Civil Justice Statistics Quarterly: October to December 2020

Published 4 March 2021

1. Main Points

| Covid-19 and associated actions have had an impact on all civil actions | This quarter, civil justice actions remain below pre-Covid-19 levels. However, the marked recovery seen last quarter has continued for some actions following the impact of measures undertaken by the courts. |

| Decrease in County Court claims driven by specified money claims | In October to December 2020, County Court claims were down 16% on the same period in 2019, to 400,000. Of these, 335,000 were specified money claims (down 13%). |

| Unspecified money claims were up 4% to 31,000 | The slight increase in unspecified money claims was driven by an increase in Other unspecified money claims (up 115% to 7,100. This increase was offset by Personal Injury claims (down 10% to 24,000). |

| The number of claims defended and number of trials has decreased | There were 69,000 claims defended (down 5%) and 13,000 claims that went to trial in October to December 2020 (down 23%). |

| Mean time taken from claim to hearing has increased | The mean time taken for small claims and multi/fast track claims to go to trial was 51.2 weeks and 73.9 weeks, 14.1 weeks longer and 13.0 weeks longer than the same period in 2019 respectively. |

| Judgments were down 32% and default judgments were also down 32% | Judgments were down 32% (to 214,000) in October to December 2020, compared to the same period in 2019; with 88% of these being default judgments. |

| 15,000 enforcement applications and 9,200 enforcement orders made | Enforcement applications were down 40% while enforcement orders were down 44%. |

| 34,000 warrants were issued | Warrants issued were down 50% when compared to same quarter in 2019 - driven by a decrease in warrants of control. |

| 2,800 judicial review applications in 2020 | There were 2,800 applications for Judicial Reviews in 2020, down 16% on the same period in 2019. Of the 1,500 cases in 2020 that reached the permission stage, 260 (17%) were found to be ‘totally without merit’. |

This publication gives civil county court statistics for the latest quarter (October to December 2020), compared to the same quarter of the previous year. The judicial review figures cover the period up to October to December 2020. For more details, please see the supporting document.

Statistics on the Business and Property Court for England and Wales have also been published alongside this quarterly bulletin as Official Statistics. For technical detail, please refer to the accompanying support document.

For general feedback related to the content of this publication, please contact us at: CAJS@justice.gov.uk

2. Statistician’s comment

The impact of Covid-19 continues to be seen across all Civil Justice data this quarter. While the start of recovery has been noticeable, for example in claim and defence volumes, this increase has been gradual and volumes are still significantly below previous (pre-Covid) trends. This is evident in the volume of cases that have gone to trial this quarter which is a further increase on the rise from the last quarter and now just over three quarters of what it was in the same period last year. Volumes of claims defended are even closer to trend levels, just 5% lower than the same period in 2019. The mean time taken from claim to hearing has been significantly negatively impacted by Covid-19.

The only increase in volumes has been seen in unspecified money claims, which increased by 4% compared to the same period in 2019, driven by a marked increase in “other” unspecified money claims (up 115% on the same quarter in 2019). This increase is as a result of PPI-related claims that rely on a section of the Consumer Credit Act that relates to unfair relationships and follows a series of court rulings on the matter.

Due to the nature of Civil claims and while Covid-19 restrictions remain in place, it may be some time until any improvements as a result of recovery measures taken begin to show in the data and claim volumes and timeliness return to historic trend levels. Nightingale courts continue to be used to provide additional venues to help cope with demand.

While these statistics are still believed to be of interest to the public, it is worth noting that the significantly reduced volumes of claims being registered mean that the data is unlikely to be representative of general trends in civil actions. Caution should therefore be used when interpreting and applying these figures.

3. Claims Summary

County court claims were down 16% on the same quarter of 2019, driven by money claims.

There were 400,000 County Court claims lodged in October to December 2020. Of these, 367,000 were money claims (down 12% from October to December 2019).

Non-money claim volumes were at 33,000, down 47% when compared to the same quarter last year.

Mortgage and landlord possession claims were down 73% over the same period to 8,600, ‘other non-money claims’ were down 17% to 23,000 and claims for return of goods were down 52% to 1,200.

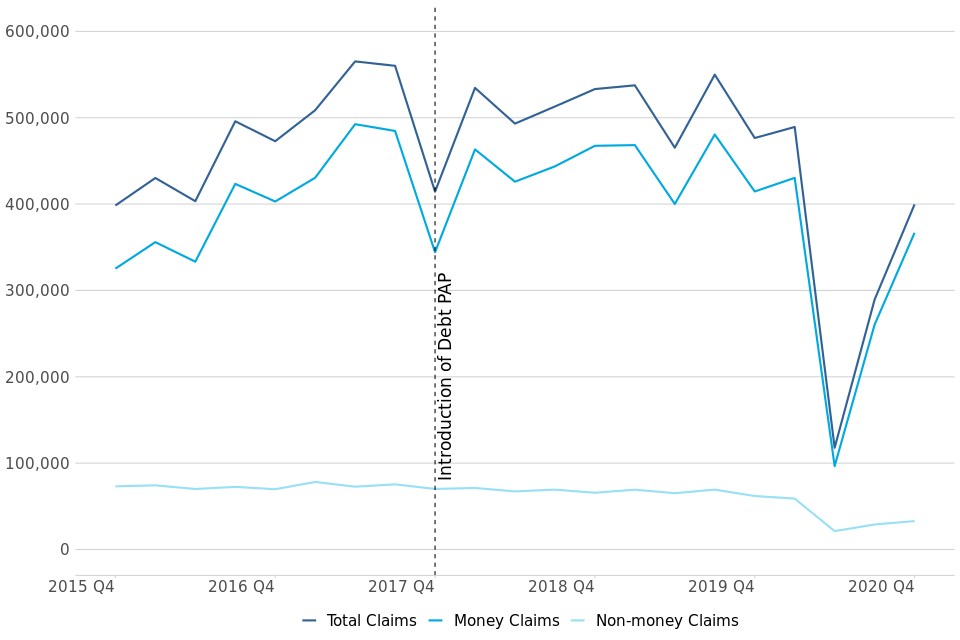

Figure 1: County Court claims by type, Q4 (October to December) 2015 to Q4 (October to December) 2020 (Source: table 1.2)

In the most recent quarter, total claims were down 16% compared to the same period in 2019 (from 477,000 to 400,000). Of these, 367,000 were money claims, down 12% from October to December 2019 (from 415,000). Money claims made up 92% of all claims in October to December 2020 in comparison to 87% of total claims in October to December 2019 (up 5pp).

