Civil Justice Statistics Quarterly: January to March 2024

Published 6 June 2024

Applies to England and Wales

1. Main Points

| Decrease in County Court claims, driven mostly by money claims | Compared to the same period in 2023, County Court claims from January to March 2024 were down 7% to 415,000. Of these, 343,000 (83%) were money claims (down 8%). |

| Damages claims were down 3% to 23,000 | The decrease in damages claims was driven by a fall in personal injury claims (down 16% to 14,000) compared to the same quarter in 2023. |

| The number of claims defended, and the number of trials decreased compared to 2023 | There were 64,000 claims defended (down 2%) and 11,000 claims that went to trial in January to March 2024 (down 26%) compared to the same quarter in 2023. |

| Mean time taken from claim to hearing continues to rise for multi/fast track claims | The mean time taken for small claims and multi/fast track claims to go to trial was 51.6 weeks and 82.9 weeks, 0.6 weeks less and 2.7 weeks longer than the same period in 2023 respectively. |

| Judgments were up 5% and default judgments were up 8% | Judgments were up 5% (to 279,000) in January to March 2024, compared to the same period in 2023; with 93% of these being default judgments. |

| Enforcement applications rose to 13,000 and orders also rose to 9,700 | Enforcement applications were up 16%, while enforcement orders were up 8% when compared to the same quarter in 2023. |

| Warrants issued decreased to 76,000 | Warrants issued were down 11% when compared to the same quarter in 2023. |

| 730 judicial review applications | There were 730 applications for Judicial Reviews in Q1 2024, up 22% on Q1 2023. Of the 160 cases in 2024 Q1 that have so far reached the permission stage, 5 (3%) were found to be ‘totally without merit’. |

This publication gives civil county court and judicial review statistics for the latest quarter (January to March 2024), compared to the same quarter in 2023. Should users wish to compare the latest outturn against earlier time periods, they can do so using the accompanying statistical tables. For more details, please see the supporting document.

Statistics on the Business and Property Court for England and Wales have also been published alongside this quarterly bulletin as Official Statistics. For technical detail, please refer to the accompanying support document.

The consultation for the Royal Courts of Justice statistics which was launched on 1st June 2023 and ran for 6 months has now ended. The findings have been provided in the RCJ section of this bulletin.

A visualisation tool that provides further breakdowns in a web-based application can be found here. For general feedback on the tool and related content of this publication, please contact us at: CAJS@justice.gov.uk

2. Statistician’s comment

Claims received in the county courts decreased this quarter compared with the previous year, with associated decreases in claims defended, claims allocated to track and claims gone to trial. Notably, while claims received, defences and allocations all fell by between 2% and 7% over the year, the number that went to trial fell by 26%.

The decrease in claims was mostly driven by money claims which were down 8%. Within this claim type, claim bands valued below £3,000 were all down while the higher value bands – above £3,000 all increased.

After increasing in the previous quarter, the average time between issue and trial for small track claims decreased this quarter, by 0.6 weeks. The average time between issue and trial for fast/multi track claims continued to increase, by 2.7 weeks.

There were 730 judicial review applications received this quarter, up 22% on the previous year, 130 of these have already closed.

3. Claims Summary

County court claims were down 7% on the same quarter of 2023, driven mostly by money claims.

There were 415,000 County Court claims lodged in January to March 2024. Of these, 366,000 (88%) were money and damages claims (down 7% from January to March 2023).

Non-money claim volumes were at 49,000, stable when compared to the same quarter in 2023.

Mortgage and landlord possession claims were up 10% over the same period to 30,000, ‘other non-money claims’ were down 12% to 16,000 and claims for return of goods were down 18% to 2,400.

