Commentary - Company Insolvency Statistics April to June 2021

Published 30 July 2021

Released

30 July 2021

Next release

29 October 2021

Media enquiries

Steven Fifer

+44 (0)30 3003 1568

Statistical enquiries

Becca Wedge-Roberts (author)

Kate Palmer (responsible statistician)

1. Main messages for England and Wales

- One in 386 active companies (at a rate of 25.9 per 10,000 active companies) entered liquidation between 1 July 2020 and 30 June 2021. This is a decrease from the 36.9 per 10,000 active companies that entered liquidation in the 12 months ending 30 June 2020.

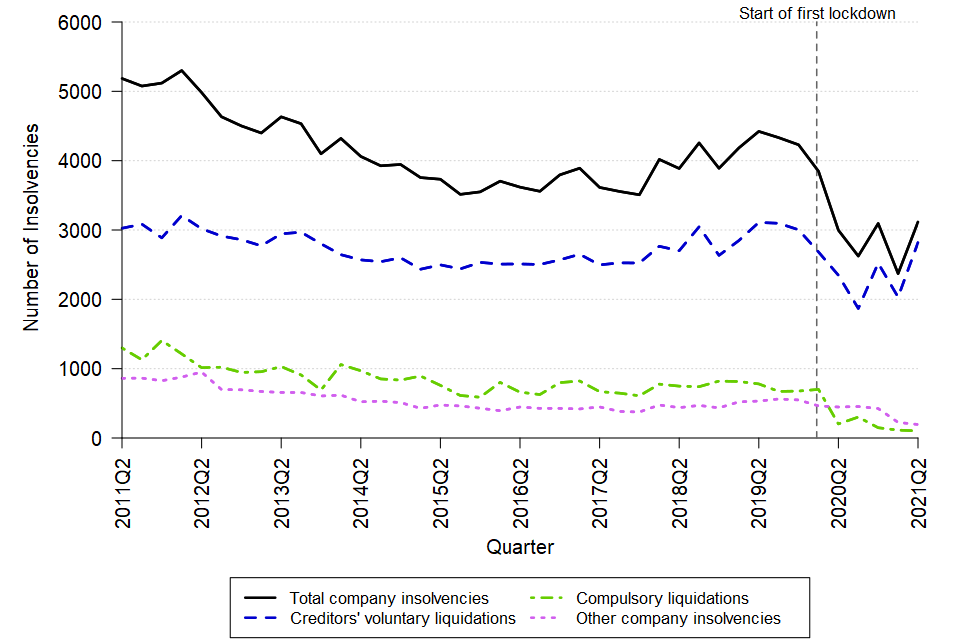

- During Q2 2021, there were 3,116 (seasonally adjusted) registered company insolvencies, as shown in Figure 1, comprising 2,819 creditors’ voluntary liquidations (CVLs), 102 compulsory liquidations, 169 administrations, 25 company voluntary arrangements (CVAs), and one receivership appointment.

- After seasonal adjustment, the number of company insolvencies was 31% higher than in Q1 2021 and 4% higher than in Q2 2020. This was driven by an increase in CVLs, while all other company insolvency procedures were lower than the previous quarter and the same quarter of the previous year.

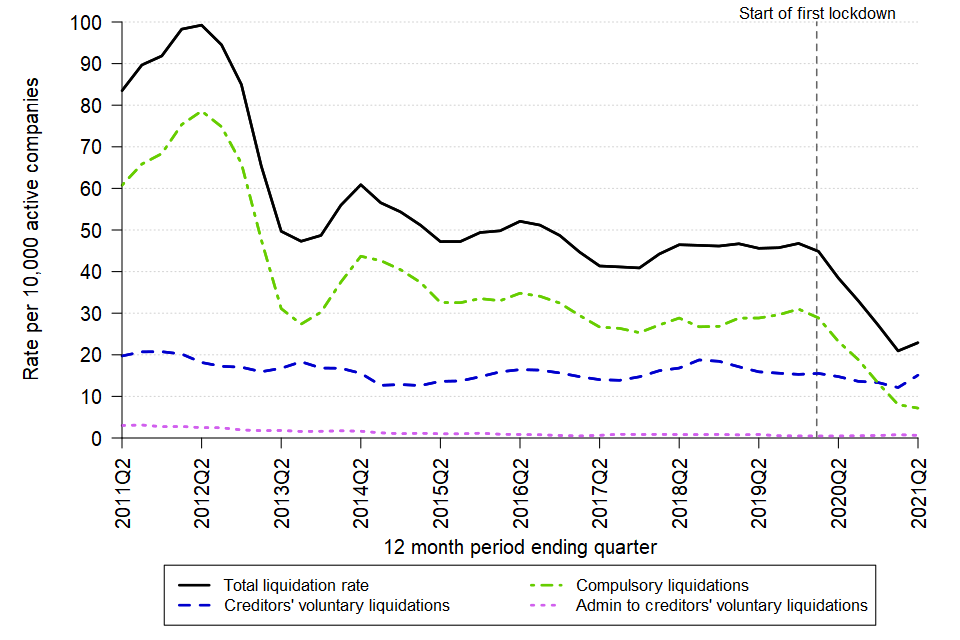

Figure 1: Registered company insolvencies increased in Q2 2021, driven by an increase in CVLs, but remained lower than pre-pandemic levels.