Prior to the previous quarter, County Court claims had been generally increasing from 2015, reaching a peak of 565,000 claims in April to June 2017. This increase was driven by a rise in money claims, which make up the majority of claims received. Prior to 2020, claim volumes have been relatively unchanged but volatile, driven by a few “bulk issuers” slowing down and then ramping up their volume of claims. Claim volumes decreased significantly following the outbreak of Covid 19, with volumes this quarter representing only a partial recovery towards pre-Covid levels.

Non-money claims have been generally decreasing since 2015. While these showed less of an impact following Covid-19 in contrast to money claims, the recovery of the volumes of non-money claims to pre-Covid volumes has been slow. In the current quarter, these claims were down 47% (from 62,000 to 33,000) compared to the same period in 2019.

Within non-money claims, ‘other’ non-money claims have shown a decline since 2018. In the most recent quarter, these were down 17% (from 28,000 to 23,000) compared to the same period in 2019.

The overall trend in Mortgage and Landlord Possession claims has been decreasing since a peak of 60,000 in January to March 2014. There were 8,600 claims in October to December 2020, down 73% compared to the same quarter of 2019 (32,000 claims). This decrease has been driven by a fall in all claims types since March 2020 due to actions following Covid19. Further details can be found in the Mortgage and Landlord Possessions publication annex here.

Claims for return of goods increased steadily to a high of over 3,000 in July-September 2018, with this trend stabilising in recent quarters. This quarter, as for other claim types, claims for return of goods were down 52% (from 2,500 to 1,200) in October to December 2020 compared to the same period in 2019.

4. Money Claims

Specified money claims were down 13% (to 335,000 claims) in October to December 2020 compared to the same quarter in 2019, driving the overall trend in money claims.

Specified money claims of up to (and including) £1,000 were down 13% over this period to 200,000, driving the overall trend in specified money claims.

Unspecified claims were up 4% to 31,000, driven by a rise in personal injury claims (down 10% to 24,000) compared to the same quarter in 2019.

Personal Injury claims accounted for 77% of all unspecified money claims in the most recent quarter, down 12pp on October to December 2019, when they accounted for 89% of all claims.

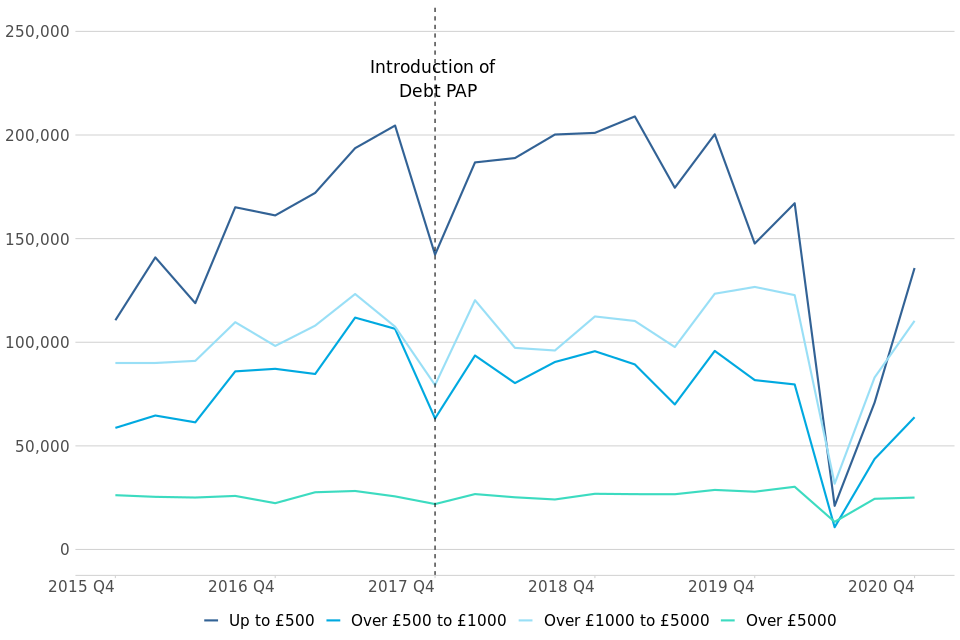

Figure 2: Specified money claims by monetary value, Q4 (October to December) 2015 to Q4 (October to December) 2020 (Source: civil workload CSV)

Historically, specified money claims reached a peak in October to December 2017, at which point the implementation of the Pre-Action Protocol (PAP) for Debt Claims in October 2017 led to a sharp drop in claims. An increasing trend resumed the following quarter, suggesting that the impact of the PAP on claim volumes was temporary. The main aim of the protocol is to encourage early engagement between parties to resolve disputes without needing to start court proceedings. In the most recent quarter (October to December 2020), there were 335,000 claims, down 13% on the same quarter in 2019 (384,000 claims).

This quarter, the majority (84%) of specified money claims were processed and issued at the County Court Business Centre (CCBC). There were 282,000 such claims at the CCBC in October to December 2020 (down 11% on the same quarter in 2019). CCBC claims have been particularly affected by Covid-19 and associated actions, with a more significant decrease than other specified money claims, and consequently they made up a smaller proportion of specified money claims than in previous quarters (for example, making up 83% of specified money claims in October to December 2019). This is as a result of bulk issuers almost completely ceasing their issue during the immediate response to the pandemic and only slowly starting to increase these volumes these past two quarters.

The change in specified money claims is driven by lower value claims (under £1,000). These were down 13% to 200,000 claims in the period October to December 2020, compared to 2019, and account for just 60% of total specified money claims in the most recent quarter. This is a return to historical levels following the previously noted significant decline, with this category makeing up 60% of total specified money claims in October to December 2019. When compared to the same quarter in the previous year, the next claim band (above £1,000 up to and including £5,000) was similarly affected, down 13% to 110,000 claims. As a result, this value bracket made up 33% of total specified money claims in the most recent quarter, compared to 33% in October to December 2019.