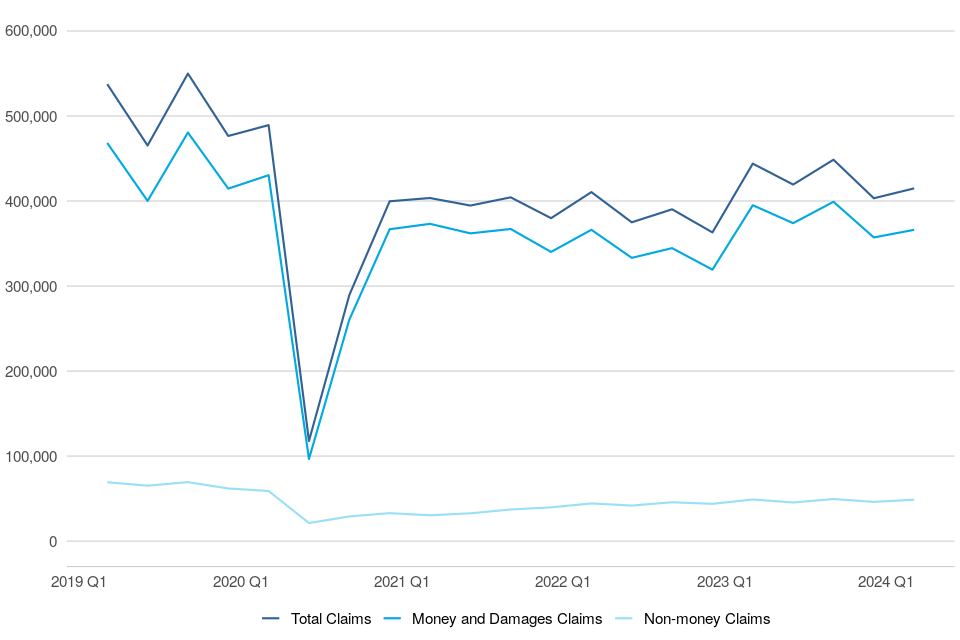

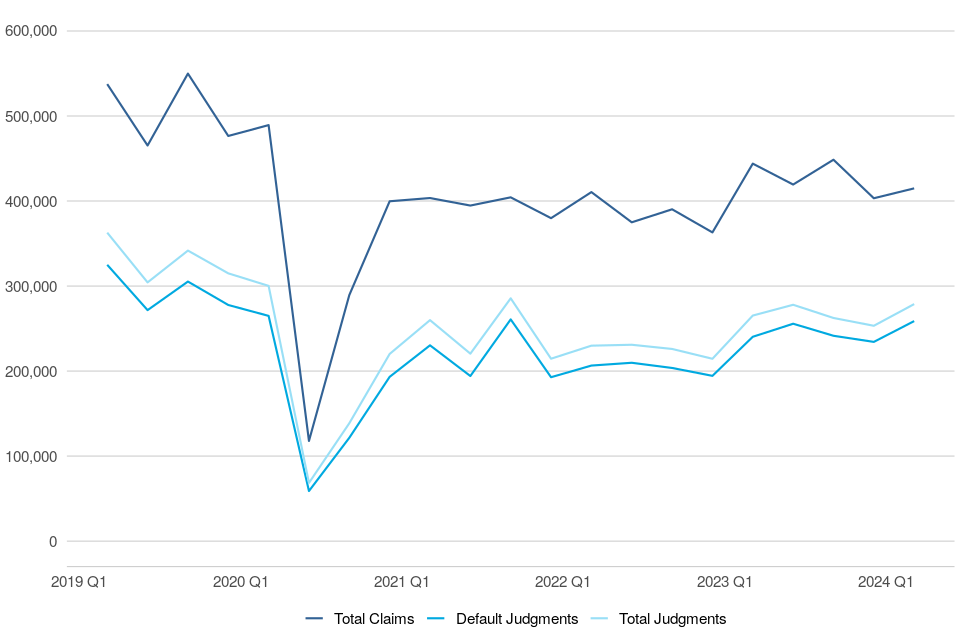

Figure 1: County Court claims by type, Q1 (January to March) 2019 to Q1 (January to March) 2024 (Source: table 1.2)

In the most recent quarter, total claims were down 7% compared to the same period in 2023 (from 444,000 to 415,000). Of these, 366,000 were money and damages claims, down 7% from January to March 2023 (from 395,000). Money and damages claims made up 88% of all claims in January to March 2024, down 1pp on its share in January to March 2023.

Prior to 2020, claim volumes had been relatively unchanged but volatile, driven by a few “bulk issuers” slowing down and then ramping up their volume of claims. Claim volumes decreased significantly following the outbreak of Covid-19. After an initial recovery towards pre-pandemic levels in the second half of 2020, claims issued remained relatively stable. Although volumes have risen in this quarter, this is still down 23% compared to the same quarter in 2019.

Non-money claims generally decreased between 2015 and Q1 2020. While these showed less of an impact following Covid-19 in contrast to money and damages claims, the recovery to pre-Covid19 volumes has been slow. In the current quarter, these claims were stable (at 49,000) compared to the same period in 2023, with increases in Mortgage and Landlord Possession claims being offset by decreases in claims for return of goods and ‘other non-money claims’. However, these remain down 30% below the same quarter in 2019 (pre-covid baseline).

Within non-money claims, ‘other’ non-money claims have shown a decline since 2018. In the most recent quarter, these were down 12% (from 19,000 to 16,000) compared to the same period in 2023. These continued decreases are likely to be partly as a result of whiplash reforms reducing the volume of road traffic accident claims going to court.

The overall trend in Mortgage and Landlord Possession claims has been decreasing since a peak of 60,000 in January to March 2014. Following the impact of Covid-19, when it fell to 3,200, the lowest recorded, these have increased gradually to 30,000 claims in January to March 2024, up 10% compared to the same quarter of 2023 (27,000 claims). However, this remains down 18% compared to the same quarter in 2019. Further details can be found in the Mortgage and Landlord Possessions publication here.

Claims for return of goods increased steadily to a high of 3,500 in July-September 2018 but have since declined. Following a further decline due to the impact of Covid-19 to 700 in Q2 2020, there has been recovery in these figures and volumes have remained relatively stable since Q1 2022 around pre-covid levels. This quarter, volumes are down 18% (from 2,900 to 2,400) compared to the same period in 2023.

4. Money and Damages Claims[footnote 1]

Money claims were down 8% (to 343,000 claims) in January to March 2024 compared to the same quarter in 2023.

Money claims valued up to £500 were down 5% over this period to 163,000, claims between £500 and £1,000 were down 23% to 48,000 and claims between £1,000 and £3,000 were down 16% to 71,000, driving the overall trend in money claims.

Damages claims were down 3% at 23,000 driven by a decrease in personal injury claims (down 16%) to 14,000 compared to the same quarter in 2023, offsetting an increase in other damages claims (up 29%) to 8,900 over the same period.

Personal injury claims have continued a generally downwards trend since Q4 2020. This is likely due to a combination of factors including the introduction of whiplash reforms (with some cases being processed via the online portal rather than going to court).