England and Wales, Q2 2011 to Q2 2021, seasonally adjusted

A line chart showing the change over time in the quarterly number of company insolvencies in England and Wales between Q2 2011 and Q2 2021. The data can be found in Table 1a of the accompanying tables. [Sources: Insolvency Service (compulsory liquidations only); Companies House (all other insolvency procedures)]

Note that bulk CVLs were previously presented in Figure 1. These have been removed but can be found in the accompanying tables. Further information on bulk CVLs can be found in the Glossary.

The long-term series back to Q1 1984 (where applicable) can be found in the csv file that accompanies this release.

Overall numbers of company insolvencies have remained low since the start of the first UK lockdown in March 2020, when compared with pre-pandemic levels. This is likely to be partly driven by government measures put in place in response to the coronavirus (COVID-19) pandemic, including:

- Temporary restrictions on the use of statutory demands and certain winding-up petitions (leading to company compulsory liquidations).

- Enhanced government financial support for companies and individuals.

As the Insolvency Service does not record whether an insolvency is directly related to the coronavirus pandemic, it is not possible to state its direct effect on insolvency volumes.

2. Things you need to know about this release

This statistics release contains the latest data on company insolvency in the UK, presenting the numbers of companies who have entered a formal insolvency procedure after being unable to pay their debts. Information is presented separately for England and Wales, Scotland and Northern Ireland.

The Insolvency Service separately publishes monthly statistics to provide more up to date information on the numbers of company and individual insolvencies during this time of economic uncertainty. However, they have not replaced the quarterly National Statistics, since the information presented on a monthly basis is less granular and is less reliable for monitoring changes in trends over time. Note that the monthly statistics on company insolvencies may not be consistent with data presented within this statistical release.

Underlying data for these quarterly statistics for England and Wales were adjusted where there was evidence of seasonality, to account for variation in company insolvencies across the year and allow for comparison to the most recent period within years. Data for Scotland and Northern Ireland were not adjusted. The seasonal adjustment models are typically reviewed on an annual basis. However, the trend in individual insolvencies during the 2020/21 financial year has reflected a very different pattern to that seen in previous years; largely a result of the coronavirus (COVID-19) pandemic. Therefore the 2021 review was not conducted, and 2021 data will continue to be seasonally adjusted using the 2020 model. See methodology section for further details.

Quarters referred to in this publication are calendar year quarters, such that Q2 2021 is the period from 1 April to 30 June 2021.

2.1 Designation as National Statistics

The United Kingdom Statistics Authority has designated these statistics as National Statistics, in accordance with the Statistics and Registration Service Act 2007 and signifying compliance with the Code of Practice for Statistics. Once statistics have been designated as National Statistics it is a statutory requirement that the Code of Practice shall continue to be observed.

The last compliance review was conducted in July 2019.

Designation can be broadly interpreted to mean that the statistics meet identified user needs; are well explained and readily accessible; are produced according to sound methods, and are managed impartially and objectively in the public interest.

3. Company insolvency in England and Wales

3.1 Numbers of company insolvencies

After seasonal adjustment (where applicable), there were 3,116 company insolvencies registered in Q2 2021, 31% higher than the number of company insolvencies registered in the previous quarter and 4% higher than during the same quarter in the previous year.

Creditors’ voluntary liquidations (CVLs) were the most common company insolvency procedure (90% of cases), followed by administrations (5% of cases), compulsory liquidations (3% of cases) and company voluntary arrangements (CVAs; 1% of cases). There was only one receivership appointment, which are now rare (see glossary for further details) and due to small numbers percentage changes were not calculated. A summary of company insolvencies since Q2 2020 can be found in Table 1 below. The long-term series prior to Q2 2020 can be found in the excel and csv files that accompany this release.

Unlike the monthly statistics, quarterly statistics are seasonally adjusted to account for seasonal variation in insolvencies across the year and allow for comparison to the most recent period within years.