Other than Q2 2020, unspecified money claims have fluctuated between 30,000 and 39,000 claims each quarter over the last five years (since October to December 2015). More recently, the volumes were up 4% in October to December 2020 compared to the same period in 2019 (up from 30,000 to 31,000). This was driven by other unspecified money claims, up 115% from 3,300 to 7,100. This was partially offset by a fall in personal injury claims, down 10% compared to the same period in 2019 (from 27,000 to 24,000). The increase in other unspecified money claims is as a result of PPI-related claims that rely on a section of the Consumer Credit Act that relates to unfair relationships and follows a series of court rulings on the same matter.

4.1 County court claims by month and 5-year average

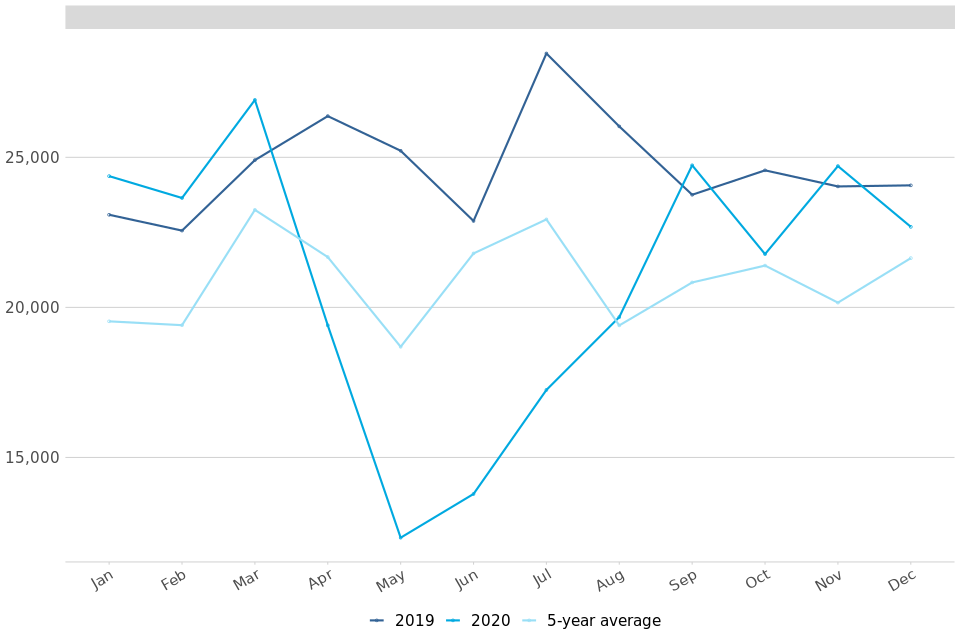

Claims for quarters 1 to 4 of 2020 – which covers the peak Covid-19 period, have been shown by month (figure 3) to further examine the impact of Covid-19 and related actions on claim volumes in county courts.

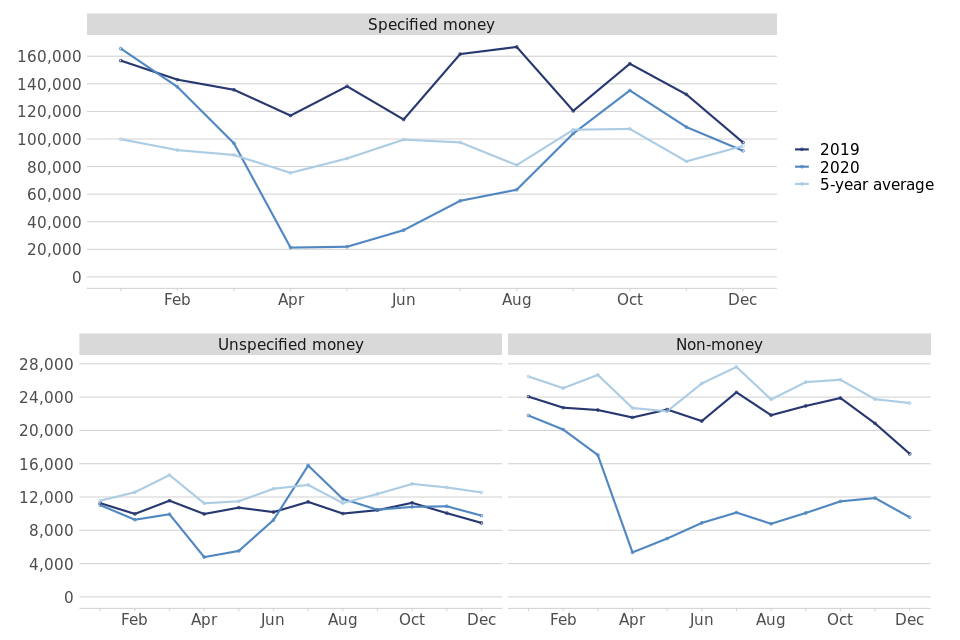

Figure 3: Monthly county court claims by type, January-December 2019 and 2020, and 5-year average

A pronounced trend is visible for specified money claims; the initial fall in volumes was seen in March (down 29% on 2019 and up 10% on the five-year average), coinciding with wide-scale closure of courts[footnote 1] across England and Wales as a result of Covid-19, and many bulk claim issuers “pausing” new claims following guidance from the FCA[footnote 2]. This was followed by further falls in April and May with just 21,000 and 22,000 claims respectively (down more than 70% on the five-year average in both cases).

The first significant uptick was seen in June, with 34,000 claims. Similar rises were then seen throughout Q3 of 2020; with 55,000 and 63,000 claims in July and August (down 43% and down 22% on the five-year average respectively). After the continued recovery in September 2020, October claim volumes, at 135,000 claims, were up 26% on the 5-year average, although still down 13% on the higher volumes seen in 2019. This recovery seems to have continued into the final two months of the year (109,000 and 91,000 claims respectively) as the levels in this quieter period generally remained somewhere between the 5-year average and the higher 2019 levels.

