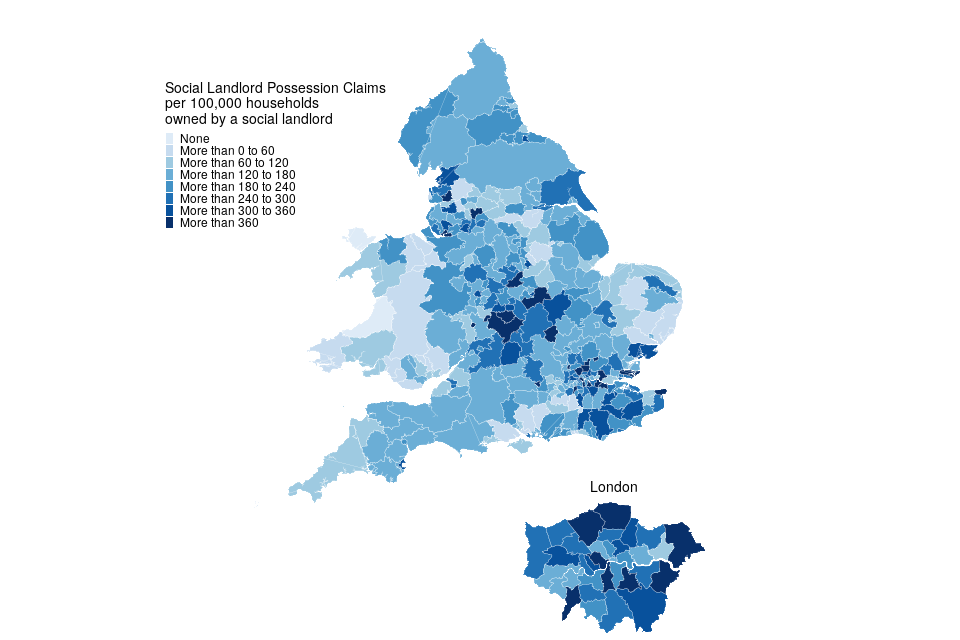

Figure 7: Social landlord possession Claims per 100,000 households owned by a social landlord, July to September 2023 (Source: map.csv; see supporting guide)

| Local Authority | Rate (per 100,000 households owned by a social landlord) | Actual number |

|---|---|---|

| Redditch | 668 | 49 |

| Barnet | 569 | 114 |

| North West Leicestershire | 526 | 32 |

London boroughs accounted for 5 of the 10 local authorities with the highest rate of social landlord claims.

3 local authorities had no social landlord claims during this period. Excluding this, Pembrokeshire had the lowest rate of social landlord claims (11.1 per 100,000 households owned by a social landlord).

8. Regional Repossessions (by County Court Bailiffs)

City of London had the highest overall rate of mortgage repossessions at 147 per 100,000 households owned by a mortgage or loan.

Private landlord repossessions were highest in Medway with 138 per 100,000 households owned by a private landlord.

Social landlord repossessions were highest in Oadby and Wigston with 167 per 100,000 households owned by a social landlord.

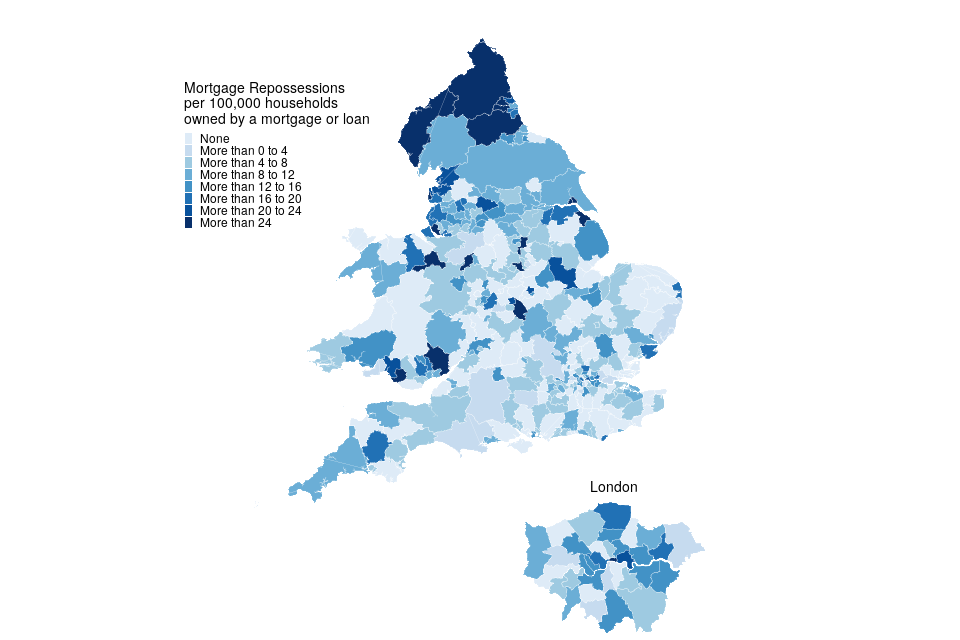

Figure 8: Mortgage repossessions per 100,000 households owned by a mortgage or loan, July to September 2023 (Source: map.csv; see supporting guide)

| Local Authority | Rate (per 100,000 households owned by a mortgage or loan) | Actual number |

|---|---|---|

| City of London | 147 | <10 |

| Blackpool | 53 | <10 |

| Cumberland | 37 | 13 |

No repossessions by county court bailiffs were recorded during this period in 107 local authorities out of a total of 318.