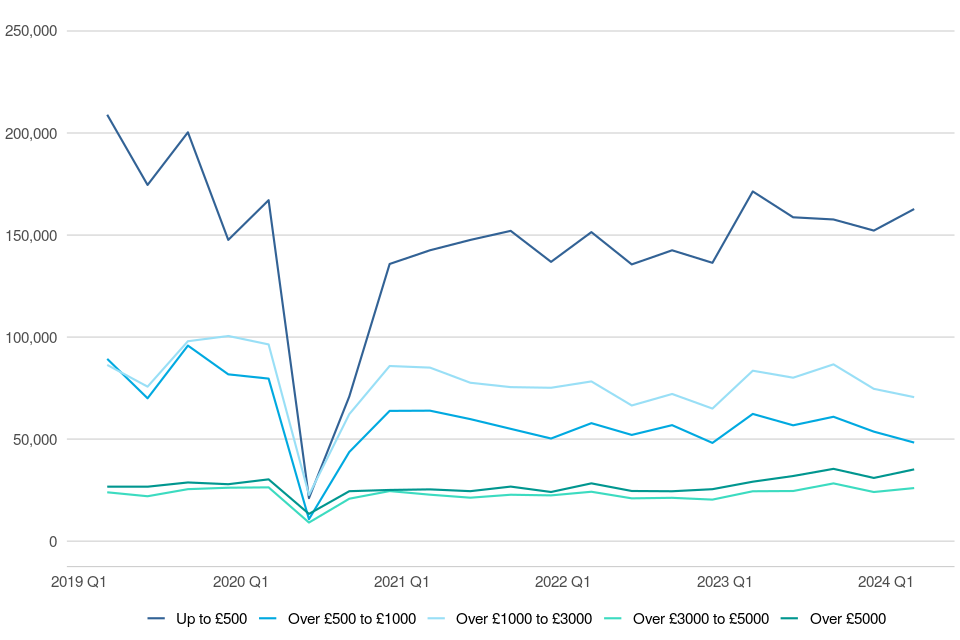

Figure 2: Money claims by monetary value, Q1 (January to March) 2019 to Q1 (January to March) 2024 (Source: civil workload CSV[footnote 2])

Historically, money claims reached a peak in April to June 2017, after which the implementation of the Pre-Action Protocol (PAP) for Debt Claims in October 2017 led to a sharp drop in claims. An increasing trend resumed the following quarter, suggesting that the impact of the PAP on claim volumes was temporary. The main aim of the protocol is to encourage early engagement between parties to resolve disputes without needing to start court proceedings. In the most recent quarter (January to March 2024), there were 343,000 claims, down 8% on the same quarter in 2023 (371,000 claims).

Almost all (over 99%) money claims are processed and issued at the County Court Business Centre (CCBC)[footnote 3]. There were 342,000 such claims at the CCBC in January to March 2024 (down 8% on the same quarter in 2023). CCBC claims were particularly affected by Covid-19 and associated actions, recording a more significant decrease than other money claims. This is due to bulk issuers almost completely ceasing their issue during the immediate response to the pandemic. These have now returned to historic trend levels and may account for the increase this quarter.

The increase in money claims is driven by claims valued under £500, claims between £500 and £1,000 and claims between £1,000 and £3,000. These were down 5%, 23% and 16% to 163,000, 48,000 and 71,000 claims respectively in the period January to March 2024 compared to the same quarter in 2023. The proportion of claims valued under £500 has increased from 42% in Q1 2021, to 46% in Q1 2023, and now account for 47% of total money claims in the most recent quarter. This is slightly down from historical levels when this category made up 48% of total money claims in January to March 2019.

Other than in Q2 2020, damages claims – made up of personal injury and other damages claims - have fluctuated between 21,000 and 38,000 claims each quarter over the last five years (since January to March 2019). However, in the current quarter volumes were down 3% to 23,000 in January to March 2024 compared to the same period in 2023. This was driven by a decrease in personal injury claims down 16% from 17,000 to 14,000. Other damages claims volumes can be prone to volatility and this quarter was up 29% from 6,900 to 8,900. Other damages claims accounted for 38% of all damages claims in the most recent quarter, up 9pp compared to January to March 2023, when they accounted for 29% of all damages claims. Personal injury claims were down 16% compared to the same period in 2023, continuing a generally decreasing trend since Q4 2020.

4.1 Allocations (table 1.3)

In January to March 2024, 35,000 money and damages claims were allocated to track, down 7% (from 37,000) compared to the same period in 2023. Allocations to track, which dropped to 24,000 in Q2 2023 have started to recover after the decline following the closure of the County Court Money Claims Centre in Salford and the transfer of work to the Civil National Business Centre. These volumes are expected to increase in the coming months as the Civil National Business Centre recovers performance to previous levels. Compared to January to March 2023, of these allocations:

- 25,000 were allocated to small claims, stable on January to March 2023. This accounts for 72% of all allocations (compared to 67% of all allocations in the same quarter of 2023);

- 8,100 were allocated to fast track, down 19% on January to March 2023. This accounts for 23% of all allocations (compared to 27% of all allocations in the same quarter of 2023);

- 1,700 were allocated to multi-track, down 27% on January to March 2023. This accounts for 5% of all allocations (compared to 6% of all allocations in the same quarter of 2023);

In October 2023, the extension of Fixed Recoverable Costs saw the introduction of a new Intermediate track which sits between the Fast and Multi track, the Intermediate track will be the normal track for claims valued between £25,000 and £100,000, with some exemptions[footnote 4]. The track applies to both money and damages claims and introduces fixed recoverable costs to claims in this track which would previously have been allocated to the multi-track. Currently only 32 claims have been allocated to this track. These cases will be included in subsequent publications when the volumes increase enough to make reporting non-disclosive.