Unspecified money claim volumes did not see such a significant decline; at the lowest points this reached 4,800 claims in April, down 57% on the five-year average. A partial recovery to pre-Covid levels had commenced by June, with claim volumes only down 29% on the five-year average. By July, volumes had risen to 16,000, up 17% on the five-year average. Following this, claim volumes declined slightly, returning to volumes consistent with previous years in August and September and this pattern continued in the fourth quarter (11,000, 11,000 and 9,800 claims for October, November and December respectively).

In contrast, non-money claim volumes had declined significantly by April, reaching just 5,400 claims, down 76% on the five-year average. Following this, volumes rose slightly through May-July, reaching a high of 10,000 in July, still down 63% on the five-year average. Claim volumes have fluctuated slightly for the rest of the year (11,000, 12,000 and 9,600 claims respectively for the last three months of the year). December was down 59% compared to the 5-year average and showed no signs of returning to pre-Covid levels.

4.2 Allocations (table 1.3)

In October to December 2020, 44,000 money claims were allocated to track, down 9% (from 49,000) on the same period in 2019. A decrease was seen across all tracks, with fast-track allocations showing the largest decline. Compared to October to December 2019, of these allocations:

- 27,000 were allocated to small claims, down 8% on October to December 2019. This accounts for 61% of all allocations (compared to 61% of all allocations in the same quarter of 2019);

- 15,000 were allocated to fast track, down 6% on October to December 2019. This accounts for 33% of all allocations (compared to 32% of all allocations in the same quarter of 2019);

- 2,500 were allocated to multi-track, down 20% on October to December 2019. This accounts for 6% of all allocations (compared to 6% of all allocations in the same quarter of 2019);

5. Defences (including legal representation) and Trials

The number of claims defended was down 5% to 69,000 compared to the same quarter in 2019.

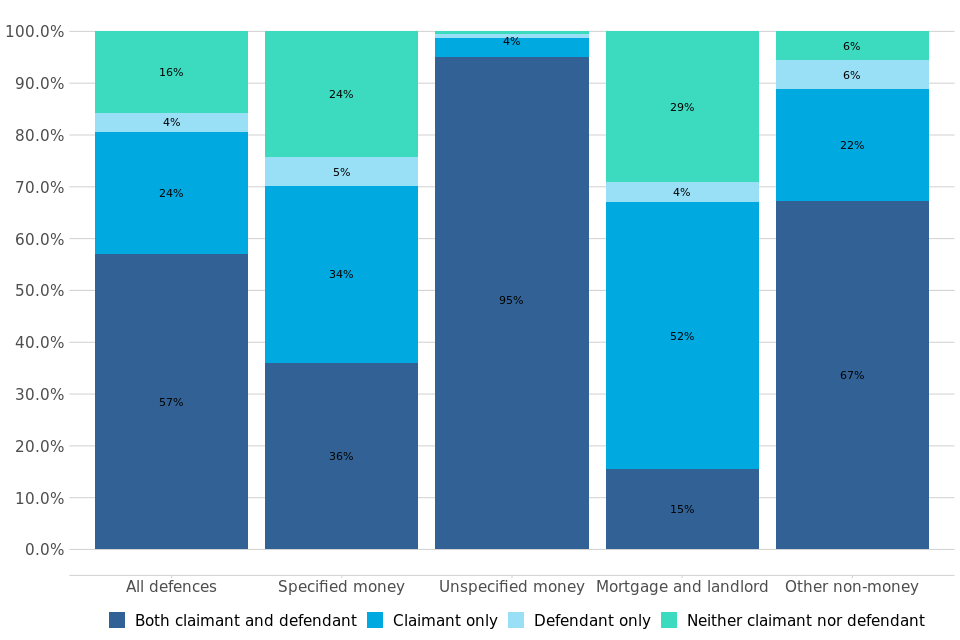

Of those claims defended, 57% had legal representation for both claimant and defendant, 24% had representation for claimant only, and 4% for defendant only.

The number of trials was down 23% to 13,000 compared to the same quarter in 2019

Average time taken for small claims was 51.2 weeks (14.1 weeks longer compared to the same quarter in 2019) and for multi and fast track claims it was 73.9 weeks (13.0 weeks longer than October to December in 2019).

Of those claims defended in October to December 2020, 57% had legal representation for both claimant and defendant, 24% had representation for claimant only, and 4% for defendant only. Almost all (95%) unspecified money defences had legal representation for both the defendant and claimant, compared with 36% of specified money defences.

Changes in representation compared to the same quarter last year is primarily influenced by the larger fall in specified money claim volumes in comparison to unspecified money claims, with the latter being more likely to have representation for both parties. It should also be noted that the proportion of unspecified money claims where only the claimant has representation was 4%. This is the highest proportion noted since 2013 (when these figures were first provided) - both parties in such cases usually have representation.

Figure 4: Proportion of civil defences and legal representation status, October to December 2020 (Source: table 1.6)

The total number of claims defended was down 5% in October to December 2020 compared to the same quarter in 2019, from 73,000 to 69,000 cases. This was driven by decreases across all claim types, with the most significant impact from specified money claims being defended (down 4% from 44,000 to 42,000). However, it should be noted that this fall in specified money claims defended (down 4%) is much less than the fall in specified money claims issued (down 13%).

Figure 5: Monthly county court claims defended, January-December 2019 and 2020, and five year average

As with total claims, the monthly breakdown of claims defended in figure 5 shows variance throughout the past three quarters. Due to the time taken from claim to defence, the initial decline in defence volumes was not seen until April, where claims defended were down 10% to 19,000, followed by a more significant fall in May to 12,000 defences. Defence volumes then showed a steady recovery through June and July (14,000 and 17,000 defences respectively). By August, defence volumes were up 1% on the five-year average (20,000 defended claims) and continued to rise, with September 2020 volumes (25,000 defended claims) being up 19% on the 5-year average, as well as up 4% on the higher volumes seen in 2019.

This recovery continued in Q4 but has not been steady. The monthly figures (22,000, 25,000 and 23,000 defended claims for October, November and December respectively) have been volatile. For example, November was up 23% on the 5-year average and up 3% on the higher volumes seen in 2019, whilst December was only up 5% on the 5-year average and down 6% on 2019.

