Mortgage and landlord possession statistics: April to June 2022

Published 11 August 2022

1. Main Points

This publication provides mortgage and landlord possession statistics up to April to June 2022. In general, we have reverted to comparing figures to the same quarter in the previous year (in this case 2021). Should users wish to compare the latest outturn against 2019 as a pre-covid baseline, they can do so using the accompanying statistical tables. For technical detail, please refer to the accompanying supporting document.

| Mortgage claims, orders, warrants and repossessions have increased significantly when compared to the same quarter in 2021 | Compared to the same quarter in 2021, mortgage possession claims increased from 2,499 to 3,476 (39%), orders from 400 to 2,382 (496%), warrants from 525 to 2,419 (361%) and repossessions by county court bailiffs increased from 45 to 770 (1,611%). These figures are between 50% to 60% of pre-covid baselines. |

| Landlord possession actions have also all increased significantly | The pattern is repeated for landlord possession actions. When compared to the same quarter in 2021, landlord possession claims increased from 6,997 to 18,201 (160%), orders from 5,431 to 14,319 (164%), warrants from 3,786 to 7,728 (104%) and repossessions from 1,582 to 4,900 (210%). |

| Mortgage and Landlord possession claims, and repossession rates have risen across all regions | Increases in possession claims have been recorded in all regions. Landlord claims remained concentrated in London (with 9 of the highest 10 claim rates). |

| Mortgage median average time (from claim to repossession) has increased | The median average time from claim to mortgage repossession has increased to 110.1 weeks, up from 106.7 weeks in the same period in 2021. It should be noted that the Q2 2021 figure was based on only 41 cases. |

| Median timeliness for landlord repossessions has increased when compared to 2019 and 2020 and decreased when compared to 2021 | The median average time from claim to landlord repossession has decreased to 23.4 weeks, down from 60.1 weeks in the same period in 2021. |

A data visualisation tool has also been published that provides further breakdowns in a web-based application. The tool can be found here.

For feedback related to the content of this publication and visualisation tool, please contact us at CAJS@justice.gov.uk

2. Statistician’s Comment

This report covers the quarter to the end of June 2022 and shows continued gradual recovery in all court actions when compared to the same period last year. These figures follow very similar trends to last quarter. Claim volumes for Mortgage and Landlord possession continue to slowly increase following the lifting of bailiff restrictions but are not yet at pre-covid levels: claims issued have increased quarter on quarter since Q2 2021 and claim receipts now hover around 60% of the pre-covid baseline.

Restrictions on bailiff enforcement ended on the 31st May 2021. Residual covid-19 restrictions have all been lifted and bailiffs are now working to reduce backlogs. Although numbers remain about 33% below pre-Covid-19 levels, they are rising steadily, when compared to the same period last quarter.

Restrictions on bailiff enforcement in Wales ended on the 30th June 2021 and repossessions volumes are just under half of baseline. Wales recorded its highest private landlord claims receipts (265) this quarter, this is possibly due to announcements made regarding changes to no fault eviction rules[footnote 1].

Timeliness figures are still above pre-covid baseline figures, although compared to the same period last year, median and mean average time has decreased for orders, warrants and repossessions (with the exception of the Mortgage repossessions’ median time). Measures have been announced to extend 30 Nightingale court rooms to aid backlogs across all jurisdictions[footnote 2].

Where numbers presented are significantly below pre-covid levels, any volatility should be considered within the context of the relatively small volumes and the invariable additional time needed where normal court procedures could not be followed.

3. Overview of Mortgage Possession

Mortgage possession actions are slowly recovering from the impacts of Covid-19, with claims, orders and warrants currently around 39%, 496% and 361% above Q2 2021 levels.

As a result of coronavirus and associated actions, all mortgage possession actions had dropped significantly in 2020 and 2021. Compared to the same quarter in 2021, mortgage possession claims (3,476) are up 39%. Mortgage orders for possession (2,382) are up 496%, warrants issued (2,419) are up 361% and repossessions (770) are up 1,611%.