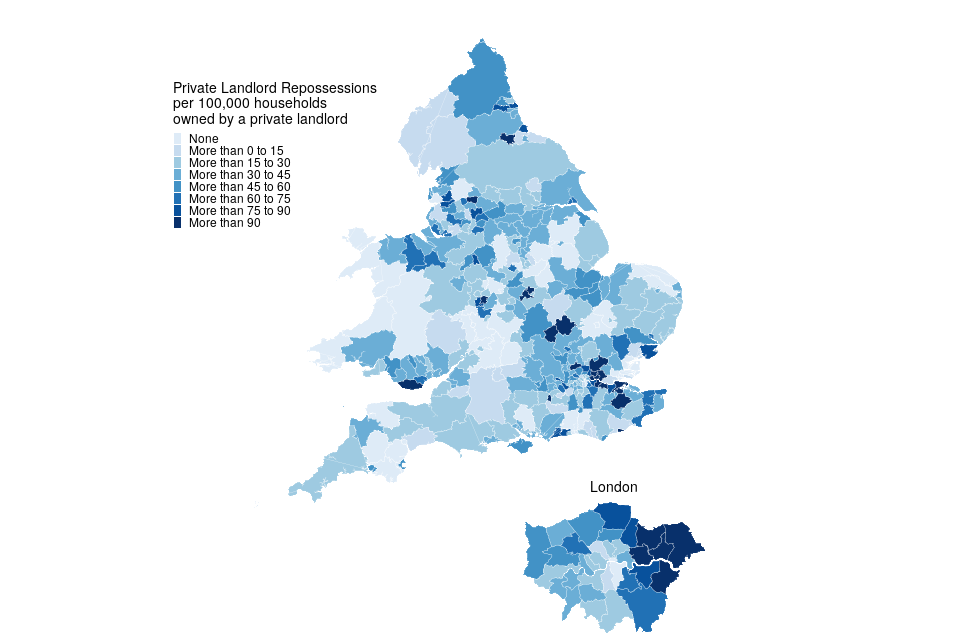

Figure 9: Private landlord repossessions per 100,000 households owned by a private landlord, July to September 2023 (Source: map.csv; see supporting guide)

| Local Authority | Rate (per 100,000 households owned by a private landlord) | Actual number |

|---|---|---|

| Medway | 138 | 31 |

| Bexley | 137 | 20 |

| Redbridge | 136 | 43 |

London local authorities account for 3 of the 10 boroughs with the highest rate of private landlord repossessions.

47 local authorities had no private landlord repossessions by county court bailiffs in July to September 2023.

Figure 10: Social landlord repossessions per 100,000 households owned by a social landlord, July to September 2023 (Source: map.csv; see supporting guide)

| Local Authority | Rate (per 100,000 households owned by a social landlord) | Actual number |

|---|---|---|

| Oadby and Wigston | 167 | <10 |

| Stafford | 147 | 12 |

| Solihull | 144 | 18 |

The East Midlands and South East regions each had 3 local authorities within the 10 LAs with the highest rate of social landlord repossessions.London local authorities account for none of the boroughs with the highest rate of social landlord repossessions.

43 local authorities had no social landlord repossessions by county court bailiffs in July to September 2023.

As with claims, it should be noted that for some of these areas the rates are based on a small number of possessions.

9. Further information

The statistics in the latest quarter are provisional and revisions may be made when the next edition of this bulletin is published. If revisions are needed in subsequent quarters, these will be annotated in the tables.

9.1 Accompanying files

As well as this bulletin, the following products are published as part of this release:

-

A supporting guide providing further information on how the data is collected and processed, including a guide to the csv files, as well as legislation relevant to mortgage possessions and background information.

-

A set of overview tables, covering key sections of this bulletin.

-

CSV files of the map data and the possession action volumes by local authority and county court.

-

A data visualisation tool which provides a detailed view of the Mortgage and Landlord statistics. We welcome feedback on this tool to help improve it in later editions and to ensure it meets user needs.

9.2 National Statistics status

National Statistics status are accredited official statistics that meet the highest standards of trustworthiness, quality and public value.

Accredited official statistics are called National Statistics in the Statistics and Registration Service Act 2007. These accredited official statistics were independently reviewed by the Office for Statistics Regulation in September 2021. They comply with the standards of trustworthiness, quality and value in the Code of Practice for Statistics and should be labelled ‘accredited official statistics’.

It is the Ministry of Justice’s responsibility to maintain compliance with the standards expected for National Statistics. If we become concerned about whether these statistics are still meeting the appropriate standards, we will discuss any concerns with the Authority promptly. National Statistics status can be removed at any point when the highest standards are not maintained, and reinstated when the standards are restored. These statistics have been audited and re-accredited as National Statistics. The most recent compliance check completed by the Office of Statistics Regulation can be found here.

9.3 Future publications

Our statisticians regularly review the content of publications. Development of new and improved statistical outputs is usually dependent on reallocating existing resources. As part of our continual review and prioritisation, we welcome user feedback on existing outputs including content, breadth, frequency and methodology. Please send any comments you have on this publication including suggestions for further developments or reductions in content.

9.4 Contact

Press enquiries should be directed to the Department for Levelling Up, Housing and Communities press office:

email: newsdesk@levellingup.gov.uk

Other enquiries and feedback on these statistics should be directed to the Data and Evidence as a Service division of the Ministry of Justice:

Carly Gray - email: CAJS@justice.gov.uk

Next update: 8 February 2024

© Crown Copyright

Produced by the Ministry of Justice

Alternative formats are available upon request from ESD@justice.gov.uk

-

Tenure - Office for National Statistics ons.gov.uk. ↩

-

Please note rates for private and social landlord possession claims and repossessions do not include accelerated claims. This is because accelerated claims are recorded onto the case management system at point of entry so do not specify the tenure type. ↩