5.1 Trials and Time Taken to Reach Trial (table 1.5)

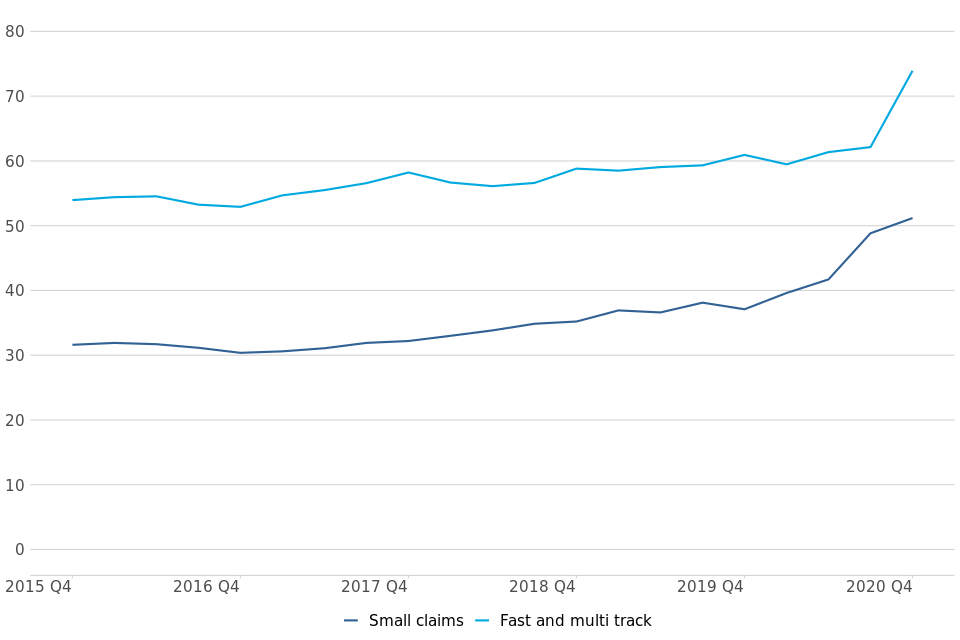

Defended cases which are not settled or withdrawn generally result in a trial. In total, there were 13,000 trials in October to December 2020, down 23% compared to the same period in 2019. Of the claims that went to trial, 9,800 (76%) were small claims trials (down 22% compared to the same quarter in 2019) and 3,100 (24%) were fast and multi-track trials (down 25% from the same quarter of 2019).

Figure 6: Average number of weeks from claim being issued to initial hearing date, Q4 (October to December) 2015 to Q4 (October to December) 2020 (Source: table 1.5)

In October to December 2020, it took an average of 51.2 weeks between a small claim being issued and the claim going to trial, 14.1 weeks longer than the same period in 2019.

Small Claims have been disproportionally impacted by Covid-19 in terms of timeliness for a number of reasons. These claims have shorter timeframes to begin with, and so delays will be observed sooner in the timeliness figures, whereas delayed Fast and Multitrack claims may not yet have reached a hearing. Small claims may also be less suited to remote hearings as they tend to be in person claims rather than professional users.

Measures put in place to help with the backlog of small claims include: Small Claims Mediation (re-referring cases back to mediation) and Early Neutral Evaluation (where a judge will try and engineer agreement without any finding on the fact). These measures, when successful, result in outcomes which are not used within the timeliness calculations. This means the final cases used in timeliness measures include a disproportionate number of more complex cases which take longer to dispose of.

For multi/fast track claims, it took on average 73.9 weeks to reach a trial, 13.0 weeks longer than in October to December 2019 – continuing to exceed the upper limit of the range 2009-2019 (52 to 62 weeks).

Covid-19 and associated actions have led to an uptick in time taken for all claims to reach trial. However it should be noted that this timeliness is calculated from a significantly reduced volume of cases, and is not necessarily representative of a trend. Prior to this, a sustained period of increasing receipts has increased the time taken to hear civil cases and caused delays to case progress. Additional venues have been provided to add temporary capacity to hear cases and help the court and tribunal system to run effectively.

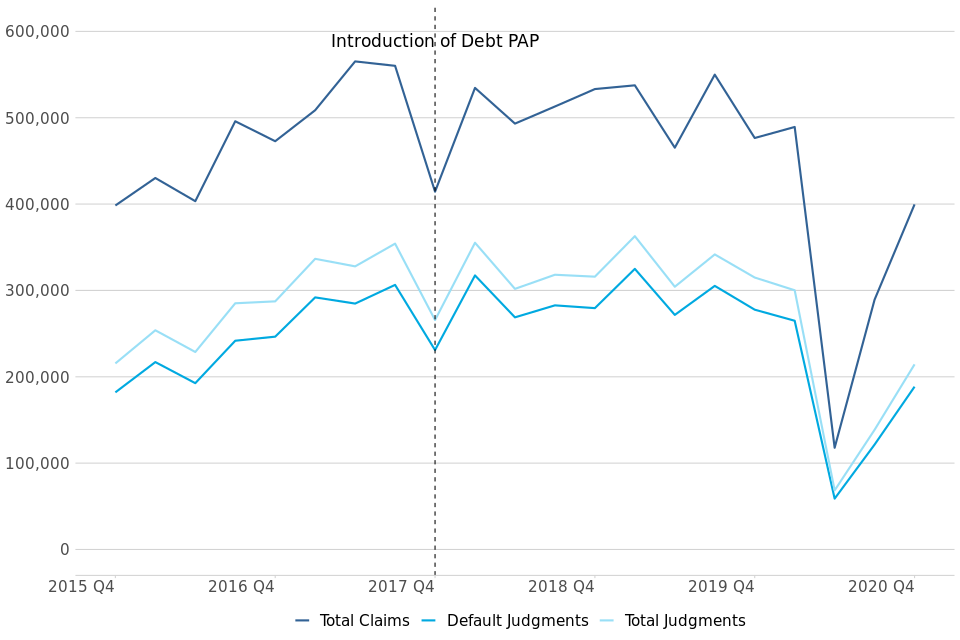

6. Judgments

Judgments were down 32% compared to same quarter in 2019

There were 214,000 judgments made in October to December 2020, in comparison to 315,000 in the same quarter of 2019. Of these judgments, 189,000 (88%) were default judgments.