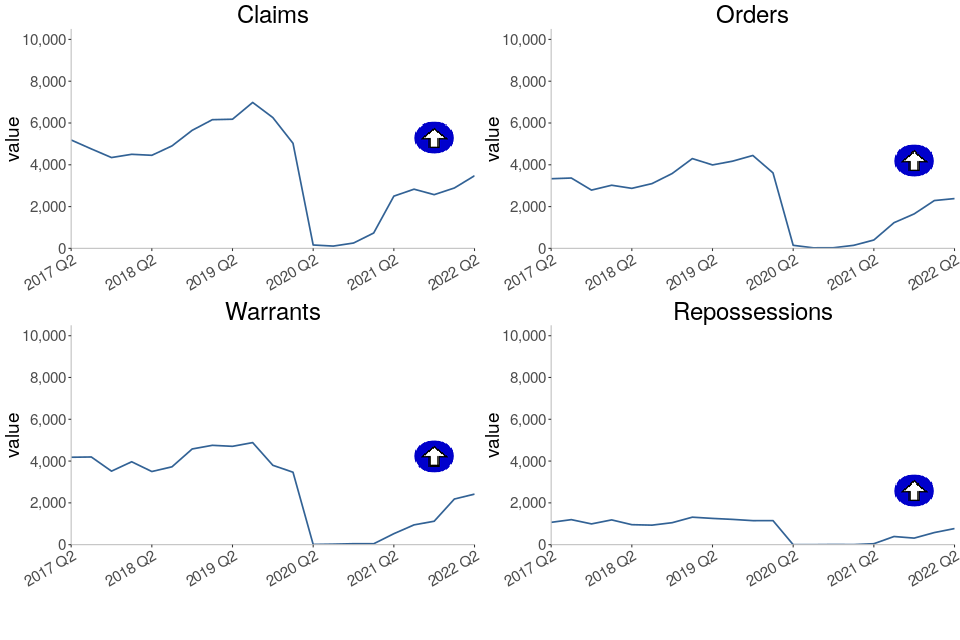

Figure 1: Mortgage possession actions in the county courts of England and Wales, April to June 2017 to April to June 2022 (Source: Table 1)

All Mortgage possession case types have been steadily increasing but are still not at their pre-covid baseline. Claims, warrants and repossessions volumes are now at 56%, 51% and 61% of their pre- covid baseline. This is a significant increase when compared to the same quarters in 2020 and 2021 however it is still short of the 2019 baseline.

Mortgage possession claims fell from a peak of 26,419 in April to June 2009 before stabilising from April to June 2015 (4,849, see table 1). In the most recent quarter, April to June 2022, there were 3,476 claims for possession, up 39% from the same quarter in 2021.

Orders and warrants for possession followed a similar trend to mortgage claims, falling from a peak of 23,850 orders in July to September 2009 and 21,350 warrants in January to March 2009, and stabilizing around 2016/17. Compared to the same quarter in 2021, orders are up 496% to 2,382 and warrants are up 361% to 2,419 in April to June 2022.

Historically, repossessions by county court bailiffs fell from a high of 9,284 in Q1 of 2009 to 934 in Q3 of 2018, the lowest recorded level of the series at the time. Following the complete cessation of repossession proceedings from March to September 2020 where no repossessions took place, the FCA guidance advised mortgage lenders not to commence or continue possession proceedings until April 2021 (unless there were special circumstances). As a result, there were only 10 repossessions over the whole of last year from April 2020 to March 2021 (Q2 2020 to Q1 2021), and 770 in April to June 2022, up 1,611% compared to the same quarter in 2021.

Before the impact of coronavirus, the historical fall in the number of mortgage possession actions since 2008 has generally coincided with lower interest rates, a proactive approach from lenders in managing consumers in financial difficulties and other interventions, such as the Mortgage Rescue Scheme and the introduction of the Mortgage Pre-Action Protocol. Additionally, the downward trend seen in recent years mirrors that seen in the proportion of owner-occupiers.

