Food chain total factor productivity 2015 (final estimate) (published 27 July 2017)

Updated 19 June 2025

1. Key messages

- In 2015 the productivity of the food chain has increased by 0.3 per cent while the wider economy increased by 1.0 per cent.

- Benchmarking against a wider economy measure shows that the average annual growth in the food chain in the ten years to 2015 was 0.2 per cent compared to 0.3 per cent in the wider economy.

- In 2015, productivity in catering saw the highest increase of 1.6 per cent, while food wholesaling saw the largest decrease of 1.4 per cent.

- In 2015, the value of Gross Value Added for the four sectors of the food chain was £101 billion. This counted for about 9 per cent of the UK non-financial business economy.

2. Overview

The total factor productivity (TFP) of the United Kingdom food chain is an indicator of the efficiency and competitiveness of the food industry within the United Kingdom. An increase in TFP indicates the industry is improving its efficiency. If TFP in the UK food chain increases faster than other countries, this indicates that the industry is improving competitiveness. The food sector plays a significant part in our economy, accounting for about 9 per cent of the Gross Value Added of the UK non-financial business economy. Four sectors make up the food chain: retail, manufacture, wholesale and non-residential catering. Both alcoholic and non-alcoholic drinks are included in food. Total factor productivity is a measure of the efficiency with which inputs are converted into outputs. For example, TFP increases if the volume of outputs increases while the volume of inputs stays the same. Similarly, TFP increases if the volume of inputs decreases while the volume of outputs stays the same. Although there is a practical limit on how much food people want to buy the volume of output can increase due to increases in quality of products and by increases in exports.

2.1 Gross value added of the UK food sector 2015

Gross value added of the UK food sector 2015

In 2015, the value of Gross Value Added for the four sectors of the food chain was £101 billion. Catering was the largest contributor with £31.6 billion while wholesaling was £11 billion. This estimate for 2015 is final as the underlying data used are final estimates. See the notes section for more details. The background data and charts in this release can be downloaded here.

3. Sector trends

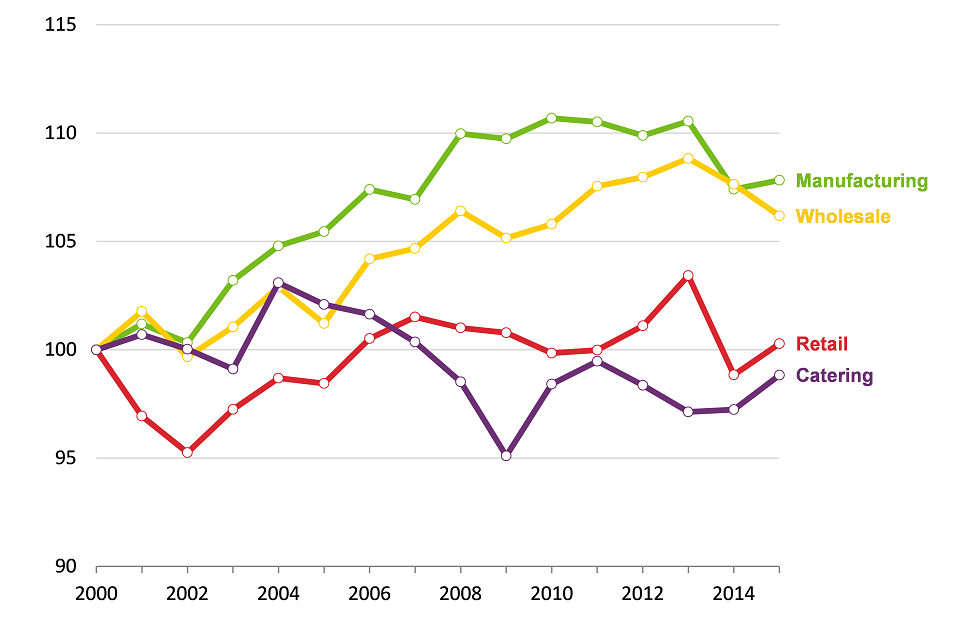

3.1 Total Factor Productivity trends within the UK food industry 2000 to 2015

Total Factor Productivity trends within the UK food industry 2000 to 2015

- Since 2000 manufacturing has had the highest productivity except for 2001 and 2014 when wholesale was very slightly higher.

- From 2001 to 2006 retail had the lowest productivity, but from 2007 catering has had the lowest.

- Manufacturing and wholesale have steadily risen from 2000 to 2015, while retail and catering have had a flatter trend, but with some one-off spikes.

- In 2015, catering has a lower productivity than in 2000, while all other sectors have increased their productivity. However, manufacturing and wholesale have increased much more than retail.

- In 2002 and 2009, all sectors had a decrease in productivity. 2004 is the only year when all sectors increased their productivity.