Figure 7: All claims, judgments and default judgments, Q4 (October to December) 2015 to Q4 (October to December) 2020 (Source: tables 1.2 and 1.4)

There were 214,000 judgments made in October to December 2020, down 32% compared to the same quarter of 2019. Of these, 88% were default judgments. The number of default judgments was down 32% (from 278,000 to 189,000) on October to December 2019.

The second largest type of judgment was ‘judge’, of which there were 8,400 in October to December 2020, down 33% on the same quarter in 2019 (from 13,000). ‘Judge’ judgments accounted for 4% of all judgments.

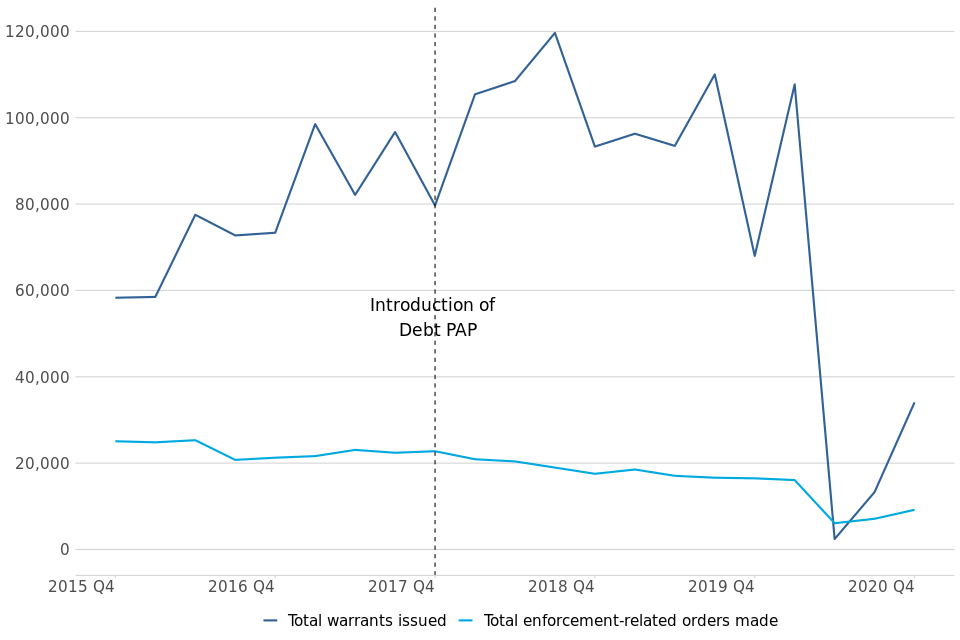

7. Warrants and Enforcements

Warrants issued were down 50% when compared to same quarter in 2019

In October to December 2020, 34,000 warrants were issued, down 50% from 68,000 in the same quarter of 2019. Of these, 32,000 (94%) were warrants of control, down 37% compared to the same period in 2019.

Enforcement applications were down 40% and enforcement orders were down 44% when compared to October to December 2019

All application categories were down on October to December 2019. Attachment of earnings (AoE) applications were down 43% (from 17,000 to 9,600), while AoE orders were down 42% (from 7,500 to 4,300).

Figure 8: Warrants and enforcements issued – Q4 (October to December) 2015 to Q4 (October to December) 2020 (Source: tables 1.7 and 1.8)

7.1 Warrants (table 1.7)

In the latest quarter (October to December 2020) there were 34,000 warrants issued, down 50% (from 68,000) on the same quarter in 2019; this decline was due to the continuing impact of Covid-19 and related actions.

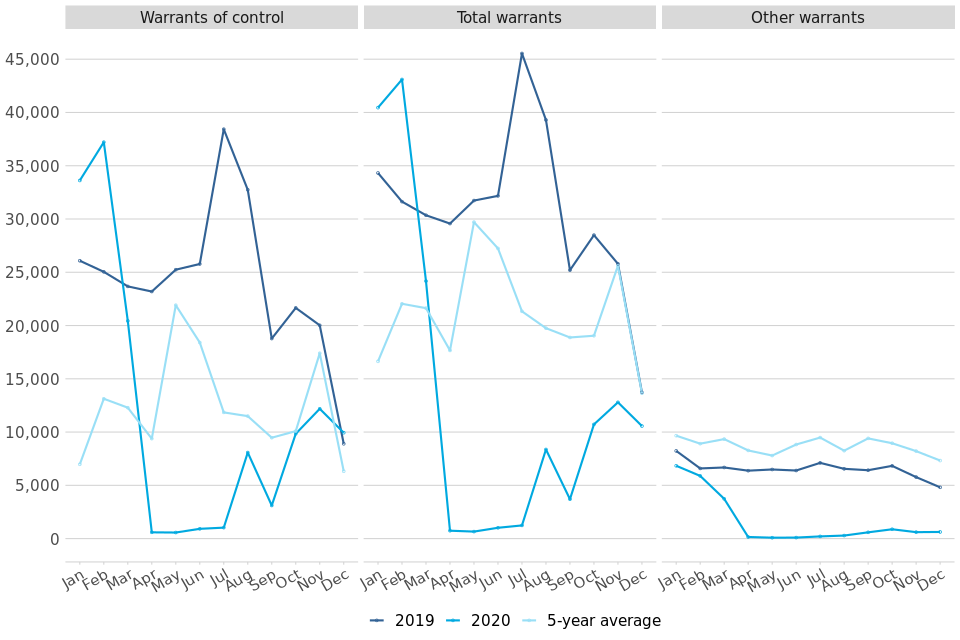

Figure 9: Monthly warrants issued by type, January-December 2019 and 2020, and five year average

A monthly breakdown of warrants issued shows a particularly sharp decline following the initial impact of Covid-19. Following a significant decline in March and April, warrant volumes in April fell to just 740 (down 96% on the five-year average). Volumes remained similarly low for May, June and July (660, 1,000 and 1,200 warrants issued respectively).