4. Mortgage Possession Action Timeliness

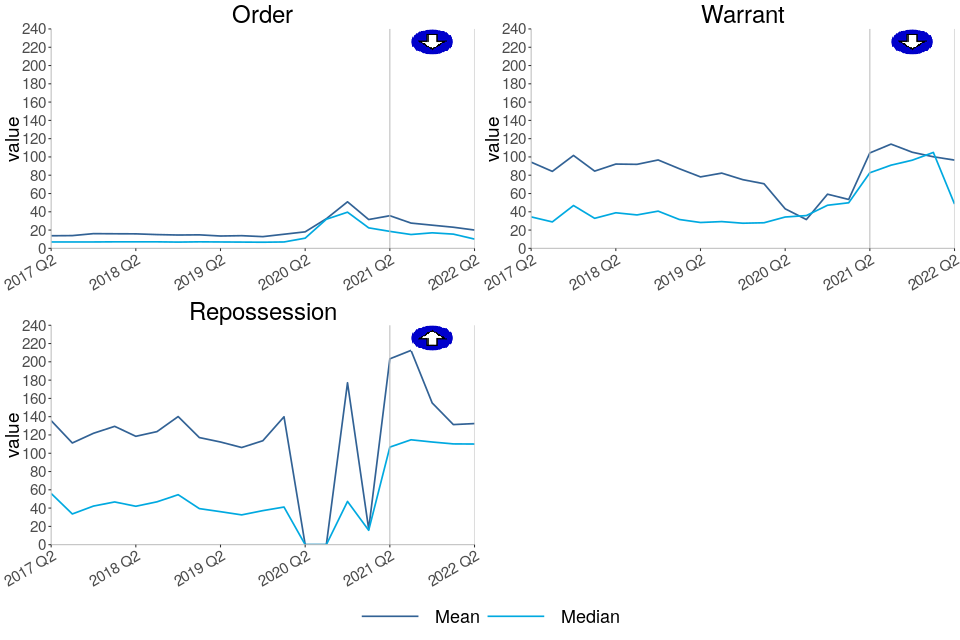

Median timeliness figures are volatile for mortgage orders, warrants and repossessions due to low volumes being processed and the impact of Covid-19 on these low volumes.

Median average time has increased for orders and warrants. As the courts continue to recover, it is unlikely that these timeliness figures are representative of any statistical trend and instead reflect the pause in actions, therefore, caution should be used when interpreting these results.

The median average time from claim to repossession has increased to 110.1 weeks, up from 106.7 weeks in the same period in 2021. However, it should be noted there were much fewer cases in April to June 2021.

Figure 2: Average timeliness of mortgage possession actions, April to June 2017 to April to June 2022 (Source: Table 3)

Number of weeks taken from initial mortgage claim to…

-

Claims to order median timeliness has decreased to 10.1 weeks, down from 18.6 weeks in the same period in 2021.

-

Claims to warrant median timeliness has decreased to 48.5 weeks, down from 82.7 weeks in the same period in 2021.

-

Claims to repossession median timeliness has increased to 110.1 weeks, up from 106.7 weeks in the same period in 2021.

The above charts distinguish between the timeliness of possession claims at different stages of a case. Average time taken from claim to warrant or repossession can fluctuate and is affected by various factors. For example, the final two charts take account of the amount of time between the court order being issued and the claimant, such as the mortgage lender, applying for a warrant of possession.

The short-term increases noted over the past few quarters reflect the stay on most possession claims implemented between March and September 2020 for case progression and the stay to evictions (with some exceptions) implemented between March 2020 and June 2021. Those cases that have progressed to repossession therefore include the duration of the stay within their timeliness. This “hold stay period” will form part of many possession actions over the next few quarters.

The long-term increases in the mean average time from claim to warrant and claim to repossession are due to an increasing proportion of historic claims (dating from 2007 to 2013) reaching the warrant and repossession stages respectively in recent quarters. This is possibly due to defendants recently breaking the terms of the mortgage agreements put in place at the start of the process. Although these historical outlying cases inflate the mean average, they have less effect on the median.

5. Overview of Landlord Possession

The number of landlord possession actions for all court stages have increased compared to the same quarter of last year.