4. Benchmarking the UK food chain against the wider economy

An estimate of total factor productivity in the wider economy is calculated for comparison purposes from the same data sources as the food chain using the same method. This measure does not cover the full economy but rather non-public sector industries that are covered by the Annual Business Survey. Financial services are the largest sector not included in the measure. In 2015 the productivity of the food chain increased by 0.3 per cent while the wider economy increased by 1.0 per cent. In the 10 years prior to 2015, the average annual growth rate of the food chain was 0.2 per cent whereas the wider economy’s average annual growth rate was 0.3 per cent. From 2006 to 2013, the food chain had a higher productivity than the wider economy.

4.1 Total factor productivity of the UK food sector compared with the wider economy for the UK

Total factor productivity of the UK food sector compared with the wider economy for the UK 2015

5. Sector Analysis

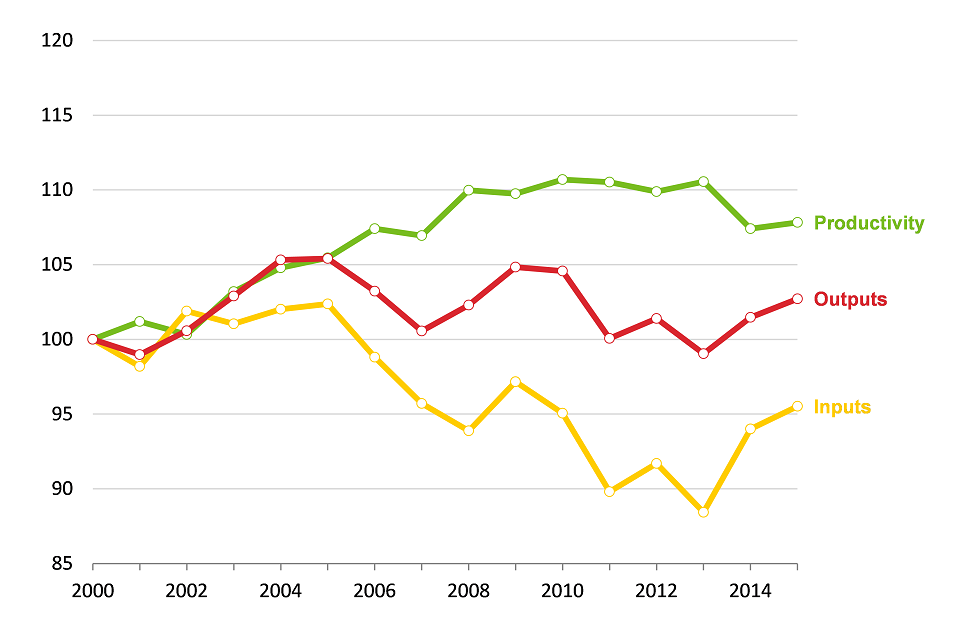

5.1 Manufacturing

Food Chain Productivity Manufacturing 2015

- In 2015, total factor productivity in food and drink manufacturing increased by 0.4 per cent and in the last 10 years has shown an average annual increase of 0.2 per cent.

- In 2015 both inputs and outputs grew, but outputs increased more than inputs (1.2 per cent and 0.8 per cent respectively). From 2003 inputs have consistently been lower than outputs.

- Since 2014, labour input has increased by 4.1 per cent. However, in the last 10 years there has been an average annual decrease of labour input of 1.1 per cent.

- In 2015, food and drink manufacturing contributed 27 per cent to Gross Value Added of the food chain beyond the farm-gate.

5.2 Wholesaling

Food Chain Productivity Wholesaling 2015

- Total factor productivity of food wholesaling decreased by 1.4 per cent in 2015, but in the last 10 years has shown an average annual increase of 0.5 per cent.

- Both inputs and outputs have increased between 2014 and 2015, but inputs have gone up more than outputs (2.6 per cent and 1.2 per cent respectively) resulting in the decrease in productivity.

- In 2015 labour volume decreased by 2.9 per cent, the highest decrease of all sectors. Labour decreased by 12.4 per cent between 2008 and 2009, but increased by 21.3 per cent between 2011 and 2012.

- In 2015 the wholesale sector contributed 11 per cent to Gross Value Added of the food chain beyond the farm-gate.

5.3 Retail

Food Chain Productivity Retail 2015

- Productivity of the food retail sector has increased by 1.5 per cent since 2014. The increase is due to there being an increase in both inputs (4.8 per cent) and outputs (6.3 per cent), but the increase in outputs being higher. In the last 10 years, productivity has increased by 0.2 per cent. Since 2000, inputs and outputs have followed a similar pattern resulting in little change in productivity.

- Labour input has increased by 1.2 per cent since 2014. Labour in NRC is at its highest level since 2005, having dipped between 2009 and 2013.

- In 2015 food retailing contributed 31 per cent to Gross Value Added of the food chain beyond the farm-gate.