Table 1: The total number of registered company insolvencies in Q2 2021 was the highest seen since the start of the pandemic, driven by an increase in CVLs

England and Wales, Q2 2020 to Q2 2021, seasonally adjusted

| Total company insolvencies | Compulsory liquidations | CVLs | Administrations | CVAs | Receiverships | |

|---|---|---|---|---|---|---|

| 2020Q2 | 2,997 | 203 | 2,347 | 399 | 47 | 1 |

| 2020Q3 | 2,624 | 302 | 1,868 | 390 | 63 | 1 |

| 2020Q4 | 3,094 | 148 | 2,521 | 345 | 80 | 0 |

| 2021Q1 | 2,371 | 114 | 2,032 | 188 | 37 | 0 |

| 2021Q2 | 3,116 | 102 | 2,819 | 169 | 25 | 1 |

| Percentage change, latest quarter (Q2 2021) compared with: | ||||||

| vs 2021Q1 | 31% | -11% | 39% | -10% | -32% | [z] |

| vs 2020Q2 | 4% | -50% | 20% | -58% | -47% | [z] |

Sources: Insolvency Service (compulsory liquidations only); Companies House (all other insolvency procedures)

[z] indicates percentage changes are not applicable as these have not been calculated where both numbers are less than five.

CVLs

The overall increase in company insolvencies in Q2 2021 was driven by a rise in CVLs which accounted for 90% of all company insolvencies. These increased by 39% from Q1 2021 and were 20% higher than during the same quarter last year, after seasonal adjustment.

Compulsory liquidations

The number of compulsory liquidations in Q2 2021 was lower than numbers in both the previous quarter and the same quarter of 2020 (by 11% and 50% respectively).

Administrations

The number of administrations in Q2 2021 was lower than the numbers in both the previous quarter and the same quarter of the 2020 (by 10% and 58% respectively, after seasonal adjustment).

CVAs

The number of CVAs was lower in Q2 2021 than in Q1 2021 and Q2 2020 (by 32% and 47% respectively).

Receivership appointments

There was only one receivership in Q2 2021, compared to none in the previous quarter.

Since the start of the first UK lockdown the overall numbers of company insolvencies have remained low compared to pre-pandemic levels. The overall reduction in company insolvencies is likely to be in part driven by the range of government support put in place to financially support companies in response to the coronavirus (COVID-19) pandemic. Further details can be found on the Gov.uk website.

The Corporate Insolvency and Governance Act 2020 that came into force on 26 June 2020 introduced new measures to support businesses including: a new moratorium to give companies breathing space from their creditors while they seek a rescue, and a new Companies Act procedure, known as a restructuring plan that allows companies to restructure unmanageable debt. The aim behind both measures is to rescue eligible companies as a going concern where possible, rather than jumping straight into an insolvency procedure.

Between 26 June 2020 and 30 June 2021, five companies had obtained a moratorium and nine companies had a restructuring plan sanctioned by the court. Moratoriums and restructuring plans are not formal insolvency procedures and are therefore not presented in the accompanying tables.

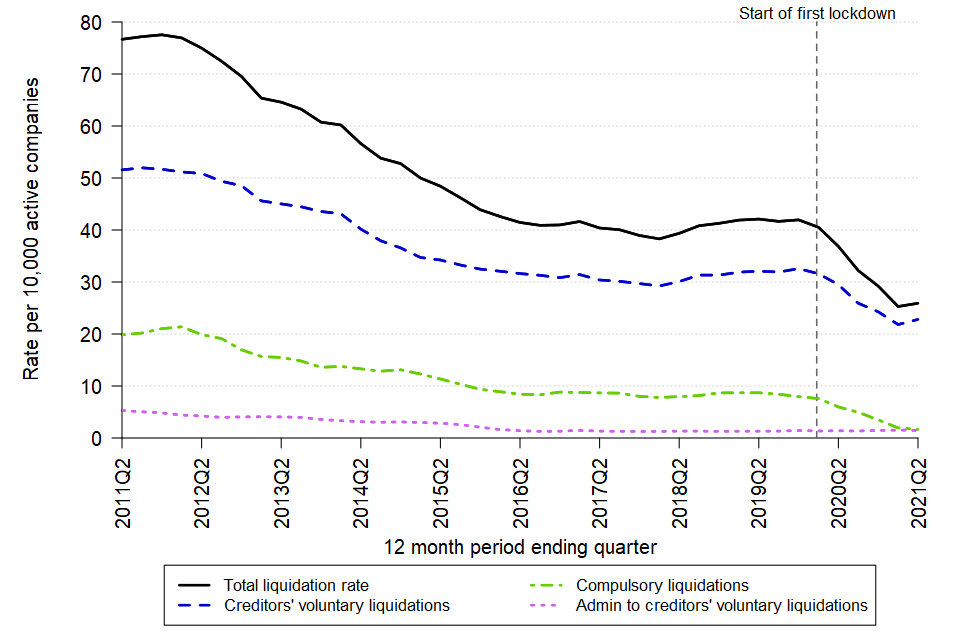

3.2 Liquidation rates per 10,000 active companies

In the four quarters ending Q2 2021, the company liquidation rate was 25.9 per 10,000 active companies in England and Wales (Table 2 and Figure 2 below). This corresponds to 1 in 386 companies becoming liquidated in the 12 months ending Q2 2021.