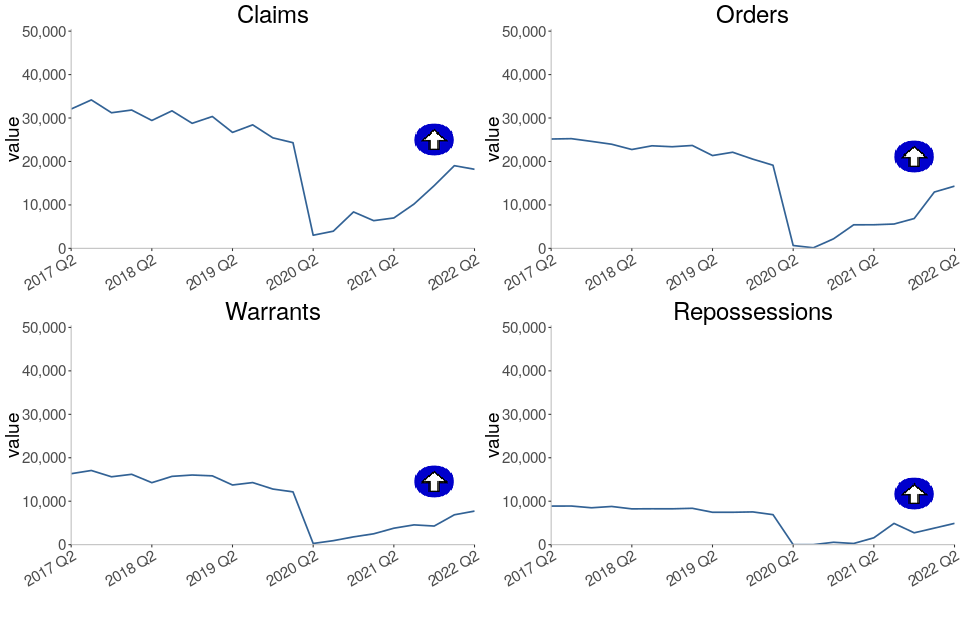

As a result of coronavirus and associated policy actions, all landlord possession actions had dropped significantly. Compared to the same quarter in 2021, landlord possession actions; claims (18,201), orders for possession (14,319), warrants (7,728) and repossessions (4,900) have increased by 160%, 164%, 104% and 210% respectively.

Figure 3: Landlord possession actions in the county courts of England and Wales, April to June 2017 to April to June 2022 (Source: Table 4)

In April to June 2022, a similar proportion (33% or 5,988) of all landlord possession claims were social landlord claims compared to private landlord claims (35% or 6,425). 32% (5,788) were accelerated claims.

This contrasts with previous quarters. For example, in April to June 2019, the majority (58% or 15,581) of all landlord possession claims were social landlord claims, while accelerated claims and private landlord claims made up just 19% and 23% of all landlord claims respectively.

The rise in claim and orders volumes is observed across all geographical regions. As in previous quarters, a concentration was seen in London, with 4,703 landlord claims and 3,481 landlord orders at London courts in April to June 2022, accounting for 26% and 24% of the respective totals. In London, there was an increase of 131% (from 2,032 in April to June 2021) for landlord claims and an increase of 159% for landlord orders (from 1,346 in April to June 2021).

The 104% increase in landlord warrants compared to April to June 2021, was accompanied by large increases across all regions. The largest regional number (2,033) was again found in London, making up 26% of all landlord warrants. There was an increase of 73% for landlord warrants in London (from 1,177 in April to June 2021 to 2,033 in April to June 2022).