5.4 Non-Residential Catering (NRC)

Food Chain Productivity Non-Residential Catering (NRC) 2015

- Non-residential catering (NRC) showed the highest increase in productivity of all sectors, with an increase in productivity of 1.6 per cent in 2015.

- The increase in productivity was due to an increase in both inputs and outputs, however inputs increased by 2.7 per cent while outputs increased further by 4.4 per cent. In the last 10 years, productivity has seen an average annual decrease of 0.3 per cent, while all other sectors have increased. Outputs have been lower than inputs for much of the last 15 years resulting in low productivity.

- Productivity of NRC was at its strongest prior to the recession, then dipped to its lowest level in 2009, but since the recession has seen an increase. This sector would have been affected strongly by the recession that started in 2008 and lasted through most of 2009. These challenging economic times will make it difficult for companies to make proportionate savings across all inputs, especially with labour being a relatively high component. Consumers find it easier to cut on this form of spending on food. During periods of economic downturn it is likely that consumers will make savings through eating out less and switching to home cooking.

- Labour in NRC is at its highest level since 2000, having dipped between 2009 and 2013. There was an increase in labour in 2015 of 5.9 per cent.

- In 2015, NRC contributed 31 per cent to Gross Value Added of the food chain beyond the farm-gate.

6. Background notes

6.1 TFP calculation

The method incorporates the inputs and outputs that are associated with monetary transactions but does not incorporate external effects on society and the environment. TFP differs from labour productivity by factoring in capital consumption. This calculation covers labour, capital and purchases while output is the volume of sales. TFP is measured only in the form of changes as the change in the ‘volume of outputs’ divided by the change in ’the volume of inputs’. The series is annually rebased and chain linked. Inputs are measured in the form of labour, capital and purchases. Purchases (mainly food but also energy, water and other consumables) dominate the inputs in all sectors.

6.2 Contribution of inputs

Food Chain Productivity Contribution of inputs 2015

A more detailed methodology note to accompany the release sets out methods, assumptions, data sources and revisions, and is available here.

7. Uses and potential uses of this data

Defra use TFP in the food chain beyond agriculture as a measure of how well the UK food industry beyond agriculture is improving its productivity and thereby on course to be competitive in the future. Improving the productivity and competitiveness of food and farming businesses, while improving the environment is a priority for Defra. Domestically a more competitive, profitable and resilient farming and food industry is needed. As the UK economy recovers, this sector, like all others, needs to maximise its potential for sustainable growth, maintain and increase its chance of securing European and global trading opportunities, and meet society’s needs. We also need a basic level of resilience against changing environmental conditions, price fluctuations, financial uncertainty and food availability. The Food and Drink Federation use this data to communicate to its members (by tracking the industry’s progress and promoting the sector) and they make this information available on their website. Food and drink businesses can also use this data to track progress of the industry in general but this measure is not comparable with competitiveness measures applied to individual businesses and cannot be used to benchmark their own performances. This measure is not directly comparable with the general calculation used by the Office for National Statistics to measure whole economy productivity. To enable a comparison with the wider economy we calculate TFP growth in the wider economy using this calculation, i.e. data from the annual business survey. It is limited to coverage of the economy by the Annual Business Survey. The Annual Business Survey is the main structural business survey conducted by the Office for National Statistics. Prior to 2009 it was known as the Annual Business Inquiry - part 2. It collects financial information for about two-thirds of the UK economy, covering agriculture (part); hunting; forestry and fishing; production; construction; motor trades; wholesale; retail; catering and allied trades; property; service trades. The financial variables covered include turnover, purchases, employment costs, capital expenditure and stocks. Further details on the survey are available here.

8. Notes

- The original research this statistics release is based on was published in May 2006 and is available here.

- Total factor productivity of agriculture is published in Agriculture in the UK, Chapter 5. Data up to 2016 is available in Chart 5.1.

- The UK food sector is defined in terms of the standard industrial classification (SIC 2007) as food manufacturing, food wholesaling, food retailing and non-residential catering:

| Category | SIC Code |

|---|---|

| Food Manufacturing: | 10 & 11 |

| Food Wholesaling: | 46.17 & 46.3 less 46.35 |

| Food Retailing: | 47.11 & 47.2 & 47.81 less 47.26 |

| Non-residential Catering: | 56 |

- These estimates are produced twice yearly. Most of the data is sourced from the Annual Business Survey (ABS), which is produced by the Office for National Statistics (ONS). The ONS release the ABS provisional estimates normally around November and the revised estimates are released around June.

- Data in this release comes from the Annual Business Survey published in June 2017, The Annual Survey of Earnings and Hours published in November 2015 and Capital Stocks: Consumption of Fixed Capital published in August 2016. The next TFP update will be in January 2018.

- Enquiries to:David Lee, Tel: +44 (0) 208 026 3006, email: david.lee@defra.gsi.gov.uk Defra, Area 1A Nobel House, 17 Smith Square, London SW1P 3JR