The insolvency rate gives an indication of the probability of a company entering liquidation in the previous 4 quarters. As the rates are calculated as a proportion of the total number of active companies, they are more comparable over longer time periods than the absolute numbers.

The rates presented for each quarter reflect a 4-quarter rolling rate per 10,000 active companies. Therefore, the Q2 2021 rates, for example, were calculated using data covering the period Q3 2020 to Q2 2021.

Table 2: The rate of company insolvencies in the 12 months ending Q2 2021 was similar to during the previous quarter but lower than Q2 of the previous year

England and Wales, 4-quarter rolling rate per 10,000 active companies

| Total liquidations | Compulsory Liquidations | CVLs | CVL following Administration | |

|---|---|---|---|---|

| 2020Q2 | 36.9 | 6.0 | 29.5 | 1.4 |

| 2020Q3 | 32.2 | 4.9 | 25.9 | 1.3 |

| 2020Q4 | 29.2 | 3.5 | 24.3 | 1.5 |

| 2021Q1 | 25.3 | 1.9 | 21.8 | 1.5 |

| 2021Q2 | 25.9 | 1.6 | 22.8 | 1.5 |

| Change in rate per 10,000 active companies, 12 months ending latest quarter (Q2 2021) compared with: | ||||

| vs 2021Q1 | 0.6 | -0.3 | 1.0 | -0.1 |

| vs 2020Q2 | -10.9 | -4.3 | -6.7 | 0.1 |

Source: Insolvency Service (compulsory liquidations only); Companies House (all other insolvency procedures)

Change in rate numbers may not equal the difference in rates presented due to rounding.

The long-term series back to Q1 1984 (where applicable) can be found in the csv file that accompanies this release.

The overall rate of company insolvency for the four quarters ending Q2 2021 was similar to the rate of company insolvency for Q1 2021 but lower than the four quarters ending Q2 2020.

In the four quarters ending Q2 2021:

- The rate of compulsory liquidation fell by 0.3 per 10,000 active companies from Q1 2021, and by 4.3 from Q2 2020;

- the rate of CVLs rose by 1.0 from Q1 2021, but fell by 6.7 from Q2 2020; and

- the rate of CVLs after administration fell by just 0.1 from Q1 2021 and rose by 0.1 from Q2 2020. Note that CVLs following administration are not new insolvency procedures, and are counted as administrations in Table 1.

Figure 2: The liquidation rate in the 12 months ending Q2 2021 fell compared to the 12 months ending Q2 2020, but increased from the previous quarter for the first time since the start of the pandemic.

England and Wales, 4-quarter rolling rate per 10,000 active companies, not seasonally adjusted

A line chart showing the change over time in the liquidation rate in England and Wales between Q2 2011 and Q2 2021. The data can be found in Table 3a of the accompanying tables.