6. Landlord Possession Timeliness[footnote 3]

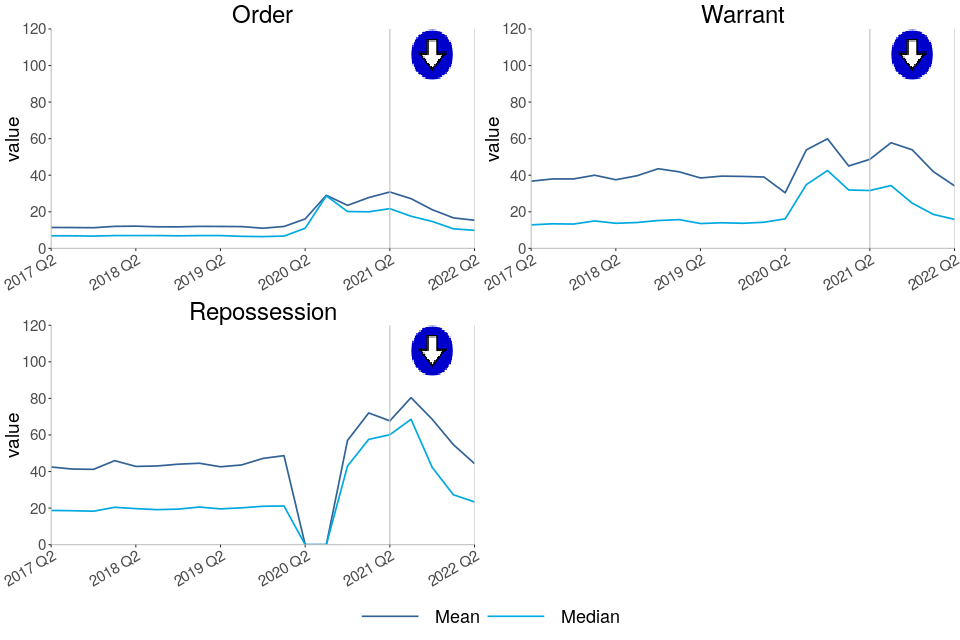

Median timeliness figures are volatile for landlord orders, warrants and repossessions due to low volumes being processed and the low volumes as the courts recover.

Median and mean average time has decreased for orders, warrants and repossessions. However due to the low volumes of possession actions this quarter, caution should be used when interpreting these results. It is unlikely that these timeliness figures are representative of any statistical trend and will instead reflect the pause in actions.

The median average time from claim to repossession has decreased to 23.4 weeks, down from 60.1 weeks in the same period in 2021.

Figure 4: Mean and median average timeliness of landlord possession actions, April to June 2017 to April to June 2022 (Source: Table 6)

Number of weeks taken from initial landlord claim to…

-

Claims to order median timeliness has decreased to 9.9 weeks, down from 21.7 weeks in the same period in 2021.

-

Claims to warrant median timeliness has decreased to 15.9 weeks, down from 31.6 weeks in the same period in 2021.

-

Claims to repossessions median timeliness has decreased to 23.4 weeks, down from 60.1 weeks in the same period in 2021.

The short-term increases noted over the past few quarters reflect the stay on most possession claims implemented between March and September 2020 for case progression and the ongoing stay to evictions (with some exceptions). Those cases that have progressed to repossession therefore, include the duration of the stay within their timeliness. This “hold stay period” will form part of many possession actions over the next few quarters.

As shown by Figure 4, median figures are generally considerably lower than mean figures, demonstrating that on average, the progression from claim to successive stages can be positively skewed by outlying cases when using a mean measure of average timeliness.