Following this, different types of warrants showed different patterns. The volume of warrants of control spiked in August at 8,100 before falling in September 2020 to 3,100, down 67% on the five-year average. This fluctuating pattern was caused by large backlogs being issued by key bulk issuers in August, as well as local Covid restrictions in September. The pattern for the final three months of the year seems to slowly be returning to historical levels but again with the previously explained volatility (9,800, 12,000 and 9,900 warrants of control for October, November and December respectively). This was down 2%, down 30% and up 57% respectively compared to the 5-year average.

In contrast, other warrant types remained consistently low throughout the final few months of the year, with just 880, 610 and 630 other warrants issued in each of the final three months of 2020.

7.2 Enforcements (table 1.8)

In October to December 2020, there were 15,000 enforcement-related order applications (which include attachment of earnings orders, charging orders, third party debt orders, administration orders, and orders to obtain information), down 40% compared to the same quarter of 2019. All application types were down, in particular attachment of earnings (AoE) applications, which were down 43% (from 17,000 to 9,600).

There were 9,200 enforcement-related orders made in October to December 2020, down 44% compared to the same quarter of 2019. As with applications, orders fell across all order types, with the decrease driven by AoE orders, which were down 42% (from 7,500 to 4,300).

Over the longer term, there has been a decreasing trend in enforcement-related applications received and orders made since 2009, possibly due to claimants’ preference for using warrants instead to retrieve money, property or goods.

8. Judicial reviews[footnote 3]

Of the 2,800 applications received in 2020, 55% have already closed, and 260 were found to be ‘Totally Without Merit’ (17% of cases that reached the permission stage).

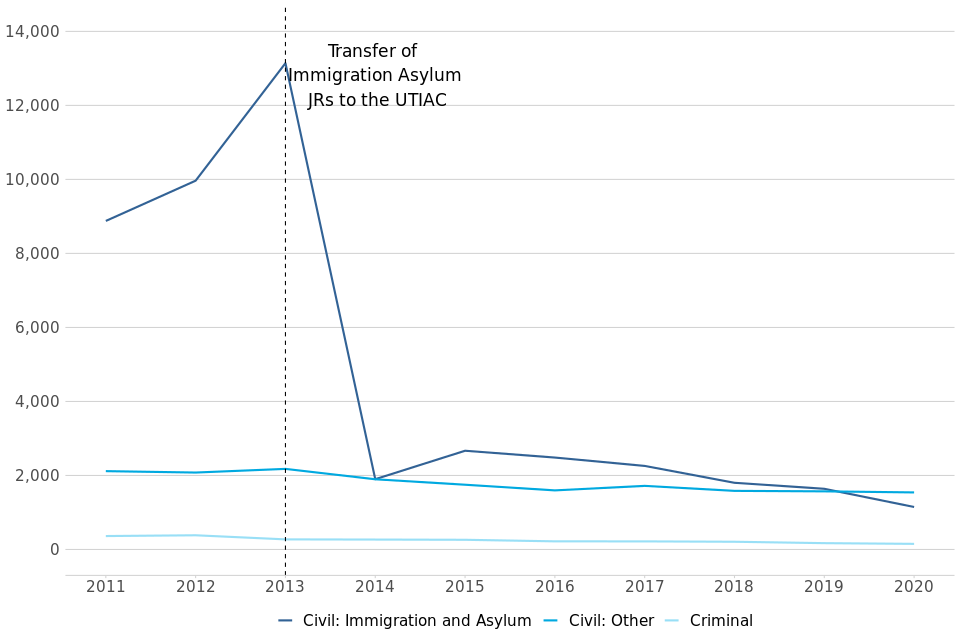

There were 2,800 judicial review applications received in 2020, down 16% on the same period in 2019. In 2019, there were 3,400 applications received in total, down 6% on 2018 (from 3,600).

Figure 10: Annual Judicial Review Applications, by type; calendar year 2010-2019 (Source: table 2.1)

Of the 2,800 applications received in 2020, 1,100 were civil immigration and asylum applications, 1,500 were civil (other), and 150 were criminal, down 29%, down 3% and down 9% respectively on the same period of 2019. 27 of the civil immigration and asylum cases have since been transferred to the UTIAC.

Of the applications that were made in 2020 in the period January to December, 55% are now closed. Of the total applications, 1,500 reached the permission stage in 2020, and of these:

- 17% (260) were found to be totally without merit (TWM).

- 390 cases were granted permission to proceed and 1,100 were refused at the permission stage. However, 53 of cases refused at permission stage went on to be granted permission at the renewal stage.

- 450 of the 2020 cases have been assessed to be eligible for a final hearing and of these, 69 have since been heard.

- For the 2020 cases, the mean time from a case being lodged to the permission decision was 86 days, slightly up from 66 days across the same period of 2019. The mean time from a case being lodged to final hearing decision was 175 days, similar to the same period of 2019 (162 days).

8.1 Applications lodged against departments (table 2.5)

This quarter’s tables include judicial review figures by defendant type (i.e. individual government department or public body) – table 2.5. This table, which will now be published quarterly, provides the number of judicial review applications lodged, permission granted to proceed to final hearing, and decisions found in favour of the claimant at final hearing.

The information presented is derived from the ‘defendant name’ – a free text field completed by the claimant, which is automatically matched and grouped by department. All efforts have been made to quality assure the data presented. However, this is a manually typed field, and as such is open to inputting errors and should be used with caution.

The key findings from January 2020 to December 2020 are:

- The Home Office was the department/body with the largest number of JR applications lodged against them, with 840 applications. Of these, 115 were granted permission to proceed to final hearing (14% of applications) to date.

- The second largest recipient of JR cases was the Ministry of Justice, with 750 cases received, of which to date 87 were granted permission to proceed to final hearing (12% of applications).

- The third largest recipient was Local Authorities, having 570 applications lodged against them. Of these, 150 were granted permission to proceed to final hearing (26% of applications) to date.

A more granular view of the JR data by department and case type can be found in the newly developed data visualisation tool found here. Feedback is welcome on this tool to ensure it meets user needs.