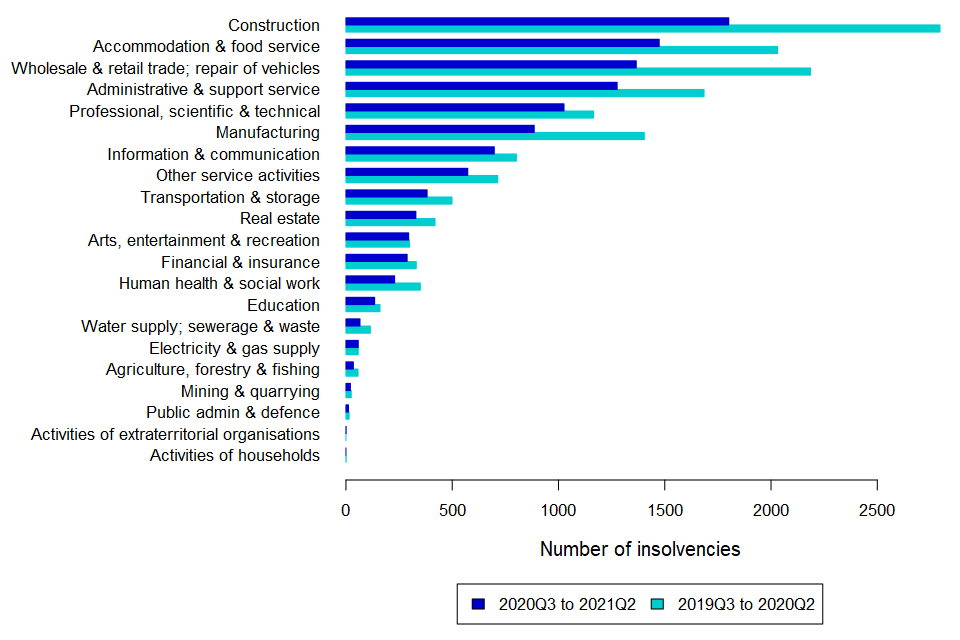

3.3 Company insolvencies by industry (SIC 2007)

The following analysis excludes insolvencies where the company industry was unknown, non-trading or dormant (233 in the 4 quarters ending Q2 2021, compared to 262 in the 4 quarters ending Q2 2020). In some cases, confirmation of industry sector for compulsory liquidations may be delayed by one quarter or more and therefore overall insolvencies by industry are provisional.

The three industries (in accordance with SIC 2007) that experienced the highest number of insolvencies in the 12 months ending Q2 2021 were:

- Construction (1,801 insolvencies, 16% of cases with industry captured);

- Accommodation and food services activities (1,474 insolvencies, 13% of cases with industry captured); and

- Wholesale and retail trade; repair of vehicles (1,366 insolvencies, 12% of cases with industry captured);

The construction industry tends to have the highest quarterly number of insolvencies of any industrial grouping.

Decreases in insolvencies were seen across most industries in the previous 4 quarters compared to the 12 months ending Q2 2020, as shown in Figure 3. Notably, insolvencies in the construction industry were 36% lower than during the 12 months ending Q2 2020.

The numbers in these categories are likely to be driven by the number of active companies in a given category rather than the relative likelihood of companies in each industry entering insolvency.

Figure 3: Most industries saw fewer insolvencies in the four quarters ending Q2 2021 than in the period ending Q2 2020

England and Wales, Q3 2019 to Q2 2021, non-seasonally adjusted

A bar chart showing number of company insolvencies by industry in England and Wales in the four quarters ending Q2 2021 and the four quarters ending Q2 2020. The data can be found in Table A1a of the accompanying industry tables. [Sources: Insolvency Service (compulsory liquidations only); Companies House (all other insolvency procedures)]

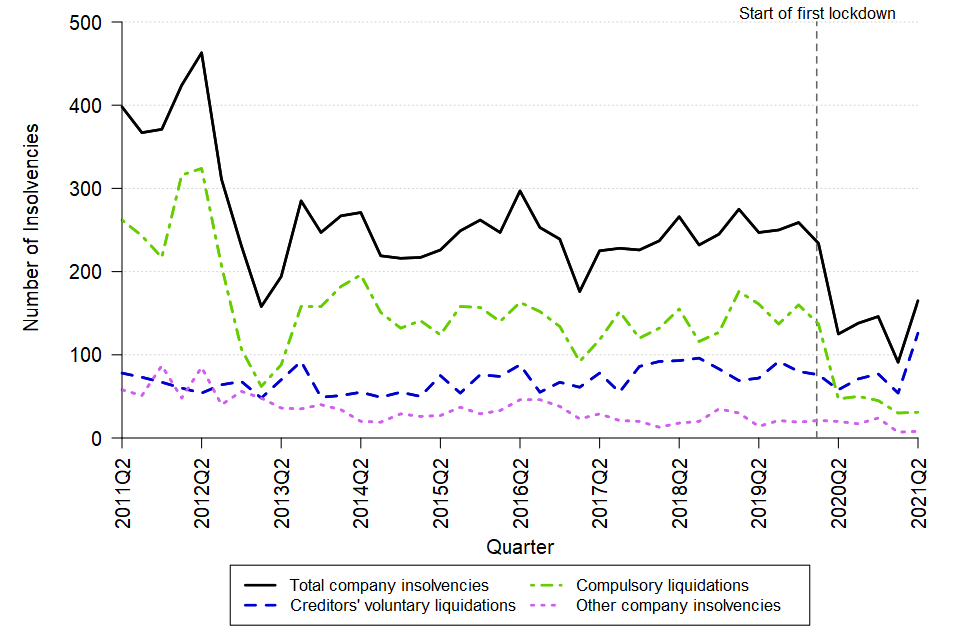

4. Company insolvency in Scotland

Legislation relating to company insolvency in Scotland is devolved. The Accountant in Bankruptcy, Scotland’s Insolvency Service, administers company insolvency in Scotland. The figures below are not seasonally adjusted.