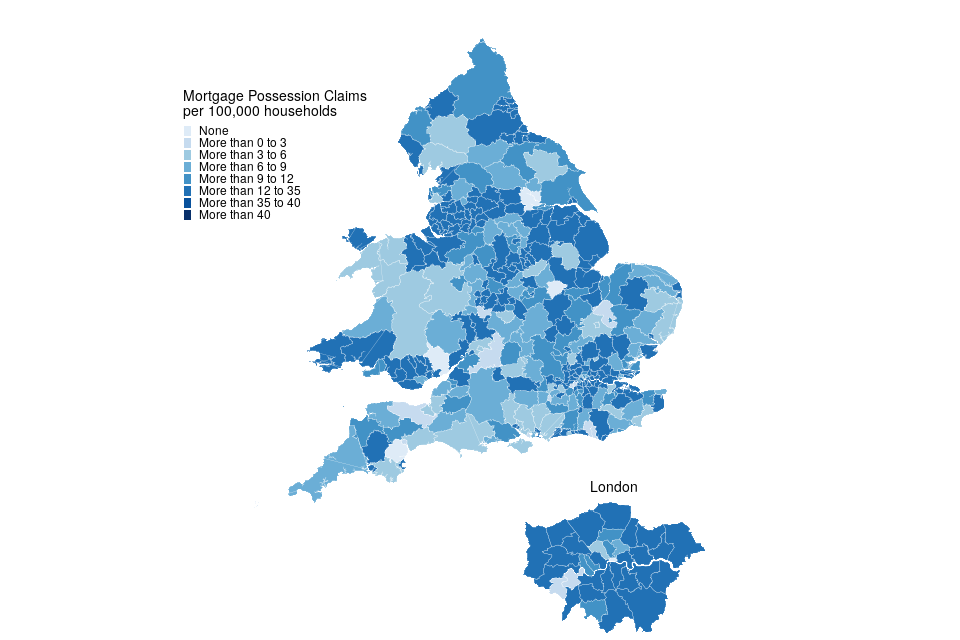

7. Regional Possession Claims

Copeland in the North West region had the highest rate of mortgage possession claims at 34 per 100,000 households, followed by Bradford (Yorkshire and The Humber region) and Great Yarmouth (East of England region); with 31 and 29 claims per 100,000 respectively. Note that these rates are based on relatively low numbers and so the relativities between areas should be treated with caution.

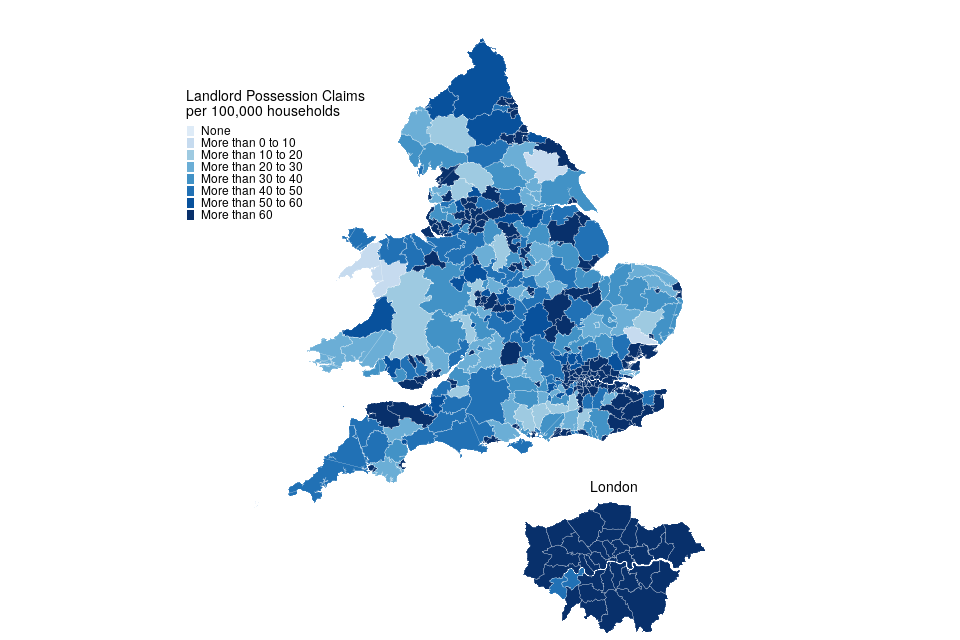

The majority of the highest landlord possession claim rates were found in London, with 9 of the 10 highest rates occurring in this region. Newham had the highest rate (210 per 100,000 households).

Figure 5: Mortgage possession Claims per 100,000 households, April to June 2022 (Source: map.csv; see supporting guide)

| Local Authority | Rate (per 100,000 households) | Actual number |

|---|---|---|

| Copeland | 34 | 10 |

| Bradford | 31 | 63 |

| Great Yarmouth | 29 | 13 |

6 local authorities had no possession claims during this period. Excluding these, Somerset West and Taunton had the lowest rate of mortgage claims (1.4 per 100,000 households).