5. Defences (including legal representation) and Trials

The number of claims defended was down 2% to 64,000 compared to the same quarter in 2023.

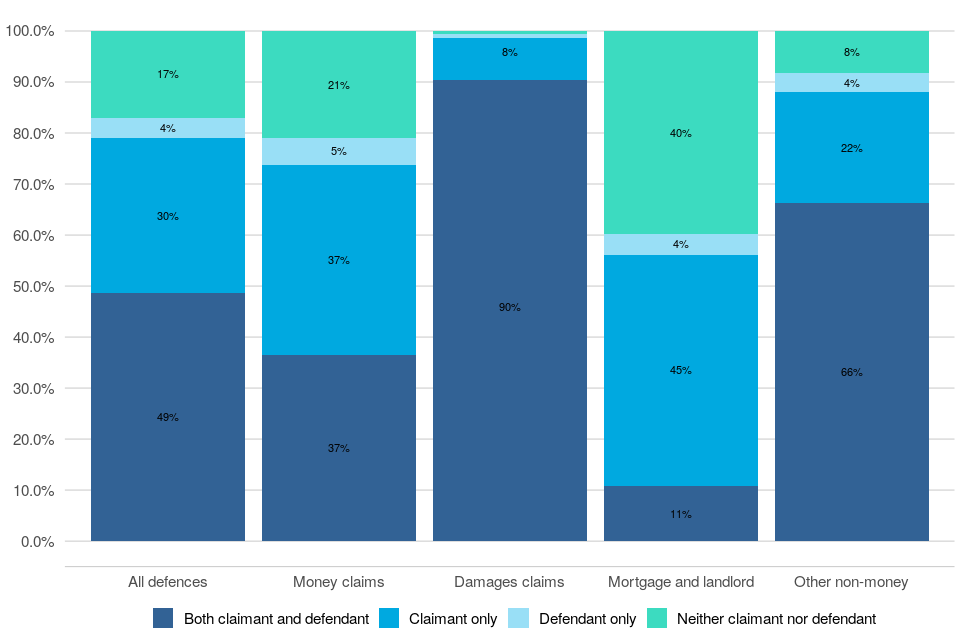

Of those claims defended, 49% had legal representation for both claimant and defendant, 30% had representation for claimant only, and 4% for defendant only.

The number of trials was down 26% to 11,000 compared to the same quarter in 2023.

Average time taken for small claims was 51.6 weeks (0.6 weeks less compared to the same quarter in 2023) and for multi and fast track claims it was 82.9 weeks (2.7 weeks longer than January to March 2023).

Of those claims defended in January to March 2024, 49% had legal representation for both claimant and defendant, 30% had representation for claimant only, and 4% for defendant only. Almost all (90%) damages claim defences had legal representation for both the defendant and claimant, compared with 37% of money claim defences.

Figure 3: Proportion of civil defences and legal representation status, January to March 2024 (Source: table 1.6)

The total number of claims defended was down 2% in January to March 2024 compared to the same quarter in 2023, from 65,000 to 64,000 cases. Mortgage and landlord possession defences were up 10% from 4,100 to 4,500 compared to January to March 2023. On the contrary, a decrease was seen in defended damages claims (down 18% from 19,000 to 16,000).

5.1 Trials and Time Taken to Reach Trial (table 1.5)

Defended cases which are not settled or withdrawn, generally result in a trial. In total, there were 11,000 trials in January to March 2024, down 26% compared to the same period in 2023. This decline is likely due to the decrease in claims allocated to track caused by the closure of the County Court Money Claims Centre in Salford. Of the claims that went to trial, 8,600 (75%) were small claims trials (down 28% compared to the same quarter in 2023) and 2,800 (25%) were fast and multi-track trials (down 23% from the same quarter of 2023).

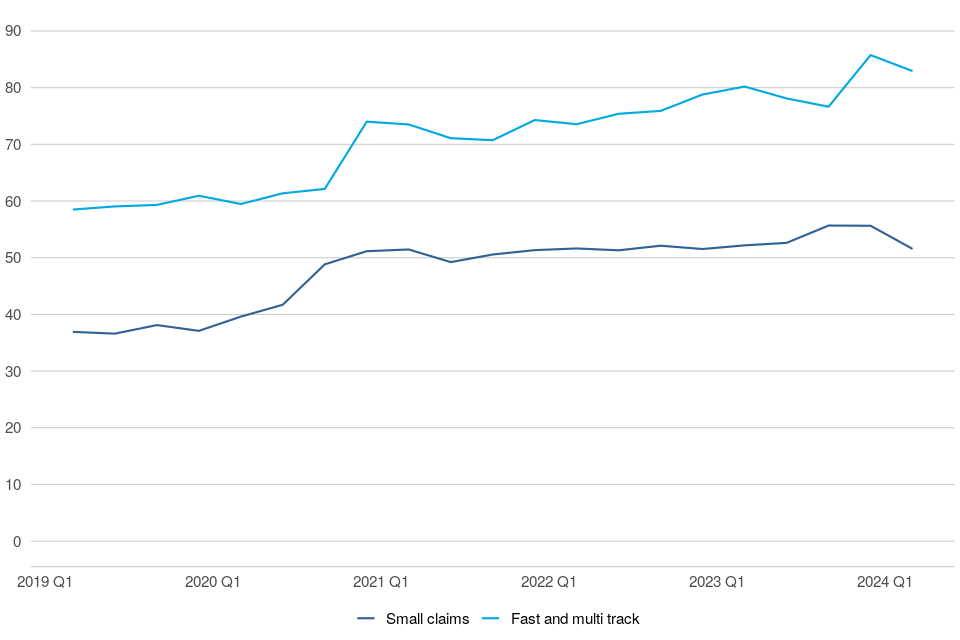

Figure 4: Average number of weeks from claim being issued to initial hearing date, Q1 (January to March) 2019 to Q1 (January to March) 2024 (Source: table 1.5)