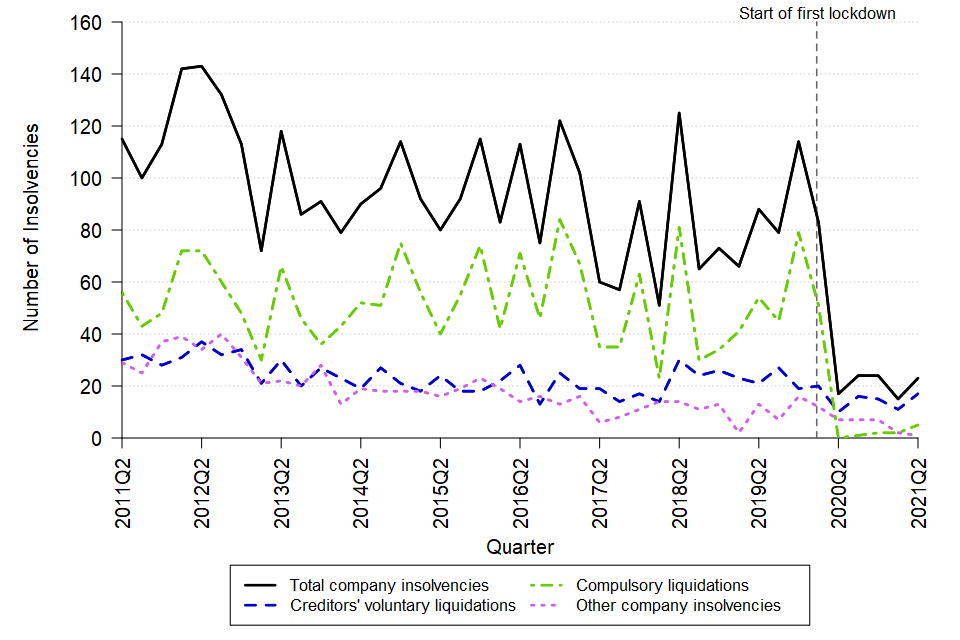

In Q2 2021, there were 165 total company insolvencies in Scotland, 32% higher than during the same quarter of 2020. This comprised 31 compulsory liquidations, 126 CVLs, seven administrations and one CVA. There were no receivership appointments. These numbers are shown in Figure 4.

Figure 4: Company insolvencies were higher in Q2 2021 than in the same quarter last year, but remained lower than pre-pandemic levels

Scotland, Q2 2011 to Q2 2021, not seasonally adjusted

A line chart showing the change over time in the quarterly number of company insolvencies in Scotland between Q2 2011 and Q2 2021. The data can be found in Table 4 of the accompanying tables. [Source: Companies House]

Historically, the numbers of company insolvencies in Scotland have been driven by compulsory liquidations. However, in the last five quarters there have been fewer compulsory liquidations than CVLs.

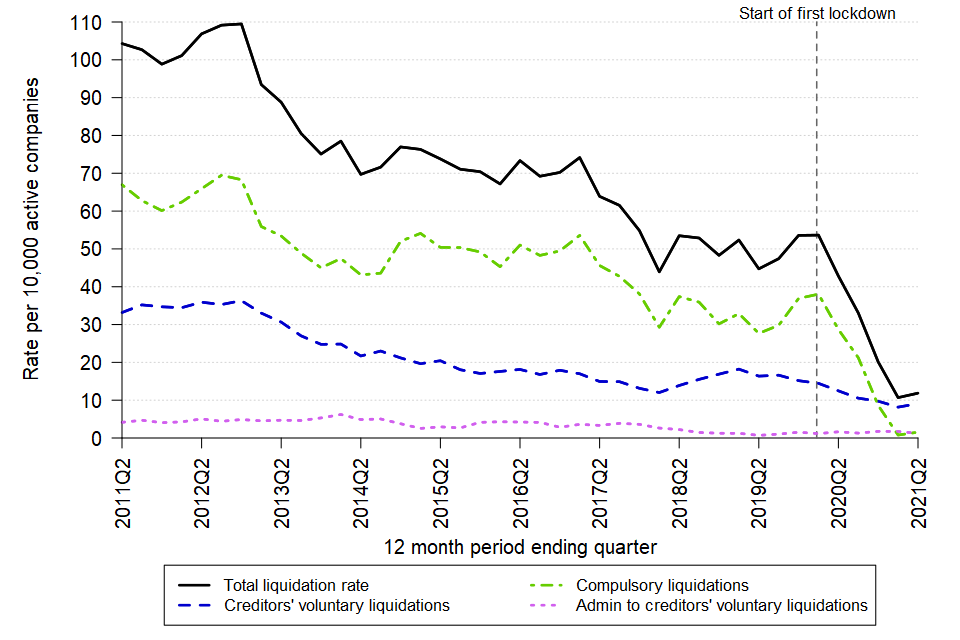

The total liquidation rate in Scotland for the 12 months ending Q2 2021 was 22.9 per 10,000 active companies, as shown in Figure 5. This is down by 15.5 (from a rate of 38.4 per 10,000 active companies) from the 12 months ending Q2 2020.