Figure 6: Landlord possession Claims per 100,000 households, April to June 2022 (Source: map.csv; see supporting guide)

| Local Authority | Rate (per 100,000 households) | Actual number |

|---|---|---|

| Newham | 210 | 245 |

| Slough | 191 | 106 |

| Ealing | 189 | 233 |

London boroughs accounted for 9 of the 10 local authorities with the highest rate of landlord claims.

One local authority, the Isles of Scilly, had no landlord claims during this period. Excluding this, Gwynedd had the lowest rate of landlord claims (5.4 per 100,000 households).

8. Regional Repossessions (by County Court Bailiffs)

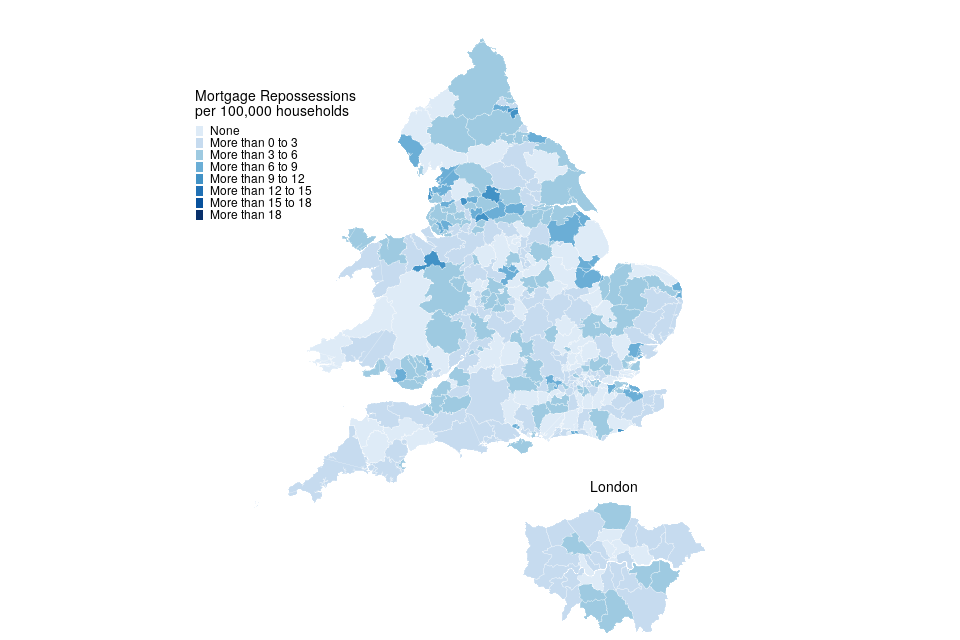

Wrexham had the highest overall rate of mortgage repossessions at 12 per 100,000 households.