In January to March 2024, it took an average of 51.6 weeks between a small claim being issued and the claim going to trial, 0.6 weeks less than the same period in 2023. Timeliness for Small Claims remains a challenge with this metric measuring only those cases concluding at trial (rather than through settlement following mediation for example). There is regional variation within this metric with longer waiting times experienced in London and the South East.

Mediation is being fully integrated as a key step in the court process for small civil claims valued up to £10,000. This, when successful, results in outcomes which are not used within the timeliness calculations. This means the final cases used in timeliness measures include a disproportionate number of more complex cases which take longer to dispose of.

The HMCTS Reform programme is modernising and digitising the systems to allow the courts to work more efficiently and cases are expected to progress from issue to directions more quickly.

For multi/fast track claims, it took on average 82.9 weeks to reach a trial, 2.7 weeks longer than in January to March 2023, continuing to exceed the upper limit of the range seen in 2009-2019 (which was 52 to 61 weeks).

Covid-19 and associated actions have led to an uptick in time taken for all claims to reach trial. Prior to this, a sustained period of increasing receipts had increased the time taken to hear civil cases and caused delays to case progression.

6. Judgments

Judgments were up 5% compared to the same quarter in 2023.

There were 279,000 judgments made in January to March 2024, compared to 265,000 in the same quarter of 2023. Of these judgments, 259,000 (93%) were default judgments.

Figure 5: All claims, judgments and default judgments, Q1 (January to March) 2019 to Q1 (January to March) 2024 (Source: tables 1.2 and 1.4)

There were 279,000 judgments made in January to March 2024, up 5% compared to the same quarter of 2023. Of these, 93% were default judgments, up 2pp on its share in January to March 2023. These have remained relatively stable since 2018, with around 9 out of every 10 judgments resulting in a default judgment.

The second largest type of judgment was ‘admissions’[footnote 5], of which there were 12,000 in January to March 2024, down 12% on the same quarter in 2023 (from 14,000). ‘Admission’ judgments accounted for 4% of all judgments.

7. Warrants and Enforcements

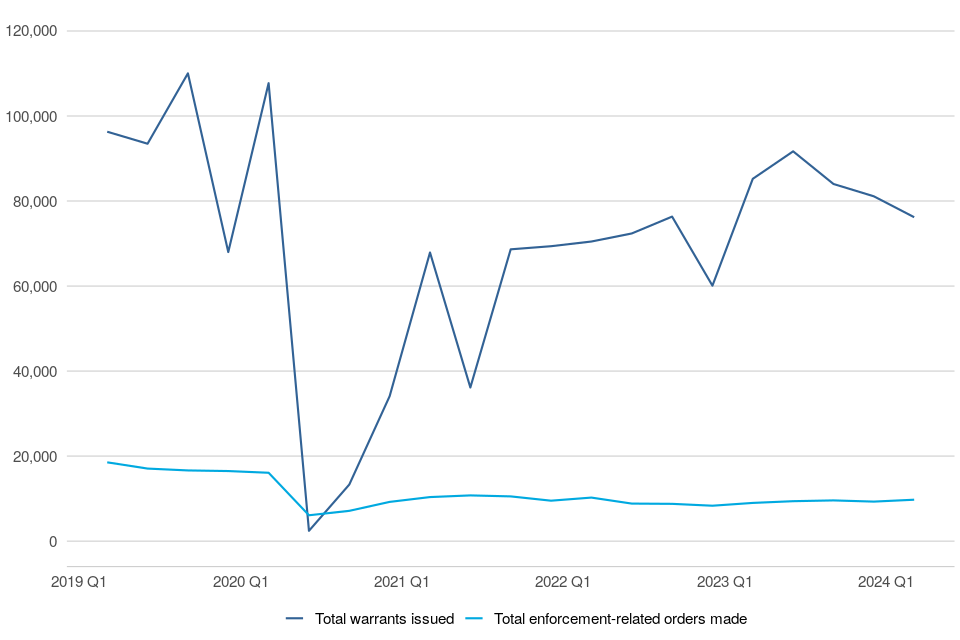

Warrants issued were down 11% when compared to same quarter in 2023.

In January to March 2024, 76,000 warrants were issued, down 11% from 85,000 in the same quarter of 2023. Of these, 61,000 (80%) were warrants of control, down 14% compared to the same period in 2023.

Enforcement applications were up 16% and enforcement orders were up 8% when compared to January to March 2023.

This rise in enforcement applications was mostly driven by an increase in Attachment of earnings (AoE) applications which were up 45% (from 4,400 to 6,300), whilst a decline in Attachment of earnings (AoE) orders, down 24% (from 3,300 to 2,500) was offset by a rise in Charging orders, up 55% (from 3,700 to 5,700).