Figure 5: Overall liquidation rates in Scotland fell in the 12 months ending Q2 2021 compared to the 12 months ending Q2 2020, but increased from the previous quarter

Scotland, Q2 2011 to Q2 2021, not seasonally adjusted

A line chart showing the change over time in the liquidation rate in Scotland between Q2 2011 and Q2 2021. The data can be found in Table 5 of the accompanying tables. [Source: Companies House]

5. Company insolvency in Northern Ireland

Company insolvency in Northern Ireland is governed by separate, but broadly similar, legislation to England and Wales, and so figures are presented separately.

There were 23 company insolvencies in Northern Ireland in Q2 2021, an increase of 35% on the same quarter of 2020. This comprised 17 CVLs, one administration and five compulsory liquidations. There were no CVAs or administrative receiverships. These numbers can be seen in Figure 6.

Figure 6: Company insolvencies in Northern Ireland remain lower than pre-pandemic levels

Northern Ireland, Q2 2011 to Q2 2021, not seasonally adjusted

A line chart showing the change over time in the quarterly number of company insolvencies in Northern Ireland between Q2 2011 and Q2 2021. The data can be found in Table 6 of the accompanying tables. [Sources: Department for the Economy, Northern Ireland (compulsory liquidations only); Companies House (all other insolvency procedures)]

The total liquidation rate in the 12 months ending Q2 2021 in Northern Ireland was 11.9 per 10,000 active companies, as shown in Figure 7. This is a decrease of 31 (from a rate of 42.8 per 10,000 active companies) from the 12 months ending Q2 2020.

Figure 7: Liquidation rates in Northern Ireland fell in the 12 months ending Q2 2021 compared to the 12 months ending Q2 2020

Northern Ireland, Q2 2011 to Q2 2021, not seasonally adjusted

A line chart showing the change over time in the liquidation rate in Northern Ireland between Q2 2011 and Q2 2021. The data can be found in Table 5 of the accompanying tables. [Sources: Department for the Economy, Northern Ireland (compulsory liquidations only); Companies House (all other insolvency procedures)]

6. Data and Methodology

6.1 Data Sources

Company insolvency data were sourced from Companies House, except for compulsory liquidation data for England and Wales which were sourced from the Insolvency Service, and compulsory liquidation data for Northern Ireland which were sourced from the Department for the Economy.

Companies House data were used to determine all active companies registered in each quarter in the previous twelve months, to calculate insolvency rates for England and Wales. These data are separately published by Companies House on the Gov.uk website.

More information on the administrative systems used to compile insolvency statistics can be found in the Statement of Administrative Sources.

6.2 Methodology and data quality

Seasonal adjustment

To aid analysis between quarters, underlying data for England and Wales were adjusted where there was evidence of seasonality to minimise the effect of the time of year and provide a true picture of the trends in insolvency. Full details on the models used to adjust the data can be found in the Seasonal Adjustment Review published in April 2020.

The data series for Scotland and Northern Ireland do not demonstrate consistent seasonality and only the unadjusted series have been presented, as agreed with the appropriate officials in the devolved administrations.

The seasonal adjustment models for England and Wales are typically reviewed on an annual basis, in accordance with the Insolvency Service Official Statistics Revisions Policy. However, the trend in company insolvencies during the 2020 reflected a very different pattern to that seen in previous years; largely a result of the coronavirus (COVID-19) pandemic. Therefore the 2021 review was not conducted and data for 2021 will continue to be seasonally adjusted using the 2020 model.

Rates of insolvency

Insolvency rates were calculated for England and Wales, Scotland and Northern Ireland. The total number of companies entering insolvency in each location during the previous twelve months was divided by the mean average number of all active companies registered with Companies House in that location in the same twelve-month period.

Further details on the methodology and quality information for these statistics can be found in the accompanying Quarterly Statistics Methodology and Quality document.

The main quality and coverage issues to note:

- This statistical release presents the numbers of creditors’ voluntary liquidations (CVLs), administrations, company voluntary arrangements (CVAs) and receivership appointments based on their registration date at Companies House, and therefore reflect company insolvency registrations rather than insolvency procedure start dates.

- Compulsory liquidation numbers are marked provisional as any cases that are later annulled or rescinded will be removed from future releases to avoid duplication should the company enter insolvency again in the future.