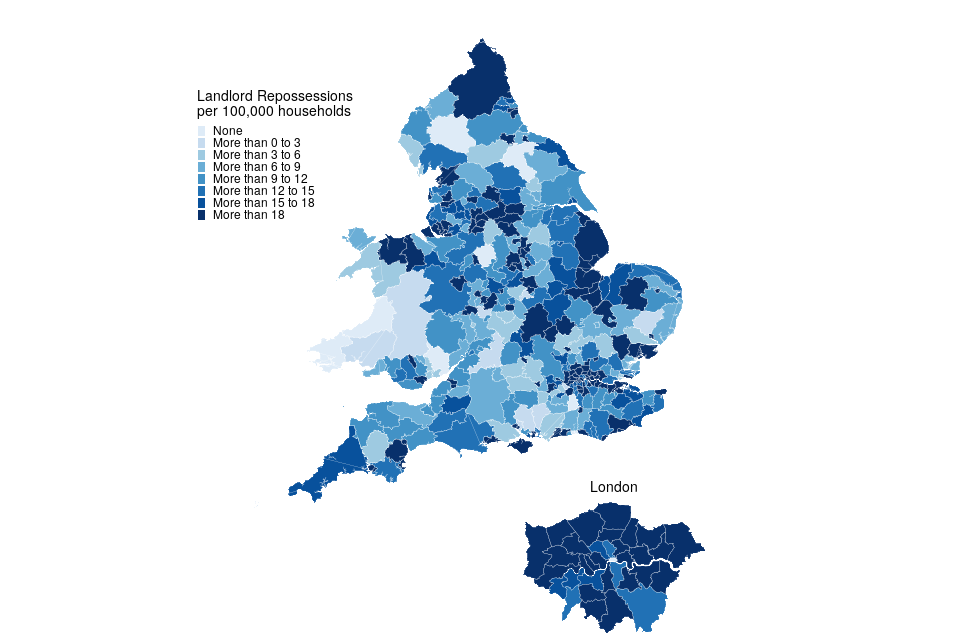

Landlord repossessions were highest in Barking and Dagenham with 65 per 100,000 households and were generally concentrated in London (7 out of the 10 highest rates).

Figure 7: Mortgage repossessions per 100,000 households, April to June 2022 (Source: map.csv; see supporting guide)

No repossessions by county court bailiffs were recorded during this period in 86 local authorities out of a total of 331.

Figure 8: Landlord repossessions per 100,000 households, April to June 2022 (Source: map.csv; see supporting guide)

| Local Authority | Rate (per 100,000 households) | Actual number |

|---|---|---|

| Barking and Dagenham | 65 | 51 |

| Ealing | 63 | 78 |

| Slough | 60 | 33 |

London local authorities account for 7 of the 10 boroughs with the highest rate of landlord repossessions.

10 local authorities had no landlord repossessions by county court bailiffs in April to June 2022.

9. Further information

The statistics in the latest quarter are provisional and revisions may be made when the next edition of this bulletin is published. If revisions are needed in subsequent quarters, these will be annotated in the tables.

9.1 Accompanying files

As well as this bulletin, the following products are published as part of this release:

-

A supporting guide providing further information on how the data is collected and processed, including a guide to the csv files, as well as legislation relevant to mortgage possessions and background information.

-

A set of overview tables, covering key sections of this bulletin.

-

CSV files of the map data and the possession action volumes by local authority and county court.

-

A data visualisation tool which provides a detailed view of the Mortgage and Landlord statistics. We welcome feedback on this tool to help improve it in later editions and to ensure it meets user needs.

9.2 National Statistics status

National Statistics status means that official statistics meet the highest standards of trustworthiness, quality and public value.

All official statistics should comply with all aspects of the Code of Practice for Statistics. They are awarded National Statistics status following an assessment by the Authority’s regulatory arm. The Authority considers whether the statistics meet the highest standards of Code compliance, including the value they add to public decisions and debate.

It is the Ministry of Justice’s responsibility to maintain compliance with the standards expected for National Statistics. If we become concerned about whether these statistics are still meeting the appropriate standards, we will discuss any concerns with the Authority promptly. National Statistics status can be removed at any point when the highest standards are not maintained, and reinstated when the standards are restored. These statistics have been audited and re-accredited as National Statistics. The most recent compliance check completed by the Office of Statistics Regulation can be found here.

9.3 Future publications

Our statisticians regularly review the content of publications. Development of new and improved statistical outputs is usually dependent on reallocating existing resources. As part of our continual review and prioritisation, we welcome user feedback on existing outputs including content, breadth, frequency and methodology. Please send any comments you have on this publication including suggestions for further developments or reductions in content.

9.4 Contact

Press enquiries should be directed to the Department for Levelling Up, Housing and Communities press office:

email: newsdesk@levellingup.gov.uk

Other enquiries and feedback on these statistics should be directed to the Data and Evidence as a Service division of the Ministry of Justice:

Rita Kumi-Ampofo - email: CAJS@justice.gov.uk

Next update: 10 November 2022

© Crown Copyright

Produced by the Ministry of Justice

Alternative formats are available upon request from ESD@justice.gov.uk

-

Tenants: housing law is changing (Renting Homes) - GOV.WALES ↩

-

Nightingale Courts extended to support justice recovery - GOV.UK (www.gov.uk) ↩

-

The law requires at least 4 and no more than 8 weeks between claim and court hearing. Possession orders stipulate when a tenant must vacate the property - typically within 4 weeks from the date the order was made. Landlords cannot issue a warrant until after this period (if the tenant has failed to comply). ↩