Figure 6: Warrants and enforcements issued – Q1 (January to March) 2019 to Q1 (January to March) 2024 (Source: tables 1.7 and 1.8)

7.1 Warrants (table 1.7)

In the latest quarter (January to March 2024) there were 76,000 warrants issued, down 11% (from 85,000) on the same quarter in 2023. Warrants of control accounted for 80% of total warrants, and were down 14%, from 71,000 to 61,000, compared to the same period in 2023.

There were 15,000 possession warrants issued in January to March 2024, up 9% (from 14,000) on the same quarter in 2023. These have continued a general upwards trend since Q3 2020, following a sharp drop in Q2 2020 due to the impact of Covid-19.

7.2 Enforcements (table 1.8)

In January to March 2024, there were 13,000 enforcement-related order applications (which include attachment of earnings orders, charging orders, third party debt orders, administration orders, and orders to obtain information), up 16% compared to the same quarter of 2023. All application types increased, except charging order applications. Attachment of earnings (AoE) applications up 45%, third party debt applications up 11% and administration orders applications up 167%. Charging order applications were down 5%.

There were 9,700 enforcement-related orders made in January to March 2024, up 8% compared to the same quarter of 2023. AoE orders fell, which were down 24% (from 3,300 to 2,500). Charging orders rose, which were up 55% (from 3,700 to 5,700), driving the overall rise in volumes. Orders to obtain information were down 25% (from 1,800 to 1,400). All other types of enforcement order remained relatively stable over this period.

Over the longer term, there has been a decreasing trend in enforcement-related applications received and orders made since 2009, possibly due to claimants’ preference for using warrants instead to retrieve money, property or goods.

8. Judicial reviews[footnote 6]

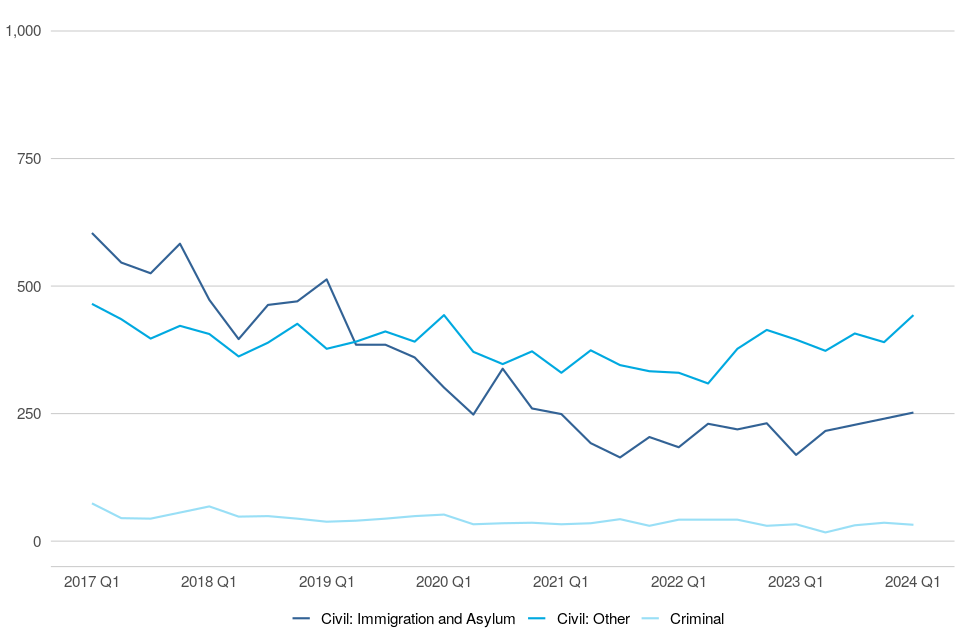

There were 730 judicial review applications received in Q1 2024, up 22% on Q1 2023 (600) and down 22% on Q1 2019 (from 930) as a pre-Covid19 baseline.

Of the 730 applications received in Q1 2024, 130 have already closed, and 5 were found to be ‘Totally Without Merit’ (3% of cases that reached the permission stage).

Judicial review cases moved to a new management system, CE-file, from September 2023. Only cases open from 2020 have been moved to the new system, and these cases may have small revisions when compared to previous publications. Cases prior to 2020 will no longer be revised as these have not been moved to CE-file; over 99% of these cases have already been closed.

Figure 7: Judicial Review Applications, by type; Q1 2017 to Q1 2024 (Source: JR CSV)

Quarterly JR Receipts – January to March 2024:

Of the 730 applications received in Q1 2024, 250 were civil immigration and asylum applications, 440 were civil (other), and 32 were criminal, up 49%, up 12% and down 3% respectively on Q1 2023. 3 of the civil immigration and asylum cases have since been transferred to the UTIAC.

Of the applications that were made in Q1 2024, 17% are now closed. Of the total applications, 160 reached the permission stage in Q1 2024, and of these:

- 3% (5) were found to be totally without merit.

- 41 cases have already been granted permission or granted permission in part to proceed and 87 were refused at the permission stage. 1 case refused at permission stage went on to be granted permission at the renewal stage.

- 42 cases were assessed to be eligible for a final hearing and of these, 3 have since been heard.

- the mean time from a case being lodged to the permission decision was 49 days. Although timeliness for cases being lodged to final hearing are included in the tables, this is based on too few cases to be meaningful. The actual time taken for these cases will only be known when they have had time to work their way through the system.

8.1 Applications lodged against departments (table 2.5)

Table 2.5 presents judicial review figures by defendant type (i.e. individual government department or public body). This table provides the number of judicial review applications lodged, permission granted to proceed to final hearing, and decisions found in favour of the claimant at final hearing.