- These statistics may not equal the sum of monthly statistics, published separately, which cover the period January 2019 to June 2021, due to differing methodologies including seasonal adjustment. In addition, the administrative systems used to capture data are live systems and are subject to amendments.

- These statistics may not align with information published separately by Companies House, or with data extracted from the Gazette. Further information on why numbers may not align can be found in the accompanying Methodology and Quality document.

6.3 Revisions

These statistics are subject to scheduled revisions, as set out in the published Revisions Policy. Other revisions tend to be made as a result of data being entered onto administrative systems after the cut-off date for data being extracted to produce the statistics. Any revisions to these statistics will be marked with an ‘[r]’ in the relevant table.

Non-routine revisions since previous release

Bulk creditors’ voluntary liquidations (see glossary) were previously included in the accompanying Industry Tables A1 and A3. These have now been removed, resulting in a large number of revisions between 2016 Q4 and 2019 Q1.

Further details on routine and non-routine revisions can be found in the accompanying Quarterly Statistics Methodology and Quality document.

7. Glossary

Key Terms used within this statistical bulletin

| Term | Definition |

|---|---|

| Administration | The objective of administration is the rescue of the company as a going concern, or if this is not possible then to obtain a better result for creditors than would be likely if the company were to be wound up. A licensed insolvency practitioner, ‘the administrator’, is appointed to manage a company’s affairs, business and property for the benefit of the creditors. |

| Bulk Creditors’ voluntary liquidation | IR35 rules are intended to prevent the avoidance of tax and National Insurance contributions using personal service companies and partnerships. Between April 2016 and early 201, following changes to the IR35 rules and/or changes in VAT flat rate, some directors of personal service companies had cited these changes as the primary reason that their company’s activities had become unviable, therefore leading to creditors’ voluntary liquidation (CVL) of large numbers of these companies. These additional CVLs are referred to as “bulk insolvencies”. |

| Company voluntary arrangement (CVA) | CVAs are another mechanism for business rescue. They are a voluntary means of repaying creditors some or all of what they are owed. Once approved by 75% or more of creditors, the arrangement is binding on all creditors. CVAs are supervised by licensed insolvency practitioners. |

| Compulsory liquidation | A winding-up order obtained from the court by a creditor, shareholder or director. See Liquidation for details on the process. |

| Creditors’ voluntary liquidation (CVL) | Shareholders of a company can themselves pass a resolution that the company be wound up voluntarily. See Liquidation for details on the process. Administrations which result in a Creditors’ Voluntary Liquidation are recorded separately by Companies House and are excluded from CVL figures as they do not represent a new company entering into an insolvency procedure for the first time. These cases are only ever recorded as Administrations. |

| Liquidation | Liquidation is a legal process in which a liquidator is appointed to ‘wind up’ the affairs of a limited company. The purpose of liquidation is to sell the company’s assets and distribute the proceeds to its creditors. At the end of the process, the company is dissolved – it ceases to exist. Statistics on compulsory liquidations and creditors’ voluntary liquidations are presented in these statistics. A third type of winding up, members’ voluntary liquidation is not included because it does not involve insolvency. |

| Moratorium | Moratoriums were introduced under the Corporate Insolvency and Governance Act 2020 to give struggling businesses formal breathing space in which to explore rescue and restructuring options, free from creditor or other legal action. Except in certain circumstances, no insolvency proceedings can be instigated against the company during the moratorium period. It also prevents legal action being taken against a company without permission from the court. |

| Partnership Winding-up Orders | This is similar to the liquidation of a company. When the partners have decided that the partnership has no viable future or purpose then a decision may be made to cease trading and wind up the partnership. There are two basic ways that the partnership can be wound up: the creditors petition and a partner’s petition. |

| Receivership Appointments | Administrative receivership is where a creditor with a floating charge (often a bank) appoints a licensed insolvency practitioner to recover the money it is owed. Before 2000 receivership appointments also included other, non-insolvency, procedures, for example under the Law of Property Act 1925. The use of this procedure is restricted to certain types of company, or to floating charges, created before September 2003. |

| Restructuring Plan | New restructuring measures were introduced under the Corporate Insolvency and Governance Act 2020 to support viable companies struggling with unmanageable debt obligations to restructure under a new procedure. They allow the court to sanction a plan that binds creditors to a restructuring plan if it is fair and equitable. Creditors vote on the plan, but the court can impose it on dissenting classes of creditors (‘cram down’) provided that the necessary conditions are met. |

| Standard Industrial Classification (SIC 2007) | Used in classifying business establishments and other statistical units by the type of economic activity in which they are engaged. Further information can be found on the ONS website |