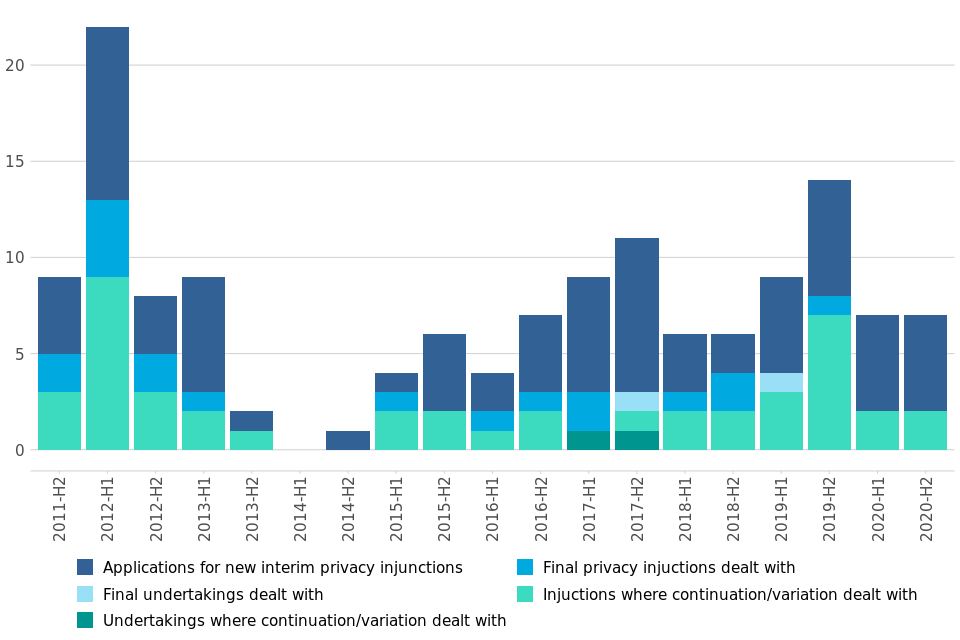

9. Privacy Injunctions[footnote 4]

In the final six months of 2020, there were 5 proceedings where the High Court considered an application for a new interim privacy injunction.

Two proceedings were considered at the High Court on whether to continue or amend an interim injunction, and no proceedings were considered to issue a final permanent injunction.

There were no proceedings considered at the High Court on whether to continue or amend an undertaking, and no proceedings considered a final undertaking[footnote 5].

Figure 11: Revised number of privacy injunction proceedings, by type of proceeding, from Aug-Dec 2011[footnote 6] to Jul-Dec 2020 (Source: tables 3.1, 3.2 and 3.3)

9.1 New interim privacy injunctions (Table 3.1)

All five of the proceedings at the High Court that took place in July to December 2020 were granted. In one of these an undertaking was given. In the previous six months (January to June 2020) 5 new interim privacy injunction proceedings took place, and three of these were granted.

9.2 Continuation of existing interim injunctions (Table 3.2)

The continuation of two existing interim injunction proceedings that took place in July to December 2020 were all granted/varied. In January to June 2020, the continuation of two existing interim injunctions proceeding were granted/varied.

9.3 Final privacy injunctions (Table 3.3)

There were no final privacy injunctions or final undertakings dealt with in July to December 2020.

10. Further information

10.1 Provisional data and revisions

The statistics in the latest quarter are provisional and revisions may be made when the next edition of this bulletin is published. If revisions are needed in subsequent quarters, these will be annotated in the tables.

10.2 Accompanying files

As well as this bulletin, the following products are published as part of this release:

- A supporting document providing further information on how the data is collected and processed, as well as information on the revisions policy and legislation relevant to civil justice.

- The quality statement published with this guide sets out our policies for producing quality statistical outputs for the information we provide to maintain our users’ understanding and trust.

- A set of tables providing statistics on the Business and Property Courts of England and Wales.

- A set of overview tables and CSV files, covering each section of this bulletin.

- A new JR data visualisation tool (to provide a more granular view of the JR data by department and case type). This can be found here.

10.3 Rounding convention

Figures greater than 10,000 are rounded to the nearest 1,000, those between 1,000 and 10,000 are rounded to the nearest 100 and those between 100 to 1,000 are rounded to the nearest 10. Less than 100 are given as the actual number.

10.4 National Statistics status

National Statistics status means that official statistics meet the highest standards of trustworthiness, quality and public value.

All official statistics should comply with all aspects of the Code of Practice for Official Statistics. They are awarded National Statistics status following an assessment by the Authority’s regulatory arm. The Authority considers whether the statistics meet the highest standards of Code compliance, including the value they add to public decisions and debate.

It is the Ministry of Justice’s responsibility to maintain compliance with the standards expected for National Statistics. If we become concerned about whether these statistics are still meeting the appropriate standards, we will discuss any concerns with the Authority promptly. National Statistics status can be removed at any point when the highest standards are not maintained, and reinstated when standards are restored.

10.5 Future publications

Our statisticians regularly review the content of publications. Development of new and improved statistical outputs is usually dependent on reallocating existing resources. As part of our continual review and prioritisation, we welcome user feedback on existing outputs including content, breadth, frequency and methodology. Please send any comments you have on this publication including suggestions for further developments or reductions in content.

10.6 Contacts

Press enquiries should be directed to the Ministry of Justice (MoJ) press office:

Sebastian Walters - email: sebastian.walters@justice.gov.uk

Other enquiries about these statistics should be directed to the Data and Evidence as a Service division of the Ministry of Justice:

Carly Gray - email: cajs@justice.gov.uk

Next update: 3 June 2021

-

https://www.gov.uk/government/news/priority-courts-to-make-sure-justice-is-served ↩

-

https://www.fca.org.uk/publications/finalised-guidance/personal-loans-coronavirus-temporary-guidance-firms ↩

-

The judicial review data are Official Statistics ↩

-

The privacy injunction data are Official Statistics ↩

-

An undertaking is different from an injunction, in that it is a promise given by the defendants, rather than an injunction which is an order of the court ↩

-

H2 2011 only covers the period August-December 2011 and is not a full half-year ↩