The information presented is derived from the ‘defendant name’ – a free text field completed by the claimant, which is matched and grouped by department. All efforts have been made to quality assure the data presented. However, this is a manually typed field, and as such is open to inputting errors and should be used with caution.

The key findings for Q1 2024 are:

- Home Office had the largest number of JR applications lodged against them, with 240 applications. Of these, 12 were granted permission or granted permission in part to proceed to final hearing (5% of applications) to date.

- The second largest recipient of JR cases was the Local Authorities, with 200 cases received, of which to date 19 were granted permission or granted permission in part to proceed to final hearing (10% of applications).

- The third largest recipient was the Ministry of Justice, having 86 applications lodged against it. Of these, 4 were granted permission or granted permission in part to proceed to final hearing (5% of applications) to date.

A more granular view of the JR data by department and case type can be found in the data visualisation tool found here. Feedback is welcome on this tool to ensure it meets user needs.

9. Royal Courts of Justice

Annual appeals that are administered by HM Courts and Tribunals Service (HMCTS) can be found in the accompanying Royal Court of Justice and Sitting Days tables. Key findings covering the year to 2023 are summarised below:

The High Court – The King’s Bench tables 4.3 and 4.5 have not been updated to 2023 in this publication as, during compilation of the 2023 figures, we found some discrepancies in the data collection which we are currently investigating. We have decided not to report on the figures for 2023 due to these errors. Everything is being done to ensure this does not happen in future publications.

Days sat by Judge - We have updated figures for King’s Bench Sitting days figures for the period since 2020. Previously published King’s Bench Sittings Days for 2020-2022 were partial. We have now been able to update total figures to include the missing days sat, though it is not possible to provide the full judge type or the regional level breakdown on a consistent basis and so this data has been recorded in the unknown category.

We recently conducted an internal and external survey to better understand who uses the Royal Courts of Justice statistics, how they use them and what changes might help us meet user needs better. The survey was launched on 1st June 2023 and ran for 6 months with 7 responses received. The findings showed that most respondents use the bulletin, summary table (1.1), King’s bench division tables (4.1 and 4.2), judge sitting days tables (9.1 and 9.2) and Senior Courts Costs Office table (10.1) but suggested that the tables for the Admiralty Court (5.1, 5.2 and 5.3), Office of the Official Solicitor and Public Trustee (6.1) and Child Abduction and Contact Unit (ICACU) (7.1 and 7.2) are used to a lesser extent. There were several suggestions for increased granularity within some of the tables and a greater level of detail within footnotes which we are currently investigating.

In light of the feedback some changes have been made to the tables to make them more user friendly. Details of the changes made can be found in the tables and in the accompanying guide. We will continue to review all feedback and assess what further changes can be made to this publication to help better meet user needs, subject to resource constraints.

Although the closing date for this consultation has now passed, user engagement is a continuous process, and users are invited to submit their comments and suggestions to the team at any time using the contact details at the end of this document.

The Court of Appeal Criminal Division saw a 14% increase over the year in the number of applications received, from 3,800 in 2022 to 4,300 in 2023. Increases were recorded across all three appeal application types (conviction, sentence and other[footnote 7] appeal applications, up 29%, 9% and 11% respectively). These volumes are now approaching pre-Covid19 levels, with the total number of applications received only 5% lower than in 2019. Compared to 2019, conviction and other applications increased by 4% and 53% respectively, whereas sentence applications remain 12% below this level. (RCJ Table 2.1)

The Court of Appeal Civil Division had 573 appeals filed in 2023, down 6% on 2022. Of the appeals filed in 2023, the largest number (107 appeals, 19%) came from the Chancery. The number of disposals in 2023 increased by 13% to 420, following the lowest volume of disposals reported in the timeseries in 2022 (372). Chancery cases made up the largest category (66 cases, 16% of all disposals), followed by Family (59 cases, 14% of disposals). (RCJ Table 2.3)

Civil Division mean timeliness to Permission to Appeal (PTA) decision has remained stable in 2023 at 14 weeks, the same as 2022. Mean timeliness from PTA granted to appeal hearing start has increased by 2 weeks over the same period to 24 weeks in 2023. (RCJ Table 2.4)

Chancery Division: Proceedings started increased by 16% compared to last year, to 13,600. Within the Chancery Division, total proceedings have decreased by 11%, from 3,600 to 3,200. (RCJ Table 3.1)

Winding-up petitions increased by 70% this year, from 2,900 to 4,900. This is likely because the number of Winding-up petitions issued by HMRC were reduced during the pandemic and are now increasing again following the effects of this. (RCJ Table 3.5)

The High Court – The King’s Bench - had 3,900 proceedings started in 2023, a decrease of 12% compared to 2022. Of these proceedings, the most common types in 2023 were for “personal injury actions”, “miscellaneous”, “clinical negligence” and “other negligence”, which made up 25%, 21%, 19% and 19% of all proceedings respectively. The share for personal injury has fallen by 7 percentage points, whereas the share for miscellaneous has increased by 6 percentage points compared to 2022, when the share was 32%, 16%, 19% and 18% respectively. (RCJ Table 4.2)

Commercial Court claims continue to reverse their long-term downward trend seen since 2014. Compared to 2022, claims increased by 32% (to 1,360 claims). This is the highest volume in the timeseries reported (since 2012). The largest category of claim (not including “Miscellaneous / unassigned”) remains “General commercial contracts and arrangements, including agency agreements”, with 286 such claims issued in 2023. (RCJ Table 5.4)

Days sat by Judge[footnote 8] - there were 339,000 days sat by judges in 2023, the highest annual sitting days since 2011, up from 328,000 (an increase of 3%) in 2022.

This upturn was driven by continued increases in Crown Court sitting, which rose by 9% (from 103,000 to 112,000 sitting days) and formed around a third of all sitting days in 2023. In addition, County Court sitting days rose by 1% over the same period from 204,000 to 207,000 (RCJ Table 9.2).

Within the court types, the High Court Family Division and T&C Courts saw the largest decreases in sitting days, falling by 15% and 11% respectively in 2023. However, all courts within the Court of Appeal and the High Court either saw a decrease in sitting days over this period or these remained stable (RCJ Table 9.2).

Circuit judges continue to make up the largest proportion of days sat (35% of all days sat in 2023). District judges sitting days increased by 8% to 72,200 in 2023, whereas days sat by Deputy circuit judges fell by 15% to 2,700 over the same period.

The majority of regions’ days sat increased in 2023, except for the categories ‘Elsewhere – Bulk centre’ which fell by 12% and ‘Royal Courts of Justice’, which fell by 5% and North West and Wales which remained stable.

For further information on these summarised figures or on the statistics available in relation to the appeals courts’, please see the accompanying tables; ‘Royal Courts of Justice, 2023’.

10. Further information

10.1 Provisional data and revisions

The statistics in the latest quarter are provisional and revisions may be made when the next edition of this bulletin is published. If revisions are needed in subsequent quarters, these will be annotated in the tables.

10.2 Accompanying files

As well as this bulletin, the following products are published as part of this release:

- A supporting document providing further information on how the data is collected and processed, as well as information on the revisions policy and legislation relevant to civil justice.

- The quality statement published with this guide sets out our policies for producing quality statistical outputs for the information we provide to maintain our users’ understanding and trust.

- A set of overview tables (also available in accessible format) and CSV files, covering each section of this bulletin.

- A set of tables providing statistics on the Business and Property Courts of England and Wales, also available in accessible format.

- A Judicial Review data visualisation tool (to provide a more granular view of the JR data by department and case type). This can be found here.

- A Sankey tool which shows case progression of civil cases in the county courts is here.

- A Civil data visualisation tool to provide a more granular and interactive view of cases through the civil claims system. This can be found here.

10.3 Rounding convention

Figures greater than 10,000 are rounded to the nearest 1,000, those between 1,000 and 10,000 are rounded to the nearest 100 and those between 100 to 1,000 are rounded to the nearest 10. Less than 100 are given as the actual number.

10.4 National Statistics status

National Statistics status are accredited official statistics that meet the highest standards of trustworthiness, quality and public value.

Accredited official statistics are called National Statistics in the Statistics and Registration Service Act 2007. These accredited official statistics were independently reviewed by the Office for Statistics Regulation in January 2019. They comply with the standards of trustworthiness, quality and value in the Code of Practice for Statistics and should be labelled ‘accredited official statistics’.

It is the Ministry of Justice’s responsibility to maintain compliance with the standards expected for National Statistics. If we become concerned about whether these statistics are still meeting the appropriate standards, we will discuss any concerns with the Authority promptly. National Statistics status can be removed at any point when the highest standards are not maintained, and reinstated when standards are restored.

10.5 Future publications

Our statisticians regularly review the content of publications. Development of new and improved statistical outputs is usually dependent on reallocating existing resources. As part of our continual review and prioritisation, we welcome user feedback on existing outputs including content, breadth, frequency and methodology. Please send any comments you have on this publication including suggestions for further developments or reductions in content.

10.6 Contacts

Press enquiries should be directed to the Ministry of Justice (MoJ) press office:

Sarah Cottrill - email: sarah.cottrill@justice.gov.uk

Other enquiries about these statistics should be directed to the Courts and People division of the Ministry of Justice:

Matteo Chiesa - email: cajs@justice.gov.uk

Next update: 5 September 2024

-

From 16th November 2023, a small proportion (approximately 14%) of data relating to stages from allocation to track to final hearing may be missing, incomplete or not correctly represented for money claims and damages claims. This is due to some of these cases progressing on the damages and online money claims systems, rather than the legacy caseman system. The data will be included as soon as the change is completed. ↩

-

Following the alignment of the fees for online and paper civil money and possession claims in May 2021, figure 2 shows all data with the updated claim brackets for comparison, a further breakdown of these brackets is available within the CSV. The CSV shows updated claim brackets from 2021. ↩

-

This includes claims for the County Court Business Centre, County Court Money Claims Centre, Courts and Tribunals Service Centre Salford, and County Court Online. ↩

-

PART 28 - THE FAST TRACK AND THE INTERMEDIATE TRACK - Civil Procedure Rules (justice.gov.uk) ↩

-

Judgment by admission is where the defendant admits the truth of the claim made. ↩

-

The judicial review data are Official Statistics ↩

-

See footnote on the Royal Courts of Justice table 2.1 for the full list of other receipt applications. ↩

-

These figures represent only the days sat in court or in chambers in the following jurisdictions: Court of Appeal (Criminal and Civil), High Court (Chancery Division, Queen’s Bench Division, Family Division, Technology and Construction Court), Crown Court and County Court (including Family Law). Judges sit in other areas (including High Court hearings in regional County Courts) and also undertake a range of other functions outside the courtroom that are not included here. ↩